VC DEALS PLUNGE AS PROFITABILITY QUESTIONS LOOM INRISKABLE STREAMLINES SME CREDIT ASSESSMENT FOR BANKS THROUGH AI

INVESTORS FACE HIGHER INVESTMENT THRESHOLD FOR HONG KONG RESIDENCY

ENDOWUS CHALLENGES COMMISSION BIASES IN HONG KONG’S FINANCIAL ADVISORY SCENE

Display to 30 June 2024 HK$40 Hong Kong’s Best Selling Business Magazine Issue No. 74

Awards 2024 Outt nd g te pi SURVEY MBA PROGRAMMES RANKINGS

Manage ment Excellence

追寻科学

奇迹,

焕发生命光彩

赛诺菲是一家全球领先的创新医药健康企业,于����年 进入中国,多元化业务覆盖制药、人用疫苗和消费者保 健。赛诺菲与中国同心同行,致力于将创新药品和疫苗加 速引进中国,不断变革医疗实践,造福更多中国百姓,也 为合作伙伴、社区和员工创造更美好的生活。

更多信息,请关注“赛诺菲中国”微信公众号,或访问 http://www.sanofi.cn.

赛诺菲中国官微赛诺菲中国官网

Established 1982

Editorial Enquiries:

Charlton Media Group Hong Kong Ltd

Room 1006, 10th Floor, 299 QRC, 287-299 Queen’s Road Central, Hong Kong | +852 3972 7166

As Hong Kong seeks to enhance its reliance on local suppliers for crops or food, a notable uptick in food tech startups has emerged in the city. One of the standouts in the space is Meat The Next, which is part of this year's Hottest Startups. For the full list of emerging ventures in Hong Kong, go to pages 38 to 40.

For more conservative investors, fintech remains a favorite domain. Find out why on page 36.

Venture capital firms elaborate on the reason for investors' selectiveness and their preference for startups with clear profit returns on page 32.

Innovators who have set new standards for excellence with their products and services are recognised in this year’s Hong Kong Business High Flyers Awards. Turn to pages 52 and 53 for the list of winners.

Exceptional initiatives that promote collaboration, investment, and development in the region are also honoured at the recent Hong Kong Business Greater Bay Area Enterprise Awards, whilst the Hong Kong Business Management Excellence Awards spotlights the best individuals and teams who have made significant contributions in employee engagement, corporate social responsibility, health, and inclusion. Congratulations to all the winners! Check out pages 54 to 57 to know more.

SINGAPORE

101 Cecil St., #17-09 Tong Eng Building, Singapore 069533 +65 3158 1386

HONG KONG

Room 1006, 10th Floor, 299 QRC, 287-299 Queen's Road Central, Sheung Wan, Hong Kong +852 3972 7166

MIDDLE EAST

FDRK4467,Compass Building,Al Shohada Road, AL Hamra Industrial Zone-FZ,Ras Al Khaimah, United Arab Emirates

www.charltonmedia.com

PRINTING

Gear Printing Limited

Flat A, 15/F Sing Teck Fty. Bldg., 44 Wong Chuk Hang Road, Aberdeen, Hong Kong

Can we help?

Editorial Enquiries: If you have a story idea or press release, please email our news editor at editorial@hongkongbusiness.hk.

Tim Charlton

HongKongBusiness is a proud media partner and host of the following events and expos:

HongKongBusiness is available at the airport lounges or onboard the following airlines:

2 HONG KONG BUSINESS | Q2 2024

To send a personal message to the editor, include the word “Tim” in the subject line. Media Partnerships: Please email editorial@hongkongbusiness.hk with “Partnership” in the subject line. Subscriptions: Please email subscriptions@charltonmedia.com. Hong Kong Business is published by Charlton Media Group. All editorial is copyright and may not be reproduced without consent. Contributions are invited but copies of all work should be kept as Hong Kong Business can accept no responsibility for loss. We will however take the gains. Sold on newstands in Hong Kong, Macau, Singapore, London, and New York. *If you’re reading the small print you may be missing the big picture HONG KONG BUSINESS FROM THE EDITOR PUBLISHER & EDITOR-IN-CHIEF Tim Charlton ASSOCIATE PUBLISHER Louis Shek EDITORIAL MANAGER Tessa Distor PRINT PRODUCTION EDITOR Eleennae Ayson LEAD JOURNALIST Noreen Jazul PRODUCTION TEAM Diana Dominguez Frances Gagua Olivia Tirona

Villegas EDITORIAL RESEARCHER

GRAPHIC ARTIST

Engracial COMMERCIAL TEAM

Posadas ADVERTISING

Vann

Angelica Rodulfo

Simon

Janine Ballesteros Jenelle Samantila Cristina Mae

CONTACTS Louis Shek +852 6099 9768 louis@hongkongbusiness.hk Shairah Lambat shairah@charltonmediamail.com AWARDS Julie Anne Nuñez awards@charltonmediamail.com ADMINISTRATION Eucel Balala accounts@charltonmediamail.com EDITORIAL editorial@hongkongbusiness.hk

HONG KONG BUSINESS | Q2 2024 3 CONTENTS 3 HONG KONG BUSINESS | JANUARY 2019 Published Quarterly by Charlton Media Group Pte Ltd, Room 1006, 10th Floor, 299QRC, 287-299 Queen’s Road Central, Sheung Wan, Hong Kong For the latest business news from Hong Kong visit the website www.hongkongbusiness.hk FIRST STARTUP EVENT SPACE WATCH PROPERTY WATCH CEO INTERVIEW INDUSTRY INSIGHT FINANCIAL INSIGHT ANALYSIS 36 COVER STORY FOODTECH AND FINTECH EMERGE AS BRIGHT SPOTS IN HONG KONG’S STARTUP LANDSCAPE MBA PROGRAMMES SURVEY MBA PROGRAMMES ATTRACT GLOBAL TALENT AND BOOST FEMALE ENROLLMENT 41 52 EVENT HONG KONG’S MOST EXCEPTIONAL INNOVATORS CELEBRATED AT HKB HIGH FLYERS AWARDS 2024 06 3 key strategies for Hong Kong retailers to amplify sales in 2024 07 Cooling measures rollback fails to stop housing market decline 54 Visionary leaders and enterprises lauded at Hong Kong Business Awards 20 Trip.com innovates workspace with fun features to boost employee morale 22 New eco-haven AIRSIDE boasts urban farm, smart bike parking system and more 18 inRiskable streamlines SME credit assessment for banks through AI 24 Endowus challenges commission biases in Hong Kong's financial advisory scene 26 Travel insurance sales in Hong Kong soar after unprecedented holiday boom 46 Why HK investors flock to Thailand's residential market 47 Tax incentives may not be enough for Hong Kong's global maritime hub goals 32 VC deals plunge as profitability questions loom 34 Hong Kong banks should play ‘long con’ to reap 2025 growth benefits BRIEFING 12 Government scraps MPF Offsetting Scheme to enhance employee protection 14 What does retail trading of tokenised securities mean for HK's Web 3.0 scene? 16 Retailers are urged to view returns management as loyalty drivers

News from hongkongbusiness.hk

Daily news from Hong Kong

MOST READ

MARKETS & ECONOMY

10 investment ideas for 2024

Anticipating the volatility in public markets in 2024 due to prolonged periods of rising interests, experts make a compelling proposition to invest in private and alternative assets. Some investors already see this as a strategic move to sidestep the more obvious jitters.

MARKETING

‘Emotional loyalty,’ the new way retailers retain customers

Loyalty programmes tend to focus on “transactional loyalty” or rewarding customers as they make purchases. But in Hong Kong, where almost half of consumers want to actively engage with brands, experts suggest that companies also prioritise building of “emotional loyalty.”

LEGAL/PROFESSIONAL SERVICES

Hong Kong’s most influential lawyers under 40

This year’s awardees specialise in international trade, restructuring and insolvency, commercial dispute resolution, banking and finance, aviation, commodities, energy, family and matrimonial law, and more. After a rigorous review, four women and six men made it to the final cut.

STARTUP

Ticketing and membership platform extends customer journeys through

In a traditional Web 2 ticketing platform, a customer’s journey ends after the event, leaving organisers unable to build loyalty or relationships with their attendees. In order to change that, Jonathan Mui and Peter Hui built an NFT ticket and membership platform called Moongate.

INSURANCE

Hong Kong’s top 50 insurers experience 7.7% YoY premium contraction in 2022

The premiums of Hong Kong’s top 50 insurers contracted by 7.7% year-onyear (YoY) in 2022, on the back of lower demand for linked products, decreased population size, and market uncertainty. In total, the top 50 companies saw their premiums reach HK$511.7b, smaller than the HK$554.2b in 2021.

COMMERCIAL OFFICE

Lodes flips the switch at new Hong Kong office to turn on creative minds

In its Hong Kong office, Lodes employs its innovative lighting solutions to serve a dual purpose: showcase products to clients and foster employee creativity. The Venice-based lighting solutions brand underscores the role of lighting environments in stimulating creative thought in indoor settings.

Vastcom's C.E.S.F,

powered by Check

Point, boosts stakeholder visibility and cybersecurity

By protecting company assets, we strengthen trust, safeguard operations, and pave the way for a secure digital future.

In today's cyber threat landscape, companies need top-notch cybersecurity. Next, we will discuss the significance of cybersecurity protection, the growing importance of visibility for C-level executives, and how Vastcom, in collaboration with Check Point Software, is enhancing company visibility and fortifying cybersecurity through their expert services and the Check Point Enterprise Security Framework (C.E.S.F).

Check Point Software Technologies: Leading the Way in Cybersecurity

Check Point Software Technologies is a renowned cybersecurity company that provides industry-leading solutions to protect organisations worldwide against cyber threats. With a focus on innovation and security excellence, Check Point is committed to delivering cutting-edge technologies to safeguard businesses in today's digital landscape.

Vastcom Technology Limited: Your Trusted Check Point Solution Partner

In the digital age, cybersecurity is not just a concern—it's a necessity. Vastcom Technology Limited, founded in 2010, is at the forefront of cybersecurity solutions, with a strong focus on customer satisfaction. With offices in Macau, Hong Kong, Zhuhai, and Singapore, Vastcom offers a wide range of products and services tailored to assist customers in their digital transformation journey.

The Alarming Rise of Cybercrime

Recent years have witnessed a staggering surge in cybercrime incidents, affecting businesses of all sizes across various industries. Hackers, armed with sophisticated tools and techniques, exploit vulnerabilities in digital systems, causing financial losses, reputational damage, and compromising sensitive data. The consequences of such attacks emphasise the need for comprehensive cybersecurity measures.

The Importance of Cybersecurity Protection

Cybersecurity protection is no longer an optional investment but a critical necessity for companies. It encompasses a range of practices, technologies, and strategies aimed at safeguarding digital assets, infrastructure, and customer data. A robust cybersecurity framework serves as a shield against cyber threats, ensuring business continuity, trust, and compliance with regulatory requirements.

The Role of Visibility for C-Level Executives

In the face of growing cyber threats, C-level executives are increasingly realising the importance of cybersecurity visibility. They understand that a lack of visibility into the organisation's cybersecurity posture can lead to severe consequences. By having a clear understanding of the company's security landscape, executives can make informed decisions, allocate resources effectively, and proactively mitigate risks.

Vastcom's Expert Services and Check Point Software

Vastcom, a leading cybersecurity solutions provider and the highest-tier partner of Check Point in Macau, has partnered

In the digital world, comprehensive cybersecurity is not just important for your company—it is imperative. By prioritizing the visibility of your business in cybersecurity, you establish the foundation for trust, protect your assets, and safeguard your future in the ever-evolving landscape of technology.

with Check Point Software to enhance company visibility and fortify cybersecurity measures. Their team of experts brings years of experience, knowledge, and cutting-edge technologies to deliver comprehensive services, including risk assessments, vulnerability management, incident response, threat intelligence, and security awareness training, empowering organisations to achieve cybersecurity excellence through the Check Point Enterprise Security Framework (C.E.S.F).

Check Point Enterprise Security Framework (C.E.S.F)

At the heart of Vastcom's approach to enhancing company visibility and security lies the Check Point Enterprise Security Framework (C.E.S.F). This framework provides a holistic and integrated approach to cybersecurity, enabling organisations to strengthen their security posture. C.E.S.F addresses key areas such as network security, cloud security, mobile security, endpoint security, and IoT security. By adopting this framework, companies can achieve a unified and proactive security approach.

Enhancing Company Visibility and Security

Vastcom's collaboration with Check Point Software empowers companies to strengthen their visibility and increase their security levels. By leveraging Vastcom's expert services and the C.E.S.F, organisations can identify vulnerabilities, detect and respond to threats in realtime, and establish a robust security infrastructure. The comprehensive risk assessments and vulnerability management provided by Vastcom enable companies to proactively identify and address potential weaknesses.

Conclusion

In the face of the escalating cyber threat landscape, companies must prioritize cybersecurity protection and visibility. Vastcom's expert services, powered by the Check Point Enterprise Security Framework, provide a comprehensive solution to enhance company visibility and fortify cybersecurity measures. By adopting these services, organizations can mitigate risks, protect sensitive data, and maintain business continuity in the digital age. With Vastcom and Check Point Software as trusted partners, companies can confidently navigate the complex world of cybersecurity and emerge stronger against evolving cyber threats.

HONG KONG BUSINESS | Q2 2024 5

AI DEMOCRATISATION Outsta d g Enterpises

3 key strategies for Hong Kong retailers to amplify sales in 2024

Hong Kong's retail sector is witnessing a robust recovery with a 7.2% increase in sales compared to the previous year, prompting experts to recommend innovative strategies to maintain this growth. Emphasising the use of generative AI, livestreaming, and an omnichannel approach, e-commerce provider SHOPLINE outlines key tactics for retailers to enhance customer engagement and sales.

Strategy 1 AI-assisted chat

Utilising AI through a message centre can handle and consolidate incoming chats from all social platforms can reduce the working load on customer service representatives. WhatsApp, Facebook, and Instagram.

With SHOPLINE, merchants are allowed to upload store-specific information, such as return policies and business hours, to its AI Database. The AI assistant will then provide suggested replies, accelerating productivity and improving conversion rates.

SHOPLINE reported that 77% of customers place orders successfully after receiving salesrelated messages through chat.

"Recently, consumers in Hong Kong have increasingly preferred using instant messaging applications to communicate with merchants. The introduction of Gen AI can eliminate long waiting times and avoid generic responses," SHOPLINE added.

Strategy 2 Livestreaming

SHOPLINE underscored that, on average, consumers in Hong Kong spend nearly two hours daily using social media platforms.

Hopping on the livestream selling trend, SHOPLINE began supporting YouTube Shopping, enabling merchants to use the YouTube platform for marketing, which

showed favourable results, driving merchants’ GMV and website traffic.

"Since its introduction to SHOPLINE, YouTube Shopping has proven its value in supporting business success. In one case, live streaming has contributed to over 30% of a merchant’s GMV and has been responsible for driving 23% of their website traffic," SHOPLINE shared.

According to data analysed from the e-commerce platform, livestream sales in Hong Kong were most significant during the year-end shopping peak season, with conversion rates ranging from 50% to 70%.

In 2024, the 15-day period leading up to Chinese New Year is a peak shopping period.

Year-on-year comparisons of the week preceding Chinese New Year have shown that merchants who sell Chinese New Year products experienced a 15% annual increase in GMV, said SHOPLINE.

Many customers also utilised livestream shopping to purchase some of the top 10 New Year goods for 2024, which include radish cake, red date cake, and taro cake.

In addition, merchants who sell seafood products and Chinese New Year goods achieved seven-figure revenue through livestreaming alone.

Strategy 3 Omnichannel

According to SHOPLINE, many Hong Kong residents flocked to membership warehouse clubs and mega malls in Shenzhen, such as Sam's Club and Costco, in search of slashed prices and bulk-buy deals.

SHOPLINE also observed that its merchants have started offering personal shopping services for Sam's Club products, with electronic appliances being particularly popular amongst Hong Kong consumers.

"Between December 25th 2023 and January 28th 2024, the average year-on-year GMV growth of merchants providing Sam’s Club purchasing services increased by 25%. Among them, some merchants recorded a year-on-year GMV growth of nearly 40%, whilst some others have been able to achieve six-digit revenues," the platform reported.

To take advantage of this trend, SHOPLINE merchants implemented an OMO (Online Merge Offline) strategy, integrating digital storefronts with physical stores which bolstered their average YoY sales growth to 1.7 times.

Live streaming has contributed to over 30% of a merchant’s GMV and has been responsible for driving 23% of their website traffic

6 HONG KONG BUSINESS | Q2 2024 FIRST

An order management system can be made more dynamic with an OMO (Online Merge Offline) strategy (Photo from Shopline)

RETAIL

Cooling measures rollback fails to stop housing market decline

Hong Kong’s withdrawal of all property cooling measures in the residential property market is expected to lead to a significant sales increase. Despite these changes, which include the removal of multiple stamp duties, analysts predict only a modest boost in sales and caution that the overall downward trend in housing prices is likely to continue due to high interest rates and a sluggish economy.

In the 2024 Hong Kong budget speech, Financial Secretary Paul Chan unveiled a full roll-back of property cooling measures. These include the special stamp duty (SSD)

of 10% to 20% if owners resell their units within 2 years; the Buyer’s Stamp Duty (BSD) or an additional 7.5% for non-Hong Kong and company buyers; and the New Residential Stamp Duty (NRSD) of HK$100 to 4.25% of the property value.

The move may lead to a 10% to 15% sales increase in 2024, says JLL Hong Kong chairman Joseph Tsang.

Still, Tsang expects housing prices will still fall by 10% as the market continues to grapple with high interest rates and a weak economy.

“Currently, there is a potential new housing supply of 109,000 units, which poses pressure

Commercial property woes weigh on Hong Kong banks

The ongoing office and retail property market woes in Hong Kong will weigh on local banks’ asset quality challenges in 2024, says Fitch Ratings.

However, the expected receding risks in the banks’ mainland China property portfolio will help offset impact and drive a modest decline in credit costs.

“We expect the impact on the banks’ asset quality and profitability from strains in the local CRE market to be more muted than in the previous two years when they had to make considerable provisions against their exposures to mainland China’s property sector,” Fitch Ratings said.

Banks are mitigating risks in the commercial real estate (CRE) sector by requesting additional credit enhancements from borrowers, whilst also maintaining conservative loan-to-value (LTV) ratios, the ratings agency said. Fitch estimates that the average LTV ratio is less than 50% for all commercial property-

backed loans amongst its rated banks.

“This conservative approach should enable the banks to withstand potential valuation deterioration in collateralised commercial properties this year, limiting the increase in credit costs, in our view,” Fitch said.

Risky investment

As of September 2023, lending to property development and investments made up 15.7% of banks’ total loans, and 5.9% of total assets, according to Fitch.

Meanwhile, the risk in unsecured loans will depend on the borrowers’ financial strength and access to alternative cash flows.

“[But] these loans are typically only granted to those with diversified rental income streams that could help them weather a potential downturn in a single CRE segment such as the office market,” Fitch noted.

on developers. It is expected that developers will accelerate their pace of launching new projects,” Tsang said.

Colliers’ head of research Kathy Lee noted that the positive impact from the policy will only become more evident in H2 2024, with housing prices rising by 5% to 10% in 2025.

Gradual rebounding

The withdrawal of cooling measures may also lift the second-hand residential market, with transaction volumes likely to rebound to 63,000 units for 2024, around the same level as in 2017 to 2021, Lee said.

CBRE’s head of research Marcos Chan also expects recovery of transaction volumes to be gradual.

“We believe this is seen as a positive move and will likely create positive momentum for the market, however, any pickup in transaction volume will be gradual as high borrowing rates remain a hurdle for many commercial investment activities - rental recovery and vacancy improvements remain the key for a more sustainable recovery in investment demand,” Chan said.

Short term pause

Meanwhile, after declining for 9 consecutive months, the downward trend in residential prices will likely pause and stabilize in the short term, said CBRE

Hong Kong senior director for valuation & advisory services Eddie Kwok.

Kwok, like Colliers’ Lee, expects that the removal of special stamp duty (SSD) to spur second hand-units to be put up for sale.

HONG KONG BUSINESS | Q2 2024 7

FIRST

RESIDENTIAL PROPERTY BANKING Price index Rental index (fresh lettings) 0 50 100 150 200 250 300 350 400 450 2013 2015 2017 2019 2021 2023 Year Index (Year 1999=100) 0 50 100 150 200 250 300 350 400 450 1/22 4/22 7/22 10/221 /234 /237 /231 0/23 Month/Year Index (Year 1999=100 ) Price and rental indices of private domestic units

Source: Hong Kong Monthly Digest of Statistics March 2024, Census and Statistics Department

Source: Fitch Ratings, Hong Kong Rating and Valuation Department, JLL

Hong Kong private office market

FIRST THESE ARE THE BEST AND WORST PERFORMING SECTORS IN HONG KONG ACCORDING TO STAN CHART’S SME INDEX NUMBERS

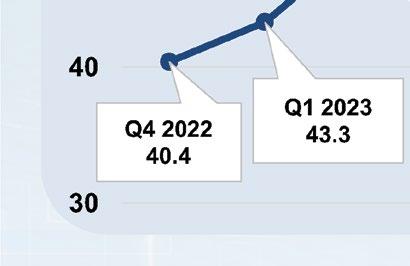

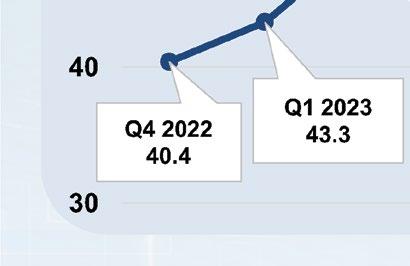

The “HKPC SME Support” announced the Standard Chartered SME Index for Q1 2024. According to the report, the overall index retreated by 3.9 to 43.7 in Q1 2024.

Of the five component subindices, only Investment Sentiment remained stable (48.8) whilst Profit Margin, Business Condition, Global Economy, and Recruitment Sentiment all declined, representing a weakened confidence in SMEs’ Q1 2024 business turnover.

In 11 business sectors, Finance and Insurance produced the best performance in Q1. This is followed by Social and Personal Services, according to the report.

In contrast, larger drops were recorded for Accommodation and Food Services, Import / Export Trade and Wholesale, Professional and Business Services, Information and Communications and Retail.

8 HONG KONG BUSINESS | Q2 2024

Source: Standard Chartered Hong Kong SME Leading Business Index Quarter 1, 2024

HONG KONG BUSINESS | Q2 2024

How to turn online window shoppers into sales

Discover the essential strategies to convert casual browsers into committed customers in the digital marketplace.

In the bustling world of e-commerce, it’s not enough just to capture the attention of shoppers. You also need to convert them into buyers. Just like in-store shopping, potential customers will browse your online products to see if anything catches their eye. Some may even click the ‘add to cart’ button. However, until the sale has been completed, there’s still the possibility that your would-be customer abandons their cart.

There are a number of factors that determine whether those online window shoppers will ultimately complete their purchase. Here’s how you can create an online customer experience that increases the chances of conversion.

Understand your audience

The first step is knowing who's browsing your online store. You can then craft a customer experience that takes into account their desires and expectations. Recent trends show a significant shift towards online shopping, with a notable preference for trying new brands. This trend is largely driven by the 'Discovery Generation'—consumers who are inspired by digital discovery and are open to exploring new products through online experiences.

Offer flexible shipping options

Consumers desire flexibility in how they receive their products. The absence of

options like click-and-collect, flat-rate shipping or curbside pickup can lead to cart abandonment. In fact, 57% of shoppers in the Asia Pacific region say they would swap retailers if they were not provided flexible shopping options. Providing various delivery choices caters to individual preferences, making the purchase decision easier for your customers.

Guarantee quick and on-time delivery

A common reason for brand switching is the anticipation of faster delivery elsewhere. 51% of e-commerce customers in Southeast Asia have switched brands for reasons including faster delivery time. Ensuring your logistics can meet or exceed customer expectations for delivery speed is essential. This builds trust in your brand’s efficiency and increases the likelihood of retaining customers.

Prioritise value and reliability

Customers are looking for value for their money and reliable service. Implementing cost-effective shipping solutions that do not compromise on service quality is key. Working with a trusted logistics partner like FedEx can enhance your delivery services,

offering both savings and reliability to you and your customers.

Embrace technological solutions

New technologies are making it easier than ever for e-commerce retailers to streamline their operations and improve their shipping services. FedEx, for instance, provides solutions that offer online tracking and digitised customs clearance, giving both you and your customers greater control and convenience.

Create a seamless e-commerce experience

The goal is to make every aspect of the online shopping experience – from browsing to receiving the product –smooth and easy. Integrating services that automate processes like shipping label creation makes your fulfillment of orders more efficient. This translates into a customer experience that’s intuitive and encourages self-service.

Building trust through transparency

Offering a transparent process where customers can easily track their orders and receive updates enhances customer satisfaction. This level of visibility and communication fosters a sense of security and trust in your brand.

Converting window shoppers into loyal customers in the e-commerce world requires flexibility, speedy logistics, technological integration and exceptional customer service. By understanding and implementing these key strategies, small businesses can enhance their online presence, offering a shopping experience that meets the high expectations of today's consumers.

Partnering with FedEx for logistics solutions can further streamline your operations, ensuring your products reach your customers efficiently, wherever they are in the world. Discover more tips to develop a winning e-commerce customer experience on the FedEx Small Business Center

Partnering with FedEx for logistics solutions can further streamline your operations, ensuring your products reach your customers efficiently, wherever they are in the world

10 HONG KONG BUSINESS | Q2 2024

THOUGHT LEADERSHIP ARTICLE

Turn browsing into buying with tailored experiences and seamless delivery.

HONG KONG BUSINESS | Q2 2024 11

Government scraps MPF Offsetting Scheme to enhance employee protection

Employers are no longer allowed to offset long service and severance payments from its contributions.

For decades, Hong Kong’s Mandatory Provident Fund Offsetting Scheme has been a subject of countless debates, with critics condemning how employees appear to be cheated out of their hard-earned money because employers are allowed to draw from their pensions to offset severance and long service payments.

This all ends in 2025 when the government greenlights the motion to finally abolish the scheme.

Under the Employment and Retirement Schemes Legislation (Offsetting Arrangement) Bill 2022, employers will no longer be able to use accrued benefits derived from the employer’s mandatory pension contributions to offset employee statutory severance and long service payments.

Breaking down the legal aspects of the proposed amendment, Tess Lumsdaine, partner at Baker McKenzie’s Employment & Compensation Practice in Hong Kong, explained the details in an interview with Hong Kong Business “By way of background, under the Employment Ordinance (EO), an employee with at least 24 months’ continuous service is entitled to a statutory severance payment (SP) if the employee is made redundant,” said Lumsdaine. This SP is meant to function as interim financial support whilst an employee transitions to new employment.

She continued to elaborate on the long service payment (LSP) provision, saying: “An employee with at least five years’ continuous service is entitled to a statutory long service payment if the employer terminates the employment contract for reasons other than redundancy or summary dismissal.”

Calculating contributions

The SP and the LSP are calculated in the same way. For a monthly rated employee, the calculation is: 2/3 x last full month’s wages (capped at $22,500 or US$2,876) x years of service pro rata for any incomplete year of service.

When it comes to MPF contributions, employees earning at least $7,100 (US$907) per month, along with their employers, must make mandatory contributions to the employee’s MPF of 5% of the employee’s relevant income capped at $1,500 (US$192) each for employer and employee.

“Employers and employees may also make voluntary contributions, subject to the governing rules of the relevant scheme,” Lumsdaine said.

“At the moment, there is an offsetting mechanism under the existing arrangements where employers can use the accrued benefits derived from the employer’s (not the employee’s) MPF contributions to reduce the employee's statutory SP or LSP entitlements,” she added.

Employers will have to adjust

“To reduce the risk of large-scale dismissals before the Transition Date, a grandfathering arrangement has been put in place,” Lumsdaine said.

Addressing this, the Labour Department said, “to assist employers, especially micro, small and medium-sized enterprises, to adapt to the policy change, the Government

is pressing ahead with the implementation of a 25-year Government Subsidy Scheme to share out employers’ SP and LSP expenses after the abolition.”

“The Labour Department will continue to conduct extensive publicity to help employers and employees understand the arrangements of the abolition and the Government Subsidy Scheme,” it said.

Lumsdaine explained that for the pre-transition date portion, “employers can continue to use the accrued benefits derived from the employer’s MPF contributions to offset SP and LSP entitlements before the Transition Date.

She said this is irrespective of whether the employer contributions are voluntary or mandatory.

An employee with at least 24 months’ continuous service is entitled to a statutory severance payment if the employee is made redundant

Ensuring balanced labour welfare

“With the removal of the offsetting arrangement, Hong Kong has taken a great step forward towards better employee protection. Employees’ benefits in their MPF/ORSO schemes will not decrease after the Effective Date even if they are dismissed or laid off,” Rosanna Chu, managing partner for EY Hong Kong firm, LC Lawyers, said in a report.

“While the abolition will inevitably increase the costs of operation, it is good news for employers that the abolition arrangement will not have any retrospective effect,” Chu added.

12 HONG KONG BUSINESS | Q2 2024 HR BRIEFING

MPFA hosts awareness campaigns to orient workers and social enterprises of the new programme (Photos from MPFA)

HR & EDUCATION

Tess Lumsdaine

Fidelity MPF

Your ultimate choice

At Fidelity, we have a forward-looking vision to help empower our clients to take charge of their investments and build a nest egg through digitalisation and retirement planning education. Our commitment has been recognised by industry awards and accolades over the years.

Fidelity MPF

Outstanding investment capabilities

“The 2024 MPF Awards” by MPF Ratings

Gold Rated Scheme for 12 consecutive years1

Retirement solutions tailored to members

“The 2024 MPF Awards” by MPF Ratings

Best MPF Post-Retirement Product 3

Dedicated investor education

“The 2024 MPF Awards” by MPF Ratings

Best Communication & Education for 8 consecutive years2

Commitment to business innovation

Hong Kong Business High Flyers Awards 2024 Financial Services4

Fidelity Investor Hotline: 2629 2629

Fidelity.com.hk/awards

The above awards are for reference only. It is not indicative of the actual performance of the constituent funds. For the award information details, please refer to https://www.fidelity.com.hk/awards.

1 Fidelity has won Gold Rated Scheme from MPF Ratings for 12 consecutive years during the period of 2013 to 2024 - the rating(s) only represent MPF Ratings’ assessment standard (for details, please visit: https://mpfratings.com.hk/ratings-methodology/).The results are based on the investment choices and performance, fees and charges and qualitative assessment of an MPF scheme as of 31/12/2012, 31/12/2013, 31/12/2014, 31/12/2015, 31/12/2016, 31/12/2017, 31/12/2018, 31/12/2019, 31/12/2020, 31/12/2021, 31/12/2022 and 31/12/2023.

2 Fidelity has won Best Communication and Education Award from MPF Ratings for 8 consecutive years during the period of 2017 to 2024 - the award(s) only represent MPF Ratings’ assessment standard (for details, please visit: https://mpfratings.com.hk/awards-methodology/). The results are based on the assessment across the various communication and education criteria of an MPF scheme as of 31/12/2016, 31/12/2017, 31/12/2018, 31/12/2019, 31/12/2020, 31/12/2021, 31/12/2022 and 31/12/2023.

3 Fidelity has won Best MPF Post-Retirement Product in 2024 from MPF Ratings - the award(s) only represent MPF Ratings’ assessment standard (for details, please visit: https://mpfratings.com.hk/ awards-methodology/). The results are based on the assessment on the post-retirement initiatives of an MPF scheme as of 31/12/2023.

4 The award only represents Hong Kong Business Magazine's standards for innovative business practices, outstanding quality of service, and relentless efforts to contribute towards social progress and business growth. The results are based on the assessment across nominations of financial services industry as of 31/10/2023.

Investment involves risks. Past performance is not indicative of future performance. Please refer to the Key Scheme Information Document and MPF Scheme Brochure for Fidelity Retirement Master Trust for further information including the risk factors. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. FIL Limited and its subsidiaries are commonly referred to as Fidelity or Fidelity International. Fidelity only gives information about its products and services. Any person considering an investment should seek independent advice on the suitability or otherwise of the particular investment. The third party mark appearing in this material is the property of the respective owner and not by Fidelity. This material is issued by FIL Investment Management (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission.

HONG KONG BUSINESS | Q2 2024 13

What does retail trading of tokenised securities mean for HK's Web 3.0 scene?

Previously, only professional investors were permitted due to the assets' novel nature.

As Hong Kong pushes forward with the development of the Web 3.0 ecosystem, retail investors can now participate in boosting its growth by gaining access to tokenised securities.

This access remains limited, however; as secondary market trading of tokenised securities amongst retail investors is still prohibited.

“One of the key elements of the Web 3 ecosystem is the adoption of blockchain technology, and, consequentially, the circulation of virtual assets,” said Katherine Liu, a partner and head of Fintech and Financial Services at Stephenson Harwood, when interviewed by Hong Kong Business. “By making virtual assets becoming more accessible to the public, the Hong Kong government is definitely taking positive steps in encouraging Web 3 development.”

Previously, the Securities and Futures Commission of Hong Kong (SFC) only allowed the issuance of tokenised securities to professional investors, partly because they were regarded as a novel asset class at that time and hence the product nature might be too complex for retail investors to understand.

But under SFC’s updated regulatory framework for security token offerings (STOs), this shall no longer be the case.

Padraig Walsh, partner at Tanner De Witt, said the issuance of tokenised securities follows a “same product, same risk, same regulation” principle, meaning existing regulatory requirements will apply to these products including the prospectus and investment public offering regimes, with additional requirements applied only to account for the tokenisation process.

“Regulated intermediaries engaged in regulated activities related to tokenised securities must fulfil existing conduct requirements for securities-related activities,” said Walsh.

“Primary dealing of tokenised SFC-authorised investment products can only proceed if the underlying product can meet the usual product authorisation requirements,” he explained.

Walsh highlighted that whilst traditional securities regulations apply to tokenised securities, the SFC has implemented extra internal controls to mitigate the unique risks of tokenisation technology and token ownership management.

Ownership and technology risks

To address ownership risks or how tokenised securities are transferred and recorded and technology risk such as blockchain network outages and cybersecurity risks, SFC has laid out several measures.

According to Walsh, the SFC circulars issued November 2023 provide that “intermediaries must conduct due diligence on the technology aspects of tokenised securities” and “must have the necessary resources to understand and manage ownership and technology risks.”

Intermediaries include virtual asset trading platform operators, virtual asset fund managers, virtual asset dealers and advisers, and virtual asset distributors.

Alan Wong, an associate at Stephenson Harwood,

clarified that only licensed corporations who have notified and received the SFC’s approval in carrying out restricted virtual assets-related activities are covered by the commission’s virtual asset regulations. Other licensed corporations are not permitted to undertake such restricted virtual assets-related activities.

Under SFC’s circulars, Walsh said intermediaries must also look into the investors’ experience and track record, as well as money laundering and terrorist financing risks, when dealing tokenised securities.

“Dealers, advisers and fund managers investing in tokenised securities must also conduct due diligence on the issuers and their third-party vendors or service providers involved in the tokenisation arrangement, as well as the features and risks of the tokenisation arrangement,” he said.

Regulatory standards

The SFC will aslo also implement a higher regulatory standard if product providers propose to use publicpermissionless blockchain networks. The SFC will expect additional controls and must address and mitigate heightened cybersecurity threats, data privacy concerns, system outages, and recovery issues, whilst also maintaining a thorough and effective business continuity plan. The generally preferred approach will be using permissioned networks.

“Product providers should confirm to the SFC that they have at least one competent staff with relevant experience and expertise to operate and supervise the tokenisation arrangement, and to manage the ownership and technology risks arising from the tokenisation arrangement,” Walsh explained to Hong Kong Business.

In the case of a loss of security tokens, Walsh said responsibility will depend “on the circumstances at the time.”

“The regulatory framework is focused on the measures that intermediaries must take to mitigate the risk of loss of security tokens. Responsibility for loss is a fact-specific issue that is not addressed in the regulatory framework,” Walsh said.

14 HONG KONG BUSINESS | Q2 2024 LEGAL BRIEFING

the Securities and Futures

only

STOs to professional investors

its novel and complex product nature

Responsibility for loss is a fact-specific issue that is not addressed in the regulatory framework Previously,

Commission

issued

due to

Katherine Liu

Padraig Walsh

Alan Wong

FINANCIAL SERVICES

HONG KONG BUSINESS | Q2 2024 15

Retailers are urged to view returns management as loyalty drivers

15% of customers abort a transaction if the return policy is subpar.

Returns management is now emerging from the shadows to claim its rightful place as a core element of any retailer’s customer strategy, as trends show that it is one of the most effective means of retaining customer loyalty and satisfaction.

However, some retailers still choose to shelve this concern, resulting in a disorganised or dysfunctional system.

“The industry needs to shift its mindset from viewing the return experience as a revenue drain to seeing it instead as a loyalty driver,” Michelle Evans, global lead for Retail and Digital Consumer at Euromonitor International, shared in an interview with Hong Kong Business

How to handle returns

Returns can be prompted by a variety of reasons but one thing’s for sure: a returned item came from an unhappy customer. To counter this, retailers must deploy strategies that would work best for their brand.

For example, Evans said that for some brands, offering their customers generous compensation has proven to be an effective approach in retaining the customers' patronage.

“Innovative retailers can create returns policies that offer more generous terms on higher margin goods. For example, US-based retailer Target offers a more lenient return policy on its 45 store brands,” she told Hong Kong Business

“Another option is to offer a more favourable returns policy as part of a loyalty membership programme to reward those who regularly shop with the brand,” she added.

Greg Buzek, president and lead analyst of global market research and analyst firm IHL Group, suggested that encouraging customers to return items in-store is also a good strategy as customers may be prompted to buy more items.

Euromonitor’s Voice of the Consumer: Digital Survey showed that 43% of digital consumers point to mail as the preferred channel for online purchase returns, with preferences varying by generation. For example, Baby Boomers prefer to return by mail, whilst Gen Zs prefer to return their previous purchases in-store.

“Though on the decline, half of digital consumers desire free returns, citing it as the most preferred delivery feature only after free delivery (63%). 15% say they will abort a transaction if the return policy is subpar. In addition, consumers value prompt refunds,” Evans said.

Third-party services

In mitigating the overwhelming stress brought about by returns, Buzek also suggested exploring innovative systems and "leveraging a trusted third-party service that can help design and execute the reverse logistics process.”

Commenting on this, Evans said: “Other retailers, especially in Europe, participate in an open locker network to make delivery and returns more convenient and cost-effective.

To achieve a successful returns management system, retailers should be able to balance the benefits to themselves and the customer.

Evans cited samples from some renowned global retailers, “TJ Maxx, Zara and H&M are charging a nominal fee of US$2-US$12 for returns to offset the expense,” she added “some retailers have [also] shortened the return window to discourage return fraud, and incentivise customers to opt for an exchange or store credit.”

“By offering seamless, free-of-charge returns and prioritising swift refund processing, e-commerce companies can enhance customer loyalty and differentiate themselves in a competitive market,” she said.

Optimizing omnichannel solutions

To cater to the ever-evolving digital sphere, Buzek highlighted the importance of data and analytics to determine the optimal price, channel, and timing for reselling or liquidating the returned items.

Buzek affirmed that the use of AI-powered features in retailers' digital platforms such as “true-fit sizing technology, virtual try-ons, and chatbots can help customers make better purchasing decisions and reduce returns.”

In Asia, Thailand-based fashion brand POMELO embraces technology in developing a seamless supply chain management system through its Tap.Try.Buy feature.

“In POMELO we have an omni-channel approach that we call Tap.Try.Buy. We allow customers to select online in their application item that they want to try on, select the store that they would like to try and get it delivered to the store [which] the customer can try within 24 hours,” explained Lai Tze Siung, chief logistics officer at POMELO Fashion.

With the Tap.Try.Buy feature, customers can try on their desired item at preferred stores where they can either choose to buy it or leave it at that store. This enables POMELO to complete a whole purchasing cycle within 24 hours.

16 HONG KONG BUSINESS | Q2 2024

MARKETING BRIEFING

Processing returns in-store may prompt customers to buy additional items

Michelle Evans

Greg Buzek

Lai Tze Siung

RETAIL | by Diana Dominguez

From dreaming about your children’s future

to securing a legacy for themº

Protect your wealth for the next generation

With our 160-year heritage across a global network, clients trust us to manage their wealth so they can leave a long-lasting legacy for the next generation. From here, possibilities are everywhere.

New clients signing up for Priority Banking to enjoy up to HKD22,000 cash rebate

HONG KONG BUSINESS | Q2 2024 17

IssuedbyStandardCharteredBank(HongKong)Limited

and conditions apply.

Terms

STARTUP

inRiskable streamlines SME credit assessment for banks through AI

One of the great challenges for banks these days is the accurate assessment of credit risks associated with small and medium-sized enterprises (SMEs). Screening and filtering processes may be more efficient and easier for banks with inRiskable's AI-powered solutions.

Deriving its name from a mix of the words “invisible” and “risk,” the firm co-founded by Megan Chau in 2022 helps financial institutions “discover the invisible risks [of SMEs] out there on the internet.”

“Banks always deal with a lot of SMEs. For example, 10,000 [SMEs]: ‘How can I manage 10,000 SMEs at the same time?’” Chau told Hong Kong Business. “What we’re doing is we use AI to help them to automatically filter out the high risk level and the low risk level so that

the analysts can minimise the time to do it.”

By utilising AI, the risk intelligence platform is able to minimise the amount of time and effort to exercise due diligence for SMEs. “In our experience, about 80% of the time can be reduced and our accuracy is 97%,” she said.

No wonder, the demand for such agile and reliable banking services has hit at an all-time high. Whilst the financial landscape is rapidly evolving, traditional methods of credit risk evaluation no longer suffice.

The challenge

For financial institutions, fulfilling its responsibility and task to know their customers thoroughly and ensure security has become a tall order.

Info gathering

Almost every time a bank makes an assessment, it is faced with the lack of data and reliable sources when it comes to business information. For SMEs, in particular, shared information is usually limited to financial reports and oftentimes this is not enough to fully evaluate the company’s credit risks.

“The way they’re doing it is mainly based on the financial report [of] the SME profile [of their] financial data. For example, if they want to open a bank account or if they try to request for financial service from the bank, they use the financial report to do so. But financial reports are not really often reliable or cannot reflect your credit risks in a timely manner,” Chau explained.

“Actually, they try to Google it or they try to do it in Baidu or whatever such channel they can find. But it’s not very structured, it’s not standardised and it takes a lot [of time] and a lot of effort to do so. But it’s still not reliable,” she added.

inRiskable provides the platform that bridges this information gap between SMEs and financial institutions through more efficient and accurate ways of gathering data, Chau asserted.

“We do it in a SaaS way and we’re helping financial institutions to evaluate SMEs credit risk,” she said, noting that their AI-powered solution is tailored to illuminate the obscured risks that SMEs carry — risks that often go unnoticed until they manifest into larger financial calamities.

Meat The Next’s dairy-free milk targets lactose-intolerant Asia

Believe it or not, 90 percent of the Asian population is lactose intolerant, and although alternatives like oat milk, soy milk, and plant-based milks exist, these options often have high sugar content or do not fully meet nutritional requirements.

To address this problem, Hong Kong-based startup, Meat The Next, developed the Tiger Nut Oat Soy Milk, which is made from tiger nuts, odourless non-genetically modified organism (GMO) soybeans, and oats.

Tiger nut benefits

Edmund Chan, COO and co-founder of Meat The Next, said the milk’s key ingredient tiger nuts are highly nutritious, rich in dietary fibre and healthy fats including omega-3 and omega-9, and has essential minerals like potassium, magnesium, and iron.

“Tiger nut offers several health benefits, including aiding digestion, promoting heart health, and helping to regulate blood sugar levels,” Chan explained.

Apart from being a healthier option, Meat The Next’s Tiger Nut Oat Soy Milk also helps combat desertification on a large scale and enhancement of biodiversity, said Chan.

“Tiger nuts are a valuable resource found in desert regions, and their cultivation promotes the restoration and conservation of these habitats. As we cultivate more tiger nuts, we gradually reduce the size of desert areas, allowing for the reestablishment of diverse ecosystems and the return of native flora and fauna,” Chan said.

“Just one litre of our tiger nut oat soy milk supports the cultivation of an area equivalent to that of an iPhone 14 Plus in the desert, demonstrating how even small choices can have a significant impact on biodiversity,” he told Hong Kong Business China currently has the world’s largest desertification area, spanning 2.57 million square kilometres or 26.81% of its land. Globally, 20 million hectares of farmland cease cultivation resulting in US$42b losses.

18 HONG KONG BUSINESS | Q2 2024

InRiskable founders Megan Chau and Kenyon Wong

Edmund Chan, COO and co-founder of Meat The Next

FINANCIAL TECHNOLOGY

FOOD & BEVERAGE

Supercharging the power of data with Tecsa’s OneViu retail analytics platform

Retail analytics delivers incredible insights to increase sales, reduce costs and create amazing customers experiences, but only if you can navigate your data.

In today’s digital age, many retailers feel like they are drowning in data and clutching for insights. As consumers interact with brands and retailers through numerous touchpoints, the amount of data collected by medium to large size businesses is immense. Much of this data could provide valuable insights about products, online and in-store sales, inventory and customer behaviour and preferences, but it’s often scattered across platforms and locations and never fully utilised.

The Tecsa Group helps organisations conquer this overwhelming sea of data. By transforming the way businesses access and use data, Tecsa’s OneViu platform helps retailers gather diverse information from a vast number of sources and analyse millions of transactions in real-time.

“OneViu is a decision intelligence platform that empowers retail-decision makers with direct access to data and in-depth insights, presenting a “single source of truth” so anyone in an organisation can get actionable insights and make faster, better and more profitable decisions,” says Tony Buffin, Chairman, The Tecsa Group. “By harnessing data effectively, OneViu also enables retailers to deliver personalised engaging customer experiences and boost operational performance.”

Pan-Asian success story

Earlier this year Tecsa successfully piloted OneViu in collaboration with DFI Retail Group, whose 10,700 stores across Asia include well-known brands such as Wellcome and Mannings in Hong Kong, and Giant, Cold Storage and Guardian in Singapore. Tecsa has a long-term partnership with the group, having designed and launched yuu, Hong Kong’s most popular rewards program with 4.6 million members.

”We recognise that embedding this new capability as a critical component within different DFI processes is as important as the technology itself,” adds Tim Duff, Tecsa’s Director of Retail Consulting.

The speed of adoption of OneViu continued to be strong, with over 10.8k reports run in the 10 months following its launch in February 2023.

Despite its extensive regional footprint, DFI had no unified method of analysing retail data. Like so many retailers it was capturing huge amounts of data across its businesses, but it was using several analytics solutions, each with their own proprietary tools and methodologies that slowed decision making.

Tecsa worked with DFI’s commercial teams to understand their needs and tailor the platform for their businesses and streamline and strengthen its analytics. The result is the bespoke OneViu platform that offers a 360-degree view of the retail landscape, making it easier to identify trends, understand consumer behaviour, and make fast data-driven decisions. Most importantly for DFI, the platform is putting its rich customer data at the heart of its retail strategies.

Supercharging the power of DFI’s data has already earned honours for Tecsa and DFI, with OneViu winning for Analytics – Retail in the Hong Kong Business Technology Excellence Awards 2023.

By analysing customer behaviours OneViu supports more personalised shopping experiences and identifies cross-selling and upselling opportunities. It also helps to anticipate and respond to changing customer needs by quickly recognising demand and identifying emerging trends. For example, DFI have used this capability across their brands to understand long-lasting consumer behavioral changes post-Covid.

OneViu’s cutting-edge data science and technology, provides users with answers to questions that would normally require significant analytical resources and time. After Tesca conducted training sessions, within a few hours DFI commercial team members were able to optimise their product assortments and improve merchandising strategies, and promotions.

“OneViu has been a true transformation for the DFI business. The platform has enabled us to leverage the vast data we have, in order to provide our customers with a better experience both in our stores and online, particularly when it comes to ranging and assortment,” says Danni Peirce, Chief Executive Officer 7-Eleven, DFI Retail Group.

Network of services and solutions

With a network of consultants worldwide combining global best practice with extensive local knowledge, Tecsa works with brands seeking to boost their in-house loyalty and analytics capabilities. It creates multi-partner loyalty programmes and ecosystems that expand opportunities for customer engagement.

Not only did Tecsa launch yuu, one of Asia’s most successful loyalty programs, the group also brought together some of Hong Kong’s leading brands in retail, financial services and dining as part of DFI’s “loyalty super app”. An estimated 70% of Hong Kong’s adult population uses the yuu app regularly. The concept was recently rolled out to Singapore where partners are seeing similar results.

“Over the past five years we have partnered with some of the world’s most successful consumer brands across a range of sectors including retail, fashion, QSR, financial services, travel and energy,” said Koos Berkhout, Co-Founder of Tecsa. “Across the world these loyalty programs and brand partnerships have impacted well over half a billion customers!”

Following this successful launch of OneViu, Tecsa is working with a number of companies from diverse sectors to explore the potential for the platform to unleash more opportunities to build better relationships and profitability through putting customer data at the heart of their digital and business transformation.

HONG KONG BUSINESS | Q2 2024 19

Trip.com innovates workspace with fun features to boost employee morale

It equipped its new office with height-adjustable standing desks and leisure spots, enhancing the work environment.

To break from traditional corporate environments, Trip. com's new office in Tsim Sha Tsui incorporates leisure features aimed at enhancing employee well-being and workplace satisfaction. Amongst these, the inclusion of claw machines and exercise bikes stands out, underscoring the company's commitment to fostering a stimulating and enjoyable work environment.

The decision to introduce such features was driven by the understanding that the nature of work is evolving. Today’s workforce values flexibility and well-being as much as productivity and results. Recognising this shift, Trip.com's leadership sought to create a space that not only meets the functional needs of its employees but also encourages them to engage in activities that rejuvenate their minds and bodies.

The claw machines are strategically placed within the office landscape, offering a fun and casual break for employees during their hectic schedules. This element of play not only adds a layer of excitement to the day-to-day but also serves as a tool for creative relaxation, allowing employees to return to their tasks refreshed and invigorated.

Similarly, exercise bikes provide a health-oriented diversion. Positioned to overlook the scenic Victoria Harbour, they offer an irresistible incentive for employees to step away from their desks and get moving. Physical activity helps in reducing workplace stress and promoting mental clarity, which is crucial for productivity in a fast-paced environment like Trip.com.

1 Trip.com's Trip Café

2 Trip Café

3 The

4 The

5 Private meeting areas for productive employee discussions.

6 Trip.com's office just got more fun with the addition of a new claw machine.

20 HONG KONG BUSINESS | Q2 2024

Eddy Yip

creates a home-away-from-home vibe for its employees.

conference room boasts an amazing view of the Victoria Harbour.

is the ultimate chill spot for employees.

office’s common area facilitates seamless communication amongst employees.

1 3 5 2 4 6 SPACEWATCH: TRIP.COM

New eco-haven AIRSIDE boasts urban farm, smart bike parking system and more

The commercial property supplies its F&B outlets with harvested produce from its urban farm.

Nan Fung Group’s mixed-use landmark, AIRSIDE, is charting a new course in sustainability by housing a 6,000 square feet urban farm within the mall premises that provides fresh produce to its F&B tenants.

Located on the second floor of the shopping mall, AIR FARM houses over 50 varieties of seasonal crops.

Apart from F&B tenants, AIRSIDE also shares the produce harvested from the AIR FARM to the community and charitable organisations in need to “promote a low-carbonfootprint lifestyle and nature-based solutions to the public.”

AIRSIDE also organisers regular urban farming workshops in AIR FARM for the public and its tenants.

Doing such activities allows AIRSIDE to bring its “place of wholeness” concept to life, according to Billy Hui, executive director and spokesman at Nan Fung Group.

“AIRSIDE advocates a unique urban lifestyle concept of ‘wholeness’, promoting the harmonious cohabitation of humans and nature,” Hui said.

“The architectural design and facilities of AIRSIDE draw inspiration from a seamless integration of the complex with the natural environment,” he added.

Billy Hui

Billy Hui

Eco-haven

Showing its commitment to sustainability, AIRSIDE has dedicated one-third of its site to green spaces. On the sixth floor of AIRSIDE, there is a rooftop garden that features a variety of tropical plants and native flora.

Beyond green spaces, what AIRSIDE has that makes is sustainable are a range of innovative facilities like an Automatic Refuse Collection System, the largest office building monocrystalline PV farm and walkable PV, smart bicycle parking system, and 850 car parking spaces fully equipped with electric vehicle (EV) charging facilities.

AIRSIDE is also the first commercial development in Hong Kong to adopt the Electrical and Mechanical Services Department’s (EMSD) Kai Tak District Cooling System (DCS), Hui shared with Hong Kong Business.

“We are immensely proud of the project’s status of having earned seven highest sustainable building certifications, including Platinum WiredScore and SmartScore Certifications, and WELL Core Platinum [amongst others],” Hui said.

22 HONG KONG BUSINESS | Q2 2024

PROPERTY WATCH: AIRSIDE

COMMERCIAL PROPERTY

Rhenus Warehousing Solutions HK sets benchmark with robotics, transforming logistics landscape

With the launch of the Rhenus Innovation Hub in Hong Kong and collaborations with Geek+ and the Hong Kong Productivity Council, the company has successfully deployed state-of-the-art solutions.

Rhenus Group is a leading global logistics service provider with an annual turnover of EUR 8.6b ($73.28b). With 39,000 professionals spread across 1,120 locations worldwide, the company offers comprehensive supply chain solutions that cover transportation, warehousing, customs clearance, and value-added services. As a family-owned business, Rhenus prioritises the needs of its customers above all else and continuously strives for innovation. This commitment to excellence has solidified its reputation as a leader in the industry.

Rhenus Warehousing Solutions HK has been actively pursuing digitalisation and innovation in the logistics industry. In 2021, the company launched the Rhenus Innovation Hub (RIH) in Hong Kong as a platform for incubating innovative ideas. With the strategic partnership with Geek+ (a leading global provider of advanced robotics and artificial intelligence solutions), Rhenus Warehousing Solutions HK has successfully deployed the first AMR project, the GTP Solution with Geek+ P800 robots in Greater China.

Efficiency boost and precision enhancement

Building on the partnership with Geek+, Rhenus Warehousing Solutions HK continued their digitalisation journey with a trilateral cooperation with the Hong Kong Productivity Council (HKPC) in 2022. They brought out another smart warehouse solution project in RIH, a Goods-to-Person RobotShuttle (GRS)

solution. Distinct from the first GTP project, GRS is a “Tote-to-person” picking solution. Completed in May 2023, the project went live in mid-June and can support both B2B and B2C businesses, mainly serving Rhenus Warehousing Solutions HK’s existing fashion and cosmetics customers in Hong Kong.

The GRS project made Rhenus Warehousing Solutions HK the first warehouse in Hong Kong to deploy three different models of picking robots (Geek+ P800, RS5-DA & P40). The AMR solution eliminated the time and effort of Rhenus’ warehouse operators travelling between inventory sites and locations. It aimed to boost efficiency by 300%, whilst the Putto-Light system improved order accuracy and efficiency by using lights to guide warehouse operators to specific bin locations for picking and packing inventory, thereby reducing errors and minimising rework. The project was not only a new operational solution but also another showcase of RIH.

RHENUS WAREHOUSING SOLUTIONS HK CONSISTENTLY STRIVES TO BUILD UP COMPETENCIES TO BECOME MORE COMPETITIVE, CATCH UP WITH THE LATEST TECHNOLOGY TRENDS, AND SEIZE PROGRESSIVE OPPORTUNITIES

Flexibility and competency in a dynamic landscape:

In 2023, the same GTP solution with Geek+ P800 was implemented at Rhenus Logistics AG Switzerland. This was an example of how vision, insights, and innovative technology transition smoothly from the Rhenus Innovation Hub in Hong Kong to different locations worldwide and serves as an illustration showcasing how innovation can benefit and influence the worldwide operations of a company.

On the other hand, the company has connected with the community by collaborating with local universities and government departments. Multiple government departments have visited and explored Rhenus’ smart warehouse in Hong Kong. In June 2023, Rhenus Warehousing

Solutions HK launched its Summer Internship Programme in collaboration with the Hong Kong Polytechnic University and the Hong Kong Metropolitan University. This initiative aims to create shared value and have a positive impact through the RIH platform. For this project, the company was given the Automation – Logistics award in the recently concluded Hong Kong Business Technology Excellence Awards. Now in its fourth-year run, the awards programme recognises outstanding companies that have made exceptional contributions in the pursuit of technological innovation.

In today’s rapidly evolving and dynamic business environment, maintaining a competitive edge and flexibility are paramount. As one of the key players in the logistics industry, Rhenus Warehousing Solutions HK consistently strives to build up competencies to become more competitive, catch up with the latest technology trends, and seize progressive opportunities. The partnership between Rhenus Warehousing Solutions HK, HKPC, and Geek+ is a collaborative effort to drive digitalisation and innovative solutions. By investing in modular and scalable systems, as well as adopting cutting-edge solutions and technology, Rhenus Warehousing Solutions HK is equipped to respond to evolving customer demands and industry trends, ensuring its sustained leadership as a 3PL service provider through innovation. This approach also affords the flexibility to tailor both software and hardware solutions to address specific customer requirements and seamlessly expand operations when necessary.

HONG KONG BUSINESS | Q2 2024 23

Dennis Mak, Director, Warehousing Solutions & Distribution - Greater China Rhenus Logistics

AUTOMATION - LOGISTICS 2023

Combined photo of AMR & GRS

Endowus challenges commission biases in Hong Kong's financial advisory scene

The digital wealth advisor offers a 100% rebate on all trailer commissions.

SERVICES | by Diana Dominguez

Financial agents in Hong Kong often follow a commission-based sales model which can lead to misaligned advice and limit investors’ access to products that actually align with their investment goals. This is what pushed Singapore-based wealthtech, Endowus, to step into the market.

“Investors often end up paying high fees and hidden commissions that eat into their returns, with limited access to products that fit their investment goals due to distributors being incentivised by trailer commissions,” Gregory Van, cofounder and CEO of Endowus, told Hong Kong Business.

The reality is that individual investors face limitations in obtaining high-quality investment solutions across public and private markets, whilst institutional investors typically receive better advice and products at a lower cost. And that’s the disparity being addressed by Endowus.

“Unbiased advice and fee savings do not only solve an individual Hong Konger’s pain point but can also positively impact the greater retirement adequacy issues facing the city by helping people save and invest better for their futures,” Van said.

Endowus presents a unique value proposition that addresses these pain points. “We charge a low, transparent, all-inclusive fee that covers everything from expert financial advice to execution and rebate 100% of all trailer commissions, an industry-first move that ensures alignment with our clients,” Van said.

The platform provides professional and personalised advice in line with the client’s unique goals and risk profile. They achieve this through combined digital solutions and human advisory services. “We are also partnered with over 50 top global asset managers, curating more than 200 best-in-class funds for our clients to select from, covering various markets and asset classes,” Van said.

This strategy also allows Endowus to facilitate higher liquidity through select open-ended funds on the platform, reducing the barrier to accessing private markets and alternative investment solutions.

The firm’s Hong Kong expansion will focus on strategically expanding product offerings and solutions to help investors achieve near-term and long-term wealth management goals.Providing another positive impact is Endowus’ move in reducing overall investment cost and improving returns for their clients.

Endowus’ Hong Kong-centred efforts

As revealed in the latest Endowus Insights Report, Hong Kong investors are described as “risk-seeking” with about 54% willing to take on higher levels of risk for greater returns.

Considering this, Endowus offers Hong Kong clients a vast selection of investment opportunities.

“Finance professionals have been very attracted to Endowus’ offering in Hong Kong covering straight-through institutional share-class access to funds across all asset classes and strategies, from money market funds to index funds, to

Gregory Van, co-founder and CEO of Endowus

active fixed income, to private equity and private credit, to hedge funds. Many of these strategies are exclusively available on Endowus at a lower cost and lower bite size than ever before,” Van shared with Hong Kong Business.

Endowus’ service is also localised to regulation and the availability of products and solutions in the Hong Kong market and maintains an evidence-based asset allocation advisory and fund curation process.

Offerings in Hong Kong are “doubled down,” following partnerships with global private equity giants such as iCapital, EQT, Carlyle, and Partners Group. The acquisition of Carret Private will also service ultra-high-net-worth clients.

Unbiased advice and fee savings do not only solve a pain point but can also positively impact greater retirement adequacy issues

“As our conflict-free business model is new to Hong Kong, Endowus places a lot of emphasis on financial literacy, educating investors about the pitfalls of loaded fees and hidden commissions that erode their returns and lead to misalignment between the client and platform. We need to empower them with the financial know-how to make informed investment decisions,” Van explained.

He said clients of the firm save US$40m (HK$312m) annually through its institutional share class access, 100% cashback on trailer commissions, and never charging subscription fees. “Investors have absolute transparency and streamlined visualisations of their portfolios, their total wealth, and personalised advice that suits their goals and risk profile on one convenient digital platform,” Van added.

24 HONG KONG BUSINESS | Q2 2024 CEO INTERVIEW

FINANCIAL

Travel insurance sales in Hong Kong soar after unprecedented holiday boom

506,953 residents flew out of Hong Kong on 23 December alone, up 1,727.56% from the previous year.

The pent-up travel demand resulting from years of pandemic restrictions snowballed into 1.32 million Hong Kong locals travelling during the holiday season last December, sparking higher demand for travel insurance.

“Additionally, throughout the year 2023, there was a noticeable trend of longer trip durations among Hongkongers. This suggested that people were willing to take extended vacations, possibly due to the desire for a more immersive travel experience after being deprived of travel opportunities for an extended period,” Jim Qin, chief executive officer of General Insurance at Zurich Insurance (Hong Kong), told Hong Kong Business.

On 23 December alone, 506,953 residents flew out of Hong Kong whilst on 24-25 December, 458,652 and 362,139 departures were logged, respectively. Compared to 2022 when 27,770 locals departed Hong Kong on 23 December, the latest figure reflects a 1,727.56% leap, based on data from the Immigration Department.

An Allied Market Research report said Asia Pacific’s travel insurance market was estimated to record $9.9b in 2022. In another research conducted by Ancileo, the global market size for travel coverage could reach $50b by 2025.

This expansion is driven by increased travel and the rise of digital platforms, making the travel insurance industry highly competitive and dynamic. In turn, the travel insurance industry has seen substantial growth due to heightened consumer awareness of travel risks and a demand for quality coverage, according to the report.

This demand has led to the development of personalised insurance policies tailored to individual needs. The region’s market is expected to grow by 17% in the next five years, with Japan, Bangladesh, and India as key players.

The allure of destinations like Japan continues to captivate Hongkongers, further contributing to the surge. Also, the strength of the US dollar and favourable foreign exchange effects may have boosted purchasing power, incentivising more individuals to plan and embark on international travels.

The World Travel & Tourism Council (WTTC), on the other hand, forecasts a robust recovery for the Asia Pacific travel and tourism sector by 2023, with the region’s tourism revenue projected to surpass pre-pandemic levels by 32%.

This resurgence is expected to generate 65% of the new jobs in the global travel industry over the next decade, with China and India being key contributors.

Collaboration

A recent milestone with Zurich Hong Kong is its collaboration with Hutchison Telecommunications Hong Kong (HTHK). This partnership combines Zurich’s digital insurance skills with HTHK’s telecom expertise, targeting tech-savvy consumers. Customers can now purchase Breezy Travel Insurance and data roaming services in under five minutes via a fully digital platform, highlighting Zurich’s dedication to digital innovation and customer convenience amidst the pandemic’s challenges.

People were willing to take extended vacations, possibly due to the desire for a more immersive travel experience after being deprived

Zurich Hong Kong said it puts digitalisation forward to upgrade processes and maintain business sustainability despite external interruptions.

“During the COVID-19 pandemic, many insurance companies were unable to provide e-service options for intermediaries, leading to disruptions in business operations. In response to this challenge, Zurich took proactive steps to standardise our e-delivery sales model and enhance our suite of self-service capabilities,” said Qin.

“This allowed our business partners to easily quote new business, submit relevant documents in digital formats, and update policies without any interruption from external factors,” he added.

Outlook

The global travel insurance market, valued at $19.14b in 2022, reached $22.44b in 2023 with a compound annual growth rate (CAGR) of 17.3%, according to a report by Research and Markets titled “Travel Insurance Global Market Report 2023.”

The Russia-Ukraine war disrupted global economic recovery from the COVID-19 pandemic, leading to economic sanctions, commodity price surges, and supply chain disruptions.

26 HONG KONG BUSINESS | Q2 2024 CEO

INTERVIEW

Jim Qin, chief executive officer of General Insurance at Zurich Insurance

INSURANCE | by Olivia Tirona

HONG KONG BUSINESS | Q2 2024 27

Hong Kong readies for shift from coal with LNG bunkering infrastructure for 2025

Transport Minister Lam Sai-hung noted, however, that supply remains a challenge.