RISKY BUSINESS - REALTOR® SAFETY Page 6 2023 LEGISLATIVE SESSION UPDATE Page 12 MORTGAGE RATES VS. EARLY PAYOFFS AND BANKS SCRATCHING THEIR HEADS Page 14 Official Magazine of the Colorado Association of REALTORS® c o l or a d o RE ALTOR® MAGAZINE AUGUST 2023 PLUS: THE STATE OF THE REAL ESTATE INDUSTRY IN 2023 Page 4

Bite-Size Learning Sessions

●Creating a Clause Library & Email Message Library

● Managing a Multiple Offer Situation

●Enhanced Integration Features

●Ordering an O&E and Title Electronically

●Client Database - CRM Options & Client Summar

●Contract to Buy and Sell Save Time Features

2

NEW!

Take advantage of the New User REALTOR® discount scan code with mobile or visit: +1 303 233 1918 | support@ctmso ware.com Proud to partner with Colorado Association of REALTORS® View Training Calendar coloradorealtors.com/realtor-marketplace/

The COLORADO REALTOR® is published by the Colorado Association of REALTORS®

309 Inverness Way South Englewood, CO 80112 (303) 790-7099 or 1-800-944-6550 FAX (303) 790-7299 or 1-800-317-3689

EDITOR: Lisa Dryer-Hansmeier, VP of Member Engagement & Public Relations: lhansmeier@coloradorealtors.com

DESIGNER: Monica Panczer, Creative Marketing Specialist: monica@coloradorealtors.com

The Colorado Association of REALTORS® assumes no responsibility for return of unsolicited manuscripts, photographs or art. The acceptance of advertising by the Colorado REALTOR® does not indicate approval or endorsement of the advertiser or his product by the Colorado Association of REALTORS®. The Colorado Association of REALTORS® makes no warranties and assumes no responsibility for the accuracy or completeness of the information contained herein. The opinions expressed in articles are not necessarily the opinions of the Colorado Association of REALTORS®

This is a copyrighted issue. Permission to reprint or quote any material from this issue is hereby granted provided the Colorado REALTOR ® is given proper credit in all articles or commentaries, and the Colorado Association of REALTORS® is given proper credit with two copies of any reprints.

The term “REALTOR ®” is a national registered trademark for members of the National Association of REALTORS®

The term denotes both business competence and a pledge to observe and abide by a strict Code of Ethics. To reach a CAR director who represents you, call your local association/board.

3 11 JOIN US AT THE CAR FOUNDATION HOMECOMING AUGUST 2023: The State of the Real Estate Industry in 2023 4 CEO Update - Risky Business 6 CAR Fall Forum 2023............................................... 8 Seller Impersonation Fraud Best Practices ........... 9 Colorado Association of REALTORS® Foundation Impact Report 10 Join Us at the Foundation HOMEcoming ........... 11 2023 Legislative Session Update ......................... 12 Mortgage Rates vs. Early Payoffs and Banks Scratching Their Heads 14 Support Maui Wildfire Relief 16 Housing Markets Mellow with Weakening Prices and Softening Demand ........................................ 18 Market Trends Snapshot for July 25 Get Involved at CAR 26 The Value of Your CAR Membership 28 RPAC Update .......................................................... 30 RPAC Pickleball Tournament ............................... 31 CAR Member Resources ........................................ 33 Every Apple Watch Wearer Should Know These Three Simple Tricks 34 Best Practices to Secure Your Business Network, Email, and Intellectual Property.......................... 35 AE Spotlights on Melissa Maldonado and Tess Pickerel ................................................................... 36

MAGAZINE c o l o r a d o RE ALTOR® 26 GET INVOLVED AT CAR c o l o r a d o RE ALTOR® MAGAZINE

THE STATE OF THE REAL ESTATE INDUSTRY IN 2023

A RESILIENT TRANSFORMATION

As we step into the heart of 2023, it's essential to take a moment to reflect on the journey we've undertaken together as real estate professionals. Through the highs and lows, we have continued to thrive and evolve, making Colorado's real estate industry a shining beacon of growth and opportunity. I am thrilled to share some exciting developments that have shaped our industry in 2023, our steadfast commitment to fostering Diversity, Equity, Inclusion, and Belonging, and a glimpse into the inspiring path that lies ahead for the remainder of 2023.

THE STATE OF THE REAL ESTATE INDUSTRY IN 2023: A RESILIENT TRANSFORMATION

The real estate landscape has undergone a remarkable transformation in 2023. We’ve witnessed unprecedented challenges, ranging from economic fluctuations to shifts in buyer preferences. However, our collective resilience and adaptability have proven that we can weather any storm. Despite initial uncertainties, the housing market remains robust, with steady demand and a plethora of opportunities. While navigating through a dynamic market, we have embraced innovation and technology to enhance customer experiences. Our ability to adapt swiftly has been crucial in maintaining our industry's momentum to continue to provide value and relevance in this time of change.

Furthermore, Colorado's economy has shown remarkable growth, attracting new businesses and professionals to our beautiful state. This influx of talent has spurred a surge in real estate demand, pushing us to elevate our services and deliver exceptional experiences to our valued clients and articulating our value proposition to the community members we serve.

STRIDES TOWARDS PROFESSIONALISM: EMBRACING DIVERSITY, EQUITY, INCLUSION, AND BELONGING

One of the proudest achievements of our real estate community in 2023 has been our unwavering commitment to fostering Diversity, Equity, Inclusion, and Belonging. We

4

Greetings, Colorado REALTOR® Family!

Natalie Davis

2023 President of the Colorado Association of REALTORS®

FROM THE PRESIDENT

believe that our industry should reflect the vibrant tapestry of our society, and we have taken concrete steps to ensure that everyone feels welcomed and valued. Earlier in the year, the Colorado Association of REALTORS® launched a Diversity and Inclusion toolkit to equip local associations, brokerages and practitioners with tools and resources that can be used to help build greater and more inclusive environments for the members of our community.

We are also benefiting from the comprehensive training programs (At Home With Diversity (AHWD), Bias Override, etc.), seminars (Advocating for Your Community’s Future, NAR Leadership365, etc.), and tools (DEI Toolkit, Fairhaven, C2EX), that have championed cultural competency, dismantled biases, and embraced a deeper understanding of the unique needs of diverse clientele. By promoting a culture of inclusivity, we have created an environment where all individuals can thrive, breaking down barriers that once limited opportunities.

As we build stronger bridges between communities, we have forged bonds that extend beyond transactions, creating lasting connections with our clients and fellow professionals. Our commitment to Diversity, Equity, Inclusion, and Belonging not only defines our industry today but will set the precedent for future generations of Colorado REALTORS®.

PIONEERING THE PATH AHEAD

As I envision the future of Colorado's real estate industry, I am filled with unwavering optimism. We stand at the precipice of incredible opportunities and possibilities. With technology, innovation, and a magnitude of value as our ally and Diversity, Equity, and Inclusion as one of our guiding lights, we have the power to shape a thriving, interconnected, and compassionate real estate community.

Let us embrace innovation with open arms, continually seeking ways to leverage technology without losing the essence of the human touch. By harnessing data-driven insights, we can make more informed decisions, empower our clients, and redefine personalized experiences in the digital age.

The commitment to Diversity, Equity, and Inclusion should be an ongoing journey, as we strive to create an inclusive and supportive ecosystem that fosters the growth and success of every individual. Embracing diversity not only enriches our industry but also strengthens the very fabric of our society.

As Colorado REALTORS®, we have the privilege of helping people find their dream homes and build their futures. Let us never lose sight of the profound impact we can make in the lives of others. With every transaction, we sow seeds of positive change, contributing to the growth and prosperity of our communities.

Let us unite as one cohesive force, committed to empowering each other and uplifting our profession. Together, we can shape a future where the Colorado real estate industry becomes an exemplary model of professionalism, empathy, and unwavering dedication.

I am immensely proud of the resiliency and the strides we have made in 2023 and deeply inspired by the transformational journey we continue to undertake. Let us embrace change with open hearts, for it is through change that we grow, evolve, and create a brighter tomorrow for all.

Thank you for your dedication and passion for our industry. Together, let's continue to make 2023 a year of prosperity, growth, and boundless possibilities.

5

RISKY BUSINESS

Knowledge. Awareness. Empowerment. These are the Core Components of REALTOR® Safety.

We all know real estate is a risky profession. Sadly, enough we too often hear reports of real estate professionals getting robbed, assaulted, or worse. Are you doing everything you can to stay safe?

According to the National Association of REALTORS®, four percent of REALTORS® nationally said they have been a victim of a crime while working as a real estate professional. Thirty-five percent of REALTORS® have met a new or prospective client alone at a secluded location/property. If these statistics hold true for Colorado, that means over 1,000 of our members have been a victim of a crime while working.

Even with this reality, NAR reported that only 46 percent of agents said their office has standard procedures for broker/agent safety. Twenty-seven percent said they had no procedures, and 27 percent said they didn’t know if their office did or not.

Interestingly enough, statistics were better when it came to procedures to safeguard client data. The report stated 71 percent of agents said their office had policies for keeping customer information safe and for assuring proper disposal of client data. The obvious question: why do brokerages put more emphasis on protecting data than on safeguarding their human sales team?

Criminals are opportunistic and may see you and/or your potential transaction as an opportunity to harm you and your clients, whether that opportunity is for theft, fraud, or other unlawful activities. By prioritizing safety, you can minimize the risk of becoming targets for such crimes.

Do you know what to do? Knowing how to handle these situations safely can prevent harm and ensure your personal and clients’ wellbeing. Afterall, your clients and potential buyers/sellers trust you to provide a secure and reliable service and indirectly keep them safe from harm during the transaction.

6

Tyrone Adams

CEO of the Colorado Association of REALTORS®

FROM THE CEO

So, what can you do? Again, it begins with Knowledge, Awareness, and Empowerment. Make protecting yourself a priority by having personal safety protocols that you adhere to 100 percent of the time. Some other tips safety experts cite are:

• Insist on meeting prospects you don’t know at your office or at a neutral location.

• Whenever possible, don’t meet anyone alone, especially for the first meeting.

• Take a self-defense class.

• Take a REALTOR® safety course.

• Carry a self-defense weapon, i.e., pepper spray, small spray can of Lysol, gun (ensure you follow all conceal carry laws), etc.

• Use a smart phone safety app. Many local associations offer Forewarn as part of their value proposition.

• Follow proactive measures to lock down client data and personal information.

• Trust your intuition. If it doesn’t feel right, it probably isn’t. The bottom line is, no transaction is worth the value of your life, livelihood, or that of your clients. The small sampling of tools listed are only effective if you use them. Don’t be the person who doesn’t believe it can’t happen to you. Make sure you are

MAKE

SURE TO UPDATE

prioritizing safety as part of your business plan. While a real estate career can be very rewarding, it still is a risky business.

7

Thanks for choosing to be a Colorado REALTOR®! SOMEONE

ABOUT YOUR LOCATION

CAR Fall Forum 2023: An Exceptional Line-up of Keynote Speakers AwaitsRegister Now!

See You in Snowmass!

Spots are still available for the 2023 CAR Fall Forum, taking place October 8-11th at the beautiful Viewline Resort in Snowmass. This event is an extraordinary opportunity to connect with seasoned industry professionals and benefit from their insights and experiences.

Your Full Conference registration provides access to the following:

• Christine Hansen's Keynote: "Discovering the True Authentic Leader Within You" - Immerse yourself in a transformative leadership journey with Christine Hansen, renowned for her ability to nurture authentic leaders.

• Jason De León's Keynote: "Uncovering the Stories at the U.S.-Mexico Border" - Engage with Jason De León, an expert in border studies, as he unravels riveting stories from the U.S.-Mexico border. Brought to you by CAR’s Diversity & Inclusion and Global Committees.

• Strategic Thinking with Brian Copeland: Join Brian Copeland at the Strategic Think Tank Forum for

a powerful, interactive brainstorming session designed to reset the way you approach business and leadership, leaving you with new tools to create amazing, memorable moments.

Space is limited due to the intimate nature of this event, so ensure your spot by registering now!

8

DON'T MISS SCOTT PETERSON AND FRIENDS AT THE CAR RISK MANAGEMENT SESSION

REGISTER TODAY

- RED FLAGS AND BEST PRACTICES

SELLER IMPERSONATION FRAUD

HOW CAN REALTORS® PROTECT THEMSELVES AND THEIR CLIENTS FROM SELLER IMPERSONATION FRAUD?

With the increasing prevalence of agents working remotely and communicating with clients through email and text, it’s crucial to confirm the identity of potential clients. Any verification process your brokerage uses must be applied uniformity to all individuals. Stay up to date with these recommendations to protect you and your clients from seller impersonation fraud.

WATCH FOR RED FLAGS

ABSENTEE OWNERS

• Listing property that is non-owner occupied (aka absentee owner).

• Examples include vacant land, in-fill vacant lot, unoccupied acreage or ranch land, rental property, short-term rental property such as Airbnb, a second home, and a vacation home.

LOW-PRICED OR ALL-CASH DEALS

• A prospective seller wants to list the property below market value and only wants offers from buyers willing to pay all cash.

FSBO; UNKNOWN SELLER

• The property wasn’t listed with a regular agent, but instead through a For-Sale-By-Owner website that shares the listing on public platforms like Zillow.

• No one involved knows the seller or has even talked to the seller until a buyer wants to make an offer.

COMMUNICATES ONLY THROUGH TEXT OR EMAIL

• The seller actively avoids any face-to-face or phone conversations, solely relying on text or email for communication.

• When called, the seller’s voicemail picks up and they respond through text or email.

RUSH TO CLOSE

• During negotiations with the buyer, the seller readily accepts almost all terms, prioritizing a quick cash transaction.

• They show no objections to proposed fees, cost allocations, commissions, or other terms.

REFUSES TO ATTEND CLOSING

• The seller might initially express willingness to attend the closing in person, but as the closing date nears, they suddenly become unavailable due to being “outof-town” or for other reasons. However, they are still available to sign the documents with a notary, often in a different city or state.

SUSPICIOUS WIRE INSTRUCTIONS

• The seller provides wiring instructions for their proceeds to a bank that is not geographically close to the property or the mailing address for the tax bill.

SUSPICIOUS PHONE NUMBER

• When the seller’s phone number is reverse searched to determine if it belongs to the owner of the property, it shows as a completely unrelated name or as unknown (ie: a burner phone).

9

No I’m too busy

SELLER BEHAVIOR TO BE SUSPICIOUS OF

COLORADO ASSOCIATION OF REALTORS® FOUNDATION IMPACT REPORT

The Colorado Association of REALTORS® Foundation continues its commitment to all Coloradans, where we’ve been investing in grants to help local communities for 31 years. These grants would not be possible without the support and vision of Colorado REALTORS® and industry partners.

In 2022, the CAR Foundation helped more Coloradans in a single year than ever before. We did it because there was greater need than perhaps ever before. In the final days of 2021, the Marshall Fire roared through Boulder County, decimating the towns of Superior and Louisville as well as unincorporated areas. Thousands of homes and businesses were destroyed or damaged and the damage totals are in the billions. The CAR Foundation moved swiftly to secure a landmark $2M grant from the REALTOR® Relief Foundation and put into place an efficient application, verification, and grant distribution system.

In total, we provided $1,274,017.17 in mortgage and rental relief to 541 households, helping more than 1,600 individuals with more than 16,000 nights of shelter. We’re proud of the impact we’ve had across our state in the last year and excited to share this report with you, along with stories from some of our partners. Please join me in continued support of our mission to help Coloradans achieve a place to call home.

2022 Annual Report DOWNLOAD

10

January 1, 2022 - December 31, 2022

THE REPORT

JOIN US AT THE COLORADO REALTOR® HOMECOMING

As a REALTOR®, you play a crucial role in shaping neighborhoods and supporting homeownership. By joining us for the Colorado REALTOR® HOMEcoming, you have the power to make a tangible difference in the lives of those we serve.

Join the Colorado Association of REALTORS® Foundation and over 200 REALTORS®, industry influencers, and business leaders for a premier fundraising event on Friday, September 8, 2023 at one of South Denver’s most welcoming event venues – Hudson Gardens.

This celebratory event will commemorate 32 years of REALTOR® engagement and investment into Colorado communities and will raise funds for the CAR Foundation’s program to support safe and attainable housing, advance homeownership for all

Coloradans, and provide housing-related disaster assistance.

The event will include a special collaborative gratitude project, gourmet dinner, lively entertainment, a high-end live auction, mingling with fellow leaders and real estate community influencers, and more.

We invite you to attend, sponsor, and be recognized as we bring the CAR Foundation’s one-of-a-kind hospitality to the picturesque Hudson Gardens for an evening to remember to help all Coloradans find a place to call home.

FRIDAY, SEPTEMBER 8

HUDSON GARDENS

REGISTER TODAY

11

2023 LEGISLATIVE SESSION UPDATE

Life post-legislative session has been busy with CAR Government Affairs staff unshackled from Capitol happenings and now traveling a bit for conferences, events, and meetings. We have presented 2023 legislative debriefings for various local associations and look forward to more in the future. Following the passage of HB23-1304, there have been Proposition 123 implementation meetings around the state with Colorado Housing and Finance Authority (CHFA), Colorado office of Economic Development and International Trade (OEDIT), and Division of Housing –Colorado Department of Local Affairs (DOH DOLA) to try and identify best practices or new programs in maximizing Proposition 123 funding locally. CAR staff Jesse Zamora and Lauren Cecil are meeting with legislators and business leaders across the state as part of Colorado Competitive Council Basecamps. Kerrianne Brenzel led a successful RPAC Road Tour across the Front Range and southern Colorado in June. Government Affairs staff attended conferences both in Colorado and out of state to explore and discuss innovative policy concepts to help REALTORS® in their business and advance property ownership and property rights across our state.

For those attending our Fall Forum in October, we are excited to share CAR’s 2023 Legislators of the Year, who you will hopefully see there depending on their availability. After Fall Forum, ballots will start hitting your mailboxes for November elections that include two statewide ballot measures: Proposition II “Retain Nicotine Tax Revenue” and

Proposition HH “Reduce Property Taxes and Retain State Revenue.” Proposition II would retain excess nicotine tax revenue to fund preschool programs, which falls outside our policy wheelhouse, while Prop HH does have real estate ramifications.

PROPOSITION HH

To start, CAR is still going through our internal processes and have *not* taken a position on Proposition HH at this time. We have been waiting for a Supreme Court ruling on a legal challenge to Prop HH meeting single-subject requirements and we are also polling likely voters to see where the electorate stands on the issue. Any position we take on Prop HH will have political ramifications, and potentially impact REALTORS®’ businesses, requiring us to make a thoughtful and well-informed decision.

Below are key components of Proposition HH with a sole focus on real estate impact. There are also TABOR impacts affecting taxpayer refunds along with funding local government services and education that we are confident other groups will address as the election approaches.

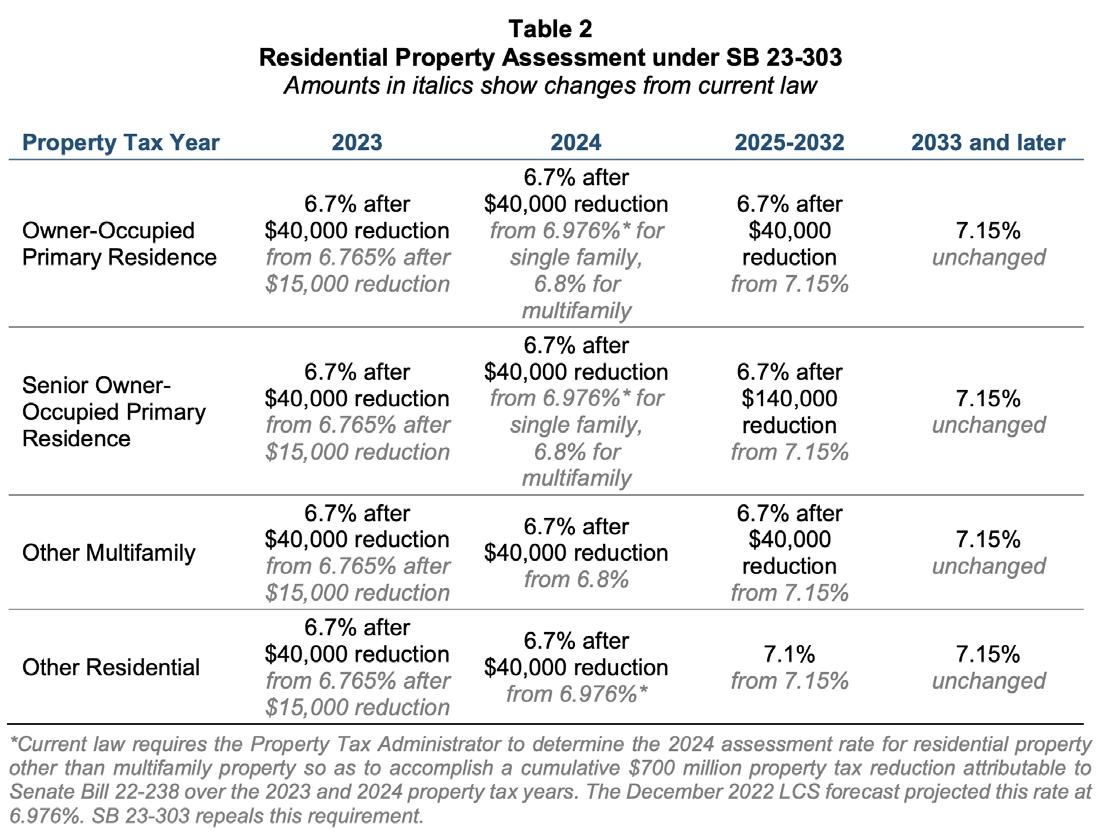

WHAT WOULD PROP HH DO RELATED TO REAL ESTATE?

If a simple majority of voters approve Prop HH in November, there would be a slight reduction in property taxes owed for both residential and non-residential property compared to current law. Prop HH would be in effect for at least the next 10 years, and then subject to legislative review. It’s important

12

Brian Tanner

VP of Public Policy, Colorado Association of REALTORS®

continued on next page

LEGISLATIVE UPDATE

to highlight that the result for most property owners would be smaller increases in property taxes beginning in 2023, but the vast majority will still likely pay more, just not as much. This is mainly due to property valuations increasing more than the market value reductions in Prop HH due to the repeal of the Gallagher Amendment in 2020.

TWO NEW SUBCLASSES OF RESIDENTIAL PROPERTY

Prop HH creates two new subclasses of residential property for “Owner-occupied primary residences” and “Qualifiedsenior primary residences.” These new subclasses would take effect in 2025. To qualify for these two subclasses for primary residences, property owners would need to complete and file an application or affidavit declaring their primary residence with their local county assessor.

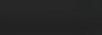

ASSESSMENT RATES AND MARKET VALUE REDUCTION

The assessment rate would be reduced for all Residential properties to 6.7% from current law of 6.765%. This assessment rate would be fixed at 6.7% for until at least 2032. This assessment rate would be applied after a reduction of market value. For 2023, it would be a $50,000 reduction (up from current law of $15,000) then $40,000 in 2024.

Starting in 2025, there would be a variance between property classifications on market value reductions. First, for “Other single-family residential properties” or non-owner-occupied properties, the market value reduction completely goes away from 2025 to 2032. This classification commonly referred to as “Other Residential” could be second homes, rental properties, et cetera. Second, for seniors who qualify for the senior homestead exemption, their market value reduction increases to $140,000 for 2025 to 2032 and more importantly becomes portable so they can receive this benefit if they purchase and move to a new home. Last, for “Owner-occupied primary residence” and “Other Multifamily” the reduction remains at $40,000 until 2032. (See Table 2 below.)

NONRESIDENTIAL PROPERTY

Prop HH makes changes to Nonresidential Property, too. It would create a new subclass for “Renewable Energy Agricultural Land”. The actual value of this new subclass would be based on the waste land subclass valuation formula from the Division of Property Taxation. (See Table 3 below.)

Senate Bill 23-303 Fiscal Note May 8, 2023

PRIMARY RESIDENCE PROPERTY WORKING GROUP

Senate Bill 23 – 303, which passed and referred Prop HH to the November 2023 ballot, also created a working group of assessors and elected county officials to be convened by the Division of Property Taxation to help in the administration of the primary residence subclasses of Prop HH. This working group will make recommendations to House and Senate committees by January 1, 2024.

Please expect more information on Prop HH once a position is established and as the election draws nearer. If you have any questions related to Prop HH or anything electoral, please email govaffairs@coloradorealtors.com.

13

MORTGAGE RATES VS. EARLY PAYOFFS AND BANKS SCRATCHING THEIR HEADS

By Mathew Schulz President/Owner at Firelight Mortgage, Board of Directors at the Colorado Mortgage Lenders Association

By Mathew Schulz President/Owner at Firelight Mortgage, Board of Directors at the Colorado Mortgage Lenders Association

Welcome back ladies and gentlemen to this quarter’s edition of Notes from a Mortgage Professional. I just got done watching a program on Netflix called Quarterbacks. It was fascinating. This upcoming article? Meh…not so much! I kid, I kid. While reading this article, you’ll laugh, you’ll cry, you’ll call your grandmother, it has a little of everything. I know the suspense is killing you, so what is it? Drum roll please. Why are we seeing some of the strangest rates and rate sheets we have seen in decades and what makes a rate sheet look strange (it’s when they wear pantyhose) and how do these oddities relate to early payoffs (EPOs)?

It’s no secret that since I have started writing this column a year and a half ago, the real estate and mortgage markets have reflected another Netflix series, Stranger Things. Last year, we saw hyperinflation (the cost of goods rapidly increasing) as we slowly came out of the COVID economic crisis. This hyperinflation stemmed from the United States Government printing money to keep not only our economy, but the entire world out of a global economic meltdown. They succeeded in doing so (according to most economists), however, when you overwhelm a market or economy with that “free money” – I know, it didn’t feel free to me either – ultimately the cost of goods will rise. People are getting paid for not working and are able to go out and buy goods.

Introduce inflation, and in this case a lot of inflation. Enter an eight-dollar carton of eggs.

As I remind readers in every article, mortgage rates come from mortgage-backed securities or mortgage bonds (NOT THE FEDERAL RESERVE, THE FEDERAL FUNDS RATE OR THE FEDERAL PRIME RATE). As our mortgage bonds are the true standard in where mortgage rates come from, and, as an investment tool, traditionally do not make large rates of return as they are a “secured” investment tool, when inflation is bad (or the dollar is losing value), our bonds will make even less money. Therefore, with this incredibly rapid increase to inflation, we saw one of the fastest increases to mortgage interest rates in history.

Fast forward to the beautiful, yet delayed summer of 2023. I have been noticing oddities in our morning rate sheets since the end of last year. As another quick reminder to real estate agents of all skill levels: as mortgage loan originators, the banks that we work for will distribute a rate sheet, or a document that posts all the different loan programs being offered by the bank and the different rate and price options offered that day. As a broker who works with 18 different banks, I receive a lot of them, cough, cough, pat on my back, #brokersarebetter. These rate sheets are typically

14 continued on next page

broken out into boxes with each individual loan program represented in its own box with the different pricing options for that program. Mathew, or as I prefer, Dr. Matty, what do you mean by different pricing options? Let’s envision in our heads that my go-to lender told me that for a given loan scenario, they could offer 6.5% with no discount points but they could also offer 6.375% with .5% in discount points. These are the different pricing options we are discussing. The lower the rate we go, the more discount fees we will expect to pay. Yet, as we go higher in rate, we get pricing options that

if a borrower were to choose a 5.875% rate as indicated in the far-left column, as we navigate to the right in that row, we can see a (0.185) or next to that ($894). That means to get that rate, the borrower would be paying a .185% discount point or $894 per the loan amount that was entered. As we go lower in rate, that discount increases. We are choosing to pay less in interest over the term of the loan. Banks are greedy, they want their money somehow, so as we go lower, we pay more upfront versus over the term of the loan. As we possibly move to a higher rate, the negative turns to a positive and these rate options come with a credit from the bank to the consumer to be applied to closing costs or prepaid items. So, at 5.99%, the consumer would be receiving a .355% credit toward closing costs or $1,716. Again, if you have ever heard of a no closing cost loan, that statement is not entirely accurate, legally, there must be some closing costs and pre-paid items to close the loan. The bank is simply assigning a rate to that transaction that has enough money to cover those closing costs and pre-paid items. There is not a right or wrong option. A first-time homebuyer might barely have saved enough money for their down payment and needs some help with the closing costs and pre-paid items. A more established or wealthier borrower may just want that lowest possible rate and is comfortable with some discount points. This is where a loan officer must be in tune with the consumer, their qualifications, and their goals.

will give the borrower cash back at closing to cover some or all their closing costs and pre-paid items. This is how a buyer receives a “no closing cost” loan.

Alright Mr. Longwinded, what’s the point? Above is a “rate stack” of pricing options for a very standard 30 Year Fixed, FHA transaction. We don’t need to focus on the exact scenario or terms, let’s focus on the different rate options being offered. For you sleuths out there, before reading any more, take five minutes to look at these options and make a note or two of these “oddities” I am talking about.

For those of you who are brand new to looking at different rate options on a mortgage, this is how a loan originator provides different pricing options to a client. In this scenario,

Alright, it’s brass-tacks time. Let’s be a well-trained, studious loan officer and really study our options here. I would like to start by stating that in a traditional, more normal market, each .125% (rates generally go by .125% increments), would traditionally have a .5% difference in price. Meaning, if a 6% rate had no discount points nor any credit towards closing costs (we call that the par rate), I would normally expect to go the 5.875%, I would be paying a .5% discount point. I can tell you now, without a calculator, that the cost-benefit analysis is not good for this scenario. The consumer would typically have to wait 8-10 years to save enough money monthly to recoup those costs. Now, I would like you to look at the price comparison between 6.375% and 6.25%. At 6.375%, the consumer is receiving $4,596 credit to closing costs, and 6.25% is getting $5,341 credit towards closing costs. Wait, that doesn’t make any sense, I get more money toward closing costs by going down in rate? What the heck?

Another example – and this is where it is critical that the originator is truly consulting the consumer and not just

15 continued on next page

taking orders – let’s compare 5.75% to 5.625%. Yes, there are slightly higher discount points associated with the lower option, however, it is negligible. The consumer is not paying the expected .5% in additional discount fee, rather they are only paying .029% additional discount fee. I can tell you in this scenario, the monthly savings by going to the lower rate is $45. The difference in additional closing costs is $140, meaning this consumer recouped their additional costs in just over three months. As a loan originator, I would never let my consumer go with 5.75%, even if it was their lucky number, it would truly make no sense. There are several other instances in this rate stack that show .1 or .2% difference that will also have a very good recouperation period.

Why is this happening? Why would a bank (or candidly in this case, Wall Street investors) offer better pricing at lower rates? EPOs my friend, EPOs. EPOs, or Early Payoffs, are about to plague the mortgage industry. With one of the fastest and most dramatic increases in interest rates in history last year, shifting from the high 2.0% range to the mid to high 7.0’s by October, many loans were written that are just biding time to refinance. If we think that nearly every loan written this year or last will be refinancing sometime next year (fingers crossed), banks will barely have collected enough in payments to cover the cost to produce that loan. Right as these loans get into the black, they are being refinanced and paid off. Envision fire coming out of mortgage-backed securities investors ears.

Now, let’s remove our loan originator hat and put on our

much nicer, very expensive Wall Street mortgage-backed securities investor hat. What can we do to reduce the likelihood of these EPOs happening? Let’s put out pricing that incentivizes consumers to start with a lower interest rate, and, if they start with a lower interest rate by paying some discount points, we could be in better shape in the event of a miniature refinance boom. If a consumer starts their loan with a lower rate, the likelihood of them refinancing goes down, AND, if they do payoff early but we’re able to suck some “discount point fee” money out of them, at least we have some extra money in our coffers to cover some of that cost to produce money. Messed up? Yes. Does it make complete sense? Not so much. But I hope you appreciated a lowly loan originator’s best way to explain it in somewhat understandable language. Am I a professional secondary markets guy with a background in Wall Street investing? No, but I did stay at a Holiday Inn Express last night.

See you next time with Notes from a Mortgage Professional where we will be discussing brain surgery dos and don’ts and how they relate to the real estate industry. It will be easier to explain than the concepts discussed today.

Donate to the REALTORS® Relief Foundation for Victims of Maui Wildfires

As Hawai'i faces the devastation of the Maui fires, the REALTORS® Relief Foundation has announced a $1.5 million grant to assist the affected community. Regardless of size, your contribution can help further this crucial mission and show Hawai'i the generosity of our REALTOR® community. Donate by texting TEAMRRF to 71777 or going to the REALTORS® Relief Foundation website.

16

Mathew Schulz, CML, is the President of Firelight Mortgage Consultants in Greenwood Village, Colo., a mortgage company that he has owned for 15 years. He is also a board member and past president of the Colorado Mortgage Lenders Association. You can reach him at mschulz@FirelightMortgage.com. Mathew provides a regular look into the market called MMG Weekly. Click here if you’d like to subscribe.

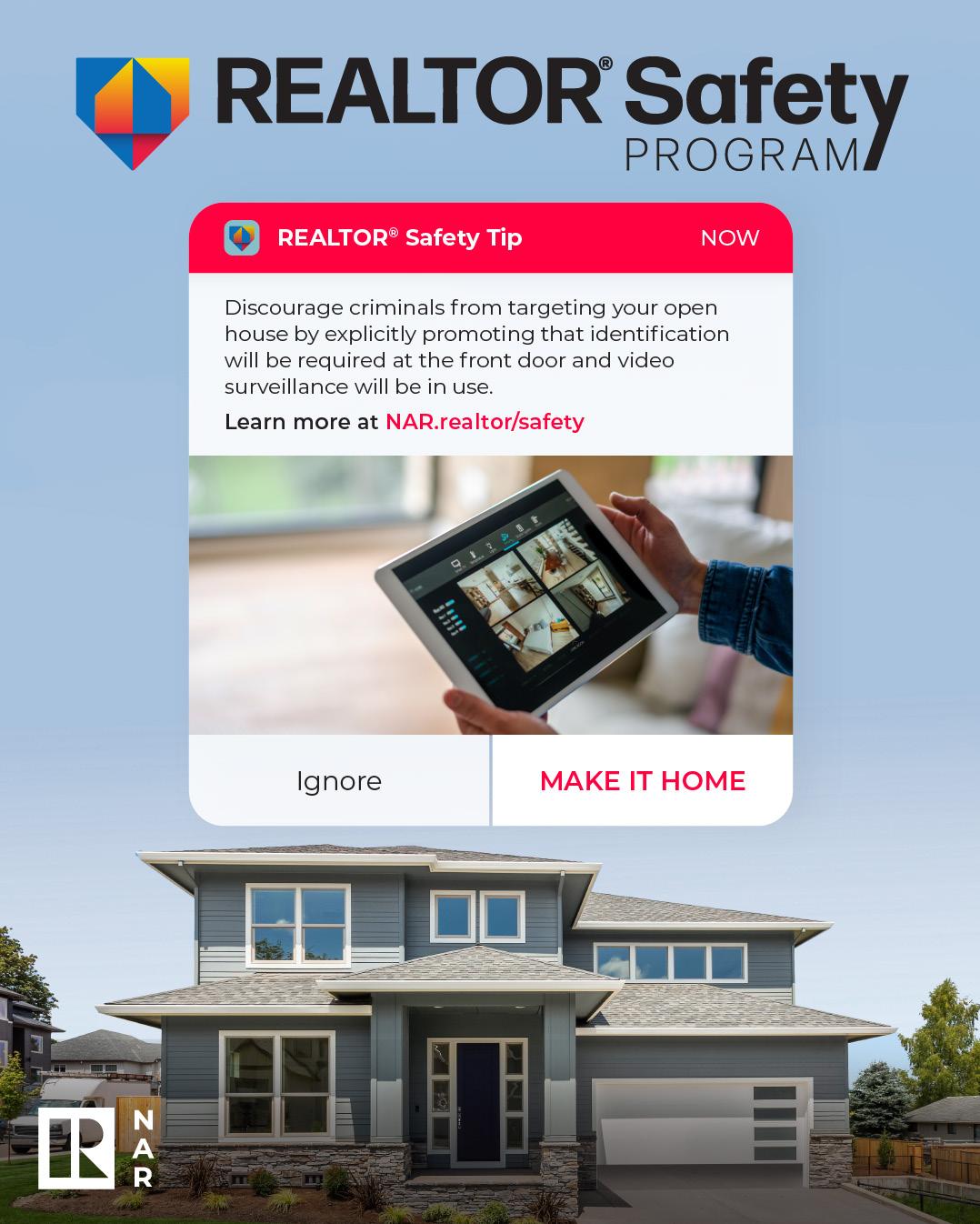

MAKE IT HOME

STAY SAFE ON THE JOB YEAR-ROUND

With tips and tools from NAR at nar.realtor/safety

REALTOR® Safety Pledge

Commit to prioritizing your safety.

Social Media Content

Follow NAR on Facebook, Instagram, LinkedIn and Twitter for weekly safety tips to share.

Safety Webinars

View past sessions on data security, mental health, personal and client safety.

Monthly Articles

Stay in the loop on the latest safety topics.

Training Videos

Learn best practices to keep yourself, your clients, and your business safe.

Office Forms

For REALTORS ® and clients.

Questions? Contact safety@nar.realtor

Housing Markets Mellow with Weakening Prices and Softening Demand

Temperatures ran hotter in July, but the housing market did not follow suit thanks to the continuation of elevated interest rates and a lighter inventory of active listings as more and more would-be sellers choose to sit on their low interest rate mortgages rather than move, according to the latest Market Trends Housing Report and analysis from the Colorado Association of REALTORS® (CAR).

Inventory of active listings for single-family homes in the seven county Denver metro area fell 3.2% from June to July and are down just shy of 28% from a year ago. Townhome/condos were off 5.7% from June to July and are down 19% from July 2022. Statewide, the story is similar with active listings down 1% from June to July but down nearly 19% from July 2022. Active listings for townhomes/condos fell 3.2% over the past month and are down 9.4% from a year ago.

New listings for all property types were down 24.3% in the Denver-metro area, and more than 21% statewide compared to July 2022 and closings were down 17.4% and 15.7%, respectively.

With plenty of shoppers still in the market, higher rate loans continue to diminish affordability and push potential buyers to be much more selective with their offers. At the same time, sellers are facing concessions not seen in a few years. The combination of factors helped push the percent-of-list-price received down again in July to under 100% for all property types in the seven-county Denver area (99.7%) and statewide (99.4%), an unusual result in what is typically a hot selling summer month.

Also reflecting the slowdown of the market frenzy seen over the past few years, average days on market for all property types sits at 26 in the seven-county Denver area, up 73% from a year ago, while statewide, the 37 average days on market reflects a 42.3% increase over July 2022.

The combination of interest rates, inventory, and affordability factors has had its impact on median pricing as well. In the seven-county Denver area, median pricing compared to the prior year fell for the seventh straight month but still hovers near those peaks seen in the summer of 2022. A single-family home in Denver metro sits at $625,000 in July. Statewide, the year-over-year monthly decline hit its sixth straight month with single-family homes ticking down to $578,250. For the first time since February, townhome/condo median pricing rose 3.6% in the Denver metro area to $427,000 and 3.7% statewide to $425,000.

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“Just like they say with the weather, wait a day and things will change – so goes the Aurora real estate inventory. Active listings are still down 31% from July 2022. Current single family, residential listings in Aurora stand at 857 as of Aug. 8, 2023, with a median price of $545,000, down 1.8% from July 2022.

18 MARKET TRENDS

INVENTORY OF ACTIVE LISTINGS STATEWIDE - JULY 2023 SINGLE FAMILY TOWNHOUSE/CONDO 3,689 JULY 2023 JULY 2022 4,073 -18.8% JULY 2023 JULY 2022 17,349 14,092 -9.4%

Sold inventory is up 2.4% with 527 closed properties. Inventory is down anywhere from 51% in 80010, with a median price of $430,000, to a 39% decrease in 80015 and a median price of $600,000. Looking to 80111 in Englewood/Greenwood Village, we have 22 active properties, down 57% from a year ago, and a median price of $995,000. Average days on market ranges from 12 to 16 days, depending on location.

“Bottom line, homes are still selling and inventory is still low as sellers are reluctant to give up their low interest mortgages. Pricing is down slightly due to the interest rate increases and days on market is up by just a few days. In general, the market feels a little more balanced. Sellers need to be realistic, and buyers have a few more opportunities, although, we still have a housing shortage. If rates come down, even a small amount, we could see a flurry in the market,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“After a significant slowing in the market due to unprecedented interest rate hikes throughout the year, the real estate market in Boulder and Broomfield counties seems to have leveled out. Last month, our median price was down 6% from January. The ship appears to have righted itself a bit in July with Boulder down 4% and Broomfield up almost 1%. Sellers have finally received the message about the change in the market, have corrected their pricing, and started offering concessions to help attract buyers. Their adjustments have resulted in sales where the average sales price to list price remains at 99% and the price reductions have slowed. Sellers are coming out of the gate at a more realistic list price and when they do, buyers are willing to pay.

“The lack of houses on the market continues to be one of our biggest challenges with sellers holding on tightly to their homes and their rate. With 2.8 months of inventory on the market in Boulder County, the choices are slim, but buyers are taking their time in hopes the rates go down. The days on market in Boulder have doubled from 28 to 50 days as buyers weigh their options.

“Broomfield continues to be one of the only counties showing

positive numbers. Prices are up just a bit since January and days on the market remain a quick 31 days on average. The relatively affordable median sales price of $695,000 continues to make Broomfield a popular destination and while inventory is also a challenge here, buyers seem to be gobbling up listings as fast as they hit the market.

“Based on the activity in both counties, it feels like we’ve hit a stride where our new market has settled in, and buyers and sellers have adapted. Until interest rates change, the inventory will remain low, and some buyers will choose to sit on the sidelines. Once those rates start to make a move, the game will be on,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“This is one of the strangest markets I have seen in a long time, maybe ever. And that is because there is not a one size fits all going on right now. While we are 1.8% off our top median prices, further home value decreases remain resilient. We’ve also seen a roughly 25% year-over-year decline in sold listings on all property types (2012/2013 levels). Sales are off, prices are down from the highs, active listings are down 17.9%, interest rates remain elevated, and despite all that, sellers continue to be fortunate when you have the right home at the right price. On the flip side, other sellers are not getting the showings or offers and are having to reduce prices or place their home into property management.

“Where is the market headed? Nationally, we have economic news that would make one pause. July brought about Yellow, the third largest freight company, declaring bankruptcy. Americans now have surpassed $1 trillion in credit card debt, a first ever. We did see the Federal Reserve raise interest rates. But then jobs came in strong. The Fed is walking a tight rope trying to battle inflation, equalize jobs, and avoid a crash. We have also seen freight drop from China to the U.S. as consumer demand slows. Not usually a good sign. But, despite all this, housing stands tall in the Pikes Peak region.

“One other caveat I have not seen in a long time is that rents for homes have softened while mortgage payments for those same homes, if purchased, are far higher. A renter can save

19

$500-$1,000 per month compared to the cost to own. We are seeing two strange forces at work right now. Low interest rates for many are keeping them from selling, and low rents (compared to buying) are keeping people from buying. The past has shown us that the market does find balance. My experience is when it does, it is never painless. But for now, sellers who are reasonable with their homes price are still selling, and buyers bear the brunt of the pain with higher interest rates, higher home prices, and higher cost of living. As we move to fall, we will have to see how inventory goes, if interest rates adjust, and how demand holds up,” said Colorado Springs-area REALTOR® Patrick Muldoon.

DENVER COUNTY

“Denver continues to perplex and bewilder as July’s real estate market numbers roll in. Last month marked the seventh straight month where the median price was lower than the month/year before - a trend generally mirrored by metro and state data. What doesn’t mirror it is the parallel drop in demand. With a list-to-sales price ratio now below 100% (houses selling on average below the asking price), a July first since the Colorado Association of REALTORS® started tracking the data, it’s notable and rare that you see prices going down and demand not going up - a clear sign of a diminishing demand for what Denver has to offer. At 99.8%, well within a margin of error, we almost always see 100%-plus figures and, in the rare instance of July 2021, 104.4%. These figures point to our continued mellowing of markets as, despite the lower amount of new property hitting the market, 26% fewer than July 2022 and a whopping 40% decline from July 2021, inventory of available homes is up - statistically tying the all- time highs of 2016 and 2019,” said Denver-area REALTOR® Matthew Leprino.

DOUGLAS COUNTY

“While July is known for fireworks and festivities, it looks like the real estate market in Douglas County didn’t get the memo. The market is slowing down as the end of the summer nears, with new listings decreasing over 22% between June and July. Average days on market for single-family listings remained at

28 days month-over-month. Close prices, however, pressed upwards due to persisting inventory constraints. The median close price for single-family homes in July was $740,000— nearly reaching the all-time highs of the spring 2022 craze. Despite this, I don’t expect to see prices climb much higher this year, as buyers are likely to face prolonged affordability challenges while relentlessly positive economic news keeps interest rates elevated.

“From my perspective on the ground, it seems that overpricing continues to be prevalent. From a seller’s point of view, it’s incredibly difficult to let go of your home for relatively less than you would have gotten at the market’s peak last Spring. While low inventory is keeping prices higher, we are seeing a significant increase in buyers’ negotiating power, especially when it comes to concessions for rate buy-downs. Surprisingly, there does still seem to be a steady stream of cash buyers lurking in the market.

“There’s a fascinating mixture of economic conditions driving the real estate market, and it makes forward-looking commentary especially difficult. With a presidential election year around the corner, an ongoing war in Eastern Europe, and the lingering effects of a pandemic, there are too many variables at play to make an accurate guess on where we go from here. Regardless, if there’s one comfortable place to live in such uncomfortable times, market demand says Douglas County is the place to be,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“La Plata County continues to attract buyers with its scenic beauty, recreational opportunities, and desirable lifestyle. Buyer demand, economic conditions, and local development influence the market's dynamics. The decrease in buyer demand can be attributed to fewer buyers qualifying for mortgages. The median home price in Durango is $749,500. A buyer with 20% down and good credit will have a monthly mortgage over $5000 and need a monthly income of at least $11,000 to qualify, leaving many buyers on the sidelines until rates begin to lower.

20

“While July has seen a decline in specific metrics, the market remains relatively active. However, the monthly supply of homes gradually increases only in specific price segments, particularly in the higher-end luxury market. The under-onemillion segment remains very active, with little to no inventory available. The median and average sales increase suggests continued interest in the county's real estate. However, fluctuations in inventory and percentage of list price received highlight the importance of monitoring market trends for a comprehensive view of future developments,” said Durangoarea REALTOR® Jarrod Nixon.

MARKET HIGHLIGHTS FROM LA PLATA COUNTY

JULY 2023:

• New Listings: The number of new listings decreased 5.1% compared to the previous year, totaling 99 new listings in July. Year-to-date, new listings fell 17.8%, indicating potential challenges in inventory replenishment.

• Sold Listings: The count of sold listings decreased 12.5% compared to the previous year, with 63 homes sold in July. The year-to-date sold listings are down 24.8%, suggesting a cooling in sales activity.

• Median Sales Price: The median sales price showed a significant 12.8% increase, reaching $725,000 in July. Yearto-date, the median sales price grew 5%, hitting $749,500.

• Average Sales Price: The average sales price rose 9.2% from the previous July to $996,479. Year-to-date, the average sales price increased 5.5% to $939,077.

• Percent of List Price Received: The list price received decreased 1.2% compared to the prior July, with sellers receiving 98.2% of their listing price. Year-to-date, the percentage decreased 3.3% to 97.6%, possibly indicating a shift in buyer bargaining power.

• Days on Market Until Sale: Properties spent an average of 66 days on the market before selling, reflecting a 16.5% decrease from the previous July. However, year-to-date, this metric saw a marginal 1.2% decrease.

• Inventory of Homes for Sale: The number of homes available decreased 7.7% to 203 properties.

• Months Supply of Inventory: The monthly supply of inventory increased 27.3% to 4.2 months, indicating a slight decrease in buyer demand.

FORT COLLINS

“With the dog days of summer upon us, the housing market is cooler than a pitcher of iced lemonade. The total number of homes sold is down 46% from July 2021, and 19.5% lower than last July. Yet the median price of single-family detached homes topped out at $659,300. How does that happen with interest rates over 7% and the total number of listings available up by over 6%?

“It may be this: First time home buyers are on the sidelines waiting for interest rates to come down, leaving the largest cohort of buyers in the $500,000-$699,000 price pocket. These buyers can bring lots of cash to the deal from savings or equity built in their current homes and they can use the stalling of the housing market to negotiate a better price on homes that may have sold for tens of thousands more just 13 months ago.

“If you’ve got cash, solid employment, and equity in your current home, there’s more leverage for this buyer pool than ever before because sellers that need to sell are recalibrating their expectations. Homes aren’t selling for inordinately more than they were last year, there’s just a higher number of houses selling in this particular price point than in previous years. The increase in median price is an illusion of arithmetic not an indicator of home price appreciation.

“The rolling 12-month gage of houses sold in the $400,000$499,000 price bracket has plummeted nearly 40%, whereas the same gage of houses sold in the $500,000-$699,000 has only dropped 20%. Since price points over $700,000 have markedly dropped but not as much as in the lowest price point, median price by definition has simply shifted upward but primarily because there are fewer people buying in the lowest price points and fewer homes available to buy in the lowest price points.

“This recent stack of data, showing more balance in the housing sector, is giving buyers plenty to wag their tails about. With 2.5 months supply of homes currently on the

21

market, buyers have the luxury of time and choice. Sellers may be howling about price reductions and nearly 50 days on the market before a sale is completed and therefore must up their game by presenting aggressively priced, nicely updated, and turn-key homes to attract the buyers out there chasing the dream of a home of their own,” said Fort Collins-area REALTOR® Chris Hardy.

GLENWOOD SPRINGS

“REALTORS® who were excited to enter what would normally be our hot selling season have been gravely disappointed with this stagnant summer. The month of July saw new listings for single family homes down by 15.1%. Pending and sold followed suit with pending sales down 7.5% and sold properties down 8.2%. The constant in this market is the continued rise in the median sale price for homes which is up 24.6% over 2022, coming in at $828,500.

The one clue of a softening in our local market comes in the increase in days on market, which although slight at 23.5% or 42 days, does indicate that buyers are holding off and waiting for the rates to also soften. We currently have an inventory of 176 active listings or a 3.3 months’ supply.

New listings remained down in multi-family by 42.9% but had a little better showing in pending sales which were up by 14.3% or three under contracts. July saw 18 townhomes/ condos sold which is a 40% decrease over July of last year. Echoing the single-family sector, the Days on Market increased by 110% or 40 days. There are currently 30 multi-family units for sale, which equals a 1.7-month supply, which is a decrease of 19% over last year,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION/MESA COUNTY

“Grand Junction and Mesa County continue to have a lot of statistics in the negative. New listings, pendings and solds are all down year-to-date, listings are down 25.4%, pending sales down 15.1% and solds down 21.2%. On the plus side, median price is up to $400,000 and average is up to $460,315 because

more properties over $400,000 make up the majority of the current sales. As the most affordable home in this area is under $400,000, it is pretty clear that the first time or moderate income buyer is not in the market right now. We have a total of 552 active residential listings available for sale currently, and only 183 of those are under $400,000. Until we see some relief on interest rates, it is possible the market will continue to follow this trend,” said Grand Junction-area REALTOR® Ann Hayes.

JEFFERSON COUNTY – ARVADA/GOLDEN

“Our summer selling season feels like our fall selling season. Buyers are still on the fence and they are waiting for the other shoe -- interest rates – to drop. In Jefferson County, July finished with new listings down 28%, solds down 14.4% and a median sales price hovering at an even $700,000. Average days on market increased 58.3% for single-family homes. If a seller wants their home to sell in a reasonable amount of time, they must price their home correctly. Success also depends on where the seller's home is located. Some neighborhoods are still seeing multiple offers and some other nearby neighborhoods are stale.

“For townhome/condos, new listings are down 34.6% along with solds, decreasing 11.9%. The median sale price of $448,410, reflects an uptick from this time last year and the average days on market is up 71.4%. Even with all the lending programs available today, buyers are still weary to take the leap into home ownership or change their current location,” said Jefferson County-area REALTOR® Barb Ecker.

PAGOSA SPRINGS

“The sizzling news for Pagosa Springs is not only unusually high summer weather temperatures but also more inventory and higher home prices. At first glance, the month's home supply reflects a more normal, healthier market inventory at 6.8 months. Prices increased with median sales price of $586,500 and average sales price $864,211 (up more than 23% from 2022).

22

“Nationwide, over 67% of homeowners have either paid off their mortgage or have at least 50% home equity. Pagosa sellers placing homes on the market seem to be among those national homeowners. Many sellers are investors or second homeowners understanding that now is the time to cash out. Inventory is slim in homes under $450,00 with buyers migrating to the new norm of average sales price -not by choice, but necessity.

“Buyers looking for homes under $550,000 do not have the luxury to stall their purchase, as homes go under contract swiftly. The overall sale is only 2.6% less than the list price received, even with a hefty price-per-square-foot scenario in most price points. Sellers realize they must price well and have more patience and allow more time to sell, as average days on market are climbing towards 4 months.

“Land prices and sales have also been brisk in the last month due to higher home prices. Homes needing updates tend to stay on the market longer, as buyers paying higher mortgages simply do not have the extra income to renovate, nor the time to perform renovations. Winter is a good time for sellers to make those home renovations, as contractors are winding down from summer builds. Sellers who do not desire renovations are adjusting their prices, giving closing cost concessions, or point buy down incentives to achieve a home sale. Higher interest rates have driven first-time homebuyers off the sidelines and into the spectator seats.

“Archuleta County will continue to struggle with affordable housing issues for local workers, as housing prices are not adjusting to wages and living expenses. Sellers were spoiled in the last few post COVID years, which brought more fulltime workers and homeowners as prices and interest rates suited their desires to relocate to a rural setting. Unfortunately, today’s higher interest rates, home prices, and living expenses are overpowering those buyers in today’s market. Historically, Pagosa Springs has been a resort, second home community. Perhaps that is the wheel turning and driving today’s sales back to Pagosa’s historical character. Reality shows less buyers and sellers are in the game these days. Sales show those choosing to participate in real estate are serious motivated players with the intent to succeed in buying and selling,” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“We remain on the same downward trend across the Pueblo market since the first of the year. Sold listings were down 23% in July compared to a year prior and are down 27.6% year-todate. New listings were down 25.3% compared to last July and are down 18.3% year-to-date.

“The median price fell 7% to $301,000 from last July and is down 1.6% year-to-date at $310,000. The percent-of-list-price received dipped 1.5% to 98.4% but still a good sign that prices are staying strong.

Looking to average days on market, we saw an increase to 3.1 months as it remains a seller's market, but the trend this year is that it is taking a little longer to sell homes and buyers are enjoying just a little more time to look and evaluate. Sellers are looking for buyers and agents are hosting a lot of open houses to help get those buyers off the sidelines. Interest rates are still causing buyer hesitation.

“Looking at new construction, we also saw things slow down in July with only 25 permits pulled and putting the year-todate figure down 47%,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“Months’ supply of single-family homes for July was 4.6 months compared to 4 months the previous July and a full month from June’s 3.6-month supply. The average sales price for singlefamily homes dropped almost 12%; if you look at face value, you might get the wrong impression. In July of 2023 only one home closed over $4.4 million; in July 2022 there were three – with one of them closing at $7.5 million. The median sales price is up to $1.65 million. In the early days of August, there are four single-family homes under contract priced above $4.4 million. So why the increase in supply? Some say interest rates, some say some wrong pricing – both of those are having impacts. It is not unusual in our market to search for a home for a year or more before purchasing. Buyers are pretty dialed in on what they are looking for and wanting in a property. If they find what they are looking for, they are getting off the

23

sidelines, contracting on it and in some cases still incurring a multiple offer situation. There can be windows of opportunity to purchase without a multiple offer situation and negotiate purchase price and/or inspections – but leave the door open long enough and someone else can walk in. I anticipate seeing the stats for months’ supply in August less than what July delivered.

“Single-family inventory is still very limited and with certain price ranges it can be even more limiting. Many buyers look to find more affordability in the Hayden, Stagecoach, and Oak Creek communities. If they want to live with a Steamboat address, some may find multi-family housing to be the option for their budget. Multi-family supply is at 1.7 months, down from 2.3 months for the same period last year and less than June’s 2.1. With new listings down almost 44%, demand is strong with the number of sales the same as last year, sellers are still receiving over 100% of their list price and the median sales price similar to last year at $842,000.

“Inventory continues to be a culprit, but interest rates have played havoc with consumers who have experienced affordability affect them a percent at a time while they wait for inventory to come,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK, AND LAKE COUNTIES

“July is another example of our market being unpredictable. We were on a trend of fewer sales than the previous year, but July saw a one-year change in sold listings that were up 33% from last year. While active listings fell 8.7%, July bucked the trends.

“In Summit County, the median sale price was up 13.8% in July compared to a year prior while the average sale price was up 37.7% ($2.2 million) for single-family homes. Townhouse/ condo properties median sales price was up 2.6% while the average price was down 3.4% ($849,964). Year-to-date numbers are still down for single-family homes and up for townhouse/condos. Sellers received a little over 97% of their list price.

“Park County’s year-to-date average single-family home price was $685,719, while Lake County’s was $563,550. There are 623 residential active listings in the Summit MLS that range from a low-price, mobile home in Grand County for $75,000 to a high price single-family home in Breckenridge for $19.49 million (on the market for 1,069 days). Out of the 150 July sales, the lowest price was a condo in Dillon for $305,000 and the highest was a single-family home in Breckenridge for $6.9 million. These numbers exclude deed restricted, affordable housing,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“Telluride’s 2023 housing market is moving along as predicted. Dollar amount of sales in July was down 35% at $44.59 million and the number of sales, 24, was down 45%. What is even more telling is that two sales, one at $7.7 million for a home in the town of Telluride, and another home in the Mountain Village at $9 million, comprised about 37% of the total dollar amount of sales in July.

“Looking at the remainder of the year, I anticipate more of the same and maybe a little worse. The Federal Reserve is not quite done with interest rate increases, according to most economists,” said Telluride-area REALTOR® George Harvey.

VAIL

“The Vail market continues its quest for a normal market trend. Each month, we see areas of stabilization which reach a less volatile level of performance. July delivered a slightly lower inventory than July 2022 however, pending sales were positive 12.5% versus the previous year which created the slight decline in active inventory. Pricing continues to hold well as unit sales for the month were off 17.2%, but sales dollars were down just 2.3%. Year-to-date transactions are off 36.2% and dollar sales are down 31.5%. The mix of sales by pricing niche remain relatively stable which is a factor of inventory by niche along with macro factors of money rates and inflation.

24

“We continue to maintain an active market with showings and, as previously mentioned, pending sales. Days on market have increased, headed toward a more normal historical range. The strength of the market pricing is supported by the average sale at 98.3% of list price. The market is finally up to five months of supply, closing in on the six months of inventory considered a stable market.

“Historically, as we enter the month of August, our local’s activity slows driven by the start of school. This market

niche is also the area most impacted by mortgage rates and inflationary pressures. The second and tertiary home market should continue at current levels through the next couple of months as is normal,” said Vail-area REALTOR® Mike Budd.

READ MORE READ MORE

25

more data, visit ColoradoREALTORS.com Percent changes calculated using year-over-year comparisons. All data from the multiple listing services in the state of Colorado. Powered by ShowingTime. STATEWIDE DATA MEDIAN SALES PRICE STATE OF COLORADO ALL PRODUCT TYPES PERCENT OF LIST PRICE RECEIVED July 2023 = 99.4% July 2022 = 100.2% AVERAGE DAYS ON MARKET July 2023 = 37 July 2022 = 26 MONTHS SUPPLY July 2023 = 2.4 July 2022 = 2.1 NEW LISTINGS July 2023 = 10,740 July 2022= 13,629 July 2023 = 8,774 July 2022= 9,058 PENDING/UNDER CONTRACT REAL ESTATE SNAPSHOT JULY

-0.3% +3.7% +0.5% July 2023 $425,000 July 2022 $410,000 July 2023 $578,250 July 2022 $580,000 July 2023 $542,500 July 2022 $540,000 42.3% 99.4% 14.3% -21.2% -3.1% INVENTORY OF ACTIVE LISTINGS SOLD LISTINGS 0 5000 10000 15000 20000 25000 0 2000 4000 6000 8000 10000 18,210 6,973 5,855 1,823 2,123 -15.7% -16.0% -14.1% -16.9% -18.8% -9.4% 7,758 9,201 3,689 4,073 14,092 17,349 21,920 CONDO CONDO SINGLE FAMILY ALL INVENTORY ALL SOLD LISTINGS SINGLE FAMILY DEC 2022 - $530,000 DEC 2021 - $529,995 DEC 2020 - $449,250 DEC 2019 - $400,000 DEC 2018 - $376,450 DEC 2017 - $363,000 DEC 2016 - $335,000 SINGLE FAMILY HOMES DEC 2022 - $415,000 DEC 2021 - $385,000 DEC 2020 - $348,294 DEC 2019 - $319,000 DEC 2018 - $297,500 DEC 2017 - $285,000 DEC 2016 - $260,000 CONDO/TOWNHOMES HISTORICAL MEDIAN SALES PRICE

For

2023

GET INVOLVED AT CAR!

LPC and CARPAC Are Accepting Member Applications Through September 15

REALTORS® need a voice in state legislation to ensure that public policy is supportive of a healthy real estate market for today and tomorrow. Apply for CAR’s Political Action Committee (CARPAC) and Legislative Policy Committee (LPC) for 2024. The deadline to Send Applications is Friday, September 15.

CAR Committees Accepting Applications Through October 31

Whether it’s the Professional Standards Committee, Strategic Thinking Committee, Colorado Project Wildfire, or any other of CAR’s 20 committees, your involvement is essential. Your time working on a CAR committee will create professional connections and lifelong friendships. Apply before October 31 for the 2024 committee year.

CAR Leadership Academy Applications Are Open!

Are you eager to step up your leadership game in the real estate industry? The CAR Leadership Academy is tailored for members like you, aiming to hone leadership skills further and deepen association and real estate industry knowledge.

If you're passionate about the industry and are poised to enhance your leadership competencies, submit your application by September 29th!

Future CAR Events and Courses

OCT 8-11

CAR Fall Forum, Snowmass

OCT 25

Expanding Housing Opportunities Webinar

NOV 6

How to Challenge Segregation Enacted Under The Color Of Law

NOV 7-8

Professional Standards WebinarSave the Date

26

27

THE VALUE OF YOUR MEMBERSHIP

We know that being a REALTOR® member is a choice, and we’re grateful for your commitment to professionalism and property rights. CAR will continue to lead the way by investing in your business, fighting for your rights at the state capitol, and offering programs that help you succeed.

$462.2 Million in property values saved by defeating proposed rent control bills.

$23,000 saved in potential legal fees by bringing legislation that protects Coloradans from predatory business practices.

$4,500/yea r saved for an average REALTOR® by protecting the industry from a sales tax on services

$6,00 0 saved for an average REALTOR® by killing a proposed transfer tax

$1,286 saved for REALTORS® by successfully amending legislation to protect brokers from frivolous litigation.

$4,000 + saved for property owners by modifying legislation to ensure owners could transition rental properties to the market without being subject to mandatory relocation assistance to a tenant.

36 calls per day, on average, for the CAR Legal Hotline, a service that provides REALTORS® with direct access to a qualified attorney, saving participating REALTORS® thousands per year in attorney’s fees.

42 ethics complaints processed in 2022, furthering our committment to professionalism and protecting consumers

$1.8 Billion consumer touches annually, reinforcing REALTOR® professionalism, knowledge, and using a REALTOR® in real estate transactions.

$10 Million+ invested in Colorado communities by the CAR Foundation, touching more than 90,000 lives and providing aid to 541 households.

$1,600/year

in money saved by any member who takes full advantage of business tool discounts.

3,500 members annually take advantage of CAR’s virtual and in-person education and event opportunities.

LEARN MORE

29

UPCOMING EVENTS

RPAC UPDATE!

Summer may be coming to an end, but that doesn’t mean the RPAC fundraising stops! Check out how much we’ve raised so far this year and the fun events we have coming up!

2023 Total Goal: $1,060,000

RPAC Total Raised: $713,116

Major Investor Goal: 301

Total Major Investors: 197

Participation Goal: 37% Total Participation: 34.75%

**Numbers current as of 8.2.23**

Thank you to everyone that participated in the 2023 RPAC Virtual Silent Auction! We raised over $20,000! The most popular items that were bid on were the Dyson Hair Dryer with 47 bids, the Apple iPad with 31 bids, and the Pet Grooming Kit with 24 bids.

CYPN

WHEN: September 14th, 2pm – 5pm

WHERE: Apex Simms Street Rec Center, 11706 W 82nd Ave, Arvada, CO 80005

COST: $50 Per Player, $25 for Spectator

REGISTER: https://ai360.aristotle.com/AI360FormBuilder/Form.aspx?dbid=2e166870-894a-423a-a6f76560a8904c6c&page_id=11749

Email Kerrianne at kbrenzel@coloradorealtors.com for more information!

RPAC

We’re looking forward to kicking off the second half of the RPAC Road Tour September 18th – 21st. We can’t wait to visit with the members at the 7 local associations participating. • Gunnison Crested Butte, Montrose, Grand Junction, Four Corners, Durango, Glenwood Springs, and Grand County

FALL

WHEN: Tuesday, October 10th at 4:30pm – 6:30pm

WHERE: The Viewline Resort, Snowmass COST: $25

REGISTER: https://ai360.aristotle.com/AI360FormBuilder/Form.aspx?dbid=2e166870-894a-423a-a6f76560a8904c6c&page_id=11648

**ALL RPAC MAJOR INVESTORS GET IN THE DOOR FREE!**

30

RPAC PICKLE BALL TOURNAMENT!

ROAD TOUR – PART II

FORUM RPAC RECEPTION

RPAC Pickleball Tournament

Date: Thursday, Sept. 14th Time: 2pm – 5pm

Location: Apex Simms Street Rec Center 11706 W 82nd Ave Arvada, CO 80005

Join us for the 1st Annual Pickleball Tournament supporting RPAC!

Players of all experience levels (rookies & legends) are welcome! The tournament is a single player, round robin style.

COST:

• $50: Player (Spots are limited to 32 players)

• $25: Spectator (Fan section)

• $25: Court Sponsor (Can’t attend, but still want to support!)

AWARDS!

• 1st Place – Legend

• 1st Place – Rookie

REGISTER

• Best Dressed / Costume

• Best Cheerleader / Biggest Fan

Questions: Email Kerrianne Brenzel (kbrenzel@coloradorealtors.com)

Scan the QR code above or visit this link: https://ai360.aristotle. com/AI360FormBuilder/Form.aspx?dbid=2e166870-894a-423a-a 6f7-6560a8904c6c&page_id=11749

31

Hosted by CYPN

CLASSES OFFERED SIGN UP HERE SIGN UP HERE 10/8/2023 CAR Fall Forum SUNDAY VIEWLINE RESORT SNOWMASS 100 ELBERT LN SNOWMASS VILLAGE, CO 81615 JOIN THE COLORADO RRC FACEBOOK GROUP! 5 STEPS TO SUCCESS IN ANY MARKET 8 AM - 12PM Addie Owens $50 NON-MEMBERS $40 RRC MEMBERS 12:30 PM - 4:30 PM SPONSORED BY: PRICING IS PARAMOUNT $50 NON-MEMBERS $40 RRC MEMBERS

CAR BUSINESS RESOURCE CENTER

CHECK OUT YOUR YOUR BENEFITS AS A CAR MEMBER!

CTMECONTRACTS, AN MRI SOFTWARE COMPANY

29% off in first year for electronic contract software.

ONETAP CONNECT

A powerful marketing and prospecting tool that will help you immediately present yourself in a way that is unforgettable.

KAPLAN REAL ESTATE EDUCATION

10% discount for Pre-Licensing and CE.

KAYDOH VIDEO MESSAGING

Personalize Your Video Message in Just a Few Clicks. CAR members save on set-up fee.

PITCHHUB

Professional Videos Made Easy for REALTORS® at a discount. Easily create the professional content you need to grow your Real Estate business.

IXACT CRM

Organize your contact data and get more referrals. Get IXACT Contact CRM FREE for 5 Weeks!

Moving your office or office equipment? Exodus can help. Call 800-549-1488.

LEGAL SHIELD / ID SHIELD

EXODUS MOVING AND STORAGE WILLIAMS UNDERWRITING GROUP IT PLEASE

Legal support for REALTORS® and their families on any topic as well as Identity theft protection.

REN 360/AMARKI

CAR members can get a FREE limited access account or take advantage of REN 360 Premium for less than $10/ mo. by using coupon code CAR10OFF.

KNOME

Stay connected to your clients by helping them manage the homes maintenance throughout the year. Use code COLORADO20 to save

Real Estate E&O InsuranceAdditional Coverage Endorsement at no additional premium.

Members receive over 20% discount and get access to great legal coverage and the ability to protect your identity.

ODP BUSINESS SOLUTIONS RENTSPREE

CAR Members can Save up to 75% off on ODP Business Solutions Best Value List of preferred products!

Discover the premier rental application and screening suite of RentalSpree. Enter code ColoradoPRO for 12 months of free RentSpree Pro for all new users.

33 WWW.COREALTORMARKETPLACE.COM Become a Partner! Contact Angelika Jones: ajones@coloradorealtors.com | 303-785-7108

Every Apple Watch Wearer Should Know These Three Simple Tricks

TECH CORNER

D. Jonathan Griggs

VP of Internal Operations, Colorado Association of REALTORS®

FLASHLIGHT:

You’ll find the Apple Watch flashlight button in Control Center. Surely, every iPhone user knows there’s a flashlight built in their cell phone. But it might come as a surprise to some that Apple Watch has one, too. Activating it is as simple as swiping up from the bottom of the wearable’s watch face to open Control Center, then tapping the flashlight button. This makes the watch’s display light up bright white. The result isn’t as intense as an iPhone LED, but it’s always with you whenever you need it.

Most Apple Watch users quickly master the features they bought the wearable for. They figure out the in-and-outs of activity tracking or how to send and receive texts from the wrist computer. The Apple Watch does so much that it’s possible for some of its handy tricks to get lost, and it’s easy to overlook some of its capabilities, even ones that might be considered basic. Here are a trio of them that aren’t marquee features but can make life just a bit more convenient.

FIND YOUR IPHONE:

Press a button in the Apple Watch Control Center to make your iPhone play a little tune. If you’re wearing an Apple watch, you really can’t misplace your iPhone. It’s quicker and easier than using Find My App.

As with the flashlight, start by opening the Control Center by swiping up from the bottom of the watch face. Then press the button that looks like an iPhone playing a sound. The sound is loud enough to be heard from across a house. If that’s not enough, you can even make your iPhone’s camera flash on and off. To do so, simply tap and hold that same icon. That will add a blinking light to the pinging sound, which proves especially useful in dark places.

TIMERS AND ALARMS:

You don’t have to be near your iPhone to silence or snooze timers and alarms going off on the handset. iPhone makes a convenient kitchen timer. But if a timer or alarm goes off when your iPhone isn’t right next to you, you can silence it from your Apple Watch. Or start it again. This one is easy because you don’t have to do anything to set it up.

When a timer starts going off on the iPhone, it’ll also appear on your Apple Watch. Tap on the stop button or the reset button on the wearable to control the timer on the handset. Alarms work the same way. You can stop or snooze an iPhone alarm right from the wearable.

34

continued on next page

GO THROUGH THE APPLE WATCH CONTROL CENTER