WHY DUBAI?

Dubai is one of the most iconic cities in the world.

A magnet for multinational corporations and world-class luxury brands, the emirate is also a major tourist destination with landmark attractions like the Burj Khalifa.

It is supported by cutting-edge infrastructure like the Dubai Metro, elite healthcare and high-end education.

Once part of antiquity’s Silk Road, Dubai has continued to be a vital trade hub connecting Asia and Europe via facilities like the Dubai International Airport and world-class ports.

Emirates that make up the U.A.E.

17.15 Million

International tourists in 2023

The Busiest Airport in the World

Since 2022

~3.64 Million

Dubai’s population as of 2023

1st Place

In the Middle East as per the Global City Index

The Burj Khalifa

The world’s tallest tower

The Burj Khalifa

The world’s tallest tower

The Burj Al Arab

The Burj Al Arab

The Museum of the Future

The Museum of the Future

Dubai International Airport

Dubai International Airport

• In 2002, Dubai became the first emirate in the U.A.E. to pass laws allowing freehold ownership for foreigners

• Its population then was ~1.5 million, one-third of today

• Initial market growth was fueled by lower-than-global property prices, high ROIs and long-term leases

The 2008 financial crisis saw a sharp drop in prices and demand – a shock to real estate. Instead, critical infrastructure projects continued apace, creating the imperative basis for future growth.

The Dubai Metro Served 260 million passengers in

The Dubai Metro Served 260 million passengers in

The 2010s decade saw Dubai rebound:

Prominent neighbourhoods like Arabian Ranches 2, Damac Hills, and more opened

Peaks and troughs in the market – a sign of maturation

Off-plan emerged, with over AED 200 billion (~$54.45 billion) in sales

• Dubai real estate weathered the unprecedented downturn well, especially compared globally

• Supplemented by continued tourist inflow and government support

• One of the earliest places in the world to reopen following the pandemic

Dubai government economic stimulus

8.8 million

Hotel guest arrivals

100%

U.A.E. citizen COVID-19 vaccination rate

$70 billion

U.A.E. government economic stimulus

In perhaps the most overt fallout of the pandemic, Expo 2020 was delayed a full 12 months – and still took place spectacularly.

• Over 24 million visits

• Visitors from 178 countries

• Sustained demand for short-term residential units

• 2021 residential sales transactions – AED 151.07 billion (~$41.13 billion), a 12-year high

Expo 2020

World Expo hosted by Dubai, in the UAE

Expo 2020

World Expo hosted by Dubai, in the UAE

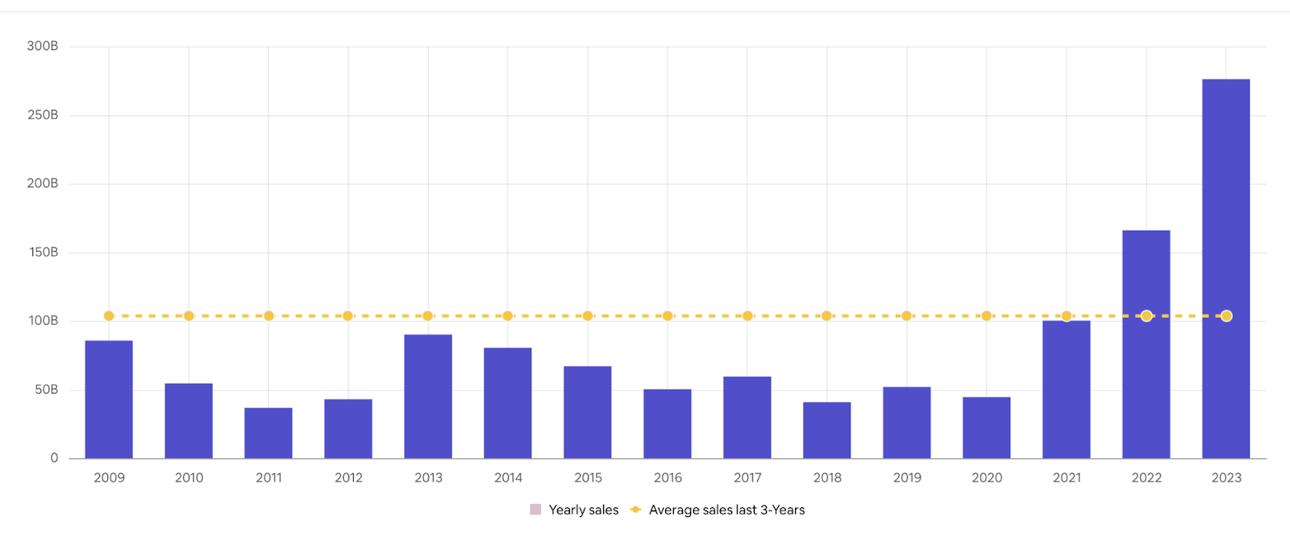

• In 2022, a record-breaking AED 265.58 billion (approximately $72.3 billion) in sales value was recorded from over 97,000 transactions – a 61% gain from 2021

• Dubai significantly outperformed global markets. As an example, while Paris and Singapore at one point offered ~2.5% yields, prime areas in Dubai could fetch up to 8%

• The post-pandemic era is now the best-performing period in Dubai real estate history

Bluewaters Dubai

Sales value in all areas

AED 411.74 billion (~$112.1 billion)

Sales value in 2023 – the highest ever

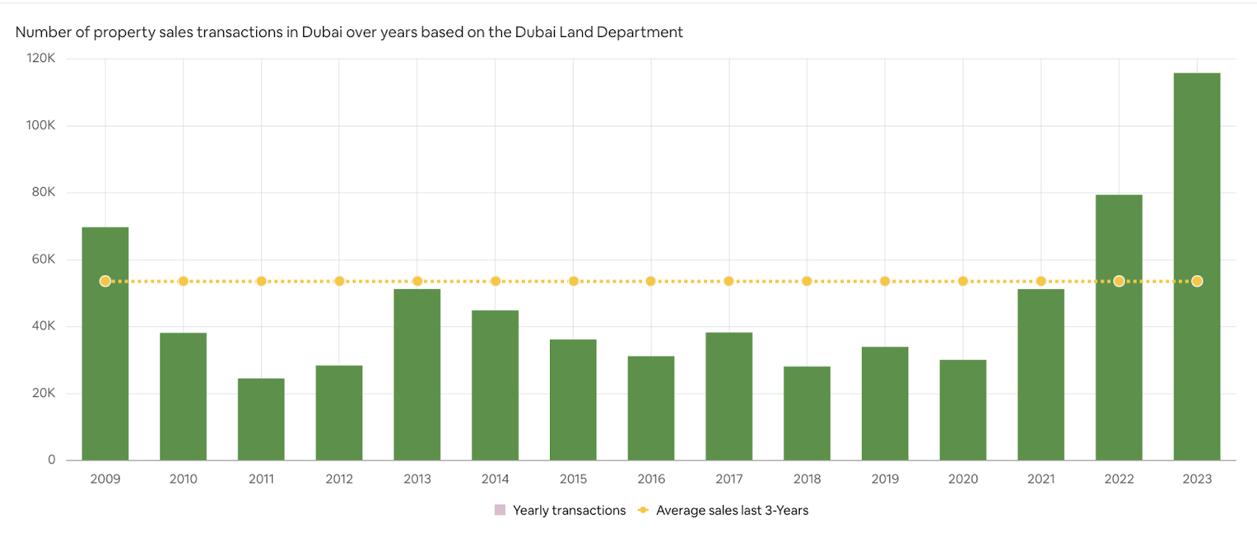

133,134 Transactions

The highest ever recorded

Unprecedented demand

Dubai sales values through the years, with a sharp increase upwards from 2021. Courtesy DXB Interact. Dubai sales volume through the years, with a sharp increase upwards from 2021. Courtesy DXB Interact.

Dubai sales volume through the years, with a sharp increase upwards from 2021. Courtesy DXB Interact.

~40,000

Units expected in 2024

~36,000

Units expected in 2025

~31,000

Units expected in 2026

Despite this, supply is not expected to catch demand. Resultantly, prices to grow steadily at 3-8% per year.

Initial residential prices on the Palm Jumeirah in 2001

166

Palm Jumeirah properties that sold above $10 million, which constituted 38.5% of all Dubai homes sold above $10 million

The most expensive home sold in Dubai in 2023 was on the Palm Jumeirah

Palm Jumeirah

Dubai's iconic, palm tree-shaped island

Palm Jumeirah

Dubai's iconic, palm tree-shaped island

2003

First launched

AED 209 million (~$56.9 million)

Plot of land recently sold in the area

AED 750 million (~$204.195 million)

Dubai’s most expensive villa, currently for sale

Emirates Hills

One of Dubai's most prestigious gated communities

5 new projects in 2004; now one of the city’s most bustling neighbourhoods

Dubai Marina Arabian Ranches

829 homes handed over in 2005; now accompanied by Arabian Ranches II and III

Arabian Ranches

829 homes handed over in 2005; now accompanied by Arabian Ranches II and III

Jumeirah Golf Estates

Luxury residential golf living with a course on the DP World Tour

Jumeirah Golf Estates

Luxury residential golf living with a course on the DP World Tour

Initial Palm Jebel Ali construction

2

Two times the size of the Palm Jumeirah

7 Connected islands

Palm Jebel Ali vs. Palm Jumeirah

Palm Jumeirah Palm Jebel Ali

Residences

4000 luxury properties

1200 planned villas so far

Annual ROI

3.34% (as of Q3 2023)

7 to 9% (expected)

Recent residency and visa changes in the U.A.E. have attracted an influx of new (and particularly high-net-worth) residents:

1. The Golden Visa

• Aims to attract more long-term residents and investment into the country

• 10 years and automatically renewable

• Can qualify upon a minimum AED 2 million (~$544,521) property investment

• Also available for:

• Skilled professionals

• Entrepreneurs

• Scientists/researchers

• Exceptional talents in culture, sports, art and more

• High-performing students

2. The Business Entry Visa

Eases entry regulations for investors and entrepreneurs, who no longer need sponsors or hosts to obtain a visa

5. The Residence Visa for Retired Expatriates

Valid for 5 years for those 55 or older; comes with a list of financial prerequisites to choose from

3. The 5-Year, Multi-Entry Tourist Visa

Allows tourists to stay within the U.A.E. for a maximum of 90 continuous days sans sponsorship

6. The 1-Year Remote Work Visa

Enables individuals to live in the U.A.E. but work for a company that does not operate in the country

4. The 5-Year Green Visa

Available to:

• Investors or partners in commercial activities

• Freelancers and those who are self-employed; no sponsor required

• Skilled employees

7. Unmarried Couples Law

Such couples are now legally allowed to reside together

• 4500 new millionaires in the U.A.E. by the end of 2023 – a number second only to Australia

• On the back of the Golden Visa, other new visas and more confidence in the market

• Taking advantage of:

o No income tax

o U.A.E.’s 100% foreign ownership facility

o Low corporate tax

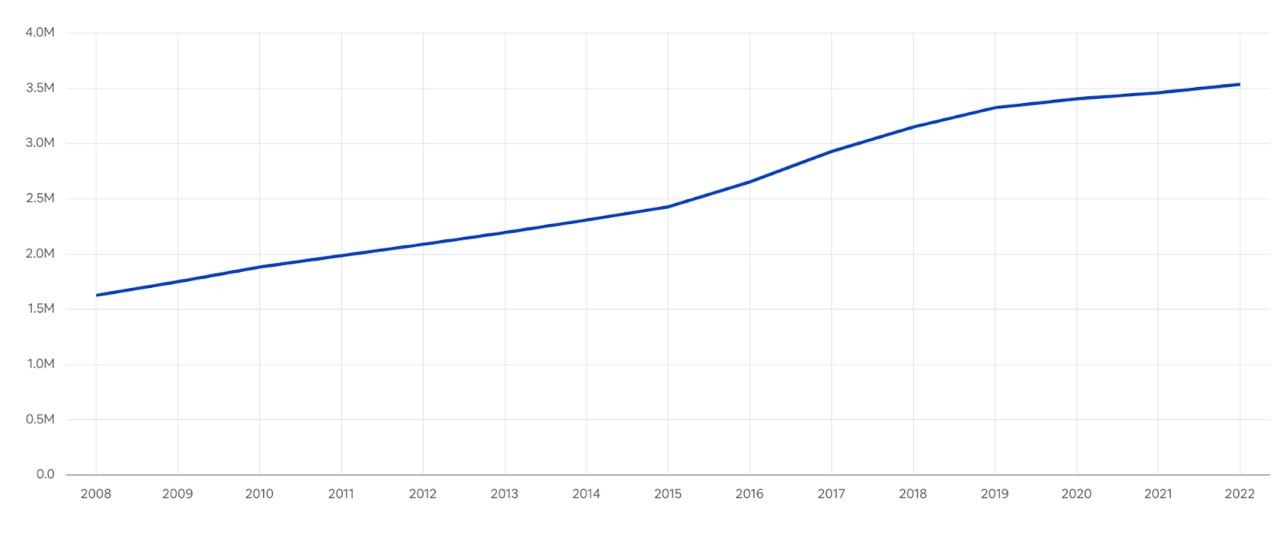

Dubai's Population Over the Years

~1.5 million

Dubai's population in 2002

~3.64 million

Dubai's population in 2023

~6 million

Dubai's population by 2033

• Fueled by COP28 and future-thinking plans like Dubai 2040

• Up to 80% of investors are now prioritising sustainability

• 70% of foreign investors are willing to pay a premium for sustainable properties

Privacy x Space

• Fueled by the pandemic

• Recognised by developers in upcoming projects

Waterfront Living

• A mainstay in Dubai real estate

• Set to grow even further with mega-projects like the Palm Jebel Ali

• Dubai’s centi-millionaires are expected to increase by 52%

Launched in 2023 by His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the U.A.E. and Ruler of Dubai, the Dubai Economic Agenda D33 aims to cement the emirate as one of the world’s leading financial centres through diverse initiatives and policies that will involve both the public and private sectors.

Set to be realised in 2033

Will double Dubai’s economy to AED 32 trillion (~$8.71 trillion)

Increases foreign trade to AED 25.6 trillion (~$6.97 trillion)

Expected FDI totalling AED 650 billion (~$176.97 billion)

How will this impact affect real estate?

Symbiosis – the real estate market and D33 will necessitate the success of the other, attracting both tourism and property investment in droves.

The Dubai 2040 Urban Master Plan aims to completely revamp the city to meet, propagate and pioneer sustainable urban development.

Focused on making Dubai the most resident-friendly city in the world, the plan also directly impacts the Emirate’s economic targets and other future strategies.

• Dubai to be the most liveable city in the world

• Nature-filled areas – 60% of total Dubai area

• The Loop – 93 km-long, climate controlled pedestrian walkway

Dubai’s rapidly growing real estate sector is also expected to be realigned to match the plan.

Importantly, the plan hopes to achieve a happy balance between supply and demand.

As the exclusive affiliate of Christie’s International Real Estate in the Middle East, we are part of an illustrious brand that shares the same heritage of service excellence at the highest echelons of luxury as the over 250-year-old auction house, Christie’s.

Our invitation-only, international network includes significant operations in key global markets such as London, New York, Paris, Japan, Geneva, Amsterdam, New Delhi, Zurich, Cape Town, Rome and more.

This worldwide reach provides our clientele with unparalleled access to the rarest real estate opportunities.

50+ countries

106 affiliate brokerages

10,000 agents

~11,000 luxury properties worldwide

$43 billion worth of luxury properties worldwide

~$500 billion in real estate sales over the last five years

2 million - social media reach