ON THE ROAD AGAIN

HOW DOES THE NEW NORMAL LOOK?

INVESTING IN NEW ENERGIES

FUTURE RULES DISCUSSED

DANGERS OF BATTERY VEHICLES

THE INFORMATION SOURCE FOR THE INTERNATIONAL DANGEROUS GOODS PROFESSIONAL SINCE 1980

MONTHLY SEPTEMBER 2023

IN PARTNERSHIP WITH TSA Tank Sto ge Associa on

CIMC SAFEWAY TECHNOLOGIES CO., LTD.

Globe Sales Contact:

NO.159 Chenggang Road, Nantong, Jiangsu, China 226003

Tel: +86-513-85066022 (Sales)

+86-513-85066888 (Switchboard)

www.cimctank.com

E-mail: tanks@cimc.com

Europe Sales Contact:

Middenweg 6 (Harbour nr.397-399) 4782 PM

Moerdijk , The Netherlands

Tel: +31 880 030 860

www.cimctankcontainers.nl

E-mail: info@cimctankcontainers.nl

AFTER SALES DEPOT SERVICES

CIMC SAFEWAY TANK SERVICE CO., LTD.

MANUFACTURE SERVICE TECHNOLOGY

BURG SERVICE B.V.

Middenweg 6, 4782 PM, Moerdijk, The Netherlands

Tel: +31 88 00 30 800

Fax: +31 88 00 30 882

www.burgservice.nl

E-mail: info@burgservice.nl

CIMC SAFE WAY TANK SERVICE (Jiaxing) CO., LTD.

No. 318 , Washan Road, Port Authorities, Jiaxing, Zhejiang Province, China 314201

Tel: +86 15806290956

E-mail: ning.li@cimc.com

CIMC SAFEWAY TANK SERVICE (Lianyun gang) CO., LTD.

Safety and Environmental Management Center, Xuwei New Chemical Park, Lianyungang, Jiangsu, China 222047

Tel: +86 13814742170

E-mail: lichunfeng@cimc.com

TECHNOLOGY

Telematics

Tankmiles

Tel: +86 15262722292

www.tankmiles.com

E-mail: tankmiles@cimc.com

Cleaning Maintenance Testing Repair Modification Data Collection Global Monitoring IOT Platfrom Digital Display Sensor Temperature Pressure Liquid Level ··· Temperature Control E-heating System

Refrigeration & Heating System Tank Container Manufacture After Sales Depot Services Smart Devices BUSINESS PORTFOLIO

Glycol

EDITOR’S LETTER

“We are normal and we dig Bert Weedon,” sang the Bonzo Dog Band back in the late 1960s. They were not being entirely serious, of course – Bert Weedon was hardly cool by then and is chiefly remembered now for having written the guitar tutor Play In A Day, which promised putative plank-spankers in suburban Britain that they would be rocking out to Frankie & Johnny before bedtime. In fact, the Bonzo Dog Band were never normal, even in those crazy times, and if they dug anything it was Dada.

What has also not been ‘normal’ is the past four years, ever since the Covid-19 virus emerged in China. But this month, talking to many in the chemical logistics arena, we hear talk of ‘normalisation’ – something approaching ‘normal’ business conditions. Or maybe the ‘new normal’ we heard so much about when we were still in the middle of the mayhem.

Pretty much all links in the supply chain, so stressed at times, have benefited at some point or another. The deepsea container lines did extremely well in 2020/21; tank container operators had a good 2021/22, as did many chemical distributors and other logistics providers. Operators in the chemical and gas tanker sectors are very happy right now, though that is more to do with supply-side tightness than any surge in demand.

Now the smoke is beginning to clear: ocean freight costs have returned to the bounds of normality, distributors talk of normalisation (though they are mostly still doing pretty well), and the tank container sector is left to figure out what to do with all the new tanks that arrived over the past few years, now

that they are not needed for holding buffer stocks along the chain.

The events calendar is also getting back to normal, though HCB is surely not alone in having to adjust its schedule to accommodate EPCA’s decision to bring its Annual Meeting forward by a couple of weeks. And while there have always been those who doubt the value of conferences and exhibitions, surely this year is the time for event organisers to really show their worth. Industry has got a lot on its plate – not just the changing marketplace but also the new demands placed on it by the UN, governments, customers and the public in terms of enhanced sustainability.

So this issue of HCB arrives at a time when we are beginning to get back to the idea of travelling more regularly to meet industry and talk these matters through. This month we will be in Spain for the FECC Annual Congress, to talk to chemical distributors; TSA’s Annual Conference takes place as normal in Coventry later in the month; then there is the EPCA Annual Meeting, where there will be plenty of opportunity to discuss the new normal; and the lesser spotted International Industrial Packaging Conference, which takes place only every three years (and missed its last slot), will rumble round to Gent at the end of September.

There will be more events coming in October and November too, and we look forward to meeting up with old friends (assuming they have not retired in the interim) and making some new ones as we start racking up the air miles once more. It’ll be good to get back to normal.

Peter Mackay

UP FRONT 01 WWW.HCBLIVE.COM

Managing Editor Peter Mackay, dgsa

Email: peter.mackay@chemicalwatch.com Tel: +44 (0) 7769 685 085 Advertising sales

Sarah Smith

Email: sarah.smith@chemicalwatch.com Tel: +44 (0) 203 603 2113

Publishing Manager

Sarah Thompson

Email: sarah.thompson@chemicalwatch.com Tel: +44 (0) 20 3603 2103

Assistant Francesca Cotton

Petya Grozeva Chief Operating Officer Stuart Foxon Chief Commercial Officer Richard Butterworth

UP FRONT 03 WWW.HCBLIVE.COM CONTENTS VOLUME 44 • NUMBER 08 TANKER SHIPPING The right fleet Odfjell goes back to sail 53 Pushing forward Digitalising IHM documentation 54 News bulletin – tanker shipping 56 CHEMICAL DISTRIBUTION Paying off Azelis plans for succession 58 Normal conquest Brenntag reports normalisation 60 News bulletin – chemical distribution 62 BACK PAGES Conference diary 65 Incident Log 66 Not otherwise specified 68 NEXT MONTH Drum and IBC manufacturing Tank container depots Digitalisation Global regulations FRONT COVER Sponsored by M&S Logistics UP FRONT Letter from the editor 01 30 Years Ago 04 Learning by Training 05 REGULATIONS One day in June VCA gets together in Birmingham 06 One size fits all COSTHA hears about global changes 12 SAFETY Working at the car deck MCA advises on vehicle safety 16 Hit or miss Learning from near misses 18 Change management OCIMF introduces new SIRE 22 TANKS & LOGISTICS Road to zero Dachser heads for carbon neutrality 24 Navigating the waves Leschaco faces the new normal 26 Paving the way TEC improves bitumen transport 30 New for old Blackmer promotes repairable pumps 32 News bulletin – tanks and logistics 34 NEW ENERGIES The baggy green Vopak to handle renewables in Queensland 36 What goes around Wastefront gets circular with tyres 37 Open the gate Mabanaft accelerates ammonia plans 38 Show and tell Antwerp explains what ports can do 40 Tap turn on the water Stanlow plans CCS with ENI 41 News bulletin – new energies 42 STORAGE TERMINALS Strength in depth Vopak demonstrates resilience 44 Tanks you like Koole adds renewables capacity 46 Combination carrier Exolum invests in HSL 48 News bulletin – storage terminals 49 TSA INSIGHT The magazine of the Tank Storage Association HCB Monthly is published by CW Research Ltd. While the information and articles in HCB are published in good faith and every effort is made to check accuracy, readers should verify facts and statements directly with official sources before acting upon them, as the publisher can accept no responsibility in this respect. ©2023 CW Research Ltd. All rights reserved

Publishing

ISSN 2059-5735 www.hcblive.com CW Research Ltd Talbot House Market Street Shrewsbury SY1 1LG

Designer

30 YEARS AGO A LOOK BACK AT

THE SEPTEMBER 1993 issue of HCB led with the first part of our annual report by ‘HJK’ on the Pira Update Seminar. There are parallels with this issue, which includes a report on the VCA seminar, the same event but under new management. In the 1990s it was common for the chairman to announce in a stentorian manner at the start that, if anyone were in the room who did not already have a good grasp of the transport regulations, then they had better be elsewhere. These days the chairman is rather more forgiving and VCA has worked hard over recent years to make sure that those new to the wacky world of dangerous goods are not only welcomed but even given a friendly shove on the road towards becoming experts in their field.

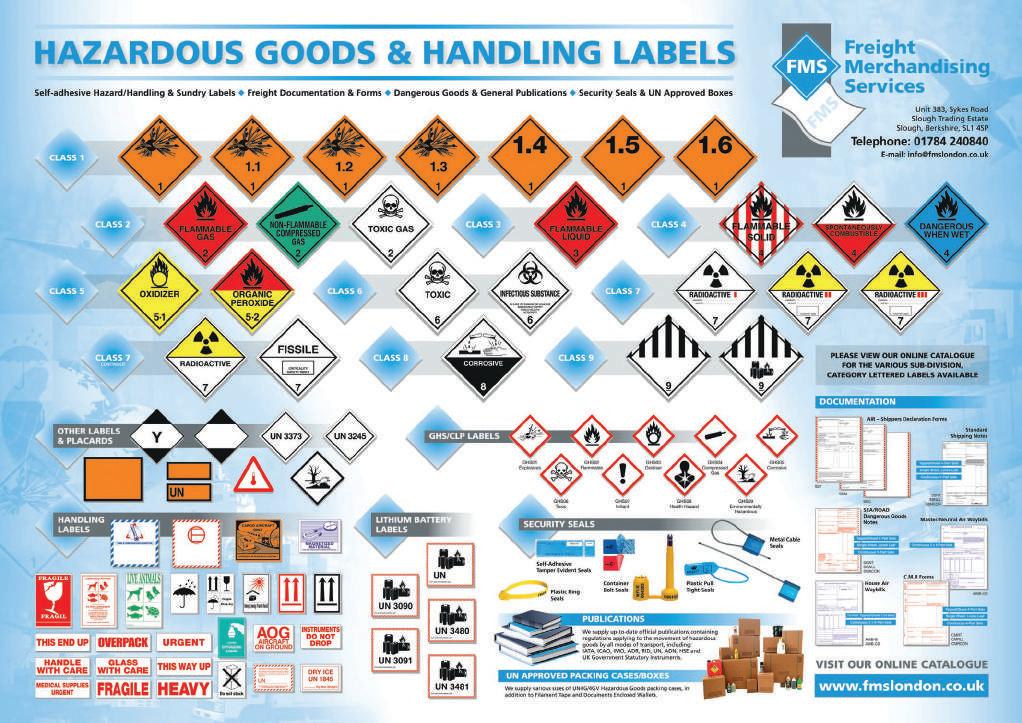

Still, looking back at what Pira covered in 1993, those coming fresh to the business might be relieved that they were not around thirty years ago, so complex were the rules at the time. There was, though, some light on the horizon, with the promise that the modal regulations would be more closely aligned as from 1995. On the way, RID and ADR had added a new Division 1.6 and aligned its flash point cut-off values for Class 3 material with those in the IMDG Code and ICAO Technical Instructions. Class 6.2 would no longer take account of “unpleasant odours” and “abhorrence” as classification criteria.

One interesting point that today’s dangerous goods expert may not be aware of is that in the 1990s, before the widespread use of the worldwide web and emails, many delegates to the June 1993 Pira seminar were unaware of what the UN experts had decided at their

SEPTEMBER 1993

December 1992 session and would have to wait until the physical publication of the revised Orange Book to find out – unless, of course, they were HCB readers, as the magazine had a much more important role in that regard in the pre-internet era.

And, in a passing mention in HJK’s report, it was noted that the Rio Earth Summit the previous year had “given an impetus to encouraging the harmonisation of transport hazard criteria with those used for health, environmental and consumer protection purposes”, an impetus that fairly rapidly translated into GHS, which leaned heavily on the work already done by the committee of transport experts.

Elsewhere, the September 1993 issue carried our regular survey of tank container manufacturing, coming at a time of some change in the business, with a number of new entrants (Atlantic Tank in Ireland, NDA in New Zealand, Dorbyl and Forgeweld in South Africa and Cryenco in the US) alongside weak demand for new tanks, although the major producers - Welfit Oddy, UBH, Van Hool and BSLT – were all expecting to increase output.

There were to be casualties in the years after, especially as the South African manufacturers were cost-advantaged in terms of the production of standard units. Manufacturing had not really taken off in the US, except for special units, and signs were beginning to emerge that engineering firms in the Far East and south-east Asia had aspirations to enter the market, though we could not predict that Chinese companies would storm into the sector and completely overturn the business.

HCB MONTHLY | APRIL 2022 04

SEPTEMBER 2023

LEARNING BY TRAINING

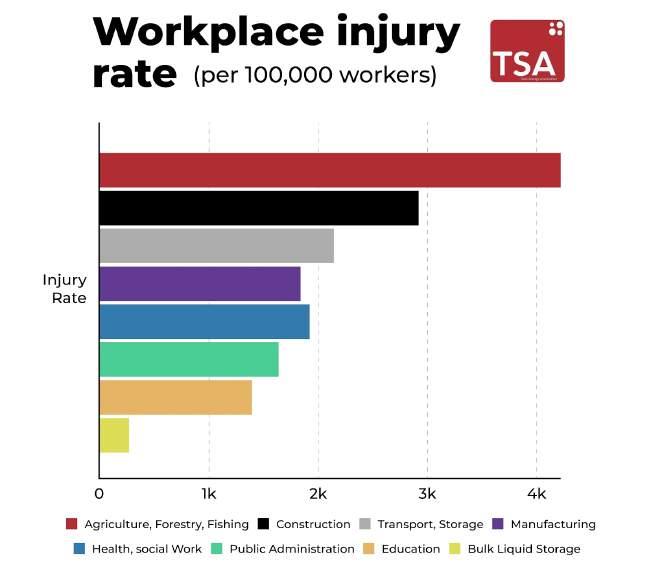

by Arend van Campen BUILDING A BEHAVIOUR-BASED SAFETY CULTURE

IN EARLIER COLUMNS I have explained that information is a physical substance that warrants the functionality of all living systems. Through communication and the use of feedback, processes can sustain themselves. When this knowledge is applied to HSEQ policies in marine chemical storage terminals, safety performance will be maximised.

During a training in Abu Dhabi where I was invited to train a new team of lead operators and loading masters, it became clear that this message was well understood. It is not about the number of checklists, not about safety rules or regulations, not about being forced into compliance, but about the collection and use of all available and relevant information before any action is started.

Based on the acronym S.T.O.P. - which stands for ‘Stop – Think –Observe- Plan’ - HSEQ behaviour is improved drastically. The question is not: Are you safe, put your helmet and safety glasses on; but: Have you collected sufficient information to do work?’

BBS, Behaviour Based Safety is a method designed by us to raise awareness about why people sometimes do stupid things. Having research psychological biases such as cognitive dissonance, the bandwagon effect or confirmation bias, the students learn that every person has so-called cognitive failures. Some examples: I often drop things, I forgot where I left my keys, I put the milk in the cupboard and the cookies in the refrigerator. Another insight is that our brain consists of three brains: the reptilian brain, mammalian brain and neo cortex. When an operator does not have the awareness, the knowledge or the skill to perform his tasks, he will be afraid, perhaps too careful because he or she will be stressed. Physical stress is related

to narrowmindedness which could lead to mistakes and incidents, because only the reptilian brain decides.

If you believe that your contractors don’t know about such psychological risks, you’d have the responsibility to educate them too. Understanding the psyche a bit better helps to mitigate and prevent HSEQ risks.

During the training at ACT in Abu Dhabi we discussed the requirements for total safety and launched so-called Behaviour Observation Teams. Every employee, including managers, office staff, operators or contractors, takes part in rotating observation teams of four to six people. They ‘observe’ the day-to-day operations for a period of two weeks. They list risky behaviours and convene to talk about this with management. By using the findings, an HSEQ culture can be built and sustained, because it will be an ongoing process. Every two weeks the team is replaced by a new team and so on.

It should start with housekeeping. Everyone who works at the terminal must keep the place clean. This means picking up plastics, debris or junk, not later, but right away. Information is key, because when one would have information and ignore it, there will be an information shortage. This is physics. It means there will be an energy shortage to do work. When there is not enough information=energy, the functionality of the terminal is endangered, because disorder (entropy) accelerates.

This is the latest in a monthly series of articles by Arend van Campen, founder of TankTerminalTraining, who can be contacted at arendvc@ tankterminaltraining.com. More information on the company’s activities can be found at www.tankterminaltraining.com.

UP FRONT 05 WWW.HCBLIVE.COM

ONE DAY IN JUNE

facility than they had been used to. They also faced a rather long day, since VCA had condensed proceedings into a single day. Helen North was introduced as moderator; this was her last public appearance in her role within DfT’s Dangerous Goods Unit as she was shortly to take up a new post with the UK Civil Aviation Authority (CAA), a move that will be DfT’s loss and CAA’s gain.

THE ONE OPPORTUNITY the UK dangerous goods community is offered to get up close and personal with its regulators is the annual Dangerous Goods Seminar organised by the Vehicle Certification Agency (VCA) on behalf of the Department for Transport (DfT). This event has taken place annually for close to 40 years now, except for the pandemic lockdown years, initially under the aegis of Pira International before that organisation was taken into private ownership.

The two years off for Covid gave VCA time to sit back and take stock – what is it that delegates and regulators need from the event and was the old two-day format still working? While the 2022 Seminar followed on from pre-pandemic years in its former home in Daventry, VCA also listened to feedback from attendees and this year took the major step of moving to a one-day format and relocated the Seminar to a city centre location in

Birmingham – convenient for those arriving by train but less so for those driving to the event. Furthermore, while delegate numbers held up reasonably well, the new format proved less attractive to those service providers that have regularly supported the Seminar and taken space to promote their wares. The new venue, The Studio, offered much improved catering compared to the Daventry Court Hotel, and a light and airy meeting room, but it was short on space for exhibition stands. Air Sea Containers, a regular at the Seminar, did have a table-top booth and kindly sponsored an evening reception the day before the event, but others stepped back for this year, the only other sponsor being Lithium Battery Recycling Solutions.

GET STUCK IN

When delegates arrived in the meeting room on 20 June, they found a much less formal

Helen put the 2023 VCA Seminar into context: it was taking place in the shadow of war in Ukraine, ongoing supply chain issues and, in the UK at least, a revolving political door, each of which has an impact on the transport of dangerous goods.

Helen handed over to the day’s first presenter, Mario Ranito, dangerous goods policy officer at CAA, who spoke about the issues facing the air transport industry and its regulators. Perhaps surprisingly, the big issue is not lithium batteries (not that they have gone away) but the increasing demand for the use of remotely piloted aircraft systems (RPAS), or ‘drones’ to the non-specialist. CAA is getting an increasing number of requests for approval to use RPAS to carry dangerous goods, Mario reported, including from Royal Mail for the distribution of parcels in the Scottish islands.

CAA is now looking at developing and delivering a national framework for the use of drones in the transport of dangerous goods,

06

CONFERENCE REPORT • VCA HAS SLIMMED DOWN ITS ANNUAL DANGEROUS GOODS SEMINAR BUT IT OFFERED PLENTY OF INTEREST AND IMPORTANT INFORMATION FOR THOSE IN ATTENDANCE

HCB MONTHLY | SEPTEMBER 2023

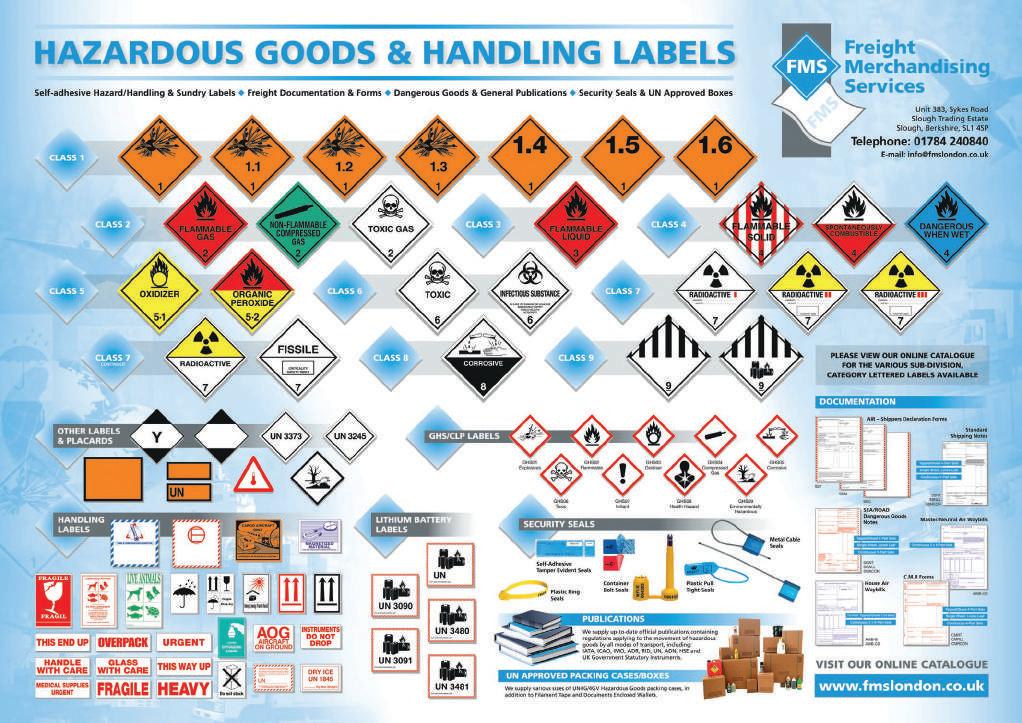

and Mario is also chairing a panel to look at the topic at the International Civil Aviation Organisation (ICAO). He reported that ICAO is aiming to publish a new Part IV to Annex 6 of the Chicago Convention to cover RPAS operations late in 2024 or early in 2025. There are, though, continuing developments in the air transport of lithium batteries; ICAO’s Dangerous Goods Panel has a working group on electric storage devices that has been tasked in particular with determining whether lithium batteries packed with/contained in equipment (UN 3481) pose an unreasonable risk in air transport. The working group will look to identify and quantify risk mitigation measures that may need to be in place, including a restriction on the state of charge.

JOLLY COPPERS

After a coffee break and the opportunity to speak to the regulators in the room, the Seminar reconvened to hear from two regular speakers, Terry Harvey of the Suffolk Constabulary and Police Sergeant Jason Dearsley of the Commercial Vehicle Unit at Essex Police, representing the Carriage of Dangerous Goods Practitioners Forum (CDGPF), of which Terry is currently chair. The two were instrumental in establishing the Forum in 2000 to promote a more standardised approach to the enforcement of

dangerous goods transport across the UK.

CDGPF also has an important role to play in bringing together other enforcement and regulatory agencies as well as industry bodies to discuss issues surrounding the transport of dangerous goods and, Terry said, provide police forces with a way to close the information loop with dangerous goods safety advisers (DGSAs) regarding enforcement activity and infractions. After all, they stressed, “undeclared dangerous goods is a crime”.

Terry and Jason also gave their regular update on the nature of non-compliance that emerges from roadside inspections, although the figures they gave were little different from those presented at previous Seminars. Rather disappointingly, haulage companies still have trouble keeping their vehicles equipped with properly functioning fire extinguishers and there are the usual problems with documentation. Most bizarrely, enforcement officers still regularly report that the instructions in writing required under ADR are often missing or out of date: this is a simple matter to get right and the fact that so many get it wrong seems to point to a lack of training or understanding.

Other issues are emerging with the increasing use of magnetic orange plates; these are required to remain visible for 15

REGULATIONS 07

WWW.HCBLIVE.COM Who do you contact for the latest DG compliant labels? Tel: +44 (0)870 850 50 51 Email: sales@labeline.com www.labeline.com Free DG Label ID poster with every order appointed

minutes in a fire, but it seems that the magnetic properties are lost at 80°C. The use of electronic documents is also causing problems; police forces report that drivers often do not know how to access transport documents, devices become unserviceable, or they do not produce all the information required by ADR.

The non-compliance reported by Terry and Jason was not only familiar from previous years but was also mirrored by figures presented by Kellie McNamara, principal inspector for the Health and Safety Executive for Northern Ireland (HSENI); indeed, she began her presentation by apologising for the similarity and then provided some startling illustrations of how even big-name transport and fuel supply companies can get things very badly wrong.

Enforcement bodies understand that the dangerous goods regulations are complex but Kellie’s point was this: dutyholders seem to be getting so much of the basics wrong, so how can the authorities expect them to get the complicated bits right?

CALL FOR THE SPECIALISTS

Perhaps there is a solution to Kellie’s conundrum to be found in the role of DGSAs – and, as most of those in the audience at the VCA Seminar (and most of the speakers, too) were DGSAs themselves, they were keen to hear from Liz Heaton, senior national standards and accreditation service manager in the Strategy, Policy and Digital Technology Directorate at the Driver and Vehicle Standards Agency (DVSA), not least since the contract to provide DGSA examination and accreditation services expires in 2024 and it may well be that the Scottish Qualifications Authority (SQA), which has run the DGSA scheme in the UK since its inception, will no longer be involved.

DVSA has recently launched a broadreaching ‘Vision to 2020’, Liz reported, which

includes the aim of raising the profile of DGSAs and informing the public about their role in ensuring safety in the transport of dangerous goods. As part of that, DVSA wants to draw up a list of active DGSAs – something that, rather surprisingly, is not publicly available – and she urged the DGSAs in the room to sign up at dgsalist@dvsa.gov.uk.

In addition, Terry and Jason had already mentioned that the CDGPF has become aware that DGSAs are not being alerted to roadside inspections, whether or not they result in an infraction; this makes it difficult for them to produce accurate annual reports or to know when to undertake a company visit. CDGPF is now asking officers to get the name of the DGSA from the transport manager.

ON THE RIGHT TRACK

Each of the transport modes has its own role to play in moving dangerous goods around the UK and rail is important for transport goods in bulk, particularly fuels, spent nuclear fuel and munitions. Fresh from a refreshing lunch, delegates heard from Rob Staunton, who works at the Rail Safety and Standards Board (RSSB) to bring innovation and research to bear on the sector; he also established the

Freight Research Programme, of which he is joint lead, to solve sector issues and remove barriers to further growth.

Rob remarked that the derailment at Llangennech on 26 August 2020, when 25 tank cars with diesel and gasoil spilled nearly 450,000 litres of fuel, had concentrated the minds of industry. The accident was caused by one tiny component on the rails moving out of place, he added. RSSB’s Annual Health & Safety Report for 2021/22 noted that derailment represents the largest proportion of risk in railfreight transport, twice that of personal injuries to workers. The identified risk profile is helping to inform the priorities for RSSB’s Freight Research Programme, which aims to increase payloads and average freight speeds while increasing safety and reducing carbon impact. It also aims to help motivate change within the industry, by providing business cases and carrying out pilot studies; it is also part of the impetus behind the move to digital automatic couplers (DACs).

Rail is in a strong position to meet the needs of a lower carbon transport network, Rob said. It is not going to be a battle between road and rail but, if the industry is on the right

08 HCB MONTHLY | SEPTEMBER 2023

ENFORCEMENT PERSONNEL REGULARLY COME ACROSS NON-COMPLIANT ORANGE PLATES, WHICH SEEM TO CAUSE CONFUSION

path, will be about rail leading the way on better integration and interoperability, helping it to made the biggest contribution possible on the road to net zero.

An emerging issue across the dangerous goods transport sector is the increasing penetration of electric vehicles (EVs), both in terms of their use in carrying dangerous goods (including as power supplies for freight trains) and as a generator of demand for the transport of large format lithium batteries. Alan Colledge, technical director of Lithium Battery Recycling Solutions, part of the Cawleys Group, is heading a new department concentrating on the safe collection, handling and recycling of lithium batteries.

One major problem is that, while the traditional lead-acid batteries used in internal combustion engine vehicles are relatively easy to recycle, the same cannot be said for lithium batteries, which have a complex design that does not come apart easily. Alan explained the various recycling technologies that are available and the limited capacity to handle battery recycling in the UK, which is something that will need to change if the

country is to meet its decarbonisation targets.

change things, both by investing in recycling facilities and by promoting ‘second life’ battery batteries that no longer offer the efficiency required can be repurposed to provide ad hoc

perspective and this year had managed to get Operators Dangerous Goods Association

REGULATIONS 09

Experts on the Transport of Dangerous Goods WWW.HCBLIVE.COM 2023 IATA DGR Tel: +44 (0)870 850 50 51 Email: sales@labeline.com www.labeline.com Who do you contact for the latest DG compliant labels? Tel: +44 (0)870 850 50 51 Email: sales@labeline.com www.labeline.com Free DG Label ID poster with every order For a local, professional consultant DGSA, contact Labeline The ‘Biennial’ returns! THE multimodal regulatory update webinar 18th October 2022 Do you consign Dangerous Goods? All UK consignors must have an appointed DGSA by 1st January 2023 Free worldwide shipping from IATA’s leading international distributor

international regulatory bodies, providing them with technical input to ensure that new regulations are relevant and workable. COSTHA can also raise issues directly with the regulators, whether they relate to problems its members are having in applying current rules or when technical developments raise a need for new regulation. An example of the latter is fire suppressant dispersant devices, which use a similar technology to that in airbags; these devices had been introduced to the market but were being regulated differently around the world. Industry took the problem to the UN Sub-committee of Experts on the Transport of Dangerous Goods, which has now come up with a definitive solution in the UN Model Regulations, levelling the playing field.

Tom’s presentation also offered a primer on the US Hazardous Materials Regulations and the regulatory process for those not familiar with them, as well as some of the main peculiarities they contain, such as combustible liquids, materials of trade exceptions, medium

battery exceptions, hazardous substances and reportable quantities.

COUNTING CRASHES

The afternoon coffee break gave another chance to talk to the regulators, something that Bethan Davies has been doing for several years. Beth manages the Chemsafe scheme at the National Chemical Emergency Centre (NCEC), in which role she has to deal with the emergency services and other government agencies, though her focus now is on a research project NCEC is carrying out on behalf of DfT, which had come to suspect there is a significant level of under-reporting of ADR-related incidents and non-compliance. NCEC has drawn on its own experience to begin compiling a database of such incidents and, since the start of this year, has been pulling in data from other agencies. This has involved collating information from various sources into a consistent template to help it identify any key trends. There is more data to be included, Beth said, especially from the fire services, but on the basis of what is available so far, it certainly appears that DfT is correct in its suspicions. Once all the data is collated, NCEC will perform a full analysis and prepare a report for DfT – it is to be hoped that this will be available in time for next year’s VCA Seminar.

To help promote the project and to encourage better ADR reporting, DfT is planning to issue four quarterly bulletins over the course of the project, the first of which has already been circulated. This included items on ADR incident reporting requirements, an enforcement perspective on load security, a summary of the changes in the 2023 edition of ADR, an update on the GB Carriage of Dangerous Goods (CDG) Regulations, and changes to the Emergency Action Codes.

BY THE SEASIDE

The day’s final presentation came from Gemma Harvey, hazardous cargoes adviser within the Maritime & Coastguard Agency’s (MCA) UK Technical Services – Ship Standards team. Gemma had given a very informative paper at the 2022 VCA Seminar, which had promised a lot of imminent developments, and it was useful for her to return and make good on those promises, which she certainly did.

For a start, MCA is engaged in a major reorganisation and simplification of the legislation pertinent to the carriage of cargoes by sea, with the intention of slimming down the current plethora of statutory instruments (SIs) to just two: the Carriage of Cargoes Regulations and the Carriage of Dangerous Goods and Harmful Substances Regulations. MCA was close to getting consultation on the process underway and Gemma said she was optimistic that this could all be wrapped up before the end of this year.

The process will not create any new provisions but will bring the existing regulations – some of which are around 25 years old, including the Carriage of Dangerous Goods & Marine Pollutants Regulation 1997 – up to date and consolidate what is a somewhat fragmented legislative picture. MCA will draw up a new marine guidance note (MGN) to explain how dangerous goods are regulated in the marine environment. There will likely be a change to the reporting requirements and it is planned to include an ambulatory reference to international regulations that apply; MCA will review the list of offences and the current level of penalties, and is also planning to review and re-issue existing MGNs in light of the new legislative structure. Some new MGNs may address

10 HCB MONTHLY | SEPTEMBER 2023

RAIL OFFERS THE POTENTIAL TO MOVE A LOT OF DANGEROUS GOODS BUT MORE WORK NEEDS TO BE DONE IF IT IS TO OFFER AN ATTRACTIVE ALTERNATIVE TO ROAD

Who do you contact for the latest DG compliant

You need Labeline.com

Labeline is the leading worldwide “One Stop Dangerous Goods Service” for Air, Sea, Road, and Rail

We serve Freight Forwarders, Shippers, Airlines, DCA’s, Port Authorities, Petrochemical industry and the Pharmaceutical industry.

Labeline is one of the world’s leading regulatory services and product provider; we hold comprehensive stocks with a fast worldwide delivery service.

We are one of the very few authorised Multi-mode providers worldwide and described by industry as a pro-active organisation, our name is recommended by many leading authorities and a world class service providers.

When it’s time to order your DG products and services, Labeline will be your “One Stop Service”

Compliant with IATA, ICAO, ADR, IMDG, RID, DoT

electric scooters, high-speed offshore service craft, workboats, jet skis and other powered water craft, fire safety and storage on yachts, and the charging of electric vehicles.

Elsewhere, MCA is looking at autonomous and remotely operated vessels, the use of alternative marine fuels, the problem of plastic pellets in the environment, and ‘grandfather’ rights. It is also supporting innovation with appropriate guidelines.

provisions and packing instructions. Revised text for data loggers has been approved.

Tel: +44 (0)870 850 50 51

Email: sales@labeline.com

www.labeline.com

Gemma also covered recent developments at the International Maritime Organisation (IMO) as it works to bring the latest UN revisions into the International Maritime Dangerous Goods (IMDG) Code for Amendment 42-24. IMO’s Carriage of Cargoes and Containers (CCC) Sub-committee and its Editorial & Technical (E&T) Group have already agreed to two new UN entries for sodium ion batteries and others for batterypowered vehicles and fire suppressant dispersant devices, and related special

Gemma looked ahead to the September sessions, where there were to be discussions on a revision to 2.10.2.7 on environmentally hazardous substances (UN 3077 and 3082) and a new special provision for vehicles as cargo, something that has become more urgent in light of a number of recent shipboard fires. In addition, there will be a continuation of the discussions on the transport of carbon in its various forms, again in response to a worrying number of fires

Delegates were sent home with a head full of new information, representing very good value for the time it took, though at the cost of

Tel: +44 (0)870 850 50 51

GHS

Email: sales@labeline.com

www.labeline.com

networking. It will be interesting to see how VCA takes this forward in 2024, but HCB will certainly be in attendance and will report back

Tel: +44 (0)870 850 50 51 Email: sales@labeline.com

www.labeline.com

REGULATIONS 11 WWW.HCBLIVE.COM

Goods Labels Regulations

Software Training

Dangerous

Documentation Packaging

Chem

Free DG Label ID poster with every order For a local, professional consultant DGSA, contact Labeline The ‘Biennial’ returns! THE multimodal regulatory update webinar 18th October 2022 All UK consignors must have an appointed DGSA by 1st January 2023

Regs

ONE SIZE FITS ALL

THIS YEAR’S ANNUAL Forum of the Council on Safe Transportation of Hazardous Articles (COSTHA), held in Frisco, Texas in the first week of May, encouraged a lot of hazmat professionals to get back to travelling to get together with more than 200 of their peers. The event, which was also partly available online, featured presentations on dangerous goods regulations at home and abroad, with speakers arriving from Asia, Africa and North and South America, along with representatives of the main US federal agencies with responsibility for domestic and international transport of hazardous materials.

For those attendees with a primarily domestic operation, Kevin Leary, international

transportation specialist at the US Pipeline and Hazardous Materials Safety Administration (PHMSA), gave an explanation of the US position in respect of the international regulatory framework, and summarised the work of the UN Sub-committee of Experts on the Transport of Dangerous Goods (TDG) in the 2021/22 biennium.

That UN Sub-committee is responsible for updating and managing the UN Recommendations on the Transport of Dangerous Goods, otherwise known as the UN Model Regulations (or just the ‘Orange Book’). That document sits at the core of the international regulatory system, providing the basis for both international transport of dangerous goods by air (through the International Civil Aviation Organization’s (ICAO) Technical Instructions) and packaged dangerous goods by sea (through the International Maritime Dangerous Goods (IMDG) Code). Virtually all countries observe

the IMDG Code and ICAO Technical Instructions for international transport and most apply them also to domestic operations; there is also a long-term trend towards road and rail regulations to harmonise with the UN Model Regulations, though those in effect in North America – the US Hazardous Materials Regulations (HMR) and Canada’s Transportation of Dangerous Goods Regulations (TDGR) – have some way to go to achieve complete alignment.

But, Leary said, the UN system is crucial, with the UN Model Regulations not just setting a safety benchmark for the transport of dangerous goods but also facilitating international trade. The regulations are also multimodal in nature, recognising that goods in international transport are very likely to utilise more than one more of transport. There are currently 30 member countries represented at the TDG Sub-committee; the US delegation is led by PHMSA and at present has the chair of the Sub-committee. The Sub-committee was set up in 1954, publishing the first edition of its Recommendations in 1956; these were reformatted in 1996 (on the basis of the air transport regulations) to allow them to be more easily transposed into modal and national regulations. The US brought its own HMR more into line with the international standards in 1991 through the HM-181 rulemaking and now updates HMR every

12

HCB MONTHLY | SEPTEMBER 2023

THE US HOLDS THE CHAIR OF THE UN SUBCOMMITTEE OF EXPERTS BUT DOES NOT ALWAYS AGREE WITH

IT

INTERNATIONAL • COSTHA’S ANNUAL FORUM GAVE ATTENDEES THE CHANCE TO HEAR WHAT’S COMING ALONG FROM THE UN, DIRECTLY FROM THE PEOPLE INVOLVED

two years in line with the biennial publication of the latest revised edition of the UN Model Regulations.

The global position is, though, far from fully harmonised; to help international shippers and carriers keep up with the latest information, PHMSA publishes a very useful map and list of competent authorities on its website at www.phmsa.dot.gov/internationalprogram/international-list-competentauthorities-andor-contacts-transportdangerous-goods.

THE LATEST EDITION

Leary followed up on this introduction with more detail on what the UN Sub-committee had adopted over the previous two years, noting several proposals that will improve safety, enhance the protection of the environment, facilitate the use of new technologies and support US stakeholders.

For example, partly in response to its mandate as an agency of the UN to observe the UN Sustainability Development Goals but also in response to industry’s desire to improve sustainability performance levels, the Sub-committee amended the definition of ‘recycled plastics material’ to allow a wider use of recycled plastics in packagings for the transport of dangerous goods. Similarly, the TDG Sub-committee adopted new proper shipping names and transport provisions for fire suppressant dispersing devices, with one entry in Division 1.4S and one in Class 9. This will facilitate the distribution of such devices, which are designed to protect lives and reduce the environmental impact of fire extinguishing systems; they may also have a role in addressing the need for effective extinguishers for lithium battery fires.

A small change that will have a big impact for some shippers is an increase in the Limited Quantity threshold for certain non-flammable, non-toxic gases in pressure receptacles, from 120 ml to 1 litres; this change, which was supported by COSTHA, applies to argon, nitrogen, helium and carbon dioxide.

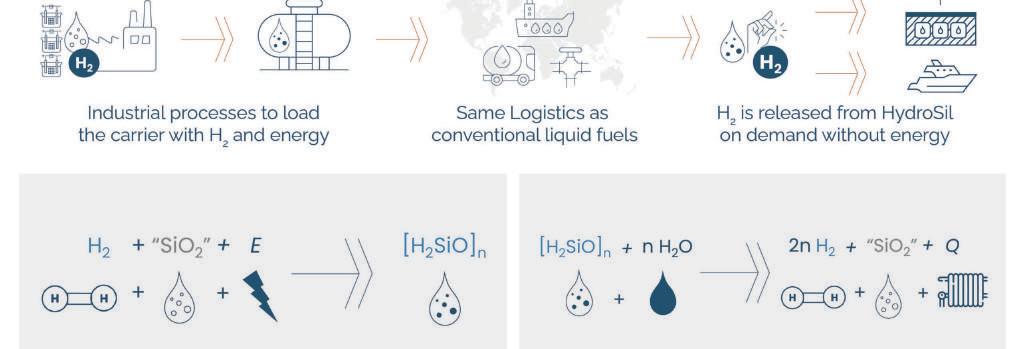

The TDG Sub-committee also adopted provisions that will allow certain alkali metals and alkaline earth metals in dispersions to be carried in UN portable tanks. Some of the products involved are dispersions of lithium

and sodium, which will be in increasing demand to help support growing electrification as part of the energy transition.

The Sub-committee also adopted specific proper shipping names and transport provisions for sodium ion batteries and sodium ion batteries packed with or contained in equipment (UN 3551 and 3552). There are also new proper shipping names for batterypowered vehicles, which will provide clarity to emergency responders and differentiate between specific types of battery.

Leary also noted the addition of a toxic primary or subsidiary hazard for tetramethylammonium hydroxide (TMAH) to the entries in the Dangerous Goods List, which will provide more accurate hazard communication and increase awareness of the hazards in transport and workplace situations.

All these changes will appear in the 23rd revised edition of the UN Model Regulations, which will be published this year; the changes will be picked up by international modal, regional and national regulators for entry into force beginning in 2025.

FLYING WITH POWER

Those modal bodies are already well on the way to implementing the UN’s changes, Leary reported, while the TDG Sub-committee has begun to set out its priorities for the 2023/24 biennium – including bringing to a conclusion, if at all possible, the discussions seeking to establish a rationalised classification system for lithium batteries, which will help when it comes to drawing up parallel provisions for other chemistries as battery technology develops.

Meanwhile, ICAO’s Dangerous Goods Panel (DGP) has already made strides on the next edition of the Technical Instructions and also issued at the end of March a first addendum to the 2023-2024 edition, setting out the limitations posed on portable electronic devices containing batteries when carried as checked baggage.

DGP has now created a Working Group on Energy Storage Devices (ESD WG) to ensure that the provisions related to the transport of liquid batteries or other energy storage devices and supporting guidance material

REGULATIONS 13

WWW.HCBLIVE.COM

deliver the expected and acceptable level of safety. The Working Group has been tasked with carrying out a safety risk assessment on lithium batteries packed with or contained in equipment, which would identify hazards and any existing mitigation measures. This analysis was due to be presented to the May meeting of the DGP Working Group, just after the COSTHA Annual Forum, with the full risk assessment due to be presented to the 29th session of DGP this coming November, potentially with proposals for amendments to the Technical Instructions.

TROUBLE AFLOAT

The International Maritime Organisation (IMO) is also well underway with transposing the recent UN changes into the IMDG Code, with

the Editorial & Technical (E&T) Group, which does most of the drafting work, having met already in March. That session threw up a few issues, including the use of special provisions 961 and 962 for the new entries for electric vehicles. It did, though, incorporate proposals that had been agreed in principle at the prior session of the Sub-committee on the Carriage of Cargoes and Containers (CCC) regarding the use of data loggers and other devices attached to cargo transport units and containing lithium batteries to be used during transport. The E&T Group agreed that the new provisions will not come into effect until 2028 (and 2034 for reefer units).

One important item for the maritime regulators involves the transport of carbon, a cargo that – especially in the form of charcoal – has been implicated in a number of serious onboard fires in recent years. This was a topic addressed both by Steve Webb, international standards transportation specialist at PHMSA and chair of the E&T Group, and Dr Amy Parker and Hillary Sadoff, respectively lead chemical engineer and chemical engineer in the Bulk Solids and Packaged Hazmat section

of the US Coast Guard’s (USCG) Hazardous Materials Division.

The proposed amendments to the IMDG Code relating to carbon have not yet been finalised though, as Dr Parker reported, a drafting group has been able to agree on some issues. Firstly, regarding UN 1361, any material that is not tested must be assigned to packing group III at least; material must undergo a weathering period of 14 days prior to being packed. Stowage methods have been defined, and it will not be permitted to load UN 1361 in bulk in containers. A maximum temperature at the time of packing will be set, though it has not yet been agreed whether this will be 40°C or 50°C.

There was disagreement on the value of the vanning certificate, which requires a marine surveyor to confirm that the cargo is packed in accordance with the IMDG Code and to record the temperature and dead space when loaded into the container; it was felt by some experts that this is a matter for carriers to decide.

For UN 1361, these changes will be reflected in a new special provision that will replace SP 925. Details of the date of

14 HCB MONTHLY | SEPTEMBER 2023

ICAO IS WELL ON THE WAY TO COMPLETING THE REVISED TEXT OF ITS TECHNICAL INSTRUCTIONS DUE TO COME INTO EFFECT IN 2025

production, date of packing and temperature on the day of packing will have to be included in the transport document. Another new special provision will detail the exemptions available to UN 1361 activated carbon that has passed the test for self-heating substances.

IMO hopes that these and other outstanding issues will be brought to a conclusion at the ninth session of CCC, which takes place in London from 20 to 29 September, with a meeting of the E&T Group following.

One of those issues that has become more pressing over the course of this year relates to the carriage of vehicles, both on dedicated car carriers and on ro-ro ferries, following a number of very serious fires. Up until now, the focus at IMO has been on the hazards posed by

electric and hybrid vehicles and it is expected that changes to align SP 388 with the UN Model Regulations will be adopted; this will close a gap relating to the testing requirements for lithium batteries in hybrid vehicles, which is currently limited to such vehicles loaded in the cargo spaces of a ro-ro vessel.

It would appear that a number of recent shipboard fires have involved vehicles powered by internal combustion engines, rather than electric vehicles, and a correspondence group has been established to conduct a broader review of the current provisions. The group is looking at potential amendments to SP 961 and 962, specific problems relating to damaged vehicles, and the carriage of vehicles in containers.

Later in the Annual Forum, Tom Ferguson, COSTHA’s chief technical officer and administrator, gave a detailed presentation on the structure of the international regulatory process, as well as the ways in which COSTHA can help its members influence that process. This was a great help to those not used to dealing with UN bodies and gave a very clear insight into why changes happen.

The third and final part of HCB’s report on the 2023 COSTHA Annual Forum in next month’s issue will cover a number of presentations on domestic regulations around the world. The 2024 event is scheduled to take place in Fort Myers, Florida from 21 to 24 April; more details can be found at www.costha.com.

REGULATIONS 15

WWW.HCBLIVE.COM

WORKING AT THE CAR DECK

VEHICLES • BATTERY FIRES PRESENT VERY PARTICULAR HAZARDS. FERRY OPERATORS ARE NOW SEEING A RISE IN THE VOLUME OF ELECTRIC VEHICLES AND NEED TO UNDERSTAND THE RISKS

THE TRANSPORT OF vehicles by sea is a well established trade. Dedicated car and truck (PCTC) carriers, while being perhaps some of the ugliest ships afloat, provide a vital service to vehicle manufacturers in the distribution of new cars, while ro-ro and ro-pax ferries move large numbers of vehicles of all types on a daily basis. There is also a thriving market in secondhand vehicles using a range of ship types, including container vessels.

The arrival of battery-powered vehicles into the mix over the past few years has raised concerns, given the well known hazards of lithium batteries in other transport chains. Furthermore, there have recently been several major fires involving cars and trucks on ships, even if some – such as the fire on the PCTC Fremantle Highway off the Dutch coast in late

July – were clearly sparked by incidents in more traditionally fuelled vehicles.

The UK’s Maritime and Coastguard Agency (MCA), alert to the lack of requirements from the International Maritime Organisation (IMO) specifically addressing the carriage of electric vehicles (EVs) on ro-ro or ro-pax vessels, has worked with industry to develop a guidance note, MGN 653 (M), to set out what it sees as best practice in the safe carriage – and, potentially, onboard charging – of EVs. The lengthy note aims to raise awareness of the risks posted by EVs and provide guidance on fire detection and firefighting measures.

SPOT THE FIRE

Fires in EVs do not release significantly more energy than those in vehicles powered by

internal combustion engines (ICE) using gasoline, diesel or LPG as fuel. Nor is the risk of fire breaking out any greater. On the other hand, battery fires can last longer, as they are self-sufficient and, once alight, do not rely on a supply of oxygen, and are prone to reignition. In hybrid vehicles there is also the risk that a fire involving the battery will spread to the hydrocarbon fuel.

The greatest hazard posed by lithium batteries is thermal runaway, when the heat generated within a battery exceeds the amount of heat that is dissipated to its surroundings. This creates a feedback loop that, if not addressed quickly, can lead to the fire spreading or the battery exploding, though MCA notes that recent lithium ion battery designs encourage the burning battery to vent rather than explode.

It is therefore vital to spot an event before it gets out of hand, by detecting the gases that are given off immediately before and during thermal runaway; these can include carbon dioxide, carbon monoxide, hydrogen and other volatile organic compounds (VOCs). Some of these are heavier than air and will accumulate at deck level but others are lighter than air and will accumulate at deck-head level or dissipate, making it hard to determine where best to place detectors. Furthermore, when considering the use of off-gas detectors for

16 HCB MONTHLY | SEPTEMBER 2023

early detection of thermal runaway, the presence of other conventionally fuelled vehicles, which also produce many of the same gases in their exhaust during the loading process, will likely cause false alarms until the deck is cleared of exhaust gases. Air circulation systems and natural ventilation may result in the off-gases being mixed with air and being difficult to detect at lower concentrations. If off-gas detectors are used, it is recommended that they are used to detect gases not normally present in exhaust fumes, such as long-chain hydrocarbons and droplets of VOCs, or after exhaust gases have been vented following embarkation.

Fire patrols also need to be aware of the different indicators of fires aboard EVs and are advised to look for evidence of smoke or heat from the areas of vehicles where a battery is normally located, for example the underside. They should also listen for ‘popping’ sounds that may indicate a potential thermal runaway event. Thermal imaging investigations should be undertaken if there are any concerns over a vehicle raised by the fire patrol. Operators might also consider the use of closed-circuit television (CCTV), which can incorporate a flame recognition system.

PUT IT OUT

A ship’s fixed fire-extinguishing system will usually be the most effective first response in dealing with an EV fire as it will provide boundary cooling and reduce the likelihood of fire spreading to nearby vehicles; however, a localised manual response may be more effective in certain circumstances and will be required to supress the fire in the vehicle the fire originates from. This should be considered as part of the emergency response plan. The decision to send crew to engage in manual firefighting activities should be carefully considered, especially where there is already fire spread to nearby vehicles, limited visibility or other hazards that would increase the risk to crew undertaking firefighting.

In case of fire involving lithium ion batteries only water supplied in large quantities can cool the batteries. It is possible that this will have to be manually applied as the pressurised fixed water-drench in the vehicle spaces may not satisfy the fire suppression

needs for electric vehicles due to the limits of the scope of the spray, though it will help to slow the spread of fire. The use of water monitors to provide water to the vehicle is recommended where available. Traditionally fuelled vehicles require approximately 4,000 litres of water to suppress a fire while EVs can require around 10,000 litres, depending on battery size and application method. It is also worth noting that the battery in an EV is often located on the underside, and operators may want to consider installing systems to spray water upwards from the vehicle deck.

OTHER ISSUES

MCA’s note also considers both larger EVs, including trucks, vans and other commercial vehicles, and small EVs such as bicycles and scooters fitted with batteries, personal watercraft and hoverboards. These are not subject to the same approval and acceptance regime as electric cars and trucks and there is a higher risk of low-quality batteries being used, which carries a higher risk of ignition. It is recommended that these vehicles are carried on the weather deck where available and not stowed in car boots or other similar spaces where any ignition could lead to a larger fire developing quickly.

Another particular risk is posed by damaged EVs, such as crash-damaged cars being

repatriated or returned to the mainland from an island. Such vehicles may be at a significantly higher risk of catching fire, depending primarily on whether the battery itself is damaged. They should be examined by a competent person before being allowed on board and should, if possible, be carried on weather decks rather than on enclosed vehicle decks.

Where there is suspicion that the battery pack may be damaged then the battery should be disconnected and carried separately in compliance with the International Maritime Dangerous Goods (IMDG) Code, in accordance with Special Provision 376.

When it comes to onboard charging of EVs, there are some provisions in the International Convention for Safety of Life at Sea (Solas) that should be observed. Ideally, charging should be carried out on the weather deck in a dedicated area.

The carriage of EVs by sea is a relatively new phenomenon and, as vehicle and battery technologies develop, represents a moving target in terms of safety. MCA will update and reissue its guidance to take account of future developments but, for now, its guidance note provides a very thorough summary of the factors that vessel operators need to bear in mind when accepting EVs for carriage.

WWW.HCBLIVE.COM SAFETY 17

HIT OR MISS

INCIDENT INVESTIGATION • MUCH CAN BE LEARNED FROM INCIDENTS AND FROM NEAR MISSES. DUTCH AUTHORITIES HAVE BEEN INVESTIGATING WHY THE PROCESS IS NOT FULLY ENGAGED

IT HAS LONG been acknowledged that learning from accidents is the best way to prevent them happening again. It is also widely understood that near-misses can also provide important learnings – and given that there are more near-misses than actual accidents, investigating near-misses can significantly expand the pool of safety information available.

It is also widely believed that there is a serious problem in investigating near-misses, since those involved are often reluctant to divulge the event in the first place. However, that is something that needs to be overcome if the potential to learn from all events, whether actual incidents or near-misses, is to be fully exploited.

The Netherlands’ Ministry of Infrastructure and Water Management (IenW) has set itself a goal of achieving the intrinsically safe transport of hazardous substances by 2050. Its goal is to reduce the number of incidents and near-misses in the transport chain and learning from past events is an important tool in getting to that target.

Early in 2021, IenW asked the Dutch National Institute for Public Health and the Environment (Rijksinstituut voor Volksgezondheid en Milieu, RIVM) to carry out an exploratory study into incidents involving the transport of hazardous substances; as a result of that work, it was determined that further work was warranted to establish the bottlenecks to learning from accidents and, especially, from near-misses. IenW commissioned RIVM to carry out a fuller study in September 2021, the results of which have recently been made available.

WHERE DO WE STAND

RIVM chose to use safety advisers (DGSAs) as its research population; all companies involved in the transport of dangerous goods are required by ADR, RID and ADN to appoint a DGSA, one of whose roles is to analyse and, if necessary, draw up a report on any accident involving the company’s activities in the transport of dangerous goods. That may also involve making recommendations for measures to prevent the recurrence of such incidents. RIVM felt, not unreasonably, that DGSAs would be best placed to know whether and how lessons are learned from incidents, where bottlenecks are experienced in practice and what points for improvement might be possible.

RIVM worked with the Association for Safety Advisors (Vereniging van Veiligheidsadviseurs, VVA), the employers’ association Evofenedex and the Dutch Chemical Industry Association (VNCI) to distribute questionnaires online during the third quarter of 2022; it received 83 fully completed surveys, primarily from in-house DGSAs with expertise in road transport. As a result, RIVM’s analysis does not cover rail or inland waterway transport. The results of the questionnaires provided a first insight into the learnings that are taken from incidents and near-misses by DGSAs. RIVM subsequently held three focus group

18 DUTCH DGSAS HAVE THE POTENTIAL TO ENCOURAGE NEAR-MISS REPORTING HCB MONTHLY | SEPTEMBER 2023

meetings in November, with 16 DGSAs participating in person. These groups discussed the questionnaire results in more detail, generating insight into the bottlenecks that are experienced and points where improvement might be made.

It appears, RIVM concluded, that many companies are learning from accidents and near-misses, but that they do not always go through the entire learning process. In order to effectively learn from these events, it is important to do so completely. Many companies can also learn more from near-misses. It is also important that safety advisors learn from each other’s experiences by sharing bottlenecks and solutions.

One problem seems to be that companies do not always report a near-miss because they do not feel it would be useful. In addition, some companies do not evaluate whether remedial actions are effective because they have difficulty in assessing this. DGSAs suggested some improvements, such as paying more attention to learning from incidents during DGSA training and encouraging companies that cooperate in the transport chain to discuss safety more often.

VVA, trade associations and government bodies can help in the process, RIVM says. They can talk to each other about the tasks of DGSAs and about learning from incidents and near-misses.

RESULTS IN SUMMARY

RIVM’s survey came up with five main conclusions. Firstly, companies generally pay attention to learning from accidents but not so much to learning from near-misses. Most DGSAs who participated in the study indicated that there are well established procedures for learning from incidents, which indicates that attention is paid to the process.

To gain more insight, respondents were asked whether the learning process is also put into practice. Most respondents indicated that in practice the steps of the learning process are carried out ‘often’ or ‘always’ for incidents but, for near-miss incidents this is ‘sometimes’ to ‘often’. This applies all the way through the learning process.

The second conclusion is that the further one gets in the learning process, the less

often learnings steps are performed and fewer procedures exist. This applies both to incidents and to near-misses.

Thirdly, there are still bottlenecks in learning from incidents and improvements are possible. Most bottlenecks are experienced in steps 1 (reporting), 6 (communicating actions) and 8 (evaluation). Participants in the focus group discussions indicated that many bottlenecks are experienced in the learning process from near-misses, which are under-reported in the first place either because it is not always considered useful or because the near-miss is not recognised as such. There are also capacity constraints in terms of applying the full procedure.

Evaluating the effectiveness of actions is also a bottleneck. Safety advisers indicated that they find it difficult to determine how the effectiveness of actions should be investigated.

Another common issue derives from the fact that the transport chain consists of several links, which makes troubleshooting more complex when other parties may not

always see the need for action or do not want to free up resources for this. Prevailing commercial interests over security interests also constitutes one bottleneck within companies and within the chain. Exchanging information about good practices seems to be the answer to help solve bottlenecks, DGSAs said.

There were also suggestions for improvement, such as providing more capacity for incident and near-miss investigation, stimulating a safety culture that recognises the need for evaluation, and getting partners from the chain to sit around the table to discuss safety.

The fourth conclusion was that too little attention is paid to learning from incidents and there are different views on how big the role of safety advisers in learning from incidents should be. The respondents to the questionnaire were critical of their involvement and impact on the learning process. Most did, however, indicate they are sufficiently involved in the learning process in

SAFETY 19

WWW.HCBLIVE.COM

their organization (especially at the reporting, registration and incident investigation steps), but there were also many who felt that they are not sufficiently involved.

Most respondents indicated that they have little influence on the learning process in a broad sense, although the focus group discussions revealed that the participating DGSAs see a role for themselves in the learning process, even if there were different views on how big that role should be. Some DGSAs indicated that they are actively involved in one or multiple steps in the learning process, though it seems that the leading role is usually played by the health, safety and environment (HSE) manager or another department within the company. Some DGSAs felt they had an important role to play in coordinating the learning process.

All participants in the focus groups agreed that they should not be solely responsible for

implementation of all steps. Learning is something the entire organisation must do and in which management also has an important role to play.

The majority of participants in the questionnaire and focus groups indicated that - at least in broad terms – more attention should be paid to learning from near-miss incidents. There were different views on how much attention should be given to training for incident investigation. There are doubts whether DGSAs should conduct research themselves and whether they can learn to do so in a short time.

Finally, DGSAs (and companies in the transport sector in in general) can learn more from each other, by getting more information about incidents. Most DGSAs agreed and do talk together about incidents and near-misses that take place within the organizations where they work. They also receive information from

VVA, at least occasionally, about incidents and near-misses that take place in other organisations (when they are members of VVA) or through other sectoral or business associations to which the organisation is affiliated.

In the focus groups, all safety advisers expressed a desire for more sharing of information about incidents with each other. They also identified a need for more transparency, feedback and consultation with the government. Two-thirds of those surveyed said they rarely or never receive general information from the government about incidents.

WHAT’S TO BE DONE

RIVM’s study came up with a number of recommendations. Firstly, to prevent incidents in the future and thus to promote the safety of the transport of dangerous goods, it is important that attention is also paid to learning from near-misses.

In order to effectively learn from incidents and near-misses, it is important that the entire learning process is completed, including the evaluation step.

VVA, industry associations and government departments should discuss how it can be demonstrated that DGSAs are fulfilling their responsibilities in terms of learning from incidents. They can also play a role in facilitating meetings between DGSAs to exchange information and share their experiences and learnings. A structured method of disseminating information to the wider industry community would also help. It would be worth investigating whether a platform can be established for the anonymous reporting of incidents and near-misses in the road and rail modes, following the example of the Platform Zero Incidents system already in place for inland waterway transport.

Ultimately, RIVM says, by at least focusing on the main points in the training spend on learning from incidents, DGSAs can make a greater contribution to the learning process. RIVM’s final report, in Dutch, can be downloaded at www.rivm.nl/bibliotheek/ rapporten/2023-0211.pdf.

20 SAFETY HCB MONTHLY | SEPTEMBER 2023

TRIED. TESTED. TRUSTED.

Peace of mind counts for a lot, which is why you need parts you can rely on. Fort Vale are the worlds’ leading OEM manufacturer of safety equipment used on T50 tank containers, and the parts we supply are proven, reliable and have an exemplary safety record.

Our range of 80mm internal gas relief valves can be supplied with or without a burst disc holder and the valve can be serviced without special equipment.

The valve is located on the top of the tank in the gas phase and is designed to relieve any accidental over-pressure, including fire. The valve will operate manually if its port is covered in ice due to harsh weather, and the main seal can even be replaced in-situ without taking the valve off the tank.

We also manufacture and supply gas & liquid phase discharge excess flow valve assemblies, suitable for side or rear installation. We offer all necessary ACME fittings for connecting the tank container to the process pipework. Choose peace of mind. Choose Fort Vale.

FORT VALE.

FOLLOW THE LEADER.

Visit us at www.fortvale.com ®

CHANGE MANAGEMENT

and conducting SIRE 2.0 inspections, this time without our support, so we can really interrogate how user-friendly the system is and – of course – collect feedback and opinions through the Suggestions for Improvement function within SIRE 2.0 and in our follow-up sessions.”

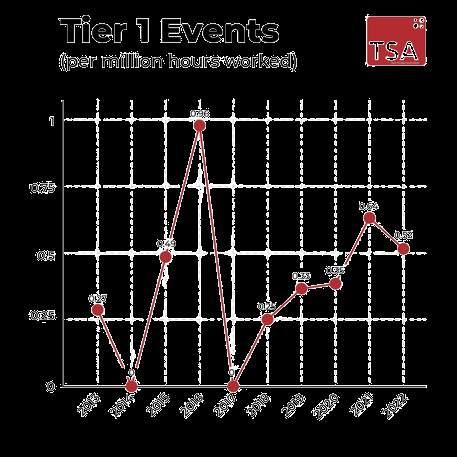

THE OIL COMPANIES International Marine Forum (OCIMF) has successfully completed the first of four planned phases of the roll-out and testing of the digitalised tanker inspection regime, SIRE 2.0, which will replace all existing SIRE inspections for tankers. Phase 2 of the transition is now underway, with invited programme users testing the entire end-toend SIRE 2.0 inspection process with minimal support from the OCIMF Secretariat. Ship Inspection Report (SIRE) inspections are widely used by the marine industry to assess vessels’ safety levels and operational performance. As a digitalised inspection programme, SIRE 2.0 will, OCIMF says, transform the way those inspections are carried out, with OCIMF-accredited inspectors completing a bespoke risk-based inspection questionnaire (CVIQ) using a tablet device rather than a static paper questionnaire. This means no two inspections will be the same and vessel operators and crew must be prepared to respond to any question within the SIRE 2.0 Question Library.

SIRE 2.0 also has an increased focus on assessing the human element, as well as the option for vessel operators as well as inspectors to submit photographic and documentary evidence. It also introduces the ability for inspectors to highlight how crews have exceeded expectations.

PREPARE FOR CHANGE

Aaron Cooper, programmes director at OCIMF, explains the process: “We are transitioning to SIRE 2.0 over several phases as we recognise that moving to a digitalised regime with new processes and procedures is a significant change for industry and it needs to be done very carefully.

“Phase 1 – where a limited number of invited parties conducted SIRE 2.0 inspections with the support of our project team – was a great success overall and we have been able to gather crucial feedback and recommendations from participants,” Cooper continues. “Phase 2, which is now underway, sees a greater number of participants involved

OCIMF has been actively engaging with industry through industry engagements and training sessions and is urging all programme participants to ensure they are fully familiarised with all documentation relating to SIRE 2.0. The organisation stressed that all parties involved in a tanker inspection, including captains and crew, should be familiarised using the training resources provided by OCIMF. Particular attention should be paid to the document SIRE 2.0 Conditions of Participation, Policies and Procedures. All these documents can be downloaded at www. ocimf.org/programmes/sire-2.0.

“It is imperative that, when the time comes, all users of the programme take the opportunity to participate in Phase 3 – when all programme users will have the opportunity to conduct a SIRE 2.0 inspection to test their own readiness,” Cooper adds. “When SIRE 2.0 does fully ‘go-live’ at Phase 4, the existing system, VIQ7, will be withdrawn. Operators, programme participants and recipients really should take the opportunity to test their readiness before SIRE 2.0 becomes the commercial tool. They need to be preparing and familiarising themselves with all of the materials now.”

All companies engaged in the SIRE programme will be provided with ample notice before Phase 3 is activated. Phase 3 will provide all programme participants with the opportunity to conduct SIRE 2.0 inspections for familiarisation and testing purposes, while VIQ7 will remain the commercial inspection programme throughout Phase 3.

More phase-specific information will be provided to all programme participants in the coming weeks through the SIRE programme portal, which can be accessed via www.ocimf. org/programmes/sire.

22 SAFETY

HCB MONTHLY | SEPTEMBER 2023

INSPECTION

• IMPLEMENTATION OF THE DIGITALISED VERSION OF OCIMF’S SIRE INSPECTION PROGRAMME IS PROGRESSING, WITH THE TRANSITION TO THE NEW PLATFORM NOW WEEKS AWAY

Wherever in the world hazardous materials are being manufactured, stored, transported, and used, CHEMTREC is available 24/7 to provide support needed to manage incidents.

We are always here, always ready, whenever and wherever you need us.

50+ YEARS assisting the hazmat and dangerous goods industry Learn more at chemtrec.com/hcb Our Worldwide Services Emergency Response • L1 Emergency Phone Number • (Local and Global) • L2/L3 Services Battery Compliance • L1 Emergency Response • CRITERION® Battery Test Summary Service • Online Training Incident Reporting • 5800 Form • Incident Report Distribution Consulting Solutions • Crisis Management • Business Continuity SDS Solutions • Access • Distribution • Authoring • Indexing Training • Online Hazmat Training

24X7 WORLDWIDE SUPPORT CUSTOMERS IN 120+

SUPPORT 14,000+

INTERPRETER SERVICES

By the NUMBERS

COUNTRIES

GLOBAL BUSINESSES ANNUALLY HANDLE OVER 100,000 CALLS AND 4,000+ MEDICAL CALLS COVER ALL 9 CLASSES OF HAZARDOUS MATERIALS

FOR 240+ LANGUAGES

ROAD TO ZERO

a much more arduous and laborious path. Once all possibilities to reduce emissions by technical means have been exhausted, projects to compensate for greenhouse gas emissions are justified. These projects, however, need to be carefully evaluated on the basis of established standards of quality and, ideally, one’s own assessment.

Active commitment to more sustainability pays off and is reflected in the rankings on rating platforms such as the Carbon Disclosure Project (CDP) and EcoVadis, which are also used by customers from the chemical industry. Site assessments under the terms of the Safety & Quality Assessment for Sustainability (SQAS) programme play an important role for the chemical industry. Such assessments can verify that work processes are continuously being improved to protect employees, the population and the environment.

For logistics providers, four fields of action are key to becoming more sustainable: process efficiency, energy efficiency, research and innovation, and social commitment beyond the company. From the perspective of a customer as well as a service provider, continuously increasing the efficiency of logistics processes - for example, through the use of artificial intelligence or internet of

THE CHEMICAL INDUSTRY is central to Europe’s - and Germany’s - technological sovereignty. Almost all industries depend directly or indirectly on the chemical industry and its products, processes and procedures, as it is the first link in many supply chains. In other words, future-proofing the chemical industry means future-proofing Europe and Germany as a business location.

It will require a great deal effort to enable this industry, which is responsible for about 5 per cent of Germany’s CO2 emissions (according to calculations by the German Chemical Industry Association VCI), to achieve the goal of net zero emissions by the year 2050 in accordance with the EU’s Green Deal. At the top of the agenda are the transition to green energy sources, increased use of renewable raw materials and better product life cycle management. Also crucial are

sustainable upstream and downstream processes, including logistics in particular.

Transformation at any cost - for example by paring back fundamental logistics servicesis not an option. On the contrary, the number of road, rail, air and sea transports is expected to rise. This means that it is vital to exploit the technologies available so as to increasingly reduce logistics services’ climate impact and in this way optimise customers’ logistics balance sheets with regard to their own sustainability goals.

REAL-LIFE REDUCTIONS

Offering ‘climate-neutral’ logistics by means of carbon trading is certainly not a sustainable long-term solution. It helps neither the climate nor energy- and emissions-intensive companies. What matters is that emissions actually be avoided and reduced, even if this is

24 HCB MONTHLY | SEPTEMBER 2023

SUSTAINABILITY • THE CHEMICAL INDUSTRY IS PLACING INCREASINGLY STRINGENT SUSTAINABILITY DEMANDS ON ITS LOGISTICS PARTNERS. DACHSER’S MICHAEL KRIEGEL* CONSIDERS THE WAY AHEAD

things (IoT) applications - is an important lever for reducing greenhouse gas emissions. Other effective tools for optimising process efficiency are maximum truck capacity utilisation, such as through the use of mega-trailers and longer trucks, intentional avoidance of empty-truck kilometres, and the deliberate use of multimodal transport in combined transport.

PRACTICAL STEPS

Wherever possible, priority should be given to energy efficiency and the use of renewable fuels. For example, all Dachser logistics facilities worldwide run completely on green power. At the same time, the company is expediting investment in photovoltaic (PV) systems on its own buildings. LED lighting, battery-powered ground conveyors, and low energy consumption through heat recovery also go a long way towards meeting efficiency goals. Electric trucks and cargo bikes are already used as standard for zero-emission

deliveries of all non-chilled shipments in precisely defined city-centre areas. By the end of 2025, Dachser will have implemented this concept in 24 major European cities.

The third field of action, research and innovation, focuses on preparing the zero-emission logistics of the future. At three e-mobility locations in Germany, zeroemission vehicles in short- and long-distance transport as well as charging infrastructures are being tested. Since efficiency also reduces emissions, digitalisation and AI-supported process optimisation play an important role as well. The Dachser Enterprise Lab was launched for this purpose with the help of Fraunhofer IML. It focuses on innovations that make the flow of goods and the associated processes more digital, more efficient, and more sustainable.

After all, social activities beyond the company’s business-related and geographical sphere of influence also play a role in making a company sustainable. In this fourth field of

action, Dachser focuses on its collaboration with childrens’ aid organisation Terre des hommes. The protection of natural resources takes centre stage in these projects. Besides actually helping children, this protection is especially important in developing and emerging countries, as they are strongly affected by the effects of climate change.

To recap, a logistics provider can do its part to promote sustainability and mitigate climate change in these four key fields of action. However, the road ahead is still long. For example, as things stand today, it is expected to take another 15 to 20 years before all diesel trucks on the road have been replaced. Climate action therefore requires a lot of staying power and, above all, a joint effort from all market participants: customers, logistics providers, transport partners, and carriers.

*Michael Kriegel is department head of Dachser Chem Logistics. www.dachser.com

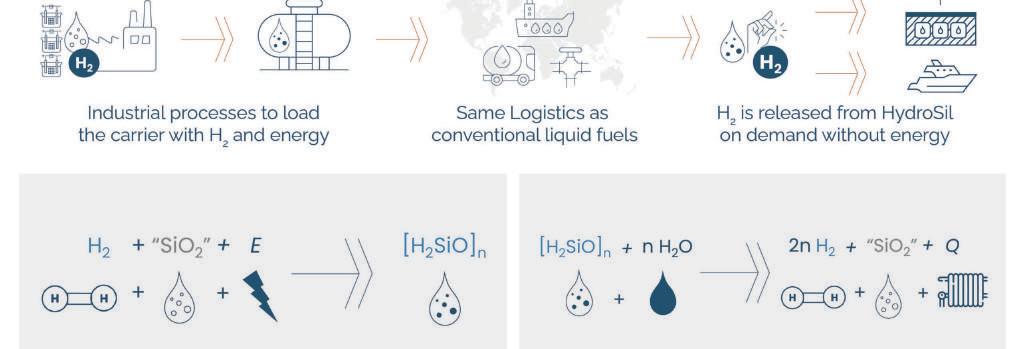

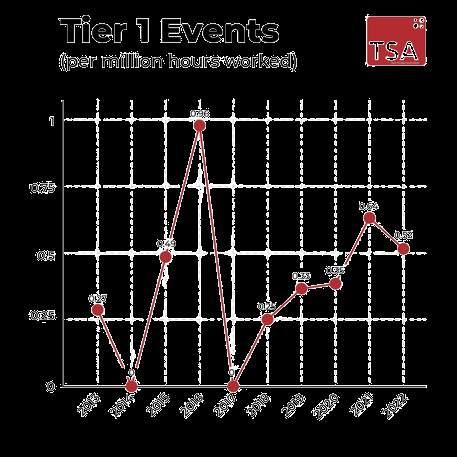

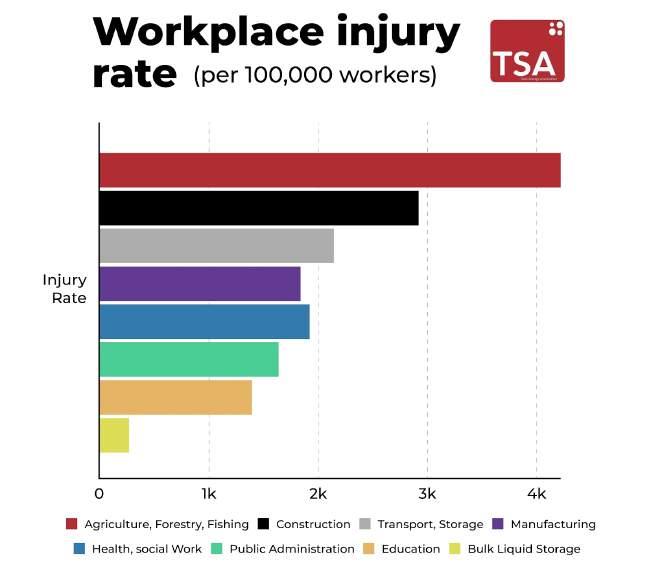

Your tank container experts