CLEAR WATER

CHEMICAL TANKERS BENEFIT FROM A MORE BALANCED MARKET

UN EXPERTS REACH THE END

MORE INTEREST IN NEW ENERGIES

YOUNGER GENERATION TAKES OVER

MONTHLY

THE INFORMATION SOURCE FOR THE INTERNATIONAL DANGEROUS GOODS PROFESSIONAL SINCE 1980

FEBRUARY 2023

you can depend on the customary high quality and safety you expect from SCHÜTZ: our GREEN LAYER ECOBULK and PE drums are optionally tested and approved for use in the hazardous goods sector.

Find out more at www.schuetz-packaging.net Phone +49 2626 77 0

CONSERVATION –MAXIMUM

4 –BOOTH D22 | NEWSCHÜTZRECYCLATE MATERIAL NEW MATERIAL

info1@schuetz.net www.schuetz.net WITH OPTIONAL UN APPROVAL RESOURCE

TESTED SAFETY

EDITOR’S LETTER

The numbers are not yet finalised – though we expect them to start trickling in any time now – but it is already clear that there were plenty of global logistics operators who did very nicely, thank you, out of 2022. In particular, some of the major liner operators raked in hundreds (if not thousands) of millions of dollars in extra profit, though not without raising the ire of shippers who often felt they had been fleeced on freight charges and demurrage costs.

A large chunk of those profits have been handed back to shareholders (and, in a few instances, to employees too) and more has been put to buying up other links in the chain, as we have noted before.

The tank container sector also enjoyed a banner year and, while ITCO is still compiling its annual fleet survey, it is evident that tank manufacturing numbers were higher than ever to meet a surge in demand that followed on from changing trade patterns. Tank operators found their customers were asking for more inventory as a bulwark against persistent supply chain disruption, holding onto tanks and delivering more demurrage revenue, while slow steaming by vessel operators provided more days of employment on each long-haul leg.

That additional demand for new tanks translated directly into added demand for tank equipment and, as Fort Vale’s Graham Blanchard reports in this issue (see page 16), equipment suppliers have been investing in new manufacturing capacity of their own. Interestingly, while consumers around the developed world have taken to online shopping in increasing numbers during the Covid years, it seems that industrial buyers are taking the same route, with

Fort Vale noting that its new webshops have generated a lot of sales.

There is a sense, as Blanchard says, that things are now beginning to get back to something close to ‘normal’; the pandemic is - broadly speaking – under control, energy prices have come off their highs, and markets are being subjected to less panic. That should make planning easier, all the way along the supply chain (barring another ship grounding in the Suez Canal or an escalation of the war in Ukraine).

What, though, of those shippers who remain aggrieved by the costs they were forced to pay to get their products to market during the freight rate boom? There had been some talk of getting away from the old style of aggressive contract negotiations towards a more balanced and longterm approach, which certainly suits the carriers; but will shippers be willing to forgive and forget the problems and costs they had to deal with, while their carrier partners sat back and counted the cash rolling in? We may have a brief opportunity to see how things are going to play out: there is every indication that global trade volumes this year will be weaker.

If Graham Blanchard is right, and we are heading back to normal, perhaps 2023 will be the year that shippers take back control of the freight market. It would be nice to think that the past three years have shown them the value of logistics and they shippers be prepared to pay a decent price for it, but perhaps the carriers have overplayed their hand. It is going to be something of a battle, I think.

Peter Mackay

UP FRONT 01 WWW.HCBLIVE.COM

SAVE TIME. SAVE MONEY.

When clients mentioned that their tanker fleets in the Southern Hemisphere were travelling long distances to deliver fuel, but were frequently unable to refill their tanks for the return journey because of the danger of chemical corrosion, we believed we could develop a solution to the problem.

As a result, Fort Vale have launched a 4” Stainless Steel API Adaptor to allow for flexible product loading and increased corrosion resistance. The adaptor, suitable for use with a 4” API coupler, used for bottom loading and unloading, provides a quick action, liquid tight mechanical connection for transportation tanks and provides liquid tightness when closed.

Ideally suited for safe chemical transfer between transport and static tanks and designed with an MAWP of 5 Bar and a temperature range of -20 deg C to 70 deg C.

Designed to conform with BS EN 13083:2008+A1:2013 & BS EN 14432:2014

Not every company can do this. Not every company is Fort Vale.

® FORT VALE. FOLLOW THE LEADER. Visit us at www.fortvale.com

Managing Editor

Peter Mackay, dgsa

Email: peter.mackay@chemicalwatch.com

Tel: +44 (0) 7769 685 085

Advertising sales

Sarah Smith

Email: sarah.smith@chemicalwatch.com

Tel: +44 (0) 203 603 2113

Publishing Manager

Sarah Thompson

Email: sarah.thompson@chemicalwatch.com

Tel: +44 (0) 20 3603 2103

Publishing Assistant

Francesca Cotton Designer

Petya Grozeva

Chief Operating Officer

Stuart Foxon

Chief Commercial Officer

Richard Butterworth

CW Research Ltd

Talbot House Market Street Shrewsbury SY1 1LG

ISSN 2059-5735 www.hcblive.com

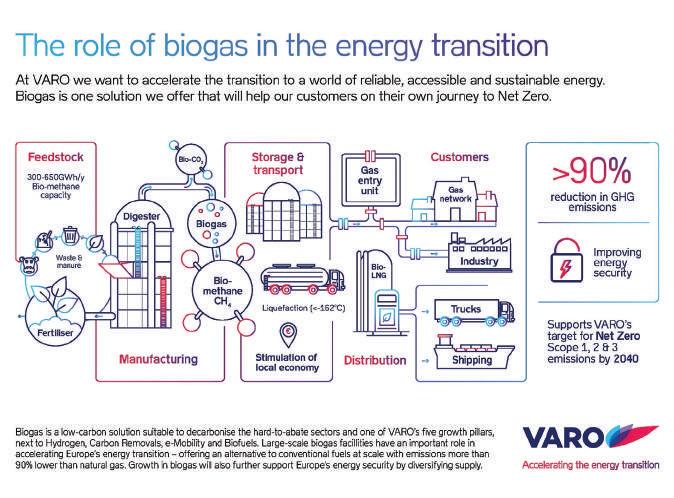

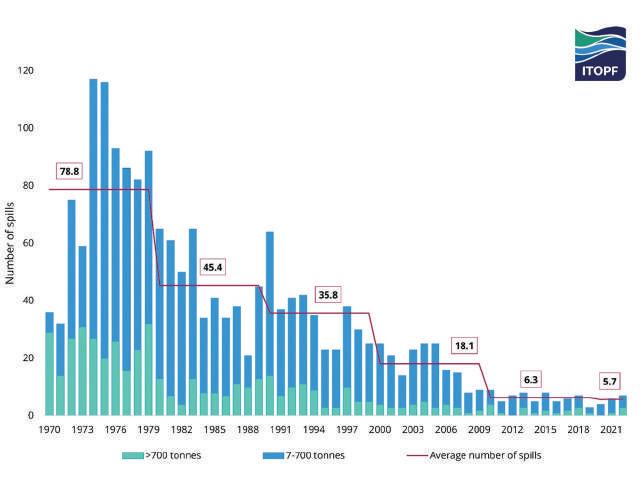

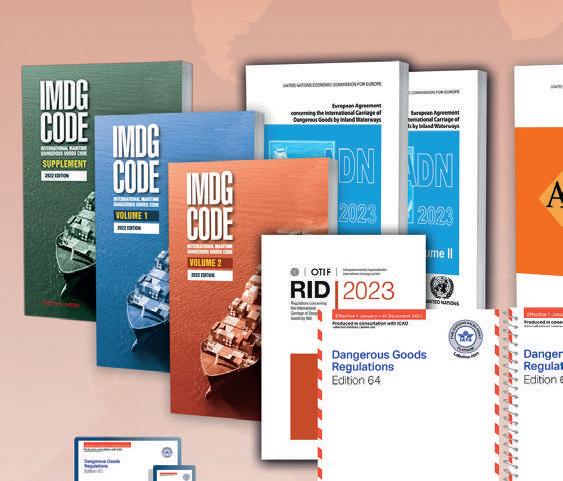

UP FRONT 03 WWW.HCBLIVE.COM CONTENTS VOLUME 44 • NUMBER 02 SAFETY Incident Log 34 Chemicals on ice EMSA renews MAR-ICE project 36 Getting better ITOPF data shows oil spill improvement 37 REGULATIONS Race to the line UN completes 23rd revision 38 Battery basics IATA updates lithium guidance 49 Final reminder PHMSA tweaks HMR 50 BACK PAGE Not otherwise specified 52 NEXT MONTH What’s new in tank terminal equipment Building intermodal networks Gas tanker markets Chemical distribution in Europe UP FRONT Letter from the Editor 01 30 Years Ago 04 Learning by Training 05 STANKER SHIPPING The results are in Strong market for chemships 07 Only connect Marlink plugs in Uni-Tankers 10 Tugging along Amogy trials ammonia for barge power 11 News bulletin – tanker shipping 12 TANKS & LOGISTICS The middle way Leschaco plans Moerdijk site 14 Cautiously optimistic Fort Vale hopes for a boring year 16 Power of three Klinge keeps it in the family 18 Speak my language ECTA expands digital guidance 20 News bulletin – tanks and logistics 22 INDUSTRIAL PACKAGING Going for growth Schütz adds to production capacity 24 Ion brew Orbis adds to battery packaging 25 Get it together Air Sea digitalises closure instructions 26 News bulletin – industrial packaging 27 NEW ENERGIES Emirates to Amsterdam Masdar plans green fuel chain 28 Uncommon carrier Vopak, Hydrogenious plan LOHC chain 29 Bio-bonanza Varo invests in biogas 30 Grab and go MISC builds CCS community 31 COURSES & CONFERENCES Conference diary 33

Monthly is published by CW Research Ltd. While the information and articles in HCB are published in good faith and every effort is made to check accuracy, readers should verify facts and statements directly with official sources before acting upon them, as the publisher can accept no responsibility in this respect. ©2022 CW Research Ltd. All rights reserved

HCB

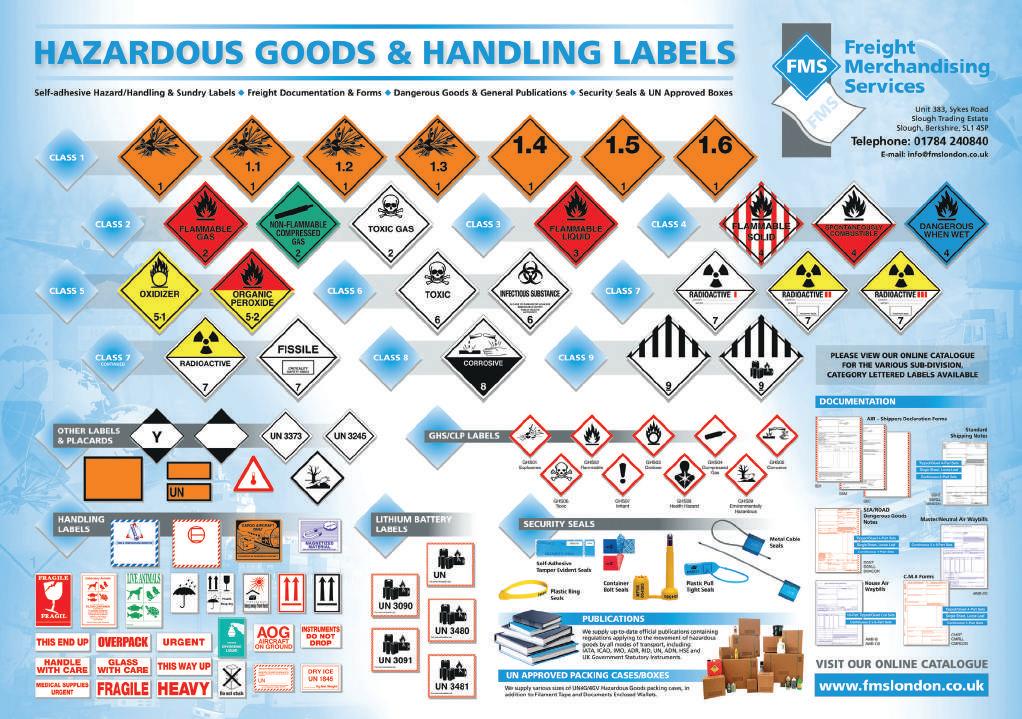

30 YEARS AGO

A LOOK BACK AT FEBRUARY 1993

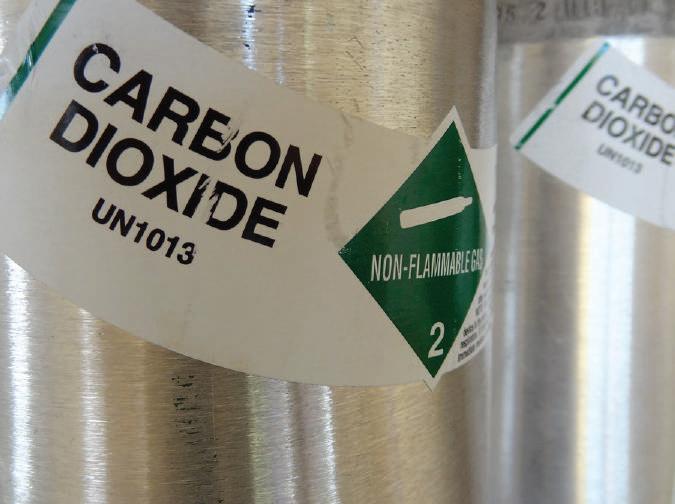

THE MEETING ROOMS and hallways of the UN’s Palais des Nations in Geneva echo down the years with the discussions at the many, many meetings of experts in the transport of dangerous goods. Reading HJK’s latest summary of the joint RID/ADR experts’ autumn 1992 meeting in the February 1993 issue of HCB is like opening a window into a world that is still so familiar. Many of the debates held that week established a basis for discussions that continue to this day.

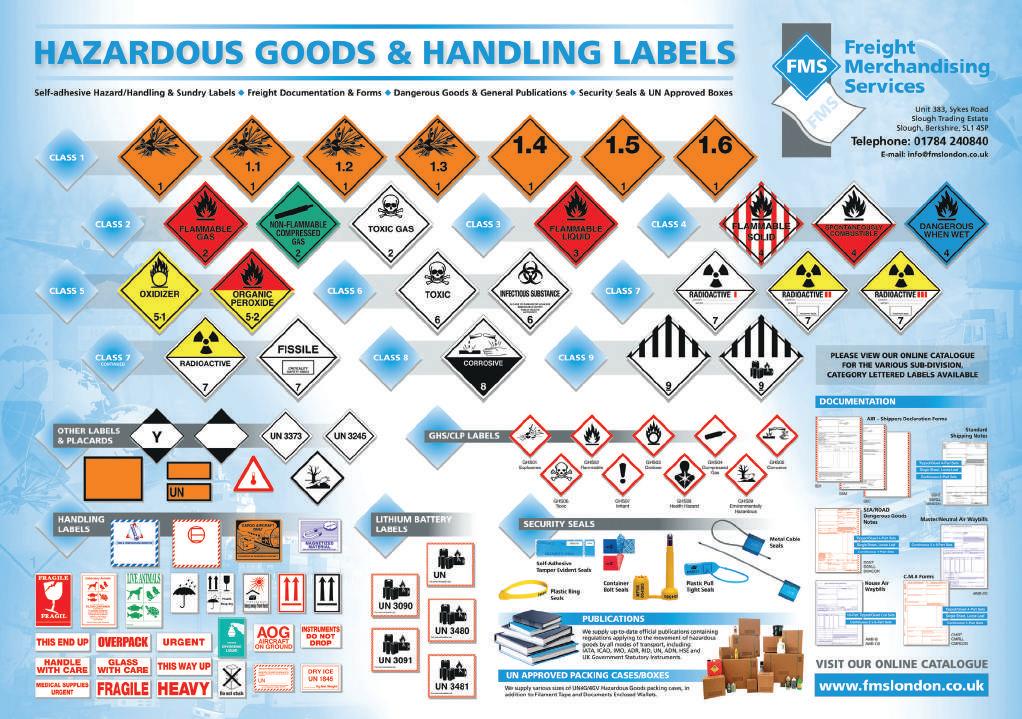

The September joint meeting included a quite radical revision of some of the provisions of RID and ADR, perhaps the most far-reaching being alignment with air and sea regulations in the upper flash point limit of 61°C, rather than 55°C, although RID and ADR were in those days still full of ‘marginals’ and the Class 8 provisions were still far from settled. It was to be a few more years before the two regulations were restructured into the form we know so well today. On the other hand, Germany had opened discussions on the possibility of using reinforced plastics for tank barrels.

Another important area of work at the time – and something that has really come into its own in recent years – was a “massive” revision of the provisions for infectious substances, which, HJK said at the time, would bring the Class 6.2 text “from the Middle Ages to the 20th century”, removing references to claws, hoofs and pigs’ bristles and introducing requirements for the transport of diagnostic specimens, micro-organisms, rickettsia and other new-fangled substances.

At the time, the experts felt it was an urgent matter to be dealt with, as the European Commission was also busying itself with the topic

and the one thing that the RID/ADR experts did not want was to be told what to do by Brussels bureaucrats with no knowledge of transport safety. Fortunately, they had the World Health Organisation on their side and the decisions made back then have helped the world cope with recent disease outbreaks and pandemics.

Elsewhere in the February 1993 issue, we reported on the expansion of the tank container concept, particularly in the Middle East, which had been identified as an important growth market for the coming decade. However, as Nigel Parkes wrote, there were challenges for those wanting a slice of that market – the long time needed to build commercial relationships with local parties, the reliance on road transport rather than rail, the demanding climate and, perhaps most importantly, the lack of cleaning and repair depots.

Hiroshi Takubo of NRS summarised the difficult position of tank containers in Japan, where the national regulations for domestic transport differed considerably from those in force elsewhere. While IMO approval of a tank container was taken as evidence of its suitability for the import or export of dangerous goods, the Japanese Fire Protection Regulations (which described a tank container, with its chassis and tractor unit, as a ‘transportable tank warehouse’) presented a labyrinthine and time-consuming challenge for domestic use.

Oddly, once a domestic tank container was delivered and removed from its chassis, it was no longer a transportable tank warehouse and fell into a regulatory gap that had to be covered by a temporary approval lasting no longer than 10 days.

04 HCB MONTHLY | FEBRUARY 2023

LEARNING BY TRAINING

by Arend van Campen

IS INFORMATION THE PRIMARY SUBSTANCE OF THE UNIVERSE?

INFORMATION IS A WORD that has never been easy to pin down. In its most familiar sense, information today is news, intelligence, facts and ideas that are needed and passed on as knowledge. But a more active and constructive meaning is something that gives a certain shape or character to matter, or to mind; a force that shapes behaviour, trains, instructs, inspires and guides. Information gives form to the formless, DNA codes are information and form human thought patterns. In this way, information spans the disparate fields of space computing, classical physics, molecular biology and human communication, the evolution of language and the evolution of man. Nature can no longer be seen as matter and energy, but must be interpreted as matter, energy and information. (Campbell, Jeremy, 1982)

The universe is a physical system that contains bits of information. Every elementary particle carries bits of information. Electrons carrying information interact in a systematic way to perform a quantum logic operation. A computer and our mobile phones work like the universe because they are part of the universe and to work they must obey the same physical laws. Computers and the universe are information processors. Quantum computing is currently possible because of information, the universe already works this way. (Lloyd, Seth, 2016)

Quantum information processing analyses the universe in terms of information: the universe consists not only of photons, electrons, neutrinos and quarks, but also of quantum bits or qubits. Professor Lloyd says that the universe is a gigantic computer, which processes information in quantum bits (qubits). Cosmologist Paul Davies says: “Instead of seeing matter as the primary substance of the universe,

we think that information is the primary substance of the universe.” (Davies, Paul, 2020)

The universe, a computer, the human body, the environment, a shipping or tank storage company; all living systems are information carriers, receptors and/or transmitters dependent on communication. The information they carry can be understood as meaning, observed and grasped by the human consciousness and processed by its brain. Without the human ability to interpret information and meaning, the usefulness (functionality) of bits of information could not have been observed.

The first entry point of information is the human observation by subconscious and conscious perception ability. Therefore it is of crucial importance how man interprets the information, because what it means to him or her will ‘in-form i.e. give form’ to one’s lived reality. A false perception by misunderstanding or deliberately invoked by lies or propaganda causes man to make choices that may be or become harmful to life, the environment and social cohesion.

For our bulk storage and transport industries, learning about this exciting theory has proven to be very useful. All you have to do is to measure the available quantity of quality in your organisation and start using all of it. This will mitigate risk and improve HSEQ and operational excellence. The research is ongoing. If you want to learn more please visit www.sustenance4all.com.

This is the latest in a monthly series of articles by Arend van Campen, founder of TankTerminalTraining, who can be contacted at arendvc@ tankterminaltraining.com. More information on the company’s activities can be found at www.tankterminaltraining.com.

UP FRONT 05 WWW.HCBLIVE.COM

TAILORED LOGISTICS.

On proven paths and new ways.

As one of the world‘s leading logistics services providers in handling and transporting liquid products, we are the first point of contact for the chemicals, gas, mineral oil and foodstuffs industries. By road, rail and sea, from road tankers to IBCs, from equipment leasing to intelligently networked Smart Tanks, we will find the optimum solution for you. We do this by using our expertise to pioneer our own new pathways that take you forward in a customised way. How can we help you?

www.hoyer-group.com

HCB MONTHLY | FEBRUARY 2018 06

THE RESULTS ARE IN

MARKET •THE CHEMICAL TANKER MARKET STAYED

came at the start of this month with StoltNielsen’s annual results. The company’s financial year runs to the end of November so it is always the first to report.

TURN OF THE YEAR

DURING THE COURSE OF the past year, it became increasingly apparent that the chemical tanker market was moving swiftly back into balance, after too many years of over-supply depressing freight rates. That recovery was founded partly on strong demand, helped by a blossoming clean petroleum product (CPP) market that pulled swing tonnage out of the chemicals sector, and partly on a small orderbook, resulting both from a lack of appetite for investment

during the market downturn but perhaps more critically on a lack of clarity over the best choice of propulsion given the uncertainty over future environmental restrictions. Later in 2022, however, global economic conditions, especially rising inflation and high energy prices, which had a dramatic impact on chemical production in Europe, threatened to derail that market improvement. The first chance we have to tell exactly how that reversal affected chemical tanker owners

For its fourth quarter, to end November 2022, Stolt Tankers recorded an improvement in net profit for the fourth consecutive quarter, as spot rates and volumes continued to improve. Operating profit rose from $61.1m in the third quarter to $78.2m, with total revenues up 1.9 per cent at $412.4m.

The improvement was felt largely in the deepsea business, where revenues were up by $24.4m on the back of a 4.1 per cent average increase in freight rates and a 3.9 per cent rise in volumes; in revenue terms, this was offset by a reduction in bunker surcharge revenue as bunker prices fell by 25.1 per cent compared to the third quarter. Revenue from the regional fleets was down $5.9m during the quarter, predominantly reflecting weaker performance in the European barging service due to higher water levels on the river Rhine causing lower freight rates.

The key to the market can be found in contracts of affreightment (COAs); renewals done during the fourth quarter were, on average, up by almost 30 per cent, which will have a positive effect over the coming year. It was also a good time to be renegotiating renewals, as the end of the calendar year is very busy, as Niels G Stolt-Nielsen, CEO of Stolt-Nielsen Ltd, explains:

“For Stolt Tankers, the fourth quarter into the first quarter is the peak contract renewal season with about 55 per cent of total contracts up for negotiations. In addition [to increased rates], we have successfully tightened terms in the contracts.” That reflects a shift in market power in a tight market, where owners feel capable of dictating terms, although it was not without its risk and, Stolt-Nielsen says, some 16 per cent of the contract portfolio was not renewed as some customers were not prepared to accept the increases that were asked for.

“Most of these customers are currently operating in the spot market,” Stolt-Nielsen adds. “With little to no growth in the global

WWW.HCBLIVE.COM TANKER SHIPPING 07

STRONG TO THE END OF THE YEAR AND, WITH LITTLE NEW CAPACITY COMING ONSTREAM, LOOKS SET TO STAY FIRM FOR A WHILE YET

chemical tanker fleet in the next few years, and newbuilding orders not available for delivery prior to 2026, we expect continued strengthening of our tanker markets.” That implies more power to the owners and greater control over rates and contract terms.

THE YEAR TURNS GREEN

For the year as a whole, Stolt Tankers saw a 28.4 per cent increase in revenues to $1,497.1m; earnings in the deepsea sector were up by 29.8 per cent at $1,257.3m, while regional fleets recorded a 21.8 per cent rise to $239.8m. Overall gross profit was up by 66.7 per cent at $260.8m, operating profit was ahead by 141.1 per cent at $205.1m and EBITDA rose 43.4 per cent to $358.8m.

That impressive financial performance has come at a time when all stakeholders in the energy and chemical supply chains are being expected to meet the challenges set by environmental targets. Stolt Tankers itself is aiming to reduce its greenhouse gas emissions by 50 per cent by 2030, compared to 2008 levels, and is also aware that it is in prime position to help its clients achieve their own sustainability targets. “Making

sustainability a key part of our culture is a big priority for us over the next couple of years,” says Gabriel Poritz, business partner, Sustainability and Decarbonisation, at Stolt Tankers. “It’s important to get to a place where our decision-making always considers the impact on the world around us as well as the profitability of the company and the safety of everyone involved.”

As has become evident over the past few years, no one company can do much on its own and Stolt Tankers is partnering with industry groups, including the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping and several industry-led future fuel initiatives. Stolt Tankers wants to be a proactive player, helping to drive positive change in the industry. Achieving that means more than working to make its own operations more sustainable – it also means helping customers achieve their sustainability goals too. “We want to be heard when it comes to the decisions being made by industry bodies, regulators and our peers,” says Poritz. “That way we can help move things forward and create the best results for our customers as well as the wider maritime industry and the planet.”

ONE FOR ALL

As Stolt Tankers moves forward on its own sustainability journey, it is finding more and more ways to help its customers on theirs too. From transporting less carbon-intensive fuels to supporting clients with their compliancerelated disclosures, this additional support is helping the company become an even more valued partner to its customers.

As well as helping customers explore ways to transition to biofuels, one of the most valuable ways Stolt Tankers is supporting customers is through transparency. The company’s Scope 1 emissions are Scope 3 for its customers – which can be difficult to calculate and verify but are increasingly required as part of sustainability-related disclosures. “Collaboration is impossible without transparency, and we have implemented the right tools and systems to provide customers with the information they need,” says Poritz. “They really value us being able to provide data on every one of the cargoes we ship for them.”

That partnership approach was demonstrated very clearly on 23 January this year in Gothenburg, when the tanker Stolt Sandpiper, which operates as part of the E&S Tankers pool, carried out the first ship-to-ship methanol bunkering operation on a non-tanker vessel, Stena Line’s ro-pax Stena Germanica The successful bunkering was a collaborative effort between the Port of Gothenburg, which was the first in the world to publish operating regulations for methanol bunkering in April 2022; Stena Line, the owner of the vessel and the purchaser of the methanol; methanol producer and supplier Methanex; and Stolt Tankers, which carried out the bunkering itself.

“Stolt Tankers is delighted to have taken part in this world-first for methanol bunkering,” says Lucas Vos, president of Stolt Tankers. “We are committed to our own journey towards carbon neutrality and to working with industry partners to explore ways to decarbonise the maritime sector as a whole. This project shows that, through collaboration and innovation, we can make real progress towards a more sustainable future for the industry.”

www.stolt-nielsen.com

HCB MONTHLY | FEBRUARY 2023

08

RAS

RISK & HAZARD MANAGEMENT

Understanding and facilitating the effective management of risk is our core business. Our expertise covers the full range of risk assessment and management services.

SAFETY BUSINESS ENVIRONMENT

Only when the risk facing an organisation is well understood can it be effectively managed. Key to the successful identification, assessment and management of risk is engagement with the right people, using the right processes at the right time. We believe we are different to many of our competitors and our approach is distinctive, we don’t always walk the well-trodden path but look at each client’s particular risk context and develop a tailored solution, working in partnership with our client.

We work across all aspects of risk, from Quantitative Risk Assessments and Predictive & Consequence modelling, through to the ‘softer’ risks which may affect an organisation’s reputation.

Cogent assured providers –Process Safety Management for Operations (PSMO)

Authorized distributor for Wolters Kluwer – BowTieXP software

ONLY CONNECT

to Marlink’s smart hybrid network, a process that relied on close co-operation and a commitment to quality,” says Tore Morten Olsen, president, maritime at Marlink. “We look forward to fully service Uni-Tankers’ global operations with the best-in-class network solution.”

GREENER SHIPPING

Uni-Tankers’ commitment to enhancing its operations has extended to initiatives designed to reduce fuel consumption and greenhouse gas emissions from its owned fleet, which have been rolled out since 2020. In addition to implementing alternative fuels, energy efficiency devices remain a key lever to reducing consumption of conventional fossil fuels and thereby minimising its carbon footprint.

“In Uni-Tankers, we are continuously looking for ways to reduce our overall impact on the environment. As a result of these efforts, we have installed fuel-saving technologies on most of our owned fleet, resulting in documented fuel savings of 8-15 per cent per vessel depending on the system installed,” the company states.

OPERATING CONDITIONS ABOARD

oceangoing ships present something of a challenge to digital systems developers: ships are subject to a great range of physical shocks and meteorological conditions, while operating far from land. Nevertheless, there are ways to do it, as Marlink, a Norway-based specialist, has shown.

Danish shipping company Uni-Tankers, which owns a fleet of 15 product and chemical tankers, was looking to implement a digital strategy that would combine hybrid highthroughput connectivity with cloud-data access, remote IT support, and proactive cyber-security to improve performance and operational safety. It turned to Marlink, which has now equipped all those vessels with future-proof smart network solutions, combining the full potential of global VSAT, L-band backup and global 4G connectivity, together with a range of digital solutions including CyberGuard and ITLink. Through its

XChange platform Marlink will deliver a fully managed service including network management and secure file transfers between ship and shore.

“Uni-Tankers’ business is built on highquality service and long-term relationships, and the safe operation of our vessels has the highest priority of both the company and our people,” says Michael Hust, IT manager at Uni-Tankers. “Partnering with Marlink has enabled us to take our fleet operations to a new level, increasing both operational flexibility and safety, which in turn enables us to deliver an even higher level of service to our customers.”

Marlink says this hybrid network solution will enable Uni-Tankers to further enhance its operations, including high volume data transfer to and from its vessels for safe and efficient navigation as well as compliance with prevailing vetting and inspection regimes. “We are delighted to have completed this successful migration of the Uni-Tankers fleet

The systems installed vary from vessel to vessel, as not all engines can benefit from the same technology. Most of the systems installed are so-called adaptive ‘on-top’ systems that ensure constant optimisation between engine and propeller, while others are an upgrade of the control system.

So far, nine of Uni-Tankers’ 15 owned tankers have been retrofitted with fuel-saving technologies, with two more scheduled to have the work done this year. Uni-Tankers is also planning to test a new hull coating on the 4,700-dwt Fenno Swan when it drydocks in April, with the aim of reducing frictional resistance in the water.

“In Uni-Tankers, we are continuously looking for ways to optimise our fleet, and with the help of new technologies, we are able to reduce our carbon footprint, living up to our ambition of being a responsible tanker operator,” says Kristian Larsen, technical director.

uni-tankers.com

marlink.com

10 HCB MONTHLY | FEBRUARY 2023

DIGITALISATION • NETWORKING MARITIME OPERATIONS IS NOT AS SIMPLE AS IT IS ASHORE. MARLINK DEMONSTRATES HOW IT HAS TRANSFORMED UNI-TANKERS’ FLEET OPERATIONS

TUGGING ALONG

The Amogy system will keep the ammonia tank pressure low, enabling Southern Devall to deliver ammonia to its customers and increase the utilisation and profitability of its fleet.

Following the barge integration and demonstration, Amogy and Southern Devall plan to pursue retrofits of additional barges and tugboats, creating an ammonia-powered fleet that includes cargo vessels as well as bunkering barges for efficient, emission-free refuelling of ammonia-powered ships.

WORK TO BE DONE

“Amogy has built an impressive platform that our team believes is an ideal solution for introducing cost-efficient, zero-carbon bunkering and powering operations to the inland barge industry,” says Sam Lewis, vice-president of engineering at Southern Devall. “Adopting their solution at scale in our fleet has both environmental and economic benefits through increased delivery volume. We look forward to demonstrating the value of ammonia-to-power solutions in our first project with Amogy and introducing industry and channel partners to these innovations.”

AMOGY INC HAS established a strategic partnership and technology deployment project with Southern Devall, which specialises in the transport by tank barge of liquid chemicals and fertilisers on the Mississippi River and Gulf Intracoastal Waterway. The partnership will centre on the application of Amogy’s ammonia-to-power technology in barge propulsion.

As with the spread of alternative power sources for oceangoing ships, the project rests on the common nature of cargo and fuel: Southern Devall services a significant proportion of the ammonia production market in the US and delivers ammonia to terminals for export and agricultural and chemical

customers along the country’s inland waterways. Amogy’s proprietary ammonia-topower system converts ammonia into hydrogen for use in fuel cells or as a more energy-dense method of long-distance hydrogen transport and has already been proven in agricultural applications; it is now being scaled for use in larger applications, including ships and ammonia bunkering barges to support the maritime industry’s decarbonisation efforts.

The partnership will, Amogy expects, also give it access to vast ammonia infrastructure as well as the Southern Devall team’s expertise in handling ammonia and maritime operations.

The first part of the project involves the retrofit of an existing barge, which is expected to be completed this year. An Amogy powerpack will generate the power needed to reliquefy ammonia as it heats up over the course of a voyage, instead of a diesel genset.

Amogy notes that the US inland shipping sector is responsible for annual CO2 emissions of some 6.2m tonnes and that many operators in the sector rely on older equipment. It hopes that the project will prove the viability of refurbishing fleets to improve quality and introduce zero-carbon power and bunkering capabilities.

Southern Devall was formed in 2021 when Southern Towing acquired Devall Towing, a family-owned firm established in 1952 that already had a specialisation in handling chemicals and was largely focused on coastwise transport. This past October, Devall said it was planning to integrate the operations and management of the two companies during the course of this year. The combined fleet comprises some 230 barges, 70 towboats and around 700 employees. Southern Devall is headquartered in Sulphur, Louisiana and is a portfolio company of CC Industries, a Chicagobased management company for the Crown family’s privately held companies.

amogy.co

www.devalltowing.com

www.southerntowing.net

WWW.HCBLIVE.COM

FOR A TRANSPORT COMPANY MOVING AMMONIA, IT MAKES SENSE TO BE ABLE TO USE SOME OF THAT AMMONIA TO POWER THE BARGES THAT CARRY IT

AMMONIA • THE ENERGY TRANSITION IS COMING TO THE NORTH AMERICAN BARGE SECTOR, WITH AMOGY’S AMMONIA-TO-POWER SOLUTION TRIALLING IN A PROJECT WITH SOUTHERN DEVALL

TANKER SHIPPING 11

NEWS BULLETIN

TANKER SHIPPING

VEDER HELPS OUT AT LUBMIN

Anthony Veder has committed three of its 10,000-m3 small LNG carriers to Deutsche ReGas to work at its new floating receiving terminal in Lubmin, on Germany’s Baltic coast. The three ships, Coral Furcata, Coral Favia and Coral Fraseri, will work as shuttle vessels, bringing LNG from oceangoing ships anchored off the port into its narrow channel for transfer to the floating regasification unit.

‘We are proud that we have been selected by Deutsche ReGas for supporting their floating LNG terminal,” says Jan Valkier, CEO of Anthony Veder. “As an integrated shipowner with extensive experience in ship to ship operations worldwide we are looking forward to collaborating with all parties involved to successfully bringing LNG via this new distribution route to Germany.”

To strengthen Anthony Veder’s role in the new import facility, the Rotterdam-based gas tanker specialist has also taken a minority shareholding in the Lubmin LNG terminal. anthonyveder.com

CONNECT THE TANKS

Scanjet PSM has developed a new tank monitoring system, certified for marine use,

based on its existing VPM central monitors with an enhanced processing unit capable of receiving input from multiple sources. The new Connect system is, Scanjet says, suitable for all tank gauging applications and has already been installed on naval oil tankers, fishing vessels and a land-based tank farm.

All signal processing and data calculations are undertaken within the Connect central processing unit and multiple input ports ensure virtually limitless expandability. Tank tables, trim and heel correction, specific gravity, overpressure, temperature, and all other related parameters are considered to provide accurate real-time display tank status. Information from Connect can be displayed in multiple formats, depending on user preferences, such as tabular, bar graph, tank plan and hybrid views. Tanks may also be grouped with dedicated alarm pages showing warnings and status at all times. psmmarine.com

STOLT HELPS SAVE THE WHALE

Stolt Tankers says it is to change its sailing patterns in parts of the world where large marine animals live and feed. In line with IMO guidance, Stolt ships travelling in waters south of Sri Lanka, the north-west of the

Mediterranean Sea, the waters around Vancouver Island and the east coast of the US will modify their routes and reduce their speed by 20 per cent to minimise the impact of shipping on the whale population and reduce the likelihood of physical injuries due to collisions.

“We believe that Stolt Tankers has an important role to play in protecting the oceans that are the lifeblood of our business,” says Lucas Vos, president of Stolt Tankers. “By reducing our voyage speed from 12.5 knots to 10, we can significantly help to reduce the risk of ship collisions with whales. I am proud that we have taken another step on our sustainability journey, and in supporting the UN Sustainable Development Goal which is focused on protecting life below water. By raising awareness of these issues, I hope it encourages others in the maritime industry to follow suit in helping to conserve and protect our oceans and marine wildlife.”

www.stolt-nielsen.com

DORIAN HELPS DECARBONISATION

Dorian LPG has signed a partner agreement with the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping; Dorian says that, as one of the leading VLGC owners and operators, with in-house technical and commercial management, it will be able to share its experience and capabilities that are relevant to driving the decarbonisation of the maritime sector.

John Hadjipateras, chairman and CEO of Dorian LPG, says: “To meet and exceed the industry’ decarbonisation targets there is an essential need for research and development collaboration amongst shipping and logistics organisations. We believe that the Center is performing a very important service to the industry and are happy to contribute Dorian

12 HCB MONTHLY | FEBRUARY 2023

expertise from Copenhagen, Athens and the US to help facilitate some of their important work.” www.dorianlpg.com

FOUR MORE FOR THUN

Thun Tankers has ordered four 7,999-dwt coastal tankers from Ferus Smit, taking the newbuilding order to six R-class tankers, which will be deployed in the Gothia Tanker Alliance. The first of the six is due for delivery in the second half of 2024.

The tankers have been designed to be the most resource-efficient vessels on their trade lanes. “Thun’s long experience of building high performing quality vessels has been used in the design process. We have been combining this with a number of new features to further improve performance while reducing our climate footprint,” said Joakim Lund, CCO of Thun Tankers, at the time of the first orders were placed in May 2022. thuntankers.com

TERNTANK HAS WIND IN ITS SAILS

Terntank has ordered two 15,000-dwt chemical/product tankers, with options for two additional vessels, at China Merchants Jinling for spring 2025 delivery. The new tankers, designed by Kongsberg, will be able to run on biofuels or methanol and also feature wind assistance fixed sails as well as the Hybrid Solution battery pack/shore connection that was installed on Terntank’s two latest newbuildings.

The design of the new tankers will reflect the experience with the earlier six AVIC-series vessels with additional innovative improvements to reduce environmental impacts. Building on the 40 per cent CO2 emissions reduction made on those vessels, the wind assistance will further reduce emissions by 8 per cent and, with methanol’s potential in terms of decarbonisation, the new ships will

accelerate Terntank’s pathway to net zero. The efficient design also results in an EEDI between 16 and 40 per cent below the 2025 Phase 3 requirements.

The new vessels will be built with 14 cargo segregations; it is expected they will be employed to transport biofuel feedstocks to refineries and pick up finished biofuels for distribution. terntank.com

IINO CARRIES ETHANE FOR INEOS

Iino Lines has signed a long-term timecharter agreement with Ineos for two 99,000-m3 very large ethane carriers. The newbuildings are due to be handed over in 2025 and 2026 and will take Iino’s ethane carrier fleet up to 18 vessels.

“This is a brilliant milestone for Iino in terms of transporting liquefied ethane gas, a new liquefied gas cargo, and we also believe that it will contribute to the expansion of our new energy transportation business,” says Hiromi Tosha, president of Iino Lines.

David Thompson, CEO of Ineos Trading & Shipping, adds: “This deal is another major step forward for Ineos Trading & Shipping and signifies our ongoing growth in ethane trade. IINO Lines are a highly experienced ship owner, with a strong focus on safety, reliability, and efficiency. We are very pleased about this new long-term partnership.” www.iino.co.jp

EVERGAS NOW SEAPEAK

Seapeak has concluded its previously announced acquisition of Evergas from Jaccar Holdings in an all-cash transaction of some $700m. Evergas will now be rebranded and operate as a wholly owned subsidiary of Seapeak. “At Evergas we are pleased to complete the sales process and become part of Seapeak - one of the gas industry’s biggest players, which also brings us significant financial strength,” said Steffen Jacobsen, CEO of Evergas, when the deal was first revealed this past October. “This will provide a solid platform on which we can continue to grow our businesses in NGLs and CO2, where we see outstanding potential for growth.”

“Acquiring Evergas is another big step in Seapeak’s evolution as a leading owner and operator of liquefied gas carriers,” commented Mark Kremin, Seapeak’s CEO, at the time. “Just as we’re bullish on LNG, we’re also bullish on natural gas liquids (NGLs), especially given the even greener nature of NGLs. Already a world leader in NGLs, Ineos is now growing in LNG, and we are thrilled to be adding them as a key customer, further diversifying our portfolio.”

Seapeak, which was formed out of Teekay LNG Partners on its acquisition by Stonepeak in January 2022, now has interests in 51 LNG carriers, 20 mid-size LPG tankers and six Multigas carriers, including newbuildings on order.

www.seapeak.com

TANKER SHIPPING 13

WWW.HCBLIVE.COM

THE MIDDLE WAY

WAREHOUSING • LESCHACO IS PLANNING TO ADD TO ITS GROWING CHEMICAL WAREHOUSE NETWORK WITH A NEW LOGISTICS CENTRE IN MOERDIJK, DUE TO OPEN LATER THIS YEAR

LESCHACO IS PLANNING to open a chemical logistics centre in Moerdijk, situated strategically between the major ports of Rotterdam and Antwerp and with optimal accessibility to the European hinterland. In January this year, Leschaco signed a lease with David Hart Group (DHG), an industrial land developer, for a new ADR warehouse on the site. The new facility is scheduled to be ready in the third quarter of this year.

The planned warehouse will offer some 45,000 pallet spaces on a footprint of 29,000 m2. It will be divided into five areas, with one for general cargo and the other four being designed to handle chemicals and other dangerous goods and featuring a CO2 fire extinguishing system.

“This project is an important strategic milestone for our presence in Europe. It is also necessary to meet the increasing demand in the region and to be closer to our customers,” says Constantin Conrad, managing partner of Leschaco Group.

The location certainly provides that proximity, with daily barge traffic along the Rhine and Meuse systems between Rotterdam and Antwerp, as well as two public rail terminals in the vicinity. Moerdijk guarantees optimal accessibility to the European hinterland and ensures that customers’ products are transported in an efficient manner in terms of cost, speed, accessibility and frequency, Leschaco says.

That approach is the same as the company

took in opening its chemicals warehouse in Port Klang, Malaysia at the start of 2022, taking advantage of rapid growth in contract logistics in the chemicals sector in the country. At the time, country manager Lothar Lauszat said: “The constantly growing demand from the chemical industry made the new building urgently necessary. This investment is of great strategic importance for our existing and new customers.”

MEET AND GREEN

The new Moerdijk site will fill a similar need. “The new logistics centre offers our global customers in the chemical, healthcare, automotive, industrial materials and consumer goods sectors a wide range of services and, in combination with other Leschaco products, complex logistics solutions at the highest level,” says Sebastian Haebler, head of Global Contract Logistics at Leschaco. “In addition to pallet storage, this includes various kinds of value-added services according to our customers’ demands.”

The new building meets all safety and environmental standards. Solar panels on the roof will be able to cover part of the electricity demand. Other sustainable measures, such as the use of electric floor heating instead of gas or oil installations, LED lighting, and the highest construction standards for isolation, also contribute to improving the climate balance, as do the short distances to the port of Moerdijk for transport by barge and rail and e-charging stations for cars.

DHG is the biggest developer of large logistics real estate in the Netherlands and, since 2015, has realised more than 1.3m m2 of distribution centres using the ‘SmartLog’ concept. These distribution centres are designed in such a way that they are suitable for a wide range of types of user. DHG’s owner, David Hart, says: “Leschaco and DHG are both family businesses; our motivation, standards and values are very similar. Partly for this reason, we are honoured to add Leschaco to our DHG ‘family’ and to be a part of their expansion within Europe.”

www.leschaco.com

14 TANKS & LOGISTICS HCB MONTHLY | FEBRUARY 2023

CAUTIOUSLY OPTIMISTIC

relief valves. We are reconfiguring the space to enlarge our office and warehouse facilities in order to improve the service we can offer to our customers in the Americas.

Our UK webshop had a very successful launch, with a 30 per cent increase in sales since last year - consequently, the webshop is opening up to the European market in March.

IN THE FUTURE , historians may look at the early years of the 21st century and wonder how we all managed to navigate the choppy waters of boom, bust, recession, recovery, epidemic and war. For many, these factors have caused strife and uncertainty in an already turbulent marketplace, but I am thankful (and happy) to say that, as 2023 begins, it’s starting to look as if we may be over the worst.

It is, of course, a dangerous hobby to predict the future and I’m not going to tempt fate by starting now, but I would suggest that after two rollercoaster years we may be entering a period of relative calm. Energy prices are on the way down as Europe has succeeded in sourcing alternatives to Russian gas (although the continuation of the war in Ukraine has the potential to destabilise these efforts); Covid would appear to be receding in its effectiveness; the logistics nightmare of 2022 is abating and supplies of raw and finished materials are getting back to normal. So while

I think it may be premature to start waving flags, I’m hoping that good, old-fashioned stability is coming into fashion again.

At Fort Vale, our love of forward planning has paid dividends, and we are in a sound position after two consecutive years of outstanding results. As ever, we look to the future and plough the profits back into the company, so that we can safely expand our operations to cater for the needs of our growing customer base.

OUT AND ABOUT

I have mentioned our rapidly growing rail business in these pages before. In the last half of 2022 we launched our RAILTYT Range to a significant amount of interest from customers old and new, and our market share has increased dramatically. As a result, our US operation is undergoing the substantial redevelopment of the Houston site, enabling us to increase our abilities in servicing gas equipment for T50 gas containers and AAR

Back in the UK, our apprenticeship scheme has broken all records - maintaining our strategic advantage in succession planning and retaining the capital intelligence that is vital to maintaining growth in any business.

And speaking of growing business, I’d like to say what a pleasure it was to finally attend some exhibitions last year. We had an excellent showing at Innotrans and Intermodal - customer and supplier engagement was at an all-time high, and it was good to see so many friends again after the long Covid layoff. We found ourselves being offered opportunities in interesting new directionsI’m not allowed to say anything about that just yet - but I am looking forward to attending StocExpo in March, and we will also be at Transport Logistic and, of course, Intermodal once again.

So where does that leave us? Well, hopefully to a year of cautious optimism and steady growth - so slightly more boring than the last couple of years - but then again, after the last few years, would that be so bad?

www.fortvale.com

16 TANKS & LOGISTICS HCB MONTHLY | FEBRUARY 2023

OUTLOOK • AS 2023 BEGINS IN EARNEST, GRAHAM BLANCHARD –FORT VALE’S HEAD OF GLOBAL SALES AND MARKETING – LOOKS AT THE YEAR AHEAD AND HOPES IT WILL BE RELATIVELY BORING

Your tank container experts

TWS has more than 25 years of experience in renting out standard and special tank containers for liquid products to the chemical and food industries. TWS also provides various sizes of spill troughs. Customers rely on the outstanding quality of its fleet and value its flexibility in terms of volume and technical features.

For more information: E-mail: tws@tws-gmbh.de and web: www.tws-gmbh.de

SECTION SLUG 17

TWS_180x124_Kombi_ENG_NEU.indd 1 23.06.16 12:23

POWER OF THREE

were operating, while other specialised reefer equipment production remained in York, Pennsylvania and both Klinges continued to press the products forward into new markets.

Henrik moved with his family to the US in 1986 to run the Klinge facility in York, now called Klinge Corporation. Throughout the 1980s, 1990s and early 2000s Henrik continued to build Klinge’s brand in the industry, also introducing tank container refrigeration and heating equipment as part of the company’s offerings, as well as starting multiple other successful companies, including a refrigerant reclaim company and a booming spare parts business.

THE THIRD GENERATION

Following in his father Henrik’s footsteps and continuing the influx of fresh energy from generation to generation, Allan Klinge joined the company in 2007. Allan brought a renewed passion to focus on the core competencies of Klinge Corporation – innovation, specialised design and customer service. New projects and endeavours followed, including large contracts with the Australian Defence Force and Swedish Defence, all while building on long-term success in the chemical industry and introducing new product lines of explosion-proof equipment for the oil and gas industry.

WITHIN THE EVER-CHANGING world of global logistics, a little consistency goes a long way. And the Klinge family business has consistently been providing high-level service and products since its founding by Paul Klinge just after the Second World War in Denmark.

Paul ventured out to the US shortly after the end of the war, seeking new partners and opportunities and eventually securing representations for companies such as Union Carbide (which at the time included the Energizer and Eveready battery brands), Bendix, Westinghouse and Borg-Warner that later invested in York International, which, among other products, also

produced refrigeration systems for marine transport containers.

In order to maintain the level of consistent service, however, adaptation and fresh thinking was also needed and, in a family business, this often comes in the form of a new generation joining the team. By 1984, Paul and his son Henrik Klinge, who had worked in the company since 1971, were the main agents for the York ocean transport business and would eventually take over the business completely as York focused on other business opportunities. The production of standard reefer equipment eventually moved to Denmark where other Klinge companies

Sadly, while Paul had been a part of the business up until the end, he passed away in 2010 at the age of 88. Henrik and Allan continued on with the work in the US, bringing on new clients in the pharmaceutical and food-processing space, and Allan eventually took over Klinge Corporation completely in 2017, becoming president and then CEO in 2022.

Henrik continues as director and is still deeply involved in the engineering side of the business, while Allan focuses on implementing a series of business process improvement plans to help keep Klinge at the forefront of innovation, while also focusing on building an engaged and passionate team to ensure long-term success – continuing the decades long-trend of generational change. klingecorp.com

18 TANKS & LOGISTICS HCB MONTHLY | FEBRUARY 2023

EQUIPMENT • FAMILY VALUES HAVE PROPELLED KLINGE CORPORATION THROUGH THREE GENERATIONS OF LEADERSHIP, BUT THE FOUNDING PRINCIPLES REMAIN THE SAME

OUTSTANDING EQUIPMENT.

Your tanks need the best equipment to remain efficient, safe and profitable.

The Fort Vale Liquid RAILTYT Product Range of fuel and chemical transfer equipment continues to evolve and expand - ensuring quality, safety and security well into the 21st century.

Our vertically integrated manufacturing strategy allows us to precisely control the quality of our supply chain so that you can be confident in the origin, integrity and reliability of all our products.

The large scale of our UK factory, coupled with all the latest production technology gives us an unrivalled manufacturing capacity - allowing us to keep even the largest wagon builders in Europe supplied with equipment that has shown time and again it is safe, easy to operate and built to last.

Contact us at sales@fortvale.com to find out more. So you can keep your tanks on track.

SECTION SLUG 19

Y Type End

® FORT VALE. FOLLOW THE LEADER. Visit us at www.fortvale.com

M24 Swingbolt Ventilation Valve

Valve 5” Bottom Valve

EUROPEAN STOCK. IMMEDIATE DISPATCH.

SPEAK MY LANGUAGE

standardised - especially so when personal data, like truck and driver data, is being shared.

At present, different standards for truck and driver data are used within the transport sector, leading to a multiplicity of data definitions, rules and data requests from each platform provider or company. This lack of truck and driver data harmonisation and standardisation results in a lot of manual work, data input mistakes, different IT interfaces and complexity and extra costs.

ELECTRONIC DATA INTERCHANGE (EDI) within and between companies is now the norm and, certainly in the transport sector, can not only improve accuracy and efficiency but also reveal inefficiencies and lead to better employment of assets. But as EDI systems and other digital networks have developed, different standards and platforms have developed, which is hindering the take-up of some potentially very useful solutions.

The European Chemical Transport Association (ECTA) is well aware of these problems and, in recent years, has done a lot to promote standardisation and best practice in the application of digital systems. It has offered standardised data formats for its members and their business partners to use in areas such as transport orders and asset visibility, but it is not stopping there. Two recently published best practice guidelines address transport invoicing and truck and driver data.

In the order-to-cash process within bulk logistics, additional data next to visibility and order data is exchanged between shippers and logistics service providers. In particular, after the transport operation has been executed, the exchange of invoice-related information takes place to trigger the completion of a service. Besides the freight costs, other cost-related items, such as heating, truck waiting times or other auxiliary services, are handled during the payment process. Furthermore, process scenarios vary case-by-case and can consist of proforma invoices/notifications, debit or credit notes.

ECTA’s Transport Invoicing Data Standards guideline aims to complement the existing

guidelines and give all relevant stakeholders additional guidance on how to facilitate electronic data exchange in this area. The guideline refers to the use of an order data standard based on the Open Applications Group OAGIS® Chem eStandard 5.42 plus some extended bulk-logistics specific attributes being identified by ECTA.

PEOPLE AND PLACES

ECTA’s other new digital guideline addresses data about vehicles and personnel. The Association notes, for instance, that chemical logistics supply chains are being transformed into hyper-connected networks where digital collaboration among all stakeholders is becoming a necessity to help meet customer demands and future societal needs. However, due to the increasing number of different IT platforms, data interfaces and parties involved in the transport and logistics chain, there is more and more need for data to be

A standard format and set of definitions for truck and driver data, exchanged digitally between different parties, will ease digital collaboration and enhance data quality, allowing greater automation and reducing errors and manual input work. There are also efficiency gains to be made: if all parties are collaborating on the same digital standards, waiting times at the gate can be reduced. When sharing truck and driver data it is also important to consider which data can or cannot be shared and how it can be shared, so that personal data is processed confidentially and complies with the General Data Protection Regulations (GDPR). In addition, commercially sensitive truck data should be handled with respect for data ownership. ECTA’s Best Practice Guideline aims to define a standard set of truck and driver data. It also offers recommendations for the digitalisation process, in compliance with GDPR. All ECTA Best Practice Guidelines can be freely downloaded from the ECTA website at https://ecta.com/guidelines/.

HCB MONTHLY | FEBRUARY 2023

20 TANKS & LOGISTICS

DIGITALISATION • AS THE WORLD GETS EVER MORE CONNECTED, IT IS VITAL THAT ALL PARTIES IN A LOGISTICS SUPPLY CHAIN CAN TALK TO EACH OTHER. ECTA IS CONTINUING TO PROMOTE STANDARDS

Klinge Corp’s versatile tank container refrigeration and heating units meet the demands of your industrial applications. > Easy installation, low maintenance, and precise temperature controls make Klinge Corp’s refrigeration and heating systems an unmatched long-term value. TEMPERATURE CONTROL UNITS FOR TANK CONTAINERS inquiry@klingecorp.com www.klingecorp.com USA: + 1-717-840-4500 DUAL AND EXPLOSION-PROOF OPTIONS AVAILABLE THE WORLD’S LEADING MANUFACTURER OF TEMPERATURE CONTROL SYSTEMS FOR TANK CONTAINERS

NEWS BULLETIN

ambitious growth strategy, building and strengthening relationships with new and existing customers and continuing to bring high levels of safety and reliability.”

www.suttonsgroup.com

DOB IN BAD SITES

DINGES ADDS REACH

Dinges Logistics has added another reachstacker to handle empty tank containers at its recently expanded operation in Grünstadt, Germany. The new Kalmar unit is equipped with an electronic weighing device and an electronic overload limiter; the spreader is fitted with a ‘soft landing system’ that slows the spreader as it approaches the container, to protect both pieces of equipment.

“We consider the concept of value-added service to be critical to success. For this reason, in particular, we want to continue to grow not only in terms of transport services, which represent our core business, but are pushing for sustainable growth in all areas of our service portfolio. In this context, we were able to increase the capacity of our container terminal and for the corresponding handling, we expanded our fleet with an empty container reachstacker,” explains Michael Klopp, COO of Dinges Logistics. dinges-logistics.com

DEN HARTOGH SHIPS ELECTROLYTES

Den Hartogh has developed a global door-todoor service for the shipment of lithium battery electrolytes, following its introduction last year

of electrically cooled tank containers. It is now offering a one-stop integrated logistics solution for electrolyte manufacturers in China exporting to Europe, using its own trucking fleet to move tanks to the port and carrying out distribution in Europe.

“Den Hartogh continues to invest in modern technology and creative logistics solutions to help fulfil our customers’ needs in an increasingly complex environment,” the company says.

www.denhartogh.com

SUTTONS GOES TO WASTE

Suttons Tankers has appointed Simon Williams as general manager, waste as part of its strategy to grow in the bulk waste transport sector. Suttons says Williams “is an industry expert and brings technical knowledge and commercial experience gained from a long career in all areas of the waste supply chain”.

Michael Cundy, managing director of Suttons Tankers, says: “I am delighted to welcome Simon Williams into the business. With decades of experience in the waste sector he will strengthen our offering to customers. Under his guidance the business will further develop into this sector in line with our

The European Chemical Transport Association (ECTA) has secured funding to help with the development of its mobile phone app for drivers. ECTA’s Driver Shortage Workgroup has pinpointed excessive waiting times and poor facilities at loading and unloading sites as a major factor in reducing the attractiveness of truck driving as a profession, hindering the recruitment and retention of drivers. It suggested developing a system that would make it easy for drivers to report poor conditions, with the aim of improving standards. Drivers will be able to rate each site on the basis of safety, waiting time, driver treatment, driver facilities and total residence time. Work on the ECTA app is now starting. www.ecta.com

VTG BUNDLES BALTICS

VTG Rail Logistics has strengthened its presence in the Baltic region, taking what was formerly VTG Project Logistics and adding a complete portfolio of rail transport services under a new company, VTG Rail Logistics Baltics, with Violeta Vlasoviene appointed managing director.

Integrating the new company, headquartered in Lithuania, into VTG’s existing panEuropean network will, the company says, enable it to optimise and harmonise its national and cross-border leasing and rail logistics activities in the Baltic region.

“VTG boasts exceptional expertise in rail transport and multimodal logistics, offering a full spectrum of services across the entire transport chain,” says Paweł Solich, head of

22 HCB MONTHLY | FEBRUARY 2023

TANKS & LOGISTICS

Region North-East at VTG Rail Europe.

“Our r2L solution (‘roadrailLink’) increases the proportion of craneable semitrailers from 5 to 95%. Even trailers carrying refrigerated goods, liquids and fuels can make use of this innovation.”

“The ongoing Rail Baltica corridor project will connect five EU countries – Poland, Lithuania, Latvia, Estonia and, indirectly, Finland,” Vlasoviene notes. “This will provide VTG with exciting new market opportunities. Having our own office on the ground is going to help us respond even better to the needs of our customers in this highly promising market environment.”

www.vtg.com

LESHACO BUYS IN COLOMBIA

Leschaco has acquired Coltrans SAS, which has been part of its agent network for more than 30 years and has a leading position in the Colombian logistics market. It provides global logistics services including import and export services for different transport modes, as well as customs clearance, warehousing and intermodal transport. Coltrans is headquartered Bogotá with eight offices around the country and some 500 employees.

“The entry into the Colombian market and the acquisition of the Coltrans product portfolio are an excellent strategic addition to Leschaco’s existing global network. Our local and international customers will benefit from this,” says Martin Sack, regional head Americas at Leschaco.

Constantin Conrad, managing partner of the Leschaco Group, adds: “We are very pleased to welcome our new Colombian colleagues and customers. The acquisition fits ideally into our already existing network and has a high strategic importance for us. It strengthens our business activities in one of the most attractive economies in Latin America.”

www.leschaco.com

VDB LOSES WEIGHT

Van Den Bosch has been continuing in its quest to maximise loading weights, following the introduction of the 35,500-litre ultra-light high volume swap body tank container last year. It has now introduced an ultra-light chassis, developed initially for those European countries that legislate for a maximum axle load of 3 x 9 tonnes; this includes the Netherlands, Belgium, Germany and France.

“Thanks to the further development of the associated ultra-light chassis, an optimal payload can now also be achieved in countries where different legislation is applied regarding axle loads and distances,” explains Emiel van Haren, operations director of Van den Bosch’s liquid bulk division.

The new chassis also allows a payload of 30 tonnes in countries that have a maximum axle load of 3 x 8 tonnes, including Spain, Sweden, the UK and Hungary.

“Efficiency in logistics not only increases convenience but also sustainability within the supply chain,” van Haren adds. “By optimising the payload, fewer runs are required to transport the same amount of freight. This results in a reduction of CO2 emissions. Thanks to the new ultra-light chassis, the next step is being taken in terms of sustainability.”

www.vandenbosch.com

H&P STILL GOING STRONG

H&P Freightways stresses that, contrary to market rumours, it and its sister operation Tankclean are continuing to grow and thrive as an independently owned company. “Careful planning and management of the operations during 2022 was key to us keeping all employees in work and not facing any redundancy situations,” the company says. “Further investment in property, vehicles and people are ongoing and this allows us to offer more capacity to customers.”

H&P Freightways, based in Hull, UK, operates a fleet of nearly 100 vehicles and Tankclean operates four tank cleaning stations, making it the largest tank container haulier and cleaning station operator in the UK. In addition, having a board of directors who are each operational within the company allows decisions to be made quickly and gives the ability to respond rapidly to customer needs.

“Our recent investments have allowed us to increase tank storage capacity in Hull and we have no less than 15 new Renault T-Range tractor units joining the fleet this year,” the company adds. “We have also purchased new Kalmar container lifters for the Hull and Teesside depots to ensure reliable service is provided to customers.

“The future of H&P Freightways/Tankclean is very positive and, very much, as an independent company.”

www.hpfreightways.co.uk

TANKS & LOGISTICS 23

WWW.HCBLIVE.COM

GOING FOR GROWTH

PRODUCTION • IT HAS BEEN A BUSY FEW MONTHS FOR SCHÜTZ, WITH ACQUISITIONS AND EXPANSIONS, AS WELL AS NEW PRODUCTS ON DISPLAY AT RECENT PACKAGING TRADE SHOWS

SCHÜTZ CONTAINER SYSTEMS has agreed to acquire Remi Tack, a Belgium-based reconditioner of composite IBCs and plastics drums that has been a long-time collaborator with Schütz. Family-run Remi Tack was founded in 1999 and, Schütz says, is one of the leading reconditioning companies in the Benelux region.

“We are grateful for the confidence and faith placed in us by the owner Tom Tack and his management team,” says Roland Strassburger, Schütz CEO. “The acquisition enables us to expand the portfolio of services for our customers in the Benelux region. This move sees us moving even closer to our customers and, together with the Remi Tack team, we are further strengthening our commitment to a sustainable circular economy.”

Schütz says the deal will support the development of the circular economy in the region to further drive sustainability and continuous improvement in the service levels for its customers.

Tom Tack, owner of Remi Tack, says: “From our many years of working together as partners, we know that Remi Tack is in excellent hands with Schütz. The philosophies of our two family businesses are a perfect match. We know that Schütz will use its significant innovative strength to drive the further development of our industrial packaging product range and offer an even wider range of reprocessing and recycling services.“

NEW SITES, NEW LINES

Schütz has also been adding to its production capacity around the world, most recently beginning production of open-head steel

drums at its factory in Pasadena, Texas. The site opened in 2016, when it was the first new steel drum plant in the US for more than 20 years, and since then has concentrated on production of tight-head steel drums in various material thicknesses.

Addition of open-head drums to its portfolio in Texas will, Schütz says, allow local customers to benefit from a fully comprehensive range of new and reconditioned intermediate bulk containers (IBCs) and plastics and steel drums.

Towards the end of last year, Schütz opened a new production facility in Spain. The 9,000-m2 Cazalegas plant, some 100 km from Madrid, will be used to produce a range of IBC models, including the eco-friendly Green Layer

range. It also houses a high-tech reconditioning line for the recycling of used containers.

“The new plant allows us to further increase supply security and ensure the comprehensive availability of our packaging,” the company states. “For the delivery of new containers and the collection of emptied IBCs, being close to our customers facilitates short transport routes and fast response times.”

The Cazalegas plant will supply much of the Iberian peninsula, including Portugal, with the existing Schütz Ibérica site in Vila-Seca near Tarragona continuing to supply the chemical industry in Catalonia.

In the UK Schütz has installed an additional multi-layer extrusion blow-moulder at its Worksop plant to expand production capacity for IBC inner bottles and allow the production of Green Layer plastics drums and IBCs, which include a high content of recycled material.

The new blow-moulder was built in compliance with the latest technical standards at Schütz’s global competence centre in Selters, Germany. It will increase the level of automation and provide maximum reliability on the production line while also raising quality control, the company says.

www.schuetz.net

HCB MONTHLY | FEBRUARY 2023

24

ION BREW

PLASTICS • ORBIS HAS STRENGTHENED ITS PRESENCE IN EUROPE AND CONTINUED WITH THE DEVELOPMENT OF INNOVATIVE, REUSABLE RIGID PLASTICS PACKAGING FOR SELECTED INDUSTRIES

ORBIS, A WISCONSIN-based international manufacturer of reusable plastics packaging, reports that it has maintained its growth in Europe during the economically challenging year just gone. “We have developed our customer base as well as our organisation,” says Jürgen Krahé, senior commercial director EMEA at Orbis. “Through regular collaboration with our customers and partners, also at events such as FachPack and The Battery Show, we continue to focus on customer needs. That helps us optimise our product portfolio with the customer in mind.”

Orbis Europe, established in 2016, represents Orbis Corp in the EMEA region from its headquarters in Hürth, Germany. Its

growth is already continuing in 2023, with the opening of a new production and distribution centre, as well as office space, in Ieper, Belgium. The 2,300-m2 clean area is being used for sensitive and complex packaging solutions, such as those being developed for the transport of lithium batteries and other equipment for the automotive industry. The design of the factory space inhibits contamination during packaging assembly and storage.

As an example of the sort of packagings Orbis is providing, last year it extended its dangerous goods packaging offering with the IonPak® range of foldable packagings, aimed in particular at the automotive market.

UN-approved for solid dangerous goods (4H2 and 50H) and with a gross load capacity of up to 915 kg, the packagings were designed primarily as a reusable unit for the safe transport of lithium ion batteries, although they are also suitable for use with other batteries and regulated automotive parts such as air bags, seat belt tensioners and others that require UN-certified packaging.

WHERE TO NEXT

One of the goals for Orbis in 2023 is to introduce proven products to other geographical and vertical markets. Customerspecific packaging solutions are currently in prototyping phase. “We already cover the rising demand for sustainable transport packaging with our existing product portfolio. Additionally, we are working on increasing the percentage of recycled material in our products and evaluating alternative materials,” says Krahé. “In that way, our customers continuously benefit from our sustainable, innovative product portfolio and expertise.”

That approach to sustainability extends throughout the Orbis range and, With a durable and supply chain optimised product design, Orbis’ customised and standard solutions help streamline product flow sustainably along the supply chain. The plastic foldable large containers (FLCs), pallets and small load carriers are 100 per cent recyclable.

Menasha Corporation, owner of Orbis Corp, is one of the oldest family-owned manufacturing companies in the US, having been in operation since 1849, and is very strongly focused on sustainability. Menasha’s latest Corporate Social Responsibility Report notes that the corporation reduced its greenhouse gas emissions by 3.2 per cent per tonne of output between 2020 and 2021 and has also reduced its water consumption per tonne of output by 90 per cent since 2010. The European market can see more of Orbis’ products at upcoming events, including LogiMAT (25 to 27 April) and the Battery Show Europe (23 to 25 May), both in Stuttgart, Germany.

orbiseurope.eu

WWW.HCBLIVE.COM INDUSTRIAL PACKAGING 25

biomedical, pharmaceutical, veterinary, petrochemical, and food and drink industries.

GET IT TOGETHER

THE UN PACKAGING standards provide a comprehensive and very strict set of requirements for the design and use of all types of packagings used in the transport of dangerous goods. All designs must be tested and must be tested in the form in which they will be used. For combination packagings, for instance, that means that they are tested with all elements of the complete package in the correct arrangement and with the outer packaging properly closed.

Packaging manufacturers are responsible for having their products properly tested and also for passing on to users the instructions for the proper assembly and use of those packagings. Those instructions have typically been provided on a sheet of paper sent along with the packaging to the user but, as we all know, those sheets can be lost along the way and, given modern digital technology, better ways are being found.

Dangerous goods packaging supplier Air Sea Containers, for instance, has introduced QR codes on its newly branded packaging. When scanned, these codes provide shippers with direct access to a comprehensive set of assembly instructions to help them assemble the packaging compliantly during the packing process. The new QR codes form part of a redesign of Air Sea Containers’ fibreboard packagings, which produce a cleaner look and give more space for labels and marks.

Laurence Richards, product manager at Air Sea Containers, comments: “We are passionate about our contribution to the safe shipment of dangerous goods. Our packaging is manufactured to the highest standards and is compliant with air, sea and road

regulations. However, correct assembly is fundamental to its performance. UN packaging must be assembled in accordance with the manufacturer’s assembly instructions - use in any other way will render it invalid. To ensure this vital information is to hand when the packaging is assembled, we have introduced QR codes on the packaging itself; the shipper simply scans the QR code and follows the assembly instructions, enabling the packaging to be correctly assembled.”

HOW TO DO IT

The new QR codes provide step-by-step assembly instructions, assembly videos, information on package contents and weight restrictions, FAQs and more. This information aims to simplify the packing process for those organisations across a variety of industries who use Air Sea Containers’ UN packaging to ship dangerous goods, including those in the

The use of electronic assembly instructions does not affect the packaging’s test certificates, as the specification of the packaging itself has not been altered and performs to the same standards as those in has replaced. The removal of paper instructions reduces waste and eliminates the risk of paper assembly sheets being misplaced and not reaching the end user responsible for assembling the packaging compliantly. The QR code placement means the person assembling the packaging will always have the instructions to hand.

Air Sea Containers stresses that it is the shipper’s responsibility to ensure that they pack their substances and articles correctly within the packaging, exactly as per the assembly sheet instructions, to ensure the chosen packaging performs to the standard it did during approval testing. If a shipper fails to follow the assembly instructions, they risk invalidating the test certificate and compromising the capability of the packaging.

Air Sea Containers’ range of 4GV, 4G, 4DV and Division 6.2 packaging all include the new QR codes, which are also included on non-UN packaging such as the Temperature Control range, which can be used to ship items requiring a temperature-controlled environment, as well as dangerous goods when consigned in an overpack.

www.airseadg.com

HCB MONTHLY | FEBRUARY 2023

26

ASSEMBLY • IT IS UP TO THE USER TO ENSURE THAT A PACKAGE IS ASSEMBLED CORRECTLY; AIR SEA CONTAINERS IS LEVERAGING TECHNOLOGY TO PROVIDE THE INFORMATION THEY NEED TO DO SO

NEWS BULLETIN

INDUSTRIAL PACKAGING

plastic bottle footprint and adds a further growth engine to our GIP business. I am excited to welcome our new colleagues to the Greif family and look forward to growing our business together with them.

“Lee is a premiere organisation and fits perfectly within the strategic parameters of our repeatable M&A playbook,” Rosgaard adds. “We foresee abundant opportunities to continue growing Lee organically as well as seeking add-on acquisitions to further broaden our footprint in jerrycans and small plastics.” www.greif.com

REBRAND FOR RECOVERY

Mauser Packaging Solutions has rebranded its international packaging collection programme as ‘Recover Syst-M’. Mauser has been collecting empty industrial packaging from users around the world for more than 50 years. It says the new name and logo “capture the essence of the programme while emphasising its key strengths – giving IBCs and drums a second life and diverting waste from landfills”.

“Every year, Mauser Packaging Solutions gives tens of millions of used IBCs and plastic and steel drums around the world a new life. Having a brand name that represents this programme unites us all around our common goal of extending the life cycle of packaging and supporting the circular economy,” says Mark Burgess, CEO of Mauser Packaging Solutions.

On the product development front, Mauser has introduced a new line of all-plastics stackable IBCs, designed as a highly durable and reusable packaging for use with industrial chemicals, agrochemicals, acids and water treatment products. The UN-rated IBC is available in 275 gal (1,000 litre) and 330 gal (1,135 litre) sizes and offers some user-friendly features, including volume indicators moulded in the sidewall, a sloping floor to drain as much product as possible, and an enlarged doghouse to give easy access to the bottom discharge

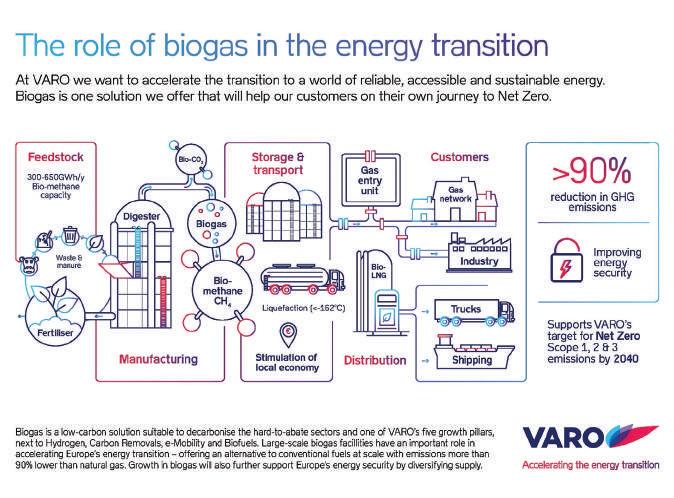

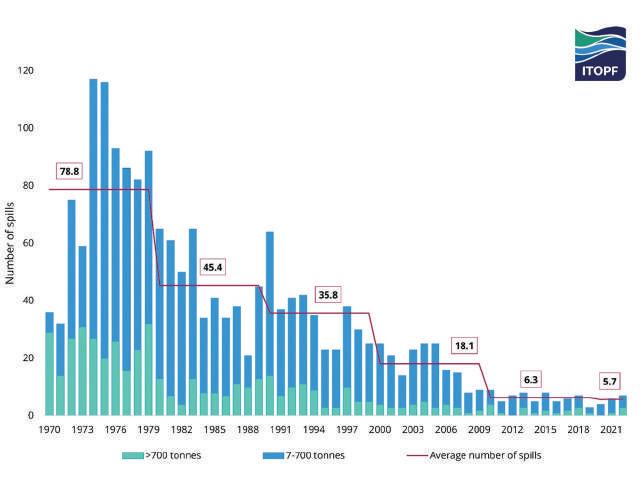

valve. The IBCs can be collected through the Recover Syst-M programme.