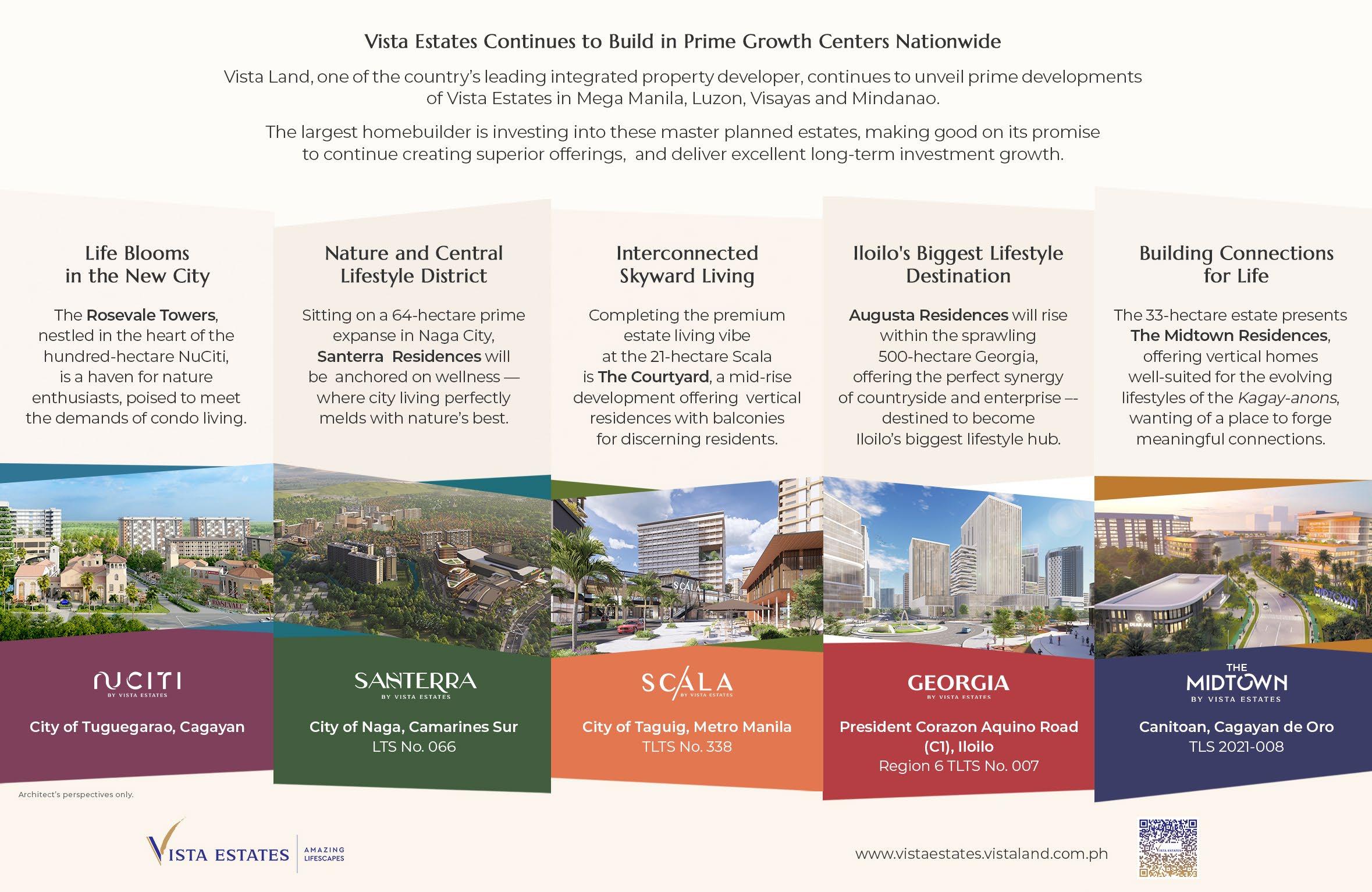

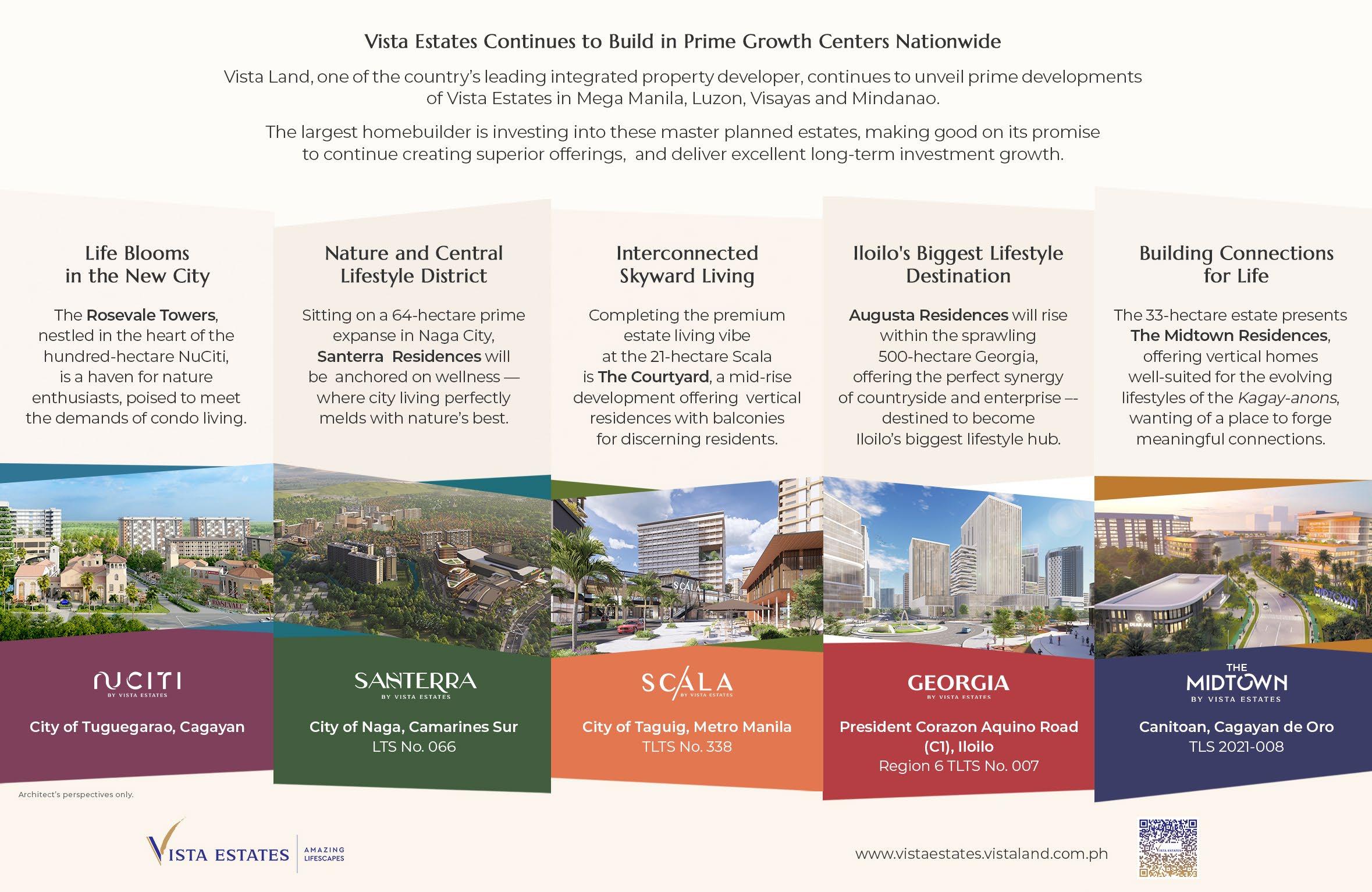

THE

ISSUE

REAL ESTATE ASIA AWARDS HONOURS THE OUTSTANDING REAL ESTATE ENTERPRISES OF 2023

HOW CAPITALAND INVESTMENT RETAINS STAKEHOLDERS’ TRUST

LANDED HOUSES OFFER SOLUTION TO HOUSING BACKLOGS

METLAND INDONESIA ADDRESSES WEAKER RESIDENTIAL PURCHASING POWER

HOW TO FIND THE RIGHT FLEX SPACE FOR AN ORGANISATION

REAL ES TATE ASIA AWARDS 2023

Real Estate Asia Issue No. 03 Display to 30 June 2024

REAL EST ATE ASIA

Real Estate Asia is the industry portal serving Asia’s dynamic real estate industry. Each section carries a balance mix of articles which appeal to the C-level executives of large real estate developers, investors, brokers, and property services institutions in Asia.

Do reach out to us if you would like us to tell your story to our readers via print and online advertising or events.

PUBLISHER & EDITOR-IN-CHIEF Tim Charlton

EDITORIAL MANAGER Tessa Distor

PRINT PRODUCTION EDITOR

Anna Mae Rodriguez

PRODUCTION TEAM Noreen Jazul

Consuelo Marquez

Vann Villegas

Frances Gagua

Ibnu Prabowo

Aulia Putri Pandamsari

Charmaine Tadalan

Roxanne Uy

FROM THE EDITOR

The real estate market continues to strike a balance between sustainability and business as SGX-listed firm CapitaLand Investment's (CLI) chief sustainability officer, Vinamra Srivastava outlines the firm's strategies on page 31 to meet their net-zero goals whilst keeping investor interests front and centre.

Directly on the heels of that is an important development from Singapore. The country's four prime sites under the 2H23 programme are stirring interest amongst the developers due to their proximity to mass transit stations and green spaces, marking a significant opportunity not seen in more than a decade. Find out more on page 14 about what these sites are.

GRAPHIC ARTISTS

COMMERCIAL TEAM

Simon Engracial

Janine Ballesteros

Jenelle Samantila

Cristina Mae Posadas

ADVERTISING Shairah Lambat shairah@charltonmediamail.com

AWARDS Julie Anne Nuñez awards@charltonmediamail.com

ADMINISTRATION Eucel Balala accounts@charltonmediamail.com

EDITORIAL editorial@realestateasia.com

SINGAPORE

101 Cecil St., #17-09 Tong Eng Building, Singapore 069533 +65 3158 1386

HONG KONG Room 1006, 10th Floor, 299 QRC, 287-299 Queen’s Road Central, Sheung Wan, Hong Kong +852 3972 7166

MIDDLE EAST

FDRK4467,Compass Building,Al Shohada Road, AL Hamra Industrial Zone-FZ,Ras Al Khaimah, United Arab Emirates www.charltonmedia.com

PRINTING Times Printers Private Limited 18 Tuas Avenue 5, Singapore 639342 www.timesprinters.com

a member of Times Publishing Limited

Can we help?

Editorial Enquiries: If you have a story idea or press release, please email our news editor at editorial@realestateasia.com. To send a personal message to the editor, include the word “Tim” in the subject line.

Media Partnerships: Please email editorial@realestateasia.com with “Partnership” in the subject line.

Subscriptions email: subscriptions@charltonmedia.com

Real Estate Asia is published by Charlton Media Group. All editorial is copyright and may not be reproduced without consent. Contributions are invited but copies of all work should be kept as Real Estate Asia can accept no responsibility for loss. We will however take the gains.

Sold on newstands in Singapore, Malaysia, Hong Kong, London, and New York. Also out in realestateasia.com with online readership of 215,000 monthly unique visitors*.

*Source: Google

Meanwhile, Indonesia’s residential sector demonstrates resilience in spite of economic setbacks with the landed houses remaining strong in demand. For an in-depth look at what's driving this trend, refer to the coverage on page 25.

Pages 32 to 39 are dedicated to recognising the Asian financial hub's most notable real estate agents under 40. Despite market challenges, these professionals have closed high-value deals, representing clients from industries as diverse as finance and technology.

Read on and enjoy!

Tim Charlton

Real Estate Asia is a proud media partner and host of the following events and expos:

REAL ESTATE ASIA 1

Analytics **If you’re reading the small print you may be missing the big picture

About Us

18 Savills pioneers next-level 3D interactive property tours in Hong Kong

24 BPO sector seeks hub in Philippines’ provincial markets over labour costs

26 Retail real estate rebounds as spending shifts from online to offline

SPACE

19 Trendsetting students drive SWID’s Metaverse apartments’ occupancies

20 Sun Hung Kai Properties’ hybrid aparthotel caters to next-gen tenant needs

21 IOI CBT redefines cooling system to reduce aircon dependence

22 Competing construction firms unite to meet industry’s towering demand

23 How to find the right flex space for an organisation

27 HK must review valuations for successful land sales

28 How Metland Indonesia deals with weaker residential purchasing power

29 Ohmyhome eyes sector and market expansion post-Nasdaq debut

30 Addressing the elderly housing gap could ease HK's broader residential crisis

2 REAL ESTATE ASIA SINGAPORE BUSINESS REVIEW | MARCH 2018 Published annually by Charlton Media Group 101 Cecil St. #17-09 Tong Eng Building Singapore 069533 For the latest real estate news from Asia visit the website realestateasia.com CONTENTS FIRST ANALYSIS INDUSTRY INSIGHT SECTOR REPORT

REPORT INTERVIEW

WATCH PROPERTY WATCH

REPORT 40 EVENT TOP INDUSTRY PLAYERS RECOGNISED AT 2023 REAL ESTATE ASIA AWARDS INTERVIEW HOW CAPITALAND INVESTMENT RETAINS STAKEHOLDERS’ TRUST 31

07

changing views on

08

hotel investment

51% to

COUNTRY

CONCEPT

PROPERTY

06 SG vs HK: Where should MNCs establish their APAC headquarters?

How APAC CBDs can thrive amidst

office use

APAC

plummets

$3.1b

WATCH

25 SECTOR REPORT LANDED HOUSES OFFER A SOLUTION TO HOUSING BACKLOGS

10 Co-living startup recreates a ‘home away from home’ experience with STAS 12 ‘Wall-less’ office opens up collaboration amongst AnyMind’s creatives

14 Developers gear up for prime sites in Singapore's H2 2023 Government Land Sales 16 Excess supply of offices depleting in Asia-Pacific

Daily news from Real Estate

Corporate occupiers grapple to fit out their offices to maximise space and create a high-performing hybrid workplace as the remote and in-office work setup becomes permanent, Cushman & Wakefield said. Employers continue to put employee experience at centre-stage in the way office is used whilst ensuring well-being of workers.

Work arrangements continuously evolving give rise to the need for flexible spaces. This challenges businesses to determine how much of the traditional office should developers retain or forego in designing a futureproof workspace. GuocoLand struck this balance in their new mixed-used development, Guoco Midtown.

As the capital city of Indonesia, Jakarta is expected to become a Transit-Oriented Development (TOD) model for other regions in the archipelagic country. With this, the government launched the Land Value Capture (LVC) scheme to attract all stakeholders, especially private developers.

Hanoi city centre retail rents to grow 4% this year

In a JLL report, the decentralisation trend in Hanoi’s retail market will be demonstrated with two new completions in the City Fringe, including the Lotte Mall Tay Ho with 80,000 sqm (NLA) in 3Q23 and The LINC Park City in Ha Dong with 10,600 sqm (NLA) in 4Q23, which will serve residents in the new neighbouring urban areas.

As development moves further away from the Jakarta city centre due to the dwindling availability of land, property developers realise that they must continue to provide supporting facilities for suburban dwellings. This effort is made to attract customers even though the products they develop are far from the city centre.

Adopting flexible working conditions is notably slower in the Asia Pacific compared to other regions across the globe. “Whether you were ready for it or not, the pandemic has changed the world, more so the corporate real estate, and office culture. Paul Seow, Associate Director, Asia Pacific Total Workplace said.

No ‘one size fits all’ in hybrid workspaces

Tradition meets modernity in futureproofing hybrid offices

Sinar Mas Land focuses the spotlight on BSD City

What is LVC scheme and why is it key to IND urban development problems

Closing gaps between C-suites and workers with flexible workspaces

COMMERCIAL OFFICE

COMMERCIAL RETAIL

PROPERTY WATCH

PROPERTY WATCH

RESIDENTIAL

No ‘one size fits all’ in hybrid workspaces

Tradition meets modernity in futureproofing hybrid offices

Sinar Mas Land focuses the spotlight on BSD City

What is LVC scheme and why is it key to IND urban development problems

Closing gaps between C-suites and workers with flexible workspaces

COMMERCIAL OFFICE

COMMERCIAL RETAIL

PROPERTY WATCH

PROPERTY WATCH

RESIDENTIAL

News

COMMERCIAL OFFICE

from realestateasia.com

MOST READ

choosing an office location in the latter market. Between 2023-2026, Hong Kong SAR will see the addition of 10% of its existing stock, whilst Singapore will welcome the completion of 7% of its existing office supply.

On areas of talent availability and attraction, office rents and prices, and influence on Asia Pacific, CBRE said both markers are tied.

“Hong Kong SAR and Singapore play complementary roles. Hong Kong SAR is more convenient for running China and North Asia operations, whilst Singapore is more suited to Southeast Asia and India,” CBRE said.

In terms of financial talent, CBRE said Hong Kong has a wider pool, whilst Singapore has more science and technology workers.

Meanwhile, CBRE said the pricing and rental gap between the two cities’ CBD offices is also narrowing.

Whilst Singapore’s CBD is cheaper, Hong Kong offers more cost-effective decentralised nodes.

SG

vs HK:

Where should MNCs establish their APAC headquarters?

Hong Kong SAR and Singapore are both attractive locations for multinational corporations seeking to establish a headquarters in the AsiaPacific (APAC) region, but when looking at several factors, such as rental rates, technology, talent, and transportation, one market is better than the other.

According to a report by CBRE, Singapore won over Hong Kong in terms of the the technology industry scale.

“Singapore invests more in research and development (R&D) and leads in high-tech manufacturing,” Marcos Chan, head of research at CBRE Hong Kong, said.

The real estate expert, however, underscored that Hong Kong is catching up by deepening collaboration with Shenzhen and the Greater Bay Area.

In terms of ESG and green building initiatives, Singapore also has the upper hand.

“Singapore’s green building adoption rate is much higher than that in Hong Kong SAR,” according to Chan.

For Hong Kong to reduce its carbon intensity, CBRE said the city can leverage the mainland’s new energy industry growth.

Meanwhile, office availability and the scale of the financial industry are areas where Hong Kong wins over Singapore.

“Hong Kong SAR is the leader in terms

of fundraising, RMB deposits, and wealth management,” Chan said.

The expert, however, noted that Singapore’s forex business is bigger than Hong Kong, but both markets are seeing growth in private wealth management.

Chan added that Hong Kong is “wellpositioned to become the largest private wealth management centre.”

“Its proximity and strong ties with mainland China will make it the leading global offshore RMB business hub. The financial services sector will continue to be one of Hong Kong’s key economic pillars. The return of mainland Chinese firms will encourage more IPOs and related financial activities. The sector currently plays an important role in the office market, accounting for 25% of all new leasing activities in the past 15 months,” Chan commented.

On office vacancy, CBRE said Hong Kong SAR “currently stands at the highest on record with substantial new supply in the pipeline over the next four years.”

Total office stock in Singapore is only 73% of that in Hong Kong SAR, giving corporate occupiers more options and flexibility when

“Hong Kong SAR’s residential rents posted the largest decline in a decade in 2022, and those in Singapore have escalated sharply over the past three years, which could soon surpass those in Hong Kong SAR decentralised districts in Kowloon and New Territories,” CBRE said.

“With the enhanced transport connectivity within Hong Kong and in the Greater Bay Area under the ‘one-hour living circle’, and more affordable residential units than Singapore, Hong Kong is appealing to highcalibre talent from overseas markets. This is important for multinational companies when deciding on the locations of their headquarters in the region,” CBRE added.

On rents, CBRE said Hong Kong will remain weak in the medium term given that it is a tenants’ market, whilst Singapore has recovered since it is a landlords’ market.

“Despite a steady recovery in leasing momentum, Hong Kong SAR office rents are still below pre-pandemic levels and are expected to decline further before 2024,” according to CBRE.

Data from CBRE showed that as of Q4 2022, Hong Kong SAR Central’s Grade A rents remain the highest globally, about 40% higher than those in Singapore’s core CBD; however, Hong Kong SAR offers more affordable office space in decentralised areas such as Hong Kong East and Kowloon East, where Grade A rents are up to 75% lower than in the Central CBD and below those in Singapore’s decentralised locations.

6 REAL ESTATE ASIA FIRST

HK SAR and SG are both attractive locations for multinational corporations (Photo by Hu Chen and Manson Yim from Unsplash)

HK SAR and SG play complementary roles. HK SAR is more convenient for running China and North Asia operations, whilst SG is more suited to SEA and India

COMMERCIAL

Anthony Couse, chief executive officer, JLL Asia Pacific.

To take advantage of long-term real-estate opportunities, CBDs in Asia Pacific will need a balanced mix of uses, with improved amenities and investment in sustainable design. According to JLL analysis, refurbishing existing buildings is more sustainable than developing new buildings, as renovations can come with carbon impacts of less than 500 kg of CO2 per square metre – well below that of new developments, which can be up to three times greater.

How APAC CBDs can thrive amidst changing views on office use

COMMERCIAL OFFICE

Asia Pacific’s central business districts (CBDs) are on the brink of transformation. With a shift in perceptions of traditional office spaces, these hubs need to evolve beyond their original purpose and reinvent as multi-purpose destinations that cater to shifting demands for office space, greater variables in commuting and travel patterns, and a desire for “experiencebased” spaces. This is according to new research on the future of CBDs by global real estate advisor JLL.

Return to office rates are over 70% in Asia Pacific – higher than many parts of Europe and the US – with re-entry rates at pre-pandemic levels in Shanghai, Beijing, and Seoul, says

JLL. However, a longer-than-expected return to pre-pandemic levels of transit usage and footfall will push CBDs and supporting real estate and infrastructure to go beyond acting primarily as places of work.

“How people perceive and use CBDs has shifted dramatically in the past three years due to the pandemic. To be future proof, cities in Asia Pacific will need to find ways to reimagine the traditional core area to attract visitors, businesses, and investment. For the future CBD to thrive as a mixeduse destination, investors and occupiers will need data-based advice and insights to collaborate strategically and make smart decisions,” said

CBDs in Asia Pacific will need a balanced mix of uses, with improved amenities and investment in sustainable design (Photo by Polina Zimmerman from Pexels) cautious. Yet, APAC fundamentals remain robust, a stark contrast from its peers.

Investors and occupiers will need databased advice and insights to collaborate strategically and make smart decisions

According to the JLL report, reinventing CBDs requires partnerships between the private sector and governments. Investors can employ a strategic, long-term mindset toward repositioning and diversifying their portfolios to cater to shifting preferences and reduce exposure to external shocks. Developers should proactively consider locations based on potential for future growth and proximity to demand, the quality and age of buildings, and ability to meet regulatory requirements regarding energy efficiency and sustainability. Finally, governments must anticipate demand changes and provide greater flexibility to developers and investors, including through expanding tax credits to offset the cost of conversion and streamlining the planning process to reduce the lead time for delivery of new products.

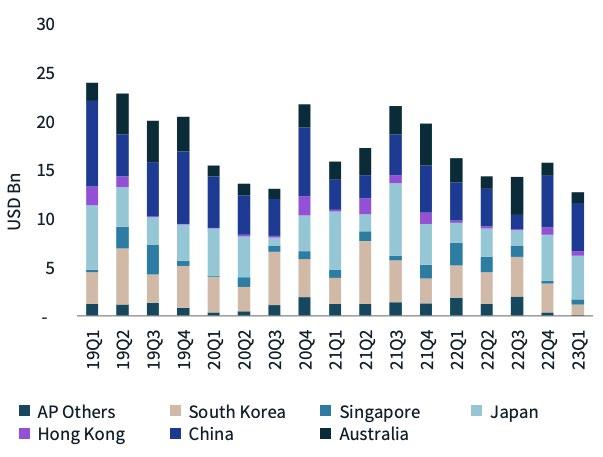

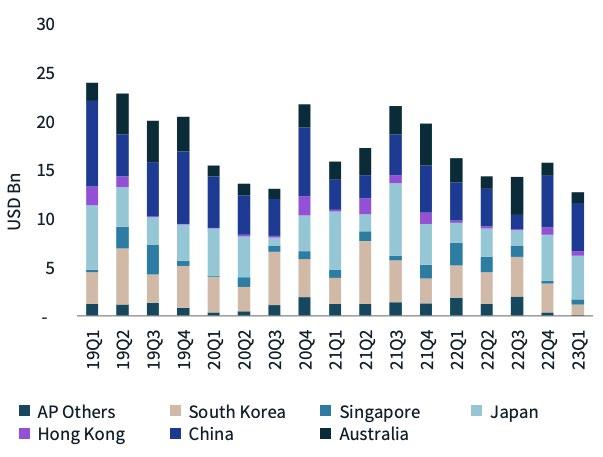

THE CHARTIST: THESE ARE THE BIG-TICKET OFFICE PROPERTY DEALS TO WATCH OUT FOR IN APAC

Adding more to the economic woes, the Asia Pacific office investment market experienced a historic decline at US$12.7b in Q1, according to a recent JLL report, sparking cautious optimism for upcoming deals and value recalibration in key markets.

Large pockets of the region reported fewer office trades were hindered by interest rate headwinds and asset repricing.

Here’s more from JLL: A lack of transactions was observed, particularly in Singapore and Hong Kong. Regionally, big-ticket deals (above US$300m) nearly evaporated with asset managers having more difficulty securing funds.

Bearish outlooks towards the US and EMEA offices started to permeate the region with global investors active in Asia turning more

The regional office market will likely see clarity around recalibration in asset values in the coming months. Highly anticipated core office deals are expected to close soon, setting a benchmark for sellers and buyers.

In Australia, the large-ticket transactions -- 50% stake in Salesforce Tower, 60 Margaret St, and 44 Market St are nearing finalisation.

In Korea, the soon-to-close prime office towers including Concordian and Alphadom Tower are expected to rejuvenate investor confidence, spurring more office sales campaigns.

Then, in Japan, the investors refocused on Grade B offices with Grade A likely to underperform amidst a strong supply cycle and weak leasing market.

REAL ESTATE ASIA 7 FIRST

Asia Pacific office investment volume from Q1 2019 to Q1 2023

Source: JLL estimates as of Mar 23

Anthony Couse

WESTERN INVESTORS LEAVE CHINA FOR JAPAN, INDIA

An unexpected shift has been seen in the Asia Pacific as India emerged as a favoured destination for Western investors, together with Japan, collectively capturing a substantial 60% share of capital inflows in 2022. In contrast, Western capital in mainland China experienced a significant downturn, reaching a 10-year low of only US$500m.

CBRE Report Figures revealed that Japan remains the top market in the Asia Pacific as buyers from the region are drawn to its positive carry, seeking markets that offer favourable returns. Likewise, India saw a remarkable investment increase of 80% yearon-year (YoY), reaching a total of US$2.8b. India was the only market in the region to gain as much capital inflows during the same period.

Surge in India's investment

The report attributes the impressive returns to the active participation of Western investors in India. Notably, the Blackstone-sponsored Nexus Select Trust acquired the Select Citywalk Mall in Delhi for US$544m. This asset is set to be included in Nexus Select Trust’s inaugural retail REIT IPO in India in May, aiming to raise US$391m (INR32b).

In their pursuit of accessing the Indian market, several investors formed joint ventures with local players in 2022. Notable examples include CPPIB partnering with Tata Realty and Brookfield, which acquired a 51% stake in Bharti Enterprises’ commercial properties.

In contrast, Western investment in mainland China experienced a sharp decline. Despite the lifting of anti-pandemic restrictions in January 2023, experts anticipate a gradual return of Western capital to mainland China. But the elevated geopolitical tension in the region, coupled with a weakened market, may still influence investor’s confidence.

APAC hotel investment plummets 51% to $3.1b

The hospitality sector in the Asia Pacific has experienced a sharp decline in the first half of 2023. Hotel investment volumes decreased by 51% year-on-year. This downturn was greatly influenced by the escalating cost of debt.

Nihat Ercan, chief executive officer of JLL Hotels & Hospitality Group in Asia Pacific explains, "We have observed the impact of a continued disconnect between robust tourism demand and macroeconomic and geopolitical challenges in the first half of 2023, resulting in a gap between sellers’ pricing expectations and buyers’ access to capital."

A closer look at JLL's data and analysis reveals that investments decreased to U$3.13b, a sharp contrast from the US$6.41b recorded during the same period in 2022.

Activity during the first half was most robust in Japan (US$1.54b) and Australia/New Zealand (US$820m), which grew by 56% and 189% year-onyear (YoY), respectively.

Gateway markets such as Singapore (US$30m) dropped by 95% YoY as the number of transactions

declined; however, with the recent sale of PARKROYAL on Kitchener Road for US$388m, the outlook for the second half of the year will be stronger. China (US$300m) also saw activity moderate by 76% YoY. Despite strong performance metrics, activity in the resort sector was muted as assets remained tightly held.

JLL's Ercan, however, has noted, "trading performance of the sector remains strong and other fundamentals including tourism arrivals and high occupancy rates provide us with full confidence that the current investment environment is externally-based, rather than industry-specific.”

Factors including the recent reopening of China in January 2023, which was earlier than expected, fuelled existing travel demand strength. As a result, there has been a considerable improvement in trading performance, particularly in the upscale and luxury segments, supported by an increase in average daily rates (ADR) across the region’s hotels.

Rise in tourism

According to JLL analysis, the rise in tourism arrivals since January 2022, which was predominantly driven by leisure demand, led to continued growth in performance amongst hotels in the region, with occupancy rates leading the recovery as more tourists return. Despite facing economic, health, and geopolitical challenges, the United Nations World Travel Organization (UNWTO) foresees the recovery in travel to continue throughout 2023. When viewing factors including the macroeconomic environment and the project interest cycle, coupled with broad investor interest in strongperforming assets, JLL has revised its full year 2023 forecast to US$8.7b, down 24% from its initial 2023 estimate.

We expect to see more specific opportunities emerge in some destinations across Asia Pacific

“Approaching 2024, we expect to see more specific opportunities emerge in some destinations across Asia Pacific, where prices have been adjusted downwards, enabling interested parties to reconsider. Investors remain very committed to the Asia Pacific hospitality sector and we see ongoing appetite amongst buyers to invest in key markets and strategic assets, with the ability to deploy capital,” says Ercan.

The long-term appeal of Asia Pacific’s hotels sector has recently been reinforced by the completion of several recent marquee transactions.

8 REAL ESTATE ASIA FIRST

Japan accounted for over half of the investments during the first half (Photo by Han Sen from Pexels)

COMMERCIAL HOTEL

COMMERCIAL

Nihat Ercan

sarai.almouj.com your ocean paradise

Co-living startup recreates a ‘home away from home’ experience with STAS

Bespoke Habitat offers short-term stays in Singapore that feel just like home.

Amidst the surging demand for rentals and ongoing construction projects in Singapore, many families are confronted with a housing dilemma. Often, those who have committed to property purchases face unexpected construction delays, whilst others, deterred by high prices, opt for rentals. The result? A growing need for short-term accommodations.

This pushed co-living startup Bespoke Habitat to transform eight vacant units in a building at 64C Telok Kurau into affordable Short-Term Accommodation Services (STAS) in four months.

Bespoke Habitat Co-founder, Ernee Ong said they also serve companies that have employees that need service apartments for four months or six months. The startup is serving 1,500 tenants from multinational corporations.

“In the market, as of now, you don’t find a place that easily for a short-term stay. It is not catered for that. As such, this is where people are coming forward to us,” said Ong.

Aside from Singapore residents, STAS can also attract foreigners looking to live in Singapore temporarily, especially those who want their families to come along on their travels.

The units have a variety of two-to three-bedrooms and penthouses at over 1,000 square feet to a 1,600 squarefoot house. The price ranges from US$3,330 to US$5,550 (SG$4,500 to SG$7,500).

Customisable units

The STAS offers flexible options whether a family wants a bare unit or a fully furnished unit. The fully furnished ones have spacious living rooms, fully-equipped kitchens, and private bedrooms. It also has high-speed Wi-Fi and laundry

machines. Some units come with a study area, a terrace with a pool, and a dining area.

For families renting units and bringing only their luggage with them, Ong said Bespoke can offer beds, tables, chairs, and other furniture for rent. Other perks are the firm’s in-house cleaning services apps such as Bespoke CleanPro and BH Aircon Solutions. All tenants and owners can check on the last service or cleaning status of their respective units with the use of the app.

The apps also allow residents to schedule their cleaning services, request maintenance, and to access a diverse range of other services.

Future locations

The STAS kicked off at the eastern side of the city-state, where it has proximity to Marine Parade, shopping malls, and corporations in Changi Business Park. But Bespokse Habitat plans to bring the STAS to the western part of Singapore.

“A lot of our contacts are [western part of Singapore]. The majority of our co-living segment, I will say 65%, is in the western part of Singapore. We have fostered a lot of relationships in the community, whether it’s school clients or engagement,” said Ong.

Since the accommodation service is affordable, Ong noted that they make profit through charging a percentage of the management fee.

“We do on a win-win basis — when a performancebased model, for example, for these tests, based on X amount that we were able to contribute to the landlords, then we charge a percentage of management fee,” explained Ong.

10 REAL ESTATE ASIA

In the market, as of now, you don’t find a place that easily for a short-term stay

SPACE WATCH

Ernee Ong

Bespoke also provides a rented sofa to liven up and add comfort to the living room

SINGAPORE

Bespoke Habitat’s co-living space has a dining area for families’ culinary needs

SPACE WATCH

There is also muted-coloured rented bed and closets for married couples

The stylish furnishings evolve the study experience in the dedicated study room

Here is another design of bedroom space at STAS

Some units have pools and a terrace to add a leisure environment for families

There is also muted-coloured rented bed and closets for married couples

The stylish furnishings evolve the study experience in the dedicated study room

Here is another design of bedroom space at STAS

Some units have pools and a terrace to add a leisure environment for families

‘Wall-less’ office opens up collaboration amongst AnyMind’s creatives

The office encourages employees to collaborate, relax, and enjoy ‘happy hour’ and ‘mental space.’

When commerce tech company, AnyMind, was planning to transfer offices, the company’s main goal was to move to a “collaboration space” rather than a “co-working space,” which is why its new headquarters in Kwun Tong was fit out to have no walls between departments.

“Everything is kind of open. We particularly picked this office because there are just full height windows all around, there are no walls,” AnyMind Managing Director for Greater China Ben Chien told Real Estate Asia.

“Our type of business requires a lot more collaboration, less room, [and] less privacy on purpose. We don’t need as many private areas. We designed it [in a way] that everyone can sort of hear what each other is doing; [that’s] the basis for collaboration. If we don’t know what other people are doing, it’s kind of hard to collaborate,” Chien explained.

Since floor-to-ceiling windows adorn AnyMind’s office – even its conference room –employees not only get good lighting but also picturesque city views, particularly of Victoria Harbour.

Apart from being “wall-less,” AnyMind’s headquarters was designed to offer employees a “relaxed environment.”

Amongst spaces in the office where employees can relax whilst doing their job or simply take a break in the “collaboration area,” which looks like a greenfield and has bean bag chairs.What also makes the office “relaxing” are its wooden furniture and flooring.

Beyond the facade

Chien underscored that apart from physical space, employees in AnyMind are also given “mental space” to

do their jobs better and come up with more creative ideas. AnyMind’s effort to boost their employees’ morale goes beyond, one of which is providing them with a relaxing space to work with.

The company also has team-building activities in the office such as “happy hour” and “TGIFridays” to increase the job satisfaction of their employees.

“We have lunch on Fridays or have a beer or something after work. We support this because it will encourage everyone to build relationships outside the office environment, to talk about other things other than just work all the time,” Chien explained.

Recognising employees

AnyMind also gives department-level awards to their best employees and rewards them with either travel or time to take a break and relax.

“It’s difficult enough to find the right people. We have to do whatever it takes to keep these people and to pretty much get the most out of each other,” Chien noted. Currently, AnyMind has 38 employees in its office in Hong Kong.

For better performance of employees, AnyMind also provides training and coaching to their senior members.

“The training and coaching program in Hong Kong is completely new. These help everyone have a stronger mindset and have a better understanding of their strengths and weaknesses and activate their power,” Chien said.

In the end, Chien emphasised it is most important to let employees know that “the company will invest in them.”

12 REAL ESTATE ASIA

SPACE WATCH

A logo of AnyMind and Acqua greets employees of the commerce tech company Full height windows surround AnyMind’s meeting room

HONG KONG

Ben Chien

If we don’t know what other people are doing, it’s kind of hard to collaborate

SPACE WATCH

AnyMind’s new headquarters in Kwun Tong have no walls between departments

AnyMind conducts team-building activities in the office such as “happy hour” and “TGIFridays” to increase the job satisfaction of their employees

Its "collaboration area" has a greenfield look and bean bag chairs for relaxation and informal work

AnyMind’s new headquarters in Kwun Tong have no walls between departments

AnyMind conducts team-building activities in the office such as “happy hour” and “TGIFridays” to increase the job satisfaction of their employees

Its "collaboration area" has a greenfield look and bean bag chairs for relaxation and informal work

Developers gear up for prime sites in Singapore's H2 2023 Government Land Sales

The programme comprises eight confirmed list and nine reserve list sites.

sitting next to Orchard Boulevard MRT station and close to the premier shopping belt at Orchard Road.

“The embassies in the vicinity and the Singapore Botanic Gardens. The last time a GLS site was sold in the Orchard Road area was in May 2018, where Cuscaden Reserve is now being developed,” Tay said.

Data from OrangeTee showed that Cuscaden Reserve attracted nine bidders. The winning bid for the site was US$1,784.28 (SG$2,377.2) per square foot per plot ratio (psf ppr) and was awarded on 17 May 2018.

Christine Sun, Orange Tee’s senior vice president of research and analytics, has stated that Orchard Road may be viewed as a “trophy project” by the developers.

With strategic locations and accessibility to mass transit stations, four prime sites under Singapore's second half (H2) of the 2023 Government Landscape (GLS) programme are drawing significant attention from real estate insiders. Not only do they promise unparalleled connectivity and luxury, they could usher in a fresh chapter in the city-state's residential development.

These four prime sites include Orchard Boulevard, two on Zion Road, and Holland Drive.

According to Tricia Song, CBRE’s head of Research for Southeast Asia, the prime sites account for 24% or 1,225 units of the total units that can be built on the Confirmed List. Including the Reserve List, these four prime sites make up about 29% of the total residential supply.

The prime sites under the Confirmed List are Parcel A - Zion Road and Orchard Road, whilst Parcel B - Zion Road and Holland Drive are under the Reserve List.

“We have not seen such prime sites since GLS H2 2019’s Irwell Bank Road site, and not as many prime

choices in a single GLS programme in a decade or more. The proportion devoted to prime sites is surprising given the recent cooling measures, which included the 60% Additional Buyer's Stamp Duty (ABSD) on foreigners and should affect the prime housing market the most,” Song commented.

Meanwhile, the four sites can also potentially inject over 2,500 units into the Core Central Region (CCR), according to Leonard Tay, Knight Frank Singapore’s head of research, as the government seems keen to develop residential catchments around these mass transit stations.

“It does appear that with the commissioning of new MRT lines in recent years, such as the ThomsonEast Coast Line, the government is also starting to populate residential catchments along some of these new mass transit stations, such as at the Orchard Boulevard, Zion Road and Upper Thomson Road plots,” Tay commented.

Orchard Boulevard

What makes this site attractive is its location, said Tay, adding that it is

“It is a plum site situated beside the Orchard Boulevard MRT station and nestled within the Orchard shopping belt, which is very rare in the market. The MRT station is along the Thomson East Coast Line opened recently. Moreover, few new developments in the Orchard area are directly linked to an MRT station,” Sun said.

“There has not been a GLS released for sale in the vicinity in the past five years ago. Therefore, developer and buying interest may be healthy for this plot…The future condominium may be marketed as a super-luxury project which may draw keen interest from high-networth individuals,” she added.

Lee Sze Teck, Huttons’ head of research, said the top bid for the site could be more than $1,500 psf ppr.

Zion Road

The two Zion Road land parcels will be attractive to developers because of the accessibility to public transport nodes, said Tay, adding that the sites are a short drive from the Central Business District (CBD).

Lam Chern Woon, EDMUND TIE’s head of research and consulting, expects strong enduser demand for the Zion Road parcels “given its choice location and

14 REAL ESTATE ASIA PROPERTY REPORT: SINGAPORE

The government is starting to populate residential catchments along some of the new mass transit stations (Photo by yenwei from WikiCommons)

We have not seen such prime sites since GLS

H2 2019’s Irwell Bank Road site

Tricia Song

Leonard Tay

proximity to the Great World City, the Tiong Bahru food centre, quaint and hip neighbourhood of cafes, and the Great World MRT station.”

Sun had a similar sentiment, saying the future development in the site may be popular among buyers as it is within walking distance of an MRT station. “However, future condominium units may not enjoy river views as they could be blocked by nearby developments,” she added.

Still, Sun expects strong interest from developers on this site, given that other GLS in the vicinity attracted many bidders.

Lee , on the other hand, expects the top bid for Zion Road (Parcel A) to reach more than $1,300 psf ppr.

Holland Drive

“The Holland Drive site introduced in H2 2023 can be an interesting one for developers, as it is located next to

units. Lam had a similar sentiment saying that the Holland Drive site will “ride” on the success and rejuvenation of the Holland Village precinct by the One Holland Village project.

“This site is likely to draw strong interest from developers given its proximity to town, the range of amenities and F&B options, as well as connectivity provided by the Holland Village MRT station on the Circle Line,” Lam added.

Other attractive sites

Other sites which experts believe will be attractive to developers include De Souza Avenue, Upper Thomson Road, Clementi Avenue 1, Lorong 1 Toa Payoh, and Tampines Street 95 (Executive Condo).

De Souza Avenue under the Reserve List, is expected to draw in developers due to its proximity to the Bukit Batok Nature Park and

due to its proximity to the ThomsonEast Coast Line. “There is ample greenery in the vicinity which will draw nature lovers and units facing the greenery may have good views. However, some units at Parcel B which faces the expressway may be noisy and dusty,” Sun commented.

Clementi Avenue 1 Site and the Lorong 1 Toa Payoh sites will gain interest as both these projects are in popular residential precincts namely Clementi and Toa Payoh, said Wong Xian Yang, Cushman & Wakefield’s head of research for Singapore & SEA. “The sites [are] underpinned by strong underlying buying demand,” Wong said.

Meanwhile, the Lorong 1 Toa Payoh site will be popular given that the supply of private homes in the area is quite limited. The top bid for Lorong 1 Toa Payoh could be more

REAL ESTATE ASIA 15 PROPERTY REPORT: SINGAPORE

Christine Sun

Lee Sze Teck

Lam Chern Woon

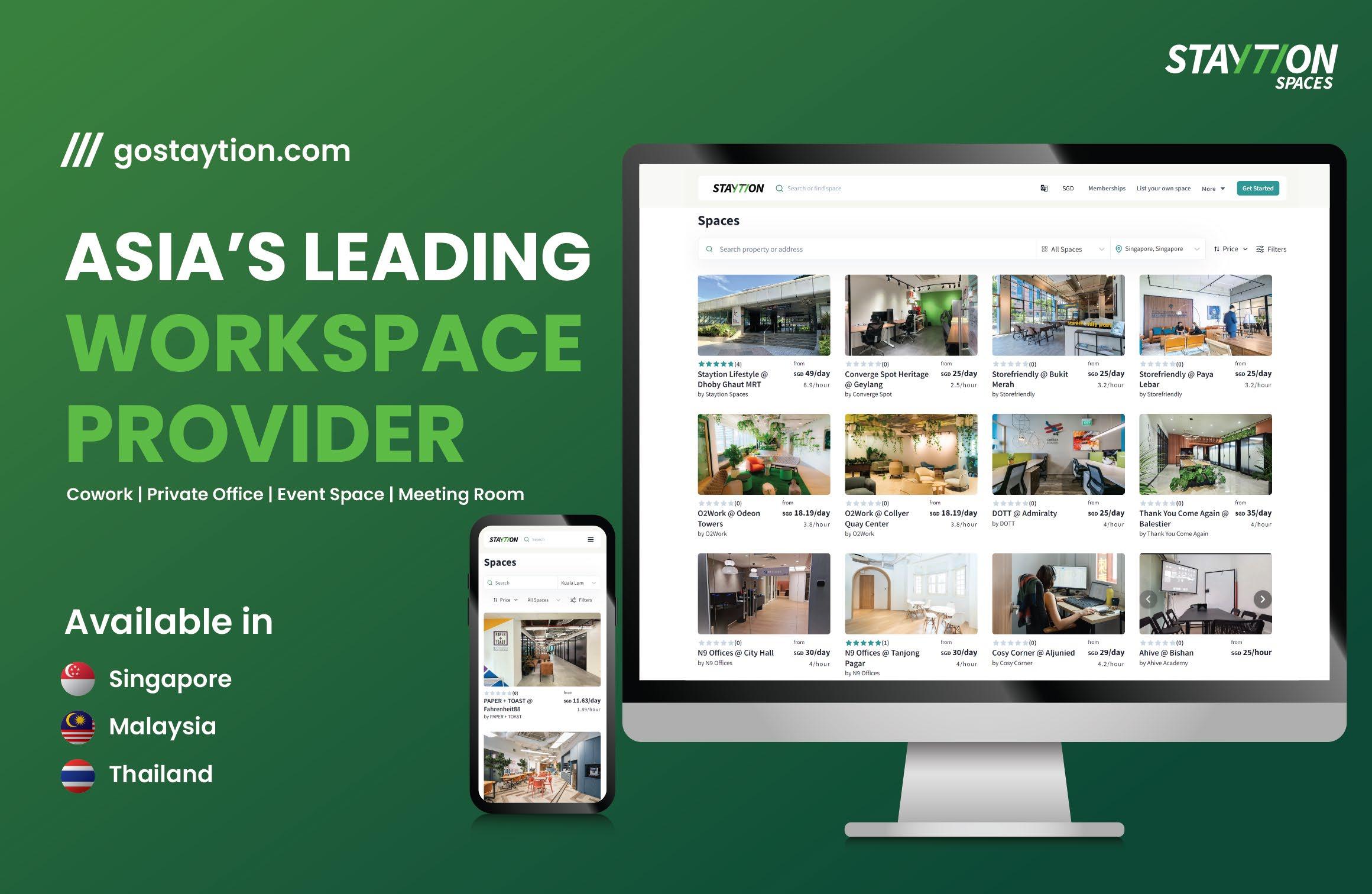

Excess supply of offices depleting in Asia-Pacific

By 2033, the region will have the lowest future office availability.

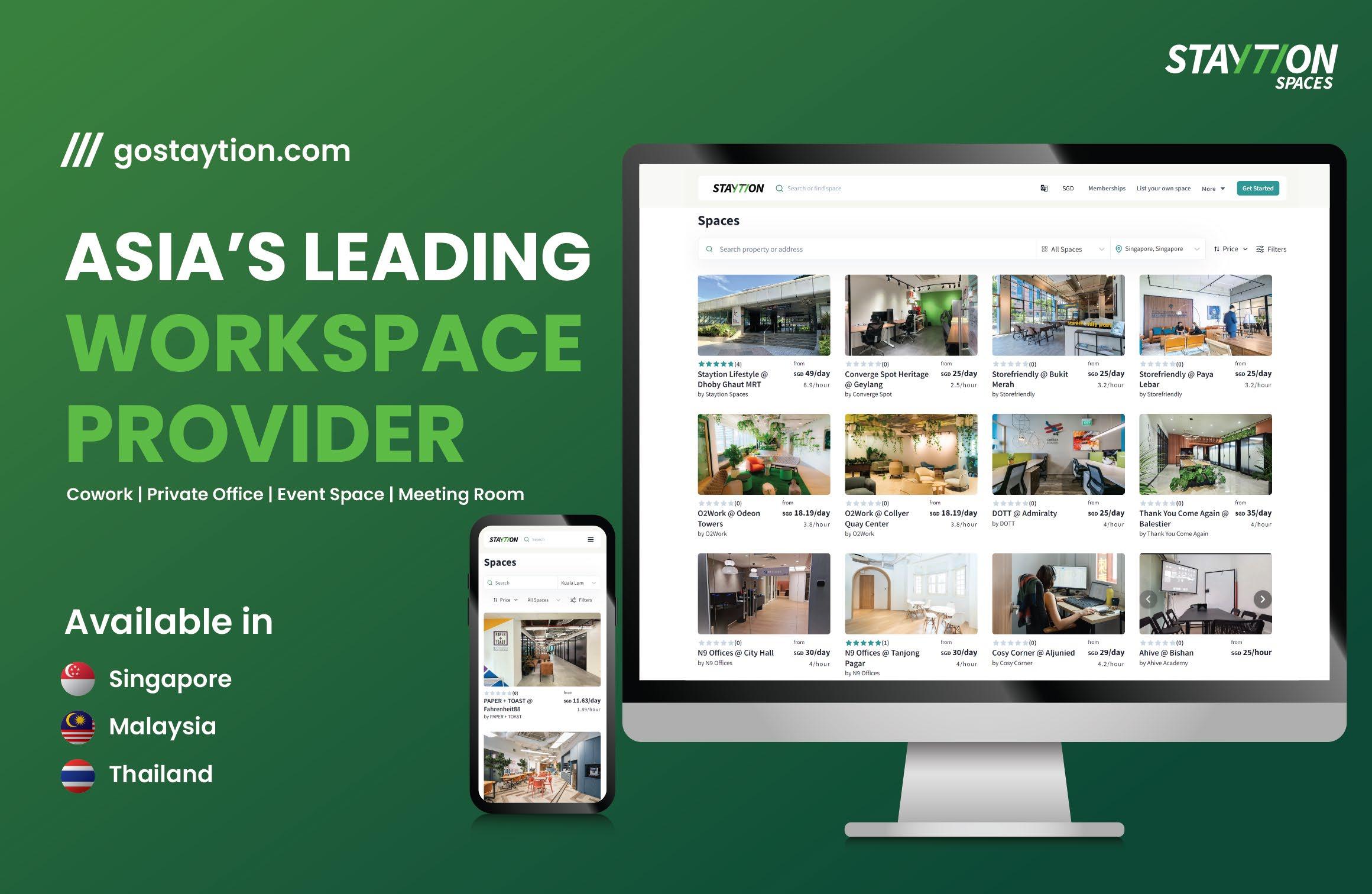

Future Office Availability Index

The Asia-Pacific region faces a looming depletion of excess office supply by 2033, driven by shifting workplace dynamics, according to forecasts by Savills' Future Office Availability Index.

Cities such as Singapore, Seoul, and Mumbai are at the forefront of this trend, in contrast to the United States, which is projected to have ample office availability in the same timeframe.

“This isn’t about offices just becoming empty due to some cities seeing lower return to work levels post-pandemic”, said Kelcie Sellers, associate at Savills World Research. “It’s about how longterm economic, demographic and development trends interact with working patterns, to determine which cities potentially need to focus most closely on retrofitting and repurposing excess office space for other uses.”

The Savills index indicates that United States cities are likely to have the highest future office availability,

whilst the excess supply for cities across the Asia-Pacific region are expected to be lowest. European cities generally fall in the middle, with supply and demand dynamics maintaining a relatively balanced state, whereas in Singapore, a growing number of employees are returning to the office, particularly in industries such as banking, finance, and companies from China, Japan, and Korea.

However, technology firms continue to embrace flexible working policies. Going forward, a hybrid working model is anticipated, driven by the need to retain millennial and Gen Z staff who value remote work and occupiers’ need to reduce rental overheads.

Singapore’s new office supply has remained relatively low from 2020 to 2022. In 2022, considering the withdrawal of office space from the market and new additions, the net lettable area (NLA) is recorded at 926,000 sq ft (Source: URA). For

2023, despite the influx of 1.9 million NLA of new space, a significant portion (1.26 million sq ft) is attributed to IOI Central Boulevard. Considering potential project delays, this upcoming development may spill over into the supply figures for 2024. Cumulatively, from 2024 to 2028, the projected new supply stands at 3,196,000 sq ft NLA (Source: Savills).

Alan Cheong, executive director of Savills Research & Consultancy, comments, “Whilst office space in most developed economies faces excess supply in the coming years, Singapore remains a relatively tight market due to a lack of new supply, which offsets the expected decrease in demand as companies adopt hybrid work models.”

In comparison, US cities are projected to experience the highest office availability over the long term. Many occupiers have already implemented “return to office” mandates in 2023, which is expected to drive short-term office demand. This will gradually reduce the surplus space in some locations, offering tenants a range of options to choose from.

Retrofitting excess space

Marcus Loo, chief executive officer of Savills Singapore, highlights, “Singapore’s office market may possibly buck the trend observed in the US, as local authorities manage the supply of land available for large-scale office developments. Moving forward, the narrative will revolve around two key themes. A limited supply-driven market and the increase in secondary stock. Two diametrically opposed effect on rents and how it will behave, and we expect these two themes to continue to play out in an economic environment as occupiers continue to remain cautious on spending.

However, it is becoming apparent that higher tiered green buildings will see sustained interest as more tenants consider environmental, social, and governance (ESG) factors in their selection and decisionmaking process.”

To read the full story, go to https:// realestateasia.com/

16 REAL ESTATE ASIA PROPERTY REPORT: APAC

More tenants consider environmental, social, and governance (ESG) factors

Source: Savills Research using Oxford Economics, Kastle Systems, and local sources

Note: Index is colour ranked from markets most likely to see an increase in office availability (dark blue), to those least likely (burnt orange). Each category is individually colour-scaled. Utilisation trends is given a half weighting. Demand trends and supply trends are equally weighted.

Alan Cheong Demand trends Supply trends Utilisation trends Total San Francisco New York Los Angeles Chicago Houston Washiton DC London Berlin Madrid Hong Kong Amsterdam Frankfurt Dubai Tokyo Paris Sydney Shanghai Beijing Kuala Lumpur Delhi Singapore Mumbai Seoul Guangzhou Ho Chi Minh City Shenzen

Kelcie Sellers

Savills pioneers next-level 3D interactive property tours in Hong Kong

Clients can see the whole property, tenants, and community virtually.

Multinational firms seeking new offices in Hong Kong will no longer need to fly out to the city to view potential properties or ink property contracts blind, thanks to Savills’ launch of interactive 3D models.

Through this technology, would-be property buyers and renters will be able to simulate what it’s like to stand and move in the same exact space as the unit they are looking to get, even when they are standing a thousand miles away from the exact property.

Godfrey Cheng, deputy senior director of Savills Hong Kong, said travelling constraints brought at the height of the COVID-19 pandemic gave Savills the reason to come up with this new service.

“People, especially those from Singapore and our overseas clients, cannot go to Hong Kong physically at the time,” Cheng told Real Estate Asia. “We found this tool which offers property tours virtually so that the client could just click on the link and browse all kinds of information they may need.”

Tech investments

Whilst the technology for 3D space capture has been available since the mid-2010s, Savills’s new technology has gone beyond the limitations of just touring a single space. Its technology allows clients to view whole buildings, as well as nearby tenants who might well be their next neighbours. “It is quite different from what we found on the market previously, which is only the Matterport-type virtual tour,” Cheng said. This technology has been on the market for five to six years, he noted, but usually only has a link to a single unit or a single floor. To offer its new service, Savills teamed up with startup Inspace XR, which makes use of virtual reality and augmented reality to create interactive 3D

models for the AEC (Architecture, Engineering, Construction) industries. This allows Savills to bring forth interactive, high-fidelity VR experiences to buyers, tenants and stakeholders beyond the confines of geography.

“For our 3D model, what we do is find the keywords that integrate all the elements in one link. An investor could just click a link, and they will be able to virtually visit the property,” Cheng explained.

He gave the magazine a tour of the service, which giv es a view not just of the building’s interface, but also information regarding which tenants are in the property, for example. It also gives an overview of nearby infrastructure and buildings, even those that have not yet been fully built. For clients, Savills Hong Kong tailors a link to show them the keywords or details they may particularly want to know about. “This saves a lot of time for

our tenants and buyers before they actually physically install in the property, because it saves them a lot of time from travelling,” Cheng said.

More than anything, the service positions Savills as a pioneer of interactive 3D model technology in the Hong Kong and Greater China real estate industry.

“As the first real estate services firm to formally adopt the interactive 3D model technology, we firmly believe it will prevail in the industry,” Raymond Lee, CEO, Greater China of Savills, remarked during the launch of the service.

“Working with Inspace XR, we hope to pioneer this technological breakthrough in our business operations in property investment, leasing and property management advisory, with a view to promoting the technology to a wider circle of asset management companies, REITs and developers that leads to the digital transformation of the local real estate industry,” Lee said.

18 REAL ESTATE ASIA CONCEPT

WATCH

INSPACE XR interactive 3D model (Photo courtesy of Savills Hong Kong)

An investor could just click a link to virtually visit the property

Godfrey Cheng

Raymond Lee

HONG KONG

Trendsetting students drive SWID’s Metaverse apartments’ occupancies

Investors, who are only 30% of the total, also rent out their units to students.

Property developers are racing to construct towering structures to target millennials in smaller cities, with Yogyakarta standing as a prime example.

PT Saraswanti Indoland Development Tbk (SWID) has recently developed a 60-metre-tall high-rise building with 18 floors in the area they call Mataram City. The infrastructure offers metaverse-era apartments, designed specifically to appeal to the preferenes of millennial and Gen Z students.

The company’s marketing director, Mita Ratri, explained that students comprise 70% of the building's occupants, with the remaining 30% being investors who rent their units to students.

Design for students

SWID recognised the potential of the market in Yogyakarta, where the demand for high-quality student housing far outstrips supply. With boarding prices in the city reaching up to US$132.20 (IDR2m) per month, SWID saw an opportunity to cater to a new generation of students with increasingly sophisticated tastes and financial capabilities.

According to Ratri, young people today are very different from previous generations in their preferences for living spaces. “They don’t just want a place to sleep; they want a place to relax and enjoy themselves. That’s why our apartments are designed to be a ‘staycation’ destination.”

Mataram City is a mixed-use area that spans nearly three hectares of land in Yogyakarta. It combines apartments with hotels, convention halls, restaurants, cafes, minimarkets, gyms, co-working spaces, ATM centres, open areas, jogging tracks, and large parking areas.

Five towers make up the development, including Nakula, Sadewa, Yudhistira, and the two towers that were recently launched, namely Arjuna and Bima. SWID has paid close attention to the design and interiors of their

apartments, recognising that current young generation today value aesthetics; hence, very design-conscious.

“I have to think creatively with my team, most of whom are young people. Once, when we made a campaign with prizes for students, we found that they were more interested in getting Yeezy shoes as prizes than prizes for TVs, air conditioners, or refrigerators,” told Ratri.

Metaverse apartments

SWID’s strategy to capture the student market goes beyond offering aesthetically pleasing apartments. They also emphasise the use of technology in their developments, with a focus on what Mita calls “apartments in the metaverse era.”

“We approach consumers through a virtual tour that we have developed. They don’t need to visit and can see everything live in hand,” said Ratri.

The units are equipped with a Google Assistant that manages everything from electricity to room temperature to water management. “Everything is integrated, including secure parking, which is typically found in high-end developments,” explained Ratri. SWID has also incorporated elements of Yogyakarta’s cultural heritage into their developments. Mataram City, for example, is named after the ancient Javanese kingdom that once ruled the region. The names of the towers also draw inspiration from Javanese mythology, with Nakula, Sadewa, Yudhistira, Arjuna, and Bima all referencing characters from the Mahabharata.

SWID’s innovative approach has paid off, with the company achieving an increase in sales even during the pandemic. It was able to hand over apartments in 2020; and in 2022, it registered as a public company on the Indonesia Stock Exchange.

REAL ESTATE ASIA 19

Mataram City is a mixed-use area that currently consists of three towers, the Nakula, Sadewa, and Yudhistira, located in Yogyakarta (Photo courtesy of SWID official website)

are designed to be a ‘staycation’ destination

Apartments

PROPERTY WATCH: MATARAM CITY INDONESIA

Sun Hung Kai Properties’ hybrid aparthotel caters to next-gen tenant needs

TOWNPLACE WEST KOWLOON offers incredibly flexible lease terms in a modern and upbeat community.

Young professionals in Hong Kong are now looking beyond location and design when searching for homes and are choosing spaces that can offer them an “exquisite living experience,” which is why Sun Hung Kai Properties created a development that offers both.

TOWNPLACE WEST KOWLOON (TPWK) is an 843unit aparthotel tailored for young professionals, offering individual layouts, mostly studios and onebedroom as well as options of two-to three-bedrooms. The size of units ranges from 243 square feet to 860 square feet.

The development was established with the help of the interior design experts at Conran and Partners and architectural firm, LAAB.

Hybrid concept

“Aparthotel is the exact answer to the modern needs of young professionals that does not rigidly define the space, but combines the good side of both apartment and hotel — that’s what we call a hybrid concept,” TOWNPLACE (TP) Deputy General Manager Elee Lee told Real Estate Asia.

Flexibility to every extent — lease terms, designs, and ondemand services

“Flexibility to every extent — lease terms, designs, on-demand services, etcetera — allows millennials to choose what they want. Flexibility is definitely our edge,” Lee added.

The TOWNPLACE features that make it attractive to young professionals include a hybrid shortand long-term leasing model and hotel service on-demand options.

Lee revealed that TPWK offers flexible leases from mere days to months, and even years.

Apart from flexible leases, the TOWNPLACE development also offers a “trio” unit which is designed for tenants who value “togetherness and privacy.”

“Each of the three private bedrooms is connected to a spacious shared living room area, providing the perfect balance of comfort and socialisation. It is perfect for a group of working buddies or partners who want to stay close together whilst still enjoying their own private space,” Lee said.

The development also prides itself on the “Community.” The development has a comprehensive clubhouse as well as a common area where tenants can socialise.

“Young professionals need a socialising platform for them to get together and to build something greater. They look for a dynamic and quality lifestyle as well as a platform allows that them to have social and business networking, We name it as ‘Blesisure’ lifestyle,” Lee said.

A centre for young professionals Sun Hung Kai Properties selected West Kowloon as the location for its new aparthotel for several reasons, but mainly for being “consumer/ customer-centric for the young professional.”

“The lively West Kowloon Cultural District is becoming an outstanding creative hub, attracting young professionals and inspiring modern and traditional ideas,” Lee said.

In addition, the government is developing West Kowloon into a business district; thus, stirring up young professionals’ preference to live in the area.

“The buzzing new West Kowloon Cultural District (WKCD) is shaping up to be a hive of outstanding creative activities, which has become a thriving destination for young professionals to gather and be inspired by both modern and ancient ideas alike,” Lee explained.

TOWNPLACE WEST KOWLOON s close to Hong Kong’s Central Business District and high-speed rail station and airport line station.

The development is also adjacent to the International Commerce Centre (ICC) and the International Finance Centre (IFC). Other notable places near the development are M+ and the Hong Kong Palace Museum.

Lee said there will also be an upcoming Grade A office development in West Kowloon, making the area the perfect place for the aparthotel.

Looking ahead, Lee said Sun Hung Kai Properties will build more developments that cater to the needs of the new generation tenants.

20 REAL ESTATE ASIA PROPERTY WATCH: TOWNPLACE

TOWNPLACE WEST KOWLOON Facade (Photo from Sun Hung Kai Properties)

HONG KONG

IOI CBT redefines cooling system to reduce aircon dependence

Real estate developer IOI Properties’ new Central Boulevard Towers (CBT) installed a smart system within its rooms to adjust the temperature depending on the number of occupants. For example, when there are two people, the temperature will not be too cold.

Each office at the tower has a double-glazed full-glass window that allows an optimal indoor environment with ample natural lighting, resulting in lower aircon consumption.

"Our facilities will help guide the tenants to design the rooms [and] the breakout area in such a way that they are able to balance the aircon proportionately within the space itself,” Karen Lau, head of business at IOI Properties Singapore, told the Real Estate Asia

The development's orientation also allows enough sunlight into the office, leading to natural ventilation in its plaza area.

IOI Properties invested US$1.89m for the CBT project, which began in 2017. It will be completed this year but will only be occupied by early next year due to pending paperwork. Morgan Stanley and Amazon may be the first businesses to occupy the CBT spaces.

Convenient space

The property has an eight- to 16-storey shorter podium tower, an eight-to 48-storey taller tower, and 70,000-square feet (sq ft) of two ultralarge floor plates at Levels 5 and 6.

IOI CBT's offices also have breakout areas to attract talent and retain employees.

The development has a “Central Green” space, a 200-metre jogging track and biking parking lots to promote healthy transportation.

IOI CBT has also changing rooms and shower facilities to encourage biking to work without feeling sweaty in the office.

We immediately saw an opportunity for a new Grade A office development to better cater the needs of Singapore

Another convenient feature is a childcare centre for working parents to let their children have a place to stay on a workday.

Perfect for hybrid workers

The development is also highly accessible to hybrid workers due to its seamless connections to at least four MRT stations, with direct underground links to Downtown, Marina Bay, Raffles Place, and Shenton Way. It also has link bridges to One Raffles Quay and Asia Square. It is within walking distance of Singapore’s key financial and business centres in Raffles Place, Shenton Way, Cecil Street, and Marina Bay.

“When we looked at other developments in the area, we immediately saw an opportunity for a new Grade A office development to better cater to the needs of Singapore’s modern workforce in the heart of the Marina Bay District,” said Lau.

Sustainability as a core design

IOI CBT is also connected to the Marina Bay District Cooling Network, making it committed to the network’s focus to reduce the district’s carbon emissions by 19,439 tonnes yearly, equivalent to getting rid of 17,672 cars on roads.

The Building and Construction Authority also awards the development of the Green Mark Platinum Certification in Singapore. With this certification, IOI CBT generated 30% energy and water savings and environmentally sustainable building practices. This means it commits to over 4,146 tonnes of carbon dioxide emission reduction each year.

Once the tower has opened to tenants, its other sustainability initiatives include recycling systems, waste disposal, and cleaning materials.

REAL ESTATE ASIA 21

IOI CBT is made of 75% of precast concrete, which cuts carbon and construction waste (Photo from Raffles Quay)

The IOI Central Boulevard Towers use a balanced air conditioning feature to lessen the carbon footprint in the units.

CBT SINGAPORE

PROPERTY WATCH: IOI

Karen Lau

ANALYSIS: CONSTRUCTION

Competing construction firms unite to meet industry’s towering demand

Builders leverage technology and shared expertise as the construction sector anticipates a $26b growth this year.

With millions to billions of dollars involved in every construction development venture, one would assume that builders compete fiercely to secure these projects. That cannot be said about Singaporean constructors that have begun to collaborate with competitors amidst an anticipated growth of the industry.

Data from the “Singapore Construction Industry Databook Series” show that Singapore’s construction industry will grow by 2.1% to reach US$26.57b in 2023. The Building and Construction Authority (BCA), meanwhile, estimates construction demand to range between US$19.93b and US$23.62b.

“Companies are actively exploring collaborations with competitors to risk-share and capitalise on new build projects,” Dennis Lee, partner at RSM Singapore, told Real Estate Asia. “Construction firms have [also] been looking closely at capacity management, reducing down time and working closer with authorities to explore flexibility and efficiency in project planning,” Lee added.

Catching up

Lee said firms are also collaborating with competitors to make up for lost time during the pandemic and work on project schedules that have been pushed back.

ISG General Manager Kelvin Hon has made the same observation, citing how several contractors are working on a single development since the clients have split big projects up into separate packages.

Lee agreed that subdivision of a project into smaller phases or packages may promote concurrent activities and reduce overall project duration.

The RSM Singapore expert added that doing such will also help “limit exposure to a single main contractor that may not have the strongest of financial positions.”

“Working with a broader range of project vendors, allows developers

to extract value by leveraging on a range of expertise, specialisation and valuable relevant experience,” Lee added. However, he underscored that there are still projects that have fallen behind timelines despite such arrangements. “This can often be attributed to coordination challenges and having to align interests with a larger pool of working parties,” said the RSM expert.

“Other downsides [of such an arrangement] include inconsistent communications in particular relating to health and safety, which can be overlooked when having to deal with numerous parties,” he added.

Tech as foundation

Apart from coming together, firms have leaned into technologies such as Building Information Management Systems (BIMS), to avoid project delays. BIMS, in particular, helps firms in terms of “better end stage visualisation and anticipation of resource or material deficiencies which could further worsen project delays.

Companies also looked hard into implementing project management systems which allowed them to reduce

data gaps and better identify project shortages that could be addressed with the necessary parties earlier,” said Lee. Hon said that adoption of technology brings enhanced efficiencies and opportunities to the construction process, whether it’s the use of game-engine derived 3D renderings to produce realistic building walkthroughs or to validatematerial products and specifications.

Head-mounted cameras are also used to provide project updates without the requirement to physically visit site for progress reports. These technologies not only help speed up projects, but also address other challenges hampering the industry such as the manpower crunch.

Addressing obstructions

Lee said labour shortage remains one of the major challenges of the industry, given that Singapore has a heavy reliance on foreign manpower for building projects. Insufficient dormitory space throughout Singapore to house registered construction workers have also affected labour supply in the industry.

To read the full story, go to https://realestateasia.com/

22 REAL ESTATE ASIA

Companies are actively exploring collaborations with competitors to risk-share and capitalise on new build projects

Downsides [of collaborating] include inconsistent communications in particular relating to health and safety

Kelvin Hon

Dennis Lee

SINGAPORE

How to find the right flex space for an organisation

Five out of 10 organisations in Singapore opt for flex leases, says an IWG expert.

situation because the landlord will retain you as a tenant and they can have space that can go back into the market to lease out again so they won’t lose the client,” he explained.

With environmental, social, and corporate governance (ESG) being a big topic in Singapore, Van Beijsterveldt said occupiers must look into sustainability credentials of the space providers.

Rogers said IWG also chooses landlord-partners whose buildings have received Green Mark Certification. An example of this is IWG’s Regus Centre at 61 Robinson Road, which has received a Green Mark Platinum certification.

“Using flex and the recyclability and the reusability of the same space helps organisations reduce that footprint from their long term leasing strategy as well,” the IWG executive said.

Demand drivers

Businesses are pivoting from traditional long-term leases to flexible spaces to cut their office footprint and meet the workers' varying demands. To help occupiers narrow down their options, operators have begun offering spaces to cater to the specific needs of businesses.

IWG, for instance, has a roster of brands that cater to different ways of working such as Signature, which has a high-end finish and resonates with users who want to give an “image and presence” of being a C-suite environment.

“We also have our Spaces brand which tends to be more entrepreneurial, a little bit more relaxed, and what you would classify as a co-working environment,”

IWG Singapore Country Manager Darren Rogers said.

Rogers underscored, however, that organisations must first identify how their organisation works and what kind of work environment is needed by the employees when choosing flex spaces.

Companies such as Standard Chartered, for instance, which may need a lot of private meeting rooms to have in-depth discussions amongst employees will likely need a clinical environment in which to work. “One product and one type of co-working

One product and one type of coworking [setup] doesn’t always work for every customer

[setup] doesn’t always work for every customer,” Rogers stressed, adding that a company’s accounts team won’t have the same demands as the tech team.

Colliers Singapore Managing Director Bastiaan van Beijsterveldt shared a similar sentiment, underscoring how important it is for organisations to know what employees want.

“Businesses should not only look at how the office is being used today, but more importantly, how employees want to use the office tomorrow,” Van Beijsterveldt said.

“It could be that today your colleagues would like to have some more informal kind of conversation points or informal meeting points; so instead of having just desks and meeting rooms in your office, you also have open spaces. But then later on, you will have more people back to the office for focus work… and want more individual desks,” he said.

Since flex spaces also translate to flexible leasing terms, Van Beijsterveldt advised occupiers to look into how their landlords can agree to more flexibility.

One option for occupiers with a five-year lease term is to propose that some space be handed back over time. “It can be a win-win

Companies’ shift from traditional long-term leases to flex leases are driven by a lot of factors, including the uncertainty of where hybrid work is going.

“Certain occupiers, prefer not making decisions right now that have a longer-term impact because they don’t necessarily know how the office will be used in three years’ time or how the business’ growth will be over the next three years,” Van Beijsterveldt said.

In Rogers’ view, many organisations are shifting to flex spaces to reduce facility spending.

“Sixty-five percent of all CFOs (Chief Financial Officers) are looking to achieve at least 10% cost savings, which they can do through resizing, remodelling their existing portfolio and existing office space,” he said.

“We also found about 50% of businesses are already reducing and opting for shorter term leases, as well, which naturally brings you into the realms of looking at hybrid and flexible solutions,” he added.

Rogers underscored that there’s an “absolute incessant demand from business to have flex as part of their core strategies.”

Citing data from JLL, IWG has realised how flexible workspaces will account for 46% of a business’ portfolio estate by 2025 from the current 30%.

To read the full story, go to https:// realestateasia.com/

REAL ESTATE ASIA 23 INDUSTRY INSIGHT: REAL ESTATE

SINGAPORE

Darren Rogers

Bastiaan van Beijsterveldt

Spaces One Raffles Place 5300 Singapore Community Desk (Photo from IWG)

BPO sector seeks hub in Philippines’ provincial markets over labour costs

The office sectors in Clark, Iloilo, and Davao are expected to be ‘very bullish.’

With a huge spike in wages and increasing labour costs, businesses, especially business process outsourcing (BPO) sector, are looking for office space outside the capital of the Philippines.

According to KMC Savills, the net absorption in the office market in 2022 was 270,900 square metres (sq m), a reversal of the negative uptake in 2021.

“The office sector in general… is a mixed bag,” KMC Savills Managing Director Michael McCullough told Real Estate Asia. “We see some really high-performing markets like the Bonifacio Global City (BGC)… other submarkets like Alabang, the area has struggled.”

The BGC market saw a net absorption of around 141,000 sq m or more than half of the total in 2022, with the lowest vacancy rate in the capital region at 7.6%, as submarket’s “superior-quality” stock and location were appealing to the tenants. The BGC’s average annual rental growth rate 1.2% YoY in 2022 was the only recorded positive growth in the submarket.

The Makati Central Business District (CBD) posted a vacancy rate of 15.7%, with the average rents dropping by 3.4% year-on-year (YoY) due to the stock of ageing buildings. Meanwhile, Ortigas Center recorded a net absorption of 22,400 sq m in the fourth quarter, with an increase in rents by 0.9% compared to the previous quarter.

Provincial pull

On the other hand, McCullough noted the provincial sites are performing well, noting that they are “very bullish” on Clark in the province of Pampanga in the northern Philippines, Iloilo in the central, and Davao in the south. He also noted that Cebu is starting to see some recovery with landlords adjusting prices. There is a shift in demand in the provinces, particularly

The deciding factor is not so much the cost of the rent ...it's the cost of labour

for business process outsourcing (BPO) due to the cheaper labour as it accounts for around 80% of their cost structure.

“The deciding factor is not so much the cost of the rent. That doesn’t force the companies that go one place or another, per se. It’s the cost of labour, which is a lot larger portion of the way their expenses go,” he said.

“Labour is really driving the decision process. If they can save a little bit of money by being in the provinces with more affordable office space, more affordable labour, then the clients feel very happy,” McCullough added.

Cebu take-up triples

According to Savills, Cebu saw its net take-up triple in 2022 to 51,800 sq m with the Cebu Bussiness Park (CBP) accounting for around half of the absorption, and Cebu IT Park (CITP) underperforming with an uptake of just 12,800 sq m.

Despite this, Cebu’s overall vacancy rate was maintained at 21.8% with the additional 65,300 sq m supply. The average rent in the province declined by 8.6% YoY,

with the Cebu Fringe suffering the worst fall at 11% YoY

“For 2023, we expect new building completions covering 187,900 sq m to reach their highest since 2015, as a bulk of new supply is set to locate in CITP,” a Savills report read.

“However, we still forecast Cebu’s vacancy rate to drop to 18.8% as we expect a rebound in demand from the IT-BPO sector assisted by the lower rents from landlords. CBP may edge closer to single-digit vacancy rates this year whilst most leasing activity may concentrate in CITP and Cebu Fringe due to the number of vacancies,” the report added.

Future of the office sector Savills expects that the rebound will continue this year, with the net absorption expected to see a slight increase. However, this may be isolated only to the top markets.

The occupancy rate is also not expected to return above 85% of office stock until 2025.

The occupancy rate is also not expected to return above 85% of office stock until 2025.

To read the full story, go to https:// realestateasia.com/.

24 REAL ESTATE ASIA

REPORT:

SECTOR

COMMERCIAL PHILIPPINES

Additional office space in Clark, Pampanga expects to bring more BPO firms (Photo from the official website of KMC Savills)

Michael McCullough

Landed houses offer a solution to housing backlogs

Millennials in urban areas are experiencing a 79% occupancy shortage.

Property developers are focusing on creating homes that cater to the distinctive preferences and needs of millennials, who not only comprise the next generation of property buyers but are also the most affected by the gap between demand for and supply of housing in Indonesia.

In addition, despite the highinterest rate set, for example, by Bank Indonesia reaching 5.5%, Lamudi. co.id has observed that property consumers remain resilient.

In December 2022, though, online property searches increased by 9%, indicating a sustained interest in property despite the challenging economic climate.

Lamudi.co.id CEO Mart Polman noted that the next generation of property buyers are the millennial and Gen-Z generations, who make up 60% of property seekers on their platform.

“Within this group, landed houses are the dominant search target, accounting for 76% of searches in the period between June to December

2022,” Polman told Real Estate Asia. This preference for landed houses is driven by the younger generation’s desire for homes that meet their needs and preferences, such as having an effective and efficient area and being connected to the internet to facilitate ease of living.

Focus on landed houses

Real Estate Indonesia (REI), an organisation representing property developers, consultants, and agents in Indonesia, said that developers are currently focusing on landed houses. Around 79% of property development in Indonesia today consists of landed houses with a price range of US$19,753 (IDR300m) to US$65,845 (IDR1b). This residence, although relatively smaller, is effective both in terms of interior and facilities.

“The most important thing is how everything is connected to the internet. Especially when all the elements in the house, such as electronic devices, can be ordered via a smartphone. Therefore, the current property market share of

65% is millennials,” said former REI Chairman Paulus Totok Lusida Meanwhile, developers are also providing convenience in payments. “For example, we make it possible for them to pay interest first, for example for the first five years, then only after 10 years they can repay the principal. That way, they feel less burdened in terms of costs,” Lusida noted, adding that this is part of REI’s current mission considering that conditions in Indonesia are different from other countries.

Overcoming backlogs

Vice President Director of Bank Tabungan Negara (BTN), Nixon L.P Napitupulu, highlighted that 5.8 million millennials currently cannot afford to own a house, with a 79% housing shortage experienced by millennials who are in urban areas.

As a state-owned enterprise engaged in the banking sector to support housing sector financing, BTN has developed a housing credit programme to make it easier for the millennial generation to have their first home.

Napitupulu said that BTN has currently two flagship programmes. First programme is called Graduated Payment Mortgage (GPM), a tiered instalment system through a product called “KPR BTN Gaess.” “This product is indeed targeting the millennial generation where installment payments in the first few years are lighter,” said Napitupulu.

Second, BTN also launched “KPR Rent to Own” for people who have not been able to prepare a downpayment or who are hesitant to buy a house due to proximity to the workplace. “With this product, people can pay rent every month while at the same time allocating some of their savings for future home purchases,” Napitupulu noted.

In 2021, the KPR BTN Gaess programme sold up to 203 housing units to millennials. Meanwhile, until June 2022, the realisation of KPR BTN Gaess has reached 946 units, with a value of more than US$25.18m (IDR382b).

Meanwhile, for the KPR Rent to Own KPR product, which was released in the third quarter of 2022, BTN is targeting more than 1,000 registrants in the first year this product was launched.

REAL ESTATE ASIA 25

Developers are currently focusing on landed houses (Photo by tirachard from freepik)

SECTOR REPORT: RESIDENTIAL

Landed houses are the dominant search target, accounting for 76% of searches

INDONESIA

Nixon L.P Napitupulu

Mart Polman

SECTOR REPORT: RETAIL

Retail real estate rebounds as spending shifts from online to offline

More than 71% of retailers in Asia Pacific have expansion plans, according to CBRE retail survey.

The battle between online and physical retail outlets sways in favour of the latter in the Asia Pacific, as CBRE highlighted that fewer than 5% of consumers shop purely online.

In its 2023 Asia Pacific Retail Flash Survey, CBRE found that nearly half of the retailers in the region expect a portion of online spending to be shifted to physical retail and 42% see that footfall in physical stores will return to its pre-pandemic levels.

“One very important fact is that fewer than 5% of consumers purely shop online. There is a huge range of hybrid shoppers, who have different shopping behavior,” Ada Choi, CBRE’s head for occupier research and intelligence and management in APAC, told Real Estate Asia.

“This is also a challenge for the brands that have to cater to different shoppers’ behaviour switching between online and offline and be able to address those issues.”

New generation of physical stores