Display to 31 December 2022 HK$40 HONG KONG’S PROPERTY MARKET ENDS DOWNCYCLE PROPERTY ISSUE THE WHERE TO INVEST MILLIONS IN HONG KONG REAL ESTATE HONG KONG’S MOST NOTABLE REAL ESTATE AGENTS UNDER 40 WHY MAINLAND’S BORDER REOPENING WILL BE CRUCIAL FOR THE LUXURY MARKET IN 2023 FORMER MANULIFE HONG KONG CEO IS NOW ONE OF ASIA’S TOP INDUSTRY EXECUTIVES Hong Kong’s Best Selling Business Magazine Issue No. 68

C2 HONG KONG BUSINESS | Q4 2022 For Deng G tastes, cross the harbour 成都風味 就在維港對岸 (九龍) 鄧記川菜 Deng G Sichuan, Kowloon (香港) 鄧記 Deng G, Hong Kong 九龍尖沙咀梳士巴利道18號K11 MUSEA 412-413號舖 +852 2545 3288 Shop 412-413, K11 MUSEA, 18 Salisbury Road, Tsim Sha Tsui 香港灣仔皇后大道東147-149號威利商業大廈二樓 +852 2609 2328 2/F, Weswick Commercial Building, 147-149 Queen’s Road East, Wan Chai @ K11 MUSEA

Established 1982

Editorial Enquiries: Charlton Media Group Hong Kong Ltd Room 1006, 10th Floor, 299 QRC, 287-299 Queen’s Road Central, Hong Kong. +852 3972 7166

PUBLISHER

COMMERCIAL TEAM

GRAPHIC ARTIST

Janine Ballesteros Jenelle Samantila Simon Engracial

ADVERTISING CONTACTS Louis Shek +852 6099 9768 louis@hongkongbusiness.hk Karisse Coderes karisse@charltonmediamail.com

ADMINISTRATION ACCOUNTS DEPARTMENT accounts@charltonmediamail.com ADVERTISING advertising@charltonmediamail.com EDITORIAL editorial@hongkongbusiness.hk

PRINTING

Gear Printing Limited Flat A, 15/F Sing Teck Fty. Bldg., 44 Wong Chuk Hang Road, Aberdeen,Hong Kong

Can we help?

Editorial Enquiries: If you have a story idea or press release, please email our news editor at editorial@hongkongbusiness.hk. To send a personal message to the editor, include the word “Tim” in the subject line.

Media Partnerships: Please email editorial@hongkongbusiness.hk with “Partnership” in the subject line.

Subscriptions email: subscriptions@charltonmedia.com

Hong Kong Business is published by Charlton Media Group. All editorial is copyright and may not be reproduced without consent. Contributions are invited but copies of all work should be kept as Hong Kong Business can accept no responsibility for loss. We will however take the gains.

Sold on newstands in Hong Kong, Macau, Singapore, London, and New York.

*If you’re reading the small print you may be missing the big picture

Experts’ 2023 outlook on Hong Kong’s property sector may entice investors to reconsider the city as a property investment destination. The property market is poised to end its downcycle in 2022 and enter 2023 with hopes of normalisation. Investors keen on putting their money into Hong Kong real estate must keep their eye on hotels in particular. Mainland’s border reopening will also be crucial for the luxury property market in 2023.

Hong Kong has slowly regained its attractiveness as a property investment destination, and amongst to thank are the region’s realtors who were determined to end the city’s downcycle. In recognition of their hard work, we feature 17 real estate agents under 40 who displayed leadership in their respective communities amidst challenging times. See the full list on page 40.

We sat down with Manulife Asia CEO Damien Green to talk about his journey as a former insurance outsider, to former CEO of Manulife Hong Kong, to becoming one of the region’s top industry executives. See the exclusive interview on page 36.

Read on and enjoy!

HONG KONG BUSINESS | Q4 2022 1

HONG KONG BUSINESS

HongKongBusiness is available at the airport lounges or onboard the following airlines:

FROM THE EDITOR

Tim Charlton

& EDITOR-IN-CHIEF Tim Charlton ASSOCIATE PUBLISHER Louis Shek PRINT PRODUCTION EDITOR COPY EDITOR PRODUCTION TEAM Jeline Acabo Tessa Distor Noreen Jazul Djan Magbanua Frances Gagua Charmaine Tadalan Consuelo Marquez

2 HONG KONG BUSINESS | Q4 2022 JANUARY 2019 CONTENTS Published Quarterly by Charlton Media Group Pte Ltd, Room 1006, 10th Floor, 299QRC, 287-299 Queen’s Road Central, Sheung Wan, Hong Kong For the latest business news from Hong Kong visit the website www.hongkongbusiness.hk FIRST ANALYSIS LUMINARIES REPORT INTERVIEW 34 COVER STORY PROPERTY MARKET ENDS DOWNCYCLE REAL ESTATE WHERE TO INVEST YOUR MILLIONS IN REAL ESTATE 42 06 Why it’s time to remove cooling measures 08 This is how much Hong Kong’s tech companies are paying their talent 09 Why the next 3 years are crucial for the office property sector 10 F&B’s performance the highest postpandemic 25 HK’s poorest to be hit hardest by extended waiting time for public flat 26 Fintech funding slows as COVID’s digital hype fades 44 Why Mainland’s border reopening will be crucial for the luxury market in 2023 40 Hong Kong’s most outstanding real estate agents under 40 16 Cathay Pacific concerned that HK has lost competitiveness 18 How key aviation players are pushing the industry for takeoff 28 Board diversity is more than giving seats to women 29 How virtual insurer Bowtie halves product prices 30 Why HK remains robust amidst energy crisis 36 Former Manulife Hong Kong CEO is now one of Asia’s top industry executives 38 What YAS MicroInsurance’s vision of an on-demand insurance product looks like 43 Addressing ESG investment gap with data BRIEFINGS 12 How financial institutions can overcome the booming demand for ESG roles 14 Why tax deduction on domestic rents is not really a win for tenants 20 STARTUP ECOSYSTEM IMPROVING HONG KONG’S STARTUP ECOSYSTEM

HONG KONG BUSINESS | Q4 2022

Daily news from Hong Kong

The adoption of conversational commerce rose in popularity as brands expanded their presence online through social media, such as Facebook and Instagram. “It’s really about capitalising on your own followers. That’s the reason why we believe that social commerce is quite an equal playing field for all brands.”

Companies racing to fill roles—this has been the state of HK’s job market as its talent pool continues to shrink year by year. In 2022, the struggle to reel in employees remains to be felt by 85% of companies, according to the Digital Salary Survey 2022 by Robert Walters and Walter People.

HK aims to regain crown as favoured arbitration hub with ORFS bill

Currently, lawyers handling arbitration cases in Hong Kong usually get paid by the hour under standard fees arrangements. But with LRC’s push to finally allow legal practitioners to enter into ORFS, lawyers can structure a fee arrangement that suits the specific client and the specific case.

Hong Kong’s top 50 insurers show a 9.75% surge in assets

With the skies clearing, Hong Kong consumers will still prioritise making sure they have an umbrella handy, a fact that Hong Kong insurers took note of as they ready health and wellness products for 2022. HK’s top 50 insurers’ total assets surged by 9.75% to $709b from $646b.

A new canvas: Why artists are jumping into the NFT space

Artist Lakshmi Mohanbabu would usually get a one-time earning for a piece of art she sells in a gallery. When she took a dive into the space, she realised that she can make much more. Artists can get a percentage of a future resale of their NFT-minted artworks with a royalty fee.

Prepare to go cashless or pay the price

With more consumers planning to drop cash and go fully digital with their payments in 2022 and in years to come, and with one in three abandoning a purchase when not given a digital payment option, small businesses really have no other way to go than shift to cashless.

INSURANCE

FINANCIAL TECHNOLOGY

INFORMATION TECHNOLOGY

News from hongkongbusiness.hk

Conversational commerce levels playing field for brands online

Competing for the best talent in Hong Kong’s shrinking talent pool

RETAIL

HR & EDUCATION

MOST READ

LEGAL

C M Y CM MY CY CMY K

THESE GROUPS DRIVE DEMAND IN LUXURY RESIDENTIAL MARKETS

Rental demand in Hong Kong’s luxury leasing market is still being driven by Mainlanders moving to Hong Kong amid the sporadic lockdowns across cities in China.

According to Savills, luxury residential rents have continued to rebound slightly as the city began to mandate a “3+4” hotel quarantine measure in August with a further relaxation in late September to “0+3” while the local epidemic situation has remained broadly contained. Luxury rents on Hong Kong Island recorded a marginal growth of 1.2%, while rents in Kowloon and the New Territories rose by 1.9% and 0.5% respectively.

Here’s more from Savills:

Luxury rents on Hong Kong Island all recorded positive increments in Q3/2022, with Mid-Levels (+0.6%), Pokfulam (+0.6%), Happy Valley/ Jardine’s Lookout (+3.2%), Southside (+1.9%) all posting modest growth.

Demand is being driven mostly by Mainlanders whose focus is on traditional luxury enclaves such as Southside, The Peak and Mid-Levels. Elsewhere, a lack of available stock is helping to support rents and a tendency to renew has resulted in a general lack of movement. In contrast to the luxury markets, rents in the larger housing estates such as Taikoo Shing and Kornhill are falling as the exodus of local professionals overseas has pushed up vacancy.

Luxury property

In Kowloon and the New Territories, luxury apartments generally recorded modest growth over the quarter, with Tsim Sha Tsui/ Hung Hom (+1.8%), Ho Man Tin/Kowloon Tong (2.2%), Sai Kung (+2.2%), Sha Tin/Tai Po (+2.1%), except for Discovery Bay (-2.0%).

PRC students are stimulating demand for shared flats in areas like Hung Hom and Ho Man Tin. Heavy rental declines have been recorded in Discovery Bay as airline housing budgets have fallen dramatically.

Why it’s time to remove cooling measures

Property expert JLL has urged the Hong Kong government to remove the cooling measures in the housing market since it is “no longer overheated.”

Amongst signs that show the market has cooled down include the mass residential prices dropping over 7% year-to-date and average monthly residential sales transactions for the last nine months hitting its lowest level in 20 years, said JLL.

In the first nine months of 2022, only an average of 4,100 flats per month changed hands, lower than the previous low of 4,200 transactions in 2013 when the government introduced the Double Stamp Duty.

With housing prices expected to drop 10% for the year, JLL said borrowers who rely on high LTV mortgages will be at risk of falling into negative equity.

Sales in the luxury markets likewise dropped in 2022, with only 500 flats worth over $20m sold per quarter in the first nine months, 55% less than the average of 1,100 deals in

If the housing prices dropped further, developers are likely to be extra cautious in land bidding

2021 and about 40% lower than the average quarterly transactions in the last five years.

“The down cycle in the housing market has just started and the market will continue to face headwinds.

Although home prices are unlikely to fall off a cliff, the city will probably suffer a prolonged down cycle that we witnessed in 1999-2003 due to interest rate hikes, a reversal in liquidity, weakening global and regional economies, and geopolitical concerns. Housing prices dropped a cumulative total of about 50% from 1999 to 2003, or about 10% a year,” Joseph Tsang, chairman of JLL in Hong Kong, said.

“We expect the prices of mass residential will extend the decline in 2023. If the cooling measures remain amid the backdrop of the global economic downturn and political turmoil, we will see a sharper price correction and rising cases of owners in negative equity,” Tsang added.

Removing stamp duties

Tsang said removing the punitive stamp duties like the Special Stamp Duty and Buyers’ Stamp Duty will help avoid negative equity from becoming an issue in the city again.

“If the housing prices dropped further, developers are likely to be extra cautious in land bidding, which will affect land sale revenue as a result,” he explained.

To avoid developers slowing down their urban regeneration efforts amidst the interest rate hikes, Tsang said the government must remove the Buyer’s Stamp Duty.

“The government can also consider adjusting the levy of Special Stamp Duty only on vendors who had made gains when the flats are sold while freeing the loss-makers from SSD liability,” he added.

In Q2, the Buyers’ Stamp Duty amounted to $410m, the lowest quarterly receipt since the duty was levied in 2014. Meanwhile, Doubled Ad Valorem Stamp Duty dropped to $1.3b, the second lowest following the lowest level recorded in the first quarter of 2022.

The low levels of stamp duties receipt are signs of subdued sentiment among both investors and owneroccupiers, according to JLL.

6 HONG KONG BUSINESS | Q4 2022 FIRST

Residential sales in the last nine months have dropped to its lowest level in 20 years

theDesk Locations

New location in Kwun Tong: theDesk One Pacific Centre Enquire about special offers theDesk Locations

HONG KONG ISLAND

Admiralty theDesk United Centre

HONG KONG ISLAND

Sheung Wan theDesk Strand 50

Admiralty theDesk United Centre

Central Jumpstart Crawford House

Beyond Space

Collaborative communities. Flexible workspaces. Event spaces. Meeting spaces. Service platform.

Collaborative communities. Flexible workspaces. Event spaces. Meeting spaces. Service platform.

Causeway Bay theDesk Leighton Centre theDesk One Hysan Avenue

Sai Wan theDesk Sai Wan

Sheung Wan theDesk Strand 50 Central Jumpstart Crawford House Causeway Bay theDesk Leighton Centre theDesk One Hysan Avenue

Sai Wan theDesk Sai Wan

KOWLOON

Whampoa theDesk Kerry Hotel

KOWLOON

Tsim Sha Tsui Jumpstart Silvercord

Whampoa theDesk Kerry Hotel

Tsim Sha Tsui Jumpstart Silvercord

Kwun Tong theDesk One Pacific Centre Jumpstart Millennium City 5 (APM)

Jumpstart Yen Sheng Centre

Kwun Tong theDesk One Pacific Centre Jumpstart Millennium City 5 (APM) Jumpstart Yen Sheng Centre

NEW TERRITORIES

Sha Tin theDesk Sha Tin

NEW TERRITORIES

Sha Tin theDesk Sha Tin

SHANGHAI

Puxi Jumpstart Wheelock Square

SHANGHAI

Xiantindi Jumpstart Central Plaza

Puxi Jumpstart Wheelock Square

Hongqiao Jumpstart L’Avenue

Xiantindi Jumpstart Central Plaza

Hongqiao Jumpstart L’Avenue

HONG KONG BUSINESS | Q4 2022 7 thedesk.com.hk @thedeskhk

thedesk.com.hk @thedeskhk

Another in-demand tech talent is in the data sciences. This is because an unprecedented number of organisations and businesses going through digital transformation, and the availability of data and the need for analytics plus data-driven solutions have skyrocketed.

Junior data analysts could earn $20k to $26k, increasing to $30k to $48k when experienced. Junior data engineers earn slightly higher at $30k to $46k, increasing to $50k to $74k for those in a senior role. Principal Data Scientists have the highest pay at $43k to $129k.

Highest earners

The highest salary is within the Crypto, Blockchain and Web3 industries. Head of Marketing in regular tech and digital industries have a salary range of $71k to$167k.

Within the crypto, blockchain and Web3 industries, the same role would be looking at a salary between $100k to $200k. Product Managers within the crypto, blockchain and Web3 industries have a salary range of $60k to $90k.

A similar role as a Junior would be seeing half of that amount, having a salary range between $22k to$40k, whilst a Senior position would be averaging between $50k to $73k.

This is how much Hong Kong’s tech companies are paying their talent

Hong Kong firms’ demand for tech talent is reflected in how much they are willing to pay those with skills, with the pay jump from the highest junior salary to the lowest senior role salary increasing by more than 100%, a report by Grit revealed.

This has not been surprising as, since the pandemic, most companies have prioritised the search for tech talent leading to an increase of IT-job functions search by 35% within various industries in the last year. Meanwhile, the demand for tech talent increased by 18% in the first quarter of 2022 alone.

Front and back end junior developers could earn $20k up to $35k. Those in senior roles could see this salary more than double from $45k to $70k. Meanwhile, junior engineering managers could earn $45k to $70k, increasing to $80k to $150k for those with experience.

Cybersecurity experts and IT

professionals are also in demand as data breaches could cost companies US$4.24m per incident according to the latest cybercrime statistics. In a survey by IDG Research last year, eight out of 10 senior IT security leaders think that their organisations aren’t sufficiently protected from attacks thus creating the demand for skilled cybersecurity professionals. Junior cybersecurity consultants could earn $30k to $45k. This will also double from $60k to $83k for those with experience. Cybersecurity engineers meanwhile earn a starting salary of $25k to $35k. Senior cybersecurity engineers earn about $40k to $60k. Meanwhile, the chief information security officer (CISO) can earn $77k to $205k.

According to the report, across various job functions, the chiefs of the various departments demand much higher salaries than those working in other industries, such as the Head of Legal ($112k to $169k) and Head of Technology ($120k to $200k). Grit said that due to the fast-growing nature of these technologies, employers are willing to pay higher salaries to develop their talent as they look to take the next step in the company’s growth.

“As the competition wages for talent, we have full confidence that individuals have plenty of opportunities to grow, develop and thrive in this booming market. Employers should look to improve their hiring processes to successfully recruit, train and retain their talent. At the same time, employees should keep upskilling to hone their skills and remain up-to-date with current market demands as they work to achieve their ideal job positions and salaries,” Paul Endacott, CEO and Founder of GRIT said.

8 HONG KONG BUSINESS | Q4 2022 FIRST

There is an almost 100% pay jump from junior to senior roles

As the competition wages for talent, we have full confidence that individuals have plenty of opportunities to grow, develop and thrive in this booming market

The next 3 years will be an inflection point for real estate as businesses rethink the

can support employee mental wellbeing and maintain productivity.

Additionally, the findings showed that 80% of organisations in Asia Pacific agree that quality space is a top priority as high-quality spaces are best suited to facilitate the kind of workplaces, health and wellbeing amenities, and sustainability credentials employees and corporates increasingly need.

The focus for companies will be on investments in quality spaces to ensure the long-term success of hybrid work.

Why the next 3 years are crucial for the office property sector

Companies will look across their real estate portfolios to rethink their office spaces, invest in new technology and prioritise sustainability, as hybrid work becomes more entrenched in corporate culture, according to new research from real estate consultant JLL.

The Future of Work report reveals the trend towards dynamic working continues, with 56% of organisations in Asia Pacific saying that they will likely make remote working available to all employees by 2025 and corporate real estate (CRE) executives saying that successfully operating hybrid work will be the most important strategic priority over the next three years. This includes

exploring flexible space options, with the average proportion of flexible spaces in Asia Pacific expected to grow between now and 2025.

“The next three years will prove to be an inflection point for real estate as businesses plot their future path and rethink the purpose of their portfolio,” said Jordi Martin, CEO, JLL Work Dynamics, Asia Pacific. “The changes accelerated by the pandemic represent an opportunity to pause, think about a long-term real estate strategy and how it aligns with future business priorities.”

According to JLL’s research, the shift to hybrid work has become a marker of change in the workplace, placing greater emphasis on how companies

HOW THE 0+3 ARRANGEMENT WILL AFFECT HK’S INDUSTRIES

The new 0+3 quarantine arrangement that scraps the compulsory hotel quarantine for inbound travellers from Taiwan and other overseas places is expected to leave a positive impact on several industries in Hong Kong, including the real estate market.

According to JLL, the new setup will positively impact the leasing market.

“An open border will facilitate companies to resume/proceed with their deal diligence processes regarding real estate requirements. We believe many such activities have been put on hold awaiting a clearer roadmap to re-opening,” the real estate expert said.

Since entry requirements got eased, JLL said Hong Kong will be able to regain its attractiveness to multinational companies and mainland firms to set up or expand its presence in the city.

“A pick-up in office leasing activities will lend

support to the rental market,” said JLL. Apart from the office market, JLL said the retail market will also benefit from the easing of quarantine, albeit “minimally initially.”

Jeffries echoed this, saying that whilst the relaxation is a “piece of positive news” for the market, it is unlikely to help retail sales in the short term given the shift in mainland Chinese consumer behaviour.

“Short term, brands and retailers expect domestic spending to be affected by the policy with local people travelling or local consumers save for travelling,” Jeffries said.

Meanwhile, the aviation sector also welcomed the relaxation, with Cathay Pacific saying the latest measure will help boost sentiment for travel.

According to the airline, the adjustment will facilitate “gradual resumption of travel activities and strengthening of network connectivity to, from and through the Hong Kong aviation hub.”

“As the office continues to evolve post-pandemic into a destination for collaboration, occupiers will need to continue increasing their investments in creative spaces,” said James Taylor, Head of Work Dynamics Research, Asia Pacific. “Real estate portfolio strategies to enhance social interaction among a geographically dispersed workforce will be more important than ever, and the focus is on organisations to create offices with less me-space and more we-space.”

Environmental and social aspirations will shape portfolio transformation

With buildings accounting for over 60% of carbon emissions in cities, organisations face ever increasing pressure to deliver clear outcomes in the race to net zero and create social value through real estate. That means sustainability strategies have a direct impact on real estate decisions, with 71% saying they are likely to pay a premium for green building credentials in the future.

HONG KONG BUSINESS | Q4 2022 9 FIRST

purpose of their portfolio

Domestic spending expected to be affected by the policy

Over half of APAC firms say remote working is likely to be available to all by 2025

James Taylor

Jordi Martin

KOWLOON WEST TO BECOME THE HEART OF

Businesses looking to establish or upgrade their office should start looking into Kowloon West where multiple developments are underway.

A report by Colliers said Kowloon East is expected to become one of the fastest-growing Grade A office submarkets in Hong Kong, especially with the construction of two government projects, Lantau Tomorrow Vision and Northern Metropolis.

The two mega projects will pave the way for different office clusters to develop around Kowloon Station, Cheung Sha Wan and the New Development Areas (NDAs) in the New Territories.

Currently, there is only one Grade A office building in the Kowloon Station Area, which is strategically located at the junction of the Tung Chung Line, Tuen Ma Line and cross-border XRL.

In the next five years, it will supply the second-highest amount of new Grade A office facilities (2.4 million sq ft) after Kowloon East, equivalent to 17% of the total new Grade A supply in Hong Kong between now and 2026.

The next Grade A office Colliers added that 29% of the next five-year Grade A office supply (202226) will also come from Kowloon West. The supply’s total size in the district is also expected to increase from 6 million sq feet in March 2022 to 9 million sq feet by 2026.

By 2026, the district will also have 11% of the entire city’s Grade A office stock.

“The focus of the city’s future developments is going to shift from the East to the West over the next two decades amidst the bigger integration within the GBA development. We believe the emerging office clusters in Kowloon West will become alternative flight-to-quality locations, supported by the relatively low rents.

F&B’s performance the highest post-pandemic

Restaurants in Hong Kong were slightly more confident in their outlook for the food and beverage (F&B) industry, increasing to 39% in the second quarter of 2022 from 34% in the previous quarter, according to the Deliveroo Q2 2022 Restaurant Confidence Index.

In a statement, Deliveroo said Hong Kong restaurant posted the highest business performance satisfaction score in over two and a half years if 6.4 from 5.3 in the previous quarter. Around 36% were also more hopeful about the economic environment, up from 32%.

Many restaurants cited the consumption voucher distribution in April as a key factor in boosting business, with 65% of those surveyed believing that their revenue slight or significantly rose during the quarter because of it.

With the increase in spending due to the vouchers, 48% of F&B owners are considering promotional or marketing plans in line with the second phase of the Consumption

Voucher scheme in the third quarter. Around 23% of restaurants already have promotional plans.

“Although the previous few months have undoubtedly been difficult due to the fifth wave of the epidemic, Hong Kong is still on the road to recovery, and we are hopeful that social distance-inducing policies will be further relaxed in the coming months,” said Deliveroo Hong Kong General Manager Andrew Hui.

“We are committed to helping restaurant partners make the most out of new opportunities in the market while preparing for any potential challenges under the evolving COVID situation,” he added.

F&B rebounding

The report also found that dine-in business performance improved in the second quarter, with 55% claiming their revenue from dinein business significantly or slightly rose compared to the previous quarter, whilst 19% said it remained unchanged.

Around half or 48% said they increased their staff during the quarter, and 55% have planned to raise wages in the third quarter to retain employees. It also found that 42% of restaurants were planning to hire more staff, and 26% planned to open new branches in the third quarter.

Meanwhile, many restaurants cited operating costs, including food ingredients and rents which are both at 39% as the highest pressure they experience over the spring and early summer months. This is followed by labour costs with 23% reporting a pinch in staff salaries.

Around 74% were very or slightly worrying about a rebound in COVID cases with the revival of longer dining hours and easing of social distancing measures, according to Deliveroo.

10 HONG KONG BUSINESS | Q4 2022 FIRST

The performance satisfaction score of 6.4 is the highest posted in two and a half years

HK’S OFFICE MARKET

The real question is whether HK can keep its relative importance as an intermediator under the evolving global trend

HONG KONG BUSINESS | Q4 2022 11

How financial institutions can overcome the booming demand for ESG roles

Data from portal Indeed showed that ESG job offers in Hong Kong soared 442% in 2022.

recruitment agencies given its cost.

“I review job boards on a regular basis, whether that be what’s being posted on LinkedIn, Jobs DBE, Financial Careers. It’s interesting to see the repetition in which organisations are posting the role, which leads you to believe they’re not filling them; hence, the role continues to be recycled until they find the right talent,” the HR expert said.

Currently, most ESG jobs offered in Hong Kong are coming from accounting and consultancy firms, as well as financial services firms.

This was echoed by Wisely Wong, Business Director at Hays, adding that accounting firms like the Big 4—EY, KPMG, Deloitte, and KPMG—are expanding ESG hiring actively in Hong Kong “in response to the increased requirements from corporates and institutions who are facing tougher reporting rules.”

In April 2022, Deloitte even announced that it will “offer a robust curriculum of sustainability training courses to all 345,000 professionals along with its clients and suppliers.”

Hong Kong’s finance sector has never been truly invested in the environmental, social, and governance (ESG) piece, according to HR expert Steve Parkes. “Strong ESG people” across the globe, who could have been considered to fill the roles are already less interested in Hong Kong for reasons like politics and the city’s pandemic response.

“There’s not enough talent. I don’t think the market was prepared for the quantity of people that was going to be required,” said Parkes, Senior Partner at Page Executive Hong Kong. According to portal Indeed, ESG job offers in Hong Kong soared by 442% from April 2021 to April 2022.

To strengthen Hong Kong’s weak pipeline of ESG talent, Parkes suggested that companies do not necessarily need to hire employees specifically with ESG-focused. Instead, they can look for individuals who are familiar with looking into the risk profile of a business.

Parkes said companies can also take current talent and upskill them. They should start asking whether they have employees who can take on the ESG responsibility.

“ESG has certain components, be it risk or compliance related. Oftentimes, people in these capacities are then shifting into an ESG role from an internal perspective,” said Parkes.

The harder way for Hong Kong to address the issue of the widening gap between demand and supply of ESG talent is to “home grow,” which will be up to the universities, said Parkes.

Unable to fill roles

Apart from lack of talent, companies struggle to fill their ESG roles because some refuse to seek help from

The market was not prepared for the quantity of people that was going to be required

More than a compliance Compliance regulation being the main driver for most companies when making ESG decisions, as stated by a PwC study, is worrying and concerning, according to the Page Executive expert.

“There’s a term being used called greenwashing, meaning organisations are painting a very pretty picture of either what they have internally, or what they’re doing, from a financial perspective,” Parkes said.

“Right now, we’re starting to see progress in organisations, but what’s the longevity of this?

What’s the sustainability of this? What is the true rationale for it? Are we truly trying to make our world a better place? Or are we just doing it to fill up a certain corporate void?” he added.

Wong, for his part, added that the benefits of assigning ESG specific roles goes beyond compliance of regulatory requirements.

According to Wong, creation of ESG roles will also leave a positive impact on the labour market.

“More roles will be created with more opportunities to come. For example, the front office would require more coverage bankers with relevant sustainability knowledge to step up the game in order to further educate ESG knowledge to their customers,” Wong said.

“There will also be an increase in issuance of Green Bonds, leading to an increased demand for investment bankers with sustainable finance experiences. Research analyst and data analyst will also be sought after as climate change and other sustainability factors will require data and studies to value investment projects. Risk experts would also be needed to further verify and value these investment projects,” he added.

12 HONG KONG BUSINESS | Q4 2022

HR BRIEFING

Companies struggle to fill their ESG roles because some refuse to seek help from recruitment agencies

Wisely Wong

Steve Parkes

Tencent’s

approach is

Tencent Holdings Ltd

TheCOVID-19 pandemic imposed tremendous challenges on global businesses, including supply chain disruption, the maintenance of normal business operations, as well as employee management under remote working scenarios.

As the pandemic gradually eases in 2022, more and more companies around the world are starting to embrace digital transformation. On the one hand, digital technologies have been proven to increase enterprise agility and prepare companies for the next black swan event. On the other hand, enterprises empowered by digital technology are believed to be in a better position to capture emerging industry opportunities. What Tencent has done may shed light on how companies can utilise digital technology to strengthen their human resource management and boost enterprise agility.

Living in the digital age, it is imperative for company management to be able to quickly understand changes and make swift strategic transformation decisions. It is also necessary to ensure that employees have the ability to adapt to development shifts in the digital age and follow management decisions to rapidly promote business-level transformation.

This requires enterprises to establish a scientific and efficient digital system to meet the new human resource management challenges brought about by the digital age, which can be translated into the adoption of “strategy digitisation” and “service

productization.” By doing so, enterprises can embed data-based thinking into their strategic decision-making and subsequent implementations while efficiently aligning action plans between senior executives and regular employees.

In addition, the productisation of HR services can also improve the timeliness and coverage of internal strategy communications and help to dynamically maintain a healthy talent structure at an organisational level, such as by designing specific training to enhance employees’ skillsets and putting talented people in more suitable positions.

A comprehensive HR strategy

Based on research conducted by a team from Guanghua School of Management, Peking University, and researchers in Tencent Social Research Center and Tencent HR Technology Center, Tencent’s approach was to build a comprehensive data and analysis system, and implement a “service productization” strategy in HR management, so that senior executives can have access to better data to assist them with strategy and HR management decision making, and also ensure the accuracy and efficiency of strategy formulation and execution. At the same time, taking employees as users and transforming different modules of HR services into digital products can help employees increase their efficiency in the workplace, and gain necessary work skills that they don’t already have.

Tencent built a human resource data management system internally and, on its basis, further built out a data-based strategic decision-making mechanism. The company set up a management committee to oversee HR data governance. By centralising talent with data management and at the same time matching business demands with employees’ strengths through a talent indicator program, internal operational efficiency and cross-team collaboration were greatly enhanced. Through this centralised data governance mechanism, supplemented by the identification of talent deficiencies, digital tools equip employees with action guides and targeted training that better match seniorlevel strategies, which are then transformed into efficient and agile strategy execution.

Tencent’s goal management system was a great example of implementing the strategy of “service productization.” In the early “customer engagement” process, Tencent noticed that employees attached great importance to the timing of different action goals. However, many employees also had difficulties aligning their own goals with organisational ones. After a revamp and upgrade, the new goal management system allows employees to communicate and update their action goals from time to time through an automatic QA system, which also allows members of one team access to each other’s plans. The resulting instant and personalised feedback can greatly improve employees’ sense of participation and enthusiasm. At the same time, the optimisation system makes individual goals visible among employees in one team, so that they can better align their goals with the broader team and, furthermore, with the whole company.

HONG KONG BUSINESS | Q4 2022 13 MEDIA & ENTERTAINMENT

to implement a “strategy

HR management.

Tencent leverages digital

Additionally, in order to refresh the process of internal knowledge sharing, Tencent established an “expert” platform for employees to exchange and learn. The platform recruits experienced employees who are willing to share knowledge and provide knowledge sharing to colleagues in need, which improves the efficiency of knowledge input in learning and sharing. Teams and personnel can share open and productive conversations internally, facilitating the personal growth of employees as well as the development of the entire organisation. TENCENT BUILT A COMPREHENSIVE DATA AND ANALYSIS SYSTEM, AND IMPLEMENT A “SERVICE PRODUCTIZATION” STRATEGY IN HR MANAGEMENT, TO ENSURE THE ACCURACY AND EFFICIENCY OF STRATEGY FORMULATION AND EXECUTION

digitisation”and“service productization” strategy in

How

technology to strengthen HR management and enterprise agility

Why tax deduction on domestic rents is not really a win for tenants

Under a newly passed bill, up to $100,000 can be deducted from a tenant’s annual rent.

When the Inland Revenue (Amendment) (Tax Deductions for Domestic Rents) Bill 2022 was passed by the Legislative Council, it was called an “ease to the burden” of taxpayers who are renting; however, a law expert argues that the bill is not necessarily a win for tenants.

“Whilst it might look like tenants will be the real winners here, the reality is that only a small proportion will reap the full benefit,” Janice Yau Garton, Partner at Stephenson Harwood, told Hong Kong Business.

According to Garton, many taxpayers will still not be able to fully claim their actual cost of rent given the deduction ceiling of $100,000 for each year of assessment.

“Given the high costs of living in Hong Kong, especially with regards to property, the deduction ceiling may be too low for many taxpayers,” Garton said, adding that property costs in Hong Kong are amongst the highest in the world.

Garton further said that a $100,000 deduction amount for annual rent is only equivalent to a monthly rent of just over $8,300.

“Hopefully, the deduction ceiling will be raised for future tax years,” she said.

The law expert also raised the possibility that employers might also choose to remove their rental reimbursement programmes to let the government “address the cost of housing instead.”

In the short- to medium-term, however, this will be unlikely given that the market for top talent is as “competitive as ever.”

Garton also countered the government’s estimate that 430,00 taxpayers will benefit from the bill, given that taxpayers benefitting from rental reimbursement programmes with their employers will not be able to claim any further deductions for rent paid.

“Many taxpayers already enjoy a more favourable tax treatment offered by their employers under existing rental reimbursement programmes, some of which offer deductions of up to 50% of an employee’s salary,” the law expert said.

Apart from taxpayers benefitting from rental reimbursement programmes, the bill will also not benefit individuals who are provided with a place of residence by their employers.

Garton said the rule applies to the individual’s spouse. The spouse likewise should not have accommodation be provided by their employer.

To qualify for the tax deduction, Garton said the taxpayer must have a stamped tenancy agreement and live at the premises.

Taxpayers, including their spouses, must also not be the owner or be an “associate” of the owner of the property they are living in.

To claim their tax deduction, Garton said taxpayers must “complete the declaration as part of the tax return.”

“As the Amendment covers the year of assessment commencing 1 April 2022, this option is already available under a newly added Part 10A of the most recent tax return form,” she said.

“The IRD can ask to see a copy of the tenancy agreement and/or evidence of rental payments, so a taxpayer should keep all relevant documents such as originals of the lease/tenancy agreement and rental receipts,” the law expert added.

Property coverage

In terms of property type, Garton said the bill covers only the private housing market, which means that no deduction will be allowed for public housing tenancies with the Hong Kong Housing Authority or the Hong Kong Housing Society.

“Essentially, most types of domestic premises that are rented through the private housing market are covered, although the ordinance states that only domestic premises are allowed,” she said.

Under the bill, domestic premises were defined as “a building, or part of such a building, including a bedspace, cubicle, room, floor and portion of a floor” which is not illegal and is being used wholly or partly for residential purposes.

Whilst the bill does not cover public housing, Garton believes that it won’t affect the demand in the market.

“Public housing will still be in strong demand, even though this group of tenants would not enjoy any rental tax deductions, because public housing rents remain low, an average of around $2.3k per month,” she said.

As for the private rental market, Garton said the effect may be muted given that the bill does not provide “enough of an incentive” to make a significant difference to the market overall.

14 HONG KONG BUSINESS | Q4 2022

LEGAL BRIEFING

Given the high costs of living in Hong Kong, the deduction ceiling may be too low for many taxpayers

Public housing will still be in strong demand even though this group of tenants would not enjoy any rental tax deductions

Janice Yau Garton C M Y CM MY CY CMY K

How key aviation players are pushing the industry for takeoff

The HKIA told Hong Kong Business that it has projects like SKYCITY to support the aviation industry’s recovery.

up to support the aviation industry’s recovery. These projects include SKYCITY, which houses offices, hotels, Hong Kong’s largest retail, dining, and entertainment complex.

Through these development projects, HKIA aims to raise its capacity and enhance its functionality, and eventually transform itself from a city airport to an airport city.

Cathay announced that it will hire more than 4,000 front-line employees, including some 2,000 cabin crew

Whilst reports say that Hong Kong has lost its aviation hub status, key players in the city remained confident in the future of the industry. What gave Cathay Pacific, Hong Kong’s flag carrier, “great confidence for the long-term future” of the industry is the HKSAR government’s removal of the hotel quarantine arrangement for locally based aircrew and travellers.

“These adjustments will help boost sentiment for travel, thereby facilitating the gradual resumption of travel activities and strengthening of network connectivity to, from, and through the Hong Kong aviation hub,” the airlines said.

“As such, we are now projecting by the end of the year to be able to operate about one-third of our pre-pandemic passenger flight capacity—about double the passenger flight capacity we operated in August—and about two-thirds of our pre-pandemic cargo flight capacity,” a spokesperson from the airlines told Hong Kong Business.

In August, the airline saw an 87.6% year-on-year increase in its total number of passengers and a 82.7% YoY jump in its revenue passenger kilometres (RPKs).

In a previous statement, Cathay’s Chief Customer and Commercial Officer Ronald Lam said adjustments made to quarantine measures boosted

These adjustments will help boost sentiment for travel

inbound traffic to its home hub.

“This was particularly so for longhaul traffic from the US, Canada, and Europe,” Lam said.

Apart from the lifting of hotel quarantine measures, the airlines said the recent commencement of flight operations on the Third Runway at Hong Kong International Airport (HKIA) also gave the industry a confidence boost.

“Under the National 14th Five-Year Plan, Hong Kong has an important role to play in the overall development of the country. Notably, it reinforces the importance of strengthening the Hong Kong international aviation hub. The recent commencement of flight operations on the Third Runway at Hong Kong International Airport gives us great confidence for the long-term future of the hub,” the airlines said.

The airlines’ high hopes for Hong Kong’s aviation industry were shared by the HKIA.

“Despite the challenges posed by the pandemic, Airport Authority Hong Kong (AAHK) is confident in the long-term development of the aviation industry and the hub function of HKIA,” a spokesperson from the HKIA explained to Hong Kong Business.

Apart from the Three-runway System project, HKIA said it also has a myriad of development projects lined

E-commerce lifts aviation Whilst passenger traffic is still on its path to recovery, HKIA said it is being supported by high demand for e-commerce and transportation of medical supplies.

“The efficient air cargo community has worked together to raise the capacity to cater to the demand, so as to consolidate our leadership position in a challenging environment,” the spokesperson said.

In 2021, HKIA saw a throughput of 5 million tonnes, making it the busiest airport in cargo operations in the world.

HKIA, however, underscored that it had already seen a gradual increase in passenger traffic following the government’s relaxation of the quarantine requirements for inbound travellers.

In August, HKIA welcomed a total of 479,000 passengers, representing a growth of 116.3% YoY. Combining the first eight months of 2022, the airport handled 1.7 million passengers, a 141.5% YoY jump.

On a 12-month rolling basis, the airport handled 2 million passengers, marking 121.9% year-on-year growth.

In response to the increase, HKIA said the AAHK has begun working with its partners to prepare for the recovery of flights and passengers.

Cathay, for its part, has started a comprehensive recruitment plan to meet its operational needs over the next 18 to 24 months.

The airline announced that it will hire more than 4,000 front-line employees, including some 2,000 cabin crew.

16 HONG KONG BUSINESS | Q4 2022

REPORT: AVIATION

HONG KONG BUSINESS | Q4 2022 17

Here are five bad habits in insurance according to HK’s insurance regulator

These habits drag down Hong Kongers’ insurance literacy rate.

For a market ranking first globally in insurance penetration according to research firm Swiss Re Institute, it is surprising that Hong Kong’s insurance literacy rate stood only at 52%.

In the 2022 Report on Insurance Literacy Tracking Survey (ILTS) in Hong Kong 2021 by the Insurance Authority (IA), it was found that most, Hong Kongers are moderately literate when it comes to insurance.

“There was a general understanding about policyholders’ rights, insurance principles and product features, but limited knowledge of risk exposure and protection needs,” the IA said.

Bad insurance behaviours

Respondents of the ILTS were analysed based on the three dimensions of insurance literacy— knowledge and skills, attitude, and behaviour. The results revealed that bad insurance behaviours exhibited by Hong Kong citizens is the culprit dragging down the insurance literacy rate of the city.

For example, the survey revealed that when it comes to buying insurance, 72% of respondents relied on the advice and experience drawn from family members or friends instead of insurance or financial

professionals. IA identified this as the first behavioural bias—over-reliance on informal information sources.

Consumers who are overly reliant on their family or friends for information and advice is a sign of bandwagon effect.

“People often want to be on the winning side when they make a decision. As a result, they look towards their family or friends to see what is right and then jump on the bandwagon,” the IA explained.

The second behavioural bias is too much focus on promotions. Promotions offered by insurance companies affect consumers’ decisions via price complexity and misdirected attention. The former means consumers find it challenging to calculate true prices when they face multiple prices, such as discounts and add-ons, leading to confusion and increased possibility of errors. The latter means promotions reduce consumers’ motivation for mental effort, resulting in choices becoming less deliberate but driven by emotions and feelings.

Most consumers also seldom shop around for better insurance deals when purchasing or renewing insurance. Nearly half of the policyholding respondents were influenced

by promotion campaigns such as premium discounts, complimentary movie tickets, and healthcare services offered by insurers. On the other hand, a mere 15% of general insurance policy-holding respondents reviewed renewal terms carefully and shopped around when they renewed their policies.

Next is passiveness and inertia. The complexity of terms and conditions makes policy comparison very time-consuming. Moreover, policyholders often renew their policies with their current insurers due to a perception that switching is risky and with preference for the familiar rather than the best deal.

Lastly, most consumers do not take the time to read the terms and conditions of their policies as many find this too long and timeconsuming in addition to being written in complex legal languages. The perception most consumers think is that no one reads T&Cs or that they have no choice but to accept them thus there is no point in reading them.

Only 32% of policy-holding respondents read and study T&Cs before committing to acquire insurance coverage. 20% read neither policy details nor brochures. The rest simply focused on brochure information and relied on verbal advice from agents, brokers, family members, or friends.

Similar results

Talking to Hong Kong Business, Danny Lee, Chief Product Officer at Manulife Hong Kong and Macau said the key findings of the IA’s study mirror a study they done in February which revealed that most Hong Kong taxpayers do not still do not fully understand the characteristics and benefits of tax-deductible products.

Manulife’s survey asked Hong Kong taxpayers about their knowledge of a trio of tax-deductible solutions: Voluntary Health Insurance Scheme (VHIS), Qualifying Deferred Annuity Policies (QDAP), and Tax Deductible Voluntary Contributions (TVC) under Mandatory Provident Fund (MPF) schemes.

18 HONG KONG BUSINESS | Q4 2022

REPORT: INSURANCE

People often want to be on the winning side when they make a decision

Danny Lee

(ia.org.hk)

Insurance Literacy Scores Source:

Insurance Authority

HONG KONG BUSINESS | Q4 2022 19

STARTUP ECOSYSTEM

Improving Hong Kong’s startup ecosystem

Microsoft created an incubation programme in partnership with the government, corporate venture capitalists, and key stakeholders.

Even with an already vibrant and healthy startup ecosystem in Hong Kong—housing 3,750 startups, of which, 18 are unicorns— the industry is not without challenges. Microsoft Hong Kong pin-pointed three pain points for these newly formed local businesses.

According to Kelvin Tse, Director for Global Partner Solutions at Microsoft Hong Kong, startups are challenged by the lack of technological stacks to support and build their businesses; a marketing strategy that will introduce them to their target customers and promote their products; and escalation for them to expand their reach internationally.

Despite these, Microsoft believes that Hong Kong is the heart of information technology. With the push from the government to nurture the space, Microsoft developed an incubation programme—an interconnected system called

Microsoft for Startups Founders Hub.

“We joined hands with key stakeholders like the Hong Kong Science and Technology Parks Corporation (HKSTP), Cyberport, universities, and corporate venture capitalists to strengthen the startup ecosystem. Together, we plan to enhance Hong Kong’s status as an international IT hub,” Kelvin said.

Tech-based solutions

Currently, Microsoft has allotted around US$300k ($2.35m) worth of benefits for all stages of startups that have scaled and need to develop a robust business model.

In the hub, startups can access Microsoft products for free and build their own products using Microsoft Azure, Microsoft’s cloud computing service for application management.

Other accessible technology in the hub include Microsoft 365, Teams, Power Platform, and Power

Automate Dynamics 365, GitHub Enterprise, LinkedIn, OpenAI, Ansarada, and Drata.

“Startups can build their infrastructure or run their solutions on an integrated secure Cloud solution powered by Microsoft. Our education and training resources also help to upskill founders and their staff,” Kelvin said.

There is also an open AI platform in the hub for most tech startups or those creating AI-powered products. This platform gives them a pre-built data model they can take and recreate.

Additionally, through the hub’s technological platform, startups can automate their business processes, automation thus making sure that they become part of the ecosystem where technologies are stacked to support each other’s businesses.

“Accessing our ecosystem is more than a marketing strategy to enhance their market exposure, startups can explore business opportunities with Microsoft and our sizable corporate customers. Startups will also have a chance to expand into the international market with Microsoft’s support when they have demonstrated customer success,” Kelvin said.

An example of a successful startup from Microsoft for Startups Founders

20 HONG KONG BUSINESS | Q4 2022

Microsoft joined with key stakeholders like HKSTP, Cyberport, and more to strengthen Hong Kong’s startup ecosystem (Photo courtesy of Web Summit via Flickr)

We plan to enhance Hong Kong’s status as an international IT hub

Hub is Clearbot, a company that makes AI-powered self-driving boats that collects trash from the ocean, which recently won a contract with Hong Kong property firm Sino Group.

Open to all

For the startup accelerator program, Kelvin said they are not targeting any specific segment.

“Anyone with an idea can just use their LinkedIn profile to apply online and within five to seven days, [they] will get feedback from us,” Kelvin explained.

Microsoft uses a back-end engine that verifies each application and determines at which stage the startup is currently. Then they identify the type of funding or support the startup is eligible for.

“Our Founders Hub is built for founders at every stage. Our technical experts are prepared to help startups and offer guidance at any development stage. For founders’ backgrounds, we see both fresh graduates and mature professionals are eager to develop their entrepreneurship,” Kelvin said.

Currently, Microsoft has 100 startup founders enrolled in the program in Hong Kong, most of them in the fintech or retail sector. They are eligible for a global mentorship program, where they can get the advice of Azure technical experts at any stage of their business

implementation. Also available are the curated learning and content from the Microsoft for Startups

Founders School, which aims to help founders understand how to reach their business goals and sharpen their technical development ability. Startups participating in the hub can also forge connections with a broad customer base, Microsoft said.

Why Hong Kong

“We can see the government continues to allocate funding and resources to nurture local startups to grow. The Hong Kong government is committed to increasing research and development (R&D) spending from less than 1% of the gross domestic product (GDP) to more than 1.5%

STARTUP ECOSYSTEM

this business year. We can still expect massive funding resources injected into different universities, incubators, or corporate ventures,” Kelvin said.

Kelvin also observed that startups in Hong Kong are not just focused on making money, but on making a difference as well.

“[Hong Kong startups] have a big ambition to do some social good and create a positive impact in terms of ESG and sustainability,” Kelvin explained.

One example is a fintech startup called Know Your Customer, which, as the name implies, is a company focused on solving pain points in KYC and providing anti-money laundering process automation. The startup runs its entire platform using Microsoft Azure with AI and machine learning.

Microsoft managed to connect Know Your Customer with KPMG, one of the big four accounting firms in Asia. The two managed to go to market together by providing an end-to-end solution that lets financial firms comply with market regulations.

Aside from fintech, e-commerce, professional services, and logistics, Microsoft said they are seeing more growth for startups in terms of property tech, education tech, health tech, and sustainability tech.

Kelvin reiterated that through the Microsoft for Startups Founders Hub, Microsoft Hong Kong is committed to investing and supporting the startup community to grow and learn together and become a better, improved ecosystem.

HONG KONG BUSINESS | Q4 2022 21

More than 40 HK startups participated in the “Microsoft for Startups Founders Hub” programme (Photo courtesy of News.Microsoft.com)

Hong Kong startups have a big ambition to do some social good and create a positive impact

Through the Founders Hub, Microsoft HK is committed to supporting the startup community to grow and learn together and become an improved ecosystem

Kelvin Tse

STARTUP

SleekFlow allows online sellers to offer checkout on social media chat boxes

Through the platform’s One Click Checkout feature, online buyers do not need to visit or be redirected to a third-party website to complete their purchase.

When sellers receive orders through social messaging apps, they typically redirect buyers to a website or another platform to check out their orders. But with e-commerce platform SleekFlow, these steps become unnecessary as online sellers can directly collect payments through chat, which, in turn, allows businesses to easily convert their prospective customers into paying customers.

“We have a feature called One Click Checkout. The buyers can just DM (direct message) the agent, and they will be given a payment link. Without even logging in, they can receive an OTP (One Time Password) and checkout directly on the social media platform and have the goods delivered to the home,” CEO of SleekFlow, Henson Tsai, told Hong Kong Business in an exclusive interview.

Currently, SleekFlow allows checkout on WhatsApp, Instagram, Facebook, Telegram, Viber, and WeChat. It plans to add iMessage, and even TikTok, to its list of platforms in the future. “We’re seeing exponential growth [of e-commerce] in short videos or livestreaming in different countries,” said Tsai.

Data from Sprout Social showed TikTok, Instagram, and Whatsapp are the top social media platforms where most Millennials and Gen Z shoppers make their purchases.

Based on SleekFlow’s statistics, 20% of e-commerce journeys are completed solely on social media. The number is growing by 34% every year exponentially. According to Tsai, the market size will even reach three trillion in 2028.

Managing better conversations and conversions

SleekFlow also helps sellers, especially large ones, manage their conversations with customers by “segmentation and intelligent classification” of their concerns which can help companies in their workflows.

“Before, when companies try to

collect data from social media, they put everything into an Excel sheet, and on the next day, they have to distribute manually to different kinds of agents to follow up with the leads,” Tsai shared.

Through SleekFlow’s namesake SaaS software, Tsai said brands can help manage conversations, orders, payments, and their products across different social channels.

Data from previous conversations with customers can also be used by sellers for their future campaigns. “They can send out automation, targeted messages, birthday promos, to actually convert the customers,” said Tsai.

Tsai said brands can subscribe to use SleekFlow’s solutions for as low as US$70, whilst multinational companies would usually just need to pay US$20,000.

“We charge our customers based on how many customer contacts they have, and how many agents, sales or support agents are using our software,” he said.

Future plans

To further improve its solutions, Tsai said SleekFlow is polishing and expanding its solutions like order management to include post checkout experience.

“We want to provide a full suite of features like payment and commerce, booking, inventory, and even logistics,” added Tsai.

The Alibaba-backed startup is also eyeing to expand its services in the United Kingdom, France, Netherlands, and Germany.

Currently, the customer experience platform has services in Hong Kong, Singapore, and Malaysia. Amongst its clients include Lalamove, foodpanda, and Bossini.

Tsai said SleekFlow will use its US$8m funding it recently bagged in a Series A round led by New York-based investment firm Tiger Global Partners in making its plans come to life.

Tsai said SleekFlow will continue to focus on conversions and stick to its goal of “driving revenue for brands on day one.”

22 HONG KONG BUSINESS | Q4 2022

Currently, SleekFlow has services in Hong Kong, Singapore, and Malaysia (Photo: SleekFlow team)

We’re seeing exponential growth of e-commerce in short videos or livestreaming

Henson Tsai

How AiR World drives more foot traffic to businesses with ‘metaverse-to-go’

Users visit their partner malls that serve as a gateway to the metaverse 3 to 5 times a month.

No danger

Whilst AiR requires players to go out and experience metaverse, Kwong assured that players are safe when they do so because all location gateways are places where a person would usually visit.

“The gameplay happens naturally throughout one’s life and everyday experience. We’re not really asking the players to go somewhere dangerous or in the woods. We’re basically just asking our players to live their lives and along the way, when they go to a shopping mall they might encounter some of our metaverse gateways in which they can easily access and enjoy with our mobile app,” Kwong said, adding that the AiR metaverse’s concept is “lifestyle gaming.”

Remember the phenomenon that was Pokemon Go, and how it boosted foot traffic in malls all around the world? This was what AiR World founder Gabriel Kwong has been doing for local businesses in Hong Kong, but he did it by incorporating the latest talk of the town - metaverse.

Kwong and his team created a metaverse-to-go gaming platform where real-life, physical locations act as a gateway to another dimension of AiR’s virtual world.

“AiR means ‘Adventure In Reality.’ So what I’m trying to do is, I want to add adventure elements in the form of gamification into real life. We’re placing this metaverse experience into the real world,” Kwong told Hong Kong Business.

“Let’s say you go to a fast food shop chain. On the tray, you will see a paper with a message ‘Why don’t you come to Burger Land?’ and a QR code. By scanning that QR code through the AiR metaverse mobile application, users can play some games, collect virtual items that can also win them a free burger from the restaurant.To the business that means conversion, and to the consumers it’s a fun way to earn a free burger” Kwong added.

Kwong said players can also collect virtual items in one location and use it in another gateway.

“For example, in the Burger Land, you might be able to collect some seeds which can be used in the Farm Land, located in another shopping mall. These seeds, when planted, might grow into a fruitbearing tree. The fruit you harvest from that tree has corresponding points which can help you redeem, let’s say a parking coupon.”

True to their claim of driving foot traffic, Kwong said a single user of their platform would visit their partner malls at least three to five times a month to access their metaverse gateways.

“People don’t visit shopping malls that often, and if they do, it’s likely just once every two to three months,” Kwong added.

As of August 2022, AiR metaverse has 10,000 active users and has recorded close to 100,000 QR code scans which according to Kwong means that users are really going to the physical gateways.

“That’s how gameplay and actual business conversion can work together. That’s how we use our metaverse ecosystem to bring two partners together,” Kwong said.

Kwong also said that one game section would take two to three minutes max.

“You can scan to play something while waiting for your food or waiting for your transportation at the Subway or the bus station,” he said.

The game also has no age restriction. “There’s no game that is not suitable for a younger audience. We actually have parents who told us that their kids enjoy playing simple games at different locations like farming and fishing, etc. There are also senior people who are into collecting benefits from shopping malls,” Kwong said.

He hopes that through the AiR metaverse, businesses and non-crypto savvy users can understand the metaverse better and see its benefits.

“Metaverse to average people or businesses is still more like a PR stint. When people want to know more about what metaverse can do for the general public or businesses, there’s still not a clear indication or a clear path,” he said.

“We wanted to make metaverse practical, meaning there is deliverable. What we’re trying to do here is to be able to lower the entry barrier, to make sure that [businesses see] metaverse as beneficial, more accessible, and approachable,” he added.

HONG KONG BUSINESS | Q4 2022 23

STARTUP

The gameplay happens naturally throughout one’s life and everyday experience

AiR metaverse’s concept is “lifestyle gaming”

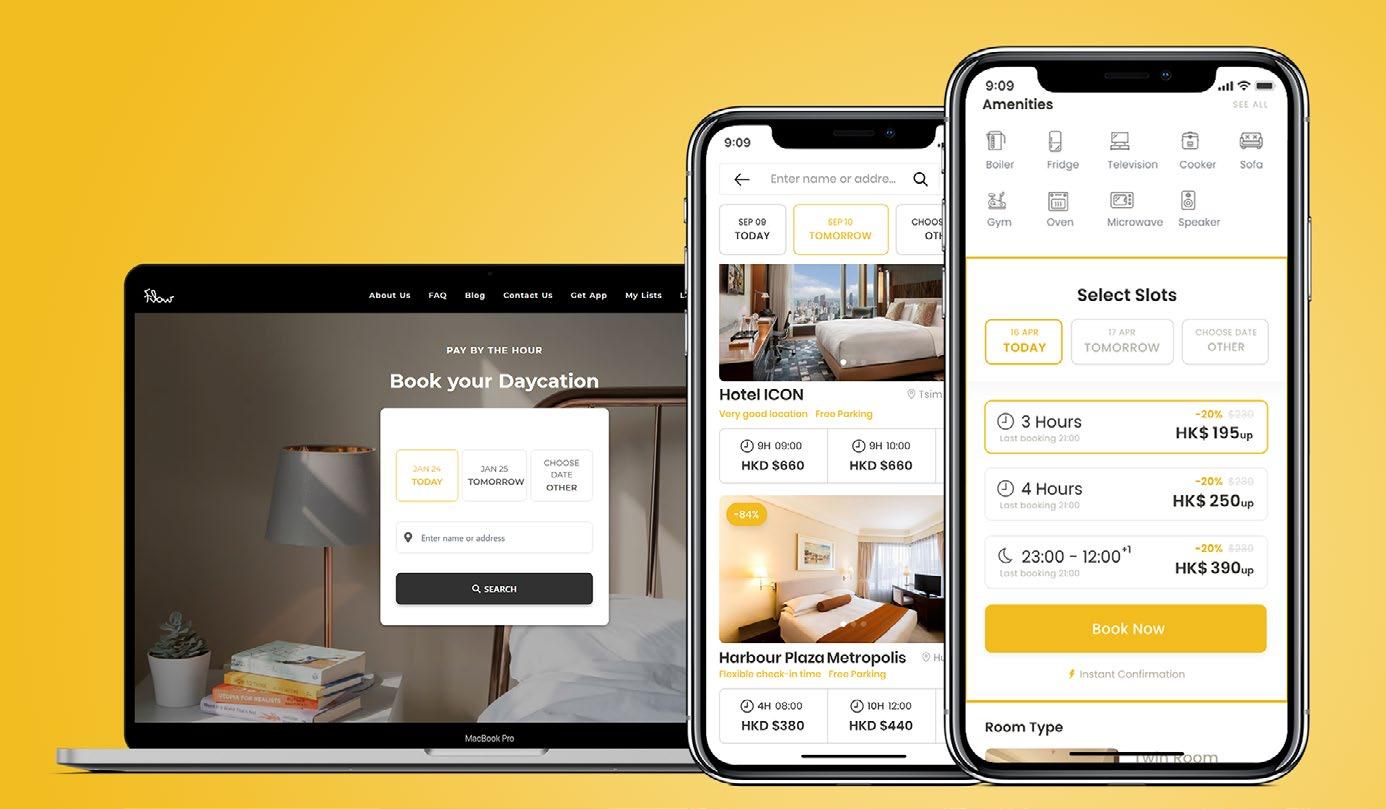

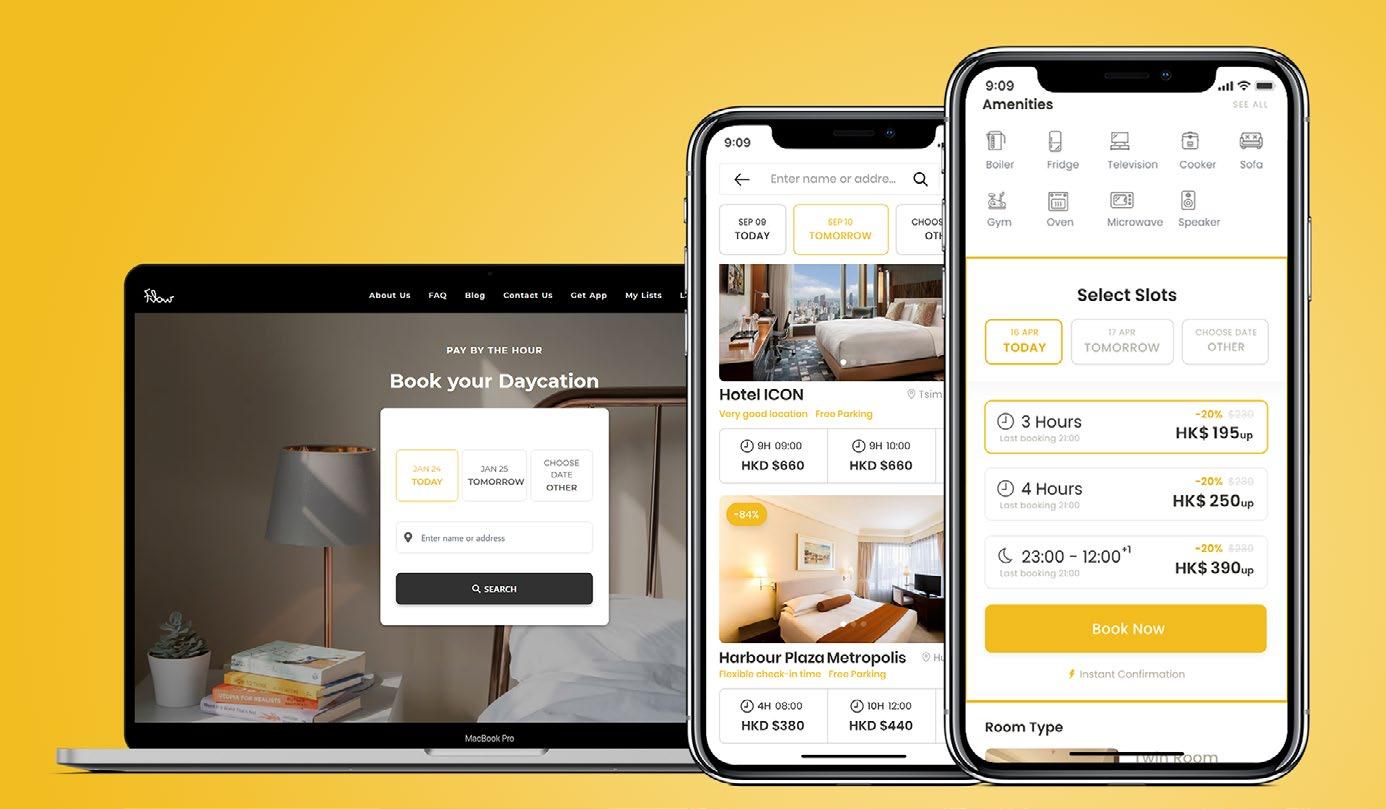

Entrepreneur Eric Lai would often go on short business trips in his previous jobs, and what would always frustrate him is how he had to pay for a 12-hour stay, but only stay in the room for less than five hours. This frustration is what led him to create Flow, a booking platform which allows users to book with flexibility.

“I almost never check in at 2 pm, but instead late at night. I also had to check out early in the morning to catch a flight,” Lai told Hong Kong Business in an interview.

Apart from benefitting customers by paying less, Lai also thought that allowing flexible booking would allow hotels to “resell empty times during daytime after a guest checks out,” which, in turn, would help them increase revenue.

“You can think of us as the Booking.com for half-day hotels. You choose a hotel, choose a duration, and choose a check-in time,” Lai said.

“This will be suitable for business travellers, short-haul travellers. For example, people coming from the Mainland or Macau. Most of them do not stay overnight and actually just come and go within the same day for client meetings,” he added.

Data from the Hong Kong Tourism Board showed that in 2019, there were 32 million same-day

travellers who visited Hong Kong coming from the Mainland.

As most of the bookings in Flow are “instant,” users can also book even a day or two before their desired stay, added Lai.

A traditional overnight stay at a four-star hotel would cost around $700 to $800. Rooms available in Flow usually cost $400 for four-star hotels for a four to five-hour stay.

Localised payment methods

Flow offers local payment gateways like Octopus for Hong Kong, GrabPay for Singapore, and ShopeePay for Malaysia.

“We support all kinds of local payment gateways because we see this as an important move. Localisation is our direction,” Lai said. adding that their payment methods are one of Flow’s advantages against other booking platforms.

Other payment methods that Flow provides include VISA, Mastercard, AMEX, Apple Pay, Google Pay, and PayMe.

Flow also does not charge customers extra fees for booking at their site, and only earns through commission from their 300 partner hotels, which include Travelodge Hotels, ibis Hotels, Holiday Inn Hotels, Novotel, Dorsett, Pullman, Intercontinental, and more.

“We charge commission out of every booking that we facilitate for the hotels and there will be no extra fee to be charged from the guests,” Lai explained.

“We provide a web-based portal for hoteliers to easily manage their timeslots and prices, which are then listed on our Flow Website and Flow App, in real-time. We usually advise hoteliers to offer four to eight hour sessions, for example 10 am to 5 pm or 3 pm to 10 pm session, but it can be fully adjustable catering to hotels’ operations,” he added.

Getting three to five-star hotels to partner with Flow was a challenge. For them, more booking during the day means more cleaning up.

“The way we dealt with it was we encouraged them to start with just a few rooms and test it out. After a while, they were okay with the setup. Eventually, the extra revenue that we generated for them was able to cover the extra cleaning costs they incurred,” said Lai.

“Most of our hotels price a session at least 30% lower than an traditional overnight price. Thus, if the room is being sold by two sessions in a day, that already results in 40% more revenue than selling by just one full night, since 70% plus 70% is equals to 140%,” he added.

To date, Lai said Flow has facilitated over 200,000 flexible room bookings and brought US$10M additional booking revenue to their hotel partners.

Not just hotels

Hotels are not the only spaces which locals can book through Flow. The marketplace also allows flexible booking of co-working spaces.

Lai said he wanted to add flexible co-working spaces in Flow given the the rise of hybrid work setup. According to Lai, most of their users are freelanders, or employees who often have client meetings outside. For more on this story, go to https://hongkongbusiness.hk/

24 HONG KONG BUSINESS | Q4 2022

Flow allows for flexible booking for short-haul travellers

2-hour hotel stay and anytime-check-in

Flow, customers can cut 50% to 70% of the price they usually pay for an overnight stay. STARTUP You can think of us as the Booking.com for half-day hotels

On a day trip? This marketplace allows

With

Eric Lai

ANALYSIS: RESIDENTIAL PROPERTY

HK’s poorest to be hit hardest by extended waiting time for public flat

Home size adjustment will be unlikely in the city after the average waiting time for public housing hit a record-high.

Hong Kong’s poorest families hoping to live in more spacious houses can bid their dreams goodbye because the per capita living space issue in the city will not be resolved anytime soon, especially after the average waiting time for public housing was extended to a record-breaking 6.1 years by end of March this year.

Waiting time is defined by the Housing Authority as the “time taken between registration for PRH and first flat offer, excluding any frozen period during the application period.” The 6.1 years was the longest average waiting time in 23 years, according to JLL. By June, however, waiting time was slightly reduced by 0.1 to 6 years.

“As the government has pointed out, the current per capita living space in Hong Kong is smaller than our adjacent cities. Without providing more public rental housing, it cannot effectively solve the per capita living space issue,” said Martin Wong, Director and Head of Research & Consultancy, Greater China at Knight Frank, told Hong Kong Business

In 2021, the average living space of public rental housing (PRH) tenants in Hong Kong was 13.1 square metres per person, which is almost the size of a jail cell.

Longer waiting time

Given the current pace of turnover in public housing, Wong added that the waiting time could even get close to seven years within five years.

This was echoed by JLL in its report, saying that if the pace of new application volume will continue, “the number of pending applications will accumulate further and the average waiting time for PRH lengthen.”

As of March 2022, there are 147,500 outstanding applications for PRH, and the annual average production of PRH in the coming five years is 12,400 units.

JLL added that based on the Transport and Housing Bureau projection, only one-third of the

government’s one-year supply target or 105,000 public flats will be completed by 2026 or 2027, which will still not be enough to house the current 147,500 applicants for PRH. By the end of June, general applications for PRH had hit 144 200, whilst there are 98 400 non-elderly one-person applications under the Quota and Points System.

Shortening the waiting time

To shorten the waiting time, Wong said some private developers have been actively providing land to develop subsidised flats, whilst the government has been investigating ways to provide more public housing like land sharing pilot scheme for agricultural land development and transitional housing development.

Transitional homes are built to accommodate low-income families who were not or have yet to be granted public housing.

By boosting the supply of transitional housing, Norry Lee, Senior Director of Projects Strategy and Consultancy Department at JLL Hong Kong, said the shortage of RPH can be relieved.

“In view of the efficiency in the construction of transitional housing, we believe the authority may boost the supply of transitional housing in the coming two to three years as a

temporary solution to alleviate the long wait. Whereas in the longer term, sufficient land supply for PRH is the fundamental solution to the housing problems in the city,” Lee said.

Nelson Wong, Head of Research at JLL in Greater China, echoed Lee, saying that by placing residents in transitional housing, they could at least be free from staying in “old and dilapidated units, sub-divided rooms or accommodations in industrial buildings,” which bear “undue safety and security risks.”

As of April 2022, the government said it has enough land to build 19,000 transitional housing units. Of the total, 4,100 are scheduled to be completed in 2022. Amongst transitional projects recently completed was the ‘1 Cheong Sun,’ which offered 205 units.

Measures like transitional housing, however, “would take some time to implement,” according to Wong and would only shorten the waiting period, but not address the lack of public housing.

On the flip side, Wong said the government has been “spending more effort in developing subsidised flats,” which can reduce the waiting time, though not in the short term.

“The waiting time…will be alleviated once the provision is ready in the new development areas,” said Wong, adding that the public-private housing provision ratio in new development areas will be 7:3.

HONG KONG BUSINESS | Q4 2022 25

The current per capita living space in Hong Kong is smaller than adjacent cities

Martin Wong

Norry Lee

Nelson Wong

Fintech funding slows as COVID’s digital hype fades

Valuations of stocks, both public and private, are down 60%, analysts said.

Fintech funding hit a record number of volumes in 2021, with 5,684 fintech deals for a whopping US$210b in total investments garnered during the year–the second-highest annual total ever, according to data from KPMG. Yet come a year later and the global fintech investment market is in a downward trend. Global fintech funding fell 33% quarter-over-quarter to hit US$20.4b — its lowest level since the fourth quarter of 2020, CB Insights reported.

The APAC region was not spared, where apart from a few certain markets, the fintech sector saw investments funnelled towards them shrink in the first half of 2022.

This is not just a fintech problem, analysts told Hong Kong Business. The volatile stock and investment market situation has pushed investors to take the flight to the sidelines and keep their monies close at the moment. Fintechs were not spared from the cautiousness.

Unicorn minting has stilted as investors take a more sanguine view of the business fundamentals of fintech firms

“There’s been a consistent declining trend in 2022 across IPOs, SPACs, and M&A transactions, not only fintech funding. Investors bearing losses from stock market valuations will become more selective in making new investments,” Tzu-Chung Liang, Southeast Asia financial services strategy and transaction leader at Ernst & Young, told Hong Kong Business in an interview.

In particular, the rising interest rates and renewed fears of a recession encouraged investors to focus first on business fundamentals and exercise more caution on where they sink their funds into, said Anton Ruddenklau, Partner and Global Head of Fintech, KPMG International.

“Rising interest rates to combat inflation has added to the cost of capital and therefore the required return on that capital. This has sharpened investor resolve to target fintech firms that are more structurally profitable, are at a later stage in the funding journey or that