Improve company culture with enhanced remote meetings

The Ohio Accounting Talent Coalition’s plans to revamp accounting curriculum

How gender impacts business decison making

MAY | JUNE 2024

July 18, 2024

9:00 a.m. – 3:00 p.m.

Connect with hundreds of peers for a day of insight and motivation at this year’s Women, Wealth & Wellness Conference. Hear from inspirational women leaders as they share actionable strategies to help you on the path to personal and professional success.

Shawna Suckow

Best-Selling Author, Speaker and Coach

Topic: Your Best Year Starts Today

Dr. Ashley Lowe-Simmons, LCSW-C

Owner, Conversations With a Clinician

Topic: Fin-Emotions: Ain’t Finance Funny

Dr. Ceara Hintz, Ph.D. Manager, Management Consulting for Accenture

Topic: Numbers Don’t Lie: Women’s Value in Leadership and Where to Go From Here

Sponsored by

Galperin Founder & CEO of Peak Productivity

Topic: Transforming Busy to Productivity

Leslie Graf, CPA Founder & CEO of LFG Consulting

Topic: Your Brain is Human—Give Yourself Grace

Virtual | 6 credits PD + 2 complimentary On-Demand credits

Elisabeth

Join us for both events and save! For details and to register, visit:

us

ohiocpa.com/BestLife

Help

celebrate this year’s Power of Change honorees and scholarship recipients at an in-person luncheon on Nov. 21 from 11:30 a.m. to 2:00 p.m. at Columbus State Community College. Be in the room as we recognize the outstanding women who have made an extraordinary impact on the profession and business community.

These enhancements use practical strategies to overcome common remote meeting pitfalls.

VOLUME 16 | ISSUE 3

EDITOR

Jessica Salerno-Shumaker –jsalerno@ohiocpa.com

GRAPHIC DESIGN

Kyle Anderson – kanderson@ohiocpa.com

EDITORIAL OFFICES

CPA Voice 4249 Easton Way, Suite 150 Columbus, OH 43219

Tel: 614.764.2727

Email: CPAVoice@ohiocpa.com Website: www.ohiocpa.com

ADVERTISING

For our display advertising rates or a copy of our media kit, contact us at sales@ohiocpa.com or call 614.764.2727

ARTICLE SUBMISSIONS

We welcome submissions of analytical articles on issues relevant to Ohio CPAs. Desired length is 800-1200 words. Send an electronic copy with a cover letter to the editor at the email address above. Please note that CPA Voice is not a peer-reviewed journal.

SUBSCRIPTIONS/CIRCULATION

From the balance sheet to the ballot box: Engaging young CPAs in the political process

Young CPAs can boost their careers and impact society by engaging in politics and advocacy.

The ethics of burnout

Learn practical strategies that tackle burnout and enhance workplace well-being and productivity.

OSCPA student ambassador thrives on embracing her authenticity

She not only excels in internships, but she showcases the far-reaching influence of accounting—even for non-majors.

The new auditing standard is set to improve audit quality and adapt to evolving business environments.

and practical application in the field?

How gender impacts business decision making

compelling case for gender diversity within the profession.

Members of The Ohio Society of CPAs receive CPA Voice as a member benefit. Nonmembers may subscribe for $39.95 annually. To update your mailing address or to subscribe to CPA Voice, contact your Member Service Center at 614.764.2727, option 2.

REPRINTS

To order reprints of CPA Voice articles, or for reprint permission, contact the editor at the address above.

CONTENTS

feature 2

letter 3

exam Free for members!

in depth

CEO

Self-assessment

4

6

8

10

Revisiting risk assessment

18

24

28

14

The Ohio Accounting Talent Coalition’s plans to revamp accounting curriculum How can we bridge the gap between academic theory

A

Members in motion

Improve company culture with enhanced remote meetings

CPA Voice is the official magazine of The Ohio Society of Certified Public Accountants. CPA Voice’s purpose is to serve as the primary news and information vehicle for more than 19,000 Ohio CPA members and related professionals. Articles are reviewed for technical accuracy. However, the materials and information contained within CPA Voice are offered as information only and not as practice, financial, accounting, legal or other professional advice. While we strive to present accurate and reliable information, The Ohio Society of CPAs makes no warranties regarding the accuracy of the information provided herein. Readers are strongly encouraged to conduct appropriate research to determine the accuracy of the information provided and to consult with an appropriate, competent professional adviser before acting on the information contained in this publication. The statements of fact, thoughts, advice and opinions expressed in CPA Voice are those of the authors alone and do not represent or imply the positions, opinions, nor endorsement of The Ohio Society of CPAs or of its publisher, editors, Board of Directors, or members. It is our policy not to knowingly accept advertising that discriminates on the basis of race, religion, gender, age or origin. The Ohio Society of CPAs reserves the right to reject paid advertising in its sole discretion. We do not necessarily endorse the resources, services or products unrelated to The Ohio Society of CPAs that may appear or be referenced within CPA Voice and make no representation or warranties about those products or services or the accuracy and claims regarding those products and services. Advertisers and their agencies assume liability for all advertisement content and responsibility for all claims resulting from such advertisements made against The Ohio Society of CPAs. The Ohio Society of CPAs does not guarantee delivery dates for CPA Voice and disclaims all warranties, express or implied, and assumes no responsibility whatsoever for damages incurred as a result of delivery delays. CPA Voice (ISSN 0749-8284) is published six times per year by The Ohio Society of CPAs, 4249 Easton Way, Suite 150, Columbus OH 43219, 614.764.2727. Subscription price for non-members: $39.95. Copyright © 2023 by The Ohio Society of CPAs; all rights reserved. No part of the contents of CPA Voice may be reproduced by any means or in any form, or incorporated into any information retrieval system without the written consent of CPA Voice Permission requests may be sent to the editor at the address above. While care will be given to all materials submitted for publication, we do not accept responsibility for unsolicited manuscripts, and they will not be returned unless accompanied by a self-addressed postage prepaid envelope. Periodicals postage paid at Columbus, OH and at additional mailing offices. POSTMASTER: Send address changes to: CPA Voice The Ohio Society of CPAs, 4249 Easton Way, Suite 150, Columbus OH 43219. MAY | JUNE 2024 | 1

A WORD from our CEO

Transforming the workplace and

the

profession. For good.

When I think about the dizzying pace of change in today’s evolving business landscape, I’m reminded of a scene from the Wizard of Oz , where Dorothy utters one of the most iconic lines of the movie: “Toto, I have a feeling we’re not in Kansas anymore.”

The future of work often feels like we’re navigating a world that is at once strange and uncomfortable, yet exciting and vibrant. Work styles, locations, and teams are constantly shifting, demanding that we become agile and nimble in our approach.

The digital revolution empowers us with tools and platforms that automate routine tasks, allowing us to focus on higher-value activities. Digital fluency has become the new career currency, fueling the futures of those who leverage new technologies to solve problems and create opportunities. Organizations that invest in upskilling and reskilling their teams will reap the rewards of higher profit margins and increased innovation.

Technology has enabled hybrid work, but it has also created challenges that we must address to retain, develop, and promote top talent. It’s important to humanize the hybrid experience by creating connections and promoting collaboration. We must be intentional about how we onboard, mentor, and develop those we recruit, or risk losing them at a time when we can ill afford it.

Other paradigm shifts are needed in the accounting profession if we are to win the war on talent. We need to take a hard look at the path to the profession and the barriers that prevent Ohio’s best and brightest from considering a career in accounting. Research from the MIT Sloan School of Management shows that the 150-hour educational requirement is a significant impediment, especially for students of color and those from economically disadvantaged backgrounds.

2 | CPA Voice

Finally, we need to better tell the story of this opportunity profession. Let’s replace the tired, stereotypical images of bean counters and introverts with a narrative that showcases the dynamic, influential problem-solvers that accountants are. You speak the language of business, and you are changing business for good.

Together, let's seize this opportunity to shape the future of the accounting profession and redefine the boundaries of what's possible.

Self-Assessment Exam

Log in to ohiocpa.com/myoscpa, look up the exam using the product ID number above and answer the 12 required questions based on content in CPA Voice

Cost Members Free Nonmembers $40

Exams remain available online – and may be completed for CPE – through the same month of the following calendar year.

SCOTT D. WILEY President and CEO

MAY | JUNE 2024

Product ID: #59838

Online Instructions

1. Log in to ohiocpa.com/myoscpa

2. Search "CPA Voice" and then find the appropriate exam.

3. If you're a member, click "Enroll." If you're a nonmember, click "Add to cart" and purchase the exam.

4. On the confirmation page click “Go to your learning center.”

5. The exam will be available under the "Current" section. Turn off pop-up blockers, then click "Launch."

Self-Assessment Exam Results

Respondents taking the exam online receive their results immediately. Respondents who pass with a grade of 70% or better receive one hour of CPE credit in specialized knowledge, as approved by the Accountancy Board of Ohio.

MAY | JUNE 2024 | 3

swiley@ohiocpa.com | 614.321.2218 (office) | 614.546.9430 (cell) Twitter: @ScottDWiley | LinkedIn: www.linkedin.com/in/scottwileycae

ADVOCACY in focus

From the balance sheet to the ballot box:

Engaging young CPAs in the political process

OSCPA staff report

In the world of accounting, where numbers often reign supreme, the importance of advocacy and political involvement might seem distant or even irrelevant to some young CPAs.

However, nothing could be further from the truth. As the landscape of business and finance evolves, so do the policies and regulations that govern them. Savvy young professionals will see the career-building advantages of engaging in issue advocacy and giving to political action committees (PACs). And smart accounting leaders will see the value encouraging young CPAs to get involved.

According to the Pew Research Center, Gen Z and Millennials share similar views on political and social issues and both have a passion for activism on climate change, diversity, and mental health. They also care about the economy and its impact on those of modest means.

Leaders who encourage and nurture political involvement among their young professionals will find it helps shape them into future leaders.

Every voice matters in influencing policies that affect the accounting profession and broader society. By getting involved early, young CPAs can contribute fresh perspectives and innovative ideas to discussions on regulatory frameworks, taxation, and financial transparency. Engaging in issue advocacy and PAC giving provides young professionals with a platform to amplify their voices and effect meaningful change beyond their individual roles.

4 | CPA Voice

In an era marked by increasing interconnectedness and rapid technological advancements, the ability to influence policy outcomes extends far beyond traditional lobbying channels. Through social media, grassroots campaigns, and community outreach initiatives, young CPAs can leverage their networks and expertise to advocate for causes they believe in, whether it's promoting financial literacy, advancing diversity and inclusion within the profession, or advocating for sustainable, commonsense business practices.

Political engagement offers invaluable learning experiences that can enhance a young CPA's professional development. Through participation in advocacy campaigns, contributions to the Ohio CPA/PAC, and involvement in grassroots efforts such as letter writing campaigns on specific issues, young professionals gain firsthand knowledge of how policy decisions are made and how they can influence such decisions. These experiences build critical skills such as communication, negotiation, and strategic thinking, which are essential for leadership roles in the future.

Political involvement provides young CPAs with opportunities to expand their networks and connect with industry leaders, policymakers, and fellow professionals

who share similar interests and goals. Building these relationships early in a young CPA’s career can open doors to mentorship, career advancement, and collaborative opportunities that may not be available otherwise.

Active engagement in the political process cultivates leadership qualities and instills a sense of responsibility and accountability in young CPAs. By taking on advocacy roles and participating in public discourse, they develop the confidence and resilience needed to lead effectively in their organizations and communities. Additionally, early involvement in politics establishes a track record of civic engagement that can strengthen their credibility and influence as future leaders.

By taking action early in their careers, young CPAs and the leaders who guide them will lay the foundation for a lifetime of meaningful civic engagement and professional growth. And who knows? It might be an opportunity to encourage more CPAs to run for political office.

Want to get involved? Email your OSCPA government relations team at government@ohiocpa.com or see the Ohio CPA/PAC information below to donate.

Want a voice at the Ohio Statehouse?

Help us protect your interests by investing in Ohio CPA/PAC. Every donation—no matter the size—allows us to amplify your voice at the Statehouse and impact the issues that matter most.

Your PAC investment helps:

• Protect and promote the CPA credential

• Limit tax expansion and cut regulatory red tape

• Secure a competitive business environment in Ohio

• Elect state legislators who share your professional interests

Let’s make our voice even louder this year!

MAY | JUNE 2024 | 5 C-Corp and S-Corp contributions prohibited. PAC investments are not tax deductible per Ohio law.

donate, visit or call 614.764.2727 ohiocpa.com/PAC

To

The ethics of burnout

By Elizabeth Pittelkow KittnerVP of Finance, GigaOm

Both individuals and organizational leaders have an ethical role to play in preventing and addressing burnout— consider these tips.

Ideally, we should block or prevent burnout from happening since it often leads to work paralysis where an individual cannot work any further due to symptoms such as fatigue, pain, sickness, decreased motivation, anxiety, depression, disillusionment, and strained interpersonal relationships.

Notably, our efforts to address burnout are closely tied to ethics because they highlight the values and principles that emphasize the rights of individuals. These rights are essential to preserving well-being and job satisfaction. When you think about the fraud diamond theory, people are more likely to cut corners and engage in unethical behavior when they are under pressure.

Blocking burnout

As an individual:

• Communicate with colleagues about your workload. You may be able to share some of the work or engage in faster problem-solving if you discuss what you are working on with others.

• Implement priority management processes. Create to-do lists, set up one-on-one meetings with team members, and schedule time on your calendar to focus on tasks.

• Practice stress management techniques. Consider meditating, exercising, or listening to music.

6 | CPA Voice CAREER center

• Prioritize wellness. Know and communicate your limits, take breaks, and address your health, as necessary.

• Celebrate your achievements. Recognizing any progress you make on tasks along the way will help you savor success and help you reflect positively on your work.

As an organizational leader:

• Limit overtime hours. Consider hiring contractors and interns during busy periods to help alleviate workloads and provide flexibility for people to be able to take time off during these times; ethical organizations care about fair work distribution, which means examining resources available to do the work.

• Offer professional development and growth opportunities. When people are excited about the work they are performing, they will be more engaged and less susceptible to burnout.

• Adopt technology solutions that will save time on tasks. Ensure the technology solutions are the right ones for the organization and are implemented before busy times to avoid adding extra stress from the new processes it brings. Additionally, apply proper security measures and backups to avoid the stress of compromised or lost data.

• Review your clients. Charge clients based on the value you provide them versus the cost it takes to perform tasks. Also, strategically transition clients out of your business who are difficult to work with or who make tasks difficult to complete.

• Promote positivity and celebrate achievements (even the small ones). Individual and team recognition helps maintain morale and excitement for the work.

Beating burnout

As much attention as we may give to blocking burnout, it may still occur. We may prioritize work over wellness, or we may be in a period of hustle to help meet a deadline or goal.

As an individual:

• Accept that you are going through burnout. You are not a failure because you reached a period of burnout— it is simply a normal reaction to stress. Recognize you have worked hard and will continue to work hard, and you may need to make some changes for your own health.

• Consider your food and beverage intake. Make dietary changes to help you have more energy and feel better throughout your day, like reducing sugar and increasing water consumption.

• Reduce screen time. Set a timer to remind you to look away from your screen during the day, and you may want to invest in glasses that block some of the screen light effects.

• Take more breaks. You may be more effective and efficient if you spend some time away from work and then come back to it with freshness.

• Seek guidance and support. Talk to colleagues or members of your personal network, such as family, friends, coaches, and counselors. Your organization may also have an employee assistance program (EAP) that can help.

As an organizational leader:

• Offer support. Spread out the workload for staff throughout the year and provide additional support as it relates to talent, technology, flexibility, etc.

• Arrange an EAP for employees to use at their discretion. Let your organization know it is okay for people to reach out for help when they need it.

• Provide regular check-ins with people. Check in with people—even via regular surveys—to see how they are doing, what well-being resources they may need, and if your well-being initiatives are effective.

Reprinted with permission of the Illinois CPA Society.

MAY | JUNE 2024 | 7

DIVERSITY, equity & inclusion

OSCPA student ambassador thrives on embracing her authenticity

By Cecilia Yontz, OSCPA marketing and communications intern

8 | CPA Voice

Authenticity

and persistence are two things that

former OSCPA Student

Ambassador Ayana Witherspoon believes have helped her stand out thus far in her college career.

Her advice to students navigating the internship process: “Be your authentic self,” said Witherspoon, a junior majoring in political science at Wilberforce University.

A self-proclaimed “internship guru,” Witherspoon has sought out and landed many great internship opportunities. This inspired her to help other students discover what opportunities await them.

“I love doing internships and being able to motivate my peers and tell them where they can reach out and go for resources to get these internships and earn these hours is really fulfilling,” she said.

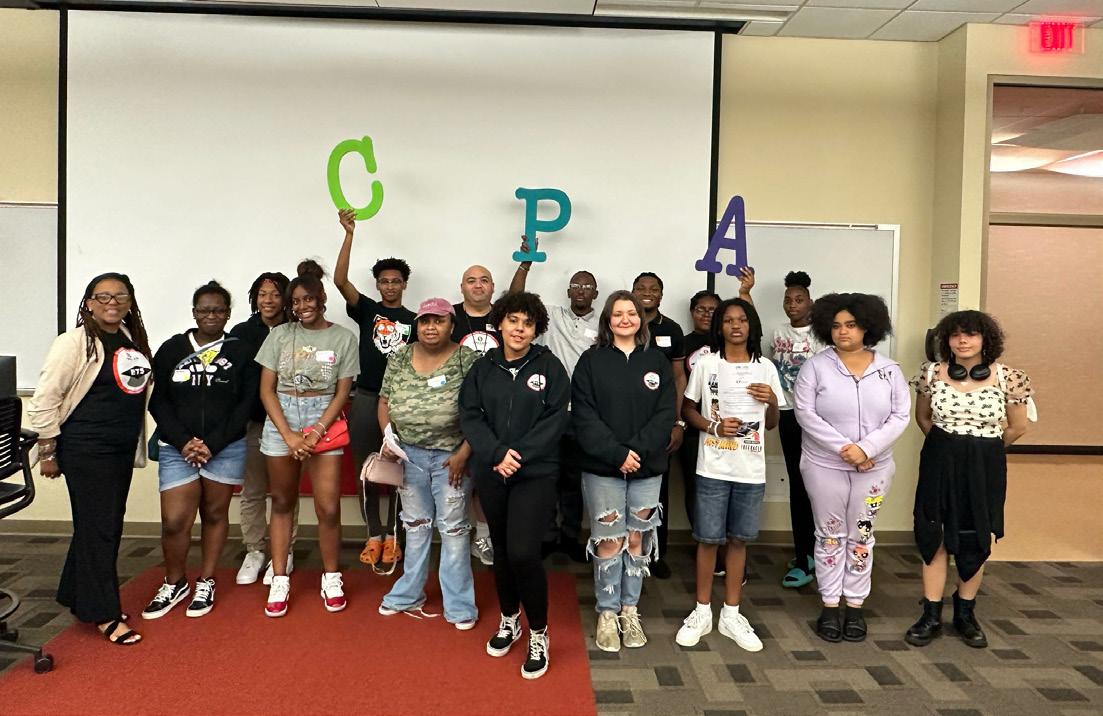

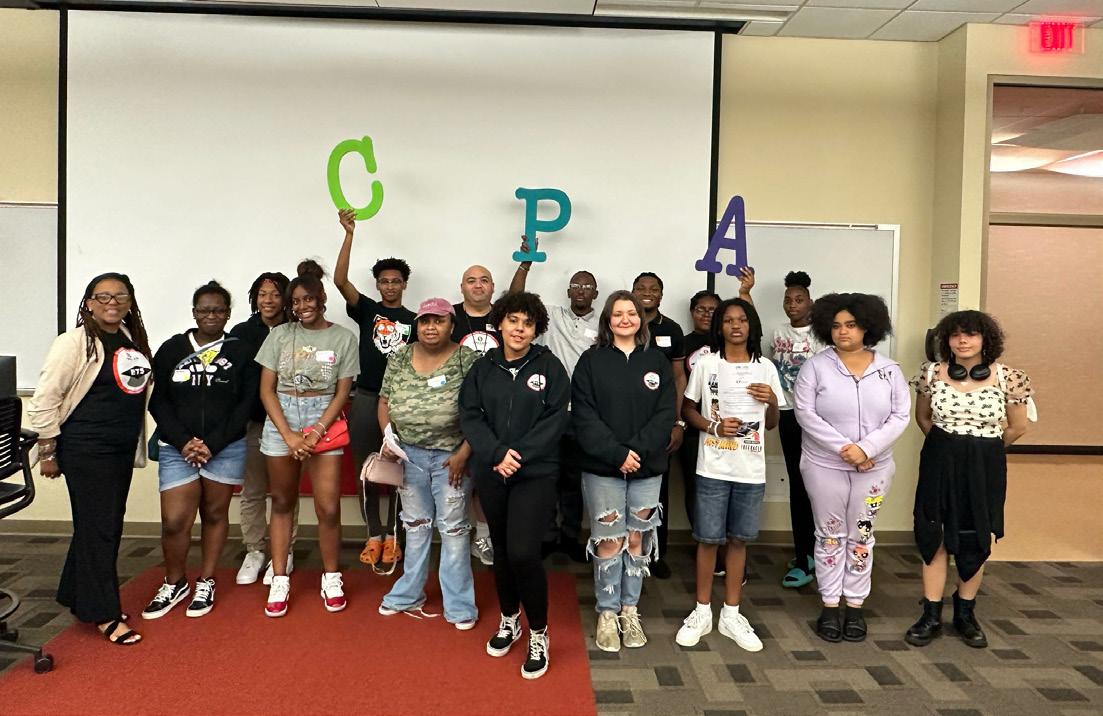

Witherspoon’s relationship with OSCPA started during her fellowship with the Ohio Auditor of State’s office where she learned more about accounting and its benefits, even as a political science major. After attending CPA Camp last summer, Witherspoon knew she wanted to bring the Student Ambassador program to her university.

“Accounting spreads everywhere. You can't escape it; everyone has accounting,” said Witherspoon. “I took on the Student Ambassador role to expose more students to the opportunities they can get within the accounting field.

Many students might not even know of the CPA Exam, and there are business majors that might want to convert to accounting majors. I'm able to spread knowledge and pay it forward, and I’ve always enjoyed doing that.”

Outside of her time as an ambassador, Witherspoon played the euphonium in the Wilberforce University marching band and was a member of the women’s golf team. She encourages others to follow their interests and put themselves out there.

“Have courage and go for it. Don't look down, just go for it,” says Witherspoon. “Anything I've ever wanted to do, I dare myself to just do it. I want to look back when I graduate from college and have no regrets.”

Witherspoon plans to take the LSAT and is looking forward to starting her career path following graduation. Cecilia Yontz, OSCPA marketing and communications intern

MAY | JUNE 2024 | 9

Revisiting risk assessment

By Laura Hay, CPA, CAE, OSCPA executive vice president

10 | CPA Voice

AUDIT & assurance

Deficiencies

in audit risk assessment procedures are the leading source of Matters for Further Consideration

(MFCs)

in the peer review program.

Statement on Auditing Standards (SAS) No. 145, Understanding the Entity and Its Environment and Assessing the risks of Material Misstatement , enhances the requirements and guidance for the auditor’s risk assessment, particularly in obtaining an understanding of the entity’s system of internal control and assessing control risks.

A risk-focused audit approach prevents the inefficiencies of over-auditing, or under-auditing resulting in deficiencies.

Effective for audits of financial statements for periods ending on or after December 15, 2023, SAS No 145 supersedes SAS No. 122, as amended, section 315 of the same title, and amends various AU-C sections in AICPA Professional Standards . Early implementation is permitted.

Significant changes

Significant changes introduced by SAS No, 145 include:

• New requirement to separately assess inherent risk and control risk

• Revised definition of “significant risk”

• Revised requirements to evaluate the design of internal controls within the control activities component, including general IT controls, and to determine whether such controls have been implemented

• New requirement to assess control risk at the maximum level such that, if the auditor does not plan to test the operating effectiveness of controls, the assessment of the risk of material misstatement is the same as the assessment of inherent risk.

• New guidance on scalability

• New guidance on maintaining professional skepticism

• New guidance on the evolving business environment, including economic, technological and regulatory aspects of markets and environments in which entities operate.

• New “stand-back” requirement to evaluate the completeness of the auditor’s identification of significant classes of transactions, account balances and disclosures

• A conforming amendment to perform substantive

procedures for each relevant assertion of each significant (rather than material, as previously required) class of transactions, account balance and disclosure, regardless of the assessed level of control risk

• Revised documentation requirements

SAS No. 145 does not fundamentally change the key concepts underpinning audit risk, which is a function of the risks of material misstatement and detection risk. The standard seeks to clarify and enhance the auditor’s identification and assessment of the risks of material misstatement to drive better risk assessment and enhance audit quality.

Obtaining an understanding of the entity’s system of internal control

The term “internal control” has been changed to “system of internal control” including five components.

1. The control environment

2. The entity’s risk assessment process

3. The entity’s process to monitor the system of internal control

4. The information system and communication

5. Control activities

Obtaining an understanding of the entity’s system of internal control is a requirement for the identification and assessment of the risks of material misstatement, regardless of the auditor’s planned controls reliance strategy. The standard clarifies that this overall understanding is achieved through performing procedures sufficient to gain an understanding of each of the five components of the system of internal control.

Inherent risk, control risk, and significant risk

Inherent risk factors, the spectrum of inherent risk, and the separate assessments of inherent risk and control risk were introduced in SAS No. 143, Auditing Accounting Estimates and Related Disclosures . SAS No. 145 elaborates that these concepts are applicable to all types of classes of transactions, account balances and disclosures, not just those involving accounting estimates.

MAY | JUNE 2024 | 11

Because of the close interaction between SAS No. 143 and SAS No. 145, their effective dates have been aligned.

The standard clarifies that it is important to consider inherent risk on its own when making the determination that an assertion is susceptible to material misstatement. The spectrum of inherent risk is based on the intersection of likelihood and magnitude of misstatement. If potential misstatement is material and the risk is higher on the spectrum, then there is “significant risk”.

Scalability

SAS No. 145 removes the “Consideration Specific to Smaller Entities” sections of the previous standards and incorporates scalability throughout the standard, recognizing that the size of an entity is not necessarily an indicator of its complexity, as some smaller entities may be complex, and some larger entities less complex.

The standard recognizes that some aspects of an entity’s system of internal control may be less formalized but still present and functioning, considering the nature and complexity of the entity. When the entity’s systems and processes lack formality, the auditor may still be able to perform risk assessment procedures through a combination of inquiries and other procedures, such as observation or inspection of documents.

Professional skepticism

The standard clarifies that gaining an appropriate understanding of the entity and its environment is a necessary foundation for professional skepticism in the audit. The standard highlights the need for effective

collaboration and communication among the audit team, and the exercise of professional skepticism when presented with contradictory evidence during risk assessment procedures.

Evolving business environment

SAS No. 145 includes a new explicit requirement to understand the entity’s IT environment, including IT applications and supporting IT infrastructure, which includes processes and personnel who support business operations and achievement of business strategies.

In addition to expanding the auditor’s understanding of the environment in which the client operates, the standard recognizes the ability of the auditor to use automated tools and techniques, including data analytics, when performing risk assessment procedures.

SAS No. 145 seeks to improve consistency in applying risk assessment procedures in the audit. Embracing the core principles of risk-based thinking, rather than a compliance culture will assist the profession in enhancing audit quality and effectiveness.

Laura Hay, CPA, CAE, is the executive vice president of The Ohio Society of CPAs and the staff liaison to the Accounting, Auditing, Professional Ethics Committee and Peer Review Committee. She can be reached at Lhay@ohiocpa.com or 614.321.2241

12 | CPA Voice

Industry experts and thought leaders will share their knowledge and experiences and explore innovative strategies and practical approaches to mastering your core skills, moving you from compliance to competence.

Get the latest updates on:

• Financial reporting and auditing

• State and local tax developments, including a legislative update

• Professional standards and responsibilities (ethics)

• The economy and what’s ahead in 2024 is your smorgasbord of learning!

May 23 | Aug. 22 | Dec. 13 8:30 a.m. – 4:30 p.m. | Virtual | 8 credits MULTIPLE

fi nancial accounting, audit and assurance, tax, and ethics expertise.

Stay ahead of the curve and advance your

ohiocpa.com/CORECon Call Member Services at 614.764.2727 (option 2) to register your group. 5-9 attendees = 10% off 10+ attendees = 20% off Register online through MyOSCPA

IMPROVE COMPANY CULTURE with enhanced remote meetings

By Emma Ball and Andrew Jordan, CPA

management & strategy

BUSINESS

14 | CPA Voice

Often, one of the downfalls about remote work for both employees and employers is virtual meetings.

If you want to improve the culture in your remote firm, internal meetings are likely the low-hanging fruit. Most people don’t really even like in-person meetings, but online ones can be so painful they make you miss being in-person! The method we use at our remote CPA firm with approximately 15 people led to us winning Karbon’s first ever international Excellence Award for Balance and Culture.

Over the last few years, we’ve learned three main factors that should be addressed to have a productive meeting with a remote team. First, you must deal with tech issues. Some of these can be funny, but they also cause delays, miscommunication and frustration. Second, online meetings lack personal connection, and it can be challenging to get everyone engaged. And finally, team members might be more distracted during online meetings than with in person ones. Here are some practical ways to address each of these issues.

Resolving tech issues

Determine how many issues are acceptable. Tech problems don’t have to be a part of every online meeting. Items that are important get attention, and they get fixed. If you expect to always have IT issues and accept them, then you will, but if your expectations are that IT issues will be very infrequent, you will fix issues when they arise.

Expect your team to be part of the solution. We had a team member who had frequent audio and video problems. Looking back, it took us way too long (months) to address the issue and finally say, “this can’t continue.” You have to be able to consistently see and hear team members. The fix feels so easy, but it was also easy to let it drag on. Don’t do that. Instead, have a candid conversation with this person, tell them that to be a part of a remote team they have to have fast, stable internet. Buy them a new headset or send them an Amazon gift card and let them buy one they will like.

Use the rule of three. To work remotely, team members need sufficient internet speed. If someone has issues in three different meetings, have a one-on-one conversation with them to ask how they are going to resolve the problem. Just like if someone were late to the office day after day (assuming you have a set start time) you’d sit them down and tell them they have to be on time. If their

role is remote, you aren’t adding requirements here, you are just calling them back to what’s needed for their role to be successful.

Building connection

Be intentional. It’s easy to disengage if you don’t feel a connection with the other people in the meeting, and building connection in a remote environment takes a lot more intentionality. In person, you have people bumping into each other in the break room and being physically next to each other. Those informal interactions happen without you having to do anything inside the office, but remotely those things aren’t happening. We address this by having a monthly meeting called our Social Huddle. Besides helping people be engaged during meetings, there are a lot of other benefits in having a team that regularly spends some time interacting with each other in a positive way.

Implement a social meeting. During these meetings, we do a brief intro, quickly remind the team not to multitask, and we share our vision and values before beginning. We use Teams or Zoom to create random rooms of about four to five people in each with three rounds of questions. We keep a bank of these questions ready and add to it whenever we find a good one, so it’s easy to have high quality questions available. We do a six-minute, a sevenminute, then an eight-minute breakout session using the same group for each of the three rounds.

The first round is a warm-up. Round two goes a bit deeper. The third round is designed to take things to a deeper level now that people have warmed up and gotten a chance to bond. This is why the final round of our Social Huddle has the longest breakout time. We intentionally extend each breakout time to accommodate the deeper discussions. What’s great about keeping the same groups during the Social Huddle, besides creating a safe environment to have those deeper discussions, is being able to reuse questions. We re-randomize the groups each Social Huddle so people will be with a different group than they were when the questions were originally asked.

Taming distractions

Remote meetings tend to be filled with participants tempted by distractions. Their focus is on the last couple

MAY | JUNE 2024 | 15

of sentences in the email they were writing or downloading that last report needed to wrap up reconciliations. These distractions cause them to not be fully present in the meeting, which can leave them feeling the time spent was worthless, and can cause unnecessary wrangling with very little results—a highly frustrating experience for everyone involved. After reading Gino Wickman’s Traction, we decided to adopt the Entrepreneurial Operating System (EOS). Even though this book was written long before COVID and the huge spike in remote team meetings, the ideas translate to remote work really well. The book describes having a cadence of weekly meetings called Level 10 Meetings instead of having multiple meetings for every issue. While having fewer meetings is a simple idea, it is effective and allows the necessary meetings to receive the most attention and be useful.

Eliminate multitasking. This tip to help people not be distracted seems simple, but is not common practice.

At the beginning of every single meeting say something like, “Remember not to multitask during this meeting.” Periodically rotate through the team to deliver this quick reminder because hearing this idea in slightly different words and different voices keeps it fresh instead of becoming easy to tune out.

Take a breathing break. With in-person meetings, getting up from your office and walking somewhere gives a physiological break from what you were thinking about and makes it easier to be engaged in the meeting. You don’t get that online, where you might literally have the email you are in the middle of typing on your other screen when the meeting starts. Talk about setting up a situation that’s hard to focus on the meeting. Right after the reminder to not multitask, have everyone go off camera and off mic to spend 30-60 seconds taking deep, slow breaths. When the leader of the meeting turns their camera and mic back on and brings everyone back, it’s amazing how much more present people can be in the meeting.

Resources that helped inform our process that we recommend:

• Traction by Gino Wickman

• The Power of Moments by Chip Heath and Dan Heath

• Thoughts on Connection from Brené Brown’s podcast series Dare to Lead

• The Art of Gathering by Priya Parker

Andrew Jordan is the president of Jordan CPA Services in Carthage, Mo.

Emma Ball is the chief operating officer of Jordan CPA Services in Carthage, Mo.

Reprinted with permission of the Missouri Society of CPAs.

THREE THINGS

1. Tech problems don’t have to be a part of every online meeting.

2. Building connections in a remote environment takes a lot more intentionality.

3. At the beginning of the meeting, remind people not to multitask.

16 | CPA Voice

Online learning for planners and procrastinators alike. OSCPA’s learning subscription o ers access to over 100 engaging, up-to-date, high-quality on-demand CPE courses vetted and approved by CPAs for CPAs—this isn’t the “check the box” stu you get other places. Take your CPE when and where you want from reputable learning providers—including OSCPA. Save time and money below. ohiocpa.com/AccessPass 2002-2024 CELEBRATING THE REGION’S LEADING INCOME TAX REDUCTION EXPERTS Call Craig Miller ACCELERATE DEPRECIATION AND SHIELD INCOME TAXES NOW OF COST SEGREGATION YEARS •Cost Segregation •Energy Efficiency Certifications (179D) •New IRS Repair v. Capitalization Cleveland 440.892.3339 / Columbus 614.362.3773 Detroit 248.289.4880 / www.costsegexperts.com 22 2002-2024 MAY | JUNE 2024 | 17

TALENT management & human resources

The Ohio Accounting Talent Coalition’s plans to revamp accounting curriculum OSCPA staff report

18 | CPA Voice

One of the

five pillars of the talent action plan of the Ohio Accounting Talent Coalition (OATC)

is curriculum, an area that

Tiffany Crosby, CAE, chief learning officer at OSCPA said will be a long-term aspect of the plan.

connecting students with individuals who can mentor, do job shadowing and provide internships.”

Workflow

changes are not easy.

Tiffany Crosby, CAE

“But the work has to start today for that change to be put in effect years from now, and we have to engage in a thorough process,” she said.

The curriculum pillar

The goal of the curriculum pillar is to increase attraction to the accounting profession by providing engaging educational experiences that accurately reflect the work of accounting professionals. For it to be successful, there needs to be a holistic approach, Crosby said. That means considering how faculty, students, employers, and others interact and work together from middle school to entrylevel employment.

The curriculum process starts with stronger engagement with students to expose them to the opportunities in accounting and dispel myths that cause students to optout early in their career planning endeavors. Crosby said that means working with faculty on providing support they can use in the classroom, such as case studies and bringing in accounting professionals to speak to the students.

“We’re looking at how we help them better integrate real life accounting into the classroom and show students realistic experiences,” Crosby said. “That also means

Crosby discussed the historical divide that existed between academia and the workplace, and the innovation that some institutions have taken to bridge that gap. Expanding the work across Ohio’s educational landscape is critical to increasing the number of students attracted to the profession. That requires engaging as many high school and college educators as possible to regularly work with accounting leaders in private and public sectors. Having an infrastructure that facilitates these connections and reduces the associated administrative time for faculty and employers is a critical factor for scaling this component of the plan.

MAY | JUNE 2024 | 19

The second part of the curriculum is geared toward the career influencers who help educate students on careers and shape the career choices that students make. People such as counselors, parents and coaches have an opportunity to give students the correct perception of the profession and the career opportunities available to them by pursuing accounting educational pathways.

Members might not realize it, but they are a vital resource in helping to shape the perception of the profession, Crosby said.

“When they are having a conversation with others in the community, how they present the profession is shaping the perception of those career influencers,” she said. “And when teachers, parents, coaches, hear those things, it spreads to students. We will need 10 times as many positive impacts to overcome the one that is negative.”

Educator involvement

The coalition is also looking at how to strengthen the pathways between two-year and four-year higher learning institutions.

“If we can get multiple two-year and four-year schools at the table and talk through what makes it so challenging for a student to start a two-year institution and finish at a four year, we could strengthen that pipeline,” Crosby said.

For a smoother transition, the curriculum offered has to provide options for individuals from traditional and nontraditional backgrounds who hold various goals for pursuing accounting. According to Crosby, having flexibility in the curriculum to support a wide variety of pathways will be an ongoing discussion as both demographics and the accounting profession continue to shift.

20 | CPA Voice

We inspire more than 5,000 student members as they prepare for a future in the accounting profession. Thank You to the individual donors and members who make the commitment to support today’s accounting students and tomorrow’s CPAs.

Our 2023 programs reached more than 1,700 students in high school and college.

We granted $95,000 in scholarships to promising students.

We’re on 26 campuses with accounting majors as our Student Ambassadors.

Follow this QR code to see the donors who generously supported the future of the profession.

Join your peers with an investment today. Make a gift to The Ohio CPA Foundation at ohiocpa.com/GiveToFoundation

Learn more about our work at ohiocpa.com/Foundation

MAY | JUNE 2024 | 21

The excitement from faculty on evolving the curriculum has been invigorating to the process, Crosby said. “The challenge is that the faculty are very busy, they have a lot on their plate. They're teaching, innovating and serving on committees. It’s not easy to bring them together into a forum to share what they are doing.”

However, one of the goals of OATC is to bring the group together so they can leverage the innovations happening at other academic institutions and add their own flavor to it. The universities that have been involved so far have come with open minds and a willingness to update the curriculum, Crosby said, so it’s a matter of timing and finding ways to share knowledge that is sustainable long-term.

Convening key groups

The role of OSCPA through the OATC is to act as a convener of the essential parties, facilitate group learning, connect faculty to resources, and support the innovation that needs to happen. “I do believe as this continues to grow and have structure, that we'll see this take off because the willingness is absolutely there,” Crosby said.

This update in the curriculum means that students will enter the profession with a clearer understanding of the realities of the profession. “This helps to minimize any disillusionment or misunderstanding of what’s expected and the associated rewards,” she said.

The shift will have a cascading effect on retention. By helping students be more career ready when starting out, onboarding is easier for companies, which improves the first-year experience and reduces attrition from the profession.

To learn more about OATC or to get your organization involved please visit our workforce development site at ohiocpa.com/getinvolved/workforce-development or contact Lori Brown ( lsbrown@ohiocpa.com) or Tiffany Crosby ( tcrosby@ohiocpa.com).

22 | CPA Voice

Virtually join thousands of your peers. Select a track or mix it up at the largest, most comprehensive learning opportunity of the year!

Unlock access to 40+ sessions, including:

• The future of automation in accounting

• Using analytics to refi ne your strategy

• Essentials in cybersecurity

• Financial components of a law enforcement investigation

• Ohio professional standards and responsibilities

Where Standards and

Intersect in Accounting Evolution. To learn more

register, go to: or call 614.764.2727 , option 2. ohiocpa.com/Showtime Register 4 weeks in advance to save $50! 8:25 a.m. – 4:30 p.m. October 23–24 | November 13-14 16 credits MULTIPLE Presented by:

Strategies

or

How gender impacts business decision making

By Jessica Salerno-Shumaker, OSCPA senior content manager

FINANCIAL

accounting

24 | CPA Voice

One professional’s Big Four experience inspired her to research gender differences in accounting, and her findings revealed the impact of having a woman in a leadership role.

In addition to working at Accenture, Hintz is an adjunct professor within the School of Accountancy at the University of Denver, and recently completed her Ph.D. research.

At a high level, a company benefits by having a female within a CEO, CFO, or audit partner role, because the financial statements are more likely to be transparent.

Ceara Hintz management consulting manager, Accenture

Earlier in her career when Hintz worked at one of the Big Four, she observed the differences between the male and female audit partners decision-making.

“I noticed as I worked my way up that I was making decisions differently from my male peers,” she said. “And it just started to trigger questions that I had, which led me into my PhD.”

She knew she wanted to focus on gender differences within accounting and noticed there was no audit partner data, unlike CEO or CFO data, which is more readily available. So, she spent about three months collecting thousands of data points herself through firm websites, LinkedIn, Google and more.

MAY | JUNE 2024 | 25

The model that Hintz created and ran proved that accounting conservatism is higher among female audit partners. She says accounting conservatism is not overstating net assets, and ideally companies want higher accounting conservatism to remain transparent.

“I was able to show that females were less likely to overstate net assets than their male counterparts,” she said. “And more specifically, the outcome of overstating your assets results in financial restatements, so you're less likely to have financial restatements with a female audit partner.”

Hintz will present her research at the July 18th Women, Wealth and Wellness Conference titled “Numbers don't lie: Women's value in leadership and where to go from here.”

Women make up about 61% of all accountants and auditors in the U.S., but only about 27% are partners or principals at their firms, according to a 2020 Catalyst report on gender parity in accounting. Hintz said her research proves there is value in having women influencing key decisions in business at an executive level, and their leadership benefits businesses.

Although this research has taken years and Hintz has since graduated, she is still working on building out additional econometrics’ models for different publications. While the original scope of work was to show the difference between male and female audit partners, she has since brought in CEO and CFO data to look at power dynamics between how a CEO can change accounting conservatism amongst a female audit partner.

This information is beneficial to business stakeholders who use financial statements to make decisions about the company, such as purchasing stock, and helps increase transparency in those decisions. Hintz said it would be informative for stakeholders to know if all males hold the CEO, CFO and audit partner position at an organization.

“I'm not saying to remove a male from an all-male team,” she said. “But I think this could alter hiring decisions. And I think the SEC could use this in the future to monitor and flag companies that have all male dominated teams to be aware that they're less conservative.”

Hintz said reviewing hundreds of different literature sources across a wide variety of business disciplines revealed

26 | CPA Voice

women have a risk-averse mindset. This risk aversion perspective can be helpful to businesses and leadership teams with financial statements.

She said she places an emphasis on the statistical analysis in her research.

“Our econometrics models show that there's value here,” she said. “There is value within the financial statements of having women in the room and our perspective.”

Now, she is looking to spread awareness of her research, especially when it comes to hiring decisions.

In sharing her research so far, Hintz said most feedback has been positive. She’s also spoken with CFOs who say they are interested in looking at past audit history and their

teams to inform their hiring decisions moving forward. And while her original research focused on audit partners, she said she’s looking to expand it out to different stakeholders across different industries.

“Women are of tremendous value in the workplace, and they are making a difference,” she said. “The numbers show it.”

Register today for the Women, Wealth & Wellness Conference on July 18 to hear from Ceara Hintz and other dynamic speakers.

Visit ohiocpa.com/www for more information.

THREE THINGS

1. Diversifying audit teams can lead to increased transparency.

2. Hintz’s research shows females were less likely to overstate net assets than their male counterparts.

3. This information is beneficial to business stakeholders who use financial statements to make decisions about the company and helps those decisions be more transparent.

MAY | JUNE 2024 | 27

MEMBERS in motion

CLEVELAND

HW&Co. has been named to Accounting Today’s list of the Top Firms in the Great Lakes, for the third consecutive year.

Brandon Miller CPA, CGMA, CEO, HW&Co. has been named to Cleveland Magazine’s Cleveland 500, a list of the most influential leaders in northeast Ohio.

HW&Co. has made the following new hires:

• Alexis Graham, Inga Kocnova, Miracle Obi, and Sarah Rock as staff accountants

• Jason Hazlett as a senior accountant

• Theresa Bartell and Maggie McClave as paraprofessionals

• Mike Pecchia as a manager

COLUMBUS

HW&Co. has made the following new hires:

• Jonah Ackerson and Madison Elliott as staff accountants

• Marco Chavez and Aimee West as senior accountants

ST MARY'S

Tony Giovarelli and Ashley Grimm have been promoted to in-charge accountants at Shultz Huber & Associates, Inc.

Chelsea Waidelich, CPA, has been promoted to supervisor at Shultz Huber & Associates, Inc.

Tony Giovarelli

Ashley Grimm

Tony Giovarelli

Ashley Grimm

Land the perfect professional connection

Whether you’re still basking in the glow of passing your CPA exam, a mid-level manager who needs a change, or a seasoned CFO who wants top talent, the OSCPA Career Center is your one-stop-shop to uncover rewarding careers and discover untapped talent.

Employers:

• Post jobs

• Review resumes

• Screen candidates

• Expand your reach with enhanced posting options

• Explore our recruitment and retention resources

Job Seekers:

• Search for jobs

• Customize your job alerts

• Post resumes anonymously

• Save resumes and cover letters on your dashboard

• Access videos and articles on interviewing, resume writing and more

• Get free interview coaching via email or more personalized coaching for a fee

For more info, visit

ohiocpa.com/career-center MAY | JUNE 2024 | 29

LEARNING events at a glance

Quarterly Ethics: Ohio Professional Standards & Repsonsibilities

Register today and fi nd more events at Explore OSCPA competency framework at ohiocpa.com/CBL ohiocpa.com/Events24 7/17 8:00 a.m. – 4:00 p.m. Governmental Accounting & Auditing Conference 8 credits MULTIPLE 8/15 12:00 p.m. – 1:00 p.m. Town Hall 2024 – August 1 credit MS 8/26 11:00 a.m. – 12:00 p.m. Women’s Leadership Series: Women’s Equality Day 1 credit PD 9/19 12:00 p.m. – 1:00 p.m. Town Hall 2024 – September 1 credit MS 10/23-24 8:30 a.m. – 4:30 p.m. October Accounting Show 16 credits MULTIPLE 11/13-14 8:30 a.m. – 4:30 p.m. November Accounting Show 16 credits MULTIPLE 11/19 11:00 a.m. – 12:00 p.m. Women’s Leadership Series: Women’s Entrepreneurship Day 1 credit PD 12/10-11 8:30 a.m. – 4:30 p.m. 2024 MEGA Tax Conference 16 credits TX 12/13 8:30 a.m. – 4:30 p.m. CORECon – Core Skills Conference 8 credits MULTIPLE 12/17 12:00 p.m. – 1:00 p.m. Town Hall 2024 – December 1 credit MS COMPETENCIES Financial Accounting Audit & Assurance Business Management Technology Ethics & Professional Standards Tax Essential Skills & Prof. Development Risk Management & Fraud Talent MGMT & Human Resources Multiple CREDIT TYPE AC Accounting RE Regulatory Ethics BL Business Law AG Accounting (Government) BE Behavioral Ethics IT Information Technology AU Auditing TX Taxes AV Auditing (Government) CA Computer Software & Applications EC Economics PR Production MS Management Services FI Finance BM Business Management & Organization CM Communications & Marketing ST Statistics HR Personnel/ Human Resources SK Specialized Knowledge PD Personal Development MULTIPLE

Jun. 13 | Sept. 26 | Dec. 6 8:30 a.m. – 11:15 a.m. | 3 credits Aug. 22 | Virtual 8:30 a.m. – 4:30 p.m. | 8 credits CORECon – Core Skills Conference Women, Wealth and Wellness Jul. 18 | Virtual 9:00 a.m. – 3:00 p.m. 6 credits + 2 complimentary On-Demand credits Fraud and Forensic Conference Aug. 27 | Virtual 8:30 a.m. – 2:30 p.m. 6 credits Mastering the A.I. Wave: 8 Strategies for CPAs to Enhance Productivity On-demand video 2 credits Fraud Forensic Conference RE MULTIPLE IT PD MULTIPLE

MAY | JUNE 2024 | 31 Read CPA Voice on Issuu.com, and never miss the latest news, best practices, trends in the profession and information on what OSCPA is doing to serve you as a member. issuu.com/cpavoice Follow us at: issuu.com/CPAVoice Read on Issuu

CLASSIFIED

Selling or Buying a Firm? Selling an accounting firm is complex. We can make it simple!

Accounting Biz Brokers, LLC has been selling accounting firms and tax practices for over 19 years! Let’s face it, you know how to run your business, but it takes a very different skill set to sell a business successfully. Our team of Certified Business Intermediaries is committed to providing personalized business brokerage services to our clients and customers. Selling professional practices like yours is all we do. Using targeted marketing strategies, we have developed a large database of active buyers ready to purchase.

Call or email us today to receive a FREE-Market Analysis or to start the confidential sales process. We can help you achieve the “win-win” results you are seeking!

Kathy Brents, CPA, CBI Office 866.260.2793; Cell 501.514.4928

Kathy@AccountingBizBrokers.com www.AccountingBizBrokers.com

32 | CPA Voice Accelerate your career and enhance your skills with quality learning from OSCPA. by CPAs for CPAs

from 9 core competencies to help you transform your skill set and compete in today’s crowded marketplace Audit & Assurance Ethics & Professional Standards Business Mangement & Strategy Financial Accounting, Reporting & Analysis Essential Skills & Professional Development Talent Management & Human Resources Tax Risk Management & Fraud Technology ohiocpa.com/CBL Duffy+Duffy Cost Segregation Services ADVERTISER INDEX

Choose

17

THE OHIO SOCIETY OF CPAs 2023–2024

CHAIR OF THE BOARD

Libby Cullins, CPA, MBA JPMorgan Chase Columbus

Brandi Carson, CPA La-Z-Boy Inc. Toledo

Courtney Clark, CPA Deloitte Columbus

Chris Igodan Jr., CPA Nationwide Financial Columbus

Gregory J. Jonovich, CPA, MBA Materion Mayfield Heights

PAST CHAIR

Craig Marshall, CPA Ernst & Young Plain City

PRESIDENT AND CEO

Scott D. Wiley, CAE The Ohio Society of CPAs Columbus

DIRECTORS

Angela Lewis, CPA Crowe Columbus

A’Shira Nelson, CPA Savvy Girl Money Cleveland

Carolyn Smith, CPA, MBA, CRMA Member, Governmental Accounting Standards Board Columbus

BOARD OF DIRECTORS

CHAIR-ELECT

Rick Fedorovich, CPA

Bober Markey Fedorovich Cleveland

Mark Welp, CPA, CFE Holbrook & Manter Columbus

Ellen Wisbar, CPA

Mayer Hoffman McCann, P.C. Cleveland

Amy Vetter, CPA, CGMA, CITP The B3 Method Institute & Drishtiq Yoga Mason

LATELY on the podcast

Listen to the entire series wherever you get your podcasts!

The Ohio Society of CPAs podcast “The State of Business” covers the latest news impacting accounting professionals, most recently with a series focused on the accounting talent shortage.

Episode title:

Introducing diverse students to accounting may solve talent shortage

From the episode:

“This is a long-term approach to solving a crisis that's been going on for a bit of time. This is not something that just happened overnight. And therefore, it's not going to be solved overnight.”

John Jones, president & CEO of HOPE Toledo, a 501(c)(3) organization that helps children obtain high-quality early childhood education through pre-K and post-secondary training in college or trade schools.

ohiocpa.com/Podcast

Technology has reshaped the accounting landscape, the skills gap is wider than ever, and a dwindling talent pool has left teams overworked. It sounds overwhelming, but as a distinguished accounting professional, you can help us grow the pipeline, advance your professional goals, and help shape Ohio’s economic future.

• Invest in your professional development that elevates your standing in the fi eld.

• Contribute to building a robust and diverse pipeline for the profession.

• Become an integral part of OSCPA’s mission to create a thriving and sustainable future for accounting in Ohio.

Scan the QR code or call 614.764.2727 , and join us in shaping the future of accounting, learning locally, and contributing to the growth and diversifi cation of the profession.

ohiocpa.com/Renew24 Accounting

all ledgers, spreadsheets,

crunching numbers. The profession has evolved, and we need

help to face the unique challenges ahead. MEMBERSHIP RENEWAL 2024

isn’t

and

your

Tony Giovarelli

Ashley Grimm

Tony Giovarelli

Ashley Grimm