Back in the days before the internet, restless youths had to make their mischief on the streets, stealing road signs, frightening old ladies or making a noisy nuisance after dark. But with new technology came new ways of making mischief. One of the most remarkable bits of information I have picked up recently is that there are tools available on the internet that will allow anyone to become a hacker in the space of a weekend.

As digitisation and Industry 4.0 concepts gain increasing traction in the dangerous goods supply chain – as we saw in great detail in last month’s HCB – the threat posed by hackers is ever more significant. And it is not just spotty teenagers in bedrooms, generating malware that might just impact your IT systems: there are some nefarious players out there in the dark, who might want to hold your IT system to ransom, and others with more geopolitical aims who may well have a yen to bring down the capitalist system – and your company with it.

So, while we have been talking a lot in these pages about digitisation over the past two years, the conversation has more recently opened up to incorporate cyber-security issues. Not before time, too: don’t forget that all high-hazard facilities covered by the Seveso III Directive in Europe – and similar provisions elsewhere in the world – have a duty to address cyber-security, just as they do physical security threats.

Like many in the business, I suspect, I am not an expert in cyber-security and I console myself by thinking that there is someone in a room somewhere in the organisation with a responsibility (and the knowledge) to take ownership of the problem. At least, I hope there is, because I don’t really

have the time – or inclination – to come up to speed on the technical issues involved.

But I did receive some succour from the UK authorities at a recent conference. It reminded me of a time I was sharing a podium with a rocket scientist. I asked him about his profession and he leaned in conspiratorially. “The thing about rocket science,” he said, “is that it’s not ‘rocket science’.” Similarly, it seems that cyber-security, despite its off-putting name, is not rocket science. For a start, any competent IT department ought to be able to put in place measures to protect against 80 per cent of cyber-attacks very quickly. Covering the remaining 20 per cent may take more time (and money) although, as with physical security, 100 per cent protection is unlikely to be feasible.

With increasing use of remote sensors to deliver data to control systems, many companies are laying themselves open to cyber-attack. Those vulnerabilities have to be identified before they can be managed, just as many companies have to identify and mitigate physical security vulnerabilities. In fact, they may well find that the assessment of cyber-security vulnerabilities is a whole lot easier than doing the same for physical security vulnerabilities, although the response to the assessment will necessarily be different.

But management of change will still be important: any change to a company’s IT network has the potential to open up new vulnerabilities, even if the greatest vulnerabilities will continue to be found at employees’ desktop and laptop computers. Be prepared for more restrictions on how you use the internet at work.

Peter Mackay

VOLUME 39 • NUMBER 11

Down by the riverside

Ports make barges more efficient 14

High flyers

Drones find a role in inspections 16

Plugged in Electronic ECD is a reality 20

Going for Ghent

A new home for H Essers 23

All for one

TCF rolls out booking platform 24

Plastic beach

Rotterdam builds polymer hub 26

Open to opportunity

What’s on at Intermodal Europe 27

News bulletin – tanks and logistics 28

News bulletin – storage terminals 46

Training courses 48 Conference diary 51

SAFETY Incident Log 52

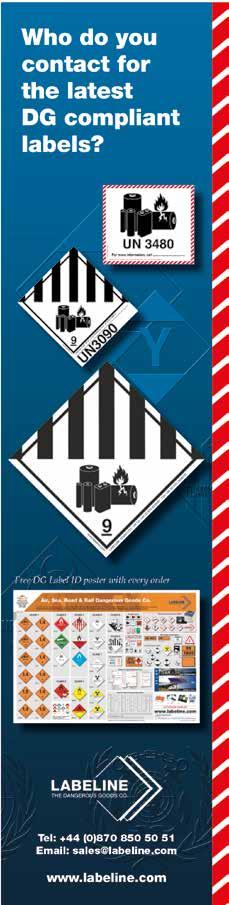

In labels we trust US update from Reliance Label 56

Buffer stock

Finalising the 2019 RID rules 58

Letter from the Editor 01 30 Years Ago 04

Learning by Training 05

IBCS

Containers of interest IPA reports rising sales 06

Packaging made easy Schütz refines its IBCs 08

New and improved Greif expands in Russia 10

Talk to your tailor Thielmann offers bespoke solutions 12 News bulletin – industrial packaging 13

A whole new world Fecc expects a different future 30

Chemical transformation Univar accelerates consolidation 35 News bulletin – chemical distribution 36

The tank arena TSA talks it all through 38 Singapore plugs in Vopak trials digital systems 44

Process progress

Ten years of IFLEXX 45

New year, new rules What to expect from IATA 64

Breaking the mould HCC a new forum for China 67

BACK PAGE Not otherwise specified 68

Report from the EPCA Annual Meeting

Annual plastics drum survey

What DG professionals think Gas shipping and storage

Peter Mackay

Email: peter.mackay@hcblive.com Tel: +44 (0) 7769 685 085

Sam Hearne

Email: sam.hearne@hcblive.com

Tel: +44 (0) 208 371 4041

Managing Director

Email: samuel.ford@hcblive.com

+44 (0)20 8371 4035

HCB

Commercial Manager

Ben

Email:

Tel: +44 (0) 208 371 4036

Campaigns Director

Craig

Email: Craig.Vine@hcblive.com

+44 (0) 20 8371 4014

Email: stephen.mitchell@hcblive.com Tel: +44 (0) 20 8371 4045

Media

Cargo Media Ltd

Marlborough House

Regents Park Road, London N3 2SZ

2059-5735

There was something of a ‘rail’ theme to the November 1988 issue of HCB. Not only was there a profile of UP Railroad’s hazmat activities and a report on tank car construction in the US, but we also posed the intriguing question: what’s safer – road or rail?

Thirty years, ago, the West German government (as it was then –the Berlin Wall had another year’s life left) had just taken action to require dangerous goods to move to rail wherever possible. The move came as a response to an accident in July 1987 when a road tanker carrying gasoline ran out of control and crashed into a café in Herborn, killing four people. The provision is still in place in the snappily titled Gefahrgutsverordnungs-Strasse and is perhaps not well understood by hauliers outside of Germany.

At the time, we said of the German action: “The move has infuriated the road transport industry, jeopardised the status of the ADR Agreement and placed the European rail tank wagon leasing business in a difficult position with practically no time to plan for their being granted a virtual monopoly on the long-distance carriage of bulk hazardous liquids through the Federal Republic.”

Perhaps, as things turned out, we were being overly dramatic: the ADR Agreement remains firm and there does not appear to be any problem with delivering dangerous goods in bulk in Germany, albeit a number of major players in the chemical industry do make more use of rail transport than their peers in other European countries.

There were suggestions at the time that other states would follow West Germany’s example. Spain, for instance, was thought a likely

candidate, not least since it suffered one of the highest rates of road accidents in Europe. Since then, and following its accession to the EU in 1986, there has been massive investment in its road network and things are much better. Plus, there was always the issue of the Iberian gauge rail network, effectively split off from the rest of Europe by the need to transload goods at the French border. While Euro-gauge tracks are making inroads into Spain, the link with the chemical hub at Tarragona is still not complete, making it harder for manufacturers there to achieve seamless movement by rail to the rest of Europe.

The November 1988 issue also looked at the latest session of the ECE Working Party on the Transport of Dangerous Goods, which had finalised the changes to ADR due to enter into force in 1990. Much of the work dealt with revision of the requirements for explosives and radioactives but there was also a lot to be done to adopt the new Class 9, as well as Appendix A.6 on intermediate bulk containers (IBCs). It is illuminating to remember that those provisions are only thirty years old, when they are now such an integral part of the dangerous goods supply chain.

HCB also reported on the August 1988 meeting of the Group of Experts on Explosives, the last prior to its merger with the UN Group of Rapporteurs. There were concerns among the explosives experts that the move would lead to less time being available for discussion of Class 1 issues which, for them at least, were obviously much more important than other classes.

I recently read an interesting article by Richard A Clarke and RP Eddy called ‘Why visionaries who can accurately predict looming disasters are often ignored’.

The authors wrote: Cassandra was a beautiful princess of Troy cursed by the god Apollo. He gave her the ability to foresee impending doom but the inability to persuade anyone to believe her.

I could not help feeling touched by this article as it confirmed exactly what I am experiencing myself. I have been writing this column and my blog for some years now, but despite the truthfulness and predictions based on logic and empirical research, most of what I write seems to be ignored.

The column which I write for HCB and my publications on LinkedIn are well researched. I trained myself as a cybernetician and a systems scientist, because by combining scientifically sound insights obtained from these sources, I learned how to predict looming disasters. I even developed a measurement or mapping tool to do this. It measures the so-called limitations of reality, for which I coined the term Realimiteit

What Clarke and Eddy write about Cassandra is that, although her predictions were sound and logical, people did not want to listen to them. Neither was she able to convince the people she was right. Thus, Troy was destroyed after the Trojan Horse was allowed to enter the city.

Information, in this case in the form of a prediction, even perhaps of negligible value, still must be contemplated when decisions are made. Not considering even a little part of it will alter the outcome beyond control (the ‘Butterfly Effect’). The suppression of information for ulterior motives - for example, a prediction based on science, an observation that is being deemed irrelevant, or suggestions by

those who are able to foresee things - directly destabilises intended results and makes them uncontrollable. Predictions and facts should be weighed and used as feedback in order to steer an organisation, because only then it learns and can adapt.

Cassandra knew this, as do many philosophers who ask ‘ALL’ questions and can reliably synthesise what is going to happen next. The same applies for our hazardous cargo industries. HSE failures and risk can only be prevented by using all information and by listening to Cassandras. Perhaps Cassandra was an early cybernetician? I feel she certainly was a ‘systems thinker’.

An example: the Macondo Oil Spill Disaster, which cost BP about $62bn, was in fact caused because information about the instability of the foundation of the cemented wellhead/Christmas tree was ignored. People and instruments warned about it, but these predictions were disregarded. Earlier I explained the value of requisite variety and the creation and sustenance of viable systems. This means that any operation, business or process undertaken can be maximally controlled by accepting even the smallest pieces of information and using them to govern our intentions. This will prevent disaster, because now you can predict catastrophe by epistemological knowledge using systems science and cybernetics. If you happen to know Cassandra, please listen to her.

This is the latest in a series of articles by Arend van Campen, founder of TankTerminalTraining. More information on the company’s activities can be found at www.tankterminaltraining.com. Those interested in responding personally can contact him directly at arendvc@tankterminaltraining.com.

DEMAND FOR INTERMEDIATE bulk containers (IBCs) continues to grow steadily across the UK, European and international markets with sales of new, remanufactured and reconditioned containers on the rise. According to Phil Pease, CEO of the Industrial Packaging Association (IPA), recent statistics show the European market growing from around 1.4m units in 2006 to just under 4.0m units in 2018. This growth is across all key markets, which cover chemicals, dangerous goods, foodstuffs and pharmaceuticals.

While there has been some conversion to IBC use from both the plastics and steel drum markets, it is believed that a substantial part of the growth is not from market share but overall market growth. IBCs are able to hold a larger capacity when compared with kegs and drums, and a general increase in raw material productivity has led to more raw materials being transported, contributing to the rise.

Never prone to resting on their laurels, IBC manufacturers continue to drive the popularity of their products through research and development. NCG-Mauser recently launched its SM-PCR series IBCs. These IBC bottles are produced using Mauser’s multilayer technology where the inner layer is virgin polymer but with post-consumer recyclate (PCR) used for the outer layer, ensuring product safety and environmental efficiency in one package. Werit, a leader in industrial packaging, now has a unique range of “mini-me” 300-litre IBCs that are available on wooden or plastics bases, complementing its already existing 600-litre, 800-litre and 1,000-litre products. Werit’s IBCs also have

a pressure management discharge system, which allows product discharge through the vale without removing the lid, thus minimising the risk of contamination.

Continuous development of IBCs and IBC technology is a driving force within the industry and with new developments come new opportunities, not only for suppliers but for consumers as well, Pease says.

Regulations and safety standards are constantly being reviewed and improved upon by international alliances of trade organisations such as the International Confederation of Plastics Packaging Manufacturers (ICPP), the International Confederation of Container Reconditioners (ICCR) and their representation at the UN Committee of Experts. The 53rd session of UN Sub-committee of Experts on the Transport of Dangerous Goods will take place in Geneva next summer and is set to reflect the current interest in IBCs, with a number of proposals from Belgium. Some of these proposals include inner receptacle marking, routine maintenance requirements and marking of dates. Other proposals on IBCs include an ICPP proposal to clarify reference to the stacking mark and a proposal from the European Chemical Industry Council (Cefic) and the Dangerous Goods Advisory Council (DGAC) on multiple marking of IBCs where more than one design type conformance is covered.

There is currently a lot of media attention on single-use, retail packaging waste reaching the ocean. One of the important aspects that is being focused on is the capability for repeated reuse on a global scale. Both drums and IBCs transport products on international journeys before being cleaned, inspected and tested to ensure safe reuse with minimal energy consumption and proven sustainability, an important step in an effort to reduce the global carbon footprint. The ability sets the industrial packaging sector in a different class of environmental efficiency compared to retail packaging and it is important that is recognised in any environmental legislation being developed. HCB www.theIPA.co.uk

CONTAINERS • IPA’S PHIL PEASE REPORTS ON THE CONTINUED GROWTH IN IBC MARKETS IN EUROPE AND THE TECHNICAL ISSUES THAT THE REGULATORS WILL BE GETTING TO GRIPS WITH NEXT YEAR

TRANSPORTING LIQUIDS – ESPECIALLY chemicals – is a risky business. Intermediate bulk containers (IBCs), while efficient and versatile, can still be subject to tampering and contamination, despite the traditional failsafe methods the industry is used to seeing. Schütz Packaging Systems, a global leader in industrial packaging, previewed two new components for its range of IBCs at the FachPack 2018 exhibition, held in Nuremberg, Germany from 25 to 27 September, that are designed to improve product security.

High-quality packaging does not only come into its own under extreme circumstances. The benefits begin much earlier during daily operations, helping users save time and money. To further boost these advantages, Schütz is constantly working to increase the overall performance of the company’s packaging systems. As well as application safety, the company focuses on the question of how handling in the supply chain can be made easier and more convenient for users.

In light of this, the company has introduced a new safeguard system for its IBC outlet

valves that aims to reform the current methods of protecting originality. Schütz

Ecobulk containers, the company’s flagship IBCs, are always transported and stored with a closed and secured outlet valve. In order to open the valve, the customer must first remove the screw cap and thus the red polyethylene disk so as to reveal the foil seal that acts as a concealed originality protection method.

Until now, there have been two options to secure the outlet valve: a steel safety screw or a plastics safety clip. In day-to-day operations, Schütz believes both options are unsatisfactory. Use of a safety screw means that an additional tool is required to open the screw, along with the constant risk that the screw might get lost. The same applies when a safety clip is used, with the additional risk of the clip being dropped when the valve is opened, making it impossible to secure the valve at a later point.

Schütz’s new safeguard system consists of a yellow tab that is integrated in the valve between the casing dome and the handle. The tab is easy to use: the latch is simply pressed up with a thumb, requiring no tools. By pressing the latch up, the handle of the outlet valve is released and can then be turned to discharge the product. After discharge, the handle is moved back into its original position to close it and the tab can then be pressed down again, snapping into place to relock the outlet valve.

The option of reclosing the container quickly and easily is a great benefit, as up to now that process has been laborious and timeconsuming. This is especially beneficial from a regulatory standpoint as transport regulations demand that the container is securely closed, a condition that is also required under the terms of the Schütz Ticket Service when the container is collected after use.

Another of Schütz’s added features is its originality sticker, designed to provide additional protection. The sticker, which is attached to closed lock at the factory, breaks when the tab is pushed up for the first time, instantly showing that the valve has been opened. The originality strip protects the filling product from tampering, effectively

ruling out the risk of contamination and protects the original quality of the product.

All of Schütz’s EVOH (ethylene vinyl alcohol) products – which are commonly used in foodgrade applications – have been fitted with the new safeguard system as standard and a final conversion of all other valves will take place over the course of the year.

To accompany its Safeguard system, Schütz has also introduced a new peelable foil seal. One of the key components used on outlet valves is the foil seal that usually has to be removed by cutting with a knife prior to initial discharge. These seals are quite fiddly and the potential for contamination cannot be ruled out if the product comes into contact with aluminium residue of the cut edges, a particularly serious problem considering aluminium reacts with number of regularly transported chemicals, such as sodium hydroxide and a wide range of acids.

This new, practical solution is made of several layers of high-quality materials –mainly polyethylene terephthalate – and brings together the benefits of increased quality and easy handling, says the company. The round seal is simply peeled off by hand without the need for additional tools and leaving behind very little – if any – residue. This new, optimised variant is ideal for packaging products that are sensitive to metal and has the added benefit of making it impossible for the filling product to accumulate behind cut edges.

The new seal also provides increased protection against contamination since it is impossible to discharge product without destroying the foil, meaning that it is obvious at a glance whether the outlet valve has already been opened.

The company will equip all outlet valves for the Foodcert and Cleancert lines with the new foil seal.

Elsewhere at the FachPack event, Schütz exhibited its Impeller, a device designed to safely stir viscous media. A stirrer can pose a potential contamination risk for sensitive filling products due to the residue of any previous products. Schütz’s single-use stirrer is connected to the screw cap of the IBC and is pre-inserted at the factory.

The use of the Impeller as a disposable system means that risk of contamination can be reduced significantly, in addition to the savings associated with cleaning. The Impeller is available for all 1,000-litre and 1,250-litre Ecobulk IBCs with DN 150 and DN 225 filling openings.

Of further interest to the food, pharmaceutical and cosmetics industry,

Schütz was displaying its new Foodcert + Asepctic and Cleancert + Dualprotect IBC models at FachPack. Both models feature a UN-approved LDPE liner, sterilised with gamma radiation, that unfolds and aligns itself within the bottle during filling. This minimises conctact with oxygen both during filling and during transport. The liners are also ideal for use with adhesives, preventing premature curing and hardening.

Schütz, founded in 1958, is a leading international producer of high-quality transport packaging, employing more than 5,500 people at over 50 production and service sites around the world.

FachPack 2019 will once again take place at the Exhibition Centre Nuremberg from 24 to 26 September 2019. HCB www.schuetz.net

Materials, and Nikita Mikhin, deputy director of Obninskorgsintez, who represent longstanding partners advocating Greif’s product quality and customer service excellence.

The new 6,000-m² facility will employ a team of 50 and features an automated steel drum line with an annual capacity of two million units. The facility is also in close proximity to several of Greif’s key customers.

shipping drums and intermodal tank containers and can be made from metal, plastic or composite material.

GREIF, A GLOBAL leader in industrial packaging, recently welcomed more than 200 guests to the official opening of its new Russian steel drum production plant in Vorsino Industrial Park, Kaluga. The new facility (above), Greif’s ninth plant in Russia, is situated 80 km south-west of Moscow and has already begun production of the company’s state-ofthe-art drums, with a new intermediate bulk container (IBC) line due to be launched in 2019.

Speaking at the opening ceremony, Pete Watson, CEO of Greif, highlighted the expertise of the Greif team in Russia and the results that they have achieved over the past 25 years. Also In attendance were Dmitry Orlov, CEO of Gazprom Neft-Bitumen

“We are delighted to officially open this latest Greif facility to better serve our local customer base,” says Konstantine Savinov, general manager of Greif Russia. “Delivering greater flexibility, reduced lead times and lower transportation costs is central to our ongoing improvement plans. The Kaluga plant will enable us to achieve all of this with existing partners and further build on our market leading position by introducing new customers.”

In addition to its new facility, Greif has introduced some improvements to its range of GCUBE IBCs. IBCs are stackable, reusable containers with an integrated pallet base mount that allows them to be easily manoeuvred with a forklift. IBCs have a volume range that sits between standard

Demand within the global market for IBCs has grown steadily in recent years with the rising need to transport liquids such as food, fuels, chemicals and hazardous materials. Some of the major growth drivers in the IBC market are the provision of cost-effective transport and storage, uncomplicated maintenance, and their reusability. The new innovations see Greif replace the generic aluminium foil seal with a GCUBE-branded one, designed specifically to remove the risk of product counterfeiting while also offering customers the reassurance of improved product protection.

“We continue to invest in our GCUBE IBC solutions and this new branded butterfly valve seal is yet another significant market development,” says Luca Bettoni, EMEA IBC and plastic product manager at Greif. “We are the first company to introduce a branded aluminium foil seal to its IBC valves giving customers total confidence in the integrity of the seal and most importantly the contents of the container at its end destination.”

Both the branded foil seal and the safety screw can be removed by hand. Additionally, the technology that Greif implement means that no foil residue will be left on the valve outlet, eliminating the risk of contamination.

MANUFACTURING • THE OPENING OF GREIF’S NEW MANUFACTURING FACILITY NEAR MOSCOW WILL UNDERPIN GROWTH IN LOCAL DEMAND AND PLUG A GAP IN GREIF’S GLOBAL IBC AND DRUM NETWORK

“With this new valve we combine safety with the easiest handling: just your hand is enough to open the valve with no need for tools such as screwdrivers or cutters,” continues Bettoni. From an operative’s perspective, it is much quicker and easier to open valves by hand and the additional benefit of full recyclability is –from an environmental standpoint – a bonus.

Other recent IBC developments at Greif include the GCUBE Shield, which offers revolutionary barrier protection compared with fluorinated and six-layer IBCs, with improved product stability, shelf-life and operational performance. By adopting IBCs, end users can benefit from a reduction in harmful air pollutants coming from their product and an increased protection of the product against oxygen permeation from outside the container. Attributes such as these make IBCs suitable for a range of industries including flavours and fragrances, paint, agrochemical, speciality chemicals.

Greif recognises that minimising the environmental impact of packaging is a priority, but when implementing sustainable practices, safety cannot be compromised, especially when dealing with hazardous chemicals. Greif’s GCUBE IBC portfolio is developed with sustainable and optimum life-cycle capabilities in mind. The company has recently secured UN 1.6 approval for its high performance IBCs with reduced environmental impact and demand for its reconditioned IBCs continues to rise.

In addition, the company has recently received gold recognition from Ecovadis for its commitment to corporate social responsibility. Ecovadis operates the first collaborative platform that enables companies to monitor the sustainability of their suppliers across 150 sectors. Greif has been reported as one of the top 5 per cent of all suppliers assessed by EcoVadis. This news comes after the company joined Operation Clean Sweep, an international programme designed to prevent pellet, flake and powder loss, earlier this year. The programme was originally designed by the plastics industry with the support of The British Plastics Federation and PlasticsEurope, and aims to protect

marine wildlife from harmful plastics and by-products that end up in the oceans.

The GCUBE model heralds the new generation of IBCs, claims Greif. New technologies are emerging every year that are enabling change within the industrial packaging industry. Greif is at the forefront of innovation. In 2018, chemical and pharmaceutical industries remain the major end-user industries of IBCs as these containers allow them to transport all types of solid or liquid products, including goods that require safe handling, Greif reports. Demand is also growing in the food and

beverage sector where product integrity and shelf-life storage are becoming increasingly important.

The company currently has ten IBC facilities across EMEA out of a total of 14 around the world after recently opening two new sites in the Netherlands and Spain, and is expanding several of its existing product lines. Greif was established more than 140 years ago and currently has annual revenues of $3.7bn. The company employs more than 13,000 employees in over 200 locations across more than 40 countries worldwide. HCB www.greif.com

MANUFACTURING • THIELMANN HAS HAD A BUSY 2018 WITH A BIG FOCUS ON CONTINUED EXPANSION INTO THE NORTH AMERICAN MARKET FOR STAINLESS STEEL IBCS AND TANK CONTAINERS

SERVING THE US market from its North American headquarters in Houston, THIELMANN has been working closely with its customers to develop solutions for their processing, dispensing, storage and transport requirements across a range of industries. The company specialises in a number of sectors, including those involving hazardous and sensitive cargoes, such as the chemical, coatings, nuclear, pharmaceutical and oil and gas industries.

As it does elsewhere around the globe, THIELMANN continues to strive for excellence in its solution development and manufacturing processes. In line with the Section 232 Tariffs on aluminium and steel that came into effect

in March 2018, all THIELMANN products sold within the US are manufactured entirely from stainless steel produced by US-owned companies, using top-quality, high grade AISI 304/316 stainless steel, and are designed to meet the stringent requirements of operations involving the storage and transport of dangerous goods.

Not only does stainless steel offer excellent isolation from external particles, pollution and oxidation, it protects against temperature changes, provides a barrier against UV light, and – as an inert materialensures that the properties of the products it stores and transports remain intact and unchanged. All of which are critical for hazardous cargo operations.

From start to finish, customers can be sure that a THIELMANN IBC or tank container will meet their operational needs throughout its service

life – a huge benefit. Unlike manufacturers looking to mass produce a one-size-fits-all solution, THIELMANN works with its clients to find the right solution – from ensuring the product meets the correct safety directives to engineering a system that fits into existing handling and transport logistics chains.

“The THIELMANN advantage is our flexibility and responsiveness to the needs of our customers,” says Sebastian Bojarski, head of THIELMANN’s sales department. “We are not looking to simply provide a generic solution for all. Instead we work closely with our customers, striving from the very beginning to meet their needs one hundred per cent, and follow that up with tailored servicing, refurbishment and maintenance options.”

These servicing options are designed to keep the containers in optimal condition throughout their service life. Full service and repair programme options include internal and external inspection, repair, pressure testing, refurbishment, re-equipping, certification and container advisory.

At the top end of its product line, THIELMANN also offers increased servicing for ISO and non-ISO tank containers, with field service support, periodic upgrades, design and safety case reviews. More indepth bespoke support solutions include post-design services, contractor logistics support, contracting for availability, operator and maintenance training, spares, codification, obsolescence management, regeneration and upgrades. These services are tailored to give THIELMANN’s customers across many different sectors increased confidence in their tank container fleets throughout their full life cycle –a period that may be as long as 30 years.

“The North American market is highly competitive, but our reputation as the leading manufacturer of stainless steel IBCs, kegs and container solutions positions us perfectly to tackle this market and we are seeing huge success here already,” Bojarski adds. “This is where our customers see the biggest advantage: we really are the one stop shop for tailor-made container solutions, and we are only going to continue to grow our market lead in the future.” HCB www.thielmann.com

Flexicon has unveiled a new Tip-Tite® pail dumper for the dust-free handling of highdensity solids. “Intended for powder metals, chemicals, pigments, minerals or other heavy, dense bulk solids, the unit features dual hydraulic cylinders that work in tandem to raise and seat the pail rim against a speciallyconfigured, elongated discharge cone and then tip the pail to an angle of 45˚, 60˚ or 90˚ with a motion-dampening feature,” the company says.

“At full rotation, the discharge cone seals against the inlet of the receiving vessel, creating a dust-tight connection and allowing controlled, dust-free discharge through a pneumatically-actuated slide gate valve.”

www.flexicon.com

BWAY, Mauser Group, National Container Group (NCG) and Industrial Container Services (ICS) have combined to form a new company, Mauser Packaging Solutions, with the aim of reliably and sustainably delivering products and services across the entire

packaging lifecycle for customers around the globe. With a promise of ‘Redefining Sustainability’, Mauser Packaging Solutions will serve customers of all four legacy companies with capabilities that span every phase of the packaging process.

“When developing our growth strategy, we recognised that customers were looking for a global partner to deliver sustainable packaging solutions and close the loop from purchase to reuse,” says CEO Ken Roessler. “For the first time, businesses have a single partner who can deliver an industry-leading portfolio of products and services, of the highest quality and widest range, around the world.” www.mauserpackaging.com

Greif has released a new line of speciality steel and stainless steel drum types at its Burton-onTrent plant in the UK. “We are constantly seeking new ways to meet customers’ expectations and market demand which is what led us to expand our range,” says Tim Hingham, speciality sales manager at Greif UK.

“Our stainless steel drums are a high-integrity option for the food, pharmaceutical and chemical industries. Stainless steel offers a high level of chemical resistance and can provide flawlessly pure and sanitary performance.”

Greif has announced a third-quarter net income of $67.7m from net sales worth just over $1.1bn. This compares favourably to respective prior-year figures of $43.9m and $961.8m. “Greif delivered solid third-quarter results, with stronger year-over-year operating profit before special items, earnings and free cash flow,”says president and CEO Pete Watson. “Our Paper Packaging and Flexible Products segments continue to demonstrate strong results. Our Rigid Packaging segment experienced strong demand across much of the portfolio, but was impacted by the continuation of rising raw material costs and unique headwinds in certain regions of our global business.” www.greif.com

General Steel Drum has acquired North Coast Container, based in Cleveland, Ohio. The move adds a fourth company to the portfolio owned by the Stavig family, joining Myers Container and Container Management Services, and gives them a foothold in the Midwest.

“We are pleased to be joining forces with the Beardsley family who have built a formidable business since its inception in 1983,” states Kyle Stavig, CEO of General Steel Drum. “The Beardsley and Stavig families have been friends for generations. This transaction is good for North Coast, good for our customers, and good for the Stavigs’ container businesses that, collectively, now have the ability to service customers across the country.”

Jim Beardsley will remain as senior executive vice-president of North Coast Container, which will now operate as North Coast Container LLC. www.generalstreeldrum.com www.ncc-corp.com

FOR MANY IN the chemical supply chain, the idea of ‘intermodal’ transport conjures up images of containers and tank containers switching between rail and road. But in some parts of the world, the use of inland waterway transport offers a third and very important leg to the concept of intermodalism. This is especially true in the port areas of the Benelux countries, where rivers and canals provide a very useful way of moving goods to the industrial hinterland – especially at a time when road congestion is continuing to get worse.

Barges are a common sight in the ports of Rotterdam and Antwerp, bringing in containers to load onto deepsea vessels, taking delivered boxes away, and shifting cargo between terminals. However, it has

become increasingly apparent that the current situation is far from ideal, with many barges spending much of their time light on cargo and having to make multiple moves within the ports to discharge and load containers.

As such, earnings in the barge sector – where much of the capacity is either independent or skipper-owned on behalf of larger players – have been low for some time, and insufficient to support the long-term health of a sector that is vital to the efficient operation of the ports themselves.

The Port of Antwerp is now taking steps to improve matters. Last month it began a pilot trial of a new system to encourage greater efficiency in container barge transport, in

effect imposing a benchmark for efficiency by requiring all barges calling at container terminals to make at least 30 container movements (on, off or on/off) per call.

The Port of Antwerp explains the purpose of the trial thus: “A roadmap has been drawn up to ensure sustainable growth of container barge transport in the port, with structural, feasible solutions to make the chain of transport more efficient. All the parties involved have committed themselves to fast implementation.”

To achieve efficiency gains, those in the supply chain will be required to collaborate in terms of planning barge movements and to consolidate container volumes. Digitisation will be needed to provide the tools and information necessary to put it all into practice. “The interplay of all these measures should create new growth opportunities for container barge transport and raise the efficiency of all partners in this transport chain,” says the port.

The first step towards Antwerp’s goal is the consolidation of container volumes so as to avoid the need for barges to tie up at the deepsea terminals to offload just a few boxes. This will require the bundling of containers at

‘consolidation hubs’, both within the port of Antwerp (on both sides of the Scheldt) and on barge waterways in the hinterland. This will involve the participation of ports such as Genk, Ghent, Moerdijk, Meerhout, Oosterhout and even Duisburg, as well as others.

The Port of Antwerp says this will provide advantages for players at all stages of the supply chain. Barge operators will make fewer terminal calls per port all, enjoy shorter turnaround times and more efficient freight movements, and make more efficient use of their resources and equipment. Similarly, for terminal operators, the aim is to allow more efficient planning and handling of barges calling at the dock, make more efficient use of resources and equipment, and generate higher productivity. An important outcome should also be faster and more reliable handling and transit of containerised goods for shippers and freight forwarders.

To help container barge operators make the transition to larger call sizes, the Flemish government and the Antwerp Port Authority are making financial support available on a temporary basis.

Backing this up, efficient planning and collaboration by barge and container terminal operators will lend more structure and transparency to the planning process in terms of the scheduling of barge movements. That transparency will lead to the smoother movement of barges through the major ports and allow terminals to guarantee minimum barge handling capacity.

The Port of Antwerp is also trialling an online Barge Traffic System (BTS), a unique slot request and monitoring system for barge and terminal operators. Barge operators send a request to the terminal operator via BTS and terminal operators draw up a schedule of loading and unloading

operations, making it available to barge operators via BTS.

This pilot project involves the participation of terminal operators PSA, MSC and DP World. Its aim is to simplify the entire planning cycle, making it more efficient. The Port of Antwerp describes it as a “unique initiative that will be continued in future, if evaluation is positive”. It will also allow active collaboration between barge operators in order to make their own planning processes more efficient.

The advantages of this aspect of the overall project include more accurate planning and communication for barge operators, through a uniform and transparent procedures. This should lead to shorter turnaround times as timeslots will be more realistic, further adding to asset productivity.

For terminal operators, realistic scheduling and monitoring of terminal operations will allow rapid and accurate adjustments to loading and unloading operations and allow any scheduling conflicts to be identified well in advance.

The entire process as envisaged by the Port of Antwerp will rely on digitisation and the centralisation of data, to permit proactive scheduling and monitoring. This aspect of the project is being led by NxtPort, which will introduce a number of new digital applications. “The focus is on sharing

information at an earlier stage, so that all parties can achieve gains in efficiency,” says the Port of Antwerp.

If successful, Antwerp’s project promises enhancements to port turnaround times not just for barges but also for the deepsea container vessels that are using terminals in Antwerp. There are also obvious advantages for the container terminals themselves, which should be able to speed throughput.

More fundamentally, though, greater efficiency and transparency in the movement of containers by barge should have the added benefit of giving shippers and freight forwarders greater confidence in the use of this mode of transport, encouraging them to move more freight off the already congested road network in northern Belgium.

And the benefits cannot come soon enough. In the first three quarters of this year, Antwerp reported a 6.8 per cent increase in the throughput of containers to 8.3m TEU; Marc van Peel, port alderman, commenting on the third-quarter figures, said: “Sustainable growth for our port is possible only if we make sure that it remains accessible to people and goods. We are assuming our responsibility on this front, together with the port community. On the goods transport front, we are aspiring to a modal shift by 2030, with a drop in goods transport by road and an increase by rail and inland navigation.” HCB www.portofantwerp.com

A RAPID INCREASE IN CONTAINER THROUGHPUT IN THE PORT OF ANTWERP IS MAKING IT MORE URGENT THAT A SOLUTION IS FOUND TO MOVING CARGO OFF THE ROADS, BY MAKING BARGE TRANSPORT MORE TRANSPARENT AND EFFICIENT

improvements in industrial safety, and this is nowhere more apparent than in the transport and storage of dangerous goods.

The tank storage and tanker shipping industries are among those sectors that have taken a particular liking to this new wave of technology. Unmanned Aerial Vehicles (UAVs)

take place over several days. A drone, on the other hand, can inspect an entire tank in as little as two hours.

ARTIFICIAL INTELLIGENCE (AI), robotics and other new technologies are transforming the world we live in. While there are understandable concerns that such technologies, should they run amok, could cause untold harm but, equally, it cannot be denied that, when they are properly organised and managed, they offer enormous benefits, both to industry and to mankind as a whole.

In particular, the emerging ability to deploy autonomous vehicles and robots to replace human beings in highly hazardous operations presents the possibility of major

- or ‘drones’ as they are commonly called - are proving to be a big hit with terminal operators, providing increased accuracy, significant cost savings and – short of one falling on someone’s head – an much lower chance of injury to personnel.

In an age where there is a heavy focus on operational efficiency, companies are losing time and money performing manual inspections. Drones have been shown to be up to four times faster than traditional inspection methods, with oil and gas businesses reporting seven-figure savings as a result. When inspections are carried out by humans, the safety measures that have to be taken can mean that the inspection has to

“We conducted the first UAV tank inspection in 2015 and have seen the industry embrace the technology wholeheartedly,” explains Malcolm Connolly, founder and technical director of Cyberhawk Innovations, a leading UAV inspection expert. Traditional inspection methods require scaffolding and teams of surveyors and technicians to perform visual survey and take measurements. “Naturally, there are multiple liabilities associated with this type of work, ranging from dropped objects when lowering equipment into the tank, to potential damage to the tank coating, and working at height within confined spaces,” says Connolly. “UAV inspection not only reduces these risks but also offers a quicker, cost-effective means of inspection.”

Vopak, a specialist in the storage of liquid and gaseous chemicals, adopted the use of drones in 2016 in order to eliminate the risks to its personnel associated with working in confined spaces. The company deployed Flyability Elios drones, which are surrounded by a protective cage, enabling them to fly right up against the walls of the tank without damaging either the tank or the drone itself. These types of drones »

DRONES • OPERATORS ACROSS THE DANGEROUS GOODS SPECTRUM ARE WAKING UP TO THE SAFETY AND EFFICIENCY BENEFITS OFFERED BY THE LATEST GENERATION OF UNMANNED AERIAL VEHICLES

have become the popular option and are normally fitted with a camera and a bright LED light in order to assist with and monitor the inspection in real time.

Avetics Global, a drone solutions company based in Singapore, creates drones for a variety of industrial uses, including visual inspection. The company has built custom in-tank drones as well as proprietary tethered drones that have an integrated power supply, giving them an unlimited fly time. Innovations like these are helping to bridge the gap between the old methods of visual scanning and confined space inspection, and modern methods using UAVs that are still being tested and adopted around the world.

UAVs have also been used in industrial markets to carry out 3D scanning, a new method of scanning large structures. By connecting a 3D scanner to a drone, not only is the 3D mapping process much safer, as nobody needs to perform any dangerous climbs, but it means that difficult-to-reach areas can be successfully mapped out, improving accuracy. For large storage tanks and barges, 3D scanning is especially beneficial as the information gathered can be used to identify true shape, geometry, deformation and locations of interior structures. Developments in drone technology are allowing a wider range of 3D laser scanners to be attached to UAVs.

Drones offer a lot of competitive advantages in other sectors as well. The maritime industry, for example, has adopted the use of drones for a variety of tasks, one of note being vessel inspection. Surveying tanks on board ships can be a risky enterprise, with enclosed cargo holds known to contain noxious and flammable gases. Cargo tanks can also sometimes be filled with water during a process known as ‘rafting’, which poses an obvious danger for anyone carrying out inspections inside the tank. Some tanks on ships are more than 25 metres deep and the use of traditional methods requires

erecting large amounts of scaffolding, hung staging equipment and other specialised solutions such as portable gas detectors, all of which must meet rigorous safety standards and be checked continuously. Drones make it possible to eliminate all of these issues, streamlining the process and reducing risk significantly. From a health and safety standpoint, drones are just the logical next step. Severe injuries and fatalities are unfortunately all too common in industries where working at height is required.

For a while now, drones have also been used for humanitarian and disaster response. Fires can cause irreparable damage to infrastructure if not attended to quickly.

UAVs have been put to work in terminals where the risk of fire might be higher than average and the results are quite extraordinary. Using current methods, should a fire break out on a tank farm, there are a few options that operators can utilise, but a lot of them are costly and either require the tank to be fitted with an auxiliary appliance as standard, or to have one retrofitted to the tank. All terminal operators know that fighting fires quickly and efficiently is vital, but it is

not always possible to have the latest, most advanced tank equipment fitted to every tank on a farm. These systems also rely on up-todate monitoring systems and an adequate supply of foam, for which tank fires will usually require large volumes.

Ultimately, drones have an extremely beneficial vantage point in the instance of a fire breaking out, enabling a lot of information to be gathered in a short space of time. Drones have provided a revolutionary way to monitor scenes, with 360-degree cameras providing all-encompassing surveillance and thermal cameras able to immediately pinpoint precise locations of fires, something that is especially useful at night. Additionally, the increased precision of a drone means that the affected and nearby areas can be evacuated quickly and efficiently. Due to the increased speed at which an assessment can be made, the response time of local fire departments can be decreased significantly and their time on-scene utilised more effectively.

A recent report on drone use from Goldman Sachs estimates that $881m has been spent to date on drone use in fighting fires globally and the sudden rise in popularity of drones is something for which the industrial sector has been more than thankful.

Drone technology continues to evolve rapidly and the next stage appears to involve automation. While already a comparatively quick and simple solution compared to the traditional alternative, drones have the potential to improve things yet further for tanker operators. Fully automated drones, pre-loaded with a 3D model of the ship, can make their way around the vessel without requiring a human operator, stopping at points of interest to obtain detailed video and images.

“I don’t even know of a manufacturer that creates purely remote-control drones,” says Robert Garbett, CEO of the Drone Major Group. “They are all – to some degree –autonomous, which is where the technology is going. Use of operators in maritime drone technology will reduce over time as the technology becomes more intelligent and better able to cope with the environment.”

Amazon, the global e-commerce website, is investing a lot of money and resources into the use of drones as delivery vehicles and many industrial sectors are keeping an eye on the development. The use of ‘cargo drones’ for the delivery of even quite large consigments is under investigation, even in the dangerous goods sector.

There are those who think that the use of unmanned vehicles would be a positive step when dealing with hazardous substances; on the other hand, many are wary of putting such substances in the ‘hands’ of a relatively young technology. There will certainly be no transport of dangerous goods by drone until it is permitted by regulations and there will also be insurance considerations to be taken into account.

Nevertheless, the International Air Transport Association (IATA) has released information regarding the future for cargo drones, stating “the industry needs to react quickly to address

challenges and capture the opportunities offered by this new branch of civil aviation”.

Not everyone is convinced. The port of Shanghai, for instance, has banned all drones from entering the vicinity. China’s Maritime Safety Administration (MSA) conducted inspections on vessels entering the Yangtse and Huangpu Rivers between 15 September and 15 November. While this is not a widespread ban – nor is it a common occurrence – it does show a lack of trust in the technology as well as a hesitancy to adopt the equipment for mainstream use in the shipping industry.

Understandably, due to their complex nature, it will take time for drones to become the norm, but the progress that has been made in the past few years demonstrates industry’s desire for advancement. And a new generation of people is now entering the workforce; with young minds come new ideas. Drones may only be the beginning of what is to come for the dangerous goods industry. HCB

TANK CLEANING IS such a fundamental part of the bulk liquids supply chain that industry operates a Europe-wide system to ensure that tanks are properly cleaned. Oversight of the cleaning process also ensures safety and operational efficiency. The uniform European Cleaning Document (ECD) was introduced by the European Federation of Tank Cleaning Organisations (EFTCO) in 2005 and has proven so effective that more than 3 million paper ECDs – each in four-fold copy – are produced every year.

That is a lot of paper. And these days, when there are alternatives, it is no longer sustainable to be generating 12 million sheets of paper a year, with all the potential shortfalls inherent in a paper-based system. Mistakes can be made, documents can be amended or even forged, and the documents themselves can get lost.

To address the issue, four organisations joined forces to see how best to digitise the process. EFTCO partnered with the European Chemical Transport Association (ECTA), the European Chemical Industry Council (Cefic) and Essenscia, the Belgian chemical industry association, to develop the electronic ECD, or e-ECD. And after successful pilot trials, the system is being rolled out during the fourth quarter of 2018.

“The new digitalised e-ECD process is a real chemical industry game changer,” the four associations agree. “It overcomes the typical administrative burdens of a paper-driven process, it increases the overall product quality by visualisation of the three previous loads, and allows a much safer, more efficient and more reliable use of logistics resources.”

Having the ECD in a digital format allows it to be shared among the relevant chemical shippers, tank operators and tank cleaning stations, and it remains accurate and available in real time. Digital communication is fully traceable among all parties, meaning fewer errors and a more transparent and accurate exchange of information, which in turn delivers a high quality service to the end customer.

In the longer term, the partner organisations expect the digital exchange of ECD information will mean less manual work and, because loading sites have access to cleaning information ahead of a vehicle’s arrival, faster site entrance and loading. At a time when transport companies are finding it very hard to recruit drivers, that on its own is a good thing: drivers need to spend more of their working hours driving rather than waiting for loading.

In addition, the e-ECD concept fits in with the industry’s Responsible Care principles. When information is lacking or incorrect, safety throughout the supply chain can be compromised. Digital exchange of the information eliminates that risk, making e-ECD “uniquely placed” to enhance Responsible Care levels right across the chemical supply chain.

The four trade associations involved in the e-ECD project wrestled with the issue of finding a neutral platform to host the system. Their solution was to form a non-profit body, the European Chemical Logistics Information Council (Eclic), which is now managing e-ECD. The platform itself is operated by NxtPort, which has built expertise in similar systems through its work in sharing data among port users in northern Europe.

Those looking to learn more about e-ECD and its benefits are invited to attend ECTA’s Annual Meeting in Düsseldorf on 29 November, where Peter Devos, joint managing director of ECTA, will be speaking on the topic. Other presentations will look at the role of digitisation in standardising operational processes in the logistics chain, for which the development of e-ECD provides a model for future projects. HCB www.eclic.eu

TANK CLEANING • THE SHIFT FROM PAPER TO ELECTRONIC DOCUMENTATION RAISES THE OPPORTUNITY TO IMPROVE QUALITY AND ACCURACY AND SAVE TIME FOR ALL THOSE INVOLVED

and expanding our warehousing facilities and solutions with added value, it also offers sufficient possibilities for further expansion in the future. Moreover, with this new site, we now also have our own location in East Flanders in addition to those in Antwerp and Limburg. This geographical spread and proximity are extremely interesting for our customers.”

with this strategy,” Bervoets adds. “So at the same time, we are building a sustainable future with this site. Therefore, we are very grateful to North Sea Port, which is experiencing strong growth itself, for its support in this extremely important new chapter.”

H ESSERS HAS formally opened its new warehouse facility in Ghent, Belgium. The site on the Kluizendok currently has 25,000 m2 of space, built for two chemical companies, with construction continuing to a planned 75,000m2 capacity.

“We were already active in Ghent, providing logistic services at the sites of our customers,” Gert Bervoets, CEO of H Essers explains. “Considering the increase in our activities in the chemical segment, and our customers’ growing demand for total solutions in this segment, our own site was bound to follow.

“Our new strategic site at the Kluizendok meets all our requirements as a further growth point in our chemicals segment,” Bervoets adds. “It is not only suitable for setting up

The location of the site adds to what H Essers calls the synchromodality of its offering for the chemicals sector, based as it is on a strategically important transport artery. “We never stop optimising our transport flows as much as we can to provide an appropriate and sustainable response to challenges such as the congestion of our roads, rising fuel prices, and the impact on the environment,” Bervoets says. “We do this by focusing on synchromodality and developing customised solutions in which we combine various transport modes such as maritime and inland shipping, and road and railway transport in a smart and dynamic way; always on the basis of the desired duration, the least impact on the environment, and at the most optimal cost price.

“Thanks to its trimodal accessibility via road, rail and water, the Kluizendok entirely accords

Recent investment by H Essers has indeed focused heavily on the chemicals sector; earlier this year it embarked on construction of a ‘megasite’ at Dry Port Genk and has also acquired the tank container operator Huktra. This latest investment fits in with the same strategy, as Bervoets explains: “This year alone, we have invested no less than €40m in new assets for our chemicals segment. In the coming years, we will continue to pursue this line of strategic development in complex supply chains. We operate internationally, but given the strong chemical cluster presence of companies in this segment in Belgium, our national operations are considerable too.”

The opening of the Kluizendok site was attended by representatives of North Sea Port, which H Essers regards as a strategic partner, as well as a number of chemical companies that have production activities in the chemical cluster in East Flanders and that have an interest in the total logstics solutions that H Essers is now looking to provide. HCB www.essers.com

WAREHOUSING • THE LATEST ADDITION TO H ESSERS’ LOGISTICS ASSETS FURTHER EXPANDS ITS CAPABILITIES IN THE BUSINESS OF HANDLING CHEMICALS IN NORTHERN BELGIUM

BUILDING A SUCCESSFUL business from the ground up is a difficult task, not least when the service you want to provide is almost unheard of within the industry. TankContainerFinder.com (TCF), coming from humble beginnings as a matchmaking service for tank container operators and users, has realised its ambition of becoming a fully operational booking platform.

The company, launched in 2017, relies on the expertise of its hard-working staff to ensure best practice and innovation is a top priority. “Working at a start-up like TCF requires everyone to wear multiple hats,” explains Léon de Bruin, co-founder of TCF. “With my knowledge in e-commerce, digital marketing and development, I am able to act as the bridge between our sales team, the developers and most importantly the clients.”

With the transition into a booking platform officially taking place in July 2018, the company is now focusing on functionality improvements by examining customer feedback. Improved features such as userto-user chat functionality allow cargo owners to get information directly from suppliers, improving the efficiency of the quotation and negotiation process. Right now the platform is free of charge but a paid version is expected to launch at the end of this year that will enable the company to further scale its development team and work on more functionality for the platform.

In a recent survey distributed by TCF to its users, it scored a Net Promoter Score (NPS) of +86. The NPS is a management tool that gauges the loyalty of a company’s customers, with scores higher than 0 generally considered good and a score of +50 or higher deemed excellent.

As part of the survey, TCF received some positive written feedback from its users: “Due to the complex nature of ISO tanks, we normally leave it to our suppliers to handle arrangements. Since they also have difficulties on their end, we often don’t hear back,” explained Russell Lecompte, sourcing manager at Chemical Distribution Network (CDN). “Since TCF launched, we have been

able to take back control, making it easier to execute quotes and manage orders.”

“This is a really easy way to find cargo for our tanks,” said Mandar Sawant, costing and system controls manager at Exodus ChemTank, a worldwide tank container operator. The platform currently has 760 active users in 103 countries worldwide and has generated 682 enquiries for tank containers, equating to $16m worth of business to date. Platform users are able to place requests by searching for products, UN numbers or T-codes, strengthening the company’s long-term dedication to practicality and ease-of-use. In addition to searching for products, users can also compare different offers, saving time, money and manpower.

Europe’s chemical producers, distributors and logistics service providers have been crying out for some years now for neutral platforms that will allow them to enhance asset utilisation, improve efficiencies in the supply chain and reduce costs all round. TCF’s offering to the market is a working example of how such platforms can amplify collaboration and digitisation in the industry.

Currently, both cargo owners and suppliers can register on TCF’s website and try out the platform for free. HCB www.tankcontainerfinder.com

PLATFORMS • TANKCONTAINERFINDER HAS EVOLVED SINCE ITS LAUNCH WITH NEW FUNCTIONALITIES HELPING IT BECOME THE LEADING BOOKING PLATFORM FOR TANK CONTAINERS

ROTTERDAM’S REPUTATION AS northern Europe’s busiest port is based primarily on its oil and – increasingly – container trade. But that does not mean that the port authority is failing to address the needs of the region’s chemical shippers.

During the European Petrochemical Association’s (EPCA) Annual Meeting in Vienna last month, the port announced the launch of its first dedicated facility for handling polymers, the Rotterdam Polymer Hub (RPH), a joint initiative of the Port of Rotterdam Authority, Euro-Rijn Group and entrepreneur Geert Van De Ven.

RPH will consist of two halls with a combined floor area of 35,000 m² and a storage capacity of some 550,000 tonnes. A plot in the Maasvlakte area has been chosen for its proximity to a number of deepsea container terminals, its modern infrastructure and good connections with the European hinterland.

RPH will consist of a hall for the storage of packaged products, an outdoor area

where cargo can be kept in 30-ft containers and, in the longer term, vertical silos for bulk storage. The operator expects to take the halls into use in the third quarter of 2019.

“We hatched the plan to set up a dedicated storage hub for polymers in Rotterdam in response to growing import flows from the Middle East and the US,” says Emile Hoogsteden, the Port of Rotterdam Authority’s director of containers, breakbulk and logistics. “I am proud that entrepreneur Geert Van De Ven and EuroRijn Group have decided to locate this new node in the port of Rotterdam.”

Van De Ven adds: “The Port of Rotterdam Authority has been closely involved in this project from the outset. Maasvlakte’s existing infrastructure aligns perfectly with the RPH concept. When you add the right partner – Euro-Rijn Group – and promising talks with various business-related service providers, Rotterdam more or less becomes a natural choice of location.”

The Port of Rotterdam has more than 100 ha of land available in the Distripark Maasvlakte West site, for which it is targeting investment by chemical logistics firms. “Maasvlakte Distribution Park West offers options for large-scale distribution of chemical products, including hazardous substances, agricultural products and high-quality consumer goods, including electronics,” says the port.

The port also notes that the site is surrounded by strong clusters, including the chemical industry – there are more than 45 chemical production companies and refineries active in the immediate vicinity. In addition, the development of Eemhaven’s ‘Cool Port’ and the strong clusters of refrigerated/frozen storage at Maasvlakte and in the Merwe-Vierhavens have also made Maasvlakte Distribution Park West an attractive location for agricultural distribution.

Maasvlakte Distribution Park West also benefits from having its own customs post and a 24-hour truck parking area, Maasvlakte Plaza, which provides a restaurant, showers and free wifi for drivers, a fuel station, truck wash, weigh station and a container repair depot. Furthermore, the port says, the site’s proximity to Rotterdam offers employers the opportunity to draw on a huge pool of highly educated and motivated workers. HCB www.portofrotterdam.com www.eurorijn.com

PORT • THE PORT OF ROTTERDAM IS CONTINUING IN ITS EFFORTS TO ATTRACT MORE CHEMICAL BUSINESS, WITH ITS LATEST INITIATIVE FOCUSING ON THE TRANSHIPMENT OF POLYMERS

THIS YEAR’S INTERMODAL Europe conference and exhibition will take place between 6 and 8 November 2018 at the Ahoy Rotterdam. The event, organised by Informa Exhibitions, will play host to exhibitors and industry leaders from around the world. The conference sessions that take place across all three days cover a wide variety of topics from digitisation to women in shipping, alongside an exhibition that is set to welcome more than 6,000 global container professionals.

The conference will open with a panel moderated by John Fossey, contributing editor of World Cargo News, that will give an overview of the worldwide container shipping market. The panel will feature a wide range of discussions on key issues impacting the market in 2018 and will include panellists

Tim Power, managing director at Drewry, Rahman Al Turky, senior manager transportation and logistics, EMEA at Alcoa, and other key industry speakers. Discussions will include the current state of the worldwide economy; trade wars; tariffs; trade routes along the One Belt One Road initiative; as well as the ongoing supply-demand imbalance and intermodal finance.

Later in the day, a forum on women in shipping and logistics will focus on key trends for the future of the industry as well as the impact of macro events such as Brexit on the industry. The forum, moderated by Lena Göthberg, shipping thought leader, consultant, host and producer of The Shipping Podcast, will also focus on methods of attracting more women into the industry. Currently, women are hugely under-represented and only with discussions like those held at Intermodal can progress be made.

One topic that will be focused on heavily this year is smart shipping and digitisation, with automation becoming more and more commonplace, and smart devices making their way into every facet of the dangerous goods supply chain. Intermodal 2018 will be covering topics such as: automated intermodal rail terminals, smart ships and digitisation in logistics. The push for automation and desire for terminals to enter the digital world is a hot topic at the moment, with companies spending a lot of money and time on research and development into new methods of digitising the supply chain.

The exhibition, which is free to attend, will bring together more than 6,500 senior buyers and over 140 global exhibitors, the organiser says. There are a number of companies on the list of exhibitors that will be familiar to HCB readers, including Emerson, Klinge and Maersk. “I think I can sum it up in one word, which is ‘productivity’,” says Mikkel Swane, regional vice president of marketing at Seaco. “It’s tremendously well-attended by our customer base.”

The closing forum on day three of the event will be largely Rotterdam-focused. Again concentrating on digitisation, the forum will contain talks from Joyce Bliek, director of digital business solutions at the Port of Rotterdam, Tom van Dijk, consultant and logistics blockchain lead at CGI as well as Anne Mieke Driessen of Intel. A heavy focus will be placed upon digitisation in ports as well as what other applications can be implemented to further improve port operations and the supply chain. HCB www.intermodal-events.com

The Hoyer Group (above) has further extended its services in the aviation fuel supply sector with four significant contracts in recent months. Its Petrolog business unit won a contract with Air BP for fuel deliveries to 96 airports throughout the UK, another with World Fuel Services (WFS) to supply four airports in the north of the UK, a deal with Total Deutschland to supply Berlin Tegel Airport in Germany, and an extension of its contract with Valero Energy in Ireland.

The Air BP contract covers the whole of Air BP’s delivery logistics, including monitoring of stocks, generating and receiving orders, and delivery.

“We are very pleased to be able to add new business that further extends our relationship with long-standing customers,” says Mark Binns, director of the Petrolog business unit. “Expansion of our involvement in aviation fuel supply is an important strategic step for Petrolog.”

Hoyer’s Chemilog business unit is also involved in helping to maintain smooth air traffic; it supplies several airports with de-icing agents for runways in the winter months and also covers distribution of aircraft de-icing agents for a major supplier over much of Europe.

In the UK, the Hoyer Petrolog tanker fleet is being expanded, with 89 new MAN vehicles due to join before the end of the year. Most of the new units, all of which meet Euro 6 standards, are replacements for older tractors, but 14 represent additional vehicles to handle new business.

“With almost 500 tractor units across the UK, Hoyer is the market leader in fuel distribution,” says Ian McLean, head of international key accounts at MAN. “It is fantastic to see MAN vehicles and service underpinning this growth and delivering on the company’s requirements. As a manufacturer, MAN offers a robust and trusted ADR and Pet-Reg approved vehicle solution, which in turn has the support from a focused dealer

network who provide the highest levels of after sales support to hazardous goods vehicles and operators.”

Petrolog has also started trials with an LNG-fuelled road tanker in a joint project with Total Deutschland. The new Iveco vehicle will be used to handle fuel deliveries to Total service stations in the Hamburg/Bremen region. Hoyer sees LNG trucks as “interesting and promising,” says Mark Binns. www.hoyer-group.com

Peacock Container has acquired Altermij Tankverhuur’s tank container fleet, lease portfolio and intellectual property rights. The deal adds 128 tanks to Peacock’s owned and managed fleet, which has more than doubled over the past three years to some 5,000 units.

“We welcome this opportunity to extend our services to logistics providers and end users in the oil, chemical, gas and food processing industries in our core European markets,” says Jesse Vermeijden, Peacock’s managing director. “Our diverse fleet of standard and specialised ISO tank containers will enable us to offer flexible solutions both to existing clients and to new customers who we look forward to serving as a result of this transaction.” www.peacock.eu

VTG AG has completed the acquisition of CIT Rail Holdings (Europe) SAS and its affiliate Nacco Group, some 15 months after first announcing the plan. The transaction adds more than 11,000 rail cars to VTG’s fleet, taking its total rolling stock to more than 94,000 units.

“The Nacco takeover will strengthen our market position in Europe for a long time to come,” says Dr Heiko Fischer, chairman of VTG’s Executive Board. VTG plans to fit its Connector telematics units to all the acquired railcars in the coming years.

As part of the takeover, VTG was required to arrange the sale of 30 per cent of the Nacco fleet; Wascosa AG and investment firm Aves One AG took 4,400 rail wagons, clearing the way for the transaction.

“By acquiring Nacco’s freight cars, we are significantly accelerating the growth we have established over recent years,” says Philipp Müller, Wascosa’s president. “Nacco’s young, modern rail wagon fleet is the ideal addition to Wascosa’s offerings and allows us to further diversify our range. This will open up additional opportunities for growth in both existing and new market segments.”

Wascosa says it expects the acquired wagons to be integrated into its existing fleet by the end of the year. The deal means that Wascosa’s fleet growth has exceeded its target for the year by more than 40 per cent. www.vtg.com www.wascosa.ch

Air Products has ordered 90 new Mercedes Benz Actros trucks (right) to handle the transport of industrial gases from its production and distribution centres in the UK and Ireland. The new trucks are fitted with FleetBoard telematics systems, which record and process data from the vehicle and can rate the driver’s performance to help target training. They also have Predictive Powertrain Control systems, an innovative cruise control that employ digital mapping and GPS data to manage vehicle speed and gear changes to reduce fuel consumption and emissions.

Air Products’ category specialist Andy Stanfield says: “Our initial analysis of the bids we received focused on the total cost of ownership, including projected expenditure on acquisition, servicing and repairs, and fuel, as well as residual values. By our calculations, the Actros was clearly the best buy.

“We also demanded the highest standards of safety, and evidence that we could rely on our new trucks to spend the maximum time out on the road rather than in the workshop. Thanks to their ground-breaking technology the Mercedes-Benz trucks ticked both of these boxes too.” www.airproducts.co.uk

Stolt Tank Containers has reported thirdquarter operating profit of $17.7m, down on the $18.8m recorded in the prior period in line with seasonal patterns but 20 per cent up on the previous year’s figure. The company notes a 2.2 per cent increase in demurrage revenue, “underscoring the global trend in the use of tank containers for inventory storage by customers”.

Over the period, STC leased in nearly 1,000 tanks, expanding its fleet by 2.6 per cent to more than 39,000 units. “The outlook remains positive,” says Niels G Stolt-Nielsen, CEO of parent Stolt-Nielsen Ltd. “Global tank container demand continues to grow and STC continues to leverage its strengths as the market leader.” www.stolt-nielsen.com

H Essers has started construction of a new headquarters complex in Genk, Belgium (above). The company is growing by more than 10 per cent a year with recent expansions in Italy, Denmark and Romania, the acquisition of tank container specialist Huktra in Zeebrugge earlier this year and, more locally, additions to warehouse capacity in Ghent and Genk.

As CEO Gert Bervoets explains, “This growth also leads to an increasing number of employees, including at our head office in Genk. Consequently, the need for more infrastructure for our employees arises.”

Work on the main building is scheduled to start next June and should take no more than two years.

www.essers.com

CHEMICAL DISTRIBUTORS, PARTICULARLY those with a full-line portfolio, operate in a very complex environment. This year’s Annual Congress of the European Association of Chemical Distributors (Fecc), which took place in Nice in June, considered some of the ways in which that complexity affects distributors and their principals and what digitisation might be able to offer to help them manage their supply chains.

Following on from Dorothée Arns’ presentation on trends and challenges affecting European chemical raw materials, as detailed in the first part of this report, (HCB October 2018, page 92), Andrea Matviw, Merck’s head of supplier quality, turned attendees’ attention to future trends within the sphere of pharmaceutical distribution partnerships. Pharma firms, she said, require