A grandfather of mine spent much of his life working in the transport industry. He reckoned it was safer than going down the pits and, while he would have preferred a career in one of the professions, he didn’t have the Latin for it.

In those days, many companies with large needs for transport services ran their own truck fleets. Independent transport firms might have had some contract work but a lot of their business involved spot loads.

One of my grandfather’s sons, an uncle of mine, followed him into the haulage trade, although by then he reckoned to be in the business of ‘distribution’ rather than ‘transport’. That reflected the trend among consumer-facing industries towards outsourcing their transport needs (and the labour issues that went along with them).

And his two sons – my cousins – also followed their dad into haulage, although they now call themselves ‘logistics experts’. And they spend a lot of their time not just organising transport but also looking for greater efficiencies in the overall business of transporting goods by road around Europe.

Which makes me wonder: if their kids go into the business, what will they call themselves? One thing is for sure: they will spend most of their time in front of a screen rather than behind the wheel of a truck. By the time the fourth generation gets involved, there will certainly be widespread use of autonomous vehicles in the freight industry – much of the technology is already in place, as HCB has reported over the past year or so, and regulations and insurance issues will surely get sorted out. Which might be fortunate, given the difficulty of attracting new drivers to the business.

And the transport sector is not immune to the trend

towards the automation of all sorts of jobs, with computer algorithms and robotics likely to replace many traditional roles (even, I have heard it whispered, magazine editors) in the next couple of decades.

New technologies are arriving in the freight transport industry at an ever-faster rate; in this issue alone, for instance, we cover the roll-out of a telematics solution by Swiss Railways to improve the operation and maintenance of its wagon fleet, the impending introduction of an electronic version of the European Cleaning Document (ECD) in the tank cleaning sector, the increasing penetration of electronic versions of IATA’s regulatory and guidance publications, and the use of e-learning tools by container lines to undertake the immense task of training their employees on the IMDG Code. Also worthy of note is the decision by chemical distributor DKSH to give a place on the board to its chief information officer, recognising the competitive advantage its software investments provide it in the current market.

Probably the biggest problem facing transport companies (or logistics service providers, if you prefer) today, both in Europe and North America, is attracting and retaining drivers. In the future, their biggest problem is likely to be attracting and retaining enough young talent to develop and implement the new technologies that will be, to a very large extent, running the business.

That means transport companies need to start thinking now about the skills that they will need and, perhaps more crucially, the image the industry presents to young people. It might be time to smarten up!

I think my grandfather would have been happy with that.

Peter Mackay

Cargo Media Ltd

Marlborough House 298 Regents Park Road, London N3 2SZ www.hcblive.com

Peter Mackay

Email: peter.mackay@hcblive.com

Tel: +44 (0) 7769 685 085

Stephen Mitchell

Email: stephen.mitchell@hcblive.com Tel: +44 (0) 20 8371 4045

Brian Dixon

Designer Natalie Clay Commercial Managing Director

Samuel Ford

Email: samuel.ford@hcblive.com Tel: +44 (0)20 8371 4035

Ben Newall

Email: ben.newall@hcblive.com Tel: +44 (0) 208 371 4036

Sam Hearne

Email: sam.hearne@hcblive.com Tel: +44 (0) 208 371 4041

VOLUME 39 • NUMBER 02

HCB Monthly is published by Cargo Media Ltd. While the information and articles in HCB are published in good faith and every effort is made to check accuracy, readers should verify facts and statements directly with official sources before acting upon them, as the publisher can accept no responsibility in this respect.

ISSN 2059-5735

Letter from the Editor 1

30 Years Ago 4

The View from the Porch Swing 6

Build high, sell low Tank container fleet keeps growing 9

Behind the wheel ECTA addresses transport problems 10

Generation game Bertschi plans succession 15

Ask the expert Orbit on electronic VMI 16

First and last Safety is paramount for H Essers 18

The gas man cometh EWS on need for gas measurement 20

Talk to the tank

Implico copes with legacy issues 22

The live rail Savvy connects Swiss railways 24

Keep dry in Duisburg Greiwing invests in bulk handling 25

Safe and secure

BDP focuses on cyber threats 26

News bulletin – tanks & logistics 28

Out of the clouds

IATA goes electric 30

Cool flyings

Jettainer’s cool chain service 32

News bulletin – DG by air 33

Shopping spree Brenntag opens its wallet 34

Geared for growth

Azelis consolidates US business 36

Safic-Alcan heads into specialities 38

Univar expands in personal care 39

Committed to the west Nexeo strengthens oil links 41

News bulletin – chemical distribution 42

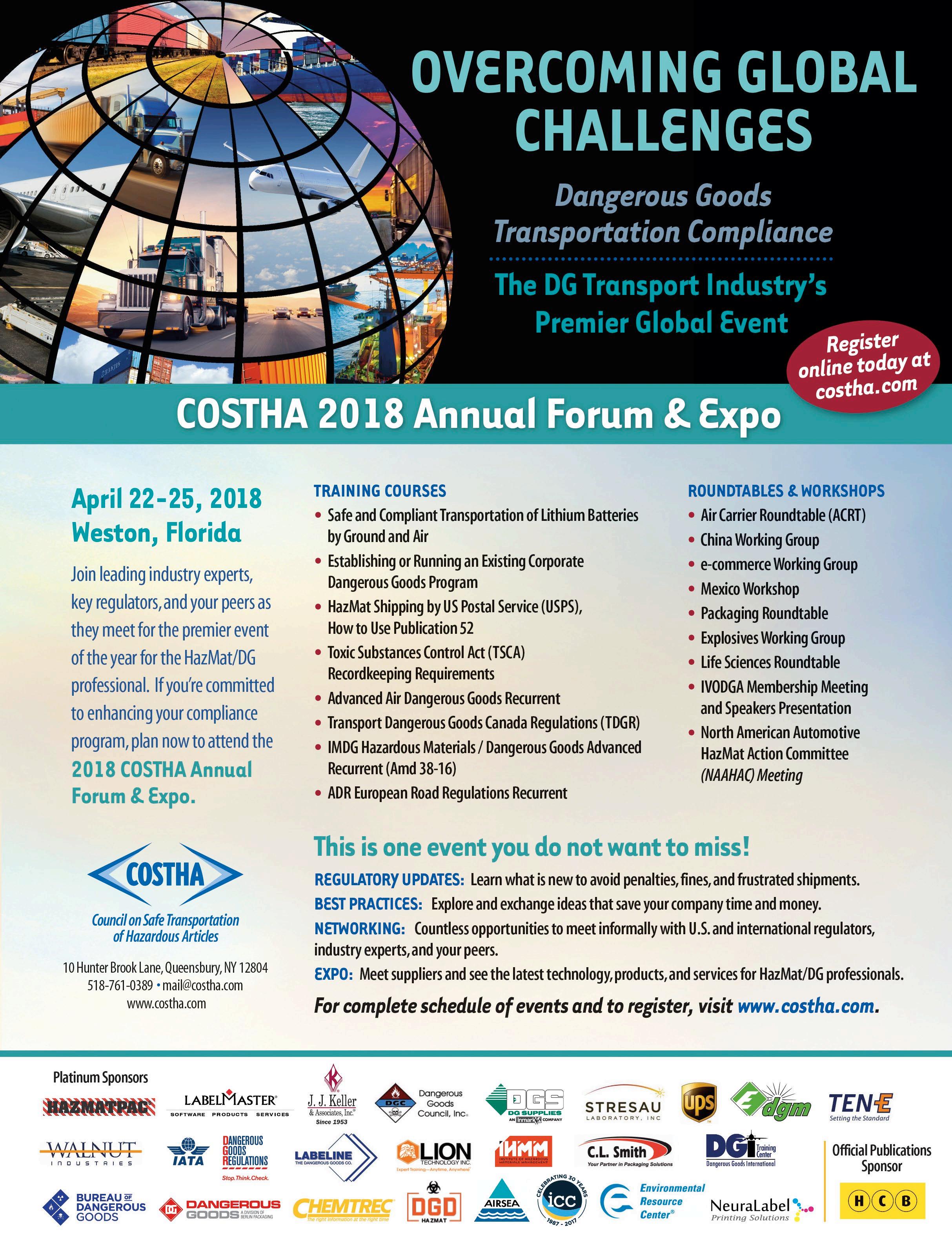

Training courses 44

Learning by training 48 Trained to comply MSC does IMDG online 51

Conference diary 52

SAFETY Incident Log 54

A bad connection CSB on unloading hazards 56 Click and collect Pharox leads on database management 58 News bulletin – safety 59

Go your own way

Struggle to harmonise the rules 60

Off-road trails

Germany enforces modal shift 68

On the road again Labeline plans for 2019 update 70

Not otherwise specified 72

Bulk liquids storage market update

Annual IBC manufacturing survey

Focus on chemical distribution in Asia

Latest moves in gas shipping

Sometimes when we look back at what we were writing about thirty years ago, one cannot help but feel a sense of sorrow at the hours of wasted effort that went into developing new regulatory provisions that, however sensible they might have seemed at the time, have since been superseded.

That was surely the case back in February 1988, when HCB reported on the outcome of the December 1987 meeting of IMO’s Marine Environment Protection Committee (MEPC), where a longstanding logjam over the selection of marine pollutants under the IMDG Code had at last been cleared. One outcome of that was the agreement of the new mark for marine pollutants: the ‘fish and chips’ triangle.

The concept of identifying marine pollutants has stuck with us but there are constant discussions about specific aspects and substances and, for some reason we fail to recall, the mark was eventually declared unsuitable and replaced with the rather more apocalyptic ‘dead fish and tree’ mark now in use.

During 1987 MEPC, in cooperation with the CDG Sub-committee, had gone a long way to establishing the ground rules for the new Annex III to Marpol but it was clear from the February 1988 issue that there was still work to do to get Annex II fully adopted – and some of its provisions are still not fully in place even now. An interesting piece by HH ‘Curly’ Cail looked at the number of legislative changes that the UK was having to make and the operational arrangements that needed to be put in place at the ship/shore interface.

The February 1988 issue was something of a regulatory smorgasbord, morphing in the turn of a page from the IMDG Code and the IBC and BCH Codes to the latest amendments to the tank provisions in ADR and RID. This took the form of two pages of changes arranged by Marginal – how happy we should all be that we do not have to wrestle with those any longer!

Following that, regular contributor HJK reported on the steady progress being made in the revision of ADR and RID, not least in terms of coping with the need to regulate those new-fangled IBCs. Perhaps irked by the fact that he only had three pages’ worth of contribution in this issue, HJK also sent a letter, warning against the possibility that the European Commission would meddle in the well established system of regulating dangerous goods in transport. That is an idea that cropped up every so often and was normally headed off at the pass; HJK felt that the Commission was prone to confusing regulations for transport with those for supply and use, something that is less likely since the agreement of GHS.

The final item in the February 1988 issue, again on the subject of regulations, was another letter, this from Kaye Warner, head of the Dangerous Goods Section at the UK Civil Aviation Authority. She wanted to alert readers to the fact that a couple of new entries in the Dangerous Goods List in the latest IATA DGR (ID 8035 and 8036, Extracts) did not appear in the ICAO Technical Instructions; anyone using those entries would therefore be in contravention of national legislation and subject to legal penalties.

There are lots of ways to define risk. Most, if not all of the ways involve incorporating the probability of something bad happening. Some of the ways also incorporate assessment of the potential consequences should the something bad actually happen. The defining of risk, and the actual calculations of risk, can be interesting topics, and relevant ones, too. Safety regulations sometimes demand that those regulated assess risks and design programs and procedures to lessen risk. But for all the variants of risk and its application, one thing is quite clear. Risk and hazard are different things.

Transport regulations recently regained an appreciation for the distinction between hazard and risk, and are tightening up their usage of the terms. For example, we’ll no longer have subsidiary risks, but instead subsidiary hazards. This makes some sense, as, roughly speaking, hazards are the bad properties of things (materials, goods) and risks are the likelihood and consequences of those bad properties

causing problems. And transport regulations generally require that those regulated assign hazards, but leave the risk assessment to the regulators.

The US Department of Transportation is good at making clear the differences in roles. Shippers are to determine hazards by applying objective (usually) criteria to what they want to have transported. The Secretary of Transportation determines what is reasonable or unreasonable risk by setting those criteria, and by determining how much packaging/containment and hazard communication each hazardous material requires.

Shippers do not get to decide what an acceptable level of risk is for a liquid that may catch fire easily, and do not get to determine which flash points and boiling points get treated as dangerous. Instead, shippers identify hazards by measuring FPs and BPs, and applying them to the regulatory criteria, and the packaging and/or quantity limits applicable to those ignitable liquids have been pre-determined by the

regulators. Because a PG I material poses a greater risk than a PG III material, stronger packaging must be used. A shipper does not have the freedom to make their own risk determination and decide that PG III packaging will be fine for a PG I material.

All this does make it easier to train on DG regulations. Less decision-making, and more ‘just follow the rules’ simplifies things somewhat. More importantly, though, it makes the outcomes much more uniform, and likelier to be safe.

Recently though, at conferences, meetings, summits, and symposia, I’ve been hearing more discussion of putting transportation riskassessment tools in the hands of the regulated. Proponents argue that excellent tools, properly applied by caring, competent personnel, will reduce risk for everyone. Maybe I’m lazy, or maybe just jaded, but I’m not in favor of moving risk assessment out of the realm of the regulators, into the hands of the regulated.

I once worked for a company that was undergoing a lengthy and ponderous merger. As some milepost in the process was passed, we were finally allowed to reach out to our counterparts in the other company. Only we couldn’t find their DG compliance folks. Our waste department found their waste department. Our air emissions group found their air emissions group. But no DG to DG connection was possible. Why not? Their company had made a conscious decision not to have a DG compliance person, because paying occasional fines was cheaper in $, €, ¥, £, than paying a person to oversee compliance was. And truly, they did pay fines on a regular basis, just not huge ones.

Do we really want that company, whose economic assessment of safety and compliance was no more sophisticated than ‘fines versus salary’ to have authority to make decisions about aviation-related transport risk, no matter how sophisticated the risk-assessment tools we can provide them are? Shouldn’t they already have earned our distrust? What makes us think they’d even try to use the tools?

And there’s the radioactive banana to consider. Or more accurately, consider the man who raged about small amounts of radioactivity. After his company took over my company (neither of us actually owned the multi-billiondollar companies), he was beyond irritated that we complied with the excepted package of radioactive materials regulations, and worse, seemed to expect him to do so, also. Showing him the regulations didn’t help, and showing him how many of our suppliers complied didn’t help. Each just seemed to raise his blood pressure. And eventually he exploded.

“This banana is radioactive! And this apple is radioactive”, he shouted. (Yes, it had started as a lunch meeting.) “And you’re radioactive, and I’m radioactive, and everything’s radioactive”, he raged. “I do the risk assessment for this company, and I’ve evaluated these ionizing smoke detectors, and I’ve assessed these anti-static devices, and their risk is minimal, absolutely minimal. We will not waste our time nor resources complying with these asinine regulations. I make the risk decisions now, I am the authority here, and we will NOT be treating these materials as regulated in any way”, he concluded.

Nothing helped. Even our most gifted diplomat couldn’t convince him to even temporarily comply while we offered to seek to have the regulations changed or to get a waiver. And there was too much of a higher level turf war going on for our VP to have his VP even listen to our complaint. So, the new combined company didn’t comply. Well, that’s not entirely true. Our old company divisions complied whenever we could do so behind his back. And eventually I voted with my feet, and got the heck out of there.

Do we really want companies undergoing high level territorial disputes to be given the responsibility to make transportation risk management decisions when they might be too ‘otherwise occupied’ to do so? Do we want each insecure, corporate risk manager to use her or his ‘common sense’ to decide which level of low risk is equivalent to no risk?

Yes, I’m radioactive, and so is that damn banana. But we’re at background level, and those ionizing smoke detectors are significantly above background. If the DG regulations continue to tell us exactly how far above background an acceptable risk is, anyone who makes even a half-hearted attempt can probably safely comply. But if we leave it in the hands of the regulated community to determine how far above background an acceptable risk is, the accountants and the political animals and self-righteous egotists will be making unsafe decisions for all the wrong reasons, placing lots of us in jeopardy, no matter how wonderful the available risk-assessment tools are.

Attention: Regulators! Yes, I can determine what a reasonable risk is, but I’m asking you not to let me decide. Don’t let any individual person or company decide. Let’s all do it together during the rule-making processes, and then enshrine those group decisions in ironclad regulations. That is essentially what we try to do now, and although what we do now may not be perfect, it could be so much worse.

P.S. I ate that radioactive banana.

This is the latest in a series of musings from the porch swing of Gene Sanders, principal of Tampa-based WE Train Consulting; telephone: (+1 813) 855 3855; email gene@wetrainconsulting.com.

“SHIPPERS DO NOT GET TO DECIDE WHAT AN ACCEPTABLE LEVEL OF RISK IS FOR A LIQUID THAT MAY CATCH FIRE EASILY”

tank containers that had been held in depots and manufacturers’ plant last year are entering service.”

Tank container output could rise further this year. Lee notes that a number of new manufacturing plants are due to open in China and eastern Europe during 2018, although he has not yet been able to determine the size and quality of these new facilities.

GLOBAL OUTPUT OF new tank containers in 2017 is estimated at 48,500 units, according to Reg Lee, who has been tracking fleet developments for many years. Lee’s sources among tank producers indicate that the five main Chinese manufacturers built 40,100 new tanks, with another 5,400 coming from South Africa.

These figures suggest an increase both in output and in the overall tank container fleet of nearly 10 per cent over the course of the year. “However,” Lee points out, “this was achieved not to meet market demand but rather by the tank container manufacturers in Asia dropping prices again to another all-time low just to keep their factories employed.”

Such low prices have had a significant impact: they have encouraged new players to enter the tank leasing sector; they have encouraged a number of small trucking companies to replace older tank trucks with tank containers; and they have discouraged the refurbishment of older tanks.

“The remanufacturing and major refurbishing of older tanks has almost stopped completely during the year because of the very low price of new-built tank containers being made available in the marketplace,” Lee says.

Lee, who collates the data separately from his role as president of The International Tank Container Organisation (ITCO), also reckons that between 3,500 and 4,000 tanks

were scrapped last year. Few were scrapped as a result of manufacturing faults, which pushed up the number in 2016, but many were tanks with a smaller capacity than is now common, making them less attractive in the market.

Despite this avalanche of new tank container capacity, Lee believes that the over-capacity that has bedevilled the sector in recent years is beginning to give way. “Over the last six months we have seen a big increase in the requirement for tank containers and seen customers agreeing to pay a more realistic freight for their services,” he says.

“We are now experiencing the previous over-supply situation being reversed and

Part of Lee’s remit at ITCO is to promote the use of tank containers, especially in emerging markets. “I believe it is important to demonstrate that the tank container market continues to grow,” he says.

“The Asian market will continue to be the driving force behind much of this growth as efforts continue to improve the transport infrastructure. Added to this, local authorities in Asia are now enforcing laws on waste disposal and closing cleaning depots that do not meet the new regulations. Authorities in Shanghai have shut down several facilities in the last year because they did not conform to regulations and I hope that other Asian countries continue this practice.”

Further data on tank container manufacturing and the fleet sizes of the world’s major operators and lessors will be included in ITCO’s annual Tank Container Survey, which is expected to be published by the end of February. HCB

MANUFACTURING • OUTPUT OF NEW TANK CONTAINERS ROSE AGAIN LAST YEAR, WITH INDICATIONS THAT THE GLOBAL FLEET GREW BY ALMOST TEN PER CENT ON THE BACK OF LOW PRICES

itself with road transport.

Indeed, the first presentation of the day, from Bernhard Kunz, CEO of Hupac, addressed the current and future challenges to the use of intermodal transport – especially rail transport – for the chemical industry within the EU. Or, to put it another way, as Kunz began his presentation, “Is rail freight traffic in Europe at risk?”

FOR ONE DAY each year, Europe’s chemical transport leaders gather in Düsseldorf for the annual meeting of the European Chemical Transport Association (ECTA). There is official work to be done and also time to sit and eat with colleagues and old friends in a convivial atmosphere.

There is also a conference, which takes up the larger part of the day between breakfast and cocktails. And it was this as much as anything that attracted some 130 delegates to ECTA’s 2017 annual meeting on 23 November. Those delegates represented both the chemical industry and its transport and

logistics providers, helping deliver a provoking and productive day.

The event also marked the 20th year of ECTA’s existence – a remarkable achievement, especially considering the doubts expressed as to the need for such an organisation when the subject was first discussed more than two decades ago, as Andreas Zink, director of LKW Walter and ECTA’s president, recalled in his introduction.

The transport of chemicals in Europe is these days a multimodal business. Industry has responded to political pressure to remove as much freight as possible – not least dangerous goods freight – from the roads and onto rail, intermodal waterways and shortsea shipping routes. Therefore, ECTA does not just concern

Hupac was founded 50 years ago so has plenty of experience in the ups and downs of the intermodal road/rail business. Nevertheless, Kunz said, 2017 was “a black year for rail” and a year that highlighted vulnerabilities within the current rail industry structure.

Hupac’s aim since its formation has been to invest in its own intermodal terminals and its own rolling stock. This is, Kunz said, “the only way to guarantee independence”. In the decades since, rail freight volumes have grown strongly, especially since deregulation in 2002.

However, the economic and financial crash in 2008 hit the sector hard; volumes dropped by around 25 per cent, with a consequent knock-on effect on investment in infrastructure. This led to problems on the rails, with lower profits hindering the »

EUROPE • CHEMICAL PRODUCERS ARE NOT ALWAYS UP TO SPEED ON THE CHALLENGES THEIR LOGISTICS PARTNERS FACE.

THOSE THAT ATTENDED ECTA’S ANNUAL MEETING LEARNED A LOT

sector’s ability to recover to the necessary level of investment. In turn, that led to poorer performance and lower customer satisfaction.

More recently, the pace of infrastructure investment has picked up again but, Kunz said, that has also led to disruption. The system has “no room to breathe”, he said, meaning that any engineering work inevitably causes delays.

The period since 2008 has also been characterised by consolidation, with many small operators being taken over. Nonetheless, in Germany it is still the case that 43 per cent of freight on the rails (and 60 per cent of that moving intermodally) is carried by private operators.

There has been a lot of work on the northsouth corridor during 2017, Kunz reported, but that investment has not been well coordinated, which led to a reduction in effective capacity. Then in August, groundwater broke into a new rail tunnel under construction near Rastatt, Germany, on the main line from Karlsruhe to Basel. The line had to be completely closed –unfortunately other main lines between Germany and Switzerland were also closed for engineering work.

As it happened, the impact was not at first a problem – this was the middle of holiday season and there was less traffic on the line. However, instead of being repaired in a week or two, as might normally have been expected, the track was out of action for two months.

What this event showed, Kunz said, is that DB Net, the German infrastructure manager, clearly has a national focus and is oblivious to the importance of international rail corridors. “Infrastructure managers need to improve their risk management,” he said. “Construction work needs to be coordinated on an international basis, with the involvement of transport ministries.” Basically, he said, there is a need for overall, international control of the European rail network.

The Rastatt incident also highlighted the language problem. Train drivers are required to be able to speak the local language, so normal trains could not simply be re-routed through France – the drivers did not speak French!

Assuming the lessons of Rastatt can be learned, the future of railfreight in Europe looks bright, Kunz said. There is a broad commitment to grow intermodal freight volumes and a lot of money is coming in. A move to longer trains will help further.

But he also sounded a warning: the cost of low quality is high; there needs to be a middle way between lower prices and higher quality and business associations have a role to play in navigating that path.

“Rastatt was an alarm,” Kunz concluded. “It needs a response. We don’t want it to happen again.”

An opportunity to look outside the particular needs of the chemical industry was provided by Christophe Leclercq and René Horsch, managers in the IKEA Group’s global transport department. Effective logistics is essential to IKEA’s market position and, ECTA hoped, their perspective would give some insightful lessons for its members.

Horsch explained, for instance, that IKEA is committed to decarbonisation; one element of that is greater use of intermodal transport – mainly road/rail. The share of multimodal transport in IKEA’s overall mix has increased from 9 per cent in 2011 to around 20 per cent in 2017 and, he said, it will reach 40 per cent in Europe in 2019.

IKEA has also changed its approach to the market, switching to what Horsch called a “collaborative network approach”. Rather than engaging in competitive tendering, the company opened dialogues with a portfolio of carriers, sharing information on its international flows and inviting comments and ideas. This approach aims to identify strategic logistics partners that can help develop the network and achieve the decarbonisation targets that IKEA has set itself.

This process has, Horsch said, already generated some surprising results, not least the potential offered by shortsea shipping. The connections are already there and in some major sourcing areas (especially Poland, Lithuania and Romania) are better than other multimodal options.

Horsch also said that he had been surprised by the extent and capability of telematics solutions now being offered to the market, up to and including machine learning capabilities.

IKEA is now experiencing better reliability in multimodal transport, Horsch concluded, but it needs to monitor performance and manage

its stakeholders. The company is, for instance, finding that private rail operators are more reliable and flexible than state-owned firms.

Peter Devos, joint managing director of ECTA, introduced an important work project – the digitalisation of the European Cleaning Document (ECD). Around four million ECDs are generated each year and, at four copies each, that is an awful lot of paper. But it is not just about saving trees – digitising ECDs will lead to better accuracy, better security, better data quality and easier distribution of the documents between those who need to have the information.

ECTA has been involved in the project alongside the European Federation of Tank Cleaning Organisations (EFTCO) and Essenscia, the Belgian chemical industry association. Although the concept of the ‘e-ECD’ is “not rocket science,” according to Devos, the number of parties involved has meant that it has taken a lot of organisation to get this far.

Those involved in the project identified a number of hurdles, not lease data ownership. As a result, the system has been designed

on a ‘pass-through’ basis, with concentrated access into the system but decentralised data within it.

A pilot project is expected to start in the first quarter of 2018. If the concept is proven, further investment will be necessary to allow full roll-out to start later in the year –ECTA itself needs to find €120,000 and both Essenscia and EFTCO are going to provide similar amounts. Devos estimated that it will take four years for the e-ECD to have complete coverage – there are more than 600 companies involved across Europe.

But Devos was clear that projects such as this are inevitable and he sees e-ECD as a first step towards the digitisation of all safety systems in the chemical transport chain.

That inevitability was echoed after lunch by Lars Nennhaus, head of corporate development at Duisport, who spoke about the ‘Startport’, an innovation hub for supply chains opened in October 2017. The aim of the hub will be to develop tailor-made solutions for various industry sectors, including chemicals, by leveraging IT capabilities and cooperative and collaborative agreements.

A regular aspect of the ECTA annual meeting is its discussion of Responsible Care issues and the Safety and Quality Assessment for Sustainability (SQAS) system, a key element in benchmarking Responsible Care performance in chemical logistics operations. Luc Renier,

EU transport safety and security leader at The Dow Chemical Company, explained that, while logistics service providers (LSPs) may initially see SQAS audits as a burden on their time, the results can provide the basis of an improvement plan.

LSPs can even structure their management systems along the lines of the SQAS questionnaires, which not only provides a rational basis but also makes life easier the next time an auditor pays a visit.

But shippers can also use SQAS audit results for their own ends, as Dow does, Renier explained. It uses SQAS data to help it define its relationships with its carriers – not only their head office but any depots and subcontractors that may be involved in handling Dow product.

Renier then introduced the big word: ‘sustainability’. How can SQAS play a part in a company’s assessment of its own sustainability? Renier explained that the best companies will, if not now then very soon, have to benchmark their environmental footprint against the benefit that their activities create. This will in due course inevitably involve the public reporting of emissions – future ‘licences to operate’ will be founded on this basis.

SQAS as an audit system is constantly evolving and it seems that, before too long, its questionnaires will have to address sustainability issues. How that will happen is open to question – and that question generated a lot of discussion among the audience, without much in the way of conclusion. Happily, the European Chemical Industry Council (Cefic), which manages the SQAS programme, will be starting a more formal dialogue on the topic.

More on the topic of SQAS came from Evert de Jong, joint managing director at ECTA and its Responsible Care coordinator. He reported that the SQAS questionnaires are to be revised in the first half of 2018, based at least in part on feedback from ECTA members. “Feel free to comment,” he urged delegates.

De Jong then looked in more detail at an ever-present problem: lost-time injuries (LTIs). The number of LTIs at loading sites and during transport has been falling for some time but there has been no »

corresponding improvement at unloading sites. Indeed, he reported, in 2017 two ECTA members stopped deliveries to particular sites because of their lack of action to remedy unsafe conditions. This indicates the seriousness of the situation, de Jong said: carriers do not often refuse work.

One ECTA member has calculated that drivers are five times more likely to suffer an LTI at unloading sites than during transit or at the loading site. There is, therefore, a need to focus on working conditions at (some) unloading sites. ECTA would like to have more data from its members on this issue, where there is clearly more work to be done.

De Jong moved on to the vexed issue of carbon dioxide calculation methodology. The established key performance indicator (KPI) reporting system is to be revised in light of

comments made at a Cefic-led meeting in May 2017.

The last session focused squarely on road carriers’ number one problem: the availability of drivers – or, rather, the lack of them. This is not a new issue, said Bernhard Haidacher, director of LKW Walter and a committee member of ECTA; the problem was being discussed in 2006, before the sudden economic downturn in 2008 masked the issue. But it is now getting worse.

There are a number of factors involved, Haidacher said. Increasing economic activity means there is more demand for drivers across all industries and the chemicals sector has to compete for them. The rise of internet shopping means there has been a rapid increase in home deliveries and many drivers have been tempted away from heavy, long-haul business into the cosier world of local distribution. There are regulatory inefficiencies too: working time restrictions

mean drivers can do less, especially if their ‘active’ time is taken up by road congestion, in-plant delays and increased border controls.

Cefic and ECTA have now introduced an initiative on driver shortages, looking for ideas to ameliorate the problem. Suggestions have been made to harmonise driver training programmes and to harmonise legislation across the EU, both of which would permit greater labour mobility. Action is needed on behaviour at loading and unloading sites. And there is talk of setting up a fund to attract young drivers.

A subsequent panel discussion, moderated by HCB’s editor-in-chief Peter Mackay, talked through some of these ideas in greater detail, but it was apparent from the very lively discussion among delegates that there is plenty of disagreement, not least on who will have to pay for all this. Doubtless this will be a subject of interest at this year’s ECTA annual meeting, details of which will be made available later in the year on the Association’s website, www.ecta.com. HCB

THE BERTSCHI GROUP has appointed Jan Arnet as its new CEO, with effect from 1 August 2018. He will take the place vacated by HansJörg Bertschi, the majority shareholder in the Switzerland-based firm, who is also chairman of the board.

After 30 years in the company, the past 24 of which have seen him act as chairman and CEO, Hans-Jörg has deemed it time to broaden the management base of the firm. He will stay on as executive chairman of the board of directors.

Arnet, who is 44, joined Bertschi in 2003 as assistant to the group management. In 2004 he was named as chief financial officer of Bertschi’s newly acquired subsidiary, Nordic Bulkers, based in Gothenburg, Sweden. He became CEO of the unit a year later. In 2009 he turned his attention to leading Bertschi’s market entry into the Middle East, where it now has an office in Dubai, before being appointed group CFO in 2011. Since 2013, Arnet has been heading Bertschi’s largest business unit, Liquids Logistics Europe.

“My decision to withdraw from the operational management of the company is the result of careful consideration within the board of directors and the family,” says Hans-Jörg Bertschi. “We firmly believe that this is the right step at the right time for the company, its customers and its staff.

Digitalisation and expanding markets are major challenges for the chemical logistics industry. “A broader management team will

help Bertschi stay ahead in this fast-changing environment,” he continues. “As executive chairman of the board, I will continue to work on a full-time basis and focus on the Group’s strategy and innovation projects on Group level.”

The move is also seen as an important step in securing a long-term succession plan. “We want the Bertschi Group to remain a family business,” says Hans-Jörg. “Alongside the second generation of the family, represented by my sister Brigitta BernerBertschi and myself, already three members of the third generation are currently working in first management positions within the company. Our third generation can see itself taking over the company management at a later point in time.”

The move also opens up an opportunity for a new leader to take over the Liquids Logistics Europe unit and that role will go to Santiago Gonzalez, currently head of the Bertschi subsidiaries in Spain and Portugal. Gonzalez has been with Bertschi for eight years and has more than 15 years’ experience in European liquid chemical logistics.

These management changes come at a time of growth in the group, which has expanded steadily over the past decades, not least since it launched its globalisation strategy in 2012. More than one-third of its revenues are now generated outside Europe. Group turnover increased by more than 20 per cent last year to some SFr 900m ($937m), despite the prolonged interruption in rail services on the north-south corridor in Germany due to the problems at Rastatt.

“Our prospects for 2018 are promising,” says Hans-Jörg Bertschi. “In order to meet the growing demand of our customers, we have once more decided [to make] substantial investments in expanding our logistics capacities in Europa and globally. Digitalising our business processes is another important focus for the Group in 2018.” HCB www.bertschi.com

HCB: In light of the ongoing process of digitalisation and the application of the Internet of Things, cognitive computing and blockchain concepts, what does vendor managed inventory (VMI) offer industry?

SS: Those technologies we see as ‘disruptive’ are not only on the horizon, they are here – right now and everywhere. Cognitive computing and software robots - and not forgetting blockchain – are just a few of the technologies that require a change in thinking and will redefine IT strategies.

However, disruption is defined as an innovation that creates a new market by providing a different set of values, which ultimately overtakes an existing market. In any change of this nature, responsible analytics

will identify what stays as a constant function.

The function of the industrial supply chain will stay the same - it is not foreseeable that one will be able to e-mail chemical products - as the functionality; the tools and the associated processes will not. That means that the interaction with the real physical world will also be a condito sine qua non –indispensable. Those stable functions will lead to a migration path which nevertheless will be steep and cliffy.

Will VMI as a value-adding concept make this transition?

Orbit Logistics is one of the leading international providers of inventory management solutions such as Vendor

Managed Inventory (VMI) and Supply Chain Management (SCM). The company also offers add-on solutions that automatically manage consigned inventory at customers’ locations.

Right from the beginning back in 2003, Orbit Logistics provided cloud hosting technologies and Infrastructure as a Service (IaaS) as well as Software as a Service (SaaS), helping customers decrease their expenses by reducing assets and therefore increase productivity. Our solutions are available in the cloud, so connectivity, visualisation, and customised web portals are part of our ecosystem. This helps the company to provide services of interoperability, reliable data security, and end-to-end visibility for all partners along the supply chain.

The company’s VMI system delivers inventory monitoring on site, using measurement technologies like radar for capturing bulk goods and radio frequency identification (RFID) and bar codes for packaged goods.

So are the benefits of VMI still the same? Will IoT and blockchain supersede or complement existing approaches?

VMI allows suppliers a deep insight into the supply chain, providing visibility of inventory levels in real time along with historic values. This enables demand sensing, aggregation, planning and decisionmaking when needed. Orbit Logistics also facilitates the client with a planning system, based on their consumption pattern, that creates production forecasts and allows automatic planning and execution of order placement.

Owing to these implementations, trading partners gain complete visibility along with a reduction in unscheduled or

unplanned production stops. In the light of the increased dynamics, complexity and ongoing globalisation of the supply chain ecosystem, these capabilities lead to increased efficiency and ultimately improved security of supply.

At the same time we also empower organisations with electronic messaging, along with a fully integrated solution in terms of ‘procurement to pay’ (P2P) and ‘order to cash’ (OTC).

Forging ahead, Orbit Logistics will launch a Supply Chain Finance Solution. This will adopt proven Blockchain technology based on the Ethereum network technology, known as Quorum. Combining physical signals (Proof of Existence and Quantity) with solutions as provided from Santander Group for tokenisation and de-tokenisation of Fiat money will provide a migration path for what is called paradigm change or disruption.

Ultimately the message is: ‘The king is dead, long live the king!’. HCB

*Dipl Ing Silvio Stephan is CEO and vicepresident of marketing at Orbit Logistics AG, based in Switzerland. The company’s operational headquarters are in Leverkusen, Germany and it also has offices in France, the US, Brazil and Mexico and a partner network in south-east Asia. More information on Orbit’s supply chain management systems can be found at www.orbitlog.com.

AS A COMPANY offering a wide range of dangerous goods transport, storage and logistics services, safety remains “a top priority” with Genk-headquartered H Essers. “In the world of logistics and transport, safety is something that cannot be discussed afterwards; human lives are at stake,” the company says. “Hence, H Essers focuses on the safety of its employees and visitors day in, day out. From the driver with the forklift truck in the warehouse to the management at the corporate headquarters, everybody is involved. We achieve this level of involvement, for example, by implementing lean manufacturing in the workspace, emergency exercises and safety days.”

“An organisation the size of H Essers needs a good structure to ensure that everything runs smoothly and to achieve optimal results. That is why, for some time now, we have been in the process of implementing the 5S programme, focusing on order and cleanliness to decrease wastage, to discover deviations faster and to involve everyone in the continuous process of improvement,” it continues, explaining that the five Ss in question stand for Sort, Set in order, Shine, Standardising and Sustain. “By reducing and avoiding wastage, we can also save on operational costs,” the company states.

“The next step is the implementation of the safety aspect,” it says, explaining that this,

among other things, includes the adoption of easy-to-understand guidelines for all staff; safety rules for visitors and third parties; clear evacuation plans at every entrance; and regular equipment checks. “In short,” the company states, “nothing is left to chance.”

“In order to keep the 5S+Safety philosophy alive, we have created a quarterly 5S Award, which goes to the [company location] with the highest scores on the different aspects of 5S+Safety. The actions and initiatives taken regarding safety, order in the workspace and visual management have led to fantastic results and have set the standard for best-inclass logistics,” H Essers reports, explaining that the staff at each winning location is rewarded with “something delicious of their choice”. In this way, it says, “we keep our employees motivated and safe”.

But there’s more to it than just that. “To make sure that procedures are mastered by everyone and that everyone is familiar with the procedures and knows what to do when push comes to shove, we regularly organise emergency exercises at [our] different sites,” the company says. For example, this past October the company’s tank cleaning depot in Tessenderlo in the Belgian province of Limburg ran a ‘save a man from a tank’ exercise in conjunction with the local fire brigade.

“The purpose of the exercise was to be able to react adequately if someone falls into a bulk trailer and cannot get out by himself. Both our employees and the firefighters, who had never before performed such an exercise, learned a lot from the experience, so much so that we decided to organise a similar emergency exercise every year from now on. After all, you can never be too prepared,” the company says.

Founded in 1928, H Essers currently employs a staff of 5,400 across a network of nearly 70 locations spanning 15 European countries. Serving customers from the chemicals, pharmaceuticals, healthcare and high-quality goods sectors, it boasts nearly 1m m2 of warehouse space coupled with a fleet of around 1,500 trucks and more than 3,000 trailers.

Moreover, the company, which closed its 2016 books with a turnover of €571m, continues to enhance its network and offering, most recently expanding its 33,000 m2 warehouse near the Romanian capital of Bucharest with a further 5,000 m2 of dangerous goods storage space and an additional 5,000 m2 of pharma storage. What’s more, the company has also purchased another 160,000 m2 of land at the same location to accommodate future growth, bringing the site’s total area to 260,000 m2

Executed over a period of five months at a cost of around €7m, the expansion work, the company says, “involved the strictest security standards”. Consequently, “the warehouse is not only earthquake proof in accordance with the highest standards, [but] the high Seveso storage room is also equipped with foam sprinklers and complete leak retention”. Furthermore, H Essers also maintains “a specialised fire team” that is “permanently present” at the site.

Over the past 12 months, H Essers has also “invested heavily” in upgrading its site in Wilrijk, near Antwerp. “We started with the launch of a new warehouse for highly flammable products and the construction of a state-of-the-art filling installation for filling intermediate bulk containers (IBCs) or tanks with chemicals with a high degree of viscosity,” the company reports. However, to offer customers “integrated solutions”, H Essers has also now added a tank container terminal “for the storage and heating of hazardous liquids”.

“To enable the filling of viscous products, the tank containers are heated at the tank terminal until they have reached the right processing temperature,” the company says. The installation can offer heating via steam, electricity or water as needed. “In addition, the procedures follow the highest standards

regarding safety, quality and the environment.

The semi-automatic filling installation was designed following the ISOPA guidelines and has a capacity of 45,000 tonnes annually,” it continues.

“The site stores, among other things, polyols and isocyanates and raw materials used for the production of insulation materials. Just like other raw materials, these materials can both be stored in the warehouse and processed with the filling installation,” it says. “H Essers continues to invest considerably in this chemical logistics site which, thanks to its excellent location relative to the port of Antwerp, remains highly coveted by chemical producers.”

Meanwhile, at the other end of the equation, H Essers has also signed a five-year contract to provide pharmaceuticals producer Fagron with various logistics services, including fine picking and fine packing, in Winterslag, near

Genk. “The fact that we can store and deliver both hazardous and non-hazardous goods offers great added value to this client,” says business unit manager Benjamin Hermans.

“Over the past few months we have worked hard to align all the procedures,” he continues. “During workshops with the client, we worked out their needs to subsequently transform [them] into processes for the organisation of our warehouse management system. More specifically, this entails that the products of Fagron or their suppliers are delivered to our warehouse in Winterslag.”

“There, we check both quantity and quality. Subsequently, we stock the goods, both physically and in our warehouse management system. Once the goods are stocked, Fagron can send us their clients’ orders. These are then completely picked, packed and shipped by us,” Hermans says, noting that all inbound and outbound movements “are linked to the client’s [IT] system”. HCB www.essers.com

ESSERS IS KEEN

RECOGNISE ITS EMPLOYEES

TOWARDS SAFETY IN

OPERATIONS

LIKE THE ROMANIAN

(ABOVE) THAT ARE LEADING THE WAY IN APPLYING IT SYSTEMS TO ENHANCE EFFICIENCY

AT LEAST ONE in ten of all the freight containers arriving in European ports is unsafe to enter, according to Marcel van den Brink, country manager, Netherlands for the EWS Group. And he is well placed to say: EWS is one of the largest players in the fast-growing market for gas measurement services related to incoming containers.

The problem first came to light about ten years ago, when Dutch customs officers started falling sick during container inspections at ports and terminals. At first authorities suspected that they were being overcome by fumigants in the boxes but, after investigation, it emerged that containers can harbour a wide range of gases or toxic vapours. These are generated either by

the cargo itself – commonly solvents, detergents or other compounds used in the manufacture of the goods – or by new paint or flooring within the containers.

Indeed, as van den Brink explains, less than 10 per cent of the affected boxes show signs of over-enthusiastic fumigation.

The Dutch government took the matter seriously and introduced provisions, primarily under the Health & Safety Act (Arbowet), that amongst other things require companies handling import containers to have gas inspection services in place as part of their overall risk assessment. EWS was well placed to step in, as the Netherlands-based company has had some 40 years’ experience with fumigation services.

The issue has also been recognised in France, Germany, Belgium and the UK, as well as elsewhere in Europe, and van den Brink says that EWS has begun to get inquiries

from the US. EWS has facilities across Europe, including two in the UK – at Bicester and Birmingham – with a third currently being planned.

That expansion is being driven by a growing awareness on the part of major importers, including retailers of the size of Ikea, Amazon, Lidl and others, of the risks posed not only to customs inspectors and terminal personnel but to their own employees. If not properly handled in the first instance, gas concentrations can rise again during the transport movement between the terminal and the distribution centre.

The range of gases found inside containers is remarkably broad and so EWS’s engineers have at their disposal a similarly wide range of gas detection equipment. This must be used before the door is opened and has to be able to detect the concentration of asphyxiants, toxic gases and other volatile organic compounds, and to measure whether the gas concentration exceeds the lower exposure limits. Some of the contaminants are carcinogenic, neurotoxic or teratogenic in very low concentrations and the acceptance levels can vary in different countries, so the EWS engineers have to be experts in dealing with detailed technical specifications.

Once a container has been identified as being a danger, it has to be ventilated to bring the gas concentration down to safe limits. In some cases, such as with high concentrations of carbon monoxide or carbon dioxide or low oxygen level, it is usually enough just to leave the doors open for a while.

Where less volatile vapours or gases are concerned, the gas concentration can rise quickly again after the container doors are closed. In such cases, forced ventilation will be required. EWS has a choice of systems for this purpose, including its patented ventilation doors. Depending on the nature of the gas in the box, it may be necessary to capture the vented gases in a filter system.

It is important to remember that, under the relevant legislation, companies are required to have procedures in place covering the planning for and delivery of gas measurement services. EWS knows these procedures well so is ideally placed to help. HCB www.ews-group.com

INTERNATIONAL SOFTWARE AND consulting company Implico has launched a new, more powerful tool enabling its customers to connect legacy field technology with the OpenTAS terminal management system. The new TCP-X-Unit is capable of simultaneously converting signals from three serial-linked field devices for OpenTAS.

In addition, Implico says, the solution represents yet another step toward the Internet of Things as users are able to monitor data throughput from anywhere and view the information sent most recently by the field devices.

The problem the TCP-X-Unit seeks to solve is the communication gap between legacy hardware and modern software, which makes it impossible for legacy field devices connected via serial links to communicate directly with the OpenTAS terminal management system. This usually requires an additional computer to convert the loading hardware’s legacy signals for the OpenTAS software.

The TCP-X-Unit is a new, compact solution from Implico that considerably simplifies the previously required hardware environment.

The complete solution comprises a suite that includes the powerful Matrix-504 microcomputer and suitable software developed by Implico especially for OpenTAS

connectivity. Except for this pocket-sized computer, no further hardware is required for the connection. The TCP-X-Unit converts the field device’s RS-232 signal into a TCP/ IP signal and transmits it to the OpenTAS automation processes via Ethernet protocol.

Furthermore, the TCP-X-Unit is significantly more powerful than its predecessor. “The computer has three ports instead of just one and can therefore control up to three peripheral devices simultaneously,” says Frank Petersen, head of OpenTAS Automation at Implico. This reduces the need for control hardware, simplifying the IT landscape and lowering total cost of ownership. “The box’s modern processor is also able to handle more data in a given time than the predecessor model,” Petersen adds.

Since the TCP-X-Unit is equipped with a web service for remote access, the solution also represents yet another step toward the Internet of Things. The web service makes it possible to manage, configure, update or start the microcomputer remotely via a web browser.

“The solution’s set of useful features includes data throughput remote monitoring and the ability to display the most recently sent and received information,” continues Petersen.

Should a TCP-X-Unit fail, it can easily be replaced by a low-cost backup device. Local staff do not require any specific IT knowledge to replace the box. After replacement, the preconfigured backup device is set to the failed unit’s IP address and restarted. The unit then automatically receives all the required settings and protocol information from OpenTAS and is available for use immediately. This minimises downtime and ensures a continuous and stable loading process.

OpenTAS automates the storage and transport of hydrocarbons at refineries, tank farms, and service station networks and is one of the high-performance IT solutions offered by Hamburg-headquartered Implico Group. Implico is a Microsoft Gold Partner, a Software Development Partner of SAP and a member of the Oracle PartnerNetwork. Founded in 1983, it now employs around 200 people in Germany, Malaysia, Romania and the US. HCB www.implico.com

LOADING • OLDER HARDWARE AND MODERN SOFTWARE OFTEN DO NOT SPEAK THE SAME LANGUAGE. IMPLICO HAS COME UP WITH A SOLUTION FOR ITS TERMINAL MANAGEMENT SYSTEM

SCHWEIZERISCHE BUNDESBAHNEN (SBB) had come to realise that it could optimise the operation and maintenance of its rail wagon fleet and last year issued an invitation to tender for a suitable telematics system. The tender stipulated that hardware and software with a minimum lifecycle of seven years was required for its ‘GPS rail vehicles – HW and portal solution’ project.

SAVVY® Telematic Systems AG offered a telematics system solution based on innovative hardware and software technologies tailored to SBB’s needs and was awarded the contract in mid-August 2017. Work on the track maintenance trains, switch engines and ten other vehicle types belonging to the SBB infrastructure began in October 2017.

To enable cost-efficient software operations, SBB required a ‘Software as a Service’ (SaaS) solution that also enables flexible user management, mobile access, personalised data visualisation and ad-hoc evaluations. “It was clear from the requirements that they were looking for a highly flexible and innovative system with which SBB would be able to achieve an excellent position both in the short and long term,” explains SAVVY’s CEO Aida Kaeser. “We are proud that we have more than exceeded the expectations and can offer SBB a highly automated future-proof solution which we very much look forward to expanding into a strategic collaboration.”

During the first phase of the project, SAVVY will equip 250 SBB railroad wagons with high-

performance SAVVY FleetTrac telematics units; in the second phase, up to 500 more railroad wagons will follow. The data gathered from the hardware is automated and brought together in the SAVVY Synergy Portal, the central management platform.

In accordance with SBB’s tender documents, all SAVVY Synergy Portal users should be in the 3- to 4-digit range and access distributed among approximately 50 different user groups. This allows SBB to always have access to reliable, consistent operating data and position information.

Thanks to the manufacturer-independence and high connectivity of SAVVY hardware and software, SBB infrastructure is also able to consolidate the telematics systems currently in use. Last but not least, the consistent data collected from a central location is automatically available for other business applications or effective evaluations. SAVVY

technology’s consistent data management and openness support SBB infrastructure in continuing to effectively develop its fleet management processes and the forwardlooking services based on them.

“SAVVY Synergy Enterprise Portal business intelligence has been proven to ensure a high degree of efficiency in different telematics and IT infrastructures, and across systems,” Kaeser says. “In this context, portal systems are not emergency solutions that have to compensate the lack of interface standards. Their openness makes it possible to integrate the existing components worldwide to form a comprehensive solution. And their flexibility ensures that telematics infrastructures are future-proof. Because, regardless of the future path of logistics in relation to Industry 4.0 and smart devices, our open collaboration platform, SAVVY Synergy Portal, will always be at the forefront.”

The SAVVY solution creates a basis with which SBB infrastructure is able to both continue to optimise the transparency and productivity of its fleet management for dayto-day operations but also to develop forwardlooking services tailored to the needs of its internal customers. HCB www.savvy-telematics.com

TELEMATICS • SWISS FEDERAL RAILWAYS AND SAVVY TELEMATIC SYSTEMS HAVE STRUCK A LONG-TERM PARTNERSHIP TO IMPROVE FLEET PRODUCTIVITY

GREIWING HAS FORMALLY commissioned a new warehouse in Duisburg. The 7,500m2 site offers 3,000 pallet spaces in a mobile rack as well as a 1,300-m2 packing area.

The €5.5m project was completed in only eight months but that is only the tip of the iceberg, as Jürgen Greiwing, managing director, explains: “The short construction time does not reflect the effort that we had to carry out for this project. The upstream emission control approval process was particularly complex. Among other things, this demanded the participation of the public and public authorities. In this context, for example, we held a public hearing in the spring of 2016 in the Duisburg Rheinhausen-Halle.”

The new warehouse, which has created 14 new jobs, will be mainly used for the storage of barium chloride in flexible intermediate bulk containers (FIBCs). Up to 3,000 tonnes of the product will be held at the site.

Planning for the new site also involved extensive design work, especially in respect of worker protection. “In order to be on the safe side here, we not only fulfilled all the regulations but partly voluntarily went beyond that,” explains Jürgen Greiwing. For example, the extinguishing water retention system has a significantly greater volume than was required. “In this respect, we have done everything we can to ensure that the facility cannot negatively affect either the environment or nearby residents.”

Barium chloride arrives at the warehouse exclusively in FIBCs in shipping containers, which are picked up from the Duisburg Intermodal Terminal (DIT), immediately adjacent to the warehouse. A small sample of around 500 g is taken from each batch, with the work performed in a special room equipped with high-grade ventilation and filtration systems.

Goods are dispatched in closed box trailers, using only Greiwing-owned vehicles. Transport is undertaken using specified routes that avoid residential areas in Duisburg and the neighbouring region.

“We have gained a lot of experience dealing with hazardous substances in the past and

have acquired a great deal of expertise in this field,” says Jürgen Greiwing. “Of course, we are very pleased that we can now make full use of this know-how at our Logport location.”

Last year Greiwing made additional investments in its Logport site, adding a new 45-tonne gantry crane and a container tilting platform to expand its range of services, particularly in the handling of pourable dry bulk products.

Furthermore, Jürgen Greiwing points out, the ability to provide a link between sea and land routes is important to many of the firm’s customers. “With the Port of Duisburg and a direct connection to the Duisburg Intermodal Terminal, we have found the optimum location for these services in Logport,” he says. “However, in order to be able to respond to the different conditions of the goods recipient, the last transport section usually takes place with one of our 200 silo vehicles.”

The tilting platform allow goods to be transferred from containers equipped with in-liners directly into silo tankers. The Logport site is also equipped with facilities for packing dry bulk products into smaller packagings for transport by container. HCB www.greiwing.de

US-HEADQUARTERED BDP has opened a new office location in Copenhagen, Denmark, bringing its total number of locations around the world to 145. The Copenhagen office, the company says, “is positioned strategically, catering to operations in Denmark while creating an accessible channel of service to clients based in Sweden’s southern tip [and] offering ocean and air import and export services, customs clearance, project logistics, ground transport and warehousing and distribution”.

BDP’s operations in Denmark will be headed up by newly appointed country manager Kenneth Werther. “Due to the healthy business climate of the region, the Copenhagen site is equipped to implement a

full scope of logistics services, with emphasis placed on air, ocean and solution selling for customers in the chemical, petrochemical, healthcare, energy, retail and automotive sectors,” the company reports.

“BDP is proud to announce the Copenhagen office as the newest addition to our global network and newest initiative in our collective mission to provide streamlined, international coverage,” says chairman and CEO Richard J Bolte, Jr. “The Copenhagen location expands our range of operations to better accommodate clients in Denmark and Sweden. As we strengthen our presence at this intersection of two vibrant markets, we plan to implement our full scope of logistics services at a regional and global level.”

Meanwhile over in cyberspace, BDP has unveiled a revamped corporate website.

Among other things, the new-look site features simplified navigation menus; an enhanced list of BDP’s global office locations; direct links to the company’s Smart Suite® visibility tools; and the BDP Blog, “a companyrun news and content hub” that provides “the latest information on industry happenings” as well as company events and developments.

“Social media and other mobile technologies have created smart consumers who want a company’s value proposition at their fingertips,” Bolte says. “Our new website delivers a functional interface for customers to learn about our organisation’s services and presents an aesthetic redesign commensurate to our industry expertise.”

The news comes shortly after the company achieved ISO 27001 certification – which it describes as “the strictest standard of information security” – to ensure its global import and export customers benefit from the highest levels of data protection. “BDP’s clients require assurance that their data is secure and private and that is exactly what we provide,” Bolte asserts. “The ISO 27001 certification is a major step toward protecting the confidentiality and integrity of customer and company information.”

A “stringent certification for information security controls”, ISO 27001, BDP says, guarantees “first-class standards for the identification, prevention and management of security risks”. To attain certification, the company first had to invest in an information security management system that was then subjected to an independent assessment by global standards company DQS. Importantly, the ISO 27001 certification, the company continues, covers all of its “online and vendor management services”, viz Tietan, BDPSmart, Cognos, Impax and DMS.

“The certification process requires an auditable, comprehensive, international framework for the implementation of an Information Security Management System (ISMS), which is a suite of processes and procedures concerning risks management of information security factors,” BDP says. “The ISMS incorporates widely recognised best practices for information security management into the organisation’s operations.” HCB www.bdpinternational.com

VLS Group has taken over the warehousing and logistics activities of Lanxess at its Rhein-Chemie business unit in Mannheim, Germany. VLS is now handling warehousing of raw materials and finished goods as well as internal transport.

“We are pleased to expand our activities in Germany with an additional location,” says Thomas Brakmann, general director of VLS-Group Germany. “It highlights our growth ambitions in Germany and contributes complementary to our existing chemical logistics, warehousing and transport management activities at Frankfurt am Main, Düsseldorf, Belgium and in the Netherlands.”

The deal adds 19,000 m3 of warehouse storage space to VLS’s existing capacity in the Rhein/Main region. VLS will also take on 23 Lanxess employees. www.vls-group.com

Hoyer has transferred its Foodlog operations in Bulgaria and Hungary to H&H Foodlog,

a joint venture established last November with H&S Group. Hoyer holds 49 per cent of H&H, which covers only European operations and does not incorporate Hoyer’s international and deepsea logistics operations in the foodgrade sector.

Hoyer says the latest move is a “logical wstep” to expand the cooperation with H&S. “We have already achieved a great deal in the first two months since the founding of H&H Foodlog,” says Adwin Verhoeks, the company’s managing director. “We look forward to further expansion of the cooperation.”

Ortwin Nast, CEO of the Hoyer Group, adds: “We are very pleased with the first results initially obtained. We are confident we have taken the right decision for a positive development of the liquid foodstuffs transport business.” www.hoyer-group.com

VTG has opened a new branch office for its wagon hire business in Trelleborg, Sweden, taking over responsibility for Scandinavia from

VTG Rail Europe’s headquarters in Hamburg. This office had been supported by Nordic Rail Logistics (NRL) and Danish agent Ib Pallesen. “Successful cooperation between VTG Rail Europe and NRL and Ib Pallesen over the past years has strengthened our presence in the Scandinavian rail freight market. This positive development has prompted us to expand our activities in Scandinavia even further,” says Sven Wellbrock, managing director of VTG Rail Europe. “The new office, with the well-established local contact network in Sweden, will help us in aligning ourselves even more closely with the requirements of the Scandinavian market.”

VTG has also established a new mobile services base in Hamburg, which will improve the mobile rail car service and maintenance operations of Waggonwerk Brühl. “The digital future of the wagon hire business will increasingly require mobile, flexible and foresighted operations to be performed directly on wagons and on tracks. Consequentially, ongoing network expansion measures in the form of additional service support centres are scheduled for 2018,” says Wellbrock.

VTG has also relocated its VTG Rail Europe and VTG Rail Logistics offices in Vienna to a common office. The move is designed to facilitate cross-disciplinary copperation and offer faster integrated rail transport solutions. www.vtg.com

Singapore’s GKE has established G-Chem, a new 65:35 joint venture with Kleio OneSolution that will provide dangerous goods warehousing, drumming and logistics services for packed and bulk chemicals.

“This joint venture will further strengthen the group’s hazardous chemical storage and logistics capabilities – [broadening] our range of services and [transforming] the group into a one-stop integrated chemical storage and logistics service provider to serve both the

chemical and pharmaceutical sectors in Singapore,” says GKE CEO Neo Cheow Hui. “We believe the horizontal expansion within the specialised chemicals space will augment growth in our core warehousing and logistics business.”

The two partners will invest S$460,000 ($350,000) in order to acquire four explosionproof drum filling machines and as initial working capital. G-Chem will operate from one of GKE’s existing warehouses in Pioneer Walk, Singapore, under the management of Lin Duanliang. www.gke.com.sg

Albatross Tank-Leasing has appointed Martin Peploe as its vice-president, Americas to head up its New Orleans office. Peploe is well known in the tank container industry, having previously worked for Sea Containers, ICL, TransOcean and TPI.

Albatross CEO Christoph Schoeler says: “We are very pleased that Martin is on board with Albatross and we believe his addition to our group illustrates our commitment to bring quality differentiation and customer-centric

excellence to our enterprise. This new American focus is an exciting development as it is a very important region for our future development.”

Albatross was formed in 2016 as a subsidiary of Sinochem International Logistics. It currently controls a varied fleet of more than 17,000 tank containers, including temperature-controlled and lined tanks and swap bodies. albatross-tanks.de

Nijhof-Wassink has added 50 new tank containers to its chemical logistics division, which will be used primarily on transports from the Benelux countries and Poland. The company runs nine trains per week from Pernis to various depots in Poland.

Nijhof-Wassink says the new tanks are configured to offer maximum payload and are bottom-operated to avoid the need to work at height. www.nijhof-wassink.com

Van den Bosch has invested in 42 new low-weight Renault trucks, which will be used with its liquid and dry bulk tankers and tank containers in Europe. The Euro 6 Renault Truck T delivers what Van den Bosch calls a “favourable cost price per kilometre” and, with its lightweight construction, will allow vehicles to carry a higher payload.

“We have tested the Renault Truck T extensively and it left a very positive impression,” says Rico Daandels, CEO of Van den Bosch. “We are reinforcing our lightweight strategy in the European bulk transport market with this investment. The use of lightweight equipment, such as trucks, containers and chassis, results in a higher payload, enabling the transport of more product volume.”

Last year, the fleet was extended with 40-ft silo containers, 40-ft silo tipper chassis and lightweight 20-ft liquid chassis. Investments were also made in connectivity, by equipping all trucks with a Trimble board computer and by providing a Trimble application to subcontractors.

www.vandenbosch.com

Suttons Tankers has won a 2017 Roadworthiness Award from the UK Freight Transport Association (FTA). The award recognises high standards in the firm’s fleet of vehicles and trailers and its control of safety-related defects.

“Within the measures that the FTA has, Suttons is consistently at the leading edge of roadworthiness and I’m delighted to present this prestigious award,” says FTA’s senior contract manager, Eric Higham.

“As the UK’s largest bulk chemical logistics company, we are delighted to receive this award,” adds Michael Cundy, managing director of Suttons Tankers. “We believe that we have exemplary standards of roadworthiness and vehicle maintenance which are well above industry averages, and this award backs up that view. Our team, particularly the drivers and technicians, makes an exceptional contribution to maintain our excellent safety record and this award is testament to that.”

www.suttonsgroup.com

WHEN HCB STOPPED off in Geneva last October to pay a visit to the offices of the International Air Transport Association (IATA), we were quite surprised to see the lack of paperwork sitting on people’s desks. After all, if there is one thing we all know about the ability of computers to fulfil the promise of the ‘paperless office’ it is that computers generate much more paper than humans ever can.

But, as we spoke to James Wyatt, IATA’s assistant director of dangerous goods publications, it became apparent that the paper-free environment in which he works mirrors a move towards greater use of online and electronic versions of IATA’s publications.

Indeed, at the time of our visit Wyatt was hard at work on the Electronic Flight Bag (eFB), a reference tool for flight crews that includes a condensed version of IATA’s Dangerous Goods

Regulations (DGR). This is proving very popular, he said, with Emirates airline being the first major customer. Helicopters and military operators are also very interested in this product.

Indeed, Wyatt said, publications are increasingly moving to electronic formats; including IATA’s Lithium Battery Shipping Guidelines, which draw out the relevant provisions in the DGR and present them in a user-friendly way for shippers that may often not be au fait with the DGR themselves.

That customer demand for electronic and online publications is strong should come as no surprise. Use of electronic editions not only saves time, it increases efficiency and regulatory compliance while also reducing

errors. In this respect IATA is no different to any other information provider.

Acceptance personnel can look forward to great things from another current project, DG AutoCheck, the aim of which is to reduce the burden of repetitive work and increase efficiency – and, most important of all, safety. After all, the current paper checklist for acceptance personnel has 53 questions for each shipper’s declaration (DGD)

In this new system, each DGD can be sent electronically to DG AutoCheck or can be scanned and read by optical character recognition (OCR) software. The DGD data is then verified against the DGR, providing the checker with an output of the check and an image of the package(s) or overpack(s) to support the physical check, including labelling and marking, of the shipment itself.

One benefit of doing this electronically, as DG AutoCheck is based on the XML version of the DGR, is that it automatically

IATA IS WORKING ON PROJECTS THAT AIM TO MAKE SURE SHIPMENTS ARE COMPLIANT BEFORE ARRIVAL AT THE AIRCRAFT

updated with the latest information on all regulatory items, including State and operator variations, further reducing the chances of goods being held up in the transport chain. This does, though, depend on the identity of all parties in the chain –the State of origin and destination as well as the carrier – being known.

“Industry is crying out for this,” said Paul Horner, manager of IATA’s dangerous goods standards. He believes that the system will reduce errors, halve the time taken to check documentation and give acceptance personnel more time to focus on problem shipments. It will, though, require users to perform a full manual check of a certain proportion of DGDs, to ensure that the competence of the acceptance checker is maintained.

DG AutoCheck is in final development and will be thoroughly tested in a pilot programme involving airlines, freight forwarders and

ground handlers. Formal rollout is planned for the second half of this year.

Moving towards electronic publications is all part of a broader project at IATA, known as ‘Simplifying the Business’ or StB for short. This has six elements, of which one is the electronic air waybill (e-AWB), and takes what is described as a ‘family of approaches’ across the organisation.

One of the six elements is the Air Cargo Incident Database (ACID), a project currently being explored. IATA wants to understand its members’ needs, opinions and concerns before progressing further. There is, Horner said, clearly an appetite for a single global database of air incidents but there are the usual worries about publication of such details deterring the reporting of them – it has to be anonymous. It also has to be easy to use if it is to be of value to those involved in the airfreight business.

But having the real information available, in a form that can be interrogated, would improve the management of safety.