It is common at this time of year to reflect on the events of the past 12 months and to promise to do better in the year to come. That strikes me as a fatuous enterprise: time is always on the move and cannot be put into neat parcels by arbitrary dates.

More to the point, in this increasingly globalised world, 1 January does not mark the start of the year for a large proportion of the world’s population. The date was set by the Romans (of course), who moved the start of their year from 1 March to mark the election of new consuls, and counted their years from that point. But many other cultures still start the year in March or April, to coincide with the first full moon of spring; this is the case throughout south Asia and much of Indochina, while China, Vietnam and Korea mark the new year in late January or February. The Islamic and Jewish new years fall this year in early September.

I was surprised to discover, through that impeccable source, Wikipedia, that the UK did not recognise 1 January as the start of the year until 1752; even then, many communities continued to regard 25 March as the first day, more or less coinciding with the vernal equinox and also marking Lady Day, one of the four days of the year when quarterly rents are due. And it is well known that, until the railways came along, each town set the church clock according to the position of the sun at noon.

So it is odd to think that – despite these cultural differences – pretty much everywhere these days runs on a consistent clock, using the same dates. It we did not, then computers

couldn’t communicate and GPS wouldn’t work. Air travel would be even more of a nightmare than it can already be. It’s only by having a unified approach around the world, using the same language (whether that’s computer code or – for aviation – English) that the machines that run much of our world for us can do their jobs. And as those machines take on a bigger role in organising our lives – Industry 4.0 again – then it will be crucial that they all know how to talk to each other.

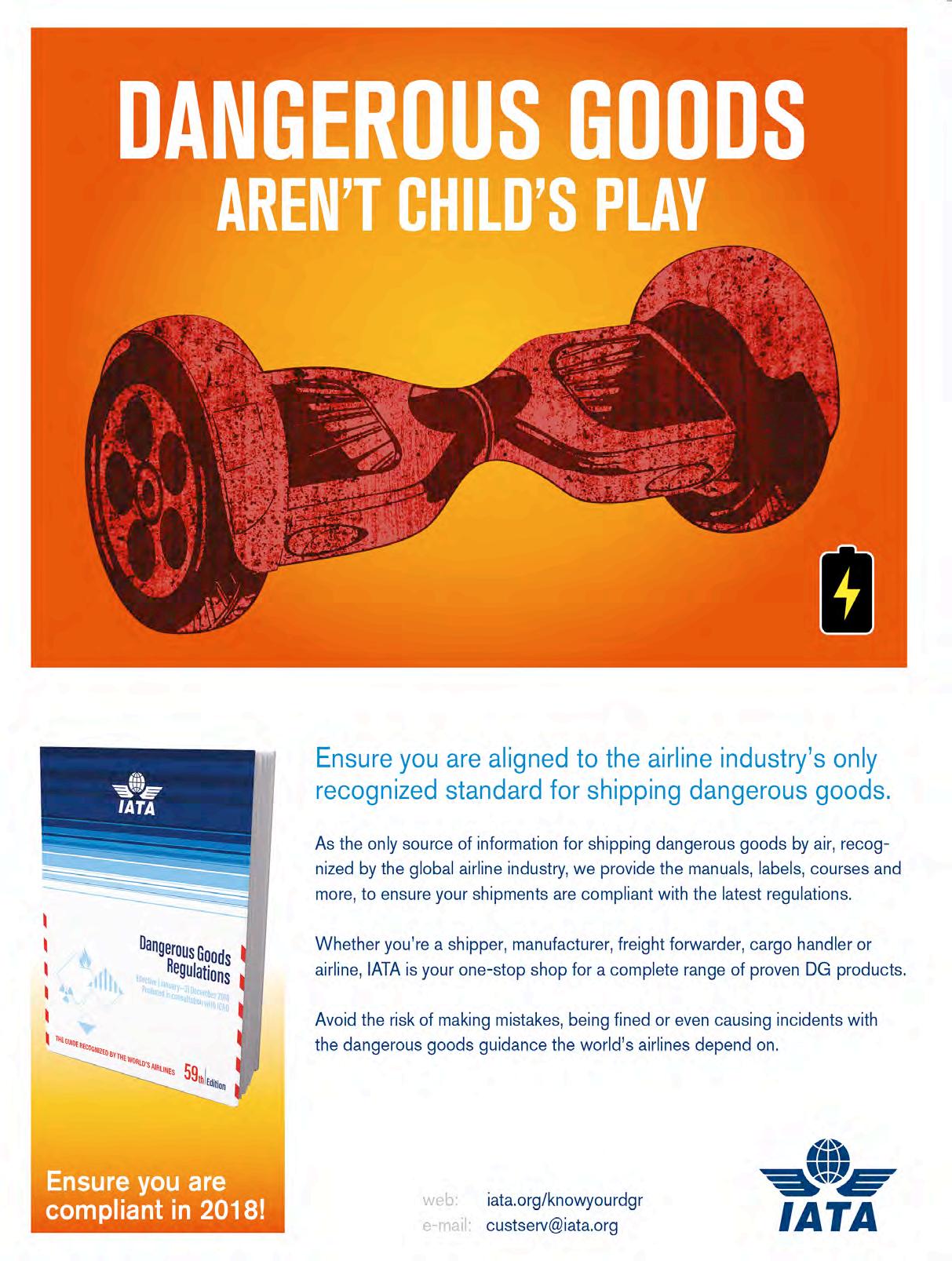

It is just the same in the world of dangerous goods (or hazardous materials – we still haven’t managed to straighten that one out). There are global standards and regulations for many international shipments, designed to allow goods – often vital to the consignor – to move seamless around the world by different modes. Those involved in such movements are (or ought to be) well aware of those standards and, by and large, seek to meet them.

Then again, dangerous goods move in large volumes on domestic trades, not least in countries with a large surface area. While the rules for such movements are often not so restrictive, they are gradually changing to come more into line with international standards.

Perhaps those involved only in local transport, when facing changes to the regulations, feel much the same as an 18th century Englishman, asked to change his idea about when the year starts. But such changes are needed if the new, interconnected world is going to work.

Peter MackayIATA’s Dangerous Goods training tackes all regulatory intricacies and propels you to the top of your field. Studies prepare you for the role of quality control spe cialist and operations guru. As a dangerous goods expert, you’ll know how to stay on top of all audits and inspections through a deep understanding of complex regulations and current training methodologies.

Complex regulatory requirements receive in-depth analysis. You’ll learn how to identify weak links in your system, focus on specific hazards such as lithium batteries and infectious substances and know how to effectively implement emergency procedures.

Discover the full industryrecognized curriculum: www.iata.org/training-dgr

Harness the proper skills to be a leader and educator. Not only will you receive the necessary technical and theoretical insight but you’ll also benefit from training that harnesses your communication, presentation and training strengths.

Designed for handling agents, freight operators and anyone interacting with dangerous good in aviation, these programs consist of four courses that can be completed over a three-year period.

Cargo Media Ltd

Marlborough House 298 Regents Park Road, London N3 2SZ www.hcblive.com

Editorial Editor–in–Chief

Peter Mackay

Email: peter.mackay@hcblive.com

Tel: +44 (0) 7769 685 085

Stephen Mitchell

Email: stephen.mitchell@hcblive.com Tel: +44 (0) 20 8371 4045

Brian Dixon

Designer Tiziana Lardieri

Commercial Managing Director

Samuel Ford

Email: samuel.ford@hcblive.com Tel: +44 (0)20 8371 4035

Commercial Manager

Ben Newall

Email: ben.newall@hcblive.com Tel: +44 (0) 208 371 4036

Production Coordinator

Sam Hearne

Email: sam.hearne@hcblive.com Tel: +44 (0) 208 371 4041

VOLUME 39 • NUMBER 01

HCB Monthly is published by Cargo Media Ltd. While the information and articles in HCB are published in good faith and every effort is made to check accuracy, readers should verify facts and statements directly with official sources before acting upon them, as the publisher can accept no responsibility in this respect.

ISSN 2059-5735

Letter from the Editor 1

30 Years Ago 5

The View from the Porch Swing 7

Thinking ahead Vopak predicts tank demand 8

Give them what they want Inter responds to customers 10

All roads lead to Rotterdam HES makes progress on projects 13

News bulletin – storage terminals 15

Take it to the streets Hoyer opens Saudi joint venture 18

Care in the community Talke applies RC in GCC 20

Going up in Chicago Odyssey expands Linden operation 21

Mos’ DEF

Blackmer has the right pumps 22

Shout out on Safety HCC promotes standards in China 24

Build a bigger barge Ineos moves butane by river 26

News bulletin – tanks and logistics 27

And the winners are…

NACD recognises excellence 29

News bulletin – chemical distribution 30

Packaging prognosis

Smithers PIRA anticipates growth 32

Truckloads of growth Greif adds to truck fleet 34

News bulletin – industrial packaging 35

Training courses 36

Learning from training 39

Conference diary 40

SAFETY Incident Log 42

Safe to ship Don’t forget the CTU Code 44

A new chapter

Pyroban prepares for change 46

Roll out the labels

FMS meets 2018 head on 47

Portal for poisons NCEC advises on poison centres 48

Messing about with boats Getting ready for ADN 2019 52

Freight all kinds

Next IMDG amendment nearly done 58 Code corrected

Last-minute corrections to IMDG 62

Calendar of regulatory meetings 63

Not otherwise specified 64

Logistics in Rotterdam

Dangerous goods by air

The latest in telematics

Focus on chemical tankers

Sponsored by Odfjell Terminals

The January 1988 issue of HCB marked a step change in design and layout for the magazine, with bolder colour and glossier paper. Perhaps the increasing number of advertisers were demanding a higher standard of reproduction – though it may just have been that the title had taken on some younger staff with a more modern eye for design.

Whatever, it was a nice chunky start to the year, kicking off with the second part of HJK’s report on the August 1987 meeting of the UN Group of Rapporteurs in Geneva – at the time the Group played a similar role to today’s UN TDG Sub-committee, preparing the amendments for adoption by the parent Committee at the end of the biennium.

While the name of the body may have changed, some of the topics remain the same: in 1987 the IMO was concerned at a lack of consistency in the design of the Class 7 placard – in particular the width of the border around the image. There was also a proposal to amend the packing requirements for Division 6.2 infectious substances and three papers from the USSR on tank containers, one of which wondered if it might not be possible to come up with a code system to describe the type of tank, similar to that used in the IMDG Code.

There was also a lot of discussion of incoming provisions for the testing of reconditioned drums, including one piece from the appropriately named (for a January issue) Vincent Buonanno, ICDR chairman. Indeed, in many ways the new provisions that were taking effect at the end of the 1980s set the framework for those that are

still with us. That included the performance testing of UN-specification packagings, both in Europe and, perhaps more revolutionarily, in the US. Producers of all types of packaging were working out how to comply with incoming rules and how to manage the regulations alongside the quality demands of their customers (and, presumably, the profit demands of their shareholders).

Another hot regulatory topic of the time was the arrival of Annex II to Marpol, which took effect in April 1987. The January 1988 issue carried a report from Rear Admiral Kime of USCG on how the US was approaching the implementation of the new provisions and, just as importantly, their enforcement. He noted that the list of chemicals being carried by sea was growing ever longer, meaning that USCG personnel had to have a deeper understanding of the business, and that there had been something of an increase in the number of older and lower quality chemical tankers calling at US ports. On the upside, he said, there were already more than 70 ports in the US complying with the requirement to provide adequate reception facilities.

Closer to home, we reported on practical difficulties being experienced by industry in applying the new Road Traffic (Carriage of Dangerous Substances in Packages etc) Regulations, which had also come into force in April 1987. In particular, there was confusion over the size and shape of the new orange-coloured plates that had to be affixed to vehicles and how to cover them up at those times when the vehicle was not carrying dangerous goods. It seems simple now but back then it was quite a novelty.

Maybe my first taste came from a bad batch. I’d been so looking forward to a frozen yogurt. I love ice cream, and I love yogurt, so why wouldn’t a frozen yogurt be spectacular? Um, cuz it tasted like curdled, lumpy, sour milk, just smoother and colder. Gross.

Every few years someone would talk me into trying another, but although none tasted exactly the same as that nasty first one, the memories invoked were always so strong I usually had to fight not to spit it out. So, me plus fro yo equaled no go.

Enter the power of free. A fancy new frozen yogurt place opened near us, and as part of the grand opening week, each customer was offered a free one. Wife and kids were excited, so I went along. I could still be the family chauffeur, even if I refused my free fro yo. The place was huge, the set-up elaborate,

and the atmosphere electric. My children were jumping up and down, wide-eyed, as if on a sugar high, before we’d even had a spoonful. Grabbing bowls, my family got creative. A layer of one flavor, a layer of fruit or nuts, followed by another flavor, topped with a scattering of sugary sprinkles or crushed candy.

Finally, the checkout counter where the concoctions were weighed and an exorbitant bill assessed. “But, but, but, …”, I stammered to the cashier, “…these are free”. “Yes”, the cashier wearily explained, “a small, plain, fro yo is free, but your family has vastly exceeded the small size limit, incurred add-on charges for the mixed in fruits and nuts, incurred add-on charges for the luxury-flavored yogurts, and incurred add-on charges for the toppings.” The charges and add-ons together exceeded the amount we paid for an entire

meal the previous time the family had gone out to eat, and this was only dessert, and without dad getting any to boot. I paid. Boy, did I pay.

Discretely complaining to my wife on the way home while the children bounced joyfully around in the back of the minivan, I muttered that I now had two reasons to hate fro yo. (BTW, has there been a competent authority determination on whether it’s fro yo, froyo, or FroYo? Sometimes these fine points elude me.) Wisely, and politely, my wife pointed out that I was still back at only one reason, as my new objection was more about the add-ons than about the fro yo itself. Yeah, I considered, she was probably right. It may be add-ons that I’m not too fond of.

Some transport regulations have add-ons, too. And for a change, I can’t point my finger

at only the US DOT regulations, because the IMDG Code, and others, do the same thing, too. IMO has us add on the words MARINE POLLUTANT to shipping documents and add on a mark to the container when a material is bad for the environment if released. We do these two add-ons whenever the material is already a dangerous good (DG). But, what do we ‘add to’ if the material isn’t otherwise a dangerous good? Well, we make it a DG, throwing it into Class 9, giving it a PSN, PG, and technical name, and then we can add “Marine Pollutant” and the diamondshaped mark.

The USA treats their “hazardous substances” and the letters RQ almost identically. If a hazardous material is also a hazardous substance (which is confusing enough), then the preparer of the shipping papers must add on “RQ” (not just near the basic description, but immediately before or immediately after), and the packer must add on “RQ” near the other required marks and labels. And analogously to the IMDG Codes treatment of Marine Pollutants (MP), the US DOT requires that a hazardous substance that isn’t already a hazardous material be thrown into Class 9 so that the add-ons can be added on.

Long before there were any Proper Shipping Names (PSNs) that began with “Toxic by inhalation…”, the US DOT required that certain ‘inhalation hazards’ have their own add-ons, a practice that continues today. For certain materials that are “toxic by inhalation”, but not for all materials that cause toxicity when inhaled (wow, again, horrendously confusing), we must add on “INHALATION HAZARD” to both the shipping papers and the package marks, and we must add “poison” or “toxic”, and an appropriate HAZARD ZONE to the shipping papers. It’s not enough for a poisonous gas, for example, that it bear a hazard label with a skull-and-crossbones pictogram and a “2” in the bottom corner, those extra words must added on. And, oh yeah, in the US, the hazard label gets a black background added on behind those skullsand-crossed-bones.

Both inside and outside the USA, materials containing extra thermal energy get add-ons, too. Depending upon the physical state at

time of offering, physical state at standard temperature and pressure (STP), flash point, and amount of thermal energy (temperature), the container might get an add-on mark that looks like a thermometer inside a triangle or an add-on mark that says “HOT” inside a diamond outline, and the documents may get verbiage such as “Hot” or “Elevated Temperature” or even “molten” added on. Of course, like the MPs and RQs, if the hot stuff isn’t already a DG, we throw it into a hazard class, usually 9 but possibly 3, and then add on from there.

There are other add-ons, too, such as control and emergency temperatures for certain self-reactives, polymerizing materials, or organic peroxides. There are ‘cryogenic’, ultra-cold warnings for some gases. There are flash point communication requirements when shipping Class 3 by water, and more. And the problem isn’t that these requirements are unreasonable, because they are justified.

It is important that people get adequate warnings to protect themselves. It’s important that emergency responders get readily available information to mitigate dangers when something is or might get free of its containment. It’s just that, well, handling them as add-ons doesn’t seem like it’s necessarily the best or most consistent way to communicate all this information.

This may be better understood if you try to construct a simple spreadsheet for transport classifications. ID#, PSN, technical name(s), Primary Class/Division, Subsidiary Hazards, and Degree of Danger (e.g. PG or category or type) seem like obvious choices for columns, and a nearly complete listing. But then, consider the add-ons. Columns need to be added for Hazard Zones, and for flash point, and for Marine Pollutant, and probably for physical state. But what do you do about things that change classification with size, such as RQ (or self-heating for that matter), or that change classification with temperature at time of offering, such as materials melted to get them into a container that may or may not be elevated temperature depending upon how long after filling the transport journey begins? All of a sudden a simple spreadsheet isn’t so simple any longer.

There’s also a point about consistency in approach that’s both philosophical and practical. Why is an MP sometimes Class 9 and sometimes not? Why can Class 9 be a primary hazard, but not a subsidiary hazard? Why aren’t Hazard Zones treated as the equivalent of “types” (like 5.2 or self-reactive) or “categories” (like 6.2) or “packaging group” (like most DG), and treated as an integral part of the basic classification? Why should Hazard Zone be an add-on, when PG isn’t? Sure, as long as the information gets communicated, we’ve got a decent system, and does it really matter if we’re ‘philosophically consistent’ in how we communicate? Well, how about the practical aspects, not including complicated spreadsheets or databases?

Both individual nations and international modal agencies are grappling with a perception (probably accurate) that DG training isn’t always well understood and applied. Is it possible that a big part of the problem isn’t just the quality of the instruction, the time allotted, and the employer follow-up, but the complexity of the material?

Is it possible that the more simple, the more uniform, the more ‘philosophically consistent’ we are, the more able students in DG courses will be able to understand the system, and more importantly, the better able to consistently apply it they’ll be? Is it possible that if we re-engineered our system a bit to reduce some of the add-ons, it would be more consistent, more understandable, and more consistently applied compliantly?

I don’t like fro yo, but I do really, really like our DG system. It’s the add-ons, though, that give me some pause, whether paying for them on nasty fro yo, or tacking them onto the framework of our basic DG classification and communication system. I can’t do much about the former, but maybe we can all weak the latter, make training simpler, and increase safety by making compliance easier to simply understand.

This is the latest in a series of musings from the porch swing of Gene Sanders, principal of Tampa-based WE Train Consulting; telephone: (+1 813) 855 3855; email gene@wetrainconsulting.com.

AS 2018 OPENED, many operators of bulk liquids storage terminals were experiencing unusually soft market conditions. This was to a great extent the result of product price trends and their effect on trade volumes and the need for intermediate storage in the supply chain. It also marked something of a shift in fortune for terminal operators, who are often insulated from the vagaries of the markets through their position as balancing points for supply and demand.

Royal Vopak, which has the most diverse network of all the major independent terminal operators, has been looking hard at the

markets that provide it with its core business and has concluded that market fundamentals remain strong and that it is well placed to benefit from underlying trends.

That analysis has also confirmed the thinking behind its strategy, developed in 2014, to concentrate on four core terminal types:

– Hub terminals in the US Gulf, ARA region, Middle East and Greater Singapore

– Distribution terminals in locations with significant structural product shortages – Gas terminals

– Industrial terminals integrated with major refining and petrochemical complexes.

As Ismael Mahmud, Vopak’s global chemicals director, explained during a presentation to financial analysts in December 2017, there are five ‘mega-trends’ currently impacting the end markets that Vopak serves, the most significant of which is increasing urbanisation – especially in China. In 1992, little more than 25 per cent of China’s population lived in cities; that proportion increased to 54 per cent in 2017 and is projected to rise to 67 per cent by 2030.

The significant factor here is that urban dwellers in China have annual income around three times that of those living in rural China, a figure that has been remarkably consistent over the years. Greater urbanisation means that personal disposable income – and, thus, consumer spending – will outstrip overall GDP, leading to greater demand for energy and chemical products.

Urbanisation across developing nations, along with demographic trends in mature markets, growing pressure for sustainable

industrial production, geopolitical changes and the impact of disruptive technologies, will drive growth in chemical demand, Mahmud said. Much of this will occur in the polymer supply chain, as emerging economies increase consumption of plastics in end market production.

The outcome of these trends will be increasing imbalances between chemical supply and demand in different regions of the world. Looking specifically at liquid chemicals trade over the next ten years, Vopak anticipates that there will be a significant increase in exports from the Middle East (up by 29 per cent) and North America (up by 500 per cent, albeit from a low base), with small export increases from Latin America and the former Soviet Union. These increases will feed rising import demand, particularly in northeast Asia (up by 90 per cent) and south-east Asia (up by 34 per cent).

Vopak believes that this outlook points in particular to the need for new industrial complexes based both on exports (from feedstock advantaged producers in the Middle East and North America) and imports, primarily in the growing end markets in Asia (especially China and India but also Vietnam, Thailand and Indonesia).

Vopak’s experience in industrial terminals goes back as far as 1973, with the establishment of the Deer Park complex in Texas, and it is currently engaged in development of the Pengerang complex in Malaysia. Mahmud said that this level of experience means Vopak is well placed to take part in any future developments, particularly given its complementary network of hub and distribution terminals.

A similar set of trends is driving the market for petroleum product storage, Hari Dattatreya, Vopak’s global oil director, explained at the same event last month. Despite pressure to reduce hydrocarbon use, oil demand is expected to continue to grow, at least out as far as 2040. While use of natural gas and

renewable sources will increase as a share of the overall energy mix, oil demand will grow in absolute terms in Asia (concentrated in China and India) for use in the petrochemical sector and for transport fuels.

As a result, global imbalances in oil product supply and demand will become more noticeable; as before, rising import demand for clean products in the Asia-Pacific region (and, to a lesser extent, in Latin America and Sub-Saharan Africa) will be met almost entirely by new export streams from North America. Vopak quoted Wood Mackenzie figures that indicate that this trend will be more significant in the ten years after 2020.

Indeed, it is the period after 2020 that holds the most uncertainties. Mature markets are likely to see greater regulatory pressure to decarbonise the energy sector and the International Maritime Organisation’s (IMO) new restrictions on sulphur oxide emissions from ships also take effect in 2020. How vessel operators will respond to those restrictions is as yet unclear: one option is to install scrubbers but this may be too expensive, depending on the cost of alternative fuels and retrofit requirements.

Ships equipped with scrubbers will still be able to burn high-sulphur fuel oil; those without will need to turn to ultra-low sulphur fuel oil, distillates (gasoil or diesel) or, more radically, liquefied gases (LNG, LPG, ethane) or other fuels such as methanol. What this means for terminals supplying marine bunker

fuels is that they will have to be able to segregate and deliver a wider variety of fuels. Many of those terminals are located in hub ports; demand for storage in those ports will also be affected by other changes in regional demand profiles and the competitive position of local refineries. Vopak has a position in all the main hub areas but, as Dattatreya explained, it is facing increasing competition from other players.

Vopak is also keeping its eyes on emerging opportunities in major markets that have a structural fuel supply deficit, where economic growth can lead directly to increasing fuel imports. In the more mature markets, refinery closures can have a significant impact on import requirements, while some developing markets – Mexico, for example - are opening up through privatisation and deregulation, raising opportunities for established terminal operators to play a part in national fuel distribution operations.

Vopak already has a presence in some of those territories and currently has new fuel import/distribution terminals under construction in Brazil and South Africa.

Overall, Vopak says, the market for oil product storage looks likely to remain comparatively soft in the short term but in the long term it will benefit from solid underlying demand. It says there will be new opportunities in the mid- to long term. Vopak also says it will update the financial markets on developments in the second half of 2018. HCB www.vopak.com

INTER TERMINALS IS due to complete the largest organic expansion of its Seal Sands terminal this month. New tanks and pipeline links have been constructed to meet contracted demand for chemical storage at the terminal, adding a total of 27,000 m3 of new capacity.

Seal Sands occupies a prime location on the River Tees in north-east England and provides easy access by road and direct pipeline to the region’s major petrochemical and industrial complexes, as well as excellent sea connections via two jetties.

“The investment at Seal Sands demonstrates Inter Terminals’ commitment to working closely with its customer base to identify and develop solutions for specific product storage and handling requirements,” the company says.

“Our Seal Sands Terminal has developed specialist expertise in storing and handling a wide range of chemicals, many of which have distinct storage requirements,” adds Paul Oseland, commercial director of Inter Terminals. “Recognising that each customer and application is different, Inter Terminals is able to apply its considerable expertise and resources to provide tailored solutions.”

The project at Seal Sands includes the construction of two 7,000-m3 mild steel

tanks with internal floating roofs and a dedicated import pipeline for receiving product into storage by sea. In addition, an existing cross-country pipeline is being redeveloped to allow the direct transfer of stored product to nearby chemical manufacturing plants.

A further three mild steel tanks, with a total capacity of 13,000 m3, have also been built at the terminal, together with interconnecting infrastructure, to enable the export of product by sea and by road via a new tanker loading facility.

The extensive design and build programme at Seal Sands is being project-managed by Inter Terminals’ own engineering division. Offering specialised engineering expertise, the company’s in-house team has a wealth of experience in the design and implementation of projects to construct, upgrade and expand capacity within its own terminals and at customers’ facilities.

Inter Terminals’ latest investment at Seal Sands forms part of a continuous programme of asset integrity management and development across the company’s European storage network to ensure facilities meet the needs of current and future operational capacity.

Elsewhere in that network, Inter Terminals recently completed the construction of six new specialised stainless steel tanks at the Mannheim Terminal complex in Germany, which are now fully operational. The company’s engineers have also been busy recommissioning old tanks and converting others to handle different products as the regional market has changed.

Inter Terminals now has a combined bulk liquid storage capacity of more than 4.3m m3 (27m bbl) at 16 wholly owned multi-product terminals in the UK, Ireland, Germany, Denmark and Sweden. These terminals, the company says, provide comprehensive storage and handling solutions for the oil, chemical, and biofuel markets, complemented with a wide range of services for the general chemical, food, agricultural and pharmaceutical sectors, including the handling and management of technical wastes. HCB www.interterminals.com

HES INTERNATIONAL REPORTS that its Botlek Tank Terminal (BTT) subsidiary, located in the heart of Rotterdam’s chemical cluster, has put 277,000 m3 of new tank storage capacity into service. After this phase of construction, BTT’s tank capacity has now more than doubled to some 490,000 m3

Work is expected to start soon on the next phase of construction, which will add another 130,000 m3 of tank capacity and, in cooperation with the Port of Rotterdam, a jetty capable of handling Suezmax tankers.

“HES International has a longstanding history and a strong track record in providing safe and reliable storage and port infrastructure at key locations in Europe,” says Jan Vogel, CEO. “Our customers are large industrial clients that count on the reliability of our services and appreciate the quality and logistical advantages of our terminals. The realisation of these key infrastructure projects is a central part of this strategy. We are equally excited that we see similar developments and opportunities at most of our other terminals.”

HES International has also acquired the Valt Asphalt Terminal in Botlek, Rotterdam. The terminal, formerly part of a joint venture between Vitol and Sargeant, provides storage, handling and blending services for the European and African

bitumen market. “This acquisition is in line with HES International’s liquid bulk strategy to expand our storage footprint in Europe,” says Paul van Poecke, head of liquid bulk terminals at HES.

“HES International is a reputable market player and we are confident that the terminal’s customers will benefit from their professionalism and the planned enhancements to the terminal,” adds Dan Sargeant, Valt’s CEO.“At Valt we are focusing on optimising the logistical services we provide to our clients worldwide.”

The terminal, located close to HES’s existing Botlek Tank Terminal and adjacent to its European Bulk Services dry bulk facility, has a storage capacity of 30,000 tonnes and a quay capable of handling the largest

dedicated bitumen tankers. HES says it will invest to upgrade the terminal, now renamed HES Botlek Tank Terminal-Bitumen, over the course of 2018 with new tanks and ancillary infrastructure.

Meanwhile, work continues on the new Hartel Tank Terminal at Maasvlakte 1, also in Rotterdam, which is expected onstream early in 2019. HES is planning to build some 1.3m m3 of storage capacity at the site in tanks ranging in size from 5,000 m3 to 50,000 m3, primarily for petroleum products. Blending and additive injection will be offered. The Hartel site will have a quay long enough to accommodate three large or five small seagoing ships, with another nine berths for inland vessels in the Hudson harbour. HES says all product movements will be by vessel, with no road or rail transport involved.

HES International currently has six operating subsidiaries, all based in Rotterdam; three are involved in bulk liquids storage and three in dry bulk terminal operations. As well as Rotterdam, there are liquids terminal operations in Wilhelmshaven (Germany) and Gdynia (Poland); there are also dry bulk operations in Belgium, France, Australia and the US. HES International itself is owned by Riverstone Holdings and The Carlyle Group, following the acquisition of HES Beheer by Hestya Energy in 2014. HCB www.hesinternational.eu

Antwerp Port Authority has agreed to acquire Nationale Maatschappij der Pijpleidingen (NMP) from Ackermans & van Haaren and Electobel. NMP operates 720 km of pipelines, 90 per cent of which serve chemical and petrochemical companies in the port and its hinterland.

“Pipelines are the ideal mode of transport for the chemical industry and oil refining,” explains Port Authority CEO Jacques Vandermeiren. “By giving them access to a pipeline network that is open to all users we gain on at least two fronts: we help to reinforce the presence in the port of this sector which is so important for the economy of Belgium and Flanders, and the many logistics flows in and around the port area are further established in the Antwerp region. Furthermore, pipelines are the most environment-friendly, energy-efficient and safe means of transport.”

NMP was set up in 1978 by the Belgian government in order to coordinate the Belgian pipeline network for transport of petrochemical products. Over the past 40 years it has become

an important link in the cost-efficient logistics chains of many chemical and petrochemical companies in the port.

“O ur cluster companies confirm the importance of pipelines, but the high initial investment cost is frequently a barrier preventing them from actually switching to pipeline transport,” explains Vandermeiren.

“Because we really want to make the modal shift happen, with goods being carried by sustainable transport methods such as rail and barge, as well as by pipeline, not only are we taking over control of this pipeline network but we also seek to harness the know-how and expertise of the NMP personnel to further expand this network.

In this way the present chemical companies and others who come along in future will have an easier transition to pipeline transport, which is the most sustainable option for them.”

www.portofantwerp.com

Vopak has reported third-quarter EBITDA excluding exceptional items of €176.4m,

down from €203.8m for the same period last year. Revenues were down 5 per cent at €312.1m, overall, with declines in all operating divisions except the Americas (other than the US).

The company reports tougher market conditions in Asia as well as unexpected expenses during the quarter, including jetty damage in Singapore. Vopak says it is now expecting full year EBITDA to be about 10 per cent below last year’s €822m, taking account of market dynamics and the effect of terminals divested in 2016.

www.vopak.com

Viva Energy has put into service a 100,000-m3 crude oil storage tank at its Geelong refinery in Victoria, Australia. The tank is the country’s largest and will increase the company’s storage capacity by 40 per cent. It will also increase production capabilities at the refinery and improve fuel supply security in Victoria.

V iva Energy has also added a new jet fuel gantry at the refinery along with a new pumping station to increase pipeline supplies of fuel to Melbourne. It is also planning to install a 25,000-m3 gasoline tank and construct a bitumen export facility. www.vivaenergy.com.au

Mobil Oil New Zealand is to build two new tanks at its fuel terminal in Lyttelton to replace tanks damaged in a landslide in 2014.

“Construction of new tanks will restore fuel storage capacity at our Lyttelton operation, which, along with the Lyttelton-Woolston pipeline and Woolston Terminal, is an important part of the fuel supply chain in the South Island,” says Andrew McNaught, country manager for Mobil.

The new tanks, which will be used to store gasoline and diesel, are due in service in 2019. www.mobil.co.nz

Gibson Energy has posted third-quarter EBITDA of C$48.0m, up from C$45.6m a year ago, and a net loss of C$8.5m, down from a loss of C$30.8m in the previous year. “We continue to deliver strong operations while executing on our strategy to focus on growing our long-term, high quality cash flows within the Infrastructure segment,” says Steve Spaulding, president/CEO.

“During the quarter, Gibsons sanctioned an additional 1.1m bbl of new tankage at the Hardisty Terminal, demonstrating the asset’s commercial competitiveness in a modest oil price environment and providing additional visibility on how the company will continue to grow its Infrastructure segment,” Spaulding adds. The new capacity at the facility in Alberta is expected to be placed into service in third quarter 2019, bringing total capacity up to some 10m bbl.

Gibsons expects to invest between C$115m and C$140m in terminal expansion projects this year, mainly at the Hardisty site, lower than in previous years following major work at the Edmonton terminal. “We continue to expect that we will sanction one to two tanks per year on a run rate basis in a flat oil price environment, but also believe that the company needs to further leverage its existing asset base to drive additional growth,” Spaulding says. www.gibsonenergy.com

TransMontaigne Partners has reached agreement to acquire the Martinez and Richmond terminals in California from Plains All American Pipeline for $275m. The west coast facilities will expand TransMontaigne’s storage and terminalling footprint in the San Francisco Bay area refining complex. The deal was expected to close on or about 1 January 2018.

“ We believe that this transaction strengthens our position as one of the leading refined

products terminalling and transportation service providers in the country,” says Fred Boutin, CEO of TransMontaigne Partners.” Together, the two terminals offer some 5.4m bbl (860,000 m3) of storage capacity for refined products and crude oil in 64 tanks.

TransMontaigne Partners has also reported net earnings for the third quarter of $11.0m, down on the $11.9m recorded a year earlier, although consolidated EBITDA rose from $23.5m to $25.4m. The company achieved another quarter of record revenue of $45.4m, up 11.8 per cent year-on-year. The period also saw completion of the 2m-bbl first phase expansion of its Collins terminal in Mississippi; the company has recently received air permits for a second phase, which will add up to 5m bbl of additional capacity. www.transmontaignepartners.com

Blackline Midstream has acquired SEA-3, which owns a major propane storage and distribution facility in Newington, New Hampshire, from Trammo Inc. The new owners plan to expand rail access at the site “in order to

position SEA-3 as the most flexible and reliable propane supply terminal in the north-east US”.

The facility has a propane storage capacity of 530,000 bbl, rail and truck loading racks, and a marine dock capable of handling oceangoing vessels. In addition, SEA-3 has a fully approved upgrade project which will significantly increase the rail unloading capacity of the terminal giving it access to both domestic and international markets.

Blackline Midstream was formed in November 2017 by Blackline Partners LLC and TPG Sixth Street Partners with the purpose of acquiring and developing oil and gas midstream infrastructure assets. The SEA-3 acquisition is its first investment in the sector. Trammo’s Houston-based team involved in its operation have transferred to Blackline Midstream, which also has an office in Houston, and the SEA-3 terminal personnel will remain in place. “All existing commercial agreements will be carried forward, and customers of the terminal will experience a seamless transition following the acquisition,” says David Herr, who is managing commercial operations at Blackline Midstream. blackline-partners.com

HOYER MIDDLE EAST is currently building a new filling plant in Al-Jubail, Saudi Arabia on an area of around 10,000 m2. On completion later this year, the facility will offer four storage tanks, two blending tanks, two filling lines and a warehouse for palletised goods. The filling plant’s capacity will amount to some 30,000 to 50,000 tonnes per year.

This new investment is the first fruits of a new joint venture established by Hoyer in Saudi Arabia to help expand activities in the Supply Chain Solutions (SCS) division of its Chemilog business unit. Hoyer has acquired a 51 per cent stake in a Saudi-based business, with local partners Petrochem Middle East FZE and Al Fahdah Al Arabia Trading Company holding 24.5 per cent each, which has been named Hoyer Middle East Ltd.

“The joint venture pools the regional and international strengths of the two partners with the core competences of Hoyer as an international logistics company specialising in handling dangerous goods,” Hoyer states.

“Hoyer Middle East will offer extensive blending, filling, bulk storage, quality testing and dispatch processing services, together with warehouse storage of palletised and non-palletised goods,” Ulrich Grätz, global SCS director at Hoyer, elaborates. “We are specialised in handling in dangerous goods and satisfy the highest international environmental, quality and safety standards.”

Menno Douwes Dekker, managing director Middle East & India for Hoyer, adds, “It’s the

first professionally operated off-site blending and filling plant in Saudi Arabia, and therefore very attractive for chemicals producers with international operations. Furthermore, we can also offer international intermodal transport beyond the plant, because we collaborate closely with the Hoyer Business Unit Deep Sea.”

Establishment of the regional joint venture marks continued growth and geographic expansion in Hoyer’s SCS division. SCS now operates at 16 locations in five countries, and has recorded a doubling of its order volume since 2008, making it one of the strongest growing business activities within the Hoyer group.

“SCS scores points through the expertise of the Hoyer group in the logistics and handling of dangerous goods, and brings this know-how into its comprehensive, customer-oriented portfolio of services: on-site and off-site logistics, filling, blending, handling of liquid dangerous goods, dry-bulk logistics, the operation of intermodal and dangerous goods terminals, and planning support for change management projects in plants,” the Hamburgbased company explains. “The utilisation of synergies, efficiency and transparency are important values in this respect.”

So far, SCS’s operations have been largely confined to Europe, so the new Saudi business marks an extension into a new theatre of activity. SCS has more than 450 staff in Europe at a number of logistics facilities, many of them on third-party premises. The division leverages Hoyer’s infrastructure assets to provide them on a needs-oriented basis to its clients.

The Hoyer group as a whole, which was founded in 1946, employs some 6,100 people in more than 115 countries around the world; its assets include some 2,400 trucks, 2,900 road tankers, 37,300 tank containers, 41,200 intermediate bulk containers (IBCs) and numerous logistics facilities, including tank depots, workshops and cleaning stations. HCB www.hoyer-group.com

THE TALKE GROUP has announced that all of its operations in the Middle East are now operating to the standards demanded by the Responsible Care initiative, the global chemical industry’s voluntary scheme. Within the Gulf Cooperation Council (GCC) states, Talke says, it is one of the first chemical logistics providers to do so. Its regional operations are now entitled to use the Responsible Care logo.

A basic principle of the Responsible Care scheme is that companies should voluntarily follow stricter environmental standards than those required by local laws and regulations.

The parent company, Alfred Talke Logistic Services, has been affiliated to the Responsible Care programme since 2009 and, for its part, was one of Germany’s very first chemical logistics providers to join the initiative.

“By implementing Responsible Care standards for our activities in the Gulf, Talke is once again leading the way in promoting safe and environmentally sustainable chemical logistics activities. All around the world, we see responsible treatment of both people and the environment as one of the most important pillars of our business activities,” says Richard Heath, Talke’s director, Middle East & USA.

“Voluntary commitments such as Responsible Care and systems such as SQAS are of particular importance in the

Gulf region, as the statutory provisions there do not cover all fields in detail. In addition, by participating in Responsible Care, we are aiming to raise awareness of environmental matters among other market players and customers, too.”

Indeed, only a couple of years ago Richard Heath played a leading role in developing a pilot project for the Gulf Petrochemicals and Chemicals Association (GPCA) aimed at establishing SQAS standards in the GCC area. That initiative, originally developed by the European Chemical Industry Council (Cefic), is designed to create a uniform set of metrics for assessing logistics companies’ performance in terms of health, safety, security, environment and quality (HSSEQ).

Talke has three joint ventures in the GCC states. It established Aljabr-Talke in 2004 in Saudi Arabia along with its partner Al-Jabr Group; another Saudi company, Sisco, later joined the venture, which is now trading as SA Talke. This company mainly handles polymer granulates and liquid chemicals for industrial customers in Al Jubail.

An Omani joint venture was also established with Al-Jabr Group in 2006, which provides efficient logistics for polymer granulates in the Gulf of Oman area. The newest joint venture in the region, RSA-Talke, was formed in collaboration with RSA Logistics in 2013. This is based around a chemical warehousing facility in the Dubai World Central industrial complex, which offers more than 19,000 pallet spaces for hazardous and non-hazardous materials. It is also well positioned to take advantage of regional and international transport links via the port of Jebel Ali and Dubai’s Al Maktoum International Airport.

Around the world, the Talke Group handles the bulk liquid, dry bulk and palletised transport of chemicals, polymers and other goods using a range of transport assets, including road tankers and tank containers. It also offers warehousing services, packaging, sampling, tank and silo cleaning, clean room drumming and other value-adding services, and operates a container terminal and rail link at Hürth, near Cologne in Germany. HCB www.talke.com

furnishes customers from the chemicals and other industrial sectors with numerous intermodal services, trucking services, managed services, international transportation management and consulting. Meanwhile, its bulk transport businesses provide “safe, reliable and cost-effective service for over-the-road tank truck, ISO tank for domestic and international shipments and rail transfer services”.

Maintaining a presence throughout North America, Europe and Asia, Odyssey operates “in all modes of transport” and is also able to offer its customers access to the Odyssey Global Logistics Platform, which “features a transportation management system that supports the safe, reliable and efficient delivery of client products throughout the world”. At the same time, its Web Integrated Network (WIN™) offers “a scalable technology solution with an accelerated deployment and faster time to value”.

& Technology reports that its Linden Bulk Transportation subsidiary, a specialist provider of chemical logistics services it acquired in 2016, has expanded its bulk transportation footprint in Joliet, Illinois. The new location, it continues, “positions Odyssey to offer its customers additional capacity and services in the greater Chicago and Midwest region”.

“Expanding our footprint and adding to our fleet addresses the capacity shortage issue that’s affecting the entire shipping industry,” says Linden’s chief operating officer Michael Salz. “Additional capacity in this area is a huge benefit to our clients and helps increase our productivity by significantly increasing our loaded miles. This also positions us for organic job growth by adding more drivers.”

Boasting a strategic location in close proximity to Chicago, Milwaukee and Indianapolis, the Joliet facility provides what Odyssey describes as “easy access to all major roadways and railways throughout the region that feed into national routes”. Furthermore, as a part of the expansion, Odyssey is adding new tractors and trailers, as well as relocating current equipment from other regions of the country to supplement the new site.

In addition to being an expansion of Linden’s growing network, the Joliet location will also utilise the onsite services of Quala, North America’s largest independent provider of industrial container cleaning services, including tank trailer, tank container, railcar and intermediate bulk container (IBC) cleaning.

A “global logistics solutions provider with a freight network of over $2bn”, Odyssey

Moreover, this past August Odyssey announced that an affiliate of the Jordan Company, “a middle-market private equity firm that manages funds with original capital commitments in excess of $8bn”, had signed a definitive agreement to become its new majority shareholder. “With the Jordan Company, Odyssey will continue its path of strategic growth, both organically and through acquisitions,” says Odyssey president and CEO Bob Shellman.

“This transaction underscores our consistent focus on providing broader service offerings, a larger transportation network and advanced technology to enhance our global supply chain capabilities,” he continues.

“As we enter this new and exciting phase in our company’s evolution, we thank our loyal customers for their support and our dedicated employees for the contributions that have made Odyssey so successful.”

“The Jordan Company targets partnerships with established and profitable companies like Odyssey,” adds Jordan Company senior partner Brian Higgins. “We are excited to partner with Odyssey’s leadership team and to support their vision for continued growth through investment in services and technologies for their customers.” HCB www.odysseylogistics.com

CHEMICAL DISTRIBUTORS HANDLE all sorts of products and, for a company like Brenntag, in all sorts of volumes. One large-volume product distributed by Brenntag North America is diesel exhaust fluid (DEF) which, although non-hazardous itself, is corrosive to certain metals – notably copper and brass. As such, handling DEF demands care in the choice of materials used in transfer equipment.

DEF is a non-toxic, high-purity solution comprised of 32.5 per cent urea and 67.5 per cent de-ionised water. Using this fluid in dieselpowered vehicles helps to reduce the amount of nitrogen oxides (NOx) emitted into the air by 90 per cent.

“We started delivering DEF in the US in 2009,” says Alan Smith, DEF business director for Brenntag North America. “Since then, we have made significant investments in DEF-dedicated terminals and delivery assets across the US and Canada. We have more than 25 dedicated DEF tankers and around 31 DEF rail locations in the US. These assets make us unique in the DEF space. We have a broad global network with outstanding local execution, allowing us to supply a wide variety of customers, including fleets, distributors, OEMs and truck stops.”

Delivering DEF can be challenging and must be handled by specifically designed equipment and vehicles. DEF is incompatible

with materials such as copper and brass, and can lead to corrosion of these materials. This means that any transport used to haul DEF, as well as all of its wetted components, needs to be made of stainless steel or approved plastics such as high density polyethylene (HDPE). This ensures fluid will not become contaminated by trace quantities of metals during its handling and transfer. The same goes for the pumps used to transfer DEF to and from vehicles.

“The main consideration when choosing a pump for a DEF application is the materials of construction,” says Matthew Sparrow, a DEF mechanical engineer for Brenntag North America. “All materials that come in direct contact with DEF must be compatible to avoid any contamination of the fluid. To ensure that all our equipment is compatible, we follow ISO 22241-3 standards, which describe best practice recommendations and requirements for the handling, transporting and storage of DEF.”

“It is essential to deliver clean, noncontaminated DEF fluid to customers,” adds Smith. “Vehicles using contaminated DEF are in danger of suffering severe damage to their SCR system. A majority of issues encountered stem from material-of-construction issues; either the wrong materials are selected or materials not on the recommended list were not properly tested by a third-party lab.”

Another major issue is downtime and leakage. When DEF dries a white crust will appear. This residue can create havoc on the internal pump components, connectors, seals and anything else that comes into contact with the fluid. Improper design can cause the equipment to lock up or leak, resulting in costly downtime or a messy clean up.

When it came time to select a transport pump capable of interacting positively with DEF during the loading and unloading process, Brenntag North America turned to STX-DEF series sliding vane pumps from Blackmer.

“We use STX-DEF pumps at our terminals to unload railcars, transfer product from one tank to another, and to load and unload tank trucks,”

explains Sparrow. “With the addition of either a bypass line or VFD (variable frequency drive), the STX-DEF pump can also be used to fill drums and totes. In addition, we use Blackmer pumps on our internal DEF tanker fleet to fill customers’ drums, totes and mini-bulk tanks. These pumps are the ideal solution for applications with long runs of piping, when suction hoses and piping need to be stripped dry, or when precise flow rates are desired.”

STX-DEF pumps from Blackmer feature 316 stainless steel construction with external ball bearings, chemical-duty mechanical seals, PTFE elastomers and non-metallic vanes, making them the ideal choice to handle DEF. These features allow STX-DEF pumps to meet the ISO 22241-3 material standards and cleanliness specifications required for DEF-handling applications.

The specific models used by Brenntag North America in its DEF streams offer high-capacity flow rates up to 250 gpm (946 l/min) and pump speeds up to 800 rpm for delivering fast fluid offloading. A 6,000-gallon (22,700-litre) tanker can be unloaded in about 24 minutes using the STX3-DEF pump. For other applications Brenntag uses Blackmer pumps with lower flow rates.

The STX-DEF Series pump’s non-metallic vanes also self-adjust for wear in order to maintain flow rate, while minimising shear and agitation. An adjustable relief valve protects the pump from excessive pressures. The pump has excellent self-priming and dry-run capabilities and maintenance is reduced because internal wear is almost completely limited to the easily replaced sliding vanes, which can be changed out without needing to take the pump out of line.

“Blackmer DEF pumps have an excellent service record,” says Sparrow. “Our facilities have reported less downtime and repair work since installing Blackmer pumps. The wetted

components have long service life, and the housings, gearboxes, motors and frames hold up well in indoor and outdoor applications. Only a handful of pumps have ever needed repairs over the last five years and, thanks to their excellent design, repairs are typically completed in a day or less depending on the availability of parts.”

“Bottom line is Blackmer pumps work extremely well with DEF thanks to their many features and benefits,” Sparrow concludes.

“As Brenntag continues to build its internal infrastructure for DEF, Blackmer pumps will continue to be an essential component. In addition, we also will continue to recommend Blackmer pumps as an approved equipment solution for our customers’ mini-bulk and bulk applications.”

Part of the Germany-based Brenntag group, Brenntag North America, headquartered in Reading, Pennsylvania, is responsible for

providing business-to-business distribution as well as sales and marketing solutions for industrial and specialty chemicals throughout the US and Canada. This responsibility includes managing complex supply chains for both chemical manufacturers and consumers and then streamlining processes to provide market access to thousands of products and services.

Brenntag itself traces its history back to an egg distribution business formed in Berlin in 1874; its move into chemical distribution started after a relocation to Mülheim an der Ruhr, close to the Dutch border, in 1943. Since then the company has grown around the world and now has a global network of more than 530 locations in 74 countries, offers more than 10,000 products, employs more than 14,000 people and serves more than 150,000 customers worldwide. HCB www.brenntag.com www.blackmer.com

CHINA • THE CHEMICAL INDUSTRY LANDSCAPE IN CHINA IS CHANGING RAPIDLY, SPURRED BY REGULATORY DEMAND FOR SAFER OPERATIONS AND REDUCED ENVIRONMENTAL IMPACTS

CHEMICAL MANUFACTURERS AND logistics service providers (LSPs) active in China need to be aware of the changes currently being driven by the 13th five-year plan for hazardous chemicals, which covers the period 2016 to 2020. Jerry Xu, conference organiser for AIT Events, which is to host the Hazardous Chemicals China (HCC) event in Hangzhou in September 2018, explains how the plan is changing the business landscape.

Around 10 million people in China are employed in the chemical industry and its supply chain, working for 19,000 registered chemical producers, 265,000 companies involved in distribution and trade, and a further 5,500 firms specialising in chemical

storage. In recent years the industry has responded to government calls for greater safety, with many companies either shutting up shop or relocating to dedicated chemical industry zones. There has also been significant investment in renovating chemical storage and handling equipment.

Nevertheless, there is some way to go. There are plenty of bottlenecks in the production and distribution sectors, Xu says, and few domestic companies have deployed advanced safety and process safety management systems. While 2015 saw the number of chemical industry accidents fall below 100 for the first time – there were 97 reported accidents involving 157 fatalities –there is clearly room to improve the situation further, and a need to retire outdated facilities.

The 2016-2020 chemical industry plan demands a 10 per cent drop in the number

of accidents and an increase in the amount of research and development work put into safety management in the sector. Xu expects there will be pilot projects to examine how the application of new safety management techniques work in practice and how they can contribute to improving the safety record.

Xu identifies some technologies that Beijing wants industry to focus on: these include gas monitoring, pipeline leak monitoring, control and alarm systems at facilities handling high-hazard chemicals, and safety instrumentation management. Xu also says there will be a focus on information sharing, using online systems to alert supply chain participants to accidents and building an online catalogue of dangerous chemicals. Further, the plan envisages the development of a single platform for supervision and data sharing in the movement of explosives and high-hazard chemicals, based on hazard communication elements.

Finally, a single nationwide centre for accident inspection and analysis will be set up, with the aim of collecting and evaluating accident data and developing warning systems for the chemical and oil pipeline sectors.

What all this means is that there is plenty of opportunity for international firms, already well versed in the provision of safety systems for the chemical industry and its supply chain, to apply their expertise in helping to develop the same levels of safety in industry in China. The HCC event, which will take place in Hangzhou on 5 and 6 September this year, will provide a marketplace to allow them to put that expertise on display.

Xu explains that the HCC event has been designed with this in mind, with separate zones for products and services aimed at the transport and logistics sector; “intelligent planning” in chemical manufacturing; wastewater and gas disposal techniques; intelligent technologies for monitoring and reporting; incident response and rescue; security inspection and occupational health; monitoring and alarm technology and equipment; and industrial repairs and maintenance. HCB

Full information on the event, which is being supported by HCB, can be found at www.hcchina.org.

INEOS HAS SIGNED a contract to partner with Imperial Logistics to design and build the largest butane river barges ever used in Europe. These barges will link the world’s largest butane tank, currently under construction at the Oiltanking Antwerp Gas Terminal (OTAGT) in the Port of Antwerp, Belgium, with the Ineos site in Köln to enable one of the largest crackers in Europe to be supplied with large volumes of butane as well as naphtha as a feedstock.

These new state-of-the-art barges will move about 3,000 tonnes of butane each, which is about three times as much as the current barges move on the Rhine system. The shipyards to build these new barges will be selected in the near future and the barges will be operational in 2019

Hugh Carmichael, director of Ineos Trading & Shipping, says: “This agreement represents a further step in a strategic investment in the future of our naphtha crackers in Köln. The new butane tank in Antwerp and the Imperial butane river barges will provide Ineos with increased flexibility and security of supply that will significantly improve our competitiveness in Europe. It also positions Ineos as a major

player in global LPG markets. We are pleased to work together with Imperial Logistics as a major barge operator in this unique project. Our joint expertise and experience will help make this a successful project.”

Steffen Bauer, COO at Imperial’s Business Unit Shipping, adds: “We are very delighted to be awarded as project partner from Ineos. To design and build the largest butane river barges ever used in Europe is an extraordinary challenge.”

The deal with Imperial marks a continuation of Ineos’s process of investing in supply chain flexibility at its European facilities, supported by similar investment by its supply chain partners. Oiltanking is currently almost doubling capacity at OTAGT, building a 135,000-m3 fully refrigerated tank – Europe’s largest – to receive butane from oceangoing gas carriers of up to VLGC size.

Similarly, LPG tanker operator Evergas has now built eight 27,500-m3 ‘Multigas’ carriers designed to carry ethane from the US to Ineos crackers at Grangemouth, UK and Rafnes, Norway. That supply chain is designed to reap the benefits of low-cost ethane from North American shale gas and improve the competitiveness of Ineos’ European petrochemical manufacturing, but was only enabled by investment in ground-breaking ship technology. That was recognised in September 2017 when Evergas was presented with the Innovation Award at the annual Lloyd’s List Global Awards. A similar level of innovation is likely to be needed in the design and construction of the new barges Imperial will build.

Ineos has 105 manufacturing facilities in 22 countries around the world, employing some 18,500 people. Imperial Logistics, a wholly owned subsidiary of South Africabased Imperial Holdings Ltd, is responsible for coordinating and managing all the group’s international logistics businesses outside Africa. The shipping business unit is part of Imperial Transport Solutions, based in Duisburg, Germany. HCB www.imperial-international.com www.ineos.com www.oiltanking.com

Katoen Natie and its partner Allied are to introduce the SuperTruck concept in Singapore. The SuperTruck design can carry two 40-foot or four 20-foot dry freight or tank containers at a time. The trucks will be used to move product between chemical plants, Katoen Natie’s logistics terminal and local container terminals.

The move follows the introduction of driverless vehicles in depot operations; both innovations are prompted at least in part by the need to address the shortage of drivers in Singapore. Katoen Natie and Allied are working with the Singapore government authorities on the certifications and operational framework for the SuperTruck.

“ We are continuously looking for innovative and new solutions to optimise our logistics operations,” says Koen Cardon, chief executive of Katoen Natie Singapore. “We work with our business partners to introduce new solutions to increase productivity and efficiency. We have been working closely with Allied to implement this SuperTruck concept whereby they have demonstrated entrepreneurship and innovative

thinking. Shortage of drivers is a real challenge in Singapore and we need such innovative solutions to address this.” www.katoennatie.com

The Talke Group has won a five-year contract from Qapco to handle the management of all logistics activities at its production facility in Mesaieed, Qatar. The deal covers warehouse logistics, packing finished products, the administration and provision of spare parts for the petrochemical plants as well as servicing and maintenance of all the logistics equipment within the entire production facility.

The spectrum of chemical and petrochemical substances stored and handled at the Qapco site ranges from hazardous materials of nearly all classes to harmless polyethylene granules of the highest quality, which are prepared for transport.

In addition, Talke is taking over both the loading and unloading of oceangoing vessels with liquid chemicals, gases and finished products and the servicing and maintenance

of heavy dockside equipment, such as straddle carriers and cranes.

Talke and Qapco have been working together since 2008, with their cooperation gradually expanding. “This latest award from Qapco serves both as recognition for our past performance and as an incentive to continue striving to improve still further,” says Richard Heath, Talke’s director, Middle East & USA. “We also see it as further confirmation that our strategy of integrating ourselves into the supply chains of our customers with an explicitly broad spectrum of high-quality and well thought-out services is right.”

www.talke.com

Suttons has won a five-year contract to deliver carbon dioxide for Praxair to customers across the UK. The deal builds on a 13-year business relationship, adding telemetry management to the existing long-term partnership.

“ Working in partnership with Suttons gives Praxair a number of advantages in the market including flexibility which enables us to respond to our customers’ changing needs,” says Mark Patterson, head of commercial and supply chain, UK at Praxair. “Our strong relationship with Suttons further builds on our aligned values of safety, service and flexibility. Suttons’ reputation for these values is well regarded in the industry and, as has already been proved, we are a natural partner to further develop these core values.”

www.suttonsgroup.com

Odyssey Logistics & Technology has announced that its Linden Bulk Transportation subsidiary

has expanded its operations in Joliet, Illinois. The site’s strategic location provides easy access to regional and national highways and railroads. “Expanding our footprint and adding to our fleet addresses the capacity shortage issue that’s affecting the entire shipping industry,” says Linden’s chief operating officer Michael Salz. “Additional capacity in this area is a huge benefit to our clients and helps increase our productivity by significantly increasing our loaded miles.”

Among other things, the Joliet location will now utilise onsite services provided by Quala, which Odyssey describes as “North America’s largest independent provider of industrial container cleaning services, including tank trailer, ISO container, railcar and IBC cleaning”. Linden will also add new tractors and trailers, and will relocate existing equipment from other regional depots. www.odysseylogistics.com

Carsten Taucke has given the board of Imperial Logistics International a year’s notice of his intention to step down as CEO and leave the company at the end of November 2018. “Over the next twelve months, Carsten Taucke will actively continue to lead the company with his typically strong commitment and focus on results in all areas of his responsibility,” says Marius Swanepoel, CEO of the Global Logistics Division at Imperial Logistics. Taucke will also be closely involved in the selection

of his successor and in the handover of his management responsibilities to that successor.

Meanwhile, Christian Berlin has been appointed director of Imperial Logistics’ road business unit, which operates some 600 road tankers in liquid foodstuffs, chemicals and gases service. He succeeds Steffen Bauer, who moved to become COO of Imperial’s shipping business earlier this year. Berlin was previously assistant to the CEO and has also managed the company’s business in China.

In other news, Imperial Logistics has agreed to sell its Schirm contract manufacturing subsidiary to South Africa-based chemicals company AECI Ltd. The deal, which is subject to approval by the authorities in Germany and South Africa, is valued at some €110.5m. Imperial acquired Schirm as part of its takeover of Lehnkering in 2011 but says that the third-party chemical manufacturing operation does not fit into its core business of transport and logistics. As part of the deal, AECI will rent four warehouses adjacent to the Schirm plant at Schönebeck, with a 12-month purchase option.

www.imperial-international.com

DOGGETT THE MAN FOR CLUGSTON Clugston Distribution has appointed Tim Doggett as distribution director. Doggett arrives from Rhenus Logistics, where he was general manager, responsible for sales and operations across the north-west of England.

Bob Vickers, chief executive of the Clugston Group, says of Doggett: “His experience across

a broad range of logistics roles will be vital to the division as we continue to examine ways to further expand our offering to both new and existing customers.”

“I’m proud to have a joined a company with such a strong history within the industry, and particularly in its 80th anniversary year,” adds Doggett. “I am looking forward to working with the team to further develop opportunities for the division and the Group.” www.clugston.co.uk

Greiwing has begun construction of a new €33m logistics centre in Burghausen in southern Bavaria, close to the Austrian border. The 60,000-m2 facility, due to enter into service late in 2018, is designed to offer contract logistics services for major customers at the nearby chemical parks, primarily for polymers and other granular chemicals. Part of one warehouse will eventually be used to handle hazardous and environmentally sensitive chemicals. The facility will be directly connected to the combined transport terminal in Burghausen.

“ The investment in a location in the Bavarian Chemical Triangle is also the result of our strategy of expanding the contract logistics division,” says Jürgen Greiwing, managing partner. “Even today, our services are an integral part of the value chain of many of our customers. And we continue to see potential that we do not want to leave unused.”

www.greiwing.de

recruiting and retaining member companies. She has provided a voice for those whose resources are limited but who fervently believe in the values and ethics of NACD. She’s accomplished this all while tirelessly leading our Membership Advancement and Retention Committee.”

At the same time, David B Garner of Brenntag North America has been awarded an NACD Lifetime Achievement Award. Marking only the sixth time in the Association’s 46-year history that this gong has been given, Garner was honoured with the award after, in NACD’s words, dedicating “his career to enhancing safety through training, mentorship, exercises and drills and incentive programmes as well as the creation of management systems with metrics to demonstrate improvement in safety”.

Additionally, Garner has also spent “countless hours providing NACD staff and peers in the industry with information, guidance and support through regulatory comments, communicating the hard work NACD members perform day in and day out to key stakeholders and advocating for better laws and regulations.”

JOSEPH FISCHMAN AND Andrea Nagle of Chem/Serv have jointly won the US National Association of Chemical Distributors’ (NACD) 2017 Distributor of the Year Award. Recipients of the award, NACD explains, “demonstrate outstanding commitment to the chemical distribution community” and “work steadfastly” on behalf of both the Association and the entire industry.

As well as having served on two NACD standing committees and the NACD Board of Directors, Fischman has hosted site visits with Congressional representatives and members of his local government while also participating in business roundtables with elected officials.

“Joe has played a critical role in advancing NACD’s advocacy efforts over the years,” says NACD president Eric R Byer. “He’s led these efforts with clear vision, passion and dedication by devoting an incredible amount of time and effort to his company and the industry as a whole and we’re proud to present him with this award.”

Nagle, meanwhile, has also served on the Association’s Board of Directors for two years and on a standing committee for nine. Throughout this time, NACD says, she has been “a thoughtful proponent for the role of the small distributor in NACD” as well as helping “to mitigate the challenges for a small distributor to fully participate in the Association”.

“Over the years,” Byer states, “Andi has contributed greatly to the growth of our association programmes targeted at

“Dave is the consummate safety professional,” says Roger Harris, president and CEO of Producers Chemical and a previous recipient of the award. “Over the years, he has taught us what it means to take safety seriously. He’s been a mentor, educator, a resource to some and a role model to everyone. It is my distinct pleasure to present this Lifetime Achievement Award to my trusted friend and colleague, David B Garner.”

All three presentations were made at NACD’s recent 46th Annual Meeting in San Antonio, Texas. Described by NACD as “the premier chemical distribution industry event of the year”, the 2017 meeting saw around 575 attendees “joining together to discuss opportunities for companies to improve business performance, management skills, recruitment and more, while getting in-depth insights into the latest trends and future of the industry”. HCB www.nacd.com

Univar has reached an agreement to acquire Kemetyl Industrial Chemicals (KIC). A division of the Kemetyl Group, KIC, Univar says, commands annual sales of around $30m and “is among the leading distributors of chemical products in the Nordic region”, providing both bulk and speciality chemicals to customers across Sweden and Norway.

“ The Nordic region is at the forefront of global R&D when it comes to life sciences, which makes this agreement a smart and strategic move to build our customer base and enhance our market expertise,” says Univar chairman and CEO Steve Newlin. “This acquisition will allow Univar to expand its leading position in pharma and strengthen its expertise in water treatment.”

“ We are very satisfied with the development of Kemetyl Industrial Chemicals over the past several years,” adds Kemetyl Group board chairman Ketil Stave. “In our ambition to further focus our business around consumer chemicals, this divestiture is a logical step to ensure that our industrial customers continue

to get the level of service and expertise they deserve. It has been a pleasure to work with the Kemetyl Nordic Industry team. I believe there is a tremendous match with Univar’s outstanding service and capabilities and we are convinced that they are in the best position to further develop and grow this business.”

Commenting on the news, Nick Powell, Univar’s EMEA president, states: “This is a great pairing of capabilities that gives Univar the ability to be even more competitive in the European market. The agreement supports our global corporate strategy to pursue market expansion and acquisitions, to continue profitably growing our core business and to accelerate growth by focusing on chosen industry segments. Both companies have deep experience and key competencies within the life sciences market and we welcome this opportunity to expand Univar’s reach within the water treatment sector, allowing us to forge deeper customer relationships.”

Meanwhile on the financial front, Univar and its wholly-owned subsidiary Univar USA have entered into an amended credit agreement

with Bank of America NA and other lenders to provide a new Term B loan facility in an aggregate principal amount of just under $2.3bn. This replaces all of the company’s US dollar loans and $96.3m of euro loans outstanding under its previous credit agreement dated 1 July 2015. “The amended term loan facility reduces the company’s interest rate from LIBOR plus 2.75 per cent to LIBOR plus 2.50 per cent,” Univar says. “This rate will be further reduced to LIBOR plus 2.25 per cent when the company’s total net leverage (total net debt to adjusted EBITDA) falls below 4.0.” www.univar.com

US-headquartered Nexeo Solutions has announced a fiscal 2017 net income of $14.4m from sales and operating revenues worth $3.6bn. This compares to a fiscal 2016 net loss of $8.4m from sales and operating revenues of just under $1.1bn. Meanwhile, for the fourth quarter of the year, it achieved a net income of $13.6m from sales and operating revenues worth $981.7m as opposed to respective prior-year figures of $8.7m and $851.4m.