INVESTMENT IDEAS FOR

8 KEY IDEAS TO ACHIEVE AFFLUENCE IN THE YEAR OF PROSPERITY

SINGAPORE’S 30 MOST INFLUENTIAL LAWYERS UNDER 40

SINGAPORE BUSINESS REVIEW’S INSURANCE RANKINGS SEES SLOW GROWTH AMONGST TOP 50

HOW TO STAY AHEAD OF SMES’ FINANCIAL NEEDS

SINGAPORE DIGS DEEP TO UNLEASH GEOTHERMAL ENERGY POTENTIAL

Issue No. 102 Singapore’s Best-Selling Business Magazine Display to March 31, 2023 S$5.90 Daily news at www.sbr.com.sg

Integrate data from any source, across all business systems, to create a single source of truth. www.jedox.com See the complete picture, quickly.

About Us

CIRCULATION: 18,000

ONLINE READERSHIP: 410,000 monthly unique clicks through Google Analytics

The SingaporeBusinessReview is the highest circulating and best read business magazine in Singapore. Our online readership has an average of 215,000 unique viewers, according to Google Analytics. We won the Business Trade Media of the Year Award at the 2017 MPAS Awards.

Do reach out to us if you would like us to tell your story to our readers via print and online advertising or events.

PUBLISHER & EDITOR-IN-CHIEF Tim Charlton

PRINT PRODUCTION EDITOR COMMERCIAL TEAM

COPY EDITOR PRODUCTION TEAM

FROM THE EDITOR

2023 is predicted to be a year of hope and prosperity. As we look forward to the abundant offerings of the New Year, we give you eight investment ideas from Singapore’s financial experts to achieve affluence in the Year of the Water Rabbit.

Jeline Acabo

Janine Ballesteros

Jenelle Samantila

Tessa Distor

Noreen Jazul

Consuelo Marquez

Djan Magbanua

Frances Gagua

Vann Villegas

GRAPHIC ARTIST Simon Engracial

ADVERTISING CONTACT Aileen Cruz aileen@charltonmediamail.com

Reiniela Hernandez reiniela@charltonmediamail.com

ADMINISTRATION ACCOUNTS DEPARTMENT accounts@charltonmediamail.com

ADVERTISING advertising@charltonmediamail.com EDITORIAL sbr@charltonmediamail.com

General Insurance Association of Singapore has collaborated with the police, insurers, and the Commercial Affairs Department to combat fraud using the Fraud Management System. Andrew Yeo, CEO of Income and GIA Management Committee Member and Insurance Fraud Committee Convenor walks us through the company’s new first line of defence to cover insurers’ blind spots on page 20.

Singapore’s roster of exceptional professionals has made the country an irreplaceable hub for businesses and high-profile individuals from around the world. This year, Singapore Business Review recognises the 30 most influential lawyers under 40 who have raised the bar for legal professionals across all fields. Meanwhile, general insurers and life insurers dominate the latest Top 50 Insurance Rankings. See the full list of esteemed lawyers and insurers on pages 34 and 40.

Read on and enjoy.

SINGAPORE

Charlton Media Group 101 Cecil St. #17-09 Tong Eng Building Singapore 069533 +65 3158 1386

HONG KONG

Charlton Media Group Hong Kong Ltd Room 1006, 10th Floor, 299QRC, 287-299 Queen’s Road Central, Sheung Wan, Hong Kong www.charltonmedia.com

PRINTING

Times Printers Private Limited 16 Tuas Ave 5 Singapore 639340

www.timesprinters.com

a member of Times Publishing Limited

Can we help?

Editorial Enquiries: If you have a story idea or press release, please email our news editor at sbr@charltonmediamail.com. To send a personal message to the editor, include the word “Tim” in the subject line.

Media Partnerships: Please email sbr@charltonmediamail.com with “Partnership” in the subject line.

Subscriptions: Please email subscriptions@charltonmedia.com.

SingaporeBusinessReview is published by Charlton Media Group. All editorial materials are covered by copyright and may not be reproduced without consent. Contributions are invited but copies of all work should be kept as Singapore Business Review can accept no responsibility for loss. We will, however, take the gains.

Sold on newsstands in Singapore, Malaysia, Hong Kong, London, and New York. Also out in sbr.com.sg with an online readership of 215,000 monthly unique visitors*.

*Source: Google Analytics

Tim Charlton

Singapore Business Review is available at the airport lounges or onboard the following airlines:

Singapore Business Review is available at the following clubs and hotels:

American Club

Hollandse Club

Laguna National Orchid Country Club

Raffles Country Club

Raffles Town Club

RSYC

Seletar Club

Sentosa Golf Club

Singapore Cricket Club

Singapore Island Country Club

Swiss Club

The Tanglin Club

The China Club

The Legends Fort

Canning Park

The Pines Club

Tower Club Singapore

Fullerton Hotel

Grand Plaza Park

Royal Hotel InterContinental

Le Meridien Orchard

New Park Hotel

Pan Pacific Raffles Hotel

The Hilton

The Regent Singapore

The Ritz Carlton

The Swiss Hotel

Stamford

Traders Hotel

Singapore

Darby Park

And at 16 serviced

residences

SINGAPORE BUSINESS REVIEW | Q1 2023 1

**If you’re reading the small print you may be missing the big picture

CONTENTS SINGAPORE BUSINESS REVIEW | MARCH 2018 Published Quarterly by Charlton Media Group 101 Cecil St. #17-09 Tong Eng Building Singapore 069533 For the latest business news from Singapore visit the website www.sbr.com.sg FIRST BRIEFINGS INDUSTRY INSIGHT INTERVIEW STARTUP RANKINGS LUMINARIES 28 COVER STORY 8 INVESTMENT IDEAS TO ACHIEVE AFFLUENCE IN THE YEAR OF PROSPERITY ANALYSIS SINGAPORE DIGS DEEP TO UNLEASH GEOTHERMAL ENERGY POTENTIAL 26 08 Singapore Budget 2023 to adopt fivepronged approach: analyst 09 Leasing conditions for Singapore REITs to soften in 2023 10 Tighter policy needed to keep inflation in check 11 Triple trouble: Singapore HDB rental market to face three key challenges 18 ONE Pass to rule them all: New work pass offers foreign workers longer stays, and more 44 HDB sees price correction amidst record-high prices 46 Three factors driving Singaporean firms to invest in Japan’s real estate 20 GIA covers insurers’ fraud blind spots 24 How to stay ahead of SMEs’ financial needs 14 No more cafe hopping: This startup allows employees to work at MRT stations 15 PokeSpace invents a ‘GoogleMapslike’ parking app for EV owners 40 Singapore Business Review’s Insurance Rankings sees slow growth amongst top 50 34 30 most influential lawyers under 40 SPACE WATCH 16 New 260-sqm command centre enhances security services with advanced technology 32 INDUSTRY INSIGHTS LAWYER TURNOVER PUSHES FIRMS TO REASSESS RETENTION STRATEGIES

Fresh & Fast

For RedMart, Singapore’s largest online grocery retailer, order fulfilment speed, reliability, accuracy, and productivity are key in delivering on customer promises, especially during the pandemic, when online visitors increased 11-fold.

Optimising capabilities through leading-edge logistics automation from Dematic, RedMart’s online fulfilment centre features robotic shuttles, ergonomic pick stations, intelligent conveying, and high-rate despatch sortation – all across five temperature zones and managed by sophisticated software, making grocery fulfilment easy, accurate, efficient and safe.

Read more and see it in action at www.dematic.com/redmart

the orders,

the SKUsin a smaller footprint. Online Groceries

Dematic.com/redmart

10 times

5 times

info.asia@dematic.com Scan to watch the video!

+65 6229 4500

Daily news from Singapore

MOST READ

Singapore’s most outstanding architecture professionals under 40

As the world continues to be battered by environmental and health challenges, Singapore’s architecture professionals also moved to create spaces which can withstand these obstacles. This year, SingaporeBusinessReview recognises 20 young and awardwinning architecture professionals under 40 who contributed to keeping Singapore as one of the world’s best-developed cities.

MOST READ COMMENTARY

Setting the foundation for success in the commercial real estate sector in Singapore

BY Michael Velten and Junwei Han

BY Michael Velten and Junwei Han

Across Singapore, every industry has experienced fundamental transformation in the last two years – and the commercial real estate sector (CRE) is no exception. Increasingly, the real value of property will no longer be defined solely by the space and its location, but the convergence of infrastructure and technologyenabled real estate service models.

Singapore’s most notable real estate agents under 40

Singapore’s status as a safe haven for property investors remained intact amidst global headwinds, thanks to the city’s realtors who were determined to push the city to a holistic recovery in 2022. In recognition of their hard work, SingaporeBusinessReview listed down 20 realtors under 40 who not only thrived in managing clients and negotiating deals but also displayed leadership in their respective communities amidst challenging times.

What it means for Singapore now that the electric vehicle charging bill has been passed in parliament?

BY Abhijit Sengupta

The newly tabled Electric Vehicle (EV) Charging Bill in Parliament is a muchwelcome step in the right direction as mobility in Singapore continues to evolve. By ensuring the reliability and accessibility of the EV charging network and services in Singapore, we’re already advancing the conversation on EV adoption – from increasing the number of EV charging points to discussing the quality of such infrastructure.

How realtors dealt with the new realities of the real estate market

Apart from client demands, real estate agents in Singapore also had to deal with changes in the real estate industry, which include the market being more driven by global challenges like inflation, rising interest rates, and the pandemic. To keep up with the new realities, ERA Realty’s Division Director, Jazreel Lim said she had to change her mindset and the way she approached her clients.

Adapt to survive in 2023: A step guide for business models in fintech

BY Pat Patel

The origins of FinTech date back to the Global Financial Crisis of 2007 to 2008, when financial institutions suffered large losses and needed government assistance to survive. In the same period, mobile technology exponentially grew, which further yielded a new breed of financial institutions. Web 2.0 created opportunities for FinTech companies through leveraging mobile, social and cloud.

News

sbr.com.sg

from

REAL ESTATE REAL ESTATE REAL

ESTATE

OPPORTUNITIES

DOCUSIGN

DocuSign helps organizations connect and automate how they prepare, sign, act on and manage agreements. As part of the DocuSign Agreement Cloud, DocuSign offers eSignature, the world’s #1 way to sign electronically on practically any device, from almost anywhere, at any time.

Today, over a million customers and more than a billion users in over 180 countries use the DocuSign Agreement Cloud to accelerate the process of doing business and simplify people’s lives.

NORDVPN OPPORTUNITIES

NordVPN is the world’s most advanced VPN service provider, used by millions of internet users worldwide. NordVPN provides double VPN encryption, Onion Over VPN, and guarantees privacy with zero tracking. One of the key features of the product is Threat Protection, which blocks malicious websites, malware, trackers, and ads. NordVPN is very user-friendly, offers one of the best prices on the market, and has over 5,000 servers in 60 countries worldwide.

OPPORTUNITIES

S P JAIN SCHOOL OF GLOBAL MANAGEMENT

S P Jain School of Global Management (SP Jain) is an Australian business school with campuses in Mumbai, Dubai, Singapore and Sydney. The School offers a plethora of undergraduate, postgraduate, professional and doctoral programs with a motive of crafting leaders for the 21st century workplace. The learning experience provided by them is modern, relevant and truly global. Their full-time MBA programs have significant recognition as evinced through global rankings by Forbes, The Economist and The Financial Times to name a few.

To know more, please visit www.spjain.sg

6 SINGAPORE BUSINESS REVIEW | Q1 2023 visit charltonmedia.com FOR MORE INFORMATION on EVENTS AND ADVERTISING PEOPLE | PLACES | SERVICES | OPPORTUNITIES

AGENDA

Great is being prepared for all of life’s twists and turns.

Reach for Great financial expertise and award-winning financial tools.

Find the confidence you need to build a financially secure future with our award-winning financial management tool, the Financial Storyboard. With our tool and the expertise of our Financial Representatives, you can enjoy personalised data-driven insights and an interactive simulation of your various life goals and milestones. All to help you visualise your long-term financial needs and ensure you’re prepared for whatever life throws at you.

Talk to us today!

Copyright© 2022 Great Eastern Holdings Limited (Reg No 1999 03008M) Great Eastern Holdings Ltd | Great Eastern Life Assurance Co Ltd | Great Eastern General Insurance Ltd

@greateasternsg @greateasternsg

greateasternlife.com

@greateasternsingapore

Singapore Budget 2023 to adopt fivepronged approach: analyst

The government will likely address five areas of concern in the 2023 budget to ultimately achieve its goal of developing Singapore’s competitiveness and strengthening its social safety nets, RHB Senior Economist Barnabas Gan said.

In a report, Gan said the budget will focus on helping Singapore stay relevant and viable in tomorrow’s world, helping the vulnerable and lower-income, supporting businesses, developing a skilled workforce, and developing a sustainable and green Singapore.

For Singapore to stay economically relevant and viable, Gan said the nation must invest in new capabilities and strengthen its digital capabilities. “With pandemic-related risks likely a thing of the past, we think the focus will be on building Singapore’s medium- to long-term priorities in technology, innovation and enterprise...We expect policymakers to earmark monies to invest in Singapore’s broadband infrastructure, especially for future technologies such as 6G,” Gan said.

To provide more support for vulnerable and lower-income groups, RHB said the government should make enhancements to the current Workfare Income Supplement (WIS), by tweaking the minimum wage of at least $500/month and/or maximum income cap of $2,500/month. “Supplementing

wages is also paramount, given that average inflation of 7.3% as of 3Q22 has surpassed wage growth of 7.1% over the same period. In addition, wage support may be introduced in response to the rise in hybrid work arrangements, as employees who adopted such work arrangements may see some form of ‘work from home’ relief in recognition that the burden of costs has shifted away from employers to employees,” Gan said.

“Separately, we do not discount the introduction of unemployment support for retrenched workers in FY2023. However, this should include specified prerequisites such as a minimum period of full-time work before retrenchment, property ownership below a specific annual value and showing efforts to seek re-employment after retrenchment,” he added. The budget will also likely be geared towards supporting SMEs, said Gan, given that they account for 99% of all enterprises and employ 72% of Singapore’s workforce.

“Support for businesses may also include introducing aid for SMEs in defraying the added costs of the hybrid working

arrangement adopted across most companies, should there be a rise in ‘Work-from-home’ relief for employees in adopting such work arrangements. Elsewhere, tax incentives may also be introduced for industries in need of foreign talents, such as in the biomedical sciences, financial services and digital technology-related sectors, for these industries recruit and retain talent,” Gan said.

Whilst Singapore’s labour force remains relatively tight, Gan said “ the issue of structural unemployment remains on the table as we move into a more digitalised global economy.”

“There is a need for Singapore to invest in the lifelong learning of its workforce, especially the midcareer workers, in the skills and capabilities relevant to the evolving business needs. We think some enhancement to the Workfare Skills Support (WSS) scheme will allow more inclusivity amongst low-wage workers and encourage them to undertake training. The enhancement may be from increasing the income cap of the current S$2,300 per month and topping up more training allowance beyond the current stipulated S$6 per hour, given the higher cost of living,” Gan commented.

“We also think a SkillsFuture top-up is due, especially since the last top-up was made in December 2020,” he added.

Green Singapore

The last area of focus for the budget will likely be on “enabling a sustainable and green Singapore.” Beyond carbon taxes, Gan said the government must create policies that encourage corporate investments in green technologies.

“We expect the policymakers to introduce allowances on capital expenditure incurred respectively to energy efficiency and emissions reduction solutions. Moreover, GST rebates and/or vouchers may also be considered for individuals and households to purchase certified energies from providers and subsidise purchases on energy-efficient appliances,” he said.

“Separately, we think that an extension of the Sustainable Bond Grant Scheme beyond the current validity of 31 May 2023 may materialise. The extension will encourage the issuance of green, social and sustainability bonds, thus helping issuers cover additional costs associated with the green initiative,” the RHB senior economist added.

8 SINGAPORE BUSINESS REVIEW | Q1 2023 FIRST

To provide more support for vulnerable and lower-income groups, the gov’t should make enhancements to the current Workfare Income Supplement (Photo from MOF.gov.sg)

ECONOMY

With pandemic-related risks likely a thing of the past, the focus will be on building Singapore’s medium- to longterm priorities in technology, innovation, and enterprise

Leasing conditions for Singapore REITs to soften in 2023

COMMERCIAL PROPERTY

Experts at S&P Global Ratings are expecting a slowdown in the rental growth momentum of leases of Singapore REITs.

The slowdown will be more pronounced in office leases, said S&P Global Ratings credit analyst Hwee Yee Ong in a recent report.

Ong said Macroeconomic softening could temper business confidence this year which, in turn, will weigh on office demand.

“Firms may cut their real estate footprint or hold off on leasing decisions, particularly as hybrid work practices remain common,” the S&P Global analyst said.

The expert added that the waning leasing demand from the technology sector will particularly weigh on the office sector.

“Technology firms globally are entering a phase of heavy retrenchments. Singapore has not been spared. Over 1,000 employees in the Singapore technology sector were made redundant from July to mid-November 2022, according to the Minister for Manpower, Tan See Leng. This is almost five times the number of retrenchments during the first half of 2022,” she said.

“Technology firms have been one of the key drivers of leasing demand

in recent years. As the entities give up or sublet offices, shadow space - floor area that is leased but not utilised - could increase,” the S&P Global analyst added.

Ong, however, underscored that it is not all gloom for the Singapore office sector, saying that the flightto-quality trend will benefit prime offices. “Other sectors, such as nonbank financial institutions, professional services, and flexiblespace operators may absorb some of the space that is becoming available,” she said.

Unlike the office sector, Ong said the retail sector will continue its stable performance in 2023, underpinned by consumption growth and limited supply. “A post-pandemic boom in inbound tourism will bolster retailers’ confidence across downtown malls,” said the S&P analyst.

The Singapore Tourism Board forecasts international visitor arrivals to reach around 12 million-14 million in 2023, which is about 60%-75% of 2019’s arrivals but about double that of 2022. “We expect suburban malls to remain relatively resilient. Their high exposure to non-discretionary spending and proximity to residential hubs should continue to add stability,’’ S&P analyst, Simon Wong, said.

S&P added that the limited pipeline for shopping malls supports a healthy vacancy rate and rental growth in the market.

SHIFT TO DIGITAL INITIATIVES AND CUSTOMISATION TO DRIVE GROWTH FOR SINGAPORE INSURERS

The shift towards digital initiatives and customisation will drive continued revenue growth for Singapore insurers, Manogna Vangari, Insurance Analyst at GlobalData, said.

“Prompt scaling of technology and increased adoption of digitalisation enabled insurers to create new opportunities and improve customer experience,” Vangari said.

“To build a resilient business, Singapore insurers strengthened their distribution channels by adding digital tools to their core channels like agencies, financial advisers, and bancassurance,” she added.

The positive environment created by easing COVID-19 restrictions and a recovery in global economic activity to pre-pandemic levels has enabled top insurers in the country to improve their offerings. Singaporean insurers have also focused on customisation to provide support for their customers following the pandemic.

For example, NTUC Income Insurance launched low-cost subscription-based customised insurance policies in July 2021.

“These short-term policies offer modular packs which allow customers to customise, and the low-cost pocket-friendly policies also provided flexibility to modify coverage or add-on options based on changes in customers’ lifestyle,” Vangari said.

The market share of the top five and top 10 insurers increased by 3.2 percentage points and 0.6 percentage points, respectively, in 2021 compared to 2020, according to GlobalData’s report.

Great Eastern Life Assurance continues to lead the Singaporean insurance industry with a market share of 25.7% in 2021, while Manulife jumped up from the fourth position in 2017 to the second largest insurer in 2021.

Prudential Assurance slipped to the third spot from the second position in 2017.

SINGAPORE BUSINESS REVIEW | Q1 2023 9 FIRST

The waning leasing demand from the technology sector will particularly weigh on the office sector

As entities give up or sublet offices, shadow space could increase

Hwee Yee Ong

Simon Wong

SG IS WELL-POSITIONED FOR INDUSTRIAL SPACE OCCUPIERS

Aproperty expert said Singapore remains attractive for occupiers of industrial spaces even as there is a softening global demand and an expected economic slowdown in the market.

Tricia Song, head of research at CBRE, said life science firms expanding their presence are driving demand for industrial property in Singapore.

Song was commenting on JTC’s industrial rental index which went up by 2.1% in the final quarter of 2022. This maintained the same pace of increase from the previous quarter, resulting in a 2022 rental increase of 6.9%.

“As for the warehouse segment, an acute shortage of quality space and high levels of pre-commitments at upcoming buildings should lead to further rental increases in the near-term,” said Song.

Whilst there is over 18.9 mil sq. ft. of new industrial space (or around 3.5% of total stock) to be completed in 2023, about half are single-user factories and only 28% are warehouses.

Singapore also posted a full-year warehouse rental growth to 7.9%, an acceleration from 2021’s 2.7% which is possibly due to the sustained demand for logistics space despite easing of pandemic.

Industrial prices stay stable

Even as upcoming industrial supply comes in a time of subdued manufacturing sector, Knight Frank said the Lion City will attract fixed asset investment into the manufacturing industry.

Despite challenges faced by the electronics sector, investments continue to flow into Singapore with the belief that growth will return and be sustainable in the long-run.

These factors will result in stabilising of industrial prices and rents, with a marginal growth of 1% to 3% for the whole year.

Tighter policy needed to keep inflation in check

ECONOMY

Brokers suggested that Singapore’s central bank should continue to tighten monetary policy if core inflation shows signs of reacceleration.

Singapore’s headline inflation went down 6.5% in December 2022 but core inflation was at 5.1%.

UOB senior economist Alvin Liew said sources of core inflationary pressures were broad-based, but food and services and healthcare stood out as notable contributors. Core inflation is seen to stay elevated in the first half of 2023 but will stay subdued in the second half as domestic labour market eases and global inflation moderates, said UOB.

RHB senior economist Barnabas Gan said the inflation risks and potential for more tightening of monetary policy of MAS in 2023.

It said momentum of inflation has slowed in Singapore and other key Asian economies, but that year-on-year rates remain elevated.

To address these challenges, the UOB and RHB analysts said there needs to be more policy tightening, due to reasons such as core inflation will be above 2.0%, a stronger Singapore dollar, and potential risks from global

geopolitical tensions and pandemics.

“With the MAS pulling only one lever in its last decision in Oct (2022), we think there is still room for further tightening into 2023, especially if core inflation shows signs of meaningful re-acceleration in the months ahead,” said UOB.

Import and domestic price pressures

When the CPI report showed that supply chain frictions continued to ease, prices of energy and food commodities reached the peak from earlier in 2022 but are still elevated.

The central bank adjusted its warning that “as accumulated costs pass through global value chains,Singapore’s imported inflation is expected to remain firm for some time.”

Domestically, the MAS said unit labour costs are projected to increase further in the near term along with robust wage growth.

Car and accommodation prices will likely stay firm in the quarters amidst tight certificate of entitlement quotas for cars and strong demand for rental housing. Authorities also project that businesses will pass through accumulated import, labour, and other costs to consumer prices. UOB said these expectations are similar to the November report.

Policy tightening remains unchanged

The further tightening of monetary policy for April 2023 will remain unchanged, RHB said.

It mentioned three key reasons behind its statement which is first, the core inflation is expected to persist above 2% handle from now until the first six months of 2023 before dissipating lower then.

This means there is a need for monetary policy response to stay pre-emptive in anchoring inflation projections, RHB said.

Second, RHB said their Singapore Dollar Nominal Effective Exchange Rate (S$NEER) model suggests that the S$NEER maintained above the midpoint seen since 2021 and was resilient around 6.5% all over 2022.

“Notwithstanding that relative weakness in the SGD NEER at the time of writing (S$NEER is estimated at 0.66% above midpoint, against 1.0% in 4Q22), we think more appreciation headroom may be needed for a stronger SGD in response to the current inflation environment,” said RHB.

10 SINGAPORE BUSINESS REVIEW | Q1 2023 FIRST

Core inflation is seen to stay elevated in the first half of 2023

COMMERCIAL

PROPERTY

Alvin Liew

Barnabas Gan

Triple trouble: Singapore HDB rental market to face three key challenges

Asupply crunch looms in Singapore’s HDB rental market in the next few years. According to OrangeTee’s Senior Vice President of Research & Analytics, Christine Sun, the HDB rental market may face a triple whammy.

First, new home supply will fall as the number of Minimum Occupation Period (MOP) flats continue to decline.

Sun said flats obtaining their five-year MOP

are slated to drop significantly from 31,325 units in 2022 to 15,748 units in 2023; dipping further to 13,093 units in 2024 and 8,234 units in 2025.

Second, rental stock will shrink in the long term as tenants sign longer leases.

Third, fewer flat owners may put up their units for lease.

“More families may stay put in their units since their upgrading opportunities could

Built for Innovation, Trusted for Security

Trusted by thousands of organisations to secure and manage their digital asset operations.

be affected by the new cooling measures. For instance, some HDB upgraders may take longer to find suitable buyers since the purchasing power of potential buyers may be affected by tighter borrowing limits,” Ong said.

“Sellers’ flats may not fetch as high a price as before the measures. With interest rate hikes and prices of private homes not expected to fall anytime soon, fewer people may purchase a private property for owner-occupation and lease their flats for rental income, resulting in fewer flats put up for lease,” she added.

In 2023, Ong predicts that rental price growth will slow, and leasing volume will slip slighty. “We expect HDB rents to rise at a slower pace of around 15 to 18 per cent next year, down from the estimated 26 to 28 per cent for 2022. Rental volume is expected to be robust as flats will continue to be an affordable, entry-level housing option for many tenants. Bigger flats may be in demand among local families and foreigners with tight budgets,” Sun said.

“Private homeowners affected by the 15-month wait-out period before they purchase a resale flat may turn to the HDB rental market for their interim housing needs. Around 34,500 to 36,000 units may be leased this year, and the numbers may dip slightly to 32,000 to 35,000 next year,” she added.

SINGAPORE BUSINESS REVIEW | Q1 2023 11

FIRST

Rental stock will shrink in the long term as tenants sign longer leases (Photo by Choo Yut Shing)

The perks of being a certified project manager

Breen of PMI talks about the importance of power skills and the role they play

The rising utility of power skills

Today’s project managers are required to go beyond just technical skills, but to also understand the impact of a project on the business. They are expected to work with multiple teams across different locations to deliver the project.

Project managers are in high demand and organisations are willing to play for qualified talent. In today’s fast-paced business world, having a Project Management Professional (PMP) certification comes with significant advantages over other job candidates. Across Asia Pacific, employees who hold Project Management Professional (PMP)® certification have reported earning 13% higher median salaries than those without, with portfolio managers and project management consultants in Singapore being in the top ten of the highest paid globally. This makes expertise and certification in the field of project management particularly important. Having worked for many years in the construction industry, PMI’s Ben Breen, Managing Director for Asia Pacific and Global Head of Construction, shares his insights on why certifications are becoming increasingly important and can be a key differentiator in one’s career.

Advantages and roles for PMP-certified project managers

Project managers need to take the lead on whatever project they are assigned to. They need to make quick decisions, right from conception to execution and set the project towards success. An agile mindset provides project managers with the key trait to handle unexpected circumstances and make these important and quick decisions.

Understanding the larger vision of the business and how the project is aligned with the overall business objective is important. Project managers need to have the understanding to align the project with the business direction and outcomes.

“They need to understand the purpose of the project, which may not be specifically their

scope, but the overall vision of the business or the overall project, and then how the project that they’re doing is aligned with that business vision,” said Breen,

These projects can cover a broad range of instances, from small projects within an organisation to more large-scale projects with a macro social, economic or business impact.

Designed by project managers for project managers, PMP® certification is a globally recognised project management certification. It proves that a certified project manager has the ability to lead projects for any organisation and in any industry.

PMP-certified individuals have displayed a distinct thoroughness in their project delivery and a clear understanding of strategies and tools required to achieve their set goals. PMI helps individuals looking to gain a PMP certification by empowering them with the PM body of knowledge or the PMBOK guide that shows them how to properly run a project, helping them demonstrate their capability to lead and direct projects.

As the world’s leading authority on project management, PMI’s PMP certifications provide the ample skills and flexibility that individuals need in order to properly develop their careers and help them set themselves apart from their colleagues through skills and opportunities.

For several years now, PMI has been advocating the importance of power skills — those “soft” or “interpersonal” skills like communication and strategic thinking. Built on top of a solid foundation of technical skills, power skills enable project managers to align their projects to organisational objectives, and inspire their teams to work together to solve problems and deliver results that contribute value to the organisation and its customers. However, less than 30% of the budget allocated is for developing power skills, with the main barriers being cost and lack of perceived value.

Despite this, organisations have now started to invest in a whole range of learning and development opportunities such as e-learning, online learning, and in-person training to help them manage the training and mentoring of individuals towards their professional development.

Organisations must look towards prioritising power skills, focusing on those most relevant to achieving objectives such as communication, problem-solving, collaborative leadership, and strategic thinking. A growing need for project managers in all sectors, especially in manufacturing, infrastructure, consulting, and oil and gas has put project management skills a must have.

“As we move into the new year, we will see projects around key mega trends like climate change, demographic shifts, sustainability and various technological innovations. Hence, the role of project management is bound to become significant. What will be important is that projects are delivered on time and within budget and scope. This in turn will have an impact on the need for certified project managers that can add value and deliver the desired outcomes”, remarked Breen.

1PMI Pulse of the Profession 2023 Report: https://www.pmi.org/learning/thought-leadership/pulse/power-skills-redefiningproject-success

2Earning Power: Project Management Salary Survey—Twelfth Edition (2021): https://www.pmi.org/learning/careers/projectmanagement-salary-survey

12 SINGAPORE BUSINESS REVIEW | Q1 2023

Ben

Organisations must look towards prioritising power skills, focusing on those most relevant to achieving objectives such as communication, problem-solving, collaborative leadership, and strategic thinking

CO-PUBLISHED CORPORATE PROFILE

Fixed income digital assets: Unpacking Digital Bond Issuance

HSBC has been pioneering the exploration of digital assets to transform capital markets infrastructure in Asia, supporting the development of new technologies which promote economic growth and financial stability.

The pilot bond issuance, which replicated an issuance by Olam International in August 2020, was a First in Asia for digital syndicated public corporate bonds. Since then, HSBC has continued to partner with SGX and Temasek on their joint venture, Marketnode, launched in January 2021, to complete several successful digital bond issuances, including a S$1 billion perpetual securities issue by Singtel and S$600m of Perpetual Capital Securities at 2.55% by UOB.

STARTUP

No more cafe hopping: This startup allows employees to work at MRT stations

Founder Jane Toh said Staytion seeks to address the lack of “work near home” amenities.

Working from home was never an option for Jane Toh who lives with elderly parents, two young kids, a dog, and a husband who is frequently on Zoom calls. This is why she opted to work in cafes instead. However, cafes would often chase her out for doing work there. Tired of this situation, she decided to start “Staytion,” a co-working space situated in MRT stations.

“The concept of Staytion was borne to allow working parents like me to have the cake and eat it too. I need not go to the office to enjoy enterprisegrade facilities and I get to do my work in a productive zone,” Toh told Singapore Business Review.

“Staytion is a connector and a lifestyle enabler. We alleviate the demands of employees in multigenerational families and people living in tight spaces,” she added.

Toh said she put up co-working spaces directly at MRT stations because having a space located in a transport node will allow its users to get the “best of every world - a caffeine fix, catch-up with friends, or a conference call.”

“We are not five minutes away from the MRT, we are at the MRT.

Staytion is at the forefront of the 15-minute city concept, and we are flying the flag high in support of the work-near-home movement as it significantly lowers the carbon footprint,” she said.

“Convenience is a key factor as a lot of our members are very much in favour and support of our sustainability efforts, hence we want them to be able to easily work in our spaces before they get on a train, or immediately after they hop off a train,” she added.

The first Staytion was opened on 28 September 2022 at Marsiling MRT Station. Two more Staytions will open soon, one at Paya Lebar MRT Station on 14 December 2022 and another at Woodlands MRT Station in February 2023.

Toh said that Staytions are located in stations outside the central business district or in the urban areas to cater to people who want to work in decentralised locations.

Booking a ‘Staytion’

Hybrid workers who wish to work at a “Staytion” can book through its Web App platform, gostayiton.com, where they will need to sign up for an account.

After signing up, users can select their preferred work desk and location. Those who booked a space will receive a confirmation email of their booking. Workers can stay at Staytion spaces for as low as $4.90 per hour. Users can also gain one month of access to the spaces for at least $49.

When staying in the Staytion spaces, Toh said users must comply with house rules which include basic co-work etiquette to clean up after each use and to take calls and/or meetings in dedicated phone booths. Toh said most of Staytion’s users are from small-medium enterprises and large corporations with staff residing near their centres.

Amongst Staytion’s users is renowned literary artist, Shelly Bryant, who said that the startup has given her a place where she can focus on her work without disruption, helping address the challenges she faces with the temptation to overwork and/or over-commit.

“Having the space to really focus allows me to be more productive whilst working, which means I can put my work away at the end of the day feeling it has been a fruitful day, and now it is time to rest. It is a good feeling,” Bryant said.

14 SINGAPORE BUSINESS REVIEW | Q1 2023

Having a space located in a transport node will allow its users to get the “best of every world” (Photo from GoStaytion.com)

Staytion is a connector and a lifestyle enabler

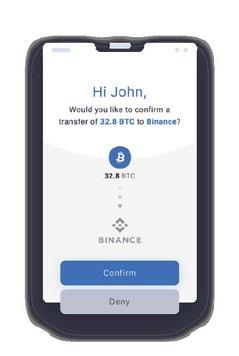

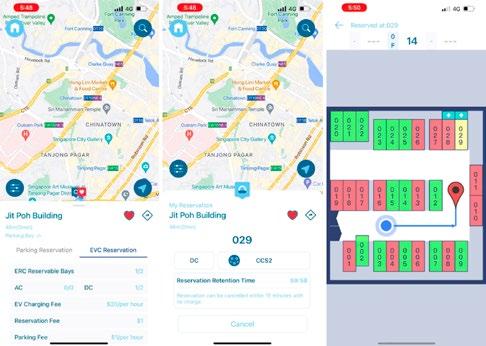

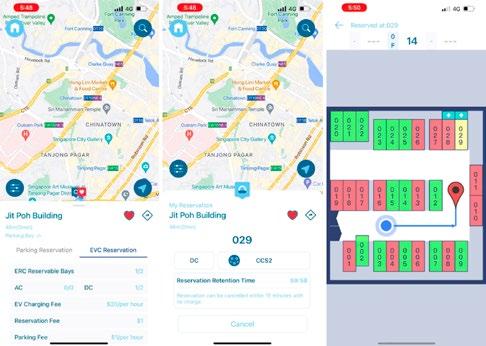

PokeSpace invents a ‘GoogleMaps-like’ parking app for EV owners

The app makes electric vehicle owners’ search for parking spaces and chargers seamless.

The growth of the electric vehicle (EV) industry has been accelerating since the government seeks to implement 100% cleaner energy vehicles by 2040. But according to KPMG, EV drivers are anxious that there are insufficient parking spaces with chargers for EV. This is what a team of developers from Ochlos Holdings Limited is trying to resolve with the app, PokeSpace.

PokeSpace is an app that EV owners can access as if they are searching through Google Maps. They can search for available parking space and EV charging solutions in real time.

Curve shared that developing the app stemmed from frustrations of landlords, drivers, and car park operators on wasting time on unnecessary activities just to secure a car park space.

“You don’t want to spend 10 to 15 minutes in the building and trying to look for a car park. Every time you spend time looking for a [spot] to park, that will likely mean that you are likely to be late for a meeting that doesn’t set up a good atmosphere or mood to enter into a meeting,” said PokeSpace CEO Curve Khong, in an interview with Singapore Business Review

How to navigate the app

When entering a car park, owners would be faced with a lot of beacons in the ceiling, which would show red and green lights to indicate if the parking space is vacant or occupied.

Despite this feature, Curve said vehicle drivers still tend to get lost, especially at parking spaces with two lanes. With the help of the app, Curve said drivers can reserve a parking space and can know the status of the parking space before getting to the car park or even a charging station.

“As you enter the car park, if you have to launch our app, you will pop up a map to bring you to the car park space, which you have reserved,” he said. If they cannot reserve a parking space, the app can offer a satellite view of the whole car park.

“You see where the car is available,

where it’s taken, and you can always select a spot. You try to find a spot that is closest to the area that you are very familiar with,” said Curve.

After a busy day at work in a clinic or getting your groceries from the supermarket, finding where your car is will also be convenient.

The app will also provide you with a path or area where you can get your car to the parking lot.

“That’s how our navigation works. It is very close to what a global positioning system [GPS] would do in your Google Maps when you drive but this is all indoor,” said Curve.

App limitations

The PokeSpace app is still not fullproof as it needs to fix some issues such as installing the navigation setup of its map, where it will include the parking space information.

Developers said some landlords are hesitant to include their parking lots in the app due to privacy.

Landlords are also barring hourly parking as some tenants already paid for season parking, which allows parking a vehicle at a specific space regularly with a fixed rate.

“That conversation is what strikes fear into the landlord and we have to solve this. At the end of the day, the landlord needs to increase revenue as we are facing more inflation nowadays,” he explained.

They eventually found that a car park is 75% full of tenants with season

parking, which allows them to use 25% of the space for tenants that are for hourly parking.

Now, Curve said they are in the process of updating their system by enforcing solutions for seasonal parking and traditional car park users.

‘Poking around’ for sustainability

Aside from providing efficient solutions for EV owners, the team coined the app’s name, PokeSpace, to help users easily understand or read the software.

“We need some words that are easy for them to read out so poking around seems like a good word. Also, the fact that we are managing space so we combined these two words and we call it PokeSpace,” Curve explained.

EV driving is already sustainable but PokeSpace makes it more environment-friendly by reducing carbon footprint when cutting idle driving time for EV owners.

“What PokeSpace does is that you will already know that you are going to have a charging station when you reach your point before you leave your home. You already know that you’re going to be at a charging station. You already know that you’re going to be at a certain place several times,” Vas Jagarnath, Chief Marketing Officer of PokeSpace, told Singapore Business Review.

In the next five years, the PokeSpace CEO is looking to hit 300,000 car parks for its app.

SINGAPORE BUSINESS REVIEW | Q1 2023 15 STARTUP

EV owners can use PokeSpace to search for available parking space and EV charging stations in real time

[Our navigation] is very close to what a GPS would do in your Google Maps when you drive but this is all indoor

Vas Jagarnath

Curve Khong

New 260-sqm command centre enhances security services with advanced technology

It brings together operational silos to offer 24/7 unified remote monitoring capabilities.

Within the purpose-built AETOS Headquarters at 5 Corporation Drive in Singapore is a 260-squaremetre room with hexagonal-shaped ceiling lights and a 12-metre wide LED screen in the centre of the room. This unassuming space is the AETOS Integrated Command Centre (ICC)—the nerve centre of island-wide operations which houses 13 security operators.

Implementing Singapore’s largest 3D digital twin, the ICC is an agnostic platform that ingests data from unlimited subsystems from multiple premises and beyond borders.

“Our Integrated Command Centre unifies what used to be silo operations to catalyse value for our stakeholders,” said AETOS CEO Alfred Fox

It took over more than a year for AETOS to build the ICC. It was launched in March 2022.

Comfortable operator chairs

To ensure that the AETOS staff remain vigilant and motivated whilst being well-trained, Alfred said they make the command centre a comfortable working environment for its operators by providing gaming chairs.

“Our concept was if a gamer can sit on a chair for hours, such chairs will provide good support for our people as well— and they like it,” said Alfred.

The 36 chairs, customised in collaboration with Singaporebased company, Secretlab, were installed in the new ICC.

Hexagonal-shaped

ensure a well-lit command centre without being too overpowering.

16 SINGAPORE BUSINESS REVIEW | Q1 2023

Alfred Fox

lights

AETOS instals gaming chairs for a comfortable workspace for security operators.

The three-dimensional twin is being used to track sustainability targets.

The LED screen allows efficient remote surveillance of multiple locations.

1 1 3 3 5 5

2

4 SPACE WATCH

Security operators also have their own computers when handling clients.

2

4

TRON founder, Justin Sun sees blockchain watering the financial industry’s growth

competitors, the traditional financial institutions like banks and insurance companies, our space is still very small, I think around $1 trillion. The traditional finance industry is probably tens of hundreds of trillions of dollars. That’s why I think this is more like a future as we move forward to become a mainstream financial institution,” he added.

Justin launched TRON, in 2018 and has since then become one of the largest public blockchain platforms in the world. In the same year, TRON acquired BitTorrent Inc., which had more than 170 million active users per month. To date, TRON has more than 110 million users and up to 1,4000 decentralized chain applications.

On sustainability and climate change

Apart from being a business executive, Justin has been the Permanent Representative of Grenada to the World Trade Organization (WTO) since December 2021.

Traditional financial services have been moving to digital as customers shift to making wireless transactions — but is this shift enough to keep them stable in the changing market?

In an exclusive interview with Singapore Business Review, TRON founder and cryptocurrency entrepreneur Justin Sun said that integrating blockchain with traditional banking will be crucial in the industry’s growth.

“I think one of the biggest advantages with blockchain [is it combines] internet services with financial services. Financial services is always considered as premier [and] you need to spend a very big amount of money to build financial services amongst different countries,” he said.

Justin said that whilst there are known financial centres worldwide, such as London, New York, Singapore, and Hong Kong, which have built their standards to be sustainable for many years, most rural areas and developing states are not willing to spend money on building branches.

Comparing this with blockchain business, access can be from everywhere. This makes it a preferable option for customers in developing countries.

“So, for example, if you are based in

Cambodia, there’s no difference. If you are based in London, you can get access to blockchain services instantly. That’s why we basically reduce the cost of financial services almost to zero and you can get the services 24/7. I think that’s the biggest advantage of blockchain,” Justin said.

Justin explained that bringing blockchain forward will be beneficial, there are also several hurdles to get through first.

Whilst he pushes crypto and blockchain tech forward with his personal endeavours, Justin also takes part in wider issues such as tackling sustainability in trade and business.

Justin said that the WTO has been studying different states and the main commitment they have identified is that states are willing to commit to becoming carbon neutral. This, however, is not without its own challenges.

“I think going to mass adoption, we still have lots of things to do. We need a better user experience, or when you claim lots of regulatory hurdles, but I think eventually we will get there.”

Justin said he sees blockchain merging with exchange platforms in the future, as it provides a more powerful purchasing capacity for customers holding different currencies.

“I think blockchain will merge with the exchange business… Compared to

“In 2023, we will talk about sustainable development and global warming. This has been a very hot topic in the WTO for many years. Right now, the biggest hurdle or obstacle is that most of the world’s developing states find it hard to come up with an agenda because many of these developing countries still focus on getting everyone in their country to have a sustainable income. The priority continues to be economic development,” Justin said.

Amongst these include countries that have more urgent concerns, pushing their concerns on climate mitigation backwards and, in effect, back by years compared to developed countries. “For example, China has committed to being carbon neutral in the next 10 to 20 years, but since they have about 1.4 billion people, for them to reach carbon neutral is a very big challenge. The same goes for India as well,” he added.

SINGAPORE BUSINESS REVIEW | Q1 2023 17

Justin Sun speaks to Singapore Business Review about working with the WTO and financial institutions.

One of the biggest advantages with blockchain is it combines internet services with financial services

CO-PUBLISHED CORPORATE PROFILE

Justin Sun, TRON founder and cryptocurrency entrepreneur

ONE Pass to rule them all: New work pass offers foreign workers longer stays, and more

The pass, however, is only granted to talents who meet the salary threshold of $30,000.

With talent being the only resource of Singapore, the country cannot afford to lose the global war for talent. This is why the government has further enhanced its work pass framework and introduced the Overseas Networks & Expertise (ONE) Pass.

Zhao Yang Ng, local principal in the Employment Practice Group of Baker McKenzie Wong & Leow, said the ONE Pass is more beneficial to foreign workers compared to the other work passes, like the Employment Pass (EP), since it has a five-year validity period.

Typically, an EP has a two- to three-year validity, whilst the Personalised Employment Pass (PEP) is granted for up to three years, Bird & Bird ATMD’s Senior Associate, Natasha Cheng, explained. Apart from longer validity, ONE Pass also eliminated the need for holders to reapply for a new pass to change jobs, unlike EP holders who need to undergo the process of reapplication.

ONE Pass holders will also be able to “concurrently start, operate, and work for multiple companies at any one time. EP holders can only work for the entity which sponsored his/her EP unless specific permission is sought and obtained from the MOM,” said Ng.

But amongst the benefits that ONE Pass provides, Cheng said the biggest privilege a holder could get is having a dependent, particularly their spouse, to work in Singapore on a letter of consent.

Cheng explained that dependents of EP and PEP pass holders can only work in Singapore on a work pass.

“If an EP holder’s spouse wishes to work in Singapore, the spouse will need to ensure that he/she qualifies for a work pass on his/her own merit,” NG commented.

Qualifying for the ONE Pass

To qualify for the ONE Pass, applicants must meet the salary threshold of $30,000. “Candidates must be earning at least $30,000 as a fixed monthly salary for the last year or they will have to show that they will be earning a $30,000 fixed monthly salary with an employer in Singapore,” according to Cheng.

The salary threshold of the ONE Pass is its most important difference from other existing work passes by the MOM, according to Ng. “The current EP salary threshold is $5,000, or $5,500 if the applicant is in the financial services sector. The salary threshold of $30,000 was chosen as it is comparable to the top 5% of EP holders,” the Baker McKenzie Wong & Leow expert added.

Candidates who do not meet this criterion can still apply for ONE Pass if they have outstanding achievements in the field of arts and culture, sports, science and technology, and research and academia.

“More details on the eligibility criteria for new applications and renewals under this route will be announced closer to 1 January 2023,” Ng said.

On top of these requirements, Cheng said candidates must show that they are going to be working for a company which has a market capitalisation of at least $669m

(US$500m) or a revenue of $267m (US$200m).

Those who are not eligible for the ONE Pass can consider applying for an EP or a PEP.

The PEP, like the ONE Pass, is not tied to a single employer; however, this type of pass is not renewable, according to Cheng. The qualifying salary for the PEP is $18,000 per month currently, but this will increase to $22,500 in September 2023.

“At some point, a PEP holder will lead to transit either to an EP or perhaps to ONE Pass,” she said.

If the ONE Pass and the EP are not viable options, Ng said foreigners can also consider S Pass and Work Permit. However, as these are for mid- to low-skilled workers, it is unlikely they will be helpful in such a scenario,” Ng added.

Potential loopholes

According to Goh Seow Hui, Head of Bird & Bird ATMD’s Employment Practice, the requirements set by the government disqualify “quite a number of people” and “weeds out most companies.”

“To get a seat at the table is really not easy. Just on that alone, I think the idea of it being abused is quite hard to fathom. It’s hard to abuse a system that you can’t even get into in the first place,” Goh said.

Goh, however, said there could potentially be loopholes to the work pass framework.

“There is no time limit for the ONE Pass holder to remain employed. A lot of things can happen in five years. You do well in the first two years and in the middle of that you may lose your job, or circumstances change,” Goh said. The potential loophole, however, can be dealt with through proper enforcement of measures, according to Goh.

“The minister’s response is that everyone reserves the right to cancel [the pass] if there are periods of economic inactivity. It’s a logical response but what remains to be seen is its enforcement. How much of a watchful eye can MOM be? How can they keep tabs on ONE Pass holders and their movements? It’s really an enforcement issue,” she said.

18 SINGAPORE BUSINESS REVIEW | Q1 2023 LEGAL BRIEFING

To get a seat at the table is really not easy

The government has enhanced its work pass framework and introduced the ONE Pass for foreign workers (Photo from One-Visa.com)

Zhao Yang Ng

Natasha Cheng

Embedded finance to be the next big

in disruptive

Future

The banking industry has been enveloped by the rapid demands of its users: adapting to the latest technology, going digital, and being able to serve customers practically anytime and anywhere.

This past year, another development has been seen rising in the industry. Embedded finance and embedded insurance have started to pick up as effective tools to deliver banking needs more instantly to a wider number of users –and this time not just in banking apps.

To delve deeper into what embedded finance is, Singapore Business Review spoke with Peter Miller, CEO of Fermion, to know how different it is from banking-as-a-service (BaaS) models.

“Embedded finance revolves around integrating access to financial services and solutions, whilst banking-as-a-service (BaaS) centres on providing a technological foundation that banks rely on to offer those financial services and solutions,” Miller said.

Expounding on the concept, Miller explained that embedded insurance stands as a subset or part of embedded finance or BaaS model.

The idea is to add embedded finance as an interconnected set of complimentary services. A good example of embedded insurance is when purchasing an airplane ticket, travel insurance or further extensions such as telemedicine or emergency money are made available to the customer.

However, the main goal of embedded finance is to provide for the customer’s needs—at the exact moment, they may need it without having to redirect or jump to another platform or site.

“Thus, what banks need to consider always

is how can they best serve customers with banking and insurance products wherever and whenever customers need banking and insurance products and how they can best leverage their considerable assets to ensure they are always offering a differentiated proposition,” Miller said.

Fermion helps banks and non-bank affinity partners to on-sell insurance. It also offers insurers ready access to over 230 banks and numerous financial institutions. This enables insurers to connect and seamlessly embed insurance into customer-centric sites.

Including pension funds, Fermion’s savings & protection ecosystem connects 500,000 corporations and financial services providers, reaching over 11 million members.

With Fermion’s deep domain expertise, of having worked with over 150 insurance companies, Fermion helps banks embed insurance products into their customers’ journeys by analysing data and turning these into assets. Key touch points that can maximise revenue at a minimal cost are determined in the customer journey.

A personal and transformative shift in digital banking

Speaking next to Andrew Tan, Silverlake Axis’ Group Managing Director, one new trend that he saw in the digital banking scene is that there is now a shift to having cloud-based platforms.

“From an IT spending perspective, cloud spending represents a very robust area of growth. Some 65% of Asia Pacific banks surveyed either plan to move or have already moved their workloads to private and/or public cloud environments. Cloudbased platforms are the cornerstone to building new capabilities and deploying cost-effective transformative solutions,” Tan shared.

He said that the past years have seen a rise in digital lending, thus uploading banking services to digital is no longer an option.

To stay competitive in the APAC financial services market, banks are required to leverage modern, digital-first and component-driven transformation technology to effectively scale their digital capabilities.

Disruptive technology not only transformed banks into customer-centric institutions, but also revamped their business model to become modern, secure, and stable. Disruptive technology has transformed into a reliable system with real-time problem-resolution capability.

Silverlake Axis has a strong 100% successful track record and continues to provide solutions for both digitally mature and traditional players. It offers MÖBIUS, a composable out-of-the-box digital cloud for banks seeking to transform to a cloudnative solution, whilst it has the SIBS for banks that do not require a rip and replace in order to innovate and modernise.

Tan said that Silverlake Axis remains to make its banking partners successful as it provides experience, expertise, and execution to help banks navigate through digital transformation swiftly.

“Banking transformations are generally risky and fail more often than not due to people issues rather than technical ones. Most solution providers focus purely on technical issues. This is why experience, expertise and execution matter,” Tan said.

“Silverlake Axis has helped many banks transform over the years. We have been there when the ATM was first introduced in the 80s, then banks started to invest much later in internet banking…Technology will always evolve but having a Stable Core with an experienced partner to help integrate all these platforms transact seamlessly and successfully [is key].”

SINGAPORE BUSINESS REVIEW | Q1 2023 19

banking apps should be more customer-centric, much like Grab and Netflix.

thing

tech

To stay competitive in the APAC financial services market, banks are required to leverage modern, digital-first and component-driven transformation technology to effectively scale their digital capabilities.

CO-PUBLISHED CORPORATE PROFILE

Andrew Tan, Silverlake Axis’ Group Managing Director, and Peter Miller, Fermion’s CEO

GIA covers insurers’ fraud blind spots

The Fraud Management System uses data analytics and AI that analyse suspicious claims.

In mid-2022, a Singaporean woman fooled six insurers before being sentenced to five months in prison for making 20 fraudulent travel claims worth more than S$14k. The perpetrator used photos of damaged goods, receipts, boarding passes, and even police reports she found online and digitally altered them to support her claims. She would have gotten away with it if not for the General Insurance Association of Singapore (GIA)’s Fraud Management System (FMS).

According to Andrew Yeo, CEO of Income and GIA Management Committee Member and Insurance Fraud Committee Convenor, insurance fraud cases in Singapore more than tripled from 20 in 2018 to 71 in 2021.

“With the reopening of the borders, we are observing an increase in suspicious travel insurance claims between January and July of last year compared to the same period in 2021,” Andrew said.

Aside from travel insurance fraud, one of the biggest and most vulnerable segments is motor insurance.

“Motor insurance fraud syndicates are known to operate through a network and recruit individuals to participate in the scam,” Andrew explained. A report by Crawford said at least 20% of all motor claims are fraudulent with claimants exaggerating their injuries and/or inflating the damage to their vehicle. Most of these cases are made by organised crime syndicates which stage traffic accidents and recruit hundreds of people as part of their activities.

“To date, over 300 subsequent motor insurance claims have been investigated by insurers with 13 confirmed as fraudulent cases which have now been turned over to the police,” Andrew added.

General insurance’s first line of defence

GIA has collaborated with the police, insurers, and the Commercial Affairs Department to combat fraud using FMS. First launched in 2017, the FMS uses data analytics and AI to detect potentially fraudulent claims at scale.

“When a suspicious claim is detected through the FMS, insurers involved will be contacted to verify the suspicious claim. If sufficient evidence reveals that there is fraud, a police report will be filed and the insurers involved will then need to cooperate with the police,” Andrew explained.

Andrew stressed the importance of the FMS as most of these cases would have gone unnoticed if it was just done through a manual review and even embolden fraudsters to continue with these schemes.

Other ways

Aside from the FMS, the GIA also collaborates with specialist investigators from the Commercial Affairs Department and insurance representatives through the GIA Insurance Fraud Committee (IFC).

Insurers provide claims insights which are then shared with the police and fed into GIA’s FMS

The GIA is also working closely with the Singapore police’s specialised fraud investigation branch, which is also part of the IFC. These agencies share information and best practices in detecting and preventing insurance fraud.

“For example, should the police receive reports on a new variant of insurance fraud, they will inform us and we will review our safeguards and conduct more stringent checks to verify the authenticity of the claims,” Andrew said.

This collaboration goes both ways as the GIA also exchanges information with the police on the possible characteristics of fraudulent insurance claims.

“Insurers play a pivotal role as they provide claims insights such as the latest trends and common forms of insurance fraud that they observe, which are then shared with the police and also fed into GIA’s FMS for further refinement of its detection capabilities,” Andrew added.

The GIA is also tapping the public to help them identify insurance fraud. Under the GIA Insurance Fraud Tip-off (GIFT), a person who reports fraudulent activities can get a reward of up to $10k leading to successful prosecution and conviction of general insurance fraud cases concerning members of the GIA.

Insurers’ role

“Insurers are able to provide insights such as the latest trend and common forms of insurance fraud that they observe. This feedback will help refine the FMS system further,” Andrew said.

20 SINGAPORE BUSINESS REVIEW | Q1 2023

CEO INTERVIEW

The GIA is also working closely with the Singapore police’s specialised fraud investigation branch (Photo: Andrew Yeo, CEO, GIA)

Flexible work arrangements key to employee recruitment, retention

Paradise Group Holdings’ Karen Tan talks about their commitment to employees’ work-life harmony and their adoption of the Tripartite Standard on Flexible Work Arrangements.

Out-of-the-box FWA Programmes

Today, about 15% of Paradise Group’s 1,300-strong workforce benefits from the company’s FWA and telecommuting programme. To hire and attract more employees, the organisation came up with four out-of-the-box FWA schemes for its frontline or operational F&B employees.

• Half-day regulars - For senior workers, those with family or caregiving responsibilities

• Workday regulars - For homemakers who prefer working certain hours on weekdays

• Weekends/Public holidays - For tertiary students and young adults

• 3-day work week - For senior workers, those with family or caregiving responsibilities. Newly implemented in 2020.

have returned to the office to facilitate interaction and operational needs after the two-year lockdown. However, the organisation continues to provide telecommuting opportunities and staggered work hours.

More Flexibility in the Future

To further demonstrate its commitment to its employees’ work-life harmony, Paradise Group adopted the Tripartite Standard on Flexible Work Arrangements in April 2020 and enhanced their flexible work options that benefit both the organisation and their employees.

The food and beverage industry is known for its long working hours and different work shifts, making hiring and retaining employees an enormous and continuing challenge. These issues were magnified at the height of the COVID-19 pandemic.

As pandemic restrictions have considerably eased, companies are discovering that adopting flexible work arrangements (FWA) is key to hiring or getting their employees to return to the office. Paradise Group Holdings, a Singapore-based restaurant group, was a pioneer in implementing work-life and FWA initiatives in 2012.

“We started such flexi-work schemes ten years ago when it was still pretty unheard of. We wanted to attract and retain employees by offering flexibility in working hours. We also wanted to attract more locals, such as secondary breadwinners and tertiary students, to supplement our full-time workforce,” said Karen Tan, Regional HR Director of Paradise Group.

“Over the years, our flexi-work schemes have generated much interest. Other F&B companies have also started implementing similar schemes in the last few years.”

The implementation of FWAs has improved Paradise Group’s talent retention significantly. Company data shows that their employees stay for an average of 3 years. More than 22% have been with the company for 5 years and above, whilst 5% have more than 10 years of service. The longest-serving service/kitchen staff has served for about 17 years, and about 100 employees are set to receive their 10-year-long service award early next year.

Remote Work Corporate Functions

For employees who perform office or corporate functions, the company introduced the telecommuting scheme. Prior to launching the programme, the company laid down the groundwork to ensure employees were ready for the switch. This included establishing the infrastructure, arranging for laptops for all employees, providing access to databases and VPNs, and having the IT support team on standby. The company also researched industry-based protocols for staff working from home, and updated employees on remote work initiatives, including employee engagement. Currently, Paradise Group’s employees

Implementing FWAs has given the company flexibility in manpower deployment, and the capability to better attract and retain employees. It also enhances engagement, motivation, productivity, and satisfaction whilst addressing employees’ work-life needs.

Moving forward, Paradise Group “expects hybrid remote work arrangements to dominate the future of work patterns and is likely one of the main motivations for employees, especially the relatively younger generation,” Tan predicted.

She highlighted that the sooner employers embrace FWA practices, the fewer challenges they would face in meeting the needs of the evolving workforce. This, in turn, will translate into greater employee satisfaction and retention.

The Tripartite Standard on Flexible Work Arrangements (TS FWA) specifies a set of verifiable and actionable practices that employers should implement at the workplace to help their employees better manage their work-life needs through flexible work options.

The Tripartite Alliance for Fair and Progressive Employment Practices (TAFEP) also offers complimentary Tripartite Standards Clinics to help employers establish these practices.

To learn more about the Tripartite Standard on Flexible Work Arrangements, visit tafep.sg today.

SINGAPORE BUSINESS REVIEW | Q1 2023 21

CO-PUBLISHED CORPORATE PROFILE

Over the years, our flexi-work schemes have generated much interest. Other F&B companies have also started implementing similar schemes in the last few years

Love, Bonito uses data to develop actionable insights in fashion

to maximise stock levels at each store and decisions to select what products they should offer and how and when they should be released.

The company’s in-house design trackers, meanwhile, work with the designers to identify winning designs and gain insights from under-performers. “In the long run, we turn customer insights into actionable plans that drive the design process,” Leong said, adding that customer lifetime value over customer acquisition cost ratio increased seven times.

Trends and challenges

In the past two years, Love, Bonito has been accurately forecasting the demands of its customers, with a monthly mean average percentage error of less than 10%. Because of this accuracy, the brand is able to prevent overproducing items and cut out underperforming products. This was all thanks to its established data team and infrastructure.

Love, Bonito’s in-house data team and infrastructure were established in 2019. It initially aimed to make analytics scalable and build a data culture within the company.

Now, its data team focuses on translating actionable insights from data, building automation and decision modelling to drive growth and efficiency across the organisation.

“This allows us to identify and recreate winning designs that customers love and at the same time, improve other designs based on customers’ likes and preferences. There are also plans to use data

science and AI to enhance customer experience based on customers’ psychographics and shopping habits online and in-store,” CEO Dione Song told Singapore Business Review

“It’s critical because it helps us make better decisions. Data is knit into every part of our business from understanding customer preferences and changing trends to driving efficiency in our inventory decisions and identifying new opportunities for our business,” Vice President of Data and Growth, Jane Leong added.

Data strategy

Love, Bonito uses both first-party data which include transaction, behavioural, and survey data collected from their platforms, and third-party data or industry and competitor research. It keeps track of over 100 product attributes per SKU and gathers information and feedback from customers.

The data team looks at various information which includes product attributes of popular designs, ways

To date, Love, Bonito has 16 physical stores in Singapore, Hong Kong, Malaysia, Cambodia, and Indonesia and also ships to 20 countries worldwide. Even if the company started as an e-commerce business in 2010, it was still not spared from the supply disruption caused by the pandemic. Song, however, said that this presented an opportunity for Love, Bonito to recalibrate their omnichannel efforts to emphasise online versus in-store activations due to uncertainties in movement.

“Now, we’ve pivoted to designing home and comfort wear, such as our Staples (officially named The Staples) and Loungewear lines. We also started to incorporate workwear into our assortment a few months ago as safety measures have eased and we see more customers adapting to clothes needed for the hybrid workhome environment,” Song said.

Song said that whilst it is important to have channels and touchpoints needed to reach customers, it is also vital to be as “channel-agnostic, customercentric, and hyper-thoughtful as possible to go to where shoppers are,” noting that customers expect convenience and want connections and a sense of community. It is also important for brands to have an “authentic and clear purpose, and value system” as customers have become more discerning, especially the millennials and Gen Zs.

22 SINGAPORE BUSINESS REVIEW | Q1 2023 STORE WATCH

Love, Bonito turns customer insights into actionable plans that drive the design process (313 Love, Bonito store reopening. Photo courtesy of Love, Bonito)

The brand’s data strategy led to an 8% increase in its second purchase rate.

Data is knit into every part of our business

Dione Song

Jane Leong

Transform how dentists treat with the

How to stay ahead of SMEs’ financial needs

ANEXT Bank’s CEO talks about why digital banks are the key to this challenge.

Toh Su Mei recalls a time during the early days of her career when a former colleague made a data entry mistake in the bank record of a small and medium-sized enterprise (SME).

“That seemingly small mistake ended up affecting the SME’s request and access to a credit line to fund his business operations. That was when I realised banking was more than just a job for me,” Toh, CEO of ANEXT Bank, told Singapore Business Review

Prior to that, banking just seemed the natural course of action given Toh’s education background, saying that she “stumbled” into the industry after graduating with a major in Economics. But moments such as this cemented to Toh how critical their role is to small and medium enterprises.

“I’ve not looked back since my first experience where I witnessed first-hand how the right financing solution and quality of banking services could make or break a business. And for small and medium enterprises, this was even more apparent,” she said. It became more than just banking to Toh. “It was an opportunity for me to make an actual difference – it’s not about financing a business, but a person’s livelihood and aspirations. Constantly and actively listening to customers is key, and I enjoy the deep relationships built with my customers in this process. If I somehow had to choose my first job again, I’d pick banking and do it all over again!” the CEO explained.

Decades later, Toh is now Chief Executive Officer of ANEXT Bank, one of the newest digital-only banks granted a license to operate by the Monetary Authority of Singapore (MAS), with over two decades of serving SMEs both in Singapore and across the region. Prior to her new role, Toh was regional head, SME loan product management & alternative lending for DBS Bank.

It was a role that prepared Toh to lead one of the country’s most anticipated virtual banks, and she has incidences like the one she shared earlier in mind as she and her team took advantage of their structure as a digital-only bank to find ways to better service SMEs.