Dr. Veronica Appleton always knew children’s literature was a space where she could create an impact, with stories about children accomplishing their goals and dreams. Despite being rejected by multiple publishers over the course of five years, she decided to continue to write.

Giannoulias Announces Flag Contest

Next-Steps Illinois Secretary of State Alexi Giannoulias announced the Illinois Flag Commission received 4,844 entries during the six-week submission period that closed Oct. 18.

“I’m thrilled by the number of submissions the commission has received, as well as the excitement that this project has generated. I can’t wait to see which designs the commission selects for public voting,” Giannoulias said. “The contest has encouraged us all to reflect on what makes us proud to be Illinoisans, resulting in some great stories and unique designs reflecting what our state represents.”

Now that the submission period is closed, the Illinois Flag Commission will meet before the end of the year to select the top 10 designs. Beginning in January, the public will have the opportunity to vote online for one of 10 new designs, or one of the three former flag designs, including the current state flag, the 1918 Centennial Flag and the 1968 Sesquicentennial Flag.

After a public feedback period, the commission will report its findings to the Illinois General Assembly by April 1, 2025, whose members will vote on whether to adopt a new flag, return to a previous iteration of the flag or retain the current flag.

Senate Bill 1818, sponsored by State Senator Doris Turner (48th District— Springfield) and State Representative Kam Buckner (26th District—Chicago), was signed into law in 2023, creating the commission with the goals to gauge public sentiment on a new flag and to bolster civic pride. The Secretary of State’s office chairs the commission.

The commission will evaluate if a new state flag would better represent the state. The state flag has not had a major redesign since 1915.

NEW LAW SPONSORED BY REP. BOB RITA EMPOWERS PARK DISTRICTS AND LOCAL GOVERNMENTS TO SET THEIR OWN DRONE RULES

Senate Bill 2849 Promotes Local Oversight, Protects Recreation Across Illinois

Blue Island, Ill. – A new law sponsored by State Representative Bob Rita (D-Blue Island) is giving local governments the power to make their own rules about drones flying over public spaces. This month, Rep. Rita joined Forest Preserves of Cook County Interim General Superintendent Eileen Figel at the Calumet Woods Forest Preserve to discuss the positive impact of the legislation and its importance.

“Whether it’s parents watching their child’s softball game, young swimmers in a competition, or people enjoying our trail system, everyone should be able to enjoy local parks without worrying about drones causing problems,” Rep. Rita said. “This legislation will allow park districts to regulate drone usage so that guests can feel safe and secure while enjoying public spaces.”

Under the new law authorized by Senate Bill 2849, local governments like park districts and forest preserves are empowered to implement rules on the use of airspace immediately above parks, playgrounds, aquatic facilities, wildlife areas, sports fields, or other recreational facilities so drones don’t interfere with activities.

Continued from page 1

BY TIA CAROL JONES

“Journey to Appleville” was the first in her collection of books. This summer, Appleton released “Mama Why,” a comic book about a young boy who loses friends to gun violence and becomes a community activist.

“Journey to Appleville” is about six children from a neighborhood going to Appleville and visiting the Appleville Fairy in order to accomplish their goals. The book sold more than 900 copies and has been featured in different places throughout the Chicagoland area.

“I’m just very, very happy with the ways in which families have connected with the book, and also children,” Appleton said.

Appleton is a certified diversity professional and the co-founder of Candidly Connecting, a diversity education firm. She is also Publicis Media’s U.S. Senior Vice President of Diversity, Equity and Inclusion. With that work, she educates workplaces on creating safe environments for people of color, people with disabilities and veterans and those who are aging. With her books, she tells stories about children accomplishing their goals with the hope they will be inspired to create change in their communities. Appleton said her work and the books work hand in hand, operating as roles in the same world, even though they look very different.

“It’s important for us to create stories where children can see what’s happening, where they may not have full context, but through a tool, like “Mama Why,” … that’s how we can make it happen,” she said.

The comic book, which is recommended for children ages 9 years old to 12 years old, also has a discussion guide, as well as tips for equity. It encourages readers to understand the past, while recognizing the need to advocate for a safe and brighter future.

Appleton hopes that readers of the comic book feel empowered to create a sense of community and further the commitment of equity, as well as encouraging a sense of giving back, while educating others. In the comic book, there are ads from Bernie’s Book Bank, Burst Into Books and Therapy for Kids, which are organizations that have a commitment to young people that Appleton admires. She said that when a reader feels empowered, they are inspired to do more in the community they live in.

“It’s a part of educating and creating stories and narratives that can help share some sort of change, whether it is for the child, whether it’s for the community, whether it’s for the parents in the home, even the teachers they encounter,” she said. Appleton came up with the idea for “Mama Why” after writing “Journey to Appleville.” She knew because of what was going on in the world, with the deaths of Eric Garner, Tamir Rice, Trayvon Martin, Laquan McDonald and others. She wanted it to be a reflection of what systemic change could look like. The book was a way for her to say to parents, churches, educators and the community that it was necessary to look at the way children process violence in the community.

Appleton said the children who read her books have been really excited to see characters who look like them. She said those children have also been inspired to hear from an author. She said “TuTu Goes to School,” which is the second book in the “Journey to Appleville” series, and “Mama Why” go hand-in-hand because they are both books that feature Black children who love school and also love serving and committing to their community.

“I am just so grateful that what was intended to inspire and empower the little humans in the world has also done so for their families and for their parents, and that’s a beautiful thing to see,” she said.

Appleton wants to encourage writers, illustrators and creatives to create moments for writing and connecting. She wants people to be inspired to create their own stories because there is room and space for them.

For more information about Dr. Veronica Appleton and her books, visit www.veronicaappleton.com.

Chicago – Attorney General Kwame Raoul, as part of a coalition of 24 attorneys general, filed an amicus brief in United States v. Idaho to protect access to emergency abortion care in Idaho. The brief urges the United States Court of Appeals for the Ninth Circuit to uphold a lower court’s preliminary injunction blocking Idaho’s restrictive abortion ban.

“No pregnant patient experiencing an emergency health condition should be denied care or be forced to travel long distances for life-saving treatment,” Raoul said. “Emergency abortion care saves lives and prevents further bodily harm, and a patient’s access to a potentially-lifesaving abortion should not depend upon the state in which they reside. I will continue to stand up for the rights of patients to access all forms of reproductive health care not only here in Illinois but across the country.”

The federal Emergency Medical Treatment and Labor Act (EMTALA) generally requires hospitals that operate an emergency department and participate in Medicare – virtually every hospital in the country – to treat all patients who have an emergency medical condition before discharging or transferring them. Attorney General Raoul and the coalition maintain that several government agencies and courts have long determined that emergency abortion care and other pregnancy related emergencies are covered under EMTALA, and so Idaho’s ban cannot be enforced.

The attorneys general argue that allowing Idaho to

Continue on page 3

CHICAGO – As part of a larger investment to accelerate the equitable growth of electric vehicles (EVs) in northern Illinois, ComEd is announcing that its business and public sector fleet EV rebate program can now be utilized for the purchase of certified, pre-owned electric fleet vehicles and repowered battery electric vehicles to help reduce the costs of transitioning to electric commercial and public sector fleets.

“We want making the switch to EVs to be easy, which is why ComEd is continuing to offer more tools, resources and programs to remove barriers, like cost, from EV adoption,” said Melissa Washington, Senior Vice President of Customer Operations and Strategic Initiatives at ComEd. “As fleet electrification continues to grow in Illinois, ComEd is now offering rebates in the same amount for customers pursuing both pre-owned EV models and new EVs, which will help support a

more affordable journey for the customer and accelerate the clean air benefits of widespread fleet adoption for all of our communities.”

Recognizing that the cost of new EVs is still a main barrier to EV adoption, the ComEd Pre Owned Electric Fleet Vehicle Rebate will help more commercial customers—including businesses of all sizes and public sector customers—qualify for pre-owned electric fleet vehicle purchase rebates ranging from $5,000-$180,000 depending on the vehicle class they are purchasing and on whether the customer is located in or primarily serves a low income or equity-investment eligible community (EIEC).

Customers interested in utilizing the fleet EV rebate program must complete a rebate application within 90 days of vehicle delivery. Through the program, pre-owned vehicles qualify for the same amounts of funding as new EVs. ComEd customers can submit rebate applications at ComEd.com/clean.

Owned Electric Fleet Vehicle Rebate is one of the many ways dealers are staying at the forefront of the EV revolution.”

ComEd’s residential and business & public sector EV rebate programs are helping residential, business and municipal customers alike increasingly turn to EVs. With nearly $90 million in rebates launched earlier this year, and more available in 2025, the programs are designed to ensure equitable EV adoption by reserving more than half of all funds for low-income customers and for customers who reside or primarily serve EIECs.

When Alzheimer’s disease is diagnosed in its early stages, individuals can often maintain independence, continuing daily activities like driving, working, or volunteering. Early-stage Alzheimer’s, which may last for years, presents a unique caregiving role—offering support, companionship, and assistance with future planning.

“Programs such as the newly expanded Comed Pre-Owned vehicle rebates will be instrumental in expanding access to electric vehicles across the state,” said Megha Lakhchaura, EV Officer for the state of Illinois. “Pre-Owned EVs can be a key entry point for business and public entities to adopt electric vehicles and further benefit from fuel savings. We commend ComEd for launching this program and allow more customers to make the transition to zero emission vehicles.”

Getting more zero-emissions fleet vehicles on the road is an essential component of reducing tailpipe emissions and reaching the state’s goal of putting 1 million EVs on the road in Illinois by 2030, as outlined in the state’s Climate and Equitable Jobs Act (CEJA). Today, over 116,000 EVs are registered in Illinois, with a majority owned by ComEd customers.

“With dangerous air pollution still a regional challenge, and with the burdens of asthma weighing more heavily on lower income communities, ComEd’s preowned EV fleet rebates will help increase the number of EVs on the road and reduce air pollution in northern Illinois,” said Brian Urbaszewski, Director of Environmental Health Programs at Respiratory Health Association. “Making access to EVs more affordable is key to increasing adoption and supporting critical health benefits.”

EVs provide a variety of benefits for customers. Not only do they offer fuel and maintenance cost savings and performance benefits, but communities can experience broad environmental improvements from reduced tailpipe emissions. Additionally, electrifying transportation— especially vehicle fleets—can create tangible health benefits for all communities and families across northern Illinois, especially communities which have traditional borne the brunt of climate change and air pollution.

Care partners, or “caregivers,” play a vital role. With an early diagnosis, there is time to make important decisions together regarding legal, financial, and long-term care planning. Care partners help the person with Alzheimer’s adjust to new routines, manage daily schedules, and find a balance between independence and support. The goal is to maintain their strengths while fostering confidence and autonomy.

Care partners are not limited to immediate family members. Friends, neighbors, and distant relatives can all provide secondary support, allowing primary caregivers the flexibility to plan and share insights. Adopting strategies that focus on safety, minimizing stress, and encouraging independence can enhance the quality of life for both the person with dementia and the care partner.

CHATHAM-SOUTHEAST

Chatham, Avalon Park, Park Manor,GreaterGrand Crossing, Burnside,Chesterfield, West Chersterfield, South Shore,and Calumet Heitghts.

SOUTH END

Washington Heights,Roseland,Rosemoor, Englewood,West Englewood, Auburn-Gresham, Morgan Park, Maple Park, Mt. Vernon, Fernwood, Bellevue, Beverly, Pullman, West Pullman, West Pullman,Riverdale, Jeffrey Manor and Hegewisch.

SOUTH SUBURBAN

Serves communities in Harvey, Markham, Phoenix, Robbins, Dixmoor, Calumet Park, Blue Island,SouthHolland,and Dolton. Shopping- their favorite pastime!

HYDE PARK

Lake Meadows, Oakland, Prairie Shores,Douglas, Grand Boulevard, Kenwood, Woodland,South Shore and Hyde Park.

CHICAGO WEEKEND Chicago Westside Communities, Austin and Garfield Park

SUBURBAN TIMES WEEKLY

BloomTownship, Chicago Heights, Flossmoor,FordHeights, Glenwood, Homewood, Lansing ,Lynwood, Olympia Fileds, Park Forest,Sauk Village,South Chicago and Steger

and

“As EV adoption grows in Illinois, so does the interest in certified, pre-owned EVs,” said Jennifer Morand, President of Chicago Automobile Trade Association (CATA). “CATA new-car dealers are committed to supporting vehicle electrification for interested consumers, and being able to offer a wide selection of pre-owned EVs that can benefit from a ComEd Pre-

ComEd is committed to making EV funding accessible to all qualifying customers. In addition to its various EV fleet and charging rebates, ComEd offers an EV Toolkit, which includes EV load capacity maps, fleet electrification assessments for commercial customers and a new make ready reservation process, helping grant commercial and public sector customers more visibility around infrastructure funds available to support EV charging expansion and installation.

To learn more about the various resources available and explore ComEd’s EV rebate options, visit ComEd.com/clean.

Managing emotions is essential. Care partners may experience denial, fear, stress, and grief, while individuals with dementia often feel similar emotions. Open conversations, support groups, and selfcare practices are crucial to navigating the challenges and preparing for the future. The Alzheimer’s Association offers resources, including support groups, educational courses, and information on treatments and clinical trials. Care partners are encouraged to stay connected, accept help, and create a robust support system to navigate the journey effectively.

Through education, planning, and compassionate caregiving, early-stage Alzheimer’s care partners can make a meaningful difference in the lives of those they support.

override EMTALA’s protections for emergency abortion care could lead to pregnant patients dying or suffering irreversible injuries. The brief also notes that this action by Idaho could cause health care providers to leave the state, leading to worsened patient care and pregnant patients seeking care in other states, which can overwhelm their health care systems. In fact, within a few months of Idaho’s abortion ban going into effect, nearly one in four obstetricians left the state or retired. This past March, a multistate coalition of attorneys general filed an amicus brief with the

United States Supreme Court in this case, urging the court to maintain the district court’s preliminary injunction. The court ultimately sent the case back to the Ninth Circuit with the district court’s injunction intact. Joining Raoul in filing the amicus brief are the attorneys general of Arizona, California, Colorado, Connecticut, Delaware, the District of Columbia, Hawaii, Maine, Maryland, Massachusetts, Michigan, Minnesota, Nevada, New Jersey, New York, New Mexico, North Carolina, Oregon, Pennsylvania, Rhode Island, Vermont, Washington and Wisconsin.

Contact: Lionell Martin, Public Relations Manager, Alzheimer’s Association, lrmartin@ alz.org, 773.593. 4211

About the Alzheimer’s Association - Illinois Chapter:

The Alzheimer’s Association offers a 24/7 Helpline (800.272.3900) is available 365 days a year. Through this free service, specialists and master’s-level clinicians offer confidential support and information to people living with dementia, caregivers, families and the public. For more information about Alzheimer’s disease or the Alzheimer’s Association Illinois Chapter, visit alz.org/illinois or call (800) 2723900. For the latest news and updates, follow us on Facebook, Twitter and Instagram

LOS ANGELES, PRNewswire -- Blavity, Inc., the dynamic digital media company behind Blavity, 21Ninety, Home & Texture, AfroTech, Travel Noire, Blavity House Party, Blavity360º, and Talent Infusion, is thrilled to announce exciting additions to the highly anticipated AfroTech Conference 2024, taking place November 13-16 in Houston, TX. Joining the speaker lineup are artist, actor, entrepreneur, philanthropist, and podcast host Tip “T.I.” Harris; Kendrick Sampson, actor, founder, and president of BLD PWR; Angelica Ross, actress, human rights advocate, and founder & CEO of TransTech Social Enterprises; and Colin Kaepernick, founder and CEO of Lumi and Super Bowl quarterback for the San Francisco 49ers. These additions reflect AfroTech’s mission to bridge culture and technology, driving innovation and inspiring future leaders.

at the forefront,” said T.I. “I’m excited to join AfroTech and speak to the next generation of creators and entrepreneurs about harnessing innovation to amplify our voices and impact globally.

A powerful lineup showcases the intersection of culture and technology, amplifying Black voices and inspiring the next generation of innovators.

Kaepernick will discuss his groundbreaking AI-driven platform, Lumi, which empowers creators by providing them with the tools to independently create, publish, and merchandise their stories. Moderated by Brian Dixon, Managing Partner at Kapor Capital, the session will also explore how Kaepernick’s innovative approach to content creation and distribution has liberated creators and democratized storytelling.

NEW YORK, PRNewswire -- The Local Initiatives Support Corporation (LISC) announced that the Entrepreneurs of Color Fund (EOCF) has surpassed its $500 million goal for small business lending across the country — more than two years ahead of schedule. LISC is now expanding the program to double its impact, aiming to support $1 billion in financing for underserved businesses and communities.

“We are working to level the playing field—to connect promising but overlooked businesses to affordable financing so that whole communities can benefit from economic development and growth,” said Steve Hall, LISC vice president of Small Business Lending.

EOCF is specifically designed to strengthen the local infrastructure for small business lending. It provides grants, loans and technical assistance to community development financial institutions (CDFIs) so they can better reach businesses that the traditional market does not serve.

The program particularly addresses capital gaps that affect communities of color. According to the Federal Reserve, Black and Latino small business owners are turned down for financing at more than twice the rate of their white counterparts. Those owners are also more likely to say that a lack of financing is a significant challenge to their business success.

“We want to expand financing opportunities so owners can buy a building, purchase equipment, increase their inventory or expand their staff,” Hall said. “The $500 million deployed thus far is an investment in local wealth-building. It not only benefits businesses and their employees but also expands access to goods, services and jobs for residents in the communities where these firms operate.”

“Having T.I., Kendrick, Angelica, and Colin at AfroTech 2024 underscores what this event is all about — pioneering the future of technology by challenging the status quo,” said Morgan DeBaun, Founder and CEO of Blavity, Inc. “Each of these leaders brings a unique perspective on harnessing technology to not only scale businesses but to break down barriers. We’re here to push the boundaries of what’s possible and to empower the next generation to think bigger.”

For instance, Colin Kaepernick will highlight how Lumi is empowering creators with AI tools to democratize storytelling, and T.I. will share strategies on thriving in today’s rapidly evolving innovation economy. The aim isn’t just to inspire but to equip attendees with the insights to drive tangible change in their own ventures.”

T.I. will join Tosh Ernest, Head of Catalyst 2045 at Silicon Valley Bank, A Division of First Citizens Bank, for “Strategies for Success: Thriving in the Innovation Economy,” a session tailored for Black leaders, entrepreneurs, and changemakers. While this landscape offers exciting career and wealth-generation opportunities, systemic and historical barriers have limited access for women, Black, and Latinx individuals. T.I. and Ernest will share practical strategies for overcoming these challenges and navigating networks to create lasting impact.

“Technology is driving the future of business and culture, and it’s vital for us to stay

Sampson will engage the audience in a vital discussion on technology and election integrity, emphasizing the importance of civic engagement in driving change. Meanwhile, Ross will lead an inspiring fireside chat dedicated to empowering LGBTQIA+ talent in the tech industry, highlighting strategies to create inclusive environments and amplify diverse voices.

Attendees can also look forward to over 50 speakers, including Anton Vincent, President of Mars Wrigley North America & Global Ice Cream, who will lead a panel on brand building through sustainability, diversity, and ethical leadership. Zuhairah Washington, Founder & CEO of Unlimited Ventures, will join a panel on overcoming barriers to success, focusing on mentorship and leadership development for women of color in tech and other underrepresented fields.

Engaging discussions will be paired with interactive networking sessions and handson workshops, offering a comprehensive experience for attendees. By learning from industry leaders and peers, participants will gain valuable insights and strategies to overcome challenges and capitalize on opportunities, contributing to a more inclusive and innovative tech landscape.

The conference will culminate in the highly anticipated Blavity House Party Block Party, featuring live performances from renowned artists, creating a vibrant atmosphere for attendees to celebrate culture and connection.

Please visit afrotechconference.com for more information about AfroTech Conference 2024, the full agenda, and to purchase tickets.

EOCF currently partners with 24 CDFIs in 10 metro areas, including Atlanta, Chicago, Detroit, Los Angeles, Miami, Newark, New Orleans, New York City, Oakland, and Greater Washington, D.C. Together, they have supported more than 9,500 loans to small businesses in the retail, business services, food, small manufacturing and transportation sectors. Approximately half of the borrowers serve low-to-moderate income communities.

In their most recent survey of owners, EOCF found that 62 percent of firms increased their staffing after obtaining a loan, and 55 percent saw revenue growth. In addition, because of the high-touch business services provided, 82 percent of owners with a low credit score when they applied for a loan (below 651) were able to increase their score, which better positions them for conventional financing in the future.

Johnnie Akons, owner of Legacy Cutz in Chicago, is a good example. Unable to get a conventional loan to move out of rented space, he worked with LISC and EOCF to open his first real estate loan for his barbershop, grow his staff, build his financial expertise and, two years later, purchase commercial space for a second location. Both shops serve majority-Black communities.

“Even with all the hard work and everything I put into this business and this industry, it would be basically impossible to grow if I hadn’t been able to get these loans,” he said.

In addition to financial support, the EOCF team collaborates with local CDFIs to identify barriers that block the flow of capital—like outdated underwriting approaches or gaps in digital access—and develop products and services that respond.

“It is clearly possible to successfully implement fair and inclusive lending policies,” Hall said. “But it requires a different way of thinking about the process and a willingness to step back from traditional notions about risk.”

Supporters of the EOCF program include JPMorganChase and the W.K. Kellogg Foundation—which piloted the EOCF in Detroit in 2015, before LISC took the reins as program manager in 2020—as well as Fifth Third Bank, Prudential, The Rockefeller Foundation and U.S. Bank.

For more information, visit www.lisc.org/eocf/.

OLYMPIA, Wash., PRNewswire -- Ayéya, a beauty and lifestyle brand dedicated to preserving African traditions and empowering local women through ethically sourced body care and home products, is thrilled to announce its official launch. Beginning today, Ayéya is debuting a range of bath soaps, laundry and dish tablets, and home cleaning supplies at Whole Foods Market nationwide. On a mission to provide economic independence to women in Africa and mitigate climate change globally, Ayéya is redefining what it means to create impact through conscious consumerism.

Created with intention to honor the rich cultural heritage of West Africa, Ayéya is committed to creating meaningful employment for African women and supporting community development through their sustainably sourced products made with authentic, functional and high-quality ingredients, and recyclable packaging. With every purchase, Ayéya supports fair wages and sustainable employment for over 300,000 people in Ghana and Togo.

The brand’s debut at Whole Foods Market, as well as direct-to-consumer, launches Ayéya into the $11 billion natural and organic skincare space with a portfolio of purpose-driven, transparently sourced, artisan made products, including:

Naked Soaps and Bath Bombs, exclusive to Whole Foods Market

Home Cleaning Laundry Tablets, Dish Tablets, Multi-Function Spray and All Purpose/Multi-Surface Cleaner Tablets, first to market at Whole Foods Market

Ina by Ayéya Bar Soaps, Bath Bombs, and Bath Salts, exclusive to Sprouts Farmers Market

Traditional African Black Soaps

Foaming Hand Soaps

Whipped Body Butter

2-in-1 Face and Body Moisturizer

Shampoo & Conditioner Bars

Baby & Children Body Care Products

Ayéya was founded by Olowo-n’djo Tchala, who sought to catalyze positive change in West Africa by creating not just skincare and haircare products, but also a socially conscious enterprise that uplifts communities. With over 20 years of experience working directly with African communities, Ayéya stands as a beacon of empowerment and cultural respect.

“Our brand is about more than just beautiful

products,” said Olo Tchala, founder of Ayéya. “It’s about creating a virtuous cycle where business success is intertwined with social impact. We believe in the strength of women and the potential of local communities to thrive through meaningful economic opportunities.”

Ayéya works directly to support West African women and youth by providing them with sustainable wages, clean water and employment to break the cycle of economic injustice and gender equality through The Ayeya Family of Impact Organizations. This organization is dedicated to improving market access for women and youth in Ghana and Togo, addressing challenges such as economic opportunity and clean water access. By supporting African communities through sustainable wages and employment, Ayéya is breaking the cycles of economic injustice and gender inequality, while delivering products that shoppers can feel good about purchasing and using. Additionally, Ayeya operates on climate forward brand practices by using sustainable ingredient choices, local processing, climate impact reduction and less packaging and plastics.

Available now on shelves is a line of unwrapped soaps and complementary bath bomb bars featured exclusively at Whole Foods Market in support of their “mood” campaign, with SKUs ranging from “Empower” and “Nurture” to “Uplift”, “Love” and “Cheer.” Additional products including their Home Cleaning Line, Traditional African Black Soaps, and exclusive line with Sprouts will launch this November, with additional items continuing to roll out in 2025. All products are also available online and on Amazon for nationwide shipping.

For more information on Ayéya, please visit https://ayeya.com/.

Ayeya is a socially conscious beauty and lifestyle brand dedicated to celebrating the rich traditions and generational wisdom of African women through ethically sourced body and home care products. Our mission is to empower local communities in West Africa by providing sustainable economic opportunities and promoting cultural heritage. By partnering with fair-trade suppliers and investing in community development, Ayeya impacts the lives of over 350,000 individuals, fostering independence and environmental stewardship. Join us in honoring heritage while making a difference with every purchase.

SAN FRANCISCO, PRNewswire -- This holiday season, Old Navy invites everyone to come play with style with the launch of its latest campaign, “Love is in the House,” starring Emmy, Grammy, Oscar and Tony (EGOT) award winner Jennifer Hudson. As the go-to destination for fashion, fun, and togetherness, Old Navy tapped Jennifer Hudson to help celebrate the holiday spirit with a campaign that invites you to bring your unique style, dressed-up dogs, and chosen family to the Old Navy house, where everyone is welcome.

The ‘Love Is In The House’ campaign presents Jennifer Hudson as the season’s hostess inside an Old Navy house - a magical holiday home packed with style and wonder. Sparkling in Old Navy’s High-Rise Rockstar Jeans in Black Shine, Long Sleeve Sweetheart Velvet Top, and a Black Faux-Fur Jacket, Hudson hosts a whimsical house party featuring festive and surprising characters as guests, including dancer and influencer, Lexee Smith; dancer and choreographer, Raphael “The Sandman” Thomas; nine-yearold dancer, Brody Hudson Schaffer, a.k.a. Boss Baby Brody; and Old Navy’s very own, Magic the Dog. From a conga line of shimmering denim cha-chaing through the house foyer, to fair isle-wearing guests blatantly ignoring the “no skiing in the house” rule, and an indoor winter wonderland filled with snow, holiday wonder is around every corner.

The Old Navy holiday campaign will air across Cinema, Social platforms, Primetime networks, and streaming services like Bravo, HGTV, Netflix, Amazon Prime, Hulu, Disney +, and during 34 NFL games, including Thanksgiving and Cyber Monday game days.

Old Navy’s “Love Is In The House” campaign brings the ultimate holiday style, all under one roof. From embellished and metallic denim to festive warm sweaters, puffer coats and fleece zip ups, this collection has it all. The iconic Jingle Jammies, perfect for a coordinated photo shoot or styled with denim and accessories for a “glammie” dinner look, make Old Navy the season’s go-to destination for family fashion. Offering both holiday glam and comfort at a great value, Old Navy has something special for everyone.

“It was a dream come true to work with Jennifer Hudson and see her sparkle in our new Shine denim, said Zac Posen, Executive Vice President, Creative Director of Gap Inc. and Chief Creative Officer of Old Navy. “When we learned that Jennifer Hudson was launching her first-ever holiday album, we thought, now is the time to collaborate with an EGOT winner to spread joy in our “Love is in the House” holiday campaign.”

“The holidays are my absolute favorite time of year and there is no one who knows how to celebrate the season like my friends at Old Navy! We had so much fun creating this holiday party together – from the decorations to all the amazing outfits, you can’t help but feel transported to a magical winter wonderland. Love was in the house, and we were feeling fabulous!” says Jennifer Hudson.

The campaign includes Jennifer Hudson’s rendition of “Winter Wonderland” from her newly released, first-ever holiday album, “The Gift of Love”. The holiday album four city tour will begin at The Kings Theatre in Brooklyn on November 24th, followed by The Chicago Theatre in Chicago on December 13th, Walt Disney Concert Hall in Los Angeles on December 18th, and completing at the Fontainebleau Las Vegas on December 21st and 22nd. “The Gift of Love” album will be sold at select Old Navy stores on the four city tour.

Learn more at https://www.jenniferhudson.world/#/

OAKLAND, Calif., PRNewswire -- A selection of The Dr. Huey P. Newton Foundation Inc. collection, the largest Black Panther Party archive and one of the most researched collections at Stanford University Libraries, will be digitized and made accessible to people around the globe. Thanks to a generous $150,000 grant from the Mellon Foundation to the Dr. Huey P. Newton Foundation, a selection of the collection will be digitized by Stanford University Libraries in this pilot project and made available online through SearchWorks, the Libraries’s catalog, and in the community research room at the Black Panther Party Museum, recently established in downtown Oakland, CA. Stanford University Libraries has housed the Dr. Huey P. Newton Foundation Collection since Huey’s widow Fredrika entrusted it to them in 1996.

As one of the most frequently consulted and critically important archival collections housed at Stanford University Libraries, the Dr. Huey P. Newton Foundation Inc. collection includes Dr. Newton’s private papers, letters, writings, videos, and photos as well as the Party’s political campaign ephemera, documents on how they ran their Survival Programs, and drafts of the Ten Point Program, among many others. The collection also includes a series of FBI surveillance documents obtained by the Dr. Huey P. Newton Foundation via the Freedom of Information Act.

“In the very early days of the Dr. Huey P. Newton Foundation, we identified multiple pathways toward our goal of making the accurate history and legacy of the Black Panther Party as widely available as possible,” said Fredri -

ka Newton, co-founder of the Foundation. “An essential part of this was taking the voluminous amount of archives Huey left and placing them where they can be accessed, studied and utilized by as many people as possible. We are grateful for the care and partnership that Stanford University has provided to us and to this significant collection.”

The Dr. Huey P. Newton Foundation and Stanford University Libraries’s archivists are working together to identify and prioritize the works to be digitized during this initial pilot, with the hopes of possibly digitizing the entire collection, and ensuring the preservation of these critical historical documents for future generations. This digitization project aligns with Stanford University Libraries’s ongoing commitment to making its archival resources more accessible and to supporting research that advances our understanding of social justice and civil rights.

Roberto Trujillo, Associate University Librarian for Special Collections at Stanford states, “It is critically important to broaden discoverability and access for a continued critical reception of the Black Panther Party history.”

In an environment where the teaching and discussion of racial history is being discouraged if not forbidden in classrooms across America, Stanford University Libraries are seeing an even larger interest in The Dr. Huey P. Newton Foundation Inc. collection. Students and scholars across the country continue to use it for research, making it one of the most heavily consulted collections at Stanford.

The Dr. Huey P. Newton Foundation is dedicated to preserving and promoting the true legacy and ideals of the Black Panther Party. Since 1995, the Foundation has commissioned public art and created education tools to inspire and inform real social, economic and political change. The Foundation is the number one source for historical preservation and archival collections for people seeking the truth about the Black Panther Party. The Dr. Huey P. Newton Foundation, a 501(c)(3) organization, was co-founded by Fredrika Newton and is based in Oakland, CA, the birthplace of the Black Panther Party. Follow on Instagram @hueypnewtonfoundation

HOUSTON, PRNewswire

-- Uncle Funky’s Daughter, a leading natural hair care brand, has partnered with Texas Southern University (TSU) to empower female entrepreneurs through the MPoWR Her Grant. This initiative, supported by a $50,000 endowment from The Rhoten Morris Family Foundation, will be awarded annually to an African-American female student at TSU’s Entrepreneurial Hub, providing critical financial support for their startup ventures.

This initiative is especially significant in light of the current entrepreneurial landscape. According to J.P. Morgan, African-American women are the fastest-growing demographic of entrepreneurs in the United States, increasing by a staggering 50% between 2014 and 2019, compared to the 24% increase among women-owned businesses overall. However, despite their growing presence, African-American female founders receive less than 0.35% of total venture capital funding in the U.S.,

forcing many to rely on personal savings and credit to fund their ventures.

A recent 2023 report from the Federal Reserve Bank revealed that 65% of Black women business owners rely on personal funds to start and grow their businesses, compared to just 55% of their white counterparts. The MPoWR Her Grant seeks to address this inequity by providing critical financial support to early-stage African-American female entrepreneurs, alleviating some of the financial barriers that often hinder business growth.

Renee Rhoten Morris, Uncle Funky’s Daughter’s Chief Curl Officer and founder of the Rhoten Morris Family Foundation, expressed the importance of the partnership, “We must create channels that change the playing field. HBCUs play an essential role in cultivating female African-American talent, and we’re proud to be part of TSU’s Entrepreneurial Hub, which will

nurture the next generation of innovators. This grant underscores our dedication to empowering future female leaders, fostering education, and creating pathways for building generational wealth.”

TSU, a historically Black university with a strong tradition of leadership and social change, will benefit from the partnership as it enhances its academic environment and attracts talented, entrepreneurial students. This collaboration, ahead of TSU’s 100th anniversary, reflects the university’s ongoing efforts to foster innovation and community empowerment.

Together, Uncle Funky’s Daughter and Texas Southern University are charting a course toward a brighter future—one in which education, entrepreneurship, and community empowerment go hand in hand.

For more information about the MPoWR Her Grant and the partnership between Uncle Funky’s Daughter and TSU, visit https://ktvz. com/cnn-regional/2024/10/08/texas-southern-university-triumphs-with-homecoming-2024-a-celebration-of-legacy-community-and-unstoppable-partnerships/.

Last week I shared an insightful look into the reason reverse mortgages have been problematic in our Black communities. This week and in weeks to come I will share the details of real-life cases of families battling for their elder’s homes that had reverse mortgages. I will point out the “red flags” that should have been noticed; thus, avoiding problems later.

Bren Sheriff

Fifteen years ago, Mr. A, a widower, was convinced by a contractor to get a reverse mortgage of $65,000; $45,000 for quoted repairs on his home and an additional $25,000 for his personal use. Fifteen years later, the error in Mr. A’s understanding became known when his health failed, and he was placed in a nursing home. It was only then that his children learned that their father had a reverse mortgage.

Mr. A had no long-term care insurance nor money in the bank to pay for his nursing home care of $15,000 a month. The State of Illinois placed a lien on his home to pay for his nursing home care.

To compound the family’s problem, the reverse mortgage company sent notice of foreclosure to Mr. A. Reverse mortgages have a clause that requires the borrower to maintain their mortgaged home as his principal residence. Mr. A’s placement in the nursing home violated this clause.

The news of foreclosure was particularly devasting to the son and granddaughter of Mr. A as they faced eviction.

Continued next week, Bye for now, Bren.

What type of life insurance policies build cash value using Indexed stock funds?

Answers to last week’s quiz: No, a public notary only attests to the identity of the singer. To get more detailed answers to last week’s QUIZ question or for general questions that you may have, please call me: 773-819-1700

Disclaimer: The illustrations presented in this column are not, nor are they intended to be, legal, financial, or any other licensed professional advice, you should contact the licensed professional of your choice for advice on your individual situation

WASHINGTON, DC -- The National Association of Real Estate Brokers (NAREB) released a comprehensive study of appraisal bias today, finding some narrowing of contract price undervaluation gaps and reduction of disparities in appraisals in Black neighborhoods compared to White communities. Notably, significant progress was made in specific cities, offering hope for environments where Black intergenerational wealth can thrive.

The study identifies two types of appraisal bias: the gap between median appraisal values of homes in Black communities Dr. Courtney Johnson Rose relative to similar-quality homes in White neighborhoods and “contract price undervaluation,” which is the share of appraised homes that fail to meet or exceed the price set by sellers in sales contracts.

“HUD recognizes that appraisal bias is a significant barrier to fair housing and economic opportunity, particularly for communities of color who are most affected by undervaluation and discriminatory practices,” said HUD Acting Secretary Adrianne Todman. “It not only limits the wealth-building potential for families but also perpetuates a cycle of inequity in our housing market. I commend NAREB for their leadership in releasing this important report and advancing collective efforts to ensure that every homeowner has an equal opportunity to realize the full value of their property.”

Sandra Thompson, Director of the Federal Housing Finance Agency (FHFA), said, “Today’s report showing that appraisal disparities between Black and White neighborhoods have narrowed proves that shining a light on these longstanding concerns can drive real change benefiting thousands of aspiring and current homeowners. However, we recognize that persistent and unacceptable inequities remain. Our work to ensure fairness throughout the housing finance system and enable underserved communities to build generational wealth continues.”

Dr. Courtney Johnson Rose, NAREB President, asserted

that while the study, entitled “Home Appraisals in Black and White: Disparities in the Estimated Valuation of Homes by Neighborhood Racial Composition” shows that appraisal bias continues to exist, there has been improvement following the establishment of the White House’s Federal Interagency Task Force on Property Appraisal and Valuation Equity (PAVE) in 2021. The release of the PAVE Action Plan on March 23, 2022, outlined policy measures actively working to lessen the occurrence and impact of appraisal bias.

Dr. Rose also credited FHFA Director Thompson and former HUD Secretary Marcia L. Fudge for facilitating the public release of Uniform Appraisal Dataset Aggregate Statistics, which provides aggregate data on home appraisals. Some major housing industry stakeholders had opposed its release. The data empowers housing experts to monitor appraisal practices, similar to the impact of the public release of Home Mortgage Disclosure Act data in 1991, a cornerstone in fighting housing and lending discrimination.

Dr. Rose noted that home equity comprises 65 percent of the median net worth for Black households, making it a leading component of Black wealth. As a result, appraisal bias, housing discrimination, and the Black-White homeownership gap have been significant factors in restricting Black wealth over the decades.

Compiled by James H. Carr and Michela Zonta, the study determined that the most significant decline in contract price undervaluation in Black communities was in neighborhoods with the largest shares of Black borrowers (at or higher than the national average). Those communities experienced a fall in contract price undervaluation from 14.8 percent to 10.3 percent.

In reviewing data from the 20 metropolitan areas with the largest Black populations, the study found that in Houston, the Black median appraised home undervaluation gap narrowed by 31 percentage points, falling from 41% in 2021 to 10% in 2023. The undervaluation gap plunged 14%

in the Washington, DC, metropolitan area, from 35% in 2021 to 21% in 2023. The median appraised home undervaluation gap has also narrowed in the Atlanta, Chicago, Dallas, Detroit, Philadelphia, Richmond, and Virginia Beach metropolitan areas.

However, there were other locations where the gap increased. In Los Angeles, the Black appraised undervaluation gap grew 17 percentage points, from 31% in 2021 to 48% in 2023. The gap also rose by four percentage points in Baltimore and Miami. It increased by up to three points in the Charlotte, Cleveland, Memphis, New York, St. Louis, and Tampa metropolitan areas while remaining the same in Orlando.

The research also found that:

Ø When the volume of home purchases by Blacks in Black neighborhoods (i.e., neighborhoods where Blacks are buying rather than simply residing) is considered, in both 2021 and 2023, homes in Black neighborhoods with large shares of loan originations to Black borrowers had a median home appraised undervaluation gap of 47% compared to White neighborhoods with no Black borrowers.

Ø After controlling for housing quality and neighborhood location, amenities, and socioeconomic characteristics, homes in Black neighborhoods in 2023 had a median appraised home value of $299,572 compared to $430,915 in White neighborhoods, a 30% undervaluation gap.

Ø Between 2021 and 2023, the median appraised home undervaluation gap fell from 38% to 23% in gentrifying Black neighborhoods with no Black loan originations compared to White neighborhoods with no Black loan originations.

Ø Nationally, the adjusted median appraised home valuations gap increased between 2013 and 2022. From 2022 to 2023, however, the gap decreased. The median appraised home valuation gap between Black and White neighborhoods varied significantly based on the share of Black and White borrowers in Black census tracts.

(Black PR Wire) LOS ANGELES, CA – It’s beginning to look a lot more like Christmas as Lifetime announces the greenlight of the new original movie, A Very Merry Beauty Salon, executive produced and starring Tia Mowry. RonReaco Lee, Donna Biscoe, Cocoa Brown and Ashli Auguillard are also set to star in A Very Merry Beauty Salon. The movie follows the lively women of an Atlanta beauty salon owned by Sienna (Mowry) who must prepare for the annual Tinsel Ball, but is Sienna also prepared for love when Lawrence (Lee) arrives to town? This marks a reunion for Mowry and Lee who previously starred together in the iconic sitcom Sister, Sister. This marks the final installment of Mowry’s three-picture deal with the network.

In A Very Merry Beauty Salon, Sienna, the owner of the bustling Divine Beauty Salon is preparing for Atlanta’s Tinsel Ball, where she will be honored for her charitable work in the community. The annual event takes a glamourous turn with the arrival of Lawrence, a charismatic CEO whose family’s wine brand is now co-sponsoring the Ball. Sparks fly between them, but Sienna’s mother Georgia (Donna Biscoe) who is the head of the Ball’s committee, worries his involvement may ruin the event’s traditions. As

Sienna and Lawrence are unexpectedly paired as dance partners, romance blooms, setting the stage for a steamy romance that challenges Sienna’s thoughts on love and family and makes this year’s Tinsel Ball the most memorable yet.

Cocoa Brown and Ashli Auguillard star as Miss Kimmy and Ella, hairdressers at the salon.

A Very Merry Beauty Salon is produced for Lifetime by FOX Entertainment Studios’ (FES) Mar Vista Entertainment in association with GroupM Motion Entertainment. Adam Shepard, Larry Grimaldi, Hannah Pillemer and Fernando Szew executive produce for FES. Richard Foster and Chet Fenster executive produce for GroupM Motion Entertainment. Tia Mowry, Adam Griffin and Mychael Chinn also executive produce. Bobby Yan directs from a script by Tara Knight.

A Very Merry Beauty Salon joins the slate of the previous announced movies including FES’ The Holiday Junkie starring Jennifer Love Hewitt, as well as Christmas in the Spotlight starring Jessica Lord, Laith Wallschleger, Jennie Mai and Haley Kalil. Lifetime’s full slate will be announced in the coming weeks.

Mowry is represented by UTA, Vault Entertainment, True Public Relations and Felker Toczek Suddleson McGinnis Ryan.

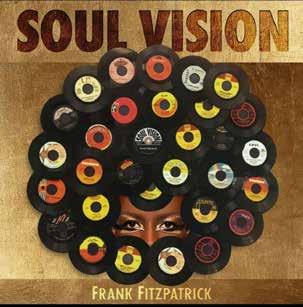

LOS ANGELES, PRNewswire -- SOUL VISION, a new music and wellness initiative celebrating the healing power of Soul music and the global impact of writer/producer Frank Fitzpatrick launched on Oct.23, with SOUL VISION, Pt. 1 – NEO.

“Many people have a hard time making the connection between music and health, despite all the scientific literature, case studies, and books on the subject,” says Fitzpatrick, one of the world’s foremost authorities on science-backed music for health and human potential. “The mission of SOUL VISION is to create a positive impact through the healing power of music while providing a resonant backdrop for timely and critical work at the forefront of health and wellness.”

In his four decades in the music and wellness industries, Motown-born Grammy-nominated, and multi-platinum producer Frank Fitzpatrick has emerged a visionary at the intersection of music and health. Having served as Apple’s first Music & Health Specialist and faculty for Singularity University’s Exponential Medicine, Frank has written and spoken extensively about the subject as a best-selling author, journalist, TED speaker, and philanthropic entrepreneur.

“Through all of my work – be it in health, media, or technology,” continues Fitzpatrick “my purpose remains the same: to help people find calm in the midst of chaos and thrive in the face of challenge. Redefining the future of music as

medicine is at the heart of it”.

The debut NEO release, from Amplified Media and Virgin Music Group, features previously unavailable tracks spotlighting Fitzpatrick’s collaborations with Neo-Soul legends like Jill Scott, Van Hunt, and Les Nubians.

The full SOUL VISION album –- releasing November 20th -- is a stunning 16-track collection that showcases his additional collaborations with iconic Soul and socially conscious hip-hop artists, including Anthony Hamilton, Ziggy Marley, K’naan, Brownstone, Nneka, Talib Kweli, KRSOne, and Jazz of Dru Hill.

SOUL VISION aims to create positive change while supporting at-risk youth in the face a global mental health pandemic. Proceeds from the project will benefit EarthTones, a 501(c)(3) nonprofit organization dedicated to empowering young people with the healing and transformative power of music.

SOUL VISION will be available for streaming and purchase on all music platforms (Spotify, Apple, Amazon, etc).

To learn more about SOUL VISION, visit SoulVision.Community. More about Frank Fitzpatrick is at FrankFitzpatrick.com. For details about EarthTones visit EarthTones.org.

Cook County Annual Tax Sale Notice to Property Owners, Annual Tax Sale Schedule, and Delinquent Real Estate Tax List

This legal notice includes a list of properties of real estate on which 2022 property taxes (due in 2023) are delinquent and subject to sale as of October 8, 2024.

NOTE: This list may include some properties on which the taxes were paid after the list’s preparation on October 8, 2024. It is the property owner’s responsibility to verify the current status of payment. This list does not include all the properties in Cook County that are delinquent and subject to sale. For a complete listing of the properties in your neighborhood that are subject to sale, please visit www.cookcountytreasurer.com.

Under Illinois law, the Cook County Treasurer’s Office must offer properties having delinquent real estate taxes and special assessments for sale. IF YOUR PROPERTY IS LISTED IN THIS NOTICE FOR SALE OF DELINQUENT REAL ESTATE TAXES, IT IS IMPORTANT FOR YOU TO TAKE ACTION SO THAT YOUR TAXES ARE NOT SOLD. The tax sale is scheduled to begin TUESDAY, DECEMBER 10, 2024. The sale of taxes will result in a lien against the property that will add, at a minimum, hundreds of dollars in fees to the amount currently due. Sale of the tax and continued failure by the owner to redeem (pay) may result in the owner’s loss of legal title to the property.

Prior to sale, delinquent taxes may be paid online from your bank account or credit card by visiting cookcountytreasurer.com. Personal, company, and business checks will be accepted only through November 22, 2024. After November 22, 2024, all payments must be made by certified check, cashier’s check, money order, cash, or credit card. Please note that under Illinois law, the Treasurer’s Office cannot accept payments of delinquent taxes tendered after the close of the business day immediately preceding the date on which such taxes are to be offered for sale. For questions about submitting a payment or to verify the precise delinquent amount, you may contact the Cook County Treasurer’s Office by phone at (312) 443-5100 or by e-mail through our website at www.cookcountytreasurer.com (click on “CONTACT US BY EMAIL”).

SALE BEGINS TUESDAY, DECEMBER 10, 2024, AT 8:30 A.M. THE TAX SALE HOURS OF OPERATION ARE 8:30 A.M. TO 5:00 P.M. (CHICAGO LOCAL TIME) EACH SCHEDULED DAY. THE DATES OF SALE AND THE DAILY SALE HOURS MAY BE EXTENDED AS NEEDED. TAX BUYER REGISTRATION WILL TAKE PLACE BETWEEN NOVEMBER 8 AND NOVEMBER 27, 2024. FOR REGISTRATION INFORMATION, VISIT WWW.COOKTAXSALE.COM OR CONTACT THE TREASURER’S OFFICE.

SALE DATEVOLUMES TOWNSHIP/CITY

December 10, 2024 001 TO 147

Barrington, Berwyn, Bloom, Bremen, Calumet, Cicero, Elk Grove, Evanston, Hanover, Lemont, Leyden, Lyons, Maine, New Trier, Niles, Northfield, Norwood Park, Oak Park, Orland

December 11, 2024 148 TO 270 Palatine, Palos, Proviso, Rich, River Forest, Riverside, Schaumburg, Stickney, Thornton, Wheeling, Worth, Hyde Park

December 12, 2024 271 TO 464

Hyde Park, Jefferson, Lake

December 13, 2024 465 TO 601 Lake, Lake View, North Chicago, Rogers Park, South Chicago, West Chicago

VETERANS SERVICES LLC12836 IRVING AVE03825-31-105-052-000002022 $7,181.91

VETERAN SERVICES LLC2250 IRVING RD03825-31-105-053-000002022 $5,642.40

VETERAN SERVICES LLC12843 GREGORY ST03825-31-105-058-000002022 $4,218.75

VETERAN SERVICES LLC12834 IRVING AVE03825-31-105-061-000002022 $3,936.89

VETERAN SERVICES LLC12843 GREGORY ST03825-31-105-062-000002022 $2,832.46

VETERAN SERVICES LLC12829 GREGORY ST03825-31-105-064-000002022 $11,598.58

VETERAN SERVICES LLC12921 WESTERN AVE03825-31-113-001-000002022 $6,524.34

VETERAN SERVICES LLC12921 WESTERN AVE03825-31-113-002-000002022 $5,748.70

VETERAN SERVICES LLC2329 UNION ST03825-31-113-011-000002022 $17,010.47

VETERAN SERVICES LLC12921 WESTERN AVE03825-31-113-021-000002022 $17,268.45

VETERAN SERVICES LLC12921 WESTERN AVE03825-31-113-022-000002022 $16,203.44

VETERANS SERVICES LLC12935 GREGORY ST03825-31-115-001-000002022 $105,436.68

VETERANS SERVICES LLC12935 GREGORY ST03825-31-115-002-000002022 $239,954.34

VETERANS SERVICES LLC12935 GREGORY ST03825-31-115-003-000002022 $60,286.02

VETERANS SERVICES LLC12935 GREGORY ST03825-31-115-004-000002022 $72,473.75

VETERANS SERVICES LLC12935 GREGORY ST03825-31-115-005-000002022 $9,601.64

VETERANS SERVICES LLC12935 GREGORY ST03825-31-115-006-000002022 $8,027.84

VETERAN SERVICES LLC13000 IRVING AVE03825-31-120-003-000002022 $37,522.41

VETERAN SERVICES LLC13001 IRVING AVE03825-31-123-001-000002022 $36,650.37

VERMONT HOTEL 2140 VERMONT ST03825-31-123-017-000002022 $9,553.36

VICTOR LOZANO 1964 VERMONT ST03825-31-215-033-000002022 $26,310.60

WILLIAMS AUTOMOTIVE1800 VERMONT ST03825-31-215-093-000002022 $14,093.71

TAXPAYER OF 13021 WOOD ST03825-31-217-051-000002022$468.47

BLUE ISLAND - RESIDENTIAL

TYESHA DIGGINS 2243 119TH ST03725-30-101-037-101002022 $2,275.22

JESUS MENDOZA 2152 119TH PL03725-30-102-025-000002022$789.98

JESUS MENDOZA 2152 119TH PL03725-30-102-026-000002022$469.24

GREATLY TAKEN LLC 2058 119TH PL03725-30-104-011-000002022 $5,315.50

MARIE COFFEE 2255 120TH PL03725-30-118-005-000002022 $2,737.94

THUNDERBIRD INV INC2244 121ST ST03725-30-118-015-000002022 $4,818.31

JAVIER ALVARADO 2209 120TH PL03725-30-119-004-000002022 $3,729.92

VERNA A DOYLE 2112 121ST ST03725-30-120-011-000002022 $6,737.61

NICOLAS PEREZ 2101 120TH PL03725-30-120-014-000002022

PATRICK A NAPE SR 2160 121ST PL03725-30-124-019-000002022 $2,508.63 ROBERT

OFFICE OF THE TREASURER AND EX-OFFICIO COLLECTOR OF COOK COUNTY, ILLINOIS.

Advertisement and Notice by Collector of Cook County of Application for Judgment and Order of Sale of Delinquent Lands and Lots for General Taxes for the years indicated, for order of sales thereof, as provided by law.

COUNTY OF COOK, STATE OF ILLINOIS

November 6-7, 2024

NOTICE is hereby given that the said Collector of Cook County, Illinois, will apply to the County Division of the Circuit Court of Cook County, Illinois on Tuesday, November 26, 2024, for judgment against all lands and lots, hereinafter described as being delinquent, upon which taxes (together with any accrued interest and costs) remain due and unpaid, for an order for sale of said lands and lots for satisfaction thereof, fixing the correct amount due. Final entry of said order will be sought on Wednesday, December 4, 2024.

NOTICE is further given that beginning on the 10th day of December, 2024, A.D., at the hour of 8:30 A.M., all said lands and lots, hereinafter described for sale for which an order shall be made, or has been made and not executed as noted, will be subject to public sale

at 118 N. Clark St, Room 112 (Randolph Street entrance), in Chicago, Illinois, for the amount of taxes, interest and costs due thereon, respectively.

The following is a list of the delinquent properties in Cook County upon which the taxes or any part thereof for the 2022 tax year remain due and unpaid; the name(s) of the owners, if known; the property location; the total amount due on 2022 tax warrants (excluding delinquent special assessments separately advertised); and the year or years for which the taxes are due.

In lieu of legal description, each parcel of land or lot is designated by a property index number (PIN). Comparison of the 14-digit PIN with the legal description of any parcel may be made by referring to the cross-indices in the various Cook County offices.

The Cook County Collector does not guarantee the accuracy of common street addresses or property classification codes at the time of sale. Tax buyers should verify all common street addresses, PINs, classifications, and ownership by personal inspection and investigation of said properties and legal descriptions prior to purchasing general taxes offered at the sale.

NO TAX BUYER WILL BE PERMITTED TO OBTAIN A TAX DEED WITH RESPECT TO ANY PROPERTY OWNED BY A TAXING DISTRICT OR OTHER UNIT OF GOVERNMENT. WHEN AN ORDER TO VACATE THE TAX SALE OF ANY SUCH PROPERTY IS ENTERED, THE FINAL RESULT MAY BE A REFUND WITHOUT INTEREST.

GUERRERO MANUEL J1817 BURR OAK AVE03825-31-203-005-000002022$781.12

CAROL J BITHOS 12818 HONORE ST03825-31-208-027-000002022$836.04

JESUS L PEREZ 1844 HIGH ST 03825-31-211-021-000002022 $2,454.05

ISMAEL RIVERA 13005 DIVISION ST03825-31-215-003-000002022 $2,825.17

MGP GLOBAL PROPERTIESI1705 VERMONT ST03825-31-217-008-000002022$477.76

STANDARD B & T TR1734513028 WOOD ST03825-31-217-027-000002022

$4,808.27

OLIVA DELGADILLO 2242 FULTON ST03825-31-311-006-000002022 $4,951.49

CHARLES ZACHERY 2061 GROVE ST03825-31-314-001-000002022$893.88

PAULINE BOUDOS 2347 W CANAL ST03825-31-338-001-000002022 $6,602.14

MARIA B ALVAREZ 2307 W CANAL ST03825-31-339-002-000002022 $5,492.09

2049 CANAL ST TRUST2057 W CANAL ST03825-31-343-002-000002022 $1,649.72

URBANO GUADARRAMA2061 BROADWAY AVE03825-31-351-001-000002022 $2,648.24

BRENDA WILBOURN 2026 MARKET ST03825-31-352-006-000002022 $3,418.03

EDWARD N MOY 2304 DESPLAINES ST03825-31-355-014-000002022 $2,667.98

BULMARO RODRIGUEZ2155 MARKET ST03825-31-357-015-000002022 $2,150.23

ANN STOOTS 2043 DESPLAINES ST03825-31-367-006-000002022$811.13

CTLTC 8002383854 1936 W CANAL ST03825-31-426-024-103102022$546.37

TERRY YAZIANA NICOLE1850 W CANAL ST03825-31-426-024-106002022$549.12

BLUE ISLAND - VACANT LAND

HOWARD J ROSENBURG11915 WESTERN AVE03725-30-100-032-000002022$214.47

GREATER OPEN DEV 2021 120TH ST03725-30-116-004-000002022$617.13

GREATER OPEN DEV 2028 120TH PL03725-30-116-016-000002022$617.13

GREATER OPEN DEV 2020 120TH PL03725-30-116-017-000002022$617.13

DISC12509VINCENNES B I12509 VINCENNES AVE03725-30-307-006-000002022 $1,635.73

MARY ARENAS 12519 VINCENNES AVE03725-30-307-007-000002022 $1,674.12

DISC2613VERMKONT BLUEI2613 VERMONT ST03725-30-307-008-000002022 $1,842.18

JOHN J JURISS 1951 BURR OAK AVE03825-31-200-003-000002022$656.23

1859 BURR OAK HOLDING12718 LINCOLN ST03825-31-201-011-000002022 $1,689.83

1859 BURR OAK HOLDING12718 LINCOLN ST03825-31-201-012-000002022$687.32

TAXPAYER OF 12721 LINCOLN ST03825-31-202-010-000002022$810.36

TAXPAYER OF 12714 HONORE ST03825-31-202-024-000002022$810.36

RAFAEL DIAZ 2201 VERMONT ST03825-31-304-026-000002022$146.73

TAXPAYER OF 2016 BROADWAY AVE03825-31-344-017-000002022$942.85

NIALL HYDE 13100 LINCOLN ST03825-31-401-006-000002022 $1,504.61

M&I DEVELOPMENT LLC13106 LINCOLN ST03825-31-401-007-000002022 $1,504.61

NIALL HYDE 13110 LINCOLN ST03825-31-401-008-000002022 $1,504.61

TAXPAYER OF 13114 LINCOLN ST03825-31-401-009-000002022 $1,504.61

NIALL HYDE 13118 LINCOLN ST03825-31-401-010-000002022 $1,504.61

NIALL HYDE 13122 LINCOLN ST03825-31-401-011-000002022 $1,504.61

NIALL HYDE 13126 LINCOLN ST03825-31-401-012-000002022 $1,504.61

TAXPAYER OF 1806 BROADWAY AVE03825-31-437-013-000002022$107.15

CALUMET PARK - COMMERCIAL/INDUSTRIAL

HILLCREST APTS 12527 S ASHLAND AVE03625-29-313-013-000002022 $10,009.33

CHICAGO FIRST RE INVES12531 S ASHLAND AVE03625-29-313-017-000002022

$12,097.01

CHICAGO FIRST RE INVES12531 S ASHLAND AVE03625-29-313-018-000002022 $11,444.09

YVETTE MCPHAN 1566 W 127TH ST03625-29-321-041-000002022

$26,167.46

YVETTE MCPHAN 1566 W 127TH ST03625-29-321-042-000002022 $3,452.74

TAXPAYER OF 1436 W 127TH ST03625-29-323-035-000002022 $17,760.04

VILLGE OF CALUMET PARK1300 W 127TH ST03625-29-326-067-000002022 $38,569.65

JOHN W ZANDERS 911 W 123RD ST03625-29-405-076-000002022 $26,545.80

MARTIN PIETERS 12406 S HALSTED ST03625-29-415-009-000002022 $3,335.86

AM SUNRISE CONST CO12018 S MARSHFIELD AVE03725-30-209-033-000002022 $3,657.73

LESSIE MOBLEY 12048 S MARSHFIELD AVE03725-30-209-039-000002022 $3,604.34

JIMMIE HOLLOWAY 12048 S MARSHFIELD AVE03725-30-209-040-000002022 $3,601.05

JIMMIE HOLLOWAY 12048 S MARSHFIELD AVE03725-30-209-041-000002022 $3,601.05

JIMMIE HOLLOWAY 12048 S MARSHFIELD AVE03725-30-209-042-000002022 $5,150.44

WOLFE ROOFING INC 1745 W 124TH ST03725-30-404-015-000002022

SIMBORG CAL PK 4 1719 W 123RD ST03725-30-404-019-000002022 $13,123.02 WOLFE ROOFING 1744 W 124TH ST03725-30-404-029-000002022

OF 1742 W 124TH ST03725-30-404-034-000002022 $41,644.49

PAUL A PANOZZO 12322 S ASHLAND AVE03725-30-405-012-000002022 $2,455.15

PAUL A PANOZZO 12322 S ASHLAND AVE03725-30-405-013-000002022 $1,536.92

PAUL A PANOZZO 12322 S ASHLAND AVE03725-30-405-014-000002022$884.28

PAUL A PANOZZO 12322 S ASHLAND AVE03725-30-405-015-000002022$884.28

PAUL A PANOZZO 12322 S ASHLAND AVE03725-30-405-016-000002022$884.28

MINHAJ AHMED 12658 S ASHLAND AVE03725-30-422-043-000002022 $29,351.72

MINHAJ AHMED 12658 S ASHLAND AVE03725-30-422-044-000002022 $29,351.72

DILLARD ENTERPRISES12700 W 127TH ST03925-32-101-007-000002022 $2,841.73

DILLARD ENTERPRISES12700 W 127TH ST03925-32-101-008-000002022 $4,984.78

DILLARD ENTERPRISES12700 W 127TH ST03925-32-101-009-000002022 $8,136.96

AMERICAN LODGING PTRS12809 S ASHLAND AVE03925-32-103-005-000002022 $3,360.24

AMERICAN LODGING PTRS12809 S ASHLAND AVE03925-32-103-006-000002022 $3,360.24

AMERICAN LODGING PTRS12809 S ASHLAND AVE03925-32-103-007-000002022

AMERICAN LODGING PTRS12809 S ASHLAND AVE03925-32-103-008-000002022

TAXPAYER OF 1301 W VERMONT AVE03925-32-109-011-000002022

$3,360.24

$3,360.24

$68,061.98

TAXPAYER OF 1313 W VERMONT AVE03925-32-109-031-000002022 $53,265.61

NETWORK TRADING LLC1133 W 127TH ST03925-32-216-028-000002022

$63,811.47

NETWORK TRADING LLC1333 W 127TH ST03925-32-216-029-000002022 $11,208.73

CALUMET COURT APARTMEN12726 S ABERDEEN ST03925-32-217-024-000002022$986.43

ROBERT L MCMILLIAN1204 W 127TH ST03925-32-217-050-000002022

ANT DEVELOPMENT GR LLC1129 W 127TH ST03925-32-217-051-000002022

CALUMET PARK - RESIDENTIAL

COMMAND PROP 12301 S LAFLIN ST03625-29-301-013-000002022

LAFLIN TOWNHOME ASN12323 S LAFLIN ST03625-29-301-071-000002022

ROY L WILEY SR 12329 S BISHOP ST03625-29-302-071-000002022

$1,749.90

$56,785.81

$1,011.76

$5,064.97

$1,399.62

SAMIH SWEIS 1301 W 123RD ST03625-29-304-009-000002022$592.34

SABRINA L CATLETT 12328 S THROOP ST03625-29-304-059-000002022

AVESTA HOLDINGS LLC12338 S ELIZABETH ST03625-29-305-045-000002022

BYRON HODGES 1245 W 123RD ST03625-29-305-058-000002022

CT&T 12324 S RACINE AVE03625-29-306-031-000002022

RFN CONSULTING LLC12434 S THROOP ST03625-29-310-083-000002022

$2,514.58

$2,698.92

$2,509.53

$4,511.31

$3,272.11

BRIAN MATHIS 12440 S ELIZABETH ST03625-29-311-048-000002022 $1,077.25

REO ACCEPTANCE CORP12459 S ELIZABETH ST03625-29-312-020-000002022

STANDARD PROPERTIES LL12500 S JUSTINE ST03625-29-313-047-000002022

VICTOR BROWN 12318 S ABERDEEN ST03625-29-401-029-000002022 $1,264.21

WILLIAM D KOPROWSKI12333 S MAY ST03625-29-401-041-000002022$402.95

SHONDA PRINCE 12317 S CARPENTER ST03625-29-403-012-000002022 $8,351.40

JAMES CRUES 12319 S CARPENTER ST03625-29-403-013-000002022 $4,454.18

ANGELIC HOME OF HOPE1013 W 123RD ST03625-29-403-038-000002022 $3,351.90

DEXTER GETTIS 12314 S MORGAN ST03625-29-403-046-000002022 $2,906.89

DANIEL MCDUFFIE 12312 S PEORIA ST03625-29-405-027-000002022 $7,242.08

SALLYR SCHNEIDER 12316 S PEORIA ST03625-29-405-028-000002022 $1,053.51

SALLY R SCHNEIDER 12316 S PEORIA ST03625-29-405-029-000002022 $3,955.00

SALLY R SCHNEIDER 12318 S PEORIA ST03625-29-405-030-000002022 $1,053.51

FREDERICK SAWYER 12356 S PEORIA ST03625-29-405-042-000002022 $4,265.23

FREDERICK SAWYER 12356 S PEORIA ST03625-29-405-043-000002022 $1,053.51

CALVIN WATKINS 853 W 123RD ST03625-29-406-003-000002022 $4,235.79

ALDER NCM LLC 12315 S PEORIA ST03625-29-406-012-000002022 $6,144.19

BARBARA WILSON 12320 S GREEN ST03625-29-406-050-000002022 $2,723.08

MARSHEL BROWN 12342 S GREEN ST03625-29-406-053-000002022$210.70

HOWARD GADDIS 12346 S GREEN ST03625-29-406-054-000002022 $1,896.98

FULTON D NEALY 12355 S GREEN ST03625-29-407-018-000002022 $1,053.51

STEVE BROWN 12330 S HALSTED ST03625-29-407-038-000002022$911.58

LEONARD WRIGHT 811 W 123RD ST03625-29-407-050-000002022 $3,958.95

ETHEL M COOPER 12323 S GREEN ST03625-29-407-056-000002022$300.00

JUAN GAYTAN 12423 S RACINE AVE03625-29-408-010-000002022 $2,449.11

JON M MERRILL 12435 S RACINE AVE03625-29-408-042-000002022 $2,842.17

RAYHAHMAN A LEWIS12437 S RACINE AVE03625-29-408-043-000002022 $2,108.21 KEITH SCONIERS 12445 S RACINE AVE03625-29-408-045-000002022 $4,718.08 THE RONALD J TALASKI T12413 S MAY ST03625-29-409-007-000002022 $3,123.18 HOLLY H LEE 12426 S ABERDEEN ST03625-29-409-029-000002022 $1,580.59 DEWAYNE RUSSELL 12437 S MAY ST03625-29-409-044-000002022 $2,373.80

$4,132.31

$5,242.94

CHICAGO FIRST RE INVES12501 S ASHLAND AVE03625-29-313-056-000002022 $6,330.74

RHODA CHEATHAM 12501 S BISHOP ST03625-29-316-002-000002022 $2,975.18

WALTER HAMPTON 12500 S LOOMIS ST03625-29-316-041-000002022 $1,546.54

SANTRICIA MACK 12520 S LOOMIS ST03625-29-316-043-000002022 $2,998.39

REMBRANDT BUILDERS12538 S LOOMIS ST03625-29-316-049-000002022 $3,919.63

ERIC A AGUILAR 12525 S BISHOP ST03625-29-316-057-000002022 $2,522.10

DEBRA G ROSS 12509 S LOOMIS ST03625-29-317-046-000002022 $3,833.72

NATHAN & EVELYN SMITH12524 S ADA ST03625-29-317-063-000002022 $4,095.17

DERRICK GORDON 12523 S ADA ST03625-29-318-047-000002022

CHERYL ROBY 12600 S JUSTINE ST03625-29-321-025-000002022$617.78

PERZIE

DWAYNE HOLT 12615 S JUSTINE ST03625-29-322-046-000002022

S WINCHESTER AVE03725-30-411-055-000002022 $3,769.34 VILLAGE OF CALUMET PAR12526 S HONORE ST03725-30-412-049-000002022 $4,603.14

J C RAMIREZ 12615 S WINCHESTER AVE03725-30-417-008-000002022 $9,144.77

J C RAMIREZ 12615 S WINCHESTER AVE03725-30-417-009-000002022 $9,144.77

TAXPAYER OF 12633 S LINCOLN ST03725-30-418-015-000002022

$7,301.18

MARK F ROLING 12613 S WOOD ST03725-30-420-006-000002022 $1,080.53

JAMES ZELINSKI 12614 S PAGE ST03725-30-420-025-000002022 $5,019.49

ERIC BROWN 1744 W 127TH ST03725-30-420-055-000002022 $8,283.29

DARLENE SMITH ROBERTS12627 S MARSHFIELD AVE03725-30-422-013-000002022 $1,018.14

DARLENE SMITH ROBERTS12627 S MARSHFIELD AVE03725-30-422-057-000002022$421.40

LEON BUTLER 12621 S MARSHFIELD AVE03725-30-422-059-000002022 $10,076.78

QIANA HARVEY 12529 S PAGE ST03725-30-423-002-000002022$498.10

CYNTHIA E CARTER 12545 S PAGE ST03725-30-423-006-000002022$399.96

JAIME TAMAYO RAMIREZ12558 S PAULINA ST03725-30-423-022-000002022 $2,345.69

KENNETH COLLIER 12609 S PAGE ST03725-30-424-003-000002022 $5,210.20

JAMES WILLIAMS 12725 S JUSTINE ST03925-32-101-046-000002022$946.51

MGE 12817 S ASHLAND AVE03925-32-103-011-000002022 $1,048.24

G JONES & Y GRIFFIN12808 S JUSTINE ST03925-32-103-050-000002022$560.38

MGE 12817 S ASHLAND AVE03925-32-103-062-000002022 $7,657.11

DANIEL A SAMUELS 12744 S BISHOP ST03925-32-114-021-000002022$100.77

DIMITRIUS DOUGHTY12728 S RACINE AVE03925-32-115-035-000002022 $4,642.47

HAROLD STEWART 12723 S BISHOP ST03925-32-116-005-000002022 $2,702.21

REGINALD & K HANNAH12756 S LOOMIS ST03925-32-116-028-000002022$416.48

MARK BROWN 12767 S BISHOP ST03925-32-116-034-000002022 $3,817.15

DEBBIE M SLEDGE 12740 S ADA ST03925-32-117-027-000002022 $1,265.41

CHERYL BEDAR 12756 S ABERDEEN ST03925-32-217-030-000002022 $5,086.95

ROBERT L MCMILLIAN1115 W 127TH ST03925-32-217-045-000002022 $7,648.02

ROBERT L MCMILLIAN1115 W 127TH

CALUMET PARK - VACANT LAND

IRENE ROTH 1451 W 123RD ST03625-29-301-002-000002022

SAMIH SWEIS 1301 W 123RD ST03625-29-304-010-000002022

STITNICKY ROBERT 12512 S LAFLIN ST03625-29-314-047-000002022

HOWARD J RYNBERK 12353 S SANGAMON ST03625-29-405-024-000002022$526.64

VIN12313SPEO 12313 S PEORIA ST03625-29-406-011-000002022

VIN12350SPEO 12350 S PEORIA ST03625-29-406-039-000002022

ANDREW J KENNEDY 12413 S RACINE AVE03625-29-408-007-000002022 $1,264.21 CV INVEST OF ILLINOIS12426 S MAY ST03625-29-408-034-000002022 $1,264.21

CV INVEST OF ILLINOIS12426 S MAY ST03625-29-408-035-000002022 $1,264.21

ALLEN FOSTER 12419 S CARPENTER ST03625-29-411-008-000002022 $1,264.21

ELIZABETH DLUZEN 12400 S SANGAMON ST03625-29-412-008-000002022 $1,060.54

REMBRANDT BLDRS LLC12412 S SANGAMON ST03625-29-412-016-000002022

$1,584.11

WILLIAM V RUNDLES 12400 S HALSTED ST03625-29-415-007-000002022$919.27

WILLIAM V RUNDLES 12400 S HALSTED ST03625-29-415-008-000002022$910.26

TAXPAYER OF 12408 S HALSTED ST03625-29-415-011-000002022$910.26

ANGELA HOOPER 12018 S MARSHFIELD AVE03725-30-209-030-000002022

STAN BERNARD 12353 S HONORE ST03725-30-403-022-000002022

DANIEL HENDRICK 1701 W 124TH ST03725-30-404-023-000002022

$1,393.84

$1,386.15

$2,363.86

PAUL A PANOZZO 12322 S ASHLAND AVE03725-30-405-022-000002022$197.92

REMBRANDT BLDR LLC12457 S LINCOLN ST03725-30-407-023-000002022 $1,053.51

REMBRANDT BUILDERS LLC12457 S LINCOLN ST03725-30-407-024-000002022 $1,053.51

E CHAVEZ 12402 S WOOD ST03725-30-408-025-000002022 $1,011.76

HOWARD J ROSENBURG1800 W 126TH ST03725-30-413-074-000002022$413.05

LYNDA M HAWKINS 12527 S MARSHFIELD AVE03725-30-416-014-000002022 $1,053.51

TAXPAYER OF 12510 S ASHLAND AVE03725-30-416-072-000002022 $2,750.55

TAXPAYER OF 12510 S ASHLAND AVE03725-30-416-073-000002022 $2,166.78

TAXPAYER OF 12637 S LINCOLN ST03725-30-418-020-000002022$741.96

TAXPAYER OF 12620 S HONORE ST03725-30-418-030-000002022 $3,736.61

TAXPAYER OF 12633 S LINCOLN ST03725-30-418-048-000002022$379.00

TAXPAYER OF 12607 S HONORE ST03725-30-419-004-000002022 $1,030.44

MARK F ROLING 12613 S WOOD ST03725-30-420-007-000002022 $1,053.51 A TO Z AUTO TRK REPAIR12831 S ASHLAND AVE03925-32-103-017-000002022 $1,214.12 A TO Z AUTO TRK REPAIR12833 S ASHLAND AVE03925-32-103-018-000002022 $1,214.12 A TO Z AUTO TRK REPAIR12835 S ASHLAND AVE03925-32-103-019-000002022 $1,214.12

SMOKE DEVELOPMENT LLC1335 W VERMONT AVE03925-32-109-002-000002022 $12,242.97 YOUTH AND ADULT CENTER12711 S MAY ST03925-32-217-056-000002022 $1,032.20

RIVERDALE - COMMERCIAL/INDUSTRIAL

CHICAGO SALT CO 902 W 134TH ST03925-32-401-020-000002022 $13,815.23

JOSEPH DELAURENTIS1050 W 134TH ST03925-32-401-022-000002022 $41,038.45

D J SCHNERING LLC 13417 S HALSTED ST03925-32-402-026-000002022 $31,239.20

CHICAGO SALT CO 650 JACKSON ST03925-32-402-039-000002022 $35,816.24

AGCQ HOLDINGS LLC 13747 S HALSTED ST03925-32-405-025-000002022 $37,149.95

CHONGSUL KIM 251 W 138TH ST03925-33-327-028-000002022 $29,425.36

CHONGSUL KIM 241 W 138TH ST03925-33-327-029-000002022 $5,170.75

CHONGSUL KIM 231 W 138TH ST03925-33-327-030-000002022 $5,249.50

CHONGSUL KIM 221 W 138TH ST03925-33-327-031-000002022 $47,057.55

CHONGSUL KIM 211 W 138TH ST03925-33-327-032-000002022 $18,721.81

CHONGSUL KIM 301 W 138TH ST03925-33-327-033-000002022 $158,516.51

ARVELL HODGES 13757 S ILLINOIS ST03925-33-411-009-000002022

RIVERDALE - RESIDENTIAL

HILLARD 13760 S WALLACE AVE03925-33-311-040-000002022

DAVE GATES 13732 S WALLACE AVE03925-33-311-053-000002022

VANCE WHITEHEAD 13730 S WALLACE AVE03925-33-311-054-000002022

DEVON ST REALEY LTD13708 S WALLACE AVE03925-33-311-061-000002022

DEVON ST REALEY LTD13638 S WALLACE AVE03925-33-311-073-000002022

COLLINS 13636 S WALLACE AVE03925-33-311-074-000002022

KATHLEEN STENSON 13630 S WALLACE AVE03925-33-311-075-000002022

ADAM GUTIERREZ 13620 S WALLACE AVE03925-33-311-079-000002022

DEVON ST REALTY LTD556 W 136TH ST03925-33-311-081-000002022

PAMELA MAUL 554 W 136TH ST03925-33-311-082-000002022

KATHLEEN STENSON 544 W 136TH ST03925-33-311-086-000002022

KATHLEEN STENSON 534 E 136TH ST03925-33-311-089-000002022

JUDITH M MCMAHON526 W 136TH ST03925-33-311-092-000002022

HERMAINE RALSTON 502 W 136TH ST03925-33-311-100-000002022

CHEM FREE INC 466 W 136TH ST03925-33-311-101-000002022