2019 BEST AND WORST STATES FOR BUSINESS

MAY/JUNE 2019

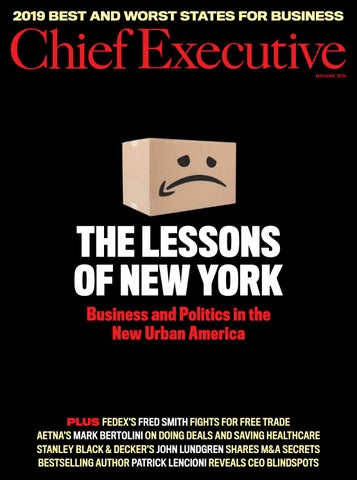

THE LESSONS OF NEW YORK Business and Politics in the New Urban America

PLUS FEDEX’S FRED SMITH FIGHTS FOR FREE TRADE AETNA’S MARK BERTOLINI ON DOING DEALS AND SAVING HEALTHCARE STANLEY BLACK & DECKER’S JOHN LUNDGREN SHARES M&A SECRETS BESTSELLING AUTHOR PATRICK LENCIONI REVEALS CEO BLINDSPOTS