The TBR Center for Workforce Development’s mission is to develop and maintain a statewide approach for workforce development that directly impacts the State and our communities.

• Collaborate with business, industry, government agencies, local agencies, and our college institutions to develop and deliver rapid response workforce training programs that will prepare and support a competitive workforce across a range of occupational levels;

• Monitor statewide workforce activities and initiatives that contribute to the economy of our state and communities;

• Assess, develop, deliver and evaluate the system’s economic development effectiveness through collaboration with our college system leadership and subject matter experts.

“Workforce Development is the coordination of public and private-sector policies and programs that provides individuals with the opportunity for a sustainable livelihood and helps organizations achieve exemplary goals, consistent with the societal context” (Jacobs and Hawley, 2007)

For a complete list of eligibility requirements and to receive more information, please contact TNECD.

FastTrack Economic Development Fund*

FastTrack Job Training Assistance Program*

Grant provided to local communities to reimburse a company for eligible expenditures not covered by infrastructure or job training grants. The grant can help offset expenses such as real property acquisition, new construction, and building retrofitting.

Grant provided directly to new or expanding companies that provides funding to support the training of net new full-time employees.

FastTrack Infrastructure Development Program*

Bonus Incentive

Grant provided to local governments for public infrastructure needs for new and expanding companies. TNECD will work with local officials to identify eligible needs for a project, such as water, sewer, rail, gas, electric, roadway, telecommunications or other site improvements.

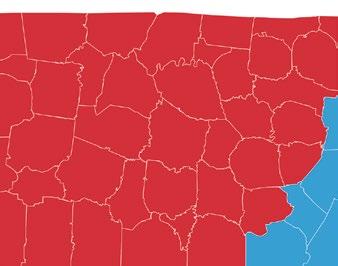

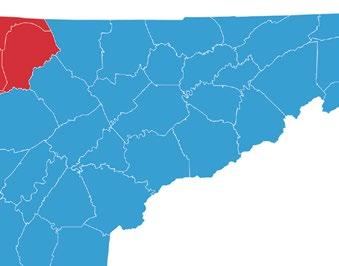

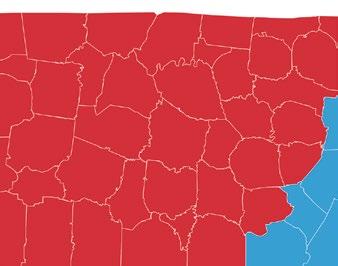

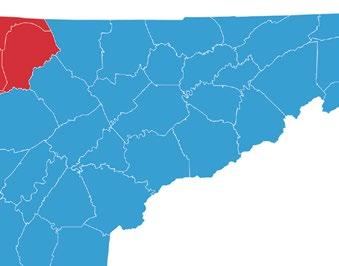

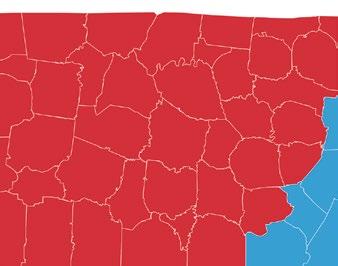

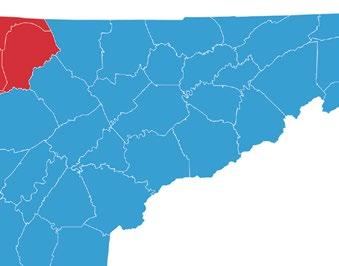

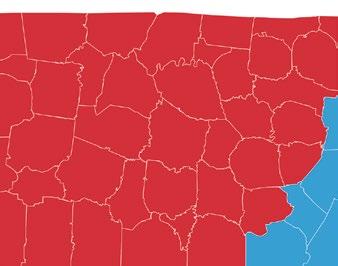

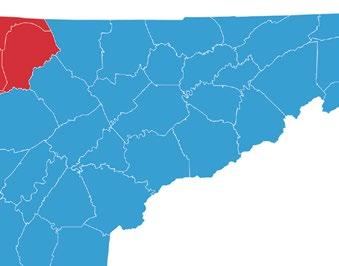

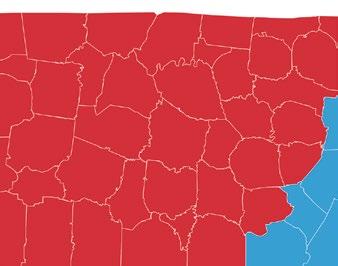

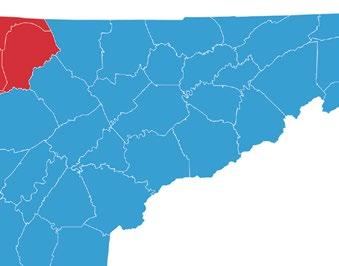

At-Risk Counties: 35% premium to projects that locate in a county defined by the Appalachian Regional Commission as “at-risk”.

Distressed Counties: 50% premium to projects that locate in a county defined by the Appalachian Regional Commission as “distressed”.

Job Tax Credit*

Credit of $4,500 per position to offset up to 50% of franchise and excise (F&E) any unused credit may be carried forward for up to 25 years .

Community Resurgence: Credit of $2,500 per each position.

Only used in exceptional cases where a company’s impact, such as net new full-time positions and capital investment, in a community is significant. These funds are available subject to terms of the Accountability Agreement executed by the state, community and company. TNECD is not able to provide incentives prior to the execution and approval of a contract.

Funding levels are based on the number of net new full-time positions created, amount of capital invested, wages of new employees and the types of skill and knowledge levels required. TNECD is not able to provide training incentives for any positions filled prior to the execution and approval of a contract.

Must be for public infrastructure improvements benefiting a specific company generating net new full-time positions and capital investment; requires local matching funds. For onsite improvements, the community must provide a PILOT on the real property investment for at least 5 years. TNECD is not able to provide incentives prior to the execution and approval of a contract.

In order to receive either premium, the project must provide an average starting wage that meets or exceeds the county median wage. TNECD reserves the discretion to approve or deny the premium based on the facts and circumstances of the project.

Create at least 25 net new full-time positions within a 36-month period and invest at least $500,000 in a qualified business enterprise.

Create 10 net new full-time positions each paying the state’s average occupational wage and also be located in a census tract where poverty rate exceeds 30%.

Enhanced Job Tax Credit*

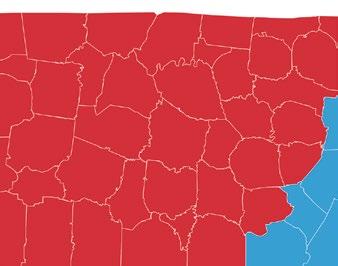

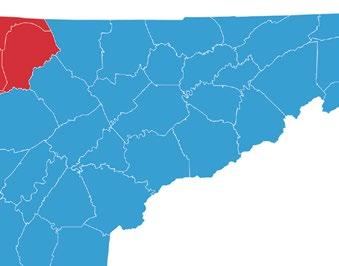

Allows an additional annual credit for locations/expansions in designated Tier 2, Tier 3, and Tier 4 Enhancement Counties. Enhanced JTC can offset up to 100% of F&E liability.

Tier 2: 3-year annual credit at $4,500 per position with no carry forward.

Tier 3: 5-year annual credit at $4,500 per position with no carry forward.

Tier 4: 5-year annual credit at $4,500 per position with no carry forward.

Create at least 25 net new full-time positions within a 36-month period and invest at least $500,000 in a qualified business enterprise.

Create at least 20 net new full-time positions within 36-month period and invest at least $500,000 in a qualified business enterprise.

Create at least 10 net new full-time positions within 36-month period and invest at least $500,000 in a qualified business enterprise.

* Definition of net new full-time job: 37 1/2 hours a week, 12 months and health coverage offered.

Industrial Machinery

Tax Credit

Credit of 1% for the purchase of qualified industrial machinery. Credit offsets up to 50% any unused credit may be carried forward for up to 25 years.

Manufacturing: Includes purchases for machinery; apparatus and equipment with parts; appurtenances and accessories; repair parts and labor.

Warehousing and distribution: Includes material handling equipment and racking systems with a minimum $10M capital investment within 36-months.

Headquarters, call centers: Includes computer; network; software or peripheral computer devices, purchased in making required capital investment for job tax credit.

Research and development: Purchases of equipment must be necessary to and primarily for research and development purposes.

Sales and Use Tax

Exemptions or Credit

Manufacturing: Exemptions include industrial machinery, repair parts and industrial supplies used in the manufacturing process. Reductions sales tax on water, to 1.5% on gas, electricity and various energy sources.

Headquarters: Receive a sales tax credit of 6.5% state sales tax for qualified personal property directly related to the new full-time position creation.

Warehouse/Distribution: Sales tax exemption for material handling and racking systems purchased for a qualified warehouse or distribution center.

Call Centers: Sales tax exemption on any sales of interstate telecommunication and international telecommunication services sold to a business for use in the operation of one or more qualified call centers.

Data Centers: Sales tax exemption for certain hardware and software purchased for a qualified data center.

Research and Development: Sales tax exemption on equipment must be necessary to and primarily for research and development purposes.

State Industrial Access Program (TDOT)

On The Job Training (TDOL)

Applicant Recruitment and Screening (TDOL)

Consultation (TDOL)

Technical Training (TBR)

Registered as a manufacturing facility.

Investment $10M capital investment with 100 new full-time positions each paying 150% of the states AOW†

Investment of $10M or more in real and personal property, including the purchase of new equipment, made during a 3-year period.

Must have at least 250 positions engaged primarily in call center activities.

Minimum capital investment of $100M and 15 new full-time positions paying at least 150% of the state’s AOW† made during a 3-year period.

Registered as a research and development facility.

The Tennessee Department of Transportation (TDOT) contracts with local governments for projects to be developed through the State Industrial Access Program. The program provides funding and technical assistance for highway access to new and expanding industries.

The Tennessee Department of Labor (DOL) offers reimbursement up to 50% of a new hire’s wages for up to six (6) months of their initial training.

Free assistance with the recruitment and screening of job applicants based on a company’s specific job requirements. More than 70,000 potential employees in statewide database.

Consultative Services are offered to employers to assist them in achieving a safe and healthful workplace for their employees. Consultative Services offers both occupational safety and industrial hygiene services to manufacturing, construction, and other types of businesses in Tennessee.

With 37 colleges and over 175 teaching locations statewide, TBR - The College System of Tennessee is ready to deliver customized and economical industry training for your company in agriculture, manufacturing, health care, construction, transportation, and information technology sectors.

† Average Occupational Wage (AOW)

Tennessee's Youth Employment Program (YEP) links ambitious young adults aged 14-24 with employers in diverse industries across Tennessee. Participants dive into hands-on workforce experiences, gaining invaluable skills and test-driving future careers while earning up to $4,000 along the way. This year-round program from the state of Tennessee offers much more than youth job opportunities — it teaches lifelong and life-changing skills. YEP is THE vibe to thrive in the workforce.

Take charge of your future, build your resume, and gain real-world experience all while earning up to $4,000.

Pursue your passion and discover firsthand insights and mentorship to help guide the right career fit for your future.

YEP isn't just another internship; it's a paid job that instills discipline and vital soft skills. By encouraging youth to participate, you're helping tomorrow's business leaders cultivate the confidence, resilience, and adaptability needed to thrive in today’s dynamic career fields.

Sign up and find answers to frequently asked questions at YepTN.com

Every career rockstar started as a rookie, and YEP is your ultimate training ground for building foundational skills for long term success.

From local “mom-and-pop shops” to Fortune 100s, Tennessee-based businesses can uncover a pipeline of motivated young talent through Tennessee’s Youth Employment Program. YEP is designed to create meaningful employment opportunities for young individuals by matching employers with talent who align perfectly with their business and industry requirements.

Your business plays a crucial role in empowering tomorrow's workforce with resume-building and life-changing skills. With YEP, you’ll gain access to motivated young adults eager to make a positive impact in your organization, while simultaneously shaping the future of Tennessee. TALENT

YEP empowers you to test and develop a talented pool of young adults while the state covers the costs.

We help employers identify and nurture potential young adults and future employees who will align with their business operations.

WHO: 14-24 Year Old tennesseans

WHen: Year-round

Where: Statewide

HOW MUCH: $4,000 max payout per employee

Program administrators handle the legwork from enrollment to insurance, and reimbursement, ensuring a hassle-free experience for employers.

1. How would you, as a business leader, characterize the current supply/demand dynamic? For example, is higher education supplying sufficient graduates with the skills for your industry?

i. Follow-up: Does the data profile generally fit with their understanding of the industry profile?

2. Do employers provide additional training for new hires, or do graduates come ready for the job?

3. Is higher education willing and able to update curriculum and training when industry needs change?

4. Employers demand both technical skills and durable (or soft) skills in an employee. How can colleges better prepare students with durable skills?

i. Follow-up: What specifically are employers looking for (e.g.,communication, passing a drug test, showing up on time, etc.)?

5. Are you aware of college/program advisory boards? How would you describe your connection to colleges/programs through advisory boards?

i. Follow-up: Do you feel that you have influence over curriculum and training content that fulfills your workforce needs?

6. How effective is dual enrollment (and early postsecondary opportunities more broadly) in preparing students for the workforce?

i. Follow-up: Are high school graduates (with and without dual enrollment experience) prepared for entry-level jobs within an industry?

7. Higher education preparation can be delivered via credit or non-credit activity. Is that a meaningful distinction? Do you prefer either approach?

i. Follow-up:How does higher education improve the process of training students for careers?

8. What other providers or training opportunities do you rely upon for training existing workers and identifying new employees?

i. Follow-up: Do you provide significant in-house training?

ii. Follow-up: Do you prefer graduates from private or proprietary colleges?

iii. Follow-up: What can TBR colleges learn from other providers’ approaches to training?

5,728 16,356

2,534

Graduates in 2022-2023 from Advanced Manufacturing programs at TCATs

Projected job openings in Tennessee over the next 10 years in Advanced Manufacturing.

5,714

1,152

47,557 Students in 2022-2023 in Business programs at TCATs and

3,695

795

2,966 Students in 2022-2023 in

AVIATION MAINTENANCE

Programs at 5 TCATs & 2 community

3,143

LOGISTICS/ SUPPLY CHAIN TRUCK DRIVING

Programs at 15 TCATs & 5 community colleges

1,454