HOMEBUYER’S GUIDE

Friendly, Knowledgeable Agent.

A dependable, seasoned, result-driven, motivated professional with more than 12 years of a solid combined background in telecommunications, mortgaging, real estate and education. Brian offers a rare combination of superior interpersonal and business skills to meet challenges with a positive attitude and thrive with strong commitment to deliver timely, accurate quality service. Excellent team-building skills and competent with demonstrated ability to easily transcend cultural differences. Strong leadership with excellent analytical and cross-cultural communication skills in English and Spanish.

“I am here to be of service and assist you in having a great homebuying experience attaining the ideal home. I look forward to working with you.”

“Take advantage of tools and tips to help you assess your buying power, decide where you’ll live, plan your search, and more.”

Owning a home verses renting has several financial advantages. Instead of rent checks paid and gone, when you make your monthly mortgage payment, you are in essence investing in your home and your future. As you pay down the mortgage loan amount and make home improvements, you build equity: the difference between what you owe on the loan and the home’s fair market value. Another benefit of homeownership is that you can often deduct mortgage loan interest amounts and property taxes from your federal income tax if you itemize your return. Consult your tax advisor about your specific situation and see www.irs.gov/publications/p936/ar02.html

In addition to the financial benefits of owning a home, there are important responsibilities to anticipate: maintenance, repairs and improvements.

Mortgage lenders will be taking a close look at your financial history including income, credit score, debts and assets. You’ll be asked to disclose to the lender all outstanding debts, including any loan or financial obligations such as credit card balances, alimony and child support payments, car loans, medical bills, etc. Lenders will also want to see how much money you have in savings, after deducting your down payment amount. You’ll also be asked for your employment history and will need to show job and income stability and security.

TIP: Request and review your credit reports before you start looking for a home or going through the loan pre-approval process.

35% PAYMENT HISTORY - Have you paid your bills on time or do you miss payments? The more severe recent & frequent late payments the greater impact on your score.

30% AMOUNT OWED - The total balance owed, how many accounts have balances & how much of available credit you are using are some of the key factors of scores.

15% LENGTH OF CREDIT HISTORY - The age of your credit accounts including the age of the oldest account, the average age of all accounts & specific type of accounts.

The best-known and most widely used credit score model in the United States is the Fair Isaac Corporation (FICO) score and is calculated statistically with information from a consumer’s credit files. It provides a snapshot of risk that banks and other institutions use to help make lending decisions. Applicants with higher FICO scores may be offered better interest rates on mortgage or automobile loans. Visit annualcreditreport.com. This is the only authorized online source for totally free credit reports. By federal law, you are entitled to a free credit report once every 12 months. This site gathers your information from each of the three nationwide consumer credit reporting companies: Equifax, Experian and TransUnion. Check your report and look for any misinformation. If you find an error, you should address and correct it right away with the individual credit bureaus.

1. Always pay all bills on time, even if it means making only the minimum amount due. Your payment history counts for 35% of your FICO score, the most heavily weighted category.

2. Pay down your outstanding debt. Lenders look at the amount you owe verses your credit limit on charge cards. If the amount you owe is close to the limit the company has set, it is likely to have a negative effect on your score. You can also ask for a higher line of credit to change the ratio, but don’t be tempted to increase your outstanding balance.

3. Don’t start applying for more credit cards or other types of loans while you are house hunting.

4. Improve your credit file by disputing errors and inaccurate information on your credit report

10% TYPES OF CREDIT - Consider credit cards, retail, install & mortgage loans etc. This is more important if your credit report doesn’t have any other info to base a FICO.

10% NEW CREDIT - FICO take into account how many new sccounts opened an whether you rate shopped for a loan or applied for multiple new credit lines.

TIP: Resource - www.creditunlimited.com

Don’t be a victim of flaws in the credit reporting system. Credit Unlimited can be a great resource on building and correcting your credit profile when you are planning to buy a home. Whether your credit has a few dings or enough bad marks to severely damage your credit score, you may be able to improve your credit score by disputing the inaccurate or incomplete items on your credit reports. Using Credit Unlimited credit repair service makes this process easy. Discuss this with your real estate agent to learn more about the free consultation and benefits with the service. Let this resource help you get the credit score you deserve.

Take a realistic look at how much future income you anticipate having and how many expenses you expect to incur. Most lenders use the debt-to-income ratio that includes mortgage, property taxes and insurance, which is generally 28 to 36% of your monthly gross income. Remember, the lender will tell you how much you are qualified to borrow, not necessarily how much you can afford. Only you know how much you can comfortably handle, what your other expenses are, how much you need to save and what kind of lifestyle you wish to maintain. When calculating your monthly budget, don’t forget to include homeowner insurance premiums, property taxes, any homeowners’ association fees, utilities and monthly maintenance in addition to your other expenses. Your Realtor® can tell you how much property taxes are for each property.

The pre-approval determines two things: if you are qualified for a home loan and the maximum mortgage amount you can afford. Lenders will review your financial circumstances including income, debts and assets to determine the loan amount for which you qualify. The lender will issue a letter indicating the amount you are qualified to borrow. Mortgage pre-approval gives you a couple of advantages. First, it lets you know how much money you have to work with. Second, it signals to sellers that you are serious about an offer and that you can indeed qualify for the necessary mortgage to complete the purchase. If you make an offer on a house with multiple bids, being pre-approved can often give you an edge over other purchasing offers.

Social Security card copies

Drivers license copies

Birth certificate copies

Marriage certificate copy

W-2 forms for the past two years

Recent pay stubs (at least two months)

Copies of checking and savings account statements

Asset documentations

Salary verificcation

Written explanations for any late payments, recent credit inquiries, collections, judgements or liens

Credit card numbers and balances

Income tax statements

Car and other loans documents: amount of loan; date of loan; current balance; monthly payment

Corporate or partnership tax return (if applicable)

Gift letter if any of the funds (such as the down payment or earnest money) are being given to you by a family member

Current landlord’d name and contact information (if you rent)

Current and previous addresses

Remember interest rates fluctuate, so lock in the best interest rate as soon as you can

A down payment is a percentage of the cost of the home that is paid up front. Down payment requirements vary, but 10 to 20% of the home’s price is often needed to secure the best mortgage rates. The higher the down payment, the lower your monthly mortgage payments will be. Federal Housing Authority (FHA) loans, however, require roughly 3.5% of the home price as a down payment, which is why these loans are often attractive for first-time buyers or those with lower credit scores.

TIP: There is a wealth of online mortgage calculators that can help you determine what you can afford.

* Whether you’re a first-time home buyer, seeking to sell, upgrade, downsize, interested in investment property or are relocating, I will help you through this process every step of the way!

Purchasing a home is a major milestone that tops many people’s lifetime To-Do-Lists. It also maybe on their list of financial fears too. But it certainly doesn’t have to be a scary or a stressful experience. With time, care, and research and the right Real Estate Team behind you, you can take control of the Home-Buying Process!

There are going to be many factors and decisions for you to make. That’s why, when buying, it’s crucial for you to have all the available resources necessary to make a well-informed decision, together with the time required to make complete use of them.

That’s also why you should enlist the help of a trusted REALTOR®.

Many REALTORS® are Buyer Specialists who focus on helping people successfully find and buy the homes they’ve always wanted. A REALTOR® will be able to provide you with expert consultation at each step of the buying process.

to release the mortgage) and auctioned homes may also be attractive deals. Be prepared as these types of listings often require maintenance and repair work, as the homes may have been empty for a while or may have been neglected. There also may be programs sponsored by your state or local government or other organizations to help you buy your first home: http://www.hud.gov/buying/localbuying.cfm.

The first step is to clearly determine why you’re buying and what kind of home you’re looking for. It also means checking your current financial situation and not taking on a larger mortgage commitment than you can afford.

This is why it’s so important to seek help from a financial professional, who can help walk you through an appropriate breakdown, based on your individual situation.

Your Mortgage Banker will be able to help you figure out which mortgage is right for you and start getting you Pre-Approved. The process in which a lender reviews your financial information, like your credit report, W2s and bank statements and commits to giving you a mortgage for a specified interest rate.

IT’S A GOOD IDEA TO CONSIDER DOING THIS NOW!

Finding and purchasing a home includes many steps, which I will be going over with you.

Buying a home is a big step, it’s important for you to educate and prepare yourself as much as possible in advance.

Different Homes Sales on The Market: In addition to traditional home sales, you may come across U.S. Department of Housing & Urban Development (HUD) foreclosed homes on the market. When someone with a HUD insured mortgage can’t make the payments, the lender forecloses on the home and HUD takes ownership. Typically, HUD strives to sell the homes at market value very quickly. For this reason, a HUD home may be good a deal for first-time homeowners. Previously foreclosed homes, sometimes known as real estate owned (REO) properties, may also be good opportunities for first-time buyers. These properties are usually owned by banks that are eager to sell. Homes known as short-sales (meaning the seller’s lender accepts less than the amount owed on the home

* Currently, it is a Seller’s Market and houses are going quickly, sometimes even in multiple offer situations. You wouldn’t want to lose the opportunity of getting your Dream House. Having the Pre-Approval Letter attached to your offer makes it more attractive to the Seller. It helps prove to a Seller that you’re a Qualified Buyer, and once an offer is made and accepted, the bank will just have to appraise the home, not the property and your finances!

FIND

NEXT, YOU WILL WANT TO CONTACT YOUR REALTOR® IF YOU HAVEN’T ALREADY.

While you’re not under any obligation to do so, there are many potential benefits in working with one. First of all, a REALTOR® can provide more home access options than you’ll find yourself, as well as set up viewing appointments. One of the many benefits of using their services is that they hear about listings right when they come on the market. In fact, sometimes even before they’re on the market!

• Educate you about Buyer Agency, outlining their professional responsibilities to you, including complete Disclosure, Loyalty, Confidentiality, Obedience and Accountability.

• Help you explore your financing options and, if required, refer you to some excellent mortgage professionals so you can make the best possible mortgage decision.

• Save you time by regularly searching the market for affordable homes that meet your criteria.

• Email you homes that just came on the market that meet your specific home requirements.

• View homes with you and provide Comparative Analysis.

• They can also refer you to expert Attorneys, Home Inspectors, Insurance Agents and other Real Estate Professionals that will provide more in-depth analysis and advice.

• Provide consultation in relation to your written offer to purchase a home, will all terms approved by you.

• Negotiate best possible price, terms and take care of all the documentation details for you.

• Keep you fully informed about all activities that lead to the transaction closing.

• Assist you, if necessary, in finding any home-related services you need.

In short, they’ll provide you with comprehensive, high-quality Buyer’s service!

Buying Real Estate is a complex matter, given that there are so many factors to consider and that no two homes or transactions are alike. Home-Buying can be an emotional process, a REALTOR® can guide you through the property search, give you sales comps, negotiation and transaction processes and can act as a mediator between You and the Seller.

To find someone, interview several REALTORS® until you find someone that is experienced, knows the local market, understands your needs and makes you feel comfortable.

As a final step, check your state’s Real Estate Licensing Board’s Website to ensure they’re registered and don’t have any complaints or suspensions logged against them.

There is a lot to think about as you prepare to buy your first home, such as:

• Deciding What You

• Comparison Shopping

• How Will I Find The “RIGHT” House?

• How Can I Negotiate The Purchase?

• Deciding How Much To Offer?

• How Can I Summit The Offer?

• What Is Earnest Money?

• Who Will Negotiate The Final Purchase Price

This is why choosing the right agent does make a difference!

Single family home with a yard; a condominium with no lawn maintenance, a town home, a co-op or a zero lot line? If you aren’t sure, tell your real estate professional that you are open to several types. It’s fine to dream big, but now that you are serious about buying, it’s probably best to limit yourself to visiting areas that are within your budget. Generally speaking, it’s best not to buy the biggest or most expensive house in the neighborhood, especially for your first home purchase. That’s because you want to make sure you can get your money back at resale for any changes or improvements you make to the property.

It’s the rare lucky person who finds the perfect home within their budget. The key to the home search process is knowing what you’re looking for and distinguishing between “MUST HAVES” and “LIKES-TO-HAVES”. Before you go house hunting, brainstorm a list of what you absolutely must find in a home and decide which features are simply nice extras such as:

• What style or type of house do you want? What is an ideal price?

• Ranch, two-story, condominium, townhouse or duplex?

• What size do you want?

• Do you want a fireplace? Do you want a basement, garage?

• Do you want a yard, or would you prefer minimal yard work?

• Do you want a fenced backyard? Do you prefer hardwood, tile or carpet floors?

• Do you want a short drive to work or be close to family?

• Would you like a swimming pool or a hot tub?

• Do you want to live in a neighborhood with a homeowners’ association?

• Is there an architectural style you prefer? Number of floors?

• About how many square feet would suit your needs?

• How many bedrooms and baths do you need?

• Do you need to be near schools or public transportation?

• Are you open to a property that needs remodeling or renovation?

Once your list is made, go back over it and decide what is more important to your lifestyle. It may be privacy, creativity or recreation. Decide which items are musts and which you are willing to give up. Assign each item a priority so that you will know what to look for as you begin your house hunting journey.

*Examples of must-haves might include the number of bedrooms and bathrooms, proximity to work and other places you frequent, and access to your preferred school districts. You might also have a strong preference on the amount of outdoor space a house offers and whether it’s move in ready.

THINGS THAT SHOULDN’T BE ON YOUR MUST-HAVE LIST? The way a house is decorated, wellmanicured landscaping, a pool or anything else you can easily fix or install yourself.

Deciding where you want to live may be the single most important factor in choosing a home. Location affects your day-to-day living. Location to employment centers, shopping centers, schools, major traffic highways or toll ways and other attractions are important. Evaluate location carefully. Location of a property is one of the most significant influences on value. Your choice of location may be limited somewhat by the price you can afford.

Also make sure you consider such things as:

• Prices of properties

• Property taxes

• Distance to work, schools, shopping and entertainment

• Potential hazards such as flooding and noise from a nearby airport or highways

A single-family detached home is attractive to a lot of people because it typically provides more living space and land area than other types of living units (condominiums, townhouses and duplexes). Typically, the detached structure permits you greater freedom (less restrictions) on remodeling, expanding, painting and altering the appearances of the structure. If you don’t like spending leisure time on yard work, consider attached homes (condominiums, townhouses or duplexes). These homes are set on small lots and share common garden areas. They sometimes share membership in private recreational facilities such as fitness health centers, swimming, golf and tennis.

In selecting the type of home you would like, consider new versus preowned homes. Preowned homes usually have established yards and usually the neighborhood or subdivision is built-out. On the other hand, older homes may require more maintenance and need some repairs. New homes are not without problems. Although they require less maintenance in the first few years, you may have to put in landscaping and call the builder back to correct faults. If buildings are still active in the area, you may have to endure nearby construction. Finally, consider size and style. You may already have in mind a wood-and-glass contemporary lodge with sun decks or a two-story Victorian mansion with a cozy attic. Or you won’t know what you like until you see it! Either way, your REALTOR® will listen to your preferences and help you find the right home for you!

What are neighborhood demographics and median incomes? How is the school district? Don’t forget to check crime statistics, too. You can view neighborhood statistics at realtytrac.com. It’s also a good idea to get out and walk in the neighborhoods you are considering and get a feel for the areas. Are the other homes been well maintained? What is the traffic like? Are there any visual distractions, such as large power lines, water towers, signage, unsightly walls or unattractive commercial buildings? Visit the neighborhoods at different times of the day to see how traffic and noise levels might change.

Although you should plan to stay in your first home for a while to build equity and to maximize investment advantages, keep in mind that few people remain in their first home forever. First homes are often used as spring boards to future, more valuable real estate purchases. That’s why it is especially important to consider resale value when you choose your first home.

Many first-time buyers choose homes that need remodeling and put in “sweat equity”— work they perform themselves. While this can be a great idea from an investment standpoint, be sure to assess If professionals will be needed, have you accurately projected how much their services will cost? Will the needed improvements be good investments, or do you run the risk of over-improving the property when compared to surrounding homes?

How far do you want to travel to work? Calculate how much commuting time will be needed each day and how that will affect your schedule, budget and lifestyle.

Refer to this list if you need help down the line making an objective decision between two or more houses, as well as to remind you, of what’s really important, versus what could be luring you to pay more than necessary.

A REALTOR® can help you shop for a home, compare homes and compile your unique wish list to find the PERFECT HOME FOR YOU!

That said, here are a few recent facts (National Association of REALTORS® Profile of Home Buyers) about the search process that might put your experience in perspective:

• Almost 90% of Buyers use the Internet to search for homes

• The typical Buyer searches for 12 weeks and views 12 homes

• 81% of Buyers view REALTORS® as very useful in the search process

There are many benefits to starting the search process at a Real Estate Website. You can view many homes and their details, take video tours and access neighborhood information. Educating yourself on your local market and working with an experienced REALTOR® can help you narrow your priorities and make an informed decision about which home to choose.

However, it’s also important to view homes in person. While their property details may seem similar online, homes can actually be very different in terms of layout, design, workmanship ad other aspects.

In addition, you should ideally view homes with the help of an experienced and eagle-eyed REALTOR® who will notice things you might miss, provide expert analysis.

How do you know if a particular home is reasonably priced?

While no one can know for sure what will happen to housing values, if you choose to buy a home that meets your needs and priorities and that you will be happy living in for years to come. By the time you’re ready to make an offer, you should have done your homework. You should know what homes in your area are worth. And you should know how much home you can afford. https:// www.credit.com/loans/mortgage-questions/how-to-determine-your-monthly-housingbudget/

A purchase offer is a written contract which you sign and submit to the seller. It is accompanied by a certain amount of “earnest money” (a small good faith deposit to show you are serious about buying the home). The written purchase offer indicates the amount you are willing to give the seller for his or her property. If you are working with an experienced real estate agent, he or she will typically provide a standard purchase offer form which you can complete, sign and then hand over to the seller to sign.

SHOWS YOU ARE SERIOUS. Nothing is accomplished by going in with a low-ball offer (except sometimes, in the cases of foreclosures or when a home is significantly overpriced and has been on the market a long time). If you go in too low, you’re going to insult the Seller. Sellers love their homes and offering a lot less than what a property is worth won’t win you any points. If your research shows that the property is fairly priced, offer just slightly less than the listing price. If your offer does not elicit a meaningful counter-offer from the seller, your offer failed. How do you negotiate with someone who won’t respond? You can’t. You have to get them to believe that you are a serious buyer who will actually complete the transaction. To do this, you have to first get them to believe that you’re capable of arriving at a price that is agreeable to them. That starts the negotiation process.

*Ask your REALTOR® to create a list of comparable sales (or comps) for any house you are seriously considering. That way, you can see what similar properties that have SOLD for in the same neighborhood.

Your local Real Estate Association, working with Legal Counsel has developed the contracts that are used for transactions in your area. These contracts enable you to specify a Sale Price and also include many clauses for specifying various terms of purchase, such as the closing and possession dates, your deposit amount (Earnest Money) and other conditions.

You should carefully review these clauses with your REALTOR® to ensure that they express your desired offer. In addition to drawing up the Contract, your REALTOR® will be happy to address all your questions and the offer process.

But before you sign on the dotted line, you should make sure to review the contract thoroughly and understand every single clause.

Pay special attention to contingencies in the contract, which spell out situations when you can back out of the sale to help protect yourself in case something goes wrong. For instance, such scenarios can include if you discover that the home has serious physical defects or if your bank rescinds financing.

*Since your written offer forms the basis of a legal contract with the Seller, be thorough. There are some important details you should be sure to talk through with your REALTOR® and make sure are accurately included on your purchase offer, such as:

• The amount you are offering for the home and how you will pay the seller (cash,FHA/VA/ Conventional Financing, etc.)

• Concessions, such as any closing costs or other costs which you would like the Seller to pay

• The amount of earnest money you are offering

• The size of your down payment (This will be in your Pre-Approval Letter)

• The “Earnest Money” deposit. Your earnest money is typically put towards your closing costs; however, if you enter into a contract with the Seller and then breach that contract, you could stand to lose this money.

Once you have written the Offer, your REALTOR® will present it to the Seller’s Agent. At that point, the process, given that a home’s eventual sale price is subject to Supply and Demand, will depend on the kind of market you’re in. Currently, we are in a Seller’s Market. After the Seller receives your offer, Seller can Accept Your Offer, Reject It, or Counter it to initiate the negotiation process.

Successive Counter Offers, with deadlines for responding and meeting conditions, will be exchanged between you and the Seller by their REALTORS® until a mutually satisfactory pending agreement is reached or the negotiations breakdown.

Negotiations can involve many factors relating to different market conditions, homes and Sellers. Negotiating the transaction is usually the most complex aspect of buying a home. At the same time, it is the one that can involve the most creativity. That’s why it’s important to have an experienced and savvy REALTOR® who has successfully worked through many different transaction scenarios.

*That said what follows are a few strategies for negotiating a good deal in a Seller’s Market like this one, all of which involve:

• Presenting yourself as a serious Buyer

• Keeping your emotions in check

• Trying to understand respect the priorities of the Seller

• Being creative and

• Where necessary, willing to compromise to get the deal done

*If you can’t put together a deal on the first property you like, don’t worry. There will be many more homes for sale. It is VERY common to end up finding a home a week later that you like even more than the first. Not taking that first home might be a blessing in disguise.

The earnest money deposit is an important part of the Home Buying Process. It tells the Seller you’re a committed buyer and it helps fund your down payment.

Without earnest money, you could make offers on many homes, essentially taking them off the market until you decided which one you liked best. Sellers rarely accept offers without deposits. Assuming that all goes well and your offer is accepted by the Seller, the Earnest Money will go toward the down payment and closing costs. In many circumstances, you can get most of your deposit back if you discover something that you don’t like about the home.

The amount you’ll pay for the earnest money deposit will depend on a few factors, such as policies and limitations in your state, the current real estate market, and what the Seller requires. On average, you can expect to hand over 1-2% of the total purchase price as Earnest Money. In some real estate markets you may end up putting down more or less than the average amount. In a real estate market where homes aren’t selling quickly, the Seller may only require 1% or less for the earnest money deposit. In markets where demand is high, the seller may ask for a higher deposit, perhaps as much as 2-3%. You can sometimes win a bid if you give the seller a large deposit. In fact, the Seller may be willing to come down in price a little if you make a bigger deposit. However, you may wind up having to do some paperwork for your mortgage lender, and the bank may want to verify the source of the funds for larger deposits. It won’t be a problem if you can show that you’ve had the money for at least 60 days.

The earnest money deposit is an important part of the Home Buying Process. It tells the Seller you’re a committed buyer and it helps fund your down payment.

Without earnest money, you could make offers on many homes, essentially taking them off the market until you decided which one you liked best. Sellers rarely accept offers without deposits. Assuming that all goes well and your offer is accepted by the Seller, the Earnest Money will go toward the down payment and closing costs. In many circumstances, you can get most of your deposit back if you discover something that you don’t like about the home.

The amount you’ll pay for the earnest money deposit will depend on a few factors, such as policies and limitations in your state, the current real estate market, and what the Seller requires. On average, you can expect to hand over 1-2% of the total purchase price as Earnest Money. In some real estate markets you may end up putting down more or less than the average amount. In a real estate market where homes aren’t selling quickly, the Seller may only require 1% or less for the earnest money deposit. In markets where demand is high, the seller may ask for a higher deposit, perhaps as much as 2-3%. You can sometimes win a bid if you give the seller a large deposit. In fact, the Seller may be willing to come down in price a little if you make a bigger deposit. However, you may wind up having to do some paperwork for your mortgage lender, and the bank may want to verify the source of the funds for larger deposits. It won’t be a problem if you can show that you’ve had the money for at least 60 days.

In most cases, after your offer is accepted and you sign the purchase agreement, you give your Earnest Money deposit to the Seller’s Real Estate Brokerage or Attorney and in some instances the Buyer’s Real Estate Brokerage or Attorney may hold the Earnest Money. Always check the credentials of the firm or broker taking the deposit and verify that the funds will be held in escrow. Never give the Earnest Money to the Seller; it could be difficult or impossible to get it back if something goes wrong.

After turning over the deposit, the funds are held in an escrow account until the home sale is in the final stages. Once everything is ready, the funds are released from escrow and applied to your down payment.

If the deal falls through, whoever holds the deposit determines whether you should get the money back under the terms of the purchase agreement. Make sure that the purchase agreement covers how a refund is handled. To be on the safe side, make sure the purchase agreement covers how a refund would be handled. Keep in mind that even if you are pre-approved for a mortgage loan, you can be declined when you apply for one. In such cases, standard contracts allow you to recover your earnest money deposit. You can also usually get your money back if you find problems with the property. Your attorney will take care of this.

The seller accepted your offer—CONGRATS! Your offer now becomes a contract and you are on your way to owning the home. But before you sign on the dotted line, you should make sure to review the contract thoroughly and understand every single clause.

Pay special attention to contingencies in the contract, which spell out situations when you can back out of the sale to help protect yourself in case something goes wrong. For instance, such scenarios can include if you discover that the home has serious physical defects or if your bank rescinds financing. Speaking of defects, now is also the time when you’ll get the home inspected.

If there are issues, such as a non-functioning fireplace or an old boiler, you may be able to ask for a price reduction to help cover the cost of repairs. And if you find any deal breakers, such as an unstable foundation or serious mold, you have the option of backing out now!

Once your Inspector confirms that there are no big defects that could affect the home’s value, you’ll submit a mortgage application. Review all closing costs—the ones you’ve hopefully saved up 3% to pay for, which might include an attorney’s fee, title insurance and partial property taxes—before you sign the contract.

While it’s not uncommon for prospective Buyers to believe the deal is sealed at the signing, in many cases the negotiations begin afterward.

If you’ve conducted a home inspection, you can ask the Sellers for a cash-back credit at the close of escrow, which can help you, complete the project yourself. You can also ask the Seller for a credit to fix certain issues in the interest of offsetting closing costs. Your attorney will address any issues you have with the Seller’s attorney. See https://www.credit.com/loans/mortgage-questions/ how-to-get-home-appraisal-and-homeinspection/

Be sure to look at ease when walking the property at the inspection — the last thing you want is to mention a gut renovation you’d like only to have the Sellers refuse to make needed repairs. And if you haven’t already, now is the time to check into getting House Insurance. Real estate insurance protects owners in the event of catastrophe. If something goes wrong, insurance can be the bargain of a lifetime.

included in the coverage if they are destroyed by an insured event or stolen. High-value items, like jewelry, usually have coverage limits. You can purchase additional coverage, called riders, for such items. Umbrella policies provide additional liability coverage.

Almost all lenders will require you to maintain adequate home insurance coverage over the life of the loan to protect the lender’s investment in the property, also known as collateral. Depending on where you live, some lenders may also require you to carry additional flood or earthquake coverage. Although premiums are usually included in the mortgage payments, you can shop for homeowner insurance on your own. Homeowner insurance gives you coverage and financial protection for damage to your property caused by disasters and calamities (except for floods and earthquakes, which generally require separate policies or riders), and liability for injuries and damage you or your pets cause to other people. Policies usually do not cover routine wear and tear to the home, its necessary components or appliances. Personal belongings, like furniture and clothes, are generally

Your insurance agent will help you with the details, limitations and amounts needed, but here are some guidelines to consider.

It’s usually advisable to insure your home for the total amount that it would take to rebuild it. When you shop for homeowner insurance, make sure you consider and compare different coverage types, limits and deductibles. In case you ever need to make a claim, it’s a good idea to take an inventory of all the items in your home. Make a written list of your possessions, including any sales receipts or appraisals that you have. Record the serial numbers of appliances and electronic equipment. Take photos and/or videotape of the rooms, garage, closets, storage spaces, drawers and cabinets. Keep the inventory records in a separate location, such as a safety deposit box, for safe keeping. Be sure to update the list when you make new purchases.

Just as homeowner’s insurance covers the property against damage or repair based on your designated deductible, a home warranty helps protect your home system components and appliances against costly repairs or replacements. A home warranty is a renewable service contract that covers many of the most frequently occurring breakdowns of home system components and appliances that are not usually covered by homeowner insurance. Home warranties offer coverage of many of the critical major system components and appliances in a home that generally are of a high cost to repair or replace due to normal wear and tear.

Breakdowns are inevitable and always seem to happen at the worst possible time for your wallet and for your schedule. A home warranty can offer you quick relief, sensible protection and affordable coverage that could save you up to hundreds of dollars and hours of frustration. Firsttime homebuyers often stretch themselves financially to afford the down payment and monthly mortgage costs. Being hit with the high costs of an appliance or home system component breakdown, repair and replacement soon after moving in can be financially overwhelming.

The closing is the final meeting, usually with your real estate agent, sellers (although the sellers may complete paperwork separately), the closing agent or attorney and sometimes a mortgage representative. This is where you sign the necessary final paperwork including settlement, make the monetary transactions and take possession of the house immediately or in a designated time period shortly thereafter. At closing, the property is officially transferred from the seller to the buyer. You will be asked to sign and initial numerous papers, including the final financial settlement amounts.

Your real estate professional, lender and/or attorney can help you estimate the amount of closing fees you will incur well in advance so you can have the correct amount of money on hand. Note that you will most likely need several checks payable to different entities.

On closing day, after your final walk through usually one hour before closing (you want to make sure the property is in the same condition as when you placed your offer), bring your photo I.D., as well as any paperwork you received throughout the home-buying process, including insurance and home inspection certificates.

Prior to closing, buyers usually have an opportunity for a final walk-through of the property to inspect its condition and to ensure that any contractual repairs were made. At closing, you will receive the title to the property and your purchase will become public record for tax purposes.

Typical closing costs include fees: some paid by the seller and some by you, the buyer:

• The appraisal fee

• Attorney or closing agent’s fee

• Survey fee

• Any loan discount fee (points)

• Inspection fees

• Title fees

• Title insurance and closing fees

• Proof of homeowner’s insurance with the mortgage company as designated beneficiaries

Price Range: ________________

Area: _______________________

Detached/Attached: ______________

House Style(s): _____________________

Age of Property: ___________________

Lot Size: _____________

Square Footage: _______

Number of Bedrooms: _______

Number of Bathrooms: ______

Garage: ____________________

SPECIFIC FEATURES

(e.g., view, large lot, pool, fireplace, basement, garage size, distance to school, additional room preferences, etc.)

MAIN REQUIREMENTS

Price Range: Area: Detached/Attached: House Style(s): Age of Property:

Lot Size: Square Footage:

Number of Bedrooms:

Number of Bathrooms: Garage:

MAIN REQUIREMENTS

Price Range: Area: Detached/Attached: House Style(s): Age of Property:

Lot Size: Square Footage:

Number of Bedrooms:

Number of Bathrooms: Garage:

SPECIFIC FEATURES

(e.g., view, large lot, pool, fireplace, basement, garage size, distance to school, additional room preferences, etc.)

SPECIFIC FEATURES

(e.g., view, large lot, pool, fireplace, basement, garage size, distance to school, additional room preferences, etc.)

ADDITIONAL COMMENTS

ADDITIONAL COMMENTS

ADDRESS

PRICE LOCATION

NUMBER OF BEDROOMS

NUMBER OF BATHROOMS

PARKING ACCOMODATIONS

TOTAL SQUARE FEET

KITCHEN SIZE & LAYOUT

FLOOR PLAN

LIVING ROOM

FORMAL DINING ROOM

POOL/SPA/HOT TUB

FENCED YARD

PATIO/PORCH

LOT SIZE

LANDSCAPING

STORAGE: CLOSETS/OTHER

HOA FEES

NUMBER OF FLOORS

BASEMENT/CRAWL SPACE

SCHOOLS

CONDITION

COMMUTE TIME

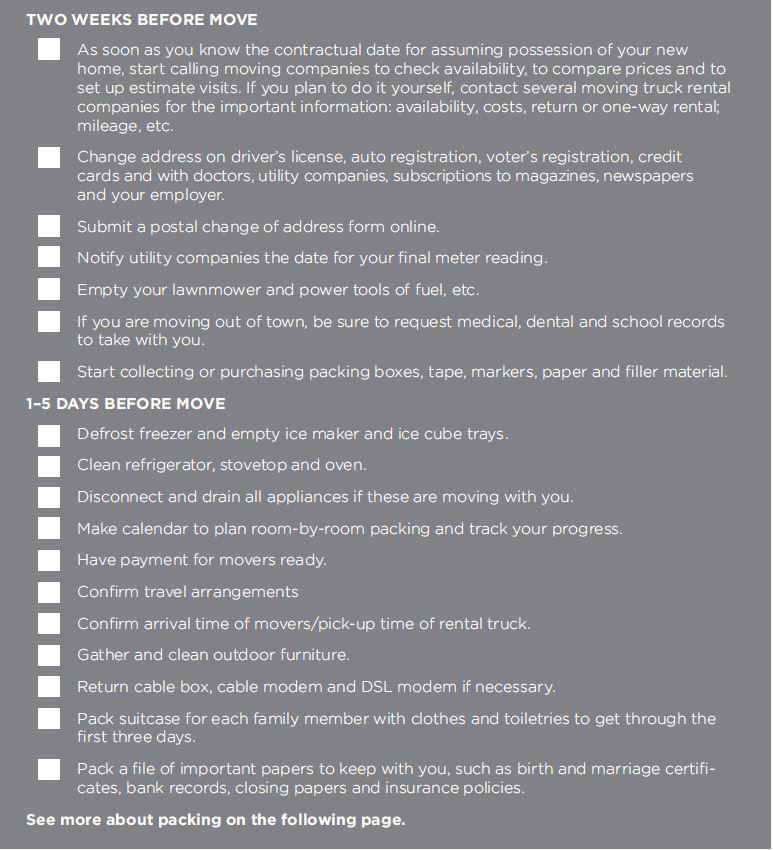

CURB APPEAL