Display to June 30, 2023 HK$40 Hong Kong’s Best Selling Business Magazine Issue No. 70 FUNDING SHIFTS TO DEEP TECH AS GENERATIVE AI DRIVES INVESTMENTS MBA COMPETES WITH SPECIALISED POSTGRAD PROGRAMMES THROUGH AI CONSUMERS CRAVE HUMAN CONNECTION AMIDST THE ERA OF AUTOMATION VC VERSUS ENTREPRENEUR ‘STAND-OFF’ DECREASES FUNDING VOLUME KEY SKILLS INSURERS ARE LOOKING FOR IN NEW HIRES IN 2023 SURVEY

HOTTEST STARTUPS

HONG KONG AWAR D S 2022 MA D E IN AWAR D S 2022 HONG KONG D ESIG N ED I N

MBA PROGRAMMES RANKINGS

2023

Established 1982

Editorial Enquiries: Charlton Media Group Hong Kong Ltd

Room 1006, 10th Floor, 299 QRC, 287-299 Queen’s Road Central, Hong Kong | +852 3972 7166

PUBLISHER & EDITOR-IN-CHIEF Tim Charlton ASSOCIATE PUBLISHER Louis Shek

PRINT PRODUCTION EDITOR COPY EDITOR

PRODUCTION TEAM

FROM THE EDITOR

COMMERCIAL TEAM GRAPHIC ARTIST

Jeline Acabo

Tessa Distor

Noreen Jazul

Consuelo Marquez

Djan Magbanua

Frances Gagua

Charmaine Tadalan

Janine Ballesteros

Jenelle Samantila

Simon Engracial

ADVERTISING CONTACTS Louis Shek +852 6099 9768 louis@hongkongbusiness.hk

Aileen Cruz aileen@charltonmediamail.com

Reiniela Hernandez reiniela@charltonmediamail.com

ADMINISTRATION ACCOUNTS DEPARTMENT accounts@charltonmediamail.com

ADVERTISING advertising@charltonmediamail.com EDITORIAL editorial@hongkongbusiness.hk

PRINTING

Gear Printing Limited

Flat A, 15/F Sing Teck Fty. Bldg., 44 Wong Chuk Hang Road, Aberdeen, Hong Kong

Can we help?

Editorial Enquiries: If you have a story idea or press release, please email our news editor at editorial@hongkongbusiness.hk. To send a personal message to the editor, include the word “Tim” in the subject line.

Media Partnerships: Please email editorial@hongkongbusiness.hk with “Partnership” in the subject line.

Subscriptions: Please email subscriptions@charltonmedia.com.

Hong Kong Business is published by Charlton Media Group. All editorial is copyright and may not be reproduced without consent. Contributions are invited but copies of all work should be kept as Hong Kong Business can accept no responsibility for loss. We will however take the gains.

Sold on newstands in Hong Kong, Macau, Singapore, London, and New York.

*If you’re reading the small print you may be missing the big picture

Deep tech is increasingly getting popular in many sectors. Emerging startups are developing deep-learning applications to enhance the productivity of traditional processes, and experts believe that more startups will build upon their business models on generative AI applications such as text bot ChatGPT. In this year’s Hottest Startups list, we feature companies categorised as deep tech. See them and the rest of this year’s outstanding startups on page 30.

As the modern workforce evolves, MBA education is changing to keep pace with the new demands. MBA programmes are expanding globally despite cost pressures, and providers are offering experiential learning programmes through disruptive tech. In this issue, we rank the top MBA providers that included state-of-the-art innovations in their curriculum as demand for advanced digital skills rises. See the full story and list of MBA programmes and providers on page 26.

Top companies and initiatives are acclaimed at the latest Hong Kong Business Management Excellence Awards, Made in Hong Kong Awards, Designed in Hong Kong Awards, and Greater Bay Area Awards. Take a look at the list of exceptional executives and teams on pages 46, 52, and 56.

Read on and enjoy!

Tim Charlton

HongKongBusiness is available at the airport lounges or onboard the following airlines:

HONG KONG BUSINESS | Q2 2023 1

HONG KONG BUSINESS

46 Recognising the top executives and companies at the 2022 HKB MEA

52 Here are the winners of the HKB Made in & Designed in Hong Kong Awards 2022

56 Exemplary companies and organisations were recognised in this year’s HKB Greater Bay Area Enterprise Awards

2 HONG KONG BUSINESS | Q2 2023 JANUARY 2019 Published Quarterly by Charlton Media Group Pte Ltd, Room 1006, 10th Floor, 299QRC, 287-299 Queen’s Road Central, Sheung Wan, Hong Kong For the latest business news from Hong Kong visit the website www.hongkongbusiness.hk CONTENTS STARTUPS 22 Jumppoint offers AI-driven courier routing to deliver to underserved markets FIRST BRIEFINGS INTERVIEW 30 HOTTEST STARTUPS 2023 FUNDING SHIFTS TO DEEP TECH INDUSTRY AS GENERATIVE AI DRIVES INVESTMENTS EVENT

FINANCIAL INSIGHT VC-ENTREPRENEUR ‘STAND-OFF’ DECREASES FUNDING VOLUME 36 06 New policies position HK as leading centre for international dispute in APAC 08 Experts assess the impact of AVD Scale 2 rates 09 HK risks narrowing fiscal buffers amidst ‘sizeable’ spending plan 10 Hong Kong set for strongest retail rebound as tourists flock back 11 Experts see slim chance of relaxing property cooling measures

Experts rally for change in legal industry’s traditional ‘billable system’ 14 New ordinance slashes transaction costs for Hong Kong market makers

Three ways retailers can serve ‘budgeteers’

DBS’ Lareina Wang on why role models matter to women in banking CONCEPT WATCH 24 Eatology cooks up a ‘halfway diet’ for Hong Kongers 26 MBA PROGRAMMES SURVEY MBA COMPETES WITH SPECIALISED POSTGRAD PROGRAMMES THROUGH AI

12

16

20

HONG KONG BUSINESS | Q2 2023

Daily news from Hong Kong

MOST READ

Hong Kong’s 10 most influential lawyers under 40 for 2022

Hong Kong’s roster of exceptional lawyers has made the city an irreplaceable legal hub for businesses and high-profile individuals from the Mainland and other parts of the world. Hong Kong Business recognises 10 young lawyers who have raised the bar for legal professionals across all fields in 2022.

8 investment ideas to achieve affluence in the year of prosperity

Feng shui experts predict that 2023 will be a year of hope and prosperity, however, financial experts warned that familiar foes like inflation and geopolitics will continue to haunt investors during the year. Finance experts share eight investment ideas for 2023 that can help investors to navigate these systemic risks.

Mainland firms’ influx brings new opportunities for local lawyers

In 2022, Hong Kong’s legal industry saw a growing number of Mainland firms setting up operations in the city. Rather than perceiving this as a threat, local firms saw it as chance to increase collaboration with firms in the Mainland which will be beneficial to them given the improvements in the Greater Bay Area (GBA).

Life insurers take the lead in Hong Kong Business Insurance Rankings

The HKB Insurance Rankings reveal a trend towards more life insurers joining the list of the top 50 insurers. This shift can be attributed to the opportunity in Mainland China. A significant proportion of whole life insurance premiums came from Chinese visitors who purchased their policies from Hong Kong pre-pandemic.

Specialist tech firms to gain major boost in Hong Kong

Innovative technology companies in need of funding would often turn away from Hong Kong due to its highprofit threshold for listing. To regain its attractiveness and improve fundraising activities, Hong Kong has proposed a new regime where specialist tech companies will be exempt from existing financial eligibility tests.

Firms revamp benefits to retain older workers amidst youth emigration

After many young employees emigrated from Hong Kong, local firms had to shift their focus on what was left of their talent pool: the older workforce. To retain their older employees, companies would usually offer benefits such as flexible work schedules, training and education, and healthcare.

News from hongkongbusiness.hk

LEGAL INSURANCE MARKETS & INVESTING MARKETS & INVESTING LEGAL HR & EDUCATION

HONG KONG BUSINESS | Q2 2023 5

New policies position HK as leading centre for international dispute in APAC

Hong Kong and the Mainland’s closer ties had led the government to push for more policies that will position the city as a leading centre for international dispute in the Asia Pacific region.

Amongst these policies is the Mainland Judgments in Civil and Commercial Matters (Reciprocal Enforcement) Ordinance (MJREO), which got passed in December 2022.

Justin Tang, Partner, Dispute Resolution, at Linklaters, said the policy opens a new chapter |in reciprocal recognition in enforcement of civil and commercial judgments between the Mainland and Hong Kong.

“Once in effect, the MJREO will remove the requirement for an exclusive jurisdiction agreement before the parties may benefit from the Hong Kong and Mainland court’s reciprocal recognition of judgments arrangements,” Tang said.

“Mainland judgments, both monetary and non-monetary judgements that are civil and

commercial in nature, handed down on or after the commencement of MJREO could be recognised in Hong Kong, subject to an ‘excluded list’ such as personal bankruptcy and corporate insolvency matters, cases concerning succession and distribution of estate, family and matrimonial cases, and certain cases concerning intellectual property and maritime matters,” added Tang. In the same month, Hong Kong also lifted its ban on the outcome-related fee structures (ORFS) in arbitration and related proceedings.

Compared to Singapore and other top arbitral seats, Hong Kong’s proposed ORFS regime is broader because it permits the full range of ORFS structures, namely Conditional Fee Agreement (CFA), Damages Based Agreement (DBA), and the Hybrid DBA. Explaining the three

arrangements, Tang said: “Conditional fee agreements [is] where the client pays a success fee to the lawyer if the claim is successful; damages-based agreements [is] where the lawyer receives payment only if the client recovers a financial benefit in the matter and the payment is calculated by reference to the financial benefit obtained by the client; and hybrid damages-based agreements [is] where the lawyer receives fees for legal services, at a discounted rate, together with a contingency fee calculated by reference to the financial benefit obtained by the client if the client recovers a financial benefit in the matter,” Tang explained.

Since clients globally are “moving away from hourly rates and towards sharing risk with their advisers,” Kathryn Sanger, a partner at Herbert Smith Freehills and co-chair of the LRC’s sub-committee that proposed the ORFS changes, said establishment of the regime will attract more clients to have their case arbitrated in Hong Kong, and put the city on the same playing field as its competitors—London, New York, Mainland China, and Singapore—which are already allowing similar fee agreements.

Tang , for his part, said the framework “further expands the funding options available to parties to Hong Kong seated arbitrations, further enhancing the position of Hong Kong as an international commercial arbitration hub.”

AMLO

This year, amendments to the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO) will take effect.

Shirley Au-yeung, Senior Associate, of Linklaters Hong Kong, said the amendments introduces a “new statutory regime for virtual asset service providers (VASP) in Hong Kong under which a person who seeks to carry on a virtual asset service business must obtain a VASP licence from the SFC.”

“Licensed VASPs will be subject to all AML/CTF requirements in AMLO that apply to regulated financial institutions such as customer due diligence and record-keeping requirements. The SFC will be vested with supervisory powers to enforce AML/CTF and other regulatory requirements on VASPs, including the power to investigate and impose disciplinary sanctions on VASP licensees,” Au-yeung said. “We envisage a proactive approach from the SFC on the supervision of and enforcement against VASP,” she added.

6 HONG KONG BUSINESS | Q2 2023 FIRST

Hong Kong also lifted its ban on the ORFS in arbitration and related proceedings

LEGAL

Once in effect, the MJREO will remove the requirement for an exclusive jurisdiction agreement

HONG KONG BUSINESS | Q2 2023 7

FOUR KEY ACTIONS FOR I&T GROWTH IN HONG KONG

Under the HK I&T Development Blueprint, the city plans to grow the industry by 5% in 5 years.

There are four key actions that Hong Kong could undertake to reach its targets under its I&T Development Blueprint, Colliers revealed.

The first step is to streamline procedures for the transformation of primitive land into I&T facilities, especially in the Northern Metropolis.

Dorothy Chow, Executive Director, Valuation & Advisory Services, Asia at Colliers Hong Kong, said seamless development-related statutory processes will fast track the supply pipeline. The second key action is to create a more proactive approach to land supply for I&T uses and related developments. The city needs to increase the supply of I&T property by twofold over the next few years to realise the development targets set out in the blueprint.

“Only about 3.3 million sq. ft. GFA of new I&T property is expected to come on stream in the next three to five years, which results in a shortage of over 5 million sq. ft,” said Dominic Chung, Executive Director, Asia, Capital Markets & Investment Services.

Policies and incentives

The third action, according to Bill Chan, Head of Industrial Services at Colliers Hong Kong, is the need for industry-protective measures, including a concessionary land price policy.

Chan said the government should refer to the terms and conditions for the sale and rental of I&T-allocated property in Singapore and Shenzhen as operational overhead is one of the key factors for I&T firms when deciding on a location.

The last and fourth strategy is Hong Kong should offer greater incentives to I&T talent and firms.

Experts assess the impact of AVD Scale 2 rates

REAL ESTATE

After more than a decade, the government has adjusted value bands of Scale 2 rates of the ad valorem stamp duty (AVD) payable for sale and purchase or transfer of both residential and nonresidential properties to ease the burden of firsttime home buyers.

One of the changes in the scale rates is that buyers will need to pay AVD of $100 for properties worth $3m, instead of $2m previously. The scale rates apply to transactions of both residential properties and nonresidential properties entered into at or after 11 a.m. on 22 February 2023.

Mayer Brown experts Eugene Y. C. Wong and Wayne K. W. Cheng believes the adjusted scale rates will effectively “lower the transaction costs associated with sale and purchase of small and medium residential and non-residential properties.”

“We believe it is likely that, as Hong Kong’s economy recovers from the pandemic, this measure will further boost the transaction count, particularly in small and medium residential units,” the Mayer Brown experts added.

Adjustments

Rosanna Tang, executive director, head of Research, Hong Kong of Cushman & Wakefield, had a similar sentiment, saying that broadine of the AVD Second Standard Rate bands will ease the burden on ordinary families and first-time buyers purchasing their first residential properties.

Whilst the adjustments does ease the burden of homebuyers, Hannah Jeong, head of Valuation & Advisory Services, Colliers Hong Kong, argued that it will have an “insignificant” impact on the price level of properties. adding that it will only result in less than 1% reduction in property value.

Rather than just adjusting the scale rate, Jeong believes it is time for the government to “ relax stamp duty on home purchases.”

“The special stamp duties launched were intended to curb speculation. However, the main factors affecting property prices are usually interest rates, local economy and citizens’ purchasing power. The current property prices have fallen by about 17% compared to the peak in 2021. Considering the high interest rates and the recovering domestic economy, we do not see the need to keep special stamp duties at this point in time,” Jeong said.

“We understand that the government cannot waive the special stamp duty all at once, but further relaxation can help attract more buyers into the market and stimulate the second-hand residential property market,” Jeong added.

A relaxation of buyer stamp duty will also have an overall positive impact on the property market and also complements the government’s talent acquisition scheme to increase Hong Kong’s attractiveness to foreign talent, said Jeong.

8 HONG KONG BUSINESS | Q2 2023 FIRST

Relaxation of buyer stamp duty will have an overall positive impact on the property market

I&T

This measure will boost the transaction count in small and medium units

Rosanna Tang

Hannah Jeong

Adjustments will have an insignificant impact on the price level of properties

HK risks narrowing fiscal buffers amidst ‘sizeable’ spending plan

Hong Kong will struggle to balance its budget as it launched a “sizeable” budget amidst a wide fiscal deficit, S&P reported. The Hong Kong government projected spending to exceed $760b and a deficit reaching $119b in the fiscal year ending in March 2024, which is wider than S&P forecasts.

“The government could take much longer to balance its budget, especially if it keeps rolling out support measures each year,” Rain Yin, S&P Global Ratings analyst, said. S&P noted the larger-than-expected 2022 and 2023 fiscal deficits, along with the higher recurring expenses

intended to stimulate the economy will likely weaken Hong Kong’s fiscal resources. “We estimate the government’s current liquid assets, which includes the fiscal reserves and bond fund assets, at more than 30% of GDP. Although this ratio has fallen substantially from 45% of GDP in 2019, this is still sufficient to withstand some fiscal deterioration in the next one to two years,” the report also read.

“If investments to improve productivity and boost potential growth bear fruit, this could restore the government’s fiscal health over the medium term and maintain support for the rating at the current level.” Days before the budget

was announced, Alice Leung, Tax Partner, KPMG China, said Hong Kong can narrow down its fiscal deficit with immediate measures such as the distribution of consumption vouchers.

Aside from $5,000 worth of vouchers for permanent residents and new arrivals, Leung suggested the same could be distributed to permanent residents aged 70 or above. In addition, the government could also extend a monthly work allowance of $3,000 to newly employed tourism workers during 2023/24 over a three-month period, and the Tourism Industry Additional Support Scheme by providing each eligible licensed travel agent with a one-off cash subsidy. “In order to attract talent and support business growth, the government could introduce a tax concession where share-based remuneration offered by strategic enterprises to its Hong Kong employees would be exempt from Salaries Tax,” Leung said.

“Apart from this, the government could provide immigration incentives by shortening the number of years required to obtain a Hong Kong permanent residency from 7 years to 4 years for successful applicants/employees under Quality Migrant Admission Scheme, Top Talent Pass Scheme and certain tax incentives to make it more attractive and comprehensive,” she added.

THE CHARTIST: CREDIT AND CHARGE CARD PAYMENTS TO EXCEED $800B IN 2026

Hong Kong’s credit and charge card payments value is expected to reach $831.9b (US$106.7b) in 2026, according to GlobalData.

In a report, GlobalData said the market will likely grow at a compound annual growth rate (CAGR) of 3.9% between 2022–2026 given the “significant shift in consumer preferences towards non-cash payment methods and recovery in consumer spending. ”In 2020, credit and charge card payments declined by 17.1% due to a decline in consumer spending during the pandemic. The following year, the market saw a 15.4% growth, thanks to economic recovery and government initiatives.

This year, GlobalData forecast that credit and charge card payment value will register a 4.6% growth. “Credit and charge cards

are the most preferred payment cards in Hong Kong, accounting for 71% of total card payments by value in 2022. Government initiatives and opening of businesses have all increased consumer spending in Hong Kong, thereby benefiting its credit and charge card market,” Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, commented.

Sharma added that Hong Kong has a card penetration of 2.7 cards per individual and a frequency of payments of 48.1.

The expert, however, warned that the market still faces several challenges, including global geopolitical risks and inflation.

Hong Kong’s inflation rate skyrocketed to 4.4% in September of 2022, and to tackle inflation, the central bank increased its benchmark interest rate to 4.75% in December 2022.

HONG KONG BUSINESS | Q2 2023 9 FIRST

ECONOMY

The gov’t projected a deficit reaching $119b in the fiscal year ending in March 2024 (Photo from https://www.budget.gov.hk/)

The gov’t could take much longer to balance its budget

Rain Yin

Alice Leung

Hong Kong: Credit and Charge Card Payments Value (HKD billion), 2018-26f

Source: GlobalData

Hong Kong set for strongest retail rebound as tourists flock back

Hong Kong SAR is amongst the top three preferred destinations of retailers planning a cross-border expansion in Asia Pacific, CBRE’s 2023 Asia Pacific Retail Flash Survey revealed.

“China and Hong Kong are forecasted to enjoy the strongest sales rebound after lifting pandemic-related measures. Retailers are positive yet believe the rebound is in sight but will happen gradually over a longer period,” Lawrence Wan, Senior Director, Head of Advisory & Transaction Services – Retail, CBRE Hong Kong, said.

Hong Kong will also see the strongest retail rental rebound amongst markets, according to the CBRE report.

“The return of Mainland China tourists to Hong Kong will give a strong boost to the sector. This is expected to drive leasing demand and rental growth, especially for tourist-oriented retailers,” Wan said.

According to CBRE, 72% of the retailers expect their sales to rise from 2022 and 71% intend to open new stores despite rising costs. It also reported that nearly half of retailers surveyed expect physical store footfall to return to pre-pandemic levels.

The report noted that, in particular, retailers prefer quality retail spaces in

shopping malls and along prime high streets. CBRE also believes that prime locations will outperform in 2023. They also have higher interests in secondary high streets (37% in 2023 vs 23% in 2021) due to their lower rents as compared to prime locations.

“As vacant units in prime locations are gradually absorbed and rents stabilise, some especially cost-sensitive retailers may seek opportunities to add new stores in secondary locations,” said Henry Chin, Head of Research, CBRE Asia Pacific.

Other locations which retailers prefer for their new physical stores include decentralised neighbourhoods and community malls (44%), transit hubs like metro or railway stations (28%), and outlets (18%). One factor that may slow retail expansion, however, is the rising cost of store-fit-outs. According to the survey, 60% of retailers said fit-out costs have risen by 10% from pre-pandemic levels.

“With the retail market yet to fully recover, most retailers are asking landlords to provide more incentives or other contributions to

offset growing fit-out costs,” said Chin.

Data from Cushman & Wakefield’s Asia Pacific Office Fit-out Cost Guide showed that the average office fit-out costs in Hong Kong was $1,081.61 or US$138.

Behind Hong Kong is Shenzhen with an average office fit-out price of $932.70 (US$119), Beijing with $917.02 (US$117), Guangzhou with $901.35 (US$115), and Shanghai with $839.51 (US$114).

Rising fit-out costs

In Asia Pacific, Hong Kong ranked fifth in terms of the priciest office fit-out markets. This also makes Hong Kong the most costly office fit-out markets in the Greater China region. In response to increasing fit-out costs, retailers (45%) plan to keep their budget unchanged in 2023. F&B retailers intend to cut fit-out budgets in 2023, whilst 36% of nonF&B retailers plan to spend more.

Most retailers (79%) also asked landlords for longer rent-free or fit-out periods in response to fluctuations in fit-out costs.

Others asked landlords to pay for store improvements (31%), looked for units with readily available fixtures and other equipment (24%), put upgrading or expansion plans on hold (16%), and cancelled leases (9%).

Other concerns of retailers which are hindering them to expand include the increase in production and labour costs (87%), labour shortages (67%) and the rising cost of running an online business (66%). Meanwhile, more than half (57%) of retailers are also cautious to expand because they plan to increase the footprint in existing markets.

“Although inflation in Asia Pacific is forecasted to ease in 2023, most retailers expect operational costs to continue to rise. Low unemployment will push up wage growth and production costs. For online retailers, the rising expense of new custom acquisition and logistics will erode margins,” Chin commented.

Marcos Chan, Executive Director, Head of Research, CBRE Hong Kong, added: “Hong Kong’s retail sector has experienced a downcycle since the pandemic. The overall vacancy of high-street shops remained high at 15.4% in December 2022.”

“While high-street shop rents have declined by over 40% since the commencement of the market downturn in mid-2019 and the current retail leasing market still favours tenants, retailers shall consider regaining their exposures and footprints in tourist hotspots and take advantage of the deeply discounted rents,” Chan added.

10 HONG KONG BUSINESS | Q2 2023 FIRST

Retailers believe the rebound is in sight but will happen gradually over a longer period (Photo by Tusginewko)

Hong Kong will see the strongest retail rental rebound amongst markets

RETAIL

Experts see slim chance of relaxing property cooling measures

The government did not make any adjustments on the cooling measures for the housing market, which has been subdued due to interest rates and weakening economy. In a statement, JLL said it may be an adequate time to adjust the market by loosening cooling measures.

“As the government has not relaxed measures in this situation, I believe there will be little chance of relaxation in the future,” Joseph Tsang, Chairman at JLL in Hong Kong, said. Kathy Lee, Head of Research at Colliers Hong Kong, said mass market home prices will not see a major recovery as there are no practical measures to support

its rebound. During the budget announcement, the government implemented adjustments on the stamp duty such as computation for the ad valorem stamp duty payable for selling, purchasing, and transferring residential and nonresidential properties.

This includes families allowed to buy a residential property worth $3m with stamp duty worth $100.

Rita Wong, Executive Director, Head of Valuation & Consulting, Valuation & Advisory Services, Greater China at CBRE, said the stamp duty was lowered but the overall policy remains unchanged.

“The transactions or transfers of residential and non-residential

properties will benefit from a lower ad valorem tax. This includes both small residential units and non-residential such as carparks transactions. It’s noteworthy that transactions of residential units below $3m only accounted for less than 5% of total transaction volume in 2022,” said Wong.

Tsang said only buyers who bought a flat worth below $10m will benefit from the stamp duty adjustments.

“However, they cannot save much. Currently many flats are selling for over$10m, and therefore, the policy on the housing market has little effect,” he added.

Housing supply

Whilst 105,000 units are expected to be available in the residential market for the next three to four years, Hannah Jeong, Head of Valuation & Advisory Services, in Colliers Hong Kong, said they fear that the failed residential and commercial land sales will affect land and housing supply. She further called on the government to address this land supply issue. “The government should improve valuation accuracy based on the latest market conditions and increase the attractiveness of sites using all means necessary to prevent consecutive failed sales, which would slow down land supply and hurt the overall development of Hong Kong,” she said.

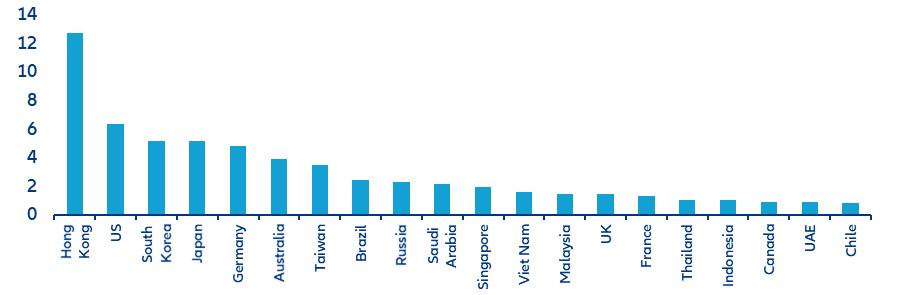

THE CHARTIST: INTEREST FOR EV ADOPTION GROWING IN HONG KONG

Discussions on electric vehicle (EV) adoption has grown in Hong Kong over the past year, with 124 firms participating in such talks.

Data analytics company, GlobalData, said Hong Kong ranks third amongst Asia-Pacific markets which are actively showing interest towards the zero-emission vehicles and its related infrastructures.

Amongst Hong Kong companies who have taken part in the discussion was CLP Holdings.The company recently discussed a joint venture with the manufacturer of smart equipment Qingdao TGOOD Electric Company for launching electric vehicle charging networks.

“Amid the surging gas prices and energy shortages companies continue their efforts to enter the electric vehicles (EVs) market.

EV is considered the next big environment, social, and governance (ESG) investment,” GlobalData reported.

Also part of the top five markets for EV discussions were India (320), China (154), Australia (128), and Taiwan (99).

Region-wide, EV talks grew 28% yearon-year in 2022.

Misa Singh, Analyst at GlobalData, said discussions around EV-related infrastructure is also picking pace.

“Companies are concerned about the charging infrastructure. There is heavy investment in battery manufacturing as the demand for lithium-ion batteries is on the rise due to the growth in EVs. Furthermore, companies are looking forward to hydrogen fuel cell electric vehicles (HFCEV),” Singh said.

Companies’ Discussion on Electric Vehicles in APAC region: 2016 - 2022

Source: GlobalData

HONG KONG BUSINESS | Q2 2023 11 FIRST

REAL ESTATE

Only buyers who bought a flat worth below $10m will benefit from the stamp duty adjustments (Photo by Radu Micu on Flickr)

There will be little chance of relaxation in the future

Joseph Tsang

Kathy Lee

Rita Wong

Experts rally for change in legal industry’s traditional ‘billable system’

“A most-hours-wins system disproportionately disadvantages women partners,” reported UC Hastings.

Female lawyers with family responsibilities—those taking care of their kids or having just given birth— find it difficult to earn the same professional service fees as their male counterparts, creating a gap between genders in the field with twice as many women as men saying they are not able to progress their careers. This is why experts are calling for change in the legal industry’s traditional billable system where lawyers are paid by the amount of time they spend on various tasks, including research, document drafting, client meetings, and court appearances.

This concern was also echoed by Rutgers Center for Women and Work in a 2022 report, saying that “the current culture around compensation places too heavy weight on billable hours and origination credit in determining pay, and this culture needs to change.”

A report from UC Hastings College of the Law also stated that “a most-hours-wins system disproportionately disadvantages women partners.”

“Many more men than women have two person careers in which they can rely on their partner to take care of all matters outside of work,” the paper stated.

A joint report by Mayer Brown and Women In Law Hong Kong (WILHK) suggested a billable system of including work on diversity, equity, and inclusion (DEI) be recognised and rewarded to incentivise DEI involvement. In the same report, it was found that four in 10 (38.2%) female lawyers have felt left out of career-building opportunities because of their gender or care responsibilities.

Nisha Chugh, Head of Legal, Compliance & Company

Secretarial at ConnectedGroup, said law firms are looking beyond deliverables. “They are also looking at what other contributions women are making, rather than just focusing on billables,” ConnectedGroup’s expert said.

Change of mindset

Apart from a change in the billable system, a change of mindset is also needed to address gender disparity across industries, including the legal field.

“When someone who has a young kid or has a child, we tend to think that they would need more time off or they would need to be home more or take a step back in their career,” Hays expert, Adrian Lam, said.

“[But] having a child doesn’t [always] mean that [they] want to be more relaxed, it may just mean that [they] perhaps need to work a different set of hours. [They] might perhaps need to have that little bit more flexibility,” Lam added.

This is why Johnny Hui, Manager for Legal at Robert Walters Hong Kong, encourages firms to offer familyfriendly flexible work arrangements, such as parttime, telecommuting, or even job-sharing options, to accommodate the needs of female lawyers who may have family or caregiving responsibilities. Hui said firms can also offer flexible parental leave policies to allow women to take time off for childbirth and child-rearing without facing adverse consequences in their careers.

Doing more

Offering flexibility as well as changing the billable system are just few of the things that firms can do to ensure gender equality in the legal industry.

In Mayer Brown, new mothers who have come back to work are offered back-from-maternity-leave coaching.

“[We] coach them with a professional to help facilitate the transition and address issues such as work-life balance, boundary setting, and stress management,”

Amita Haylock, Co-Chair of Mayer Brown’s Women’s Network in Asia, shared. Haylock said the firm is also planning to provide training on confronting gender microaggressions, or the subtle or indirect comments or actions that can be interpreted as discriminatory or derogatory. These can be intentional or unintentional, and they can have a negative impact on the recipient’s well-being and sense of belonging in the workplace.

According to the joint report, 23.0% of women with senior roles in the legal industry had clients directing questions or queries to a more junior male colleague instead of them.

“We will talk about privileges and biases that are often the core of microaggressive behaviours, ways to interrupt microaggressions, and preventive measures to limit microaggressions and create a more inclusive work culture,” Haylock said. Ultimately, Chugh said there needs to be awareness and education amongst employees as to what counts as microaggression.

“With respect to microaggression, even if you have workplace policies against that, how do you enforce it? Because people may not even recognise that they’re doing something wrong, or that they may be hurting someone or making someone feel intimidated,” Chugh said.

“What is really important is educating and creating awareness within employees that [a certain] action is labelled as microaggression. There has to be education and awareness, before you implement the policy because policies don’t mean anything if people don’t understand them or are not accustomed to using them.”

12 HONG KONG BUSINESS | Q2 2023 HR BRIEFING

Firms are encouraged to offer family-friendly flexible work arrangements

Nisha Chugh

Johnny Hui

Adrian Lam

Amita Haylock

New ordinance slashes transaction costs for Hong Kong market makers

The government gazetted a bill waiving stamp duty payable on certain transactions relating to dual-counter stock.

Hong Kong’s stock market is set to see a boost in liquidity and reduced transaction costs for market makers engaged in dual-counter stock trading. This comes after the government passed a bill that waives the stamp duty on certain transactions related to dual-counter stocks. The move is expected to encourage more exchange participants to sign up for Hong Kong Exchanges and Clearing Limited’s (HKEX) Dual Counter Market Making Programme, leading to a more efficient and liquid market.

Minny Siu, Partner at King & Wood Mallesons, said market making activities include providing bid and ask quotes within a specified range of the latest market price in the Renminbi (RMB) counter for matching investors’ orders. Liquidity providing activities, on the other hand, include arbitrage trading, which involves taking advantage of price differences between two markets.

Before the changes to the Stamp Duty Ordinance were proposed, a stamp duty of 0.13% was levied on the value of transactions involving securities listed on the Stock Exchange of Hong Kong Limited. Additionally, the seller of each security had to pay a stamp duty of $5.00 for each instrument of transfer.

According to Pan Tsang, a Partner at Robertsons Hong Kong, these stamp duties accounted for a significant portion of the trading costs of securities transactions, comprising over 90% of the total cost. In other words, the stamp duty was a major expense for market participants and reducing or waiving it could significantly reduce transaction costs and promote more trading activity.

With the removal of stamp duty for a sale or purchase of dual-counter stock, Tsang and Siu believe more exchange participants (EPs) will sign up to be market makers under Hong Kong Exchanges and Clearing Limited’s (HKEX) Dual Counter Market Making Programme and engage in market making activities and arbitrage transactions.

When this happens, Siu said the price gap between the Hong Kong Dollar (HKD) counter and RMB counter will be minimised and promote liquidity of the latter.

RMB business hub status

Citing a working group formed by the HKEX, Hong Kong Monetary Authority (HKMA), and Securities and Futures Commission, Siu said RMB counters have “relatively low liquidity,” which resulted in a price difference between HKD and RMB counters of the same stock.

The price difference, in turn, caused a low market appetite for RMB counters generally.

“The stamp duty exemption will reduce the transaction costs of market makers and help increase the liquidity and price-efficiency of RMB securities,” Tsang said.

“It is anticipated that a surge in market appetite and liquidity of the RMB counter will promote the issuance and trading of RMB securities in Hong Kong,” Siu commented. This will foster the city’s position as the “leading offshore RMB business hub.”

“The increase in trading volume [of RMB securities in

Hong Kong] will promote the further development of the relevant financial infrastructure in Hong Kong and create synergies with other current RMB-related products, which in turn strengthens Hong Kong’s status as the world’s leading offshore RMB business hub,” Siu said.

Apart from market makers, Tsang said the stamp duty exemption will also benefit Hong Kong listed issuers.

“Under the Dual Counter Model, Hong Kong listed issuers will be able to apply to launch a new RMB counter so that investors can trade eligible RMB-denominated securities under the RMB counter,” Tsang said.

“HKEX and the Mainland authorities are exploring an initiative to expand the Stock Connect to allow Mainland investors to trade RMB-denominated securities through southbound Stock Connect such that listed issuers could potentially tap into additional capital from Mainland investors,” he added.

Siu said the DCMM Programme will support this initiative by the Mainland and Hong Kong.

Impact of RMB internationalisation

Ultimately, the bill will also enhance the internationalisation of RMB, said Verona Ho, Partner at Robertsons Hong Kong.

“If the RMB-denominated stock market can gradually flourish, and if foreign investors can purchase RMBdenominated stocks in addition to those from the Mainland, there will be an increase in the number of quality Mainland companies listed in Hong Kong,” Ho explained.

“When the Renminbi stock market in Hong Kong becomes active, these giant mainland stocks can be issued in Hong Kong at the same time, attracting international investment and speeding up the internationalisation of Renminbi,” Ho added.

RMB’s internationalisation, however, raises several questions, such as whether opening up RMB trading too much will weaken the HKD, or if the RMB capital pool can support the growing volume of RMB trading.

Ho also questioned whether the pricing power of the market value of stocks will shift from Hong Kong dollar investors to Renminbi investors after more Hong Kong stocks are denominated in Renminbi.

14 HONG KONG BUSINESS | Q2 2023 LEGAL BRIEFING

The move will encourage more participants to sign up for HKEX

A surge in market appetite will promote the issuance and trading of RMB securities (Photo by Mcy jerry)

Minny Siu

Pan Tsang

Verona Ho

Three ways retailers can serve ‘budgeteers’

A budgeteer is someone who is not willing to spend more than necessary.

With inflationary pressures as a top concern, retailers are faced with a new challenge to adjust price strategies for customers who insist on value for money without sacrificing sustainability and quality. These consumers are called budgeteers, according to marketing firm Euromonitor International.

This type of customer is adopting a new spending behaviour called “sustainability by proxy,” which means choosing sustainable products that have minimal impact on the environment and opting for subscription-based models or repairing old items instead of buying new ones.

This trend is rapidly gaining popularity. Euromonitor identified in its study a gap between the majority of consumers (75%) not planning to increase spending and more than half of retailers (55%) looking to raise product price points to help their businesses survive.

Retailers, therefore, must meet budgeteers halfway. One way to do this is by giving a second life to a product that will help customers buy affordable items and be sustainable, according to Euromonitor International Research Consultant Sahiba Puri.

Rewards programmes

IKEA Thailand’s buyback and reselling service was developed in response to budgeteers’ behaviour. With millions of pre-owned furniture thrown in landfills, the furniture store is buying back used chairs, shelves, or chests of drawers from customers. In exchange for the used IKEA furniture, customers receive a gift card that allows them to buy new items in-store.

“In doing so, you’re offering your brand’s product at a more affordable price point so you’re already catering to a bigger audience. Second, you’re helping to extend the life of the product,” said Puri.

Ben Chien, AnyMind Managing Director in Greater China, said that sustainable supporters could advise people on how to keep preloved items last longer.

“There are affordable furniture stores that are very easy to build and use. But maybe their durability might not last as long. For example, some tables’ shelf life can last 20 years,’’ Chien, who oversees AnyMind’s Hong Kong, Taiwan, and Mainland China operations, told Hong Kong Business

Chien also suggested that brands can create a pre-owned programme that promotes second-hand products. One example is IKEA Singapore’s partnership with Carousell in April 2022, which extends the shelf life of its products through secondhand transactions or free-cycling on the Carousell marketplace. Customers then receive Carousell Protection vouchers or IKEA Family points.

As of 31 December 2022, an IKEA Singapore spokesperson told Hong Kong Business that over 6,754 IKEA family members and Carousell users participated in the rewards programme. IKEA furniture transactions grew by 30.5% since the programme began.

IKEA also said that buyers who might receive fake items or those unqualified for the listing can get a refund. The company aims to have 100% of all material sourced to be renewable or recycled by 2030.

Carousell, widely known as a secondhand marketplace, has been doing the preloved business since 2012. In 2021, it posted $49.5m in revenue and is focusing on being more profitable in the next three to four years.

Repairing and renting services

Consumers are also opting to repair their electronics instead of buying new ones, said Puri. In doing so, consumers may choose to rent or take subscription-based offers.

“This way, you’re providing a level of flexibility to your consumer segment where they do not have to make a big ticket purchase or commit to a big ticket item,” said Puri.

“At the same time, they can use it regularly by paying a monthly subscription. They can still own this product for whatever amount of time they need,” added Puri.

One example is Bundlee, a baby clothes rental service in the UK. It offers subscription services to help parents rent baby clothes at a low price. Parents can save over US$319 (EUR300) whilst paying only US$41.60 (EUR39) for the Bundlee subscription services.

Bundlee’s business model reduces 86% of carbon emissions and 96% of water usage compared to getting a new one at the store.

Balanced portfolio

Puri said even though budgeteers are on a tight budget, businesses do not necessarily need to trade off profitability in exchange for offering sustainable or second-hand products. Businesses can tap preloved items to keep their businesses afloat whilst retaining their core products.

“It’s about the portfolio of products that you offer and how you best decide on which portfolios need to be brand new versus where you can include second-hand products,” said Puri.

She also suggested tapping Buy Now, Pay Later, a growing payment scheme used for the underserved audience.

Chien said second-hand trade has existed for a long time but it has evolved due to the ease of selling a preloved item with just a snap of a photo and finding a community making the product more hip.

For the full story, go to https://hongkongbusiness.hk/

16 HONG KONG BUSINESS | Q2 2023 MARKETING

BRIEFING

Retailers must meet budgeteers halfway

Brands can create a pre-owned programme that promotes second-hand products

Sahiba Puri

Ben Chien

Tower 1, Enterprise Square 5, 38 Wang Chiu Road, Kowloon Bay

Address: 26/F,

Email: info@thedesk.com.hk

Sits above Kowloon Bay’s iconic MegaBox Offers flexible work and event spaces and essential business services theDesk’s new location at Enterprise Square 5 Grade A office tower overlooking amazing harbour views WhatsApp us to know more about the new location

Website: https://thedesk.com.hk

ANALYSIS: AUTOMATION

Consumers crave human connection amidst the era of automation

Businesses should balance AI and machine learning with personal care, says Euromonitor International.

Shoppers are attracted to e-commerce for its convenience and accessibility, but the lack of personal interaction that comes with traditional in-person shopping experiences can lead to a sense of disconnection and isolation. Euromonitor International has referred to this as “over-automation,” highlighting the potential negative impact of excessive automation on human connection.

In the time of ChatGPT and robotic baristas, salespersons remain valuable to some shoppers. This was highlighted by a 2023 Asia Pacific Retail Flash Survey conducted by CBRE, which found that 28% of consumers still visit physical stores to seek help from salespersons.

“Whilst automation is definitely about driving efficiencies, over-automation should be a genuine concern for businesses,” Euromonitor International Research Consultant Sahiba Puri told the Hong Kong Business

So, how can businesses bring in technology for seamless service and at the same time tap the human touch for customer experience?

To address these “opposing motivations,” Puri said businesses should learn authentic automation. This involves the purposeful application of technology in businesses.

When to automate

It is important for e-commerce platforms and retailers to find ways to offer personalised recommendations and chat support to help shoppers feel more engaged and connected with the products they are purchasing, Puri told the Hong Kong Business

Puri cited an example from the beauty shop, Lancôme, which launched a tech flagship in Singapore. The store provides consumers with personalised skin analysis from the brand’s skin tool and to balance it with human connection, they offer an in-person consultation with Lancôme experts. “In doing so the brand combined tech-driven skin

analysis with human expertise and curated a well-rounded customer experience,” said Puri. Another example is when scientists at Nanyang Technological University and Tan Tock Seng Hospital developed a prototype device designed to detect and prevent falls among the elderly population.

This is a mobile robotic balance assistant that enables seniors to have increased mobility whilst providing a high level of attention and swift response that may not be attainable by their human caretakers.

“As such, robotics that improves the quality of life and complements human expertise will be a competitive advantage moving forward,” Puri said.

For Ben Chien, AnyMind managing director of Greater China, brands in Hong Kong are having problems with “under customisation,” which means businesses are struggling to create new experiences with people going offline as well as online.

“How to sort of maximise this online back to offline experience through social and through video, this is very, very new, and does require a lot of customisation to different groups, different segments, user segments so I would imagine that no one is properly

equipped to have a full-army workout on this type of customised creative and custom content,”

Chien told Hong Kong Business.

Chien said under customisation may happen when retailers struggle with marketing campaigns for a product with two purposes. For example, developing a marketing strategy for gaming laptops that can be used as working laptops.

“Now you have a problem that you are selling one thing that provides two purposes to two completely separate groups… How do you sort of custom your creative assuming if you have the data? You still have to customise these very differently,” he said. Data from Euromonitor’s marketing trends for 2023 showed that 58% of consumers are comfortable talking to a human when addressing customer service issues. Only 19% said they interacted with an automated bot on a website.

Shorter attention span

Consumers also demand functionality and efficiency when shopping online. Puri said mindlessly browsing for hours makes consumers “unproductive and wasteful.”

With excessive use of social media, consumers now have reduced attention spans and an increased risk of mental health issues.

18 HONG KONG BUSINESS | Q2 2023

Over-automation should be a genuine concern for businesses

Over-automation can lead to a sense of disconnection and isolation

Ben Chien

Sahiba Puri

A Green Frontier at HKIS

By Kaitlin Shum ‘24, Hong Kong International

Asthe shadows of COVID-19 begin to lift, a new era is emerging for ‘ESG’, which stands for environment, social, and corporate governance. It is an acronym often used to summarise the 17 U.N. sustainable development goals which companies are now racing to implement into their operations. As part of Hong Kong International School’s (HKIS) dedication to ESG, the school has been busy planning a big sustainable development project since early 2022. Without giving too much away, it will include a fully functional greenhouse on campus, one of its kind amongst peers.

How HKIS brings sustainability goals to life

According to HKIS’s Director of Facilities Management, Raman Paravaikkarasu, this sustainable development project will move in three phases. The first phase encompasses massive data collection- converting numbers into emissions using a benchmark assessment. The assessment begins with an analysis of raw data from all divisions in the school, allowing the team to identify the average amount of carbon the school emits per day. The data collection process will accurately represent how much energy is spent, how much water is used, the amount of waste recycled, and much more. Raw data, also known as absolute numbers, is a term specific to ESG experts and is often challenging to translate to figures and quantities that a layman may understand. Through this assessment, absolute numbers can be reconfigured to data that the HKIS community and stakeholders may appreciate and use effectively to

School

reduce their carbon footprint. This phase is critical; data must be accurate for the team to continue onto phase 2. Once the data is collected and the baseline benchmark identified, the team can project short- and long-term goals for the next few years. In phase 2, the team can work on bringing these goals to life by knowing what is achievable and what needs to be further improved. Paravaikkarasu emphasised that he is committed to seeing this project from start to finish. It is not just talking about what the school plans to do but implementing plans and holding the school accountable. Amongst the many proposals presented in phase 2, two specific initiatives will be implemented in phase 3 to make the school more energy efficient. The first is to enable current facilities to be used more efficiently, specifically, managing the air conditioning system in each room at the school, and the second is to introduce new sources of energyone of which are solar panels.

The future for HKIS

Solar energy is known to be the most abundant and long-lasting energy source in the world. It is also one of the most accessible renewable energy sources compared to other environmentally harmful sources, such as fossil fuels. That is why HKIS will invest in installing solar panels as part of phase 3. HKIS

believes that, in the long run, harnessing solar energy will benefit the school economically and be a driving force in its commitment to social and educational impact. It has commissioned HK Electric to begin the installation process in 2023 in nearly all its facilities, starting with the residences at the Repulse Bay Campus. Notably, a television monitor will also be installed in addition to the solar panels, enabling faculty, students, as well as the community members to visualise and track the energy collected by the solar panels on a day-to-day basis.

Why HKIS values sustainability

The school has chosen to include the school community as a whole in its ESG initiative and, in doing so, to educate and inspire students first-hand. It is not just the faculty and administration officers being involved in the process, but also having student participation through organisations such as Green Dragons and the Sustainability Board in high school that makes this a team effort from all stakeholders. As Paravaikkarasu said, “This process is both top-down and bottom-up. It is important to infuse a greater understanding to the community and the team so they can all contribute.” Most importantly, “It is all part of the ethos in being future leaders for the school; to get everyone involved and ensure they are on the right track for the future.”

HONG KONG BUSINESS | Q2 2023 19

EDUCATION 2022

The school has chosen to include the school community as a whole in its ESG initiative and, in doing so, to educate and inspire students first-hand

Sustainability in practice

Raman Paravaikkarasu, Director of Facilities Management, HKIS

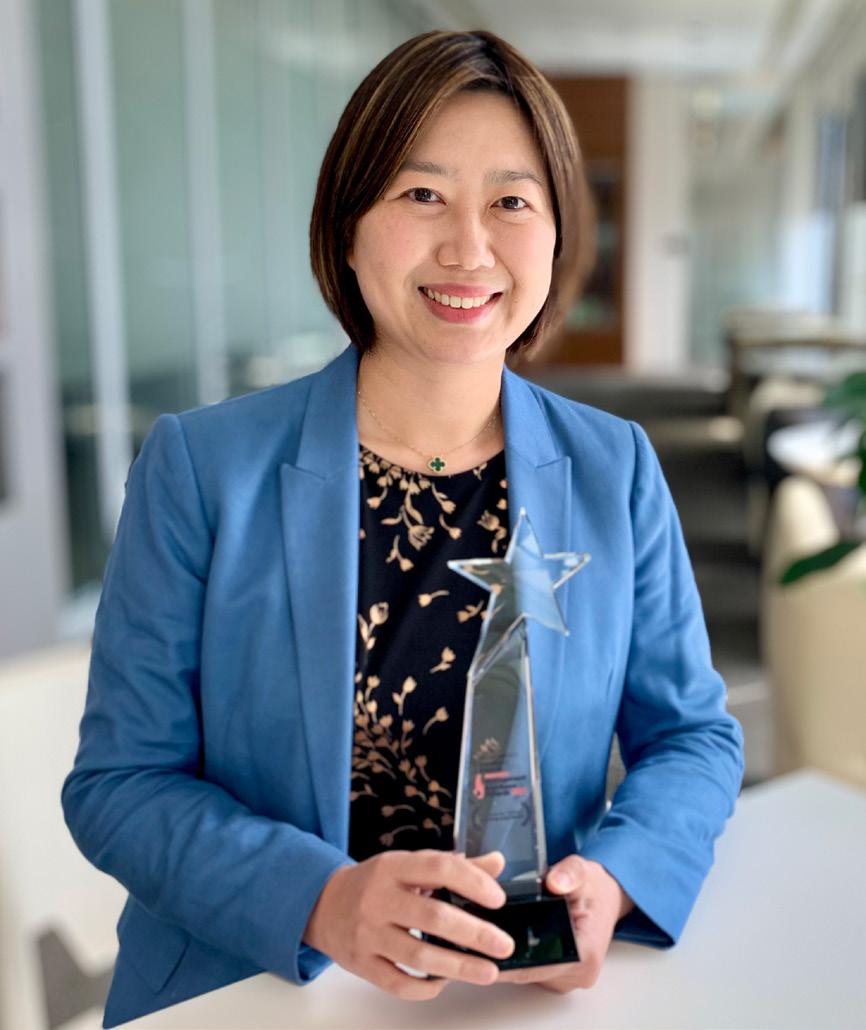

DBS’ Lareina Wang on why role models matter to women in banking

Only 20% of bankers in C-Suite and senior leadership roles in Hong Kong are women.

Women’s representation in banks has come a long way, but much work still needs to be done. In a report, Deloitte noted that barely two in 10 C-suite and senior leadership roles in Hong Kong are occupied by women, at 17.9% and 23.9%, respectively. This is below the already dismal global averages of 21% and 19% for each; and the share is not expected to change through 2030.

Having women in senior leadership positions is important to foster more women to enter the financial industry, a reality echoed by Lareina Wang, ED, head of digital & innovation, Institutional Banking Group of DBS Bank Hong Kong.

“I have been fortunate enough to have had many female senior leaders that I look up to and learn from, they all have different backgrounds, different styles and different personal life setups, which is brilliant because that sends a strong message that success comes in many different formats and shapes,” Wang told Hong Kong Business

Wang makes it a point that this applies not just to women, but to any underrepresented groups– be it different ethnic groups, neuro groups or LGBTQ groups.

“We need to be mindful that all of us have [an] unconscious bias, [and] it’s important to acknowledge that and educate ourselves so we can overcome them. Resist the urge to box anyone in any stereotypes, be empathetic and if you are fortunate enough to be in a decision-making position, be extra generous with the opportunities you could give to under-represented groups,” Wang said, noting women, introverts, people who are non-native English speakers amongst the underrepresented.

In celebration of International Women’s Day, Hong Kong Business spoke with Wang to learn more about the challenges still being faced by women in the industry–and what Wang and DBS are doing in order to help them thrive in the banking sector.

What are the current concerns and challenges faced by women in the banking industry?

Regardless of geo-locations, the challenges have always been: one, the lack of representation at senior levels, which means the collective female voices are not as loud as their male counterparts, and also means younger women have fewer role models to look up to and be inspired by.

Second [is] the conscious and unconscious biases that form unnecessary stereotypes—for example, people tend to associate tech roles with males, and as a result, fewer females choose to enter this field and the vicious cycle continues.

Over time, as awareness and efforts in this area grow, both these areas have seen big improvements, however, the challenges are still very prevalent today.

Resist the urge to box anyone in any stereotypes

Your career in banking and finance has spanned different continents–from Europe to Asia. Could you tell us about how you began your career in the banking industry?

I’m a marketeer by training and only stumbled into the world of “digital” with Ogilvy London because there weren’t that many roles around in the depth of the financial crisis. At that time, digital marketing was only just emerging and I was fortunate enough to catch that trend and see my career progression accelerate as “digital” became more and more mainstream. As head of Digital, I see myself as a business leader rather than a tech leader, because digital is at the core of how DBS operates, and as customers become more and more digitally savvy, digital is increasingly becoming our competitive advantage to attract and engage with our clients.

Are there differences in the needs and challenges faced by women in Asia compared to Europe?

I definitely see more senior female leaders in Hong Kong than in London, and I think it has a lot to do with the “support network” women have here, be it the easily accessible paid-for help or help from family.

This is not the case for London as childcare or elderly care are extortionately expensive, and culturally families are not as involved to provide care. As a result, mothers often face a tough choice of whether to return to work after childbirth, particularly after multiple children—the childcare cost will very likely outweigh the mother’s income and because of that a lot of new mums choose to either delay the return to the workforce or only doing it on a part-time basis. Needless to say, this has a knock-on impact on these mothers’ career development in the long run.

20 HONG KONG BUSINESS | Q2 2023 INTERVIEW

Women in senior positions can foster more women to enter the financial industry (Photo: Lareina Wang, ED, DBS)

WINNER BEST HOME THEATER

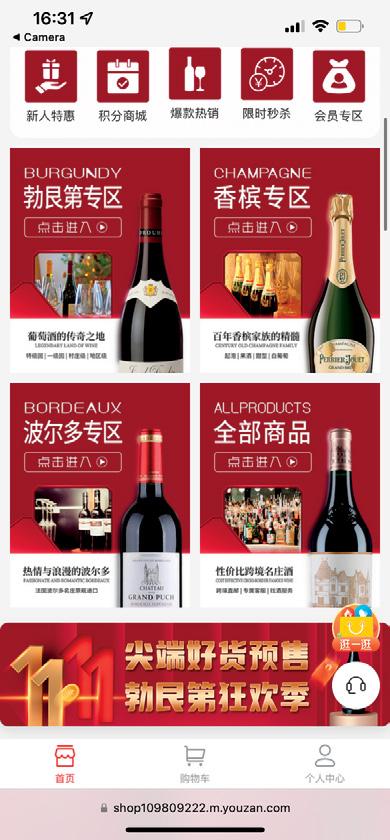

Jumppoint offers AI-driven courier routing to

deliver to underserved markets

Algorithm helps the Hong Kong-based startup predict demand per area to ensure efficient drops at low cost.

efficient logistics platform,” said Ho.

The idea that Jumppoint, since it is fictional, also breaks all the modern physics rules also reflects Ho’s company. “It is also how Jumppoint works. We break most of the rules and we want to provide a revolutionary product to the world,” said Ho.

When they were starting, Ho admitted that Jumppoint encountered some bumps on the road, particularly in keeping up with the shifts in delivery demand during COVID-19.

“The biggest challenge is always about the strong fluctuation in demand in COVID. The demand can ramp up 10 times in one day, and then drop 10 times in the next week,” Ho recalled.

As companies are busy doing what their competitors are also doing, Hong Kong-based startup Jumppoint does the opposite. Unlike other logistics platforms that offer quantity upon delivery, Jumppoint CEO and founder Samson Ho said they do it differently by using algorithms of their AI tech to plan the routes of their couriers.

What sets Jumppoint apart is that it also offers services to the “underserved market” in Hong Kong, which Ho identified as markets supplying bulky deliveries and multi-temperature items such as cold chain delivery.

Its cold-chain delivery offers four temperature ranges, which are: -18°C to -12°C; 0°C to 4°C; 19°C to 25°C, and room temperature.

“When there is competition, your product is the same as ours, and you are stuck to something that will fail. When we see a certain demand is not well served by others, we focus on that,” Ho told Hong Kong Business

Since Jumppoint allows drivers to deliver more than 50 items per route, the logistics cost can be decreased by maximising the number of deliveries per hour. For example, Ho said their drivers can deliver four orders per hour which translates to $45 (US$5.85) delivery costs.

Unlike other logistics platforms, one product being delivered in an hour usually costs an average delivery fee of $180 (about US$23).

These solutions are powered by proprietary AI tools of Jumppoint called Atlax and Hermex to assist them in creating unified GeoCode address databases and multi-level dynamic routing systems.

Jumppoint’s logistics services also enjoy a “100% acceptance rate” because they bank on historical data to predict the demand in each area. This helps them plan their supply for deliveries.

“We understand who our merchants are, and how their business looks at different times of the week of the month so that we can plan our supply beforehand,” said Ho.

Origin story

In the science fiction universe, jump points are portals used to travel from one galaxy or universe to another. Ho’s team was inspired by this science fiction term and used it for their platform’s name.

“The meaning behind Jumppoint is we want to make it the most efficient way for you to travel in the world to deliver a product to another part of the world. We want to be the most

Compared to transportation firms, e-commerce demand or logistics isn’t as steady. Ho said demand for e-commerce is high when there are mega sales such as Black Friday.

‘Blue ocean’

Five years from now, Ho said they would continue to focus on improving the situation of the underserved market, which is door-to-door delivery at low cost.

“This is still a blue ocean, the first strong growing market. We will focus on that but of course, when everyone is doing that, we have to create new value,” said Ho.

When other logistics companies focus on making their packaging stunning and tap other marketing strategies, Jumppoint takes a different direction by ensuring its retention rates for clients are higher than 90%.

“We do not rely on marketing expenses and we do not rely on advertising. We only focus on creating value and differentiated value for our customers,” he said.

Jumppoint’s lead investor and earliest supporter are MindWorks Ventures. Other investors include Headline Asia, a Japanese venture capital firm, Beyond Ventures, Hong Kong Inno Capital, Chinachem Group, and HKSAR ITVF.

The logistics startup has so far raised more than $78m (US$10m), Ho said.

22 HONG KONG BUSINESS | Q2 2023 STARTUP

Jumppoint serves markets supplying bulky deliveries and multi-temperature items (Photo courtesy of Jumppoint)

When we see a certain demand is not well served by others, we focus on that

Samson Ho

HONG KONG BUSINESS | Q2 2023 23 Work across Hong Kong with theDesk Causeway Bay Sheung Wan Kowloon Bay Admiralty Sai Wan Kwun Tong Find your own working space at our locations https://thedesk.com.hk/ Central Tsim Sha Tsui Sha Tin

CONCEPT WATCH

Eatology cooks up a ‘halfway diet’ for Hong Kongers

The flexitarian meal plan is for consumers looking to reduce their consumption of animal-based products.

Eatology started offering Hong Kongers science-backed meal plans in 2015, seeing the need for a more practical and sustainable diet that works well with customers’ lifestyles. It has since launched meal plans for vegetarians, vegans, and even pescetarians, but Eatology saw that not everyone can make the full move to becoming a vegetarian; hence, it curated a new meal plan.

Through a flexitarian meal plan, Eatology hopes that consumers looking to change their diets can consume more greens without ditching meat. Flexitarians are also occasionally known as flexible vegetarians or casual vegetarians.

“The flexitarian diet is sustainable for people to eat every day. We already have a vegetarian diet, in place for a long time, but some people are not ready to make the full move—that’s why we created a way to bring something in between that is easier to follow,”

Christophe Daures told Hong Kong Business. Citing a Temasek report, Eatology said that flexitarians made up 42% of the global market in 2021 with a quarter of Southeast Asians and Australians saying that they eat less meat now compared to three years ago.

Daures co-founded Eatology with Guillaume Kaminer. Eatology’s target market comprises men and women between the ages of 25 and 65, but mostly, its clients are busy young individuals who want to save time and start a healthy lifestyle.

More greens, less meat

Through the flexitarian meal plan, Eatology sought to encourage Hong Kongers to cut their consumption of meat or fish to once a day as an initial step toward improving their health.

“People tend to overeat protein these days because they read in magazines that they should eat lots of protein because they’re

The flexitarian diet is sustainable for people to eat every day

going to lose muscles, which is not true,” Daures shared. “[The meal plan] helps to reduce the amount of protein that you are absolving, and this is the correct amount that you should get which is a number between 18% and 25%.”

Approximately 90% of the meals also offer unrefined carbohydrates, such as brown rice, and wheat flour. These are harder to break down, compared to white rice, making the body feel full for a longer time.

The flexitarian diet also allows consumers to improve their gut health, which Daures considered critical in any diet.

“Gut health is something that very few people talk about today that is extremely important for the benefit of your body,” he said. “If your gut is not in good health, you can try to have a good diet, but it’s not going to work.”

On top of its health benefits, Eatology also said that the flexitarian meal plan ultimately helps in reducing consumers’ carbon footprint. A study by the United Nations Food and Agricultural Organisation cited that about 14% of all greenhouse gas emissions come from meat and dairy production. For the full story, go to https:// hongkongbusiness.hk/

24 HONG KONG BUSINESS | Q2 2023

Eatology encourages Hong Kongers to cut their consumption of meat or fish to once a day

Buddha Bowl with Green Curry and Plant-Based Chicken

Pork Loin Duros Iberico, Sichuan Garlic Sauce, Asian Sautéed Spinach

Eatology founders Guillaume Kaminer and Christophe Daures

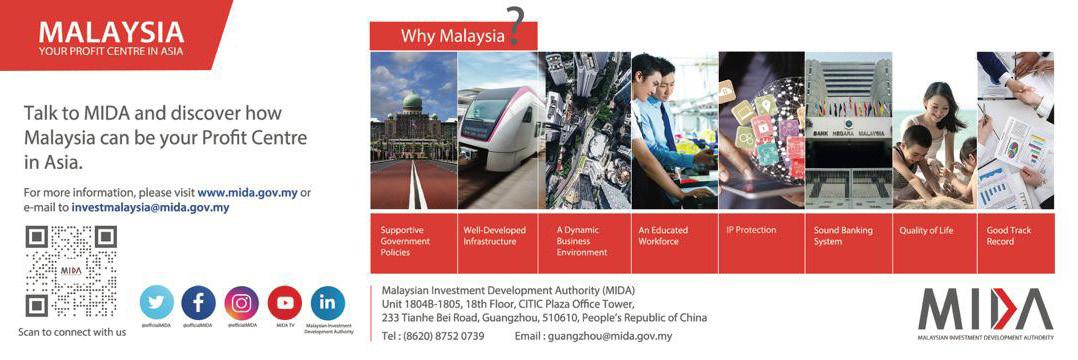

Better Industry Opportunities as Usage of Healthcare Devices Rises

According to a report published by KPMG in March 2020 which builds on figures released by Fitch Solutions, Malaysia’s medical device market is forecasted to be worth RM8.97b (US$2b) in 2022, with a compound annual growth rate (CAGR) of 7.5% between 2018 and 2022. This comes alongside the revelation that total healthcare expenditure in Malaysia will exceed RM69.2b in 2021 and is expected to grow at a CAGR of 7.6% through 2025.

Malaysia’s medical device industry comprises over 200 manufacturers, half of which are involved in producing medicalgrade gloves. The industry also produces higher value-added and high-technology products including blood glucose monitors, orthopaedic implants, pacemakers, stents, electro-medical devices and monitoring devices.

In-Vitro Diagnostic Rapid Test Kits

In-vitro diagnostic (IVD) tests are defined as tests performed on bodily samples commonly obtained through swabs of mucus from inside the nose or at the back of the throat or through blood obtained from a vein or fingerstick. IVD tests look to detect diseases present in the human body, which can be used to monitor an individual’s health and assist in diagnosing ailments. The size of the IVD market stood at US$83.4b in 2020 and is expected to grow at a CAGR of 4.5% from 2021 to 2027. This is due to an increase in the use of IVDs in COVID-19-related diagnostics and it is also expected to rise due to increased awareness of early healthcare detection and treatment.

IVD Rapid Test Kits (RTKs), such as lateral

flow tests, allow for quick results while being easily accessible due to their smaller size as compared to bulky and complex laboratory-grade equipment used for highly-sensitive diagnostic testing.

Demand for RTKs saw significant prominence during the COVID-19 pandemic due to its preliminary sensitivity and accuracy, quick-yielding results, relatively inexpensive cost and ability to scale up for mass production. COVID-19 RTKs are one of the latest entries to the long list of IVD RTKs, which have been in use way before the COVID-19 pandemic.

As awareness for early diagnosis and treatment increases, there is a need for IVD tests to be more sensitive and have an expanded scope of testing coverage while simultaneously also providing quicker test turnover rates with high accuracy. This would mean higher development costs and longer project timelines but would also ensure an overall increase in the standards and accessibility of healthcare, especially given the effort to miniaturise IVD tests into smaller, portable RTKs.

With advanced biomarker detection technologies, stricter regulations and quality standards, healthcare users can be assured that the results from these tests are reliable and trustworthy. In addition, more and more tests are being made available to assist in the detection of a growing list of health issues and complications.

In Malaysia, more than five (5) companies produce In-Vitro Diagnostic RTKs, with most of them beginning production over the past two years in a bid to cater to the overwhelming demand for COVID-19 rapid detection. As COVID-19 has not shown any

signs of waning, the domestic production of COVID-19 RTKs remains to be seen as essential, and testing needs continue to be indispensable. Having already developed an ecosystem for producing IVD RTKs, Malaysia is also primed to take advantage of the growing awareness of healthcare and the demand for early diagnostics. Local manufacturers of these diagnostic test kits can retool and accommodate a diversified range of products, with some already actively involved in the production of test kits to detect HIV, malaria, influenza, and pregnancy.

Moving Forward

As the country advances, Malaysia can position itself as one of the manufacturing champions of these next-generation diagnostics devices, in line with the national aspiration of becoming the regional medical devices manufacturing hub that caters for the global market. This is made possible with greenfield Foreign Direct Investments (FDI) and strategic collaborations with local partners, which would develop this niche manufacturing area further.

The local industry also stands a chance of being part of this new development through the supply of diagnostic kit components, whereby local manufacturers already have experience producing IVD test kits for Enzyme-Linked Immunosorbent Assay (ELISA) and RT-PCR tests.

The world-class Electronics Manufacturing and Support Services (EMS / ESS) sectors in Malaysia also boost the local manufacturing of next-generation IVD devices, which can leverage heavily from local experience and expertise in developing and manufacturing complex electronics-based components for such devices.

Investors who are intent on exploring the business prospects of this new growth area can get in touch with MIDA’s Life Sciences and Medical Technology Division for more information.

HONG KONG BUSINESS | Q2 2023 25

Increasing adoption of IVD kits bodes well for Malaysia.

COMPANY FEATURE

MBA competes with specialised postgrad programmes through AI

Providers now offer blockchain, ESG investing, and double degree programmes.

programmes are competitive as they can “better prepare students in advancing to top management roles,” Leung maintained.

As opposed to online courses, Leung said MBA offers experiential learning such as in-person networking events or professional development opportunities that online programmes do not have. In addition, PolyU’s MBA programme includes advanced technological elements in its curriculum such as blockchain, cloud computing, data science, and AI.

AI in the mix

Sachin Tipnis, senior executive director of HKU Business School, said one of the challenges they have to face is ChatGPT, the well-known AI chatbot that has garnered a mixed reception since its launch.

Master of Business Administration

(MBA) providers are facing increased competition with specialised postgraduate programmes and online courses. From 2020 to 2021, the trend was online MBA; and in 2022, providers were challenged to integrate specialised courses and AI to hone the skills of future business leaders.

Despite facing increased competition, MBA providers were able to overcome the challenges as reflected in this year’s Hong Kong Business’ MBA rankings, which saw an overall increase of 24% in the total number of students enrolled in the participating schools—from 1,090 in 2021 to 1,354 in 2022.

In the rankings, Hong Kong University (HKU) MBA remains the titleholder for the largest MBA programme, with 465 students enrolled in 2022 compared with 315 students in 2021.

Next in rank are the Chinese University of Hong Kong (CUHK) MBA in Finance at second and CUHK MBA at third with 317 and 166 enrolled students, respectively.

The new addition, Hong Kong Baptist University MBA takes fourth place with 121 enrolled students in 2022, followed by CityU MBA with 115 students in 2022 from 110 students in 2021.

Education advancements

In Hong Kong, MBA competes with more specialised taught postgraduate programmes, such as Masters in Finance or Business Analytics, Fine Leung, MBA programme director at The Hong Kong Polytechnic University (PolyU), told Hong Kong Business “Students might feel that they can get immediate benefits from these specialised postgraduate programmes in their career,” Leung said. “Some of these programmes also have lower bars in terms of admission requirements. For example, some of them don’t require work experience,” added Leung.

Another factor to be acknowledged is the emergence of online programmes and other online course providers such as Coursera.

But in comparison to specialised postgraduate programmes, the MBA

He admitted that this development is still being studied but highlighted that they are willing to adapt to changes in technology by carefully studying it.

“Because [ChatGPT] challenges the way probably the assignments are done and maybe the examinations are done. The information is easily available now so this is something which we need to work with,” Tipnis told Hong Kong Business.

“But my general thought process is that we need to embrace technology because it’s very important to work within this premise otherwise, we cannot evolve,” added Tipnis.

Dual courses and ‘real exposure’ Professor Wan Wongsunwai, associate dean of MBA programmes at CUHK, said their provider is not only the oldest school in the market and the first to offer an MBA degree in Hong Kong and the region, but also offers dual MBA and Juris Doctor opportunities as well as other flexible and exclusive double degree opportunities. “We have several students every year taking MBA JD, either in this order or the reverse. We have all these different

26 HONG KONG BUSINESS | Q2 2023

Hong Kong Baptist University is the newest addition to Hong Kong Business’ latest MBA rankings (Photo from the HKBU website)

MBA PROGRAMMES SURVEY

Some of these programmes have lower bars in terms of admission requirements

Fine Leung

Sachin Tipnis

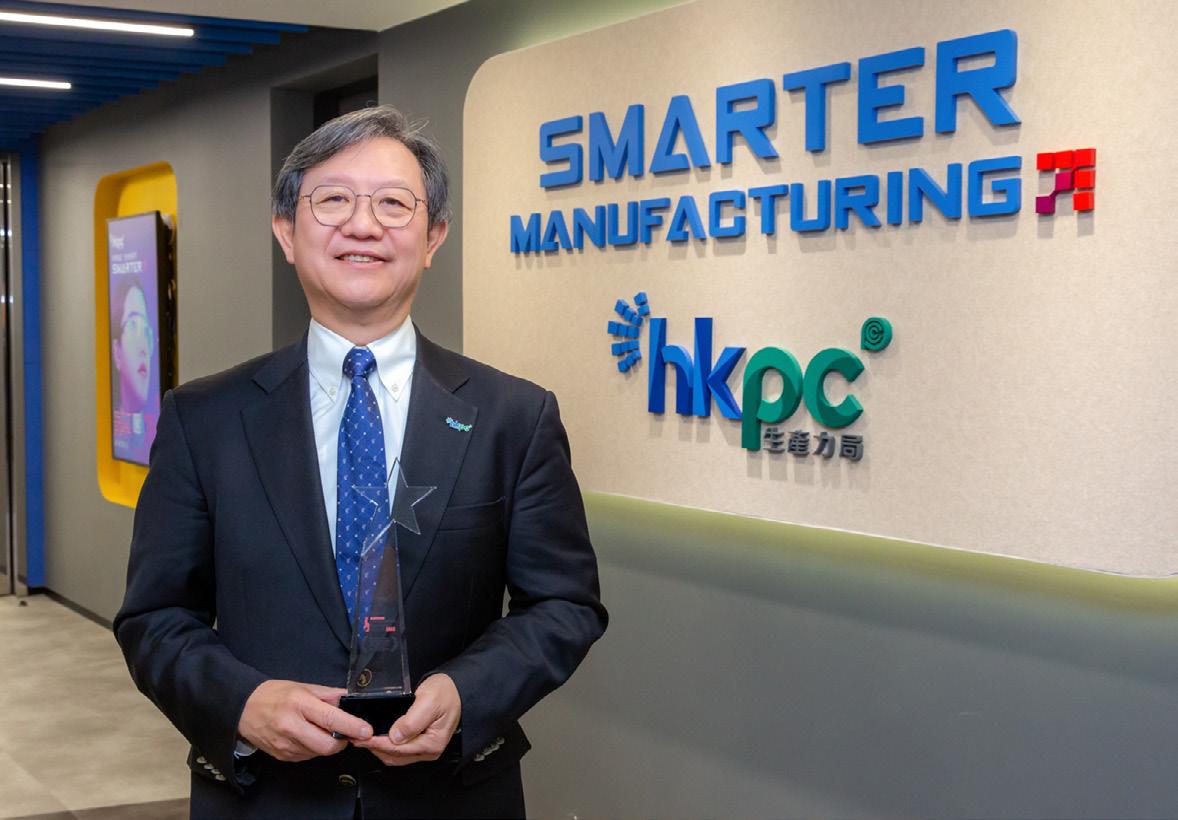

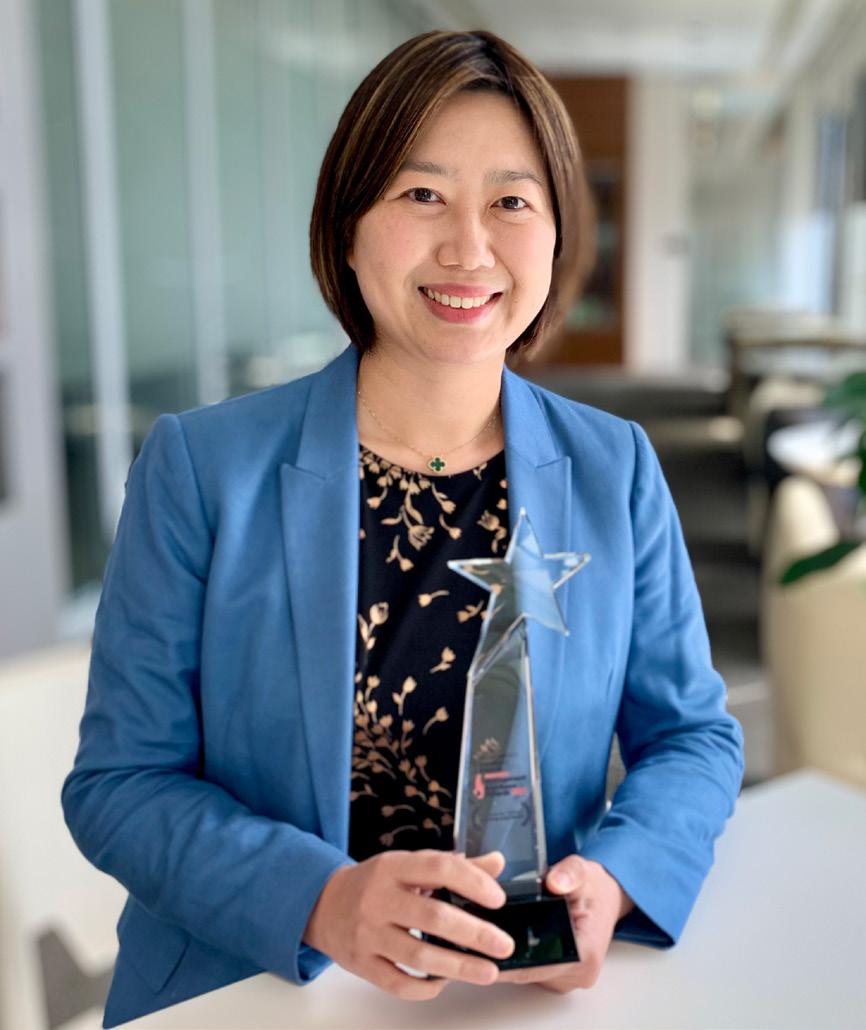

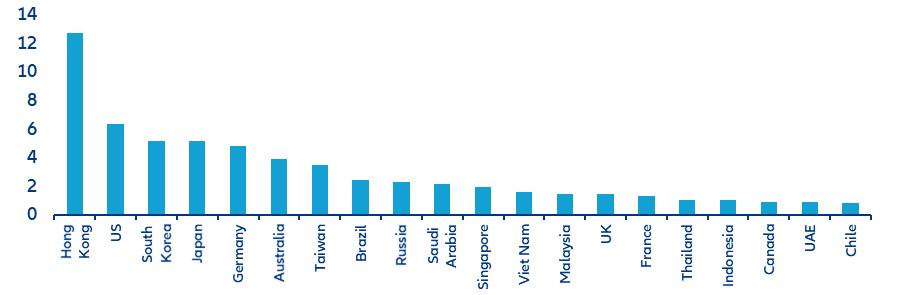

and flexible options available to students,” said Wongsunwai.