The seller has already paid for your Realtor®, so you don’t have to! Realtors are here to help, so use one!

Moving is stressful enough on families, let the professional do the work for you! First step is to find a good agent who will work hard for you and your family. Don’t let someone pressure you into using them.

Your house is one of your biggest investments. You need to have a Realtor® that you trust, one that fits your personality.

• What buyers want most from real estate professionals

• What to expect when purchasing a home

• The home buying process

• Tips on buying in a tight market

• 8 steps to getting your finances in order

• 5 factors that decide your credit score

• 8 ways to improve your credit

• 7 reasons to own your own home

• 10 steps to prepare for homeownership

• 6 reasons you need a realtor®

• 5 common first-time homebuyer mistakes

• 10 things a lender needs from you

• 10 ways to lower your homeowner’s insurance costs

• Fun Facts - Buyers

• What are closing costs?

• Common closing costs for buyers

• Closing checklist

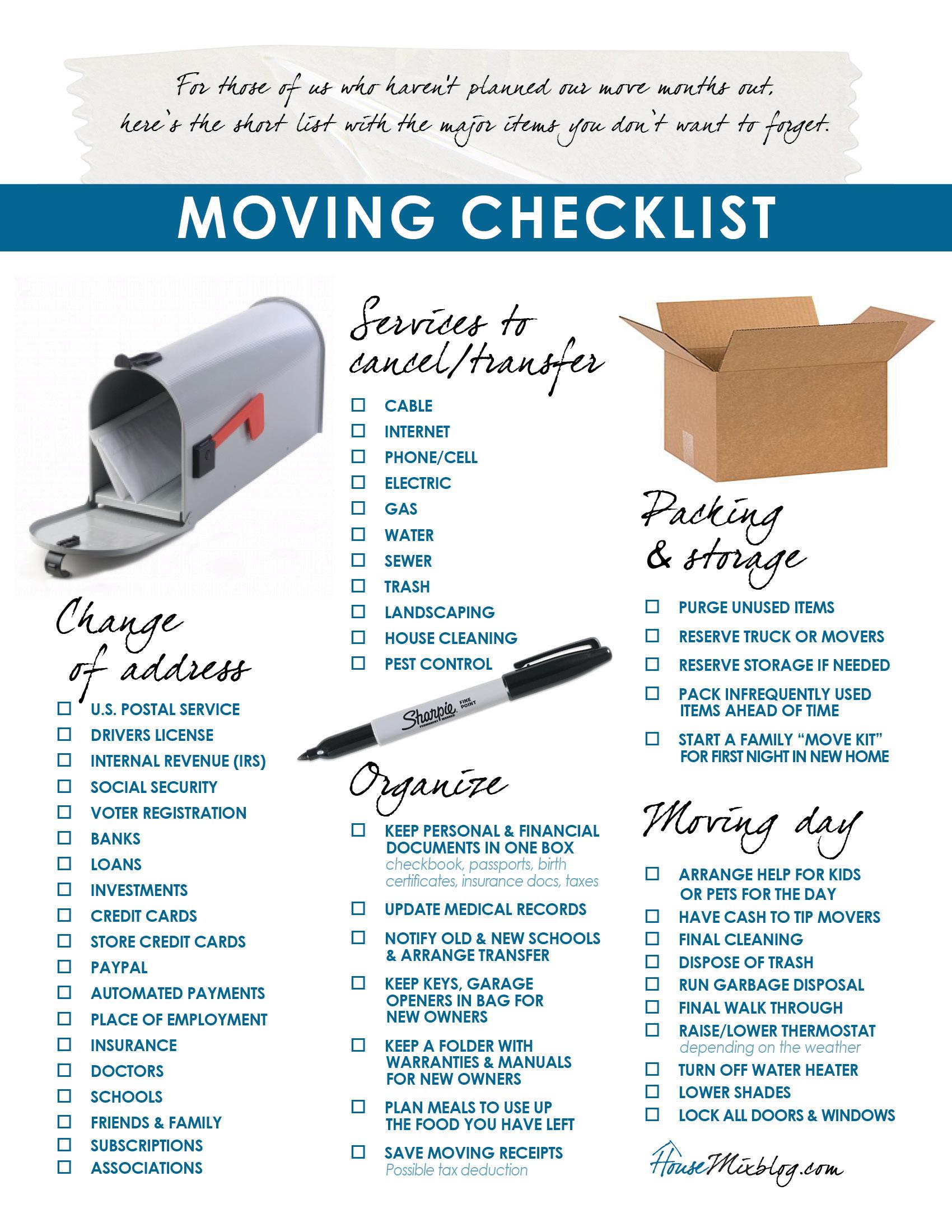

• Moving checklist

Gina has been successful in sales for over 30 years. She was one of the first female Sales Representatives for Nabisco, who tripled the sales of the territory in her first three months as a trainee! She was a top producer in the Nation for US Cellular for 10 years before opening her own successful cellular stores as an agent. She began her real estate career as an investor in Tulsa, while helping friends and family with their real estate needs.

Gina credits her success in business to having always followed the “Golden Rule” with her customers, which has helped her business become “by referrals” only. She is proud to say that most of her customers have become life-long friends. Gina is passionate about giving back to her community. She has been involved with many organizations and raised thousands of dollars for charities that are close to her heart. She was a member of the Homes for Heroes program, which helped with closing costs for Firefighters, EMS, Police Officers, Healthcare Workers, Military Personnel, Veterans and Educators. She chaired fundraisers to promote STEM Scholarships and to help fund the Children’s Science Museum.

A full-time, full-service agent, Gina is experienced in working with both buyers and sellers as well as first-time homebuyers, expanding families and empty nesters. She is a Specialist in Foreclosure, Short Sales, and Military Relocation, and Certified in New Home Sales and Residential Construction!

Her memberships include:

• GTAR (Greater Tulsa Area Realtors)

• Tulsa Homebuilders Association

• Owasso Chamber of Congress

• Served on the Executive Board of Directors of the Dulles Regional Chamber of Congress in Northern Virginia.

• NVAR (Northern Virginia Association of Realtors)

• GCAAR (Greater Capital Area Association of Realtors).

She received many awards while with US Cellular, as well as being voted Citizen of the Year in Chantilly, VA in 2013, and honored with the recognition of Best Realtor in Posh Seven Magazine’s “Best of Suburbia,” 2017.

I can help wherever you are moving, through a Nationwide Agent Referral Program!

Making Dreams Come True!

Gina Naifeh-Poindexter Licensed in Oklahoma, Virginia and Maryland gpoindexter@cctulsa.com 703-400-8754FIND A REALTOR to represent your interests in the transaction. Communication is key. We will be a team, when you have a need or concern please tell me. I will assist you in purchasing a home: for sale by owner, marketed by a realty company, new construction...

FULL LOAN APPROVAL from a mortgage banker. Most sellers are requiring a pre-approval letter from a lender before looking at an offer on their home. Getting fully approved puts you ahead of the game. (Have a copy faxed/emailed to me.) Your loan officer will let you know how much you qualify for and can give you a good idea of payments, closing costs, and other expenses you can expect along the way.

LET’S GO SHOPPING!! Now that you know how much you want to spend, we can work together to find the perfect home for you. Don’t forget your checkbook!

MAKING AN OFFER? Once you have found a home you love you will want to put an offer in. I will look up the comps in the area and disclosure for the property. Then we will want to sit down and discuss the details of your offer: purchase price, earnest money amount, close date, additional items to be left on premise, things to be removed, repair cap, home warranty, contingencies, any other requirements or items to be paid by the seller.

EARNEST MONEY is a check or money order that is given to secure the property. It is only cashed once an agreement has been reached by both parties. It is held in an escrow account until closing. At closing it will go towards to purchase of the home. You can lose this earnest money if you do something outside of the confines of the contract so remember when your Realtor, the closer or lender ask you for information or decisions, you need to respond as quickly as possible. If there is a reason you can’t respond, then you need to discuss with us so we can help or do an extension if necessary/doable to protect you.

NEGOTIATIONS: Once the offer is submitted, the seller can do one of three things: accept the offer as is, counter offer, or reject the offer. Here is where I come in handy...

INSPECTION: Now that you are under contract, your time period to do inspections begins. I will assist in scheduling the inspections to fit your schedule. Most homes have minor faults, it does not mean they are uninhabitable. You need to be aware of any issues you can take care of on your own and what if any you would like to ask that the seller be responsible for taking care of before closing. (Note: during this time your financing must get locked in and appraisal ordered.)

REPAIR REQUEST: You have a specified amount of time to request any repairs. You must submit in writing all repair requests to the sellers. The sellers will then do one of three things: they will sign off on all requested repairs, counter offer on the repairs, or they will refuse to do the repairs.

RE-INSPECTION: This may be done by the inspector for a fee or by yourself, unless specified by your lender. (ie: sometimes you must pay an appraiser to come out to re-inspect a required repair.)

CLOSING: Have the funds wired to the title company for the amount specified by your lender. Get ready to sign a stack of papers... Once they are all signed and the funding has come through... CONGRATULATIONS!!! You are the proud new owner of a home!!!

Go to open houses, enjoy looking, and remind me to set you up with your own texting program so you can instantly get information on any house you like!!

Just remember to tell the agents at the open house as soon as you walk in that you are working with me and write my information down at opens, not yours. That way the Realtors can contact me for feedback and will not bug you.

Increase your chances of getting your dream house instead of losing it to another buyer with these easy steps.

1. Get prequalified for a mortgage. You’ll be able to make a firm commitment to buy and make your offer more desirable to the seller.

2. Stay in close touch with your real estate sales associate to find out first about new listings that come on the market, and be ready to go see a house as soon as it goes on the market.

3. Scout out new listings yourself. Look at Internet sites, newspaper ads, and drive by the neighborhood frequently. Maybe you’ll see a brand-new “for sale” sign before anyone else. If you do, call me immediately.

4. Be ready to make a decision. Spend lots of time in advance deciding what you must have so you won’t be unsure when you have the chance to make an offer. (See your wish list and must-haves attached in this packet.)

5. Bid competitively. You may not want to start out offering the absolute highest price you can afford, but make your offer reflect how much you want this home. Don’t try to go too low to get a deal. In a tight market, you’ll lose out.

6. Keep contingencies to a minimum. Restrictions, such as needing to sell your home before you move or wanting to delay the closing until a certain date, can make your offer unappealing. In a tight market, you’ll probably be able to sell your house rapidly. Another option, talk to your lender about getting a bridge loan to cover both mortgages for a short period.

7. Don’t get caught in a buying frenzy. Just because there’s competition doesn’t mean you

1. DEVELOP A FAMILY BUDGET. Instead of budgeting what you’d like to spend, use receipts to create a budget for what you’ve actually spent over the last six months. One advantage of this approach is that it factors in unexpective expenses, such as car repairs, illnesses, etc, as well as predictable costs such as rent.

2. REDUCE YOUR DEBT. Generally speaking, lenders look for a total debt load of no more than 36 percent of income. Since this figure includes your mortgage, which typically ranges between 25% and 28% of income, you need to get the rest of installment debt–car loans, student loans, revolving balances on credit cards–down to between 8% and 10% of your total income.

3. GET A HANDLE ON EXPENSES. You probably know how much you spend on rent and utilities, but little expenses add up. Try writing down everything you spend for one month. You’ll probably see some great ways to save.

4. INCREASE YOUR INCOME. It may be necessary to take on a second, part-time job to get your income at a high-enough level to qualify for the home you want.

5. SAVE FOR A DOWN PAYMENT. Although it’s possible to get a mortgage with only 5% down-or even less in some cases–you can usually get a better rate and a low overall cost if you put down more. Shoot for saving a 20% down payment.

6. CREATE A HOUSE FUND. Don’t just plan on saving whatever’s left toward a down payment. Instead, decide on a certain amount a month you want to save, then put it away as you pay your monthly bills.

7. KEEP YOUR JOB. While you don’t need to be in the same job forever to qualify, having a job for less than two years may mean you have to pay a higher interest rate.

8. ESTABLISH A GOOD CREDIT HISTORY. Get a credit card and make payments by the due date. Do the same for all your other bills. Pay off the entire balance promptly.

1. Payment history. Do you pay your debts on time?

2. Amount of debt. Less is best.

3. Credit history. The longer the better.

4. Amount of new credit. New credit is considered more risky!

5. Types of credit, i.e. installment loans, credit cards, and a mortgage.

Credit scores range between 200 and 800. Scores above 640 are considered desirable for obtaining a mortgage. For more on evaluating and understanding your credit score, go to www.myfico.com.

• Pay your mortgage or rent payments on time.

• Stay current on all outstanding accounts.

• Continue working for the same employer.

• Stay with your current insurance company,

• Notify your Lender immediately if any situation arises that could possibly affect your income, assets, or credit.

• Don’t switch bank accounts.

• Don’t transfer balances between accounts.

• Don’t increase the balance of any credit cards.

• Don’t consolidate debt, including credit card debt.

• Last 30 days paystub

• Copy of last 2 years’ W-2s and tax returns

• Most recent 2 month’s checking and savings account statements

• Name of homeowner’s insurance company

• Letter explaining derogatory credit or bankruptcy (if applicable)

• Copy of Divorce Decree and Property Settlement (if applicable)

• Don’t close any accounts, including credit card accounts.

• Don’t apply for ANY credit (new vehicle, furniture, appliances, etc).

• Don’t change your job, employer, the way you are paid, or become self-employed.

• Don’t pay off charge-off or collection accounts before consulting with your lender.

• Don’t make large deposits without the ability to document the source of the funds.

Credit scores, along with your overall income and debt, are a big factor in determining if you’ll qualify for a loan and for which loan terms you’ll be able to qualify for.

1. CHECK FOR ERRORS IN YOUR CREDIT REPORT. Mistakes happen, and you could be paying for someone else’s poor financial management.

2. PAY DOWN CREDIT CARD BILLS. If possible, pay off the entire balance every month. However, transferring credit card debt from one card to another could lower your score.

3. DON’T MAX OUT YOUR CREDIT CARDS. Charging your accounts for the maximum limit can quickly damage your credit.

4. WAIT 12 MONTHS AFTER CREDIT DIFFICULTIES. Let 12 months pass before applying for a mortgage. You’re penalized less for problems after a year.

5. DON’T MAKE BIG PURCHASES ON CREDIT CARDS. Although its tempting to purchase big ticket items for your new home, it’s best to wait until after loan approval. The amounts will add to your debt and can stop your loan from going through.

6. DON’T OPEN NEW CREDIT CARD ACCOUNTS. While in the process of getting ready to apply for a loan, don’t open new accounts. Having too much available credit can lower your score.

7. SHOP FOR MORTGAGE RATES ALL AT ONCE. Too many credit applications can lower your score, but multiple inquiries form the same type of lender are counted as one inquiry if submitted over short period of time.

8. AVOID FINANCE COMPANIES. Even if you pay the loan on time, the interest is high and it will probably be considered a sign of poor credit management.

1. TAX BREAKS. The U.S. Tax Code lets you deduct the interest you pay on your mortgage, property taxes you pay, and some of the costs involved in buying your home.

2. GAINS. Between 1998 and 2002, national home prices increased at an average of 5.4% annually. While there is no guarantee of appreciation, a 2001 study by the NATIONAL ASSOCIATION OF REALTORS® found that a typical homeowner approximately $50,000 of unrealized gain in a home.

3. EQUITY. Money paid for rent is money that you’ll never see again, but mortgage payments let you build equity ownership interest in you home.

4. SAVINGS. Building equity in your home is a ready-made savings plan. When you sell, you can generally take up to $250,000 ($500,000 for a married couple) as gain without owning any federal income tax.

5. PREDICTABILITY. Unlike rent, your mortgage payments don’t go up over the years, so your housing costs may actually decline as you own the home longer. However, keep in mind that property taxes and insurance will rise.

6. FREEDOM. The home is yours. You can decorate in any way you want and be able to benefit from your investments for as long as you own the home.

7. STABILITY. Remaining in one neighborhood for several years gives you a chance to participate in community activities, lets you and your family establish lasting friendships and offers your children the benefit of educational continuity.

1. DECIDE HOW MUCH HOME YOU CAN AFFORD. Generally, you can afford a home equal in value to between two and three times your gross income.

2. DEVELOP A WISH LIST. Prioritize the features that you’d like your home to have on your list.

3. SELECT THREE OR FOUR POSSIBLE NEIGHBORHOODS. Consider factors such as schools, recreational facilities, area expansion plans, and safety.

4.WILL YOUR SAVINGS COVER DOWN PAYMENT AND CLOSING COSTS? Closing costs, (including taxes, attorney fees, and transfer fees), average between 5% and 8% of the home price.

5. GET YOUR CREDIT IN ORDER. Obtain a copy of your credit report.

6. DETERMINE HOW LARGE A MORTGAGE YOU CAN QUALIFY FOR. Explore different loan options and decide what’s best for you.

7. ORGANIZE ALL DOCUMENTATION. Review all the documents that a lender will need to preapprove you for a loan.

8. DO YOU QUALIFY FOR A SPECIAL MORTGAGE? Do research to determine if you qualify for down payment assistance programs.

9. CALCULATE THE COSTS OF HOMEOWNERSHIP. You need to be prepared for costs including property taxes, insurance, maintenance, and association fees, if applicable.

10. FIND AND EXPERIENCED REALTOR® who can help you through the process and share your goals with them.

1. A REAL ESTATE TRANSACTION IS COMPLICATED. In most cases, buying or selling a home requires disclosure forms, inspection reports, mortgage documents, insurance policies, deeds, and multiple-page government-madated settlement statements. A knowledgeable guide through this complexity can help you avoid delays or costly mistakes.

2. SELLING OR BUYING A HOME IS TIME CONSUMING. Even in a strong market, homes in our area stay on the market for three to four months. It usually takes another 60 days or so for the transaction to close after an offer is accepted.

3. REAL ESTATE HAS ITS OWN LANGUAGE. If you don’t know a CMA fro a PUD, you can understand why it’s important to work with someone who speaks that language.

4. REALTORS® HAVE DONE IT BEFORE. Most people buy and sell only a few homes in a lifetime, usually with quite a few years in between each purchase. Even if you’ve done it before, laws and regulations change. Tht’s why having an expert on your side is critical.

5. REALTORS® PROVIDE OBJECTIVITY. Since a home often symbolizes family, rest and security, not just four walls and a roof, home-selling or buying is often a very emotional undertaking. For most people, a home is the biggest purchase they’ll every make. Having a concerned, but objective third party helps keep you focused on both the business and emotional issues most important to you.

6. REALTORS® ARE MEMBERS OF THE NATIONAL ASSOCIATION OF REALTORS®, a trade organization of more than 1 million members nationwide. REALTORS® subscribe to a stringent code of ethics that helps guarantee the highest level of service and integrity.

1. They don’t ask enough questions to their lender and they miss out on the best deal.

2. They don’t act quickly enough to make a decision, and someone else buys the home.

3. They don’t find the real estate professional who is willing to help them through the home buying process.

4. They don’t do enough to make their offer look good to a seller.

5. They don’t think about resale before they buy. The average first-time buyer only stays in a home for four years.

Reprinted with permission from Real Estate Checklists and Systems.

1. W-2 forms or business tax return forms if you’re self-employed for the last two or three years for every person signing the loan.

2. Copies of one or more months of pay stubs from every person signing the loan.

3. Copies of one or more months of bank or credit union statements for both checking and savings account.

4. Copies of personal tax forms for the last two to three years.

5. Copies of brokerage account statements for two to four months, as well as a list of any major assets of value, e.g., a boat, or stocks or bonds not held in a brokerage account.

6. Copies of your most recent 401(k) or other retirement account statement.

7. Documetation to verify additional income, such as child support, pension, etc.

8. Account numbers of all your credit cards and the amounts of any outstanding balances.

9. Lender, loan number, and amount owed on other installment loans–student loans, car loans, etc.

10. Addresses where you lived for the last five to seven years, with names of landlords, if appropriate.

LET’S HAVE SOME FUN...

TELL ME 10 THINGS YOU CAN’T LIVE WITHOUT!

NOW... Circle your top 3 Buyer Must Have’s.

This is a good starting point to find out where we should start our search:

• How close do you need to be to work?

• Do you have a preference for specific school district(s)? Yes/No

• If so, which one(s)?

• What neighborhoods do you like?

• Are there specific amenities you want in your new neighborhood?

• Do you want a one-story or two-story home? One/Two

• Do you prefer a new construction or a re-sale home?

• Is there a specific age of home you prefer?

• How much repair or renovation would you consider?

• What is your preference for square footage?

• What price range would you like to be in?

• Do you have special facilities or needs that our home must meet?

• Do you require a fenced yard or other amenities for your pets? Yes/No

Please circle any of the following items you are looking for:

Pool

Patio/Deck

Shop

Garage - 2 3 4+

Bedrooms - 2 3 4 5+

Bathrooms - 1 2 3+

Formal Dining

Inside Laundry

Fireplace

Carpet /Tile / Hardwood / Laminate

Backs to Greenbelt

Walk-in Closets

1. RAISE YOUR DEDUCTIBLE. If you can afford to pay toward a loss that occurs, your premiums will be lower.

2. BUY YOUR HOME AND AUTO POLICIES FROM THE SAME COMPANY. You’ll usually qualify for a discount. Make sure that the savings really yield the lowest price.

3. MAKE YOUR HOME LESS SUSCEPTIBLE TO DAMAGE. Keep roofs and drains in good repair. Retrofit your house to protect against natural disasters common to your area.

4. KEEP YOUR HOME SAFER. Install smoke detectors, buglar alarms, and deal-bolt locks. All of these will usually qualify for a discount.

5. INSURE YOUR HOUSE FOR THE CORRECT AMOUNT. Remember, you’re covering replacement costs, not market value.

6. ASK ABOUT OTHER DISCOUNTS. For example, retirees who are home more than working people may qualify for a discount on theft insurance.

7. STAY WITH THE SAME INSURER. Especially in today’s tight insurance market, your current vendor is more likely to give you a good price.

8. SEE IF YOU BELONG TO ANY GROUPS associations, alumni groups, credit unions that offer lower insurance costs.

9. REVIEW YOUR POLICY ANNUALLY. Some items depreciate and may not need as much coverage- review the policy limits and the value of both home and possessions every year.

10. SEE IF THERE’S A GOVERNMENT BACKED INSURANCE PLAN. In some high-risk areas, such as the coastal areas, federal or state government may back plans to lower rates. Ask your agent.

Closing costs are fees associated at the closing of a real estate transaction when the title of the property is transferred from the seller to the buyer. Closing costs typically range from 2-5% of the purchase price and are incurred by both parties. Here are some common closing costs:

• A fee for running your credit report.

• a loan origination fee, which lenders charge for processing the loan paperwork for you.

• Attorney’s fees.

• Discount points, which are fees you pay in exchange for a lower interest rate.

• Survey fee, which covers the cost of verifying property lines.

• Title search fees, which pay for a background check on the title to make sure they aren’t things such as unpaid mortgages or liens on the property.

• Title insurance, which protect the buyer and lender in case the title isn’t clean.

• Escrow deposit, which pays a couple months’ property taxes, homeowner’s insurance, and private mortgage insurance.

• Prorations for your share of homeowner’s association fees.

• Recording fee, which is paid to the county in exchange for recording the new land records.

Lenders are required by law to give you a Loan Estimate, which will include what the closing costs on your home should be. At least three business days before closing, the lender will give you a Closing Disclosure statement, which outlines exact closing fees. This Closing Disclosure statement must be signed by the buyer the same day it is issued to a delay in closing.

The lender must disclose a good faith estimate of all settlement costs. A check to cover your closing costs will probably have to be a cashier’s check. The title company or closing attorney conducting the closing will tell you the required amount for:

• Down payment

• Loan origination fees

• Points, or loan discount fees, you pay to recieve a lower rate

• Appraisal fee

• Credit Report

• Private Mortgage insurance premium

• Insurance escrow for homeowner’s insurance, if being paid as part of the martgage

• Property tax escrow, if being paid as part of the mortgage. Lenders keep funds for taxes and insurance in escrow accounts as they are paid with the mortgage, then pay the insurance or taxes for you.

• Deed recording fees

• Transfer taxes

• Title insurance policy premiums

• Survey

• Inspection fees – building inspection, termites, etc.

• Notary fees

• Prorations or your share of costs, such as utility bills and property taxes

A NOTE ABOUT PRORATIONS: Because such costs are usually paid on either a monthly or yearly basis, you might have to pay a bill for services used by the sellers before they moved. Proration is a way for the sellers to pay you back or for you to pay them for bills they may have paid in advance. For example, the gas company usually sends a bill each month for the gas used during the previous month. Assume you buy the home on the 6th of each month, then you would owe the gas company for only the days from the 6th to the end of the month. The seller would owe fo the first five days. The bill would be prorated for the number of days in the month, and then each person would be responsible for the days of his or her ownership.

Call utilities to ensure they are taken out of or put into your name as of the close date. Sellers – make sure you have the code to any security system/garage keypad written down for buyers.

Bring all keys to closing and location of garage door openers.

Everyone listed on contract must be present at closing. If that is not possible, let me know ASAP so I can arrange for that person(s) to pre-sign.

Any funds that are over $5,000.00 must be wired to the title company before closing as a cashier’s check will not be accepted in any amount over $5,000.00.

The title company will issue a HUD – 1 Statement (closing statement) before closing for approval.

Any questions or changes that need to be made will have to be done quickly so as not to delay closing.

The amount to bring/receive at closing for Buyer and Seller will be listed on the HUD-1.

All parties must bring a valid driver’s license to closing. Even if pre-signing.

Buyers – Remember, do not buy things on credit. Your Lender will run a gap check (credit check) before closing to ensure you still qualify.

A final walk through of the property should be scheduled for a day before or the day of closing to ensure buyers are satisfied with the condition of the property and all repairs negotiated are complete. (At this point the property should be empty except for items negotiated in the contract.)

Buyers – Schedule movers to allow for closing. It gets stressful when closing runs late and the movers keep calling from the property wanting access.

Please note that once paperwork is complete sometimes it takes a little while for the lender to approve of the signed paperwork and release the funds. I just want everyone to be prepared...