10 minute read

Malaysia and Singapore’s small

The Malaysian central bank plans to award up to five digital licences this year.

Malaysia and Singapore’s small banks threatened as digital banks enter the fray

Small banks could lose market share as digital newcomers target underserved segments.

Small Malaysian banks are standing on shaky ground as Bank Negara Malaysia prepares to grant up to five digital banking licences this year. The entrance of digital players poses a threat to their market share given their modest franchises, according to a Fitch Ratings report, and digital banks may exploit their size and innovation to concentrate on underserved markets.

The overall Malaysian banking sector has been struggling for the past few years, S&P Global Ratings analyst Rujun Duan told Asian Banking and Finance. The country posted slow GDP growth in Q4 2019 that was forestalled by overnight policy rate (OPR) cuts in January and March.

The arrival of digital banks would only add more stress especially in terms of profitability, and adverse market trends and heightened competition would likely squeeze small banks, she said.

Big fintech players such as ride-hailing company Grab and gaming firm Razer have all expressed interest in applying for a digital licence. Even traditional banks joined in on the fray: local banking giants with large footholds in the market such as Maybank, CIMB Bank, and Hong Leong are also reportedly eyeing a license.

What makes small banks particularly at risk is their lack of market dominance to effectively defend themselves.

What makes small banks particularly at risk is their lack of market dominance to effectively defend themselves, noted Duan.

“What’s more, their limited financial resources also mean that they will likely struggle to shoulder the ongoing heavy IT investments required to stay ahead of the competition,” she added.

In addition, digital banks can push lending rates down and use their lack of physical presence to offer higher interest rates and attract deposits, according to S&P analyst Ivan Tan. They will also likely target the retail and SME markets, both of which are underserved and with high risk profiles, Fitch said.

Similarly, Singapore’s small foreign-owned lenders are also under threat even if they are already in the process of digitisation, a Moody’s report revealed, due to their insignificant operations in the Lion City which render them unlikely to benefit from the access to new digital investments. On the other hand, the country’s small domestic banks, including Malayan Banking Berhad (Maybank) and Industrial & Commercial Banking of China (ICBC), have been taking advantage of a strong retail and SME customer base to cement their competitiveness, the report added.

The Monetary Authority of Singapore (MAS) is

UOB’s TMRW, the lender’s Indonesian digital bank offering.

planning to hand out five digital banking licences in H2 2020, chosen amongst the more than 20 applications submitted last year.

But there seems to be quite a silver lining as major domestic ASEAN banks, including Singapore’s biggest banks, are well-positioned to flourish in the digital banking era. “They have two necessary advantages: the required resources to invest in technology and acquire start-ups; and a rich pool of customer data to harness the technology into a commercially viable product or app,” noted Tan.

According to Moody’s, Singapore’s big three, namely, DBS, UOB, and OCBC have all proved themselves to be capable of adjusting to the digital era and leveraging technology to offer their own digital banking services, apart from their already-established traditional banking activities.

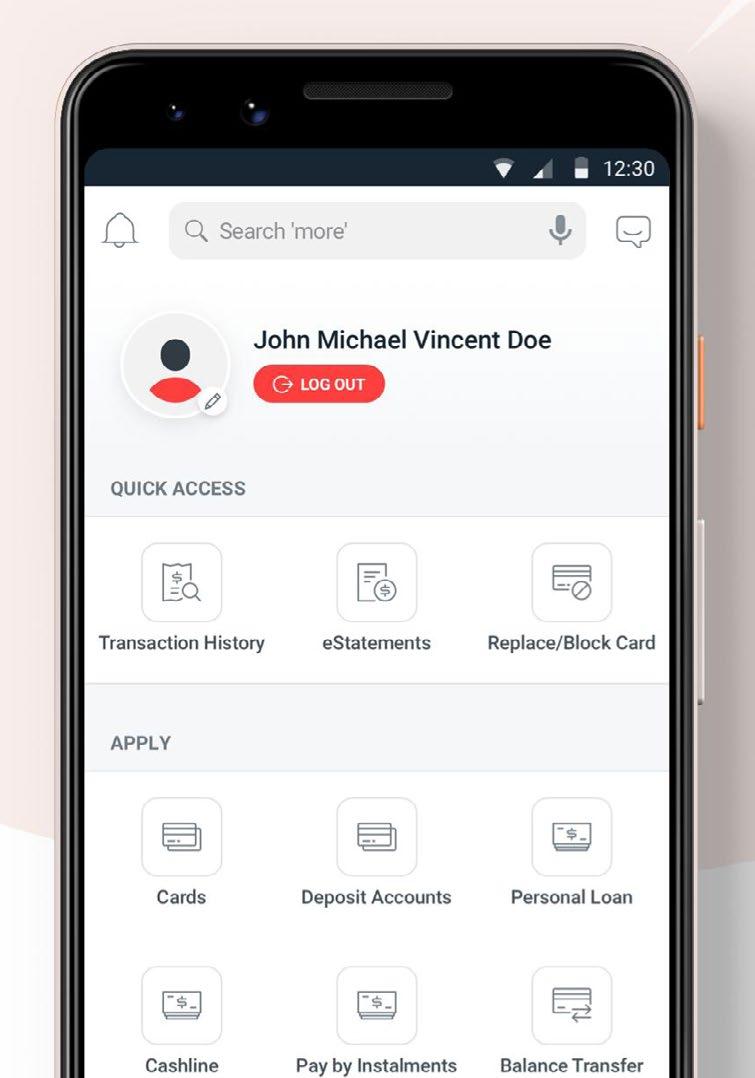

For example, DBS has taken advantage of the country’s high internet and smartphone penetration with its mobile wallet DBS PayLah!. UOB has followed suit with its all-in-one banking app Mighty Pay, whilst OCBC has two separate mobile banking and mobile payment apps.

Not to be overshadowed, Malaysia’s major banks such as OCBC, Hong Leong Bank, CIMB, and RHB have all developed their very own mobile banking apps tailored for their clients’ needs.

In the Kuala Lumpur leg of Asian Banking & Finance’s 2019 retail banking forum, Standard Chartered Saadiq CEO Mohd Suhaimi Bin Abdul Hamid emphasised that their bank’s digital agenda focuses on making digital transactions easier by reengineering digital at a price to support their plans for mobile and online banking. He stressed that if customers find their digital banking solutions easy to use, then they can also influence others to use it.

“These clients are starting to think [more] independently using digital compatibility by mobile and internet banking...and so we also do a lot of campaign digitally to grow client awareness on how to use mobile phones, for example,” he said.

But the problem is still there for Singapore’s and Malaysia’s smaller banks.

To weather the incoming competition, Fitch sees smaller banks coordinating with digital lenders, with the former providing the balance sheet, capital and

Rujun Duan

Ivan Tan

risk management and the latter taking care of the tech aspect. This is a strategy that has been widely accepted in Malaysia and elsewhere in the region, Duan said.

However, such partnerships present the potential risk of smaller banks sacrificing their relationships with their customers--as it may see them giving up client ownership to digital lenders.

“Big banks usually have better bargaining power to strike a deal to protect their own interests with such startups. The risk of giving up client ownership cannot be overestimated and may lead to marginalisation of those small lenders in the market eventually,” Duan said.

As an example, she cited the partnerships forged between Chinese rural commercial banks and tech giants AliPay and Tencent wherein the two Chinese tech giants would refer their clients to the latter for their financial needs relating to wealth management and other value-added services.

The problem is that the customers become more attached to AliPay and Tencent than to the banks themselves. “Those small lenders become pure funding channels for fintech companies, and the banks’ deposit customers are probably viewing their banking relationship more embedded in Alipay or Tencent’s own product ecosystem, rather than with that small bank,” she added.

Despite this, digital banks don’t seem to pose a long-term threat to domestic banks. As noted by Fitch, whilst Malaysia’s proposed end-point capital funds requirement of $73m (MYR300m) is lower compared to Singapore’s, the $490m (MYR2b) asset size cap per digital bank should contain the risk for now.

Bank Negara’s stipulated three-to-five year foundational phase should also limit the growth of the new banks, Duan added.

Applicants for a Malaysian digital bank licence are also required to submit a five-year business plan authenticating their profitability, which should weed out unsustainable entrants and lower the risk of value-destructive competition, noted Fitch in a separate report.

Meanwhile, ASEAN regulators have taken a “measured approach” to onboarding digital banks. In Singapore, digital wholesale banking licence grantees cannot take individual deposits except for fixed deposits of at least $179,600 (S$250,000), whilst full digital banking licences will be issued in stages, and deposits will be capped at $53,880 (S$75,000) per depositor and $35.9m (S$50m) in aggregate.

“Deposit and business restrictions will slowly be relaxed once the digital banks have proven that they can manage the risks involved, and deliver their value proposition,” Tan assured.

Other regulators are expected to implement similar restrictions, both on capital and liquidity rules, on full digital banks to ensure an equal playing turf, he added. By Alyssa Divina

BANKING : DIGITAL BANKS

Do fintechs need better marketing strategies? FINANCIAL TECHNOLOGY

Caecilia Chu CEO and Co-Founder YouTrip

Fintechs can improve their marketing communications by shifting their focus towards personalisation, instead of adopting a one-size fits all strategy. A good strategy can boost consumer trust and lower the barrier of customer acquisition for fintechs. This was extremely valuable for YouTrip during our initial launch where we were able to amass strong initial traction to top the download charts early on.

Though we do not have a physical presence like traditional banks, we maintain the personal touch by tailoring our communications to the various user segments. YouTrip caters to different lifestyle needs of our users through thematic events like fitness for travel.

Eric Chan Co-Founder/Managing Director PR Communications

In this burgeoning, nascent industry where new fintechs are coming up every day, it is imperative to stay ahead of the curve.

This is where marketing communications can help them have an edge over the competition.

The power of marketing communications, such as public relations, lies in building brand awareness, corporate reputation as well as reaching out to their desired customer. Marketing communications can help you stretch your dollar because of the earned media and ‘trust-building’ effect that you gain in marcomms.

X.Y. Ng VP Brand & Digital Validus Capital

Effective marketing communications go a long way in demystifying the technology in order to establish trust and credibility. In developing better marketing communications, the key is to turn product features into key value propositions focused on the end users or target segment and to humanise communications, particularly when educating the market.

At Validus, our business of connecting small business owners to investor funds for growth financing allows us to develop and use the stories of our SMEs to educate and engage all of our stakeholders, enabling us to build a strong brand and become the largest small business financing platform in Singapore.

DBS has rolled out an analysis tool that can review clients’ investment and churn out personalised reports, all in less than five minutes.

Co-developed with wealth technology firm EdgeLab, the Portfolio Advisory Enablement Tool (PAET) can assess investment holdings against risk appetite and aims, yield portfolio and market performance, and indicate risk exposures and asset allocation. PAET hopes to fulfill a gap in traditional client investment reviews where relationship managers scrutinise investment performance using traditional client statements, often omitting information such as comparisons to a wider portfolio and risk exposures.

PAET generates reports for one-fifth of the time it takes to compile a manual report, therefore reducing human errors and improving relationship managers’

PRODUCT WATCH productivity.

The integration of PAET into the DBS system highlights the bank’s front, middle and back-end capabilities as well as efforts for scalable public and private cloud solutions.

“PAET is a testament to our capabilities in harnessing technology to transform the usual way of doing things, empowering RMs to provide richer, more detailed and contextualised investment advice that benefits clients in the long-term,” said Sim S. Lim, group head of consumer banking and wealth management at DBS.

DBS is currently heading to the second phase of PAET development to refine advice and client engagement, which will enable relationship managers to stimulate investments into existing portfolios for clients to understand the potential valueadd, and also build new client portfolios.

Manage your investments in less than five minutes

How BPI

Makati fused history and modernity

The branch provides in-demand services such as exotic currencies and meeting spaces for clients. N estled in one of the Philippines’ top financial districts, the Bank of the Philippine Islands’ Makati City Main branch has been upgraded and given a new look to reinforce its status as an all-in-one banking hub.

Located in the Makati Stock Exchange Building, the branch is in line with BPI’s commitment to enhance customer experience through face-to-face transactions, a spokesperson told Asian Banking and Finance. Measuring 2,943 sqm, the Philippine bank opened its new location in October. Its simplistic yet modern design sprinkled with BPI’s signature red and white color reflects the marriage of the bank’s 168-year heritage and its ongoing efforts for digitisation.

“BPI Makati Main has become a go-to branch for transactions that need special handling and arrangements,” the bank explained.

The renovated branch features a corporate banking centre, dedicated spaces for preferred clients, and BPI’s first-ever interactive screen where customers can browse and access banking products and online services.

Alongside the aforementioned amenities, BPI Makati Main will also provide specialised and indemand services such as “exotic currencies” baht, yen and won, large safety deposit boxes not available in other branches, meeting spaces for retail clients, and a provision for clients with disabilities in the preferred banking section.

BPI hopes to expand the branch by another 179 sqm come December this year. By Alyssa Divina