MONTHLY JULY-AUGIST 2023

VALE OF CHEERS

EQUIPMENT PROVIDERS BENEFIT FROM RISING GLOBAL DEMAND

NEW NORTH AMERICAN REGULATIONS

LITHIUM BATTERIES HAZARDS AT SEA

LPG TANKER FLEET IN GREAT DEMAND

MONTHLY JULY-AUGIST 2023

EQUIPMENT PROVIDERS BENEFIT FROM RISING GLOBAL DEMAND

NEW NORTH AMERICAN REGULATIONS

LITHIUM BATTERIES HAZARDS AT SEA

LPG TANKER FLEET IN GREAT DEMAND

Training of Hazardous Materials employees is critical to the success of the Hazmat system. An effective training program is crucial for Hazmat employees to ensure they are using and implementing the highest level of safety in the industry.

Florida SouthWestern State College has partnered with industry experts, Hazmat Safety Consultants, LLC, and the Dangerous Goods Trainers Association to develop an online Train -the-Trainer course that blends industry knowledge and adult-learning philosophies to prepare the student to become a Hazmat Trainer.

Course covers the following:

o Hazmat General Awareness & Global Systems

o How to perform a Hazmat Needs Assessment for your company

o Adults learning philosophies and training plans

o Course development and delivery

Course Offerings

August 6 – September 10, 2023

September 23 – October 22, 2023

November 5 – December 3, 2023

December 17, 2023 – January 7 , 2024

This training is at no cost and is free to all students

The UN decided in the 1950s that there was a need for consistent regulation of the international transport of dangerous goods, both to set a safety benchmark and to facilitate international trade. I am not convinced that those who took that decision had it in mind that the process would still be continuing nearly 70 years later – after all, there are only so many dangerous goods out there. Indeed, there have been times over the past couple of decades when senior regulators have floated the idea that the rules had become mature, covered almost any eventuality and would henceforth need only the occasional tinkering to keep them up to date. Any exceptions could be managed through competent authority approval.

I have to admit that, at times like those, I worried about my future employment prospects. If the regulations were so settled that there would be no need for further significant changes, who would need to consult a publication such as HCB?

I had no need to worry. As this month’s issue confirms, there is still plenty for the regulators to be chewing over, not least our old friends lithium batteries. There are constant complaints that the provisions relating to lithium batteries change too often and that they are extremely (and unnecessarily) complex. That may well be true but pity the poor regulator who is chasing a moving target, with constant advances in battery chemistries and the products that use them. Furthermore, given the growing use of reusable batteries in all manner of equipment, the volume of lithium batteries in global supply chains is still growing fast, as are

the hazards, as the maritime sector is now beginning to wake up to.

But there is more than that – and much of it relates to the energy transition and the move towards decarbonised fuels and electrified mobility. For example, when ADR was first developed, who would have thought that electric tricycles would be being used to distribute parcels – some containing dangerous goods – to urban households and businesses? This is happening now, which puts a question mark over the as-yet unincorporated Protocol of 1993 that will, unless it is amended, restrict the scope of ADR to vehicles with at least four wheels.

Then there is the issue of recycled plastics material and its potentially wider use in packagings for dangerous goods. Many of the regulatory authorities are agencies of the UN and need to take cognisance of the UN Sustainable Development Goals, so they are being encouraged to make the use of recyclate easier. The US has recently opened a docket on the topic, seeking input from industry and the public.

Some decades ago, increasing computerisation raised the prospect of the paperless office. In the event, it actually seemed to generate more paper but maybe paperless is now possible. Electronic and automated exchange of information is becoming the norm and, while there are still a few issues in the logistics sector, documentation is increasingly being found on a screen rather than a paper document. This is creating other issues for regulators, whose provisions almost always include the need to keep a paper trail. Canada, the US and Europe are all looking closely at how they get around this in the digitalised world.

So it looks like my job – and yours – is safe for a while yet.

Peter MackayGlobe Sales Contact:

NO.159 Chenggang Road, Nantong, Jiangsu, China 226003

Editor–in–Chief Peter Mackay, dgsa

Tel: +86-513-85066022 (Sales) +86-513-85066888 (Switchboard)

www.cimctank.com

E-mail: tanks@cimc.com

Europe Sales Contact:

BURG SERVICE B.V.

Email: peter.mackay@hcblive.com

Tel: +44 (0) 7769 685 085

Middenweg 6 (Harbour nr.397-399) 4782 PM

Moerdijk , The Netherlands

Tel: +31 880 030 860

www.cimctankcontainers.nl

Commercial Director Ben Newall

Campaigns Director

Craig Vye

Email: craig.vye@hcblive.com

Middenweg 6, 4782 PM, Moerdijk, The Netherlands

Tel: +44 (0) 208 371 4014

Tel: +31 88 00 30 800

Fax: +31 88 00 30 882

www.burgservice.nl

E-mail: info@burgservice.nl

Production Manager Binita Wilton

CIMC SAFE WAY TANK SERVICE (Jiaxing) CO., LTD.

Email: ben.newall@hcblive.com

Tel: +44 (0) 208 371 4036

E-mail: info@cimctankcontainers.nl

CIMC SAFEWAY TANK SERVICE CO., LTD.

Cleaning Maintenance Testing

Email: binita.wilton@hcblive.com

Managing Editor Stephen Mitchell

Email: stephen.mitchell@hcblive.com

Tel: +44 (0) 208 371 4045

Telematics

Designer Jochen Viegener ISSN 2059-5735 www.hcblive.com

Cargo Media Ltd

Marlborough House 298 Regents Park Road London N3 2SZ

Tel: +44 (0) 208 371 4041

No. 318 , Washan Road, Port Authorities, Jiaxing, Zhejiang Province, China 314201

Tel: +86 15806290956

E-mail: ning.li@cimc.com

CIMC SAFEWAY TANK SERVICE (Lianyun gang) CO., LTD.

Safety and Environmental Management Center, Xuwei New Chemical Park, Lianyungang, Jiangsu, China 222047

Tel: +86 13814742170

E-mail: lichunfeng@cimc.com

HCB Monthly is published by Cargo Media Ltd.

While the information and articles in HCB are published in good faith and every effort is made to check accuracy, readers should verify facts and statements directly with official sources before acting upon them, as the publisher can accept no responsibility in this respect.

Tankmiles

Tel: +86 15262722292

www.tankmiles.com

E-mail: tankmiles@cimc.com

Managing Editor

Peter Mackay, dgsa

Email: peter.mackay@chemicalwatch.com Tel: +44 (0) 7769 685 085

Advertising sales

Sarah Smith

Email: sarah.smith@chemicalwatch.com Tel: +44 (0) 203 603 2113

Publishing Manager

Sarah Thompson

Email: sarah.thompson@chemicalwatch.com

Tel: +44 (0) 20 3603 2103

Publishing Assistant

Francesca Cotton Designer Petya Grozeva

Chief Operating Officer Stuart Foxon

Chief Commercial Officer Richard Butterworth

TRADE, BUSINESS AND economics have been all over the place for the past three years, making life difficult for many in the chemical logistics area. On the other hand, many companies have also been doing quite nicely out of it. How different it seems reading the July 1993 issue, when business was still in the doldrums following the 1988 financial crisis, rising oil prices and restrictive monetary policies enacted in response to worries about inflation. Volatility and uncertainty, watchwords of the past few years, were unknown in 1993: it was just a day-after-day slog through the mire of weak demand.

Those economic conditions were bad news for the tank container industry, which was still finding its feet, particularly in North America – and in contrast to today’s market. HCB said in July 1993: “Yet another year of subdued demand has not been without its casualties in a battle-weary tank container industry” and that a rapid return to profitability was not on the cards. Pressure on rates impacted lessors’ abilities to invest in new equipment, which had led to some consolidation – Dolphin Containers had been bought by Trans Ocean and East Med Tanks was absorbed by Sea Containers. On the other hand, Cronos Containers came steaming into the sector, only to be swallowed itself by Seaco (formerly Sea Containers and by then owned by HNA) some years later.

Much the same could be said of the tank container operator sector in 1993, especially in Spain where there were a number of mergers and less formal arrangements, and elsewhere in Europe, with Groupe Samat acquiring Transport Coulier, for instance.

At the time, we said that the Far East offered some optimism; Japan’s economic downturn was expected to be short-lived – though that prediction turned out to be rather wide of the mark. Latin America was also identified as a potential growth market, with the signing of the North American Free Trade Agreement expected to open up new north-south trade flows. In 1993 there was, though, one word noticeably absent from all this talk of tank containers: China. If would be some years before the country’s economy really started to open up and yet more before China’s vehicle manufacturers realised they had a major cost advantage in tank container manufacturing.

Elsewhere in the July 1993 issue, we reported on the session of IMO’s Maritime Safety Committee (MSC) in May, where several important decisions were taken, including the planned revision of the STCW Convention and several changes to Solas; IMO was planning to hold a one-day event in 1994 so that MSC and its sister body the Marine Environment Protection Committee (MEPC) could bring their respective expertise to bear on topics such as port state control, enhanced ship surveys and the International Safety Management Code.

MSC had also been charged with getting Amendment 27 to the IMDG Code ready so that it could enter into force at the same time as other international regulations, which was a tall order as it had been decided to begin the process of reformatting and consolidating the Code.

A small item mentioned that Dean Ricker had joined Skolnik Industries as market development coordinator; thirty years on, Dean is still with the company and has made it all the way to president.

THIRTY YEARS AGO, and despite the ongoing recession, HCB was sufficiently well staffed to be able to produce separate issues for July and August, despite the fact that much of continental Europe was away from its desk for pretty much the whole of August. Still, dangerous goods never sleep and there was always plenty to keep us busy.

For a start, the RID/ADR experts had redrawn the provisions for Class 6.2 substances, altering “out of all recognition” the original text relating to what were then called “infectious and repugnant” substances. As ‘HJK’ pointed out, when these requirements were originally drawn up, they related to such items as horses’ hooves being carried across Europe to be boiled down for glue, while the modern (1990s, anyway) needs were for text that could be applied to micro-organisms and diagnostic specimens. There were plenty of other changes that had been agreed and the meeting’s chair, Mr WJ Visser, provided his own wish-list for future development, stressing the need for ADR and RID to continue to move in lock-step. He also pointed out the relative lack of input from the transport sector compared to testing institutes and the chemical and packaging industries. Strangely, he did not mention the possibility of removing the use of ‘marginals’.

Elsewhere, there was still activity in the control of volatile organic compound (VOC) emissions, with the US Coast Guard weighing in with its own guidance. There had been much talk of this at the ILTA conference and exhibition, which had been held for the 13th time in June in Houston – this year’s event was held in late May, still in

Houston though now downtown rather than out on Westheimer at the Adam’s Mark Hotel – and HCB’s August 1993 issue carried a lengthy report on presentations. It also had a piece on the need for greater standardisation in chemical transfer systems by Alec Keeler, who was then a thrusting young buck of a marketing manager (judging by the accompanying photo, at least) at Emco Wheaton and is these days still in the game as boss of Carbis Loadtec.

Historians of the tank container industry would be interested in a piece by Martyn Gill of Stolt-Nielsen Leasing, reminiscing about the development of the beam tank concept by John Foster at Sea Containers. Like other companies, Sea Containers (nowadays Seaco Global) was keen to reduce the tare weight of its tanks so that they could carry more product; while some advances towards a lightweight tank had reduced average tare weights by more than 15 per cent to just over 4,000 kg, Foster believed there was more to be gained and worked in his own time to achieve his vision.

By eliminating non-structural parts of the ISO frame, and working with UK manufacturers, Foster managed to bring down tare weights even further, to under 3,500 kg. In 1986, Sea Containers acquired tank manufacturer UBH and started producing beam tanks, initially for the beer industry but later also for chemicals. Gill noted in the August 1993 issue that Stolt-Nielsen had just placed an order with UBH for 400 IMO I beam tanks, which he said was not only a tribute to John Foster – who had died at the age of 48 in 1988 – but also an excellent investment.

THE BANDWAGON EFFECT is a psychological phenomenon in which people do something primarily because other people are doing it, regardless of their own beliefs, which they may ignore or override. This tendency of people to align their beliefs and behaviours with those of a group is also called a herd mentality.

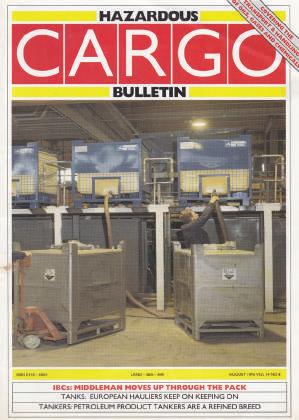

I am writing this column after a friend of mine pointed me to a recent article in the Dutch Financial Times (Financieel Dagblad). The director of Cepsa Spain announced plans to invest in hydrogen production and distribution facilities in southern Spain. In the article the journalist wrote that hydrogen is clean energy. The question which immediately came to mind was: is hydrogen really clean?

Let’s check this and ask an expert. Mark Jacobson, a professor of civil and environmental engineering at Stanford, warns that blue hydrogen is not really a climate-friendly option. Hydrogen fuel burns clean, so it has potential as a low-carbon energy source — depending on how it’s made.

Today, most hydrogen is known as ‘grey’ hydrogen. It’s derived from natural gas using an energy-intensive process that emits a lot of carbon dioxide. ‘Blue’ hydrogen is sometimes touted as a clean alternative. It’s essentially the same as grey hydrogen, but the carbon dioxide emissions are captured during production, so they’re kept out of the atmosphere. That’s partly because it still relies on natural gas. And producing and piping natural gas is a major source of climate-warming methane leaks.

However, Jacobson says there is a better way to make hydrogen fuel. “The easiest way to produce hydrogen is just to pass electricity through water,” he says. “And if you generate the electricity with clean

renewable energy like wind or solar power, then the whole process of producing the hydrogen is clean, and that’s called ‘green’ hydrogen.”

As solar and wind power get cheaper, so will the cost of green hydrogen. So Jacobson says it’s a more promising path forward than grey or blue. However, we can’t just all jump on the bandwagon without asking questions such as:

• Who will be paying for this? Answer: Cepsa will only invest if the State subsidises the transition (OPM, Other People’s Money i.e., the tax payer)

• What are the expected ‘externalities’ and who will be paying for them? The costs to social cohesion, the environment and life?

• How much mineral resources, forever chemicals, and other rare earth materials are needed to build such a structure?

The danger of the bandwagon effect is that it easily leads to ‘path dependency’. It then becomes an ideology which can only thrive when/ if contradictory information is suppressed. As an information theorist, there is a method to predict the outcome of a path-dependent ideology, which is that it cannot be achieved without becoming harmful. Potential harm consists of information which must be included in the plan. If this is not done, the goal would lack the information which is equivalent to the energy to do the work needed to succeed. This is physics. It causes a larger risk: political enforcement.

This is the latest in a monthly series of articles by Arend van Campen, founder of TankTerminalTraining, who can be contacted at arendvc@ tankterminaltraining.com. More information on the company’s activities can be found at www.tankterminaltraining.com.

include not only those emanating from the UN Model Regulations – which range far and wide across the regulations – but also the ICAO Technical Instructions, including quantity limitations and lithium battery provisions specific to air transport, as well as vessel stowage requirements taken from the IMDG Code.

Although these proposed changes make a lot of sense for those involved in the international transport of dangerous goods, PHMSA is also speaking to a political audience at home and has to make the case for the amendments. It says in its preamble to the NPRM that the adoption of the proposed amendments “will maintain the high safety standards currently achieved under the HMR” and also that “harmonization of the HMR with international regulations and consensus standards could reduce delays and interruptions of hazardous materials during transportation”, which may also lower greenhouse gas emissions and safety risks to “minority, low-income, underserved and other disadvantaged populations and communities in the vicinity of interim storage sites and transportation arteries and hubs”.

THE PIPELINE AND Hazardous Materials Safety Administration (PHMSA), an agency of the US Department of Transportation (DOT), has issued a notice of proposed rulemaking (NPRM) under docket HM-215Q. Those who follow the passage of regulatory change in the US will know that the ‘215’ series represents PHMSA’s biennial update to maintain harmonisation – insofar as is deemed desirable – between the US Hazardous Materials Regulations (HMR) and the international modal regulations.

HM-215Q represents PHMSA’s response to the amendments found in the 22nd revised edition of the UN Model Regulations, as reflected in the 2023-2024 edition of the International Civil Aviation Organisation’s

(ICAO) Technical Instructions, which is already in force, and Amendment 41-22 to the International Maritime Dangerous Goods (IMDG) Code, which becomes mandatory on 1 January 2024.

HM-215Q was published in the Federal Register on 30 May; PHMSA is inviting comments by 31 July, after which it will aim to produce a final rule as quicky as possible. It is notable that the agency has managed to catch up somewhat with the international regulatory biennium, having falling behind during the years of the Trump administration, when it needed to provide more detailed justification for its proposals.

HMR is a multimodal regulation, so the amendments being proposed in HM-215Q

Despite the above, and also the fact that the US holds the chair of the UN Sub-committee of Experts on the Transport of Dangerous Goods (TDG), which is responsible for drawing up the amendments to the UN Model Regulations, PHMSA has chosen not to adopt a number of updated international regulations. It says it has done this either because the structure of HMR makes adoption unnecessary or that it deems it safer to authorise certain transport operations by means of special permits rather than allow for general applicability by amending HMR. Use of special permits provides greater oversight and gives time to assess the safety implications of regulatory change before potentially incorporating the changes into HMR at a later date.

This time around, PHMSA has identified three specific amendments that it will not be adopting immediately. Firstly, the latest UN Model Regulations and IMDG Code include provisions for the design, construction,

USA • PHMSA’S LATEST BIENNIAL PROPOSALS FOR INTERNATIONAL HARMONISATION HAVE BEEN PUBLISHED. DUTYHOLDERS SHOULD BE ALERT TO SOME SIGNIFICANT CHANGES COMING TO HMR

approval, use and testing of UN portable tanks with fibre-reinforced plastics (FRP) tank shells. PHMSA believes that further research is needed in such areas as metal fatigue, suitability of the pool fire test and impact testing, as well as identification of the most appropriate non-destructive test methodology. Pending such research, PHMSA is proposing to adopt a change to §171.25 to allow the limited import and export of FRP UN portable tanks within a single port area but not to allow general use of such tanks.

A second variation from international regulations relates to several amendments to the definitions and requirements for assessing conformance of UN cylinders built to ISO standards. PHMSA says that, as the terminology used in international standards differs from that in HMR, further evaluation is needed to determine the full impact of the changes; it may consider making relevant changes in a future rulemaking.

Finally, international regulations have adopted maximum internal pressure limits for aerosol containers. PHMSA welcomes this additional safety measure for the transport of aerosol containers, as it makes aerosol containers constructed and filled in accordance with international standards more consistent with existing domestic requirements for aerosol containers, which are subject to internal pressure limits as part of the performance standards for their construction and use. HMR already includes a definition for aerosols and performance standards for their construction and use; harmonising this approach with maximum pressure limits would entail a complex review and evaluation, which is beyond the scope of the HM-215Q rulemaking.

One of the significant changes being proposed in HM-215Q in fact goes back six years; in the

HM-215N final rule, PHMSA added four new entries under Division 4.1 for polymerising substances, along with defining criteria, authorised packagings and safety requirements, including stabilisation methods and operational controls. At the time, PHMSA put a time limit on the validity of the changes, to 2 January 2019, to enable it to review and research the amendments. In 2020, as part of the HM-215O final rule, that limit was extended to 2 January 2023 to allow for further research. In HM-215Q, having completed its research to its satisfaction, PHMSA is proposing to remove the phaseout date entirely so that the transport provisions for these polymerising substances can be applied indefinitely.

PHMSA identifies as another highlight of HM-215Q the proposed adoption of the new UN 3550 entry for cobalt dihydroxide powder, introduced into the UN Model Regulations to allow the continued transport of the product (notably from South Africa) in flexible intermediate bulk containers (FIBCs) subsequent to its identification as a having a toxic by inhalation hazard. PHMSA notes that cobalt is a key strategic mineral, used in

various advanced medical and technical applications, including various types of batteries, and it is therefore important to keep global supply chains open. It is also proposing to include relevant packaging provisions.

Elsewhere, PHMSA is proposing to remove the exceptions provided for small lithium cells and batteries in air transport. This is consistent with the removal of similar provisions from the ICAO Technical Instructions.

There is a follow-up amendment in §171.12(a), where PHMSA had in HM-215N expanded the recognition of cylinders and pressure receptacles (including certificates of equivalency) approved in accordance with Canada’s Transportation of Dangerous Goods Regulations (TDGR). At that time, it did not include any Canadian acetylene cylinders corresponding to DOT-8 and DOT-8AL cylinders, primarily due to concerns over some differences in calculations and methods of construction for TC-8WM and TC-8WAM cylinders. PHMSA has since conducted a further comparative analysis and concluded that its initial concerns were unwarranted. It is therefore proposing to add those Canadian

specifications as comparable cylinders in the table in §171.12(a)(4)(iii).

A potentially significant amendment is being proposed in §171.23, relating to the authorised use under specific conditions of pi-marked pressure receptacles that comply with the provisions of ADR and the EU Directive 2010/35/EU. When this provision was first adopted into HMR, it was intended only to apply to cylinders, which are specifically referred to in §171.25(a)(3)(iii); however, the EU system applies to a wide range of pressure receptacles – including tubes, pressure drums, closed cryogenic receptacles, bundles of cylinders, etc – some of which have comparatively large capacities, and the paragraph as it stands appears to include authorisation for their use in the US. PHMSA is now proposing to replace the words “pressure receptacles” in that paragraph with “cylinders with a water capacity not exceeding 150 L”, to provide additional clarity. PHMSA says, though, that it understands there is growing interest in the use of some larger pressure receptacles and it plans to address that in a separate future rulemaking. There is a major amendment proposed for §173.167, which contains the packaging

instructions and exceptions for ID8000 consumer commodities, which was added to HMR in HM-215K in order to align HMR with the ICAO Technical Instructions for the transport by air of limited quantities of consumer commodity material. Inquiries from shippers and carriers have revealed some confusion over the applicability of the provisions of this section when consumer commodity material is moved by transport modes other than air and the agency issued letters of interpretation in 2012 and 2017, giving the opinion that, when transported by surface modes, the standard limited quantity mark (without the ‘Y’) could be applied. Last year, the Council on Safe Transportation of Hazardous Articles (COSTHA) petitioned for a rulemaking to clarify the situation and PHMSA is responding to that within HM-215Q. Specifically, it is proposing to rename the section to distinguish it from the former ORM-D consumer commodity entry, which was phased out at the end of 2020. More significantly, PHMSA is proposing to revise the structure of the section to provide clarity to shippers regarding the hazard communication and pressure differential requirements for all shipments of ID8000

consumer commodity packages and to ensure that such packages, wherever they are in the transport chain, meet the requirements for air transport. COSTHA had entered two other petitions relating to limited quantity consignments, which PHMSA says it will address separately.

All the other amendments being proposed by PHMSA should be familiar to HCB readers, as they are line with those included in the 22nd revised edition of the UN Model Regulations and the international and regional modal regulations that have entered into force this year. There are, for instance, a fairly large number of changes in the Hazardous Materials Table in §172.101, mostly derived from the UN Model Regulations. There are in addition a few corrections, relating to UN Nos 3129 (water-reactive liquid, corrosive, nos), 3148 (water-reactive liquid, nos), 0512 (detonators, electronic programmable for blasting), 3380 (desensitized explosive, solid, nos) and 1791 (hypochlorite solutions).

There are also a great many updated references to ISO standards, not least in Part 178. Some of these have had consequential amendments both within the relevant sections of that Part and elsewhere in HMR.

PHMSA is also proposing a revision to §178.706(c)(3) to allow the use of recycled plastics material in the construction of rigid plastics IBCs and a corresponding revision in §178.707(c)(3)(iii) for the inner receptacles of composite IBCs. These follow on from similar changes in the UN Model Regulations but PHMSA is proposing to require approval of the Associate Administrator, consistent with the existing requirements for the construction of plastics drums and jerrycans. This will, PHMSA says, allow it to maintain oversight of procedures, such as batch testing, that manufacturers will use to ensure the quality of recycled plastics.

All those subject to HMR are advised to check the proposals contained in the HM-215Q NPRM closely and, if they have comments or concerns, to transmit those to PHMSA without delay. HCB will return with a closer reading of the rulemaking once it reaches the Final Rule stage.

THE US DEPARTMENT of Transportation’s (DOT) Pipeline and Hazardous Materials Safety Administration (PHMSA) has proposed a new rule that would require the availability of train consist information in real time. A notice of proposed rulemaking (NPRM) issued in June under docket HM-263 seeks to amend the US Hazardous Materials Regulations (HMR) to require all railroads to generate in electronic form, maintain, and provide to first responders, emergency response officials, and law enforcement personnel, certain information regarding hazardous materials in rail transportation to enhance emergency response and investigative efforts.

The proposal responds to a safety recommendation of the National Transportation Safety Board (NTSB) and statutory mandates in The Fixing America’s

Surface Transportation (FAST) Act. It will complement existing regulatory requirements for the provision and maintenance of similar information in hard copy form, as well as other hazard communication requirements.

One important element in the proposals is that, in the event of an incident, railroads would be required to ‘push’ information out to authorised local first response personnel, rather than waiting to be contacted.

One trigger for the NPRM at this point in time is the February 2023 derailment of a Norfolk Southern freight train in East Palestine, Ohio (below), where firefighters responding to the incident initially could not determine what products were in the derailed cars. The proposals also go further than the mandate provided by the FAST Act, which was limited to Class 1 railroads; PHMSA believes

that it is important to extend the proposed requirements to all railroad classes, requiring them to proactively notify local first responders in the case of an accident or an incident involving a release or suspected release of a hazardous material.

The proposals have been welcomed by firefighters. Edward A Kelly, general president of the International Association of Fire Fighters (IAFF), says: “Firefighters are often the first to show up at many emergencies, including train derailments and hazmat incidents. Accurate, up-to-date information about train contents is critical to keep first responders and the communities they serve safe. The IAFF strongly supports DOT’s new rule that would give firefighters real-time data allowing for safer responses. We applaud the DOT for prioritising firefighter and public safety.”

“On-demand access to key information about hazmat shipments, coupled with proactive information sharing will enable first responders to better prepare for the risks present at the scene of an incident BEFORE they arrive on scene,” adds PHMSA’s Deputy Administrator Tristan Brown. “This will improve safety for firefighters and first responders, and the communities they so courageously serve.”

PHMSA says it understands that the availability of electronic real-time train consist information may not have changed the outcome of the recent derailment in East Palestine, but says that accident and similar events that have occurred in recent years highlight the importance of providing emergency response personnel with timely, complete and accurate information regarding hazardous materials within a train, as any additional time for responders to prepare for what they will encounter may reduce risks and result in significant public safety, commercial, and environmental benefits.

PHMSA also adds that railroads are already generating and managing train consist information electronically and that making such information readily accessible by responders will not impose any significant burden.

PHMSA is accepting comments on the proposals contained in the NPRM by 28 August.

THE CANADIAN GENERAL Standards Board (CGSB) has been busy lately, finalising two new safety standards relating to rail transport and issuing two new draft updates to existing standards.

The new standards are CAN/CGSB-43.147, Containers for transport of dangerous goods by rail, and CAN/CGSB-43.149, Ton containers for the transportation of dangerous goods. These will, once incorporated by reference into Canada’s Transportation of Dangerous Goods Regulations (TDGR), replace the existing Transport Canada standard TP14877 Containers for transport of dangerous goods by rail.

The most salient impact of the approach taken by CGSB is to separate the provisions for ton containers out from the general

provisions. For those unfamiliar with the term, ton containers are cylindrical steel containers, with a capacity equivalent to two standard drums, used for the transport of liquids and gases and normally transported in a horizontal orientation.

CAN/CGSB-43.149 also introduces some new definitions to clarify terms (such as ‘fusible plug’) that are used in the standard, and incorporates a quality management system requirement for ton container manufacturers. In addition, it revises the dangerous goods list for consistency with the TDGR and with the US Hazardous Materials Regulations.

CAN/CGSB-43.147, which was published in March, also updates the dangerous goods list but, more significantly, incorporates new tank

car specifications and removes outdated specifications. Specifically, this includes a phase-out schedule for legacy tank cars in toxic-by-inhalation (TIH) service and the introduction of the newer improved specifications for TIH tank cars; there are enhanced specifications for Class 113 tank cars in flammable cryogenic liquid service; and it removes TC114 as an option for the manufacture of new tank cars. Also, in effect, CAN/CGSB-43.147 incorporates the provisions included in Protective Direction No 39, issued in 2018, that brought forward the removal of unjacketed tank cars from crude oil and condensate service.

CGSB has also recently published two new draft updates for public comment. Safety standard CAN/CGSB-43.151, which sets out the requirements for packaging, handling, offering for transport and transport of explosives, was published on 19 June with the comment period due to close on 18 August. It updates the 2019 edition of the same standard, with a revised list of explosives, special provisions and packing instructions to

CANADA • OTTAWA’S DANGEROUS GOODS EXPERTS HAVE BEEN WORKING HARD LATELY, WITH A LONG LIST OF NEW STANDARDS AND REGULATORY CHANGES PLANNED FOR THE COMING YEARS

align with the 22nd revised edition of the UN Model Regulations and to update references to other dangerous goods packaging standards. The 2023 edition will also add requirements on the reuse of packagings and use of partially filled packagings to transport Class 1 explosives; prohibit the use of lightweight intermediate bulk containers (IBCs) for the transport of Class 1 explosives; and update the decontamination requirements.

A draft of the revised CAN/CGSB-43.126, which sets out the requirements for reconditioning, remanufacturing and repair of drums for the transport of dangerous goods, was published on 22 June with a comment period open until 21 August. The new version does not impose any new technical requirements not already in the 2019 edition so is in effect a reaffirmation of the existing provisions.

Both of these drafts will in due course be incorporated by reference in the TDGR and will then come into force, with a six-month transitional phase-in period.

Not all Canadian rulemakings rely on CGSB; Transport Canada itself has been doing a lot of work in the TDGR area lately and there are currently four rulemakings that have been published in Canada Gazette Part I for comment and consultation. The oldest and potentially most far-reaching of these aims to make changes to the training provisions in Part 6 of TDGR, in particular by the adoption of a competency-based training and assessment (CBTA) approach, mirroring the new provisions in the international air transport regulations.

This rulemaking in fact also relies on a CGSB standard, CGSB-192.3, which was published in November 2020. This too will be incorporated by reference in TDGR once the due process has been completed. Transport

Canada issued its planned revision in Canada Gazette Part I on 11 December 2021 and anticipates the final rule appearing in Canada Gazette Part II late this year; it will be accompanied by a one-year transitional period following that publication before it becomes mandatory.

Transport Canada published a proposed amendment to Part 17 of TDGR in June 2022, with the aim of creating an accurate and reliable inventory of regulated parties and sites where dangerous goods are imported, offered for transport, handled or transported in Canada. Publication of the final rule in Canada Gazette Part II is expected before the end of the year, after which regulated parties will have a one-year period to complete their initial registration in the new database.

An important change to the air transport provision in Part 12 of CDGR was proposed in Canada Gazette Part I on 26 November 2022. This will modernise some outdated domestic requirements and align TDGR more closely with the international provisions published by the International Civil Aviation Organisation (ICAO) and International Air Transport Association (IATA). Publication of the final rule

in Canada Gazette Part II is now anticipated around third quarter 2024.

A simpler proposal was made this past 25 March, which will introduce new fees and service standards for the TDG Means of Containment (MOC) Facilities Registration Program, which is currently funded through the public purse. Transport Canada is of the opinion that the regulated community should make a contribution and, in return, it will establish some standards of performance. Publication in Canada Gazette Part II is expected around the second quarter of 2024.

Canada’s Treasury Board opened a consultation on 27 March for a 60-day period on the Annual Regulatory Modernization Bill (ARMB), which is designed to give the government the opportunity to make “common sense” changes across many pieces of legislation simultaneously to address complicated, inconsistent or outdated requirements. The previous ARMB, which was introduced in parliament on 31 March 2022, included inter alia new provisions to facilitate digital interaction between stakeholders and

TON CONTAINERS ARE WIDELY USED IN NORTH AMERICA FOR THE TRANSPORT OF LIQUID AND GASEOUS DANGEROUS GOODS AND STANDARDS NEED TO REFLECT THIS

the government, exemptions from certain regulatory requirements for the testing of new products, and the promotion of cross-border trade by establishing more consistent and coherent rules across jurisdictions. This year’s ARMB may well reflect temporary measures that were put in place during the Covid-19 pandemic.

More specifically, Transport Canada is also planning to introduce a Miscellaneous Amendment Regulation, to bring forward some administrative changes to TDGR. This will be exempt from the consultation process and will go directly to Canada Gazette Part II, probably during the summer of 2023.

A broader update of TDGR is also planned, which will aim to align with new industry practices and address some comments received in recent years. This will appear in Canada Gazette Part I later this year, with a 75-day comment period. Publication in Canada Gazette Part II is not yet scheduled. Canada’s House of Commons has already held a first reading of Bill C-33, the Marine and Rail Transportation Modernization Act, this past November. The Bill includes a number of reforms to the Railway Safety Act,

Canada Marine Act, Canada Transportation Act, Marine Transportation Act, Customs Act and Transportation of Dangerous Goods Act; those relating to the latter are mostly administrative in nature, clarifying the applicability and scope of the Act and, therefore, TDGR. The text of the Bill can be consulted at www.parl.ca/DocumentViewer/ en/44-1/bill/C-33/first-reading.

Transport Canada is also planning to tidy up its regulatory portfolio with the repeal of certain specific instruments, namely the Ammonium Nitrate Storage Facilities Regulations, the Anhydrous Ammonia Bulk Storage Regulations, the Chlorine Tank Car Unloading Facilities Regulations and the Handling of Carloads of Explosives on Railway Trackage Regulations. Transport Canada says this will provide clarity to stakeholders by removing any ambiguity between these regulations and later federal regulations; the move should also strengthen the current oversight regime by removing duplicative and redundant provisions. This proposal will be exempted from the consultation process and go directly to Canada Gazette Part II, likely in mid-2025.

Transport Canada also notes the outcome of its ‘Regulatory Sandbox’ project on the use of electronic shipping documents, which involved a two-year period of testing that came to an end in March 2022. “While challenges emerged in trial-testing the conversion of hard copy shipping documents to digital, it was realised many benefits could be gained - including enabling first responders to access information without approaching potentially hazardous situations, enabling faster sharing of information, improving accuracy, and significantly reducing paper and ink usage,” Transport Canada says. It is now allowing the use of electronic shipping documents, though carriers interested in using them must apply for an equivalency certificate. The executive summary of the project’s findings, together with other relevant information, can be found on the Transport Canada website at https:// tc.canada.ca/en/dangerous-goods/electronicshipping-documents.

Transport Canada is now beginning work on a proposal to amend Part 3 of TDGR, which deals with documentation, to allow the use of electronic shipping documents for the transport of dangerous goods by rail and by remotely piloted aircraft (RPAs), and modify the format of the shipping document by eliminating unnecessary information. Publication in Canada Gazette Part I is expected in mid-2025, with a 75-day comment period.

More work on RPAs – otherwise known as drones – is also underway, with proposals being worked on to develop specific requirements for their use in the transport of dangerous goods while minimising safety risks. Transport Canada expects publication of its proposals in Canada Gazette Part I in the second half of 2024 with a 60-day comment period.

Transport Canada is also working on a change to Part 5 of TDGR, which deals with MOCs, with the aim of establishing requirements for MOC facility registrations; it will also include a long-overdue update to Part 5. Publication in Canada Gazette Part I is anticipated in late 2024 with a 75-day comment period.

CONFERENCE REPORT • COSTHA WAS PROUD TO BRING ITS ANNUAL FORUM BACK TO AN IN-PERSON EVENT THIS YEAR. THEIR STEP WAS REWARDED WITH A BIG CROWD EAGER TO CATCH UP

IT SHOULD BE clear by now that, by and large, we are getting used to a post-pandemic world and things are getting back towards some kind of normal. Anyone in any doubt of that would have had their minds changed by turning up to the 2023 Annual Forum of the Council on Safe Transportation of Hazardous Articles (COSTHA), which took place in person, with some online participation, in Frisco, Texas this past 30 April to 4 May, with training continuing on and off for the following three weeks. In total, well over 250 took part in the Forum, with numbers back to where they had been before the pandemic hit.

That COSTHA retains its power to attract a large crowd is down primarily to the energy of

Jack and Lara Currie, who ran the Council for decades until their recent retirement, along with the team they built up. No Annual Forum will now take place without some thoughts of them, especially Jack, who died too young last year.

The COSTHA Annual Forum continues to offer a very worthwhile combination of presentations on hazardous materials and dangerous goods regulation around the world; although the Council’s membership is predominantly North American, its value is also understood by shippers and carriers in other parts of the world, and that is reflected in the Forum’s agenda. This year saw presentations on developments in China,

South Africa, India and Latin America, as well as sessions on topics of general interest, such as best management practices, enhancing the image of the hazmat professional and sector-specific roundtables.

This first part of HCB’s report on the Annual Forum will concentrate on North American issues.

One salient aspect of the post-pandemic world is that there are a lot of new people around; some of the older generation have retired and sailed off into the sunset, while others have more important jobs to do. So the US Pipeline and Hazardous Materials Safety Administration (PHMSA), the prime agency for hazmat regulation in the US, was represented by a new face, belonging to Matthew Nickels, senior regulations officer in the Standards and Rulemaking Division of the Office of Hazardous Materials Safety (OHMS). Matthew is, indeed, far from the only new face at PHMSA and he began his presentation by introducing four new transportation specialists who have just joined the agency.

Matthew also explained a potentially significant administrative change; the Office of the Secretary of Transportation (OST) and Office of Management and Budget (OMB) will henceforth only bother themselves with ‘significant’ rules – i.e. those that involve a lot of money or are otherwise high profile. This implies that there will be a lot more ‘nonsignificant’ rulemakings; at PHMSA, these will pass straight from the boss’s desk to publication in the Federal Register, though the well-worn comment and consultation period will remain unchanged.

The four priority rulemakings for 2023 are by now familiar to most: the HM-224I final rule on the transport of lithium batteries by air was published in December 2022 and took effect on 20 January 2023; the notice of proposed rulemaking (NPRM) for HM-215Q, the biennial international harmonisation rulemaking, was to be published soon after the COSTHA Annual Forum (see page 8); the NPRM under HM-263 to require real-time train consist information was also expected to appear soon after the Forum (see page 11); and an NPRM under HM-208J to potentially

adjust PHMSA’s mandated registration and fee assessment programme is expected later in the year.

And there’s more: two rulemakings relating to LNG transport (which will see HM-264A superseded by HM-264B) are in progress; PHMSA is continuing with its process of incorporating longstanding special permits into the Hazardous Materials Regulations (HMR) and will issue new proposals under HM-233G; alignment with international regulations on radioactive materials will be proposed in HM-250A; and there is a more open advance notice of proposed rulemaking on regulatory reform initiatives that has since been published (see page 26).

PHMSA is, though, not all about rulemakings, and Matthew ran through some recently issued notices and policy papers, including three safety advisories issued in the wake of the derailment in East Palestine, Ohio in February. It has also issued a request for information with ideas for revising the definition of ‘recycled plastics material’ so that a broader range of recyclate can be used in the manufacture of packagings for dangerous goods.

In common with its counterparts north of the border, PHMSA is looking into the potential use of electronic means of hazard communication; it issued a request for information in July 2022 and received more than 40 comments from stakeholders, including emergency responders. PHSMA is now planning to hold a public meeting this summer to discuss the information it received.

If Matthew was a stranger to many when he started his presentation, the audience was on more familiar ground when James Simmons came forward with an update on activity by the Federal Motor Carrier Administration (FMCSA). James, senior transportation specialist in FMCSA’s Hazmat Division, is an old hand at the COSTHA Annual Forum and clearly knew his audience well. He noted that trucking is responsible for moving some 93 per cent of all hazmat in the US and that these goods are worth some $1.1 trillion. Between 2012 and 2017, the quantity of hazmat shipments by truck increased by 19 per cent

and, over the same period, hazmat ton-miles increased by around 31 per cent. Therefore, he reasoned, the likelihood of a hazmat crash or incident, and a catastrophic consequence, is higher than it was. It is FMCSA’s vision to prevent all crashes, not just those involving hazmat, but it is giving the hazmat sector some special attention.

Firstly, FMCSA’s hazmat programme is being retooled to target, reduce and prevent hazmat crashes, injuries and fatalities. The aim is, by using data on incidents and safety performance, to prioritise and allocate FMCSA resources to address the risks associated with the transport of hazardous materials by highway. Compliance initiatives will be more dependent on data to manage and monitor FMCSA resources and to gauge and measure the effectiveness of the hazmat strategic plan in preventing crashes, injuries and fatalities.

As an illustration of just how the use of data is filling in gaps in knowledge, James gave an update on the Hazmat Safety Permit

programme, which was initiated in 2005; there are now 861 active permanent permits and 47 active temporary permits issued under the programme and another 132 applications outstanding. Only a handful of permits have been suspended or revoked, he said. FMCSA gives very clear threshold figures for crash rates and out-of-service rates that qualify or disqualify a carrier for a Hazmat Safety Permit, which gives visibility to all stakeholders.

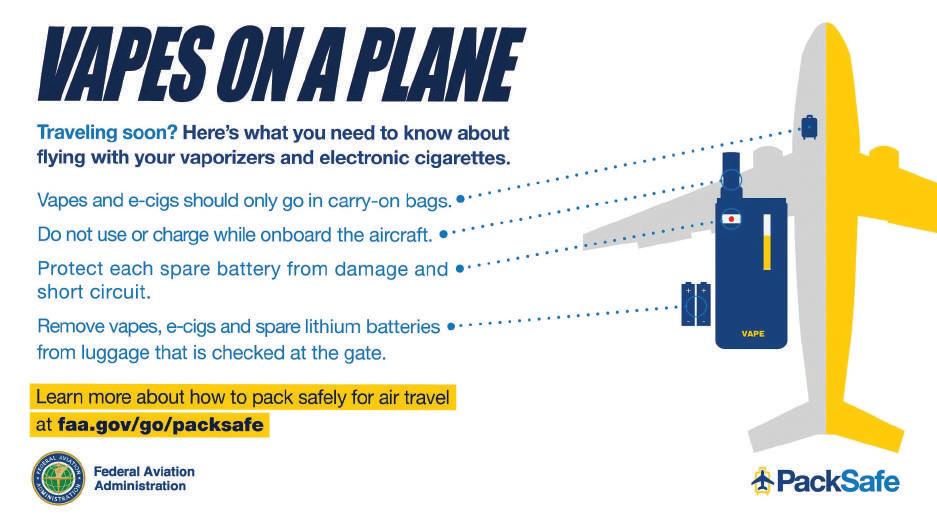

Better data is also being used by the Federal Aviation Administration (FAA) across its remit; Walter McBurrows, deputy director of FAA’s Office of Hazardous Materials Safety (AXH), explained what this means in terms of the carriage of lithium batteries in air transport. FAA has gathered some rather scary numbers together, with 442 total verified ‘thermal incidents’ involving lithium batteries between March 2006 and March 2023; of those, more than 70 per cent involved passengers’ own

equipment – most often battery packs but increasingly also e-cigarettes/vapes, mobile phones and laptops.

FAA has responded imaginatively, with new messages to get across to passengers through its PackSafe programme, including the ‘Vapes on a Plane’ idea, and is making resources available to air carriers. FAA has also updated its 120-80B guidance on fighting lithium battery fires involving portable electronic devices in the cabin of an aircraft and is encouraging air carriers to update their training programmes accordingly.

There were more familiar faces when it came to the maritime update, with the US Coast Guard’s (USCG) Dr Amy Parker and Hillary Sadoff, both from the bulk solids and packaged hazardous materials unit in the Hazardous Materials Division, on hand to let the audience know the latest. As with FAA, USCG is currently struggling to deal with the increasing number of incidents involving lithium batteries in cargo; it is trying to increase awareness of maritime-specific concerns, develop appropriate requirements and ensure consistency in regulation, policy and enforcement. As such, USCG is now participating in inter-agency and non-

governmental forums where lithium battery standards are discussed, and is supporting the work of the National Chemical Transportation Safety Advisory Committee’s lithium battery sub-committee. Through its field units, USCG is also drafting and publishing safety alerts.

In fact, lithium batteries represent just one problem; USCG’s hazmat specialists are also participating in the Undeclared Hazmat Working Group, the Misdeclared Cargo Information Exchange, the Spent Nuclear Fuel Transportation Security Working Group, and a number of PHMSA-led initiatives to coordinate intermodal transport safety.

USCG also represents US interests at the International Maritime Organisation (IMO) and it is apparent that Amy and Hillary are racking up the air miles heading to and from London this year. The calendar for 2023 includes two week-long sessions of the Editorial & Technical (E&T) Group on the International Maritime Dangerous Goods (IMDG) Code, a week-long meeting of the Sub-committee on Pollution Prevention and Response (PPR), which had taken place the week before the COSTHA Annual Forum, a two-week session of the Sub-committee on Carriage of Cargoes

and Containers (CCC) as well as the annual meetings of the Maritime Safety Committee (MSC) and the Marine Environment Protection Committee (MEPC).

One item that Amy and Hillary highlighted from the PPR meeting was the first outcomes from a correspondence group set up last year to consider ways to reduce the risk to the marine environment of the transport of plastics pellets. In the short term, IMO is considering a draft circular but may also agree specific packaging and stowage provisions in order to reduce the likelihood of such goods escaping to the environment. One question still to be finalised is whether plastics pellets should be added to the IMDG Code as a ‘harmful substance’ or should be covered by a new chapter to Annex III of the International Convention for the Prevention of Pollution from Ships (Marpol) to prescribe transport requirements without classifying the cargo as dangerous.

Amy and Hillary spoke further about some discussions that will inform future amendments to the IMDG Code; these will be covered in more detail in the September issue of HCB, along with reports of some other presentations during the COSTHA Annual Forum.

ADR • WP.15 CRAMMED A LOT INTO THREE DAYS AT ITS MAY MEETING, WITH MANY DECISIONS BEING TAKEN THAT WILL BE REFLECTED IN THE TEXTS OF ADR THAT WILL TAKE EFFECT IN 2025

THE UN ECONOMIC Commission for Europe’s (ECE) Working Party on the Transport of Dangerous Goods (WP.15) held its 113th session in Geneva this past 15 to 17 May; the session had originally been planned to last five days but, following on quickly from the spring Joint Meeting of RID/ADR/ADN Experts and with few other papers submitted, there was a relatively short agenda facing delegates.

The session was chaired by Ariane Roumier (France) with Alfonso Simoni (Italy) as vice-chair; it was attended by representatives of 21 contracting states and Zimbabwe, the Intergovernmental Organisation for International Carriage by Rail (OTIF) and five non-governmental organisations.

Having already begun work on the 2025 text of ADR, the agreement covering the international transport of dangerous goods by road within Europe and, increasingly,

elsewhere in the world, the 113th session’s primary focus was on the adoption of amendments agreed by the earlier Joint Meeting, although this is never simply a matter of rubber-stamping changes already agreed. There were in addition some challenging proposals and discussions.

The Working Party endorsed the amendments adopted by the Joint Meeting at its spring 2023 session, with some editorial changes, for entry into force on 1 January 2025. These are as follows:

• In 1.1.3.1, paragraph (a) becomes (a)(i) and a new (a)(ii) is added:

The carriage of dangerous goods by private individuals in the limits defined in paragraph (a)(i) intended initially for their personal or domestic use or for their leisure or sporting

activities and which are carried as waste, including the cases when these dangerous goods are no longer packaged in the original package for retail sale, provided that measures have been taken to prevent any leakage under normal carriage conditions;

• In 1.4.2.1.1(e), “bulk containers” is replaced by “containers for carriage in bulk”

• In Table A of Chapter 3.2, for all entries of UN 2037, “V14” is added in column (16); for UN 2073, “532” is deleted from column (6); for UN 2672, “543” is deleted from column (6); and for UN 3550, “MP18” is added in column (9b)

• In Chapter 3.3, special provisions 532 and 543 are deleted; the introductory sentence of SP 668 is amended to read:

Substances for the purpose of applying road markings and bitumen or similar products for the purpose of repairing cracks and crevices in existing road surfaces, carried at elevated temperature, are not subject to the other requirements of ADR, provided that the following conditions are met:

• In Table 4.1.1.21.6, against UN 1779, “C3” is replaced by “CF1” in column (3b)

• In packing instruction P200(10), special packing provision p, “fitted with pressure relief devices or” is deleted from the second sub-paragraph and the last subparagraph is also deleted

• In the Table in 4.3.4.1.2, a new row is added for tank code LGBV, reading “5.1 | OT1 | III”; the second row for tank codes L1.5BN and L4BN are deleted; for tank code L4BN, in the row “5.1 | O1”, “I” is deleted from the packing group column, and in the row “5.1 | OT1”, “I” is replaced by “II” in the packging group column

• In 5.4.0.1 a new second sentence is added: The information prescribed in this Chapter related to the dangerous goods carried shall be available during carriage in such a way that the goods per vehicle and the vehicle which is carrying them can be identified in the documentation.

• 5.4.1.1.21 is amended to read: Information required in specific cases defined in other parts of ADR Where in accordance with provisions in chapters 3.3, 3.5, 4.1, 4.2, 4.3 and 5.5 information is necessary, this information shall be included in the transport information.

• In 6.2.4.1, new rows are added for EN ISO 9809-4:2022 and EN 13110:2022

(both under “for design and construction of pressure receptacles or pressure receptacle shells”) and EN 14129:[2023] under “for design and construction and closures”; existing references to earlier editions of these standards are amended with a cut-off date of 31 December 2016

• In 6.8.2.1.23, a new NOTE is added after the first sub-paragraph, reading: When 6.8.5 is applicable, the impact-strength tests carried out for the qualifications of the welding process shall comply with the requirements of 6.8.5.3.

• In 7.2.4, “and gas cartridges” is added after “Aerosols” in V 14

• In 7.3.3.2.7, a new AP 11 is added to present the requirements and standards relating to the carriage in bulk of molten aluminium.

An amendment to 6.8.2.2.11 has been kept in square brackets, along with two new transitional measures, pending confirmation at the next session of the Working Party following further discussion at the autumn Joint Meeting. At present, 6.8.2.2.11 will read:

Level-gauges shall neither be part of, nor fitted to shells, if they incorporate transparent material which can, at any time, come into direct

contact with the substance carried in the shell.

The Working Party accepted a new transitional measure proposed by Germany, which will appear as 1.6.1.54:

Vats for the carriage of molten aluminium of UN No. 3257 which have been constructed and approved before 1 July 2025 in accordance with the provisions of national law but which do not, however, conform to the construction and approval requirements of AP11 in 7.3.3.2.7 applicable as from 1 January 2025 may continue to be used with the approval of the competent authorities in the countries of use.

Background information on these changes was included in HCB’s report on the spring Joint Meeting: see HCB May 2023, page 60 and HCB June 2023, page 56.

Among new proposals to be considered by the Working Party were several dealing with the construction and approval of vehicles. The UK submitted a proposal on the rear protection of tank vehicles, following up on earlier submissions and discussions about how best to ensure a clearance of 100 mm between the rear wall of the tank and the rear bumper,

including amended text to appear in 9.7.6.

The Netherlands, which had been very involved in the earlier discussions, pointed out some shortcomings in the UK’s proposal and, following discussion, it was decided that the issue would be carried over to the next session. Delegates were invited to share their opinions.

The Netherlands also reported on the work of the Informal Working Group on Electrified Vehicles, which it is chairing, explaining that progress has been slower than deemed desirable in the face of ongoing technological development. Work has been devolved to five separate discussion groups, some of which have delivered initial proposals.

One of those involved the battery master switch, although IWG-EV felt that this term was too restrictive and preferred ‘measures’ to de-energise the electrical system. The Working Party agreed to change the terminology in 9.2.1.1, 9.2.2.9.1 and 9.2.2.9.2.

IWG-EV noted that it takes a certain period of time to de-activate electrical circuits and ADR 9.2.2.8.3 currently expects this to happen within 10 seconds; it was felt that 30 seconds is more appropriate, and put forward a proposal to amend the existing text of 9.2.2.8. The Working Party accepted the proposal with some amendments so that this section will now read as follows:

9.2.2.8 De-energizing electrical circuits

[NOTE: The feature shall only be used when the vehicle is in standstill.]

9.2.2.8.1 Features to enable the deenergization of the electrical circuits for all voltage levels shall be placed as close to the energy sources as practicable. In the case the feature interrupts only one lead from the energy source, it shall interrupt the supply lead.

9.2.2.8.2 A control device to facilitate the de-energizing shall be installed in the driver’s cab. It shall be readily accessible to the driver and be distinctively marked. It shall be protected

against inadvertent operation either by adding a protective cover, by using a dual movement control device or by other suitable means. Additional control devices may be installed provided they are distinctively marked and protected against inadvertent operation. If the control devices are electrically operated, the circuits of the control devices are subject to the requirements of 9.2.2.9.

9.2.2.8.3 The de-energization shall be completed within 30 seconds after the activation of the control device.

9.2.2.8.4 The feature shall be installed in such a way that protection IP65 in accordance with IEC 60529 is complied with.

9.2.2.8.5 Cable connections on the feature Systems with a voltage that exceed 25 V AC or 60 V DC and systems under the scope of UN Regulation No. 100¹, shall comply with the requirements of the said regulation.

Systems with a voltage up to 25 V AC or 60 V DC shall have a protection degree IP 54 in accordance with IEC 60529. However, this does not apply if these connections are contained in a housing which may be the battery box. In this case, it is sufficient to insulate the connections

against short circuits, for example by a rubber cap.

The Note is kept in square brackets for review at the next session. The Working Party noted with satisfaction that the adoption of these new provisions represented a first step towards allowing the adoption of provisions for the use of battery electrified vehicles for category FL.

The Netherlands and the International Organization of Motor Vehicle Manufacturers (OICA) reported that the World Forum for Harmonisation of Vehicle Regulations (WP.29) adopted an amendment in March 2021 to the 11th series of UN Regulation No.13, introducing new tests for endurance braking systems. One outcome of this is that electric-powered vehicles with regenerative braking systems may supplement friction-type service brakes; however, when a vehicle’s batteries are charged to a level where they cannot accept any further electrical energy, the service brakes will need to be able to cope alone.

This will have some impact on Chapter 9.2 of ADR and an informal document from the

Netherlands, supported by data from OICA, sought to prompt a discussion among the Working Party on what action, if any, was needed. The Working Party agreed that the current provisions of ADR concerning braking should remain unchanged for the time being, though it may be necessary to return to the subject in the future.

The UK had been looking closely at the requirements in 9.1.3 for the Certificate of Approval to see if it may be issued in an electronic format, as part of its general move to issue documents electronically wherever possible. The UK already issues some comparable certificates in electronic format and this allows certificates to be easily verified via a publicly accessible database. However, it would appear that ADR allows only paper copies of the Certificate of Approval and in a very specific format. Should this be changed?

Some delegations indicated that the approval bodies in their countries could already issue certificates in electronic form, but that a printed version in accordance with

the format in 9.1.3 had to be carried on board the vehicle. In general, there was support for new provisions that would allow for the use of digitised certificates, including arrangements certificates. The UK was invited to continue

The Netherlands sought the Working Party’s opinion on the position regarding sensors for tyre pressure monitoring system, which are generally energised by a small battery. This

However, if the sensor is on an EX/III or FL

should comply with the IEC 60079 series of standards as appropriate in 9.2.2.9 (as they cannot be de-energised). Is this interpretation correct? Would it be feasible to require the tyre pressure sensor to be located within the pressure chamber formed by tyre and rim

The Working Party confirmed the Netherlands’ reading of the requirement but did not feel that any action was necessary.

Germany had spotted that the earth symbol used in 6.8.2.1.27 is incorrect – and probably has been incorrect since 1999. It proposed adopting the symbol as commonly used in the electrical engineering field, which was readily accepted, though some felt a reference to an IEC standard would be useful. There was also the question of whether a transitional measure was needed; it seems that the correct symbol is already used to identify earthing points on tank vehicles but delegations were invited to check the situation in their own countries prior to the next session.

The Secretariat had noticed that, following the introduction of the new list of abbreviations in 1.2.3 of the 2023 edition of ADR, there was a need to amend the title for Chapter 1.2 in 1.1.2.2. This minor editorial matter was also accepted.

Switzerland sought the Working Party’s opinion on the maximum number of teaching units per day for the training of drivers, which would help define what ADR means by

“normally” in 8.2.2.3.7. Section 8.2.2 seems to indicate a maximum of six hours teaching per day, whereas Switzerland would like to allow up to 7.5 hours. The general feeling of the Working Party was that “normally” indicated that the six hours of teaching could be exceeded in exceptional circumstances but there was no appetite to stretch the normal day to ten 45-minute sessions as Switzerland proposed.

Belgium had identified what it considered a discrepancy between RID and ADR, following the adoption of proposals by the September 2021 session of the Joint Meeting relating to the country of registration of type examination and initial approval of tanks. It felt that the Notes in 6.8.1.5.1 and 6.8.1.5.4 should only apply to tank-vehicles, not to containers and thus should not appear in the right-hand column, nor in RID. This being a multimodal issue, the Working Party suggested that the matter would best be addressed to the Joint Meeting’s Working Group on Tanks.

The International Association of Dangerous Goods Safety Advisers (IASA), in an informal document, suggested adding 8.2.3 to the list of sections given in 3.4.1 for those requirements of RID/ADR that remain valid for carriage in accordance with Chapter 3.4.

Without this, IASA felt, there is no requirement to train drivers who only transport dangerous goods packed in limited quantities.

There was a difference of opinion within the Working Party; some agreed with IASA that a specific reference would clarify the issue, while others felt that the reference to Chapter 1.3 suffices. IASA was invited to present an official document for the next session so that a decision could be made.

Given the increasing decarbonisation of transport activities, the Secretariat had been examining how ADR applies to road vehicles other than those normally thought of as being in scope. In particular, and in view of the need to observe the UN Sustainable Development Goals (SDGs), the Working Party needs to decide whether ADR applies to two- and three-wheeled vehicles or not. Some delivery companies have started using such vehicles, particularly in urban operations, and although this is mostly a local issue it could involve international transport in border towns.

As it stands the text of ADR does not explicitly prevent dangerous goods being carried by powered cycles or motorcycles; however, the provisions in the Annexes to ADR have never been designed to apply to two-wheeled vehicles and therefore some interpretation would be needed, which might vary from country to country. Another issue is that the Protocol of 1993, once it enters into force, will specifically limit the applicability of ADR to vehicles with at least four wheels.

At the last session, some delegations raised the fact that, when this protocol of amendment was adopted by the Conference of the Contracting Parties to the ADR in 1993, the question of deliveries with vehicles/ devices other than regular trucks or vans was not even foreseen. Delivery companies have only recently been introducing light vehicles with three or two wheels for last mile deliveries and most delegations felt that these should be in scope of ADR if they are carrying dangerous goods.

Several delegations presented how cycles and other cargo transport units not covered by ADR are regulated in their countries and it was felt these should be collected by the

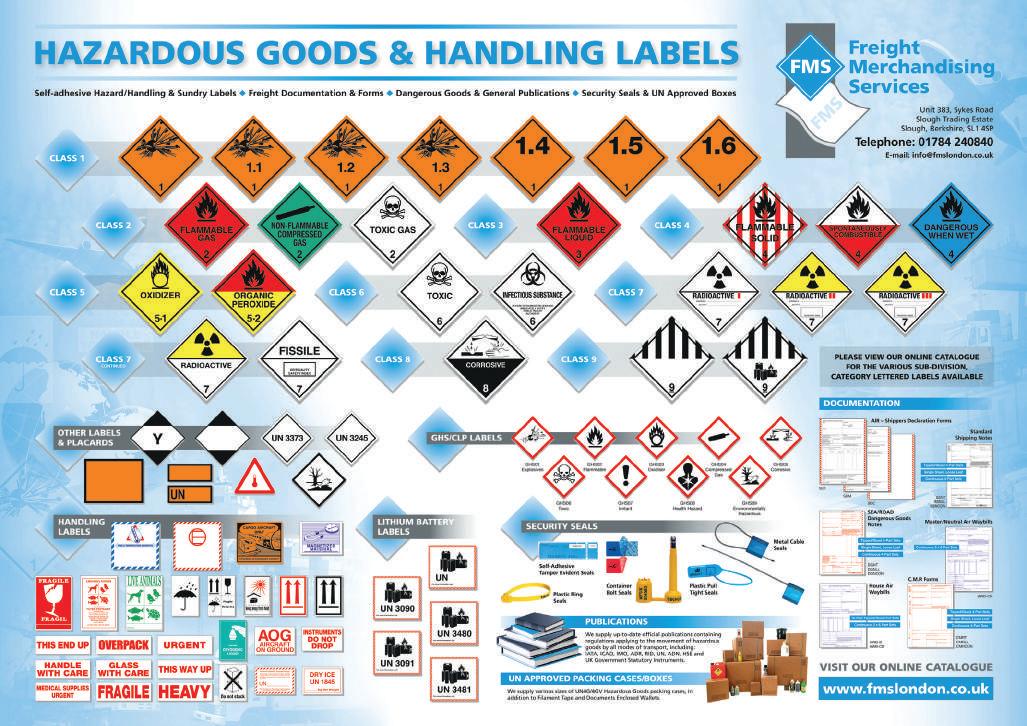

You need Labeline.com

Labeline is the leading worldwide “One Stop Dangerous Goods Service” for Air, Sea, Road, and Rail

We serve Freight Forwarders, Shippers, Airlines, DCA’s, Port Authorities, Petrochemical industry and the Pharmaceutical industry.

Labeline is one of the world’s leading regulatory services and product provider; we hold comprehensive stocks with a fast worldwide delivery service.

We are one of the very few authorised Multi-mode providers worldwide and described by industry as a pro-active organisation, our name is recommended by many leading authorities and a world class service providers.

When it’s time to order your DG products and services, Labeline will be your “One Stop Service”

Compliant with IATA, ICAO, ADR, IMDG, RID, DoT

Secretariat. The Working Party also noted that the International Civil Aviation Organisation (ICAO) has been having similar discussions regarding deliveries by remote-controlled

Several delegations were in favour of continuing the discussion at future sessions in order to study the possibilities of revising the scope of ADR and adapting the technical provisions of annexes A and B in order to allow the safe and secure transport of dangerous goods by micromobility vehicles and by cycles. The Working Party noted that this would contribute to achieving the UN

is not made explicit in ADR and, indeed, the first paragraph of 5.4.1.4.2 states that, if the size of a consignment is too large to be loaded in its entirety on a single transport unit, then the same documentation shall accompany

Tel: +44 (0)870 850 50 51

Email: sales@labeline.com

www.labeline.com

Finland raised some issues relating to the identification of dangerous goods during transport; according to 5.4.0.1, any goods carried under the provisions of ADR must be accompanied by the documentation prescribed in Chapter 5.4; it is generally understood that the documentation on a transport unit corresponds to the dangerous goods carried on that transport unit, but this

It seems that if a load consisting of several packages needs to be divided for carriage on different transport units it is sufficient that a copy of the single document covering the whole load is on each transport unit without specifying which goods are on each transport unit. Separate transport documents are required for each vehicle only in the case of prohibition on mixed loading. This is of no help to rescue services in case of an accident,

Tel: +44 (0)870 850 50 51

Email: sales@labeline.com

www.labeline.com

However, in light of the increasing use of electronic transport documents, it should be easier to specify which goods are on which transport unit, so long as those documents are accessible in an emergency. The Working Party confirmed that the amendment already adopted for 5.4.0.1 (see above) addresses part

Tel: +44 (0)870 850 50 51

Email: sales@labeline.com

www.labeline.com

HCB is the number one voice on all issues concerning the transport of dangerous goods. Subscribe today for FREE and stay connected with access to 11 issues per year, our weekly newsletter and premium web content.

of Finland’s query. It also agreed that the wider use of electronic data would facilitate the identification and tracking of goods unloaded or transferred from one vehicle to another during a delivery operation.

The Netherlands sought confirmation from the Working Party of the opinion expressed at the Joint Meeting in response to its query about the applicability of 1.1.3.1 to the transport of dangerous goods that have been recovered and collected by police and other authorities from public places; the Joint Meeting’s opinion was that such activities are covered by 1.1.3.1(d) and (e), notwithstanding that police may use specialised transport companies to actually move the goods in question.

The Working Party confirmed the Joint Meeting’s interpretation that public services (e.g. police, customs officers and other enforcement personnel) may carry dangerous goods as part of their duties to protect the public. An interpretation to that effect will be published on the ECE website.

The Working Party did, though, feel that it might be useful to spell this out in detail in

1.1.3.1 and invited the Netherlands to reconsider the question.

IASA asked for help in interpreting the requirements of 1.1.3.6.3 in relation to machinery and equipment. At present, this requires the total quantity of dangerous goods contained in machinery and equipment to be used in calculating the applicability of the exemptions provided in 1.1.3.6. IASA had been doing its research and noted that, when the provisions were first introduced in 2007, a selection of UN entries was offered as the types of machinery to which the working might apply. However, IASA said, in reality there are very different interpretations of the provision among different member countries. Furthermore, it is not always easy to distinguish between an article and machinery or equipment.

The Working Party confirmed that it is the net mass of dangerous goods that should be taken into account, not the gross mass of the machinery or equipment. As to the issue of articles, IASA was invited to contact the Spanish delegation, which has already prepared proposals on the classification of

articles and dangerous goods in machinery and equipment, which may be submitted to the Joint Meeting.

Ireland raised an issue regarding the transport of solid waste from pharmaceutical and medical device industrial sites, normally consisting of a mixture of solids such as liners, personal protective equipment (PPE) and wipes contaminated by flammable liquids. These are classified as UN 3175, for which carriage in bulk is permitted according to Chapter 7.3. However, some wastes have additional hazards, such as PPE contaminated with active pharmaceutical ingredients or corrosive materials. These wastes tend to be consigned under UN 2925 or 2926, neither of which are permitted for carriage in bulk, resulting in the need for costly and cumbersome packagings. Ireland pointed out that it is in the process of issuing an approval under the provisions of 2.1.2.8 that will permit the carriage of waste under UN 3175 with additional hazard communication to reflect the addition of toxic and/or corrosive hazards.

Ireland sought the experience of other delegations on this issue and their opinions on whether additional UN entries to cover such shipments might be valuable.

The Working Party was not unsympathetic but felt this was an issue firstly for the Joint Meeting’s informal working group on the transport of hazardous waste and then, if appropriate, the UN Sub-committee of Experts, who could make an amendment to the Dangerous Goods List.

Ireland had another query about waste, this time regarding empty uncleaned packagings. Again, it has used competent authority approval to overcome some obstacles that had been encountered in applying the provisions of ADR. Similarly, the Working Party’s advice was to pass the matter on to the informal working group on the transport of hazardous waste.

The 114th session of WP.15 is scheduled to take place in Geneva from 6 to 10 November 2023. Before then, the Joint Meeting of RID/ ADR/ADN experts is scheduled to hold its autumn session from 19 to 29 September, also in Geneva.