Shoppers

MY’s

Three

Shoppers

MY’s

Three

How

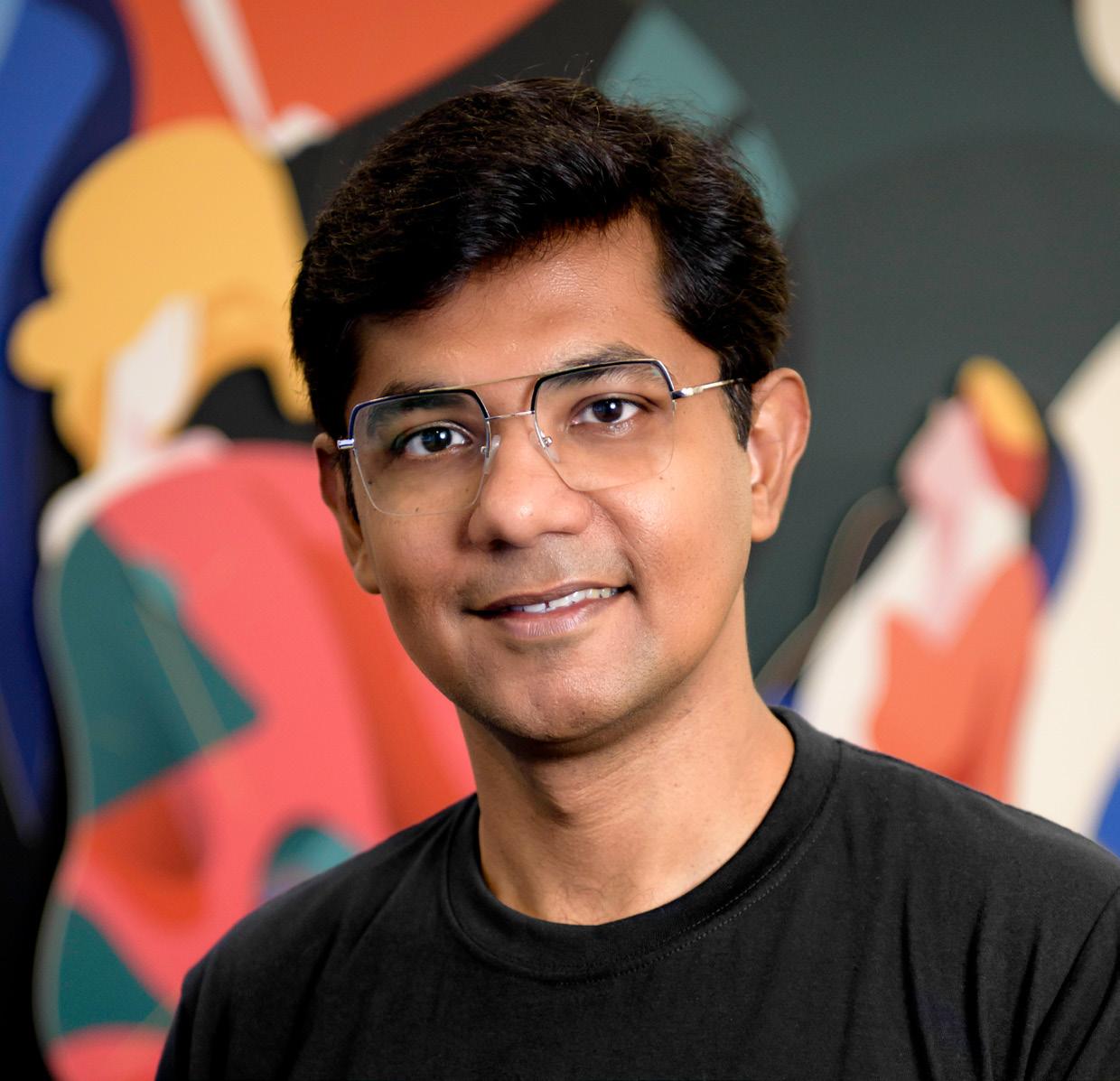

Vincent Huang VP of Overseas Business Department, MINISO p. 16

A DECADE IN THE GAME, MINISO TRANSFORMS INTO A LIFESTYLE SUPER BRAND

About Us

Retail Asia is the industry magazine serving Asia’s dynamic retail landscape. Each issue carries a balanced mix of articles that appeal to the C-level executives of large retail companies in Asia. Now a part of the award-winning Charlton Media Group, the brand attracts a combined print and online audience of more than 199,000.

Do reach out to us if you would like us to tell your story to our readers via print and online advertising or events.

PUBLISHER & EDITOR-IN-CHIEF Tim Charlton

PRINT PRODUCTION EDITOR

COPY EDITOR

PRODUCTION TEAM

Asia Pacific is witnessing a shift in consumer behaviour as people are looking for more hyperphysical and tactile experiences. The pandemic has led to the emergence of a new type of consumer known as the "sensory adventurer". This change has compelled retailers to elevate their stores' appeal and offer more interactive experiences to shoppers.

Jeline Acabo

Tessa Distor

Charmaine Tadalan

Vann Villegas

Consuelo Marquez

Ibnu Prabowo

Aulia Pandamsari

Gen Zs don't shy away from spending money on themselves, which puts them well in place to become the luxury market's largest consumer base in China. Meanwhile, Malaysia's retail sector may be impacted by the government's proposal to impose a tax on luxury goods, with retailers concerned that consumers may turn to neighboring countries to shop instead.

COMMERCIAL TEAM

GRAPHIC ARTIST

Janine Ballesteros

Jenelle Samantila

Simon Engracial

ADVERTISING CONTACT Reiniela Hernandez reiniela@charltonmediamail.com

ADMINISTRATION ACCOUNTS DEPARTMENT accounts@charltonmediamail.com

ADVERTISING advertising@charltonmediamail.com

EDITORIAL ra@charltonmedia.com

SINGAPORE

101 Cecil St., #17-09 Tong Eng Building, Singapore 069533 +65 3158 1386

HONG KONG Room 1006, 10th Floor, 299 QRC, 287-299 Queen's Road Central, Sheung Wan, Hong Kong +852 3972 7166

MIDDLE EAST

FDRK4467,Compass Building,Al Shohada Road, AL Hamra Industrial Zone-FZ,Ras Al Khaimah, United Arab Emirates

www.charltonmedia.com

PRINTING Times Printers Private Limited 18 Tuas Avenue 5, Singapore 639342

www.timesprinters.com

a member of Times Publishing Limited

Editorial Enquiries: If you have a story idea or press release, please email our news editor at ra@charltonmedia.com. To send a personal message to the editor, include the word “Tim” in the subject line.

Media Partnerships: Please email ra@charltonmedia.com with “Partnership” in the subject line.

For subscriptions, please email: subscriptions@charltonmedia.com

Retail Asia is published by Charlton Media Group. All editorial is copyright and may not be reproduced without consent. Contributions are invited but copies of all work should be kept as Retail Asia can accept no responsibility for loss. We will however take the gains.

Sold on newstands in Singapore, Malaysia, Hong Kong, London, and New York. Also out on https://retailasia.com

**If you’re reading the small print you, may be missing the big picture caveat emptor

Despite the rise of secondhand markets, consumers still have reservations due to the fear of purchasing fake products. Singaporebased recommerce platform Ox Street is campaigning for the consumption of secondhand items through its authentication process. Ox Street CEO Gijs Verheijke details the company's strategies in an interview on page 20.

Lastly, Retail Asia proudly launched the Bangkok leg of the Retail Asia Forum 2023 in April. During the forum, retail leaders and experts were able to network, share insights on the developments in the industry, and present opportunities that can be explored in the near future.

Read on and enjoy!

Tim CharltonRetail Asia is a proud media partner and host of the following events and expos:

When Erajaya introduced its four new business lines in 2021, the company wanted to strengthen its presence amongst two different types of consumers—the one that checks reviews online via YouTube and other social media platforms; and the other who wants to see and touch the item.

In the past two years, Love, Bonito has been accurately forecasting the demands of its customers, with a monthly mean average percentage error of less than 10%. Because of this accuracy, the brand is able to prevent overproducing items and cut out underperforming products.

As of September 2022, there are only 13 unicorns in Indonesia. One of them, an omnichannel commerce and lifestyle platform called Blibli shared with Retail Asia its strategy for achieving a capitalisation value of US$1b. The master plan is detecting counterfeit goods every day.

Hong

Educational toy, Tonieboxes, is launching in Hong Kong, but faces a challenge with the city's declining birth rates. Despite this, the Managing Director at Jebsen Consumer believes that children remain important to parents and they like to develop their kids from an early age.

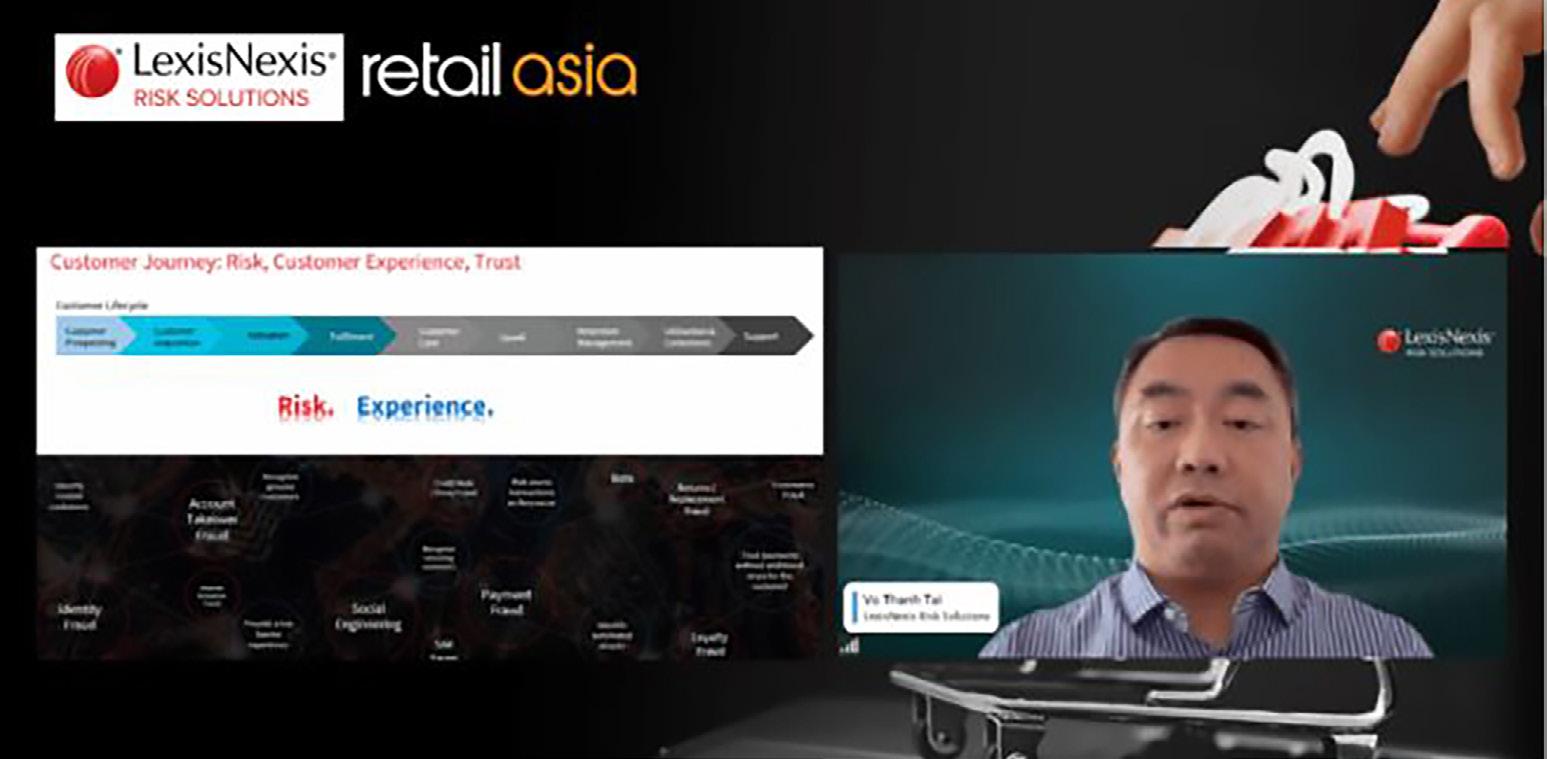

Conversational commerce levels the playing field for brands online

As brands expand their online presence through social media, the adoption of conversational commerce has become popular. Conversational commerce benefits brands by allowing them to control sales channels and reduce returns, making it an equal playing field for all brands.

From the traditional advertising spaces such as television and radio, marketing strategies have evolved and found a new space to attract more customers: social media. If brands fail to keep up the fight online, they risk losing their potential customers to their competitors, a marketing expert said.

Online stores have expanded aggressively in recent years, leading the industry to question the future of brick-and-mortar stores; but CBRE found that fewer than 5% of consumers in the Asia Pacific shop purely online, proving that it is not over yet for physical stores.

In its 2023 Asia Pacific Retail Flash Survey, CBRE found that nearly half of the retailers in the region expect a portion of online spending to be shifted to physical retail and 42% see that footfall in physical stores will return to its pre-pandemic levels.

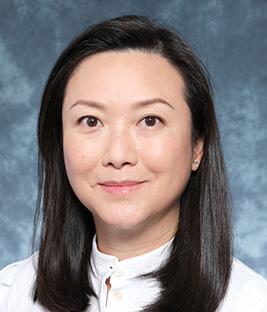

“One very important fact is that fewer than 5% of consumers purely shop online. There is a huge range of hybrid shoppers, who have different shopping behaviour,” Ada Choi, CBRE’s head for occupier research and intelligence and management in APAC, told Retail Asia. “This is also a challenge for the brands that have to cater to different shoppers’ behaviour switching between online and

offline and be able to address those issues.” CBRE found in the same survey that operating online retail platforms are increasingly becoming expensive, driven by higher transportation costs, supply chain disruptions, and labour shortages. In addition to this, Google has increased its cost-per-click fee by 15% in 2021 which was particularly detrimental to smaller retailers.

For these reasons, 66% of retailers project that it would be costly to operate online businesses this year. Moreover, 71% of retailers are planning to expand or add new stores in 2023, whilst only 15% have plans to right-size. “I think for the new generation of physical retail stores, they have to support online shopping, and fulfill other very interesting demand from the shoppers – Instagrammable or more social

media-friendly kind of elements,” said Choi. The CBRE survey also showed that whilst the younger generation is more tech-savvy, the majority of them are more likely to shop offline as they represent the market that looks out for potentially creative social media posts.

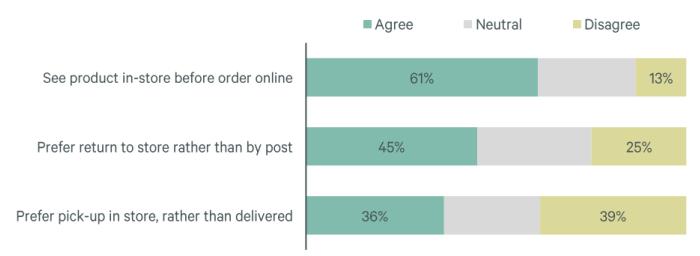

Choi added that interestingly, 61% of shoppers in the region prefer to see products in-store before ordering online, which she linked to the more condensed living environment in the Asia Pacific. This is also higher than in Europe and the Americas – yet another proof that physical stores are here to stay, she said.

“It is easier for us to go to the shopping centres and take a look at the product… The reason for going to an offline store is always about expertise, the experience… and [because] they need to feel the product,” Choi said. “I think this also makes it very important for the retailers to continue to optimise their sales network and be able to assess their consumers in different parts of the market,” she added.

Physical retail stores have started to stabilise in the latter part of 2022, and investments in the sector have improved. Choi, however, noted investment sentiments in retail are still behind other sectors, such as the office and industrial markets.

In this light, CBRE projected a “largely flat” investment volume during the year. “There are quite a lot of uncertainties. For example, the volatility in the financial markets, and the concerns about the banking sector. This will also affect the investment sentiment as a whole and therefore also the retail investment,” said Choi.

“Another investment driver is the interest rate environment. As we note, the US has had the steepest increase in interest rates in the past year. At this moment, people are expecting the interest rate to peak within the middle of this year and if this happens, the sentiment will improve after we hit that peak. Let’s hope for this to come earlier,” she added.

Retail investments have been led by markets that reopened their borders early on, including Australia, Singapore, and Japan. Japan is amongst the most preferred markets as it is not affected by high-interest rates. Also, Hong Kong may be in the running as it rebounds after reopening alongside Mainland China, added Choi.

The reason for going to an offline store is always about expertise and the experience [to feel the product]

Atotal of 60 companies from the Asia Pacific (APAC) region were amongst the Top 250 retailers globally with their total revenue for the financial year 2021 increasing by 9.7% to $887.6b, according to a report by Deloitte.

In the Global Powers of Retailing 2023 report, Deloitte said the region’s revenue accounted for 15.7% of the total globally behind North America which comprised 47.9%, and Europe at 33.2%. The revenue from retailers in Latin America was at 1.7% of the total and the Africa and Middle East at 1.3%.

“The strong performance of Asia Pacific’s leading retailers was

mainly driven by sales through digital channels and international expansion,” Deloitte said.

Deloitte also said that Japan, China/ Hong Kong SAR, and South Korea are the top growing retail markets in the region, posting a revenue increase of 11.1%, 10.8%, and 3.9%, respectively. Japan has the highest number of companies in the list at 27, followed by China including Hong Kong (13), South Korea (6), Australia (5), Indonesia (2), Thailand (2), Taiwan (2), India (1), the Philippines (1), and Vietnam (1). Only China’s JD.com, Inc. made it into the Top 10, rising two places to rank 7 with retail revenue of around $126.4b. The other

round 61% of shoppers in the Asia Pacific prefer seeing a product instore before ordering online, higher compared to consumers in Europe and the Americas, according to CBRE.

In its 2023 Asia Pacific Retail Flash Survey, CBRE found that only 13% disagreed with this; whilst others were neutral.

Moreover, 45% of the shoppers in the region prefer to return to the store rather than by post, whilst the 25% disagrees and the remaining were neutral.

It also found that 36% prefer to pick up the product they ordered, rather than have it delivered, whilst 39% do not share the same view and the others were neutral.

“Whilst evidence shows that physical stores will remain at the forefront of sales strategies, CBRE believes their role must adapt and evolve to serve omnichannel retail,” the report read in part.

“This evolution will see retail stores shift away from being locations purely where transactions are made, towards becoming hubs that provide comprehensive customer experiences,” it added. CBRE said that some retailers are displaying in brick-and-mortar stores a small volume of products that are sold only online to allow consumers to feel and test they products before they order them.

There are also retailers who are helping consumers make their online orders in-store and ship them directly, allowing businesses to reduce their inventory at their physical stores. First practised by home appliance sector, more general retail categories such as luxury, beauty, and cosmetics are also integrating this model in their business.

The report added that offering in-store returns will also help retailers attract customers to buy more in-store and reduce the re-stocking period which would also cut the reverse logistics costs.

companies that made it to the Top 10 were Walmart Inc. (1), Amazon. com, Inc. (2), Costco Wholsesale Corporation (3), Schwarz Group (4), The Home Depot, Inc (5), The Kroger Co. (6), Walgreens Boots Alliace, Inc. (8), Aldi Einkauf GmbH & Co. oHG and Aldi International Services GmbH & Co. oHG (9), and Target Corporation (10).

The integration of technology in the retail industry is gaining traction as it is playing an important role in enticing customers to go to physical stores and enabling immersive shopping experiences.

Technologies like virtual and augmented reality, artificial intelligence, and data analyticswill also provide customers with personalised recommendations, make the checkout processes smoother, and engage consumers.

“Ultimately, the future of the store is all about being where the consumer is – from the more traditional brick-and-mortar stores to metaverse storefronts and everywhere in between,” said Pua Wee Meng, Deloitte Southeast Asia’s Consumer Industry Leader.

“But retailers looking to incorporate emerging digital technologies into their customer experience will likely need to address both strategic and technical considerations,” he added.

Luxury sales in China are expected to reach its 2021 sales level this year after contracting in 2022, Bain & Company reported.

“Luxury consumption will recover as COVID subsides, mall traffic improves, and consumer sentiment rebounds. We expect to see 2021 sales levels sometime between the first and second half of 2023,” Weiwei Xing, a Hong Kong-based partner at Bain & Company said. “Whilst optimism abounds, there are also risks. Brands need to resolve pricing gaps between China and Europe before international travel resumes. In addition, as more Chinese HNWIs are residing outside of China, luxury brands must deliver excellent experiences everywhere in the world.” Personal luxury market sales in China contracted by 10% year-on-year in 2022 for the first time in five years.

Bain & Company linked this to COVIDrelated lockdowns in the second quarter of the year as well as the weaker consumer sentiment resulting from the decline in the real estate market and the higher unemployment amongst others. “Whilst most brands saw declines in 2022, a few stayed flat or grew despite challenging conditions,” Bruno Lannes, a Shanghai-based senior partner at Bain & Company, said.

“Three factors contributed to their success – first, bigger brands outperformed smaller players on average; second, brands with iconic portfolios did better than those with trendy or seasonal merchandise and finally, brands with a higher concentration of Very Important Clients (VICs) fared better.”Despite this contraction, Bain & Company observed higher sales from VICs as the economic downturn largely affected entry-level luxury consumers. VICs who bought more than three times a year accounted for more than 50% of sales.

Gen Zs are a new breed of shoppers, having been born in the digital age, and retailers have developed ways to tap into this demographic. With three out of five Gen Zs saying augmented reality will make their lives easier, retailers are now pressed to look at AR as another venue to meet shoppers’ needs.

“Gen Zs as consumers are generally well-versed in digital marketing, as more of them are engaging in building their personal ‘brand’ online,” Dan Heffernan, Head of Global Agency, APAC at Snap Inc., told Retail Asia

“This means that they expect an updated media and communication planning strategy that’s not only authentic but also relevant to their lives," Heffernan explained.

‘Gen Z’s personal brand’ Heffernan observed a growing desire for authenticity and Gen Zs sit in its centre. As consumers, Gen Zs seek greater transparency as they are inclined to reimagine online life and turn it into something that feels real, fulfilling, and genuinely fun.

“We expect that as the first truly digital generation, Gen Zs will continue

to redefine the elements of personal branding with authenticity and originality in the years to come as more social media platforms continue to emerge,” he said.

In this light, Gen Zs as consumers give emphasis on the purpose of brands. In 2023, Heffernan noted that this market is expected to follow brands that reflect their values and motivations in their messaging and brand standing.

“Gen Zs are looking for brands that can complement the spaces they are creating — spaces that are supportive and encourage self-expression and self-exploration. Brands should look to share content that authentically portrays who they truly are and what they stand for,” Heffernan added.

In a report, Snap found that 63% of Gen Zs expect AR to make the shopping experience easier for them, whilst 92% have expressed their interest in using AR for shopping. This gives rise to a need for retailers to invest in AR experiences and other emerging technologies. Moreover, Snap reported that more than two-thirds of shoppers who used AR say they intend to purchase products after using it, whilst 80% of shoppers who use AR during their process say they feel more confident in their purchase as a result of using that interactive technology as it gives them a more accurate and full view of the product.

Capturing Gen Zs

“AR has the power to re-centre the shopping experience entirely around the individual consumer, and Gen Zs are starting to expect this from their brands,” said Heffernan. “They want to seamlessly interact with, try on and purchase products, and share the experience with their friends.”

Snap has partnered with luxury fashion house Christian Dior Couture to offer users a realistic try-on experience for six pairs of Dior sneakers. In the case of Esteé Lauder, shoppers were able to virtually try on different products, such as a primer, foundation, and lipstick. Snap has also allowed shoppers to head directly from the app to the brand’s online shop to make a buy, bringing a more seamless shopping experience.

With AR, not only can Snapchat users try on the products, they can also send Snaps to their friends and family and consult them beforemaking a purchase.

Gen Zs will continue to redefine the elements of personal brandingDan Heffernan

The flexitarian meal plan is for consumers looking to reduce their consumption of animal-based products.

Eatology started offering Hong Kongers science-backed meal plans in 2015, seeing the need for a more practical and sustainable diet that works well with customers’ lifestyles. It has since launched meal plans for vegetarians, vegans, and even pescetarians, but Eatology saw that not everyone can make the full move to becoming a vegetarian; hence, it curated a new meal plan.

Through a flexitarian meal plan, Eatology hopes that consumers looking to change their diets can consume more greens without ditching meat. Flexitarians are also occasionally known as flexible vegetarians or casual vegetarians.

“The flexitarian diet is sustainable for people to eat every day. We already have a vegetarian diet, in place for a long time, but some people are not ready to make the full move—that’s why we created a way to bring something in between

that is easier to follow,” Christophe Daures told Retail Asia

Citing a Temasek report, Eatology said that flexitarians made up 42% of the global market in 2021 with a quarter of Southeast Asians and Australians saying that they eat less meat now compared to three years ago.

Daures co-founded Eatology with Guillaume Kaminer. Eatology’s target market comprises men and women between the ages of 25 and 65, but mostly, its clients are busy young individuals who want to save time and start a healthy lifestyle.

Through the flexitarian meal plan, Eatology sought to encourage Hong Kongers to cut their consumption of meat or fish to once a day as an initial step toward improving their health.

“People tend to overeat protein these days because they read in

magazines that they should eat lots of protein because they’re going to lose muscles, which is not true,” Daures shared. “[The meal plan] helps to reduce the amount of protein that you are absolving, and this is the correct amount that you should get which is a number between 18% and 25%.”

Approximately 90% of the meals also offer unrefined carbohydrates, such as brown rice and wheat flour. These are harder to break down, compared to white rice, making the body feel full for a longer time.

The flexitarian diet also allows consumers to improve their gut health, which Daures considered critical in any diet.

“Gut health is something that very few people talk about today that is extremely important for the benefit of your body,” he said. “If your gut is not in good health, you can try to have a good diet, but it’s not going to work.”

On top of its health benefits, Eatology also said that the flexitarian meal plan ultimately helps in reducing consumers’ carbon footprint. A study by the United Nations Food and Agricultural Organisation cited that about 14% of all greenhouse gas emissions come from meat and dairy production.

The flexitarian diet is sustainable for people to eat every day

HONG KONG

The store has now reached more than 21,000 outlets across Indonesia.

PT Indomarco Prismatama, also known as Indomaret, is the ubiquitous store found in nearly every corner of Jakarta, from residential neighbourhoods to office buildings and university campuses. This year, Indomaret is capitalising on the bright prospects for minimarkets in Indonesia and aims to add another 1,500 outlets to its existing 21,000.

According to DBS research, minimarkets are expected to grow faster than traditional markets and supermarkets in Indonesia due to their 24-hour accessibility and widespread locations in both urban and remote areas. Fitch Ratings also predicts that minimarket operators such as Indomaret will continue to grow in size through the expansion of their outlets. One of the strategies Indomaret will implement to become ‘top of mind’ amongst shoppers is the development of its offline stores—

Indomaret Regular, Indomaret Point, and Indomaret Fresh—and the integration of these stores with its online channels.

"Our goal is that shoppers can have all their needs met both instore and online," said Marketing Communication Executive Director Indomaret, Bastari Akmal in an exclusive interview with Retail Asia.

In addition to Indomaret Regular, the company has established Indomaret Point which offers a variety of readyto-eat and ready-to-drink products and seating areas for hangouts; and Indomaret Fresh, which provides fresh food products, frozen food, vegetable and fruits, premium, and imported products.

"We also add Point Coffee, an Indomaret subsidiary that applies the 'Grab&Go' concept to serve fresh

Our goal is that shoppers can have all their needs met both in store and online

coffee in Indomaret Fresh," said Bastari. Several Indomaret Fresh outlets also have a drive-thru service, allowing customers to shop without leaving their vehicles. They can also place orders and payments at the counter and then switch to other counters to pick up their groceries.

With this concept in mind, Indomaret Fresh is one of the business lines that Indomaret prioritises developing. The company targets to establish Indomaret Fresh in locations with middle to upper socioeconomic levels, high traffic, large parking lots, and close proximity to main roads. The goal is to have 1,000 Indomaret Fresh outlets by 2023, up from the current 400 outlets.

In terms of online stores, Indomaret has launched Klik Indomaret.

According to Bastari, online shopping offers the advantage of being able to sell products in larger packages, which are limited in physical retail spaces. Indomaret records an average of 8 million daily transactions at its physical stores, whilst Klik Indomaret averages 3.5 million transactions per month.

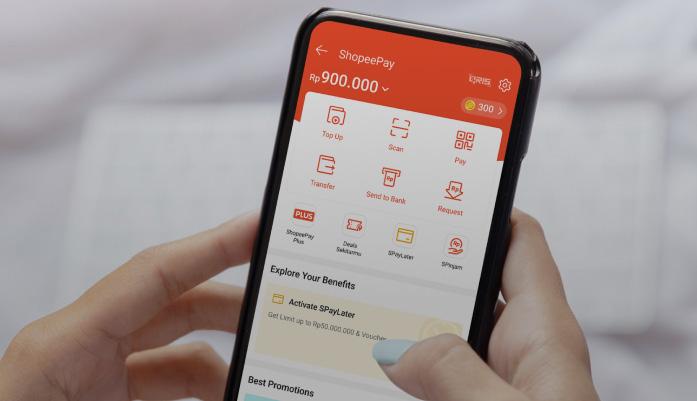

Connectivity and digitisation have fueled hyperconsumerism in the region.

Shoppers in Southeast Asia increasingly rely on cashless transactions–digital payments made in ZALORA grew to 81.20% as of 2022, up from 74.61% in 2020. Digital payments are expected to power e-commerce spending in the region, but as Southeast Asia’s payment landscape is fragmented, integration may be held back by archipelagic countries Indonesia and the Philippines where cash remains king. Transactions closed through the cash-on-delivery (COD) payment method have significantly declined in the last two years to between 15% and 20% from the previous 25%, according to ZALORA, an online fashion, beauty, and lifestyle retailer in the region.

“Despite the positive outlooks, the payment landscape in Southeast Asia has remained incredibly fragmented. In fact, due to the region’s diversity, integration from market to market is generally difficult for a single player to do at a payment level,” Achint Setia, chief revenue and marketing officer at ZALORA, told Retail Asia.

Citing its latest Southeast Asia Trender Report, ZALORA noted that cash transactions in 2021 in the Philippines reverted to pre-pandemic levels, whilst cash payments in Indonesia went up to 60% in 2021 from 58% in 2020. Setia linked this to the archipelagic topography of the Philippines and Indonesia.

“The challenge with the Philippines and Indonesia is their topography is a lot more diverse, and more spread out. There is a challenge, even logistically for incumbents to expand,” Setia said. “It’s easier for digital incumbents to do that, but even from an offline market and building trust, it is sometimes tricky with so many different segregated and fragmented islands," he said.

Setia said some customers, who are in remote places, are reluctant to use digital payment methods and opt to play it safe by relying on COD. For instance, Indonesia, which has more than 17,500 islands, has a huge digital divide between customers in Central Java Island and those in remote islands. Citing data from the Boston Consulting Group, Setia noted that 57% of Indonesians prefer to pay in cash, 8% prefer mobile wallets, and 7% use internet banking.

“There are still a lot of local intakes, but what brands and platforms can do is continuously incentivise customers to move to digital by streamlining the purchase journeys,” Setia said. “If [brands] can reduce the time from carts to final payment in just one or two clicks, and also build comfort amongst customer in refunding their money; if they can do it consistently and repeatedly, then they will trust your returns and refund policy and some of these challenges can be overcome,” he explained.

ZALORA observed that consumers have become more comfortable with real and virtual worlds, but continuously struggle between the two as they seek personalised and more humanised experiences, without foregoing convenience.

On this note, Setia said retailers and brands should not

be racing for total digitisation to reach last-mile purchasers. Rather, the race should be geared towards “an attempt for agility in a volatile climate and an attempt to make sure that experiences across touchpoints are streamlined,” he said.

Connectivity and digitisation that have grown exponentially in the region have also fueled hyperconsumerism as shoppers demand flexibility, convenience, and control. Setia noted, for instance, that a lot of high-value purchases were also enabled by “buy now, pay later” or BNPL.

ZALORA found that whilst credit cards dominate luxury transactions with 41.1% of shoppers using them as a payment method, luxury shoppers have also started using BNPL more. The BNPL method has also given shoppers access to other high-value products, such as those under home and lifestyle, beauty, and women's accessories, to name a few.

Moreover, shopping festivals, such as Single’s Day and double-digit events, have also driven hyperconsumerism amongst Southeast Asians. Setia said brands looking to capitalise on these events need to establish a stronger online presence that will bring customers through a seamless journey from intent to delivery.

“Customers want to build long-term relationships with brands that they love, but they also don’t want it to come at the cost of a lot of hassle or lack of value for money. Both are equally important,” Setia concluded.

The China-based retailer has over 5,400 stores, of which more than 2,000 are in global markets, and it’s still growing.

Lifestyle retailer MINISO has reached a milestone as it celebrates its 10th anniversary this year. This is thanks to the brand’s adaptability in coming up with new products aligned with the prevailing consumer trends, and its continued global expansion.

The company’s growth does not stop here as it now plans to transform into a lifestyle super brand “that brings joy to consumers around the world.”

“The competition amongst lifestyle retailers is getting fiercer, especially in Southeast Asian markets where we saw many newcomers and emerging lifestyle brands. As a result, MINISO has to keep upgrading and innovating to stay ahead of the competition,” Vincent Huang, Vice President of MINISO’s Overseas Business Department, told Retail Asia.

To achieve this goal, MINISO will put focus on design and innovation, and come up with products that will appeal to the emotions of its customers. Huang also shared how the company performed in the past decade and what’s in store for the company this year.

Can you share with us your story and the lessons you learned in the past decade?

There are three lessons I’d like to share with you. First of all, globalisation is the right way to go and MINISO has shown a proven record of success by having over 5,400 stores globally. More than 2,000 stores are in the overseas markets. 2022 was a successful year for MINISO. We’ve recorded total revenue of over US$1.4b and hit a couple of milestones. Last February 2022, MINISO opened its first New York City store in SoHo Manhattan. In August, MINISO India celebrated 200 local stores. In September 2022, we celebrated the opening of its 2,000th overseas store in Lyon, France. MINISO has come a long way since its founding. In the past 10 years, MINISO reaped a billion consumers around the world. In 2020, MINISO was listed on the New York Stock Exchange and in 2022, publicly listed on Hong Kong Stock Exchange. Secondly, consumers only pay for the brand’s professionalism. MINISO is responsive to new consumer trends and adaptive to consumers’ new preferences. We act fast and launch new and innovative products frequently to keep consumers excited.

Last but not least, reliable partnerships are key to success. At MINISO, we not only work with capable suppliers but also with retail partners, franchisees, distributors and intellectual property licensors. Some of our partnerships are already decade-long and we thank all of our partners who have grown with MINISO and will continue to do so in the coming years.

Over the past few years, we examined the top-performing stores in different markets and we found that a rich and diverse product portfolio and highly frequent launching of new products are the key to the success of MINISO stores.

Only by doing so, customers will always find something new when they visit our store and come back to check out our latest offerings. If our local partners want to achieve this, they must have a very professional and experienced commodity team. In the past, we only trained their commodity team for one or two months because at that time we were developing very fast. But if you ask me what I would have done differently, I think I would have them take our commodity training programme for at least six months.

What are the trends and challenges you expect to emerge in the lifestyle industry this year?

We realise that the global toy market demonstrates strong momentum. The rise of “kidult” has proven that toys are not only for kids but for everyone, with collectibles being one of the most sought-out categories for kidults. This trend led to an over 100% increase in the sales record of MINISO blind box collectibles last year. The other trend I’ve observed is that the accessories, skincare, and makeup products bounce back. In 2023, as people get back to activities and embrace the outdoor experience, spending on accessories and cosmetic products experiences a rise, too. To answer this trend, we opened a brand-new accessories warehouse in China, spanning over 7,500 sq. m. and set up dedicated zones in the store for accessories, beauty and personal care products.

What strategies will you employ to establish MINISO as lifestyle super brand?

First is to transform from a retail channel to a product brand which has its own channels. To do so, we have placed a high value on design and innovation. At present, we’ve partnered with international IP (intellectual property) owners including Disney, Smiley, Sanrio, and We Bare Bears, amongst others. We have also developed new products including scented products and pet accessories to meet younger consumers’ lifestyles and new demands.

We will establish our “Global Product Innovation Center” in China, the US, Japan, and South Korea which will serve as our innovation engine, providing more fun and professional design to global markets.

We will evolve from a retailer to an interest-driven content company. We aim to produce products with compelling stories that appeal to customers emotionally and generate social media sharing. Our IP-related products are the most representative item. We plan to bring in even more exciting IP collaborations, such as Peanuts, Hello Kitty, Barbie, and Mario Bros. In addition to IP collaborations, we are working on enhancing our creativity and advancing in-house IP incubation, such as our MINI Family characters, Dundun the Chicken. We aim to bridge customers and MINISO and build a fun and joyful wonderland for global youngsters.

Lastly, we will transform consumption into a passion; and transform customers into users. Today, consumption is now a bilateral interaction between customers and brands. For MINISO, this is reflected in our “Joy Philosophy.” There is a winking smiley face in our logo. We’ll use it as a new super symbol that magnifies the fun and joy that we would like to bring to consumers.

When MINISO first started, affordability was the most important part when consumers made purchase decisions, and MINISO has made a name for the cost-effectiveness of our product offerings. Ten years later, consumers’ purchase decisions are driven by a lot more factors. Particularly, the younger generations are not only looking for functional values but also cultural and emotional values associated with the product. This change helped us realise that only by having appealing, fun and useful products can help MINISO transform into a lifestyle super brand.

Our licensed collections with big brands in pop culture such as Disney, Marvel, Sanrio, and Minions are examples of products that will meet their demands not only for function but also for emotional parts. Licensed products have proven to be very successful for us, and MINISO has partnered with over 80 world-famous IP licensors around the world.

The lifestyle industry is changing fast. Consumer demands and preferences shift very quickly. For a brand like MINISO, we have to stay alert and responsive because new demands lead to new products and categories, and new growth opportunities. Over the past 10 years, we saw the rise of scented products, like scented candles, diffusers, perfumes and fragrances, so MINISO launched Master’s Aroma Lab which focuses on creating unique scents. Another major behavioural change is the adoption of e-commerce and more recently social commerce which drove MINISO to transform into an omnichannel retailer.

What role will your brick-and-mortar stores play as MINISO now makes an omnichannel presence?

Offline stores remain the most important channel for MINISO and the most critical revenue source. To improve the in-store shopping experience, we are in the process of upgrading our offline stores. We will be dividing a MINISO store into dedicated zones so that consumers can easily navigate whilst browsing and setting up interactive areas, or play areas where they get to touch and feel our products before buying. E-commerce is also important to MINISO. We not only operate our very own e-commerce sites but also cooperate with local e-commerce platforms such as Shopee and Lazada in Southeast Asia, and Amazon and Flipkart in India. We believe that offering additional channels of consumer experience will be a very good part for us, and will enhance our brand awareness and consumer loyalty, which increases in-store traffic and in-store purchases.

What's next for MINISO?

For MINISO, we are taking action in different aspects to ensure growth in the coming years. In terms of expansion, we will be opening new and more stores in critical markets as well as looking into entering new markets. For example, this month, we’ll have two new stores at Delhi International Airport in India as well as a flagship store in Guangzhou, China. We are launching 3.0 stores which are bigger, brighter and more interactive. For example, in February this year, MINISO opened its first flagship in Chengdu. The three-storey store featured a brand-new Fragrance Museum, dedicated to MINISO fragrances and perfumes. Guangzhou also welcomed a same store this month.

In terms of product offerings, MINISO will focus on strategic categories, especially blind boxes, plush toys, and perfumes. We will also continue to work with worldrenowned IP licensors. In the meantime, developing our original IP is also key. So far, we already had MINI Family and Dundun the Chicken, all of which are adored by customers.

We will transform consumption into a passionThe 'kidult' collectibles trend led to over 100% increase in the sales record of MINISO blind box collectibles (Photo from MINISO.com)

After years of dwelling online and adapting to a digital lifestyle, “hyperphysical and tactile experiences” are what consumers in Asia Pacific (APAC) want here and now. This change in consumer behaviour is compelling retailers to elevate their stores’ appeal and offer interactive experiences to the redefined shopper.

Jess Tang, senior consultant for APAC at trend forecasting firm WGSN, said the relaxing of restrictions due to the pandemic led to the emergence of “sensory adventurers,” the consumer type that looks for excitement and the new.

“In the thick of the pandemic in 2022, consumers were mostly embracing digital lifestyles and omnichannel retail. But in 2023, there will be new signals because APAC [consumers] are really embracing that return to travel, return to in-real-life experiences,” Tang told Retail Asia

As these consumers march back to the physical stores, Tang said retailers must counteract their “digital fatigue” and provide them with “memorable happenings” through in-person events and activities that enrich their pandemic-stalled lives.

“Now’s the time for more in-reallife innovation,” she said, noting that businesses are starting to turn their brand identity by focusing on the “interactive customer journey.”

One way brands can do this is by elevating their physical store spaces to be less about sales and selling, and more about brand storytelling and engaging customers in what they produce and what the company advocates for.

Brands can also look into more modular store designs that enable flexibility for other activities like, for example, using it as a gallery space. Tang noted how some brands in South Korea have made their store spaces for multifunctional purposes.

Tang cited Seoul-based skincare brand, Sulwhasoo, which launched

a month-long exhibition of international artworks focused on brand education through culture.

“This really gives the sensory adventurer another reason to visit instore because, for them, it’s a cultural experience. It’s not necessarily about sales, but something that taps into another kind of desire or desirable experience as part of their lifestyle,” she said. “The store needs to be a little bit more agile, responsive and more effective,” Tang added.

Even as consumers desire for in-store experiences, Tang stressed that omnichannel platforms shall remain important, especially for the type of consumers dubbed as “phygital connectors.” These consumers rely on the convenience afforded to them in this age of e-commerce. From registering online to shop for products and search for promos, to completing the transaction through digital payment systems, phygital

connectors enjoy the control right at their fingertips. But whilst they search for a wide range of products and access the best prices online, they still go in-store to probe the product for more detailed information, Tang said. “Omnichannel is still going to be a very key direction for a lot of the brands catering to this cohort,” she said.

With the younger demographic driving both the sensory adventurers and phygital connectors trend, connecting their store to the metaverse is another opportunity they can tap into to cater to the younger generation.

“They’re looking for memorable experiences to enrich their lives. Especially after the pandemic, they will be looking for activities to foster their personal sense of creativity. These kinds of gaming or metaversal experiences will be quite key. It’s just something brands can experiment with," Tang explained.

Consumers have also become cautious about their spending habits. Whilst this may seem to spell a decline in sales for businesses, leading strategic market research firm Euromonitor International said brands could turn this into an opportunity. Herbert Yum, research manager at Euromonitor, said they observed that saving money has become a priority for consumers, with nearly half of Asia Pacific consumers planning to ramp up their efforts to save. The message this gives to retailers is that in order to purchase goods, these customers will be seeking bargains and the best value for money, he said.

To cater to them, businesses should review their pricing and look internally to see where they can reduce costs. This could involve restructuring the supply chain or altering their business models.

“We encourage businesses to make sure they communicate the brand value proposition with their key customer groups over this challenging period of time so that the businesses can support and overcome this challenging period together with their target customers,” Yum said.

One business practice to attract the budget-conscious is the move of a premium coffee brand known for selling fresh coffee beans, Victoria, which entered the instant coffee market in 2021 to offer a more affordable product whilst retaining the quality. There are also consumers whose budgeting is not premised on necessity, but on saving up to live well, according to Sahiba Puri, senior consultant for home products

that allows them to split the cost over a period of time. This helps “reduce cost pressures” and expands their purchasing power, Puri said.

at Euromonitor. Puri explained that these are the people who indulge themselves in what they want, given that they buy these items at a price they can afford. “Consumers are not really abandoning financial responsibility, but they are looking for reasonable indulgences. They are being financially prudent but, at the same time, giving themselves permission to live a little,” she said. Loyalty programmes with features like cashback credits and reward points that can be used in the future to offset purchases could also be a key element in encouraging these customers to buy.

Aside from rethinking packaging sizes and formats to ensure price competitiveness, Aik Lim, senior director at Meiyume, said brands may need to improve their products to justify a price adjustment to consumers. Attracting these customers who prioritise the “here and now” also entails the implementation of flexible payment options like buy now, pay late (BNPL), which is an arrangement

With 37% of global consumers immersed in video games and their virtual environment, Tim Foulds, head of insights at Euromonitor, said tying up with the gaming sector is an opportunity brands can seriously initiate. According to Foulds, gamification is a key strategy in many Asian markets as 60% of consumers in Indonesia and Thailand are interested in online video games and the immersive environment they offer. These statistics are higher than in Australia and the US.

“The gaming population is really taking off. This once niche segment is now a mass market opportunity, which offers a great opportunity for all companies to tap into. Companies themselves getting their game on, sponsorships, advertisements, in-game purchases and product innovation are the primary revenue drivers so far,” Foulds said.

In Australia, for example, McDonald’s had integrated gaming into its strategies by partnering with the game Overwatch 2 to offer prizes when purchasing Big Macs through the MyMacca’s app. A purchase entitles the customer to a collectible skin from the game.

“Brands need to consider holistic gaming culture and how to tailor those offerings to these consumers, whether that’s through marketing, gamification of the customer journey, or product generation, targeted at that specific and growing cohort of consumers,” Foulds said.

Consumers are looking for reasonable indulgencesJess Tang Sahiba Puri Herbert Yum Aik Lim Consumers have become cautious about their spending habits

The company has an authentication process to ensure fake items do not make it to the listing.

Buying secondhand items may not be as frowned upon as before but the fear of purchasing fake products and difficulty in accessing secondhand products hinder consumers from entering the used market.

Singapore-based recommerce platform Ox Street is campaigning the consumption of secondhand items through its website and app. It has put in place an authentication process wherein it manually approves every listing on both platforms.

“One of the things that we're trying to do with Ox Street is to reduce those uncertainties and make it easier for people to dip their toes into the used market,” Ox Street CEO Gijs Verheijke said.

“Brands can help buyers get more certain about buying used, help them with guarantees, and maybe even returns, like those kinds of assurances that you will get when buying new. These really need to be brought to the used market more for shoppers to really take the jump from being very interested to actually buying a lot,” he added.

In an interview with Retail Asia, Verheijke also shared the company's plans and how the recommerce sector is evolving in Southeast Asia.

We've had a couple of really big milestones, the most important one being the “Used” launch on 25 July 2022. We thought we could do around S$40,000 in sales in the first three months, but we actually made that in the first four weeks. The “Used” category on the app is one of the most browsed pages, almost the same as the most popular section. Aside from this, we've also launched in Australia in April 2022. We're working more closely with our parent company Carousell and the different Carousell business units and potentially expanding the type of categories that are on Ox Street, like more clothing and maybe bags and other stuff.

We have clothing but it's in the beta stage. We have a couple of brands now like ADLV, Supreme, and Carhartt. We are adding apparel on a weekly basis. The next one we are looking at is bags because they were a part of the Carhartt release. Since we are already selling bags unintentionally, we thought that we should probably look into including them in our platform.

Tell us about the re-commerce of luxury products in Asia. What is driving the shift to secondhand products?

The recommerce trend starts from the global trend which we believe is underpinned by two things. The first one is climate change which is really becoming a more urgent concern, especially for young people. In a way, re-commerce is helping secondhand to become aspirational or cool to have. Another thing is the type of products that Ox Street is dealing with, like limited edition sneakers, which are expensive. As we start to make this available and make it easier to shop

secondhand, people are actually being blown away by the prices. The savings are really massive. There are lots of markets in Southeast Asia where that is very important for young people who may not yet have the spending power like in the US or other big cities in super developed countries like China, where people spend a lot on top brands.

Which markets in Asia are leading or are more open to buying secondhand products?

Based on the latest Recommerce Index Report by Carousell, the Philippines is number one where 92% of people surveyed say they've purchased secondhand before. Taiwan and Hong Kong are also very high with around 85%. When it comes to categories, it’s mostly apparel in the Philippines and Taiwan, and toys, video games, and game consoles for Hong Kong. The percentages are really high too even for the countries that are not in the top three. Everyone has basically tried to buy something used before, it's more on increasing the frequency and improving the experience.

What opportunities and challenges do we expect to emerge for the re-commerce sector?

The opportunity it presents is the extension of the life cycle of fashion items which is good for the environment and the

The opportunity it presents is the extension of the life cycle of fashion items

world. My dream is for people to start thinking differently about ownership. If you can buy something used and you can wear it for a while, and you can sell it again on the same platform, you can almost consider it as a cost of ownership. That is a huge opportunity if you can consider the possibility of selling everything again and keeping it in circulation.

On the challenges side, I feel that selling is not yet as easy as it needs to become. It's still quite cumbersome. For example, most of the time people will need to have a printer to print the shipping label. Who has a printer at home nowadays? That is one example of what seems like a minor thing, but I believe those minor things stack up and stop people from selling stuff that they want to sell if it became easier. Another challenge is definitely authentication that’s why it's very risky to buy luxury products on Facebook or even from a non-trusted seller on Carousell, because you just don't know whether a product is authentic or not. At least that part we have already been able to solve with Ox Street where every product is authenticated by experts. It is something that is going to come up more still a lot in the upcoming five to 10 years where people are scared of fakes ending up in circulation.

What are your efforts to encourage hesitant consumers to buy secondhand?

It starts with people's willingness to consider wearing a used product. We do a lot of content and marketing around positioning used as actually better than new. People are very scared to crease their shoes or make them dirty, but with used, it doesn't matter as much. One of the slogans we have is, “If you're gonna wear them anyway, you might as well buy used.” I don't like this term of educating the market, but I prefer showing people a different perspective on used, and hoping that a lot of them will give it a shot and discover the benefits. The other part is how can we improve the customer experience. We already have authentication. The other obvious one is, how people can be assured that what they get is actually what they see in the app. Right now, there are seven photos that people have to take for the listing. Our team approves manually every used listing for now but we want to come up with ways in the app to make it clearer for

people. For example, we can come up with a grading system for used sneakers. Those are some of our 2023 priorities also for making it easier for people to try buying used.

How do you see the recommerce sector evolving in the next three to five years?

When Airbnb first started to explode, people were like, “Who would let a stranger sleep in their bed?” It just doesn't make sense, but you saw that the value proposition was so compelling that it kind of moved under the radar until suddenly, it was completely mainstream. I believe the same thing is happening in the used market. It is still seen as a little bit eccentric to buy used. But it's really clear that young people just really don't care and they don't see any stigma on buying used or, wearing pre-loved fashion. You can just see it taking off all over the world in the next five years and we believe it's really going to breakthrough in Asia.

Ox Street is open to sellers from 10 markets. Any plans to expand to other countries to accommodate more sellers? Our approach has been to be open to selling and buying to as many countries as we can. The challenge is that, since we have this authentication step, the seller has to ship the products first to us and that becomes very expensive over long distances. So, we are limiting ourselves to Southeast Asia, a bit of East Asia and then Australia and New Zealand. Even though we are open to selling in 10 countries, we were not focusing our energy and marketing resources equally across all of them. We're mainly focusing on growing our customer base in our top markets and will also work on building further in markets where our parent company Carousell has a big presence such as Hong Kong and Taiwan, as well as Australia, Singapore, Malaysia, and the Philippines. The most important thing is really still “Used.” We don’t have any competition in authenticated used. Our goal is to become the undisputed leader in the used category where people think of us first. That is really what a lot of our efforts will be focusing on.

It starts with people's willingness to consider wearing a used productSelling secondhand items is not yet as easy as it needs to become Young people don't see any stigma on buying used or wearing pre-loved fashion (Photo courtesy of Ox Street)

Younger consumers are ready to spend 16% of their income on signature brands.

Gen Zs are not shy to spend their money on themselves, particularly in China where more than 20% of Gen Zs are willing to shell out over 16% of their income for luxury products. This puts the Gen Zs well in place to become the luxury market’s largest consumer base, overtaking other age groups.

In a study, KPMG China found that whilst a larger 29% of Gen Zs are willing to pay less than 5% of their annual income for luxury items, the 21% who are willing to pay more stand at the same ratio as Baby Boomers (55+). This is just 11 percentage points behind compared to Millennials (25-34).

In addition, around 43% of Gen Zs are open to paying a premium of more than 5% for products that are aligned with their values, just 4 points lower than Millennials, which signifies the strong propensity to pay amongst this age group.

“Gen Z will soon become the major force of purchase in China. Brands need to understand their values,

world where luxury is very accessible] is an environment that they would've already been born into

beliefs, motivations and behaviours, and factor those insights into retail experiences and customer journeys,” Anson Bailey, head of Consumer & Retail ASPAC, KPMG China, said.

Wealth access

The report noted that Gen Zs are considered the wealthiest generation in the market, which is thanks to the one-child policy imposed in China, better education levels, and financial literacy. Understandably, this generation has greater access to disposable incomes.

“[Gen Zs] will already have been born into a world where luxury is very accessible,” Fflur Roberts, Industry Manager-Luxury Goods Research of Euromonitor, told Retail Asia. “Their parents, and grandparents probably did not have access to luxury, and they would have had to travel to buy these goods, whereas now it’s on their doorstep.” She noted that for Asians, luxury is perceived as an aspirational product, as opposed for instance, to their Nordic counterparts who are not

as interested in luxury despite having a high disposable income.

“It’s very aspirational, and very status driven. This is an environment that they would have already been born into, and there will be that drive to get a good job, and a good education. There will be that kind of aspirational desire to have access to these products,” she said.

Roberts added that whilst it is still difficult to assess at this point, Gen Zs will eventually become the biggest consumer base, which raises the need for brands to focus on this demographic.

Targeting Gen Zs

Gen Zs are digital natives, Roberts said, making it critical for brands to look at the evolving digital space, particularly the metaverse and gaming. “Whilst a Gen Z might not necessarily be able to buy a pair of Gucci trainers, for example, they may already be very active in the metaverse and gaming. They may buy Gucci trainers, through an NFT (nonfungible tokens) for the metaverse or through gaming,” Roberts said.

Given that their disposable income is still limited, products that fall under the affordable luxury category are attractive to younger consumers. Products, such as perfume and lipstick, give the same luxury fix to younger consumers seeking to treat themselves whilst still staying within their budgets. Roberts noted this will also drive growth in alternative payment options, such as “Buy Now, Pay Later.”

Moreover, Gen Zs develop a more personal relationship with brands, compared to other age groups. These young shoppers are more likely to get involved in the creative side of luxury brands and follow not just the brands, but the creative minds behind the collections; whereas older consumers groups, such as Gen X and Baby Boomers, are more likely to follow just the brands and may not even be aware of the creative directors.

This age group is also more likely to follow brands that are aligned with their values, especially involving social and environmental issues. Roberts said Gen Zs give more weight to luxury brands’ actions towards sustainability, equality, and diversity

[AAnson Bailey

amongst others. “They will be voting with their wallets. That’s something big that we need to think about in the future,” Roberts said. “Either way, legislation is coming, and all luxury brands will eventually need to start addressing these issues.”

Similarly, KPMG found that nearly 30% of younger consumers (aged 34 and below) will prioritise purchasing from brands that emphasise sustainability and corporate responsibility, higher than 23% of the older age group. Additionally, 30% of those aged 18 to 24 include sustainability as a key consideration when buying luxury products, higher than only 16% amongst those aged between 45 and 54.

“Awareness and interest in sustainability amongst Chinese consumers may still be in its early stages, but it is on the rise and being embraced, with Gen Z consumers leading the trend,” Rani Kamaruddin, ESG Advisory, Sustainable Finance, KPMG China, said. “Luxury brands should start focusing on sustainability in the supply chain. Embarking on an all-round ESG journey that engages the whole value chain takes a lot of effort, but it will give luxury brands a competitive edge in attracting Gen Z consumers and nurturing brand loyalty from them in the long term.”

The luxury market rebounded by the end of 2020 when it reached its pre-pandemic level, largely due to local consumers channelling funds to luxury products, as they were unable to travel overseas. “They were

a lot of the local consumers will have gotten used to shopping locally and within a space of two to three years, it could be that their mindset will have changed so much that they’ll realise they don’t have to necessarily travel to Europe, the US, or Hong Kong even to buy luxury. They can actually buy it at home so it’s going to be an interesting time,” said Roberts.

Overall, the luxury markets across the Asia Pacific region will likely see a positive trajectory and record growth of about 6%. This will be driven by China, followed by the US. Other markets include Japan, and Thailand, which will be bolstered by tourism, particularly the return of affluent Chinese tourists.

shopping at home, and there were other issues around the supply chain, but generally, all of the spendings were taking place in their local markets. This trend continued in 2021 and 2022, particularly with Chinese consumers, or any consumers within Greater China,” Roberts said, noting this was also prevalent in South Korea and, to some extent, in Japan. This has led to luxury brands tweaking their marketing strategies to target local consumers in a way that highlights local cultures and local fashion. Euromonitor projected that China will be the fastest growing market in the next year; however, there may be a slowdown in China as travel activities resume with the continued border opening, which could redirect discretionary spending in markets outside China. “That said,

Despite this positive outlook, Roberts said the luxury market will still have its fair share of challenges, taking the shape of the cost of living crisis, and supply chain disruptions still linked to the pandemic and the Russia-Ukraine crisis.

“Whilst we have to look at digital and in focus areas they’re looking at – the metaverse or all of this amazing digital technology that’s coming – we still need to focus on the store because that’s important and that’s where brands can really communicate very well and offer that level of customer service,” she said.

“Within that challenge is meeting the needs of being more sustainable and that is going to be a huge challenge for luxury brands because as I mentioned, legislation is coming, if not already here.”

The move may prompt Malaysian consumers and tourists to shop overseas.

Malaysia is working on establishing itself as a “shopping haven” for tourists with measures in place to make shopping in the country tax-free. However, the tables could turn on the retail sector with the government’s proposal to impose a tax on luxury goods. Retailers worry that such a move may send consumers flying off to neighbouring countries to shop there instead.

The Malaysian government has disclosed its plan to introduce a luxury tax with a certain limit on specific types of goods that include luxury watches and fashion items in a bid to expand its means of revenue collection.

“There is a need to introduce new taxes due to the constraints on the Government’s revenue. A growing economy, where people are earning more money and businesses are performing better, will result in higher tax collection and revenue,” Farah Rosley, Malaysia Tax Leader and Partner, Ernst & Young Tax Consultants Sdn. Bhd., told Retail Asia

“Whilst there will be a potential increase in the Government’s

revenue, the projected benefits would need to be weighed against any impact to the retail sector, including tourist spending,” Rosley said.

She noted that other countries such as China, Singapore, Indonesia, and the Philippines have also implemented such taxes.

Pua Wee Meng, consumer industry leader at Deloitte Southeast Asia, said there is a high chance that the government will push through with the proposal “in support of higher social and development spending.”

According to Teresa Chong, head of consumer market at KPMG in Malaysia, the measure is being proposed at a time when consumers have higher disposable income with tax reliefs and assistance given during the pandemic.

What may be overlooked in this premise, is that the positive performance of the retail sector was due to pent-up demand, she said.

In a joint statement, Malaysian retail groups are urging the government to rethink and withdraw the proposal for a luxury tax as this could negatively affect the performance of the retail sector.

The retailers – BBKLCC Tourism Association Kuala Lumpur, Batu Road Retailers Association, Bumiputra Retailers Organisation, Federation of Malaysia Business Associations, Industries Unite, Malaysia Retailers Association, Malaysia Retail Chain Association, and the Malaysia Shopping Malls Association – said the luxury tax proposal may make pricing in the country “non-competitive” and deter tourists and locals from shopping in the country.

“This is a lose-lose proposition – losing foreign tourist arrivals and losing Malaysians from buying locally, coupled with the loss of foreign exchange. Even if a mechanism can be designed for foreign tourists to claim back such luxury taxes, Malaysians would still be enticed to do their shopping overseas,” they said.

When the country’s duties and taxes on shopping were removed, around 37.6% of tourists’ receipts came from foreign exchange earnings from shopping in 2018 as this made the prices in Malaysia attractive. Prices could match that of the immediate competitor for tourist dollars and foreign exchange, such as Hong Kong, Indonesia, Thailand, and Singapore. They pointed out that countries wanting to become shopping havens have, in fact, removed their taxes.

Retailers added that the proposal could also encourage the growth of black market operation, the same with penalising duties and taxes on cigarettes and liquors. Only “big-ticket ostentatious products” should be considered for the proposal such as sports cars, racing motorbikes, yachts, and aeroplanes, they suggested.

“We advocate that our tax policy should not deter and punish success due to entrepreneurship and risk-taking to nurture start-ups and business formation. A holistic view should be taken that will balance between risk and reward; and the flow-through multiplier effect of business activities that contributes to the economic growth of the nation,” the retailers said.

“Thus, we urge the government to judiciously evaluate the entire spectrum of wealth tax, capital

gains tax and luxury tax to ensure that such taxes do not deter entrepreneurship and even drive such enterprising individuals and companies to leave Malaysia to venture into other countries instead, and creating a brain drain loss in its wake,” they added.

Chong said the effect of the measure could not be assessed yet as there are no final specifics, according to analysts. But to address the concerns of businesses, the scope of luxury goods under the proposal needs to be determined.

It needs to be defined what constitutes ‘luxury goods’, as it can be subjective, depending on the purchasing power of the individual,” she said.

The government should carefully consider the types of goods that will be covered in the proposal, said Rosley. And they should not include essential items for the public or goods that are needed by businesses, she said.

Pua and Chong both said there has to be a clear mechanism for how the tax will be collected whether it be at the import or retail level. Pua added the taxable amount and threshold should also be stated.

For Chong, the lack of a refund scheme could also affect the attraction of foreign tourists to the country. Domestic buyers, likewise, would be compelled to travel overseas where they can purchase goods at lower prices due to the Goods and Services Tax/ Value-Added Tax refund scheme in

overseas countries, if the luxury tax is imposed at a very high rate.

“To ensure no one category of taxpayers is burdened by this proposal, it would help for the government to engage with and obtain feedback from those potentially affected such as the retailers, consumers and related industry players such as those from the tourism industry,” Chong said.

Rosley added that retailers should be given ample time for the implementation of the new tax and ensure that the compliance mechanisms that include registration and collection processes will be easy to meet.

There are issues that could be addressed by looking at the experiences of other markets that implemented a luxury tax, Pua said.

He cited China which saw an increase in “daigou” or individuals who go abroad to buy luxury items for resale when a higher luxury tax on watches was imposed.

In the US, the implementation of a 10% luxury tax in 1990 to address federal deficits resulted in the loss of 25,000 jobs in the local yacht industry and led Congress to remove it after two years as it failed to meet the objective. “There are also possible ripple effects on retail which should not be overlooked such as the effect on rental reversion rates, the possible rise of black market goods, and the negative impact on tourism receipts as foreign tourists will be enticed instead to shop in neighbouring countries as well as Malaysians saving

up to do their luxury purchases during overseas trips,” Pua said.

“Notwithstanding the downside risks discussed, the government will need to work with business stakeholders to assess its impact and actively engage with retailers on possible mitigating actions,” he said.

At present, the government has already started on such moves as the allocation of US$56.3m (RM250m) in the 2023 budget for the tourism sector, the plan to have a luxury tax rebate mechanism for tourists, and developing more dutyfree centres, Pua added.

In 2022, retail sales in Malaysia increased 19.6% year-on-year to reach $360.6b (RM1.6t), said Chong, citing data from the Department of Statistics Malaysia.

She said this was due to the rise in tourist arrivals, robust consumer spending, and a resilient labour market. This “upward momentum” in the retail sector has eased inflationary pressures.

Rosley, on the other hand, sees the cost of operations and materials, with a weaker ringgit against the US dollar, would affect the retail prices and, in turn, the consumer spending power. The reduction of the personal income tax rate by 2% for the bottom-40 and middle-40 income categories could encourage domestic spending.

But the sector’s growth is expected to be “much more muted” in 2023 due to economic headwinds and uncertainties such as high cost of living, inflation and the recent events in the financial services industry, Pua said.

“Although several measures were announced by the Malaysian government during Budget 2023 to provide subsidies and incentives to support the cost of living, consumers are expected to be cautious in spending under such conditions,” he said.

“At the same time, the increasing costs of doing business have not abated – although we saw an increase in minimum wages last year, the acute shortage of labour within this sector continues, along with the high operational cost that impact supply chains. These are factors which will continue to affect retailers in 2023,” he added.

Under the Code of Conduct, BNPL providers must show a ‘Trustmark’.

Financial industry veterans raised concerns over Buy Now, Pay Later (BNPL) platforms that opt-out of the code of conduct set by the Singapore Fintech Association (SFA). The Code of Conduct requires BNPL providers to go through a thorough audit and accreditation process to display a Trustmark, which assures customers that they comply with the code. BNPL platforms that chose not to adhere to this code, which is meant to help customers manage their expenses, may risk losing both merchants and consumers.

“Those BNPL players who have not signed up, you would hope that consumers decide to avoid those platforms, and reward the ones who have built trust, ethics, and social good into the way that they work,” said Anton Ruddenklau, partner and head of financial services, KPMG, an advisory firm,

Non-compliant BNPLs will not get access to the data that will be shared within the players in terms of creditworthiness

Currently, the participants of the code of conduct are Atome, Grab, ShopBack, Ablr, Latitude Pay, Pace, Split, and SeaMoney.

Aloysius Fua, financial services assurance partner at EY said customers will go to BNPL platforms where they feel they are most protected from over-indebtedness.

“Non-compliant BNPL players are not getting access to the data that has been shared within the players in terms of creditworthiness. They potentially are not doing any appropriate credit,” Fua told Retail Asia.

“This will hurt them from a business point of view and also the ability to enter into the BNPL ecosystem because merchants might be less inclined to work with non-[compliant] BNPL players,” added Fua. Amongst the provisions of the code, a cap of $2,000 in

outstanding payments was imposed. It could be higher unless the customer will complete an additional assessment, which includes income and credit information shared across all code-compliant BNPL firms.

A customer's BNPL access may also be halted if they failed to meet payment obligations. Since the code of conduct is meant to help consumers to spend wisely, not following such measures will decrease customer traction.

Shadab Taiyabi, president of the SFA, said consumers must still be responsible in using BNPL services despite the code of conduct in place. Consumers can do this by conducting a proper assessment of whether they can accomplish the payment terms.

“We, therefore, encourage consumers to consume the service responsibly and enjoy the benefits it can provide, such as attending to urgent purchases even when there is insufficient cash flow,” said Taiyabi, in an interview with Retail Asia.

“Ultimately, we hope that the Code provides more certainty for consumers and raises awareness of the guidelines that are in place for both BNPL providers and consumers,” he added.

a hard time working on a mutually acceptable payment arrangement. During this time, BNPL players will suspend further transactions with these types of customers. But as inflation continues, Ruddenklau said this would not have any impact in imposing a $2,000 limit on customers using BNPL.

He said the code is targeted at customers who are addicted to retail and shopping and cannot afford to pay it back through their average wage. But this group of people in the market, Ruddenklau said, are “low numbers.”

As regulations mount, Fua said BNPL players are challenged to improve customer experience through technology. One example of this is to innovate where customers can link their income and where the BNPL platform can conduct checks.

“One of the scenarios is whereby the consumer goes to the counter so you can use the platform, and inform you, ‘sorry, you already breached $2,000.’ It will then not allow me to process it because there is a technology application that controls the state so you're not allowed to spend beyond the $2,000,” Fua said.

“But if they can innovate to the extent that I can actually make the credit check on the spot, and then get approval instantaneously, assuming all the documents are in. For example, the use of SingPass that can link to your income, that can do the necessary check, and approve your so-called credit limit,” he added.

This technological innovation will differentiate BNPL platforms’ operations from other players, Fua said. In turn, it will also elevate the merchants’ interest to work with this kind of BNPL player.

When BNPL players have the data on their consumer profile, this would allow them to experiment more with products and services that they can provide to customers.

“BNPL gathers the data after you've made the purchase, the use of that data, and how that can then be built into different products or services. Ultimately, the data scientists and BNPL should be thinking about more products and services they can provide and

they build out their wallets with customers,” Ruddenklau explained. The ability to use this data could also increase competition between BNPL and other lending platforms.

“I think that's where the competition is going to come. It'll be an all-out war between banks, credit cards, and BNPL that could be good for customers at the moment with BNPL because you pay no interest right now,” Ruddenklau said.

Consumer spending amidst cost pressures has been adjusted, making more Singaporeans try BNPL applications. In the first half of 2022, data.ai reported that BNPL applications download soared by 109% year-on-year to around 423,000 from 203,000 in the same period in 2021. The BNPL Code of Conduct also allowed providers to deliver hardship assistance to financially-stricken customers having

“What inflationary measures make this two grand defeat to be less than two grand? I don't think that'll be an issue right now. I think that bar is so high at $2,000,” said Ruddenklau.

Almost half of the BNPL transactions are $100 or less, according to a Milieu Insight 2021 study. One in five Singaporeans tried a BNPL service and the majority said they will continue to do so, Milieu Insight also showed.

Fua said putting such a cap amidst inflation will not turn off customers but it will help them improve management for finances.

“When I work to make my purchases right now, I'm working with BNPL players that are trying to make things better for me in a sense, which helps make it clear how much I will be chargeable on the day,” said the EY expert.

Amongst the types of purchases considered when entering the BNPL space are home furnishings at 49% and electronics at 48%.

We hope that the Code provides more certainty for consumersShadab Taiyabi Aloysius Fua Anton Ruddenklau It will be an all-out war between banks, credit cards, and BNPL that could be good for customers

The Philippines, Vietnam, and Indonesia are more vulnerable to the risks of credit products.