MONTHLY MARCH 2024

LINE IN THE SAND

LOGISTICS PLAYERS MUST COLLABORATE IF SUSTAINABILITY TARGETS ARE TO BE MET

LATEST RULE CHANGES FROM GENEVA

GAS TANKER MARKET BREAKS RECORDS

MAKING TERMINALS FIT FOR TOMORROW

THE INFORMATION SOURCE FOR THE INTERNATIONAL DANGEROUS GOODS PROFESSIONAL SINCE 1980

IN PARTNERSHIP WITH

Tank Sto ge Associa on

TSA

CIMC

Globe Sales

NO.159 Chenggang Road, Nantong, Jiangsu, China 226003

Tel: +86-513-85066022 (Sales) +86-513-85066888 (Switchboard)

www.cimctank.com

E-mail: tanks@cimc.com

Europe Sales Contact:

Middenweg 6 (Harbour nr.397-399) 4782 PM

Moerdijk , The Netherlands

Tel: +31 880 030 860

www.cimctankcontainers.nl

E-mail: info@cimctankcontainers.nl

CIMC

Tel:

88 00 30 800

Fax: +31 88 00 30 882

www.burgservice.nl

E-mail: info@burgservice.nl

CIMC SAFE WAY TANK SERVICE (Jiaxing) CO., LTD.

No. 318 , Washan Road, Port Authorities, Jiaxing, Zhejiang Province, China 314201

Tel: +86 15806290956

E-mail: ning.li@cimc.com

CIMC SAFEWAY TANK SERVICE (Lianyun gang) CO., LTD. Safety and Environmental Management Center, Xuwei New Chemical Park, Lianyungang, Jiangsu, China 222047

Tel: +86 13814742170

E-mail: lichunfeng@cimc.com

SAFEWAY TECHNOLOGIES CO., LTD. BURG SERVICE B.V. Middenweg 6, 4782 PM, Moerdijk, The Netherlands

+31

Tankmiles Tel: +86 15262722292 www.tankmiles.com E-mail: tankmiles@cimc.com Telematics

TECHNOLOGY

SAFEWAY TANK SERVICE CO., LTD.

Contact:

MANUFACTURE SERVICE TECHNOLOGY AFTER SALES DEPOT SERVICES Cleaning Maintenance Testing Repair Modification Data Collection Global Monitoring IOT Platfrom Digital Display Sensor Temperature Pressure Liquid Level ··· Temperature Control E-heating System Glycol Refrigeration & Heating System Tank Container Manufacture After Sales Depot Services Smart Devices BUSINESS PORTFOLIO

Managing Editor

Peter

Email:

Tel:

Advertising sales

Sarah Smith

Email: sarah.smith@chemicalwatch.com

Tel: +44 (0) 203 603 2113

Publishing Manager

Sarah Thompson

Email: sarah.thompson@chemicalwatch.com

Tel: +44 (0) 20 3603 2103

Publishing Assistant

Francesca Cotton

Designer

Petya Grozeva

Chief Operating Officer

Stuart Foxon

Chief Commercial Officer

Richard Butterworth

UP FRONT 01 WWW.HCBLIVE.COM CONTENTS VOLUME 45 • NUMBER 03 Spot the difference Fort Vale warning over counterfeiters 47 Shift work Hupac hampered by rail infrastructure 48 News bulletin – tanks and logistics 50 BACK PAGES Conference diary 52 Incident Log 54 Not otherwise specified 56 NEXT MONTH What’s new in industrial packaging Digitalising supply chains Chemical tanker market update Road tanker manufacturing UP FRONT Letter from the Editor 03 30 Years Ago 04 Learning by Training 05 Tall Tales of Hazmat 06 REGULATIONS Vehicle for change WP15 faces up to sustainability issues 08 Heavy lifting UN experts work through big agenda 12 Packaging plastics IMO recommends carriage requirements 21 Put a cork in it Canada regulates VOC emissions 22 News bulletin – regulations 23 STORAGE TERMINALS See, here Previewing StocExpo 24 People get ready Rotterdam prepares for the transition 26 Planet and profit Vopak positions to reap future rewards 28 Bonding over bio Orim, Varo offer bio-blend bunkers 30 News bulletin – storage terminals 32 TSA Insights magazine – after page 24 TANKER SHIPPINS Bull by the horns Gas shipping rides a big wave 34 Blown away EPS to pilot wind propulsion 36 A tight grip Odfjell ends 2023 on a high 37 Gothic revival Furetank plans fleet replacement 38 Made to measure APC digitalises coatings platform 39 News bulletin – tanker shipping 40 TANKS & LOGISTICS We all stand together LogiChem to discuss collaboration 42 Red riding good Den Hartogh continues to invest 46 HCB Monthly is published by CW Research Ltd. While the information and articles in HCB are published in good faith and every effort is made to check accuracy, readers should verify facts and statements directly with official sources before acting upon them, as the publisher can accept no responsibility in this respect. ©2024 CW Research Ltd. All rights reserved

Mackay,

dgsa

peter.mackay@chemicalwatch.com

7769 685 085

+44 (0)

2059-5735 www.hcblive.com

Research Ltd Talbot House Market Street Shrewsbury SY1 1LG

ISSN

CW

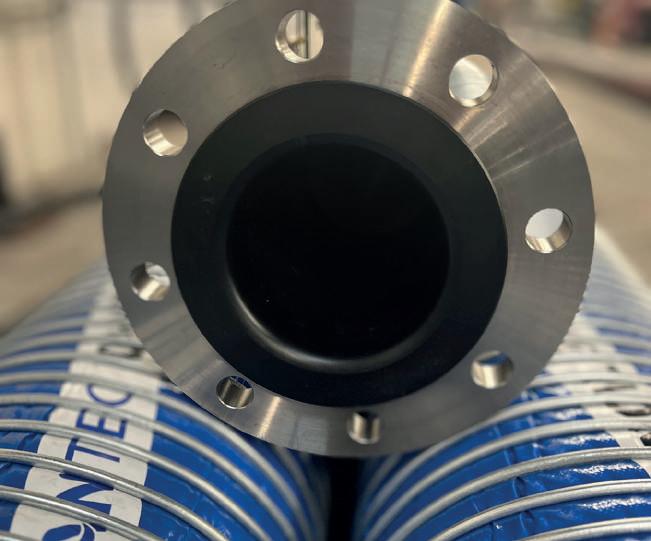

BUILT TO LAST.

Safeload. The first, and still the only API coupler on the market with a 3 Year Warranty.

Safeload is built to last, and is a byword for reliability in the fuel transfer market. That reliability also means lower M&R costs, reduced spillage and prolonged component life.

Safeload’s design is unique. Its performance is tested and proven beyond industry requirements, and endorsed by our customers for its quality. The outer housing is hard anodised to BS5599, giving long life and durability, while treated pressure-bearing components enhances mechanical strength, especially at low temperatures. We can also provide special solutions for the food, chemical and pharmaceutical sectors.

Safeload. Available in semi-automatic, high-pressure, manual and green configurations.

Peace of mind is priceless. Fort Vale is peace of mind. ®

at www.fortvale.com

02 UP FRONT HCB MONTHLY | FEBRUARY 2018

FORT VALE.

SEE IT AT STOCEXPO 12-13 MARCH ROTTERDAM STAND F32

FOLLOW THE LEADER. Visit us

EDITOR’S LETTER

I was very saddened to hear recently of the death of Frank Andreesen, former logistics vice-president at Bayer and then Covestro. Frank was a regular at chemical logistics events, always with a valuable insight to give and with his perennial plea for industry to work together to solve its common problems and realise the efficiency gains that were (and, for the most part, still are) out there.

Frank would, I am sure, have been at this month’s LogiChem conference in Rotterdam, even though he retired from Covestro last July. But looking at the agenda and line-up of speakers, it is clear that he is still there in spirit. There has been a gradual realisation within the industry that greater collaboration will be needed, not just to improve efficiency for all, but also to help meet regulatory demands for information (particularly as regards sustainability, emissions and ESG metrics) and to cope with the tight labour market that is affecting industries across the mature markets.

To a large extent, increasing digitalisation is forcing partners up and down chemical supply chains to collaborate more extensively, since it is all about providing and sharing information – it was always the ‘sharing’ that proved to be a stumbling block to increasing collaboration but industry does now seem to be coming to terms with the idea. In fact, going back a bit further, it used to be impossible to even mention the word ‘collaboration’, as this would immediately excite the attention of antitrust authorities.

Today, there is an acceptance that the sustainability imperative can only be achieved with full transparency on an end-to-end basis and throughout product lifecycles. To get

there will take commitment and a lot of investment, though there will be benefits at the end of it.

The extent of that necessary investment is particularly noticeable in Europe’s ports, especially those that handle chemicals and other liquid bulk products. Rotterdam, Antwerp, Hamburg and other ports are having to re-engineer their infrastructure to handle different products and/or to get cargo in, through and out as swiftly as possible, with due regard to sustainability in transport operations. That too is calling on new digitalised (and, potentially, AI-supported) systems that collect and disseminate information as needed.

It has been said (and I forget by whom) that, for most of human history, there have been too few calories and too little information; nowadays there are too many calories and too much information. Getting to understand how humanity must adapt to thrive in this sort of world is going to take time and the transition may be messy. One major problem is knowing which information is relevant and reliable – and the standard approach to that in an industrial setting has been to require audits and independent assessments. We have plenty of those already and a whole new bunch have arrived in recent years, to keep track of how companies’ sustainability and ESG performance is matching up to expectations, and we are surely going to see many, many more in the near future. The EU’s planned Packaging and Packaging Waste Regulation alone will call for dozens of new audit programmes.

There used to be two things that are inevitable in life: death and taxes. Now it is death, taxes and audits (though not necessarily in that order).

Peter Mackay

UP FRONT 03 WWW.HCBLIVE.COM

30 YEARS AGO

A LOOK BACK TO MARCH 1994

THOSE WHO HAVE come into the dangerous goods business in the past twenty years might well believe that this is how it has always been. That belief is a surprisingly common error in many walks of life but, looking back with the benefit of hindsight, there were some important novelties being introduced three decades ago that we now think of as permanent fixtures. But if you want to know why you do what you do, you need to know a bit of history.

For instance, in the early 1990s tank cleaning providers in the UK, France, Belgium and the Netherlands had each moved forward with the establishment, for the first time, of representative national associations. In May 1993, those four associations joined forces to form the European Federation of Tank Cleaning Organisations (EFTCO), which held its first official meeting in August, chaired by Hugo Kerkhofs of ADPO. The prime objective of the new association was to introduce a Europe-wide standard cleaning certificate, the document (or electronic version) we know today as the ECD.

The French association, APLICA, had already been trying out the concept, in collaboration with associations representing other aspects of the transport chain in France, and was to play a large role in EFTCO’s work. Other trade bodies, including Cefic and EPCA, were supportive of the plan and Cefic itself was looking at developing an auditing programme for tank cleaning stations under the SQAS umbrella – though not without some opposition from the UK and French tank cleaning associations. At the time, Germany, Sweden and Italy were also in the process of setting up national associations,

which would in turn expand EFTCO’s reach.

In the US, the Chemical Manufacturers Association (CMA) was on a similar path to Cefic, developing safety assessment protocols for road and rail transport. It had also spotted that Cefic’s work was taking in the maritime sector, via CDI, and CMA members felt that they should join CDI rather than make the effort to develop their own programme.

Meanwhile in Geneva, the UN experts had been busying themselves in bringing the various dangerous goods transport regulations up to date. One big project was a wholesale revision of the UN Manual of Tests and Criteria, a major undertaking that was due to be completed during 1994. At its session in November 1993, the UN Sub-committee of Experts had agreed several changes, including the deletion of the (much missed) small-scale cook-off bomb test.

A second major project was the revision of the packing methods for Class 1 materials, although the decisions made at that 1993 session have not survived. The revision of the provisions for multimodal tanks also proved quite difficult to resolve, although work on quality standards for gas cylinders and new generic entries for Class 2 gases were simpler to bring to a conclusion.

At the same time, the RID/ADR experts, already busy with the development of ADN, were wrestling with the restructuring of their provisions along the lines of the UN Model Regulations. In addition, WP15 was having to work out how to manage the approval of motor vehicles used in dangerous goods transport. This was becoming an urgent matter, as the EU was threatening to take the job on itself.

HCB MONTHLY | APRIL 2022 04

MARCH 2024

LEARNING BY TRAINING

by Arend van Campen STORYTELLING FOR SUSTAINABILITY

WHAT IF THE profound sciences and ideas taught by Dr Fritjof Capra and others were told and packed in a thrilling story? A thriller about people struggling and rising up against corrupt politicians and business? I wrote The Brussels Lobby, an ecothriller that was released last month.

A thinktank in Brussels named ‘Sustenance4all’ helps the world with the energy transition despite the opposition of lobbyists in Brussels. A product named Hydrogen Solar Plasma, discovered and developed by two French engineers, would make oil and gas obsolete, but 75 countries’ GDP, hedge funds, banks and oil companies depend on hydrocarbons, chemicals, oil and gas.

The fight to protect this abundant new energy source (copying the sun on earth in a Tokamak) takes place in the urban jungle of Brussels. This is not just a thriller but also based on the systems view of life, cybernetics, physics and biology, because the think tank designs an alternative society based on systems thinking and clean, renewable energy. A must-read for everyone concerned with life and wellbeing.

I have written many times in this magazine about the importance of and for non-harmful functionality of man-made things, including our industries. The book offers a solution and a new design for a functional society that benefits everyone, all living systems. The sciences and common sense to re-design that which was harmful into non-harmful are here; it is called information.

The race for limitless energy takes a dramatic turn. The International Thermonuclear Experimental Reactor (ITER), under construction in France, aims to replicate the sun’s helium fusion process using a Tokamak. However, the project faces significant delays. Amidst these delays, a French start-up achieves a ground-breaking feat by successfully

fusing hydrogen and solar heat. This innovation leads to the creation of Hysoplasm, or HSP – a cheap, abundant and sustainable energy source.

But this development doesn’t sit well with those invested in traditional energy sectors. Key players in the oil, gas and finance industries in Brussels are alarmed. To counter this emerging threat, they turn to Chris Towers, a formidable and unscrupulous lobbyist. Towers finds himself in a clandestine meeting with EU Commissioner Manuel Rojas, responsible for Climate Action and Energy Union, in an obscure café in Brussels.

This is a story about the high stakes world of energy politics, where technological breakthroughs clash with entrenched interests, while the future of global energy is at play.

“Which interests stand in the way of real climate solutions? This ecothriller tells a story of the fight of a start-up against the fossil industry. It introduces HSP as an abundant, renewable energy for a cleaner future.” Pim van Galen, journalist at Dutch Public Television

“A fascinating and well timed story.” Ton van Uffel, energy and chemistry expert

“This book convinces with the sincerity of the plot and the richness of the details. It deserves a wider audience than just environmental geeks. Captive reading.” Jochem Visser, lawyer

“Fighting injustice is tempting and honourable but not easy.” Roberto Bastida Caracuel, port development manager

For sale everywhere in paperback and ebook.

This is the latest in a monthly series of articles by Arend van Campen, founder of TankTerminalTraining, who can be contacted at arendvc@ tankterminaltraining.com. More information on the company’s activities can be found at www.tankterminaltraining.com.

UP FRONT 05 WWW.HCBLIVE.COM

TALL TALES OF HAZMAT

By Grahame Moody

NEVER TRUST A FART

Reading this back before releasing it into the wild, the era of the author’s experience is in evidence. Also, this epistle does go around the houses a bit and would not be immune to accusations of verbosity. However, this is not intended to be a scholarly dissertation, just somewhere to discuss the meaning of the word ‘compliance’ - the holy grail of safety.

Ready or not, here we go…

Have you ever played the ‘what if’ game?

The title of this piece could come into play when you feel a rumble but instead of doing something about it you gamble on staying where you are and just letting nature take its course. That’s you playing the ‘what if’ game. It is because you will have been forced to consider the consequences by thinking ‘what if I’m wrong?’ as you make the decision. Considering those words will definitely have the effect of concentrating the mind on getting the decision correct.

The following points are some of the factors that constitute the process of decisions: identifying the choices; analysing them and the thinking behind them; consideration of the consequences of a wrong decision; and – way down the list – the making up of minds, otherwise known as making a (yes that’s right) decision. All that in a heartbeat.

When you are faced with (say) a decision based on price, as an exercise begin by choosing a cheaper option, then go on to ask yourself: what if that option goes wrong and it turns out to be an unmitigated disaster?

Let us now turn to the general pursuit of compliance. In its purest form, this can come from the simple human desire of an individual to ‘do the right thing’. It can also come from playing the game of ‘what if’ it goes wrong’.

Compliance can be augmented by parental guidance or natural societal/peer-group pressures (carrot) but it must originate from within the essential nature of the individual. Whilst it is possible to augment the internal desire to comply with rules and regulations, sometimes it requires either fear of public retribution or financial punishment (or a combination of both) to be truly effective (stick).

But the concluding decision can only be finalised from within the mind of the person making the decisions.

All that looks to me suspiciously like a glutinous mix of ‘carrot and stick’ methodologies (that is a silly word, but useful describing wokeist wishy-washinessisms).

Either way, compliance starts with ‘desire’ or ‘will’ and the search for inner peace. It is not for achieving recognition or praise. Justification may be the only achievable reward. That and no adverse ‘what if’ it goes wrong events actually going wrong along the way; but that in itself is not a reward, it’s just things not going wrong.

However, compliance will always be a ‘hard sell’ as it is almost certain that it will not be among the cheaper options. But there are ways of winning over hearts and minds and collective consciences to highlight the path leading to safer ways of transporting hazardous

HCB MONTHLY | APRIL 2022 06

MARCH 2024

shipments. And yet, whatever drives the inner self down the road to compliance, it will only lead down the (by now well-lit) path of least resistance and that almost always involves the price that’s paid.

Almost always, but not always always.

For example, when the time comes to choose transport options for a shipment of dangerous goods, human nature will hopefully dictate the choice of a path that glides easily over but sticks closely to the rails of legislation. That option is unlikely to be the cheapest but it will be the one that will lead to a clear conscience.

How to choose between them, we ask ourselves? It would be fairly easy to examine transport options to assign simple cost/benefit levels of safety to every available option. You should find that when you calculate the benefits versus the costs, you will invariably find that the more expensive the option is, the more likely it is that it will be a safer and therefore better decision.

This is because you will be able to satisfy yourself that the decision was made with higher ethics than just basing it on filthy lucre. Also, in front of 12 good citizens of a jury you can prove that the decision was not taken for simple cost saving reasons, just the opposite in fact and your decision will (should) ‘justify’ itself.

Let us now examine whether the most expensive option is always the safest and therefore best option and what do we find? To play the pedant role, the correct answer should be that it is usually the safest

and best option. The best decisions should never ignore commercial considerations, even if that aspect of the decision will never be questioned by anyone other than members of the judiciary.

So then, the internal wrangling of the deciding mind must weigh up parental guidance, peer group pressures, fear of public retribution and financial sanctions. All that versus the desire to ‘do the right thing’ and the high cost of doing that.

All these brain synapses firing in different directions all at the same time and coping with pressure to come to the correct decision very quickly comes naturally to some, but not to others. Of course, compliance can be inculcated into company policy, operational procedures, and training, but it really needs to be in the heart and soul of company management and steeped in its ethical scope.

Compliance relies on personal values fighting against financial pressures and winning. In other words, compliance is not just doing the right thing - that’s efficiency. Doing things right is effectiveness*.

This is part of a regular series of articles by Grahame Moody, senior analyst (technical services) of Hazmat Logistics, who can be contacted at sales@hazmatlogistics.co.uk. More information on the company’s activities can be found at www.hazmatlogistics.co.uk.

*Paraphrased from Peter Drucker’s book The Effective Executive, mentioned here for transparency and compliance with copyright laws (see what I did there?).

UP FRONT 07

Stay ahead of the curve and the competition on: • Changing global EHS regulations • Best practices in EHS compliance management • Tips & techniques for multi-national compliance programs Free updates Sign up to receive free updates on the latest resources and insights from our qualified EHS experts via enhesa.com/subscribe

VEHICLE FOR CHANGE

ROAD • ADR HAS TO KEEP UP WITH TECHNICAL CHANGES BUT ALSO REFLECT NEW WAYS OF TRANSPORTING DANGEROUS GOODS. HOW MANY WHEELS DOES IT TAKE?

THE UN ECONOMIC Council for Europe’s (ECE) Working Party on the Transport of Dangerous Goods (WP15) held its 114th session in Geneva this past 6 to 10 November with Ariane Roumier (France) as chair. It was attended by representatives from 22 contracting parties as well as from Algeria, Egypt, Iran, Jordan, Lebanon, Morocco and Saudi Arabia. The EU and Intergovernmental Organisation for International Carriage by Rail (OTIF) were also represented, as were seven non-governmental organisations and the EuroMed Transport Support Project (TSP).

The main task of the Working Party’s session was to make progress on agreeing the amendments to the Annexes to the ADR

Agreement that will enter into force next year. Much of the groundwork had been done by the Joint Meeting of RID/ADR/ADN Experts, although WP15 read closely through the decisions taken by that body to ensure that the changes that had been agreed would be appropriate for road transport operations.

The first part of this two-part report on the November session (HCB February 2024, page 8) covered issues relating to electric vehicles, the changes agreed by the Join Meeting, and several road-specific proposals for amendment.

TWO WHEELS GOOD?

The Secretariat provided a document summarising the situation vis-à-vis two- and

three-wheeled vehicles and discussing whether they fall within the scope of ADR. The topic had been raised at WP15’s 112th session in 2022, bearing in mind that such vehicles are increasingly being used, notably by parcel delivery firms and particularly in urban areas. WP15 is also mindful of the UN Sustainable Development Goals and the potential for micro-mobility vehicles and cycles to contribute to cleaner and more sustainable cities. While most of the activities undertaken by such vehicles are local in nature, there is the potential for them to be international, particularly in border towns.

Bearing in mind Article 1 of ADR and Article 4 of the Convention on Road Traffic, the Secretariat concluded that cycles with an engine of 50 cm 3 or more, and cycles with no means of propulsion other than an engine, are ‘motor vehicles’; as such, when carrying dangerous goods in international transport, they must comply with the provisions of ADR. However, some provisions of ADR have never been intended to cover transport by scooters, motorcycles, etc and therefore the interpretation of the current

08

HCB MONTHLY | MARCH 2024

provisions may vary. The Secretariat suggested that WP15 might wish to clarify ADR by specifying which of its requirements should apply to these vehicles.

The Secretariat also noted that the EU’s ‘Framework Directive’, 2008/68/EC, which requires EU member states to apply the provisions of ADR to the carriage of dangerous goods both domestically and internationally, defines a ‘vehicle’ as “having at least four wheels”. This means that two- and threewheeled vehicles are not subject to the Framework Directive, though member states may wish to include domestic legislation to cover them.

Furthermore, the 1993 Protocol to ADR, which is not yet in force, also specifically states that a ‘vehicle’ has at least four wheels. It had already been noted that, when the Protocol was drawn up, the use of vehicles other than regular trucks or vans to deliver dangerous goods was not foreseen. Most delegations had been of the opinion that some regulations should be put in place to make sure that transport by two- and three-wheeled vehicles are done safely when carrying dangerous goods. For international transport, some delegations offered the idea of extending the scope of ADR through a new protocol of amendment. However, some delegations wondered whether it would be possible to modify the scope of ADR before the 1993 Protocol of amendment enters into force, particularly in the light of article 18 of the Vienna Convention on the Law of Treaties (1968).

The Secretariat’s paper finished with the suggestion that competent authorities might wish to inform WP15 as to whether the transport of dangerous goods by vehicles outside the scope of ADR are regulated in their territory and, if so, how.

The Working Party noted that the International Civil Aviation Organisation (ICAO) had held similar discussions regarding the use of remote-controlled aircraft (drones) to carry dangerous goods. In December 2020 it published a new model regulation to help countries establish and refine their national guidelines for the operation of drones and developed an advisory circular to provide guidance to its member states on the transport of dangerous goods by drone. A similar approach might work in this case.

After further discussion, the Working Party agreed to work on developing provisions for the transport of dangerous goods by road using vehicles or bicycles not currently regulated under ADR, which would help in harmonising of the requirements applicable to such means of transport.

Separately, the World Bicycle Industry Association (WBIA) and the Confederation of the European Bicycle Industry (Conebi) expressed their interest in participating in sessions of the Working Party. The two bodies had submitted an application to the Secretariat, which will be discussed at the next session of WP15.

MORE PLEAS FOR INTERPRETATION

Hungary raised an interesting question relating to 4.1.1.15, which places a five-year life on plastics drums and jerricans, rigid plastics intermediate bulk containers (IBCs) and composite IBCs with plastics inner

receptacles. The provision also includes the phrase “unless otherwise approved by the competent authority” and a specific indication that the five-year period of use may be shortened because of the nature of the substances to be carried. In summary, Hungary said, this means that:

• The ‘normal’ period of use for plastics packaging is five years

• A period of use shorter than five years shall be prescribed if the nature of the substance to be carried requires.

• A period of use longer than five years may be authorised by the competent authority, if it deems it appropriate.

Some delegations confirmed that derogations for use beyond five years in accordance with 4.1.1.15 had been granted by the competent authorities that issued the type approvals in their countries, subject to certain conditions. Other delegations indicated that they didn’t grant such derogations.

REGULATIONS 09

WWW.HCBLIVE.COM

The question arose as to whether such derogations are the responsibility of the competent authority in the country where the type approval had been issued, or that in the country of use. The representative of Switzerland recalled that the matter would be discussed by the Joint Meeting’s informal working group on references to competent authorities, and invited delegations interested in participating in that work to contact her.

Finland continued with its attempts to clarify the requirements for the carriage of the transport document and related information in vehicles consisting of more than one unit. Its paper said that, in general, it is understood that the documentation carried on a transport unit relates to the dangerous goods carried on that transport; however, 5.4.1.4.2 does not clearly require this. Indeed, it seems that if a load consisting of several packages needs to be divided for carriage on different transport

units it is sufficient that a copy of the single document covering the whole load is on each transport unit without specifying which goods are on each transport unit. Separate transport documents are required for each vehicle only in the case of prohibition on mixed loading.

In particular, Finland queried the first sentence of 5.4.1.4.2: “If, by reason of the size of the load, a consignment cannot be loaded in its entirety on a single transport unit, at least as many separate documents, or copies of the single document, shall be made out as transport units loaded.” Do the words “or copies of the single document” mean that each transport unit can carry an identical copy? If not, the paragraph needs to be amended. Alternatively, to correspond to the text in RID, the first sentence could be deleted.

The Working Party noted that the provisions in 5.4.1.4.2 were carried over from marginal 2002 (4) when ADR was restructured. It also

felt it would be worth checking whether the provisions of the first sentence of 5.4.1.4.2 are still being used and, if so, in what circumstances. They may be appropriate for, say, transport units carried in convoys, particularly for the transport of explosives.

Finland said it would work up a revised proposal for the next session; the International Road Transport Union (IRU) volunteered to look at how its members apply the requirement.

Malta sought clarification of 9.1.3.2, which states that a certificate of approval issued by the competent authority of one contracting party shall be accepted, so long as it is valid, by the competent authorities of other contracting parties. Being a small island nation, most of Malta’s trucks are bought secondhand and imported, being re-registered at that point. Do they then also require a new certificate of approval?

The chair confirmed that a transfer of ownership is not relevant for the application of 9.1.3.2 but those delegations that spoke confirmed that, when a used approved vehicle is imported into their country, it must be re-registered and, in accordance with 9.1.3.1, that means a new certificate of approval must be issued by the competent authority of the new country of registration.

ADMINISTRATIVE ISSUES

To address its remit to take into account the UN Sustainable Development Goals when amending the provisions containers in ADR, WP15 adopted an amendment to the rules concerning the documents to be submitted; in future, delegations will need to include a section titled ‘Justification’ and identify a link with those Goals and the circular economy.

The Working Party noted that its work at the 114th session was guided in particular by the UN Sustainable Development Goals 3 (Ensure healthy lives and promote well-being for all at all ages), 11 (make cities and human settlements inclusive, safe, resilient and sustainable) and 13 (Take urgent action to combat climate change and its impacts).

The Working Party also amended its rules concerning the submission of informal documents, clarifying the possible scope of such documents and inviting delegations to

10 HCB MONTHLY | MARCH 2024

submit informal documents in any of its working languages.

Periodically, the Working Party also looks at its schedule of meetings. It confirmed that it wished, for now at least, to maintain the schedule of its sessions (two per year) as it seems there is plenty of work coming along, particularly with regard to the dematerialisation of documents and information; the monitoring of the implementation of the new amendments concerning battery electric vehicles, fuel cell vehicles and hydrogen vehicles; and the drafting of provisions concerning the carriage of dangerous goods by road with vehicles or cycles not currently regulated in ADR.

The next session of WP15 is scheduled to take place in Geneva from 2 to 5 April 2024.

The Secretariat has prepared for that session a consolidated list of the amendments adopted thus far for entry into force on 1 January 2025 so that they can be made the subject of an official proposal. This has now been published and can be consulted on the UN ECE website at https://unece.org/transport/ standards/transport/dangerous-goods/ adr-2023-agreement-concerning-internationalcarriage. As there are still opportunities at the March session of the Joint Meeting and the April session of WP15 for further amendments, HCB will take a close look at the list of changes in a future issue.

Meanwhile, it has been confirmed that Ariane Roumier will continue to act as chair for the two 2024 sessions, with Alfonso Simoni (Italy) as vice-chair.

REGULATIONS 11 WWW.HCBLIVE.COM

HEAVY LIFTING

MULTIMODAL • AS IS OFTEN THE CASE, THE UN SUBCOMMITTEE’S SECOND SESSION OF THE BIENNIUM WAS FACED WITH A MASSIVE AGENDA BUT MANAGED TO MAKE A LOT OF HEADWAY

THE UN SUB-COMMITTEE of Experts on the Transport of Dangerous Goods (TDG) held its 63rd session this past 27 November to 6 December. Duane Pfund (US) continued as chair and Claude Pfauvadel (France) took the vice-chair position for the last time prior to his retirement in 2024. The session was attended by representatives from 22 countries, the Intergovernmental Organisation for International Carriage by Rail (OTIF), the Food and Agriculture Organisation (FAO), the International Civil Aviation Organization (ICAO), the International Maritime Organisation (IMO), the UN Institute for Training and Research (Unitar), the World Health Organisation (WHO) and 23 nongovernmental organisations. An observer from Luxembourg also took part.

This was the second of four planned sessions to be held in 2023 and 2024 to agree

and adopt the changes that will appear in the 24th revised edition of the UN Recommendations on the Transport of Dangerous Goods – the ‘Model Regulations’ – and, as is often the case, it was this session where a lot of matters were addressed, and many settled. It is indicative of the breadth of the Sub-committee’s discussions that, in the 20-page report on the session, the first four pages are taken up with the agenda.

At the time of the meeting, the 23rd revised edition of the UN Model Regulations and the tenth revised edition of the Globally Harmonised System of Classification and Labelling of Chemicals (GHS) had already been published in English, French and Chinese. Versions in Arabic, Russian and Spanish were also in preparation and have been published since then. Similarly, the eighth revised edition of the UN Manual of

Tests and Criteria has also now been published in all six official languages.

START WITH A BANG

The session began fittingly with discussion of matters relating to explosives of Class 1. Germany had taken it upon itself to investigate the reliability of the Koenen test, a bursting pressure test that uses steel tubes. For the test to give reliable results, it is vital that these steel tubes are consistent but, as Germany’s Federal Institute for Materials Research and Testing (BAM) has found, there is considerable variation in the mean bursting pressure of tubes. This confirms concerns expressed by the UK and US in 2022 and by others since then.

Germany queried whether there is a need for an additional description of the busting pressure test method, which has been used since the 1950s, and whether there is a need to identify and validate possible alternatives.

The Sporting Arms and Ammunition Manufacturers’ Institute (SAAMI) followed up on the round-robin testing work that had been carried out in response to the UK/US concerns, under the eye of the Working Group on Explosives (EWG), noting that this was prompted by the realisation that the steel alloys originally specified for the manufacture of the tubes are not longer available on the

12

HCB MONTHLY | MARCH 2024

market. SAAMI highlighted the fact that, despite some changes to the specifications for the tubes in the Manual of Tests and Criteria, there are currently no Koenen tubes available that meet all the specification, which can lead to incorrect test outcomes.

The Sub-committee welcomed the extensive information provided by Germany and SAAMI in their respective informal documents. It acknowledged that this is a complex subject and invited all interested stakeholders to contact SAAMI, which will coordinate an inter-sessional discussion on the outcome of the round-robin tests and develop a proposal to be submitted to EWG for a more detailed consideration at its next meeting. This topic is also on the agenda of the GHS Sub-committee.

The European Chemical Industry Council (Cefic) raised the idea of including a new section on energetic samples in 2.0.4.3. Cefic made the point that R&D units in industry and academia frequently need to transport substances for testing and that many of these substances consist of organic molecules that are building blocks, intermediates or active ingredients for pharmaceutical or agricultural chemicals. Although not designed to be explosives of Class 1, many of these substances carry functional groups listed in tables A6.1 or A6.3 of the Manual of Tests and Criteria, indicating that they have potentially explosive or self-reactive properties. However, it is often the case that the volume of these substances during the research phase – generally below

100 g – is inadequate to allow the required tests to be carried out to determine their physical or chemical properties.

Cefic had previously succeeded in getting simplified provisions for the transport of very small amounts of samples adopted in 2.0.4.3 but these provisions are not adequate for moving the volumes needed when shipping material for proper transport classification.

Certain untested energetic samples can theoretically be transported as potentially new explosives with special approval from a competent authority but, Cefic says, the process would be challenging for institutions with little experience in dangerous goods regulations. Furthermore, there are many thousands of instances per year where such approvals are needed, which would represent a burden on both shippers and competent authorities, with an inevitable scientific delay at all levels.

Cefic now proposed to take its earlier approach a step forward by introducing ways of consigning samples in larger amounts than permitted under 2.0.4.3. It had already worked on the subject with EWG and with the International Group for Unstable Substances (IGUS) and had developed a flowchart to determine an initial classification. It now sought to open a discussion with the TDG Sub-committee, with a view to putting forward an official proposal at a later date.

There was some support for Cefic’s proposal but other experts felt that further data and work was needed. The Sub-

REGULATIONS 13

WWW.HCBLIVE.COM T e l : + 4 4 ( 0 ) 8 7 0 8 5 0 5 0 5 1 E m a i l : s a l e s @ l a b e l i n e c o m w w w l a b e l i n e c o m W h o d o y o u c o n t a c t f o r t h e l a t e s t D G c o m p l i a n t l a b e l s ? Free DG Label ID poster with every order Si

committee agreed to continue discussion of the subject at its next session on the basis of an official document from Cefic that would take into account comments received.

SAAMI sought to open up a completely different discussion, seeking the inclusion of an acceptable level of risk in the classification criteria. Its paper noted that the Guiding Principles specify that the aim of the regulations is to “make transport feasible and safe by reducing risks to a minimum”; however, ‘risk’ is not defined in the Model Regulations. For many classes and divisions in the transport regulations, substances are assigned to a packing group to indicate their level of danger; this is not the case for explosives, though there is a categorisation into different divisions and Division 1.4S is effectively equivalent to Packing Group III. However, even here an incident is capable of causing ‘minor’ injury to an unprotected human body. The scope of ‘minor’ in this instance is not well defined but may be regarded as something that can be dealt with by first aid or characterised by the “walkaway factor”.

In GHS, low-hazard explosives are assigned to sub-category 2C; GHS states: “An explosive in this sub-category can cause minor damage to objects and moderate injuries to persons. Injuries would not normally result in permanent impairment.” SAAMI believes it would be helpful if the Guiding Principles to the Model Regulations included a similar explanation, and also that any criteria that seek to eliminate rather than manage risk may inordinately hamper commerce, which is not the goal of the regulations.

The Sub-committee welcomed that reminder but some experts were of the opinion that the Model Regulations and Guiding Principles are already clear enough on the matter. SAAMI may return with a more specific document at the next session.

The Council on Safe Transportation of Hazardous Articles (COSTHA) presented a

detailed paper on the classification of 1,4-benzoquinone dioxime (QDO), usually classified as UN 1325, Division 4.1, Packing Group II, although classified on occasion as non-regulated. The European Chemicals Agency (ECHA) had determined that a re-evaluation of this classification was warranted and subsequent testing has indicated that QDO’s thermal flux characteristics support classification in Division 1.4. Indeed, some countries have accepted this reclassification, leading to complications in international transport.

COSTHA proposed a new entry for QDO in Division 1.4C, as well as a Division 4.1 entry for desensitised material, along with a new special provision to explain the difference. The Sub-committee, though, was not convinced, offering some comments and concerns.

COSTHA said it would revise the proposal and submit it for discussion by EWG at its next meeting.

Spain followed up on earlier amendments adopted to revise some of the units used in the Model Regulations, including the deletion of the use of kg as a unit of force. As a consequential amendment, it was also proposed to delete the term ‘net explosive

weight’, though this was more problematic, since it is widely used in industry, particularly in the US. At present, the definition for ‘net explosive mass’ in 1.2.1 states that other terms, including ‘net explosive quantity’, ‘net explosive contents’ and ‘net explosive weight’ are often used to convey the same meaning. This implies an equivalence between ‘mass’ and ‘weight’ that is scientifically incorrect.

This issue certainly seems to be contentious for some but, on a vote, the Sub-committee agreed to the change requested by Spain, deleting “or net explosive weight (NEW)” from the definition of ‘net explosive mass’ in 1.2.1.

Cefic opened a discussion on its idea to introduce screening procedures to allow the self-acceleration decomposition temperature (SADT) to be estimated. One of the criteria used in the Manual of Tests and Criteria is that substances should be considered self-reactive if they have an SADT of 75°C or less for a 50 kg package. Four tests methods are offered but, Cefic said, each of these requires specialised equipment and a significant amount of substance to be tested. This presents a barrier for groups with limited experience in the classification of dangerous groups, as well as for situations where only

14 HCB MONTHLY | MARCH 2024

CHINA RAISED SOME CONCERNS OVER THE CLASSIFICATION OF HYDRAZINE, WHICH HAVE RESULTED IN REVISED REQUIREMENTS

limited amounts of substance are available, such as in the R&D phase.

On the basis of detailed technical reasoning, Cefic offered a proposal for further discussion that would, it said, close a gap in the current screening rules. The proposal included a potential text to be added as a new subparagraph to Section A6.5.1 of the Manual of Tests and Criteria. Cefic invited comments on the paper with a view to presenting an updated proposal in an official document at the next session.

An informal document from China sought agreement of a new special provision and special packing provision for UN 2029 Hydrazine, anhydrous following an examination of its classification by the Nanjing University of Science and Technology (NUST). China had raised the issue at the 60th session

Do you consign Dangerous Goods?

information had been requested; this was now

Explosives Industry Safety Group (AEISG) and objections and adopted the changes proposed, which are to add special provision 132 against UN 2029, as well as PP5, slightly reworded to reflect that it now applies to UN 2029 and well

Germany proposed an amendment to 2.0.5.5, which was introduced recently to state that the ‘articles containing dangerous goods’ (UN

appropriate, by reference to the precedence of hazards tables in 2.0.3.3. Its paper pointed out that this table does not cover all classes and divisions and, therefore, the assignment of an provisions in 2.0.3. Addition of a reference to

Since 1st Jan 2023, all UK consignors must have an appointed DGSA.

Specialist software for creating compliant DG Documentation

REGULATIONS 15

WWW.HCBLIVE.COM 2 0 2 4 I A T A D G R T e l : + 4 4 ( 0 ) 8 7 0 8 5 0 5 0 5 1 E m a i l : s a l e s @ l a b e l i n e c o m w w w l a b e l i n e c o m T e l : + 4 4 ( 0 ) 8 7 0 8 5 0 5 0 5 1 E m a i l : s a l e s @ l a b e l i n e c o m w w w l a b e l i n e c o m W h o d o y o u c o n t a c t f o r t h e l a t e s t D G c o m p l i a n t l a b e l s ? Free DG Label ID poster with every order For a local, professional consultant DGSA, contact Labeline Free worldwide shipping from IATA’s leading international distributor

Ed 65

FROM A TRANSPORT PERSPECTIVE, IT SEEMS LOGICAL TO TREAT HEAT PUMPS IN THE SAME WAY AS REFRIGERATING MACHINES

that paragraph would make things clearer, Germany contended.

The Sub-committee was not convinced; while some experts felt that a reference to 2.0.3 would be helpful, others believed the current text is clear enough. Germany offered to revise the proposal and bring it back for discussion at the next session.

Cefic brought its regular list of new organic peroxide formulations to be listed in the table in 2.5.3.2.4 and in packing instruction IBC 520 in 4.1.4.2. There were only two this time and they were adopted with a slight amendment. One small amendment was also adopted as a correction to the 23rd revised edition of the Model Regulations.

Another paper from Germany related to UN 2863 Vanadium pentoxide, non-fused form, which is currently assigned to packing group III. However, according to recent test results, and in accordance with the 18th Adaptation to Technical Progress (ATP) of the EU Regulation on the Classification, Labelling and Packaging of Chemicals (CLP), the acute toxicity of the substance warrants assignment to packing group II. Germany’s paper noted that, as such

a change would have consequences for the limited and excepted quantity values, packing instructions, special packing provisions and, most significantly, tank codes, a transitional period ought to be allowed.

There was general support for Germany’s proposal but some concern about the idea of a transitional provision. Germany will consider the feedback and return with an revised proposal at the next session.

Yet another paper from Germany addressed the emerging need to transport heat pumps, a subject that had already been discussed by the RID/ADR/ADN Joint Meeting, where it was considered sensible to treat heat pumps in the same way as refrigerating machines, since they work on the same principle and use the same refrigerant gases. Amendments to the relevant special provisions, 119 and 291, were adopted for inclusion in the 2023 editions of RID, ADR and ADN and the Sub-committee had already taken a look at the issue.

Germany now arrived with some concrete proposals for amending the Model Regulations by creating two additional entries specifically for heat pumps.

There was a divergence of opinion. Some experts supported the idea of separate UN entries and special provisions, while others preferred a similar approach to that already taken by RID/ADR/ADN. An alternative might be to group refrigerating machines and heat pumps under the same UN number but with the proper shipping name changed to ‘machines containing refrigerating gas’. Germany offered to prepare a new document, taking into account the comments received.

The Netherlands opened discussion on the transport of magnetic resonance imaging (MRI) scanners, which typically contain significant quantities of liquefied helium; these are transported under UN 1963 Helium, refrigerated liquid. Technical development has led to a new type of MRI scanner, which contains no more than 1.5 kg of compressed helium; several bodies have discussed these models, for which UN 1963 may no longer be appropriate. Some experts have suggested that these MRIs should be transported as UN 2857 Refrigerating machines while others felts UN 3538 Articles containing nonflammable, non-toxic gas, nos would be m ore appropriate.

The Netherlands proposed either a new entry and special provision for MRI scanners or the assignment of MRI scanners to UN 3538 with an explanatory special provision. The Sub-committee could see the need for a solution but could not agree what it might be; one option would be to include MRI scanners under the mooted ‘machines containing refrigerating gas’ entry. The Netherlands and Germany will work on this ahead of the next session.

Germany also followed up on earlier work around the need to reflect the corrosivity hazard of UN 1040, 1041 and 3300 Ethylene oxide mixtures, following a reclassification in the 14th ATP to the CLP Regulation. The Sub-committee had already taken a look at

16 HCB MONTHLY | MARCH 2024

MANY MRI SCANNERS ARE DESIGNED TO BE TRANSPORTABLE BUT THIS IS RAISING QUESTIONS ABOUT THE BEST CLASSIFICATION

this and agreed the need for change and Germany’s paper offered a reasoned proposal for amendments. On a vote, and with some amendment, the proposals were adopted.

In the Dangerous Goods List (Table A of Chapter 3.2), ‘8’ is added as a subsidiary hazard in column (4) against UN 1040, 1041 and 3300. In the Guiding Principles, table 4.3, in the entry for Division 2.1, in the ‘Notes’ column, “Nos. 1041,” is added after “UN”. This is to reinforce the assignment of portable tank instruction T50 to both UN 1040 and 1041.

Sweden proposed an amendment to the classification of UN 1727 Ammonium hydrogendifluoride, solid (also known as ammonium bifluoride), which is currently assigned to Class 8, PG II. However, a recent incident during loading indicated that the substance also presents an oral toxicity hazard sufficient to meet the Division 6.1 criteria. Indeed, a registration dossier for the substance held by the European Chemicals value of 130 mg/ kg, which meets the criteria for Division 6.1, PG III. Sweden proposed to reflect this in the Dangerous Goods List, with a new special provision to provide a transitional period.

Dangerous Goods?

Since 1st Jan 2023, all UK consignors must have an appointed DGSA

change is to enter ‘6.1’ in column (4) of the Dangerous Goods List against UN 1727.

Italy introduced the Sub-committee to the concept of the wearable airbag, designed primarily for motorcyclists but with plenty of other existing or potential markets. These are similar to avalanche rescue backpacks, but

Labeline is the leading worldwide “One Stop Dangerous Goods Service” for Air, Sea, Road, and Rail

We serve Freight Forwarders, Shippers, Airlines, DCA’s, Port Authorities, Petrochemical industry and the Pharmaceutical industry

Labeline is one of the world’s leading regulatory services and product providers; we hold comprehensive stocks with a fast worldwide delivery service

We are one of the very few authorised Multi-mode providers worldwide and described by industry as a pro-active organisation, our name is recommended by many leading authorities and a world class service providers

When it’s time to order your DG products and services, Labeline will be your “One Stop Service”

C o m p l i a n t w i t h

IATA, ICAO, ADR, IMDG, RID, DoT

For a local, professional consultant DGSA, contact Labeline

Specialist software for creating compliant DG Documentation

substance, together with a small lithium battery and one or two canisters containing non-flammable pressured gas (argon or helium). Lacking more precise indications, such wearable airbags are usually shipped either as UN 2990 Life-saving appliances, self-inflating, or UN 3268 Safety devices, electrically initiated. Italy was interested to hear the experts’ opinion on which of these options is preferable or, indeed, if other action

The Sub-committee agreed to the change of classification but felt there was no need for a transitional period. As a result, the only

The Sub-committee welcomed Italy’s paper and agreed on the need to include such lifesaving systems within the provisions of the Model Regulations. It was noted that the classification of dangerous goods should be hazard-based and not based on their use. The chair invited all experts to send their comments to the expert from Italy, who offered to prepare an official document for the next session and to take account of the feedback received.

REGULATIONS 17 WWW.HCBLIVE.COM

Y o u n e e d L a b e l i n e . c o m D a n g e r o u s G o o d s L a b e l s R e g u l a t i o n s D o c u m e n t a t i o n P a c k a g i n g S o f t w a r e T r a i n i n g G H S C h e m R e g s T e l : + 4 4 ( 0 ) 8 7 0 8 5 0 5 0 5 1 E m a i l : s a l e s @ l a b e l i n e c o m w w w l a b e l i n e c o m T e l : + 4 4 ( 0 ) 8 7 0 8 5 0 5 0 5 1 E m a i l : s a l e s @ l a b e l i n e c o m w w w l a b e l i n e c o m T e l : + 4 4 ( 0 ) 8 7 0 8 5 0 5 0 5 1 E m a i l : s a l e s @ l a b e l i n e c o m w w w l a b e l i n e c o m W t

Free DG Label ID poster with every order

NEW ENERGIES

Germany had also been looking at the emerging potential for liquid organic hydrogen carriers (LOHCs) to be used as a way of transporting hydrogen safely and relatively cheaply, given the increasing demand for hydrogen as a decarbonised fuel in industrial and transport applications. One of the substances identified as a suitable carrier is benzyl toluene, which is currently transported under UN 3082 as an environmentally hazardous liquid. To examine how the presence of physically dissolved hydrogen in benzyl toluene affects the substance’s hazard characteristics during transport, the Physikalisch Technische Bundesanstalt (PTB) was commissioned to carry out some tests, including looking at the potential for the creation of potentially explosive atmospheres above the liquid phase of the hydrogenated and dehydrogenated material due to the release of physically dissolved hydrogen during transport. This work indicated that an upper limit for the volume of dissolved hydrogen in the carrier is needed, which

Germany proposed as 0.5 L(H2)/kg(LOHC). It also offered a text for a new special provision to be assigned to UN 3082.

The Sub-committee welcomed the information but some experts felt that further research and a more detailed study were needed. It was also noted that benzyl toluene is only one possible LOHC and it may be necessary to take a more generic solution so as to take other possible carriers into account. Germany offered to lead inter-sessional discussions and submit a more detailed document for the next session.

The World LPG Association followed up on discussions at the previous session on changes in the LPG industry to meet renewable and sustainability goals and, most specifically, the growing use of dimethyl ether (DME) as a blending component to reduce the carbon intensity of LPG. According to the regulations as they stand, such blends should be assigned to UN 3161 Liquefied gas, flammable, nos. However, its is the Association’s belief that, for effective hazard communication, a separate UN number is needed.

The Sub-committee did not wholly agree, with some experts seeking more justification and others feeling that the transport conditions may need to be varied according to the ratio of DME in the blends. It was agreed that further work is necessary and the Association offered to work on risk-based evidence to justify a new UN number, with a new proposal planned for the next session.

The World LPG Association also reported that bio-LPG is becoming more commonplace and, while this is in all respects identical to the LPG derived from petroleum refining, it is not based on petroleum. LPG is assigned to UN 1075 Petroleum gases, liquefied; bio-LPG derived from biological or recycled carbon feedstock does not ostensibly meet this description. In an informal document, the Association raised the idea of adding a new special provision for UN 1075 and 1965 to clarify that non-petroleum gases may also be carried under those entries. While there was general support, the Sub-committee did not accept the text offered and discussion will resume at the next session.

PACKAGING PROBLEMS

At the previous session, the Netherlands had reported on cases where dangerous goods had been found to have leaked from hermetically sealed packagings; discussion at that meeting identified that the term “hermetically sealed” is not defined in the Model Regulations and that those packing instructions that require hermetically sealed packagings do not give any specific requirements or criteria. Since then, the Netherlands had gone through the Model Regulations and identified places where other terms, such as ‘gas-tight’, ‘air-tight’ and ‘leak-tight’, are used; some variation reflects the various possible phases (liquid, vapour or gas) but that does not account for all of the differences. Furthermore, it is not clear whether these terms refer to packagings being leak-tight from the inside out or from the outside in, or both.

In order to clear up the confusion, the Netherlands offered two versions of a definition for ‘hermetically sealed’, both specifying that the packaging is designed and constructed “in such a way that there is no

18 HCB MONTHLY | MARCH 2024

egress from or ingress into the package under normal conditions of transport”. The Sub-committee agreed that there was a need for clarification but that might involve addressing the different wordings used on a case-by-case basis. The Netherlands offered to return with a more detailed document at the next session.

The World Coatings Council (WCC) in an informal document reported on the outcome of discussions at a lunchtime working group at the previous session, looking at the transport provisions for small quantities of environmental hazardous paints, printing inks and related materials. The work was prompted by WCC’s concern over the availability (or rather lack of) suitable UN-approved plastics packaging in sizes between 5 and 30 litres, as commonly used by the industry. WCC made it clear that it was not aiming to change the requirements relating to classification, marking/labelling and documentation; rather, it wished to provide an

exception to allow paints and printing inks to be transported in non-UN-approved packagings in these sizes. There had been some suggestions as to how this could be achieved, with the most widely supported idea being an amendment to the existing packaging provision PP1 in Packing Instruction P001.

The Sub-committee remained hesitant to accept such an exemption for paints and printing inks but not for other substances. WCC invited all experts to send comments and suggestions, prior to developing a formal proposal for the next session.

INFORMAL GROUP WORK

Cefic reported on the discussions of the informal correspondence group on polymerising substances and selfaccelerating polymerisation temperature (SAPT), established by EWG at the previous session to evaluate industry best practice for ensuring stabiliser is present and effective

during transport. The correspondence group quickly concluded that SAPT is not the correct safety parameter to be used and, in any event, cannot be determined for stabilised polymerising substances. There was, though, general support to focus on the so-called polymerising induction time (PIT) as the parameter to be used to guarantee safety during transport; this can also be used in relation to SP386.

A second round of correspondence will be held in spring 2024, with the aim of picking up on the discussion by EWG at the 64th session of the Sub-committee in June/July 2024.

Germany proposed an amendment to the classification of chlorophenolic substances. Currently these are assigned to UN 2020 (solid) or 2021 (liquid), Division 6.1, PG III. Both the UN Model Regulations and the International Maritime Dangerous Goods (IMDG) Code also reference dichlorophenols under these entries.

However, it has emerged that 2,4-dichlorophenol presents a corrosive hazard as well as its toxic hazard, which should be reflected in its classification. It may be that there are other chlorophenols that also have additional hazards and these are not addressed under UN 2020 or 2021. IMO’s Editorial & Technical Group (E&T), on the basis of a paper from Germany, proposed allocating 2,4-dichlorophenol to UN 2923 Corrosive solid, toxic, nos and felt it appropriate for Germany to take the proposal to the TDG Sub-committee, which it now did, recalling that it had raised the issue during the previous biennium.

Germany proposed two options, firstly to introduce a new special provision for UN 2020 and 2021 specifying that chlorophenols presenting an additional hazard should be transported under the appropriate nos entry, or secondly to create two new UN entries for chlorophenols that have a corrosive hazard.

There was no clear preference among the Sub-committee, though it was agreed that action was needed. Following discussion, and on the basis of an additional informal document from German with more data, it was decided to go with a revised version of the second option. As a result, the existing proper shipping names will change slightly, with UN

REGULATIONS 19 WWW.HCBLIVE.COM

2020 becoming “Chlorophenols, toxic, solid, nos” and 2021 becoming “Chlorophenols, toxic, liquid, nos”. It has been suggested that reference to special provision 274 be added in column (6) against these two entries but there was some opposition and that has been kept in square brackets pending confirmation.

In addition, two new entries have been adopted:

UN 3561 Chlorophenols, corrosive, toxic, solid, nos, Class 8, Division 6.1 subsidiary risk, PG II.

UN 3562 Chlorophenols, corrosive, solid, nos, Class 8, PG II.

Both the two new entries are given a limited quantity value of 1 kg, excepted quantity code E2, and are assigned packing instructions P002 and IBC08, special packing provisions B2 and B4, portable tank instruction T3 and special tank provision TP33. In addition, special provision 274 is also tentatively assigned to UN 3561.

All these changes are also reflected in Table B of Chapter 3.2.

A tripartite proposal arrived from COSTHA, FAO and the Dangerous Goods Trainers Association (DGTA), which sought a reasoned revision of the transport regulations for infectious substances, noting that the Sub-committee had addressed the issue numerous times over the past 20 years in response to challenges experienced in fitting the regulations to reality. The three bodies asked for a lunchtime working group to address a list of topics.

That session resulted in a plan of action, which is likely to lead to several proposals for amendment:

• WHO shared its experience of the challenges in moving infectious substances in Central Asia, which has created barriers to timely transport; this could be ameliorated by reviewing and revising the Indicative List of pathogens in 2.6.3.2.2.1, developing particular provisions for quality assurance samples, and identifying ways to speed up the determination of Category A/B assignments to deal with regional health issues. WHO will lead this work

• COSTHA and DGTA noted that some regional health organisations consider the inclusion of pathogen names on shipping

documents represents a security risk and require the technical name to be replaced with a more general phrase; it is important, from an emergency response point of view, that the pathogen name is available.

• Packing instructions P650 and P620 do not adequately address when it is permitted for lithium batteries to be included in equipment or devices that must be shipped as Category A or B infectious substances. Similarly, the exception in 2.6.3.2.3.9 for used medical devices lacks a provision for lithium batteries. COSTHA and DGTA will lead this work.

• P650 also makes it difficult to use ‘dry shippers’ (below)’, which are designed to transport biological specimens at cryogenic temperatures. FAO and Belgium will work on a proposal for presentation to the Sub-committee.

• The group proposed that it should continue to work on these topics and any others that arise, by means of an intersessional working group. The Sub-committee

encouraged this approach and looked forward to receiving formal proposals for amendment at future sessions. Canada noted that the practice of reclassifying existing entries for dangerous goods has become more prevalent in recent years but that each reclassification involves a case-by-case revision to the applicable packaging provisions. Canada believes that a more systematic approach is needed and offered a framework for possible discussion by an informal working group. After a short meeting during a coffee break, Canada offered to lead an intersessional informal working group to review the Guiding Principles and the factors that should be taken into consideration when looking at amending the packing requirements. The Sub-committee welcomed the initiative.

The second part of this two-part report on the TDG Sub-committee’s 63rd session in next month’s HCB will cover discussions relating to energy storage devices, the transport of gases, miscellaneous proposals for amendment, global harmonisation issues and other business.

20 HCB MONTHLY | MARCH 2024

PACKAGING PLASTICS

MARITIME • IMO IS CLOSE TO AGREEING RECOMMENDATIONS FOR THE TRANSPORT OF PLASTICS PELLETS. IT HAS YET TO BE DECIDED IF THESE RECOMMENDATIONS CAN

BE MADE MANDATORY

THE INTERNATIONAL MARITIME Organisation’s (IMO)

Sub-committee on Pollution Prevention and Response (PPR) agreed draft recommendations for the carriage of plastic pellets by sea at its 11th session in London last month. The new recommendations were developed in response to growing international concern over the amount of plastics waste in the world’s oceans and the awareness that a significant proportion of this plastics waste derives from the accidental release of plastics pellets being carried as cargo.

Plastics pellets are small plastics granules widely used as a raw material in the creation

of plastic products. Normally transported by the tonne in freight containers, spills in the ocean can harm marine life and impact fishing, aquaculture and tourism activities. The most recent major incident occurred off the coast of Galicia in Spain, when millions of pellets washed ashore after accidental release from a ship.

The draft recommendations are quite general in scope, stating that:

• Plastic pellets should be packed in good quality packaging that should be strong enough to withstand the shocks and loadings normally encountered during transport. Packagings should be

constructed and closed to prevent any loss of contents that may be caused under normal conditions of transport, by vibration or acceleration forces.

• Transport information should clearly identify those containers that contain plastics pellets. In addition, the shipper should supplement the cargo information with a special stowage request.

• Freight containers containing plastic pellets should be properly stowed and secured to minimise the hazards they present to the marine environment without impairing the safety of the ship and persons on board. Specifically, they should be stowed under deck wherever reasonably practicable, or inboard in sheltered areas of exposed decks.

These recommendations were forwarded for urgent consideration and approval by IMO’s Marine Environment Protection Committee (MEPC) at its 81st session this month. The draft had already been reviewed by IMO’s Sub-committee on Carriage of Cargoes and Containers (CCC) at its ninth session this past September, where some constructive comments were made; CCC had no objection to PPR finalising the work.

AFTER THE SPILL

PPR has also drawn up some guidelines on cleaning up spills of plastics pellets from ships. These offer practical guidance for government authorities and other entities involved in development large-scale national strategies as well as smaller scale, sitespecific response plans. The guidelines cover contingency planning, response, post-spill monitoring and analysis, and intervention and cost recovery. These will be updated as the industry gains more experience with their application. These draft guidelines will be discussed by MEPC at its 82nd in October 2024, though PPR also invited IMO member states to start using the guidelines at their earlier convenience, pending formal approval. PPR also held extensive discussions on possible amendments to other IMO instruments that would allow its recommendations on plastics pellets to be made mandatory; these discussions will continue at future sessions.

WWW.HCBLIVE.COM REGULATIONS 21

PUT A CORK IN IT

EMISSIONS CONTROL • CANADA IS CATCHING UP WITH OTHER JURISDICTIONS IN SPECIFYING VOC EMISSIONS LIMITS FOR PETROLEUM STORAGE AND TRANSFER FACILITIES

CANADA’S

DEPARTMENTS

OF the Environment and Health have published proposals to introduce national provisions covering the release of volatile organic compounds (VOCs) from the storage and transfer of petroleum liquids. The proposed regulations would replace the current patchwork of voluntary and mandatory measures across the country.

The proposed Reduction in the Release of Volatile Organic Compounds (Storage and Loading of Volatile Petroleum Liquids) Regulations would require petroleum liquid storage tanks and loading racks to be equipped with emissions control equipment. Operators of these facilities would be required to install, inspect, maintain and repair equipment to ensure adequate emissions control performance. The proposed Regulations would also include recordkeeping and reporting requirements for operators. Facilities that would be subject to the proposed Regulations include petroleum

liquid terminals and bulk plants, petroleum refineries and petrochemical facilities

The proposed Regulations would establish equipment-based requirements for new and existing volatile petroleum liquid storage tanks and loading operations at regulated facilities. The proposed Regulations define criteria for the time permitted for regulated facilities to bring equipment into compliance and these criteria are based on the equipment’s prior condition and emissions risk. The implementation of the proposed Regulations would follow a phased-in approach, requiring regulated facilities to prioritize highest-emitting equipment.

WHY THE NEED?

Canada’s regulatory authorities say that petroleum liquid storage and loading operations are among the largest sources of uncontrolled VOC releases from the petroleum and petrochemical sectors. However, the voluntary and mandatory measures currently

in place do not sufficiently address the health and environmental risks associated with VOCs as smog precursors, nor do they adequately address the health risks of specific carcinogenic VOCs, such as benzene. It is common for multiple large facilities to be located near each other in and around urban areas, increasing the local population’s risk of exposure to elevated levels of benzene. Ambient air monitoring near some facilities has measured benzene levels that may pose a risk to human health.

Following screening assessments under the Chemicals Management Plan that identified risks to human health, the Department of the Environment, working jointly with the Department of Health, developed regulations to control fugitive emissions of VOCs from the petroleum and petrochemical sectors. The Reduction in the Release of Volatile Organic Compounds Regulations (Petroleum Sector) were finalised in November 2020. These Regulations limit fugitive emissions, including carcinogenic substances such as benzene, from equipment leaks at petroleum refineries, upgraders, and petrochemical facilities that are integrated with a petroleum refinery or upgrader.

It was argued by some indigenous peoples and non-governmental organisations that further action was needed to address additional sources of VOCs, including the storage and loading of petroleum liquids. The proposed Regulations would address these additional emission sources.

Initial consultations on the proposed Regulations began in May 2021 and further consultations were carried out with indigenous groups and other interested parties, prior to the publication of the proposed regulations in Canada Gazette Part I on 24 February. There is a 60-day consultation period due to end on 25 April.

The proposed Regulations and supporting material comprise an extensive document containing a lot of detail on what the regulatory bodies will expect from industry and the timeline they are proposing, as well as details of the required testing and inspection. It can be found in full at https://gazette.gc.ca/ rp-pr/p1/2024/2024-02-24/html/reg1-eng.html.

HCB MONTHLY | MARCH 2024

22

NEWS BULLETIN

REGULATIONS

PHMSA AMENDS CLASS 1 RULES

The US Pipeline and Hazardous Materials Safety Administration (PHMSA) has issued a notice of proposed rulemaking (NPRM) under docket HM-257A containing proposals to amend the Hazardous Materials Regulations in respect of: the classification and approval process for low-hazard fireworks; the classification of small arms cartridges (to include tracer ammunition); use of the PHMSA portal to submit applications for explosives approvals; and voluntary termination of explosives approvals.

The proposed changes aim to streamline procedural requirements for fireworks manufacturers and shippers and also to address classification and packaging inconsistencies.

The comment period closed on 28 February; PHMSA will now work towards finalising the rulemaking.

OSHA GIVES PSM GUIDANCE

The US Occupational Safety and Health Administration (OSHA) has issued a directive setting out its enforcement policy as regards its standard for process safety management (PSM) of highly hazardous chemicals, found at 29 CFR 1910.119. The directive provides its enforcement personnel with OSHA’s interpretation of the standard but will also be of use to facilities that are required to comply with the PSM standards.

The new directive replaces a document issued by OSHA in 1994. Since then, the agency has been instructed to update the PSM rule and it has conducted a number of reviews over the past ten years but it appears that it has decided that better enforcement is needed rather than any rule changes.

The directive itself is mainly presented in a question and answer format, based on the questions OSHA has received and the interpretations it has made since the PSM standard was first promulgated in 1992.

The directive can be downloaded from the

OSHA website at https://www.osha.gov/sites/ default/files/enforcement/directives/CPL_02-01065.pdf.

FRA ASKS FOR BA

The US Federal Railroad Administration (FRA) has published a final rule amending its occupational noise exposure provisions to include a requirement to provide train crews and certain other employees with “an appropriate atmosphere-supplying emergency breathing apparatus” when in the cab of a train carrying a hazardous material that poses a toxic inhalation hazard.

The change harks back to a number of derailment incidents in 2004 and 2005, where railroad workers died after inhaling chlorine released from damaged tank cars. The National Transportation Safety Board (NTSB) issued a recommendation that FRA require railroads to provide emergency escape breathing apparatus (EEBAs) to crew members, which was backed up by the Rail Safety Improvement Act (RSIA) in 2008. FRA responded with a proposed rulemaking in 2010 but, in light of comments received and a cost-benefit analysis, issued instead a guidance document to help railroads develop EEBA programmes. NTSB was not happy with this but it has taken another 13 years for FRA to put the recommendation into effect. The new requirements will become effective on 26 March.

ADR NOW IN ARABIC