The end of the year can be an opportune time to help those in need and the organizations one holds dear. ese year-end contributions may also be tax-deductible, so some might nd it bene cial to get their donations in before the end of the calendar year.

Jane Hargraft, chief development o cer of e Cleveland Orchestra, and Nelson J. Wittenmeyer, vice chairman, philanthropy institute, of Cleveland Clinic, discussed the importance of year-end contributions and how they can bene t donors when they go to le their taxes.

“ e tax bene ts, it depends on who you are and what your nancial situation is; you can use the deduction to reduce your taxable income,” Hargraft said. “ ere are many di erent ways to do what we call ‘tax smart’ charitable giving at the end of the calendar year.”

One can make a gift of appreciative stock or mutual funds, she said. If a person gives one of these gifts, and has held it for more than a year, that will provide them with greater tax savings

than giving cash.

“You pay no capital gains tax on the appreciation and it still quali es for an income tax charitable deduction for the full, fair market value of the share,” she explained. “ is is particularly bene cial if you’re rebalancing your portfolio.”

People who are over the age of 70½ can make direct distributions from their individual retirement accounts and it will count toward their minimum required annual distribution, Hargraft pointed out.

“You don’t receive a deduction for your gift, but there is no income tax on the transferred amount and your aggregate limit is $100,000, so if you have the required minimum distribution, because it’s the retirement account, you’re supposed to pull money out when you’re retired. is really helps you reach those.”

Hargraft recommended that, when making a charitable contribution, people keep all documentation, such as receipts, so that when they go to le their taxes, they can present these items to their tax preparers.

She emphasized the importance of giving to a reputable organization and noted that donating to a known entity is on the rise. She added it is important to visit the charity’s website to discover more about them and learn what methods can be used to make a contribution.

Many charitable organizations accept credit card donations online, but if a person is uncomfortable with electronic transactions, they can always pick up the phone and call the organization, she suggested.

Online donations, however, can be especially bene cial

if a person has procrastinated in making a contribution, Hargraft noted. If it is Dec. 31 and a person wants to make a donation but has not yet done so, an electronic contribution will be marked as made in 2022 and will therefore be eligible for deduction on the 2022 taxes.

Another method people can opt for if they procrastinated in making a donation is mailing a check and dating it in 2022, she mentioned.

“You can put a check in the mail that is dated for the 31st of December and that will be counted as a charitable gift for 2022,” Hargraft said.

Wittenmeyer said there are two bene ts of making charitable donations – avoiding or reducing income taxes.

“Charitable contributions can decrease the level of taxable income used by the IRS in its formula to determine your taxes, thereby reducing how much tax you ultimately have to pay,” Wittenmeyer explained. “Or, if the proper asset is used, charitable contributions can completely avoid income taxes.”

He advised that donors should keep receipts supplied by the charity, as well as any canceled checks, gift agreements or evidence of any asset transfers, such as stock gifts or real estate.

Searching for a legitimate organization can be done by keeping an eye out for one that is a 501(c)(3), he mentioned. In order to be a 501(c)(3), they must have a letter of determination to the entity, issued by the IRS.

“You can ask for a copy of this from the organization,” Wittenmeyer said. “ e IRS also has a list of organizations eligible to receive tax-deductible charitable contributions in Publication 78 Data. Finally, the entity’s Form 990 should be online.”

Wittenmeyer explained there is a range of di erent assets that a person can designate for charitable contributions, including stock, artwork and real estate. ere are also many gift options such as outright gifts, life income gifts and bequests.

ere are multiple reasons why charitable organizations bring in a higher in ux of donations at the end of the year, he mentioned.

“First, people are caring and generous and want to help others,” Wittenmeyer said. “Second, there is a greater awareness of need during this time, so donors are reminded of the timing to act. ird, giving during this time of year could be a person’s normal habit and actions earlier in the year are intentionally delayed in order to make sound decisions now. Finally, if tax bene ts are a goal, the calendar imposes a deadline to act.”

“Charitable contributions can decrease the level of taxable income used by the IRS in its formula to determine your taxes, thereby reducing how much tax you ultimately have to pay.”

Nelson J. Wittenmeyer

LETA OBERTACZ Special to the CJN

LETA OBERTACZ Special to the CJN

The holiday season is a time of generosity and giving – and it can also be one of the busiest times of the year. For individuals and families who want to make charitable gifts ahead of the Dec. 31 tax deduction deadline, but want more time to think strategically about where to direct their dollars for the greatest impact, a donor advised fund can be a convenient, tax-wise option for last-minute charitable giving. While donor advised funds are especially well-suited for end-of-year giving, they offer many benefits for charitable giving year-round.

Turn a variety of assets into charitable dollars – with signi cant tax advantages

A donor advised fund is like a charitable investment account, where you can deposit assets and then make grants from the fund to support various 501(c)(3) nonpro t organizations. Donors can bene t from an immediate tax deduction when they make the deposit, and they enjoy the exibility to distribute grants from the fund on a time line that works for them.

To establish a donor advised fund, you’ll need to work with a sponsoring organization where the fund will be housed. Sponsoring organizations are often a community foundation or public charity created by a nancial services rm. ere is typically a minimum contribution required to make grants from a donor advised fund, and all contributions to donor advised funds are irrevocable.

Your donor advised fund re ects your personal approach to giving. Many donors use their personal name for funds, but you can also choose a name that is representative of the types of programs you want to support, or you may choose to maintain anonymity.

You can designate family, friends or other close individuals as advisors to your fund, either during your lifetime or as part of a succession plan. Many fundholders name their children as successor advisors, allowing them to pass their donor advised fund from one generation to the next. Donor advised

funds also allow other people to contribute to your fund to mark a special occasion or support a special project that interests you.

Unlike a one-time gift to an organization, the charitable dollars you contribute to a DAF are invested to produce income for grant making and growth over time. roughout your lifetime, you can advise on the grant making activities of your fund. Whether you are passionate about supporting medical research, giving to the arts, or any number of causes, a donor advised fund can be a powerful tool for philanthropic impact.

As you consider your options for year-end giving, establishing a donor advised fund could help you realize immediate tax bene ts while giving you the exibility to think strategically about your charitable goals and the organizations you want to support.

Leta Obertacz is senior vice president, advancement at Cleveland Foundation.

Content provided by advertising partner.

The Cleveland Jewish News has an immediate opening for a full-time sta reporter. The ideal candidate will have a nose for news, possess strong writing and editing skills, be digitally savvy, and have experience with photography and videography.

The Sta Reporter will cover breaking news, hard news, spot news, features and life-cycle announcements for our award- winning weekly newspaper and post content to our award-winning website, cjn.org. Sta Reporter will also write short-form content and long-form feature stories for our award-winning magazines and produce content for our sister publications, the Columbus Jewish News and the Akron Jewish News.

Candidates who can develop sources, know how to work a beat and want to scoop the competition are encouraged to apply. The CJN competes with all other media to break stories and has won more than 250 awards in the last five years, including being named best non-daily newspaper in Ohio by the Cleveland Press Club and The Associated Press.

Candidates should have a minimum of two to three years of daily newspaper or other relevant experience, be self-starters, work well under pressure, ability to consistently meet assigned deadlines, ability to adapt to team environments and work independently, be a team player, have the ability to handle multiple assignments at one time and produce high-quality, accurate and error-free content. The CJN is an AP newsroom and familiarity with AP style in a digital first environment is desired. Experience writing and editing using Adobe Creative Cloud programs, including

InCopy and InDesign, desired, but not required. Proficiency in all social media platforms including Facebook, Twitter, Instagram and YouTube preferred. Photography and video experience helpful.

Recent college graduates who have demonstrated the above requirements through coursework and/or internships will be considered. This position will require some evening and Sunday assignments.

If we’ve just described your background, please send a resume and three writing clips of your work to jobs@cjn.org.

The Cleveland Jewish Publication Company o ers a competitive salary and excellent benefits, including medical, dental, 401(k) company match, generous PTO, holiday pay and more. The CJPC is an equal opportunity employer. Employment at the Cleveland Jewish Publication Company is based solely on a person’s merit and qualifications directly related to their professional competency. All applicants will be considered for employment without attention to age, race, color, religion, sex, sexual orientation, gender identity/ expression, national origin, veteran or disability status or any other basis.

Whether you are passionate about supporting medical research, giving to the arts, or any number of causes, a donor advised fund can be a powerful tool for philanthropic impact.

Donations to Jewish day schools through a Scholarship Granting Organization are applicable for a tax credit through a new Ohio scholarship program.

Individual donors can receive up to a $750 tax credit on their state tax liability, or $1,500 if ling jointly, when they support a Scholarship Granting Organization and can designate the donation for a speci c school or a general fund. Donations made by Dec. 31 will qualify for this tax year.

“Tax-credit scholarships are a tool that have been used in several dozen states around the country to encourage individuals, in the case of Ohio, to contribute to organizations that are called SGOs, which essentially means that they are organizations that primarily exist to fund scholarships for students to go to non-public schools,” Rabbi Yitz Frank, president of School Choice Ohio and executive director of Agudath Israel of Ohio, told the Cleveland Jewish News.

Created in House Bill 110 and signed in

2021, the program grew from seven SGOs in 2021 to 29 in 2022. School Choice Ohio launched the Every Child Every Family SGO in 2022, which had to go through the process of certi cation and approval by the IRS and Ohio Attorney General.

“ e way that the program is designed to work, the SGO will make an award to students that apply for a scholarship and those funds will then be applied to the families’ tuition obligation,” said Frank, a resident of Beachwood. “So, it helps families a ord private options that they wouldn’t necessarily be able to otherwise.”

Donors can select a speci c school to

receive their donation, or contribute to the general fund which is distributed to students regardless of what school they attend. As the funds are designated for tuition, donations to the SGO can be considered in addition to any annual giving to schools.

Donations to the Scholarship Granting Organization can be designated to the general fund or to one of the 28 partner schools, including Fuchs Mizrachi School, the Joseph and Florence Mandel Jewish Day School and Yeshiva High School of Cleveland, all in Beachwood; Chaviva High School, Hebrew Academy of Cleveland and Yeshiva Derech Hatorah, all in Cleveland Heights; and Gross Schechter Day School in Pepper Pike.

“ e schools certainly work very hard to continue to grow and provide a highquality education,” he said. “ ese funds go speci cally to tuition payments so parents can a ord it.”

Fuchs Mizrachi decided to partner with School Choice Ohio’s SGO after speaking with a couple of SGOs and nding it convenient to partner with Every Child Every Family, Head of School Rabbi Avery Joel told the CJN in an

We are only days away from the new year which means I’m here to remind you once again about charitable giving and its potential associated financial benefits. It was just over one year ago that I discussed the benefits of donating appreciated stocks to charities. Recently, I discovered that similar to stocks, you can donate cryptocurrency to charity.

e bene t of donating cryptocurrency is like the bene t you receive if you donate stock directly to a charity: the avoidance of paying capital gains tax.

In other words, by donating cryptocurrency directly to a charity you can avoid paying capital gains taxes on the cryptocurrency while claiming the full amount donated as a charitable deduction on your taxes. If you don’t recall from my prior column, capital gains is the di erence between the purchase price of a stock or cryptocurrency and the selling price. e amount of capital gain taxes you pay is dependent on two things: the length of time you’ve owned the cryptocurrency and your

total annual income.

However, if you donate cryptocurrency directly to the charity, instead of selling it rst, you can avoid paying capital gains taxes on the donation, just like donations of appreciated securities.

In addition to avoiding capital gains taxes through donation, you may also have the ability to claim a charitable deduction. To do so, you must have held the cryptocurrency for at least a year and you must itemize your deductions. Donations worth more than $5,000 must get a quali ed appraisal. e charitable deduction is limited to 30% of income, but excess deductions may be carried forward for up to ve years.

Donations of cryptocurrency are not eligible for the above-the-line charitable deduction, since the above-the-line deduction is limited to cash donations.

Donating cryptocurrency can, however, be a little more complicated than donating securities since the vast majority of charities do not have a digital wallet, and therefore do not have the ability to accept direct donations. However, entities such as Crypto for Charity, Schwab Charitable and Fidelity Charitable are attempting to make the cryptocurrency donation process easier.

How does it work?

Per the Crypto for Charity website, your cryptocurrency donation is rst funneled through Crypto for Charity’s a liated 501(c) (3) tax-exempt charity. From there, the donation is converted to dollars with the net proceeds being distributed to the qualifying charity of your choosing.

If you’re interested in donating

email.

“We saw this as an opportunity to help provide scholarships for the families in our community so that getting a Jewish education would be less of a nancial burden,” he wrote. “Over half of our families need assistance in covering tuition, and a signi cant portion of our budget is allotted to help those families. is will make it easier for us to meet those needs.”

While schools like Fuchs Mizrachi rely not only on tuition, but other sources of funding like its annual campaign to provide an education that includes general and Judaic studies, donating to the SGO is another way to support the school in its mission at no additional cost.

“Since it comes at no additional cost to the donor beyond what they would be paying in taxes anyways, we hope that donors will take this additional opportunity to both utilize this, and their annual campaign tzedakah,” Joel wrote. “Lastly, this is a great way for people to help us give families access to a Jewish education, without it materially impacting the donors’ own nancial standing.”

cryptocurrency this year or in the future, make sure you research the organization prior to your commitment. Further, given the tax rami cations associated with cryptocurrency donation, it is best to discuss your potential donation with an accountant prior to moving forward.

Andrew Zashin writes about law for the Cleveland Jewish News. He is a co-managing partner with Zashin & Rich, with offices in Cleveland and Columbus.

The Cleveland Jewish News does not make endorsements of political candidates and/or political or other ballot issues on any level. Letters, commentaries, opinions, advertisements and online posts appearing in the Cleveland Jewish News, on cjn.org or our social media pages do not necessarily reflect the opinions of the Cleveland Jewish Publication Company, its board, officers or staff.

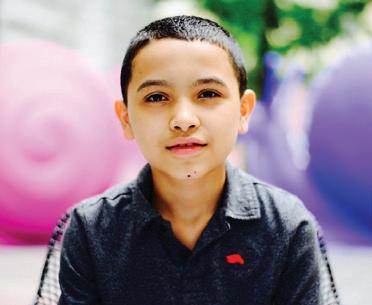

childhood

Thanks to donors like you, we were able to help Andrew beat lymphoblastic leukemia and get back to childhood as quickly as possible. Your gift of 100% kid-dedicated care helps provide the therapies, treatments and breakthroughs so kids can make the most of every moment. Because the greatest gift you can give a child is more time. Donate now at akronchildrens.org/donate. Or, scan the QR code.

Gifts to the Cleveland Foundation support our mission to enhance the quality of life for Greater Clevelanders, now and for generations to come. Over the years, gifts from individuals, families and organizations have grown our available grantmaking dollars and made possible transformative investments in education and youth development; arts and culture; economic and community development; the environment; health and human services; and more in Greater Cleveland. A gift to the Cleveland Foundation is invested so it grows over time and can support a number of organizations or causes long into the future.

As we prepare to move into our new headquarters at the corner of E. 66th Street and Euclid Avenue in MidTown Cleveland, we invite the entire community to come celebrate with us! Save the date and join us for Cleveland Foundation Headquarters Celebration Weekend & 2023 Annual Meeting Presented by KeyBank, July 13-15, 2023. This multi-day series of special events will include tours, entertainment, art exhibitions, local cuisine and activities with partners along the E. 66th Street corridor and beyond.

The Cleveland Foundation is the world’s first community foundation and one of the largest today, with annual grants of more than $120 million made in partnership with our donors. In addition to our grantmaking, the Cleveland Foundation is a leader in impact investing, with $385 million in direct and indirect impact investments.

1422 Euclid Avenue, Suite 1608 Cleveland, OH 44115 216.861.3810

clevelandfoundation.org

Community support makes music a vibrant part of life in Northeast Ohio, bringing brilliant performances to the stage at Severance and Blossom; funding robust education programming for students; creating opportunities for connection in our neighborhoods; and reaching more people through music online, on the radio, and on tour. Donations to The Cleveland Orchestra make up the most significant portion of the ensemble’s operating revenue.

Every donation makes a di erence. When you support The Cleveland Orchestra, you inspire thousands across our community through the power of music. To learn more, contact our Donor Services team at 216-456-8400 or donate@clevelandorchestra.com.

We invite you to join us! You can enjoy the music by attending concerts at Severance and Blossom. You can become a donor and support the music you love. You can join our Stand Partners monthly giving program, providing ongoing support for the music. And you can join us at special events throughout the year (see below).

The Orchestra o ers a variety of events that are exclusive to Orchestra supporters. These include Meet the Artist chamber performances with Orchestra musicians; open rehearsals, your chance to see music-making in action; post-concert receptions with musicians and guest artists; and more.

In addition, The Cleveland Orchestra hosts two major fundraising events per year: the Annual Gala at Severance every fall to benefit education and community programs; and the Blossom Summer Soirée at Blossom Music Center to benefit the Orchestra’s summer home. Each event features a beautiful cocktail hour, an elegant dinner, and a performance by the Orchestra.

11001 Euclid Ave, Cleveland, OH 44106 216-456-8400 clevelandorchestra.com

Interested in Helping? Contact our Donor Services team at 216-456-8400 or donate@clevelandorchestra.com.

Cleveland’s first Bar Association was founded in 1873, even before the American Bar Association! From the original charter documents, our Bar has always been dedicated to protecting and preserving the rule of law. 150 years later, our work has expanded through the fundraising power of the Cleveland Metropolitan Bar Foundation. Our award-winning programs provide legal education and mentorship, beginning in high school with the 3Rs, teaching rights, responsibilities and realities to students in Cleveland and East Cleveland schools. Our Louis Stokes Scholars program provides college students with the tools they need to attend law school and to create positive change as lawyers. We o er pro bono legal services, and assistance to the homeless, and to families in need.

Legacy 150 is the celebration of our 150th birthday in 2023! We are honoring our Bar’s history and contributions to the community. We’re putting that history in context, with special content online and in the CMBA’s monthly Bar Journal. We’ve created a weekly podcast series called My BarStory where members can share their own personal history with the Bar. Mostly, we’re planning for the future of our community service, ensuring that we are here to support the people of Northeast Ohio for another 150 years and beyond.

We have so many ways you can get involved! We provide volunteer opportunities for lawyers to work with students, to help keep our elections free and fair, and to build a more equitable future for all. We welcome non-lawyers as a liate members, bringing in new ideas and passion for community service. You can even join us for the biggest party in Bar history with Rock the Bar on Saturday, June 24, 2023 at the Rock and Roll Hall of Fame. Of course, your charitable financial contributions are most welcome and appreciated at clemetrobar.org/givenow.

1375 East 9th Street, Floor 2 Cleveland, Ohio 44114 (216) 696-3525 communications@clemetrobar.org clemetrobar.org

High school freshman Brandon Brown could not anticipate that his meeting with a visiting lawyer from the Bar’s 3Rs program at John Hay High School would change his life. Now a law school graduate and Cleveland lawyer, Brandon gives back as a volunteer and leader in the Bar’s programs that inspired him.

Join us as we celebrate 150 years of making a difference in the lives of students like Brandon, in the legal profession, and in our community.

Give today at clemetrobar.org/legacy150.

Adrian D. Thompson Taft Stettinius & Hollister LLP 2022-2023 CMBA President

“My experiences with through college really me to see how the achieve my career –

Zukerman, Lear & Murray Co., LPA 2022-2023 CMBF President

Litigation High school freshman Brandon his meeting with a visiting lawyer at John Hay High School would school graduate and Cleveland volunteer and leader in the Bar’s

E.

You can change lives, too!

“My experiences with the Bar and its programs from high school through college really sparked my interest in the law, allowing me to see how the law helps people, and encouraging me to achieve my career goal to be a lawyer.”– Brandon E. Brown, Litigation Associate, Calfee Halter & Griswold LLP

At Humble Design Cleveland, we change lives and communities by custom designing and fully furnishing homes for individuals, families and veterans emerging from homelessness. We know that having a home is key in breaking the cycle of poverty so we help people move forward by creating spaces that give them the pride, hope, and dignity that they deserve. Our process is simple. Twice a week, every week, we create a dignified and welcoming home by repurposing and pulling together gently used goods that have been donated by the community. We start by getting families up o the floor and into beautiful, comfortable beds. We design everything from top to bottom, from dishes to linens, from tables to couches. We make beds, fill vases with flowers, hang pictures and everything in-between. Families return to a home that will give them a fresh start, a place where they can eat, play and dream together. The stability of a fully functioning home allows our families and veterans to thrive.

Since 2009, Humble Design has transformed over 2550 empty houses and apartments into homes across 5 cities around the country. In 2020, Humble Design Cleveland opened its warehouse in Solon, Ohio. Despite the di culties of starting up in a pandemic, we served our first client in September of that year. With just over 2 years operational, Humble Design Cleveland has transformed 177 homes, completed several community projects and directly changed the lives of over 500 Clevelanders.

A: Community support is critical to the success of Humble Design Cleveland. We couldn’t do what we do without our incredible volunteers, donors and supporters who make a real di erence in the lives of children, parents, and veterans in Cleveland. We believe in our motto of ‘togetherness to end homelessness’ and we need you! Become a volunteer, donate gently used furniture or household goods, or please consider a tax-deductible donation.

29001 Solon Rd, Suite Q1 Solon OH, 44139

humbledesign.org/cleveland infocle@humbledesign.org 440-318-1039

29001 Solon Rd • Suite Q1 • Solon OH 44139 • humbledesign.org/cleveland • infocle@humbledesign.org • 440-318-1039

Restoring hope and dignity has a life-changing impact both for the people we help and the volunteers who make it possible. Humble Design impacts families and the environment, as well as our community of volunteers. Together we can end homelessness.

A house isn’t a home without a warm bed and a place to gather with family. Our home makeovers change an entire mindset, generating an immediate focus on self-empowerment and longterm stability. Humble Design sets families on a course towards a bright and hopeful future.

A: Ideastream Public Media serves Northeast Ohioans by listening, understanding and fostering dialogues across the region. As Ohio’s largest independent, publicly supported media organization, it provides free programs and services to 3.6 million people in 22 counties across radio, TV and digital platforms. Ideastream is recognized locally and nationally as an innovative model for public media, distinguishing itself from other media entities through a deep and abiding dedication to community partnerships, civic engagement and innovative use of media

A: In addition to broadcasting trustworthy news on WKSU, timeless classical and jazz on WCLV and inspiring arts and entertainment on WVIZ, our increased focus on digital content delivery ensures we are meeting the communities where they are and when they need us. Through multimedia experiences, Ideastream engages with the community and tells local stories focused on news and information, arts and entertainment, classical music and education. The creation of our Engaged Journalism department reinforces our dedication to representing Northeast Ohio’s diversity.

A: The quickest way to get involved and support Ideastream’s mission is to visit ideastream.org to become a sustaining member. Your membership support helps keep favorite programs on the air and helps fund local initiatives and special projects. Your organization can also support Ideastream by underwriting programs or sponsoring any of our stations. Create a strong, meaningful connection with our viewers and listeners — the most educated, a uent, influential, cultural and community-minded audience in Northeast Ohio. Winning the hearts and minds of Ideastream viewers and listeners pays dividends with this highly engaged audience.

1375 Euclid Avenue, Cleveland, OH 44115 216-916-6100

ideastream.org

Year Established: 2001 Number of Employees: 160

Donate Appreciated Stocks or other assets owned longer than one year. Claim a charitable deduction for the value of the donation. Save capital gains tax even if you do not itemize.

Make IRA Qualified Charitable Distributions. Persons at least 70½ may transfer up to $100,000 annually from a traditional IRA to eligible charities tax free. Transfers count toward IRA required minimum distribution.

Contribute to a Donor Advised Fund by year end and decide where to recommend charitable grants over time. Save capital gains tax for donations of long-term appreciated assets.

To learn about these and other charitable planning ideas, contact Matthew A. Kali at mkali @jewishcleveland.org or 216-593-2831

The Jewish Federation of Cleveland does not provide legal, tax or financial advice. Please consult with your professional advisor before taking any action.

Koinonia delivers whole-person, integrated care – an innovative new direction that supports the unique needs, preferences, and entirety of each person with intellectual and developmental disabilities (IDD). Developed more than two years ago, Koinonia’s care model is being shared nationwide as a model for creating collaborative communities that optimize all aspects of quality of life for individuals with IDD, including primary care and behavioral health.

Koinonia’s employees are, hands down, our most important factor in our success. Our team delivers high quality, e cient, e ective and equitable person-centered services and support. Our talented and dedicated direct support professionals (DSPs) work hard to ensure the people we serve have healthy, fulfilling and enriched lives. They are the heart and soul of everything we do at Koinonia to help people live their best lives possible.

Working at Koinonia is highly rewarding. Every day, our employees make a di erence in the lives of the individuals we serve. Our families and guardians know they can rely on Koinonia to provide the best service and care to their loved ones. Koinonia’s integrated care model has distinguished us as a

6161 Oak Tree Blvd., Suite 400 Independence, OH 44131 216-588-8777 www.koinoniahomes.org

Leket Israel, the National Food Bank, is the leading food rescue organization in Israel. Unique among all other organizations that serve the poor in Israel and food banks worldwide, Leket Israel’s sole focus is rescuing healthy, surplus food and delivering it to those in need through partner nonprofit organizations. In 2022, Leket Israel rescued 1.9 million hot meals from hotels, corporate cafeterias and IDF army bases and 60 million lbs. of fresh agricultural produce from farmers and packing houses and distributed it to 265 nonprofit agency partners, feeding 234,000 Israelis in need each week.

Leket supporters can help in many ways. The easiest way to support Leket is to ‘like’ our Facebook page, follow us on Twitter and Instagram and share our posts on social media with your friends and family. You can also organize a fundraiser or chesed (charity) project, host an information session for your community, congregation, organization, or support Leket Israel on the occasion of a simcha (special occasion) or community event by opening a personalized charity page.

If you’re visiting Israel, we’d love to have you join us at one of our volunteer experiences. Glean in the fields with our Harvest Helpers project: harvesting fruit and vegetables. The activity takes place at Rishon Lezion fields in central Israel. We also have Leket on the Move: sort and pack rescued fruit and vegetables in the Gan Haim Logistics Center (central Israel) for distribution to our non-profit partners.

Raanana 4365006

Phone: 09-7441757 | Fax: 09-7405785

Deena Fiedler | Director of PR and Resource Development | M:+972-52-8359121 | T:+972-9-790-9208 | Fax:+972-9-7405785 | deena@leket.org

In 2004, Anita Bradley founded the Northern Ohio Recovery Association (NORA). Bradley has been in recovery for over 32 years and understands the importance of blending personal and professional knowledge to promote the power and possibility of recovery. In 2014, she extended the expertise on substance abuse to the administration of President Barack Obama. In 2016, Bradley was honored by the White House as a “Champion of Change” for the programs she created within the substance abuse field. Bradley is a tremendous voice and advocate for women providing critical link between treatment, recovery, and the rest of the world. She continues “Building Recovery Into Diverse Globally E ective Systems,” or BRIDGES of HOPE, to o er culturally relevant consumer choices, presented with dignity and respect to youth, adults, and families in communities throughout Ohio.

It is very rewarding in making a di erence helping people to recover and get their lives back and o er substance abuse prevention programs that work. Drug prevention programs are an incredibly important part of drug treatment because drug addiction is a powerful and harmful disease. Knowing all this, the best possible treatment for drug addiction is prevention. Our programs include Bridges To Recovery for youth ages 13-24, East Cleveland Bridges of Hope mobilizing law enforcement, government, faith based, youth and business organizations, Jumpstart for a Better Tomorrow and Health Opportunities Prevention and Empowerment, which are a full-service mentorship programs.

1400 E 55th St. Cleveland, OH 44103

(216) 391-6672 norainc.org

Nobody Recovers Alone. With the help of many very generous people and businesses, Northern Ohio Recovery Association has been able to provide those a ected by substance abuse with a path to freedom and a healthy lifestyle. And we want to do more. Please join our network of generous and compassionate people so that we may continue to provide the treatment, prevention and training programs necessary to improve our communities. Your o ering, big or small, will benefit the lives of many struggling individuals and their concerned friends and family members. Together we can make a di erence.

Mandel JCC is a community center that makes an impact on people of all ages, backgrounds and abilities through programs, events and services that promote health, wellness and intellectual growth. At The J, you nd people who are like you, value you and accept you. For 75 years, we have played a signi cant role in helping our community thrive and create memories from generation to generation.

Join our growing Mandel JCC donor family with a gift to our Annual Campaign or through our legacy giving program.

The J is here for you. Be there for The J.

McCarthy Lebit is proud to announce that 23 attorneys at our multi-practice firm have been recognized in the 2023 Edition of Best Lawyers in America® or Best Lawyers®: Ones to Watch. At McCarthy Lebit, our philosophy is simple: we work hard to deliver outstanding legal services that achieve landmark results for our clients, each and every day. Discover what it means to “Expect More, Get More” at www.mccarthylebit.com.

In 1948, Stella Maris (Latin for “Star of the Sea”) opened its doors. Father Otis Winchester of the neighboring St. Malachi Church and members of a relatively new organization, Alcoholics Anonymous, recognized the need for a place to house and support homeless men through their recovery from alcohol dependency.

Originally housing 11 men who were undergoing alcoholic treatment and recovery, Stella Maris was a refuge where they received three meals a day, a prescribed course of treatment, and the camaraderie of others. The goal was to end their addiction and rebuild their lives.

Today, Stella Maris’s services are more important than ever. Located in the heart of Cleveland, Stella Maris is the only facility that offers a full continuum of treatment services on one campus, including: Centralized Intake and Detoxification Program, Inpatient and Outpatient Programs, Housing and Residential Services, Wraparound Supportive Services (Case Management, Family Counseling, LGBTQ+ track, Medication Assisted Treatment (MAT), Peer Support, Primary Care Medical Services, Trauma Therapy, Workforce Development Training

Still located on the same block in Cleveland’s Flats West Bank neighborhood, we look forward to our next 75 years of service.

As a non-profit community provider, we ar e experienc ing an increased demand for our services. At the same ti me, we are faced with the rising cost of care associated with wage s, food, uti lities, etc. Las t year, we treated over 3,700 individ uals who were our family members , friends or neighbors. 95% were at or bel ow the pove r ty level. And, Stella Maris is now one of only t wo s tand-alone m edi cal detox facilities in Cl ev eland, and the only site where you c an move through an enti r e continuum of care. We currently are e xper iencing wai t-lists across al l of our levels of care. W e believe in the miracle and spirit of r ecove ry W e see it each and every day. And, w e believe that re covery is for everyone regard less of an individual’s race, relig ion, how they identi fy or their abilit y to pay. Gifts to Stella Maris enable us to continue to transform and save lives of our family m e mbers, friend s and neighbors and return them to their com munities.

Yes! Next year, we are celebrating our 75th Anniversary! We are planning a year-long celebration of events that will include a Rock of Faith concert in the summer and our biggest event, Stella Fest on Saturday, September 23, 2023. More information on the full schedule of events will be posted on our website.

At University Hospitals, we take our commitment to our community seriously and are grateful for your ongoing support in this rapidly changing world. Together, we’ll continue to treat patients like family, find new treatments and cures, and prepare the next generation of caregivers. Join others who are helping advance the science of health and the art of compassion by leaving their legacy.

To learn more, contact our Gift Planning Team: UHGiving.org/giftplanning | 216-983-2200 Leave

A: Y.O.U. is the largest youth workforce development organization in Greater Cleveland. We remove the roadblocks that keep our youth from becoming economically self-su cient contributors to the region. All Y.O.U. programs include job readiness training, career exploration activities, coaching and mentoring from a caring adult, and competitive wages. We are creating pathways to success and contributing to the strength and vitality of Northeast Ohio. A contribution to Y.O.U. is an investment in Cleveland.

A: There are many ways you can help us with our work. In addition to donating your treasure, you can donate your time. We rely on volunteers to work in the schools with our youth. Opportunities include resume writing workshops, mock interviews, guest speaking, and mentoring interns. And we are always looking for businesses in the community to employ teens during the summer and young adults year-round.

A: In 2020, Case Western Reserve University conducted a study of our summer jobs program. They found that participants in our Summer Youth Employment Program (SYEP) have higher graduation rates, fewer juvenile delinquency fillings, lower adult incarceration rates, and improved school attendance, all while earning competitive wages they can take home to their families. The benefits of a summer job extend beyond the wages youth earn. Organizations like the National Institute of Justice credit programs that create living-wage jobs for youth (like Y.O.U.) as one cause for the reduction in youth-related violence.