THE RISE OF ‘KIDULT’ TREND

MINISO TRANSFORMS INTO A LIFESTYLE SUPER BRAND AFTER A DECADE IN THE INDUSTRY

ASIAN INSURERS’ AIREADINESS DICTATES THEIR COMPETITIVE ADVANTAGE

THREE WAYS RETAILERS CAN SERVE ‘BUDGETEERS’

GREAT EASTERN BUILDS 5 DIGITAL ECOSYSTEMS TO REACH INDONESIA’S UNINSURED

Vincent Huang Vice President MINISO

Vincent Huang Vice President MINISO

HOW GAR’S GOLDEN STRATEGY SHIELDS AGRIBUSINESS FROM GLOBAL SUPPLY CHAIN CHAOS

Issue No. 03 The Asian Business Review Display to 31 December 2023

The Asian Business Review is a regional magazine serving Asia’s dynamic business community. Essential coverage includes the economy, investment, manufacturing, technology, travel, and trade. It offers fresh perspectives and ideas to guide its readers through the challenges and complexities of their businesses, providing opinion and analysis on all areas of business to improve performance.

PUBLISHER & EDITOR-IN-CHIEF Tim Charlton EDITORIAL MANAGER Tessa Distor

PRINT PRODUCTION EDITOR Anna Mae Rodriguez

PRODUCTION TEAM Vann Villegas

Consuelo Marquez

Frances Gagua Ibnu Prabowo Charmaine Tadalan

GRAPHIC ARTISTS Simon Engracial Emilia Claudio

COMMERCIAL TEAM Janine Ballesteros

Jenelle Samantila

Cristina Mae Posadas

ADVERTISING Shairah Lambat shairah@charltonmediamail.com

AWARDS Julie Anne Nuñez awards@charltonmediamail.com

ADMINISTRATION Eucel Balala accounts@charltonmediamail.com

EDITORIAL asianbusinessreview@charltonmedia.com

SINGAPORE

101 Cecil St., #17-09 Tong Eng Building, Singapore 069533 +65 3158 1386

HONG KONG Room 1006, 10th Floor, 299 QRC, 287-299 Queen’s Road Central, Sheung Wan, Hong Kong +852 3972 7166

MIDDLE EAST

FDRK4467,Compass Building,Al Shohada Road, AL Hamra Industrial Zone-FZ,Ras Al Khaimah, United Arab Emirates

www.charltonmedia.com

PRINTING

Times Printers Private Limited 18 Tuas Avenue 5, Singapore 639342 www.timesprinters.com

a member of Times Publishing Limited

Can we help?

Editorial Enquiries: If you have a story idea or press release, please email our news editor at asianbusinessreview@charltonmedia.com To send a personal message to the editor, include the word “Tim” in the subject line. Media Partnerships: Please email asianbusinessreview@charltonmedia.com with “partnership” in the subject line.

Subscriptions: Please email subscriptions@charltonmedia.com.

The Asian Business Review is published by Charlton Media Group. All editorial contents are copyrighted and may not be reproduced without consent. Contributions are invited but copies of all work should be kept as The Asian Business Review can accept no responsibility for loss. We will however take the gains.

Sold on newstands in Singapore, Malaysia, Hong Kong, London, and New York. Also out in sbr.com.sg with online readership of 215,000 monthly unique visitors*.

*If you’re reading the small print you may be missing the big picture

FROM THE EDITOR

As MINISO marks its tenth anniversary, read the interview with its Vice President Vincent Huang on page 14, as he recounts the company's remarkable journey over the past decade. He also outlines the company's forward-thinking strategies, primarily focusing on consumer emotional engagement to stay ahead in fiercely competitive lifestyle retail space in the Southeast Asia.

On the consumer front, retailers are recalibrating selling and pricing strategies to cater to an emerging new wave of consumers dubbed "budgeteers." Dive into analysts' insights on page 10, where we explore how the retail market might adapt to meet the demands of this paradigm shift in consumer behaviour.

In the insurance market, Asia remains impenetrable to artificial intelligence (AI). Read the in-depth analysis on page 8, where experts discuss the challenges faced by Asian insurers in harnessing the potential of AI, along with action plans the region's insurance sector can adopt moving forward.

Celebrating resilience and innovation, pages 22 to 27 spotlight different business sectors in Malaysia, acknowledging their laudable adaptability amidst economic setbacks and global struggles, which have earned them accolades at this year's Asian Business Review Awards.

Read on and enjoy!

Tim Charlton

The Asian Business Reviewis a proud media partner and host of the following events and expos:

THE ASIAN BUSINESS REVIEW 1

2 THE ASIAN BUSINESS REVIEW INTERVIEW 12 Lippo Malls' CEO shares secrets for sustaining 70 malls in 40 cities 14 MINISO transforms into a lifestyle super brand after a decade in the industry 18 Great Eastern builds 5 digital ecosystems to reach Indonesia’s uninsured 20 How GAR’s golden strategy shields agribusiness from global supply chain chaos SINGAPORE BUSINESS REVIEW | MARCH 2018 Published Biannually by Charlton Media Group 101 Cecil St. #17-09 Tong Eng Building Singapore 069533 For the latest business news from Singapore visit the website asianbusinessreview.com CONTENTS 14 INTERVIEW MINISO TRANSFORMS INTO A LIFESTYLE SUPER BRAND AFTER A DECADE IN THE INDUSTRY INSURANCE ASIAN INSURERS’ AI-READINESS DICTATES THEIR COMPETITIVE ADVANTAGE 08 10 RETAIL THREE WAYS RETAILERS CAN SERVE ‘BUDGETEERS’ RETAIL INSURANCE FIRST 06 Physical stores catch up to e-commerce as spending shifts back to offline 07 No life and health insurance market is fully inclusive—Swiss Re study 10 Three ways retailers can serve ‘budgeteers’ 08 Asian insurers’ AI-readiness dictates their competitive advantage EVENT 22 Top companies recognised in Asian Business Review Malaysia Awards 2023 OPINION 46 Rethinking fintech growth with a product-led approach 48 Fuelling the future of finance with data streams

THE ASIAN BUSINESS REVIEW 3

Daily news from Asia

MOST READ

Time for businesses to go beyond WiFi and connect to Private 5G

When businesses rely on WiFi, they are at risk of not being able to make fast and accurate decisions in critical situations given its higher latency, meaning data is transferred and received slower than other types of connection. This risk can be eliminated if companies adopt a private 5G connection.

Does the future of banking lie in the metaverse?

The future of banking may just lie within the comforts of your home whilst you transport yourself into a digital world and your digital self discusses finance with your banking assistant. Global lenders have been reportedly snapping up virtual land on which to lay the seeds of their burgeoning digital empires.

Here are five bad habits in insurance according to HK’s insurance regulator

For a market ranking first globally in insurance penetration (Swiss Re Institute), it is surprising that Hong Kong’s insurance literacy rate stood only at 52%. In the 2022 Report on Insurance Literacy Tracking Survey (ILTS) in HK 2021 by the Insurance Authority (IA), the majority are moderately literate in terms of insurance.

Less than half of global losses due to calamities insured

Preliminary estimates show that the total direct economic losses from natural hazards in the first six months of 2023 amounted to $138b, according to a Gallagher Re report. Out of this, only $52b was covered by private or public insurance entities, leaving a substantial protection gap of $86b (63%).

Southeast Asia’s nuclear ambitions dashed by public opinion

After the nuclear disasters at Chernobyl in Russia and Fukushima Daiichi in Japan, nuclear power has had a negative lasting impact on public perception. Whilst some regions have been able to revive the use of nuclear energy, Southeast Asia has yet to see its first operational nuclear power plant (NPP).

ANEXT Bank’s Toh Su Mei on how to stay ahead of SMEs needs

Toh Su Mei, CEO of ANEXT Bank, recalls a time during the early days of her career when a former colleague made a data entry mistake in the bank record of a small and medium-sized enterprise (SME). “That seemingly small mistake ended up affecting the SME’s request and access to a credit line to fund his business operations.”

News from asianbusinessreview.com

INFORMATION TECHNOLOGY INSURANCE BANKING & FINANCE POWER INSURANCE RETAIL BANKING

Physical stores catch up to e-commerce as spending shifts back to offline

The battle between online and physical retail outlets sways in favour of the latter in the Asia Pacific, as CBRE highlighted that fewer than 5% of consumers shop purely online.

In its 2023 Asia Pacific Retail Flash Survey, CBRE found that nearly half of the retailers in the region expect a portion of online spending to be shifted to physical retail and 42% see that footfall in physical stores will return to its pre-pandemic levels.

“One very important fact is that fewer than 5% of consumers purely shop online. There is a huge range of hybrid shoppers, who have different shopping behaviour,” Ada Choi, CBRE’s head for occupier research and intelligence and management in APAC, told Asian Business Review. “This is also a challenge for the brands that have to cater to different shoppers’ behaviour switching between online and offline and be able to address those issues.”

CBRE found in the same survey that operating online retail platforms are increasingly becoming expensive, driven by higher transportation costs, supply chain disruptions, and labour shortages. In addition to this, Google has increased its cost-per-click fee by 15% in 2021 which was particularly detrimental to smaller retailers.

For these reasons, 66% of retailers project that it would be costly to operate online businesses this year. Moreover, 71% of retailers are planning to expand or add new stores in 2023, whilst only 15% have plans to right-size. “I think for the new generation of physical retail stores, they have to support online shopping, and fulfill other very interesting demand from the shoppers – Instagrammable or more social

media-friendly kind of elements,” said Choi. The CBRE survey also showed that whilst the younger generation is more tech-savvy, the majority of them are more likely to shop offline as they represent the market that looks out for potentially creative social media posts.

Choi added that interestingly, 61% of shoppers in the region prefer to see products in-store before ordering online, which she linked to the more condensed living environment in the Asia Pacific. This is also higher than in Europe and the Americas – yet another proof that physical stores are here to stay, she explained.

“It is easier for us to go to the shopping centres and take a look at the product… The reason for going to an offline store is always about expertise, the experience… and [because] they need to feel the product,” Choi said. “I think this also makes it very important for the retailers to continue to optimise their sales network and be able to assess their consumers in different parts of the market,” she added.

Retail investment outlook

Physical retail stores have started to stabilise in the latter part of 2022, and investments in the sector have improved. Choi, however, noted investment sentiments in retail are still behind other sectors, such as the office and industrial markets.

In this light, CBRE projected a “largely flat” investment volume during the year. “There are quite a lot of uncertainties. For example, the volatility in the financial markets, and the concerns about the banking sector. This will also affect the investment sentiment as a whole and therefore also the retail investment,” said Choi.

“Another investment driver is the interest rate environment. As we note, the US has had the steepest increase in interest rates in the past year. At this moment, people are expecting the interest rate to peak within the middle of this year and if this happens, the sentiment will improve after we hit that peak. Let’s hope for this to come earlier,” she added. Retail investments have been led by markets that reopened their borders early on, including Australia, Singapore, and Japan. Japan is amongst the most preferred markets as it is not affected by high-interest rates.

Also, Hong Kong may be in the running as it rebounds after reopening alongside Mainland China, added Choi.

6 THE ASIAN BUSINESS

FIRST

REVIEW

The younger generation is more likely to shop offline as they represent the market that looks out for potentially creative social media posts

E-COMMERCE

The reason for going to an offline store is always about expertise and the experience [to feel the product]

No life and health insurance market is fully inclusive--Swiss Re study

Although Japan’s life and health insurance was deemed accessible, insurers in the industry are found to be weak in terms of upskilling customers and innovating its underwriting spectrum.

A study by the Swiss Re Institute noted that Japan has an aggregate inclusion score of 0.66, just behind the United States, based on a survey that measured the inclusivity of L&H

markets on three dimensions: availability, accessibility, and affordability.

Japan was reportedly influential in making L&H insurance highly accessible to a broad spectrum of customers, evidenced by its novel approaches to distribution and a high life insurance penetration rate.

Consumers in advanced markets such as Japan experience fewer difficulties accessing

their L&H insurance services than those in emerging ones. “This is primarily driven by systemic factors like their financial markets being more established, leading to high levels of financial institution accountholding and credit usage,” Swiss Re stated in its report. However, they are somewhat weaker in providing skills development opportunities for insurance professionals, and innovation on the underwriting spectrum, creating a deficit in the availability dimension, Swiss Re said.

None fully inclusive

The Swiss Re Institute report, however, underscored that no L&H insurance market is “fully inclusive.” To make L&H insurance markets in both advanced and emerging countries inclusive, the Swiss Re Institute said that they must perform consumer-focused market research across all segments.

“By making L&H insurance more affordable, available, and accessible, individuals and households are better equipped to withstand the financial challenges that occur when a primary breadwinner passes away or when they incur high costs of healthcare treatments,” said Julien Descombes, head of Swiss Re Institute’s life and health products reinsurance.

DEEPWATER COMPLEXITIES

THE ASIAN BUSINESS REVIEW 7

INSURANCE

Japan has effectively made L&H insurance highly accessible

FIRST

Trust our expertise. Count on our capabilities.

Our experts, fabrication skills and agile assets make it happen.

NEW POSSIBILITIES

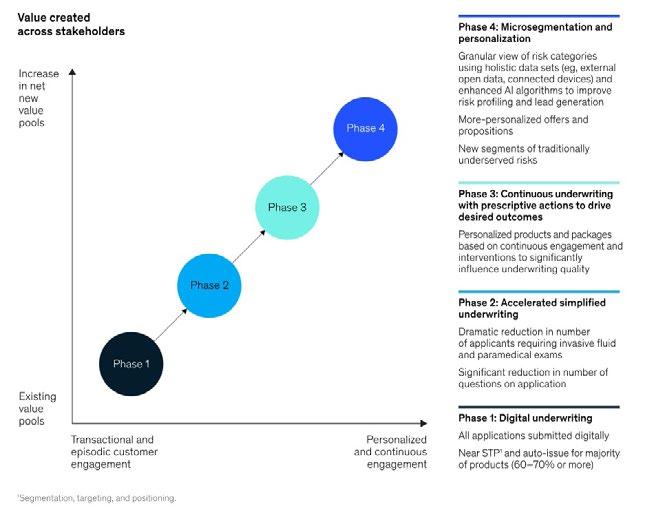

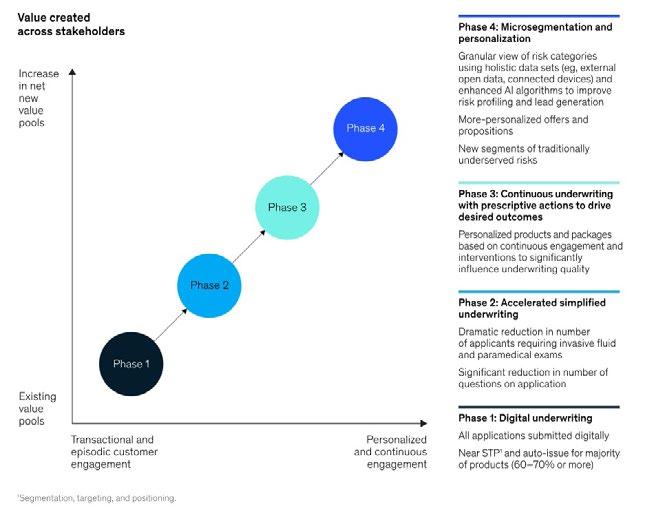

Asian insurers’ AI-readiness dictates their competitive advantage

Experts reveal why insurers that adapted AI earlier are now realising bigger extra earnings or cost reductions.

Insurers in Asia are ill-prepared to take a slice from the trilliondollar market value that artificial intelligence offers for the global insurance industry, McKinsey & Company’s analysts revealed.

“For most Asian insurance leaders, traditional organisational structures with multiple intermediaries and limited in-house tech and data resources make it difficult to visualise, let alone quantify, the potential benefits of investing more broadly in AI,” read a report by McKinsey’s Hong Kong Senior Partner Violet Chung, Singapore Consultant Pranav Jain, and Chennai Partner Karthi Purushothaman.

These legacy structures meant that insurers are missing out on the US$1.1t of annual value. Approximately US$400b of this could come from pricing, underwriting, and promotion technology upgrades. Another US$300b could come from AI-powered customer service and personalised offerings.

AI has been named by experts as amongst the biggest trends that will shape the insurance industry in the coming years. When applied in

For most Asian insurance leaders, traditional organisational structures make it difficult to visualise the potential of AI

tandem with human resource, AI’s ability to analyse data quickly and accurately will enable vast amounts of data to be leveraged in efficient and innovative ways. This is the main assertion of business management services company, Accenture, in its Insurance Industry 2023 Outlook.

“What generative AI finally presents for the industry is a very manageably actionable way to start balancing the efficiencies that they’re looking to gain with the experiences that consumers are increasingly demanding in the commercial and in the personal space,” Daria Sharman said in Accenture’s “Insurance News Analysis” segment.

“So when we think about — particularly, I talk about underwriting and the challenges of underwriting — and what generative AI finally does is, it gives underwriters and the actuaries of the world both a strategic and a tactical asset,” added the senior manager for insurance at digital agency, Accenture Song.

In the report “Insurer of the future: Are Asian insurers keeping up with AI advances?” McKinsey & Company noted that investment

in AI is increasingly becoming a source of competitive advantage amongst insurers.

Out of the 1,492 respondents surveyed in December 2022, insurers who reported the most significant gains from AI adoption – 20% or more earnings before interest and taxes – employed advanced AI practices, use cloud technologies, and spend efficiently on AI.

More notably, these companies are more likely than others to engage in a range of AI risk mitigation efforts.

Accenture Song’s Sharman echoed this sentiment. “From a risk assessment perspective on the strategy side, what generative AI does with the machine-learning algorithms is [that it] really speeds up that analysis of the data and leverages those algorithms to truly get to an accelerated predictive modeling capability for forecasting anything from just like a climate casualty to personal behaviour changes.”

Challenges for Asian insurers

Whilst some insurers have achieved select wins by implementing AI solutions within individual layers, the transformation required to achieve the full-stack capability that powers the companies mentioned above remains elusive in insurance, McKinsey’s Chung, Jain, and Purushothaman said.

“The first step is to determine how AI can support the organisation’s strategic goals and then assess the organisation’s current state of AI readiness across each of the four layers. A simple scoring methodology can help insurers identify their readiness on a scale from one to five for each layer, with stage five signifying the highest level of AI maturity,” the analysts said.

Another challenge, according to McKinsey & Co, is determining the optimal path forward depending on how far along they are in AI readiness.

To read the full story, go to https:// asianbusinessreview.com/

8 THE ASIAN BUSINESS REVIEW INSURANCE

ASIA PACIFIC

Source: McKinsey & Company

AI Enabled Insurer of the Future

GCash receives Great Place to Work certification

Forconsistently promoting the values of inclusivity, teamwork, and leadership in the workplace, leading mobile wallet GCash recently earned the Great Place to Work (GPTW) Certification after employees gave high scores to their employer and workplace. The GPTW annual research represents more than 12 million employees from thousands of organisations in over 50 countries.

“Here at GCash, our goal is not just financial inclusion, but inclusion in every possible way. This certification proves that GCash employees are highly motivated by the company’s ideals. Together, we have created tons of positive impact in the community, but remain humbled as there is always room for growth. A company that nurtures its employees develops a great culture and ultimately, an exceptional business, says GCash CEO Martha Sazon.

GCash scored highly in the categories of inclusivity, teamwork, and leadership behaviour with an impressive 88%, 84%, and 82% respectively. From the three

categories, employee sentiment revealed that they trust their leaders, are supportive of each other, and at the same time have the liberty to be themselves.

GCash understands the crucial role that leadership behaviour plays in shaping the organisational culture and employee experience. By aligning leaders’ behaviour with

the company’s strategy and values, GCash inspires and motivates its employees.

Commitment to Employee Well-Being

Furthermore, the survey revealed that 88% of GCash employees believe that the management promotes inclusive behaviour, avoids discrimination, and ensures fair appeals. Notably, 95% of employees stated that people within GCash are treated fairly, regardless of their sexual orientation.

GCash has also recently announced its new Life Partner Benefits programme which extends its comprehensive benefits to employees with LGBTQIA+ and domestic partners. Employees will only be required to submit minimal documents to enable them to declare their partners as their dependents, excluding a marriage certificate.

Additionally, 92% of GCash employees expressed satisfaction in their contributions to the community through their work; this reaffirms GCash’s efforts to effectively communicate its vision and values, creating a sense of purpose and direction amongst employees.

“GCash’s dedication to creating an exceptional workplace goes beyond individual rewards. Rather, it revolves around the trust employees have in their leaders,” said Robert Gonzales, GCash Chief People Officer.

PHILIPPINES TECHNOLOGY EXCELLENCE AWARD FOR E-WALLET - FINANCIAL TECHNOLOGY

Three ways retailers can serve ‘budgeteers’

A budgeteer is someone who is not willing to spend more than necessary.

Anew wave of consumers called budgeteers is reshaping retailers' selling and price strategies to cater for their new spending behaviour or “sustainability by proxy.” According to marketing firm Euromonitor International, it means consumers are choosing sustainable products that have minimal impact on the environment and opting for subscription-based models or repairing old items instead of buying new ones.

This trend is rapidly gaining popularity. Euromonitor identified in its study a gap between the majority of consumers (75%) not planning to increase spending and more than half of retailers (55%) looking to raise product price points to help their businesses survive.

Retailers, therefore, must meet budgeteers halfway. One way to do this is by giving a second life to a product that will help customers buy affordable items and be sustainable, according to Euromonitor International Research Consultant Sahiba Puri

Rewards programmes

First way is to develop rewards programmes. One example is IKEA Thailand’s buyback and reselling service, which developed in response to budgeteers’ behaviour. With millions of pre-owned furniture thrown in landfills, the furniture store is buying back used chairs, shelves, or chests of drawers from customers. In exchange for the used IKEA furniture, customers receive a gift card that allows them to buy new items in-store.

“In doing so, you’re offering your brand’s product at a more affordable price point so you’re already catering to a bigger audience. Second, you’re helping to extend the life of the product,” said Puri.

Ben Chien, AnyMind Managing Director in Greater China, said that sustainable supporters could advise people on how to keep preloved items last longer.

“There are affordable furniture stores that are very easy to build and use. But maybe their durability might not last as long. For example, some tables’ shelf life can last 20 years,’’ Chien, who oversees AnyMind’s Hong Kong, Taiwan, and Mainland China operations, told Asian Business Review.

Chien also suggested that brands can create a pre-owned programme that promotes second-hand products. One example is IKEA Singapore’s partnership with Carousell in April 2022, which extends the shelf life of its products through secondhand transactions or free-cycling on the Carousell marketplace. Customers then receive Carousell Protection vouchers or IKEA Family points.

As of 31 December 2022, an IKEA Singapore spokesperson told Asian Business Review. that over 6,754 IKEA family members and Carousell users participated in the rewards programme. IKEA furniture transactions grew by 30.5% since the programme began.

IKEA also said that buyers who might receive fake items or those unqualified for the listing can get a refund. The company aims to have 100% of all material sourced to be renewable or recycled by 2030. Carousell, widely known as a secondhand marketplace, has been doing the preloved business since 2012. In 2021, it posted $49.5m in

By offering renting options, you’re providing a level of flexibility

revenue and is focusing on being more profitable in the next three to four years.

Repairing and renting services

Another way retailers can serve budgeteers is by offering renting options or subscriptions. Consumers are also opting to repair their electronics instead of buying new ones, explained Puri.

“This way, you’re providing a level of flexibility to your consumer segment where they do not have to make a big ticket purchase or commit to a big ticket item,” said Puri.

“At the same time, they can use it regularly by paying a monthly subscription. They can still own this product for whatever amount of time they need,” added Puri.

One example is Bundlee, a baby clothes rental service in the UK. It offers subscription services to help parents rent baby clothes at a low price. Parents can save over US$319 (EUR300) whilst paying only US$41.60 (EUR39) for the Bundlee subscription services.

Bundlee’s business model reduces 86% of carbon emissions and 96% of water usage compared to the consumer going home with a new purchase from the store.

Balanced portfolio

Finally, businesses can tap preloved items to keep their businesses afloat whilst retaining their core products. Puri said even though budgeteers are on a tight budget, businesses do not necessarily need to trade off profitability in exchange for offering sustainable or second-hand products.

“It’s about the portfolio of products that you offer and how you best decide on which portfolios need to be brand new versus where you can include second-hand products,” said Puri.

She also suggested tapping Buy Now, Pay Later, a growing payment scheme used for the underserved audience.

Chien said second-hand trade has existed for a long time but it has evolved due to the ease of selling a preloved item with just a snap of a photo and finding a community making the product more hip. He added that the sustainability trend also came up, with younger generations driving up its popularity.

To read the full story, go to https://asianbusinessreview.com/

10 THE ASIAN BUSINESS REVIEW

Brands can create a pre-owned programme that promotes second-hand products

Sahiba Puri

RETAIL SINGAPORE

Ben Chien

Lippo Malls' CEO shares secrets for sustaining 70 malls in 40 cities

The mall has harnessed its team's 34 years of experience to adapt and offer unique retail landscape.

Lippo Malls Indonesia (LMI) stands at the forefront of the rapid changes in consumer preferences, as it adapts its mall spaces to cater to diverse demographic demands, thereby maintaining its prominence as the largest mall operator in the country.

“There is no ‘permanent’ trend where within three to four years we are trying to upgrade our mall,” Lippo Malls CEO Henry Riady told Asian Business Review

Describing their approach, LMI tailors each mall to the specific needs of the city.

As Riady puts it, “Each city has a different concept, but the most important thing is that it is unique and capable of becoming a destination.”

During the height of pandemic, for instance, Riady recalled how people sought for large open space areas. However, this preference was short-lived; as the pandemic subsided, the comfort of indoor spaces once again became appealing.

Currently, Riady observes a shift; gone are the days when people visited the mall solely to shop. Hence, malls are aiming provide a richer experience for visitors by presenting a variety of exciting entertainment and food and beverage (F&B) options.

As fashion trends resurged, LMI had to improve the mall experience, making the visitors feel they were in the right place to embody their lifestyle. To achieve this, Riady explained that they had to change from zoning based on product and services categories to zoning based on the people’s lifestyle patterns.

“In the past, it was like restaurants being one or entertainment being one. Now, restaurants can be in one area, for example with the area of toys or hobbies, where these things can be in line based on [people’s] lifestyle,” Riady told Asian Business Review

With this shift, people now visit malls for different reasons, such as attending events often held at LMI, without feeling pressured to spend.

Currently, LMI operates 70 malls throughout Indonesia, spread across 40 cities. They manage more than 3 million square metres (sqm) of gross area and have 13,000 tenants across their malls.

Malls are spread across Greater Jakarta, Bandung, East Java, Central Java, North Sumatra, South Sumatra, and Eastern Indonesia such as Makassar, Manado, Bali and Kupang.

Adjusting to demographics

LMI observes that trends in every mall vary. Hence, the layout of each LMI is different from one another. “It could be that the capacity of the F&B, entertainment, or fashion areas are not the same from one mall to another,” Riady said. However, LMI strives to maintain one image — that it is a mall for families. In living up to that, Henry explained that LMI is not intended for just one segment. This point is illustrated well by the locations of LMI malls, which are mainly near the housing area and have different grades ranging from high to middle to low. Then, locations with a

higher level of people’s purchasing power will feature more upscale malls.

In some cities where going to the mall is not yet part of the daily routine, the CEO said that LMI is making a breakthrough in those cities by offering certain brands or retailers. “With 34 years of experience with our team, who are also very experienced, we can overcome the challenge of always being able to adapt,” Riady asserted.

Strategy and flagships

To provide unique experiences from one mall to another, Riady noted that the special strategy is to work with retailers that are not found in other malls. “We want each location to have something different,” he explained.

He cited Starbucks as an example retailer that understands the strategy as it embodies different concepts for its outlets to match the specific surrounding market. There are concepts that are aimed more at young people and concepts that appeal to more mature customers.

Adding to this, one of the LMI’s flagships is the mall located at Senayan Park (Spark), right at the centre of the capital city of Jakarta. It was designed to be a landmark to contribute flair to the evolving urban landscape. “It’s not just like a boxshaped area, but here it has an open space area,” Riady said. Lippo Malls Spark was launched before the pandemic. So it can be said that LMI already had a mall concept with open spaces before this trend took place.

12 THE ASIAN BUSINESS REVIEW CEO INTERVIEW

We want each location to have something different

The most important thing is that [each city] is capable of becoming a destination

INDONESIA

(Photo: Henry Riady, Chief Executive Officer, Lippo Malls Indonesia)

SCAN FOR FULL STORY

THE ASIAN BUSINESS REVIEW 13 stc.com.bh let's go. further.

MINISO transforms into a lifestyle super brand after a decade in the industry

The China-based retailer has over 5,400 stores, of which more than 2,000 are in global markets, and it’s still growing.

Lifestyle retailer MINISO has reached a milestone as it celebrates its 10th anniversary this year. This is thanks to the brand’s adaptability in coming up with new products aligned with the prevailing consumer trends, and its continued global expansion.

The company’s growth does not stop here as it now plans to transform into a lifestyle super brand “that brings joy to consumers around the world.”

“The competition amongst lifestyle retailers is getting fiercer, especially in Southeast Asian markets where we saw many newcomers and emerging lifestyle brands. As a result, MINISO has to keep upgrading and innovating to stay ahead of the competition,” Vincent Huang, Vice President of MINISO’s Overseas Business Department, told Asian Business Review

To achieve this goal, MINISO will put focus on design and innovation, and come up with products that will appeal to the emotions of its customers. Huang also shared how the company performed in the past decade and what’s in store for the company this year.

Can you share with us your story and the lessons you learned in the past decade?

There are three lessons I’d like to share with you. First of all, globalisation is the right way to go and MINISO has shown a proven record of success by having over 5,400 stores globally. More than 2,000 stores are in the overseas markets. 2022 was a successful year for MINISO. We’ve recorded total revenue of over US$1.4b and hit a couple of milestones. Last February 2022, MINISO opened its first New York City store in SoHo Manhattan. In August, MINISO India celebrated 200 local stores. In September 2022, we celebrated the opening of its 2,000th overseas store in Lyon, France. MINISO has come a long way since its founding. In the past 10 years, MINISO reaped a billion consumers around the world. In 2020, MINISO was listed on the New York Stock Exchange and in 2022, publicly listed on Hong Kong Stock Exchange. Secondly, consumers only pay for the brand’s professionalism. MINISO is responsive to new consumer trends and adaptive to consumers’ new preferences. We act fast and launch new and innovative products frequently to keep consumers excited.

Last but not least, reliable partnerships are key to success. At MINISO, we not only work with capable suppliers but also with retail partners, franchisees, distributors, and intellectual property licensors. Some of our partnerships are already decade-long and we thank all of our partners who have grown with MINISO and will continue to do so in the coming years.

How has MINISO overcome past mistakes? Is there anything you would have done differently?

Over the past few years, we examined the top-performing stores in different markets and we found that a rich and diverse product portfolio and highly frequent launching of

The competition amongst lifestyle retailers is getting fiercer

new products are the key to the success of MINISO stores. Only by doing so, customers will always find something new when they visit our store and come back to check out our latest offerings. If our local partners want to achieve this, they must have a very professional and experienced commodity team. In the past, we only trained their commodity team for one or two months because at that time we were developing very fast. But if you ask me what I would have done differently, I think I would have them take our commodity training programme for at least six months.

What are the trends and challenges you expect to emerge in the lifestyle industry this year?

We realise that the global toy market demonstrates strong momentum. The rise of “kidult” has proven that toys are not only for kids but for everyone, with collectibles being one of the most sought-out categories for kidults. This trend led to an over 100% increase in the sales record of MINISO blind box collectibles last year. The other trend I’ve observed is that the accessories, skincare, and makeup products bounce back. In 2023, as people get back to activities and embrace the outdoor experience, spending on accessories and cosmetic products experiences a rise, too. To answer this trend, we opened a brand-new accessories warehouse in China, spanning over 7,500 square metre (sq m) and set up dedicated zones in the store for accessories, beauty, and personal care products.

14 THE ASIAN BUSINESS REVIEW

ASIA PACIFIC

A rich and diverse product portfolio and highly frequent launching of new products are the key to the success of MINISO (Photo: Vincent Huang, Vice President, MINISO)

INTERVIEW

SCAN FOR FULL STORY

Cynosure redefines aesthetic healthcare technology with groundbreaking innovations

The field of medical aesthetics has witnessed extraordinary advancements in recent years, with Cynosure Aesthetic and Medical APAC Services Pte. Ltd. at the forefront of shaping and driving these cuttingedge technologies.

The renowned company’s dedication to research and development has yielded groundbreaking industry “firsts,” revolutionising clinical outcomes and patient experiences.

Furthermore, Cynosure pioneered picosecond laser technology for aesthetic use with the launch of Picosure, the first 755nm picosecond laser FDA-approved for treating pigmented lesions. More recently, PicoSure® Pro received FDA approval for treating melasma pigment, further cementing Cynosure’s position as a true industry trailblazer.

Cynosure’s contributions to the industry have been recognised in prestigious award programmes, including the SBR Technology Excellence Awards and the SBR International Business Awards, where it took home the Machine - Healthcare Technology and Healthcare Technology wins, respectively.

Precision and reliability to ensure optimal treatment results

In the realm of medical and aesthetic procedures, precision and accuracy are paramount. Cynosure ensures the reliability and consistency of its technologies by placing a strong emphasis on research and clinical outcomes. Cynosure’s technology has been proven effective time and again. The Picosure®, for instance, boasts more than 117 papers and over 1 million successful treatments around the world, underscoring its reliability and effectiveness.

Amidst a dynamic and competitive industry landscape, Cynosure thrives by fostering a culture of innovation. By closely collaborating with practitioners and medical experts, the company gains crucial insights into ever-evolving trends in treatment and patient expectations. “As our valued partners, we work hand in hand with them to improve patient outcomes, delivering a patient-first approach,” Bebe Teo, Cynosure’s SVP of Asia Pacific and Commercial Excellence, explained. Meanwhile, Cynosure’s Prestige and Signature partnership programme focuses on personalising patient

experiences. This is whilst the company continues to innovate through its EDB technology solutions to help clinics stay at the forefront of industry developments.

Empowering lives and unlocking confidence

As a global leader in aesthetic energy-based devices, Cynosure’s technologies have left an impact on patients, practitioners, and industries worldwide. Beyond visibly improving skin quality, tone, and texture, the transformative power of Cynosure’s technology lies in its ability to boost patients’ self-confidence and mental well-being.

Bebe highlighted the case of Dr Teppei Sakai in Japan, where a patient suffered from depression due to pronounced pigmentation on the face. The patient experienced not just a physical transformation but also a change in mental state after a series of Picosure treatments that cleared the pigmentation. Witnessing such uplifting success stories drives Cynosure to unlock more treatments and continuously innovate. “This is why, at Cynosure, we believe our technology has the potential to help unlock beautiful energy within everyone by working at a level that goes beyond just skin,” Bebe said.

Looking ahead, Cynosure remains committed to pushing the boundaries of medical aesthetics. Collaboration with practitioners, active feedback collection from

medical professionals and their patients, and an unwavering focus on patient needs are factors that form the bedrock of the company’s future endeavours.

“We are always interested to learn how our customers are using Cynosure and other technology, what they like or dislike, and importantly, what their patients are asking for and prefer,” notes Nadav Tomer, the CEO of Cynosure.

As patients embrace their post-pandemic freedom, the demand for non-invasive treatments with minimal downtime is growing. Cynosure’s upcoming projects and innovations will cater to this need, aiming to provide practitioners and their clinics with faster yet equally safe and effective treatments.

Cynosure’s spirit and commitment to innovation have propelled it to the forefront of the medical aesthetics industry. With a legacy of “firsts” and a global impact on many patients’ lives, Cynosure continues to illuminate the path towards a more confident and beautiful future for everyone.

THE ASIAN BUSINESS REVIEW 15

Bebe Teo, SVP of Asia Pacific and Commercial Excellence

2023 MACHINE - HEALTHCARE TECHNOLOGY HEALTHCARE TECHNOLOGY

Nadav Tomer, CEO of Cynosure

The company’s commitment to research and clinical evidence ensures the reliability and consistency of its technologies.

We are always interested to learn how our customers are using Cynosure and other technology, what they like or dislike, and importantly, what their patients are asking for and prefer

INDONESIA TECHNOLOGY EXCELLENCE AWARD FOR AUGMENTED REALITY AND VIRTUAL REALITY - TECHNOLOGY

WIR Group Drives Digital Transformation in the Philippines with Immersive Technology and Web3

sector which is one of SM Group’s focuses. Within the discussion, WIR Group is expected to provide their expertise and experience in the development of immersive technology and web3 to support SM Group in targeting the wider Philippine market.

Immersive Advertising Solutions

WIR Group, the leading immersive technology and web3 company focusing on Augmented Reality (AR), Virtual Reality (VR) and Artificial Intelligence (AI) in Southeast Asia was invited by the Philippine business sector to explore the implementation of WIR Group’s technology within the country.

During one of the agendas, WIR Group was welcomed by Frederick Go, Philippine Presidential Advisor for Investment and Economic Affairs, at the Malacanang Presidential Palace. The purpose of the visit was to discuss digital transformation initiatives and explore various technology solutions that could be applied in the Philippines. At the meeting, Frederick Go gave his full support to WIR Group’s efforts in supporting digitalisation and strengthening the technology ecosystem in the Philippines.

This support serves as a green light from the government to go forth in pursuing collaborations between WIR Group and various business sectors in the Philippines in advancing digital transformation.

Strategic Collaboration

To establish a strong partnership, WIR Group is joined by Orbos Consulting and Advisory Group OPC (ORCA), a management consulting and advisory firm based in the Philippines, as a strategic partner. The purpose of this collaboration is to work hand-in-hand with each other in navigating and expanding into the right target market in the Philippines. Furthermore, WIR Group also met with other key players such as SM Group, one of the leading conglomerate companies in the Philippines to explore the use of WIR Group’s technology solutions in the retail and property

Another collaboration that was formalised during WIR Group’s visit was the signing of an MoU with AdSpark Inc., a company engaged in advertising and digital media business and is part of Globe Group’s portfolio companies of AdTech and data businesses: Brave Connective Holdings, Inc. under 917Ventures, the largest corporate incubator in the Philippines, wholly owned by Globe Telecom Inc., one of the leading telecommunications service providers from the Philippines.

Through this collaboration, WIR Group is envisioned to strengthen AdSpark’s digital ecosystem through various AI, AR and VR-based technology solutions. By utilising AR technology, AdSpark can provide a more immersive and interactive experience through visually enhanced content. Whilst, the use of AI technology can assist AdSpark in obtaining analytical data to gain deeper insights into customer preferences and needs from the ads created.

“Our collaboration with WIR Group is a strategic step to bring leading adtech solutions in the market. WIR Group has had numerous projects originating from various countries. We are confident that the immersive technology solutions of WIR Group will enrich our creativity in creating ads and enhance AdSpark’s offerings in providing cutting-edge adtech solutions and digital media services to customers,” said John Louie Erestain, COO of AdSpark.

Gupta Sitorus, Group Chief Sales & Marketing of WIR Group added “We hope that the opportunity given to WIR Group in this visit to the Philippines will be a new achievement for the Indonesian company. It will prove that the immersive technology solutions developed by Indonesians can be accepted internationally. We are committed to continuing presenting technological innovations that drive business growth and expand Indonesia’s global influence in the digital field. With this collaboration, we are optimistic that we can achieve great results in creating a sustainable digital ecosystem that provides tangible benefits to various business sectors in the Philippines and the Filipino people at large,” concluded Gupta.

16 THE ASIAN BUSINESS REVIEW

We are committed to continuing presenting technological innovations that drive business growth and expand Indonesia’s global influence in the digital field

WIR Group at the Malacanang Presidential Palace, The Philippines

Mindstores AR&Co

Great Eastern builds 5 digital ecosystems to reach Indonesia’s uninsured

This effort succeeded in optimising their financial performance with a net profit of US$2.04m (IDR31b).

Great Eastern Life Indonesia is touting five comprehensive digital ecosystems that it hopes will make insurance more accessible to the Indonesian population. “One of the steps we are taking is to utilise technology so that customers can have additional options to connect with us digitally,” President Director Clement Lien Cheong Kiat told Asian Business Review.

Over 90% of individuals in Indonesia remain uninsured, according to Great Eastern, making the market an untapped resource that the company is keen to onboard.

To attract customers, Great Eastern said that it created a comprehensive digitisation process, from customer onboarding to after sales service. This is in line with Indonesian Life Insurance Association (AAJI) call to prioritise easy access for the public to obtain insurance products and services with the principles of customer centricity, customer protection, and digital experience.

Five digital ecosystems

First making its steps in digital transformation five years ago, Great Eastern has since built five digital ecosystems. The first, called the GoGREAT! Services Customer Portal, is an individual insurance portal that enables customers to make Fund Switches (for customers with unit-linked policies), view policy information and insurance benefits, view personal information, change the frequency of premium payments, change premium payment methods, download transaction reports, e-policies, as well as e-endorsements.

Second is the GoGREAT! Sales Website, which is the insurer’s portal for purchasing insurance online.

There is also the Great Eastern Corporate-ID (GEC-ID) application for group insurance customers. "Through this application, customers can view benefit details, claim history, submit e-claims, consult online doctors, and make appointments with doctors," said Cheong Kiat.

Fourth is the HR/Broker Portal for group insurance customers. This is where corporate and HR clients of the insurer can manage dashboards, view insurance benefit details, view participant information, add and/or remove participants, and manage premium bills and excess claims.

The final ecosystem, named Great Advice, is a mobile point-of-sales for Great Eastern Life Indonesia’s marketing staff and financial advisors. Through Great Advice, financial advisors can input life insurance requests online, making it more convenient for them to onboard new customers in the ecosystem.

“We have provided various easiness for customers to connect with us. Customers can access their policies on the Customer Portal in just 3 easy steps: enter their KTP/ Passport number, enter the Policy Holder's Date of Birth, and enter the One Time Password (OTP) sent to the customer's mobile number," said Cheong Kiat.

Cheong Kiat added that through these five portals, customers can avoid the risk of losing transaction submission documents.

Closing inclusion-literacy gap

Great Eastern, however, had also recognised that just touting the easiness of their five ecosystems is not enough.

Indonesia’s Financial Literacy and Inclusion Survey (SNLIK) in 2022 found that there remains a large gap between the financial literacy index (49.68%) and the financial inclusion (85.10%). This meant that out of every 100 Indonesians, there are 85 people who now use financial products and services—but only 49 correctly understand what the products and services are.

Therefore, apart from creating easy access for customers, Great Eastern Life Indonesia also educates the public through various financial literacy class programs to help customers understand financial planning.

Great Eastern Life Indonesia has also unveiled a program to help customers understand which insurance products better suits their needs and financial goals.

“Each product is designed according to different needs. The main key is identifying the right product so that customers can meet their needs," Cheong Kiat stated.

He believes that Great Eastern’s five ecosystems and financial inclusion drive will bring more positive impact on business growth, since the digital transformation can be correctly understood and accessed by public.

“When we identify something that we can improve through digital solutions, we will actively develop it to ensure our customer experience remains good,” Cheong Kiat concluded.

18 THE ASIAN BUSINESS REVIEW

Each product is designed according to different needs

INDONESIA

Great Eastern also educates the public through various financial literacy class programs (Photo courtesy of Great Eastern )

INTERVIEW

THE ASIAN BUSINESS REVIEW 19

the world’s #1 insurer for all .

Allfor # And

allianzpnblife.ph

INTERVIEW

How GAR’s golden strategy shields agribusiness from global supply chain chaos

GAR utilises shipping partnerships and expanded logistics to mitigate supply chain disruptions.

Experts predict that the supply chain disruption will not resolve anytime soon due to persistent irregularities in the flow of raw goods because of geopolitical tensions. However, one agribusiness company managed to stay one step ahead and used existing resources to grow its business. Capitalising on long-standing partnerships and established logistics facilities, SGX-listed Golden Agri-Resources' (GAR) head of investor relations, Richard Fung, said their firm’s supply chain was “barely” affected by the Ukraine-Russia war thanks to their shipping facilities and partnership with Stena Bulk from Scandinavia, which has had a joint venture with GAR, Golden Agri-Stena, since 2013.

“[Golden Agri-Stena] helps us to be more independent in terms of being able to distribute our products so that when the Ukraine conflict started, we were well-prepared and saw a limited impact on our operations,” said Fung.

Aside from Stena, GAR has joint ventures with GSB Tankers and Sinar Mas LDA Maritime.

Data from its website showed that GAR shipped over 4 million metric tonnes of cargo in 2020 and delivered cargo to 45 ports worldwide.

GAR’s chartering arm, Golden-Agri Maritime, had prepared them for transportation needs such as shipping, trade, and distribution of its products to local and export markets. The company also operates an extensive distribution and logistics network in Europe, encompassing shipping, freight, and warehousing facilities, as well as dedicated storage terminals or warehouses in Italy, Spain, the Netherlands, Bulgaria, Romania, and Colombia.

Indonesia’s ban

GAR’s logistics facilities also helped counter Indonesia’s export ban on crude palm oil, one of the top products that GAR produces. The restriction was imposed in April 2022 to improve the accessibility and affordability of cooking oil in the Indonesian market. Despite this, GAR did so well because of its global distribution network.

“During the ban, we could continue to serve our international clients from our overseas inventories” explained Fung. The ban also had little effect on GAR since it exported higher value-added products unfazed by the export restriction such as specialty fats, oleochemicals, and biodiesel.

“Historically, the company was initially very much focused on upstream operations, but as volumes expanded, we realised that we needed full vertical integration, so we will not become too dependent on our off-takers,” Fung explained.

This 2023, the company is again embattled by the newest restriction that the Indonesian government imposed against palm oil exports. Exporters were allowed to ship six times their domestic sales volume, down from eight times domestic sales before January 2023. The country also suspended the majority of its palm oil export permits until the end of April to boost domestic supplies. GAR said it is complying with the government’s strict rules by balancing its

export of palm oil. For every six tonnes sold for export, GAR provides one tonne for the domestic market.

On the suspension of permits, the agribusiness said it has enough export permits to serve its international customers during the suspension period.

GAR’s net profit grew 1% to S$528m (US$392m) in the second half of 2022, supported by the company’s downstream earnings.

When GAR left the High Carbon Stock Approach (HCSA), environmental groups accused the firm of weakening its stance on “no deforestation.” GAR is one of the biggest supporters of the HCSA methodology, as one of the founders.

Anita Neville, GAR’s chief sustainability and communications officer, said they may have ended the membership but did not halt the support for the HCSA methodology across its supply chain.

To date, GAR conserves 79,000 hectares of high conservation value (HCV) and high carbon stock (HCS) areas. GAR is backing suppliers in conserving 117,000ha of HCV and HCS areas. In a March brokerage report, Malaysian-based RHB Bank’s overall ESG score for GAR was 2.67 out of 4. It mentioned that GAR reduced greenhouse gas emissions intensity by 25%.

“The company has continuously rolled out conservation planning programmes and, in 2019, set aside over 7,700 ha of HCS forests for conservation,” RHB analysts said.

RHB cited that GAR partnered with major palm oil producers and buyers to develop a new radar-based forest monitoring system to oversee deforestation as it happens in near-real-time.

20 THE ASIAN BUSINESS REVIEW

GAR has joint ventures with GSB Tankers and Sinar Mas LDA Maritime (Photo from GoldenAgri.com.sg)

Richard Fung

Anita Neville

SCAN FOR FULL STORY

SINGAPORE

How Boost evolved into a regional full-spectrum fintech player

The

Last year, Malaysia’s financial services landscape experienced a seismic shift when its central bank announced five successful digital bank licence applicants. At the top of the soon-to-be digital bank list1, is Boost, the fintech arm of Axiata.

The Origin of Boost

In 2017, Boost was one of the first local eWallets that popularised QR code payments. As digital demands grew, Boost’s eWallet also expanded, to become an allin-one fintech app that simplifies offline cashless payments, online transactions, bill

management, and so much more.

On the other hand, the same goes for its merchant solutions platform. Through Boost, MSMEs can not only seamlessly and affordably digitalise their business, but also expand their reach, optimise cash flow, gain business insights, and more.

Fast Forward to Boost’s Fintech Frontier

Having established a trusted household name amongst Malaysians, Boost then became the official brand that consolidated the previously segmented fintech services across Axiata Digital2. This development resulted in the creation of Boost’s holistic fintech ecosystem, which now also includes the AI-based micro-financing business and cross-border payments.

As of early 2023, Boost’s Gross Transactional Value (GTV) reached RM1.5 billion, its all-in-one fintech app users grew

to over 10 million, whilst its merchant touchpoints reached over 600,000. Its cross-border payments have also attracted over 100 global digital partners in Southeast Asia. Most importantly, since its inception, Boost’s AI-based micro-financing business accumulated over RM3b in financing disbursed across Malaysia and Indonesia.

The Venture into Digital Banking

Boost’s evolution into a full spectrum fintech brand came full circle after it secured the digital bank licence. Now equipped with a fully built fintech ecosystem and track record of excellence, Boost stands ready to pave the way for the next great frontier of the fintech industry.

1 https://www.bnm.gov.my/-/digital-bank-5-licences

2https://www.marketing-interactive.com/axiata-digitals-boostholdings-rebrands-to-unify-fintech-services

THE ASIAN BUSINESS REVIEW 21

company secures digital bank licence and expands its comprehensive fintech ecosystem.

DIGITAL - FINANCIAL TECHNOLOGY

Now equipped with a fully built fintech ecosystem and track record of excellence, Boost stands ready to pave the way for the next great frontier of the fintech industry

AWARDS

Top companies recognised in Asian Business Review Malaysia Awards 2023

Many companies in Malaysia have adeptly shifted strategies to continue operating, whilst others have risen and thrived amidst the challenges. To honour such resilience, the Asian Business Review presented the Malaysia International Business Awards, Malaysia National Business Awards, and the Malaysia Technology Excellence Awards 2023. These awards celebrate the organisations’ remarkable milestones and contributions to Malaysia’s economic growth. This year’s entries for the Malaysia Technology Excellence Awards 2023 were evaluated by a panel consisting of Alvin Gan Partner, Head of Management Consulting at KPMG in Malaysia; Michael Lim Jr,

Malaysia National BusinessAwards 2023

Affin Bank Berhad

Financial Services

Bason Group Holdings Sdn Bhd

Food & Beverage

Creative Factory Painting Sdn Bhd

Arts & Lifestyle

Eco-shop Marketing Sdn Bhd

Retail

Gameka Sdn Bhd

Training and Development

Kenanga Investment Bank Berhad

Investment Banking

KPJ Healthcare Berhad

Health Products & Services

Konoha Pte Ltd

Marketing

Marksan Co. Limited

Engineering

Senja Aman Holdings Sdn Bhd

Hospitality & Leisure

MalaysiaInternationalBusinessAwards2023

Adient Automotive Holding (M) Sdn Bhd

Automotive Services

Air Liquide APAC Global Services

Chemicals

Exyte Malaysia Sdn Bhd

Industrial Construction

McDermott

Marine and Offshore Engineering

OCBC Bank (Malaysia) Berhad

Banking

Perfios Software Solutions Private Limited

Credit Solutions Technology

Webhelp Malaysia Sdn.Bhd.

Business Services

Managing Director at Crowe Growth Consulting; and Justin Ong, Partner and FSI Financial and Regulatory Risk Leader at Deloitte. Meanwhile, nominations for the Malaysia International Business Awards and Malaysia National Business Awards 2023 were judged by Ngu Heng Sing, Executive Director, Transaction Services, Deal Advisory at KPMG in Malaysia; Dato’ Robert Teo, Managing Partner at RSM Malaysia PLT; and Tan Chin Teck, Executive Director, Tax at. BDO Malaysia. These exemplary companies were celebrated on May 8 at the Intercontinental Kuala Lumpur with an awards dinner. See the full list of winners here.

MalaysiaTechnologyExcellenceAwards2023

Agensi Kaunseling dan Pengurusan Kredit (AKPK)

Fintech Education - Financial Services

AGTC Genomics

Medical Technology - Healthcare Technology

Air Liquide APAC Global Services

Automation - Chemicals

Data Management - Chemicals

Al Rajhi Banking & Investment Corporation (Malaysia) Bhd

Fintech - Retail Banking

Alliance Bank

Fintech - Banking

Malaysia Berhad

Fintech - Financial Services

AmBank (M) Sdn Bhd

Automation - Banking

Appier

AI - Retail

BAC Education Sdn Bhd

Online Services - Education

Baker Hughes Services (Malaysia) Sdn Bhd

Automation - Business Services

BIGLIFE Sdn. Bhd.

API - Airline

Billion Prima Sdn Bhd

Security Technology - Cargo Handling

Boost

Digital - Financial Technology

Boustead Properties Bhd

Smart City - Real Estate

CelcomDigi Berhad

RegTech - Telecommunications

Cloud Mile Sdn Bhd

Cloud - Transportation

CTOS Digital Berhad

RegTech - Financial Technology

Event Plus (M) Sdn Bhd

Digital - Advertising

22

EVENT: ABR MALAYSIA

THE ASIAN BUSINESS REVIEW

Extreme Broadband

Connectivity - Financial Services

Fusionex Group

AI - Logistics

Gleneagles Hospital Kuala Lumpur

Medical Technology - Healthcare

Hong Leong Assurance Berhad

Insurtech - Life Insurance

Kenanga Investment Bank Berhad

Fintech - Investment Banking

Kerry Group

Learning and Development Technology - Manufacturing

KG Information Systems Pvt. Ltd (KGISL)

Robotics - IT Services

LexisNexis Southeast Asia

Legal Tech - Legal

Magnum Corporation Sdn. Bhd.

Automation - Retail

Maybank Group

Digital - Banking

E-Wallet - Banking

Novartis Malaysia

Analytics - Pharmaceuticals

OKG Global Business Services (GBS) Centre

AI - Financial Technology

Perfios Software Solutions Private Limited

Insurtech - IT Services

Petroliam Nasional Berhad (PETRONAS)

AI - Energy

Petroliam Nasional Berhad (PETRONAS)

AI - Oil & Gas

Automation - Oil & Gas

Big Data - Oil & Gas

Pos Malaysia Berhard

Software - Logistics

Qashier Malaysia

Emerging Technology - Business Services

Securelytics Sdn Bhd

Cybersecurity - IT Services

Sharp Electronics (Malaysia) Sdn. Bhd.

Learning and Development Technology - Technology

Shell Business Service Centre Malaysia

Automation - Energy

Learning and Development Technology - Energy

Shinjiru Technology Sdn. Bhd

Data Centre - IT Services

Telekom Research & Development Sdn Bhd

Digital - Utilities

Theta Edge Berhad

Software - IT Services

Touch ‘n Go Sdn. Bhd.

E-Wallet - Financial Technology

Fintech - Financial Technology

UCSI Education Sdn. Bhd.

Emerging Technology - Renewable Energy

Manufacturing Technology - Food Manufacturing Solutions

UOB Innovation Hub 2 Sdn Bhd

Digital - Financial Services

ZUS Coffee

E-Commerce - Food & Beverage

Affin Bank Berhad

THE ASIAN BUSINESS REVIEW 23

Gameka Sdn Bhd

Kenanga Investment Bank Berhad

Senja Aman Holdings Sdn Bhd

EVENT: ABR MALAYSIA AWARDS

24 THE ASIAN BUSINESS REVIEW

Air Liquide APAC Global Services

Exyte Malaysia Sdn Bhd

McDermott

OCBC Bank (Malaysia) Berhad

Agensi Kaunseling dan Pengurusan Kredit (AKPK)

AGTC Genomics

Al Rajhi Banking & Investment Corporation (Malaysia) Bhd Alliance Bank Malaysia Berhad

THE ASIAN BUSINESS REVIEW 25

Appier

BAC Education Sdn Bhd

BIGLIFE Sdn. Bhd.

Billion Prima Sdn Bhd Boost

Cloud Mile Sdn Bhd

CTOS Digital Berhad Event Plus (M) Sdn Bhd

Extreme Broadband

Fusionex Group

Gleneagles Hospital Kuala Lumpur

EVENT: ABR MALAYSIA AWARDS

26 THE ASIAN BUSINESS REVIEW

Kerry Group

LexisNexis Southeast Asia

Magnum Corporation Sdn. Bhd.

Novartis Malaysia

OKG Global Business Services (GBS) Centre

Petroliam Nasional Berhad (PETRONAS)

Petroliam Nasional Berhad (PETRONAS)

Shell Business Service Centre Malaysia

THE ASIAN BUSINESS REVIEW 27

Telekom Research & Development Sdn Bhd

Theta Edge Berhad

Touch ‘n Go Sdn. Bhd.

UOB Innovation Hub 2 Sdn Bhd

ZUS Coffee

Petroliam Nasional Berhad (PETRONAS)

Petroliam Nasional Berhad (PETRONAS)

Optimising Operations: Machine Learning in PETRONAS Gas Berhad’s GTOPS Platform

The GTOPS platform transforms PETRONAS’ operations by optimising fuel gas consumption and enhancing efficiency, through data-driven decision-making and advanced analytics.

In pursuit of operational excellence, PETRONAS Gas Berhad (PGB) has embraced machine learning technology to optimise fuel gas consumption and enhance compressor efficiency. The Gas Transmission Optimisation (GTOPS) platform, implemented by the PETRONAS Gas Control Centre (PGCC), serves as an advisory dashboard, leveraging data-driven decision-making and users’ tacit knowledge. This article delves into the inner workings of GTOPS’ machine learning operations, explores the challenges faced during its development and deployment, highlights its unique features and functionality, examines its impact on dayto-day operations, and discusses the future role of machine learning in PGB.

This initiative to integrate machine learning operations into the GTOPS platform aims to optimise fuel gas consumption and improve compressor efficiency. Recognising the potential for lower energy consumption, through load shifting towards compressor stations with higher efficiency, has led the

PGCC to implement the machine learningbased advisory dashboard in 2022.

To develop the platform, the project team consolidated various datasets through exploratory data analysis, examining data quality, structure, and insights. This allowed them to gain significant data model regression through continuous iterations and improvements via extensive discussions with users. Through a web-based application, users gained immediate visibility of real-time actual and predicted fuel gas consumption, including CO2 emissions. This eliminates the need for manual dependencies and timeconsuming updates.

The team encountered several challenges during the development and deployment stages of the GTOPS platform. Careful consideration and collaboration were required for the mapping of operator experience and tacit knowledge into machine learning operations. The team ensured the suitability of regression models by focusing on the best prediction value and fine-tuning

the algorithms to match the specific requirements of PGB’s operations. To overcome these challenges, rigorous discussions with the operations team and benchmarking with industry standards were conducted. By seeking insights from other industry players, PGB was able to enhance the GTOPS platform and align it with best practices in machine learning applications.

Enhancing Decision-Making and Operational Efficiency

The GTOPS platform offers unique features that set it apart from other similar systems in the industry. It enables monitoring operational parameters through a userfriendly webpage, providing users with immediate access to critical information for analysis and decision-making. The platform’s ability to store and retain historical data allows for continuous improvement and future enhancements, safeguarding valuable insights and knowledge from being lost.

The GTOPS platform has garnered positive

28 THE ASIAN BUSINESS REVIEW

PETRONAS team at the Malaysia Technology Excellence Awards 2023

feedback from users, especially those with less compressor exposure on-site, as it empowers them to make data-driven decisions and eliminates the need for inefficient manual processes. With real-time visibility into key operational parameters, the platform enables users to respond quickly to changing conditions and minimise risks. By harnessing the power of machine learning algorithms and advanced analytics, PGB has achieved improved operational efficiency and enhanced decision-making capabilities.

This platform has transformed PGB’s day-to-day operations by providing valuable insights into fuel gas consumption, compressor efficiency, and CO2 emissions. The adoption of machine learning has allowed PGB to optimise its operations and enhance overall operational efficiency. The immediate and actionable information provided by the GTOPS platform has transformed the decision-making process, enabling operators to make informed choices based on real-time data, resulting in more efficient and effective operations.

Transforming Operations and Driving Future Growth

Machine learning and other advanced technologies have immense potential in shaping PGB’s future operations. Predictive maintenance, optimisation of operations, energy management and efficiency, datadriven decision-making, and safety and security are key areas where machine learning can drive significant improvements.

By leveraging big data analytics and machine learning algorithms, PGB can gain deeper insights into market trends, customer preferences, and operational performance, enabling proactive decision-making. The implementation of machine learning can also

contribute to PGB’s sustainability goals by optimising energy usage and identifying energy-saving opportunities.

Looking ahead, PGB plans to further improve and expand the GTOPS platform. The application of machine learning techniques will be extended to other areas of PGB’s operations, such as plant operations, predictive maintenance, anomaly detection, process optimisation, and quality control. These advancements will drive profitability, and value-added tasks,

and further enhance PGB’s position as a leader in the gas industry.

The integration of machine learning operations within the GTOPS platform has altered PGB’s approach to managing its gas transmission systems. By harnessing the power of data-driven decision-making and leveraging advanced analytics, PGB has achieved improved operational efficiency, optimised fuel gas consumption, and positioned itself for a data-powered future in the gas industry.

THE ASIAN BUSINESS REVIEW 29

AI - OIL & GAS

By harnessing the power of data-driven decision-making and leveraging advanced analytics, PGB has achieved improved operational efficiency, optimised fuel gas consumption, and positioned itself for a data-powered future in the gas industry

Burhan Abdullah accepting the trophy

Burhan Abdullah, Head of Gas Transmission and Regasification at PETRONAS

Malaysia LNG Sdn Bhd takes home AutomationOil & Gas award at Malaysia Technology Excellence

Its initiative to implement automated production ramp-up processes in PETRONAS LNG Complex, Bintulu.

Malaysia LNG Sdn Bhd, a group of companies under Petroliam Nasional Berhad (PETRONAS), has received the Automation - Oil & Gas award at the Malaysia Technology Excellence Awards 2023 for its implementation of the Autopilot.

The PETRONAS LNG Complex (PLC) is one of the largest LNG production facilities in one location spread over 276 hectares of land. PLC is located in Bintulu, Sarawak, and forms the bedrock of PETRONAS’ supply reliability, with a production capacity of close to 30 million tonnes per annum.

PLC is also strategically located and close to key demand centres such as Japan, Korea, the Chinese Mainland, Taiwan, Southeast Asia, and South Asia.

The integrity of Main Equipment is Key for Reliable LNG Supply

In the past, manual ramp-up activities were not standardised and were dependent on the experience and tacit knowledge of the panel operators. This potentially impacted the integrity of the main equipment, subsequently leading to temperature excursions and safe operating envelope violations.

To ensure a reliable supply of LNG to meet industry demands, changes needed to be made to ensure the main equipment was able to run for longer periods with zero downtime.

Transformation journey to ramp up plant production from 0% to a desirable level via automated operations.

PETRONAS aspires to have an automated LNG start-up that is safe and efficient by leveraging digital solutions. Moreover, LNG start-up quality differs for each panel operator. Leveraging the fact that the process is repetitive and suitable for automation, Autopilot was introduced. Autopilot not only ensures standard start-up quality is met but also enables panel operators to focus on more value-adding tasks, such as supervising the quality and efficiency of the overall production ramp-up activity.

Overcoming challenges in manual production ramp-up

One of the challenges of manual production ramp-up is sustaining quality start-up every single time. The start-up quality through manual adjustment varies depending on

panel operators’ experiences, skills, and focus. Autopilot is the solution that captures the best operators’ actions and has the capability to consistently monitor process changes and adjust accordingly every minute, ensuring compliance with plant safety limits and eliminating unnecessary flaring.

Autopilot in PETRONAS’ larger digital

transformation strategy

Steered by PETRONAS’s Moving Forward Together (MFT) 50.30.0, Autopilot offers better operational excellence strategies for start-up activities to achieve optimum startup durations and zero flaring through the power of technology and digitalisation.

The New Way of Working through the Introduction of Autopilot

One of the positive feedbacks received from key users of the operations team highlighted how Autopilot had supported panel operators by enabling better control of MCHE temperature profiles and minimising the negative impact on MCHE tube integrity due to temperature shock.

Other feedback received also highlighted

30 THE ASIAN BUSINESS REVIEW

PETRONAS team at this year’s Malaysia Technology Excellence Awards

the reduction in the number of process parameters to be adjusted by panel operators which are now handled by Autopilot.

Continuous Improvement of Autopilot towards Automated Start-Up

The automated start-up was first explored

by PLC as part of achieving operational excellence for start-up activities through digital solutions. Operations with Advanced Process Control (APC) have been established in PLC for years. PLC plans to improve the transition from Autopilot during start-up activities to operating using APC seamlessly through one click of a button.

THE ASIAN BUSINESS REVIEW 31

AUTOMOTION - OIL AND GAS

PETRONAS team accepting the trophy

Mohamed Syazwan Abdullah, Managing Director & CEO, Malaysia LNG Group of Companies, PETRONAS

PETRONAS aspires to have an automated LNG start-up that is safe and efficient by leveraging digital solutions

Innovating for a Sustainable Future: PETRONAS

PIVOT DA leads the way

PETRONAS empowers operational excellence through advanced data analytics.

In today’s rapidly evolving world, the pursuit of operational excellence has become a paramount goal for businesses across industries. As challenges arise, innovative solutions pave the way for success.

PETRONAS, a global leader in the energy industry, stands at the forefront of this innovation with its ground-breaking project, PETRONAS Integrated Vision for Operational Excellence and Technology Descriptive Analytics (PIVOT DA).

PIVOT DA has emerged as a gamechanger, revolutionising how PETRONAS manages its downstream operations. This advanced integrated platform combines digital innovation and data analytics to empower PETRONAS Downstream employees with real-time insights and actionable data, ensuring safer and more reliable plant operations as well as driving continuous improvement.

Through its Enterprise Data Hub (EDH), pertinent data is combined from various sources into a single system. Automation of this process, considering the large amounts of

data involved, effectively eliminates manual data entry and reduces errors.

With PIVOT DA, PETRONAS has redefined the landscape of operational excellence by enhancing performance monitoring, and decision-making. The platform’s precision in descriptive analytics enables historical and present operational data to be accurately interpreted, compared, and analysed. This invaluable capability allows PETRONAS to identify facility strengths, vulnerabilities, and threats ahead of time, proactively addressing improvements with data-driven insights. Astute decisions ensure plant operations remain safer and more reliable than ever before.

Streamlining Operations and Empowering Users

One of PIVOT DA’s greatest strengths lies in its data automation capabilities. With automatic reporting and real-time dashboards, PIVOT DA effortlessly handles the massive influx of over 480,000 data points generated daily.

PIVOT DA has transformed these processes, reducing the time required to mere hours. The result is increased productivity, optimised man-hours, and a more effective workforce. With these newfound efficiencies, PETRONAS now focuses on analysing data to drive continuous improvement and operational excellence.

PIVOT DA has been designed with its users in mind. The platform’s sleek and intuitive interface ensures seamless navigation, whilst the dynamic, customisable dashboard allows for comprehensive data and detailed analytics to be visualised and presented with clarity and accuracy through interactive dashboards, charts, and graphs. From the plant floor to the boardroom, PIVOT DA delivers real-time insights and bespoke reports that meet users’ specific needs.