IN A NEW ERA

SOUTHEAST ASIA’S NUCLEAR ENERGY AMBITIONS DASHED BY PUBLIC OPINION

RENEWABLE ENERGY USE MAY BECOME MANDATORY FOR SOME INDIAN SECTORS

HYBRID PLANTS COULD FIX RENEWABLES’ INTERMITTENCY

ACEN’S ETM DEAL MARKS A NEW ERA FOR COAL DIVESTMENT

Eric

Eric

ISSUE 107 | DISPLAY TO 31 MARCH 2023 | www.asian-power.com | A Charlton Media Group publication US$360P.A. KS ORKA’S GRADUAL DEVELOPMENT MODEL INCREASES GEOTHERMAL PROJECTS’ SUCCESS

Riza Pasikki COO & CTO, KS Orka

USHERING

Issue No. 107 Asian Power

Francia CEO, ACEN p. 18

Reiniela Hernandez reiniela@charltonmediamail.com

FROM THE EDITOR

Asian governments are increasingly getting involved and actively supporting clean energy projects. Indonesia has recently issued a regulation to limit coal power plants to speed up energy transitions. Meanwhile, India will mandate a minimum consumption of energy from non-fossil fuel sources in several sectors. On the other hand, many Southeast Asian nations are still struggling to change the negative public perception of nuclear power, despite it being a potential source of clean energy.

When it comes to developing geothermal power plants, the traditional approach can be risky and time-consuming. But Indonesian power plant developer KS Orka has found a solution: the gradual development model. COO & CTO Riza Pasikki walks us through this strategy that enabled the company to simplify the conversion of energy into electricity on page 16. Meanwhile, the Philippines-based energy group ACEN has been working towards divesting the SLTEC power plant for years, which was made possible with the help of ADB’s Energy Transition Mechanism. ACEN President and CEO Eric Francia shares why the ETM deal is considered historical and the company’s plans moving forward on page 18.

Accounts Department accounts@charltonmediamail.com advertising@charltonmediamail.com ap@charltonmedia.com

SINGAPORE

Charlton Media Group Pte Ltd. 101 Cecil St. #17-09 Tong Eng Building Singapore 069533 +65 3158 1386

HONG KONG

Charlton Media Group Room 1006, 10th Floor, 299QRC, 287-299 Queen’s Road Central, Sheung Wan, Hong Kong www.charltonmedia.com

Can we help?

Editorial Enquiries: If you have a story idea or press release, please email our news editor at ap@charltonmedia.com. To send a personal message to the editor, include the word “Tim” in the subject line.

Media Partnerships: Please email ap@charltonmedia.com with “partnership” in the subject line.

Subscriptions: Please email subscriptions@charltonmedia.com.

Asian Power is published by Charlton Media Group. All editorials are copyrighted and may not be reproduced without consent. Contributions are invited but copies of all work should be kept as Asian Power can accept no responsibility for loss. We will, however, take the gains.

*If you’re reading the small print you may be missing the big picture

Read on and enjoy.

Tim Charlton

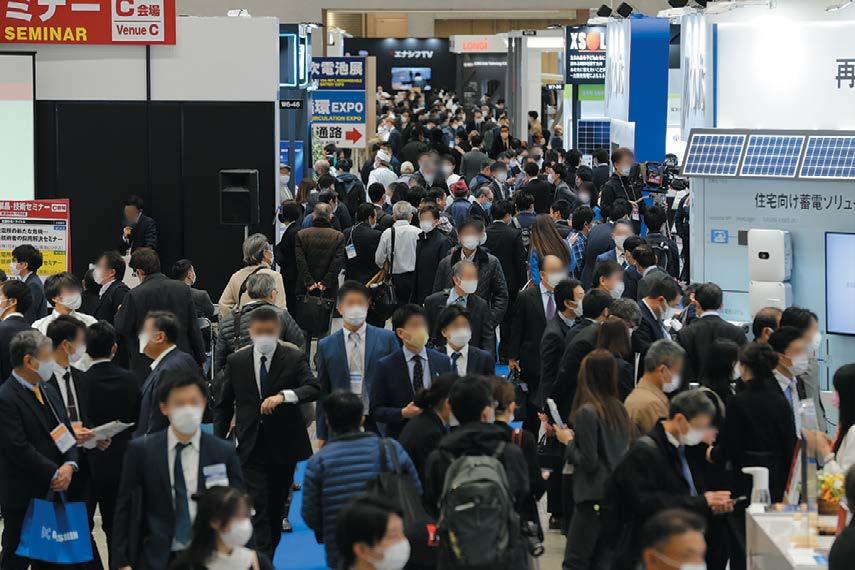

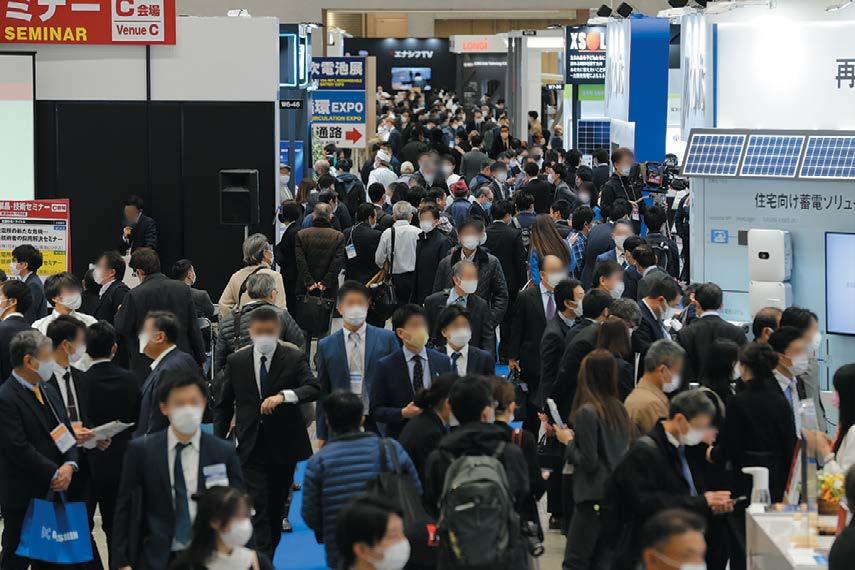

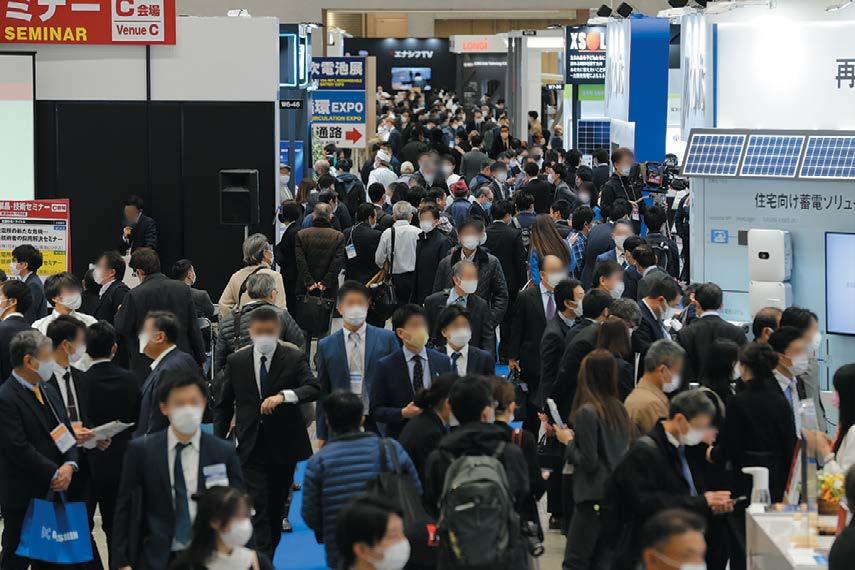

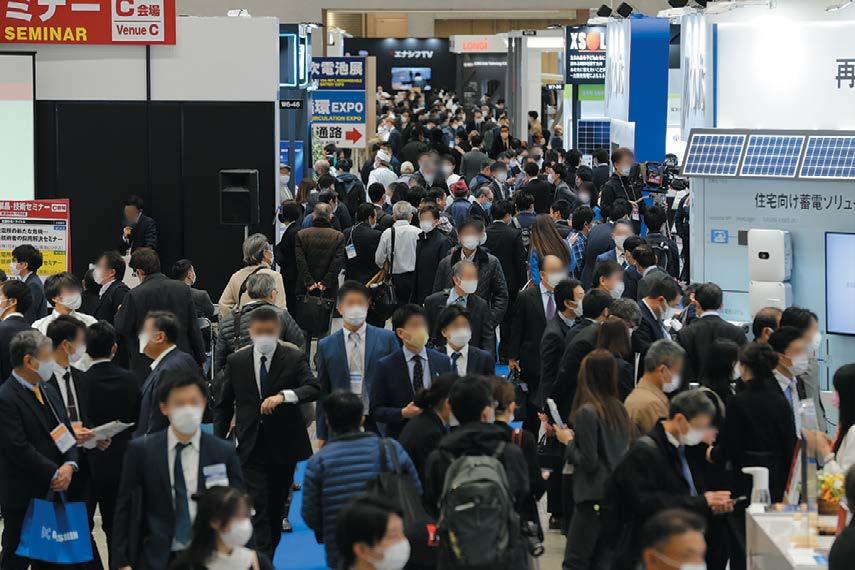

Asian Power is a proud media partner and/or host of the following events and expos:

2 ASIAN POWER

ADVERTISING

ADVERTISING CONTACT ADMINISTRATION

EDITORIAL

&

PRINT PRODUCTION EDITOR COPY EDITOR PRODUCTION TEAM Jeline Acabo Tessa Distor Charmaine Tadalan Vann Villegas Ibnu Prabowo COMMERCIAL TEAM GRAPHIC ARTIST Janine Ballesteros Jenelle Samantila Emilia Claudio

PUBLISHER

EDITOR-IN-CHIEF Tim Charlton

ASIAN POWER 3 CONTENTS Published Quarterly by SG: Charlton Media Group 101 Cecil St. #17-09 Tong Eng Building Singapore 069533 For the latest news on Asian power and energy, visit the website www.asian-power.com HK: Room 1006, 10th Floor, 299QRC, 287-299 Queen’s Road Central, Sheung Wan, Hong Kong FIRSTS 06 China, Australia are Asia’s key energy storage market drivers INTERVIEW KS ORKA’S GRADUAL DEVELOPMENT MODEL INCREASES GEOTHERMAL PROJECTS’ SUCCESS IN INDONESIA 16 20 GENERATION REPORT SOUTHEAST ASIA’S NUCLEAR ENERGY AMBITIONS DASHED BY PUBLIC OPINION REPORT COUNTRY REPORT EVENT COVERAGE 18 CEO INTERVIEW ACEN’S SUCCESSFUL ENERGY TRANSITION MECHANISM DEAL MARKS A NEW ERA FOR COAL DIVESTMENT REGULATION WATCH INTERVIEW VOX POP 12 Indonesia’s new regulation speeds up renewable energy transitions 14 Renewable energy use may become mandatory for some sectors in India: IEEFA 11 What could dry up Laos’ hydropower potential 22 Philippines considers nuclear energy as a solution to potential baseload power crisis 15 Solar firm Sun Cable up for sale to power cross-border grid integration project 30 Russia-Ukraine crisis ushers in a new era of energy security for Asia 24 Vietnam’s energy transition faces hurdles due to increasing use of gas-fired power 26 Hybrid plants could fix renewables’ intermittency 28 Reducing green hydrogen costs hangs on gov’t support 10 Could coal-based power still get funding?

Daily news from Asia

MOST READ

What happens to CLP Power as Hong Kong transitions to carbon neutrality

With 15% of its generation mix coming from coal in 2020, CLP Power is in the middle of its energy transition journey when the Hong Kong Government declared its intention to be carbon neutral before 2050. It seems that the company already has its strategies in place to align itself with the government’s target.

Private firms eclipse the growth of the Philippines’ solar power industry

With only around 1,370 megawatts (MW) of installed solar capacity, the Philippines still has a long way to go before meeting its 20-gigawatt target by 2030. This is even as the government has provided enough support to enable the industry, leaving the fault to the private sector for having a supply that falls short of meeting high demand.

Where to put big batteries within Australia’s ‘skinny grid’

In a market, where there is plenty of land and a “unique” power grid, developers are asked—where is a good place to build a battery?

Vena Energy CEO Nitin Apte shared the company had two key considerations–good grid connection and strong demand–when it built the first utilityscale BESS in Queensland.

Supreme Energy takes a bold initiative to further develop geothermal

Next to the US, Indonesia is the second country with the largest geothermal energy source in the world. Indonesia has a potential of 23,766 megawatts (MW) with an installed Geothermal Power Plant capacity of 2,286 MW, the Handbook of Energy and Economic Statistics in 2021 from the Ministry of Energy and Mineral Resources shows.

Indonesia’s Pertamina signs up for hydrogen development

There has been an imbalance between the potential and utilisation of renewables in Indonesia. Of the 3,686-gigawatt (GW) potential renewables estimated by the Ministry of Energy and Mineral Resources of Indonesia, only 0.3% has been utilised. Pertamina NRE seeks to fill this space with hydrogen development.

Why the Philippines’ EDC will not fire up coal production

Philippines’ Energy Development Corporation (EDC) is adamant to only stick to renewables and will not venture into coal for one main reason: climate change. It also recognised the effects of the Russia-Ukraine conflict as another reason to accelerate the adoption of renewables to protect consumers from inflation shocks.

News from asian-power.com

IPP IPP IPP IPP IPP

PROJECT

Knowledge in Power

Whether global or local, events that change the way we live and work only intensify the demand for reliable electricity. And they amplify issues like financing and regulation that make the path toward sustainable, resilient grids challenging.

Stay informed with free access to Black & Veatch’s Repowering Asia Webinar Series.

In these times of uncertainty and rapid change, we’re investing in you with forward-looking educational webinars on the latest trends, technical resources and best practices across power generation, transmission and distribution.

Hydrogen

Hot Topics When Considering Solar PV and Battery Energy Storage Projects

Black & Veatch is your partner in delivering innovative, end-to-end services and full engineering, procurement and construction (EPC) solutions. Let us help you safely achieve profitable outcomes while improving the communities you serve. bv.com/power-on-demand

ASIAN POWER 5

Watch Now Watch Now Watch Now

Renewable Integration into the Transmission Systems

Market Overview

COAL PROJECTS IN CHINA’S BRI TO DECLINE CHINA

China, Australia are Asia’s key energy storage market drivers

ASIA PACIFIC

Mainland China and Australia are the key drivers for Asia’s energy storage market as Fitch Solutions projected the markets to see a significant growth in their non-hydropower renewables capacity in the next decade.

Coal projects under China’s Belt and Road Initiative (BRI) will likely decline after the government’s announcement to stop funding coal-fired power plants overseas, Fitch Solutions reported.

China is amongst the global leaders that have pledged to stop coal financing, alongside Japan and South Korea in September 2021.

After 2021, there were no new project announcements from the top three financiers and state banks which are the Japan Bank for International Cooperation, China Development Bank, and Bank of China.

Despite this, Fitch noted that China will still lead global financing but its share will decline. Based on Fitch’s Key Projects Data (KPD), there are still 94.8 gigawatts of coal capacity in its BRI project pipeline.

“Although we expect recent divestment commitments from the Chinese government on halting overseas coal places risks on this pipeline,” the report read.

“In contrast, our Q421 KPD assessment contained significantly higher coal capacity.” Vietnam, Indonesia, the Philippines, Zimbabwe, Pakistan, and Mozambique all have 40% less coal capacity in the pipeline than in Q421.

A total of 32 coal projects, which are currently in the planning stage, are at risk of being cancelled by China, it said.

Just last March 2022, a policy document, “Opinion on Jointly Promoting Green Development of the Belt and Road,” tackled the pledges of Chinese authorities to stop building new coal-fired power plants in other markets.

“Although there is debate over what this means for plants in the pre-construction phase, we believe there are risks to the 69 projects and 71.5 gigawatts in the Belt and Road Initiative, and the 32 projects financed by Chinese banks,” the report read.

Suspended coal plants

Citing data from the Centre for Research on Energy and Clean Air, Fitch added that about 12.8GW across 15 China-backed coal plant projects overseas have either been cancelled or suspended since September 2021.

A total of US$63b is at risk from China’s withdrawal from coal financing, according to Global Energy Monitor.

Fitch said Zimbabwe and Vietnam are the most at risk of China’s project cancellation which is expected to reduce coal expansion and drive support for alternative energy sources. India has 12.9GW, Zimbabwe has 12.3GW, Vietnam has 15.6GW, and Pakistan has 5.1GW of project capacity in the preconstruction stage under its BRI pipeline.

“This is 5%, 700%, 39% and 17% of our total estimated thermal capacity in 2022 respectively. Therefore, Zimbabwe and Vietnam have the highest exposure to China pulling out,” the report read.

Around 53% of Vietnam’s energy supply is sourced from coal and the country would have received 44% of its coal financing from Chinese banks and 17% from Japanese financiers. It has 12 projects under the BRI with a capacity of 19GW and it plans to build new plants with 1.2GW.

In a report, Fitch forecast that 31% and 26% of the total electricity generation of China and Australia will come from renewable sources by 2031, respectively. This is in comparison to the 35% projected in the US, which will lead the market globally.

“A large proportion of this will come from intermittent wind and solar power. Furthermore, we highlight that markets, particularly those with a high energy import dependence, are struggling with energy supply issues, which will support the more rapid development of energy storage systems,” the report read.

In terms of battery systems development, Fitch expects the United States and Australia to lead globally as the markets combined account for 55% of projects in the pipeline, based on their Key Project Database (KPD).

Fitch also sees battery storage will sustain its lead amongst all types of energy storage, considering it is the most cost-effective energy storage solution. On top of this, costs of battery energy storage systems are likely to “decline significantly” in the coming decade.

The US currently has 115 battery

storage projects in various stages of development. This is expected to have a non-hydropower renewables capacity of 608 gigawatts by 2031.

Australia, meanwhile, has 41 gridconnected battery and 50 hybrid battery storage projects in the pipeline.

Fitch noted that battery systems are the leading storage technology type. Of the nearly 500 energy storage projects, 43% were hybrid projects, whilst compressed air and thermal storage accounted for 2% and under 1%, respectively.

“We believe that battery storage will continue to outperform all other types of energy storage, as it is currently the most cost-effective energy storage solution with costs expected to decline significantly over the coming decade,” Fitch noted.

“The National Renewable Energy Laboratory (NREL) expects lithium battery system costs to fall by 40% by 2030.”

JERA’s 340MW offshore wind project Greenko to develop pumped storage Nakasato Wind Project goes online

JERA is targeting to develop an offshore wind power generation project with a maximum generation capacity of 340 megawatts (MW) in Akita Prefecture in Japan.

The project, which will involve as many as 29 wind turbines, will be located off the coast of Oga City, Katagami City, and Akita City.

JERA believes that the favourable wind conditions and shallow seabed off Oga and Katagami cities in Akita Prefecture make the area suitable for the development of bottom-fixed offshore wind power generation.

Renewable energy firm Greenko is investing around $1.2b (Rs10,000) crore to install a pumped storage project with a daily storage capacity of 11 gigawatt-hours.

The project located near Gandhi Sagar in Neemuch district will dispatch the infirm renewable electricity stored in the project during lean demand hours to support the state’s peak power demand, which leads to cost savings.

The project is expected to start operations by December 2024 and will be linked to the Inter State Transmission System Network.

Vena Energy said the 47-megawatt (MW) Nakasato Wind Project in the outskirts of Nakadomari Town in Aomori Prefecture in Japan has begun operating. In a statement, Vena Energy said the wind project which consists of 13 wind turbines spans an area of 47 hectares.

It can supply energy to up to 22,000 local households annually. It can also reduce 61,000 tonnes of greenhouse gas emissions and save up to 87 million litres of water annually.

6 ASIAN POWER

A large proportion of this will come from intermittent wind and solar power

PLANT WATCH JAPAN INDIA JAPAN

NREL expects lithium battery system costs to fall by 40% by 2030 (Photo from NREL.gov)

FIRST

Enhance the reliability of boiler-feed pumps for flexible thermal power generation

It’s no secret that renewable energy’s variety and unpredictable nature is putting pressure on the grid.

Electricity demand in APAC is growing by 6% yearly – one of the fastest rates in the world. And the Association of Southeast Asian Nations wants to get 23% of its power from renewables by 2025, up from 9% in 2019.

As it stands, power plants are typically designed for base load and they are walking a flimsy tightrope. Different types of renewable energy place varying demands on power plants due to flexible generation requirements. The load is subject to fluctuation, and if renewable energy dips, conventional power plants must compensate to meet the demand. Such an extreme fluctuation in load can damage the plant, equipment, and materials. Most importantly, energy loss can occur as plants aren’t designed to run at such variable loads.

There are more problems with plants that are built at a lower cost and simply not reliable long-term. Coupled with equipment and materials that aren’t well designed or optimised, this can point to a bumpy road ahead for renewable energy integration.

Flexible and efficient thermal power generation will continue to play a critical role in the energy ecosystem. It will also provide reliable back-up power that complements plants generating renewable energy. Thermal is needed to support both the peaks and the shortfalls in renewables and mitigate frequency issues.

But the viability of flexible thermal power generation requires a deep understanding of a power plant’s current condition – and a strategy for mitigating the issues associated with an energy system overhaul.

Flexible thermal power generation: Not without its risks

To achieve flexible thermal power generation – without damaging vital plant components – plants will need to make operational improvements to existing turbines to help them respond to demand quickly and more reliably, whilst reducing startup fuel costs.

Some enhancements can be made to ramp up combustion versatility, making your turbines more robust in any weather, fuel, and grid variations. This will give them the ability to operate at different plant loads reliably and efficiently.

Flexible operation poses risks to existing boiler feed pumps in coal power plants, increasing the probability of wear and tear and energy losses. The emphasis is largely placed on turbines when it comes to meeting flexible power generation requirements, with the needs of the pumps often being neglected. However, upgrades and modifications are required to enable the pumps to manage all the fluctuation risks.

For example, at a coal-fired power plant that has implemented flexible operation, frequent stops and starts can cause damage to a boiler feed pump’s shaft, thrust disk, impeller, and diffuser. The pump is also at risk of low flow cavitation at the suction impeller and flow accelerated corrosion at highvelocity areas of the casing.

Preparing boiler feed pumps for flexible thermal power generation

Boiler feed pumps are critical components in power generation plants. Plants can’t afford to lose their productivity and output due to flexible thermal power generation requirements imposed by the grid.

The solution lies in a thorough pump energy audit. This will help power plants to get to the root of the issues, even before they arise – by assessing the reliability-maintenance of the pump, looking for temperature and vibration basic data trend analysis.

Then the power plants can look at possible re-rate solutions, such as de-staging, or a new hydraulic to meet real operating conditions. An efficient speed variation system – changing from fixed speed to variable speed – can also help to quantify energy saving and emissions reduction for the plant.

Power plants need their boiler feed pumps to be at optimal efficiency. And the key to reducing costs, protecting the longevity of equipment and materials, and adapting to flexible thermal power generation demands lies in properly preparing plant components. It’s also worth mentioning that energy optimisation of pumps and turbines can translate into fewer CO2 emissions and lower carbon taxes.

Avoid asset and profit loss with proactive maintenance

Older plant assets – boiler feed pumps that are nearing 20 or even 30 years old – can become a severe liability for plants looking to meet grid and

flexible operation requirements. Boiler feed pumps diminish in efficiency and output power capacity as they age.

That means energy decision-makers must reassess their existing boiler feed pump assets and carry out any work necessary to ensure they can meet the demands of flexible thermal power generation. Failure to do so puts them at risk of losing out on profit and productivity.

Sulzer is a global leader in pump engineering. We bring nearly two centuries of engineering heritage and experience in the power industry. Our equipment installation and maintenance services, coupled with continuous investment in pump engineering R&D, help facilities across the globe become leaders in reliability and efficiency for their pumps. To date, Sulzer has retrofitted more than hundreds of boiler feed pumps worldwide.

We look forward to continuing to help our partners around the world fortify their plant’s critical rotating equipment assets to cope with the demands of flexible power generation.

CONTACT

Florent Ralu | Head of Engineering, APAC | Sulzer Services

Email: florent.ralu@sulzer.com

Contact: +61 447 831 093

ASIAN POWER 7 CO-PUBLISHED CORPORATE PROFILE

We look forward to continuing to help our partners around the world fortify their plant’s critical rotating equipment assets to cope with the demands of flexible power generation

Sulzer assists clients in pump engineering

EthosEnergy dives into industry-changing lifeextension solutions

Business models in various countries have slowly adapted to the changing needs of the world, one of which is the necessity to be more adaptive to renewable energy and to be more conscious about the environment.

As multiple alternatives for energy sources have recently emerged, so have companies slowly shifted its operations to use these newer forms of energy. One such example is hydrogen energy. Apart from being able to produce energy by burning hydrogen or compounds that comprise it, energy is produced without many negative resulting causes to the environment compared to other kinds.

In an exclusive interview with EthosEnergy, Asian Power spoke with Massimo Valsania, the company’s Vice President of Engineering.

“Hydrogen is technically an energy vector that can be used as a fuel in gas turbines to produce energy with an immediate positive impact on emissions. In fact, even starting with a low percentage in H2 blending, there is an immediate CO2 reduction at the exhaust with very limited investment and modification of existing assets,” he said.

Asia’s role in hydrogen generation

Expounding on its effects in Asia, Valsania said that the continent will play a big role in promoting hydrogen energy on the worldwide stage.

“Asia will have a huge and crucial role within the hydrogen value chain. Thanks to its huge area, which is suitable for renewable fields (solar and wind), and to a very highly industrialised region,

Asia is already a key player, and it will be one of the most important in a few years.”

According to Valsania, the main goal is to use hydrogen in the gas turbine to compensate for the energy demand. Essentially, with the increase in renewable energy, the portion in excess can be converted into hydrogen, which can be stored and used when renewable energy is not available. However, the same is not wrought with possibilities. He said that whilst hydrogen is the lightest, and smallest molecule, it is also the most available in the universe.

“The main challenges are safe transportation and storage of this energy vector due to its propensity to leak and degrade the mechanical properties of some specific steels. Therefore, existing pipeline and infrastructure (for natural gas) can be used, after validation and some retrofitting where required.”

In EthosEnergy, this change being introduced is one of its main projects at the moment.

First, it has the Rotor Life Extension, specifically targeted to ageing fleets to address operating risk concerns. Its end-of-life rotor solutions have been engineered to meet or exceed the original equipment manufacturer and the recommended end-of-life.

“We have developed the Phoenix Rotor life extension program. So far, we have delivered this solution on GE Frame 6, 7E and 9 turbines and have completed the design phase on rotor life extensions for the GE F7F.03. In parallel, we have also developed a life extension solution for the mature Westinghouse family of gas turbines,

which we call the Bolted Rotor,” he said.

The second is the Steam Turbine Blade Repair. As pressure on the energy industry grew, the focus on sustainability did as well.

Levaraging innovative solutions

Many power plants are searching for ways to reduce maintenance spend and time. A common issue seen in plants powered by steam turbines is service failures due to severe erosion to endstage blades caused by poor steam quality. The replacement of blades is expensive, and lead times can be long, leaving plants with decreased power output and an increased risk of a forced outage.

“At EthosEnergy, we have developed an innovative repair solution to eliminate the need to replace existing blades and instead extend their lifespan. We enhance existing blades and upgrade with a weld repair replacing the leading-edge material with a Stellite alloy, restoring the original geometry and offering increased wear resistance without reliance on being sprayed on coatings or mechanically attached shields,” Valsania said.

As it now stands, Asia can be a leader in the entire value chain of hydrogen, including production, transportation, storage and the utilisation in different sectors: mobility, hard-to-abate, energy and aviation.

Valsania added that whilst Asia can immediately leverage the very active policy around Hydrogen in Europe and US working closely with their industries, governments and universities need to be part of this evolution.

8 ASIAN POWER

CO-PUBLISHED CORPORATE PROFILE

The common ground is finding ways to develop the use of hydrogen energy.

EthosEnergy provides innovative repair solutions for plant maintenance

Experts weigh in on roadblocks to coal financing

Kung Chan Founder, ANBOUND

Judging from the policies of some countries, resuming coal is a short-term approach. That being said, I hope that coal power plants can have a certain proportion. Even Japan, which has very strict environmental requirements, still retains certain coal-fired power plants. The utilisation technology of clean coal is now mature, coupled with various carbon capture technologies and storage. Coalfired power plants based on clean coal should be a long-term approach, or at least have the prospect of doing so.

This issue may be influenced by the stigma associated with coal. For a long time, coal, as the most important fossil fuel, has been considered an important source of carbon dioxide emission. However, in China’s case, due to the development of clean coal utilisation technology, the Chinese government has set up a special refinancing of RMB200b in 2021. In accordance with focused, more operable requirements and market-oriented principles, special support is given to the safe, efficient, green, and intelligent mining of coal, as well as its efficient processing and clean utilisation. Although the Japanese government has stated that it no longer supports coal power generation, the Institute for Energy Economics and Financial Analysis stated in its 2019 report that Japan’s public finances for fossil fuels are about US$9b per year, mainly provided to power plant development agencies. According to a report released by Greenpeace in August 2019, from January 2013 to May 2019, Japan’s public financial investment in coal power plants was US$16.7b. Another major country in financing fossil fuel power generation projects in Asia is South Korea. I believe that the attitudes and policies of governments, banks, and financial institutions towards coal projects may be affected by overly aggressive environmental policies, coupled with the long-term impact of coal stigma, which is very detrimental to the clean use of coal.

Global coal market

Coal companies have faced enormous difficulties in the past, and the global coal market has shrunk significantly for a period of time. However, the state of convergence of coal companies should not be overly exaggerated. Since 2021, one-tenth of the investment funds in China’s coal industry came from overseas, and 48 international banks provided a total of US$21.7b in financing in the form of stocks and bonds. The largest international investors in Chinese coal companies are American investment companies BlackRock and Vanguard, which invested US$2.7b and US$2.2b respectively. Qatar Investment Authority, with US$17m ranked third. These data show that although the coal industry has been attacked by environmental radical public opinion, real-world capital still continues to support its development. I believe that as long as market demand exists objectively, this kind of capital support will not disappear immediately. Now, due to the geopolitical turmoil in the winter of 2022, many countries in the world have to reconsider their attitudes toward coal mining and utilisation. Therefore, I believe that the situation of coal companies in the future will be slightly better. In my opinion, for coal companies, some directions of technological progress in the future are worthy of high attention. The first is the development of coal-to-hydrogen. Although carbon emissions are a problem in this regard, its market size may be considerable. The other is clean coal technology. This applies to the entire system, from mining to utilisation. Technological progress, production capacity, and price trends in these areas may determine the future prospects of coal companies. Whilst the coal industry is a sector that is strongly subject to public opinion interference, the long-term development trend is still determined by the objective demand of the market.

Flora Champenois Research Analyst, Global Energy Monitor

Recent headlines claim that coal is making a comeback, but this isn’t what the data ultimately shows. In Europe, to wean themselves off Russian fossil fuel imports and to avoid power and heating shortages over the next few winters, several governments announced a last resort, short-term reserve coal measures. However, all coal power plants affected by these temporary measures deployed to date still have pre-2030 closure dates in line with various Paris Climate Agreement-aligned pathways. The current crisis highlights the importance of energy resilience and self-sufficiency, meaning a shift away from fossil fuels. In terms of new coal projects, outside of China, proposals in the Asia-Pacific region and beyond are continuing to decline despite headlines about the recent energy crisis paving the way for coal’s revival.

The trend is notable as South Asia and Southeast Asia have long been regarded as the next centre for coal power growth after China. The two regions represent nearly two-thirds of the proposed capacity remaining globally outside of China: 37.2 gigawatts (37%) in Southeast Asia and 25.6GW (25%) in South Asia. Proposed capacities represent a fraction of what they did just a few years ago. Tightened financing for coal plants, the decreasing costs for solar and wind power, Just Energy Transition Partnership approaches, and public opposition may close the door on many of the remaining coal proposals in the regions. The international community can support these regions through the provision of public and private clean energy finance; support to develop flexible grid infrastructure; and technical and capacity assistance to bolster regulatory and policy frameworks that accelerate the transition from coal to clean.

China continues to be the glaring exception to the ongoing global decline in coal plant development. Power shortages predating Russia’s invasion have been leveraged by pro-coal interests this year to revisit the country’s energy policy. The government awarded permits to 21GW of new coal in the first half of 2022, the largest half-year increase since 2016, and this boom has not slowed down this fall. The country argues that the continued coal capacity additions do not directly contradict its climate commitments. However, overcapacity in coal-fired power will only make the transition to a lower-carbon grid harder and more costly.

Ending the era of coal

Banks and other financial institutions have been moving away from coal and we don’t see this trend slowing down. The price of renewables has dropped dramatically in the last decade, so the case is now clearer than ever that uneconomical, dirty energy needs to go. Although international public coal financing is essentially dry as a funding tap, support for coal can arrive through a variety of financial pipes as GEM’s report “The Hidden Financial Pipelines

Supporting New

Coal” outlined.

For the era of coal to come to an end, all these pipes must be closed. Financial institutions have the capacity, the power, and the incentive to put the world on course to meet our global climate and public health goals by ending the flow of capital that has sustained the era of coal for too long. Until then, energy planning that promotes new coal plants or props up existing coal plants presents a risk and delays the much-needed transition. More generally, coal-dependent communities often lie in the shadows of belching smokestacks and in the toxic zones resulting from leaking coal ash ponds, and these sacrifice zones are areas of concern across the world. Power plant constructions and retirements are more than numbers on a carbon balance sheet.

10 ASIAN POWER

ASIA PACIFIC

VOX POP

What could dry up Laos’ hydropower potential

The market is poised to become a key electricity exporter in Southeast Asia.

Hydropower abundance in Laos puts it at the forefront of the electricity trade in Southeast Asia where it is poised to be a leading electricity earning US$1.76b in exports in 2022. Grid integration projects in the region give Laos a stronger case to be a key player, but this is not to say the market will not face droughts.

The market’s hydropower potential is currently at about 26.5 gigawatts (GW), according to the International Hydropower Association; but Fitch Solutions estimates Laos’ hydropower to stand only at 8GW, as of end-2021.

“Just from this alone, you can see that there’s much room for hydropower sector growth, and this is in addition to the increasing electricity demand from its neighbouring markets such as Thailand, Vietnam, and even Singapore,” David Thoo, Power & Renewables Analyst, told Asian Power.

The market is further supported by the Laos-Thailand-MalaysiaSingapore Power Integration Project (LTMS-PIP), which integrates the power grids of these four countries. Laos is also exporting to Vietnam, on top of its existing two-way power trade with China.

Reliability woes

The reliability of hydropower could, however, hold back Laos as weather phenomena, such as drought, are increasingly intensifying which could lead to under delivery.

Thoo cited, for instance, the recent drought in China that heavily impacted the Sichuan province, considering hydropower accounted for 80% of its power mix. This eventually led to a halt in manufacturing activities and a disruption in supply chains.

“This may happen to Southeast Asia if it relies too much on hydropower for its electricity supply and [there is] no doubt that government authorities have already taken this into consideration, but the risk is still there,” Thoo said.

Aside from threats to reliability, Thoo said sourcing capital for hydropower plants is another challenge. Citing Fitch Solutions’ Key Projects Database, it was estimated that the country currently has 38 hydropower dams in development with a combined value upwards of about US$18b in total, of which, 16 were backed by the Laos government.

“Whether taking on more projects will increase thve debt that Laos currently has could be a cause for concern,” Thoo said. “Our country risk team estimates the current total government debt as a percentage of GDP, to be about 88% in 2021, expanding to a further 90% this year 2022.”

Moreover, Laos will also need to jump over the hurdles of environmental and social protests, as well as set up the infrastructure necessary for electricity trade.

Thoo noted that at present, the average transmission and distribution losses of markets in the region are about 8.6%, and with more electricity running across various markets, he said financing for grid infrastructure will need to improve. Otherwise, the markets could suffer further losses to actual electricity running through the grids.

Multiple electricity trade

Amidst these challenges, the Laos government has taken steps to ensure that the market has the support it needs to become a

regional leader. “This can be seen from the multiple electricity trade, MOU, and agreements signed with neighbouring markets,” he said. Just last June, Laos started exporting through the LTMS-PIP to Singapore, which allows the market to draw up to 100 megawatts of hydropower electricity. Laos is also in talks with the Electricity Generating Authority of Thailand over plans to export 1.2GWs of electricity, in addition to the 9GW electricity Thailand earlier agreed to purchase. “With the commencement of the LTMS-PIP, we expect further memoranda of understanding and agreements to progress,” Thoo said.

In a September industry report, Fitch Solutions noted that the import agreements and developments in electricity trade alleviate the risks to the technical practicality and regulatory feasibility of grid integration in the region. The connectivity of electricity markets is also underpinned by advancements in technology, particularly in high-voltage direct current (HVDC) systems and subsea cables.

In this light, Fitch Solutions projected Laos’ electricity exports to grow to 43.8-terawatt-hour (TWh) in 2031, growing by an annual average of 5.9% from 25.TWh in end-2021.

“Ambitious” Australia-Asia PowerLink

The region is also in the position to capture Australia’s power market with the development of the “ambitious” Australia-Asia PowerLink project. The project, led by Sun Cable, seeks to develop a 4,200-kilometre HVDC subsea cable, stretching from Darwin to Singapore through Indonesia. Up to 3.2GW of solar power capacity will be sourced from the 17-20GW Tennant Creek Solar Farm, Sun Cable is developing in the Northern Territory.

ASIAN POWER 11

LAOS

Whether taking on more projects will increase the debt that Laos currently has could be a cause for concern

INTERVIEW

The reliability of hydropower could hold back Laos as weather phenomena are increasingly intensifying (Photo: David Thoo, Power & Renewables Analyst, Fitch Solutions)

Indonesia’s new regulation speeds up renewable energy transitions

Indonesia is committed to increasing the use of renewable energy. Currently, there are only 12.2% renewables in Indonesia’s power generation mix, which means that more than 85% are still fossil-based energy—coal 38%, oil 33%, and natural gas 17%. However, the new regulation will set the country to undergo a renewed and aggressive commitment to transition to cleaner energy. It will also limit the construction of new coal-fired power plants (CFPPs) and encourage the implementation of CFPPs early retirement in Indonesia.

Last September, Indonesia just submitted Enhanced Nationally Determined Contribution (E-NDC) with an increased emission reduction target from 29% or equivalent to 835 million tons CO2 to 32% or equivalent to 912 million tons CO2 in 2030. Energy contributes about 10.9% of the 29% total emission reduction target or equivalent to 314 million tons of CO2 and higher up to 12.5% of the 32% total emission reduction target or equivalent to 358 million tons of CO2 under the E-NDC scenario.

“During the G20 Energy Transition Ministerial Meeting 2022 in Bali, the Ministry of EMR and IEA signed a Joint High-Level Statement and launched the

IEA’s roadmap for the energy sector in Indonesia. The IEA’s roadmap shows the international perspective of the energy sector in Indonesia and will be considered as important aspects for energy sector based on national circumstances,” said Dadan Kusdiana, Director General of New Renewable Energy and Energy Conservation, Ministry of Energy and Mineral Resources of Indonesia.

Investments and incentives

In the roadmap, the ministry identified new renewable energy (NRE) investment of US$1.108b or an average of US$28.5b is required per year to reach 708 gigawatt (GW) capacity by 2060. This large investment need cannot be met with State Budget alone, so Indonesia needs investors both from within and outside the country, Dadan explained.

“In line with this, the government continues to encourage the development of attractive and affordable NRE funding scheme by collaborating and involving international financial institutions and funding facilities such as the Sustainable Energy Fund, Green Climate Fund, Clean Energy Fund, SDG Indonesia One, Tropical Landscape Finance Facility,

Global Green Sukuk, as well as other sources of green economy funding from ADB, World Bank, JICA, KOICA, and BPDLH,” said Dadan.

The banking sector has started to get involved in the preparation of funding schemes that adapt to the risk characteristics of new renewable energy projects. For example, national banks have offered funding package for the installation of solar PV rooftop for households.

To facilitate and increase project feasibility, the government also provides incentives to accelerate the development of renewable energy and energy conservation, amongst others are Tax Allowance and Tax Holidays for renewable energy investment (with certain requirements), Import Duty Facilities for power generation raw materials, Geothermal Sector Infrastructure Financing and Geothermal Resource Risk Mitigation for geothermal, and BPDPKS Fund for biofuels.

Utilisation of renewable energy

The renewable energy potential includes hydro potential spread throughout Indonesia, especially in Kaltara, NAD, West Sumatra, North Sumatra, and Papua;

12 ASIAN POWER

REGULATION WATCH

We prioritise solar energy development in the future considering its huge potential

Dadan Kusdiana

INDONESIA

The Presidential Regulation No. 112 of 2022 limits coal-fired power plants and gradually reduce coal consumption.

One of the strategies to reduce coal consumption is implementing the Cofiring Program or mixing biomass as fuel in CFPPs (Photo: Collecting biomass. Kubu Raya, West Kalimantan, Indonesia by Kate Evans/CIFOR on Flickr)

solar potential in NTT, West Kalimantan, and Riau which has higher radiation; wind potential (>6 m/s) mainly found in NTT, South Kalimantan, West Java, South Sulawesi, NAD and Papua; sea energy potential across Maluku, NTT, NTB, and Bali; and geothermal potential spread over the ring of fire areas, covering Sumatra, Java, Bali, Nusa Tenggara, Sulawesi, and Maluku.

“Currently, only 0.3% (12,418 megawatt [MW] – Q3 2022) of the total potential of 3,686 GW has been utilised with the following details: solar energy 255 MW (from 3,295 GW potential), hydro energy 6,679 MW (from 95 GW potential), bioenergy 3,037 MW (from 57 GW potential), wind energy 154 MW (from 155 GW potential), and geothermal energy 2,293 MW (from 24 GW potential),” said Dadan.

“We prioritise solar energy development in the future considering its huge potential, PV mini-grid construction having short development period and its increasingly competitive investment costs,” he added.

Renewable energy generation is targeted to increase by 20.9 GW in 2030 as stated in the RUPTL of PT PLN (Persero) 2021-2030. The additional power plant project requires an investment of around US$55.18b and will reduce GHG emissions by 89 million tons of CO2e.

Meanwhile, in the NZE planning for the energy sector in 2060, it is projected that electricity generation renewable energy will reach 700 GW. On the non-electricity side, the government has implemented the mandatory B30 program, which created a mixture of 30% biodiesel and 70% diesel fuel. As of September 2022, 7.39 million kilolitres (kL) have been utilised from the 2022 final target of 10.1 million kL. Currently, a road test on the use of B40 is being carried out which is expected to further increase the share of renewable energy from the use of biofuels which will have an economic impact in the form of saving foreign exchange.

Setting the purchase price of electricity

The use of renewable energy will also be regulated in terms of the purchase price of electricity. The power purchase price is the price used in the Power Purchase Agreement (PPA) and will be valid until commercial operations. It will be evaluated annually against the latest average PLN contract price. The evaluation will be carried out by the Minister of Energy and Mineral Resources in coordination with the Minister of Finance and the Minister of State-Owned Enterprises (SOEs). Meanwhile, the power purchase price

from renewable energy is determined through negotiation provisions with an upper limit based on the highest benchmark price without escalation during the PPA period and applies as price approval from the minister. In addition, the formulation of the purchase price of renewable energy electricity also consists of an agreed price with or without taking into account the location factor.

The price of renewable energy electricity based on the Highest Benchmark Price (HPT) uses two stages, where the second stage is without escalation with the location factor that applies to the first stage for all capacities, including Hydroelectric Power Plants (PLTA), Geothermal Power Plant (PLTP), Photovoltaic Solar Power Plant (PLTS), Wind Power Plant (PLTB), Biomass Power Plant (PLTBm), Biogas Power Plant (PLTBg), capacity addition (expansion) PLTP, PLTA, PLTS Photovoltaic, PLTBm, and PLTBg, as well as excess power of PLTP, PLTA, PLTBm, and PLTBg.

Stop additional CFPPs

Presidential Regulation 112/2022 also regulates the government’s commitment to the energy transition, which begins with the absence of plans for additional CFPPs, except those listed in the RUPTL of PT PLN (Persero) 2021-2030, as well as CFPPs integrated with strategic industries.

“For CFPPs entering the retirement period, the electricity supply will be replaced with renewable energy plants, such as PLTA/M/MH, PLTP, PLTS, PLTB, PLTP, and PLT Bioenergy. The Ministry of Energy and Mineral Resources along with related Ministries/Agencies and PLN are currently reviewing the potential for early retirement of several CFPPs in Indonesia,” said Dadan.

“This study includes a discussion of the techno-economic feasibility of the early retirement of the CFPPs as well as the potential volume of CO2e emissions that can be avoided by replacing it from renewable sources,” he added.

Currently, the process of compiling a roadmap for accelerating the termination of the CFPPs operational period is being compiled to be further included in a sectoral planning document which is also coordinated with the Minister of Finance and the Minister of SOEs.

The CFPPs retirement plan is still being discussed in depth to ensure the funding capability of the program, which has been accompanied by a risk mitigation study, including in the context of gradually reducing coal consumption.

Reduce coal consumption

Dadan revealed that there are several strategies to reduce coal consumption, like implementing the Cofiring Program or mixing biomass as fuel in CFPPs.

As of August 2022, 32 CFPPs have implemented the Cofiring Program commercially, requiring 292 thousand tons of biomass and producing green energy equal to 340 GWh. In 2025, the target is 52 steam power plants which will require 450 thousand tons of biomass.

Currently, the government is preparing the Draft Regulation of the Minister of Energy and Mineral Resources on the Utilisation of Biomass as a Fuel Mixture in CFPPs.

“This will also gradually replace the electricity provided by coal-fired power plants to renewable energy power plants, especially those that have entered the end of operations,” said Dadan, adding that the government was also taking steps to utilise clean coal by encouraging the downstream coal program so that it can substitute fuel and gas fuels, as well as raw materials for the chemical industry (Methanol and DME).

“Finally, we also utilise Carbon Capture Storage/Carbon Capture Utilisation and Storage (CCS/CCUS) technology to absorb the greenhouse gas emissions produced,” he said.

In the near future, one of the milestones in the energy transition implementation in Indonesia will be realised by achieving renewable energy targets in the national energy mix by 23% in 2025, the Ministry

ASIAN POWER 13 REGULATION WATCH

[Biomass] will also gradually replace the electricity provided by coal-fired power plants

The new regulation will limit the construction of new CFPPs and encourage the implementation of early retirement

Renewable energy use may become mandatory for some sectors in India: IEEFA

When India’s government passes the amendments to the Energy Conservation Act, some sectors in India may be compelled to source their power from renewable energy sources, or else they will be penalised up to INR1m (INR10 lakh) for failure of compliance.

The Energy Conservation (Amendment) Bill 2022, or Bill No.177-C of 2022, which was passed by the country’s lower house or Lok Sabha in August and by the upper house or Rajya Sabha in December, will mandate a minimum consumption of energy from non-fossil fuel sources in sectors, which include mining, cement, textile, and transport such as railways and commercial buildings.

Aside from the INR1m penalty, those who fail to comply may also be liable to an additional penalty not exceeding twice the price of every metric ton of oil equivalent prescribed under the law, which is over the prescribed norms.

“They will have to necessarily use some of their energy requirements being met to non-fossil fuel energy. So I think that’s the demand side push, which the bill is trying to get by making this obligatory in some of the industries,”

Vibhuti Garg, Energy Economist and Director, South Asia at

Over time, when the prices for renewable energy and green hydrogen keep going down, most of these companies will increase the share from nonfossil fuel energy

IEEFA, said. Under the proposed measure, the government may specify the standard of processes and energy consumption for appliances, vehicles, vessels, industrial units, buildings, or establishments. Building, under the bill, includes those that have a minimum connected load of 100 kilowatts or contract demand of 120-kilovolt ampere and will be used for commercial, office, or residential purposes.

Energy-intensive industries have to get energy audits and submit a report on the status of energy consumption at the end of a financial year to the designated agency. Those who fail to comply will be liable to up to INR1m (INR10 lakh) and an additional penalty up to INR10,000 daily for continuing failures, the new bill said.

India, which aims to achieve net zero by 2070, pledged to reduce the emission intensity of its gross domestic product by 45% by 2030, from 2005 levels, and have around 50% of its total installed electric power capacity from non-fossil fuel resources at the same period, according to a statement by the Ministry of Environment, Forest and Climate Change.

Fossil fuels accounted for 58.5% of India’s total energy mix, whilst the remaining 41.5% were from non-fossil fuels, data

from the Ministry of Power showed as of 30 June 2022. Of the fossil fuels, 50.7% were sourced from coal.

Future of fossil fuel

Generally, it is easier for industries to finance their operations that are linked to environmental, social, and governance (ESG) goals, such as the reduction of carbon emissions, Garg said. Indian industry players are also tapping into international financing through ESG pools or green bonds.

Once the proposed measure is passed and there is now demand to meet the obligations for non-fossil fuel use, this will drag down the demand for coal from these industries.

However, Garg noted that clean technologies, combined with storage or green hydrogen remain expensive.

“Over time, when the prices for renewable energy and green hydrogen keep going down, most of these companies or industries will be increasing the share from non-fossil fuel energy and reduce reliance on coal,” she said.

Renewable energy received more funding than coal for the third straight year in 2020, accounting for 74% of the total US$3.2b loans during the period, all of which were solar and wind.

14 ASIAN POWER

REGULATION WATCH

Vibhuti Garg

INDIA

The Energy Conservation (Amendment) Bill 2022 will impose minimum consumption of non-fossil fuel sources.

Once the proposed measure is passed and there is now demand to meet the obligations for non-fossil fuel use, this will drag down the demand for coal from these industries (Photo: Coal workers at Rourkela, Orissa, India by benbeiske on Flickr)

Solar firm Sun Cable up for sale to power cross-border grid integration project

Developing a solar energy network comes with its set of challenges, particularly when the goal is to create the world’s largest. In January 2023, Singapore energy firm Sun Cable made the difficult decision to enter voluntary administration to secure additional capital and progress the development of its Australia-Asia PowerLink project (AAPowerLink Project). As a result, an independent third party, FTI Consulting, was appointed to oversee the solar company’s financial affairs and make crucial decisions.

This decision follows the “absence of alignment with the objectives of all shareholders.” According to Sun Cable, they could not arrive at a consensus on the future direction and funding structure of the company despite having funding proposals at hand.

“The administrators intention is to continue to pursue the company’s development portfolio, with a view to achieving either recapitalisation via Deed of Company Arrangement or a going concern sale in the short term,” FTI Consulting, the voluntary administrators of Sun Cable, said in a statement.

“Indicative timing for the sale process is approximately three months,” it added.

John Park, Leader Australia, Corporate Finance & Restructuring for FTI Consulting, said the administrators aim to “preserve” the value of the company and look into all the options for the project’s development.

“We will seek to crystalise the interest expressed in the future of Sun Cable into a firm offer for the benefit of creditors and

other stakeholders via the sale process. Ultimately, the successful bidder will have the opportunity to take the business forward in line with their vision,” Park said.

Sun Cable’s portfolio consists of a further 11 GW of proposed projects.

AAPowerLink project progress

The around US$24.8b (A$35b) project aims to supply 15% of Singapore’s electricity supply through the world’s largest solar farm, battery, and 4,200 kilometres of undersea cable, traversing Indonesia.

Once completed, Sun Cable CEO and Founder David Griffin said in an email interview in December 2022 that the solar generation site, which spans 12,000 hectares of the solar array, will have a capacity between 17 gigawatts (GW) to 20GW, and a battery energy storage system capacity between 36GW-hours (GWh) to 42GWh, located in Darwin, Australia.

“This will support regional neighbours as they undertake the energy transition and simultaneously bolster green industrial economic development. Further, it will open significant renewable energy supply chain opportunities in many parts of Asia,” he told Asian Power.

“Ultimately, our vision is to connect the grids of the Asia Pacific and export Australian renewable electricity, as demand in Southeast Asia continues to grow. Through the Australia-Asia PowerLink and future projects, Australia’s abundant solar resource can supply low-cost and reliable solar power to Asia, with the opportunity to become a major renewable energy exporter to meet Asia’s electricity needs,” Griffin added.

The project’s construction is expected to commence after reaching a financial close in 2024 and will start operations starting late this decade.

AAPowerLink has also been 50% oversubscribed for offtake interest in Singapore with Letters of Intent for around 2.5GW, compared to the planned supply of around 1.75GW, as of October 2022.

Griffin said projects of such scale have “certain complexities,” one of which is design optimisation and ensuring that the end-to-end system will deliver resilient supply at a competitive price.

As the project has one of the largest logistical undertakings, Sun Cable is focusing on prefabrication and efficient logistics, as well as improving the delivery of solar and storage projects in Asia.

Sun Cable in October 2022 also launched the Asia Green Grid Network along with nine corporate and research institutes to push for innovation that will support a connected grid in Asia. Aside from this, the network also aims to provide education on key areas of the green grid through briefings and seminars, and foster collaboration for research and new connections.

Priority listing

The AAPowerLink project was also identified as “investment ready” by Infrastructure Australia, which meant that AAPowerLink has met the requirements to be included in the priority list, and affirmed its economic benefits.

“Securing Stage 3 ‘Investment ready’ status sends a strong signal to investors and Australian government funding agencies that the AAPowerLink has an appropriate net cost benefit, which means it is a project that is good for the nation and one that the Commonwealth Government would see merit in supporting,” Griffin said.

Sun Cable said in a statement that the benefits of AAPowerLink to Australia include 800 megawatts of zero-carbon electricity for Northern Australia, A$8b in expected investments, A$2b in expected annual export revenue from 2028, creation of around 14,000 direct and indirect jobs, and the abatement of around 2.6 million tonnes of estimate carbon emissions.

AAPowerLink last November was also included amongst the 26 projects in the energy sector in the G20 Action for Strong and Inclusive Recovery list. The list includes “concrete” actions, projects, and initiatives that will provide an opportunity for international collaboration.

ASIAN POWER 15

PACIFIC REPORT

John Park

ASIA

Its project aims to deliver renewable energy from Australia to Singapore.

Through AAPowerLink, Australia’s abundant solar resource can supply low-cost and reliable solar power to Asia (Photo from SunCable.energy)

Our vision is to connect the grids of the Asia Pacific

We support the government’s efforts to make geothermal energy not only clean and reliable, but also affordable

Riza Pasikki COO & CTO KS Orka

16 ASIAN POWER

KS Orka’s gradual development model increases geothermal projects’ success in Indonesia

By implementing this strategy, the company can mitigate the risk of incurring a US$5m loss from drilling a single well.

When it comes to developing geothermal power plants, the traditional approach can be risky and time-consuming. But Indonesian power plant developer KS Orka has found a solution: the gradual development model. This model enables KS Orka to minimise operational risk and costs, converting any well with a pressure of 4 bar or more into electricity. This not only reduces the risk of drilling wells that do not generate revenue but also speeds up the development process, taking just five years to reach a target capacity of 220 MW. By using an expander instead of a turbine, the company is able to simplify the conversion of energy into electricity.

There are at least two critical financing for geothermal developers, namely drilling costs and power plant construction costs which take up around 80% of the total financing of a project. “So if we can make cost efficiencies, speed up power plant construction time and reduce drilling risk, in the end, we can still implement projects with the business value expected by investors,” said Riza Pasikki, Chief Operating Officer & Chief Technology Officer of KS Orka to Asian Power.

KS Orka applies a gradual development model using a modular power plant concept with technology from Kaishan Manufacture which is their sponsor. The Kaishan power plant technology has high flexibility in terms of well characteristics. Wells with low pressure (3 bar) can still be used for electricity generation so that subsurface risk, which is one of the biggest risks in geothermal development, can be minimised.

Gradual development model

Gradual development model is carried out by KS Orka through its two geothermal power plants, namely Sorik Marapi Geothermal Power (SMGP) in North Sumatra and Sokoria Geothermal Indonesia (SGI) in East Nusa Tenggara. Riza said that this was different from most other developers who did it serially. According to Riza, this gradual model is much more efficient in minimising development time and reducing initial investment, which in turn reduces the payback period of the investment model.

“So far, the developers have been doing it serially. This means that when they target the development of 240 MW, after the exploration process, they will first drill massive wells to ensure that the steam needed is sufficient for the operation of the 240 MW power plant, then they can enter the construction phase and start operations,” said Riza.

According to Riza, this method usually takes a long time, even up to ten years. Meanwhile, with gradual development, the time needed is much shorter. For example, the development of SMGP Unit-1 with a capacity of 45 MW was completed in just 3 years after the exploration well was drilled, followed by Unit-2 in 20 months.

“It’s different from us, which implements gradual development,” explained Riza. He gave a further example of the phased model in the SMGP project by dividing the 240 MW development into 5 phases. The first phase (45 MW) started operating in late 2019, the second phase (45 MW) in 2021, and the third phase (50 MW) has been operational since October 2022. The fourth unit (50 MW) which is currently under construction is expected to start operating at the end of 2023 and the fifth unit (50 MW) in the following year so that a total generation of 240 MW can be achieved by the end of 2024.

The technology they use also allows for a faster fabrication and installation process and is very flexible to the pressure and enthalpy conditions of the well. “In our two projects, wells with any performance can still be converted into electricity. So there are no wells that are not functioning,” said Riza.

“The application of modular technology also allows the placement of each power plant close to the well (decentralised

wellhead power plant) thereby eliminating energy loss when flowing steam from the well to the power plant located on the pipeline as is the case in geothermal projects that are generally developed in a centralised manner,” added Riza.

In addition, each modular power plant operates independently, thus facilitating the maintenance process with a maintained availability factor. It was noted that SMGP Unit-1 45 MW which consists of 18 modular power plants can still undergo a maintenance process according to standards but can still maintain an availability factor of above 95%.

A simpler expander

To better support this model, KS Orka doesn’t use turbine technology like other developers but uses a screw expander. According to Riza, the structure of an expander is much simpler than a turbine, it has fewer moving parts and is reliable. The screw expander in this modular generator can be applied to various operating needs and different well characteristics.

“By using an expander there will be no wasted well drilling, in contrast to a turbine which requires equal steam pressure from all production wells. Meanwhile, with an expander, various well characteristics with different pressures and enthalpies can still be used to generate electricity,” said Riza.

“Apart from that, the structure is simpler so that the operation will also be easier and more permissive to the concentration of NCG (non-condensible gas) and liquid droplets and even to small solid particles contained in steam from production wells. Even though the NCG content has increased, it has not significantly reduced the work efficiency of the expander,” he added.

KS Orka also made breakthroughs in the subsurface area including drilling. For example in selecting a fit-for-purpose rig in the SMGP project which is no longer in the exploration phase where the reservoir conditions and the depth of the well to be drilled are well defined, which is no more than 3,000 meters.

With this understanding, a rig with a capacity of 1,000 HP is sufficient to achieve the drilling target so that savings especially in fuel costs, which can cost up to 12% of the project cost, can be realised. Drilling at SMGP with a cost of between $3.5 - 4 million per well is low compared to other developers on the island of Sumatra,” said Riza.

“That is also our advantage so that in the end we can reduce costs and be able to provide electricity at a price below the State Electricity Company (PLN) Basic Cost of Supply (BPP), 8.1 cents/KWH in SMGP and 12.5 cents/KWH in SGI. We do this to support the government’s efforts to make geothermal energy not only clean and reliable but also affordable,” said Riza. “Of course, all the breakthroughs that have been made by KS Orka were also carried out without the slightest reducing concern for safety and the environment,” he added.

KS Orka has currently carried out several project contracts with PLN. The first is the SMGP project with a current installed capacity of 140 MW through geothermal power plants units 1, 2, and 3. Development of the SMGP field is continuing to achieve a generating capacity of 240 MW in 2024. The second project, SGI, starts with the first unit of 5 MW in March 2022. “Next year in March, we will enter Commercial Operations Date (COD) the second unit which is currently in the construction stage of 3 MW, then in 2024, there will be an additional 11 MW. Finally, in 2025 there will be an additional 11 MW. So the total is 30 MW,” said Riza.

Riza added that the opportunity for developing geothermal energy is still very large. Indonesia has the largest geothermal reserves in the world but its utilisation is still less than 10%. KS Orka will also open up opportunities as a technology provider for developers who want to use and implement KS Orka technology.

ASIAN POWER 17

INDONESIA

INTERVIEW

CEO INTERVIEW

ACEN’s successful Energy Transition Mechanism deal marks a new era for coal divestment

The ETM transaction will enable the early retirement of the South Luzon Thermal Energy Corp. power plant.

For years, the Philippine-based energy group ACEN has been working towards divesting the South Luzon Thermal Energy Corp. (SLTEC) power plant. But traditional banks and investors are moving away from financing coal. With the help of the Asian Development Bank (ADB)’s Energy Transition Mechanism (ETM), ACEN was able to divest the plant in November 2022. ACEN and ADB’s ETM deal is considered to be historical because it is the first market-based deal to provide funding for the retirement of coal plants.

According to ADB, the ETM is a scalable and collaborative concept that leverages low-cost and long-term funding to retire coal power assets on an earlier schedule than if they remained with their current owners.

“ETM is a very novel concept, it still takes an extra step to convince the board of directors that such investment in an ETM structure deserves a carve-out or an exception to their policy against lending coal, since technically speaking, this is still lending to a coal plant,” Ayala-led ACEN President and CEO Eric Francia told Asian Power.

The full divestment of the SLTEC power plant saw some P13.7b debt financing provided by the Bank of the Philippine Islands (BPI) and Rizal Commercial Banking Corporation (RCBC), and another P3.7b in equity investments from the Philippines’ Government Service Insurance System (GSIS), The Insular Life Assurance Company, Ltd., and ETM Philippines Holdings, Inc. This will enable the early retirement of the 246-megawatt (MW) coal plant, based in Batangas province.

Tell us about ACEN’s recent Energy Transition Mechanism deal. The ETM is an innovative approach for us to divest the coal plant in a responsible manner, initiated by ADB in this part of the world that takes in low-cost long-term, purpose-driven investors to acquire coal plants with the goal of retiring earlier than their technical life.

ACEN has, together with our parent company Ayala Corp., announced our commitment to net zero greenhouse gas emissions by 2050. This entailed the divestment or spinning out of our thermal assets, both coal and diesel, to achieve at least zero Scope 1 emissions by 2025–that is coming from our own generation.

We got a positive reaction from our investors because it is where the world is headed in terms of the energy transition. By and large, we got strong support for that initiative; however, there were some ESG investors who raised concerns. We may be just passing the emission problem to somebody else through a plain vanilla divestment and worse, if we just divested to an unlisted company or a private company that is typically less transparent in reporting, and less incentivised to do the right thing in managing those emissions as they have no public stakeholders or investors that will keep them honest. They may extend the life of the plant to maximise their investment.

When we were grappling with this issue and trying to come up with solutions, we found out about this Energy Transition Mechanism being pushed by ADB and a host of other big financial major financial institutions. It was really an “Aha!” moment for us in terms of being the potential solution to the issue at hand. We had a series of conversations with various partner institutions, including ADB, to explore this opportunity.

What are other key challenges you encountered for this transaction and how did the company address them?

One of the key challenges of this transaction was for the stakeholders

ETM is a very

technically speaking, this is still lending to a coal plant

to accept the very notion of the ETM, where you put money in a coal plant with the intention of retiring the plant earlier than its technical operating life. We have to remember that many institutions already have a policy against lending or investing in coal plants. A lot of banks and investment funds, and investors are already shying away from coal assets.

If you have such a policy, then you have to go back to the board for some exemption or carve-out and that’s not easy. We started with the two banks, BPI, and RCBC. Interestingly enough, these two banks are amongst the first banks in the Philippines to establish a policy about lending to coal. They were the first two banks that limited coal lending. Fortunately, when they took the initiative of going back to their boards and getting this carve-out, that for us was a breakthrough because it is quite important to get these like-minded individuals to support the concept of ETM.

The insurance companies also saw the value of the ETM concept, seeing it as an additive to the costs of sustainability and energy transition. They also saw that the inherent structure of the deal meant that they would have stable long-term cash flows. It is like hitting two birds with one stone, both from a sustainability impact perspective, and the long-term cash flow perspective. Those were the critical enablers to the top challenge of embracing ETM as a new concept, notwithstanding the policies or stance against call investment.

What will happen with South Luzon Thermal Energy Corporation now that the deal has been completed?

Coal plants typically operate for around 50 years. What we committed in the SLTEC ETM is that ACEN will retire the SLTEC

18 ASIAN POWER

novel concept;

The ETM is an innovative approach for us to divest the coal plant in a responsible manner (Photo: Eric Francia, President and CEO, ACEN)

PHILIPPINES

after its 25th anniversary, which happens to be in 2040. Under normal circumstances, the plant would still be fit to run for another 15 to 25 years. That is if you make the proper maintenance and investments. We committed that it will be retired by 2040 or earlier and we will transition it to cleaner technology.

The new owner can do the transition themselves, but we also ensure that we have the ability to effect the retirement and the transition by having the option to buy back the plant when it is time to retire and transition. ACEN has the ability to control the plant in the future, if we had to, in order to effect the transition.

Between now and 2040, the plant is expected to operate and provide reliable, affordable power to the grid, especially during this time when supply is tight in the country. To ensure the viability of SLTEC, ACEN will be purchasing the entire output of the power plant until 2040. This establishes the steady cash flows that the investors are looking for. We are still the purchaser of the output of the program.

In addition, the new investors will be comfortable with their investments. We have an agreement between ACEN and SLTEC to make sure that we have operations and maintenance oversight whilst the 200 people who run and operate the power plant remain in SLTEC. As part of the transaction, we have an arm’s length contract where ACEN will ensure the quality, safety, and reliability of the plant to give quality assurance to investors that their investments or in this particular case, the plant is running safely, reliably, and efficiently.

In the meantime, we have around 18 years to manage the transition of SLTEC and we are collaborating with the SLTEC organisation to ensure a just energy transition.

The deal retains ACEN’s ability to assist the new owner in phasing out the coal plants and gives it the option to buy back the plant. What are initial plans of the company in converting the plant?

No definite decision yet, because it is still early given that our commitment is to retire the whole plant in 2040. We still have 18 years ahead of us. If you asked me if we had to do this today or in the next five years, the most likely answer is something that companies in Australia, for example, are already doing, which is to decommission the coal plants and replace them with big batteries. That is not to say that it is what we are going to do for sure because for now, a big battery is probably the most viable source of energy, but in 10 to 15 years time, there might be other, more compelling technologies other than big batteries. We’ll have to see how technology progresses over the next decade.

The ETM resulted in a P17.4-b worth of proceeds. How do you plan on using this?

Around P10b of that was used to refinance the legacy loan of SLTEC. The P7.2b approximately was the amount that went to ACEN, which ACEN will redeploy to support our aggressive renewables expansion.

To give you an idea, with the P7.2b of equity, we could add project debt or corporate debt, we can put leverage into that that would give us more than P20b of capital if you include the debt component that could be supported by that P7.2b of equity and that could then go towards enabling some of our solar and wind projects in the Philippines.

In some Southeast Asian countries, there are moves to reverse their coal phase-out plants amidst the threats to energy security. How did the energy crisis affect ACEN particularly, its transition goals?

It emboldened us and motivated us more to be aggressive in our renewables rollout. The reversal of policy or treatment of coal plants is more true in the likes of Europe, which has already shut down its coal plants but has not decommissioned yet. This really more of a short gap solution; but mid to long term, this energy crisis is a staunch reminder that energy security is critical. Therefore, countries will look to really harness their indigenous resources.

Despite the short-term setback of reopening coal plants, and coal mines. I think the silver lining here is that renewables expansion has

to be accelerated because it is cost competitive now, especially with the elevated fossil fuel price. It provides price stability, given that once you build renewables, it’s a fixed price, it’s stable for the long term and not subject to all this price volatility.

The stance that we are taking is that this energy crisis is a catalyst for accelerating renewables expansion. The one missing link in all this is energy storage, which has also become more expensive because of increases in commodity prices and supply chain issues. Bottlenecks resulted in a higher cost of battery storage, but the global consensus is that this is a temporary setback and that energy storage, particularly battery storage will resume its trend in price decline and efficiency gains. It should be cost-competitive and scalable over the next few years, perhaps in the mid to long term.

What’s next for ACEN? What can we expect in the next year?

Well, we are currently building around 1,000MW worth of renewables in the Philippines alone. We’re also building close to 1,000MW worth of renewables outside of the Philippines. A lot of this, close to 2,000MW new capacity, will be operational in the next 12 to 18 months.

We will be adding significant capacity to markets where we participate, and in this particular case, the three biggest beneficiaries are the Philippines, and Australia, where we are building 500MW. In fact, we expect that number to be close to 1000MW in Australia in the next few months. Then we’re also building more than 400MW in India.