ART ISSUE

AUCTION HOUSES IN APAC THRIVE ON MILLENNIALS’ ART-BUYING POWER

PHILLIPS’ ‘MINIMALIST’ HQ SHOWCASES

DIVERSE COLLECTION OF ASIA’S FINEST ART

LIVI BANK LAUNCHES

GAME-CHANGING APP FOR SMES

GOVERNMENT SHIELDS LOCAL MNES FROM EU’S TAX DEFENSIVE MEASURES

HK LEAPS INTO DIGITAL SICK LEAVE VERIFICATION

Display to 30 September 2023 HK$40 Hong Kong’s Best Selling Business Magazine Issue No. 71

Fidelity MPF

Tax Deductible Voluntary Contributions

Apply for TVC via SmartRetire Pay less tax and save more wisely

The Fidelity SmartRetire mobile app makes setting up your TVC account easier and quicker. Upon successful application, you can save up to HK$10,2001 on contributions yearly. Download SmartRetire now to set up your TVC account or make additional TVC contributions!

(TVC)

3 key benefits of managing TVC via the SmartRetire mobile app

Streamlined and convenient process

The entire online application process can be completed in 15 minutes! Best yet, you can conveniently make contributions by selecting various payment methods including Faster Payment System for instant online payment.

Debut launch of remote identity verification capability

The identity verification process no longer has to be done face-to-face2. You can now complete the required identity verification anytime, anywhere with our mobile app.

Change or make additional contributions to your TVC account anytime

You can make additional lump sum/monthly contributions or change your

current monthly

contributions to your TVC accounts easily.

Download

1 The actual tax savings depend on personal income level, entitled tax allowances and deductions as well as the amounts of qualifying deferred annuity policy premiums paid or the amounts of TVC made. Based on the prevailing highest tax rate (i.e. 17%) and the maximum tax deductible limit of HK$60,000, the maximum tax savings can be HK$10,200.

2 Applicable to HK permanent identity cardholders only.

FIL Limited and its subsidiaries are commonly referred to as Fidelity or Fidelity International. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. Investment involves risks. Fidelity only gives information about its products and services. Any person considering an investment should seek independent advice on the suitability or otherwise of the particular investment. The third party marks appearing in this material are the property of the respective owners and not by Fidelity. This material is issued by FIL Investment Management (Hong Kong) Limited and it has not been reviewed by the Securities and Futures Commission.

C2 HONG KONG BUSINESS | Q3 2023

the SmartRetire mobile app today

Fidelity.com.hk/TVC

Established 1982

Editorial Enquiries:

Charlton Media Group Hong Kong Ltd

Room 1006, 10th Floor, 299 QRC, 287-299 Queen’s Road Central, Hong Kong | +852 3972 7166

PUBLISHER & EDITOR-IN-CHIEF Tim Charlton

ASSOCIATE PUBLISHER Louis Shek

EDITORIAL MANAGER

PRINT PRODUCTION EDITOR

PRODUCTION TEAM

Tessa Distor

Anna Mae Rodriguez

Noreen Jazul

Consuelo Marquez

Olivia Tirona

Frances Gagua

Charmaine Tadalan

FROM THE EDITOR

Millennials have been paving a new path for multiple industries – from the art market to the financial sphere. Find out on page 24 how this generation invigorates the art market, with renowned auction houses like Christie's, Sotheby's, and Phillips abuzz as these new collectors bask into the limelight.

Gen Zs, on a different note, who will make up most of the workforce in years' time, are driving companies to be active in deals that address diverse aspects of ESG. Read on page 32.

The youngbloods are also changing the way brands do marketing, being the most likely to respond to influencer marketing efforts. Page 18 teaches brands how to ensure growth when working with micro-influencers.

COMMERCIAL TEAM GRAPHIC ARTIST

Janine Ballesteros

Jenelle Samantila

Cristina Mae Posadas

Emilia Claudio

ADVERTISING CONTACTS Louis Shek +852 6099 9768 louis@hongkongbusiness.hk

Reiniela Hernandez reiniela@charltonmediamail.com

ADMINISTRATION EUCEL BALALA accounts@charltonmediamail.com

ADVERTISING advertising@charltonmediamail.com EDITORIAL editorial@hongkongbusiness.hk

PRINTING

Gear Printing Limited

Flat A, 15/F Sing Teck Fty. Bldg., 44 Wong Chuk Hang Road, Aberdeen, Hong Kong

Can we help?

Editorial Enquiries: If you have a story idea or press release, please email our news editor at editorial@hongkongbusiness.hk. To send a personal message to the editor, include the word “Tim” in the subject line.

Media Partnerships: Please email editorial@hongkongbusiness.hk with “Partnership” in the subject line.

Subscriptions: Please email subscriptions@charltonmedia.com.

Hong Kong Business is published by Charlton Media Group. All editorial is copyright and may not be reproduced without consent. Contributions are invited but copies of all work should be kept as Hong Kong Business can accept no responsibility for loss. We will however take the gains.

Sold on newstands in Hong Kong, Macau, Singapore, London, and New York.

*If you’re reading the small print you may be missing the big picture

Keeping up with the trends that define the new generation and the fashion industry has also opened its doors to artificial intelligence. Read on page 42.

We are witnessing substantial changes across the Hong Kong market, with the art market, technology, and finance sectors at the forefront of this transformation.

Continue reading to learn more about these compelling stories of innovation and transformation in the APAC region.

Read on and enjoy!

Tim Charlton

HongKongBusiness is available at the airport lounges or onboard the following airlines:

HONG KONG BUSINESS | Q3 2023 1

HONG KONG BUSINESS

COVER STORY AUCTION HOUSES THRIVE ON ASIAN MILLENNIALS’ ART-BUYING POWER

06 SG vs HK: Where should MNCs establish their APAC headquarters?

08 Retail market rebounds as tourists return

09 Faster recovery awaits Hong Kong’s high-end hotels

10 Ageing HK demands more senior facilities

11 Why are residential prices in Hong Kong losing growth momentum?

20 Phillips’ ‘minimalist’ HQ showcases diverse collection of Asia’s finest art

21 ‘Wall-less’ office opens up collaboration amongst AnyMind’s creatives

28

RANKINGS

JOB LOSSES LOOM IN HONG KONG BANKS AS FOCUS TURNS TO PRODUCTIVITY

36 Physical stores catch up to e-commerce as spending shifts back to offline

STARTUP ANALYSIS

22 Bilby.AI enables business to capitalise on regulatory changes with predictive insights

HR BRIEFING LEGAL BRIEFING

23 Gov’t must review valuations for successful land sales

14 Hong Kong leaps into digital sick leave verification

40 AT-1 write-down ‘negligible’ to APAC banks, but should they still worry?

16 Government shields Hong Kong’s local MNEs from EU’s tax defensive measures

MARKETING

18 Smart strategies with microinfluencers ensure brand growth in 2023

32 Digitalisation and decarbonisation drive M&A deals in Asia-Pacific

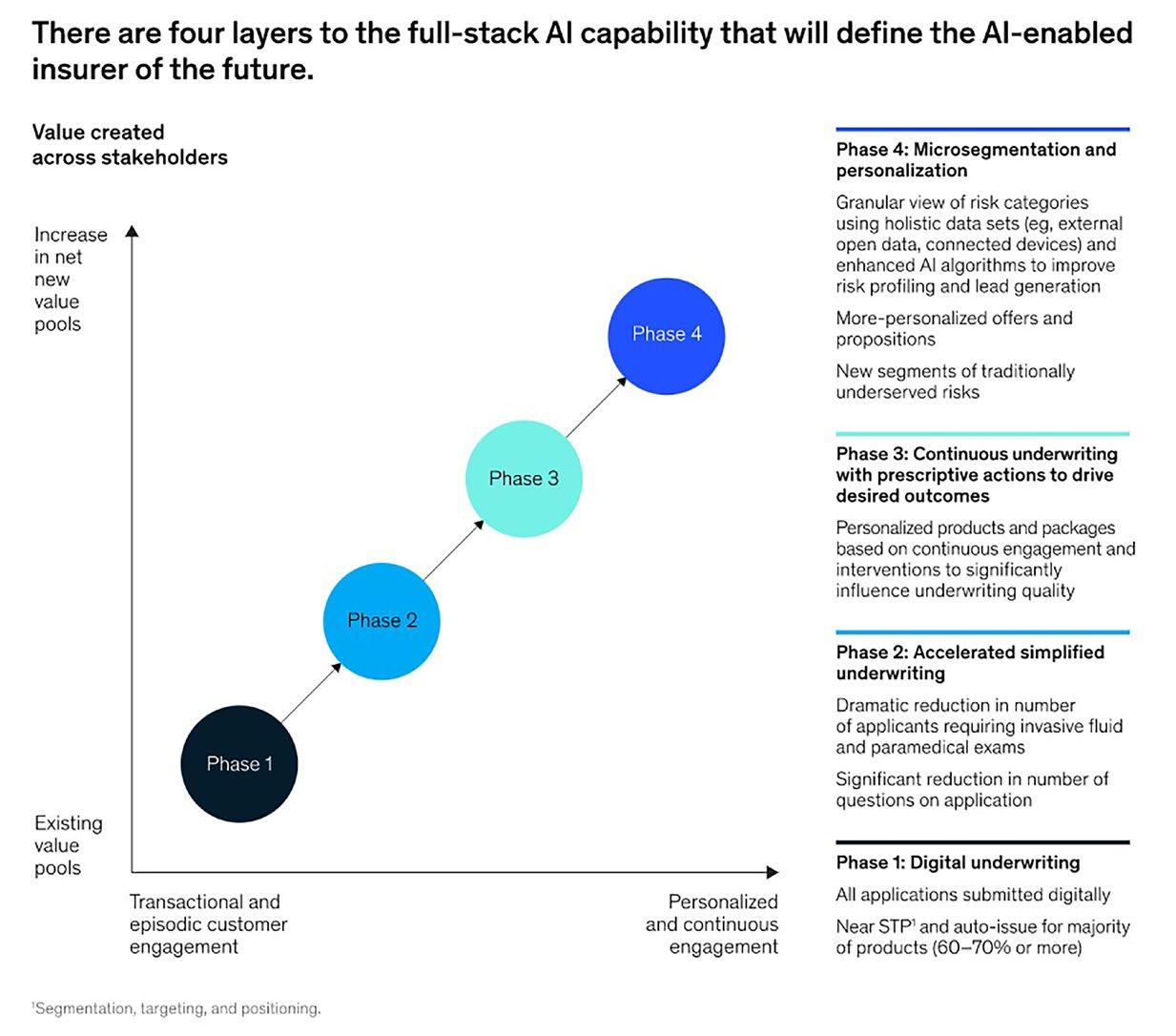

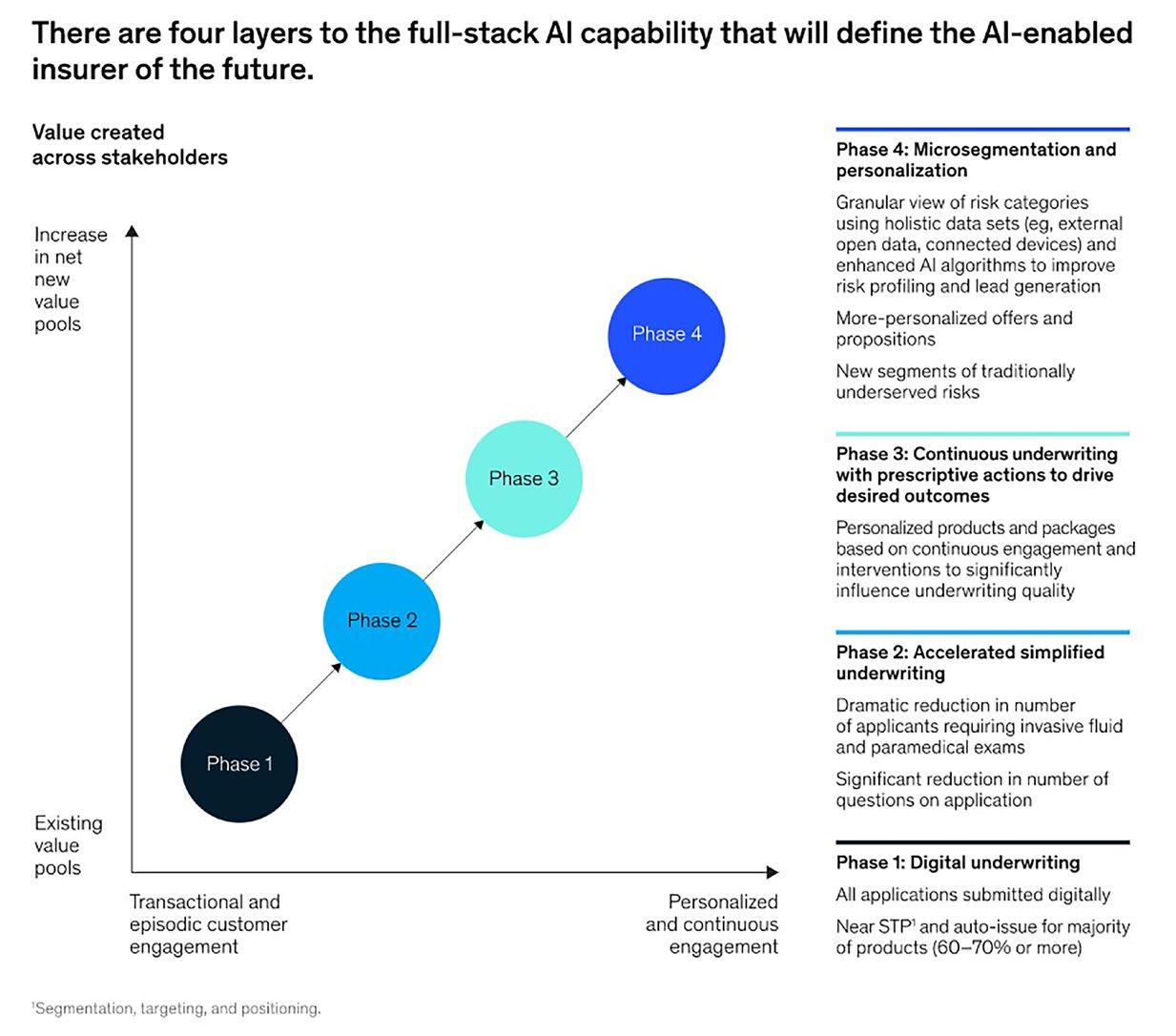

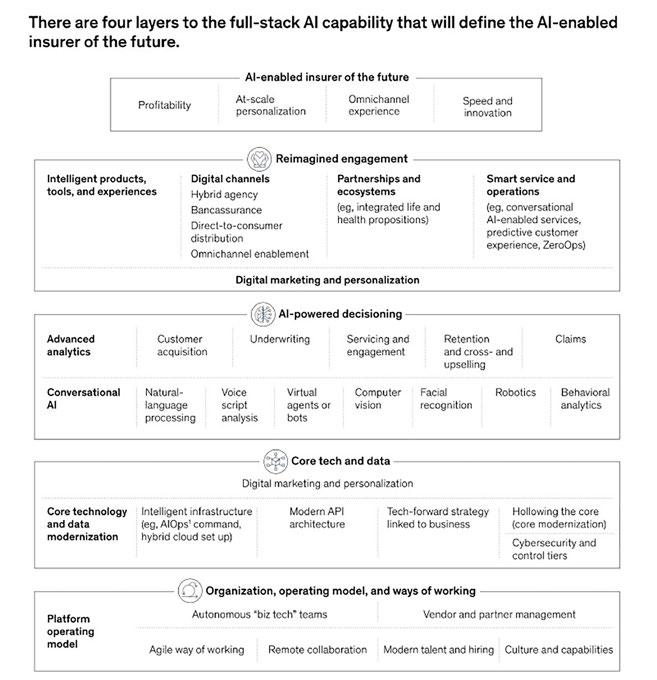

34 Asian insurers’ AI-readiness dictates their competitive advantage

42 Creating 'smarter' fashion with AI integration

43 HK reclaims status as global hub for lifestyle products

44 Four ways HK hospitals can become an ‘innovation pathway’ in the GBA market

EVENT COVERAGE COMMENTARY

46 Can voluntary carbon markets accelerate decarbonisation in Asia?

48 Getting the right accomodation mix will be crucial to Northern Metropolis’ succes

2 HONG KONG BUSINESS | Q3 2023 JANUARY 2019 Published Quarterly by Charlton Media Group Pte Ltd, Room 1006, 10th Floor, 299QRC, 287-299 Queen’s Road Central, Sheung Wan, Hong Kong For the latest business news from Hong Kong visit the website www.hongkongbusiness.hk CONTENTS FIRST

INDUSTRY INSIGHT REPORT FINANCIAL INSIGHT

INTERVIEW LIVI BANK LAUNCHES GAMECHANGING APP FOR SMES 38

BRIEFING SPACEWATCH

24

HONG KONG BUSINESS | Q3 2023

News from hongkongbusiness.hk

Daily news from Hong Kong

MOST READ

In the last few months of 2022, levels of venture capital funding declined, which were not seen since 2017. Whilst macroeconomic headwinds played a role in this drop, experts pointed the “stand-off” between investors and investees, because investors and startups contrast in valuations.

The government gazetted a bill waiving stamp duty payable on certain transactions relating to dual-counter stock. This aims to encourage more exchange participants to sign up Dual Counter Market Making Programme of HKEX, leading to a more efficient and liquid market.

DBS’ Lareina Wang on why role models matter to women in banking

Women’s representation in banks has progressed, but much work is yet to be done. Deloitte noted, women occupied barely two in 10 C-suite and senior leadership roles in Hong Kong, at 17.9% and 23.9%, respectively. It is already below the dismal global averages, 21% and 19% for each, and is not expected to change in 2030.

STARTUPS

The ChatGPT effect? Investors bet big on deep tech startups

Back in 2014, logistics tech and e-commerce businesses were not as big, but when Ninja Van arrived, the startup scene saw more entrepreneurs gravitating towards the sector. This will likely recur in the current startup economy, particularly deep tech—technologies requiring substantial investment in R&D.

Hong Kong, Singapore build stronger data centre hubs despite land limits

Hong Kong and Singapore have held their own as amongst the leading destinations for data centres in Asia and the world in 2022. Admirable as their feat stands amidst the lack of available land, how these markets sustain their growth with such limited space for expansion is a question worth answering.

MBA competes with specialised postgrad programmes through AI

Master of Business Administration (MBA) providers are facing increased competition with specialised postgraduate programmes and online courses. From 2020 to 2021, the trend was online MBA; and in 2022, providers were challenged to integrate specialised courses and AI to hone the future business leaders.

VCs and entrepreneurs 'stand-off' pushes funding volumes down

New bill slashes transaction costs for Hong Kong market makers

VCs and entrepreneurs 'stand-off' pushes funding volumes down

New bill slashes transaction costs for Hong Kong market makers

& EDUCATION

MARKETS & INVESTING HOTTEST

2023 MARKETS INFORMATION TECHNOLOGY INTERVIEW HR

SG vs HK: Where should MNCs

establish their APAC headquarters?

Hong Kong SAR and Singapore are both attractive locations for multinational corporations seeking to establish a headquarters in the Asia-Pacific (APAC) region, but when looking at several factors, one market is better than the other.

According to a report by CBRE, Singapore won over Hong Kong in terms of the the technology industry scale.

“Singapore invests more in research and development (R&D) and leads in high-tech manufacturing,” Marcos Chan, head of research at CBRE Hong Kong, said.

The real estate expert, however, underscored that Hong Kong is catching up by deepening collaboration with Shenzhen and the Greater Bay Area.

In terms of ESG and green building initiatives, Singapore also has the upper hand.

“Singapore’s green building adoption rate is much higher than that in Hong Kong SAR,” according to Chan.

For Hong Kong to reduce its carbon intensity, CBRE said the city can leverage the mainland’s new energy industry growth. Meanwhile, office availability and the scale of the financial industry are areas where Hong Kong wins over Singapore.

“Hong Kong SAR is the leader in terms of fundraising, RMB deposits, and wealth management,” Chan said.

The expert, however, noted that Singapore’s forex business is bigger than Hong Kong, but both markets are seeing growth in private wealth management.

Chan added that Hong Kong is “wellpositioned to become the largest private wealth management centre.”

“Its proximity and strong ties with mainland China will make it the leading global offshore RMB business hub. The financial services sector will continue to be one of Hong Kong’s key economic pillars. The return of mainland Chinese firms will encourage more IPOs and related financial activities. The sector currently plays an important role in the office market, accounting for 25% of all new leasing activities in the past 15 months,” Chan commented.

On office vacancy, CBRE said Hong Kong SAR “currently stands at the highest on record with substantial new supply in the pipeline over the next four years.”

Total office stock in Singapore is only 73% of that in Hong Kong SAR, giving corporate occupiers more options and flexibility when choosing an office location in the latter market. Between 2023-2026, Hong Kong SAR will see

the addition of 10% of its existing stock, whilst Singapore will welcome the completion of 7% of its existing office supply.

On areas of talent availability and attraction, office rents and prices, and influence on Asia Pacific, CBRE said both markers are tied.

“Hong Kong SAR and Singapore play complementary roles. Hong Kong SAR is more convenient for running China and North Asia operations, whilst Singapore is more suited to Southeast Asia and India,” CBRE said.

In terms of financial talent, CBRE said Hong Kong has a wider pool, whilst Singapore has more science and technology workers.

Meanwhile, CBRE said the pricing and rental gap between the two cities’ CBD offices is also narrowing.

Whilst Singapore’s CBD is cheaper, Hong Kong offers more cost-effective decentralised nodes.

“Hong Kong SAR’s residential rents posted the largest decline in a decade in 2022, and those in Singapore have escalated sharply over the past three years, which could soon surpass those in Hong Kong SAR decentralised districts in Kowloon and New Territories,” CBRE said.

“With the enhanced transport connectivity within Hong Kong and in the Greater Bay Area under the ‘one-hour living circle’, and more affordable residential units than Singapore, Hong Kong is appealing to highcalibre talent from overseas markets. This is important for multinational companies when deciding on the locations of their headquarters in the region,” CBRE added.

On rents, CBRE said Hong Kong will remain weak in the medium term given that it is a tenants’ market, whilst Singapore has recovered since it is a landlords’ market.

“Despite a steady recovery in leasing momentum, Hong Kong SAR office rents are still below pre-pandemic levels and are expected to decline further before 2024,” according to CBRE.

Data from CBRE showed that as of Q4 2022, Hong Kong SAR Central’s Grade A rents remain the highest globally, about 40% higher than those in Singapore’s core CBD; however, Hong Kong SAR offers more affordable office space in decentralised areas such as Hong Kong East and Kowloon East, where Grade A rents are up to 75% lower than in the Central CBD and below those in Singapore’s decentralised locations.

6 HONG KONG BUSINESS | Q3 2023 FIRST

HK SAR and SG are both attractive locations for multinational corporations (Photo by Jimmy Chan and Martin Hungerbühler from Pexels)

HK SAR and SG play complementary roles. HK SAR is more convenient for running China and North Asia operations, whilst SG is more suited to SEA and India

COMMERCIAL PROPERTY

Sales hotline sales@thedesk.com.hk

3-month FREE Offer* 39/F Dah Sing Financial Centre, 248 Queen’s Road East, Wan Chai Private Office | hotDesk | Meeting Room Total floor area 11,000 sq.ft. Private office ranged from 2 – 30 pax 852 9544 3045 *Limited time offer. Terms & conditions apply

theDesk Wan Chai

4 WAYS TO UNLOCK

E-COMMERCE POTENTIAL

IN HK

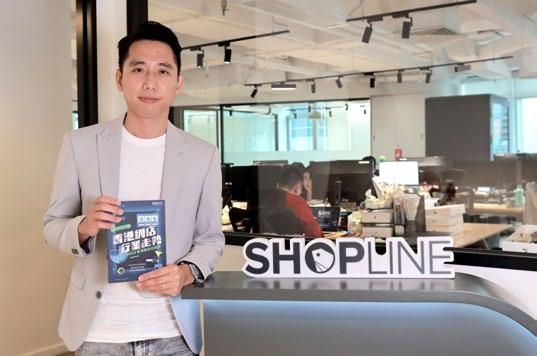

Nick Chiu, SHOPLINE HK General manager

E-commerce enabler, SHOPLINE, identified four key trends in Hong Kong’s online retail market in the post-pandemic era that can better prepare merchants to unlock the potential of e-commerce.

In its whitepaper, SHOPLINE said the omnichannel commerce ecosystem will continue to grow.

Merchants, therefore, will have to accelerate in transforming their businesses to an Online-merge-offline (OMO) business model to allow shoppers to discover, select, pay, and collect in the mode they prefer, from the online store to brick-and-mortar touch points, as well as Facebook / Instagram pages and WhatsApp communications.

Apart from an OMO model, the platform said that chat commerce is also on the rise, indicating importance of communication between merchants and customers through Facebook, Instagram, and WhatsApp.

Merchants said more than seven in ten of their customers (72%) use WhatsApp to contact them.

In terms of the devices shoppers use to purchase online, SHOPLINE said smartphones remain king.

SHOPLINE said 59.5% of orders in 2022 were made through smartphones, so the platform believes branded mobile apps will become essential for merchants.

“Over three-fourths of the surveyed merchants recognised the benefits of launching a branded app, including it becoming a trend in the market (74.9%), encouraging repeat purchases (78.9%), as well as building trust in the brands (76.8%),” the platform reported.

SHOPLINE also emphasised the benefits of using artificial intelligence (AI) and machine learning in business operations.

The whitepaper stated that integration of AI technologies enable automated analytics of customers' firstparty data to optimise sales tactics.

Retail market rebounds as tourists return

ECONOMY

The city’s retail market is set for rebound in 2023 thanks to the return of tourists, particularly from the Mainland.

Data from CBRE’s “Hong Kong Retail Recovery: Opportunities and Challenges” report showed that an average of 86,600 inbound tourists arrived daily in Hong Kong between March 19 to 25. Of these, 81% are from Mainland.

Tourist volumes grew exponentially since the start of the year, the majority of which are from mainland China, CBRE Hong Kong revealed. In a research conducted by CBRE Hong Kong titled Hong Kong Viewpoint – Hong Kong Retail Recovery: Opportunities and Challenges, results showed an average of 86,600 inbound tourists arrived daily in Hong Kong. Of these, 81% are from the Mainland.

To recall, Mainland tourists accounted for 30% of the city’s retail sales before the pandemic.

“Tourists are expected to return in greater numbers over the course of this year, driving growth of tourist-oriented trades,” Marcos Chan, head of research at CBRE Hong Kong, said.

“The beginning of 2023 marked a return to normalcy as cross-border travel resumed and all restrictions

in Hong Kong related to COVID-19 were lifted. The resulting increase in economic and business activity, coupled with Hong Kong’s inherent strength means the city’s retail market is now poised to make a comeback,” Chan explained.

The expert, however, underscored that the pace of the recovery of the retail market will still depend on “how recent financial market turbulence and ongoing geopolitical tension impacts the global economy.”

Meanwhile, the study also underscored that Hong Kong is a “gateway” destination for mainland tourists. Noting that there are about 86 million people residing in the Greater Bay Area (GBA), the travel for mainlanders only takes about two hours to arrive in Hong Kong.

“Whilst local consumption has proven to be a resilient, sustainable driver of retail sales amid market headwinds, the return of mainland tourists will fuel the growth of the retail market, particularly touristoriented retailers, such as luxury brands, medicines, cosmetics, and beauty,” Chan said.

The proportion of inbound mainland tourists consists of 80% of the total, nearing the pre-pandemic years of 2017 to 2019.

For total retail sales, the six-month moving average of Hong Kong in January 2023 was 25% under the first quarter of 2019’s peak. Meanwhile, private consumption expenditure stood just 2% below the level before the turn of the market in mid-2019, the report said.

Some hurdles that challenge Hong Kong’s competitive advantage are the growing presence of luxury brands on the mainland, similar nearby tourist destinations that are also gaining traction, and the easing of restrictions on international travel.

“With rents in prime shopping areas and high streets approximately 40% below the mid-2019 peak, leasing costs will climb in the next 12 to 24 months due to reduced vacancy and increasing leading demand. Beyond the traditional core districts, retailers could also explore other tourist hotspots such as West Kowloon and waterfront promenades alongside Victoria Harbour, as well as emerging office clusters,” said Lawrence Wan, Senior Director of Advisory and Transaction Services – Retail CBRE Hong Kong.

8 HONG KONG BUSINESS | Q3 2023 FIRST

The return of mainland tourists will fuel the growth of the retail market, particularly tourist-oriented retailers

(Photo from CBRE Hong Kong)

Leasing costs will climb in the next 12 to 24 months due to reduced vacancy and increasing leading demand

Marcos Chan

RETAIL

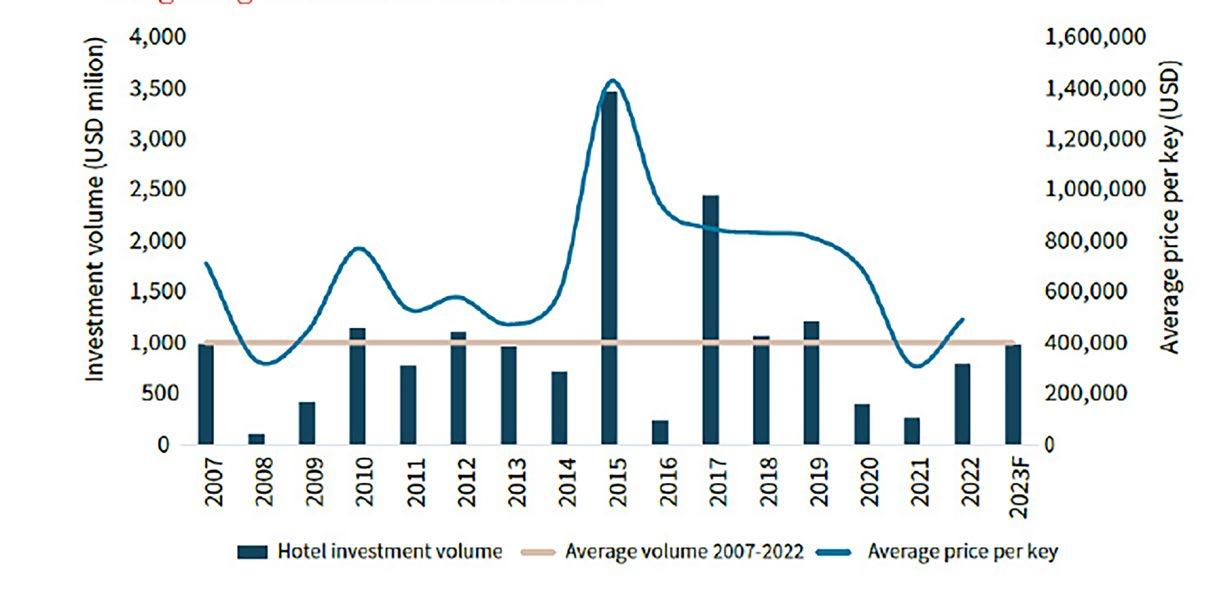

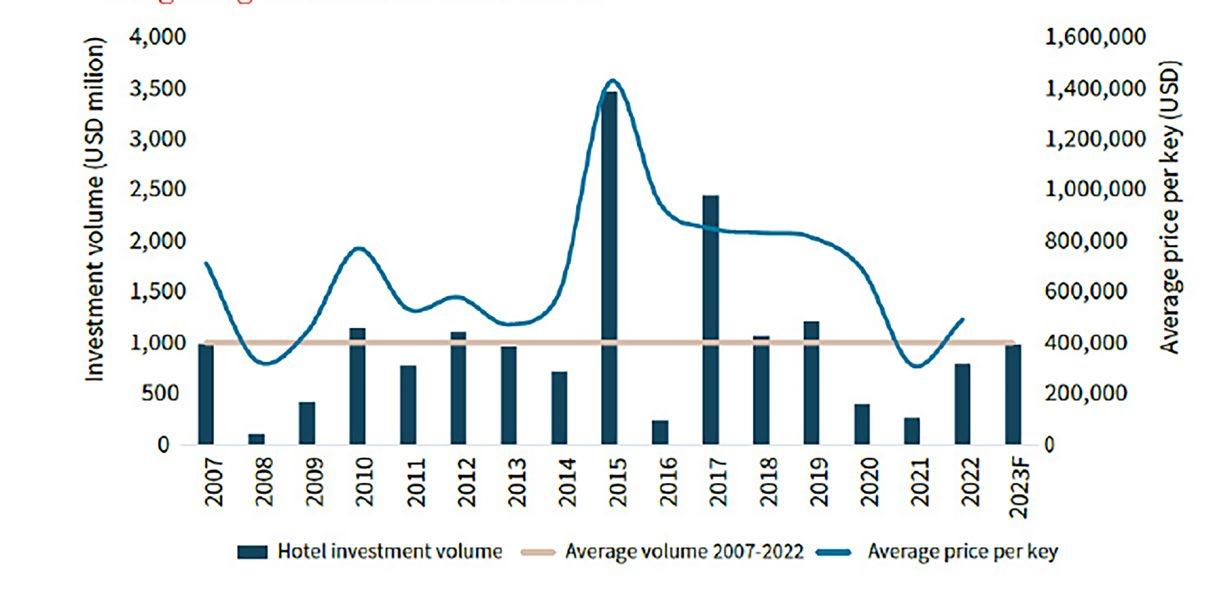

Faster recovery awaits Hong Kong’s high-end hotels

Hong Kong’s high-end hotels will likely rebound and achieve faster growth this year, according to JLL.

Based on the report, hotel transaction activity will pick up in Q4 and will likely reach US$1b.

JLL also expects the Revenue Per Available Room (RevPAR) of high-end hotels to rebound to preCOVID levels in 2024.

In February 2023, the RevPAR of High Tariff A hotels jumped 161% year-on-year to US$160.55, which JLL said is the strongest growth amongst all hotel segments.

“We expect RevPAR to rebound to 2018 levels during 2024, driven by the rebound of tourism with the lifting of border restrictions to inbound travellers. We expect pentup demand from mainland China to be significant and on average higher spending than pre-pandemic, favouring the full-service and luxury segments. This rate-led recovery is in line with other Asian gateway markets which have reopened,” Xander Nijnens, head of Hotel Advisory and Asset Management at JLL in Asia Pacific, said. Unlike high-end hotels, some of

The hotel capital market is expected to pick up towards the end of 2023, reaching US$1b for the full year.

the budget and midscale hotels will take longer to recover, given that they have a “large proportion of long-stay guests.”

“They would have to wait for those leases to expire before being able to welcome short-stay guests… Similarly, it is going to take a prolonged period for inbound airlift into Hong Kong to be fully reinstated, and this will put a brake on the recovery,” Nijnens said.

Historically, Hong Kong has been a well sought-after hotel investment market, with an average hotel transaction volume of US$1b between 2007 and 2022. Between 2020 and 2022, during the pandemic, the hotel transactions in the city dropped significantly to an average of US$500m.

JLL, however, underscored that the improving hospitality sector is expected to attract investors back to the hotel market.

“The hotel capital market is expected to pick up towards the end of 2023, reaching US$1b for the full year. Investors will likely continue to acquire hotels with smaller rooms with conversion opportunities,” Jonathan Law, vice president of Investment Sales at JLL in Hong Kong and Asia Pacific, said.

At the end of 2022, Hong Kong counted 89,466 hotel rooms with the future supply expected to remain limited over the next four to five years despite an anticipated return of tourists.

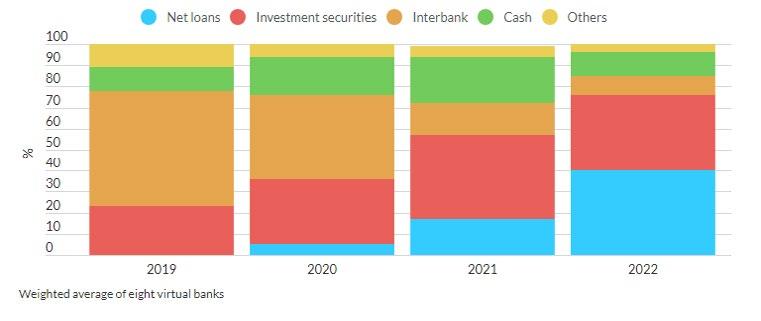

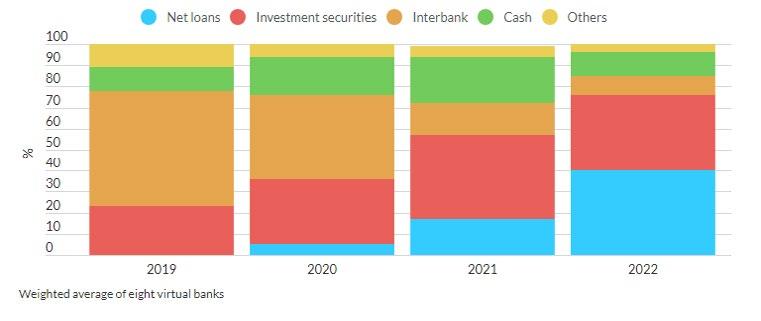

SHAREHOLDER SUPPORT IS KEY FOR HK VIRTUAL BANKS TO WEATHER FAILURE RISKS

Continuous shareholder support should help Hong Kong’s virtual banks weather initial losses on the path to growing their business, says Fitch Ratings.

Six out of eight virtual banks in Hong Kong reported narrower losses in 2022 amidst a moderation in operating cost growth and expansion in higher-yielding lending, the ratings agency noted.

However, as they stand, the nascent banks remain vulnerable to higher failure risks than traditional banks due to a limited record in terms of customer loyalty, economies of scale, and risk management.

“Virtual banks are more reliant on costlier deposits than traditional peers due to their nascent franchises,” said Savio Fan, associate director at Fitch (Hong Kong Limited).

“These higher funding costs drive virtual

banks’ risk appetite, evident from their lending to higher-risk segments, such as SMEs and unsecured borrowers, and investing in higheryielding corporate debt securities,” Fan added.

Investment securities and corporate debt accounted for 36% of virtual banks’ total assets on average as of end-2022.

Their loans to higher-risk borrowers expose them to potentially higher credit costs in an economic downturn. This also renders them more susceptible to potential market confidence issues in the event of stress, especially since their depositor loyalty is unproven and easy transfers make the deposit base vulnerable to flight risk, Fan warned.

Senior Director at Fitch Wire, Lan Wang, said continued support from the shareholders remains critical to the business growth, and helps mitigate higher risks.

Hong Kong Virtual Banks' Asset Mix

Source: Fitch Ratings, HKMA, banks

HONG KONG BUSINESS | Q3 2023 9 FIRST

Xander Nijnens

COMMERCIAL PROPERTY Hong Kong hotel investment volume Source: JLL

CHALLENGES FOR HK AIR TRAVEL AMIDST RECOVERY BY 2024 AVIATION

Hong Kong’s removal of its travel restrictions, and mainland China’s reopening of its borders in January, would drive the city’s strong rebound in its air traffic, says Fitch Ratings.

Recent traffic data at the Hong Kong International Airport (HKIA) showed that the city’s passenger volume surged to the 3.1 million mark in April, recovering 54% of its 2019 level. The statistic was 25 times the same as last year.

The rating agency also said that Hong Kong is ready for the pentup travel demands, as routes are beginning to resume gradually and traffic to revive despite economic headwinds and geopolitical tensions.

Short-haul routes led the recovery, with faster growth and traffic to and from Southeast Asia, mainland China, and Japan. Near-term optimism from tourists will become high for the upcoming summer travel season.

“The ‘Hello Hong Kong’ promotional campaign with air ticket giveaways and welcome packs launched by the government should further entice worldwide visitors and boost enthusiasm for travel,” Zoey Wang, director, Fitch (Hong Kong Limited) said.

However, the rating agency said that several challenges remained to hinder Hong Kong’s growth prospects and its pace of recovery.

The city, along with others in the Asia-Pacific Region, had a slow air traffic recovery from the pandemic due to delayed border-opening policies, whilst the concentration on international routes made its aviation industry more vulnerable to travel restrictions.

Other risks like labour shortages, routes yet to resume fully, soaring inflation, and higher airfares may threaten HKIA's near-term plans.

But, Sunny Huang, director at Fitch (HK Limited) still expects growth in air travel "to spill over in medium term."

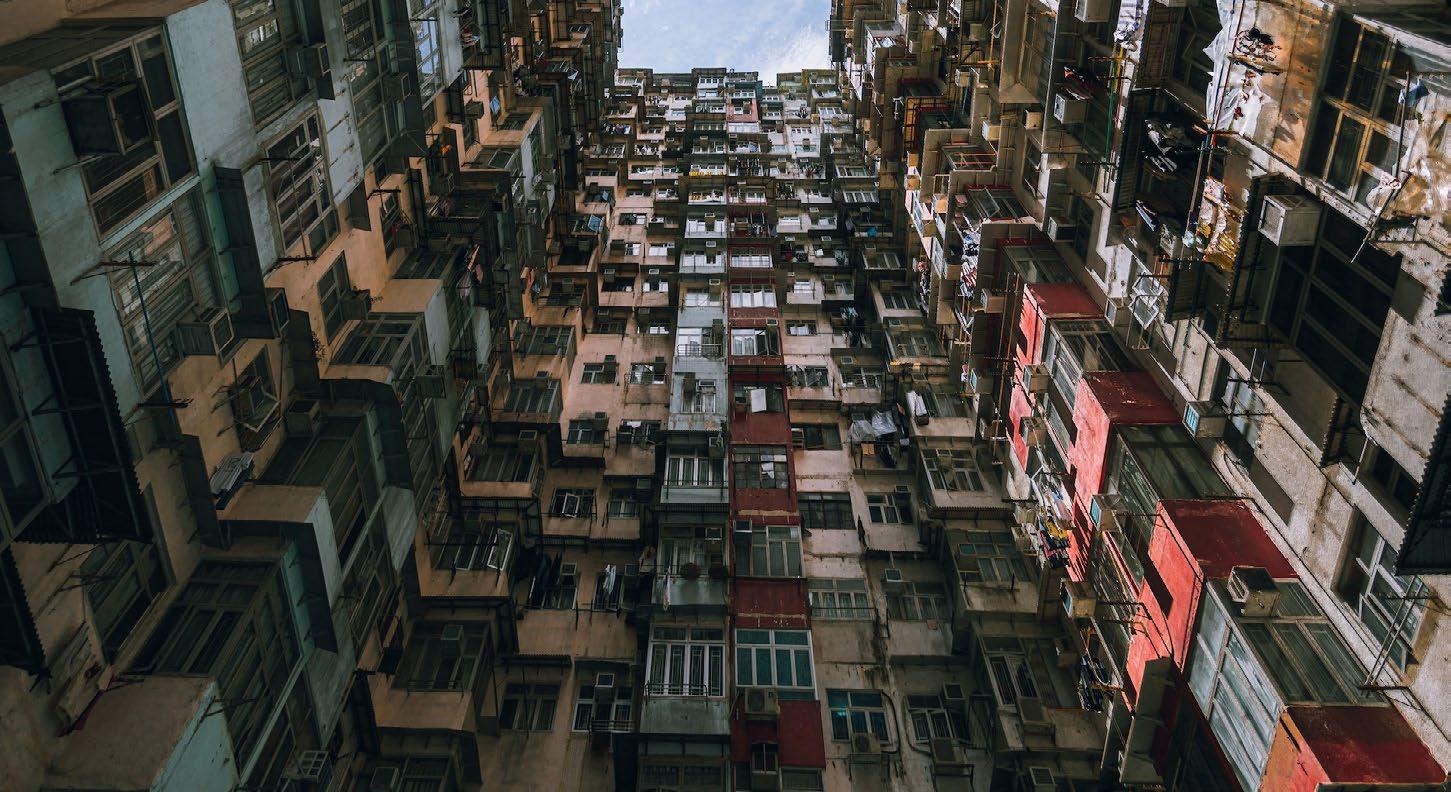

Ageing HK demands more senior facilities

RESIDENTIAL PROPERTY

Real estate expert, JLL, has called on the Hong Kong government to encourage more developers to build more senior living places in the city.

The call came in light of the expected increase of the city's older population by 46.3% in the next decade.

In a report, JLL warned that the city will face a shortage of over 60,000 suitable elderly places by 2032

"The number of residential care places for the elderly is scheduled to increase by 0.24% only. At the same time, our elderly population has never been healthier or wealthier, and the way our parents and grandparents want to live is very different from the way their parents and grandparents lived," JLL said.

"With a projected senior population of 2.2 million by 2032, we also consider that Hong Kong needs to find an alternative to residential care homes which may be more suitable for our growing senior population," JLL added.

By 2050, Hong Kong is also expected to have the highest global share of people aged 60 or above by 2050 at

over 40% of the population

"With our elderly population forecast to grow by half a million over the next decade, it is critical to have enough suitable accommodation in the city and the mainland cities in Greater Bay Area (GBA) to defuse the problem," JLL stated.

Currently, options for the elderly in Hong Kong are mostly limited to living with their families and Residential Care Homes for the Elderly (RCHE) which provide 74,200 care places providing crucial services and care to elderly residents. These facilities, however, can be basic and offer limited privacy and independence to residents.

“We expect that there are more elderly residents with greater wealth who wish to continue to live independent and active lifestyles in retirement. Therefore, the government should consider dedicating land specifically for elderly home use, encourage public-private partnerships to unlock this sector and offer incentives to speed up development. The Northern Metropolis presents a particularly good opportunity to set aside land for this very purpose and this could help to ease some of the burden that the government will face with this population time bomb," Wendy Chan, GBA Growth Director of Value and Risk Advisory at JLL in Greater China, said.

JLL proposed that government build luxury-style residential apartments within a complex that also offers nursing, medical, entertainment and service facilities to residents.

"The development could be similar to co-living or serviced apartments with on-site medical and nursing care, and the facilities can be self-contained communities, with access to dentists, medical care, restaurants, cafes, gyms and cinemas. Such would provide the residents with both independence and an aspirational lifestyle with highquality accommodation and several services at hand to make their lives more convenient," JLL said.

"At the same time, by providing more suitable elderly accommodation, more conventional flats would be released to the market after increasing elderlies move into these new projects, which could also help to alleviate some of the existing housing shortages," JLL added.

10 HONG KONG BUSINESS | Q3 2023 FIRST

The city's older population is expected to increase by 46.3% in the next decade (Photo by Jimmy Chan from Pexels)

More conventional flats would be released to the market after increasing elderlies move into these new projects

Wendy Chan

HK is ready for the pent-up travel demands (Photo from HKIA)

Why are residential prices in Hong Kong losing growth momentum?

The decreasing birth rate and marriages in Hong Kong, alongside interest rate hikes, will affect the growth momentum of residential prices in the near term, according to JLL.

Based on JLL’s latest Residential Market Monitor, the city’s population has fallen by 187,000 in the past three years and the number of new births is also on a downward trend.

“In 2020-2022, the average number of marriages registered per year was 28,248, 41.8% lower than the average of 48,556 in 2017-2019. The total fertility rate or the live births per 1,000 women decreased from

1,128 in 2017 to 772 in 2021, below those in Japan and Singapore,” said Norry Lee, Senior Director of Projects Strategy and Consultancy Department at JLL in Hong Kong.

With fewer new births and home formation, there will also be less starter home demand and upgrade demand, added Lee.

Apart from the low birth rate, interest rate hikes are also affecting rental growth momentum in Hong Kong.

JLL said changes in economic reality have “become less conducive” for mainland Chinese buyers to enter the market.

The expert underscored that buyers from

the mainland accounted for over 15% of the residential transaction volume in 2017.

“Mainland Chinese investors attracted by Hong Kong’s lower borrowing costs and higher rental yields are finding these factors less appealing than before, and while the average mortgage rate in Hong Kong rose by 213 bps to 3.58% in 2022, the nationwide average mortgage rate in mainland China dropped to a record low of 4.26%,” Cathie Chung, Senior Director of Research at JLL in Hong Kong, said.

“In addition, the rental yield of Class A property in Hong Kong narrowed from 2.8% in 2017 to 2.5% in 2022. Furthermore, non-local end users settling in Hong Kong face more difficulties in buying homes than local buyers because they need to prepare a much higher upfront payment than local buyers for the same property, due to higher stamp duties and the lower maximum LTV ratio allowed,” Chung added.

Chung underscored that whilst the rate hike cycle has ended, “mortgage rates are likely to stay elevated, which is not conducive for demand growth.”

“Although the economic recovery will eventually translate into higher income and greater affordability to support home prices, that process could be gradual,” she said.

What could help Hong Kong attract nonlocal investors and family offices would be new policy measures, including a revamped investment-immigration scheme and tax incentives, like launching the Top Talent Pass Scheme in December 2022, and raising the Additional Buyer's Stamp Duty in April.

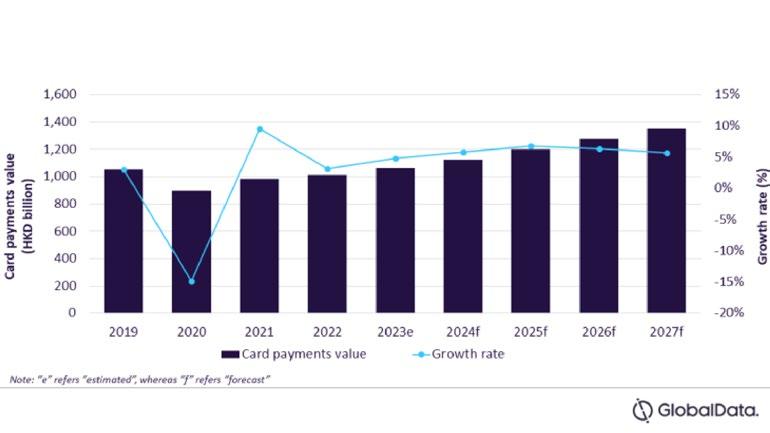

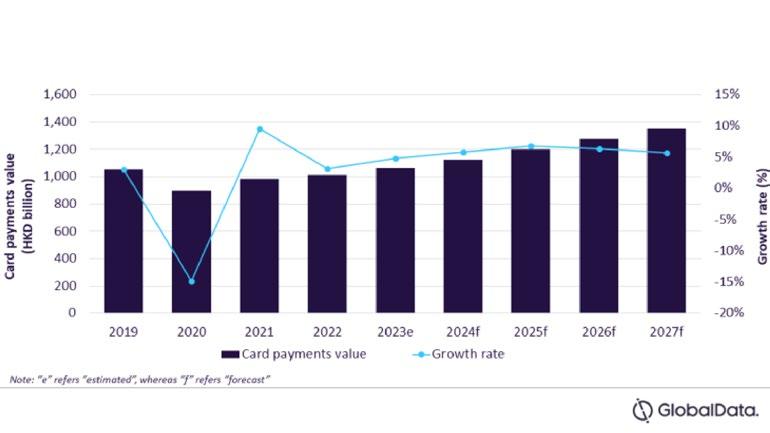

HONG KONG’S CARD PAYMENTS MARKET TO GROW 4.8% IN 2023

Growing preference for electronic payments and the city’s economy rebounding are expected to carry Hong Kong’s card payments to a 4.8% growth in 2023.

In a report, data and analytics company GlobalData said that the value of card payments in the city will reach HK$1.06b ($136b) by end 2023, growing faster than the 3.2% growth reported in 2022.

“The convenience of electronic payments, well-developed payment infrastructure, a growing preference for contactless, and e-commerce payments are all facilitating increased payment card usage in Hong Kong,” said Ravi Sharma, lead banking and payments analyst, GlobalData.

Credit and charge cards are the preferred payment cards, accounting for 71.7% of card payments value in 2022. This is mainly due to the associated reward programs, said Sharma, which makes it more beneficial than

debit cards for consumers.

Credit cards also have wider acceptance among merchants, while debit cards are not that popular, Sharma added. Debit cards accounted for the remaining 28.3% share of card payments in 2022. The key reason for low debit card usage is the limited acceptance of domestic EPS debit cards. These cards can only be used for offline payments in the country.

E-commerce growth is also anticipated to support Hong Kong’s payment card market. According to GlobalData’s 2022 Financial Services Consumer Survey, credit cards are the most preferred payment method for e-commerce payments accounting for over one-third of total online purchases.

GlobalData’s 2022 Financial Services Consumer Survey was carried out in Q2 2022. Approximately 50,000 respondents aged 18+ were surveyed across 40 countries.

Source: GlobalData Banking and Payments Intelligence Center

HONG KONG BUSINESS | Q3 2023 11 FIRST

RESIDENTIAL PROPERTY

With fewer new births and home formation, there will also be less starter home demand and upgrade demand, Nory Lee (Photo by Aleksandar Pasaric from Pexels)

Hong Kong: Card Payments Value (HKD billion), 2019-27f

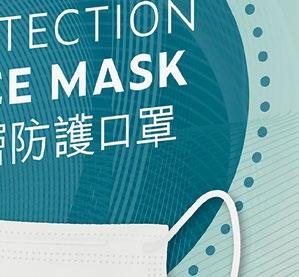

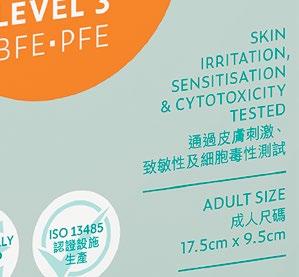

Designed for you: How Mannings’ face masks were redesigned for public safety

The onset of the COVID-19 pandemic saw the supply scarcity of medical equipment such as face masks. Worse, people came into a frenzy and face masks instantly became inaccessible to the masses. This has led not just to the need to produce supplies at a much quicker rate, but also to the rise of positive cases from the virus.

Mannings, as one of Hong Kong’s leading and trusted health and beauty products chain stores, embarked on a mission to support the community in times of need aligned with its company’s core values. Its face mask products were identified as a strategic opportunity to be redesigned and relaunched to meet customers’ changing needs and expectations in staying protected.

The Mannings 3-Ply Protection Face Masks were redeveloped in September 2021 after its initial launch in 2020. This relaunch aimed to serve a wider goal to protect the Hong Kong community. It offers a credible assortment from core to new products. The range has been extended from adults to kids.

“We are agile to ensure that new trends and changing customer dynamics are taken into consideration to continuously develop

relevant products for our customers,” the company said.

The product is manufactured in an ISO 13485 factory. It has fluid-resistant materials and a high-quality filter; it has also been tested against skin irritation, sensitisation, and cytotoxicity. Moreover, the masks have breathable material that meets the international standard quality of safety and efficacy.

It has also passed the highest standard of ASTM, which is amongst the most wellrecognised mask test standards or quality credentials in Hong Kong. Mannings 3-Ply Protection face masks featured additional testing that required additional time and investment to ensure the products pass the toxicology test on product safety for longhour wearing.

Engaging customers with quality initiatives With

such features and specifications,

the 3-Ply Protection face masks led sales, volume and profit within the face mask category. Moreover, the product and assortment transformation plan of Mannings was designed to focus on improved quality and a wider assortment of choices for customers.

New initiatives were also launched to educate and engage customers. These included new mask fixtures with prominent customer navigation to help them make their choice.

Mannings’ efforts to educate people on the benefits of using 3-Ply face masks and the quality of its product have been recognised by the Made in Hong Kong Awards 2022, with the company winning in the Healthcare category.

The prestigious awards programme recognises exceptional products that are proudly manufactured and designed in Hong Kong.

12 HONG KONG BUSINESS | Q3 2023

Its 3-Ply Protection face masks have fluid-resistant materials and high-quality filters.

We are agile to ensure that new trends and changing customer dynamics are taken into consideration to continuously develop relevant products for our customers

HEALTHCARE

Mannings Plus

HONG KONG BUSINESS | Q3 2023 13

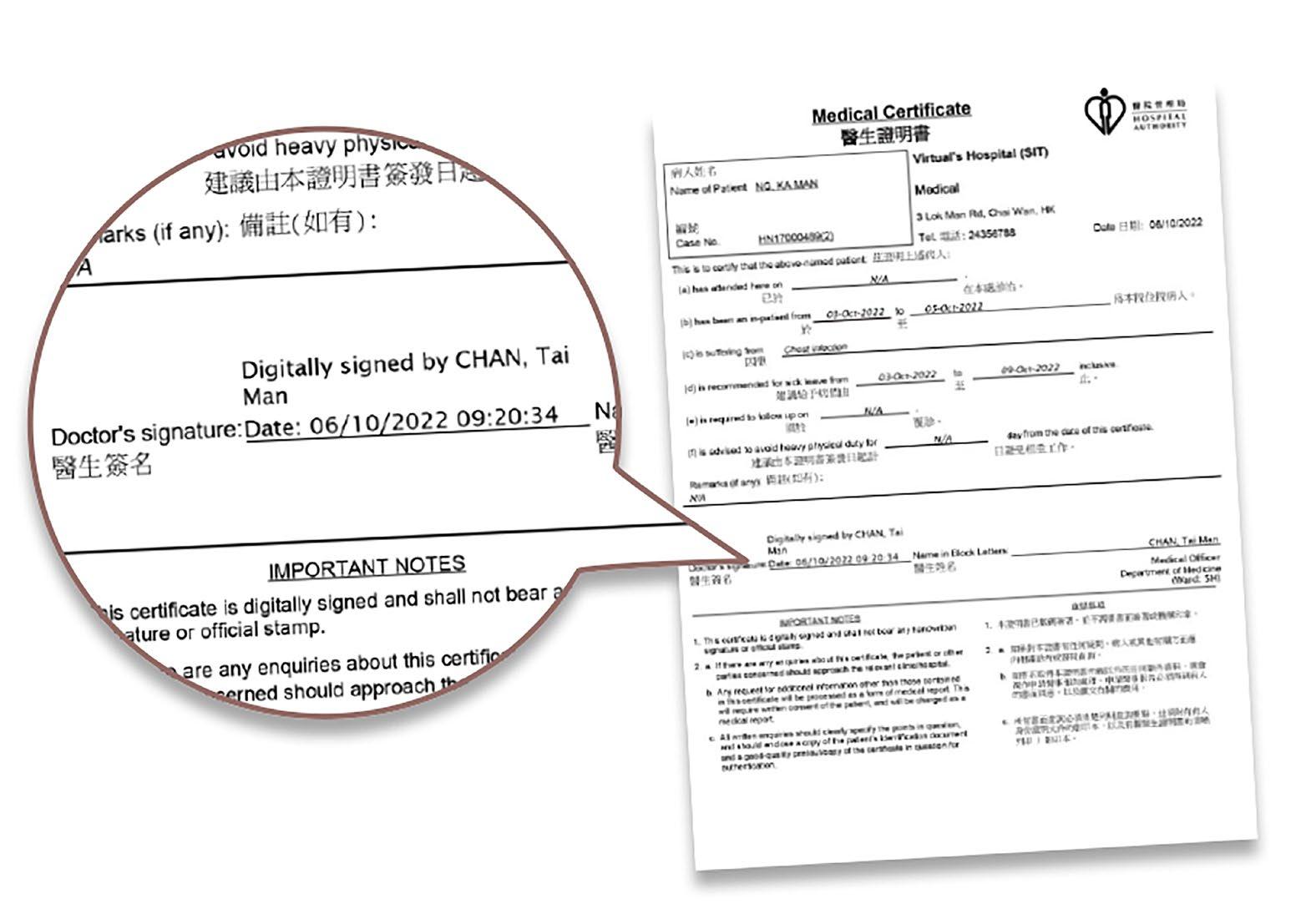

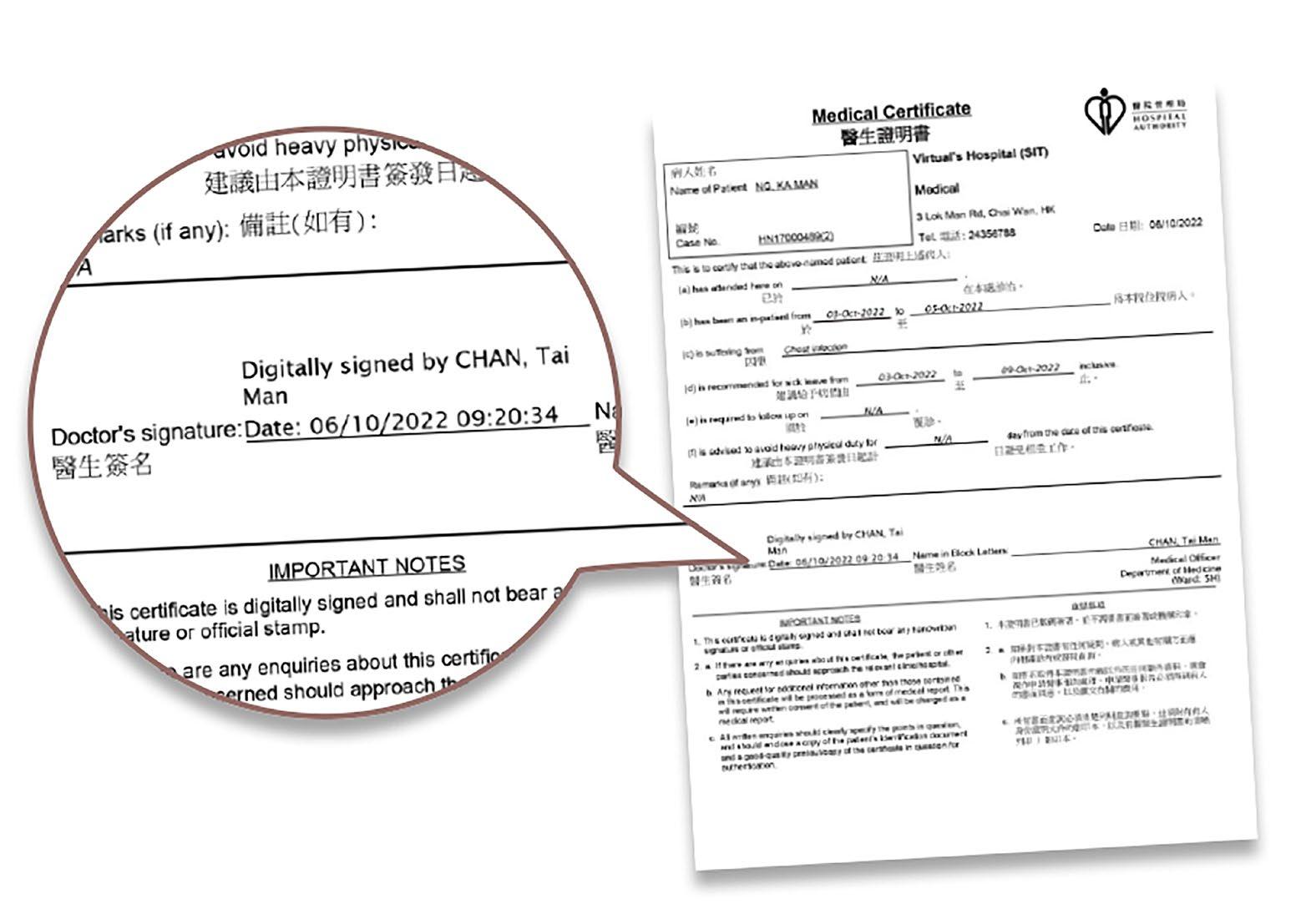

Hong Kong leaps into digital sick leave verification

Experts advise employers to ensure proper data storage in response to the development.

In Hong Kong, employees are only allowed a limited period to turn in a sick leave certificate, some as short as three days, which is why many have welcomed the Hospital Authority’s (HA) move to digitise their medical certificates.

With HA’s introduction of the e-sick leave certificate, employers need not wait for their employees’ medical certificate via mail or courier and can access it through a QR code.

The e-sick leave certificates will also cut the time HR experts dedicate to verifying the medical document, said Casper Fung, senior consultant at PERSOLKELLY.

Andrea Randall, a partner at RPC Hong Kong law firm who specialises in employment, said that HA’s e-sick certificates allows employers to ensure that their employees’ sick leave records are kept up to date.

“This is a useful development; a paper ticket is subject to theft and loss, but with the HA e-sick certificates, employees can access their certificates electronically anywhere, anytime and share it with their employers

This is a useful development; a paper ticket is subject to theft and loss

immediately,” Randall said. Under Hong Kong’s employee ordinance, employers are required to “maintain clear and updated records of their employees’ sickness days.”

“In the future, if an employee is granted sick leave after a teleconsultation by the HA, he/she will receive an electronic medical certificate remotely and will not need to return to the hospital or clinic to obtain the paper certificate,” added Randall.

Employers’ responsibility

With the digitisation of sick leave certificates, Randall said employers must take steps to safeguard and protect the privacy, security, and confidentiality of their employees’ personal details.

“Employers should ensure proper storage and access to these e-sick certificates, and ensure that such is done so in accordance with the Personal Data (Privacy) Ordinance,” the legal expert said.

“Whilst there is no statutory provision regarding the retention of

electronic health data specifically, the Code of Practice on Human Resource Management (COP) has set out some guidance regarding the collection, sharing, use, and safekeeping of their employees’ health data,” she added.

According to the COP, employers should put in place an in-house policy to restrict access to, and processing of, personal data of employees on a “need-to-know” and “need-to-use” basis.

This means that data collected from the e-sick leaves must be limited to relevant departments such as the HR or those related to salary calculation, said Fung.

Apart from requirements set by the COP, Fung advised employers to update their employee handbook.

“We suggest that the employer mention that they have the right to verify the e-certificate, and that the employee’s sick leave application will only be confirmed after all the verification is done,” the expert said.

Similar to what the COP states, Fung also recommended that employers provide appropriate training for all their employees on how to handle personal data.

Accessing e-sick leaves

Employers who wish to verify the authenticity of their employees’ e-sick leave certificate may do so by scanning the QR code in the document. Employers will then have to input their employee’s name and their sick leave date.

“Employers do not have to install additional tools or software to access the HA e-sick certificate,” Randall clarified.

Employees, on the other hand, can access their e-sick certificate through the HA mobile application called HA Go, under the “MyHealth” feature. The certificate will be stored in the “MyRecord” section of the app.

The HA also issues the e-sick certificate electronically and in paper form. “If a patient requires it, the HA will continue to print paper sick leave certificates,” Randall said. “It follows that employers can expect to receive both paper sick leave certificates as well as HA e-sick leave certificates for the time being,” she added.

To read the full story, go to https:// hongkongbusiness.hk/

14 HONG KONG BUSINESS | Q3 2023

Employees can access the HA e-sick certificates anywhere, anytime and share them with their employers immediately (Photo from HA.org.hk)

HR BRIEFING

Andrea Randall

Casper Fung

HONG KONG BUSINESS | Q3 2023 15

LEGAL BRIEFING

Government shields Hong Kong’s local MNEs from EU’s tax defensive measures

It introduces the foreign source income exemption regime to benefit local MNEs if certain requirements are met.

Before 2023, multinational enterprises (MNEs) in Hong Kong did not need to prove their economic presence in the city to receive tax exemption for their offshore passive income. This setup has landed Hong Kong in the European Union’s “watchlist” of markets with risks of double non-taxation. To remove the city from the watchlist, and prevent it from landing on the “blacklist,” the government introduced changes to its foreign source income exemption (FSIE) regime.

“If Hong Kong fails to comply with the EU’s request, it would be listed on the blacklist and Hong Kong-based enterprises would be subject to tax-related defensive measures imposed by the EU member states. These measures include denial of deduction of costs, higher withholding tax rate, reinforced monitoring of certain transactions, and higher audit risks for taxpayers,” Wei Kang, partner at Stephenson Harwood’s Greater China Private Wealth Team, told Hong Kong Business

The refinement of Hong Kong’s FSIE regime will also uphold the city’s competitiveness.

“The FSIE regime is only applicable to certain types of specified income received by MNE entities in Hong Kong, with certain exclusions available to certain types of entities. Furthermore, the specified income remains non-taxable provided that the relevant exception requirement is met, such as the economic substance (ES) requirement,” PwC Hong Kong tax partner, Agnes Wong, told Hong Kong Business.

“In other words, in-scope taxpayers that already have business substance in Hong Kong should have no difficulties in meeting the ES requirement under the FSIE regime and they will not be impacted by the implementation of the bill,” she added.

The exemptions

Under the refined FSIE regime, interest, dividend, disposal gain from sale of equity interests in an entity and intellectual property income arising in or derived from a territory outside Hong Kong and received in the city are subject to tax.

Regulated financial entities which derive interest, dividend or disposal gain from its business as a regulated financial entity, however, are exempt from the rule. The foreign-sourced income received from Hong Kong by MNEs, however, will not be deemed chargeable to tax if they meet exception requirements for the particular type of income, Kang explained. For interests to be exempt from tax, MNEs must meet the FSIE’s ES requirement.

“The latest international tax standards require a taxpayer benefiting from a preferential tax treatment in a jurisdiction to have substantial economic presence in the jurisdiction and to establish an explicit link between the relevant income and real activities in the jurisdiction,” Wong said.

“Such requirements generally entail a taxpayer having an adequate number of employees and incurring

an adequate amount of expenditure to undertake the relevant core income generating activities,” she added.

The ES requirement, or participation requirement, can also exempt dividends and equity disposal gains from tax. Meanwhile, MNEs must meet the nexus requirement to exempt their IP income from tax.

Impact on MNEs

The new FSIE regime will likely only have minimal impacts on MNEs with business substance in Hong Kong, said Wong.

Those who do not meet the ES requirement or the other conditions needed to be exempt can still look at other avenues to achieve tax neutrality like the enhanced tax credit mechanism.

“Under the mechanism, any foreign tax paid by a Hong Kong resident on the specified foreign-sourced income that is chargeable to profits tax under FSIE is eligible for a bilateral or unilateral tax credit against the profits tax payable on the same income, subject to the amount of the profits tax payable in respect of the income in Hong Kong,” Wong said.

To read the full story, go to https:// hongkongbusiness.hk/

16 HONG KONG BUSINESS | Q3 2023

FSIE will likely only have minimal impacts on MNEs with business substance in Hong Kong

If Hong Kong fails to comply with the EU’s request, it would be [blacklisted]

Agnes Wong

Wei Kang

WINNER BEST HOME THEATER

Smart strategies with micro-influencers ensure brand growth in 2023

Businesses confirm ‘micro is mighty’ as brands make US$5.78 per US$1 spent on influencer marketing.

Micro-influencers have been a favourite of brands and rightfully so, given that they cost less, but receive higher engagement rates. E-commerce platform, Shopify, reported that 2023 is the year when brands tap more influencers with around 10,000 to 100,000 followers.

For brands to ensure growth when working with this new generation of marketing partners, marketing experts said they need to follow five rules, beginning with choosing the right micro-influencers.

In choosing who to work with, Monica Hon, deputy head of Influencer Marketing of AnyMind Group Hong Kong, said it is important for brands to select those who align with their image and values. Hon said it is also important to look at the engagement rates of the micro-influencer and check if it is “stable and satisfactory.”

Jude Khu, regional social media lead for Intrepid Group Asia, expressed the same sentiment. She advised brands to look for micro-influencers who maintain an “engaged and active following.”

Latest data from Spiralytics show that micro-influencers have an average engagement rate of 3.86% on Instagram, 1.64% on YouTube, and 17.96% on TikTok.

But apart from their having an engaged audience, microinfluencers considered for marketing brands must also be capable of producing quality content. “[Brands have to check] whether the influencer’s skills can fulfill campaign requirements, such as their photo-taking skills/makeup skills or styling skills,” Hon stressed.

Check cost

Next consideration which Hon and Khu agree on is cost and affordability. “Micro-influencers may have lower rates than macroinfluencers or celebrities, but brands should still consider their budget when choosing which influencers to work with,” Khu said

[Brands have to check] whether the influencer’s skills can fulfill campaign requirements

Based on experience, Khu said the rate of micro-influencers in Southeast Asia (SEA) ranges between HK$1,500 and HK$3,000 for photo content, depending on the campaign brief and complexity. In Asia-Pacific, microinfluencers receive a similar range in US dollars at US$200-US$250 per photo post, said Hon.

Other factors which brands should check when working with microinfluencers are their location, as well as their flexibility and attitude.

“Brands should consider working with micro-influencers who are based in the same geographic region as their target audience to ensure localised relevance and cultural context,” Khu said.

“[Brands need to check] whether the micro-influencers are willing to work with the brand in the long run and open to promoting the brand on a continuous basis, instead of a oneoff collaboration,” added Hon.

To ensure micro-influencers promote a brand in the long run, businesses must cultivate strong relationships with them.

Brands can do this by “communicating clearly and regularly about your expectations, campaign goals, and vision.

Establishing good communication with the influencer is essential to have stable and sustained collaborations. So companies should schedule regular meetings or video conference calls with the influencers they’re working with,” said Khu. Likewise, Hon shared her experience on how talents “prefer clear guidance for photo-taking or video shooting.”

“Communicate the campaign brief and requirements as clearly as possible to talent but also give some flexibility for talent to create their content in order to make sure the content is authentic and fits their fans’ expectation,” Hon said.

Setting clear expectations and providing clear guidelines for a collaboration will also help brands make the most out of their partnership. It is also important for brands to acknowledge the contributions that their microinfluencers make.

To make them feel valued, Hon said brands can consider inviting micro-influencers to annual events or frequently send newly launched products to them.

To read the full story, go to https:// hongkongbusiness.hk/

18 HONG KONG BUSINESS | Q3 2023

MARKETING BRIEFING

Micro-influencers considered for marketing brands must be capable of producing quality content

Jude Khu

Monica Hon

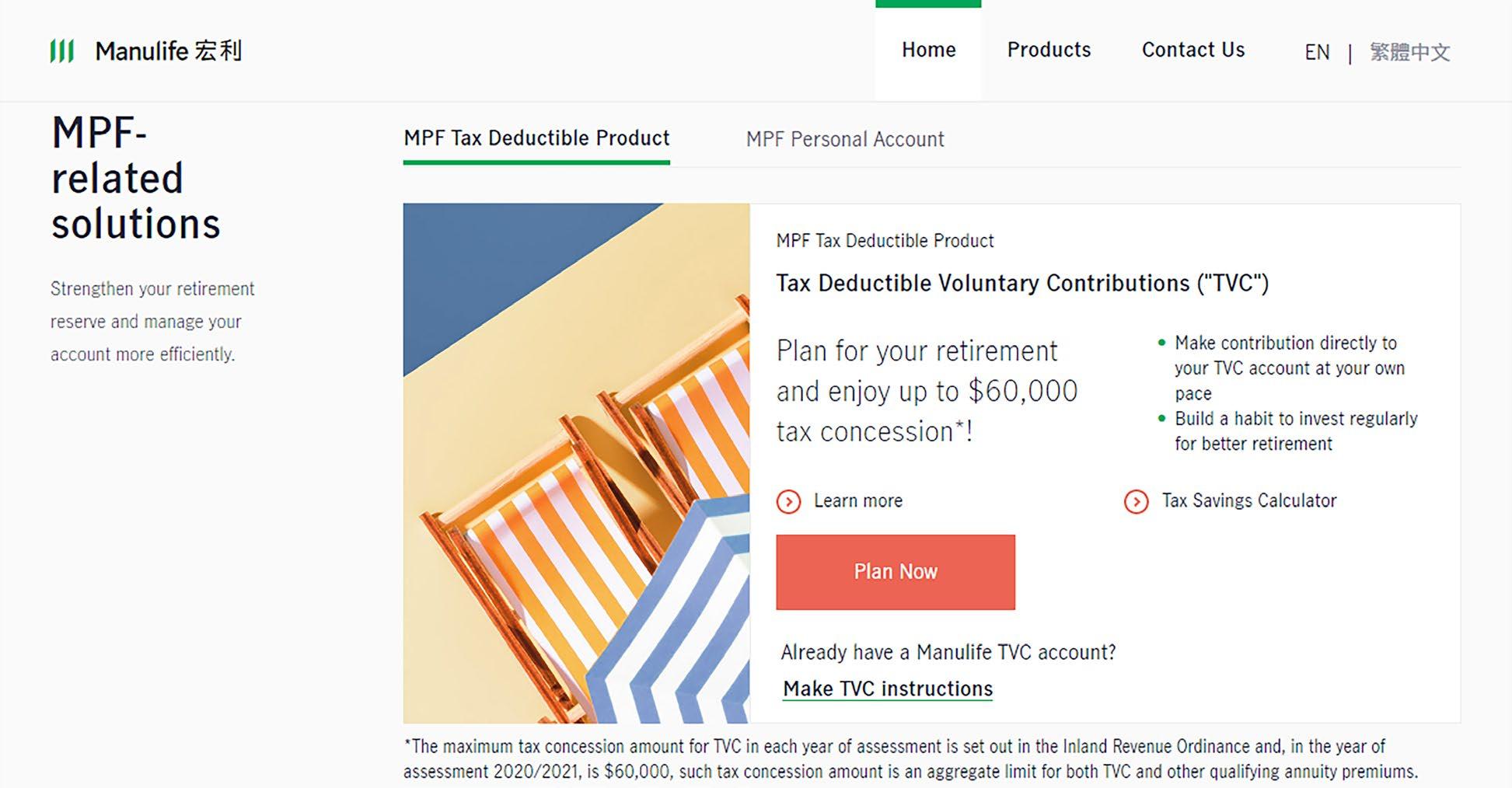

Manulife drives digital adoption in the MPF industry with its pioneering online

Its MPFTransferSimple.hk website was recognised at the HKB Technology Excellence Awards.

As the largest mandatory provident fund (MPF) scheme sponsor in Hong Kong1, Manulife has already started to transform the digital experience for its customers as well as intermediaries for quite some time.

Manulife is keen on continuously driving the MPF industry on digital take-up as it can see that more customers are starting to prefer using digital platforms for all kinds of transactions. It is expected to continue investing in digital experiences for customers, leveraging the latest technologies.

In this regard, Manulife has introduced the “MPFTransferSimple.hk” website for its intermediaries to provide a simple, flexible, and straight-through processing digital journey for its customers to onboard and/ or transfer to Manulife’s designated MPF scheme for Personal Account (PA) as well as Tax Deductible Voluntary Contribution Account (TVC).

Streamlining sales and CX MPFTransferSimple.hk offers both face-toface and non-face-to-face sales journeys for intermediaries as well as customers.

For face-to-face sales journeys, intermediaries are required to log in to MPFTransferSimple.hk via two-factor

authentication. They can help customers prepare and fill out the onboarding and/or transfer applications in advance to facilitate a simpler and faster customer journey.

Personal information of the customers can be pre-populated by scanning the HKID card to capture their details using OCR technology, offering a seamless journey. In traditional paper-based applications, multiple signatures from customers are required for several administration forms. With MPFTransferSimple.hk, customers are given the convenience of signing once as compared to multiple signatures in traditional paperbased applications.

This web application also includes a dashboard for the intermediaries to manage and review the status of all applications and transfers served by them within 45 days.

Seamless self-service sales experience

Apart from assistance provided by intermediaries, there is also the option of a link shared by intermediaries to customers via WhatsApp, email, or WeChat for non-face-to-face sales journeys, whereby customers can perform the application and/ or transfer journey by themselves.

Manulife’s enablement of this seamless process in MPF PA & TVC application has been recognised by the Hong Kong Business Technology Excellence Awards 2022, crowning it as the winner in the Digital - Insurance category. The prestigious awards programme honours outstanding companies that have made exceptional contributions in the pursuit of technological innovation in Hong Kong.

HONG KONG BUSINESS | Q3 2023 19

Manulife has introduced the “MPFTransferSimple.hk” website for its intermediaries to provide a simple, flexible, and straight-through processing digital journey for its customers to onboard and/or transfer to Manulife’s designated MPF scheme for Personal Account (PA) as well as Tax Deductible Voluntary Contribution Account (TVC)

DIGITAL - INSURANCE

1 Source: “Mercer MPF Market Shares Report” as of June 30, 2022 by Mercer (Hong Kong) Limited, in terms of market share of total MPF assets by scheme sponsor.

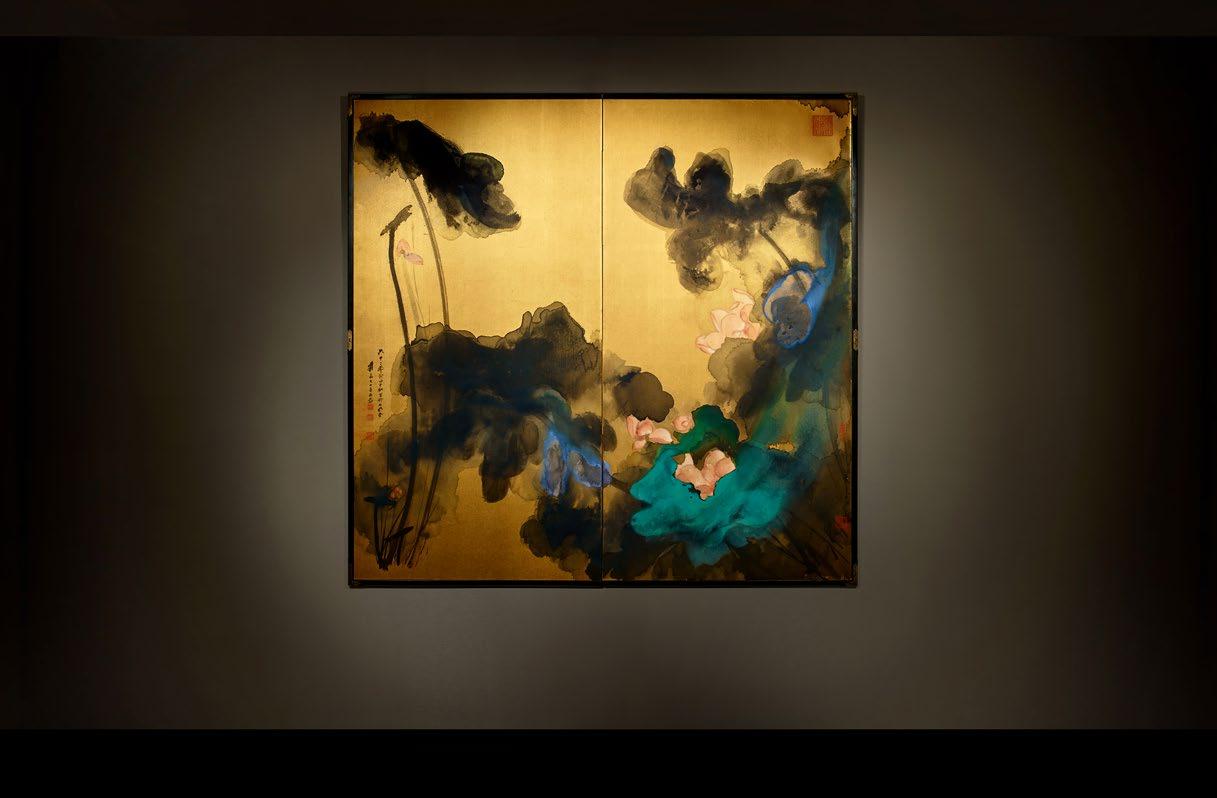

Phillips’ ‘minimalist’ HQ showcases diverse collection of Asia’s finest art

The 50,000-square-foot headquarters features a purposely built auction room on the ground floor.

International auction houses usually operate on a pop-up model, renting out spaces to hold auctions in Hong Kong. For Phillips, however, that is no longer the case.

In March 2023, the auction house opened its new Asia headquarters in West Kowloon.

The six-storey headquarters, spanning 50,000 square feet, has visitors hooked on checking Philips’ purposely built auction room and main galleries on the ground floor.

“With our new space, we’re able to have auctions permanently. We’re able to have something on view,” Jonathan Crockett, chairman for Asia at Phillips Auction House, told Hong Kong Business

What this has achieved for Phillips is the ability to shake up their calendar and hold a series of events by ensuring a continuous display of captivating exhibitions, auctions, and various selling or non-selling activities.

“Essentially, [we] have something on view throughout the year. That is the unique proposition we offer,” said Crockett, noting that this year, Phillips has auctions slated from September to November.

Apart from its main galleries on the ground floor, Phillips also has exhibition spaces on its first and third floors. The auction house will also have a VIP lounge where they can host private events.

20 HONG KONG BUSINESS | Q3 2023 SPACEWATCH

1 3 5 2 4 6

Jonathan Crockett

The Patek Philippe Wristwatch and historically important artefacts once belonging to Aisin-Gioro Puyi are displayed at the PHILLIPS Asia Headquarters.

3

Press gather for the opening of PHILLIPS' Asia headquarters in West Kowloon.

5

Inside the ground floor auction room by Otto Ng, LAAB Architects

Inside the ground floor gallery by Otto Ng, LAAB Architects

1

2

The facade of PHILLIPS' Asia headquarters in West Kowloon at night.

4

Members of the press tour around Phillips new Asia headquarters in West, Kowloon during its opening ceremony.

6

‘Wall-less’ office opens up collaboration amongst AnyMind’s creatives

The office encourages employees to collaborate, relax, and enjoy ‘happy hour’ and ‘mental space.’

2

1

A logo of AnyMind and Acqua greets employees of the commerce tech company.

2

Full height windows surround AnyMind's meeting room.

3

4

Amongst spaces in the office where employees can relax whilst doing their job or simply take a break in the “collaboration area,” which looks like a greenfield and has bean bag chairs.

4

AnyMind's new headquarters in Kwun Tong have no walls between departments.

5

AnyMind conducts team-building activities in the office such as “happy hour” and “TGIFridays” to increase the job satisfaction of their employees.

When marketing company, AnyMind, was planning to transfer offices, the company’s main goal was to move to a “collaboration space” rather than a “coworking space,” which is why its new headquarters in Kwun Tong was fit out to have no walls between departments.

“Everything is kind of open. We particularly picked this office because there’s just full height windows all around, there’s no walls,” AnyMind Managing Director for Greater China Ben Chien told Hong Kong Business.

“Our type of business requires a lot more collaboration, less room, [and] less privacy on purpose. We don’t need as

many private areas. We designed it [in a way] that everyone can sort of hear what each other is doing; [that’s] the basis for collaboration. If we don’t know what other people are doing, it’s kind of hard to collaborate,” Chien explained.

Since floor-to-ceiling windows adorn AnyMind’s office, even its conference room–employees not only get good lighting but also picturesque city views, particularly of Victoria Harbour. The headquarters was also designed to offer employees a “relaxed environment.” Chien underscored that employees are also given “mental space” to do their jobs better and come up with more creative ideas.

HONG KONG BUSINESS | Q3 2023 21 SPACEWATCH

1 3 5

Ben Chien

Bilby.AI enables business to capitalise on regulatory changes with predictive insights

The startup predicts regulations by tracking over 100,000 entities in China.

In 2021, the Chinese government cracked down on online education providers, resulting in the drop of share prices of onlinetutoring and ed-tech firms that affected multiple investors. One of Bilby.AI’s clients in the financial services sector, however, was spared from the crackdown’s rubble as the platform predicted the regulation three weeks before it happened.

“We provided a signal to our client saying why we thought this change would happen and which sectors would be affected. Then it happened,” Ryan Manuel, founder of Bilby.AI, told Hong Kong Business.

The Hong Kong-based startup also predicted a change in China’s ESG regulations, allowing one of its clients – a bank – to update its portfolio funds ahead of the implementation.

Bilby.AI is able to predict such regulatory changes by bringing data on all policy activities across a sector to a centralised database, which it then queries by running a series of algorithms that in turn generate software. Manuel explained: “We convert whatever comes out of China’s government into trading signals for big quantitative hedge funds, then provide the output as an application programming interface (API).” The startup tracks about 110,000 entities, including listed companies in China, Hong Kong, on-shore and offshore, ADRs or companies that are listed in New York Exchanges, and US companies that have exposure in China. The platform also tracks 31,000 private companies, and around 3,000 to 4,000 top leaders.

Digging deep

What Bilby.AI does is allow businesses to take advantage of changes in a country’s regulations by making policies “testable, predictable, and available as an Application Programming Interface (API).”

The startup’s predictive insights can help improve portfolio management, trading performance,

[Bilby.AI wants to] listen more and dig into things better

and the pricing of risks. Bilby.AI was born out of Manuel’s frustration working as a computer programmer, management consultant, and professor on Chinese politics. Manuel said that working across these three fields, he saw a huge need to understand what China was “saying and doing” using computers.

“After years of frustration waiting for someone else to do something about this, I just decided to do it myself,” Manuel said.

“I [felt like] there were so many missed opportunities to engage and do business and analyse [regulations] that no one was taking advantage of, because there wasn’t a computer model and that could [do it],” Manuel added.

Manuel named his startup after an Australian marsupial.

“The bilby is an Australian desert animal that digs into things. It also has big ears for listening. That seemed like a pretty good metaphor for what I wanted to do: listen more and dig into things better,” Manuel explained.

To “dig into things better” in the future, Bilby.AI is utilising recently raised funds of HK$11.77m (US$1.5m) in three ways.

“One is to improve our operational efficiency as we scale. [That involves] building repeatable and tractable

sales. Second is to improve our software for our products. The final part is to expand into new markets,” Manuel said.

Currently, Bilby.AI has models for China and India. Models for Indonesia, Vietnam, South Korea, and Japan are also in the pipeline, said Manuel.

In the next three to five years, Manuel also plans to integrate Bilby’s data and applications at a “vast scale” to become the world’s first regulations-as-an-API business.

“In essence…[we want to] add a regulatory component to financial market trading, to healthcare and pharmaceuticals, to big data companies. All of these things where APIs are starting to talk to APIs and make completely new products. We want all the world’s regulations to be available as an API and a range of different products and signals,” said Manuel.

“We already have a ChatGPT-like functionality within our work. That lets us ask questions about every signal we generate and offer, what’s known as explanatory AI. From that, our next one- to three-year vision is to bring in all our partners and their data and offer them the same function,” Manuel added.

22 HONG KONG BUSINESS | Q3 2023

Bilby.AI makes policies testable, predictable, and available as an API

STARTUP

ANALYSIS: REAL ESTATE

Gov’t must review valuations for successful land sales

Colliers estimates Hong Kong land revenue last year hit only 50% of target. The gov't always has a reserve price and it has to be realistic

Last year, the government missed its revenue target of $420b (US$54b) under the 2021-2022 land sale programme, mustering only $71.7b (US$219m). Hannah Jeong, head of valuation & advisory services in Colliers, said the factors that led to this failure boiled down to faulty valuation.

To ensure the success of Hong Kong land sales for 2023-2024, Jeong advised the government to reflect on market conditions in their valuations, given that developers, investors, and market players are under financial pressure due to interest rate hikes.

“Getting a new land with a significant billion dollars amount was not really an easy decision for many developers,” Jeong told Hong Kong Business. “I suggest that they have a discussion with different market players like surveyors, developers, and investors so that they understand (the sentiment).”

The Colliers expert cited the failed sale of the residential plot on Cape Road as an example of government valuations not matching with the market sentiment.

“The site is a luxury area, but it still has geographical challenges. Also, the interest hike was giving a lot of pressure into the luxury market, which is something not everyone can invoke. The government should reflect [on] these factors and make the reserve price more reasonable so that when bidders come in, they will be able to sell those land,” she explained.

“The government always has a reserve price and it’s not known in the market. It’s their own information. That valuation, reserve price, has to be realistic,” Jeong said.

KK Chiu, international director and chief executive for Greater China of Cushman & Wakefield, expressed the same sentiment and suggested that the government “review standard land price and bidding price to make sure they are on par with market situation.”

There are 18 plots under the 20232024 land sale programme, 12 of which are residential. Jeong pointed out that half of these residential plots are “rolling over from last year.”

“This means that the government’s KPI was actually only 50%. They

didn’t sell as they promised,” she said. Another view on why the government failed to meet its revenue target last year, said Jeong, is because the actual price at which the lots were sold are lower than the original estimation from the government.

In order for the Hong Kong government to successfully sell their plots, Jeong said it needs to “dispose of a site in a consistent manner based on their KPIs.”

Best plots

Amongst plots under the 2023-2024 land sale programme, three are likely to draw the most attention, said Jeong.

One of these is the residential site on Castle Peak Road, So Kwun Wat, Area 48, Tuen Mun, New Territories which is offering over one million square feet. The other two sites developers would be eyeing are at Yau Kom Tau, Tsuen Wan, in New Territories and Kai Tak Area 4B Site 5, Kai Tak, in Kowloon.

“The Tuen Mun and Tsuen Wan area traditionally have huge populations, and are well received in the local market. Last year, there were two successful land sales [in these areas], one bought by CK Asset Holdings in Tuen Mun. The site in Tsuen Wan was bought by Kerry Properties,” Jeong said.

Driving her point, she said: “These two sites [Yau Kom Tau and Kai Tak Area] are very close to last year’s land sales so they will receive a good response from the market.”

However, Jeong underscored that whilst the Kai Tak area offers a significant 1.13 million square feet, the site is located on a runway.

“The runway infrastructure is still not there. There are residents complaining a lot about [how] there is no monorail. Not enough public transportation, and not enough reach to go outside from the runway,” she said. That considered, Jeong thinks the site will not be well received in the market or would fetch a lower bidding price.

For 2023-2024, it is expected that 20,000 units will be brought in the supply pipeline, indicating the government’s “eagerness to make the supply and demand balanced” and make housing “more affordable,” said Jeong.

To read the full story, go to https:// hongkongbusiness.hk/

HONG KONG BUSINESS | Q3 2023 23

The gov't must review standard land price and bidding price to make sure they are on par with market situation (Photo by Diego Delso)

KK Chiu

Hannah Jeong

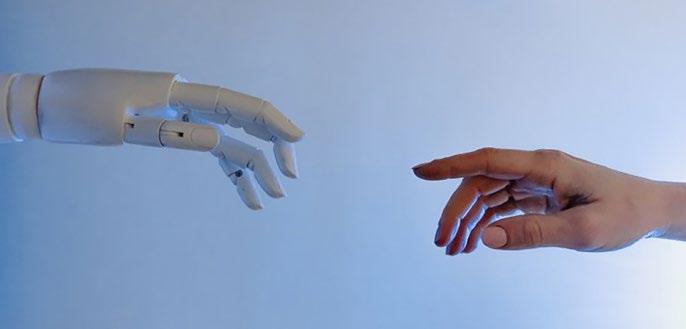

Auction houses thrive on Asian millennials’ art-buying power

Gen Y's affinity for contemporary art fuels anticipated growth for Christie's, Sotheby's, and Phillips.

Millennials have proven themselves to be the new generation that paints a profitable path for auction houses. In fact, last year, younger collectors accounted for 34% of Christie’s, close to 40% of Sotheby’s, and nearly a third of Phillips’ buyers.

“Asia-Pacific (APAC) remains the powerhouse of new and millennial buyers with strong buying power,” Francis Belin, president of Christie’s Asia Pacific, told the Hong Kong Business. In Christie’s recent Spring Auctions in Hong Kong, millennials accounted for 45% of all new buyers to the sales.

Sotheby’s Chairman for Asia

Nicolas Chow said millennials are also the biggest growing demographic amongst their Asian buyers in contemporary art, fashion, and luxury. Apart from accounting for the lion’s share of auction houses’ buyers, millennials from the APAC region are

also spending hefty amounts on art. In 2022, 62% of the spending from millennials at Christie’s globally was from APAC millennials.

Jonathan Crockett, chairman for Asia at Phillips Auction House, said young collectors from Asia, even first-time buyers, are spending millions of dollars on art.

“People in their 20s and 30s in the West dip their toes in the water or start off buying something that costs around US$1,000 to US$20,000. But here [in Asia], it never ceases to amaze me how pretty much every auction we have, new, first-time buyers come in at the million-dollar level and above. Sometimes, to the tune of up to US$10m.

It’s something that doesn’t really happen in the West, but seems to be prevalent here,” Crockett said.

In terms of art type, millennials are drawn to contemporary art, particularly those by Western artists.

According to Crockett, Asian buyers have been “increasingly supportive of the Western market” in the last five to 10 years.

“Asian buyers are now responsible for even creating or supporting the entirety of the market for certain artists in the West,” Crockett said.

But Crockett thinks that whilst these young Asians are influenced by Western pop culture, this influence could be temporary and can be expected to change in the future.

“I think that there’s so much talent here in Asia that is being overlooked in favour of their Western counterparts and I think that change will happen sooner rather than later."

Auction houses are brushing up their efforts to ensure that Asian artists get their deserved spotlight. Christie’s, for example, increased the number of works by Asian artists in their 20th and 21st Century Art Hong Kong Spring auctions this year

COVER STORY 24 HONG KONG BUSINESS | Q3 2023

Sotheby's Hong Kong Spring Sales 2023 (Photo from Sotheby's)

New, first-time buyers come in at the milliondollar level and above

Jonathan Crockett

by almost 20% compared to 2022. Asian contemporary art is specifically favoured by Gen X collectors, said Belin. However, millennials are also showing a growing interest in this category.

Chinese art takes centre stage

Apart from contemporary art, Asian buyers are also drawn to Chinese art.

“We saw the resurgence of the Chinese art market, the demand for classical categories, like Chinese works of art, Chinese modern paintings, and Chinese classical paintings,” Chow said, adding that the reopening of borders played a part in the market’s comeback.

“We had more collectors coming from Mainland China than we’ve seen in many years during the pandemic. For the last three years, particularly in categories that are very connoisseurship driven, like antiquities, or paintings, where each and every piece requires a physical examination, we posted the nineyear high result for those categories, selling for over HK$1.6456b (US$200m), which is an incredible result,” Chow added.

Belin said Chinese classical furniture is also sought after by Asian collectors. An example of Chinese classical furniture sold last year was a Huanghuali Circular Incense Stand. The piece sold for HK$71m (US$9m) in November 2022 at Christie’s Hong Kong, achieving a world auction record for an incense stand.

“APAC buyers collect objects that speak to their passion, cultural and historical roots,” Belin commented.

Artists fetch millions

Looking at artists, females and those with modern style are fetching millions from Asian collectors.

“There’s been a lot of interest in female artists in the last two years and there’s been a huge growth,” said Chow, adding that female artists are particularly famous in the contemporary area.

Modern artists are also gaining popularity amongst Asian collectors. Pieces by modern artists which were sold at Christie’s Hong Kong in 2022 include Zao Wou-ki’s 29.09.64. for HK$278m, Marc Chagall’s L’envol du peintre for HK$22.7m, and Pablo Picasso’s Buste d’homme dans un cadre for HK$175m.

In addition, in Spring 2023, Le promenoir des amants by René

Magritte reached HK$51m, marking the modern master’s auction debut at Christie’s Asia, and the artist auction record for Singaporean modern painter, Georgette Chen, was broken by Christie’s again with the work, Still Life with Big Durian, which realised HK$14m.

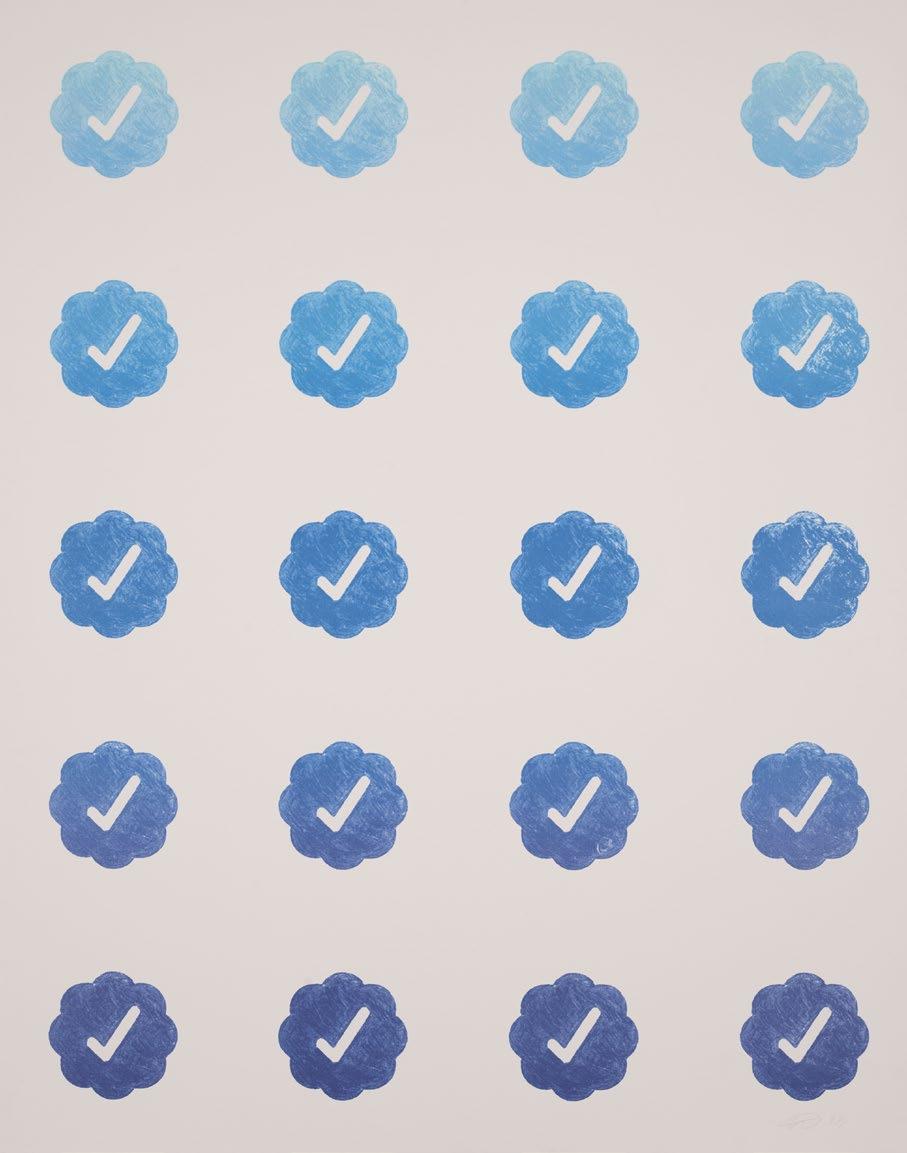

Digital market and NFTs

Unlike the past years, the digital art market has been “a little bit quiet,” said Chow. However, the expert believes that digital collectables like nonfungible tokens (NFTs) will see some growth either by late 2023 or 2024.

“Looking at how cryptocurrencies are making a comeback, we expect digital collectables to be pulled along,” Chow said.

“I think there are signs that digital collectables, may be on the way back, we have a platform now Sotheby’s Metaverse for trading in the primary sector and secondary sector, digital collectables, and we’re sort of primed to take this opportunity when the market is expected to bounce back,” Chow added.

Despite NFTs being tested amidst the volatility of the broader crypto market, Christie’s sold 87 NFT lots in 2022 across all its platforms for a total of US$5.9M (HK$46m) from artists such as Diana Sinclair, Mad Dog Jones, and Fewocious. An auction in May 2023 of digital artworks by Jack Butcher was 100% sold and totalled US$93,000 (HK$724,470).

COVER STORY HONG KONG BUSINESS | Q3 2023 25

There’s been a lot of interest in female artists in the last two years and there’s been a huge growth

Nicolas Chow

Francis Belin

An image of Yoshitomo Nara's "In the Milky Lake" is displayed during the Hong Kong Spring Sales 2023 of Sotheby's

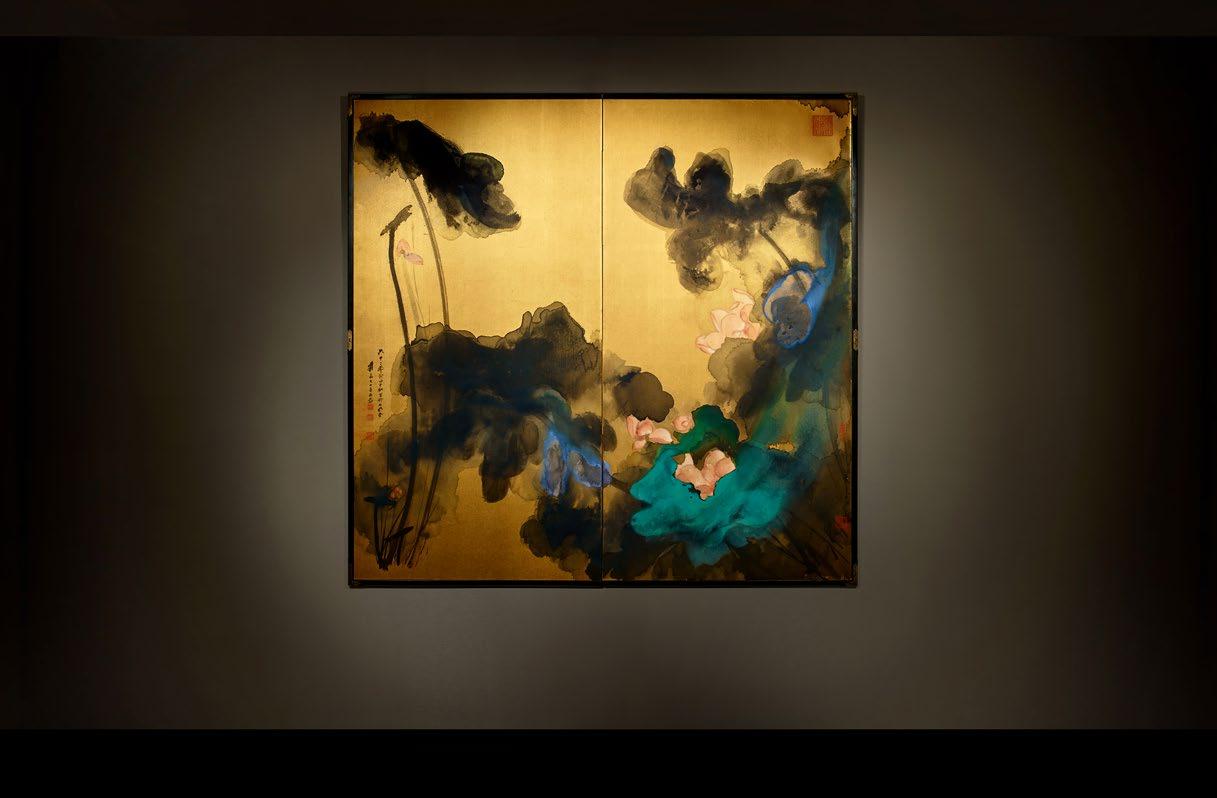

Zhang Daqian’s "Pink Lotuses on Gold Screen" (Photo from Sotheby's)

Moving forward, Belin said Christie’s will continue to advance digital art and NFTs as a serious collecting category within Contemporary Art.

Uptrend in online auctions

Whilst the COVID-19 pandemic halted auction houses from conducting in-person live events, it also gave them a new avenue to recruit new clients.

The online platform of Christie’s, for example, was its number one recruiter of new clients in 2022,

accounting for 64% of its new buyers.

Phillips was also able to tap into an entirely new database of clients through its online offerings, said Phillip's Crockett.

“Online selling grew out of the requirement to replace our engagement with our clients and replace our in-person live events with something else. With a return of in-person, live events and the ability to travel, the requirement for an enhanced online auction offering no longer exists,” Crockett said.

“However, we found that when

we had our first online sales, we were able to serve [not only] our existing client base, but we also found that we were tapping into an entirely new database of clients we previously had no contact with,” he added.

Going forward, Phillips will have a selection of both online and live auctions, he said.

Art as an investment

Rather than buying art as an investment, the auctioneers advised clients to collect out of passion. But for those who are considering investing in art, Belin said “true masterpieces stand the test of time.”

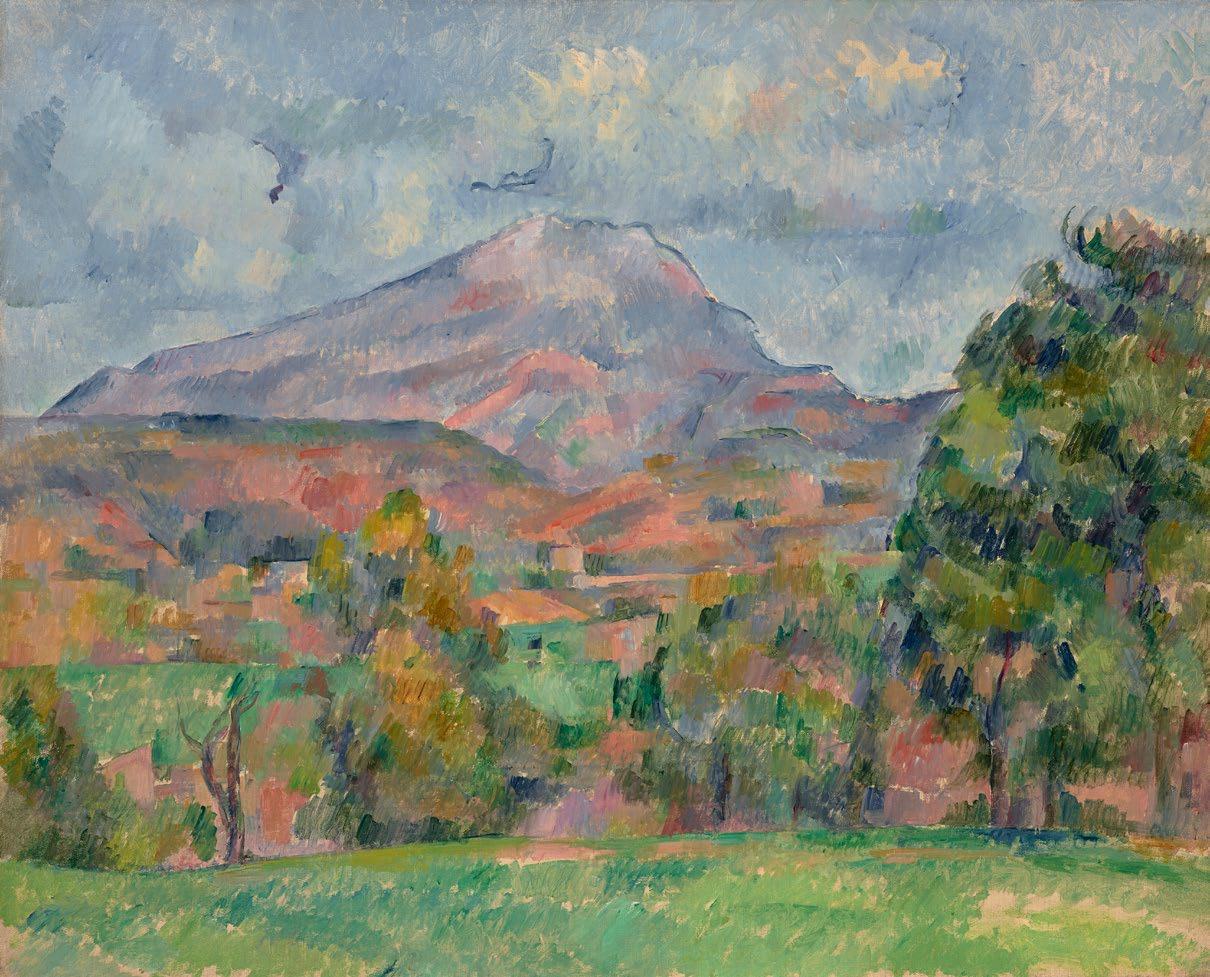

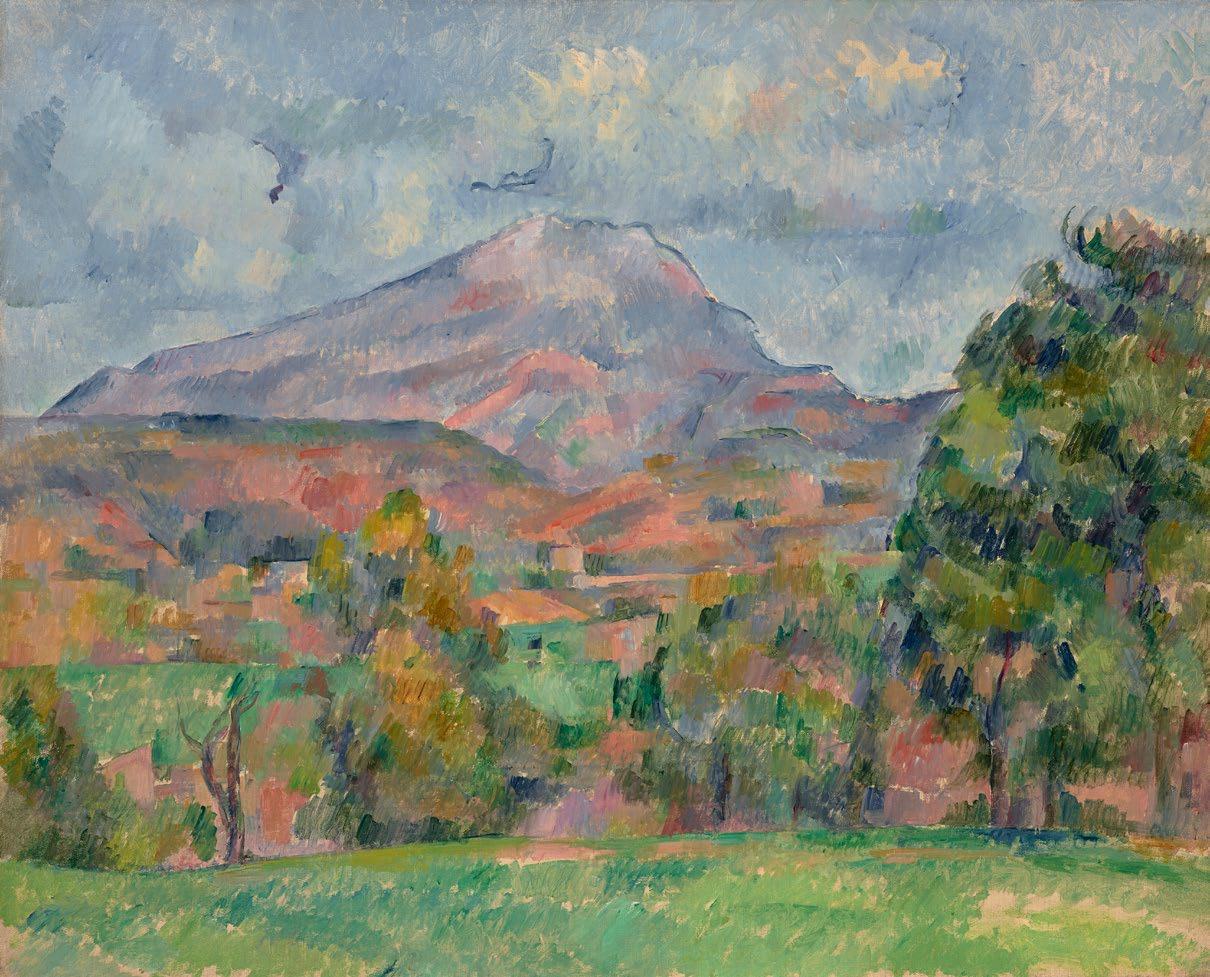

La Montagne Sainte-Victoire by Paul Cézanne, for example, saw a 258% increase in its value. In May 2001, the painting was sold for HK$301m (US$38.5m) and by November 2022, its realised price was HK$1.08b (US$137.8m) during the sale of the collection of Microsoft cofounder, Paul G. Allen

Chinese works of art whose market value also increased throughout the years include a rare Qianlong period doucai moonflask.

According to Belin, the moonflask’s market value has soared over 10 times since it was first sold in May 1995 for HK$8.16m (US$1.03m). In May 2023, it sold for HK$108m (US$13.8m) when it was presented at Christie’s Hong Kong Spring Auctions.

Chow also had a client who bought imperial seals in the 90s. Back then, his client bought the seals for about HK$391,140 (US$50,000). Ten years ago, the seals were sold for about HK$469m (US$60m).

Chow, however, underscored that he does not encourage buying art as an investment.

“This is not what we’re here for and we really try to bring the passion and the precision of the art to the collectors around the region,” he said.

Art market's growth

Singapore is amongst the emerging art markets of Asia, given that it connects collectors from all over Southeast Asia. Whilst Hong Kong remains the location of Christie’s APAC headquarters as Asia’s key art hub, they have continued to invest in Singapore.

In October 2022, Christie’s hosted

COVER STORY 26 HONG KONG BUSINESS | Q3 2023

We really try to bring the passion and the precision of the art to the collectors around the region