FISCAL YEAR 2024 OPERATING BUDGET

CHARLES DANIELS City Manager

JON THATCHER City Attorney

ROSA RIOS City Secretary

Jason Roberson Mayor

Sarah Salgado

Mayor Pro Tem Place 4

James Traylor Place 1

Cecil Chambers Place 2

Sandi Primous Place 3

Zahnd Schlensker Place 5

Greg Helm Place 6

CITY COUNCIL & STAFF

KARL ZOOK Assistant City Manager

DEBORAH WOODHAM Director of Finance

MELONIE WALKER Budget Analyst

CARRIE WHITE Police Chief

DEREK BRIGGS Fire Chief

JOHN CASEY City Engineer

PETER MORGAN Director of Community Development

KYLE GROVES Director of Public Works

KYLE ROUVALDT Director of Parks & Recreation

ZACH SMITH Director of Communications & Marketing

LYNN SPENCER Director of Economic Development

Dear Mayor and City Council:

In accordance with the City Charter and the laws of the State of Texas governing home rule cities, please accept this letter as the budget transmittal and executive summary for the Fiscal Year 2024 annual budget. The budget is structurally balanced, meaning that reserves have not been used to balance the operating budget. It provides for all available resources and expenditures for the City and acts as the general financial and operating plan for the City of Forney.

INTRODUCTION

As always, this budget was prepared with great diligence in allocating limited resources for the best benefit to the citizens of Forney. The City will finish FY 2023 with an unexpected surplus in funds. Forney has continued to experience unprecedented growth in building permits and associated fees.

The property tax base in Forney has continued to grow at a rapid rate with a 148% increase in values in the last 5 years. The increased values and early redemption of debt have allowed for a decrease in the property tax rate of just over $0.21 in the same period. This budget proposes a tax rate of $0.366533 and will raise an additional $2,920,776 or 31.82% in property tax revenue from FY 2023.

The payment in lieu of tax agreement with Luminant power plant expired on December 31, 2022, and the property was annexed into the Forney city limits during calendar 2023. The city received one-half of the estimated property tax due in 2023, or $1,287,323.10, during Fiscal Year 2023. The remaining half will be remitted in Fiscal Year 2024 and is reflected in both the General Fund and Debt Service Fund of this budget. Prior City Councils reserved excess funds to offset the partial payment and this budget includes a transfer of $1,900,000 into the General Fund for that purpose.

Both sales tax and building permit revenue depend on the health of the economy. Therefore, this budget includes a conservative 7% increase in sales tax over the budgeted amount in FY 2023 and a 50% increase in building permit revenue due to the anticipated residential growth Associated permit fees were also kept flat or decreased.

Forney’s continued growth and increased revenue will allow the funding of additional staff and supplies required to meet the needs of the citizens. Last year staffing levels were increased by 22 new positions and this budget includes 11.5 additional positions to address these needs.

The FY 2024 budget fully incorporates the new police and fire contracts negotiated during the Meet and Confer process. It includes new step plans for police and fire personnel with additional certification and education incentives. All civilian employees will receive a 4% cost of living adjustment and a possible 3% merit increase.

The City of Forney charter specifies that no more than 7% of current expenditures may be kept in the undesignated general fund balance. In effect, this provision requires that excess funds at year end be obligated for one-time purchases or expenditures. The city is poised to complete FY 2023 with a surplus of more than $7,500,000 of which $4,000,000 will be allocated to capital improvement projects, $2,517,331 to capital equipment purchases, and $1,000,000 to the general operating reserve fund.

Forney is a member city of the North Texas Municipal Water District (NTMWD) and purchases water and wastewater services from NTMWD. The NTMWD will be increasing the price per 1,000 gallons of water purchased by 9% for FY 2024 and will also impose a 12% increase for wastewater services. Therefore, this budget includes an increase of 9% for both commercial and residential water rates as well as a 10% increase in all sewer rate charges for Forney citizens. These increases are necessary to be able to provide the required maintenance for the water and wastewater systems within the City of Forney.

The City recently renewed the contract for solid waste disposal services for a five-year term. The contract includes a provision that there will be a potential 5% rate increase during FY 2024 and this budget proposes to pass along that increase to the citizens.

The Hotel Occupancy Tax (HOT) Fund is a special revenue fund that receives revenue through a 7% tax charged on all room rates by hotels or motels within the city limits. This fund is typically used for special events and the revenue from local reservations will allow for a transfer of $215,000 to cover events in FY 2024.

The Capital Purchases Fund will provide for General Fund capital purchases through the $2,517,331 transfer from unallocated fund balance. This transfer will cover both vehicle and equipment requests from general fund staff for FY 2024 Capital requests of $972,000 for equipment to be used by the utility crews will be funded through unallocated fund balance in the utility fund.

The City of Forney Capital Improvement Program (CIP) is comprised of several funds. The General CIP fund accounts for projects such as facilities, parks, technology, and roads. The General Fund transfer of $4,00,000 will fund $1,375,000 requested by staff in this budget. The remainder will stay within the fund as unallocated fund balance to be used for future projects. The Utility CIP fund accounts for water and sewer infrastructure projects and will not receive a transfer from the Utility Fund during FY 2024.

The City of Forney received $6,755,000 in American Rescue Plan Act (ARPA) funds from the federal government during Fiscal Years 2022 and 2023. City Council awarded a portion of these funds to households, non-profits, and small businesses during Fiscal Year 2023. Council also obligated $1,750,000 for the replacement of the public safety radio system. The remaining funds will be used to complete current utility capital projects.

GENERAL FUND

The General Fund is the City’s principle operating fund and is supported by taxes, fees, and other revenues that are not restricted to specific uses. This fund accounts for City functions such as police, fire, community development, parks, municipal court, and administration.

GENERAL FUND REVENUE

Fiscal Year 2023 total General Fund revenue is expected to end the year 14% above the original budget. This is the result of increased permits and inspections for commercial building within the Forney city limits

Total revenue for Fiscal Year 2024 is projected to be $34,816,912. This is an increase of 13.03% from the prior year’s budget. This increase is due to increased property tax revenues, permit fees, parks programs, and interest on investments.

Taxable Valuation & Tax Rate

The total certified property valuations for Fiscal Year 2024 are $4,903,432,800. This is an increase of 43% or $1,478,099,688 in total valuation. Seventy-one percent of this increase can be attributed to the annexation of the Luminant power plant as well as new construction. The remainder is an increase in existing property valuation, which indicates a thriving community.

3,500,000,000 4,000,000,000 4,500,000,000 5,000,000,000

3,000,000,000

0 500,000,000 1,000,000,000 1,500,000,000 2,000,000,000 2,500,000,000

While valuations have increased by 148% since 2020, the total tax rate has decreased by $0 21. The increased valuations, along with sound debt management including early redemptions and refunding, has contributed to the decreased tax rate. A tax rate of $0.366533 is proposed for Fiscal Year 2024. This represents a $0.068 decrease from the prior year.

Both the debt service portion and the maintenance and operations portion of the tax rate will be decreasing. However, additional revenue will be generated from new construction, annexed property, and increased valuations and will be used for increased operating cost. Further information on the changes in the tax rate, including adjustments for tax abatements and tax increment financing districts, can be found in the General Fund section of this document.

Sales & Property Reduction Taxes

1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 7,000,000 8,000,000 9,000,000

Over the past five years, sales tax revenues have increased an average of 16 91% per year. This continued increase is indicative of a growing local economy, resulting from continued population growth within the city limits and the surrounding areas, as well as increased commercial development. The city has always taken a very conservative approach to budgeting sales tax. The Fiscal Year 2023 budget assumed a 7% increase in sales tax revenue and actual collections are trending slightly below the budgeted amount. The budget for Fiscal Year 2024 also assumes a conservative 7% increase due to increased inflation and a slowing economy but recognizing growth in local retail and commercial businesses.

Permits & Inspections

This revenue category is expected to end the year at approximately 93% above the original budget. The largest increases will be reflected in the areas of Engineering Inspection Fees, Fire Marshal Plan Reviews and Building Permits. 1,758,138,986

While the City of Forney has continued to experience unprecedented growth in both residential and commercial projects, staff acknowledges that this growth is dependent on the health of the economy. Although there are several planned developments underway, the city has adopted a very conservative approach in projecting revenue for Fiscal Year 2024. This budget includes moderate increases in some items with holding revenue flat in the remainder of the permits and inspections category.

Other Revenue Sources

Fire Protection fees are now included in the tax revenue category and are charged to the Kaufman County Emergency Services District #6 (ESD #6) and the Town of Talty. Certified property values have increased in both jurisdictions resulting in an additional $371,523 for Fiscal Year 2024.

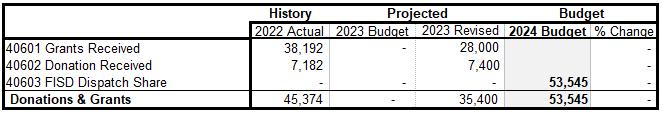

Park fees were restructured in Fiscal Year 2023 to help offset the cost of programs that serve not only Forney citizens but many residents in the surrounding area. Park revenues are expected to increase with the addition of youth baseball and softball programs. Court Fines and Miscellaneous Revenues are expected to remain flat. Donations & Grants are expected to increase with the addition of revenue from the Forney Independent School District dispatch service agreement, and Interest Income is expected to increase based on rising interest rates for available funds.

GENERAL FUND EXPENSES

The Fiscal Year 2024 Budget includes an increase in expenditures of 13.11%. This increase is primarily the result of 9.5 additional full-time equivalent positions as well as increased salary and benefits related costs. Each new position will also require other expenses as they are outfitted and equipped for their department.

Employee Compensation

Personnel costs account for 71% of the General Fund’s expenses. The Fiscal Year 2024 budget includes a 4% cost of living adjustment and up to 3% merit increases for all employees not on a step plan. It also includes new step plans and additional certification and education incentives for sworn police and fire personnel.

Health Insurance Premiums

The City competitively bids employee health insurance in October however, our insurance broker is expecting the cost to increase due to claims experience. Therefore, this budget includes a 12% increase.

Texas Municipal Retirement System

The Texas Municipal Retirement System contribution rate for 2024 will decrease to 14.24% from 14.48% in January of 2024. With the longer tenure of employees, increased salaries, and a significant number of new employees, the City’s General Fund contribution to TMRS will increase by $345,157 to $2,651,349 for the upcoming fiscal year.

New Positions

The Fiscal Year 2024 budget includes 9.5 new full-time positions in the General Fund. Details on the new positions can be found in the Full Time Equivalent section on the following pages.

Contingency & Reserves

A $300,000 line-item contingency is included to offset unexpected costs. There is also a $1,000,000 transfer budgeted to the emergency reserve fund in Fiscal Year 2024 to keep the fund balance at a level to adequately cover 25% of general fund expenditures.

CAPITAL PURCHASES FUND

The Capital Purchases Fund is used to make one-time purchases for General Fund Departments. It is primarily funded through a transfer from the General Fund of unrestricted fund balance. Segregating these purchases in this manner helps to ensure that fund balance is not used for recurring operating expenses and assists in the tracking of fixed assets. The following purchases are scheduled for Fiscal Year 2024:

ENGINEERING

• Inspector Vehicle - $60,000

POLICE

• Patrol Vehicles (7) - $700,000

• CID Vehicle - $60,000

• Various Equipment to include Justice Center upgrades - $74,500

FIRE

• Fire Station #1Bay Doors & Roof - $55,000

• Escrow-Fire Engine Replacement - $500,000

• Various Equipment - $88,600

PARKS

• New Vehicles (4) - $220,000

• Electric Carts - $23,500

• Mowers - $15,000

• Splash Pad Update - $14,000

• Mobile Stage for events - $170,000

ANIMAL CONTROL

• Improved dog kennels - $38,000

• Industrial Washer & Dryer – $40,000

• Various Equipment - $48,200

STREETS

• Foreman Truck - $60,000

• Sand Spreader - $20,000

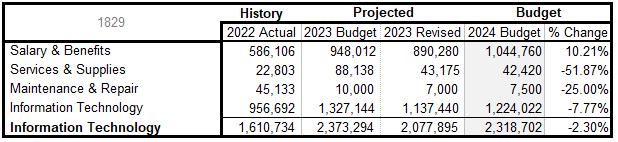

INFORMATION TECHNOLOGY

• PD Body Camera Grant Match - $15,000

• PD Software - $55,123

• Animal Control software and MDTs - $34,300

• EOC A/V Upgrades - $20,000

FACILITIES MAINTENANCE

• Custodian Van (2) - $84,000

• City Hall interior upgrades - $55,000

The total transfer from the General Fund for Fiscal Year 2024 is proposed at $2,517,331. This will cover all the requested purchases and allow for $500,000 to be committed for the future purchase of a Fire Engine.

UTILITY FUND

The Utility Fund is an enterprise fund that accounts for the water, sewer, and refuse services that are provided to the City’s residents. Revenues are derived from charges for water consumption, wastewater collection, and refuse services.

UTILITY FUND REVENUE

Fiscal Year 2023 total Utility Fund revenue is expected to end the year 6.6% above the original budget. The increase is attributable to residential and commercial growth as well as existing industrial and wholesale contracts.

Total revenue for Fiscal Year 2024 is projected to be $28,613,621. This is an increase of 14.23%.

Utility Rates

The North Texas Municipal Water District (NTMWD) is increasing the cost of water purchases by $0.30 per 1,000 gallons or 9% for Fiscal Year 2024. This budget proposes passing the cost increase on to all water customers including both residential and commercial.

Additionally, NTMWD is increasing the cost of wastewater treatment and transmission and this cost will be passed on to customers through a 10% increase in both residential and commercial sewer rates.

The contract with Community Waste Disposal for refuse services includes a freeze on rate increases to the city for the first three years. This is the fourth year of the contract, and the city is anticipating a 5% increase for Fiscal Year 2024 that will be passed on to all customers.

Utility Expenses

Operating expenses in the Utility Fund are projected to increase 24.14% from $21,727,469 to $26,973,289. Much of this increase is related to the increasing cost of providing water and wastewater services.

The cost of purchasing water for Fiscal Year 2024 will increase by 18.8%. The NTMWD will be increasing the rate to purchase water by $0.30 per 1,000 gallons. Also, the city has exceeded the 2023 contract minimum by 252,549,000 gallons resulting in additional cost for Fiscal Year 2023. The new contract minimum of 2,926,332,000 gallons for 2024 will result in annual charges of $10,798,165.

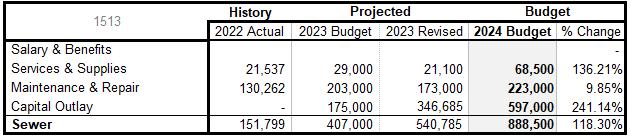

The cost of sewer services is divided between the Utility Fund and the Interceptor Fund. Maintenance and operation of the interceptors is charged to the Utility Fund and the debt owed for construction of the interceptor lines is charged to the Interceptor Fund. Total costs for sewer services to the city will be increasing 34.01% due to increased flow estimates.

Employee Compensation

Personnel costs account for 13 4% of the Utility Fund’s expenses. The Fiscal Year 2024 budget includes a 4% cost of living adjustment and up to 3% merit increases for all employees.

Health Insurance Premiums

The City competitively bids employee health insurance in October however, our insurance broker is expecting the cost to increase due to claims experience. Therefore, this budget includes a 12% increase.

Texas Municipal Retirement System

The Texas Municipal Retirement System contribution rate for 2024 will decrease to 14.24% from 14.48% in January of 2024. With the longer tenure of employees, increased salaries, and a significant number of new employees, the City’s Utility Fund contribution to TMRS will increase by $18,939 for the upcoming fiscal year.

New Positions

The Fiscal Year 2024 budget includes funding for 11.5 new positions. Two are funded in the Utility Fund. Details on the new positions can be found in the Full Time Equivalent section on the following pages.

Capital Purchases

The 2024 Utility Fund budget includes $972,000 in capital purchases.

• Replacement Foreman Truck (2) - $120,000

• Utility Billing Truck - $60,000

• Replacement Backhoe - $170,000

• Zero-turn Mower - $14,000

• Bobcat Hydraulic Breaker - $17,000

• Air Compressor Trailer - $19,000

• Utilityscan Pro (GPR) - $35,000

• Vac Truck (Sewer) - $525,000

• Sewer Camera - $12,000

Contingency & Reserves

A $50,000 line-item contingency is included to offset unexpected costs. As with the General Fund Operating Reserve, there will be a $1,000,000 transfer to the reserve fund in Fiscal Year 2024 to keep the fund balance at a level to adequately cover 25% of utility fund expenditures.

CAPITAL IMPROVEMENT FUNDS

The Capital Improvement Funds account for the design and construction of City facilities, roads and drainage, parks, and water and sewer systems. Unlike the operating budget, the capital improvement budgets do not conclude at the end of each fiscal year, as many CIP projects remain in progress over several years.

Capital Improvement Projects are funded from several different sources. Based on the funding sources, projects are put into one of two different funds: the General Capital Improvement fund, or the Utility Capital Improvement Fund.

General Capital Improvement Fund

The projects in the General Capital Improvement Fund can be funded from bond proceeds, developer contributions, transfers from the General Fund or other funds not classified as water sewer related, and donations or grants.

Funding sources for Fiscal Year 2024 projects are as follows:

$1,375,000 transfer from the General Fund

o $400,000 Mulberry Park Baseball Field Redesign

o $700,000 Shands/Mulberry Street Drainage

o $75,000 LED Signs for City Hall

o $200,000 Johnson Elementary connecting sidewalk

Utility Capital Improvement Fund

The projects in the Utility Capital Improvement Fund can be funded from bond proceeds, developer contributions, the Utility Fund, Water and Sewer Impact Funds, and grants. There are no new project requests for Fiscal Year 2024.

The City of Forney received $6,755,000 in American Rescue Plan Act (ARPA) funds from the federal government during Fiscal Years 2022 and 2023. Approximately $3,820,500 in remaining funds will be used to complete current utility capital projects.

DEBT SERVICE FUNDS

The City issues debt to support capital improvements. This debt is either tax supported and accounted for in the Debt Service Fund, or it is utility revenue supported and accounted for in the Utility Debt Service Fund. The combined total debt payments for Fiscal Year 2024 will be $4,262,086.

General Debt Service Fund

Revenues required to pay the City’s outstanding tax supported debt are restricted to debt payments. Revenues in this fund are collected through the debt service portion of the property tax rate.

The required general debt payments for Fiscal Year 2024 total $3,953,830. In calculating the debt service tax rate, this number is reduced by $324,800 of available fund balance for the 2017 Tax Notes. This results in the tax rate being based on payments of $3,629,030 and is a reduction of $0.0076 per $100 valuation.

The final debt service portion of the tax rate is $0.084575 and will generate $3,629,030 in revenue for bond payments. Of this total, $0.054 (64%) results from voter approved general obligation debt.

Utility Debt Service Fund

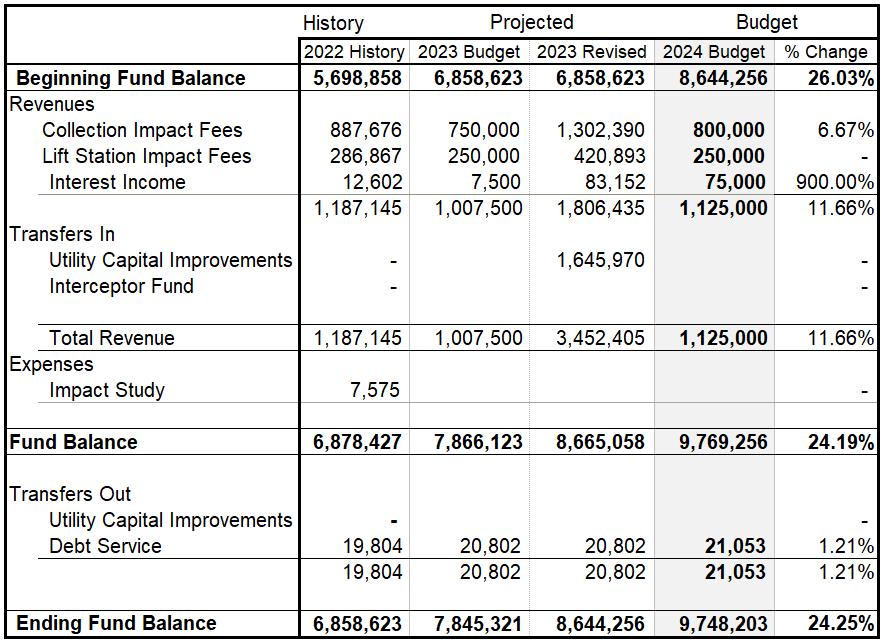

Revenues required to pay the City’s outstanding revenue supported debt are transferred from the Utility Fund, the Water Impact Fund, and the Sewer Impact Fund. The exact amount required to cover the bond payments is transferred in each year and the fund maintains a zero-fund balance. The total required debt payment for Fiscal Year 2024 is $308,256.

ECONOMIC DEVELOPMENT CORPORATION FUND

The Economic Development (EDC) Fund is a special revenue fund that receives revenue from type 4B sales tax. Expenditures are restricted to activities that support and promote economic and community development.

Economic Development Revenue

Economic Development Corporation revenues are expected to finish Fiscal Year 2023 close to original projections.

Fiscal Year 2024 revenues are expected to increase 6.45% from the previous year due to increasing sales tax revenue and interest income.

Economic Development Corporation Expense

Economic Development Corporation expenses have increased 36.7% from the original budget in Fiscal Year 2023. This increase is the result of economic incentives that were not originally expected to be funded during the fiscal year and the unplanned purchase of a downtown building. Expenses for Fiscal Year 2024 are budgeted at a 49.26% increase from the prior year to account for economic incentives and increased personnel costs.

CONCLUSION

The Fiscal Year 2024 budget is a balanced budget and provides an operating basis for the next year. It provides for strategic planning and investment in our most valuable asset, our workforce. At the same time, we are maintaining the long-term fiscal viability of the community by promoting cost saving measures and supporting quality development.

While the budget process is always a challenge, we have produced a budget that is both balanced and sufficient to meet the needs of the upcoming fiscal year.

On behalf of myself and the staff, I want to express my appreciation to the City Council for your diligent efforts throughout the year in providing guidance, direction, and support for this budget. I feel this budget accurately represents the goals of the city which are designed to provide the highest quality of services to our citizens with the resources available.

Respectfully Submitted,

Deborah Woodham, Director of Finance

CITY ORGANIZATION CHART

FULL TIME EQUIVALENTS

STAFFING LEVELS ARE BUDGETED TO INCREASE BY 11.5 DURING FISCAL YEAR 2024. The impact to the total budget is approximately $900,000 in Salary & Benefits.

ENGINEERING

Senior Construction Inspector – (Reclassification)

Assistant Director-Capital Improvements Program (Reclassification)

POLICE

Five Police Officers

Two Communications Officers

One Sergeant for joint task force (Texas Anti-Gang funded)

PARKS & RECREATION

Youth Baseball and Softball Coordinator

Youth Sports Manager (Reclassification)

Administrative Assistant – Part-time

COMMUNITY DEVELOPMENT

Senior Plans Examiner (Reclassification)

PUBLIC WORKS

Assistant Director

UTILITY BILLING

Meter Technician

GENERAL FUND FULL TIME EQUIVALENTS

The CIP Manager position will be reclassified to Assistant Director of CIP, and the Senior Construction Inspector will be reclassified to Construction Manager.

The Social Media Intern position was eliminated for Fiscal Year 2024.

Municipal Judges are contracted by the City Council and are not considered City employees.

Finance

The Police Department will add five additional police officer and two additional communications officer positions In addition, the four Corporal positions will be reclassified to Sergeant positions. The Texas Anti-Gang task force will fund an additional Sergeant position bringing the total number of Sergeant positions to ten for Fiscal Year 2024.

For Fiscal Year 2024, a Youth Sports Coordinator and a part-time Administrative Assistant have been added. The Sports Coordinator position was reclassified to Youth Sports Manager.

The Plans Examiner position will be reclassified to a Senior Plans Examiner for Fiscal Year 2024.

The General Fund will add nine new full-time equivalents and one part-time equivalent in Fiscal Year 2024, for a total of 209.50. Not all these positions are 100% funded by the General Fund. Any positions that divide their time between multiple functions are adjusted via the annual operating transfers.

UTILITY FUND FULL TIME EQUIVALENTS

During Fiscal Year 2023, the Public Works Administration Department converted two seasonal positions into one full time Technician 1. The Assistant Director position will be added for Fiscal Year 2024.

An additional Meter Technician position will be added for Fiscal Year 2024.

The Utility Fund will add 2 new full-time equivalents in Fiscal Year 2024, for a total of 49.5. Not all positions are 100% funded by the Utility Fund. Any positions that divide their time between multiple functions are adjusted via the annual operating transfers.

ECONOMIC

SUMMARY OF ALL FUNDS

The city budget is a planning document for the use of financial resources during the fiscal year. The City of Forney is a complex organization, providing a wide range of services to its residents, customers, and visitors. City resources annually exceed $75 million. As with any large organization that provides a mixture of services, planning and management of financial resources are vital to the City. With increasing financial requirements of the School District, State and Federal governments on our citizens, it becomes even more important for the City to adequately plan and manage the use of its financial resources.

GENERAL BUDGET INFORMATION, PLAN, & PROCESS

FUND ACCOUNTING

In accordance with Generally Accepted Accounting Principles (GAAP), the accounts of the City are organized on the basis of funds and account groups, each of which is considered a separate accounting entity.

Government resources are allocated to and accounted for in individual funds based on the purpose for which they are to be spent and the means by which spending activities are controlled.

A fund is defined as a fiscal and accounting entity with a self-balancing set of accounts recording cash and other financial resources, together with all related liabilities and residual equities or balances, and changes therein, which are segregated for the purpose of carrying on specific activities or attaining certain objectives in accordance with special regulations, restrictions, or limitations.

Fund accounting segregates funds according to their intended purpose and is used to aid management in demonstrating compliance with finance related legal and contractual provisions. It divides our reporting responsibility into several functional types as well as classifications. A brief explanation will facilitate your usage of this document. The minimum number of funds is maintained consistent with legal and managerial requirements.

Governmental fund types are used to account for the city’s general government activities and include the General, Debt Service, Capital Project and Governmental Restricted Funds. Proprietary type funds are used to account for operations that provide services to other City departments or that are operated in a manner similar to private business and include both Enterprise and Internal Service Funds. Currently, there are no Internal Service Funds established and in operation. Additional information on Fund types is available in the Organization of Funds section.

BASIS OF ACCOUNTING

The basis of accounting is the method by which revenues and expenditures or expenses are recognized. The accounting treatment applied to a fund is determined by its measurement

focus. All governmental funds are accounted for using a current financial resources measurement focus and the modified accrual basis of accounting. Under the modified accrual basis of accounting, revenues are recognized when they become susceptible to accrual (i.e. both measurable and available). Expenditures are recorded when the related fund liability is incurred, if measurable, except for un-matured interest on general long-term debt which is recognized when due, and compensated absences which are recognized when the obligations are payable from currently available financial resources. All proprietary fund types are accounted for on a flow of economic resources measurement focus and use the accrual basis of accounting. Revenues are recognized when they are earned and expenses are recognized when they are incurred.

BASIS OF BUDGETING

Annual budgets are adopted on a basis consistent with Generally Accepted Accounting Principles (GAAP) with the exception of Capital Projects Funds, which adopt project length budgets. Governmental type fund budgets are prepared on a modified accrual basis. Governmental revenues are budgeted when they are measurable and available and expenditures are budgeted in the period in which the liability is incurred. All proprietary fund types are budgeted using a flow of economic resources measurement focus and use the accrual basis of accounting. Revenues are budgeted when they are earned and measurable and expenses are budgeted in the period in which the liability was incurred. The City departs form GAAP in the treatment of depreciation and encumbrances. Depreciation of fixed assets is not recognized in proprietary fund budgets. All annual appropriations lapse at fiscal year end. Under the City’s budgetary process, outstanding encumbrances at year end are reported as reservations of fund balances since they do not constitute expenditures and liabilities and the commitments will be re-appropriated and honored in the subsequent fiscal year.

ACCOUNTING CODE STRUCTURE

Our Accounting Code Structure is designed to function with a 10-digit code, which is further divided into four sections. A Fund is a specific purpose classification, with a self-balancing set of accounts. A Department is an organizational or functional unit and may cross fund lines. Activity/Object denotes a distinguishable service performed by an organizational component and is the final detail identification within the Account Number. Departments and divisions are not specified on the Revenue side; revenues are grouped by type instead of Activity and object is the final detail identification.

THE BUDGET PROCESS

The City of Forney’s Home Rule Charter provides for the submission of the budget to the City Council by the City Manager by August 15th. The City’s Fiscal Year runs from October 1 to September 30.

•Budget Preparation Begins

January

•Department Directors begin developing budgets

February

March

April

May

June

July

August

•Directors meet with Finance for review

•Budgets due to Finance

•Finance compiles information for City Manager review

•City Manager budget review meetings

•Council Budget Review Meetings

•Budget Preparations & Meetings Continue

•Certified Values Received

•Proposed budget due to City Council

•No New Revenue and Voter Approval rates received from Kaufman County

•Public Hearings on budget and tax rate

•Notices Published

September

•Budget and Tax Levy voted dates set

•Additional Public Hearings

•Adopt budget and tax rate

The following information provides a brief overview of the steps taken to prepare the City’s annual budget, including the budget calendar used by City Staff. Please keep in mind that this is a simplified version of a complex process that is a combined effort of members of each of the City’s departments and requires an extensive period to complete. Both revenues and expenditures are subject to change until the meeting when the City Council officially adopts the budget. Likewise, the budget calendar serves as an approximate timeline and the events may not always occur at the exact time indicated.

The annual budget is prepared under the direction of the City Manager. Each department director formulates a base budget for each of the departments included in their division. Base budgets include costs related to all existing personnel, services, and functions. Directors also prepare supplemental requests that provide a separate set of expenditures required to provide a new service, increase staffing levels, or purchase new equipment. Once base and supplemental requests are prepared, the directors submit their budgets to the Finance department.

The Finance department compiles the information submitted, along with the revenue estimates, for review by the City Manager. Meetings are then held with the department directors to review and revise. The proposed budget document is prepared and then submitted to the City Council by August 15th. Shortly thereafter, a budget workshop is held for the Staff and City Council to review and discuss the proposed budget. Tax rate calculations and all related notice publications and public hearings, if necessary, occur throughout August and into September. A Public Hearing on the Budget is held in early September and revisions continue. The final budget is reviewed by the City Council and adopted in late September.

LEGAL LEVEL OF BUDGET CONTROL

The legal level for expenditure budget control is the Fund level. Each Department Director is responsible for the budget in their respective departments. The Directors are given latitude to transfer budget funds within their departments, except for the personnel services category. Transfers affecting the personnel services category or outside of the department require the approval of the City Manager. Additions to the budget that are not countered by a reduction elsewhere require amendment of the budget by City Council. Article VII of the City's Charter governs the preparation and submission of the budget and the Schedules and Attachments in this budget meet or exceed its requirements. Formal budgetary integration is employed as a management control device during the year for the General Fund and Enterprise Funds.

Formal budgetary integration is not employed for the Debt Service and Capital Projects Funds because effective budgetary control is alternatively achieved through bond indenture provisions and legally binding construction contracts, respectively.

AMENDMENT OF APPROVED BUDGET

The amendment of a departmental budget, which affects the total budget, requires approval by City Council. The City budgets a contingency amount in the operating funds. These contingency amounts are available to be used by the City Manager for any emergency, unforeseen expense or opportunity that might arise.

FUND BALANCE & RESERVE POLICIES

In accordance with the requirements of Governmental Accounting Standards Board (GASB), the City describes fund balance as: (1) Restricted; (2) Committed; (3) Assigned; and (4) Unassigned. The Charter requires that we maintain under 7% of General Fund budgeted expenditures as fund balance. In addition, the City has reserved unassigned fund balance at

90 days of current year budgeted expenditures for both the General and Water/Sewer Funds. In other operating funds, the City shall strive to maintain a positive retained earnings position to provide sufficient reserves for emergencies and revenue shortfalls.

Except for special revenue funds, Fund Balance shall be used only for emergencies, nonrecurring expenditures, or major capital purchases that cannot be accommodated through current year savings.

ORGANIZATION OF FUNDS

The City has the following Fund Types and Funds:

Governmental Fund Types

General Fund - Used to account for tax-supported or generic activity that is not specifically accounted for elsewhere. These are funds through which most governmental functions are typically financed.

Hotel Occupancy Tax Fund - Used to account for the accumulation of resources from the Hotel Tax assessment levied by the City. These monies are to be spent to promote the development or progress of the City within the guidelines set forth on disposition of revenues collected under the authority of the Texas Hotel Occupancy Act (Article 1269; Vernon’s Civil Statutes).

Economic Development Fund - Used to account for funds received from the Section 4B ½ cent sales tax dedicated to certain economic and infrastructure projects.

Special Revenue Funds – Used to account for funds that are legally designated for specific purposes, and for those that have restrictions designated by City Council.

Proprietary Funds

Utility Fund - Used to account for activity surrounding the provision of water and wastewater service to the City residences. These funds derive revenues from fees charged for goods or services.

Capital Improvement Funds

General Capital Improvement Projects Fund - Used to account for major capital construction and/or acquisition projects that normally effect the general operation of the City.

Utility Capital Improvement Fund - Used to account for major capital construction and/or acquisition projects that effect the utility operation of the City.

Debt Service Funds

General Debt Service Fund - Used to pay interest and extinguish debt of the outstanding General Obligation Issues of the City.

Utility Debt Service Fund - Used to pay interest and extinguish debt of the outstanding Revenue Bond Issues of the City.

FINANCIAL POLICIES

Broad policy decisions regarding long-range debt management for the City of Forney that have emerged and that will be followed are summarized below:

o Borrowing must not overload future taxpayers to the point where they will not be able to pay.

o Borrowing must be confined to capital improvements or projects which cannot be financed from current revenues.

o Long-term debt should not provide for current operating expense.

o Borrowing for each object or purpose should be related to a period of probable usefulness of the project and should in no instance be repaid in a time greater than the period of probable usefulness of the project.

► The long-range policies of the City of Forney regarding financial management will be to exercise a discipline which allows us to retain a sound financial condition; strive to achieve the best possible rating on bonds; provide future generations with the ability to borrow capital for construction of facilities without severe financial burden; and give recognition to the community’s needs and ability to pay. These goals are accomplished in the following manner:

o Prudent budgeting and effective budget control. Budget replacement of capital equipment as the need arises. (Office machines, automobiles, heavy equipment, etc.)

o Pay-as-you-go financing of some capital improvements where feasible.

o Scheduling bond issues so that an equal principal amount is retired each year over the life of the issue producing a total debt service schedule with a declining balance each year.

o Providing an adequate reserve fund to meet requirements under bond covenants.

o Planning for capital improvements on a five-year plan which is updated annually.

o Passing on the cost of extending utilities and improvements in subdivisions rather than burden the public.

o Provide working capital in all funds sufficient to meet current operating needs.

o Financial accounting and reporting in accordance with the method prescribed by the National Committee on Government Accounting of the Municipal Finance Officers Association and making such reports available to bond rating agencies and other financially interested organizations.

o Maintaining a fund balance sufficient to provide interim financing for necessary projects and meet unanticipated contingencies such as lawsuits, tax roll tie-ups, and severe seasonal fluctuation in sales of the city owned utilities.

CITY OF FORNEY CHARTER

The following are financial polices as established by the City of Forney Charter, Article VII

Section 7.01 Fiscal Year

The fiscal year of the City shall begin on the first day of October and end on the last day of September of the next succeeding year. Such fiscal year shall also constitute the budget and accounting year.

Section 7.02 Submission of Budget and Budget Message

On or before the first day of the eleventh month of the fiscal year, the City Manager shall submit to the Council a budget for ensuing fiscal year and an accompanying message.

Section 7.03 Budget Message

The City Manager’s message shall explain the budget both in fiscal terms and in terms of the work programs. It shall outline the proposed financial policies of the City for the ensuing fiscal year, describe the important features of the budget, indicate any major changes from the current year in financial policies, expenditures, and revenues together with the reasons for such changes, summarize the City’s debt position and include such other material as the City Manager deems desirable.

Section 7.04 Budget a Public Record

The budget and all supporting schedules shall be filed with the City Secretary when submitted to the City Council and shall be open to public inspection by anyone interested.

Section 7.05 Public Hearing on Budget

At the Council Meeting when the budget is submitted, the Council shall name the date and place of a public hearing and shall have published in the official newspaper of the City the time and place, which will be not less than ten days nor more than thirty days after the date of notice. At this hearing, interested citizens may express their opinions concerning items of expenditures, giving their reasons for wishing to increase or decrease any items of expenditure.

Section 7.06 Proceeding on Adoption of Budget

After public hearing, the council shall analyze the budget, making any additions or deletions which they feel appropriate, and shall, at least ten days prior to the beginning of the next fiscal year, adopt the budget by a favorable majority vote of the full membership of the Council. Should the City Council take no final action on or prior to such day, the current budget shall be in force on a month-to-month basis until a new budget is adopted.

Section 7.07 Budget, Appropriation and Amount to be Raised by Taxation

On final adoption, the budget shall be in effect for the budget year. Final adoption of the budget by the council shall constitute the official appropriation as proposed by expenditures for the current year and shall continue the basis of official levy of the property tax as the amount of tax to be assessed and collected for the corresponding tax year. Estimated

expenditures will in no case exceed proposed revenue plus cash on hand. Unused appropriation may be transferred to any item required for the same general purpose.

Section 7.08 Contingent Appropriation

Provision shall be made in the annual budget and in the appropriation ordinance for a contingent appropriation in an amount not more than seven percent of the total general fund expenditures, to be used in case of unforeseen items of expenditures. The contingent appropriation shall apply to current operating expenses and shall not include any reserve funds of the City. Such contingent appropriation shall be under the control of the City Manager and distributed by him only after prior approval by the City Council. The proceeds of the contingent appropriation shall be disbursed only by transfer to other departmental appropriation, the spending of which shall be charged to the department or activities for which the appropriations are made.

Section 7.09 Amending the Budget

Under conditions which may arise, and which could not reasonably have been foreseen in the normal process of planning the budget to provide for any additional expense in which the general welfare to the citizenry is involved. These amendments shall be by ordinance and shall become an attachment to the original budget.

Section 7.10 Certification; Copies Made Available

A copy of the budget as finally adopted shall be filed with the City Secretary and such other places required by State law or as the City Council may designate. The final budget shall be printed, or otherwise reproduced and sufficient copies shall be made available for the use of all offices, agencies and for the use of interested persons and civic organizations.

Section 7.11 Capital Program

The City Manager shall submit a five-year capital program as an attachment to the annual budget. The program submitted shall include:

(a) A clear general summary of its contents.

(b) A list of all capital improvements which are proposed to be undertaken during the five fiscal years succeeding the budget year, with appropriate supporting information as to the necessity for such improvements.

(c) Cost estimates, method of financing and recommended time scheduled for each improvement.

(d) The estimated annual cost of operating and maintaining the facilities to be constructed or acquired.

The above information may be revised and extended each year regarding capital improvements still pending or in process of construction or acquisition.

Section 7.12 Defect Shall Not Invalidate the Tax Levy

Errors or defects in the form or preparation of the budget or the failure to perform any procedural requirements shall not nullify the tax levy or tax rate.

Section 7.13 Lapse of Appropriations

Every appropriation, except an appropriation for a capital expenditure, shall lapse at the close of the fiscal year to the extent that it has not been expended or encumbered. An appropriation for a capital expenditure shall continue in force until the purpose for which it was made has been accomplished or abandoned. The purpose of any such appropriation shall be deemed abandoned if three years pass without any disbursement from or encumbrance of the appropriation. Any funds not expended, disbursed, or encumbered shall be deemed excess funds.

Section 7.14 Borrowing

1. The City shall have the right and power, except as prohibited by law or by this Charter, to borrow money by whatever method it may deem to be in the public interest.

2. Tax Obligations Bond General

a) The City shall have the power to borrow money on the credit of the City and to issue general obligation bonds for permanent public improvements or any other public purpose not prohibited by law and this Charter, and to issue refunding bonds to refund outstanding bonds previously issued. All such bonds or certificates of obligation shall be issued in conformity with the laws of the State of Texas and shall be used only for purposes for which they were issued.

b) No tax obligation bonds shall be issued without an election. The City Council shall prescribe the procedure for calling and holding such elections, shall define the voting precincts and shall provide for the return and canvass of the ballots cast at such elections. If at such elections a majority of the vote shall be in favor of creating such a debt or refunding outstanding valid bonds of the City, it shall be lawful for the City Council to issue bonds as proposed in the ordinance submitting same. However, if a majority of the vote polled shall be against the creation of such debt or refunding such bonds, the City Council shall be without authority to issue the bonds. In all cases when the City Council shall order an election for the issuance of bonds of the City, it shall at the same time submit the question of whether or not a tax shall be levied upon the property of the City for the purpose of paying the interest on the bonds and to create a sinking fund for their redemption.

3. Revenue Bonds The City shall have the power to borrow money for the purpose of constructing, purchasing, improving, extending or repairing of public utilities, recreational facilities or any other self-liquidating municipal function not prohibited by the State of Texas. With an affirmative vote of at least five of the elected members of the City Council, it shall have the power to issue revenue bonds and to evidence the obligation created thereby. Such bonds shall be a charge upon and payable from the properties, or interest therein pledged or the income therein gained from, or both. The holders of the revenue bonds shall never have the right to demand payment thereof out of monies raised or to be raised by taxation. All such bonds shall be issued in conformity with the laws of the State of Texas and shall be used only for the purpose for which they were issued.

4. Emergency Funding In any budget year, the City Council may by an affirmative vote of five (5) City Council Members pass a resolution authorizing the borrowing of money. Notes may be issued which are repayable not later than the end of the current fiscal year.

Section 7.15 Purchasing

1. The City Council may by ordinance give the City Manager general authority to contract for expenditures without further approval of the Council, for all budgeted items not exceeding limits set by the Council. All contracts for expenditures involving more than the set limits must be expressly approved in advance by the Council. All contracts or purchases involving more than the limits set by the Council shall be let to the lowest bidder whose submittal is among those responsive to the needs of the City after there has been opportunity for competitive bidding as provided by law or ordinance. The City Council, or City Manager in such cases as he is authorized to contract for the City, shall have right to reject any and all bids.

2. Emergency contracts as authorized by law and this Charter may be negotiated by the City Council or City Manager if given authority by the Council, without competitive bidding. Such emergency shall be declared by the City Council.

Section 7.16 Administration of Budget

1. No payment shall be made, or obligation incurred against any allotment or appropriation except in accordance with appropriations duly made, unless the City Manager or his designee first certifies that there is sufficient unencumbered balance in such allotment or appropriation and the sufficient funds there from are or will be available to cover the claim or meet the obligation when it becomes due and payable.

2. Any authorization of payment or incurring of obligation in violation of the provisions of this Charter shall be void and any payment so made illegal. Such action shall be cause for removal of any officer who knowingly authorized or made such payment or incurred such payment or obligation and shall also be liable to the City for any amount so paid.

3. This prohibition shall not be construed to prevent the making or authorizing of payments or making of contracts for capital improvements to be financed wholly or partly by the issuance of bonds, time warrants, certificates of indebtedness or certificates of obligation, or prevent the making of any contract or lease providing for payments beyond the end of the fiscal year, providing that such action is made or approved by ordinance.

4. The City Manager shall submit to the council each month a report concerning the revenues and expenditures of the City in such form as requested by the City Council.

Section 7.17 Depository

All monies received by any person, department, or agency of the city for or in connection with the affairs of the City shall be deposited promptly in the City Depository or depositories. The City Depositories shall be designated by the City Council in accordance with such regulations and subject to the requirements as to security for deposit and interest thereon as may be established by ordinance and law. Procedures for withdrawal of money or the disbursement of funds from the city depositories shall be prescribed by ordinance.

Section 7.18 Independent Audit

At the close of each fiscal year, and at such other times as may be deemed necessary, the City Council shall call for an independent audit to be made of all accounts of the City by a certified public accountant. The certified public accountant selected shall have no personal interest, directly or indirectly, in the financial affairs of the City or of its officers. The report of audit with the auditor’s recommendations will be made to the City Council. Upon completion of the audit, the summary shall be published immediately in the official newspaper of the City and copies of the audit placed on file in the City Secretary’s office as a public record.

Section 7.19 Power to Tax

1. The City shall have the power to levy, assess and collect taxes of every character and type for any municipal purpose not prohibited by the Constitution and laws of the State of Texas as now written or hereafter amended.

2. The City shall have the power to grant tax exemptions in accordance with the laws of the State of Texas.

Section 7.20 Taxes; When Due and Payable

1. All taxes due in the City of Forney, Texas shall be payable to the designated agent or agency of the City or at such location or locations as may be designated by the City Council and may be paid at any time after the tax rolls for the year have been completed and approved. Taxes for each year shall be paid before February 1 of the next succeeding year, and all such taxes not paid prior to that date shall be deemed delinquent and shall be subject to penalty and interest as the City Council shall provide by ordinance. The City Council may provide discounts for the payment of taxes prior to January 1 in amounts not to exceed those established by the State of Texas.

2. Failure to levy and assess taxes through omission in preparing the appraisal rolls shall not relieve the person, firm or corporation so omitted from obligation to pay such current or past due taxes as shown to be payable by recheck of the rolls and receipts for the years in question, omitting penalty and interest.

Section 7.21 Tax Liens, Liabilities and Suits

1. All taxable property located in the City on January 1 of each year shall stand charged from that date with a special lien in favor of the City for the taxes due. All persons purchasing any such property on or after January 1 in any year shall take the property subject to the liens provided above. In addition to the liens herein provided on January 1 of any year, the owner of the property subject to taxation by the City shall be personally liable for the taxes due for that year.

2. The City shall have the power to sue for and recover personal judgment for taxes without foreclosure, or to foreclose its lien or liens, or to recover both personal judgment and foreclosure. In any such suit where it appears that the description of any property in the City appraisal rolls is insufficient to identify such property, the City shall have the right to plead a good description of the property to be assessed, to prove the same, and to have its judgment foreclosing the tax lien or for personal judgment against the owners for such taxes.

GENERAL FUND

The General Fund accounts for all financial transactions not required to be accounted for in another fund. All tax revenues and other revenues not required by law or other City Council action to be accounted for in another fund are accounted for here.

Property taxes provide one of the largest sources of revenue for the City and determining the tax rate is a significant component of the annual budget process. Therefore, discussion of the General Fund cannot be separated from discussion of the tax rate and associated revenue.

ANALYSIS OF PROPERTY VALUATIONS & TAX RATE

PROPERTY VALUATION

The Kaufman County Appraisal District (KCAD) establishes and certifies the value of each property within the City of Forney and provides this information to both the city and the County Tax Assessor’s Office. The total certified value for Fiscal Year 2024 (Tax Year 2023) is $4,903,432,800. This is an increase of $1,478,099,688 or 43%.

Assessed Values

However, the Kaufman Country Appraisal District does not adjust the certified taxable value for the Tax Increment Reinvestment Zone (TIRZ). To provide an accurate revenue estimate, the City subtracts 85% of the value of the properties included in the TIRZ. Total TIRZ value for Fiscal Year 2024 is $720,603,140 and 85% of that yields $612,512,669. Therefore, property tax revenue estimates are based on a value of $4,290,920,131. This is an increase of $1,342,082,068 or 45.5% from the previous year’s adjusted taxable value.

5,000,000,000

4,000,000,000

3,000,000,000

2,000,000,000

1,000,000,000

The significant increase in assessed values is attributed to the annexation of the Luminant power plant valued at approximately $736,390,412 during Fiscal Year 2023, as well as new value added to the tax roll in the amount of $317,447,662.

TAX RATE

The total tax rate is made up of two portions: Maintenance & Operations (M&O) and Debt Service.

MAINTENANCE & OPERATIONS RATE

M & O TAX RATE

The Maintenance & Operations (M&O) portion of the tax rate provides funding for all general fund operations. This portion of the tax rate is flexible and can be adjusted to a higher or lower rate based on the needs of the community. The M&O rate also generates reserve funds for future capital expenses and allows the City to maintain a 90-day operating reserve. The proposed Fiscal

Year 2024 Maintenance & Operations rate will decrease $0.02928 (-10.38%) to $0.281958. This rate will result in $12,098,593 in General Fund revenue; an increase of $2,920,776 (31.82%) from the previous year’s General Fund revenue. A portion of this increase, $1,030,227, will be used to repay Luminant for the advance payment of taxes received in Fiscal Year 2023.

DEBT SERVICE TAX RATE

The Debt Service (DS) portion of the tax rate covers the City’s bond payments and other outstanding debt. This portion of the tax rate is not flexible and is set by a calculation based on the required fiscal year payments of the City’s debt. The Fiscal Year 2024 debt service rate is $0.084575. This is a decrease of $0.03874 (‐31.42%) from the Fiscal Year 2023 rate, resulting in $3,629,030 in revenue to be used for debt payments.

DEBT SERVICE TAX RATE

The Debt Service tax rate is calculated by subtracting any revenue paid from other sources from the annual required debt payment and then dividing that result by the adjusted taxable value and multiplying by 100.

TAX NOTES

The 2017 Tax Notes were issued to purchase fire equipment with the understanding that payments would be made from the debt service fund balance. This fund balance is the result of interest collected in the fund, as well as delinquent and penalty taxes that have accumulated over prior years. These funds are restricted and can only be used for debt payments.

TOTAL TAX RATE

The total tax rate for Fiscal Year 2024 is proposed at $0.366533. Tax revenue estimates are calculated at a 100% collection rate and are expected to result in a total of $15,727,622. This is an increase of $2,913,417 (22.74%) from Fiscal Year 2023 and is the result of an increase in assessed valuation, annexed properties, and new taxable value. New taxable value and annexations added to the tax roll contributed 102% of the revenue increase.

The total tax rate has decreased each year since Fiscal Year 2020 (Tax Year 2019). The total five-year reduction is $0.21.

PROPERTY VALUATIONS & TAX RATE SUMMARY

• Property values have increased 148% in the past 5 years, due to significant new development and the annexation of the Luminant power plant during Fiscal Year 2023

o The Fiscal Year 2024 property value increase is 43.15% - of that increase 71% is the result of new value added and annexed properties.

• Total Tax Rate has decreased $0.21 in the past 5 years.

o Maintenance & Operations tax rate has decreased $0.104.

While the M&O tax rate is no longer increasing, the increase in property values still provides funding for enhanced existing services, new services, and cash funded capital improvement without increasing taxpayer burden.

• Debt Service tax rate has decreased $0.1093.

GENERAL FUND STATEMENT

GENERAL FUND REVENUE

Tax revenue is the General Fund’s largest source of income and makes up 79% of the revenue collected. Tax revenue includes property tax, sales taxes, and franchise taxes. The General Fund also collects revenue from permits and inspections, court fines, fire protection, park fees, donations, grants, and interest earnings.

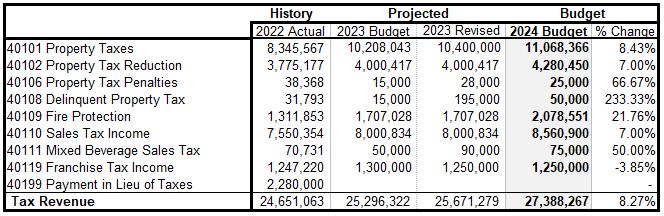

Tax Revenue - $27,388,267

At 47% of the city’s total budgeted tax revenue, sales tax is now the city’s largest source of tax revenue. Property taxes are now at 40% of tax revenue collections.

Property Taxes - $11,068,366

The Kaufman County Appraisal District (KCAD) establishes the value of each property within the City of Forney. The certified taxable value for 2024 is $4,903,432,800. However, the KCAD does not adjust certified taxable value for property in the Tax Increment Reinvestment Zone (TIRZ). As explained in the property tax analysis, the City subtracts these amounts in order to provide an accurate revenue estimate. This results in property tax revenue budgets being based on a value of $4,290,920,131. The General Fund property tax revenue estimate is calculated by dividing the taxable value by 100 and multiplying by the maintenance and operations tax rate. The maintenance and operations tax rate for 2024 is set at $0.281958, a decrease of 0.02928 (-10.38%) from the prior year’s rate. This rate will result in an increase of $2,920,776 (31.82%) from the Fiscal Year 2023 budget and can be attributed to increased property values as well as annexed property and new property added to the tax roll. The budgeted revenue has been adjusted to account for the repayment of the Luminant advance payment during Fiscal Year 2023.

Property Tax Reduction - $4,280,450

In May of 1994, Forney citizens approved an additional 1.00% sales tax for the purpose of creating and funding the Forney Economic Development Corporation (FEDC) and property tax reduction. Half of the approved 1.00% funds the FEDC and the other half is retained by the City to offset property taxes. Therefore, property reduction tax is equal to 25% of total sales tax collections and is a reduction of $0.10 on the property tax rate

Property Tax Penalty - $25,000

Collection of penalties from ad valorem taxes due from previous years.

Delinquent Property Tax - $50,000

Collection of ad valorem taxes due from previous years.

Fire Protection - $2,078,551

The City has an agreement with the Town of Talty whereby the Forney Fire Department provides emergency and fire protection to the Town of Talty. The agreed upon fee is $0.03 per $100 of total property valuation. The expected revenue from the Town of Talty for Fiscal Year 2024 is $105,817.

A similar agreement is in place with the Kaufman County Emergency Services District #6 for fire protection. The agreed upon fee is $0.03 per $100 of total property valuation resulting in $1,972,734 in fire protection revenue.

Sales Tax - $8,560,900

Sales tax is levied on taxable commodities and services purchased within the Forney city limits at the point of sale. The sales tax rate in the City of Forney is 8.25%. Over the past five years, sales tax revenues have increased an average of 16.91% per year. This continued increase is indicative of a growing local economy, resulting from continued population growth within the city limits and the surrounding area, as well as increased commercial development.

The Fiscal Year 2023 budget assumed a 7% increase in sales tax revenue over Fiscal Year 2022, and actual collections are trending slightly below the budgeted amount. The Fiscal Year 2024 budget remains conservative with a projected 7% increase over 2023 year-end projections.

Mixed Beverage Sales Tax - $75,000

This is the combination of the State of Texas Mixed Beverage Gross Receipt and Mixed Beverage Sales Tax. These are taxes imposed on the gross receipts of an alcohol permittee from the sale, preparation, or service of mixed beverages or service of ice or nonalcoholic beverages that are sold, prepared or served for the purpose of being mixed with an alcoholic beverage and consumed on the premises. The gross receipt tax is charged at a rate of 6.7% to the permittee and can not be passed on to the customer. The sales tax is charged at a rate of 8.25% and is passed on to the customer. Both of these taxes are collected by the state and disbursed to the City at a rate of 10.7% of total collections. Estimates for mixed beverage sales taxes are based on prior years collections and has increased in recent years with new development bringing in more restaurants and establishments that prepare mixed beverages.1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 7,000,000 8,000,000 9,000,000

Franchise Tax - $1,250,000

This is a tax charged to utility and public service companies that require the use of City right of way to run transmission lines in order to provide their services. These fees vary by company or service and are established by the City Council when the use of right of way is requested by the service provider. Generally, this fee is a percentage of the revenues collected by the service providers from their use of the City right of way.

Sales Revenue - $7,500

Payment Processing Fees - $7,500

The City added a payment processing fee in Fiscal Year 2021. Credit card companies charge an average of 3% per transaction to process credit card payments and the city has absorbed these fees for a number of years. The City now passes along the processing fee by collecting a 3% surcharge on each debit and credit card transaction.

Court Fines - $203,800

Animal Control Revenue - $15,000

Fines are collected for the violation of animal control ordinances and fees are assessed for the adoption of animals held at the animal shelter.

Municipal Court Fines - $170,000

The majority of the City’s Municipal Court fines are collected from traffic and code violations. While the City retains the largest portion of these fines, based on the offense committed and other factors, portions of the fines are distributed to the state, the county and other agencies. Some of the fines collected by the Municipal Court have restrictions set on the use of those revenues and are accounted for in special revenue funds.

Permits & Inspections - $2,602,500

Revenue categories for Permits & Inspections are relatively self-explanatory. This revenue category as a whole is expected to finish 2023 at approximately 96% above the original budget, which indicates a continuing substantial growth period for the city.

Building Permits

The largest increases are in the areas of Engineering Inspection Fees and Fire Marshal Plan Review Fees. Building permits for the year are once again significantly higher than the original budget.

Revenue estimates for 2024 are conservative, and take into account the possibility that growth will slow. The Finance department approaches permit and inspections revenue with the understanding that this revenue is directly related to growth and will not continue at these levels, and attempts to prepare the General Fund budget in a way that keeps the city from being reliant on this revenue to fund operations.

& Grants - $53,545

FIDS Dispatch Share – $53,545

During Fiscal Year 2023 the Police Department entered into an agreement with the Forney Independent School District (FISD) to provide dispatch services for the FISD Police Department.

Parks and Recreation - $427,100

Parks and Recreation collects fees for private use of facilities, classes, user fees, tournament fees and events put on by the Parks or Special Events departments. All parks revenue categories are budgeted based on averages from prior years, unless upcoming events indicate a change in revenue. Park fees now include the addition of the sports pass for all youth participating in programs offered by the Parks and Recreation Department. This fee is used to offset the cost of programs that serve not only Forney citizens but many residents in the surrounding area. The city will also be adding youth baseball and softball programs for Fiscal Year 2024.

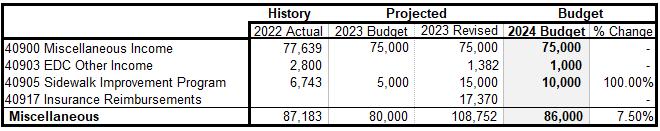

Miscellaneous Income - $86,000

Revenues collected under Miscellaneous Income include all items that do not fall into any other category, insurance reimbursements, other reimbursement, and participation from other agencies on joint purchases.

Transfers from Other Funds - $3,298,200

The Utility Fund Operating Transfer reimburses the General Fund for expenditures incurred on behalf of the utility related functions of the City. This includes salary and benefits for all employees that are partially funded from both funds.

The Building Security Fund transfer is used to offset the cost of Police Officers functioning as Municipal Court Bailiff.

The operating transfer from the Economic Development Corporation covers services provided by the city’s Legal Services, Finance, Human Resources, and Information Technology departments. The transfer also includes a fee for office space at city hall.

The transfer from the Capital Improvement Fund will be used to offset the loss of revenue from the expiring payment in lieu of tax agreement with Luminant power plant.

GENERAL FUND EXPENSES

The General Fund accounts for all expenses not required to be accounted for in other funds. This includes the expenses for services such as Police, Fire, Parks, Streets, Community Development, City Council, and all other administrative services.

Salary & Benefits accounts for 71% of total General Fund expenses. This includes 209.50 of the total 262 city employees. Services & Supplies makes up the second largest expense category at 13% and accounts for all the supplies and professional services utilized in the general functions of the city. Maintenance & Repair includes costs associated with maintaining equipment and facilities as well as drainage and roadways within the city limits. Parks & Recreation includes the addition of youth baseball and softball leagues for Fiscal Year 2024. Miscellaneous expenses include the General Fund line-item contingency of $300,000. Capital outlay for the General Fund is accounted for in the Capital Purchases Fund.

General Fund Expenses are expected to increase 13.04% for Fiscal Year 2024. Approximately 90% of the increase in operating expenses is the addition of 9.5 new full-time equivalents. Other items impacting budget are covered in the department summaries below.

GENERAL FUND DEPARTMENT SUMMARIES

CITY COUNCIL

The City Council is the legislative body for the city, functioning under the Home Rule Charter adopted November 4, 1997. The department provides funding related to the administration of the legislative function.

With several new City Council members, funding was increased for education and training, uniforms, and travel.

ENGINEERING

The Engineering Department is responsible for ensuring that capital and operation projects follow City and NCTCOG design standards. In addition, the department acts as the flood plain administrator to guarantee the National Flood Insurance Program is secured.

There is an increase in this department for the reclassification of two existing positions and the related benefit expenses.

LEGAL SERVICES

The City Attorney is appointed by and answerable to the City Council, as representatives of the City of Forney. The increase in this budget is for personnel cost for the two employees.

CITY MANAGER

The City Manager’s Office is responsible for the overall administration and coordination of all City departments and functions, assuring that the City Council policies are implemented, and legal requirements are met. The department also serves as the primary contact between the City Council and City departments and is responsible for advising the City Council regarding policy decisions.

CITY SECRETARY

The City Secretary department provides administrative support to the legislative function of the city. The department oversees preparation of the City Council agendas and minutes and enrolls laws adopted by the City Council. The department is also responsible for election administration, records retention, processing requests for public information and coordinating the appointment process for Boards & Commissions.

COMMUNICATIONS & MARKETING

This department was created during Fiscal Year 2022 to develop internal and external communications and assist managing citizen participation initiatives. This department also oversees media relations, the City’s website, social media, newsletters, and video content.

MUNICIPAL COURT

The Municipal Court department has jurisdiction over all fine-only offenses committed within the Forney city limits. These offenses include Class C misdemeanors, traffic offenses, and City code violations. The court collects fines, conducts trials, and issues warrants of arrest. The Municipal Court Judge also arraigns prisoners and performs other magistrate duties.

FINANCE

The Finance department is responsible for safeguarding the City’s financial resources by maintaining central accounting records and bank accounts, disbursing all City obligations, annual budget and audit preparations, financial forecasting and overseeing the City’s investment policy.

POLICE

The Police department protects the lives and property of the citizens through the enforcement of state and local laws and the use of established crime prevention techniques. The department is staffed with certified peace officers and trained civilian employees who work in the areas of patrol, criminal investigation, emergency dispatch, and department administration.

The Police department is adding five additional patrol officers, one sergeant, and two dispatchers for Fiscal Year 2024.

ANIMAL CONTROL

The Animal Control department works to unite owners with their lost pets and to promote the adoption of unclaimed, unwanted, stray, and abandoned pets within the Forney city limits.

This increase in Animal Control is due to the increasing cost of supplies and professional veterinary services.

FIRE

The Fire department consists of full-time paid professionals. The department responds to incidents involving fires, rescues, and emergency medical needs as well as fulfilling the

requirements of fire prevention/education, building inspections, fire investigations, and various other public service and safety needs within our community. The Fire department responds to an area of approximately 80 square miles that consists of the City of Forney, the Town of Talty, and Kaufman County Emergency Services District #6.

PARKS & RECREATION

The Parks & Recreation department is responsible for providing well maintained facilities that foster recreational and athletic activities in a safe, clean, and comfortable environment. The department provides routine maintenance, repairs, and improvements to the parks system which currently includes seventeen park sites with a variety of amenities.

This department will be adding a Youth Sports Coordinator as well as a part-time Administrative Assistant. These positions are needed to manage the addition of youth baseball and softball programs for Fiscal Year 2024.

STREETS

The Streets department is responsible for the maintenance of over 98 miles of streets, 35 miles of storm drainage and more than 1,000 street signs within the city limits. The department is also responsible for mowing and tree trimming in the City rights of way and medians.

Maintenance & Repair budgets have been decreased as the Public Works department works to include more capital street reconstruction projects during Fiscal Year 2024.

FACILITIES MAINTENANCE

The Facilities Maintenance department accounts for the costs to maintain city facilities including electrical, plumbing, and HVAC repair and installation. The department also accounts for the purchase of paper and cleaning supplies for all facilities along with the personnel that support the department.

The largest increase in the Facilities Department is in the Services & Supplies category. Much of the increase is due to rising utility cost as well as the increased cost of cleaning supplies.

FLEET SERVICES

The Fleet Services department accounts for the cost of supporting and maintaining the city's vehicle fleet. The department consolidates all previous department allocations for fuel and maintenance for vehicles from UTV to Medium Duty trucks. Fleet maintenance will also manage the purchase and standardization of all future vehicles to the city’s fleet.