Edmond Housing Assessment

Prepared for the City of Edmond

August 2023

Prepared for the City of Edmond

August 2023

We are thrilled to present the final report of the Edmond Housing Assessment, which encapsulates months of dedicated research, analysis, and community engagement. Our mission was to study Edmond’s housing opportunities, understand its challenges, and develop strategies and policies to advance the community’s housing goals. With the support and collaboration of the City Council, housing partners, and the community, we have achieved a comprehensive understanding of Edmond’s housing landscape.

The Housing Assessment aimed to ensure that suitable housing options are available in Edmond for all residents, regardless of their backgrounds, ages, and income levels. Our committee’s research considered the conversations and concerns expressed by frontline workers, educators, healthcare professionals, and other vital occupations who face difficulties finding suitable housing in our city. We also recognized the ongoing debate surrounding rental housing distribution and the scarcity of available options in both the sale and rental markets.

As someone who works day in and day out in the real estate and housing industry, I was not surprised by these results. I often hear stories about how difficult it can be to find housing in Edmond, especially at lower price points. In many cases, these individuals grew

up in Edmond and are returning home, yet finding it a struggle to secure housing at a price they can afford.

We firmly believe that the recommendations within this report will empower the City of Edmond and its housing partners to make informed decisions about planning and investing in suitable housing for all residents. The strategies, policies, and tools outlined herein will equip decision-makers with the means to navigate the complexities of our housing landscape effectively.

We extend our heartfelt gratitude to the City Council, city staff, community members, and housing partners who actively participated in this process. Your contributions, insights, and unwavering support have been instrumental in shaping this report. The Edmond Housing Assessment stands as a testament to our shared dedication to improving the lives of our residents and enhancing the vibrancy of our community.

Jenni DuncanOn behalf of the Edmond Housing Assessment Steering Committee

CEO, The Duncan Group, Sage Sotheby’s International Realty

Martha Ball

Trustee, Edmond Economic Development Authority

Brian Blundell

Commercial Loan Officer & Senior Vice President, BancFirst

Randy Decker

Associate Superintendent - Human Resources, Edmond Public Schools

Nicole Doherty

UCO Residential Life Director of Community Engagement, University of Central Oklahoma

Mary Dulan

Executive Director, Metro Fair Housing

Jenni Duncan

CEO, The Duncan Group, Sage Sotheby’s International Realty

Angela Grunewald

Superintendent, Edmond Public Schools

Sherry Jordan

President & CEO, Edmond Chamber of Commerce

Jenny Landes

Board President, Turning Point Ministries

Caleb McCaleb

President, McCaleb Homes

Richard McKown

Community Developer & Designer, SSLM Development

Chris Sperry

Executive Director, HOPE Center of Edmond

Ronnie Williams

Advisor & Past President, Edmond Neighborhood Alliance

Christy Batterson

Housing & Community Development Manager, Planning

Department

Destiny Andrews

Associate Long-Range Planner

Bill Begley

Marketing & Public Relations Manager

Courtney Bradford

Marketing & Public Relations Assistant

Ken Bryan

Long-Range Planner

Randy Entz

Director of Planning & Zoning

Julianna McCullough

Community Development Block Grant (CDBG) Coordinator

Corey Winston

Housing & Community Development Assistant

Consultant Team

Justin Carney, Principal

Andy Pfister, Principal

Jenny Connelly-Bowen, Project Manager

Olivia Borland, Project Planner

Catherine Kazmierczak, Project Planner

Gaargi Kulkarni, Project Planner

Richa Singh, Project Planner

Megan Hinrichsen, Art Director

Carolyn Flesaker, Research Analyst

Anjali Katare, Research Analyst

VENICE COMMUNICATIONS

Jayne Siemens, President

Image credits

Development Strategies, unless otherwise noted

49 Strategy 1

Reduce barriers to expanding production of all housing types, for-sale and for-rent

55 Strategy 2

Diversify types and price points of housing

61 Strategy 3

Facilitate the improvement of older housing stock condition while preserving affordability

65 Strategy 4

Support employers, economy, and workers through workforce housing

73 City Council’s Role

75 Priority 1: Ensure Edmond’s new zoning code allows more housing diversity

75 Priority 2: Form a Housing Task Force

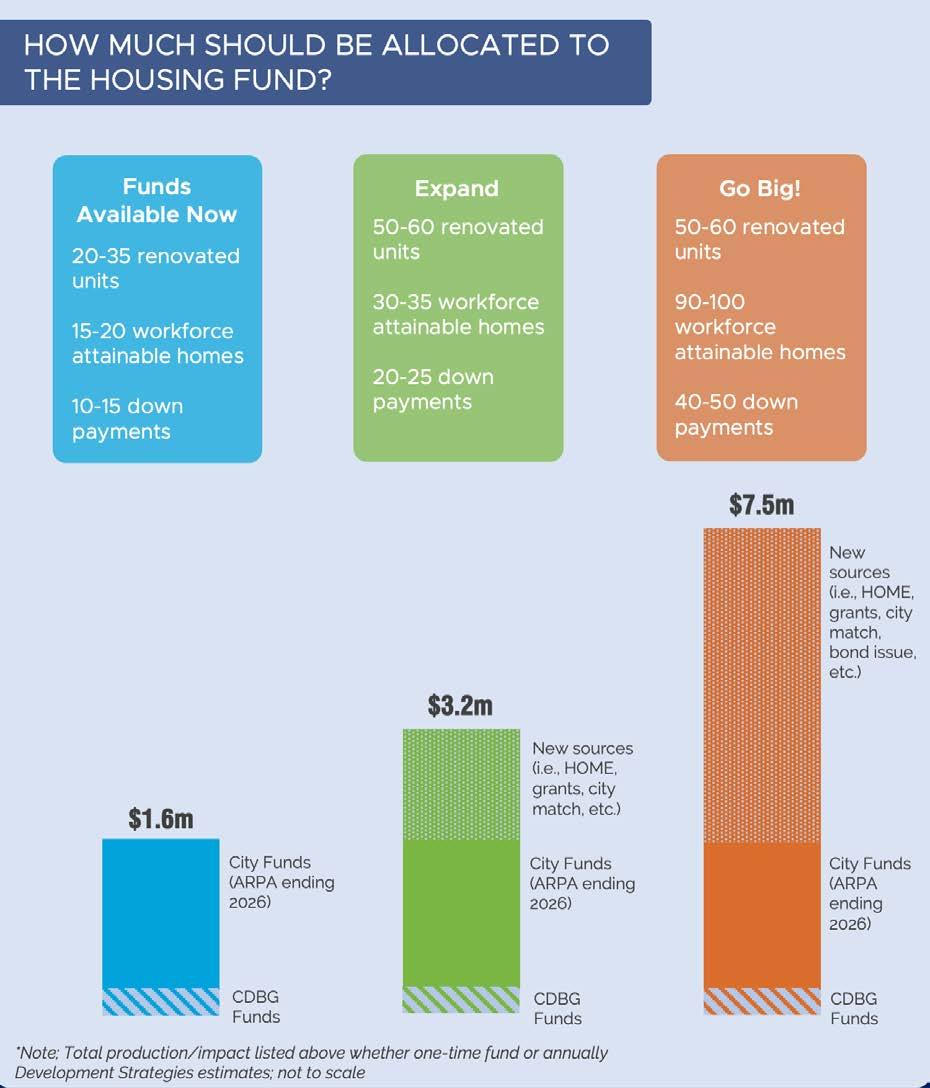

76 Priority 3: Establish a Housing Fund

77 Priority 4: Establish a baseline of housing/ neighborhood conditions

77 Priority 5: Create an education campaign about Edmond resident and worker experiences with housing

78 What is the potential impact of a housing fund?

79 Implementation Matrix

87

95

Edmond’s leadership recognized that housing affordability is a major challenge in recent years. This assessment uncovered broad support for more housing variety in Edmond and substantial demand for more housing across all price points. Edmond needs 8,900 homes over the next 10 years. Achieving this target will require a change in approach from everyone involved in the housing ecosystem.

The Edmond Housing Assessment studied the community’s housing landscape and opportunities. It proposes strategies, policies, and tools that the City and their partners can use to help ensure that housing options are available in the community for households of all types, all ages, and all income levels.

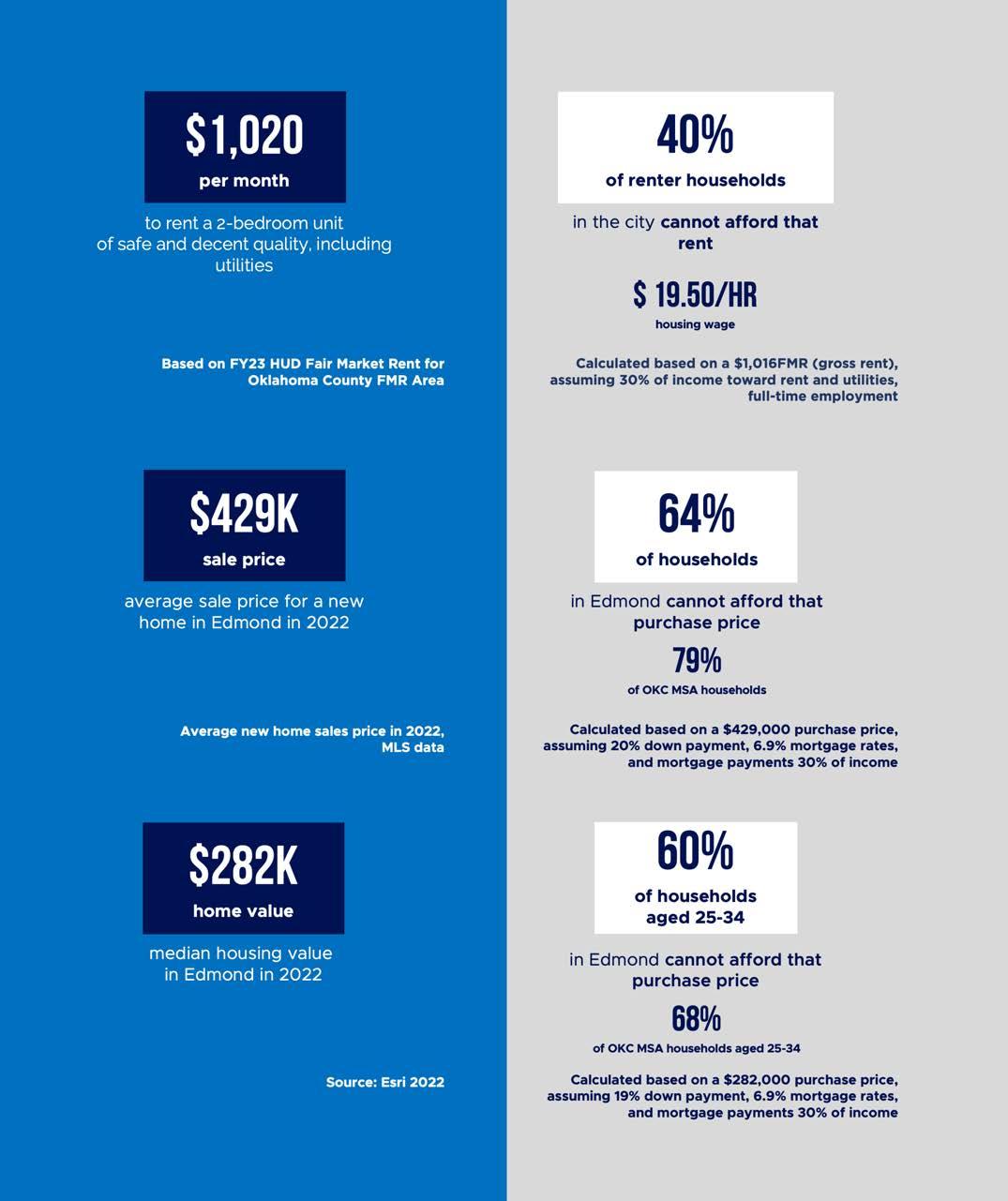

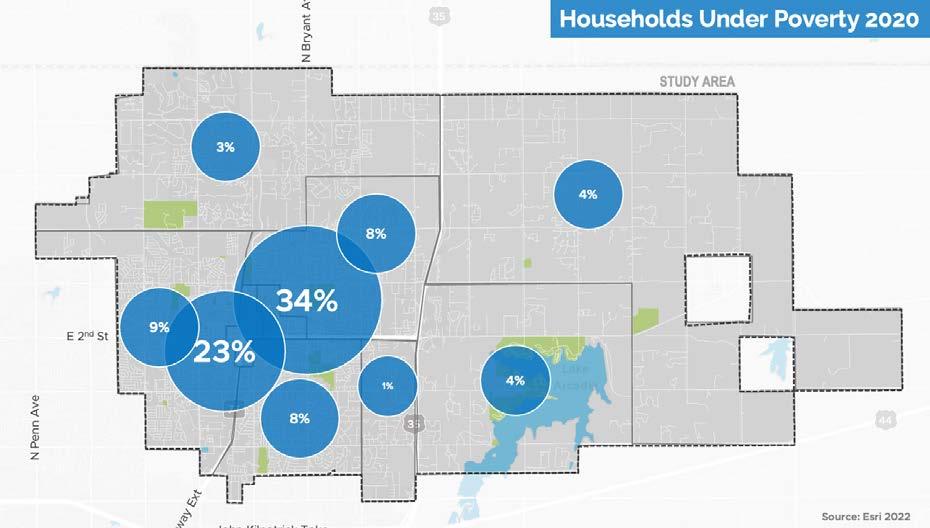

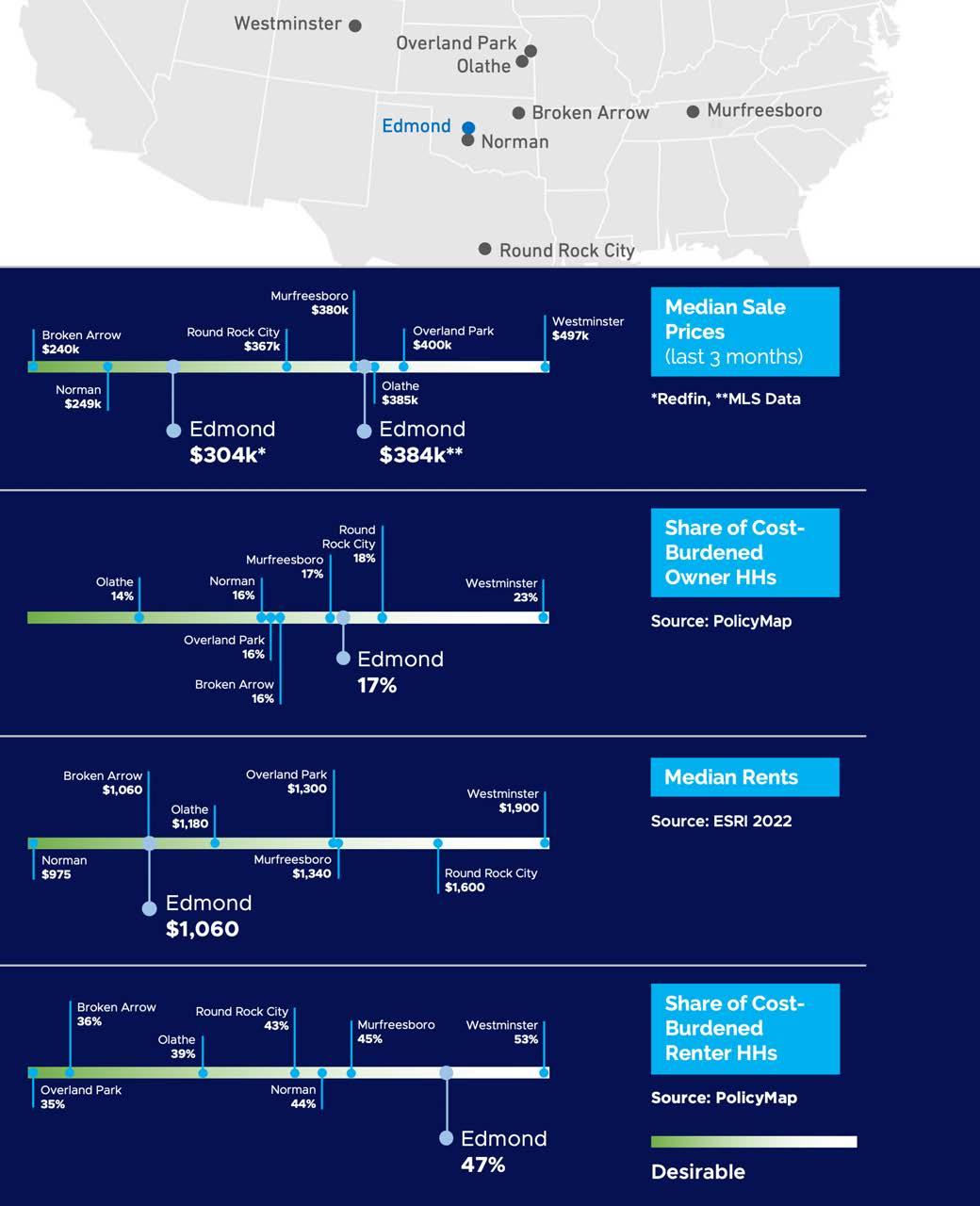

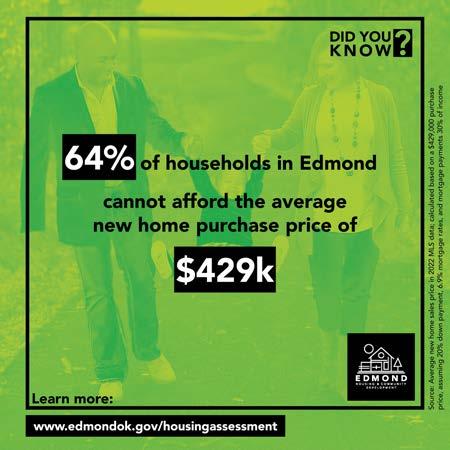

Nearly one-third of all households in Edmond are housing cost burdened, including 17 percent of homeowners and 47 percent of renters. Rent for a safe and decent two-bedroom home in Edmond costs around $1,020, including utilities, which 40 percent of renters in the city cannot afford. There is also a disconnect between the housing that is available in the city and what Edmond residents can generally afford: the average sale price for a new home in Edmond is about $429,000, and 64

percent of Edmond households cannot afford that purchase price. Housing in Edmond is especially unattainable for young people: even Edmond’s median housing value of $282,000 is unaffordable to 60 percent of households aged 25 to 34.

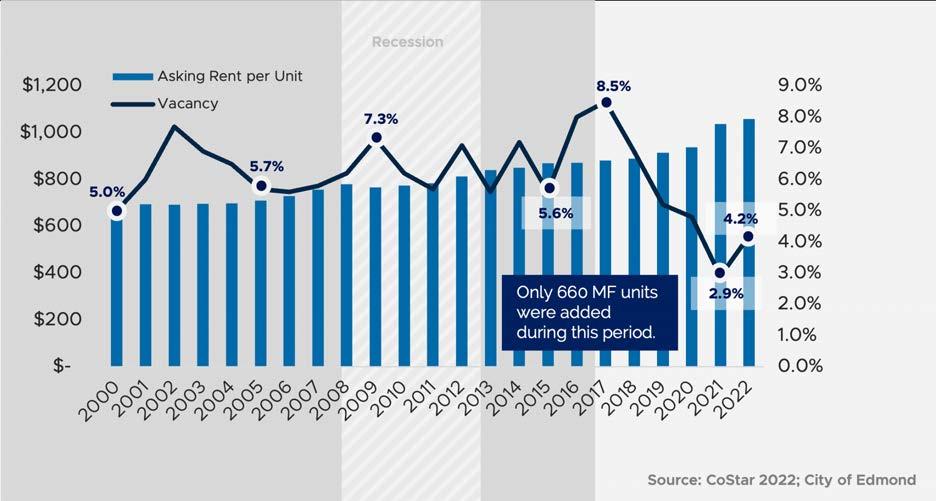

Between 2017 and 2022 in Edmond, new home prices increased by 31 percent, the median home value increased by 38 percent, and the average number of days a home was on the market decreased from 83 to 36. The rental housing market is also very competitive: only 660 multifamily homes were built in Edmond in the last five years, and most of those homes are agerestricted for people aged 55 and older. Dedicated affordable housing is limited across Edmond. Currently, there are 7,425 households that qualify for affordable housing, but only 1,790 to 2,250 dedicated affordable units are available to serve them.

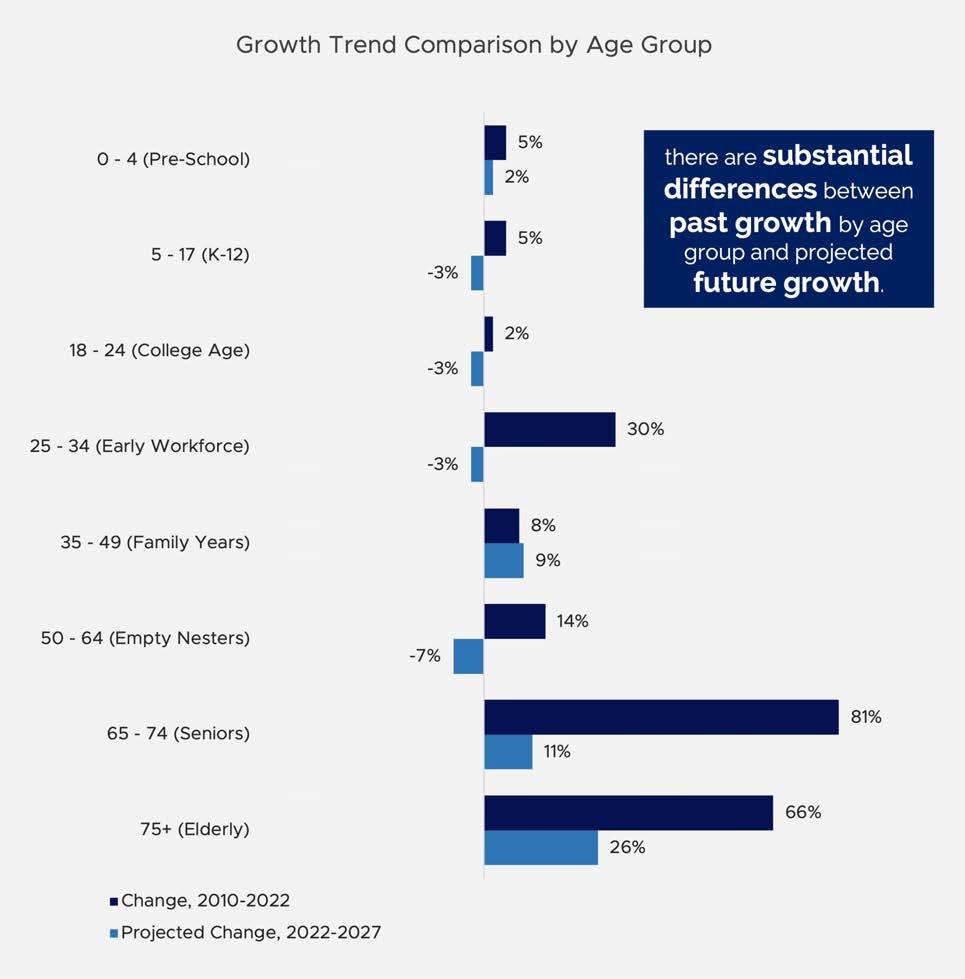

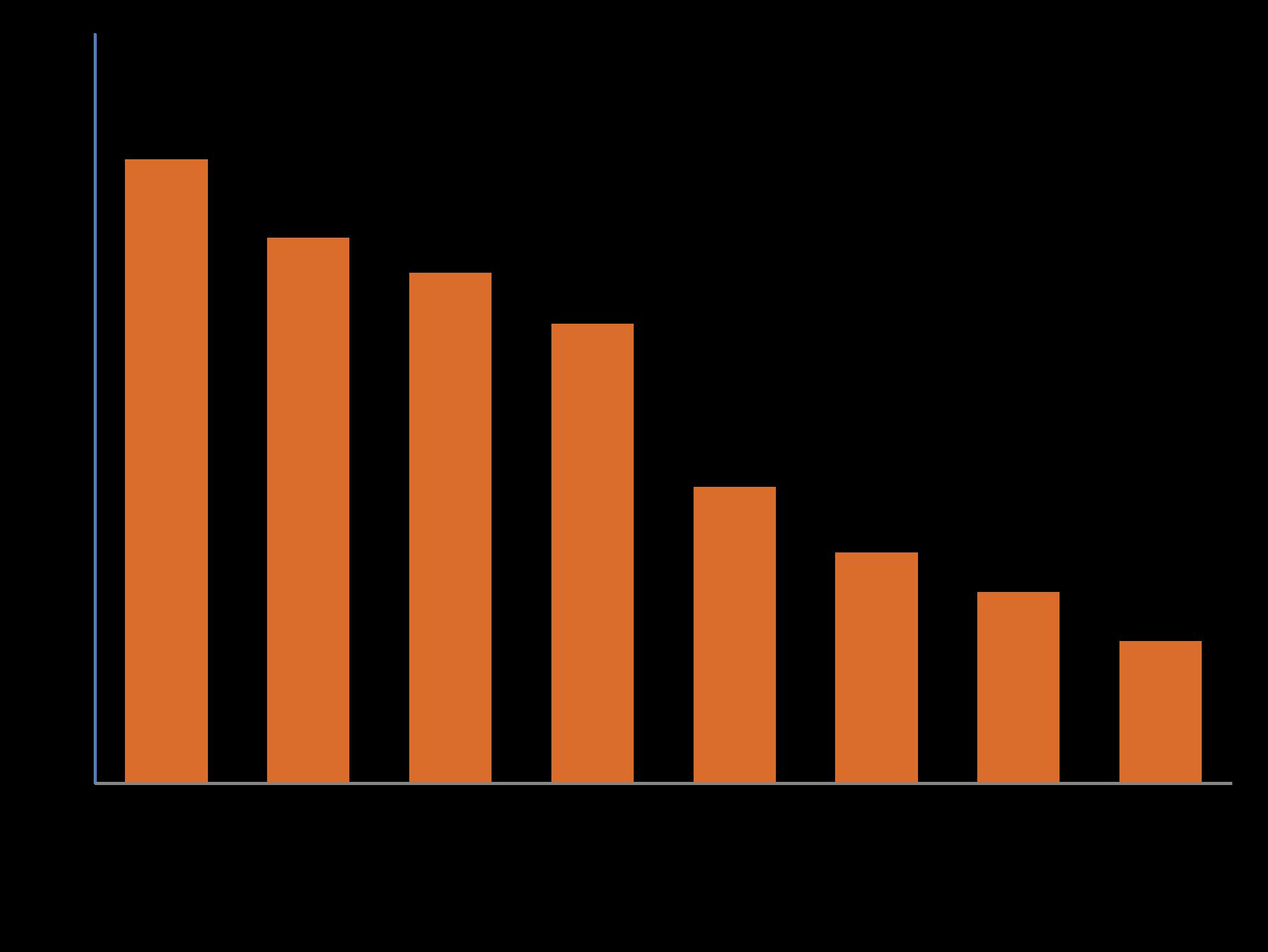

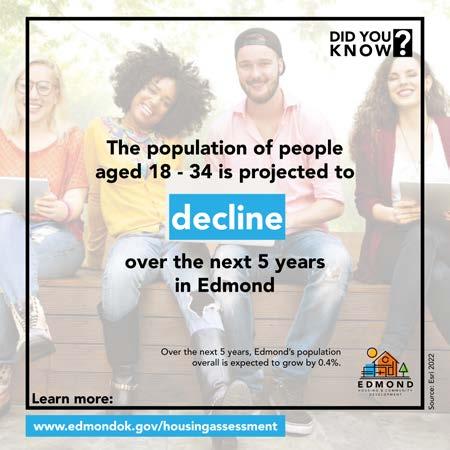

The age distribution of Edmond’s population is projected to shift over the next five years. Edmond’s current population makeup was very similar to Oklahoma County, the Oklahoma City MSA, and the United States as of 2022, and the early workforce (age 25 to 34), senior (age 65 to 74), and elderly populations (age 75+) grew substantially in Edmond between 2010 and 2022. However, the early workforce cohort is expected to decline between 2022 and 2027, along with school-aged children (age 5 to 17), collegeaged young adults (age 18 to 24), and empty nesters (age 50 to 64). These trends underscore Edmond’s housing challenges. If Edmond is

to remain a community for all ages, it needs a variety of housing that is attainable for people and families throughout their lives.

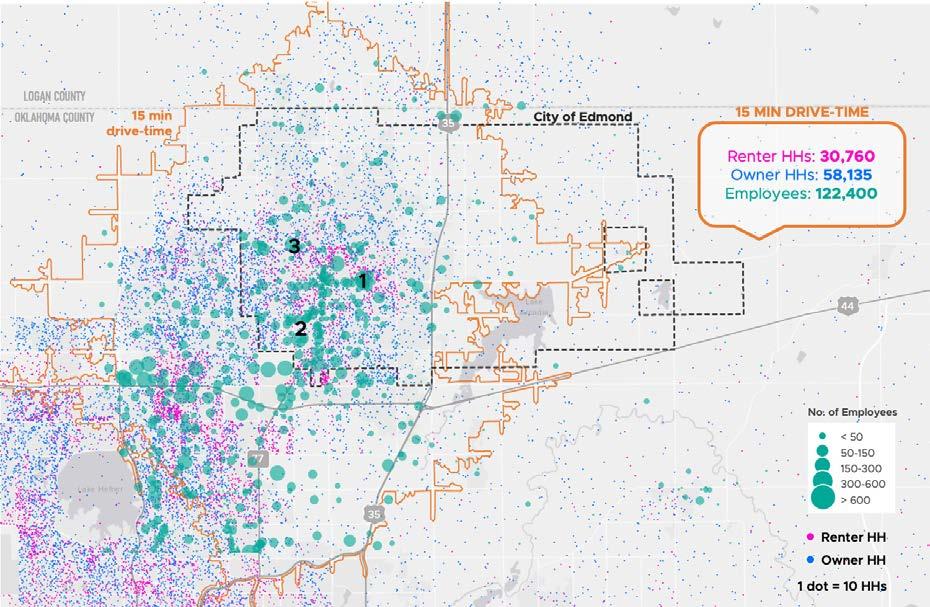

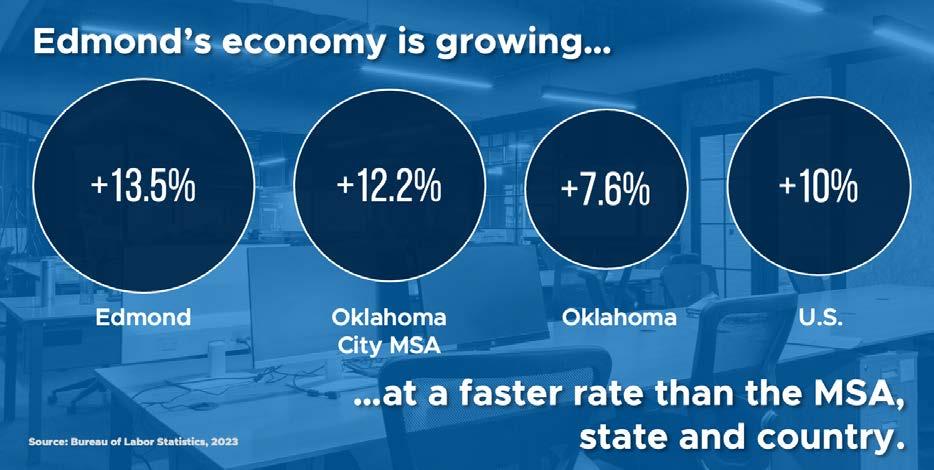

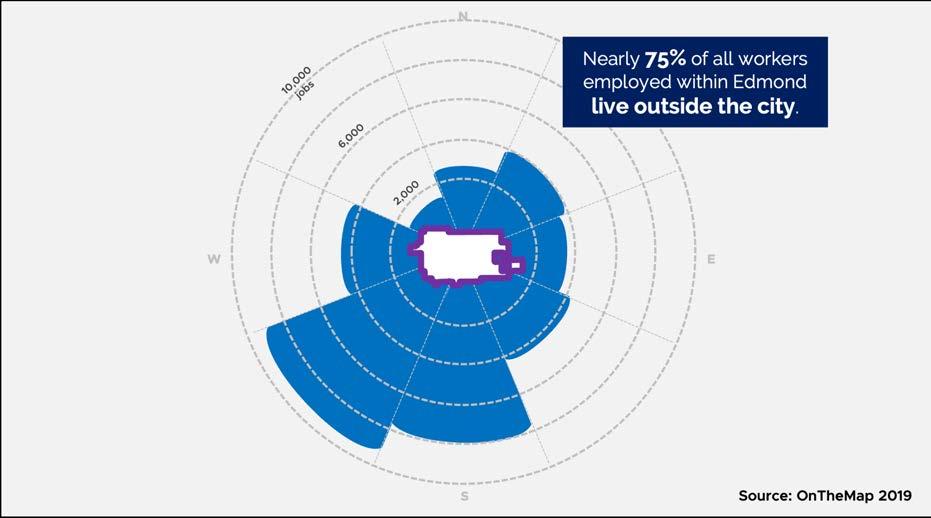

Edmond is a major contributor to the Oklahoma City Metropolitan Statistical Area (MSA) economy with eight percent of the county’s total jobs and 14 percent of the county’s retail supply. The economy in Edmond is growing at a faster rate than the Oklahoma City MSA, the state of Oklahoma, and the United States. This job growth is expected to continue, and appropriate housing development at price points workers can afford will be critical to ensure that employees are able to both live and work in Edmond. Currently, nearly 75 percent of all workers employed in Edmond live outside the city, and long commute times combined with limited regional transit are both contributing to traffic congestion and making it harder for local employers to fill open positions.

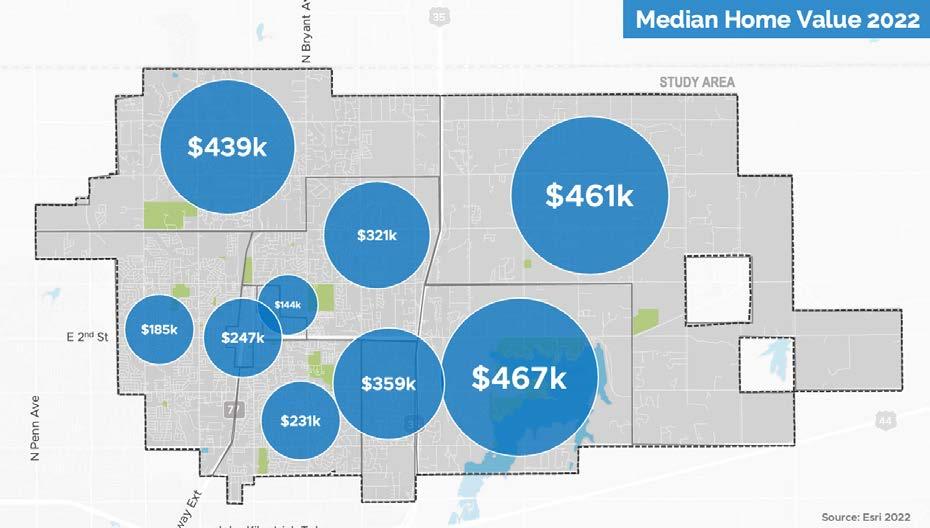

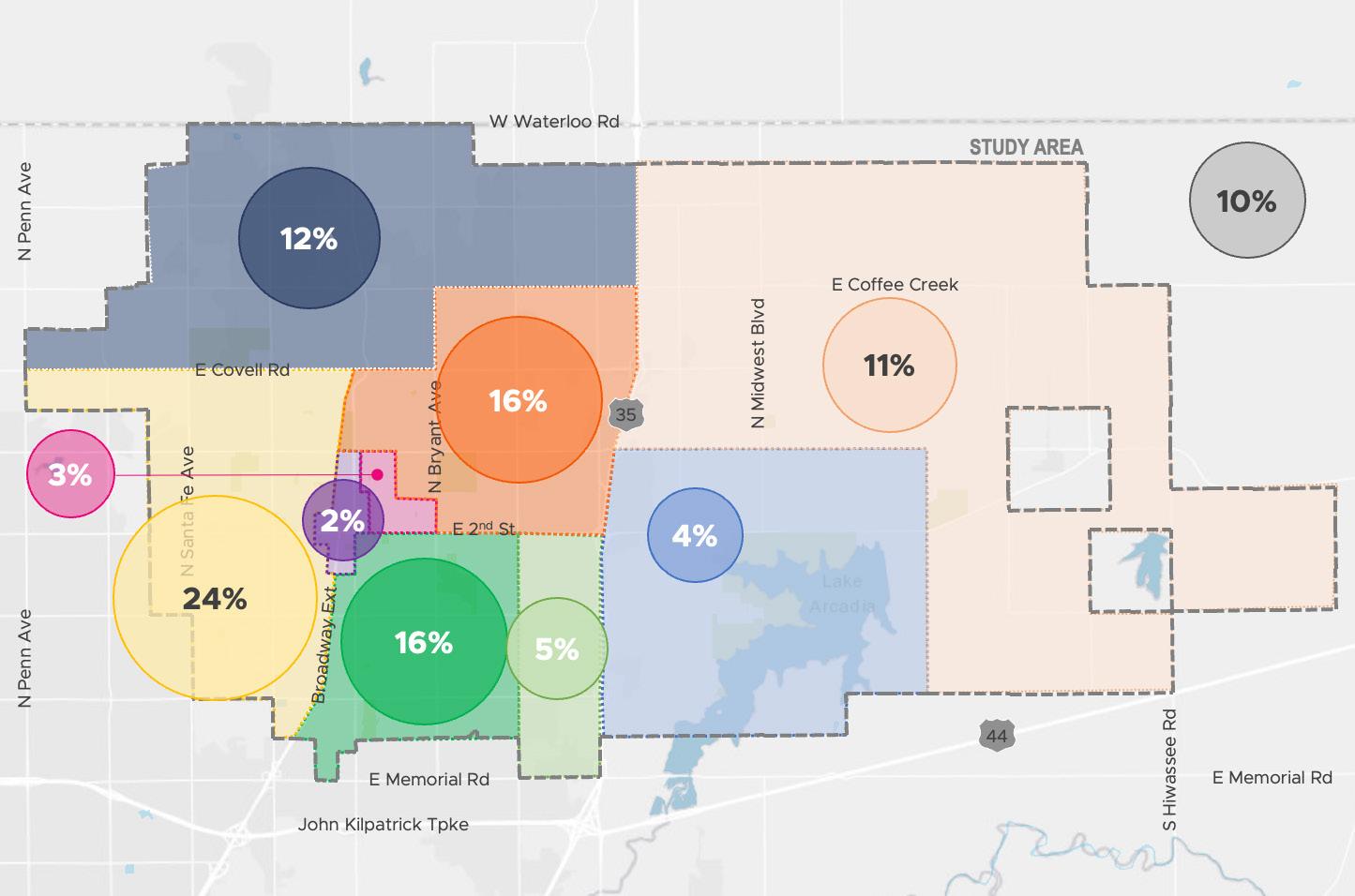

Housing stock and home values vary greatly from neighborhood to neighborhood in Edmond. This has important implications not only for the housing options available for Edmond residents, but also for tailoring and targeting the strategy tactics and resources outlined in this assessment. Not all Edmond neighborhoods will need the same types of investment and support. Poverty is concentrated in Edmond’s core areas, and existing programs are insufficient to meet the needs of the community’s cost-burdened households. Preservation of lower-cost housing will help reduce poverty. Currently, rental housing is also concentrated in Edmond’s core areas,

but spreading more for-rent options throughout the city will provide residents with more housing opportunities and choice.

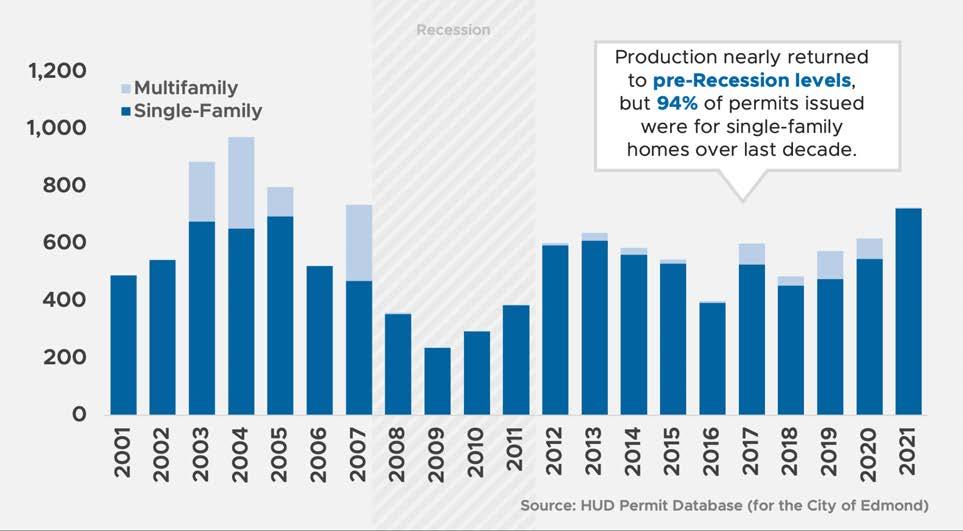

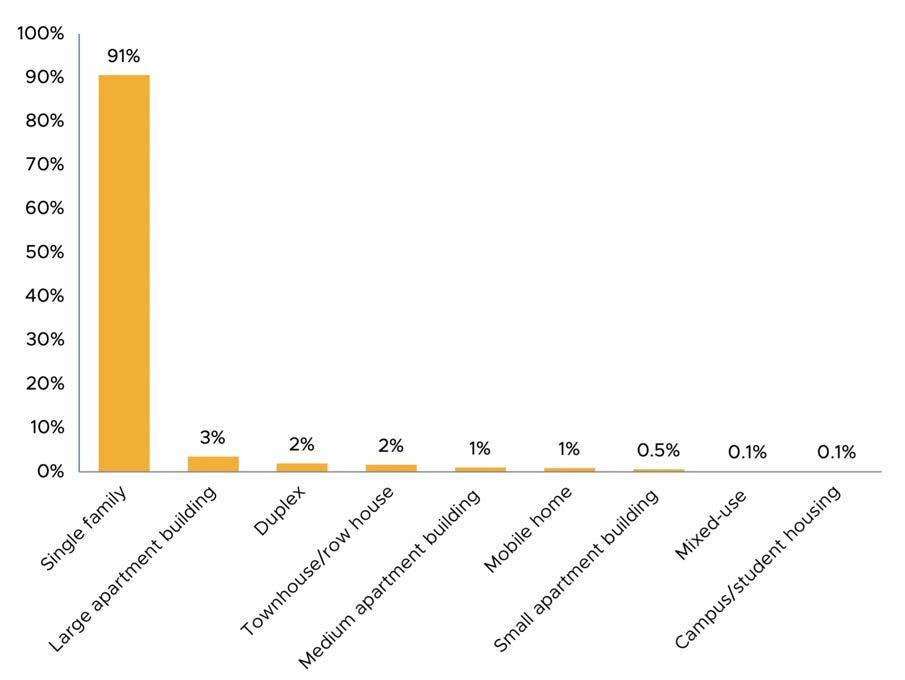

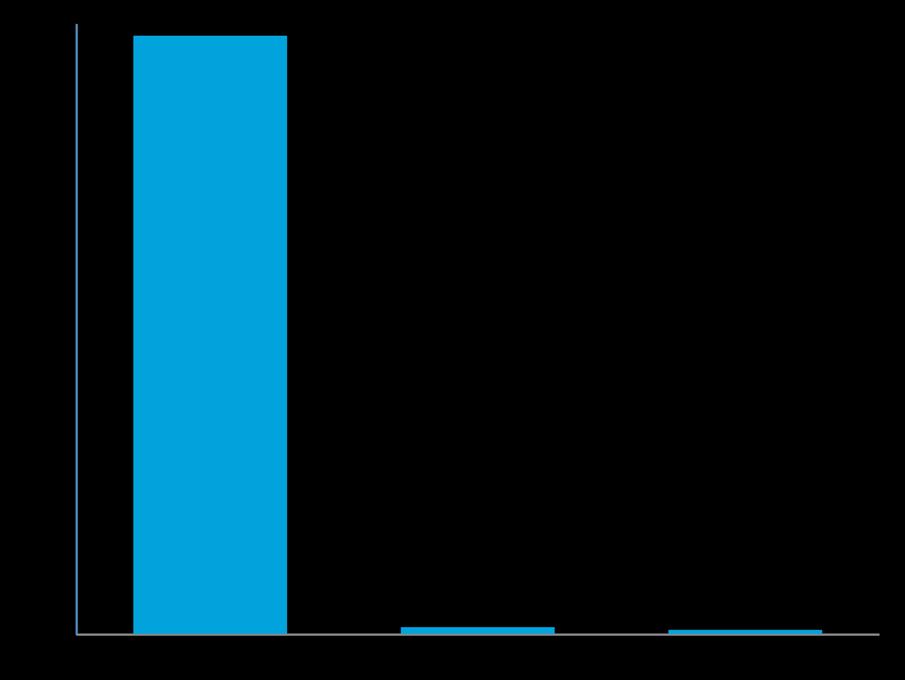

Housing production in Edmond has nearly returned to pre-Recession levels, but 94 percent of permits issued over the past decade were for single-family homes. Edmond’s housing values are also generally higher than the state’s and the country’s. Although Edmond’s housing challenges are not completely unique, many are more intense than they are in other communities with similar growth trends. Most notably, both owner and renter households are more likely to be cost-burdened than they are in the majority of Edmond’s peer cities.

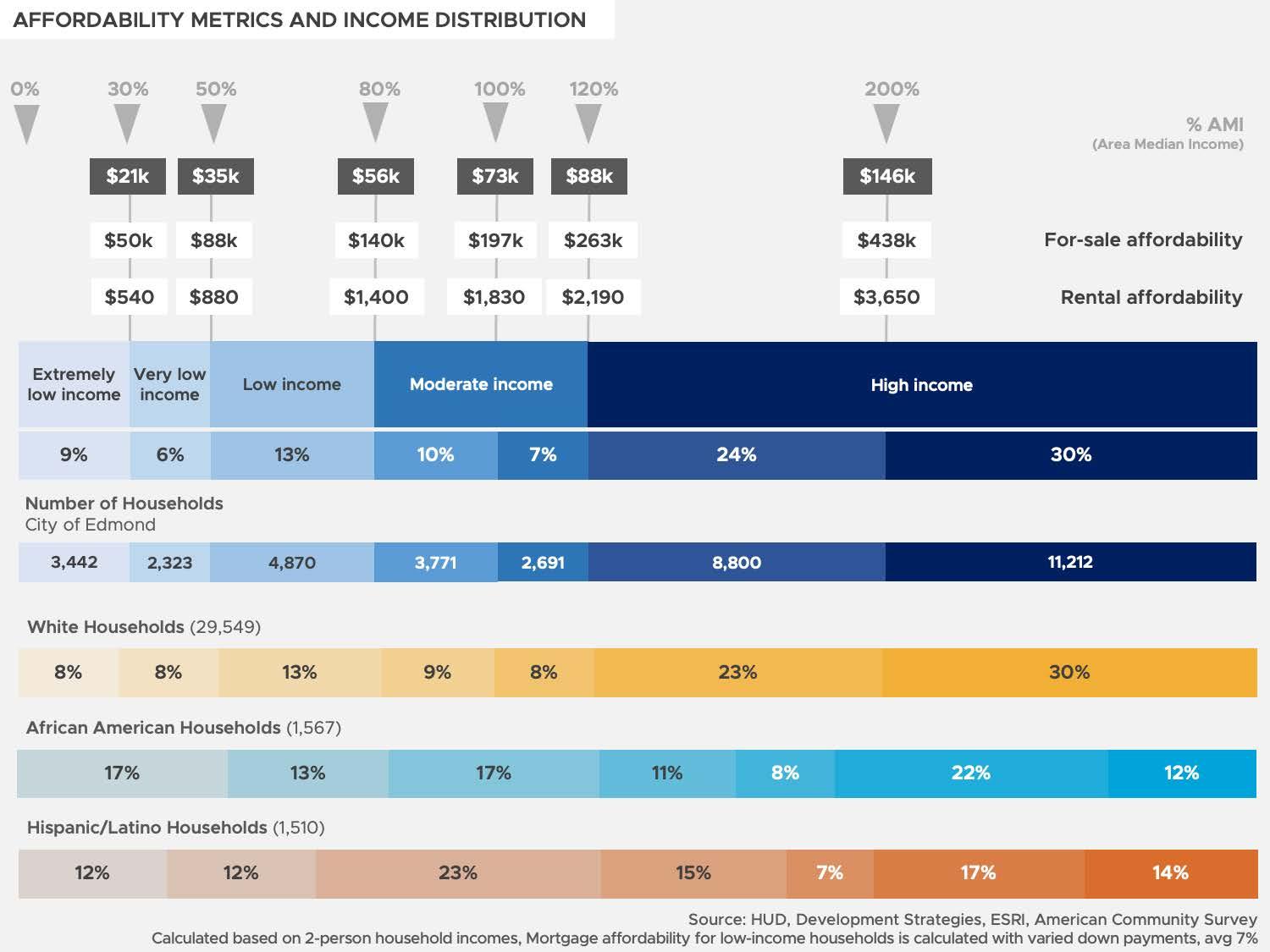

Area Median Income (AMI) is a metric calculated by the U.S. Department of Housing and Urban Development (HUD) to determine the income eligibility requirements of federal housing programs.

Attainable Housing is an umbrella term that reflects the many aspects of a home that make it suitable for a household in the City of Edmond. Attainable Housing is appropriate in:

• Size (e.g., number of bedrooms, square footage)

• Type (e.g., detached home, townhome, apartment)

• Quality (e.g., healthy, safe, in good repair)

• Affordability (i.e., within the price range for the household income)

• Tenure (e.g., rental, for-sale)

• Location (e.g., near employment, school, services, etc.)

Generally, Attainable Housing is a more inclusive term to describe affordability at a range of different area median incomes. It is usually used to talk about housing where housing cost and utilities make up no more than 30 percent of gross household income for households earning up to 120 percent of the city’s AMI.

All the people who occupy a housing unit. A household includes related family members and all the unrelated people. Unrelated people may include lodgers, foster children, wards, or employees who share the housing units. A person living alone in a housing unit, or a group of unrelated people sharing a housing unit such as partners or roommates, is also counted as a household.

Households are considered cost-burdened if they spend more than 30 percent of their income on housing and severely cost-burdened if they spend more than 50 percent of their income on housing.

The assessment’s market analysis applied a combination of methods to project housing demand in Edmond for the next decade.

This segment measures demand across all incomes, housing types, and price points. Demand calculations considered the following:

• Pent-up or current demand by unmet needs and imbalances in the market today.

• Growth projections, factoring in historic growth, as well as county and state-wide trends.

• Housing preferences of different population groups.

• Needs and opportunities in all affordability categories.

A key outcome of this demand analysis is the creation of a development program that details future demand for rental and for-sale housing products by types and price points.

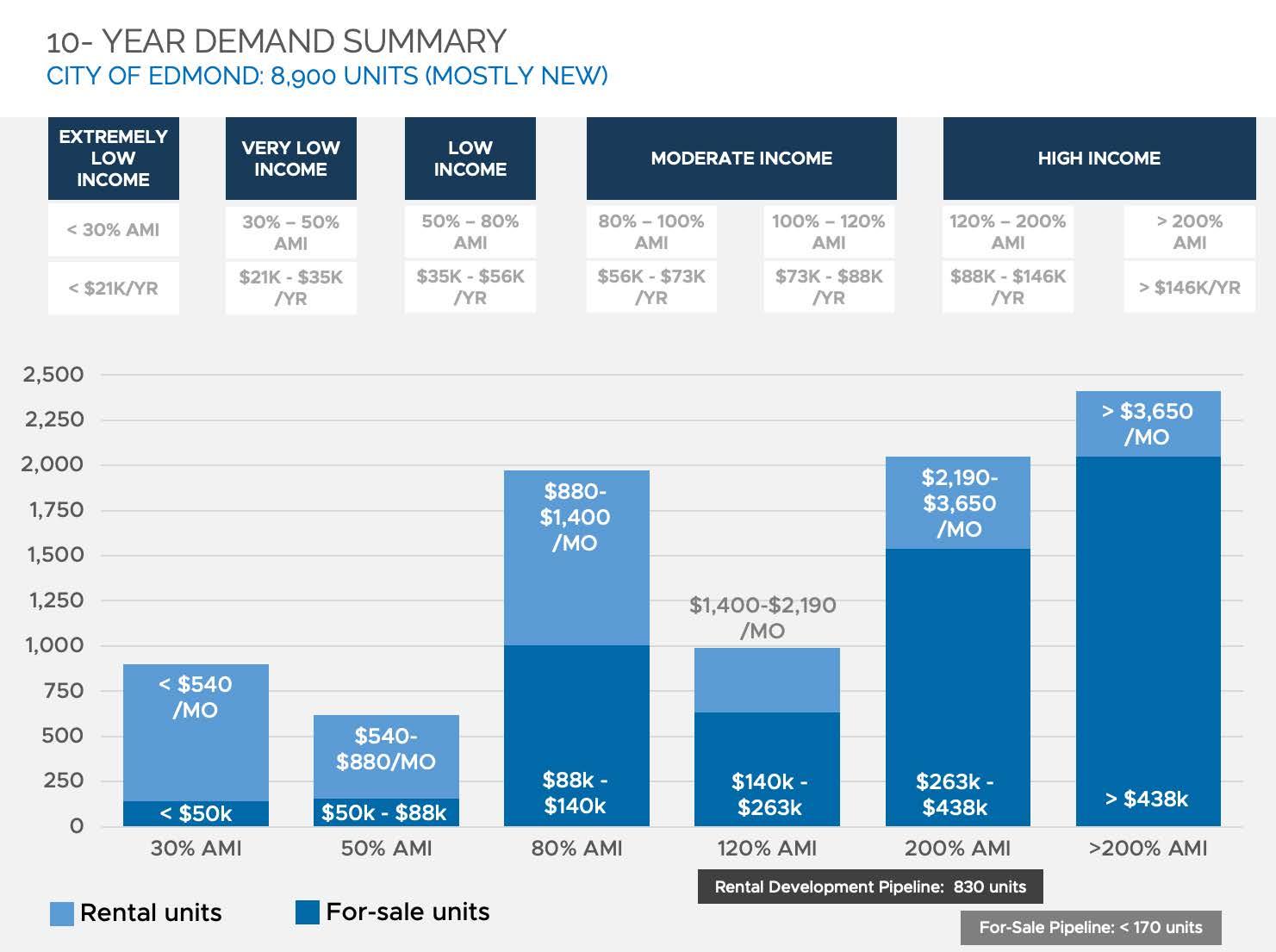

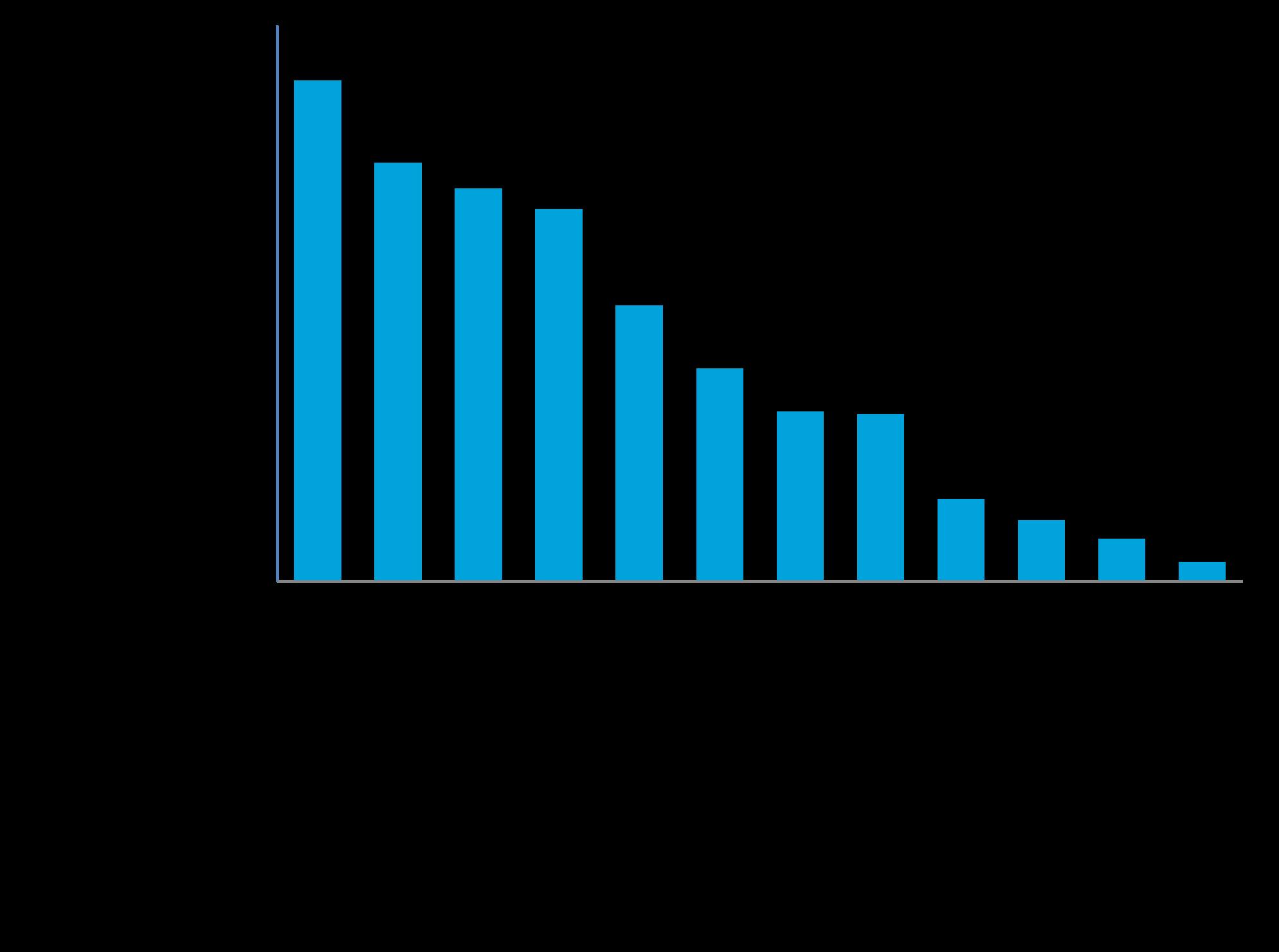

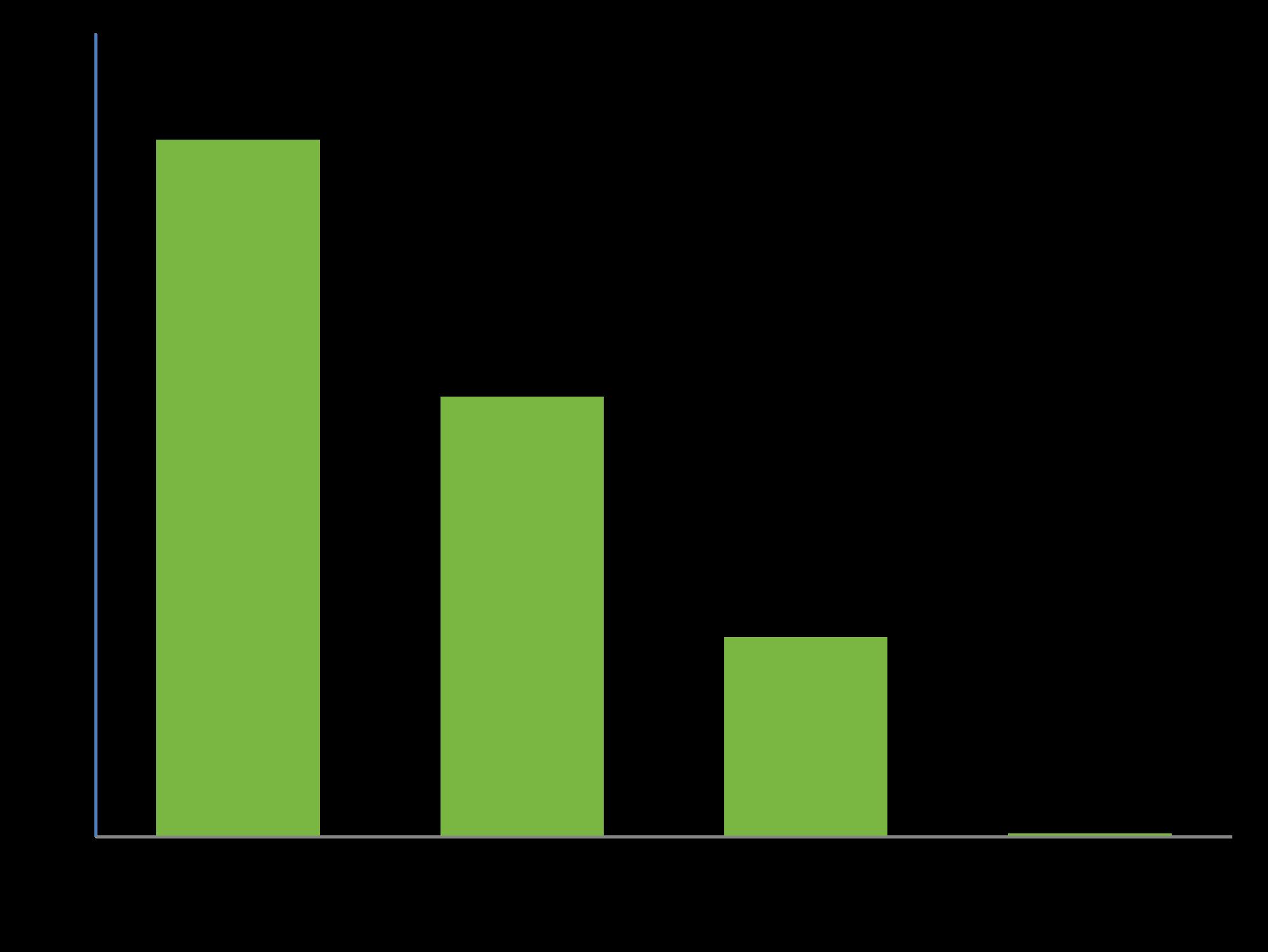

This assessment concludes that there is demand for approximately 8,900 units of housing in Edmond over the next 10 years, or an average of 890 per year. This demand spans the entire spectrum of affordability, including housing needs for low-income, middle-income, and high-income households. The graphic on the following page illustrates projected housing needs.

Housing is needed across the affordability spectrum

Edmond needs housing across the affordability spectrum, and adding housing units of any type or affordability level will help the overall market.

About 40 percent of housing demand is for units at or below 80 percent of the Area Median Income (AMI), or households earning at or below $56,000 per year. About 10 percent of housing demand is for units at or below 30 percent of AMI, or households earning below $21,000 per year.

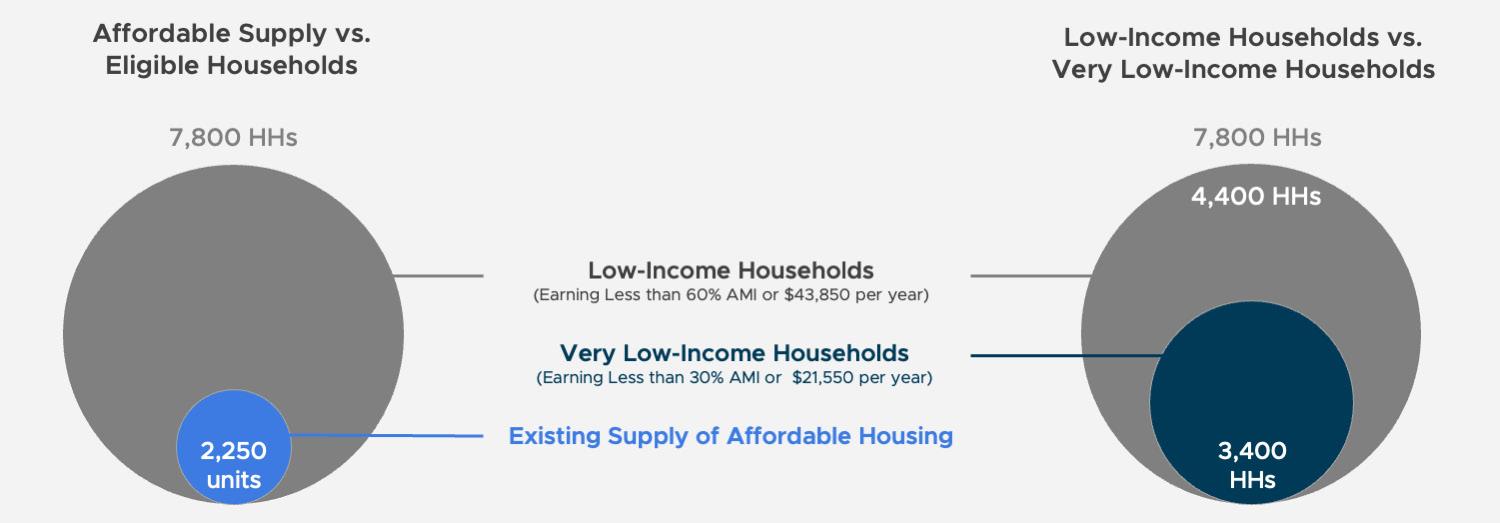

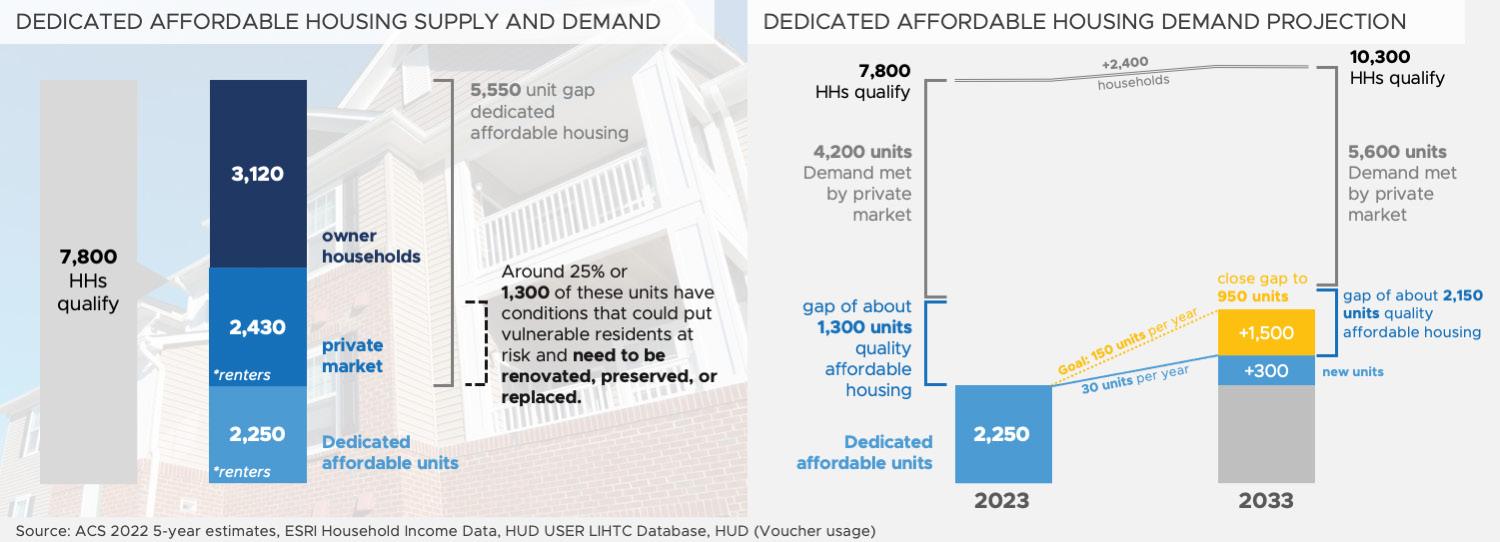

This type of housing is very difficult to develop without gap funding or incentives. Currently, there are only up to 2,250 dedicated affordable housing units available in Edmond, even though data suggests there are roughly 7,800 local households that would be income-eligible for dedicated affordable units. Many households try to find affordable or attainable housing on the open market, and some do, but today’s market pressures make that more challenging. As a result, some may end up cost-burdened, living in a unit with condition challenges, or “doubling up” with family members or friends.

households moving from out-of-state have been a primary cause of Edmond’s housing challenges, data suggests that net in-migration in Oklahoma County has been relatively flat in recent years. That said, there are growing population groups in the region who would likely consider moving to Edmond if the right housing products were available. Some of these groups will be attracted to the newer single-family homes that already predominate Edmond’s housing market. Other groups, however, will be in search of housing products that are currently less abundant in Edmond, including housing targeted to seniors, modestly priced single-family homes and duplexes, and mobile homes.

Projected population growth calls for a greater diversity of housing types and price points

Edmond currently produces more single-family housing than its peers. While single-family homes will continue to be Edmond’s dominant housing type in the future, there is growing demand for attached and/or maintenance-free homes, as well as for quality multifamily options over the long term. The community needs a diversity of housing types to retain and attract residents, especially young families and seniors.

Although some residents suggested through the project’s community engagement efforts that

Edmond is an outlier in the Oklahoma City region in terms of the distribution of household income groups. Many households —including young professionals, young families, older adults, frontline and service workers, and longterm residents on fixed incomes—have very few housing options in Edmond. Yet, these and other groups are important to the long-term viability of the community.

is not currently a major driver of housing demand, but different housing products could attract underrepresented population groups to Edmond

This housing strategy was created to provide the City of Edmond with programs, policies, and best practices that can be implemented over the next several years to address the community’s key housing challenges.

Edmond’s housing strategy was developed using the demographic, economic, and market analysis discussed previously; input from community stakeholders; housing needs and housing preferences survey results; and conversations with the client team and Steering Committee. It includes tactics for housing production, preservation, and services designed to help households of all types find attainable, quality housing.

The housing strategy includes six housing goals (summarized at right), four strategies designed to serve those goals, and 19 tactics for implementing the strategies (summarized on the following page).

• Goals: the ‘Why’. What are our north-star priorities for Edmond over the next 10 years?

• Strategies: the ‘What’. What do we need to do to make our defined goals a reality?

• Tactics: the ‘How’. How specifically will we implement our chosen strategies?

No single program will address all of the housing challenges facing Edmond. To achieve its goals, the City and its partners will need to take a holistic approach that emphasizes collaboration, coordination, and partnership.

Reduce barriers to expanding production of all housing types, for-sale and for-rent

Tactic 1.1: Use funding tools, such as TIF or impact fees, to help pay for infrastructure improvements that support affordable and workforce housing development

Tactic 1.2: Leverage City-owned assets to support affordable, workforce, mixed-income, and mixed-use development

Tactic 1.3: Work with other City departments to reduce time required for the development review and approval process for housing that meets goals

Tactic 1.4: Update zoning code to allow more housing types-by-right, incorporate other incentives and inclusionary zoning/affordability set-asides, and include flexible design standards

Tactic 1.5: Work with partners to expand homeownership supports like down payment assistance/loan programs, credit counseling, and homebuyer/homeowner training

Tactic 2.1: Create a “look book” of housing typologies and share type-specific resources

Tactic 2.2: Keep track of housing trends based on type, demographic markets, renter vs. ownership patterns, foreclosures/ vacancies, and available lots for development/ redevelopment

Tactic 2.3: Work with architects and builders/developers to create pre-approved plans for new housing types

Tactic 2.4: Market development opportunities to the local, regional and national development community using results of this study

Tactic 2.5: Evaluate and revise building codes related to certain requirements, such as fire sprinklers, while maintaining the safety of the units

Tactic 2.6: Expand Edmond’s ability to secure additional federal resources and participate in the real estate market

Facilitate the improvement of older housing stock condition while preserving affordability

Tactic 3.1: Expand Edmond Builds to include exploration of protections for existing residents in the neighborhoods targeted for revitalization

Tactic 3.2: Continue to support homeowner renovations and weatherization through Edmond’s Owner-Occupied Housing Rehabilitation (OOHR) program

Tactic 3.3: Adopt a more proactive approach to code enforcement of problem properties

Tactic 3.4: Create and fund new housing programs to encourage reinvestment in older rental properties while maintaining attainable rents

Tactic 3.5: Work with partners and other government staff to explore creating a tax abatement program

Support employers, economy, and workers through workforce housing

Tactic 4.1: Map/update employment concentrations and housing options within a 15-minute drive to show mismatch between what’s available and what the growing workforce needs

Tactic 4.2: Identify key development sites within employment shed(s) for workforce attainable housing

Tactic 4.3: Support the creation and funding of a workforce housing program to facilitate development of moderately-priced for-sale and rental housing

Tactic 4.4: Advocate for state and federal workforce housing programs

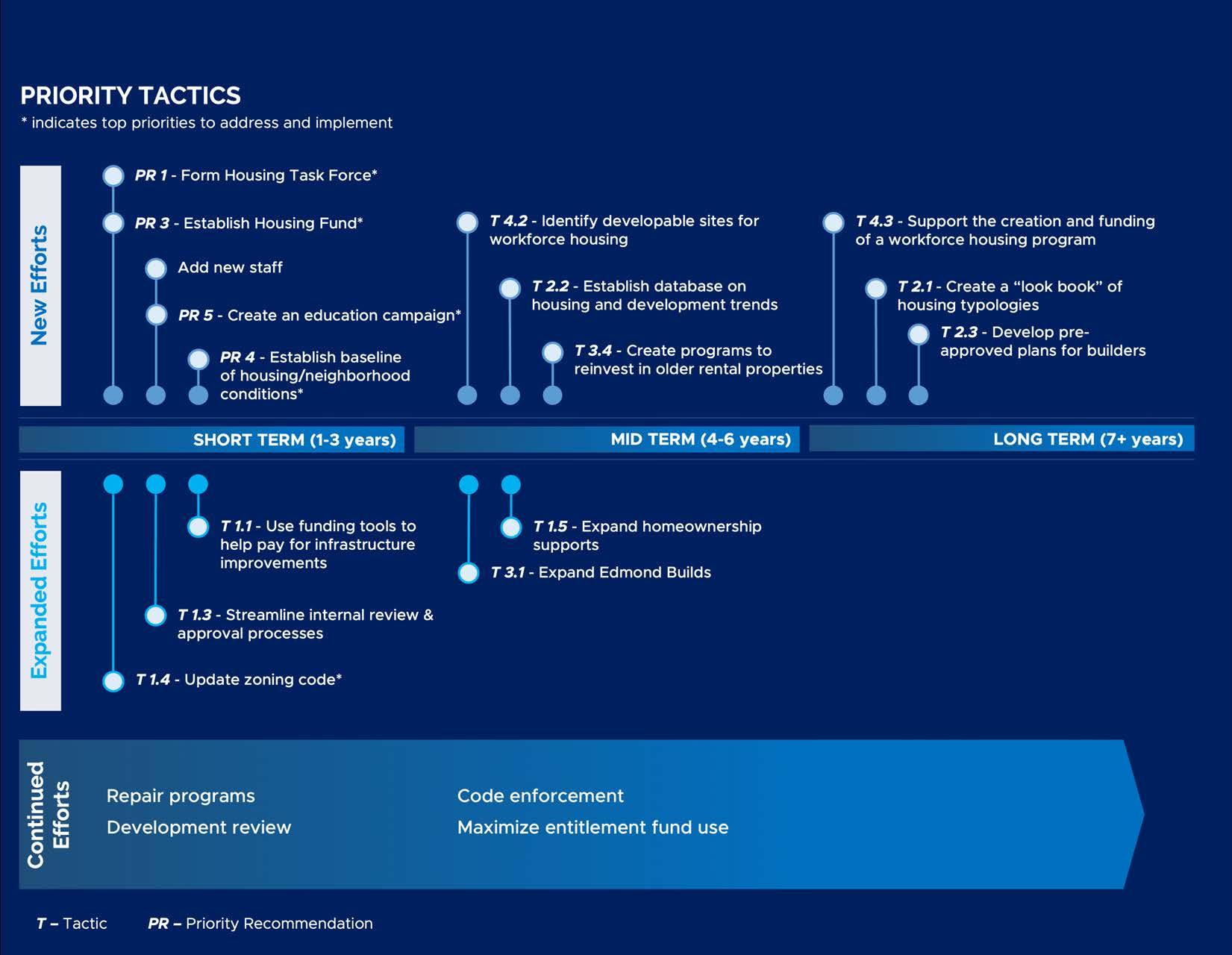

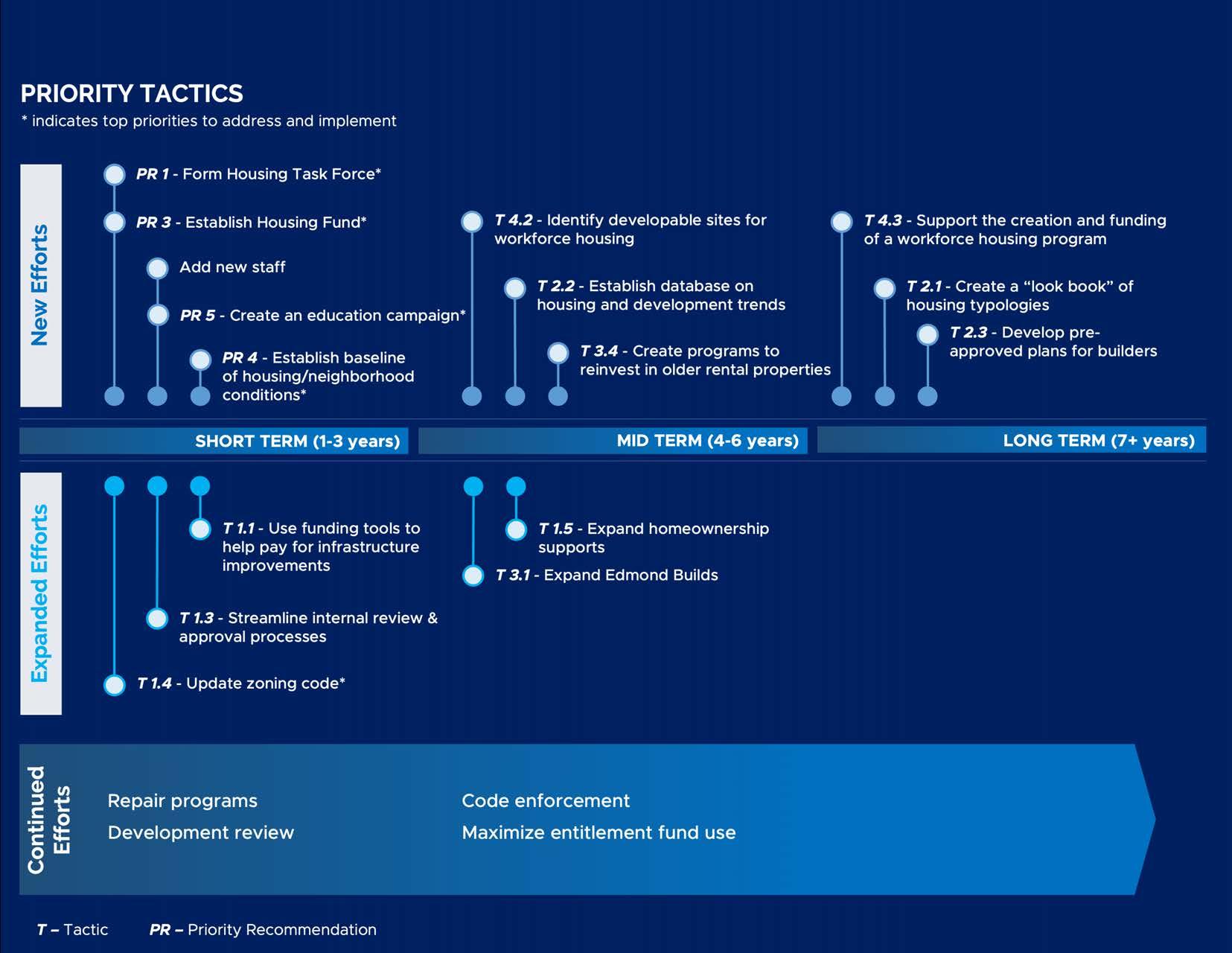

Edmond will need to prioritize actions in the short term and plan for future actions as conditions change.

The City of Edmond cannot implement all four strategies and 20 tactics at once, and it would not be prudent to do so. A more systematic approach will lead to be better long-term results.

There are clear and urgent needs in the city that can be addressed right away through strategic focus. Five priority efforts were identified through

understanding Edmond’s housing needs with input from the Steering Committee and City staff:

1. Ensure the new zoning code allows more housing diversity

2. Form a Housing Task Force

3. Establish a Housing Fund

4. Establish a baseline of housing/neighborhood conditions

5. Create an education campaign

These priorities have been selected to address the critical needs of the community now while setting the groundwork for future implementation.

This effort examined Edmond’s housing challenges and proposes policies and strategies that will help advance the community’s housing goals.

Why study Edmond’s housing? There have been many conversations in Edmond about housing over the past several years. There is ongoing debate over where rental housing is appropriate and how much of it the community needs. What’s more, the market in Edmond is strong—there are few for-sale or rental housing options available at any given time.

The City of Edmond Housing Assessment explores Edmond’s housing landscape and gives the City strategies, policies, and tools they and their partners can use to help ensure that housing options are available in the community for households of all types, all ages, and all income levels. Specifically, this study:

• Provides a data-driven assessment of the housing market, housing stock, and housing needs of the Edmond community.

• Quantifies housing demand across various price points and types.

• Engaged the community in dialogue about their housing experiences, policy options, preferences, and priorities for the future.

• Lays out a strategy with specific tactics that address Edmond’s unique housing market.

The Housing Assessment kicked off with a work session with the City team and Steering Committee and touring the City of Edmond. The kickoff trip also included several stakeholder conversations (with others conducted via videoconferencing).

The Understand phase established an in-depth understanding of current socioeconomic and

housing conditions in Edmond. This included field work, conversations with the Steering Committee and key local stakeholders, and detailed quantitative analysis.

During the Analyze phase, real estate market analysis determined the scope of present and future opportunities to both 1) supply unmet housing demand to different consumer groups and 2) evaluate competitive opportunities to deliver development that responds to current consumer demand for a greater variety of housing options. Collected data comes from a variety of

sources, including surveys, interviews with area development professionals, and third-party data providers.

The Strategize phase built on the market and economic analysis to create a set of goals and a holistic strategic framework for housing in Edmond. This included follow-up research on best practices and precedents from other cities and extensive conversation with the City of Edmond team and Steering Committee.

Based on feedback and discussion during the Strategize phase, the Align phase outlined priority strategies and implementation steps. The implementation framework identifies roles the City and community partners can take on to address the full range of housing needs in Edmond.

The assessment followed a five-step process that allowed the consultant team to have an iterative dialogue with the community. Each step brought the process closer to a clear understanding of Edmond’s housing needs and priority strategies.

While some elements of housing studies are highly technical and data-driven, it is just as important to capture and understand community experiences of the housing market. It is impossible to identify which strategies are best-suited to meet local housing needs without input from community members about local values, potential, barriers, and priorities.

The consulting team used five main methods to tap into the Edmond community’s diverse perspectives and experience and secure feedback that shaped the recommended strategies.

A 13-member Steering Committee representing a broad cross-section of the Edmond community brought expertise in housing development, real estate, advocacy, social services, education, finance, and economic development. Steering Committee members provided critical feedback throughout the assessment process and helped to prioritize possible strategies. This group is

now well-positioned to identify opportunities for collaboration as recommended strategies are implemented.

Round table discussion and interviews with local stakeholders enriched the consultant team’s analytical understanding and helped to identify key local issues. These discussions involved over 25 individuals who provided a diverse set of perspectives on housing in Edmond, including developers, lenders, major employers, local nonprofits, school and university staff, real estate agents, service providers, residents, and more.

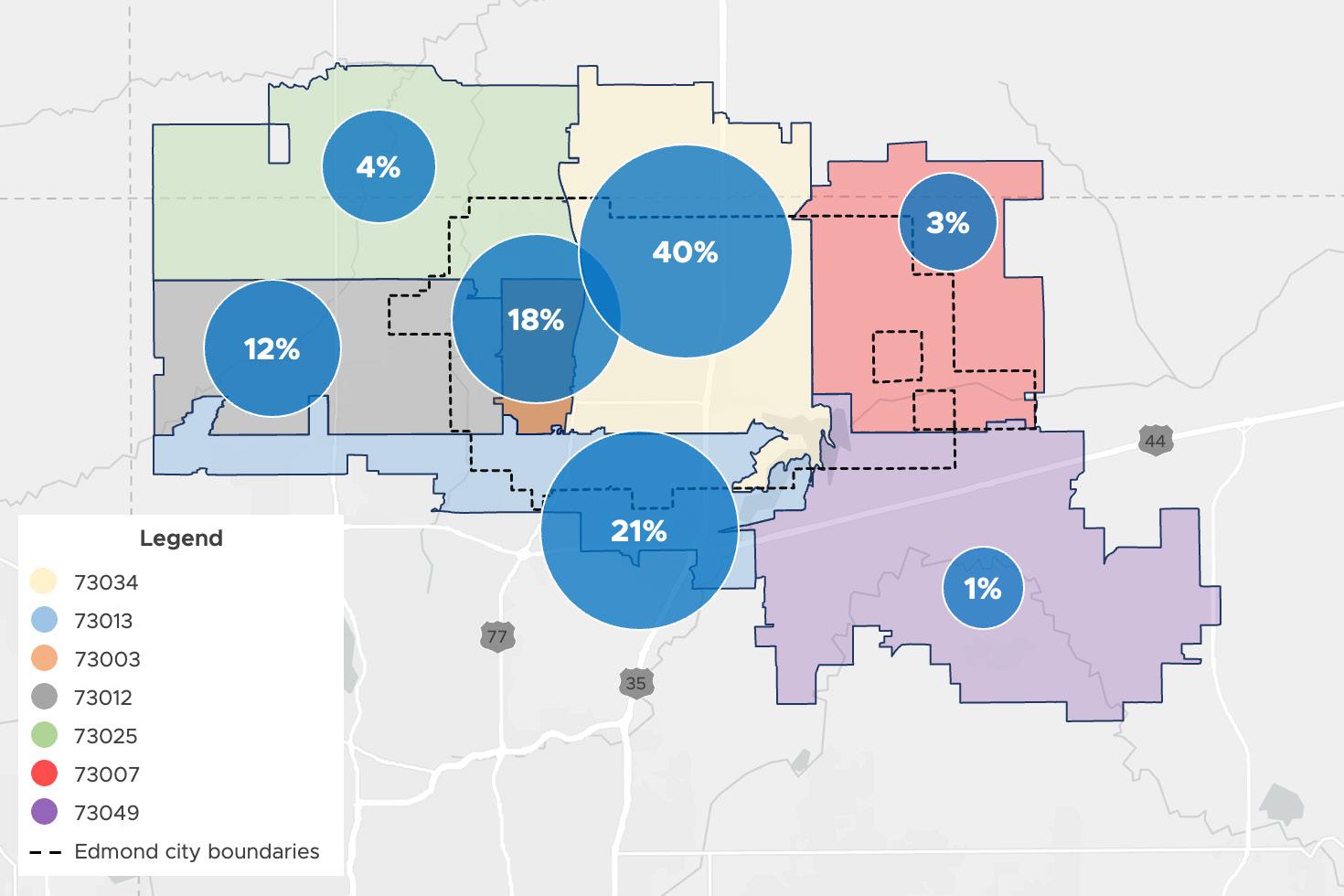

Two online surveys were created to invite community input on their housing experiences, priorities, and preferences.

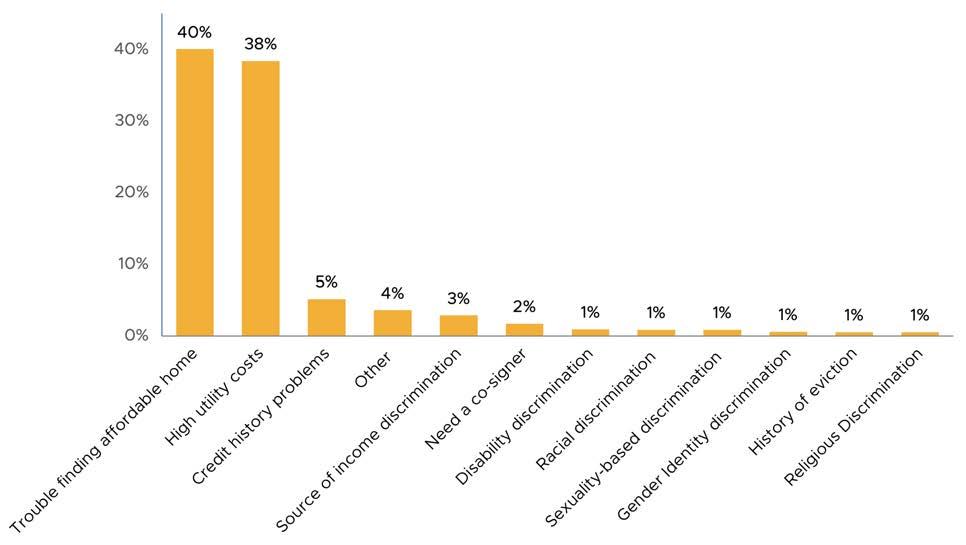

• Housing Needs Survey—launched early in the assessment process to invite community input on housing experiences and priorities in Edmond. It received more than 1,700 responses and provided valuable insight into the housing preferences and challenges facing the Edmond community.

• Housing Preference Survey—asked the community to share their feedback about different housing types and features. This survey received more 450 responses and provided context about what types and price points of housing are preferred, which helped shape recommended strategies.

During the second half of the assessment process, four focus group conversations gave Edmond stakeholders—including developers, renters, and young professionals—the opportunity to discuss their specific challenges and input on ways to combat them.

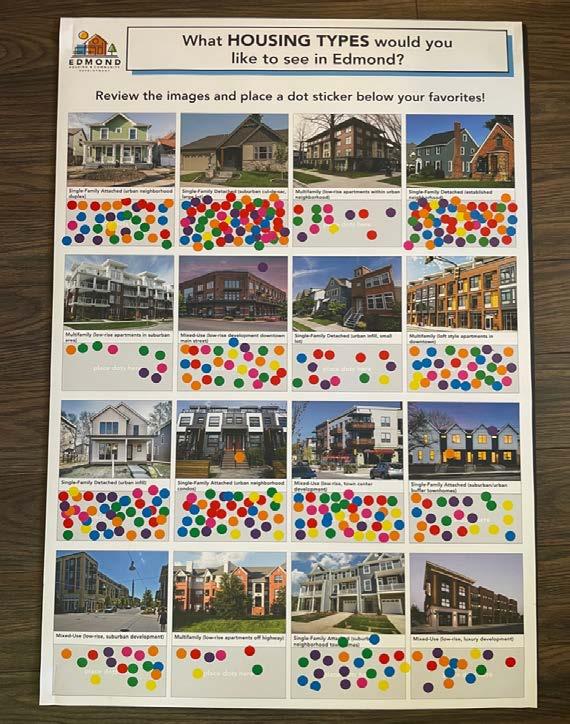

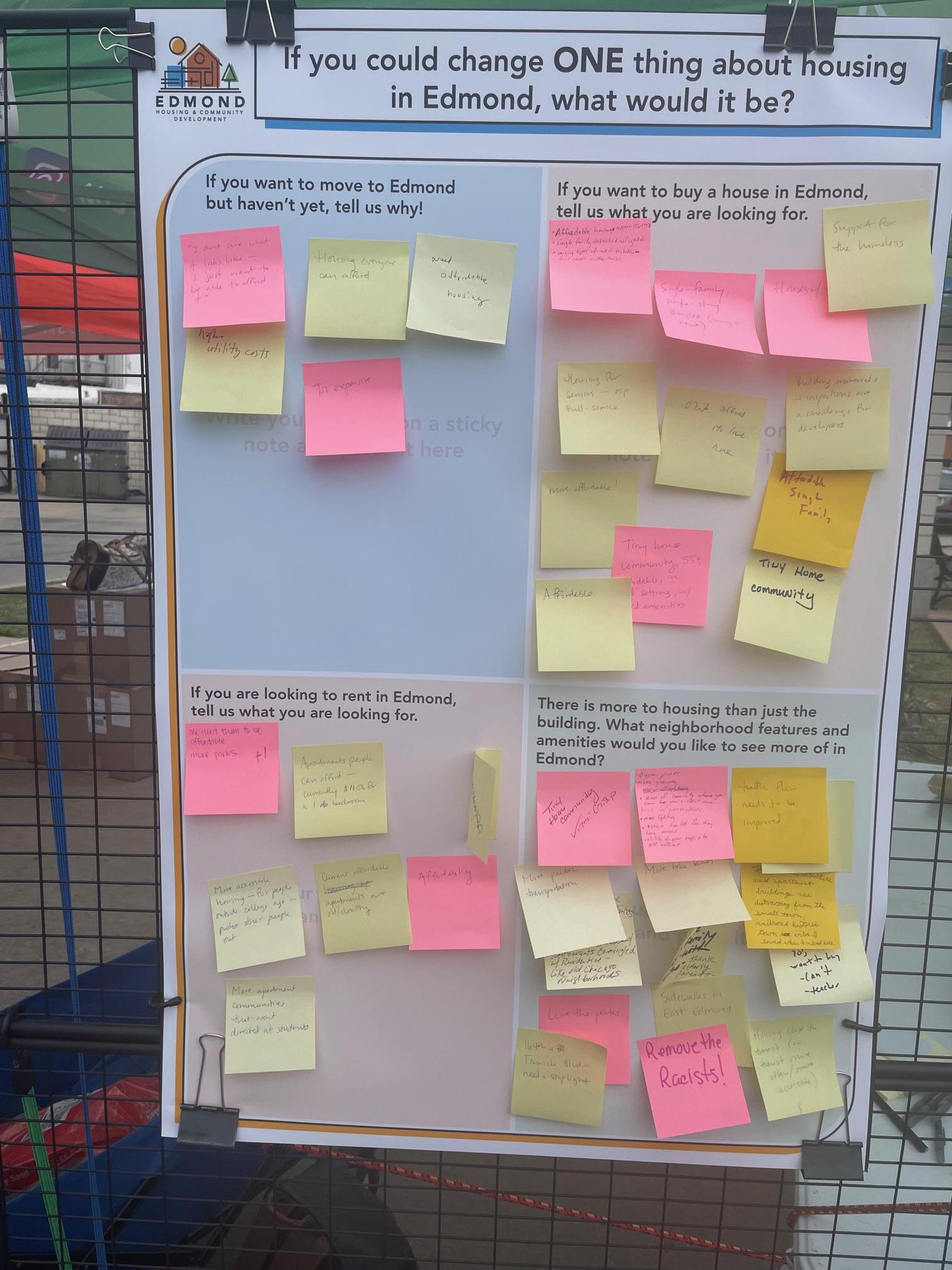

Pop-up booths at the monthly Edmond Farmers Market and Heard on Hurd music festival provided community members the opportunity to share their housing experiences firsthand.

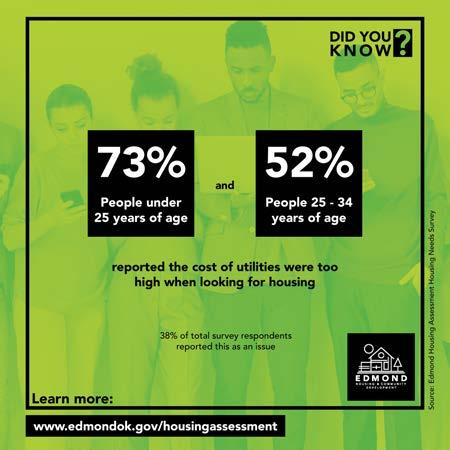

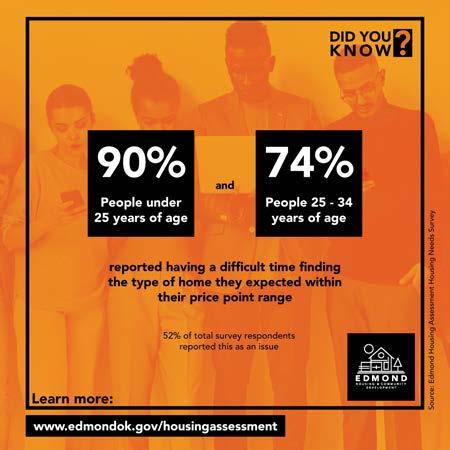

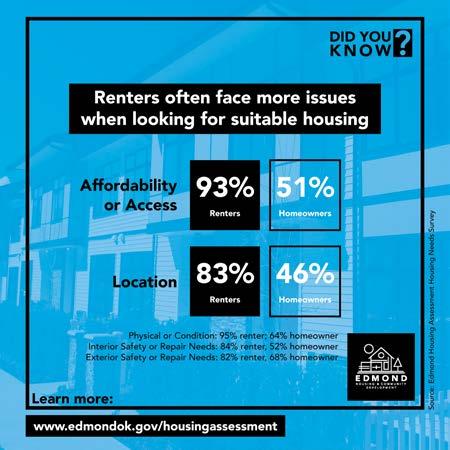

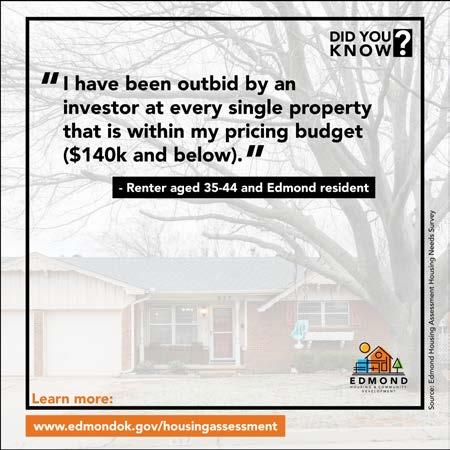

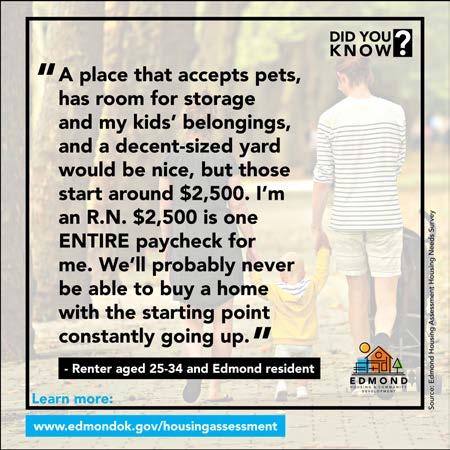

To keep the community informed about project progress, key updates and deliverables were also regularly posted on the City’s web page and shared via the City’s social media accounts. This included a series of infographics highlighting findings from the market analysis and Housing Needs Survey, as seen in the images to the right.

American households continue to navigate the long-term economic consequences of the COVID-19 pandemic.

For many households across the country, the pandemic brought growing economic equities to the forefront. While some were temporarily alleviated by policy responses, many are now being compounded by rapid inflation. In particular, the gap widened between homeowners and renters—home equity rose substantially in the past two years, while renters continued to face escalating housing costs that outpaced both inflation and wage growth. Consequently, millions of households are still behind on their housing payments and could face eviction or foreclosure as pandemic-era interventions end; according to the Federal Reserve, 10 percent of American households, including 15 percent of renter households, were behind on housing payments as of April 20221.

Households throughout the nation face a number of housing-related challenges. Housing costs increased substantially after 2020, particularly in growing metros; according to Zillow, the average market rent increased 25 percent (or nearly $400) since 2019, while Americans’ median household income rose just 5.4 percent2. As a result, 46 percent of renter households are burdened by housing costs and nearly one-third (32 percent) of households cannot afford to cover a $400 emergency expense3. Policies enacted in the wake of the pandemic, such as eviction and mortgage moratoria, improved financial wellbeing

for American households broadly in 2021. For instance, 78 percent of households reported being economically stable in 2021—up from 75 percent in 2019 and the highest level recorded since 20134. However, the expiration of pandemicera policies, coupled with rapid inflation, created new economic challenges, and households are increasingly likely to face housing insecurity, unpaid bills, and mounting debt5

Meanwhile, construction costs rose by 8.5 percent between November 2021 and November 2022, with a 31.4 percent increase in the last five years6, which contributed to the recent escalation in home prices. Since 2000, home prices rose 66 percent after adjusting for inflation, with a 37.6 percent increase since 2019 alone7. Despite these trends, households with steady incomes through the pandemic were able to capitalize on low interest rates and temporarily reduced housing values, contributing to an increase in the homeownership rate for the first time since 20168.

In response to record-breaking inflation, the Federal Reserve raised interest rates in 2022 and mortgage rates rose from 4.2 percent in March 2022 to 6.6 percent in March 2023 (30-year fixedrate mortgage, or FRM)9. Consequently, low- to moderate-income households and young families are increasingly unable to buy in the current market. Gen Xers, Millennials, and elder Gen Zers are having a harder time transitioning from renting to homeownership than previous generations did.

of households cannot afford to cover a $400 emergency expense.

32% Construction Costs

Source: Federal Reserve, 2022

31.4%

rise in construction costs over the last five years, with an 8.5 percent rise in construction costs between November 2021 to November 2022.

Source: Rider Levett Bucknall

6.6%

was the recorded interest rate in March 2023 which increased from 4.2 percent recorded in

Rising Prices

66%

increase in home prices (inflation-adjusted) since 2000, with a 37.6 percent increase since 2019 alone.

Source: Zillow Home Value Index

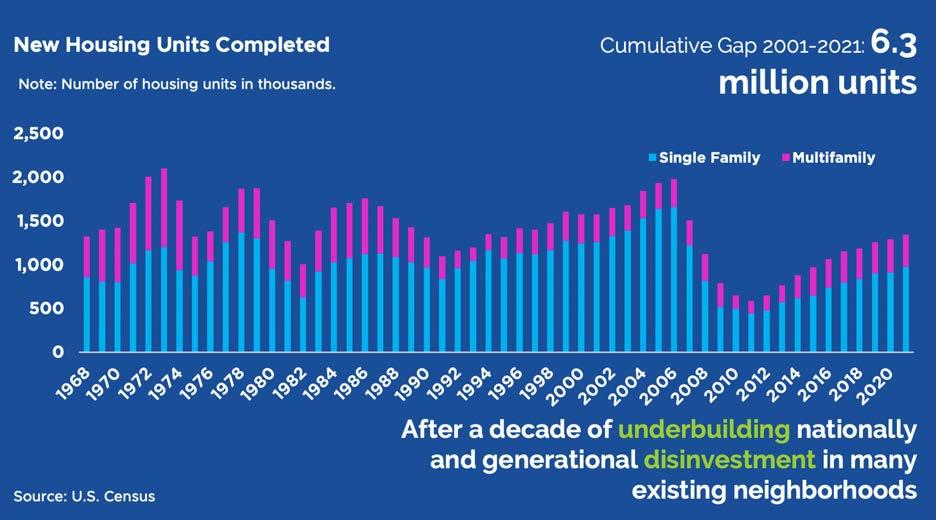

A key reason for increased housing costs is lagging housing production during the past decade.

From 2010 to 2020, the gap between supply and demand for housing units in the nation grew at a rate of nearly 600,000 units per year, including 325,000 affordable housing units. Construction of entry-level homes decreased five percent and the rate of affordable rental unit production declined seven percent10.

Recently, overall housing production increased despite rising construction costs. In 2021, singlefamily home starts exceeded one million units for the first time since before the Great Recession11 This trend continued through 2022, with 1.55 million total housing starts, including 547,400 multi-family unit starts—the highest levels seen since 198612

Despite recent increases in supply, housing costs continue to rise.

Prices for new-construction homes are increasingly costly: nationally, new multi-family units have a median rent of $1,740 and new single-family homes have a median sales price of $473,600 (Q4 2022)13, up from an average of $1,550 in 201714 and $335,400 in Q4 201715, respectively. While new construction does alleviate demand pressure on existing, comparatively affordable housing stock, the extent to which it will reduce overall costs is uncertain.

The rising cost of for-sale housing outpaced both wage growth and inflation. Per the Bureau of Labor

Statistics (BLS), inflation averaged 8 percent in 2022, compared to 4.7 percent in 202116. From 2021 to 2022, shelter costs rose 8.1 percent and rents rose by 8.8 percent17. Heightened costs for other essential goods like food, gas, and utilities further strained budgets. As a result, the national home price-to-income ratio (for the median household income) rose to 4.5—the highest level since 200618

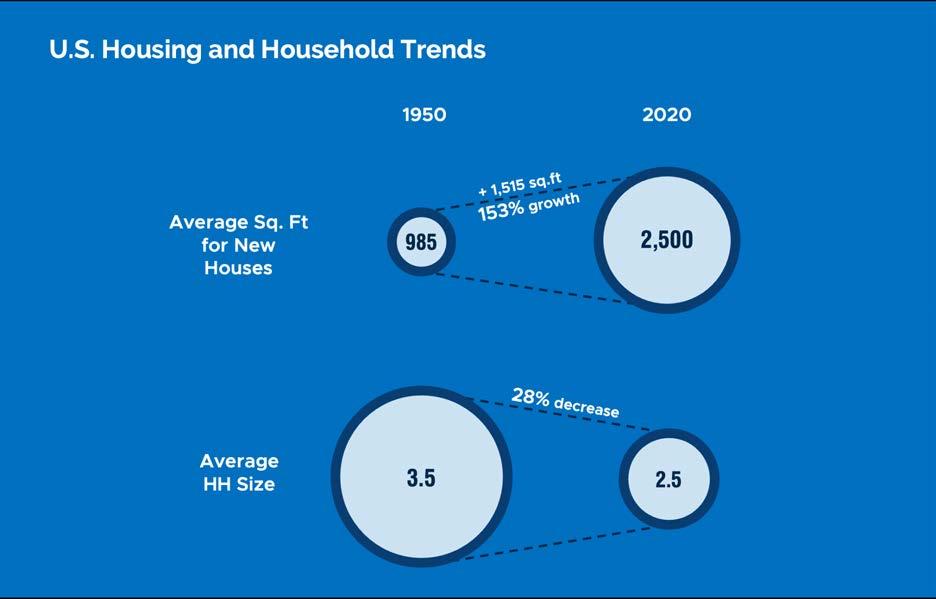

Shifting demographics are bringing changing preferences in housing types.

While single-family homes comprise an estimated 65 percent of the nation’s current occupied housing units, demographic shifts are changing the complexion of the ‘typical’ household. For instance, the average household size has dropped from 2.76 persons in 1980 to an estimated 2.55 persons in 202219. Married couples with children now comprise just under 19 percent of all households in the U.S., dropping from nearly onethird in 198020. The dominant housing typology since World War II, suburban three- to fourbedroom homes, have long served this market, yet are becoming less desirable with the increase in smaller, single-person and roommate households.

At the same time, the housing stock is aging. The median age of owner-occupied homes is now 41 years old, up from 34 years in 201021. Beyond demographic changes, older housing will require modernization to remain marketable.

Source: U.S. Census, American Community Survey USA, 1980-2020

Share of detached Single-Family homes

Share of married households with children

The share of single-family homes remained the same from 1980 to 2020

Yet, the share of married households with children, a primary market for single-family homes, declined substantially

Household sizes also decreased, impacting consumer preferences about the size of housing units

Source: U.S. Census 1950 and 2020

Single-family rental housing, both attached and detached, currently comprises around one-third of the total rental housing stock nationwide22 While the share of SFRs has remained relatively consistent over the past decade, institutional and investor-driven activity in the SFR market has escalated. According to the National Association of Realtors (NAR), institutional buyers made up around 13 percent of residential purchases in 2021—an increase from 12 percent in 202023. Investors tend to purchase moderately-priced housing that traditionally served the first-time homebuyer market, as well as low- and moderateincome home buyers. Just under half (42 percent) of the properties purchased by investors in 2021 were converted to rentals24

Because institutional ownership creates more competition for the for-sale supply, it can contribute to heightened housing costs. In 2021, the State of Oklahoma had the third highest share of institutional buyers at 18 percent of all transactions25. Oklahoma County had the largest share of institutional buyers of any county in Oklahoma and local stakeholders and Realtors in Edmond report a similar trend in the city26

Short-term rentals (e.g., vacation rentals by owner) can boost tourism and sales activity; however, they can also reduce the supply of long-term rental and for-sale housing, particularly starter homes or moderately priced rentals, thereby contributing to increases in rents and

for-sale prices27. Units are frequently purchased by investors, pricing out local buyers, to be converted to short-term rentals—a practice that has grown increasingly common over the past half decade, with the share of “hosts” owning 20 or more units nearly doubling from 2016 to 202028

According to AirDNA, there are currently 250 short-term rental properties in Edmond, of which the majority (83 percent) are entire homes29. Most short-term rentals are located in southern central Edmond, surrounding both the University of Central Oklahoma (UCO) and Oklahoma Christian University (OC)30.

According to the 2021 ACS, 42 percent of renters in the state are housing cost burdened—meaning they pay over 30 percent of their income toward housing expenses, including utilities—compared to 18 percent of homeowners31. The challenge is much more pronounced for renter-occupied households earning under $35,000 annually, 84 percent of which are housing cost burdened32. The state has a median housing value of $178,500, around $100,000 lower than the median in Edmond ($281,700)33. Per Redfin, the median sales price statewide is $229,800, 48 percent higher than it was in 2018 ($155,500)34. According to CoStar, the market rent per unit statewide is $884, an increase of 20 percent over the past five years35. The median year of housing structure built is 1979, which is similar to the nationwide median, and just over one-third (34 percent) of housing units were built before 197036.

With a population of just over 96,00037, Edmond is the fifth largest city in Oklahoma and the third largest in the Oklahoma City MSA (Metropolitan Statistical Area)38. MSAs represent a geography made up of one or more counties that contain a city of 50,000 or more residents or Census Bureau-defined urbanized area, and have a total population of at least 100,000 people39. Edmond directly borders Oklahoma City to the north. The city is intersected by Interstate 35, a major northsouth highway, connecting Edmond to Downtown Oklahoma City (15 miles south), and all the way to Fort Worth, Texas (212 miles south) and Wichita, Kansas (148 miles north). Edmond is just north of Interstate 44, providing access to Tulsa (100 miles northeast) and Lawton (100 miles southwest). A portion of historic route 66 and state highway 77 also run through Edmond.

Housing in Edmond is predominantly comprised of single-family detached structures, with a limited supply of multi-family dwellings. Relative to that of the nation, Edmond’s housing stock is newer; only about ten percent of structures were built prior to 197040. Housing production in the city escalated through the 1970s and 80s, coinciding with the population boom, and continued through the 2000s. Around 14 percent of homes were built in 2010 or later. The median age of housing units in the city is 30 years old—well below the nationwide median (41 years)41

Edmond offers numerous unique cultural assets, including a major university, historic landmarks, and multiple museums. The city is known for its family-friendly culture and amenities, high-quality school district, and historic structures situated in

its walkable downtown. In addition to its cultural assets, Edmond has a large park system, an annual Fourth of July celebration, and various public arts festivals.

Edmond is a high-growth city within a high-growth region relative to the state. The Oklahoma City MSA grew by 17 percent from 2010 to 2022, while the state grew by 6.8 percent. Edmond grew by 17.9 percent, adding 14,600 new residents during the same period42. Demand for housing remained strong in Edmond and, unlike trends nationally and statewide, the production rate in Edmond from 2011 to 2022 (on average, 585 annually) actually exceeded rates during the prior decade (570 units annually)43. Edmond’s population is projected to grow by 0.4% over the next five years44.

Esri 2022, Multiple Listing Service (MLS) 2022,

2020

The vast majority (80 percent) of housing units in Edmond are single-family detached and attached structures45, and single-family construction accounted for 94 percent of housing permits issued in the city from 2010 to 202246. Recent sales data sourced from Redfin indicates that most for-sale properties are between 1,700 to 2,500 square feet, containing three to five bedrooms, with prices ranging from $250,000 to $450,000 and a median of $364,20047. The median housing value citywide is approximately $282,00048

The multi-family housing supply in Edmond increased 72 percent, from around 4,700 units to 8,100 units from 2000 to 202249. Edmond has a significant supply of units targeting seniors and, excluding these, the current multi-family supply is 5,500 units. While supply trends for the multifamily market appear strong, recent deliveries have fallen far behind single-family construction and failed to keep up with the growing demand. Further, vacancy rates during the last three years were consistently under five percent, a decrease from the average of six to eight percent annually from 2010 to 2019.

Edmond’s new multi-family stock is larger and more expensive, and thus tends to be out of reach for most renters. The average size of a multi-family unit in Edmond is 912 square feet compared to 876 square feet in 2016 and 815 square feet in 2000, while the asking rent per square foot has risen 20 percent since 2016, not adjusting for inflation50.

Housing by Year Built in Edmond

Housing by Year Built in Edmond

Overall, Edmond has a competitive housing market, evidenced by limited supply, increasing prices and rents, and low vacancy. The city continues to be desirable for new construction, especially housing; however, the lack of diversity in housing types is contributing to market challenges. In particular, housing options are unattainable for the general workforce (i.e., teachers, nurses, frontline workers, and service workers), young families, young professionals, and older adults looking to downsize and stay in the community.

Older homes are concentrated in historically undeserved parts of the community near and around Downtown and heading south. These areas

tend to have higher rates of poverty and lower housing values. In contrast, communities in the northeastern and southeastern quadrants of the city have newer housing stock, as well as high median housing values.

The Edmond and Oklahoma City MSA economies are growing at a much faster rate than the state’s and are driven by the health care, education, manufacturing, and government sectors.

The ten largest employers in the Oklahoma City MSA include the State of Oklahoma, Tinker Air Force Base, the University of Oklahoma, INTEGRIS Health, and Hobby Lobby51. Nearly 16 percent of the region’s workforce are employed by these businesses.

The region’s workforce increased by four percent in the last year—an indication that the area employment level is recovering from job losses caused by the pandemic. Of service sector jobs, Education and Health Services and Leisure and Hospitality sectors show the most growth. Financial Activities, including the Insurance and Professional and Business Services sectors are

also important contributors to job growth in the region. The largest industry sector in the region is Education and Health Services, employing more than 30,000 workers52.

Edmond has nearly 50,000 jobs, or 6.5 percent of the jobs within the Oklahoma City MSA. With a consistently low unemployment rate, total employment in the city grew 8.7 percent from 2013 to 201953. The most recently available BLS data indicates that Edmond’s economy continues to remain strong—as of November 2022, the unemployment rate is just 2.3 percent and the city has added nearly 3,650 jobs since 202054.

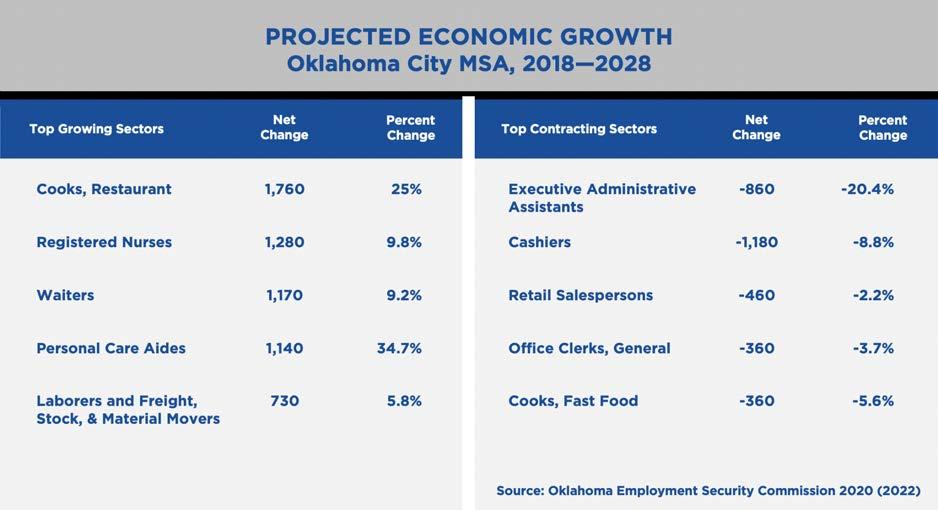

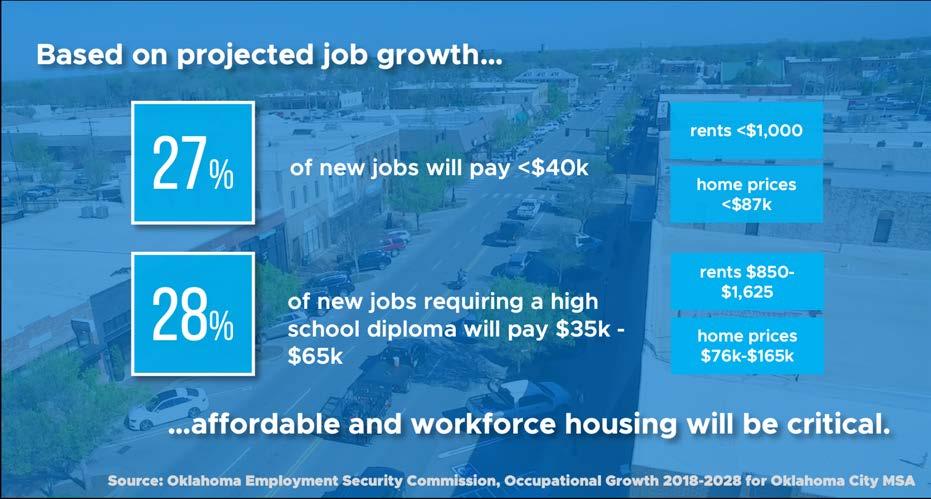

The Oklahoma Employment Security Commission publishes projected job growth for the state and Oklahoma City MSA, which includes Edmond. Many of the fastest-growing jobs in the MSA are relatively low-paying; for instance, the fastest-growing occupations in the MSA include restaurant workers, personal care aides, and freight, stock, and material movers, all of which earn between $20,000 to $35,000 annually55. Further, projections indicate that 27 percent of jobs added from 2018 to 2028 will pay less than $40,000, while a similar share of jobs requiring high school diplomas will pay between $35,000 to $65,00056. Hence, as demand for workers within critical sectors grows, the demand for quality housing within the affordable and workforce ranges will continue to grow.

1 Board of Governors of the Federal Reserve System. (May 2022). Economic Well-Being of U.S. Households in 2021. https://www.federalreserve. gov/publications/files/2021-report-economicwell-being-us-households-202205.pdf

2 Esri. (2022). ArcGIS Business Analyst. Bao. arcgis.com; Site To Do Business. https://bao. arcgis.com/esriBAO/

3, 4 Board of Governors of the Federal Reserve System. (May 2022). Economic Well-Being of U.S. Households in 2021. https://www.federalreserve. gov/publications/files/2021-report-economicwell-being-us-households-202205.pdf

5 Cutts, A. C. (February 2023). The Financial Condition of American Families Heading Into 2023. Primerica. https://www.primerica.com/public/ White_Paper_Primerica_Financial_Security_ Monitor_February_2023.pdf

6 Rider Levett Bucknall. (January 2023). RLB Construction Cost Report North America Q4 2022. https://www.rlb.com/americas/insight/ rlb-construction-cost-report-north-america-q42022/

7 Zillow. (n. d.). Housing Data. https://www.zillow. com/research/data/

8 Joint Center for Housing Studies of Harvard University. (2022). The State of the Nation’s Housing. Harvard University. https://www.jchs. harvard.edu/sites/default/files/reports/files/ Harvard_JCHS_State_Nations_Housing_2022.pdf

9 Freddie Mac. (July 2023). Mortgage Rates. https://www.freddiemac.com/pmms

10 U.S. Census Bureau. (2023). New Residential Construction Time Series / Trend Charts. https:// www.census.gov/construction/nrc/index.html

11 Joint Center for Housing Studies of Harvard University. (2022). The State of the Nation’s Housing. Harvard University. https://www.jchs. harvard.edu/sites/default/files/reports/files/ Harvard_JCHS_State_Nations_Housing_2022.pdf

12 U.S. Census Bureau. (2023). New Residential Construction Time Series / Trend Charts. https:// www.census.gov/construction/nrc/index.html

13 Federal Reserve Bank of St. Louis. (2023). Median Sales Price for New Houses Sold in the United States. FRED Economic Data. https://fred. stlouisfed.org/series/MSPNHSUS

14, 15 Joint Center for Housing Studies of Harvard University. (2022). The State of the Nation’s Housing. Harvard University. https://www.jchs. harvard.edu/sites/default/files/reports/files/ Harvard_JCHS_State_Nations_Housing_2022.pdf

16, 17 U.S Bureau of Labor and Statistics. (n. d.). Consumer Price Index. https://www.bls.gov/cpi/

18 Zillow. (n. d.). Housing Data. https://www.zillow. com/research/data/

19 Esri. (2022). ArcGIS Business Analyst. Bao. arcgis.com; Site To Do Business. https://bao. arcgis.com/esriBAO/

20, 21 United States Census Bureau. (2021). American Community Survey (ACS). Census.gov. https://data.census.gov/

22 Reid, C. K. (2018). The Rise of Single-Family Rentals after the Foreclosure Crisis. Terner Center at University of California Berkeley. https:// ternercenter.berkeley.edu/wp-content/uploads/ pdfs/Single-Family_Renters_Brief.pdf

23, 24,25, 26 National Association of Realtors. (May 2022). Impact of Institutional Buyers on Home Sales and Single-Family Rentals. https://cdn.nar.realtor/sites/default/files/ documents/2022-impact-of-institutionalbuyers-on-home-sales-and-single-familyrentals-05-12-2022.pdf

27 National Low Income Housing Coalition. (February 2023). Report Demonstrates Short Term Rentals Are Exacerbating Puerto Rico’s Housing Crisis. https://nlihc.org/resource/ report-demonstrates-short-term-rentals-areexacerbating-puerto-ricos-housing-crisis

28 AirDNA. (2021). 2021 U.S. Short-Term Rental Outlook Report. https://www.airdna.co/industryreport/2021-u-s-short-term-rental-outlook-report

29, 30 AirDNA. (n. d.). Vacation Rental Data. https://www.airdna.co/vacation-rental-data/app/ us/oklahoma/oklahoma-city/overview

31 , 32 U.S. Census Bureau. (2021). American Community Survey (ACS). Census.gov. https:// data.census.gov/

33 Esri. (2022). ArcGIS Business Analyst. Bao. arcgis.com; Site To Do Business. https://bao. arcgis.com/esriBAO/

34 Redfin. (2023). Real Estate, Homes for Sale, MLS Listings, Agents. Www.redfin.com. https:// www.redfin.com/

35 CoStar (2023). https://www.costar.com/

36 U.S. Census Bureau. (2021). American Community Survey (ACS). Census.gov. https:// data.census.gov/

37 Esri. (2022). ArcGIS Business Analyst. Bao. arcgis.com; Site To Do Business. https://bao. arcgis.com/esriBAO/

38 U.S. Census Bureau. (2021). American Community Survey (ACS). Census.gov. https:// data.census.gov/

39 U.S. Census Bureau. (n. d.). Metropolitan Areas. https://www2.census.gov/geo/pdfs/reference/ GARM/Ch13GARM.pdf

40 , 41 U.S. Census Bureau. (2021). American Community Survey (ACS). Census.gov. https:// data.census.gov/

42 Esri. (2022). ArcGIS Business Analyst. Bao. arcgis.com; Site To Do Business. https://bao. arcgis.com/esriBAO/

43 U.S. Department of Housing and Urban Development. (n. d.). SOCDS Permit Database. https://socds.huduser.gov/permits/

44 ,45 Esri. (2022). ArcGIS Business Analyst. Bao. arcgis.com; Site To Do Business. https://bao. arcgis.com/esriBAO/

46 U.S. Department of Housing and Urban Development. (n. d.). SOCDS Permit Database. https://socds.huduser.gov/permits/

47 Redfin. (2023). Real Estate, Homes for Sale, MLS Listings, Agents. Www.redfin.com. https:// www.redfin.com/

48, 49 Esri. (2022). ArcGIS Business Analyst. Bao. arcgis.com; Site To Do Business. https://bao. arcgis.com/esriBAO/

50 CoStar (2023). https://www.costar.com/

51 Greater Oklahoma City. (April 2023). Major Employers. https://www.greateroklahomacity. com/clientuploads/OKCMajorEmployers.pdf

52 Esri. (2022). ArcGIS Business Analyst. Bao. arcgis.com; Site To Do Business. https://bao. arcgis.com/esriBAO/

53, 54 U.S. Bureau of Labor Statistics. (2023). Local Area Unemployment Statistics. https:// data.bls.gov/PDQWeb/la

55, 56 Oklahoma Employment Security Commission. (2023). Industry and Occupational Employment Projections. https://oklahoma.gov/ oesc/labor-market/employment-projections.html

The prior section discussed general trends impacting housing and development in the Edmond market and they begin to create an understanding of what housing challenges the community faces. However, they do not provide a complete picture.

Detailed data analysis, conversations with community stakeholders, the housing needs survey, and other observations led to the identification of six key trends.

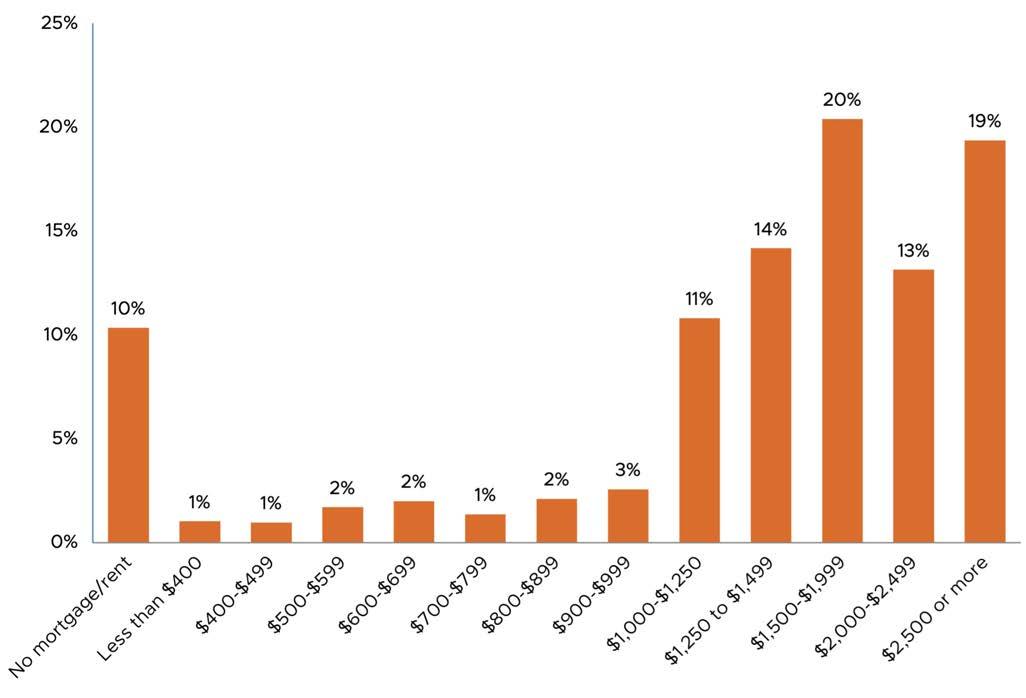

Nearly 40 percent of renters cannot afford a safe and decent two-bedroom unit in Edmond: a safe and decent two-bedroom unit costs $1,020 per month, including utilities1. “Safe and decent” means that the unit does not have any major maintenance needs, the mechanical systems are functional, and there are no health or safety hazards.

Nearly one-third of all households are housing cost burdened. Of the total households in Edmond, 17 percent of homeowners and 47 percent of renters are housing cost burdened2. Each month, these residents may have to make choices between paying for housing and securing other essentials like food, medicine, health care, and transportation.

The average sale price for a new home in Edmond is about $429,0003. Sixty-four percent of households in Edmond today cannot afford that purchase price, and 79 percent of all households in the Oklahoma City MSA cannot afford to buy a house at that price. Housing affordability is particularly challenging for young adults aged 24 to 34—75 percent of this group cannot afford the average new home in Edmond4.

The median housing value of a home in Edmond is $282,0005. Sixty percent of households aged 25 to 34 cannot afford that purchase price. Sixtyeight percent of all households in the same age range in the Oklahoma City MSA cannot afford this price point6.

New home prices increased by 31 percent from 2017 to 2022 and the median home value increased by 38 percent. The price increases are making homeownership unattainable for many in Edmond.

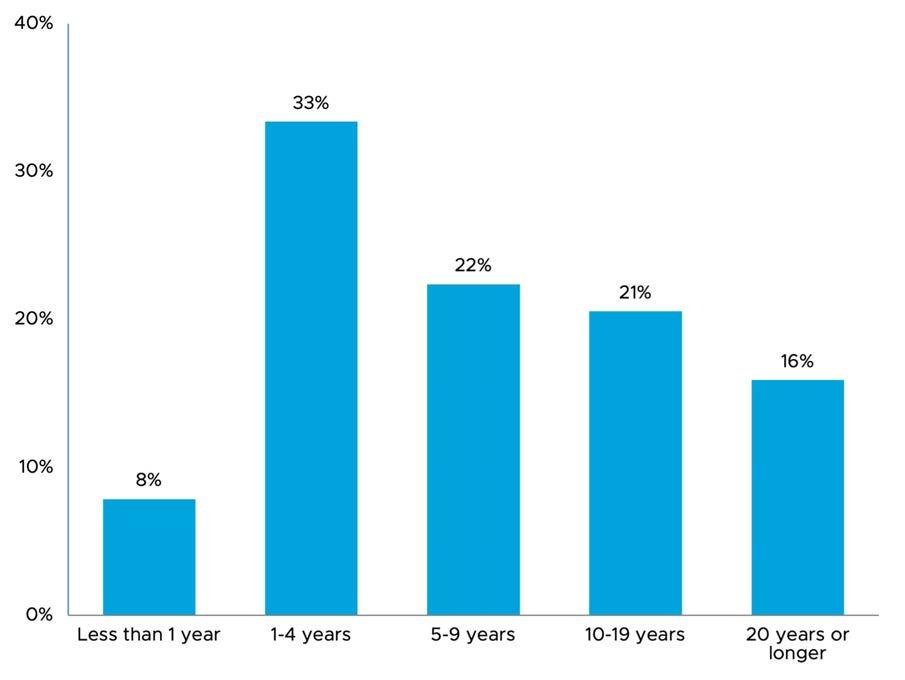

Homes are selling faster than ever. Between 2017 and 2022, the average number of days a home was on the market decreased from 83 to 367. Edmond’s desirability has made it more difficult for people to find homes in the community due to increased competition.

The rental housing market is also very competitive. Only 660 multifamily units were built in Edmond in the last five years, and most of those units are age-restricted for people aged 55 and older.8 Despite average rental rates being historically high, low vacancy rates indicate strong demand for more rental housing options in Edmond.

Long-term

is limited across Edmond. Many dedicated affordable units are located in the city’s western areas. These properties may have land use restrictions, were developed using tax credits, or are subject to housing programs that are affordable to qualifying households (those earning less than 60 percent of the area median income) and must remain affordable for a required number of years. Currently, there are 7,425 households that qualify for affordable housing in Edmond, but only 1,790 to 2,250 dedicated affordable units available to serve these qualifying households.9 Over 5,000 units are needed to close this gap.

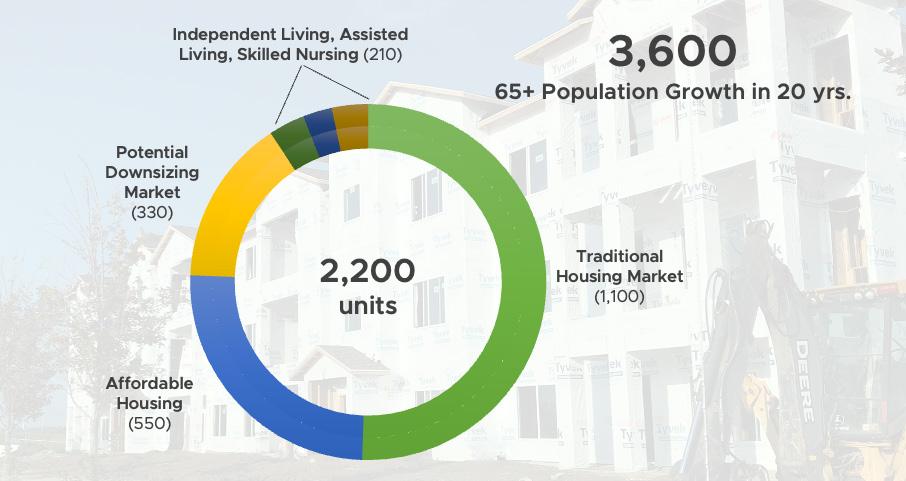

Asking Rent and Vacancy Rates in EdmondThe age distribution of Edmond’s population is projected to shift over the next five years. Edmond’s population makeup was very similar to Oklahoma County, the Oklahoma City MSA, and the United States in 2022. The early workforce (age 25 to 34), senior (age 65 to 74), and elderly populations (age 75+) grew substantially in Edmond between 2010 and 2022. However, the early workforce cohort is expected to decline between 2022 and 2027, along with school-aged children (age 5 to 17), college-aged young adults (age 18 to 24), and empty nesters (age 50 to 64)10.

If Edmond is to remain a community for all ages, it needs a variety of housing that is attainable for people and families throughout their lives. Young adults and families earn less and have less buying power. As people age and families grow, their earning potential increases, and so does their buying potential for housing. Different housing types target specific values and desires that allow people to move within in a community as their lifestyles change. Because Edmond does not have housing to support aging in place, for example, people may look to move out of the city as they grow older. Downsizing—moving to a home that has less square footage, less land, and/or is less expensive—in Edmond is also difficult given the current short supply of smaller and less expensive housing stock in Edmond. Older residents hoping to downsize are competing with first-time home buyers in an increasingly crowded market due to lack of affordable housing availability.

Edmond makes up 12 percent of Oklahoma County’s population and is a major contributor to the Oklahoma City MSA’s economy with eight percent of the county’s total jobs11. Seventeen percent of Edmond’s jobs are in education-related fields12. The job market is not expected to decline in the future, and housing products in Edmond will need to accommodate working families and their wages if the city wants to continue attracting residents to fill employment opportunities for people of all skill sets and experience levels.

Edmond is a retail center for the county. There are approximately 4,650 businesses registered in Edmond ranging in size13. The city makes up 14 percent of the county’s retail supply, which generates about $2.4 billion annually14

Edmond’s economy is growing at a faster rate than the Oklahoma City MSA, state of Oklahoma, and United States15. There are 38,000 jobs in the city, and job growth is expected to continue16. Most people will not consider commuting more than 30 minutes for a job, and some jobs require their employees live within a certain distance to work. Appropriate housing development is critical to enable employees to live and work in the same community, and situating housing near jobs helps reduce transportation costs.

Commuters face challenges, too. Nearly 75 percent of all workers employed within Edmond live outside the city17. Lack of affordable housing and limited access to regional public transit means that many employees are left with tough

choices about which shifts they are able to work. As a result, local employers have been unable to fill open positions and lose out on potential new hires.

Additionally, as Edmond is forced to import workforce, it increases traffic congestion, especially during peak AM and PM times (the period when there is the highest volume of traffic for a continuous period of time)18. Traffic is one of the most highly rated concerns reported in Edmond’s Resident Satisfaction Survey: 39 percent of 2021 respondents said it was the single biggest issue facing the city. Promoting additional housing types and price points can help reduce congestion and address this resident concern.

Rent and housing sales prices will need to decrease to house Edmond employees. Based on projected growth calculations, many of the growing and essential jobs in Edmond will not pay a wage that aligns with the housing market. It is expected that 27 percent of new jobs will pay less than $40,000 a year. Someone earning this wage will need a monthly rent less than $1,000 and home prices less than $87,000 if they want to both work and live in Edmond19. Quality housing of all types and at all price points—including affordable and workforce housing—is essential to retaining the workers that provide the services and products that Edmond residents have come to value as a part of the city’s quality of life.

Poverty is highest near the core areas of Edmond. Programs have been created to help address the problems housing cost-burdened households face, but are not sufficient on their own. Preservation of lower-cost housing will be important for reducing poverty in Edmond.

Renters live in the core areas of Edmond. Planned developments will increase density, but additional for-rent options for residents should be spread throughout the city. This will provide residents with more housing opportunities and choice.

Housing stock and home values vary greatly from neighborhood to neighborhood. This has important implications not only for the housing options available for current and potential future Edmond residents, but also for tailoring and targeting the strategy tactics and resources outlined in this assessment. Not all Edmond neighborhoods will need the same types of investment and support.

For instance, the area around UCO has the lowest median housing values, and housing there is in need of renovation, rehab, and the preservation of affordable housing options. Conversely, areas of East Edmond may be suitable for housing diversification to introduce more attainable price points, in line with what is outlined in the East Edmond Plan.

Housing production in Edmond has nearly returned to pre-Recession levels, but 94 percent of permits issued over the last decade were for single-family homes20. Edmond’s housing makeup is different from that of the state and country’s: Edmond’s median housing value is just over $100,000 more than Oklahoma’s21, and new construction sales prices in Edmond are $167,000 more than Oklahoma’s and $68,000 more than the United States’22.

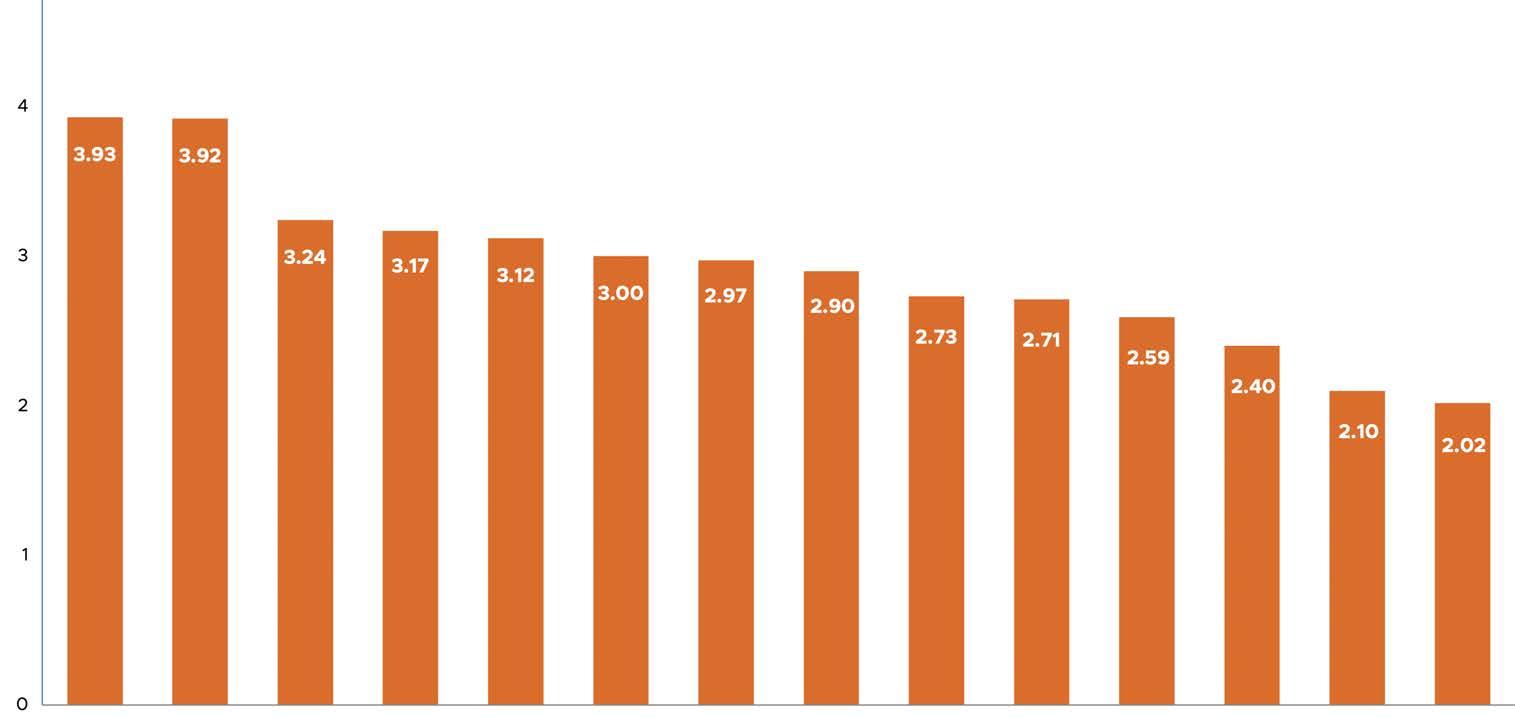

Edmond’s housing challenges are not exclusive, but they are more intense when compared to communities with similar growth trends. Comparable cities across the United States may appear to have higher rents, but renters in Edmond are more likely to be cost-burdened than renters in six of seven peer cities listed on the right.

Homeowners in Edmond are also more likely to be cost-burdened than homeowners in five of the seven peer cities. Edmond’s sluggish housing development is likely contributing to many of these issues.

There is demand in Edmond for housing of all types and price points, for-sale and for-rent, and diversifying the housing stock will help meet that need.

Demand for housing comes from several demand segments, including existing residents and new residents moving to the city. The needs of these segments differ, but there is some overlap among them—for example, many existing residents and potential residents need better access to quality housing at price points that are not currently available. It is important for the community to have a variety of housing options to support its continued growth and economic vitality.

For instance, attainable housing for young professionals and young families allows these households to establish roots, participate in the community, and invest their resources. Housing that allows aging-in-place for older adults provides options for long-time residents to stay in the community when their housing needs change. Housing that supports the workforce helps employers and business owners grown their local presence.

A community’s existing housing stock is influenced by many related factors, including historic housing policies, economic trends, and residents’ access, preferences, and choices at various points in history. Edmond’s rapid growth over the past several decades put pressure on the

local housing market overall, but housing needs still vary significantly by neighborhood and income level. Different areas and housing types require different approaches. Some areas of the city need programs that help residents with home repairs so that they can remain in their current homes, others need a greater variety of housing types, and still others may need infrastructure improvements to support housing development.

Edmond is growing because it continues to attract new residents, with its high quality of life, strong schools, job market, and favorable location within the region. However, many potential residents, including front line workers, young families, young professionals, empty nesters, and other groups, cannot find suitable housing options in the city. Part of the demand analysis considers what types and price points of housing are needed to support these target markets.

Determining market demand for the different needs and aspirations of existing and potential future residents requires a multi-faceted approach. To arrive at an overall housing demand for Edmond and project the scale of the city’s future need, five different approaches were used:

• Assesses income variables within the city to determine the amount and types of units that are affordable to existing residents.

• Considers consumer profiles of residents within the market area to determine desirable housing products that can attract them to Edmond.

• Uses household income levels and projected population growth to determine future demand.

• Uses age group projections, senior demographic data, and supply information from the market to determine future demand.

• Uses county-to-county migration data to understand inter- and intra-regional flow of population to compute demand.

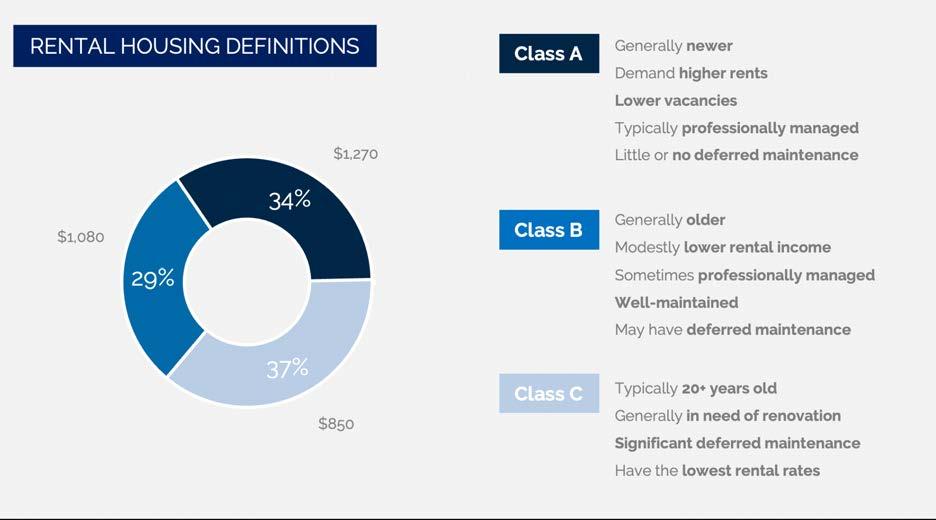

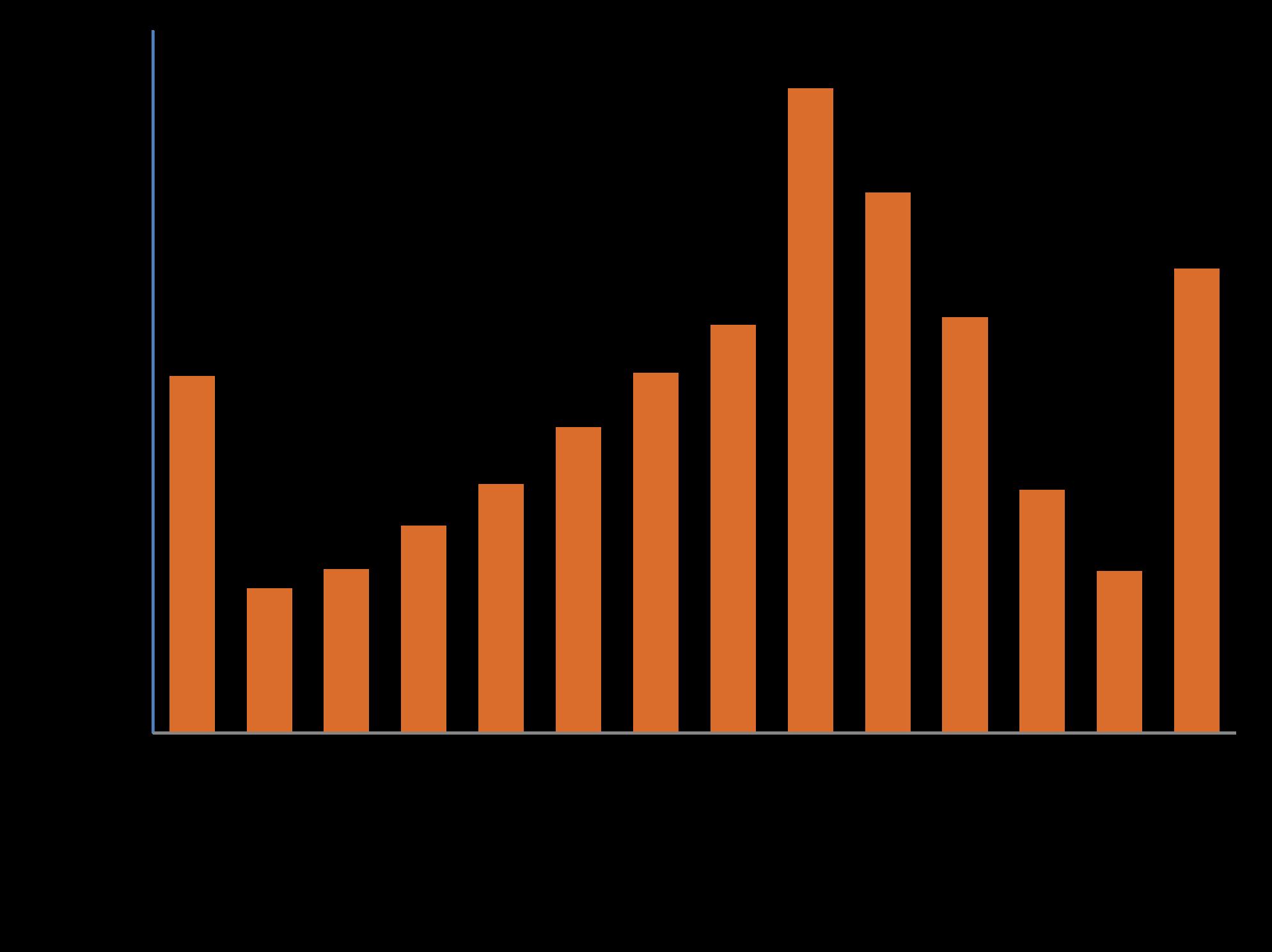

Quantifying the number of households by affordability levels and product segments can inform both the housing price and rent levels required and the scale of the need in the market to address demand. The graphic on the right distills the HUD-determined Area Median Income (AMI) for the Oklahoma City MSA, adjusted for Edmond’s average household size, into various affordability levels. At each affordability level, ideal equivalent housing prices are set so that residents are not cost-burdened. This allows us to break up the market into different segments that correspond to different types of housing products. The chart also uses American Community Survey (ACS) data to show the number of households in Edmond that fall within each price bracket, with a further breakdown by race and ethnicity.

With population growth projected to slow over the next five years, the affordability levels of existing Edmond households and workforce will drive demand for housing in the near term. Attracting households from the broader metro area with diverse housing products currently absent in the market can drive additional demand.

The first step in the demand analysis is quantifying what existing households can afford without being cost burdened compared to what housing values or rents are currently in the city. This analysis highlights potential opportunities for development where there are gaps between existing housing supply and what households can afford. It can also provide a more nuanced look at how idealized household spending for Edmond’s market—that is, scenarios where households are not housing cost-burdened—lines up with the supply currently available in Edmond.

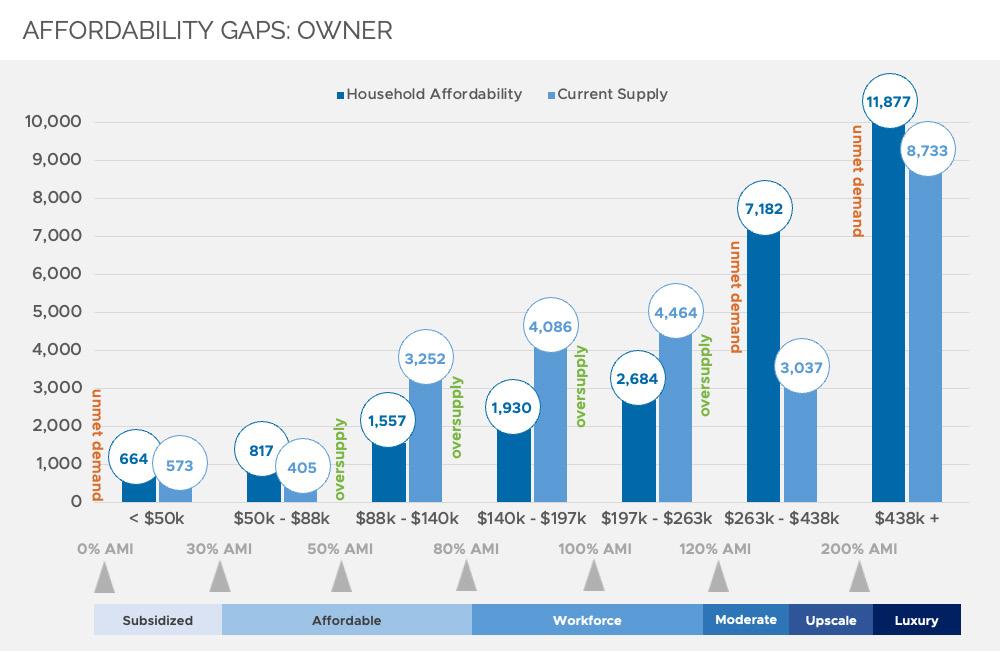

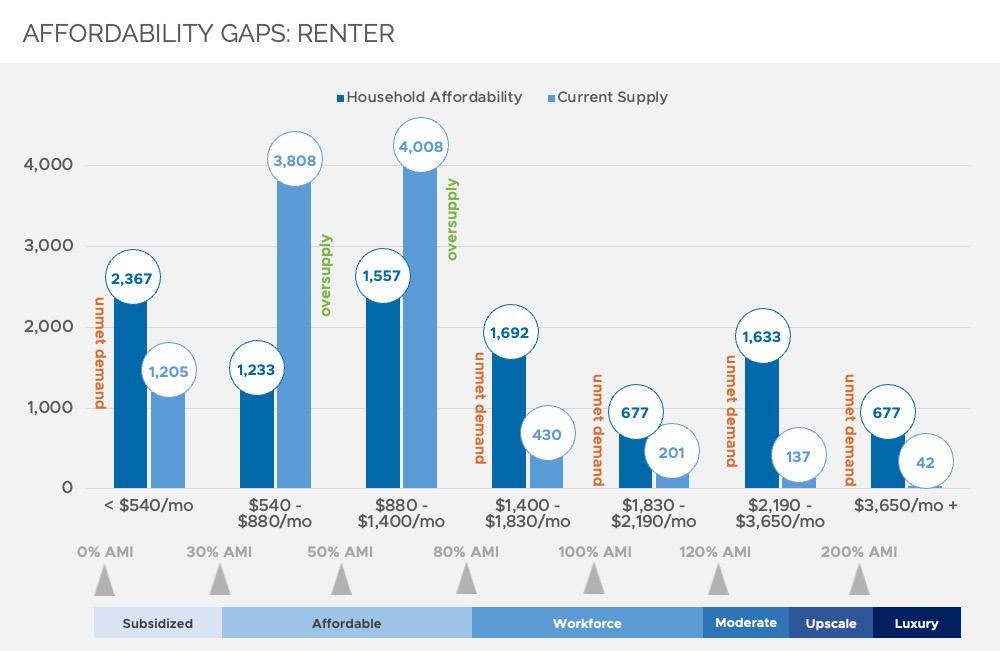

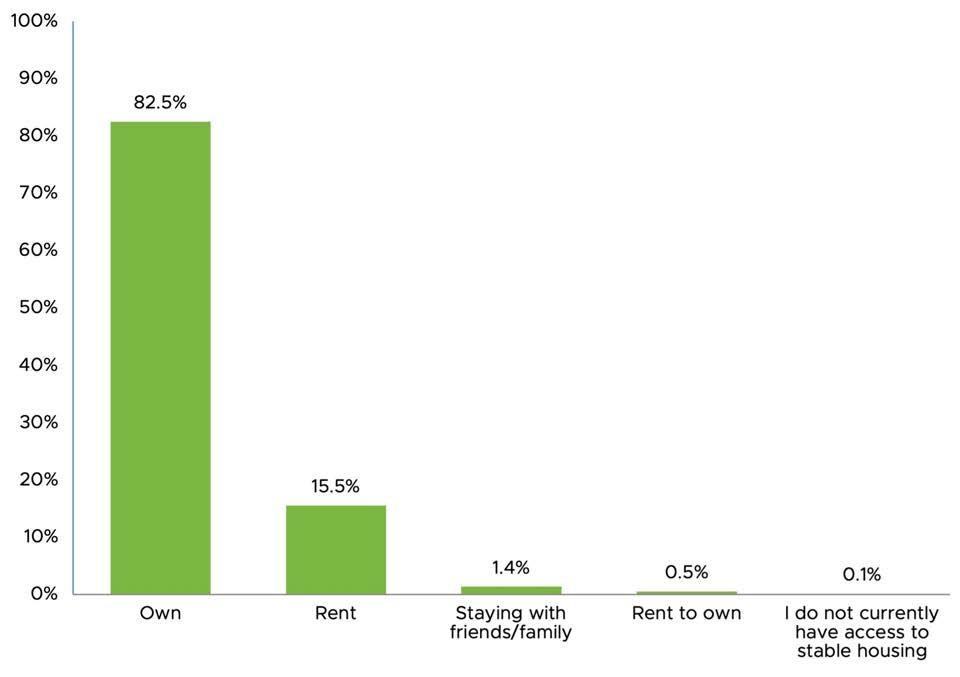

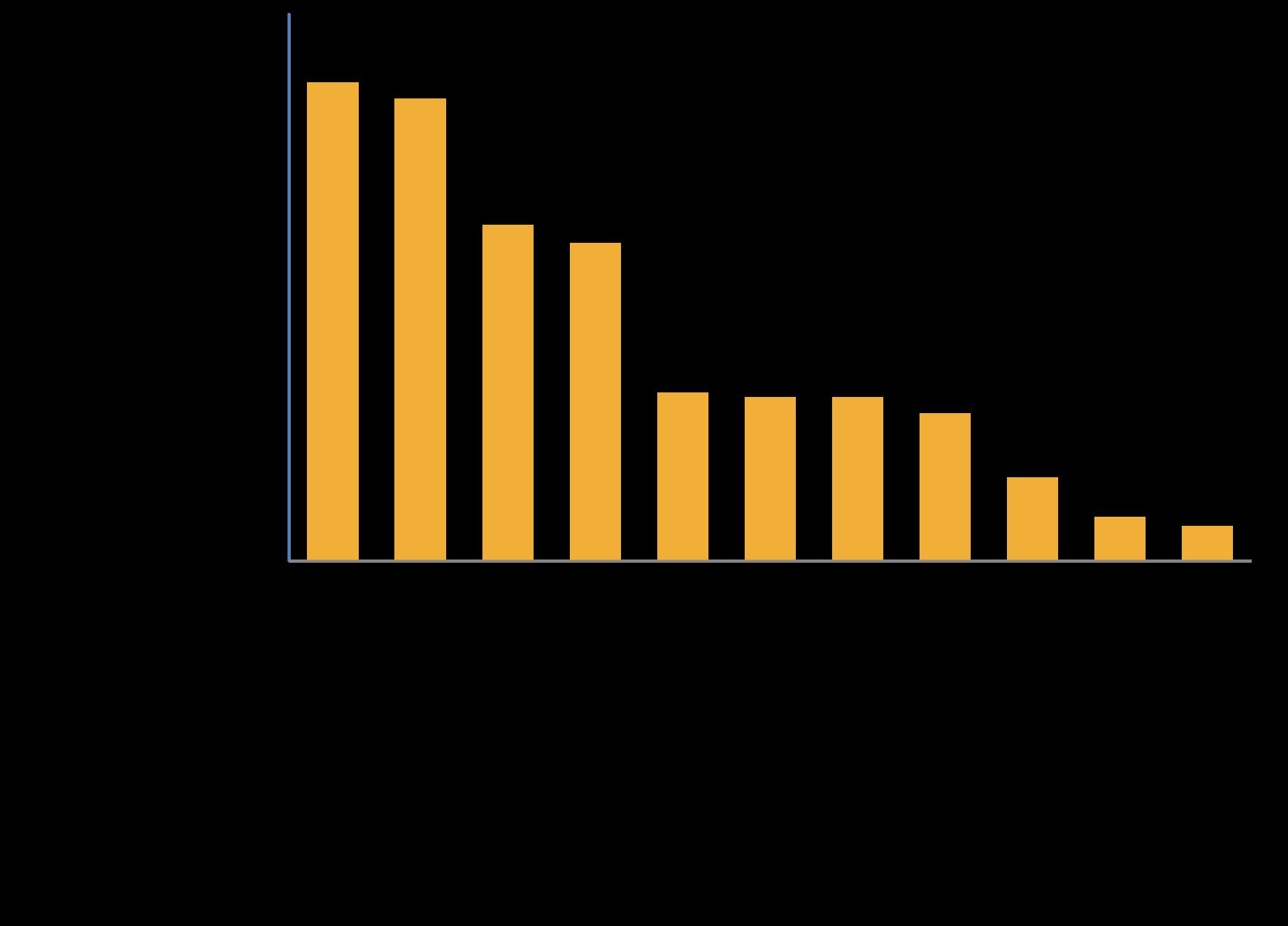

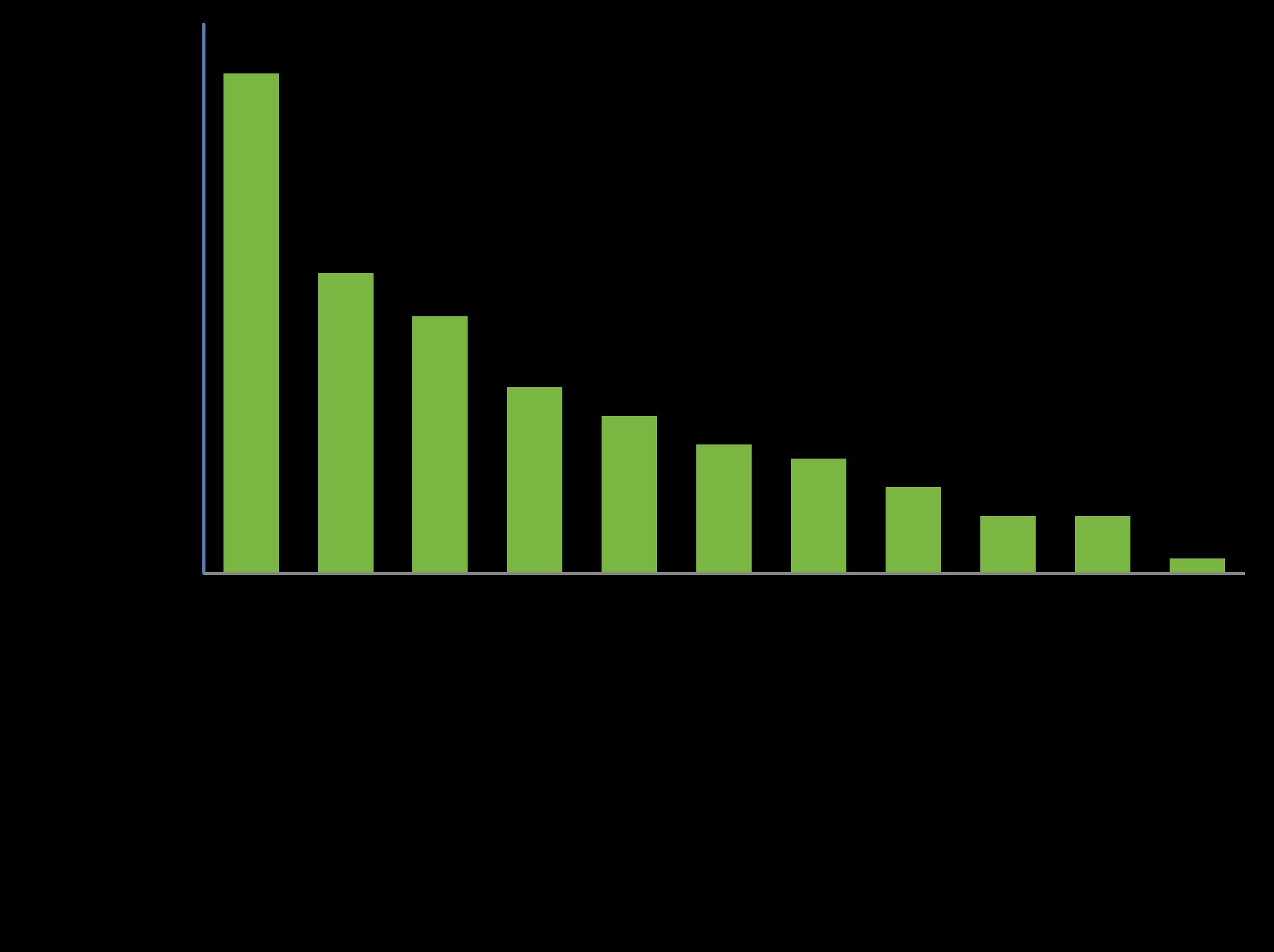

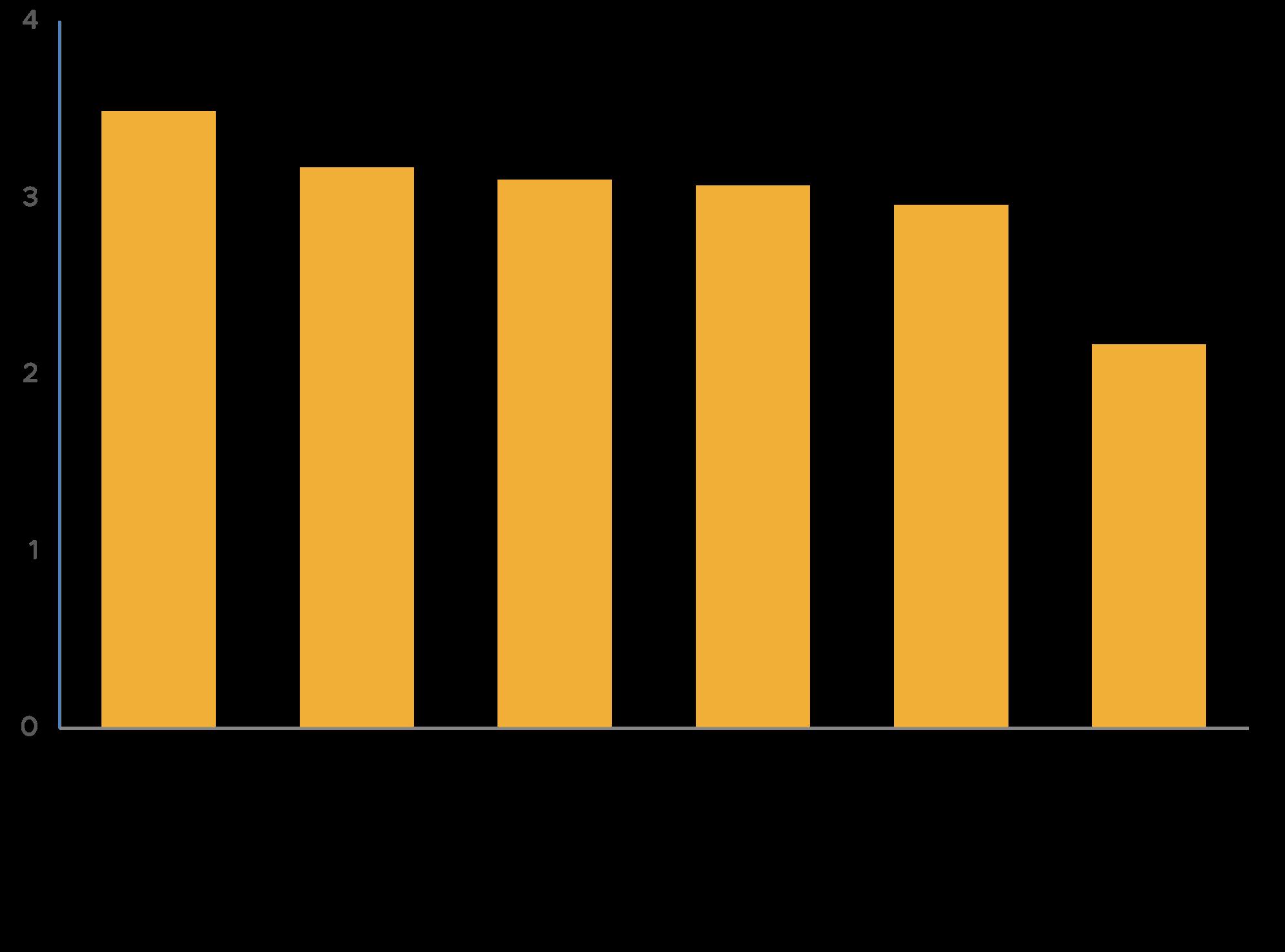

The ACS provides income distribution data by housing tenure and the share of owner and renter households in Edmond. In the charts at right, the ‘household affordability’ bars represent the number of households able to afford residential products at various price points, taking into account appropriate housing spending patterns at various income levels that would not result in a household becoming cost-burdened. This does not equate to actual household spending on housing. In some cases, households are spending more

than 30 percent of their income on housing, while others may spend significantly less due to higher saving levels, unavailability of a desired type of housing, or a number of other factors.

Each housing cost range (mortgage or rent) is assigned to a housing type to pair product with affordability, ranging from subsidized units to luxury housing products. It is important to note that housing value and rent data is for all units in the market based on U.S. Census Bureau’s ACS data and does not represent what is currently available, or listed, in the market.

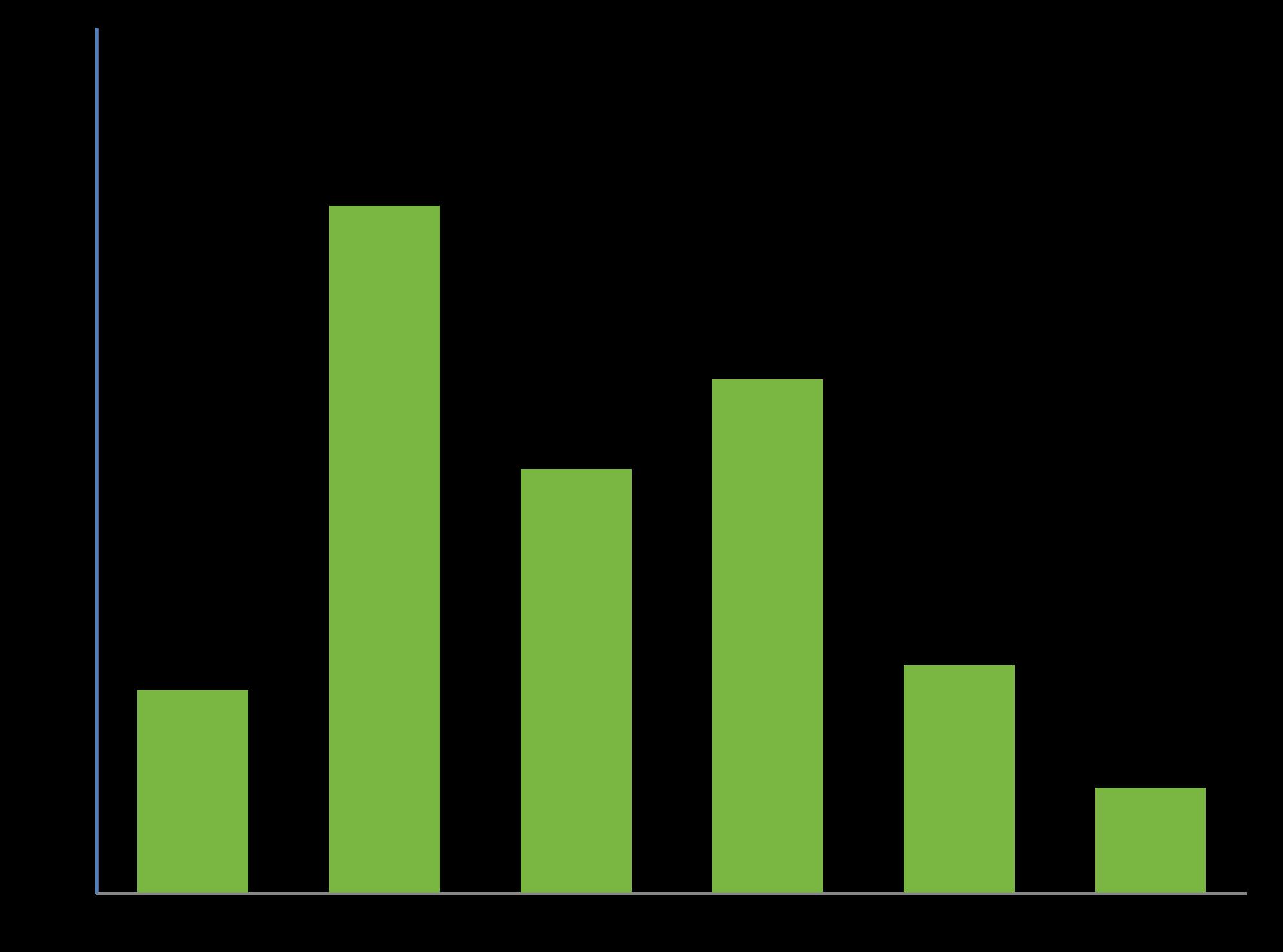

The affordability gap analysis for owners shows:

• An oversupply of existing for-sale homes priced between $88,000 and $263,000.

• An under supply of for-sale homes priced above $263,000.

• A slight under supply of for-sale homes priced under $88,000.

There are important implications to consider. First, while this data indicates there is an oversupply of moderately-priced homes, it is currently rare for homes in this price range to be placed on the market. Thus, homes in this price range are currently unavailable, or have substantial competition when one becomes available.

Second, the analysis also shows there are many

households in Edmond that could afford more expensive homes than they currently live in, specifically homes priced at $263,000 or higher; however, there is an under supply of these homes. Thus, if these homes were available, more moderately-priced homes would also become available, creating market churn.

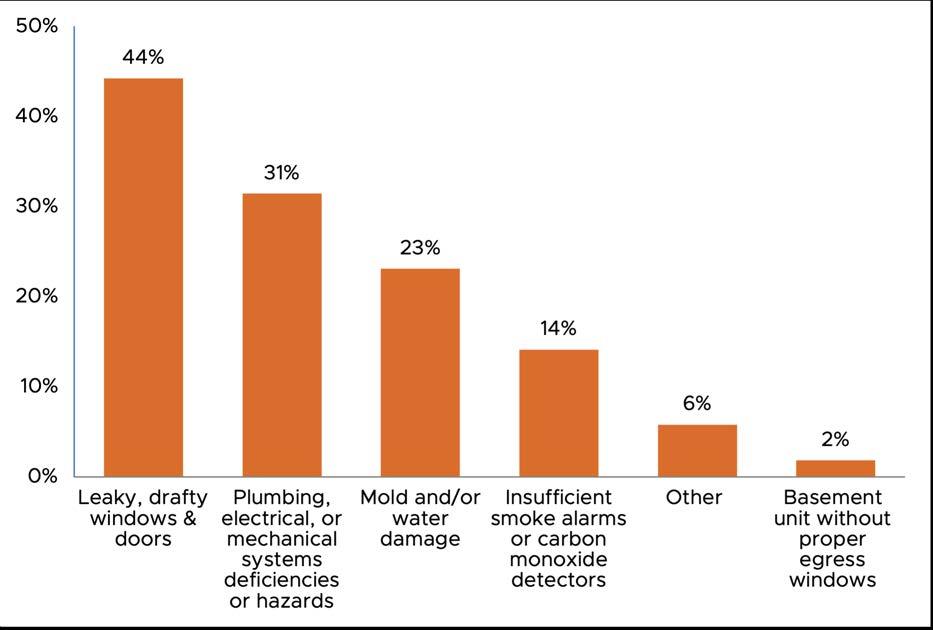

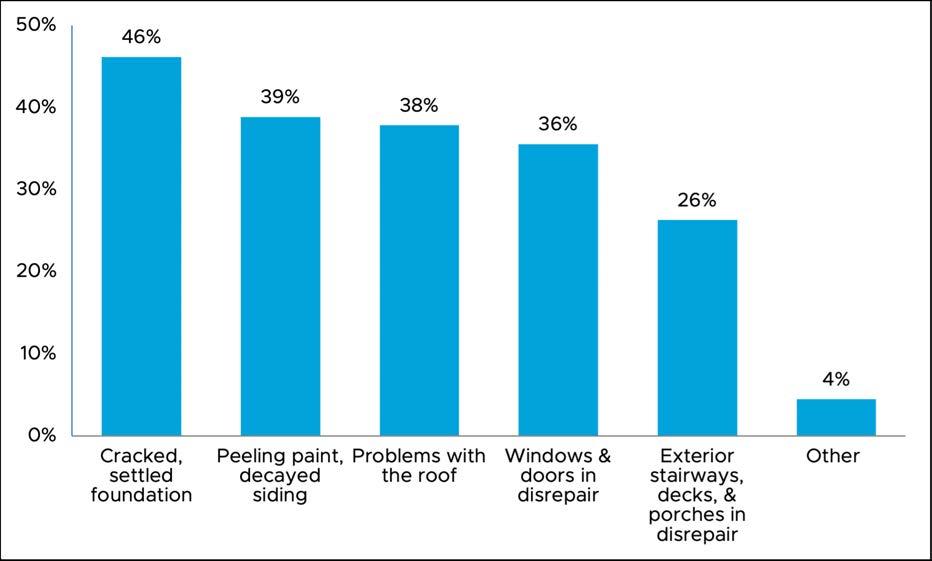

Third, this data does not include information about condition, age, number of bedrooms and bathrooms, and overall marketability. The Housing Needs Survey indicated that many households seeking housing encountered condition issues of some kind. Thus, much of this housing could require modest to substantial renovations to meet market preferences, which impacts affordability.

Finally, this data does not represent the challenges associated with attainable homeownership for low- and moderate-income households, including down payments, housing condition, etc.

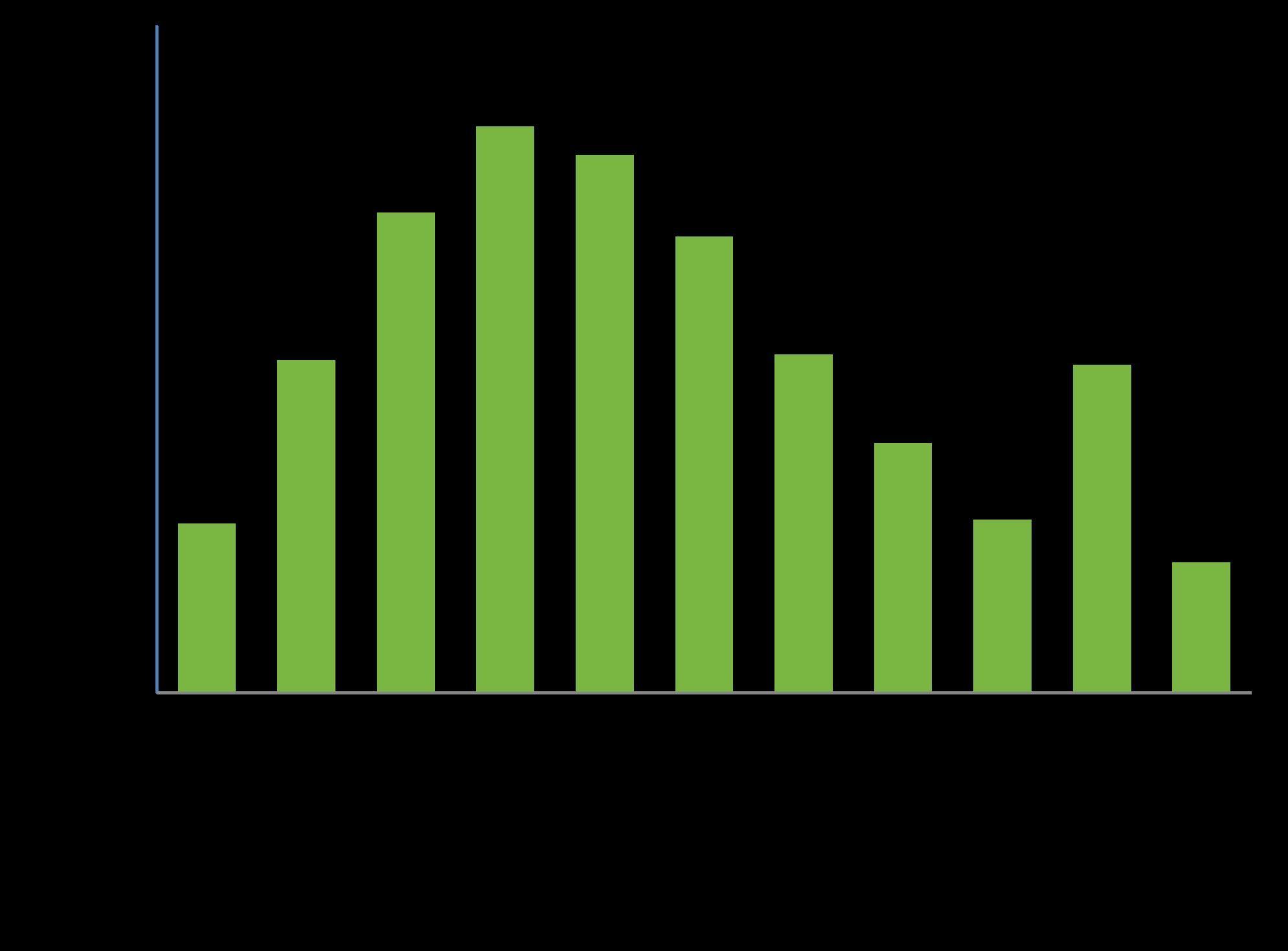

The affordability gap analysis for renters shows:

• An oversupply of existing rental homes priced between $540 and $1,400 per month.

• An under supply of existing rental homes priced below $540 per month.

• An under supply of existing rental homes priced over $1,400 per month.

The oversupply in the ‘affordable’ segment points largely to low quality of existing rental housing stock, especially in the private rental market. The high demand for publicly funded assisted housing, the low addition of newer affordable housing units, and the level of cost-burdened households in the city suggests the need for significant quality upgrades to the rental housing stock.

There is considerable unmet demand for very affordable housing—that is, housing that is affordable to those earning at or below 30 percent of AMI—at rents $540 and below. Additionally, there is substantial unmet demand for rental housing at workforce segment and above ($1,400 and up), which can be met with new construction, renovations, and natural aging of existing quality market-rate units.

The affordability gap analysis provides a high-level overview of where there are clear mismatches between supply and demand within the existing housing stock today. However, several other factors are important to consider. Housing quality is generally substandard at lower affordability levels. While these units are ‘affordable,’ their condition leads to higher utility bills and potential health and safety hazards.

Smaller for-sale units—like condos and townhomes—can be positioned at a more accessible price point for workforce and moderate-income households than larger detached single-family homes. Diversity in housing stock can fill these gaps and create a pathway to homeownership for a broader range of households. Renovating the existing housing stock will be key to meeting future demand and a wider range of housing needs.

Target market analysis provides more detail about what household groups are growing in Edmond and the region and what their housing preferences are.

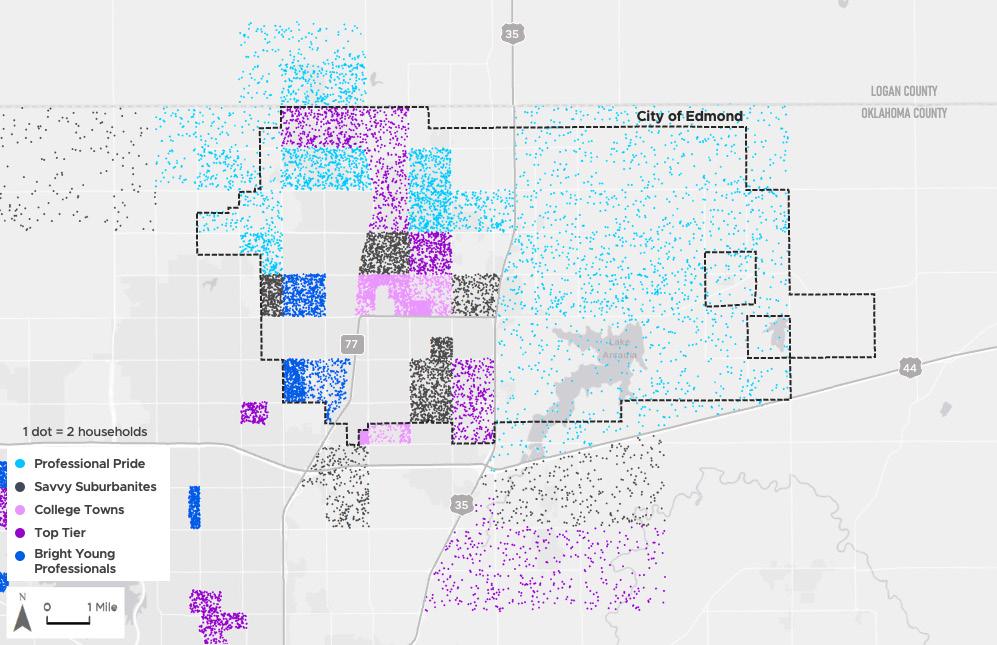

Target market analysis helps to determine demand based consumer preferences, as well as geography and demographic traits. Just as market segmentation is used to determine tendencies to buy different types of consumer products, it can also help identify demand for and affordability of different types of housing products at a particular location. The market segments present in Edmond and the surrounding region were identified using Esri’s Community Tapestry™ data, which use algorithms to link demographic, geographic, and psychographic data to create 67 unique geodemographic segments.

Given Edmond’s growth patterns, demand will likely continue from the existing dominant groups, and development of housing that meets their preferences will be important.

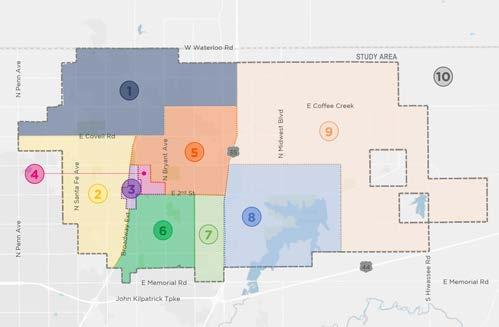

The map to the upper right shows the five groups that are most common in Edmond:

Top Tier: Married couples with no children or older children dominate this group. They own and live in the country’s highest-value homes in older neighborhoods on the suburban periphery of the largest metropolitan areas.

Professional Pride: These households are typically married couples, many with children.

They prefer single-family homes in newer neighborhoods (over 67 percent built in the past 20 years) at the suburban periphery of large metropolitan areas.

Savvy Suburbanites: Most of these households are married couples with no children or older children. They occupy single-family homes in established neighborhoods (most built between 1970 and 1990) on the suburban periphery of large metropolitan markets.

Bright Young Professionals: This group is composed primarily of couples, both married and unmarried, and also includes higher concentrations of single-parent and singleperson households. They live largely in multi-unit

buildings or row housing, much of it built between 1980 and 1999, and are more likely to rent than to own.

College Towns: This group is largely non-family households, many of whom are students living alone or with roommates. Most households rent, and housing types include dense student housing, local residences, and low-rent apartments.

The existing dominant groups in Edmond align with key trends observed through data analysis, survey results, and conversations with community stakeholders. They represent a mix of students, young professionals, and high-income households. These groups’ preferences support diversifying

housing types and price points to meet current and future demand as their populations grow.

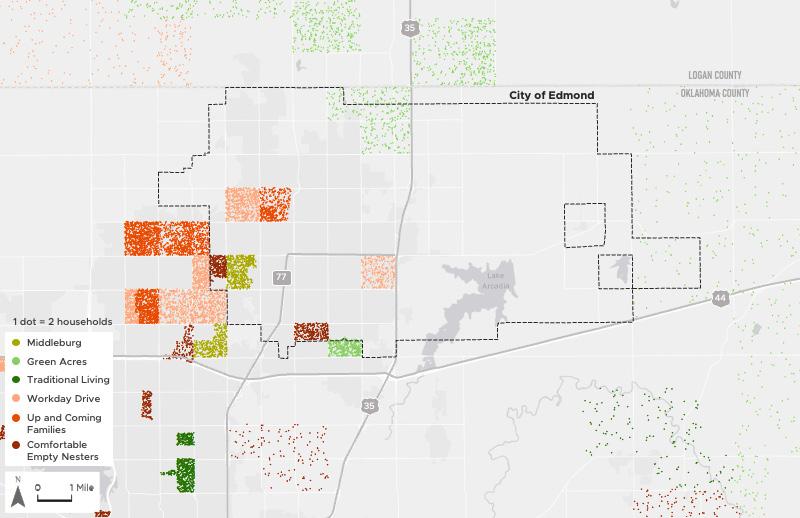

The target market analysis also considers growing groups in the region that are underrepresented in Edmond. Often, households in these groups would consider, or even prefer, to live in Edmond, if the right housing product were available.

Using the population growth trends provided by Esri, we can estimate that more than half of the new potential households in Edmond will belong to the following Tapestry segments.

Comfortable Empty Nesters: These households are primarily married couples, most without children. They live in suburbs and small towns in metropolitan areas, usually in singlefamily detached homes.

Green Acres: A majority of these households are older married couples without children. This group tends to prefer rural settings in metropolitan areas. They are primarily interested in singlefamily homes with high acreages.

Middleburg: Most of these households are young couples, many with children. They occupy semirural locations in metropolitan areas, largely formerly rural neighborhoods that have changed rapidly in the past decade as new single-family homes have been built. Many live in mobile homes.

Workday Drive: These households are typically married couples with children. They tend to cluster in the suburban periphery of metropolitan areas and prefer single-family homes in newer neighborhoods (over 60 percent built after 1990).

Traditional Living: This group includes married couples, and some with children, but also higher proportions of single-person and single-parent households. They live primarily in lower-density urban clusters of metro areas, in single-family homes or duplexes within older neighborhoods.

Up and Coming Families: Most of these households are young families occupying singlefamily homes in new housing subdivisions. This group is made of young, mobile consumers and is a fast-growing market.

The potential target market groups include young families and older adults—groups that face particular challenges finding attainable housing in

Edmond. Other potential groups include frontline workers who would benefit from having attainable housing closer to work. Many of these households also have children.

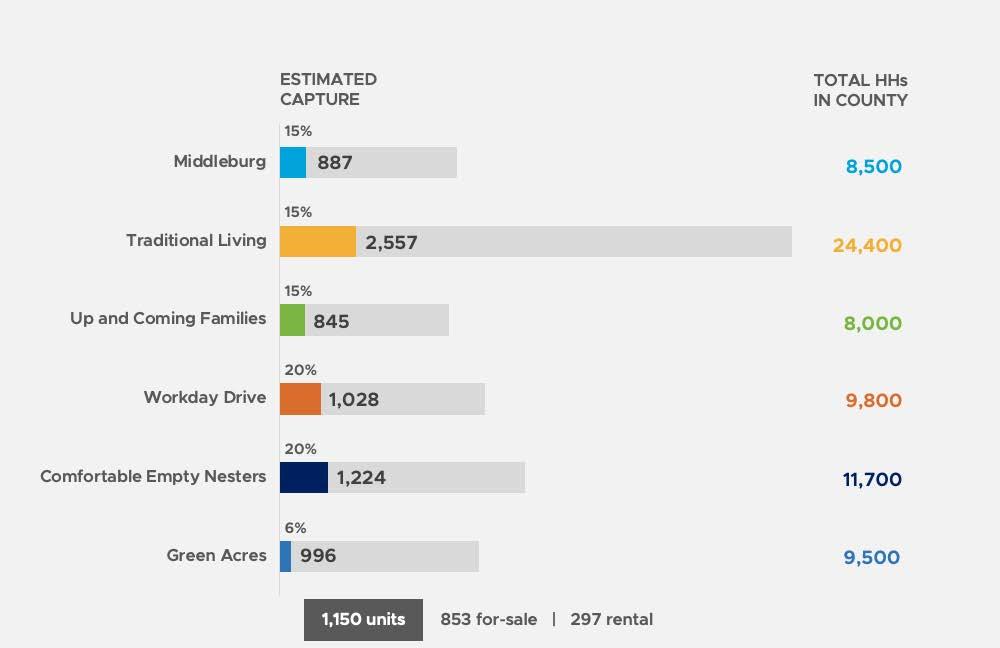

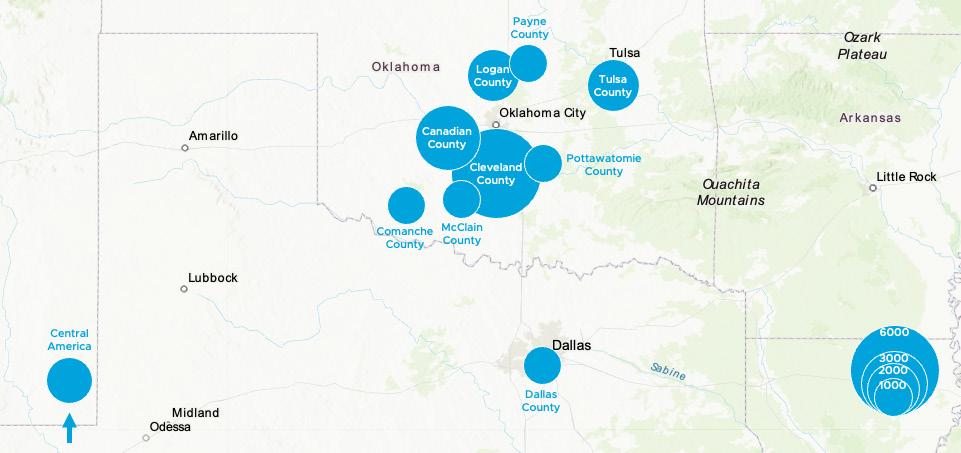

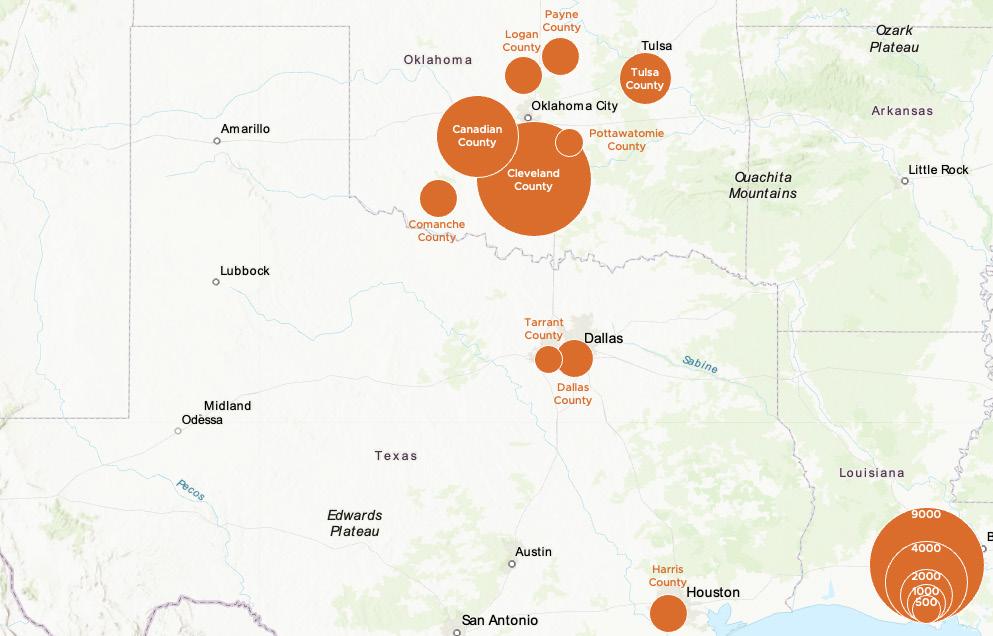

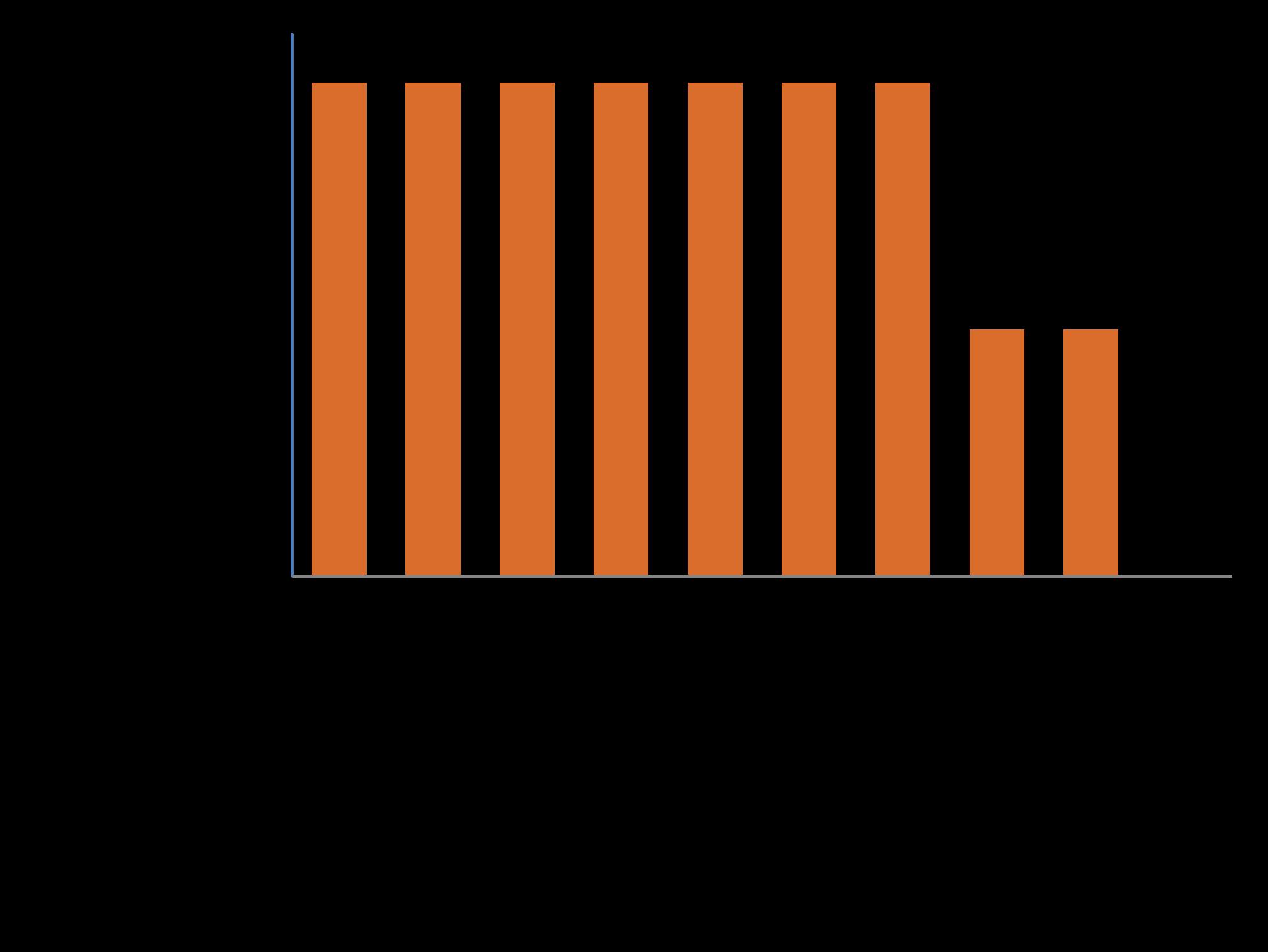

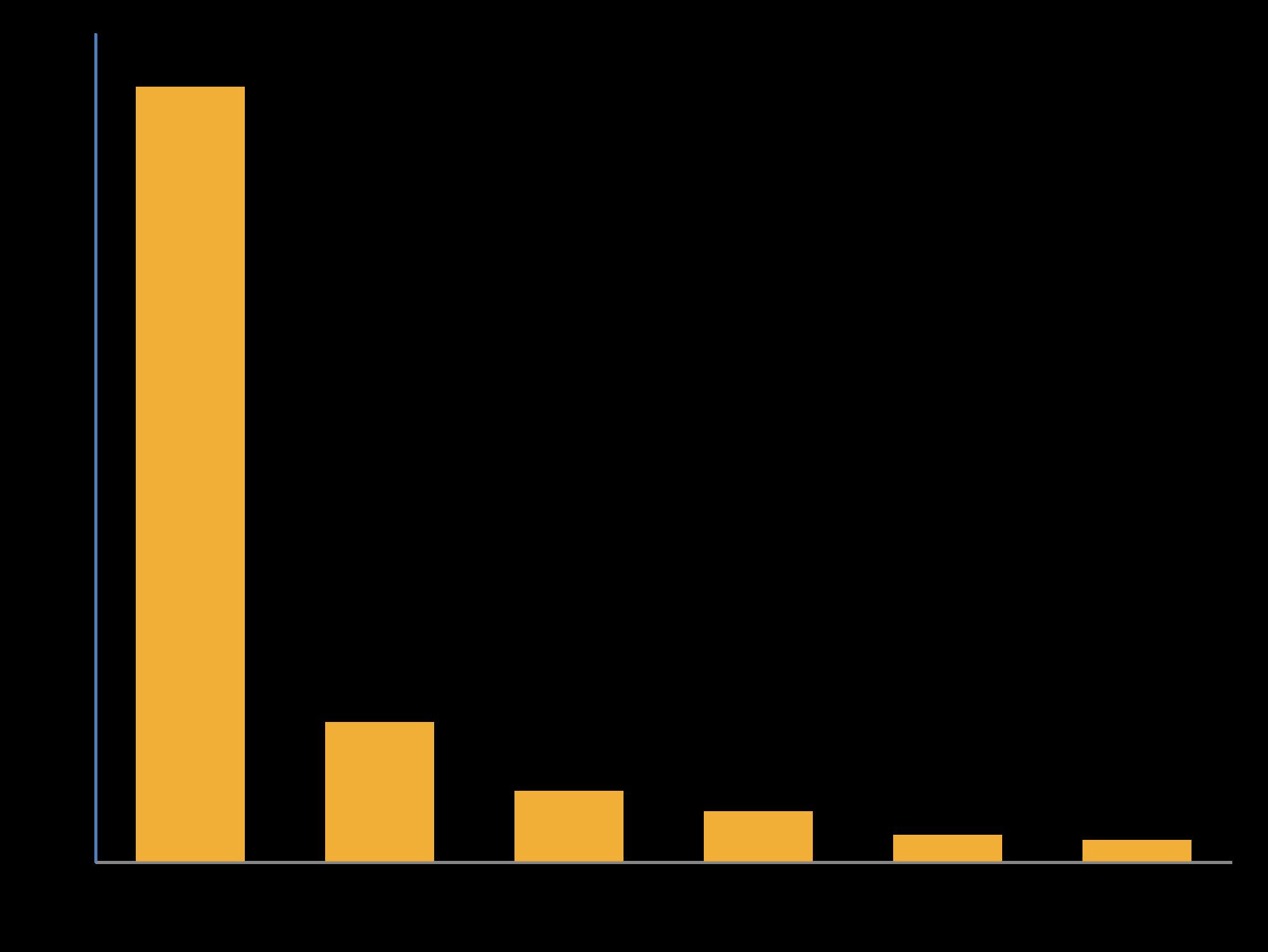

Target market analysis yields theoretical demand for about 3,000 housing units in Edmond today.

By applying a mathematical model to Esri Community Tapestry™ data on market segmentation, demand analysis of target market households with market-appropriate capture rates indicated support for about 800 rental and 2,200 for-sale units in Edmond from identified Tapestry groups found in Oklahoma County.

The graphic on the right outlines the new households available for capture in the region from Tapestry potential target market groups. The percentages estimate the share of these new households that Edmond can expect to capture by offering housing products that appeal to these groups.

The table on the opposite page shows the summary of existing owner and rental households within each Tapestry group alongside their implied housing product price point. Offering housing products within these ranges with architectural style, size, layouts, finishes, and other aligned consumer preferences can attract these household groups to Edmond.

New construction upscale and luxury for-sale and rental developments will be primarily driven by existing and new residents in the Top Tier, Professional Pride, and Savvy Suburbanites Tapestry groups. Members of the Workday Drive and Up and Coming Families Tapestry groups will also be attracted to newer single-family homes in Edmond’s newer neighborhoods. Predominantly

rental housing products in the subsidized, affordable, and workforce price points will attract existing and new residents in the Bright Young Professionals and College Towns Tapestry groups and provide opportunities for many to put down roots in Edmond.

Meanwhile, several Tapestry potential target market groups will be in search of housing products that are currently less abundant in Edmond’s market. The predominantly older residents in the Green Acres and Comfortable Empty Nesters groups are more likely to be attracted to housing products targeted to seniors, although many will opt to age in place if they are able. Young families in the Middleburg and

Traditional Living Tapestry groups will prefer modestly priced single-family and duplex housing found in Edmond’s older neighborhoods; some may also be attracted to mobile homes. These groups can afford homes priced within the affordable and workforce housing ranges.

Affordable housing is typically developed with tax credits used as equity to help finance the development of a property, while subsidized housing is generally provided through federal programs that provide a rent subsidy. Strategic usage of these programs throughout Edmond could improve housing conditions for a large share of current residents.

Low Income Housing Tax Credit (LIHTC) and mixed-income properties help diversity the existing rental housing stock. Such properties

provide quality residential options for residents who cannot afford market-rate development.

Housing affordability for Oklahoma County and Edmond is based on HUD-published household income limits, as well as tenure data from the American Community Survey (ACS).

This data indicates that there are roughly 7,800 households in Edmond that would be incomeeligible for units at 60 percent AMI. Of those, about 3,400 are very low-income households at below 30 percent AMI. This far exceeds the existing supply of the up to 2,250 dedicated affordable housing units available in Edmond. These units participate in LIHTC, Housing Choice Vouchers, and other affordability programs. Some portion of this excess demand could be met with a combination of federal programs that

include LIHTC, Section 8 subsidies, and other development incentives.

At achievable LIHTC rents, roughly 2,430 renter households in Edmond would be income-qualified for affordable rental housing at 60 percent AMI without additional project-based rental assistance. Applying a capture rate of ten percent indicates that a series of affordable properties containing up to 240 additional units could be added to the market if appropriate sites are available.

In addition, a number of households are currently living in naturally occurring affordable housing, compromising on housing quality for affordability, or in other potentially vulnerable situations. One-third of all Edmond households are cost

burdened, including 47 percent of renterhouseholds. While ACS data shows that a very small proportion of Edmond’s housing has severe condition challenges (only 100 units lack adequate plumbing, for instance), 34 percent of survey respondents indicated encountering homes and apartments in need of significant repair.

Considering these factors, approximately 25 percent of households qualifying for affordable housing but not living in dedicated affordable units are at risk. The preservation of existing naturally occurring affordable housing and addition of new units will ensure that these 1,300 households have suitable housing.

Future affordable housing projections are based