RESERVOIR LOGS

PLENTY OF ACTION IN STORAGE TERMINAL CONSTRUCTION

TANK CONTAINER FLEET STILL GROWING ALMOST THERE WITH RID/ADR/ADN 2025

PHMSA PLAYS CATCH-UP

PLENTY OF ACTION IN STORAGE TERMINAL CONSTRUCTION

TANK CONTAINER FLEET STILL GROWING ALMOST THERE WITH RID/ADR/ADN 2025

PHMSA PLAYS CATCH-UP

.

With full visibility of regulatory requirements across 279 jurisdictions.

Regulatory Database gives your team a single, standardised source of information, helping them to:

• Get a comprehensive view of what the regulation says now and how it’s changing

• Reduce risk by eliminating knowledge gaps and out-of-date information

• Save time and resources by dramatically reducing the need for desk research

Joint

GES,

Evos, Cepsa to move sunshine

Managing Editor

Peter Mackay, dgsa

Email: peter.mackay@chemicalwatch.com

Tel: +44 (0) 7769 685 085

Advertising sales

Sarah Smith

Email: sarah.smith@chemicalwatch.com

Tel: +44 (0) 203 603 2113

Publishing Manager

Sarah Thompson

Email: sarah.thompson@chemicalwatch.com

Tel: +44 (0) 20 3603 2103

Greif innovates in Scandinavia

Publishing

Designer

Petya Grozeva

Chief

Chief

• Product for safer products

It is that time of year when companies are releasing their first quarter financial results. These are always of deep interest to shareholders but they also – if read critically - give the broader community a pointer to how wider economic, trade and political factors are playing out. So far this year, the results being announced by players in the distribution, haulage and terminalling sectors have indicated that conditions are returning to something more like what we would call ‘normal’ after the pandemic years and supply chain disruptions caused by problems in the Suez and Panama canals.

This made me wonder what ‘normal’ looks like these days. We have become inured to the idea that business conditions are ‘volatile’ or ‘uncertain’ and we certainly know that supply chains, particularly in a globally connected world, are increasingly ‘complex’. The addition of ‘ambiguous’ takes us back to ‘VUCA’, a term originally developed in the US Army War College in the 1980s – not the first time that military thinking has described or influenced the world of peacetime logistics and probably not the last.

I believe it took some time for VUCA to enter our general vocabulary but I am sure that it predates the Covid pandemic. In fact, I can recall discussions about supply chain complexity during an EPCA Annual Meeting some time in the 2010s, when ‘VUCA’ was offered up as a lens to help understand the often conflicting pressures acting upon global chemical supply chains and, as a result, on the operators active all along those supply chains.

Pre-Covid, the talk was all about increasing globalisation and what that meant for trade, especially in light of the

business imperative to keep inventory as low as possible. We had occasion to question that approach when natural and manmade incidents had caused supply chain interruptions. The grounding off the UK coast of the containership MSC Napoli in 2007 led to automotive plants in South Africa having to close, as their ‘just in time’ supply chains offered no leeway. Hurricane Katrina (2005) had plenty to teach us – for instance, there is no point in keeping emergency stockholdings in the form of crude oil if refinery capacity is going to be closed.

One obvious feature of the past four years has been a willingness to increase inventories, with ‘just in time’ morphing into ‘just in case’. This has been particularly profitable for the tank container business, as tanks provide a relatively costeffective and certainly very flexible way of holding emergency stocks. Tank container operators earned a lot of demurrage income and also found a handy place to put their older, heavier tanks that were not so attractive for transport purposes.

Now that chemical companies and their customers are getting used to the post-pandemic world, those opportunities are evaporating; as ITCO’s annual survey reports (see page 44), scrapping of old tanks has increased now that they are being released from short-term storage duties and the fleet as a whole seems over-supplied. That is translating into a marked reduction in profitability for tank operators, even if the number of consignments is still increasing, although they seem happy with their lot.

China’s increasing self-sufficiency in chemicals is the next thing to worry about. This looks likely to reduce overall trade volumes but might offer opportunities in local transport operations.

Peter Mackay

THERE IS ALWAYS a risk, with the benefit of hindsight, in writing an article promising the ‘HGV of the future’ but it was a risk that HCB took in its May 1994 issue. Concern had been building about road tanker safety in the UK, which was experiencing an average of one rollover incident every month. In response, Cambridge University’s Engineering Department and Cranfield University’s Automotive Studies Group got together with some industry sponsors to study truck dynamics and suspension design, with input from new-fangled computer modelling to examine exactly how rollovers happen.

The project had piqued the interest of many, not least Shell Oil UK, and its findings fed directly into a number of innovative systems and practices that, thankfully, have almost removed the risk of tanker rollovers from UK roads. Now, if only those same innovations could be picked up in the US.

Another hostage to fortune in the May 1994 issue was a small item looking at the impending increase in the number of LNG carriers in layup. The problem was in fact caused by Abu Dhabi determining that its gas reserves could support a longer period of LNG exports than had originally been planned, so it had ordered a brand new fleet and announced that the Gotaas-Larsen ships it was relying on would no longer be needed. At the time, it was the general practice for ships to be built against long-term contracts for a specific project – there was no spot market to speak of. And, while there had been talk of the LNG tanker market developing along the lines of the crude oil trades, it was to be several years before owners started investing in speculative vessels. Now the LNG business has been turned upside

down – in 1994 the US was importing LNG, today it is the world’s largest exporter.

Another milestone reached in early 1994 was the end of the 12-month pilot phase of the new Safety and Quality Assessment Scheme (SQAS) developed by the European Chemical Industry Council (Cefic) as one part of a two-pronged approach to promoting continuous improvement in accident prevention and emergency response under the International Chemical Environment (ICE) programme.

P&O Roadtanks, which was in those days one of the largest road tanker operators in the UK, found the SQAS assessment to be quite easy to undergo, especially as it was tied in to its BS 5750 quality assurance certification, but it did provide some pointers to how the SQAS audit could be improved.

April 1994 was another important date in the UK, as it was then that the new Carriage of Dangerous Goods by Road and Rail (Classification, Packaging and Labelling) Regulations came into force as part of the UK’s effort to harmonise its domestic dangerous goods legislation with the provisions of the ADR Agreement. The new regulations imposed additional duties on consignors and replaced the carriage provisions of the Chemicals (Hazard Information and Packaging) Regulations – usually referred to as ‘CHIP’. The supply provisions in CHIP were to be copied into a new ‘CHIP 2’, due to come into effect on 1 January 1995.

This might have been seen as ‘progress’ but, thirty years on, the UK’s civil servants are still busy drawing up provisions to distance UK legislation from those pesky Europeans.

WHAT I DISCOVERED when researching information theory as part of physics is that an information deficit is equivalent to an energy (to do work) deficit. This means that functionality of all living systems, including our industry, depends on the use of real-time, optimal information. The universe and nature work like this too.

I look at the first and second laws of thermodynamics and the newly proposed law by Dr Melvin Vopson of the University of Portsmouth (I interviewed him in person) which he named the second law of information dynamics (infodynamics). This is based on the MassEnergy-Information equivalence principle. We already apply this to our work to boost performance levels dramatically. As you may know, the universe uses minimum but optimal information. This ‘minimum’ is equal to the need for a minimum quantity of energy (maximal efficiency without causing loss or waste). When you apply this, you will gain so-called free energy by the acquisition of information. Entropy is sometimes described as ‘the information we don’t have or don’t use’.

I designed the following equations to measure and predict functionality. I depends on how people understand how nature functions (perception).

¬p(m-(i ≡ e))>r→∆S entropy / disorder / dysfunctionality

¬p: false perception; m: symbol for living systems as matter/mass; i: information; ≡ equivalence symbol; e: energy; r > beyond reality → results in; ∆S: social entropy/disorder or probability of dysfunctionality.

√p(m+(i ≡ e))≤r→J negentropy / order / functionality

√p: correct perception; m: symbol for living systems as matter/mass;

i: information; ≡ equivalence symbol; e: energy; ≤ equal to within r, reality → results in; J: social negentropy/order or probability of functionality.

I then designed so called PPP’s: Performance Probability Patterns of Marine Storage Terminals based on these laws of physics: P(A) Probability Function of Information Deficit (C) = Metaphysical Equation: P(A) C: (i-e) ⇒ ∆S

Probability Function of C due to a lack of information ≡ is equivalent to dissipated (displaced) energy, which is no longer available to do useful work ⇒ implying increased (entropy) disorder (growing ∆S).

Hence: systems that are dependent on a shortage of information, lack of knowledge, unawareness, delays in preventive action, accelerate internal and external (impact) Performance Probability Patterns of dysfunctionality ≡ Entropy.

This may be look a bit odd, but when you read this slowly, I am sure you will understand the significance of this. Anyway I tested them and can demonstrate empirically that it works. Practical uses of the equations were tested empirically in marine storage terminals where the quantity of information prior to and after a loading master training was measured. Quantifying the volumetric growth in information helps industries to detect potential learning and information gaps (loss of energy to function).

This is the latest in a monthly series of articles by Arend van Campen, founder of TankTerminalTraining, who can be contacted at arendvc@ tankterminaltraining.com. More information on the company’s activities can be found at www.tankterminaltraining.com.

We’ll start with two words that seem to do the same job - poisonous and toxic. Then and just for the hell of it, let’s bring on another word - venomous. And while we’re at it let us chuck in the word toxicant in last place. The first three are adjectives that are not interchangeable and they all have different meanings. We’ll give toxicant a run out later.

Let us begin by showing a simple way to explain the difference between venomous creatures and poisonous ones by their bites: If you bite it and you die, it is poisonous; if it bites you and you die, it is venomous.

Anybody with even a passing interest in these matters can tell you that there are three ways that a toxic substance can be administered, namely inhalation (fastest and hardest to protect against), oral (slower and easier to deal with) and dermal (slowest and easiest to stop from working). Anyway, that avenue of thought is probably best left there at least for the purposes of this discussion. Anyone care to discuss albino rats? No? We’ll leave it there then and put it down to me grandstanding like there’s no tomorrow.

But back to the case in point and breaking things down a bit more: to deliver their ‘chemicals’, venomous creatures bite you — they actively inject their deadly mixture into other organisms (such as you) via fangs, spines, stingers, or similar methods of venom delivery. For example, consider Oxyuranus microlepidotus (the inland taipan). This snake is generally believed to have the deadliest venom of any known creature. If this snake bites you, things will go Pete Tong very quickly. A single drop of its venom can kill 100 adult humans. However, the

good news is that this snake is very timid, and so it runs (slithers?) away at a rate of knots rather than come into contact with humans.

Another horrifyingly venomous snake is Dispholidus typus, (the boomslang). The average size of these creatures is 1.0 to 1.6 m (3.2 to 5.2 feet). That’s significant because, while many snakes have fangs and mouths that are too small to pose a danger to humans, this is certainly not the case with the boomslang. These creatures are able to open their jaws more than 170 degrees in order to bite their prey. What’s more, the venom of the boomslang is a hemotoxin. This means that it disables the body’s clotting process. That means the unfortunate victim will likely die as a result of internal and external bleeding unless medical treatment is administered.

Fun fact: boomslang venom is also known to induce internal bleeding in muscle and brain tissues.

If you are looking for a more scientific way to define venomous creatures; a venom is:

A secretion, produced in a specialised gland in one animal and delivered to a target animal through the infliction of a wound ‘regardless of how tiny it could be,’ which contains molecules that disrupt normal physiological or biochemical processes so as to facilitate feeding or defence by the producing animal.

Conversely, poisonous creatures secrete their harmful chemicals (often through their skin). In other words, a poisonous creature can only deliver its toxin if you (or another unwary creature) eats it or

touches it. For example, let’s look at the poison dart frog (from the Dendrobatidae family). These chaps are rather small, measuring in at just 2 inches (5 cm). However, this tiny amphibian has enough poison on board to kill an estimated 20,000 mice (or about 10 adult humans).

Just out of interest, scientists believe that the poison dart frog, like many other poisonous creatures, gets its deadly concoction from its environment. Research suggests that the frog eats insects that carry the poison and that these insects in turn, get their poison from plants.

According to Oxford Dictionaries, “poisonous organism” can be defined rather simply:

An organism that produces toxins that are harmful when the animal or plant is touched or eaten.

Notably, some creatures are poisonous and venomous. Eat one and you will be poisoned and if it stings you, you will not be venomed –you will have been stung (oh all right - poisoned). And as a final point in the discussion of poison and venom, the word ‘poison’ actually has a rather broad definition; it is simply any chemical substance that causes a biological disturbance in other organisms.

So, what about toxicants (and toxin)? Unlike venom and poison, the word ‘toxin’ is not defined by a specific method of delivery. Rather, a toxin has a broader meaning. It is a biologically produced chemical substance that impacts biological functions in other organisms. In this respect, anything that is synthesised is not considered a toxin. Rather, a ‘toxicant’ is a chemical substance that is synthesised/

produced by human activity. In short, toxins and toxicants are narrower definitions for the word ‘poison’.

Keep up at the back, we’re nearly there.

In summary:

• Poisons are any chemical substances that impact biological functions in other organisms.

• Poisonous organisms secrete chemical substances that impact biological functions in other organisms.

• Venomous creatures inject chemical substances that impact biological functions in other organisms.

• Toxins are biologically produced chemical substances that impact biological functions in other organisms.

• Toxicants are synthesised chemical substances that impact biological functions in other organisms.

And there we have it. Are scales falling gently from our eyes? Or is the water still muddy?

It’s decision time and now…

Milord, I rest my case as I lean back in my green leather court chair and puff heartily on my meerschaum…..

This is part of a regular series of articles by Grahame Moody, senior analyst (technical services) of Hazmat Logistics, who can be contacted at sales@hazmatlogistics.co.uk. More information on the company’s activities can be found at www.hazmatlogistics.co.uk.

TWS offers tank containers for liquid products in the chemical and food industries for more than 30 years. Whether you opt proven standards or special requirements –we have the right equipment and develop sophisticated advanced individual solutions with you. With TWS you rent experience, quality and innovation for your success. For more information: E-mail: tws@tws-gmbh.de and web: www.tws-gmbh.de

MULTIMODAL • THE JOINT MEETING’S SPRING SESSION WAS MEANT TO MAKE ONLY MINOR CHANGES TO WHAT HAD ALREADY BEEN AGREED BUT THERE WAS A LOT OF WORK TO BE DONE

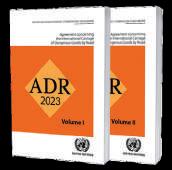

THE JOINT MEETING of the RID Committee of Experts and the Working Party on the Transport of Dangerous Goods (WP15) held its spring 2024 session in Bern from 25 to 28 March; the meeting had to be kept to four days because of a public holiday in much of Europe, and it had been decided that this session should not spend time deliberating on any new items – rather, it kept itself largely concerned with revisions to amendments already adopted and some minor changes, with a few items adopted for entry into force in 2027.

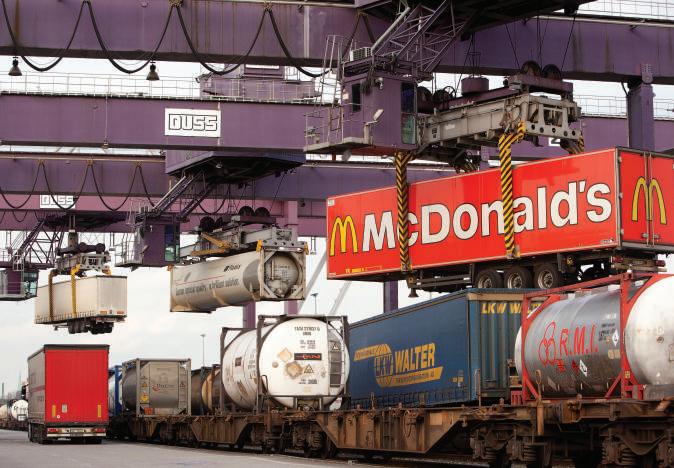

The role of the Joint Meeting is to provide a forum for the modal bodies that oversee the three sets of European dangerous goods transport regulations, ADR (road), RID (rail) and ADN (inland waterways); ADR is being used more widely than just in Europe, resulting in non-European countries now attending the meetings of WP15. The aim of this forum is to encourage the harmonisation of the three sets of regulatory provisions, the

better to ensure the seamless multimodal transport of dangerous goods across Europe.

The texts of RID, ADR and ADN that will enter into force on 1 January 2025 are now nearly complete; the Joint Meeting was to be followed by separate sessions of WP15 (for ADR) and the RID Committee of Experts, at the end of which the full list of amendments could be prepared.

The Joint Meeting’s spring session was chaired for the first time by Silvía Garcia Wolfrum, who has stepped up following the retirement of Claude Pfauvadel. The new vice-chair is Soedesh Mahesh (Netherlands). The session was attended by representatives of 22 full member countries (including the US) as well as Zimbabwe, along with the EU Agency for Railways (ERA) and 13 nongovernmental organisations.

The Joint Meeting convened at the headquarters of the Intergovernmental Organisation for International Carriage by Rail (OTIF) in Bern; the session was opened by its

secretary general, Wolfgang Küpper, who is due to retire by the end of the year. As a result, this was his last opportunity to play host to the meeting.

As always, the first item on the agenda was matters relating to transport in tanks; the Working Group on Tanks had met separately at the end of February to discuss matters arising from the autumn 2023 session of the Joint Meeting. Among these was the issue of whether competent authorities that perform inspection activities themselves, rather than rely on approved inspection bodies, should themselves be similarly accredited. The Working Group felt that technical services within the competent authority that performed the activities of approved inspection bodies would require accreditation. It also noted that the designation of bodies to act as the competent authority may create a loophole for inspection bodies not to become accredited. The Working Group suggested an amendment to the already agreed change in 1.8.6.2.1, which will now read:

When the competent authority performs the tasks of the inspection body itself, the competent authority shall comply with the provisions of 1.8.6.3. However, when a competent authority designates an inspection body to act as the competent authority the designated body shall be accredited according to the standard EN ISO/ IEC 17020:2012 (except clause 8.1.3) type A.

The previously adopted amendment to 1.8.6.3.1 remains unchanged:

The requirements above are deemed to be met in the case of accreditation according to the standard EN ISO/IEC 17020:2012 (except clause 8.1.3).

The Working Group followed up on earlier discussions where it was agreed that an intermediate inspection was required when the specified date for such an inspection has passed. However, depending on the time period that the inspection is overdue the owner/operator may decide to have an intermediate or periodic inspection performed. To prevent misinterpretation, the International Union of Wagon Keepers (UIP) suggested some alternative wording.

The Joint Meeting, however, decided that the adopted provision was not a ‘new provision’ but only a clarification; rather than amend the texts, it asked the secretariats to add this clarification to the RID and ADR Interpretations Lists. It also agreed to include a new third paragraph in 6.8.2.4.3 for the 2027 editions of RID/ADR:

If the specified date of the intermediate inspection has passed, an intermediate inspection shall be performed or alternatively a periodic inspection may be performed in accordance with 6.8.2.4.2.

The Working Group examined Spain’s proposal to improve the provisions for filling multiple-element gas containers (MEGCs) in Chapter 4.3; it was felt that, to be fit for purpose, this amendment should also address battery-wagons/battery-vehicles. This was agreed by plenary but, as it was deemed a significant change, it will not be included in the 2025 texts and will be held over to 2027. It will involve a new 4.3.3.2.5:

Prior to filling, the battery-wagons/ batteryvehicles and MEGCs shall be inspected to ensure they are authorized for the gas to be carried and that the applicable provisions of RID/ ADR have been met. The elements of batterywagons/battery-vehicles or MEGCs that are pressure receptacles shall be filled according to the working pressures, filling ratios and filling provisions specified in packing instruction P 200 of 4.1.4.1 for the specific gas being filled into

each element. When battery-wagons/batteryvehicles and MEGCs are filled as a whole or groups of their elements are filled simultaneously, the filling pressure or the load shall not exceed the lowest maximum filling pressure or the lowest maximum load of any single element. Battery-wagons/battery-vehicles and MEGCs shall not be filled above the applicable permissible masses.

The existing 4.3.3.2.5 will be renumbered 4.3.3.2.6, with some consequential amendments in 4.3.3.1.1, 6.8.2.4.1 and 6.8.3.4.2.

Russia proposed amendments to 6.8.2.1.27 (RID/ADR) and 7.5.10 (ADR) relating to tank vehicles for the carriage of UN 1361 Carbon black. Russia pointed out that, for classification under UN 1361, the material should be of animal or vegetable origin; however, most carbon black transported in tanks is derived from hydrocarbon gases and is therefore classified under UN 3190 Self-heating solid, inorganic, nos. As such, the requirements for electrostatic protection may not apply. The Working Group made some observations on Russia’s interpretation and plenary concurred that the matter should be sent up the chain for discussion by the UN Sub-committee of Experts on the Transport of Dangerous Goods (TDG), with proposals for amendments to the Model Regulations.

Spain and the European Industrial Gases Association (EIGA) had raised a problem that has arisen since the TDG Sub-committee changed the wording that must appear on the tank plate from ‘degree of filling’ to ‘maximum allowable mass of gas filled’. While this is in itself not an issue, it will take time for the necessary replacement plates to be sourced and fitted. The Working Group supported the proposal to insert a new transitional measure, akin to that already adopted by the UN TDG Sub-committee. This will appear in the 2025 texts as a new 1.6.4.66:

Portable tanks constructed before 1 January 2027 in accordance with the requirements in

force up to 31 December 2024, but which do not, however, conform to the requirements of 6.7.4.15.1 (i) (iv) applicable as from 1 January 2025 may continue to be used.

The Netherlands proposed waiving the requirement for calculating the actual holding time for tank containers in road transport, as is already done for tank vehicles. Transport operations are usually relatively short and there is a driver present to monitor the tank pressure. The Working Group supported the proposal but felt that the wording offered could be improved. In addition, there were some consequential amendments needed.

The Joint Meeting agreed, and made the following changes for ADR 2025. Firstly, a new paragraph is added to the end of 4.2.3.7.1:

The calculation of the actual holding time may be waived when the whole journey takes place by road only, without trans-shipment onto another vehicle and without intermediate temporary storage. When the calculation of the actual holding time is waived the provisions of 4.2.3.7.2,

4.2.3.7.3 and 4.2.3.8 (e) and (f) shall not apply.

The same text is added at the end of 4.3.3.5, right-hand column, except that the last sentence reads:

When the calculation of the actual holding time is waived the provisions of 4.3.3.6 (e), (f) and (g) shall not apply.

Finally, an additional paragraph is added at the end of 5.4.1.2.2(d):

When the calculation of the actual holding time is waived in accordance with 4.2.3.7.1 or 4.3.3.5 this provision shall not apply;

On a similar note, the International Union of Railways (UIC) followed up on a decision made at the autumn 2023 session of the Joint Meeting to add a new sub-paragraph (h) to 4.3.3.6 designed to prevent the premature activation of pressure relief devices on empty uncleaned tanks for refrigerated liquefied gases. There had been some discussion about clarifying the consignor’s responsibilities in this regard, but no decision was taken. The Working Group was happy with UIC’s solution

and it was confirmed by plenary, resulting in the addition of a new 1.4.2.1.1(f) in the 2025 texts. The version for RID reads:

in the case of tanks carrying refrigerated liquefied gases ensure that the actual holding time is determined or, in the case of empty, uncleaned tanks, ensure that the pressure is sufficiently reduced.

The version for ADR is the same, except that it begins: “In the case of tank-containers and portable tanks carrying refrigerated liquefied gases…”.

UIP queried whether the requirement in RID for tank wagons for gases to be marked with an orange band (as per 5.3.5 and special provision TM6 of 6.8.4) is still useful. There is no similar requirement for tank-vehicles or tank-containers and apparently no desire to introduce one. Some experts in the Working Group were not convinced by the argument and Belgium provided a summary of the

reasons for keeping the orange band mark,

situations. Belgium did note some difficulties with meeting the specifications for the orange colour, but that is another matter that can be

specifications for which differ somewhat in wording of the latter paragraph in particular is

better if it were changed, Germany says. The Working Group concurred, as did plenary, and Each

personnel – General principles, which is referenced in TT8 (RID) and TT11 (ADR) in 6.8.4 as the 2012 edition. The standard is also referenced several times in Chapter 6.2 but undated. Should the 2022 edition now be referenced? The Working Group felt that changing from 2012 to 2022 could result in problems for inspection bodies and offered an alternative solution, removing references to EN ISO 9712 in TT8 and TT11.

The last paragraph of TT8 will, subject to approval by the RID Committee of Experts, now read:

Such magnetic particle inspections shall be performed in accordance with EN 12972:2018 + A1:[2024].

Similarly, the paragraph referencing EN ISO 9712 in TT11 in ADR will be replaced by: Non-destructive checks shall be performed by personnel in accordance with EN 12972:2018 + A1:[2024] or EN 14334:2014.

Finally, the Working Group on Tanks is still dealing with the thorny issue of the dual approval of intermodal tank containers, which the regulators do not like but which seems to be very useful for operators. The International Tank Container Organisation (ITCO) had organised intersessional meetings in November and December 2023, which were well attended, with the aim of developing a list of the problems that could arise if dual approval is no longer permitted.

One problem is the case of portable tanks that are approved in accordance with Chapter 6.7 of the International Maritime Dangerous Goods (IMDG) Code but not approved in an RID/ADR contracting state/party. This can lead to the tank being refused for carriage or filling. The Working Group came up with a proposal to remove the problem, which was accepted in plenary. It involves am amendment to Note 2 under the heading of Chapter 4.2 to read:

Portable tanks and UN MEGCs marked in accordance with the requirements/the applicable provisions of Chapter 6.7 but which

were approved in a State which is not an RID Contracting State / Contracting Party to ADR or approved in accordance with Chapter 6.7 of the IMDG Code may nevertheless be used for carriage under RID/ADR.

CEN provided an update of its work relevant to the transport of dangerous goods, which the Joint Meeting welcomed. The experts also reviewed the report of the Working Group on Standards, which had met early in February. It was agreed to update the references to technical standards in Part 6 as follows.

In 6.2.4.1, in the row for EN 1964-3:2000, ‘Until further notice’ is replaced by ‘Until 31 December 2026’.

In the row for EN 13322-1:2003 + A1:2006’, ‘Until further notice’ is replaced by ‘Between 1 January 2007 and 31 December 2026’. A new row is then added for EN 13322-1:[2024].

In the row for EN ISO 10297:2014 + A1:2017, ‘Until further notice is replaced by ‘Between 1 January 2019 and 31 December 2026’. A new row is then added for EN ISO 10297:[2024].

In the row for EN ISO 17871:2020, ‘Until further notice’ is replaced by ‘Between 1

January 2023 and 31 December 2026’. A new row is then added for EN ISO 17871:2020 + A1:[2024].

In 6.8.2.6.2, in the row for EN 12972:2018, ‘Until further notice’ is replaced by ‘Until 31 December 2026’. A new row is then added for EN 12972:2018 + A1:[2024].

The Joint Meeting reminded CEN the need to confirm to the secretariat by 31 May 2024 at the latest whether those standards for which ‘2024’ remains in square brackets have been published; if they have not appeared, then they cannot be included in the 2025 texts and will have to wait until 2027.

It was also noted that EN 590:2013 + A1:2017, which is referenced in 3.2.1, 4.1.1.21.6 and 9.1.1.2, has been replaced by EN 590:2022. The Working Group on Standards asked for the appropriate experts to be consulted to see if the references can be updated. Some delegates who took the floor preferred to use an undated reference, which they considered sufficient for the purpose of classification.

At the autumn 2023 session, the Working Group on Standards had discussed the value of column (3) in the tables in Chapters 6.2 and 6.8, which is used to show those paragraphs

to which the standards are relevant. There is no equivalent column in the UN Model Regulations and it was felt that perhaps this information was no longer of much use. The Working Group recommended to the Joint Meeting that this column be removed; CEN will come back with a formal proposal to that

The Netherlands raised concerns at the provision in clause 7.3 of EN 1439:2021, which prescribes that refillable LPG cylinders, valves and valve seals shall be checked for leakage and that the admissible leakage rate shall be in any case not higher than 5 g/h. The issue is that this ‘acceptable’ rate of leakage may still allow sufficient gas to escape to cause a fire and explosion risk. The Netherlands said that there have been accidents caused by gas leakages in roofers’ vans and other vehicles. An LPG cylinder leaking at 5 g/h for 36 hours in a closed or poorly ventilated van can result in the lower explosive limit being exceeded. Furthermore, the general provisions of packing instruction P200(1) state that pressure receptacles shall be so closed and leakproof as to prevent escape of the gas or that the closures and equipment are not leaking, which runs counter to clause 7.3 of the standard. The Netherlands asked the Joint Meeting to consider if the leakage rate in

Some delegations reported similar national requirements stipulate a lower limit.

important that those interpretations do not differ. Overall, though, it was stressed that, in general, the provisions of RID/ADR/ADN should be as concise and clear as possible to

There were, though, a couple of requests. Germany sought clarification of 7.1.7.4.2 in

carriage under temperature control, the temperature must be measured by two independent sensors. Does this mean that they need to have separate power sources? Or does it just mean that two temperature measurements at different points of the

Those who took for floor were largely of the opinion that two independent power sources are required, for the purpose of redundancy. Germany will take the issue to the UN TDG Sub-committee and propose a clarification in

UIC reported that the International Railway loading units, which is referenced in footnotes been updated and a third edition published in new edition in the references in RID and ADR. The Joint Meeting agreed and made the

Tel: +44 (0)870 850 50 51

Email: sales@labeline.com

www.labeline.com

interpretation of the regulatory text is normally a task for the respective bodies in charge of RID, ADR and ADN. Nevertheless, for topics with a multimodal applicability, it is

We serve Freight Forwarders, Shippers, Airlines, DCA’s, Port Authorities, Petrochemical industry and the Pharmaceutical industry.

Labeline is one of the world’s leading regulatory services and product providers; we hold comprehensive stocks with a fast worldwide delivery service.

We are one of the very few authorised Multi-mode providers worldwide and described by industry as a pro-active organisation, our name is recommended by many leading authorities and a world class service providers.

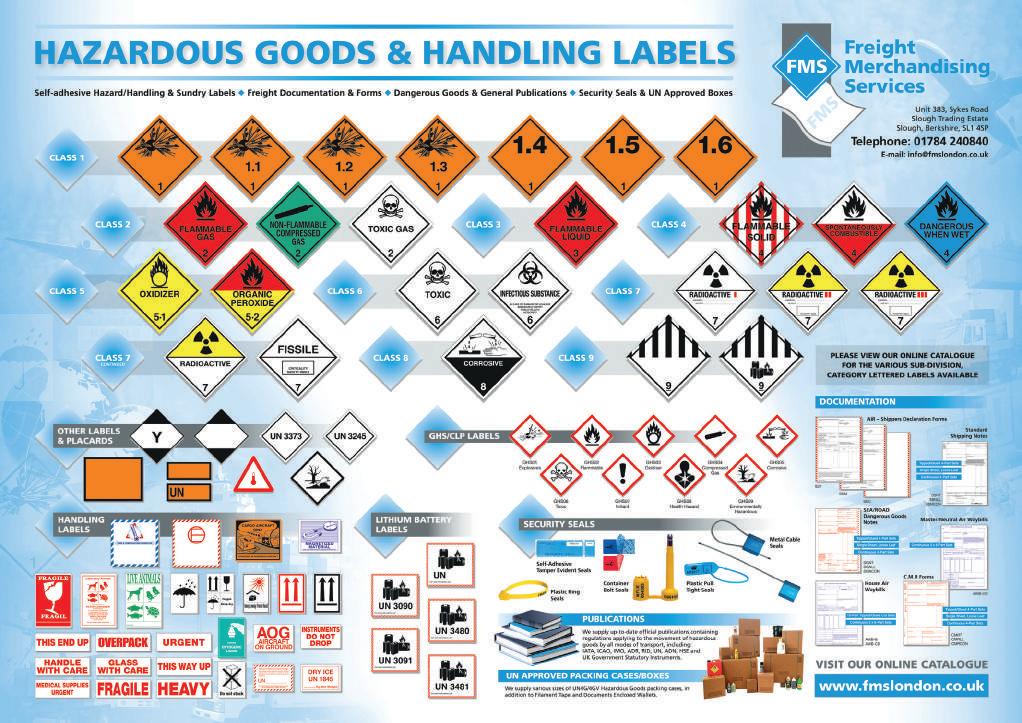

Who do you contact for the latest DG compliant labels? IATA, ICAO, ADR, IMDG, RID, DoT Labeline is the leading worldwide “One Stop Dangerous Goods Service” for Air, Sea, Road, and Rail

Since 1st Jan 2023, all UK consignors must have an appointed DGSA.

responsibilities under 1.8.1.1 of ADR, it conducts background checks on drivers and other employees involved in the carriage of dangerous goods. It recommends that employers do the same, by requesting a Disclosure and Barring Service (DBS) check on potential employees’ criminal records.

RID/ADR/ADN do not currently rule on whether staff with a criminal record can be

For a local, professional consultant DGSA, contact Labeline Free worldwide shipping from IATA’s leading international distributor Do you consign Dangerous Goods?

Specialist software for creating compliant DG Documentation

associated with, the carriage of dangerous goods, or whether background checks should be carried out before employing staff. The UK sought the Joint Meeting’s opinion as to

regulation, and was interested to hear what other contracting parties do in this regard.

Most delegations felt that there is no need to expand on the existing security provisions in Chapter 1.10. Furthermore, the issue is

administrative law. Security clearance issues should be dealt with at a national level rather

Tel: +44 (0)870 850 50 51

Email: sales@labeline.com

www.labeline.com

The second part of this two-part report on the Joint Meeting’s spring 2024 session in next month’s HCB will cover new and pending proposals for amendment, reports from other informal working groups, and accidents and risk management.

Worldwide Leading Authorised Distributor

When it’s time to order your DG products and services, Labeline will be your “One Stop Service” Compliant with

Tel: +44 (0)870 850 50 51

Email: sales@labeline.com

www.labeline.com

USA • THE LATE-RUNNING FINAL RULE UNDER HM-215Q IS HERE AT LAST. INDUSTRY DID SPOT SOME ISSUES IN PHMSA’S PROPOSALS, SOME OF WHICH HAVE NOW BEEN REMEDIED

THE US PIPELINE and Hazardous Materials Safety Administration (PHMSA) published its final rule under docket HM-215Q on 10 April; the rulemaking is PHMSA’s biennial update to maintain harmonisation – insofar as it sees fit – with international standards. In this case, the US rule has appeared somewhat behindhand, as the updates to international standards with which it aims to harmonise are those that took effect on 1 January 2023, based largely on the changes in the 22nd revised edition of the UN Model Regulations. The notice of proposed rulemaking under HM--215Q was published in May 2023 (HCB July 2023, page 08) with a comment period that closed at the end of August. PHMSA received 21 sets of comments, mostly supportive of the changes but some asking for further clarification or revisions. This article

will focus first on the comments PHMSA received and the decisions it has made in response.

Firstly, the Household Commercial Products Association (HCPA) and Medical Device Transport Council (MDTC) asked PHMSA to reconsider the definition of ‘aerosol’ in §171.8 so as to align more closely with that used in the UN Model Regulations and the international provisions. PHMSA acknowledged the concerns expressed but, having not included a proposal to amend the definition in the NPRM, it is unable to accede to the accede to the groups’ request. However, PHMSA says, it will continue to evaluate the potential harmonisation of the aerosol definition in conjunction with a petition

from the Consumer Specialty Product Association (CSPA).

PHMSA received a number of comments proposing the incorporation by reference of ISO 18119:2018, which deals with the periodic inspection and testing of seamless steel and aluminium alloy gas cylinders and tubes. The comments noted that this standard has superseded ISO 10461:2005 and ISO 6406:2005, which are currently referenced in the US Hazardous Materials Regulations (HMR) but which will no longer be included in the UN Model Regulations after the end of 2024.

Again, PHMSA said it could see the logic in making the change but it had not included the proposal in the NPRM and it will therefore have to be addressed separately; it has already received petitions from FIBA Technologies and Hazmat Safety Consulting on the issue.

The Institute of Hazardous Materials Management (IHMM) submitted comments recommending that PHMSA introduce a requirement for companies transporting hazardous materials to appoint a certified person, similar to the dangerous goods safety advisor (DGSA) required under ADR, and offered its own accredited professional certifications - Certified Hazardous Materials

Manager (CHMM), Certified Hazardous Materials Practitioner (CHMP) and Certified Dangerous Goods Professional (CDGP) – as possible models.

Once again, PHMSA acknowledged IHMM’s position but, as it did not include any proposals in this regard in the NPRM, it cannot now add any new provisions into the final rule. Such a change would necessitate evaluation by PHMSA’s own subject matter experts and a period for stakeholders to comment. PHMSA encouraged IHMM to submit a petition for rulemaking,

The American Association for Laboratory Accreditation (A2LA), while supporting the proposed amendments in the NPRM, suggested that PHMSA consider taking a further step by recommending that, when testing is required, dutyholders use the services of laboratories approved in accordance with ISO/IEC 17025, so as to help ensure the data generated to show compliance with HMR is developed by accredited bodies.

PHMSA could again not respond to this request in the final rule, since it had not been tested during the comment period. Should it wish to do so, A2LA is free to submit a petition for rulemaking.

The Compressed Gas Association (CGA) and Entegris commented on the proposal to update the reference to the ISO 11117 standard on valve protection caps for gas cylinders from the 2008 edition to the 2019 edition. The NPRM included a proposal for a phase-out date of 31 December 2026 for the old edition. This will cause problems, since industry would have to replace a large number of valve protection caps in a relatively short time, causing an unnecessary economic burden. CGA and Entegris proposed amendments that would permit the continued use of valve protection caps compliant with the 2008 edition.

PHMSA agreed that it was not its intention to require industry to replace all valve protection caps by 31 December 2026; rather, what it wanted was for all new valve protection caps to be compliant with the 2019 edition of the standard by that date, in line with the UN

Model Regulations. As such, PHMSA is revising the text in §173.301b(c)(2)(ii) to more closely align with its original intent.

CGA went further, suggesting that PHMSA modify the regulatory text for all the ISO standards incorporated by reference in §§178.71 and 178.75 to permit the manufacturing of UN cylinders conforming to the ISO standards being replaced until December 31, 2026, to better align the HMR with the intent of the 22nd edition of the UN Model Regulations.

PHMSA concurred that its intent was to closely align with the phaseout language used in the UN Model Regulations and has revised the texts indicated by CGA.

The NPRM included a proposal for a new special provision for UN pressure receptacles containing mixtures of fluorine and inert gases, to allow flexibility in the maximum allowable working pressure (MAWP), in line with the UN Model Regulations. In the NPRM,

PHMSA proposed adding special provision 441 to UN 1045 Fluorine, compressed.

CGA and Entegris pointed out that this is incorrect. Special provision 441 cannot be assigned to UN 1045 as mixtures of fluorine with inert gases containing less than 35 per cent fluorine are not Hazard Zone A gases and there is no scenario under which a gas classified as UN 1045 would be able to qualify for the exception. Instead, special provision should be assigned to nos entries UN 3306, 3156 and 1956, as per the 22nd revised edition of the UN Model Regulations.

Entegris and CGA also noted that the equations for calculation of the MAWP contained several editorial errors, as did the latest amendments in the UN Model Regulations.

PHMSA agreed with the comments made and has not applied special provision 441 to UN 1045. Rather than applying it to the nos entries for compressed gases, however, it has

added a new paragraph (g) to §173.302b, in line with a suggestion from CGA. This sets out the calculation method to determine the MAWP for mixtures of fluorine with nitrogen and mixtures of fluorine with inert gases, largely following the wording proposed for special provision 441 but including editorial corrections suggested by Entegris.

In the NPRM, PHMSA proposed to revise §§178.706(c)(3) and 178.707(c)(3) to allow for the manufacturing of rigid and composite intermediate bulk containers (IBCs) manufactured from recycled plastics, with the approval of the Associate Administrator, consistent with a change adopted in the 22nd revised edition of the UN Model Regulations. In the NPRM, PHMSA proposed including a slight variation from the international provision by requiring prior approval by the Associate Administrator for use of recycled plastics in the construction of IBCs manufactured from recycled plastics.

The Rigid Intermediate Bulk Container Association (RIBCA) disagreed with the proposed requirement for manufacturers to obtain case-by-case approval, arguing that this would be inconsistent with the UN Model Regulations, which allow the use of recycled plastics meeting a specified definition with no need to resort to competent authority approval.

RIBCA also questioned PHMSA’s rationale that approvals are needed due to lack of requirements in HMR for manufacturers to have in place quality assurance programmes, noting that these are already integral to ensuring IBC integrity. Indeed, the performance-oriented packaging requirements in HMR should sufficiently address any safety issues with recycled plastics, as demonstrated by the millions of UN plastic drums and jerricans successfully produced with recycled plastics.

PHMSA acknowledged RIBCA’s comments but said that, by requiring approval by the Associate Administrator, PHMSA would be able to maintain oversight of those procedures

– such as batch testing – that manufacturers will need to use to ensure the quality of recycled plastics used in the manufacture of IBCs. PHMSA’s position is that this is consistent with the intent of the UN Model Regulations.

In addition, PHMSA is currently conducting research to develop an Agency-wide policy on packaging manufactured from recycled plastics. It issued a request for information in April 2023 on how the potential use of recycled plastic resins in the manufacturing of specification packagings may affect hazardous materials transportation safety. It received nine comments in response to that request, which are currently being evaluated. Until this analysis is complete and an Agency-wide policy can be put in place, PHMSA feels it is prudent to leave the requirement for Associate Administrator approval in HMR. PHMSA also noted that it received supportive comments from other respondents to the NPRM.

The remaining proposals contained in the NPRM have been confirmed in the final rule, which takes effect on 10 May 2024. Those proposals included changes to proper shipping names, hazard classes, packing groups, special provisions, packaging authorisations, air transport quantity limitations, and vessel stowage requirements. These amendments are necessary to facilitate the transport of hazardous materials in domestic and international commerce. The final rule also aligns HMR’s requirements with anticipated increases in the volume of lithium batteries transported in interstate commerce from electrification of the transport and other economic sectors.

It is interesting to read the commentary on the rulemaking provided by the US Department of Transportation (DOT). Those working in the hazmat transport sector in the US are generally supportive of PHMSA’s efforts to keep the US regulations in line with those found in the international modal rulebooks – the International Civil Aviation Organisation’s (ICAO) Technical Instructions and the International Maritime Dangerous Goods (IMDG) Code – and requirements in other countries with which US industry trades.

There is, on the other hand, a section of the industry that is active only within the national borders of the US (or even within state borders in many cases) and for which biennial changes to harmonise with international regulations represent an unnecessary burden.

Still, the importance of achieving safety in the transport of hazardous materials means that HMR needs to reflect the latest and most stringent standards, and industry is behind that intent, even if to outsiders it seems that federal agencies are ladling additional regulatory burdens on an already hardpressed business.

Therefore, comments made by US Transportation Secretary Pete Buttigieg need to be seen as addressing an audience outside of the immediate hazardous materials community. Introducing the final rule under HM-215Q, Buttigieg said: “The safe

transportation of hazardous material like batteries and components used in manufacturing is integral to our supply chains and our economy. This new rule improves safety, keeps the US competitive on the global stage, and cuts shipping costs to the benefit of consumers nationwide.”

Similarly, PHMSA Deputy Administrator Tristan Brown said: “This regulatory update actually improves safety and environmental benefits while reducing red tape for businesses. It will also help improve supply chains and reduce prices for everyday Americans.”

PHMSA also has to make the case for the need for regulation. In the preamble to the final rule, it says the rulemaking will improve safety, streamline the transport of essential products — including medical supplies, batteries and components used in manufacturing — and encourage shippers to

package goods more efficiently.

And there is always a sustainability box to be ticked. PHMSA says the final rule will help reduce greenhouse gas emissions and supply chain disruptions by allowing the transport of more goods in fewer trips and aligning hazardous materials regulations requirements with anticipated increases in the volume of lithium batteries transported in domestic and international commerce. The rule also helps lessen the economic disadvantages faced by American companies that, when competing in foreign markets, are forced to comply with different or conflicting requirements or forgo exporting internationally altogether.

The text of the final rule, as published in the Federal Register, can be found online at www. govinfo.gov/content/pkg/FR-2024-04-10/ pdf/2024-06956.pdf.

MARITIME • SHIPPING HAS A DOUBLE ROLE TO PLAY IN MEETING

THE UN SUSTAINABLE

GOALS; IMO IS WORKING HARD TO PUT IN PLACE THE NECESSARY

AS AN AGENCY of the United Nations, the International Maritime Organisation (IMO) is tasked with observing and promoting the implementation of the UN Sustainable Development Goals, with specific reference to the marine environment. As a result, much of the current work of the IMO Marine Environment Protection Committee (MEPC) revolves around the adoption of measures to enhance the protection of the world’s oceans.

Over the past decades, much of that effort has been concentrated on preventing atmospheric pollution from ships, especially near to land and in port, and that programme is continuing, with successive targets for limiting emissions of greenhouse gases and other exhaust emissions. That process marked a step away from MEPC’s traditional

role in protecting the world’s oceans from pollution from cargo spills, tank washings and other noxious substances.

More recently, the focus has swung back to the water, with a higher priority being placed on preventing the inadvertent pollution of the seas by plastics materials, either jetsam such as discarded fishing nets and other plastics garbage, or flotsam in the form of cargo lost overboard, including plastics pellets.

One of the significant agenda items for MEPC’s 81st session, which took place in London this past 18 to 24 March, was to approve the Recommendations for the carriage of plastic pellets by sea in freight containers, developed by the Sub-committees on Pollution Prevention and Response (PPR) and Carriage of Cargoes and Containers (CCC). A circular,

MEPC.1/Circ.909, was adopted, which will act as a short-term measure to reduce the environmental risks associated with the carriage of plastic pellets in packaged form by sea while mandatory instruments are being developed.

The Recommendations developed by PPR and CCC are quite broad in nature, comprising three basic tenets:

• Plastic pellets should be packed in good quality packaging which should be strong enough to withstand the shocks and loadings normally encountered during transport. Packaging should be constructed and closed to prevent any loss of contents which may be caused under normal conditions of transport, by vibration or acceleration forces.

• Transport information should clearly identify those freight containers containing plastic pellets. In addition, the shipper should supplement the cargo information with a special stowage request requiring proper stowage.

• Freight containers containing plastic pellets should be properly stowed and secured to minimise the hazards to the marine environment without impairing the

safety of the ship and persons on board. Specifically, they should be stowed under deck wherever reasonably practicable, or inboard in sheltered areas of exposed decks.

It was an indication of the importance attached to the topic of plastics pollution that MEPC went ahead with its approval, despite the fact that PPR’s 11th session, where the Circular was finally agreed, took place only three weeks prior to the MEPC session; all other matters from that PPR meeting, which come under the broader Action Plan to Address Marine Plastic Litter from Ships, have been held over for discussion at MEPC’s 82nd session later this year.

There were, though, other matters relating to marine litter that were discussed. In particular, MEPC adopted amendments to article V of Protocol 1 of the International Convention for the Prevention of Pollution from Ships (Marpol), which contains provisions concerning reports on incidents involving harmful substances, to add a new requirement for reporting lost containers. Containers lost overboard can be a serious hazard to navigation and safety at sea as well as to the marine environment.

The amendment will add a new paragraph to say that “In case of the loss of freight container(s), the report required by article II (1) (b) shall be made in accordance with the provisions of SOLAS regulations V/31 and V/32”. MEPC’s sister committee, the Maritime Safety Committee (MSC), is due to adopt parallel requirements in Chapter V of the International Convention for the Safety of Life at Sea (SOLAS) at its 108th session this month. These will place a responsibility of the master of every ship involved in the loss of freight container(s) to communicate the particulars of such an incident to ships in the vicinity, to the nearest coastal state and to the flag state. These changes are expected to take effect on 1 January 2026.

IMO has addressed the issue of greenhouse gas (GHG) emissions from ships’ exhausts in two ways: firstly by imposing restrictions on the fuels that can be used, either in specific areas or more widely; and secondly by introducing measures to enhance fuel efficiency. These measures have contributed to a significant reduction in emissions from ships but, in view of the UN Sustainable Development Goals, IMO is looking at how to achieve its aim of achieving net-zero GHG emissions by around 2050.

It is already apparent that there will be no single target but that, in pursuit of the 2023 IMO Strategy on Reduction of GHG Emissions from Ships adopted at MEPC’s previous session in July 2023, there will be a number of steps. These have been sketched out in a draft net-zero framework, which identifies those regulations under Marpol that will need to be added or amended to allow for a new global fuel standard and a new global pricing mechanism for maritime GHG emissions,

which are the 2023 Strategy’s mid-term measures. The fine detail of those measures is still under consideration.

While IMO is clearly going to put in the time to get the next step on the road to net-zero right, the maritime industry itself is having to take something of a gamble on what the end result of IMO’s deliberations will be. New ships ordered today will need to comply at some point in their lifetime with rules that are yet to be written, so it is noticeable that many owners are trying to future-proof newbuildings by specifying that they be able to accommodate alternative fuels or carbon capture technologies.

In the meantime, MEPC has agreed that it should have a comprehensive impact assessment of the proposed medium-term GHG reduction measures available for its next session, which is scheduled to start on 30 September. Before then, a two-day expert workshop will discuss preliminary findings from that impact assessment. A 17th intersessional working group on greenhouse

LITTER HAS BECOME AN EMOTIVE ISSUE AND URGENT ACTION IS BEING TAKEN

gas emissions will also meet and develop draft terms of reference for a fifth IMO GHG study.

MEPC also adopted revised guidelines on lifecycle GHG intensity of marine fuels (the ‘LCA Guidelines’), updating the template for well-to-tank default emissions and adding a new template for tank-to-wake emission factors. Work on this topic will continue, with the Group of Experts on the Scientific Aspects of Marine Pollution (Gesamp) also to take part.

Two new correspondence groups have been established: the first is tasked with developing a work plan for the creation of a regulatory framework for the use of onboard carbon capture systems and to look into tank-to-wake methane and nitrous oxide emissions; the second group will look into social and economic sustainability themes and aspects of marine fuels for possible inclusion in the LCA Guidelines. An existing Working Group on Air Pollution and Energy Efficiency has already discussed onboard carbon capture and storage and will develop a work plan for a regulatory framework. These groups will report back to MEPC next year at its 83rd session.

MEPC approved the report on the fuel oil consumption data submitted to the IMO Ship Fuel Oil Consumption Database (reporting year: 2022). Data was reported by almost 29,000 ships, an increase of more than 800 ships compared to 2021. These ships reported the use of 213m tonnes of fuel, which is just higher than the 212m tonnes reported in 2021. The report on annual carbon intensity and efficiency of the existing fleet provides information on progress towards the at least 40 per cent carbon intensity improvement target to be achieved by 2030, on the basis of both demand-based and supply-based measurement metrics.

MEPC adopted updates to three sets of guidelines, covering: the development of a Ship Energy Efficiency Management Plan (SEEMP); administration verification of ship fuel oil consumption data and operational carbon intensity; and shaft/engine power limitation system to comply with the EEXI requirements and use of a power reserve. It also approved a new procedure for reporting

of uses of a power reserve, and unified interpretations of regulations 2.2.15 and 2.2.18 of Marpol Annex VI.

There was also some work on the sampling of fuel oil to determine compliance with Marpol Annex VI and SOLAS chapter II-2. Marpol requires demonstration of sulfur content while SOLAS relates to the flashpoint of fuel. There is a difference insofar as SOLAS considers ‘oil fuel’, which are generally petroleum products, while Marpol considers ‘fuel oil’, which can be any fuel delivered for use on board. MEPC approved a draft MSC/ MEPC circular, which will now go forward to MSC for approval as an urgent matter; once the new circular enters into effect, the 2009 guidelines (MEPC/182(59)) will be revoked.

In a similar vein, MEPC adopted amendments to Marpol Annex VI as regards the definition of gas fuels along with clarification of fuel sampling and bunker delivery notes for low-flashpoint fuels and gas fuels, as well as other related changes. These amendments are expected to enter into force on 1 August 2025.

The energy transition continues to generate issues for regulators; MEPC is still

struggling with the transport of biofuels by sea. Fuel oil is transported as a Marpol Annex I product on standard tankers; biofuels with a bio content of more than 25 per cent, by contrast, are transported under the terms of Marpol Annex II, requiring chemical tankers (with a limit on parcel size). This poses a challenge to the transport of biofuels, in particular to meet the demand for alternatives to very low sulfur fuel oil.

MEPC referred the matter to the Working Group on the Evaluation of Safety and Pollution Hazards of Chemicals (ESPH) for further consideration at its 30th session this coming October. It is hoped that the experts will be able to point MEPC on the best way forward.

The paragraphs above give a brief insight into some of the decisions taken by MEPC that are likely to be of most relevance to HCB readers. There were, though, plenty of other decisions taken, many relating to the ballast water management convention and its implementation; in addition, MEPC approved new Emission Control Areas (ECAs) for the Norwegian Sea and Canadian Arctic waters. MEPC has also endorsed a draft action plan to address underwater noise from commercial shipping activities, which will be discussed further at the next session.

MARITIME • THE UK IS CLOSE TO ENACTING NEW LEGISLATION COVERING THE TRANSPORT OF DANGEROUS GOODS BY SEA. BY AND LARGE, ITS CONSULTATION WENT SWIMMINGLY

THE UK MARITIME and Coastguard Agency (MCA) reports a largely favourable response to its consultation on the proposed Merchant Shipping (Carriage of Dangerous Goods and Harmful Substances) Regulations 2024. The consultation period ran from 8 December 2023 to 26 January 2024, attracting comments from 17 respondents, and MCA says the consultation was “generally well received”, with no recommendations for any substantial changes to the proposals.

The proposed Regulations would revoke the Merchant Shipping (Dangerous Goods and Marine Pollutants) Regulations 1997, along with a number of other dangerous goods related regulations, and replace them with a single set of regulations to provide a more complete, consolidated and up to date legal framework for the carriage of dangerous goods and harmful substances by sea.

One obvious change will be to include an ambulatory reference so as to allow future amendments to mandatory instruments agreed by the International Maritime Organisation (IMO) to become law into force in the UK as

they enter into force internationally; this is more efficient for UK regulators but also ensures that dutyholders are not faced with misaligned requirements. For instance, it will no longer be necessary for MCA to issue a new Merchant Shipping Notice every two years to reflect changes to the International Maritime Dangerous Goods (IMDG) or International Maritime Bulk Solid Cargoes (IMSBC) Codes.

While respondents were largely in favour of the proposals, there was some concern expressed about the proposed Regulation 12 – requirements in relation to shippers and forwarders. More clarity was urged in respect of the responsibilities of those involved in the transport chain, in particular the shipper/ forwarder/agent’s responsibilities for the stowage and securing of cargo within the cargo transport unit (CTU) and for placarding of CTUs and also with regard to Part 6 of the IMDG Code.

Regulation 12 lists sections of the IMDG Code which apply in each case but does not

reference IMDG Code section 7.3 (packing of goods inside the CTU). Regulation 10 of the proposed 2024 Regulations clearly states that master and owner must comply with all relevant sections of SOLAS Chapter VIII and MARPOL Annex III but there is no equivalent clear application of all relevant sections of the Conventions to shippers and forwarders in regulation 12.

In light of the comments received and in order to ensure that the application of SOLAS Chapter VII and MARPOL Annex III is clear and is unambiguously applied to those with particular responsibilities in the transport chain, policy leads and legal advisors have reviewed the text of regulation 12. Consequently, the text has been amended so as to more closely mirror the text already set out in regulation 10 for master and owner, making the two regulations more consistent in their wording and clearer on the application of the Regulations to shippers/forwarders.

There were some questions as to why the term ‘marine pollutants’, as used in the 1997 Regulations, has been changed to ‘harmful substances’. MCA says the change is to better reflect the terminology used in the Marpol Convention, particularly Annex III.

The UK government now plans to finalise the proposed Regulations and accompanying guidance, incorporating the amendments referred to above, with a view to having the 2024 Regulations laid in draft in May 2024 and, once approved by both Houses, to come into law in June 2024.

The International Air Transport Association (IATA) has issued an addendum to the 65th edition of its Dangerous Goods Regulations, which is in force for the whole of 2024. The addendum largely gathers together a significant number of changes to the operator variations, many of which relate to lithium batteries. There are, though, some significant changes to FedEx’s conditions. There is also one correction in 8.3.4 and updates to the lists of competent authorities and training providers.

The English language version of the addendum can be downloaded at www.iata.org/ contentassets/90f8038b0eea42069554b2f4530f 49ea/dgr_65_addendum_en.pdf. Other language versions are available via www.iata. org/en/programs/cargo/dgr/.

Australia’s National Transport Commission (NTC) has issued two more working group papers as part of its major review of the Australian Dangerous Goods (ADG) Code. The 11th paper presents the draft provisions for the use of tanks, bulk containers and vehicles for dangerous goods transport. These provisions are found in Parts 4, 6 and 9 of the draft code, along with some administrative matters in Part 1. NTC sought stakeholders’ views on the proposals, and in particular on 27 specific questions.

The 12th working group paper covers requirements for vehicle crews, equipment, operation and documentation. This will form Part 8 of the future code, combining existing provisions in the ADG Code with relevant elements of ADR. Again, NTC sought stakeholders’ views, with 20 questions designed to generate feedback from the regulated industries.

The latest papers, together with the draft parts of the new ADG Code currently

available, can all be found at www.ntc.gov.au/ transport-reform/ntc-projects/comprehensivereview-australian-dangerous-goods-code.

The US Environmental Protection Agency (EPA) has published its final rule that will require some facilities to develop response plans for a worst-case discharge of hazardous substances (or threat thereof), to include discharges resulting from adverse weather conditions. The Hazardous Substances Facility Response Plans rule, which falls under the Clean Water Act (CWA), applies to facilities that could reasonably be expected to cause substantial harm to the environment, based on their location. These include facilities with a maximum onsite quantity of a CWA hazardous substance that meets or exceeds threshold quantities, located within a 0.5-mile radius of navigable water or conveyance to navigable water, and that meets one or more substantial harm criteria.

The new rule has drawn criticism from industry. Eric R Byer, president/CEO of the Alliance for Chemical Distribution (ACD), describes the final rule as “needlessly broad in scope and deeply flawed” and says that it duplicates many of the requirements already finalised in the Risk Management Program.

“This rulemaking, compounded with additional onerous regulations coming from the Biden Administration, place businesses of all sizes at a significant disadvantage at a time when they are navigating high inflation rates and labour costs in a sluggish economy,” Byer says. “The EPA’s justification for this heavy-handed oversight does not demonstrate the need, as facilities are already required to comply with existing regulations that meet the same objective.”

EPA’s recent changes to the Risk Management Program (RMP), which drew sharp criticism from industry in the US, is facing a further challenge in Congress. Texas Representative Dan Crenshaw has introduced a Congressional Review Act Joint Resolution to

repeal the changes, which industry sees as unnecessarily burdensome.

Not surprisingly, this move has been welcomed by industry associations. Eric R Byer said: “ACD applauds Representative Crenshaw for standing with the chemical distribution industry and recognizing the current effectiveness of the RMP program. Despite countless objections from industry stakeholders, including ACD, the EPA finalized its rulemaking without demonstrating the need for these sweeping and counterproductive changes.

“It is imperative that the US House of Representatives pass this resolution without delay, and the US Senate follow with similar action. ACD wholeheartedly opposes the amendments to the RMP rule and applauds Congressman Crenshaw’s action to reverse them.”

The US Federal Railroad Administration (FRA) has published its final rule establishing minimum safety requirements for the size of train crews. The rule aims to ensure that trains are adequately staffed for their intended

operation and railroads have appropriate safeguards in place for safe train operations whenever using a one-person train crew.

The rule includes specific requirements for trains carrying certain types and quantities of hazardous materials that have been determined to pose the highest risk during transport, both from a safety and security standpoint, although there are some exceptions for existing operations and for Class II and III railroads.

FRA says the rule responds to some “troubling trends” over the past decade, including a 41 per cent increase in accidents caused by human factors; ensuring that a second crewmember is onboard can help avoid many of those errors. The final rule will take effect on 10 June. Its full text can be downloaded from the FRA website at https:// railroads.dot.gov/elibrary/49-cfr-part-218-traincrew-size-safety-requirements.

France has initiated a new multilateral special agreement under ADR, M356, to provide conditions for the carriage in bulk of waste contaminated with free asbestos (UN 2212 and

2590). The agreement anticipates an amendment agreed for the 2025 edition of ADR; as such, it is scheduled to expire on 31 December 2024. Germany is so far the only other country to have counter-signed the agreement, meaning it can now be used in France and Germany and in cross-border transport between the two countries.

The UK Health & Safety Executive (HSE) has issued a safety notice to alert industry to the proper classification of thermites and articles containing thermite. HSE says it has noticed that thermite is often being classified as Division 4.1 or as non-dangerous, while the correct classification is in Class 1, in accordance with ADR and the GB Carriage of Dangerous Goods Regulations.

In addition, the manufacture and storage of thermites and articles containing thermite are subject to the Explosives Regulations 2014 and they are also subject to the requirements for placing on the market contained in the Pyrotechnic Articles Safety Regulations 2015. Full information on the manufacture, storage and transport of thermites can be found on the HSE website at www.hse.gov.uk/explosives/ manufacture-storage-carriage-of-thermites.htm.

The Canadian General Standards Board (CGSB) has published a new edition of CAN/ CGSB-43.151, which deals with the packaging, handling, offering for transport and transport of Class 1 explosives. The 2024 edition of the standard will now be incorporated by reference in Canada’s Transportation of Dangerous Goods Regulations (TDGR) and stakeholders will be expected to comply within six months.

The new edition includes a number of updates to keep in step with international provisions; in addition, there are new requirements on the reuse of packagings and the use of partially filled packagings, updated decontamination requirements and a new provision to prohibit the use of lightweight IBCs for the transport of Class 1 explosives.

EXPANSIONS

• TERMINAL OPERATORS HAVE PLENTY OF WORK

TO DO IF THEY ARE TO BE IN A POSITION TO ENABLE THE ENERGY TRANSITION, BUT A LOT OF PROGRESS IS BEING MADE

FOR THE BEST part of a century, the bulk liquids storage terminal industry has played a pivotal role in the global energy market; it has enjoyed a similar position in the petrochemical industry since the 1950s too. Terminals do more than just offer a place to transfer product between modes of transport; they provide flexibility in long supply chains, buffering volumes to allow demand to be met, regardless of the pace of production.

As the world goes through its current phase of transition in the use of energy and, perhaps to a lesser extent, chemicals, terminals can offer the same services to make the movement of alternative fuels more efficient. After all, the areas of consumption of these new fuels are very much the same as those for traditional fuels.

This much has been apparent for a few years, as this annual review of terminal investment activity has shown. But it is also apparent that the pace of investment has picked up, despite the uncertainties that surround not just the routes that will be taken on the road to decarbonisation but also the wider geopolitical and economic environment. Terminal operators have to make a choice on the basis of the best information they can get, so as to be able to develop the sorts of facilities that will be required in the future – especially as larger projects will have a payback period measured in decades rather than years.

For some projects, the work is easier. Where existing fossil fuels are being challenged by drop-in alternatives such as

biodiesel (or even ‘e-fuels’, though there has not been much activity in that area this year), it may be enough to renew piping so as to ensure an effective separation between grades. Mass balance approaches may even make this redundant. On the other hand, building a global infrastructure for the production of renewable hydrogen and its delivery to market, whether as liquefied hydrogen, ammonia or a liquid organic hydrogen carrier (LOHC), will take a lot of money. It is noticeable that the projects such as these that are underway at present depend on long-term commitment by offtakers and, in many cases, the regulatory and financial support of governments or local authorities (including port authorities).

As a result, this year’s review of terminal construction and expansion activity is as long as ever. And we should not ignore the fact that there are plenty of projects that involve traditional fuels and crude oil. This review does not normally consider LNG terminals, since that has long been a very specific industry, but as the transition moves forward there are plenty of developments linking LNG and hydrogen, as the cryogenic technologies employed are similar.

Gibson Energy, Alberta

Gibson Energy is to build another two 435,000-bbl (70,000-m3) tanks at its Edmonton Terminal, underpinned by a 15-year take-orpay contract agreement with Cenovus Energy. Together with a similar tank already in development, this will add 1.3m bbl of new capacity by the end of 2024, giving the site a total capacity of some 3.0m bbl.

“Gibson is very pleased with the sanction of two new tanks at our Edmonton Terminal, which will further increase our high-quality, long-term infrastructure revenues and drive continued distributable cash flow per share growth,” says Steve Spaulding, president/CEO.

Vopak, British Columbia

AltaGas and Vopak have agreed to further evaluate the development of a large-scale LPG and bulk liquids terminal on Ridley Island in British Columbia, Canada. The projected Ridley Island Energy Export Facility (REEF) will sit adjacent to the existing Ridley Island Propane Export Terminal (RIPET) that the two partners commissioned in 2019, and will be used to facilitate the export of LPGs, methanol and other bulk liquids. Key approvals and permits are already in place for the construction of storage tanks, jetties and other infrastructure on the 77-ha site.

“We are excited to build on our success with AltaGas in Prince Rupert,” says Dick Richelle, Vopak CEO. “Our goal is to create together with partners high quality critical infrastructure for vital products. The strategic location of Prince Rupert, with the shortest shipping distances between North America and Asia, has the potential to increase the trade between Canada and the Asia Pacific region. REEF fits very well within Vopak’s strategic pillar to grow in gas and industrial infrastructure. We look forward to further collaboration with First Nations rights holders and key stakeholders to make this project a reality.”

Vopak, California

Vopak finalised the repurposing of 22 storage tanks at its Los Angeles terminal to offer 148,000 m3 (39m gal) of tankage for renewable fuels, including sustainable aviation fuel (SAF) and renewable diesel, this past October. Vopak

Los Angeles has a long-term agreement for this storage infrastructure with Neste, the world’s leading producer of SAF, renewable diesel and renewable feedstock solutions for various polymers and chemicals industry uses.

“Neste is fully committed to supporting the energy transition in the US as well as globally via working closely together with partners to increase the availability of our renewable fuels. Our cooperation with Vopak shows how repurposing existing fuel distribution infrastructure can accelerate the much needed transition to renewable energy,” says Annika Tibbe, acting president of Neste US.

The Vopak Los Angeles Terminal is strategically located in the Port of Los Angeles and is well-connected for logistics via various modes of transport, including vessel, barge, truck, pipeline and rail. The repurposed storage capacity at the terminal significantly increases the availability and accessibility of Neste’s renewable fuels at critical hubs in the

Los Angeles area, such as SAF for airlines at the Los Angeles International Airport (LAX) and surrounding airports, and renewable diesel for fuelling stations serving road transport.