State of the Market: Dubai

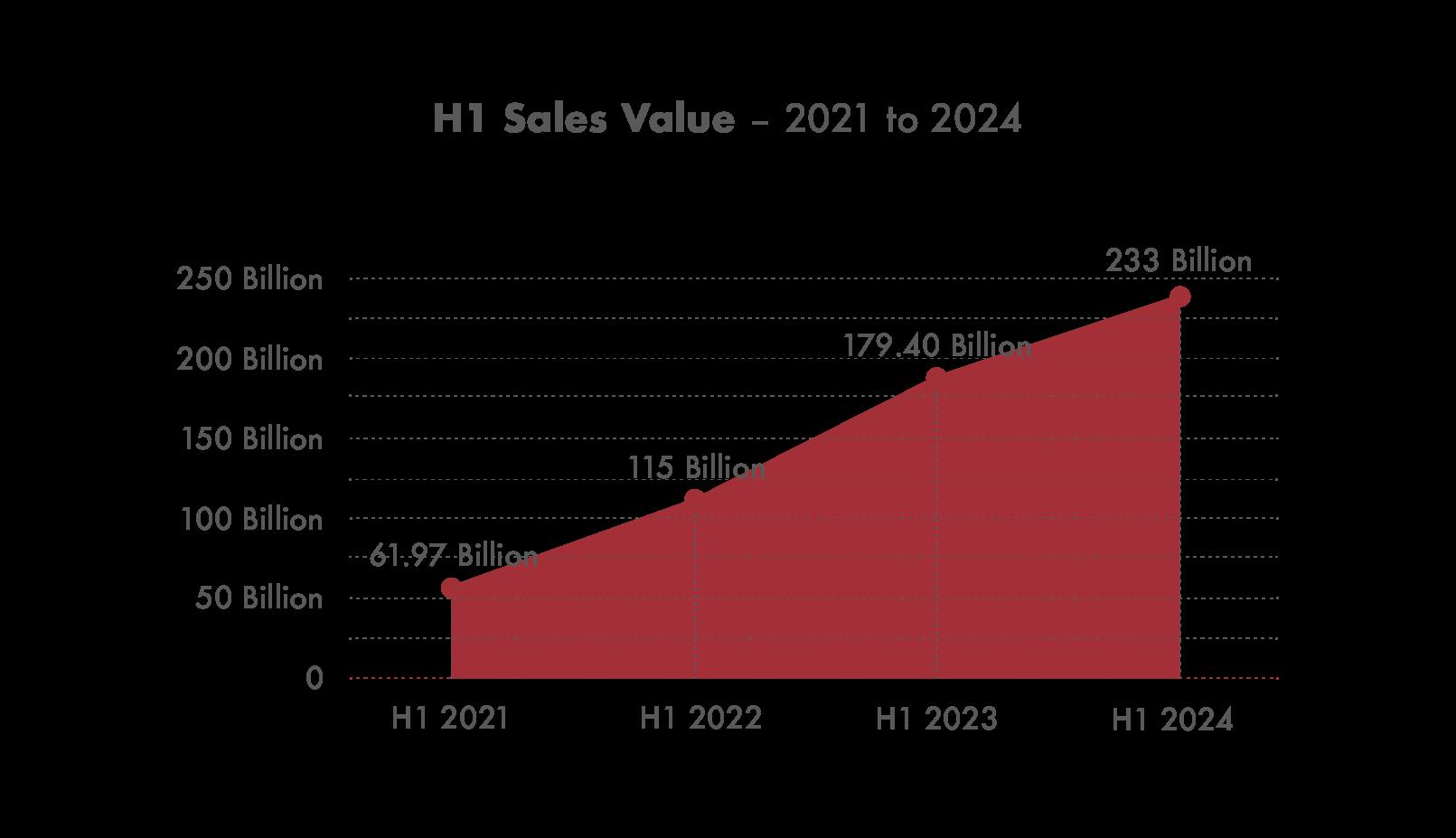

Following on from a stellar 2023, the first half of 2024 has seen Dubai real estate achieve historic figures.

~ AED 233 billion ($63.5 billion) ~ 80,000

These represent the most sales in a half-year period for Dubai real estate ever, with property prices up by as much as 41% during H1 2024 – a surge driven by an influx of high-net-worth individuals.

H1 2024’s State of the Market: Dubai pays close attention to the underlying figures behind the record year so far, the factors influencing buyers and investors, Dubai’s place in the global luxury real estate industry, and more.

In H1 2024, the AED 233 billion (~ $65.34 billion) in sales recorded in Dubai real estate was a 29.87% rise from H1 2023, and the highest-ever halfyearly figure.

Correspondingly, the ~ 80,000 transactions registered during this time period was a 31% rise from H1 2023.

“The Dubai real estate market sales transactions grew by more than 40 percent,” Zawya 28th July, 2021, https://www.zawya.com/en/press-release/h1-2021-the-dubai-real-estate-market-sales-transactions-grew-by-more-than-40-percent-wfomq79b

“Dubai property market continues its upward trajectory in H1 2022,” Zawya 19th July, 2022, https://www.zawya.com/en/press-release/companies-news/dubai-property-market-continues-its-upward-trajectory-in-h1-2022-dwuifypd

Christie’s International Real Estate Dubai, Dubai Real Estate Market: H1 2023 Outlook (2023).

For similar H1 2021-to-H1 2024 values, also consult: “Dubai Property Market Hits Record High in H1 2024,” DXB Interact 31st July, 2024, https://dxbinteract.com/news/dubai-property-market-hits-hogh-record-h1-2024

“The Dubai real estate market sales transactions grew by more than 40 percent,” Zawya 28th July, 2021, https://www.zawya.com/en/press-release/h1-2021-the-dubai-real-estate-market-sales-transactions-grew-by-more-than-40-percent-wfomq79b

“Dubai property market continues its upward trajectory in H1 2022,” Zawya 19th July, 2022, https://www.zawya.com/en/press-release/companies-news/dubai-property-market-continues-its-upward-trajectory-in-h1-2022-dwuifypd

Christie’s International

Market: H1 2023 Outlook (2023).

Prices rose by as much as 41% in H1 2024

High demand for family-friendly luxury has induced significant sales in areas like Arabian Ranches.

The average sale price-per-square-foot for luxury properties surged by up to 15%.

190 deals over $10 million (~ AED 36.7 million) were recorded. The total value of these deals reached $3.2 billion (~ AED 11.75 billion), building on 2023’s $7.7 billion (~ AED 28.28 billion).

Off-plan is H1’s veritable star, accounting for 54% of all transactions by volume. This tallies with the sector's rapid growth — remarkably, 80% of all off-plan units launched in Dubai since 2022 have now been sold.

“Dubai

“Dubai Sales Report: H1 2024,” Bayut 15th July, 2024, https://www.bayut.com/mybayut/dubai-sales-market-report-h1-2024/#:~:text=The%20data%20confirms%20an%20upward,to%2017%25%20in%20H1%202024 Ibid. “Prime properties: 190 deals over $10m recorded Dubai in H1; supply drops,” Gulf Business 8th July, 2024, https://gulfbusiness.com/dubai-prime-properties-190-deals-over-10m-in-h1/

Average Q1 2024 property price per sq. ft. in Dubai – less than half the value of the prices recorded in New York, Singapore and Los Angeles

Amongst cities for rental value growth in H1 2024, at 12.1%

Growth in capital value, higher than London, Singapore and New York, which have all experienced negative growth

Over 25,000

New residents moved to Dubai in Q1 2024 alone

Millionaires moving to the U.A.E. in 2024 –the highest globally, and with many to Dubai. For context, the prime U.K. market expects a net loss of 9500 millionaires, and China 15,200.

Over $4 billion (~ AED 14.69 billion)

Global private capital targeting Dubai’s residential market

“The UAE is set to be the No. 1 ‘wealth magnet’ in the world, new report shows,” CNBC online, 19th June, 2024, https://www.cnbc.com/2024/06/19/the-uae-is-set-to-be-the-no-1-wealth-magnet-in-the-world-henley-research.html

“The Henley Private Wealth Migration Report 2024,” Henley & Partners 18th June, 2024, https://www.henleyglobal.com/newsroom/press-releases/henley-private-wealth-migration-report2024#:~:text=Britain%20pulls%20the%20plug%20on%20millionaires&text=Notably%2C%20during%20the%20six%2Dyear,projected%20for%20this%20year%20alone “World’s ultra-rich to spend $4.4bn to buy property in Dubai,” The National online, 22nd May, 2024, https://www.thenationalnews.com/business/property/2024/05/22/worlds-ultra-rich-to-spend-44bn-to-buy-property-in-dubai/ Knight Frank, Destination Dubai (2024), https://content.knightfrank.com/research/2835/documents/en/the-destination-series-2024-11219.pdf

Market estimates suggest that Dubai is on track to deliver approximately 38,000 residences in 2024. This is indicative of a supply shortage evidenced in the price rises, and is primarily due to the relentless demand from the global wealthy arriving in their droves to Dubai.

Increasing prices is a trend that is set to continue, with off-plan property prices expected to rise by as much as 15% in H2 2024 on the back of new investors from markets such as Australia, Turkey, North America and more.

In the longer term, H1 2024 saw the announcement by the Dubai government of major infrastructure projects – the Al Maktoum International Airport and the Dubai Metro expansion. These visible shows of capital expenditure further reassure buyers, residents and investors of the emirate’s stability and growth.

With a robust market and continuing momentum, the Dubai real estate market can start looking to break 2023’s historic sales transaction value of AED

billion (~ $112.1 billion).