TAMARA GARCIA

REALTOR-ASSOCIATE®

Tamara was born and raised in Broken Arrow and graduated from Broken Arrow High School; she attended the University of Oklahoma as a Business and Marketing Major before attaining her real estate license in 2023. She is familiar with the Tulsa area, and its suburbs, including Coweta, Claremore, Sapulpa, and her hometown, Broken Arrow. She focuses on residential sales.

Prior to joining Chinowth and Cohen, Tamara was a valued Manager in the Retail Sales industry for over twenty years; managing large retail stores with multi-million-dollar production values. Her background in sales, transactions, and management was where she found an eye for design and staging, which naturally lead her to a new career as a real estate agent. “Finding the perfect home for my clients is rather similar to helping a retail customer who walks into a store unsure of how to ‘dress to impress.’ The customer knows what he wants to accomplish but needs help finding that perfect fit in a plethora of choices. Being available for a client’s needs is the key to finding the ideal trousseau, metaphorically speaking.” Customer service is always foremost on her mind as she searches for ideal properties and creates smooth transactions for both buyers and sellers alike.

Additionally, Tamara believes that partnering with the community is a personal strength, creating connections directly, translates to bringing clients together with their ideal surroundings. Consequently, she has direct links to many sporting and educational associations having coached the Broken Arrow Cheerleading squads for many years and these days, during her off hours, you are likely to find her volunteering with children’s sporting events revolving throughout the year from football and basketball to soccer, and little-league baseball fields during spring seasons.

2625 S. Elm Pl | Broken Arrow | OK 74012

“WE WERE SO THANKFUL AND APPRECIATIVE OF YOUR HELP AND HOW DILIGENTLY YOU WORKED FOR US! VERY PROFESSIONAL AND DID EVERYTHING YOU COULD TO HELP US FIND OUR HOME! WOULD HIGHLY RECOMMEND YOU FOR ANYONE ELSE LOOKING!”

- CLIENT 1

“TAMARA HELPED ME FIND THE PLACE I’LL BE SIGNING A LEASE ON TODAY. SHE WAS PROFESSIONAL AND SHOWED UP EARLY TO OUR APPOINTMENTS. SHE WAS A BIG HELP.”

- CLIENT 2

“I WORKED FOR TAMARA FOR SEVERAL YEARS. SHE HELPED ME GROW NOT ONLY PROFESSIONALLY BUT PERSONALLY AS WELL. SHE HAS ALWAYS SHOWN A GREAT BALANCE OF LEADERSHIP, TECHNICAL SKILLS AND PROCESS IMPROVEMENT. TAMARA’S ACCOMPLISHMENTS SPEAK TO HER COMMITMENT, DILIGENCE, TENACITY AND COMPETITIVE DRIVE.”

- CLIENT 3

tgarcia@cctulsa.com

(918) 766-7959

tgarcia.ccoklahoma.com

Tamara Garcia - Chinowth & Cohen Realtors

@tamara_michelle0910

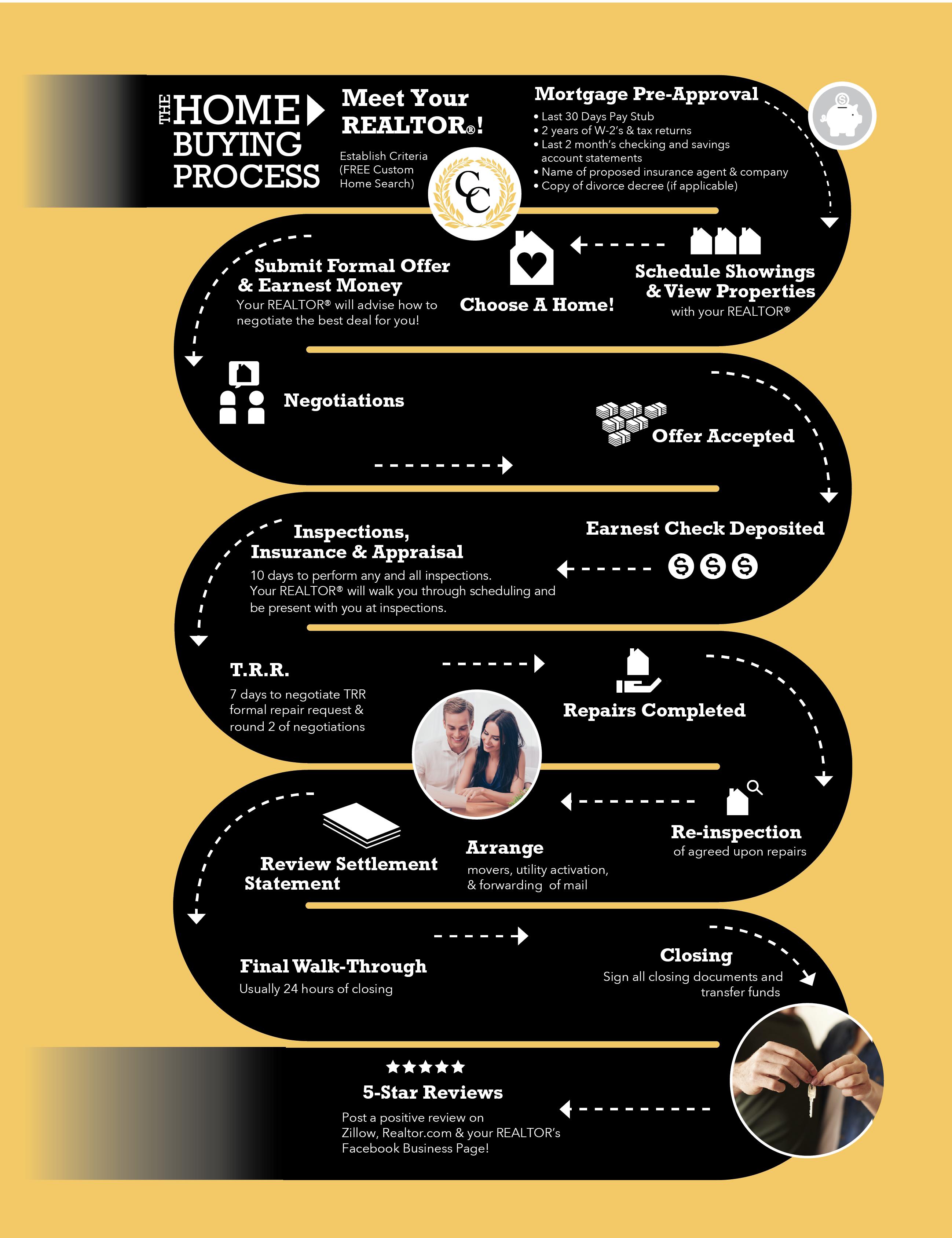

Congratulations on your decision to buy a home! It’s a challenging project, and there are many ways a professional can help. Here are some of the many ways you may benefit from working with a REALTOR®

Your REALTOR® has thousands of homes to choose from through the Multiple Listing Service (MLS), so you’re more likely to find the home that’s just right for you and find it quicker. In fact, a majority of the homes for sale are listed by REALTORS® and aren’t available to you unless you are working with a REALTOR® Networking with other realtors to find out about upcoming listings is part of the service provided.

Unfortunately, it’s true. Some transactions fall apart before closing. An experienced REALTOR® may be able to resolve problems and see your transaction through to a successful closing.

New home subdivisions will welcome you and your REALTOR®

If you’re interested in buying a new home, take your agent with you on your first visit to each subdivision. Your professional REALTOR® is an important source of information who can supply background on the builder, nearby subdivisions, and the local community, as well as ensuring your interests are out first.

You use a professional for your legal, financial and health needs. Why gamble on what may be your biggest investment without a professional at your side?

If you consider a “For Sale By Owner,” take your REALTOR® along to help negotiate the contract.

You may have more protection from legal and financial liability, especially as real estate transactions become more complicated.

Your experienced REALTOR ® will negotiate and prepare the purchase contract for you and assist you throughout the escrow process.

Real Estate is a commission-only world, however, they know when they lead with integrity and do what is best for the client above all else, you’ll send every friend, family member, and co-worker their way, which is worth so much more!

Zillow, Realtor.com, and other home sites are great resources for the public to find listings for sale, however, your realtor can provide you with more accurate and detailed information on properties from the Multiple Listings Service (MLS) that is only available to Realtors. In a hot market, it’s imperative that you take advantage of a custom search from your realtor to ensure you’re one of the first to know about new properties hitting the market.

If a home is for sale, your realtor can help! Whether it’s their listing, one of their competitor’s listings, or even a property that is not listed with a Realtor, your realtor is more than happy to schedule all showings for you, furnish market data, assist you in making an offer, and provide strategic negotiation tips.

From pre-qualification with a trusted lender, to scheduling all showings and inspections, to finalizing the closing, your realtor coordinates each step of the home-buying process for you.

1. PAYMENT HISTORY Do you pay your debts on time?

2. AMOUNT OF DEBT Less is best.

3. CREDIT HISTORY The longer the better.

4. AMOUNT OF NEW CREDIT New credit is considered more risky!

5. TYPES OF CREDIT i.e. installment loans, credit cards, and a mortgage.

Credit scores range between 200 and 800. Scores above 640 are considered desirable for obtaining a mortgage. For more on evaluating and understanding your credit score, go to www.myfico.com.

• Pay your mortgage or rent payments on time

• Stay current on all outstanding accounts

• Continue working for the same employer

• Stay with your current insurance company

• Notify your Lender immediately if any situation arises that could possibly affect your income, assets, or credit

• Don’t switch bank accounts

• Don’t transfer balances between accounts

• Don’t increase the balance of any credit cards

• Don’t consolidate debt, including credit card debt

• Don’t close any accounts, including credit card accounts

• Last 30 days paystub

• Copy of last 2 years’ W-2s and tax returns

• Most recent 2 month’s checking and savings account statements

• Name of homeowner’s insurance company

• Letter explaining derogatory credit or bankruptcy (if applicable)

• Copy of Divorce Decree and Property Settlement (if applicable)

• Don’t apply for ANY credit (new vehicle, furniture, appliances, etc)

• Don’t change your job, employer, the way you are paid, or become self-employed

• Don’t pay off charge-off or collection accounts before consulting with your lender

• Don’t make large deposits without the ability to document the source of the funds

FIND A REALTOR to represent your interests in the transaction. Communication is key. We will be a team, when you have a need or concern please tell me. I will assist you in purchasing a home: for sale by owner, marketed by a realty company, new construction...

FULL LOAN APPROVAL from a mortgage banker. Most sellers are requiring a pre-approval letter from a lender before looking at an offer on their home. Getting fully approved puts you ahead of the game. (Have a copy emailed to me.) Your loan officer will let you know how much you qualify for and can give you a good idea of payments, closing costs, and other expenses you can expect along the way.

LET’S GO SHOPPING!! Now that you know how much you want to spend, we can work together to find the perfect home for you. Don’t forget your checkbook! (Yes, you will need it for earnest money.

MAKING AN OFFER? Once you have found a home you love you will want to put an offer in. I will look up the comps in the area and disclosure for the property. Then we will want to sit down and discuss the details of your offer: purchase price, financing option or cash, earnest money amount, close date, additional items to be left on premise, things to be removed, home warranty, contingencies, any other requirements or items to be paid by the seller.

EARNEST MONEY is a check or money order that is given to secure the property. It is only cashed once an agreement has been reached by both parties. It is held in an escrow account until closing. At closing it will go towards to purchase of the home. You can lose this earnest money if you do something outside of the confines of the contract so remember when your Realtor, the closer or lender ask you for information or decisions, you need to respond as quickly as possible. If there is a reason you can’t respond, then you need to discuss with us so we can help or do an extension if necessary/doable to protect you.

NEGOTIATIONS: Once the offer is submitted, the seller can do one of three things: accept the offer as is, counter offer, or reject the offer. Here is where I come in handy...

INSPECTION: Now that you are under contract, your time period to do inspections begins. I will assist in scheduling the inspections to fit your schedule. Most homes have minor faults, it does not mean they are uninhabitable. You need to be aware of any issues you can take care of on your own and what if any you would like to ask that the seller be responsible for taking care of before closing. (Note: during this time your financing must get locked in and appraisal ordered.)

REPAIR REQUEST: You have a specified amount of time to request any repairs. You must submit in writing all repair requests to the sellers. The sellers will then do one of three things: they will sign off on all requested repairs, counter offer on the repairs, or they will refuse to do the repairs.

RE-INSPECTION: This may be done by the inspector for a fee or by yourself, unless specified by your lender. (ie: sometimes you must pay an appraiser to come out to re-inspect a required repair.)

CLOSING: Have the funds wired to the title company for the amount specified by your lender. When you get the encrypted email call me or your closer, to make sure it goes to the right place. Get ready to sign a stack of papers... Once they are all signed and the funding has come through...

CONGRATULATIONS!!! You are the proud new owner of a home!!!

Go to open houses, enjoy looking, and I can get information on any house you like!

Just remember to tell the agents at the open house as soon as you walk in that you are working with me and write my information down at opens, not yours. That way the Realtors can contact me for feedback and will not bug you.

Increase your chances of getting your dream house instead of losing it to another buyer with these easy steps.

1. Get prequalified for a mortgage. You’ll be able to make a firm commitment to buy and make your offer more desirable to the seller.

2. Stay in close touch with your real estate associate to find out first about new listings that come on the market, and be ready to go see a house as soon as it goes on the market.

3. Scout out new listings yourself. Look at Internet sites, newspaper ads, and drive by the neighborhood frequently. Maybe you’ll see a brand-new “for sale” sign before anyone else. If you do, call me immediately.

4. Be ready to make a decision. Spend lots of time in advance deciding what you must have so you won’t be unsure when you have the chance to make an offer. (See your wish list and must-haves attached in this packet.)

5. Bid competitively. You may not want to start out offering the absolute highest price you can afford, but make your offer reflect how much you want this home. Don’t try to go too low to get a deal. In a tight market, you’ll lose out.

6. Keep contingencies to a minimum. Restrictions, such as needing to sell your home before you move or wanting to delay the closing until a certain date, can make your offer unappealing. In a tight market, you’ll probably be able to sell your house rapidly. Another option, talk to your lender about getting a bridge loan to cover both mortgages for a short period.

7. Don’t get caught in a buying frenzy. Just because there’s competition doesn’t mean you should just buy anything. Even though you may want to make sure your offer is attractive, don’t just neglect inspections

Earnest money is a check written at time of offer that proves to a seller you’re serious about the purchase. Earnest money is held in escrow until closing and then applied towards the purchase. Earnest money usually ranges from $500–$5,000 depending on the price of the home.

It’s your right to choose any inspector you dream qualified, even if that’s your Uncle Billy Bob. If you don’t already have an inspector in mind, I will recommend and even schedule on your behalf a group of highly skilled, experienced, and licensed inspectors that put your best interest first. Inspections typically occur in the first 7–10 days after having a fully executed contract and can range from $250–$1,500 depending on the home’s features (pool, septic, chimney, etc) and depending on how in depth you want to go.

If a mortgage is involved, your lender must order an appraisal to ensure the house is worth the amount it’s lending. This typically costs between $450–$650 and is paid directly to your lender within the first five days of the contract period.

A service contract that covers the repair or replacement of important home system components and appliances that break down over time. That means whether it’s you’re A/C unit burning up in the summer, your heater failing in the winter or any number of other covered systems and appliances calling it quits, you and your family will have one less thing to worry about.

Breakdowns are inevitable—home system components and appliances simply wear out over time. Unlike most homeowners insurance, a home warranty plan protects your budget by covering an unexpected repair or replacement of crucial items when they stop working due to normal wear and tear, saving you money in the long run. Think of it like this…

HOMEOWNERS INSURANCE COVERS THINGS THAT MIGHT HAPPEN

Fire damage, Hail and Wind damage. Theft & Vandalism

HOME WARRANTY COVERS THINGS THAT WILL HAPPEN

Breakdowns of HVAC systems, Water Heater, Oven, Dishwasher, Plumbing & More

Repair or replacement of key home systems and appliances can be expensive. Talk with me about the average cost of a home warranty and strategies for including one in the contract so that you’re protected from unexpected problems in your first year of home ownership.

1

2.

3.

4.

5.

6.

Be sure to inform me if you want any of these additional inspections preformed since they are an additional cost and may even require different inspectors to be scheduled. It is also important to note that the inspection only covers the main dwelling, therefore shops, detached garages, pool house, and other structures are not included unless specifically requested and an additional fee will likely be applied.

No! Picking an experienced and thorough inspector is crucial. It’s also important to note that ONLY structural engineers can make structural recommendations. Beware of general home inspectors claiming to do structural inspections. In the state of Oklahoma they are not licensed to suggest remedies and will typically refer you to an engineer if there is something of concern which might end up costing you more in the long run.

Talk with me about trusted partners to help service your home inspections needs.

Closing costs are fees associated at the closing of a real estate transaction when the title of the property is transferred from the seller to the buyer. Closing costs typically range from 3–6% of the purchase price and are incurred by both parties. Here are some common closing costs:

• A fee for running your credit report.

• A loan origination fee, which lenders charge for processing the loan paperwork for you.

• Attorney fees.

• Discount points, which are fees you pay in exchange for a lower interest rate.

• Survey fee, which covers the cost of verifying property lines.

• Title search fees, which pay for a background check on the title to make sure there aren’t things such as unpaid mortgages or liens on the property.

• Title insurance, which protects the buyer and lender in case the title isn’t clean. (If combo isn’t purchased)

• Escrow deposit, which pays a couple of months of property taxes, homeowner insurance, and private mortgage insurance.

• Prorations for your share of the homeowners’ association fees.

• Recording fee, which is paid to the county in exchange for recording the new land records.

Lenders are required by law to give you a Loan Estimate, which will include what the closing costs on your home should be. At least three business days before closing, the lender will give you a Closing Disclosure statement, which outlines exact closing fees. This Closing Disclosure statement must be signed by the buyer the same day it is issued to avoid a delay in closing.

1. If possible, move on a weekday while banks, utility companies, and government offices are open.

2. Use sheets, blankets, and towels to separate pictures, dishes, and other fragile objects. This cuts down on space and moving supplies. Socks can be slipped around the wine glasses to help pad the delicate stems.

3. Instead of wrapping each plate in newspaper or costly bubble wrap, alternate the real plates with Styrofoam disposable plates and—voila! Instant padding. Genius right?

4. Packing plates vertically, rather than flat stacked.

5. Mark each box with its contents and destination room so that you an your helpers will know where each box belongs at your new pad.

6. Fill two “OPEN ME FIRST” boxes containing snacks, instant coffee, tea bags, soap, toilet paper, toothpaste and brushes, medicine and toiletry items, a flashlight, tool kit, paper plates, cups, utensils, paper towels, and any other items you cannot live without.

7. Break out the garbage bags and pull one bag up around a cluster of your hanging clothes, then tie the open end by the hangers.

8. Have suitcases on wheels? Use them for packing heavy things like books.

9. Take pictures of which TV cable goes to which input on the different components, or how certain knick-knacks are displayed on the bookshelves to serve as an unpacking guide. Photos may also protect your goods for insurance purposes should anything get damaged in the move.

10. In the new home, resist the temptation to pile box in the garage, attic, or back closet, with a promise to get to them later. If a boxful of stuff is so unnecessary that a year could pass without needing the contents, maybe it’s time to ditch the contents before the move. Otherwise, you risk forgetting where you put important things, or end up parking the car outside all winter.

11. The desire to relax is strong. The coffee table pushed up against the sofa looks so inviting, but those boxes aren’t going to unpack themselves. Resist the urge to derail your momentum. Otherwise, those boxes will just stand over your head. Unpack the TV last, sink deeply into that comfy couch, and revel in the knowledge of a well-done moving job any pro would envy.

12. If moving locally, arrange for your pets to stay with a friend or family member as animals can become confused and frightened during the move.