HOLLYWOOD EAST

A recent and ongoing surge in studio space highlights how attractive New York City has become for lm and television production

|By

Eddie Small and C. J. HughesAlthough Los Angeles has been synonymous with the lm industry for generations, a recent and still increasing boom in New York studio space is giving the City of Angels a run for its money.

New York currently has more than 50 state-quali ed production facilities, according to Empire State Development, the state’s economic development arm. ere are at least six major studio projects in the works, and according to the Mayor’s O ce of Media and Entertainment, in the past ve years alone, developers have built or renovated at least four: Panorama Brooklyn in Dumbo, Cine Magic in Long Island City, Cinelease Studios in

Real estate rails against new rules on broker fees

Lawmakers still appear set on advancing the bill

By Nick GarberCity lawmakers are showing every intention of advancing a bill that would shift broker fees from tenants to landlords, even as the real estate industry came out in force June 12 to oppose the legislation during a tense hearing at City Hall. e hearing focused on a bill by City Councilman Chi Ossé that would require the fees for a residential broker to be paid by whoever hired the broker — most often the building’s landlord. e fees are unique to New York City and Boston among major cities, and typically cost between 10% and 15% of a year’s rent — a burdensome sum for many would-be tenants.

But brokers, mobilized by the Real Estate Board of New York, argue that the bill would threaten their incomes, disrupt the rental market and result in higher rents by encouraging landlords to pass on the fees to tenants. REBNY perceives the bill as a real threat — 33 members of the council have cosponsored the bill, which is one shy of the supermajority that would be needed to override a potential veto by Mayor Eric Adams.

“Costs will go up, rents will go up, transparency of the marketplace

See FEES on Page 22

THE NUMBER of statequali ed production facilities in

East Williamsburg and Broadway Stages on Staten Island.

e six projects in development are split between three in Queens, two in Brooklyn and one in Manhattan. And two of them just broke ground last year: Sunset Pier 94 Studios along the Hudson River and East End Studios in Sunnyside.

ese projects have made the city competitive with Los Angeles and Atlanta, also a major lming destination, and are poised to generate “billions of dollars in economic impact” in the next few decades, Andrew

See STUDIOS on Page 19

City Councilman Chi Ossé led a rally in support of his bill, which requires broker fees to be paid by whoever hires an agent, before a June 12 hearing on the so-called FARE Act.

MTA board can’t revolt on congestion pricing as it needs approval from state, City Planning chief says

Nick GarberDreams of the Metropolitan Transportation Authority board revolting against Gov. Kathy Hochul’s congestion pricing reversal are not to be, City Planning Director Dan Garodnick said June 12. He is also a member of the MTA board.

Garodnick made the comments at a Crain’s New York Business real estate event in Midtown, where

But on June 12, in his rst full public comments on the issue since Hochul’s bombshell, Garodnick threw cold water on the prospect of a boardroom rebellion — echoing MTA CEO Janno Lieber’s assertions that the governor had yanked a required approval by the state’s Transportation Department.

“In short, no, the MTA board cannot move forward on a program that does not have the necessary support from the state,” Garodnick said. “ e MTA is an implementing agency, it follows state law.”

“As a member of the board, we’re going to have to gure out how you fund a capital plan that now has a big hole in it.”

Dan Garodnick, City Planning director

Editor-in-Chief Cory Schouten asked Garodnick whether the MTA board might overrule the governor’s inde nite pause of the Manhattan tolling program, as some advocates have hoped. Garodnick has been a backer of congestion pricing for years, and notably expressed continued support for it on social media this month — subtly contradicting his boss, Mayor Eric Adams, who has been less than enthusiastic about the program.

OCTOBER 29

TECH SUMMIT

Join Crain’s New York Business and Tech: NYC for a day of conversations and inspiration about the future of the city’s tech ecosystem as a key economic driver. Connect with fellow entrepreneurs, investors, policymakers, civic leaders, and technologists for a lively day of programming, networking and deal making.

Garodnick’s statements further dim the possibility of congestion pricing being suddenly revived at the next MTA board meeting on June 26. But he acknowledged the disappointment felt by city and state o cials who worked for years on congestion pricing, and stressed that it remains unclear how the MTA will ll the $15 billion hole in its capital budget that now exists as a result of Hochul’s abrupt decision.

“ at is a live question,” he said.

“As a member of the board, we’re going to have to gure out how you fund a capital plan that now has a

big hole in it, or how you thoughtfully retreat from some of those plans that you initially made.”

Garodnick was more eager to discuss City of Yes, the administration’s three-part set of zoning reforms whose housing component — the most consequential and controversial of them all — is now in the early stages of its public review. Community boards are now holding votes on the plan, and Garodnick said his focus has been explaining a fundamental fact to the public: “You make a case for: Rent high, because of supply low.”

e City Planning department that Garodnick heads is shepherding the City of Yes plan, which could allow as many as 109,000 new housing units over 15 years by permitting more mid-rise buildings in the outer boroughs, taller apartment buildings in dense areas, and small “accessory dwelling units” in backyards and garages.

Economic bene ts

e administration mainly argues that the plan would ease the city’s desperate housing shortage and historically low vacancy rate, which have caused rents to skyrocket. But speaking to an audience of real estate professionals from rms like Silverstein Properties and SL

Green, Garodnick also talked up its economic bene ts, which he pegged at $58 billion over 30 years and 260,000 jobs in the construction and service industries.

“We hear from businesses that say, ‘You know what, I’m not going to expand my business in New York or I’m not going to locate my business in New York on account of the cost of housing,’” Garodnick said. “ at’s a decision we do not want New York employers to have to make.”

Asked whether he would invest in any particular neighborhoods if he were a real estate developer,

Garodnick took the opportunity to promote ve pending neighborhood-level rezonings that the Adams administration is in various stages of pursuing: near new Metro-North stops in two East Bronx neighborhoods; in Manhattan’s Midtown South; and in Long Island City and Jamaica, Queens. All are likely to result in new housing growth if approved.

“ ose are ve areas that we, as New York City, are very publicly talking about making changes in, which I hope people will take a look at and think about what opportunities they see there,” he said.

Mount Sinai leader concerned about keeping Beth Israel running amid planned closure

Amanda D’AmbrosioMount Sinai CEO Dr. Brendan Carr said the question of how long Beth Israel will be able to continue operating amid its planned closure is one he “loses sleep” over.

Clinicians have ed for other jobs and services have dwindled since news of the closure was rst reported by Crain’s last September. e hospital has kept its operations a oat through the use of temporary physicians and negotiations with nurses’ unions to ensure enough sta to continue providing care, but Mount Sinai leadership continues to have conversations about how long that can go on, Carr said.

Carr maintained that it is necessary to close Beth Israel because of the hospital’s persistent nancial challenges. But he added that the July 12 closure date, which the hospital has held rm on, may no longer be plausible.

Mount Sinai’s ability to close the hospital hinges on the Department of Health’s approval of an updated closure plan the health system submitted last month; even if it is approved, the hospital still faces a lawsuit from community advocates and elected ocials who want to see the hospital stay open.

Carr made the comments at a Crain’s health care event in Mid-

town on June 13, responding to a question from Editor-in-Chief Cory Schouten, who asked whether Beth Israel could realistically close down in a month.

“ ey are holding it together,” Carr said. “But it doesn’t feel like people disconnected and removed from what’s happening inside the hospital should subvert the DOH and hospital leadership from making decisions.”

Keeping it a oat

Mount Sinai has repeatedly said that it has to close Beth Israel because it cannot keep pouring money into the hospital to keep it a oat, despite skepticism from local elected o cials and community advocates about Beth Israel’s de cits. Recent documents led by the health system show that Beth Israel had just $29 million in cash reserves by the end of 2023 — a sum that the hospital says it has exhausted.

e health system has faced pushback from state health regulators on its claims. e Department of Health rejected Mount Sinai’s bid to close Beth Israel in April because it said the health system did not provide enough information about its intentions or implications on the community.

Mount Sinai submitted a new closure plan for Beth Israel last month

and stayed rm on its intention to shutter the hospital by July 12. It’s currently waiting for state health o cials’ approval.

But the Department of Health is not Mount Sinai’s only obstacle. A group of community activists and politicians led a lawsuit against the health system in February alleging that it had prematurely shut down critical services and is closing the hospital to bene t from what could be a lucrative real estate deal. e lawsuit also names the state Health department as a defendant.

A Manhattan judge issued a temporary restraining order against the

closure earlier this year, ordering Beth Israel to maintain all beds and restore services that it has already shut down.

Hospital closures are a byproduct of a health care system that’s drastically changing, Carr said. Patients are less frequently getting care in hospitals as more services move to physicians’ o ces and in peoples’ homes. e shift away from hospital care has led to nancial challenges among hospitals, but it’s also led to innovation, Carr said. Physicians now have the ability to perform joint replacements without requiring a hospital stay and can infuse chemotherapy to a cancer patient at home.

Mount Sinai is also innovating how it provides care through the use of telehealth and arti cial technologies, Carr said. Virtual care models are collecting more information and stitching together a fuller picture of patients’ health, and some arti cial intelligence technologies have the potential to help clinicians make decisions about end-of-life care.

“It’s going to deliver the future of health care,” Carr said.

Mets owner Steve Cohen is bringing New York its next new sports team — tech-infused golf

The billionaire hedge fund manager recently bought the New York Golf Club, one of six teams to tee off a concept that blends the real-life game with simulators, as part of a new league from Tiger Woods and Rory McIlroy

By Jack GrieveOdds-makers give the Mets less than a 0.5% chance of winning the 2024 World Series, but owner Steve Cohen is eyeing another way to bring a championship to New York.

e billionaire hedge fund manager recently bought the New York Golf Club, one of six teams set to tee o in January 2025 as part of a new league spearheaded by Tiger Woods, Rory McIlroy and sport media executive Mike McCarley.

e TGL, short for Tomorrow’s Golf League, is a partnership with the PGA Tour that aims to liven up the sport through tech-infused play. e concept blends real-life golf with the increasingly popular simulators found at indoor entertainment facilities.

TGL matches will be played not at traditional golf courses but rather in an indoor arena: a $50 million, 250,000-square-foot stadium dubbed the SoFi Center on the South Florida campus of Palm Beach State College. Fifteen weekly primetime matches are scheduled to be televised by ESPN beginning Jan. 7.

With gameplay taking place out of state, the team’s local footprint will be limited. ere will be no boost to subway ridership or hotel bookings. Any job creation or tax revenue for the city will almost certainly be negligible.

“I don’t think it’s comparable to the New York Mets, the economic impact,” acknowl-

edged Andrew Cohen, chief investment ofcer and co-founder of Cohen Private Ventures, an o ce that identi es investment opportunities on behalf of Steve Cohen and his family. ( e two Cohens are not related.) Still, the team is planning to have a local presence. Expect to see NYGC merchandise in city shops and “activations,” or branded events, at simulator facilities. e team’s goal is for New Yorkers at public simulators eventually to be able to play on the same

digital courses the TGL uses.

“Our hope is that, despite it being in a simulator and despite it being played in Florida, through activation that will happen locally, we can build a team and build followership and fandom around the New York Golf Club,” Andrew Cohen said.

Unproven popularity

TMRW Sports, the group behind TGL,

“Our hope is that, despite it being in a simulator and despite it being played in Florida, through activation that will happen locally, we can build a team and build followership and fandom around the New York Golf Club.”

rst announced the league in August 2022. TGL is a potential brushback to LIV Golf, the Saudi-backed league that has been luring players from the PGA Tour. If it works as planned, TGL will nancially bene t players who turned down LIV mega-deals. Andrew Cohen declined to disclose the cost of the golf team purchase but characterized the investment simply as “smaller than the Mets’.” Steve Cohen bought the MLB team for $2.4 billion in October 2020. Multiple limited partners are also investing in the New York Golf Club, including athletes and entertainers who represent the

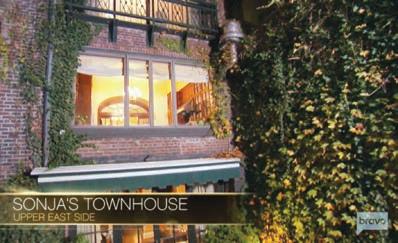

‘Real Housewives’ star Sonja Morgan sells her townhouse on the Upper East Side at a loss

The ve-bedroom property traded for about $4.5 million, a fraction of what she paid in 1998

Reality, it seems, can sometimes bite.

Real Housewives of New York alum Sonja Morgan has unloaded her Upper East Side townhouse for a fraction of what she paid for the property, despite the elegant, 5-story prewar building’s frequent presence on the show.

features a formal dining room with a replace, a primary suite with a replace and a koi pond in its large, agstone-lined garden.

$4.5M

Sale price for the Upper East side townhouse at 162 E. 63rd St.

e ve-bedroom property at 162 E. 63rd St. between Lexington and ird avenues traded for about $4.5 million Wednesday after a two-week auction, according to e New York Post

Records indicate that in 1998 Morgan and her ex-husband, John Morgan Jr., a great-great grandson of nancier J.P. Morgan, had paid $9.1 million for the home, which

e couple divorced in 2006 after an eight-year marriage, which seemed to lead to a cascade ofnancial problems for Morgan, whose failed business ideas included trying to launch her own toaster oven business, a op chronicled on the show.

Not only did the 4,500-square-foot townhouse sell at a 50% loss, but it also struggled to nd a taker for more than a decade, a period during which the house fell into disrepair. Morgan rst tried to unload No. 162 in 2009 for $9.3 million, according to StreetEasy, around the time she led for chapter 11 bankruptcy protection after reportedly racking up $20 million in debts from a failed John Travolta movie project.

After bouncing on and o the market for years, and being offered as a rental some of the time, the townhouse came back up for sale in 2019 with a new and all-timehigh asking price of about $11 million, though it began to be

discounted during the pandemic. No. 162 was last listed in April at about $8 million before the auction began. Bidding was expected to start around $2 million.

e identity of the buyer in the deal, which won’t hit the city register for days, is unknown. Adam Modlin, the last broker to market the property, declined to comment, and Concierge Auctions, which began soliciting bids May 15, did not reply to an email by press time.

e Real Housewives of New York

premiered on the Bravo network in 2008; Morgan rst appeared in its third season, in 2010, and left the show after its 13th, in 2021.

Once considered the most prized of all types of New York real estate, townhouses have fallen out of favor somewhat in recent decades as condos have become larger and more

sumptuous, brokers say, adding that like single-family homes, they don’t require the scrutiny of boards. High interest rates also seem to have taken a toll on the sector, along with other kinds of city homes.

Louis Vuitton agship in Manhattan’s Plaza District will be torn down to make way for revamped location

By Julianne CubaLVMH Moët Hennessy Louis Vuitton, the French parent company of luxury retailers such as Givenchy and Fendi, recently filed a permit to tear down its 20-story flagship Louis Vuitton location in Manhattan's ritzy

the pricey leather goods brand, according to a June 7 application led with the Department of Buildings.

LVMH, the world's largest luxury goods company, with 75 brands to its name, including Christian Dior, had previously led plans in March to bulldoze another one of its buildings next door, at 743 Fifth Ave., which shares a wall with the one on East 57th Street and is currently home to a store for Swiss watchmaker Hublot.

Demolition of the Louis Vuitton storefront between Fifth and Madison avenues is slated to cost $13 million.

Plaza District, city records show, to make way for a revamped store.

e Paris-based conglomerate, more commonly known as just LVMH, plans to raze its 91,060square-foot berth at 1 E. 57th St., which is currently occupied by

Franklin Dickinson, the senior vice president of architecture and construction at LVMH, is the signatory on both applications. Demolition of the Louis Vuitton storefront between Fifth and Madison avenues is slated to cost $13 million, according to the led permit, which was rst reported by PincusCo.

Earlier this year LVMH was in talks to scoop up the adjacent

structure at 745 Fifth Ave., a 35-story building owned by Paramount Group and occupied by the Bergdorf Goodman men's store on the rst three oors. e Parisian company was one of several bidders competing for the property, Crain's reported in January. Now six months later, it doesn't appear as if the building has been sold, according to city records.

Another lease

Amid construction of its new Louis Vuitton agship, the dimensions for which are so far unclear, LVMH has reportedly signed a seven-year lease at 6 E. 57th Street — a Trump Organization building currently home to the high-end jewelry brand Ti any & Co., which LVMH acquired in 2021. However, no construction permits have been led yet to erect the new space, records indicate.

Vital Covid nursing home inquiry neglected

Legislature should resurrect an idea for a commission with subpoena power to comb through New

York’s pandemic response

Congestion pricing isn’t the only worthy idea that’s now dead in Albany.

An e ort to set up a commission with subpoena power to examine New York’s response to the Covid19 pandemic did not make it through the legislative session that ended earlier this month. e e ort, which had buyin from progressive and moderate Democrats as well as some Republicans, would have been sorely needed — a depoliticized investigation into what went so horribly wrong four years ago.

entirely o -base when it comes to Cuomo and Covid, and there are Democrats in New York, like Julia Salazar, a Brooklyn state senator, and Jessica GonzálezRojas, a Queens Assembly member, who want to get answers. New York has lost more than 80,000 residents to Covid, the bulk of them in the rst few months of the pandemic in 2020 when Cuomo became a national hero for calming Americans during his widelywatched press brie ngs.

In Washington, congressional Republicans have attempted their own investigation, even subpoenaing Andrew Cuomo, who gained great fame and later infamy during the pandemic, and Dr. Anthony Fauci. But there’s only so much a

New York has lost more than 80,000 residents to Covid, the bulk of them in the rst few months of the pandemic in 2020.

partisan inquiry can do, especially with conspiracy theorists populating the national party.

Republicans, though, are not

Cuomo’s popularity soared as bodies piled up in morgues. And it was his poor decision-making that directly led to mass death in New York. Unlike California and Washington State, Cuomo dithered over locking down New York City when it became apparent the virus was spreading, even overriding his rival, Mayor Bill de Blasio, who wanted an earlier shutdown.

Later on, Cuomo made the disastrous decision to send Covid patients from hospitals back to nursing homes and obscured the death toll with faulty, intentionally misleading data. His health commissioner, Dr. Howard Zucker, repeatedly misled the public at Cuomo’s behest and Attorney General Letitia James later

found nursing home deaths might have been undercounted by as much as 50%. Cuomo also pocketed millions for a pandemic memoir, forcing state employees to work on the book as the virus raged and killed tens of thousands.

e legislation would have mandated that 16 members, appointed by the governor and the Legislature, hold hearings and take testimony. A de nitive report and record would then be prepared. It could be the equivalent of the 9/11 Commission Report — the terrorist attacks killed far fewer New Yorkers than Covid, but there was much more of a desire, then, to learn about what went wrong.

Aggressive examination

Gov. Kathy Hochul and the Democratic legislative leaders seem disinterested at best. Cuomo, of course, would love everyone to move on. Without an aggressive examination of the failures of 2020, New York will be doomed to repeat the same mistakes if another pandemic or mass casualty event hits the state. Albany declining to act on Salazar and González-Rojas’s legislation could, quite literally, cost future lives.

Questions must be answered. What went right and wrong with the stockpiling of lifesaving medical equipment? Why were hospi-

tals so overwhelmed? When, actually, was Covid rst spotted? What future pandemic surveillance is the state doing? How can the state Health department be guaranteed a degree of independence, and not devolve into a political pawn for the executive? How well (or poorly) was the reopening of public schools handled?

Hochul has requested a review of New York’s response by an outside rm, but there will be no subpoena power. And there have been delays: state comptroller’s transactions show the Olson Group

Ltd., the consulting rm hired more than a year ago to complete a lengthy pandemic review, has billed the state less than half of its $4.3 million contract.

With the legislative session done, lawmakers likely won’t be back to pass bills until January. A Covid commission must be on the docket in 2025. New Yorkers deserve to know what happened in their state — why so many suffered and what can be done to prevent another catastrophe.

Ross Barkan is a journalist and author in New York City.

Long Island City biotech startup Envisagenics raises $25M in Series B funding to develop cancer therapies

By Amanda D’AmbrosioA Long Island City biotech startup raised $25 million last week to advance gene therapies for cancer and other chronic illnesses. Envisagenics, which spun out of Cold Spring Harbor Laboratory in 2014, is developing RNA detection technology to help it create treatments for diseases like cancer and neurodegenerative disorders. e company plans to use its recent funding to advance potential oncology therapies for

Venture Capital, Red Cell Partners and Empire State Development participated in the funding round. Bristol Myers Squibb also participated as a new investor following its oncology research collaboration with Envisagenics in 2022.

Gene splicing

Envisagenics is advancing its technology SpliceCore to detect splicing events that could be potential targets for therapeutics.

diseases including breast cancer, said Dr. Martin Akerman, cofounder and chief technology ofcer at Envisagenics.

Existing investors ird Kind

Envisagenics’ founding scientific team got its start by developing the drug Spinraza, an RNA therapeutic to treat spinal muscular atrophy that was approved by the U.S. Food and Drug Administration in 2016. e drug works by correcting an error from a process called gene splicing, a naturally occurring process where genes split and create multiple proteins. RNA splicing is part of what makes humans such complex organisms, Akerman said. e human genome is made of 25,000 genes, which sounds like a lot, but is actually less than organisms like corn, he said.

Splicing allows for humans to have a number of gene combinations, but can also be linked to diseases.

Now, Envisagenics is advancing its technology SpliceCore to detect

splicing events that could be potential targets for therapeutics. So far, the technology has proven e ective in detecting 14 million splicing events — helping the startup whittle down to 20 to 30

gene candidates that become the basis for drug development efforts, Akerman said. Envisagenics will use the capital to further develop its SpliceCore technology, Akerman said.

TF Cornerstone to demolish two more buildings in Chelsea

By Eddie SmallTF Cornerstone is tearing down two more Chelsea buildings ahead of a likely major residential project in the neighborhood.

e real estate giant, run by members of the Elghanayan family, recently led demolition permits with the Department of Buildings for 250 and 256 W. 23rd St. e company led plans to tear down 254 W. 23rd St. earlier this year.

e rm is planning a sprawling residential project across the sites that will consist of two connected buildings, according to reporting from Chelsea Community News

to nish the work by mid-2026, according to the local news site.

The rm is planning a sprawling residential project across the sites that will consist of two connected buildings.

earlier this year. One would stand 14 stories tall with 130 apartments and ve ground- oor retail spaces, while the other would stand 7 stories tall with 40 apartments and a 35-car underground parking garage. TF Cornerstone hopes

e current building at 250 W. 23rd St. stands 3 stories and 44 feet tall, while the one at 256 W. 23rd St. stands 5 stories and 82 feet tall, according to the demolition lings. Both are retail properties, with 250 housing an Apple Bank branch that is planning a move across the street to 278 Eighth Ave., according to the commercial real estate database CoStar and multiple reports.

e building at 256 once housed a Cinépolis movie theater

that shuttered in early 2023, according to the website Cinema Treasures.

TF Cornerstone purchased 250 and 254 W. 23rd St. in 2019 for about $19.3 million, and a limited liability company linked to the rm bought 256 W. 23rd St. in 2012 for $35 million, according to property records.

e Midtown-based developer is well known for helping spearhead the residential boom in Long Island City, where it has multiple luxury apartment buildings. It has a residential property at 200 W. 26th St. in Chelsea called Chelsea Centro. Rents at available apartments, all one-bedrooms, range from $5,410 to $6,795, according to StreetEasy.

These 8 New York restaurants could soon get Michelin honors

Jack GrieveMichelin just added eight restaurants — seven in Manhattan and one in Queens — to its coveted New York dining guide.

e additions to the list are seen as something of a tease to the announcement of this year's Michelin stars, which are widely considered the crown jewels of the restaurant industry. e stars will be unveiled at a ceremony later this year, though Michelin has yet to announce a date.

e newcomers to Michelin's New York guide could also land a spot on the Bib Gourmand list, which features restaurants that serve high-quality food at a relatively low cost.

Last year, the honors were unveiled on Nov. 7 at a rst-of-its-

kind ceremony at Spring Studios in Tribeca that combined the programs for New York, Chicago and Washington, D.C. In years past, each city hosted its own event. e newcomers, which Michelin described as "culinary gems," are:

Café Carmellini, 250 5th Ave. Coqodaq, 12 E. 22nd St. Corima, 3 Allen St. Four Twenty Five, a Jean-Georges Restaurant, 425 Park Ave. Foxface Natural, 189 Avenue A Kanyakumari, 20 E. 17th St. Tolo, 28 Canal St. Vert Frais, 43-10 Crescent St.

At last year's ceremony, two new New York restaurants earned their rst 2-star designations and eight local spots received their very rst star.

Brokers, REBNY would be wise to propose a middle ground on broker fees

The Real Estate Board of New York would be wise to engage with housing advocates to nd a compromise on broker fees. REBNY mobilized an angry rally of real estate brokers June 12 to oppose a City Council bill, put forth by Councilman Chi Ossé, that would require whoever hires a broker to pay their fee, e ectively shifting broker fees from tenants to landlords. e brokers say the bill would cut their incomes and raise rents because landlords would likely pass the costs onto consumers. Supporters say that the fees, which are unique to New York and Boston, are untenable at a time when rents are already sky-high. ey also dispute the assertion that the shift would cause rent to jump further, noting that it is dictated by market forces. Plus, any potential increases would be a non-issue for the half of city apartments that are rent-stabilized.

However, this hard-line opposition is not a productive path forward. A more nuanced approach could bene t the real estate industry in the long term.

A typical broker fee is 15% of a tenant’s

LETTER TO THE EDITOR

annual rent. For the average Manhattan apartment, where median rent recently reached $4,500, that would amount to about $8,100, and that’s on top of any rst month, last month rent and security fees collected by the landlord.

Ossé’s bill has merit. Broker fees are ripe

for abuse. A broker is essentially selling access to a tight rental market. ere is every incentive for those who can pay more to o er the broker a higher fee. Better-o people can purchase access.

e city is in the midst of a housing crisis where even workers in the technology sector struggle to nd a ordable apartments. Having to pay thousands of dollars for a simple transaction is another deterrent for young professionals moving to the city. e lack of housing supply drives workers to the suburbs and deep outer boroughs, forcing them to deal with an unreasonable commute and contributing to persistently depressed return-to-ofce numbers.

What’s more, the writing is on the wall for the brokering profession. StreetEasy and Zillow have made it easier for tenants to access listings. e broker business is only the most recent example of an industry being disrupted by technology.

Middle-ground measures

Resistance to change is doomed. Instead, brokers and REBNY would do well to suggest some middle-ground measures. is could include capping fees at a lower percentage so that tenants are not faced with ve- gure deposits to move apartments. Increasing transparency around tenants’ rights would also ease the tension around this opaque and unregulated market. Another option would be to have landlords and tenants split the broker fee, similar to how the transaction is structured when buying a house. e bill is widely popular and is just one vote shy in City Council of the supermajority needed to override a potential mayoral veto. If REBNY continues with its all-or-nothing approach, it may end up with nothing.

Don’t force alcohol retailers to accept and store empty containers under bottle bill expansion

A RECENT CRAIN’S ARTICLE [“Rat pack: New York will host rodent- ghting summit,” May 15] followed Mayor Eric Adams’ announcement that New York City will be hosting a nationwide summit in an e ort to reduce rats across the ve boroughs.

Since the mayor’s 2023 declaration of war against the city’s rat infestation, this has been a hot topic, especially for small business owners combatting vermin in stores. at is why Albany legislation to expand the state’s bottle bill would be a detriment to public health.

e legislation seeks to increase the redemption value of bottle deposits, as well as expand the types of containers consumers must leave deposits for.

Despite the bill’s intention, struggling city mom-and-pop-owned wine and liquor stores simply do not have excess retail space to store returns. How can a downstate store, which is typically 300 to 600 square feet and located in tenement buildings, adapt?

Michael Correra is a Brooklyn liquor store owner and executive director of the Metropolitan Package Store Association, which advocates for 3,500 small wine and liquor retailers across the state.

Among the new categories added would be sports drinks, noncarbonated teas, hard cider, wine and liquor bottles. e legislation would also force New York’s 4,500 small, independently owned wine and liquor stores to accept and store returns.

If stores must eliminate perhaps one-third of their sales inventory to accommodate this measure, it will put many of us out of business.

Dirty bottles attract vermin and further compound the rat infestation currently facing Gotham’s residential neighborhoods.

Despite the city’s best e orts, rodent complaints still spiked 1.5% during 2023, to 41,748.

While liquor stores certainly support preserving the environment, we also need to stay in business. is legislation will have the opposite of the Pied Piper e ect, leading rats to ourish in New York City while further burdening small neighborhood retailers and public health.

number. Crain’s reserves the right to edit submissions for clarity.

Social capital is the key to ensuring access to opportunity for marginalized students

The Supreme Court’s ruling to strike down a rmative action for college admissions, in the case Students for Fair Admissions v. Harvard made higher education less accessible for many students, especially those from historically marginalized communities. It reinstated barriers that can detrimentally impact these students — by limiting access to educational opportunities that can help them gain economic mobility, and in turn, jeopardizing our country’s ability to develop a diverse, e ective workforce. However, a rmative action is not the only solution. Business leaders working with students from under-invested-in communities to grow their social capital is an e ective strategy to support student success, build a diverse talent pipeline, and enable businesses to future-proof their workforces.

Brookings Institution found in 2021 that race was the most important, consistent differentiator of social networks, with gender and income also having a notable impact.

Tara Bellevue is the vice president of Diversity, Equity, Inclusion and Access Strategy at NAF, a nonpro t focused on connecting business and education leaders.

Social capital is the network of relationships that give a person resources and help them succeed — and research shows that it is essential for securing a job and sustaining individual economic growth. However, like many resources, access is not equal. e

Students who come from under-resourced communities, who may be rst-generation college students and who may face systemic barriers because of discriminatory policies may not have the same connections that will open doors to career opportunities or help them develop skills to succeed in the future. at is why building social capital among students from under-invested-in communities is so critical for ensuring equitable access to opportunity.

Business leaders know that this is also vital for them to address. Studies show many bene ts of a diverse workforce, such as reducing employee turnover, increasing market shares, and driving economic growth. rough my role as the vice president of Diversity, Equity, Inclusion and Access Strategy at NAF, I hear rsthand how much it matters to employers. In October, we met with several of our national corporate partners about their workforce initiatives, and they all expressed a readiness

and willingness to address the gap between the high school experience and early career pipelines for students in under-invested communities.

A business presence

While it is promising to see that employers understand the importance of social capital, many still need to learn how to take action. e onus to make connections does not fall squarely on students, because many students from under-investedin communities may be unaware of the various opportunities within local industries and what is needed to gain a foothold in them. at is why it requires buy-in from business leaders. e rst step for businesses to build social capital with students is to establish a presence in the classroom. Individual conversations, where employers explain what they do and why it matters to them, are sometimes the most powerful. ey open students’ eyes to options for their future — showing them what it takes to obtain the education and experience necessary to enter a given eld, and o ering them the chance to ask questions one-on-one. And in turn, businesses receive the bene t of meeting the future talent of their industries, while students are making important decisions in high school.

We built affordable housing in the Bronx. It took nine months to fill vacant units.

In July of 2023, Services for the UnderServed (S:US), together with our development partner, opened a brand new affordable and supportive housing building in the Morrisania neighborhood of the South Bronx. e new complex is a prime example of the kind of development that New York City needs — new, modern housing that is affordable below the area median income and available to working families and those moving out of our overcrowded shelter system.

While our building opened in July, it has only recently reached close to full capacity — meaning that dozens of supportive housing and lottery-awarded a ordable units remained vacant for six months or more. is reality underscores a collection of deeper problems in the city’s housing systems that hamper the e cient allocation of subsidized housing.

Simply put, we shouldn’t let laborious bureaucracy stand in the way of solving our housing crisis.

underutilized site that had previously contained only a trash compactor unit, the new building includes 171 apartments, community and computer rooms, a wonderful outdoor play area, a community garden, a beautiful mural designed in collaboration with local NYCHA residents, and 24-hour on-site security. In addition, this development incorporated cutting edge sustainable design, construction, and operations to achieve passive house certi cation for superior energy efciency and resident comfort.

Perry Perlmutter is president and chief executive o cer of Services for the UnderServed, a nonpro t focused on providing solutions to individuals facing poverty and homelessness.

When we opened our Melrose North development, it represented a building block in a larger campaign to develop beautiful, environmentally sustainable, and deeply a ordable housing across the city. Built on an

In this development, 103 units are designated for supportive housing, which is a model that combines a ordable housing with supportive services tailored to the needs of individuals or families facing challenges such as homelessness, mental illness, substance use, or other barriers to stable housing. However, the path to accessing these units is fraught with bureaucratic challenges, involving multiple city agencies. is process is riddled with redundant paperwork and requires a litany of documentation — records that people who have lived on the street or experienced domestic violence sometimes lack. People who are already

Employers can sustain these connections, by partnering with teachers to vet curriculum and support mentoring projects relevant to their eld. Beyond introducing students to a new career path, this o ers them the chance to gain hands-on experience through work-based learning activities, as they build their networks. Students will develop future-ready skills, receive direct feedback from potential employers, and practice professional interactions — all as part of the school environment and culture. At the same time, employers will play a direct role in cultivating diverse, skilled talent by ensuring students are gaining the capabilities needed to succeed in their industry.

A rmative action was just one avenue to leveling the playing eld and creating equitable career opportunities for marginalized students and supporting a diverse workforce. Now, investing in social capital is the best way forward. Employers must deepen their presence in the classroom and directly engage with students — in doing so, they will open up pathways to opportunity for individual students, strengthen their businesses and break down fundamental societal inequities.

struggling must prove, over and over again, the extent of their troubles.

Too often, the result of that paperwork is a series of delays and frustrations, where families who nally have an opportunity to move into stable, long-term housing are stuck in the limbo of the shelter system as they gather paperwork. In some cases, we are prevented from moving families from shelters that our own organization operates — families that are known to us and already receiving care from our team — into housing that we operate.

e remaining 65 units of this development are subsidized a ordable units, open to moderate- and low-income New Yorkers through the City’s housing lottery. e lottery process is run by a platform called Housing Connect, which went through a major overhaul in 2020. Unfortunately, the underlying processes of the lottery still leads to long delays: Selected applicants are typically noti ed by email and/or mail and must then undergo a veri cation process to conrm their eligibility by providing additional documentation such as tax returns, pay stubs, and identi cation.

If an applicant is deemed ineligible at this stage, they also have the right to appeal — a process that can take additional months. In the meantime, the unit in question is required to remain empty and cannot be offered to anyone else.

e delays in bringing people to new housing are frustrating right now, but without meaningful correction, they could become debilitating. S:US has committed to bringing more than 2,000 new a ordable units online in the next ve years. Some experts believe New York is short of more than 300,000 homes.

If we are going to build real, a ordable housing at scale to ll that gap, then a process should be developed that will allow us to ll that housing at speed. While we acknowledge that city agencies have met, on an ongoing basis, with various stakeholders and advocates to try and improve these processes, a more sustained e ort is needed. We think it would help if city o cials work collaboratively with service providers and property managers to identify paperwork redundancies and streamline the approval process for supportive housing. It would also help if the lottery process to move more people into our buildings faster was streamlined. We invite city o cials to join us as partners in these e orts.

NEW YORK NEWS HOW YOU WANT IT

THE LATEST ISSUE

Just for subscribers - get exclusive digital access to our latest issue.

BREAKING NEWS

News delivered as it happens - be the first to know when big stories break.

DON’T MISS

Stay on top of the stories and special reports that should be on your radar.

MORNING 10

A carefully curated look at New York business news and insights to go with your morning coffee.

AFTERNOON 10

Our must-read daily update on New York’s top business stories to get you up to speed before you log off for the day.

REAL ESTATE DAILY

A snappy roundup of real estate scoops, analysis and deals for New York real estate enthusiasts.

Sign up for our newsletters at CrainsNewYork.com / Newsletters

5 transit projects in jeopardy from congestion pricing pause

Gov. Kathy Hochul’s decision to inde nitely postpone congestion pricing means a loss of revenue that could doom N ew Yorkers to subpar subway and commuter rail service for years. The new $1 billion annual revenue stream, plus funds borrowed against it, would help pay to replace aging and obsolete equipment so trains can run more often. Here’s a list of big-ticket projects whose future is now in limbo.

| By Aaron ElsteinSECOND AVENUE SUBWAY

THE MTA HAS POURED resources into major service expansions, such as phase two of the Second Avenue subway, which it expects to cost some $7.7 billion, according to MTA cost estimates submitted to the Federal Transportation Administration in 2022. Billions of dollars in federal funds to support the project are in jeopardy without congestion pricing revenue for the MTA to guarantee local matching funds will be in place.

The MTA has also spent $3 billion on station improvements, such as elevators and ramps, to make them more accessible.

BETTER BUS SERVICE

T HE MTA HAS ESTIMATED $4 billion would be needed for new buses. In April, state lawmakers approved $12.3 million in the new budget for improved bus service, including increased peak service on express buses into Manhattan’s core in anticipation of congestion pricing's launch.

The MTA also plans to buy more than 7,800 zero-emission buses over the next 20 years.

In May, the city gave a sneak peek of the $10 billion proposal to reimagine the Port Authority Bus Terminal into a bright, modern space with a park.

LONG ISLAND RAIL ROAD

T HE MTA HAS SPENT $700 million in recent years improving commuter stations , and another $1.1 billion has been committed. At Penn Station , all LIRR platforms are in “poor or marginal condition,” according to the N ew York State Comptroller’s Office.

SUBWAY CAR UPGRADES

MODERN SUBWAY SIGNALS

MALFUNCTIONING COMMUNICATION SYSTEMS caused 25% of major delays on subways in 2022, which isn’t all that surprising considering on some lines the signals that prevent trains from running into each other are more than 100 years old. When systems are improved, the result is noticeable: On the 7 line, signal delays fell by 60% between 2019 and 2023, and by 56% on the L. Upgraded lines run trains more frequently. Only 7% of communications systems have been modernized, but the MTA plans to spend $10 billion in the coming years on improvements, according to the state Comptroller’s Of ce. Signal upgrades on the A and C line have already been stalled due to previous congestion pricing delays.

T HE MTA ESTIMATES it will need to replace 3,900 worn-out subway cars over the next 20 years. Estimated cost: $15 billion, according to a report from the N ew York State Comptroller’s Of ce. The oldest cars in the subway system break down every 42,000 miles — the system average is 124,000 — so replacing these cars, known as R46s , would improve reliability.

In February, the MTA rolled out the rst of its sleek, new high-tech subway cars, the open-gangway R211T, on the C line in Inwood. Hochul joined MTA Chair and CEO Janno Lieber for the launch.

The new-train moment is rare. Under federal law, the MTA must turn to companies that produce railcars in the U.S. The problem is there are just two that meet the authority’s requirements: Japan-based Kawasaki and France-headquartered Alstom Ongoing supply-chain challenges from the pandemic have caused at least 17-month backups in putting new trains on the tracks. The result is an aging eet: The MTA’s 6,500 train cars are an average of 26 years old, with the oldest having entered service in 1976 — 48 years ago — when Gerald Ford was president.

Monitor to oversee trash hauler facing millions in nes

By Nick GarberThe city has appointed a monitor to oversee the work of a troubled trash hauler after Crain’s reported that the company had been accused of extensive rulebreaking shortly before winning a sought-after city contract.

e company, Cogent Waste Solutions, had been accused by a city watchdog last year of overcharging customers nearly 5,000 times and falsifying records, among other allegations — charges that could amount to some $48 million in nes if proven. Nonetheless, just weeks after those accusations were lodged by the Business Integrity Commission, the city’s Sanitation Department announced Greenpointbased Cogent as one of the 18 companies chosen to haul businesses’ trash as part of a longawaited program that will reform New York’s unruly commercial waste industry.

During a City Council hearing on June 3, Sanitation Commissioner Jessica Tisch said that Cogent will be overseen by a new independent monitor: Walter Mack, a former federal prosecutor and NYPD deputy commissioner. Mack will also monitor a second company, New York Recycling Solutions, in which Cogent has a 50% stake.

‘Record’ number of violations

e Sanitation Department decided to appoint the monitor after learning of the “record-high number of counts” led against Cogent in December, Tisch said. e 4,764 violations, which remain pending, were issued last year and stemmed from a yearlong audit by the BIC based on customer complaints.

Shaun Abreu, a Manhattan lawmaker who chairs the council’s Sanitation Committee, pressed Tisch to explain why Cogent had been chosen to help spearhead the new commercial waste program, given that each applicant was supposed to be evaluated for its “history of compliance” with the law. Tisch, in response, said the counts against Cogent had to be weighed against more than a dozen other factors — such as the hauler’s technical plans and ability to charge reasonable fees to the businesses it will serve.

“We have no indication at this time that Cogent will not continue to be able to operate,” Tisch said, addressing what would happen if the fines are upheld.

She added that Cogent and New York Recycling Solutions will bear the cost of the monitor.

The June 3 hearing focused on the upcoming reforms that will

divide the city into 20 commercial waste zones, each assigned to a specific list of private carting companies. The reforms stem from a 2019 law that aimed to tame New York City’s chaotic

bon emissions. e rst zone will launch this fall in Central Queens, with the remaining zones to follow at some point after. Cogent Waste Solutions will haul trash in three Brooklyn zones and one in Staten Island.

Cogent Waste Solutions had been accused by a city watchdog last year of overcharging customers nearly 5,000 times and falsifying records, among other allegations.

current system, in which dozens of companies speed around the five boroughs in a race to serve 100,000 businesses — resulting in unsafe driving, rampant crashes and excessive car-

aimed to stem corruption and violence — and stop haulers from overcharging customers for the waste they picked up, as was once common, by setting maximum rates for pickups by volume and weight.

Liz Crotty, the commissioner of BIC, testi ed on June 3 that Cogent had “put themselves under our lens” through its alleged misconduct. But Abreu was unsatised with how little Crotty was willing to say about the still-open case.

“It’s hard for me to come away with this that BIC is taking this seriously, given the history of violations here,” he said.

The complaint document against Cogent, obtained by Crain’s , accused the company of overcharging customers in 4,764 instances from March 2020 through December 2022, adding up to $193,000. Cogent was accused of improperly charging credit card fees, asking for rates that exceeded the amount of waste collected, and simply charging more than the maximum allowed rate.

When Crain’s rst reported on the case against Cogent in February, a Sanitation spokesman pointed to the department’s authority to appoint a monitor, although nothing was announced at the time. e rules of the waste zone program also allow Sanitation to terminate any hauler’s contract if its employees are implicated in criminal o enses or if BIC revokes its license.

David Vermillion, a spokesman retained by Cogent, said in a statement on June 3 that the company “will work proactively with the city-appointed monitor to meet our collective goals: keeping the city's streets clean and safe.”

“Cogent was awarded this contract through a thoughtful, competitive review process and we are dedicated to providing safe and reliable service with integrity,” he said.

Vermillion defended Cogent’s practices, calling it “an innovative New York company born and raised in Brooklyn that provides meaningful employment to over two hundred unionized New Yorkers.”

“We maintain the most rigorous safety standards in the industry, using new equipment operated by quali ed union employees under the supervision of highly-trained, certi ed safety professionals and 24-hour video and GPS surveillance,” he said.

Stemming corruption

BIC, which lodged the complaints against Cogent, was created in the 1990s to root out organized crime from the commercial waste industry and wholesale markets. By keeping tabs on the formerly mobcontrolled waste industry, BIC

David Biderman, a waste management consultant, in February called the extent of the violations “highly unusual.”

e case must still go before the city’s O ce of Administrative Trials and Hearings, and BIC could end up settling with Cogent for less than the $48 million that the charges would add up to. Vermillion, the Cogent spokesman, previously told Crain’s that the company “takes this matter seriously” and expected to resolve the charges.

Even before the latest allegations, Cogent had paid the city more than $500,000 in nes — the most ever paid by a private carter. Most of that cost came from one settlement paid out in April 2023, which was not detailed in city records.

e commercial waste zone program, supposed to be implemented by 2021, has been delayed as the Sanitation Department worked to avoid imposing onerous new costs on small businesses being served by new haulers. Tisch testi ed on June 3 that the timeline imposed by the 2019 law had been unrealistic to begin with.

She added that the Sanitation Department is proud of the price structures it has secured through its contracts with the 18 haulers, with multiple haulers pledging to charge less than the maximum allowed by BIC.

Antonio Reynoso, the Brooklyn borough president who helped design the commercial waste reforms as a city councilman, argued at the June 3 hearing that the Sanitation Department is giving too much weight to pricing compared to other goals of the 2019 law.

“After hearing testimony from DSNY today, it seems to have been a price reduction legislation more so than a worker safety and environmental justice one,” he said.

Massive lease extension by Bloomberg at 731 Lexington buoyed the of ce market in Manhattan last month

By Eddie SmallManhattan’s o ce market enjoyed a fairly strong May thanks in large part to Bloomberg’s extension of its sprawling lease at 731 Lexington Ave.

Companies leased just under 3 million square feet of o ce space in Manhattan overall in May, up 8.4% from April and more than 70% year over year, according to the latest data from Colliers. Roughly one-third of that activity was due to Bloomberg’s roughly 947,000-square-foot lease extension at 731 Lexington Ave., the largest lease in the borough since 2019.

“Naturally, that deal is going to move the needle and have a very big impact on overall leasing volume, but that is always the case in the Manhattan o ce market,” Colliers Executive Managing Director Frank Wallach said. “ e foundation of the Manhattan ofce market has been and continues to be driven by the tenants under 25,000 square feet.”

Demand for o ce space in May was higher than the ve-year rolling average for the month but still lower than the 2019 monthly average, before the pandemic hit.

e borough’s availability rate was 17.9%, down slightly month over month but up slightly year over year, while the average asking rent was $74.59 per square foot, up compared to April but down compared to May of last year. Available o ce space has grown by 79.2% since March 2020, to about 96.5 million square feet, according to the report.

Leasing activity grew

Leasing activity in Midtown grew to almost 2 million square feet, up more than 75% compared to April and higher than the monthly 2019 average. e Bloomberg lease played a major role in this surge, as did Bain & Co.’s taking of about 235,000 square feet at 22 Vanderbilt Ave.

But Midtown’s availability rate actually grew slightly, to 16.2%, thanks in part to large blocks of space hitting the market at 1221 Sixth Ave. and 125 W. 57th St. Its average asking rent rose slightly month over month and stayed at year over year at $78.61 per square foot.

Midtown South saw about 860,000 square feet of leases, down 40% from April but more

than double the total from May 2023, the report says. e largest deal for the neighborhood was law rm Herrick Feinstein’s renewal of about 77,000 square feet at 2 Park Ave., where it is relocating within the building. e neighborhood’s availability rate rose to 18.7%, and the average asking rent was $81.11 per square foot, up month over month but down year over year.

Downtown, rms leased about 150,000 square feet, a signi cant drop month over month and year over year. e neighborhood’s largest deal was Kroll’s subleasing of 48,000 square feet at 1 World Trade Center. Its availability rate did drop to 20.4%, the lowest it has been since February 2023, but its average asking rent fell to $57.04 per square foot, the lowest it has been since 2015, according to Colliers.

Congestion pricing delay puts MTA’s credit rating at risk

By Aaron ElsteinGov. Kathy Hochul’s decision to pull the plug on congestion pricing damages the MTA’s chances for a credit upgrade, S&P Global said, which could force the agency to pay more as it borrows for critical improvements.

“ is development adds to the uncertainty regarding where the MTA’s post-pandemic ridership will ultimately settle,” the ratings agency said in a client note June 7,

from annual negotiations in Albany.

In March, after Fitch Ratings upgraded the MTA’s credit rating to AA, its highest ever, the transit agency issued a celebratory press release in which CEO and Chairman Janno Lieber said the move re ected growing con dence in the agency’s nancial strength and would bring “tangible benets when we look to nance critical transit projects.” MTA’s nance chief, Kevin Willens, added that a higher rating could lower borrowing costs and reduce the cost of nancing transit projects, resulting in “actual savings.”

[The MTA] must deprioritize accessible subway stations, modern signals, electric buses and other upgrades in the wake of the governor’s move.

“and could potentially constrain the MTA [credit] rating.”

Moody’s described the loss of congestion pricing as “credit negative” for the MTA in a report June 7.

High credit ratings are vital to the Metropolitan Transportation Authority, which carries $42 billion in debt and pays $3 billion a year to service those obligations, equal to 15% of its operating budget. Congestion pricing would have created a recurring revenue stream of the sort valued highly by investors because it would have shielded a slug of the MTA budget

S&P’s endorsement would have been especially helpful. Its opinions are given great weight by institutional investors and would have supported the rst-mover Fitch, which said congestion pricing was a key reason for its upgrade. Fitch director Tammy Gammerman told Crain’s this month she wasn’t optimistic that lawmakers can nd a way to replace congestion funding given how long it took to get it approved in the rst place.

“To try to gure out something long term and sustainable in just a few days doesn’t feel very likely,” she said.

Yet Fitch senior director Michael Rinaldi told Crain’s it was

premature to cut the transit agency’s AA rating.

Additional uncertainty

In March S&P said it also would consider raising the A- rating for MTA bonds backed by farebox revenue and would base its decision in part on congestion pricing and ridership. In its note June 7, it said that an MTA upgrade hinges on “if we believe it can sustain nancial metrics consistent with a higher rating.”

at belief is looking i y after Hochul’s bombshell this month, S&P acknowledged. e outcome could be higher costs, paid for by passengers and their employers, when the MTA looks to nance transit projects.

“Although we believe the MTA’s operations are a key priority of the state, the nature and level of state support to replace congestion pricing, if delayed, introduce additional uncertainty to the outlook

for the authority,” S&P said. e MTA has not yet sold bonds against the $1 billion in recurring revenue it was expecting from congestion pricing to raise an expected $15 billion for capital improvements and said it must deprioritize accessible subway stations, modern signals, electric buses and other upgrades in the wake of the governor’s move. S&P’s comments concerned the transit agency’s $10 billion in bonds already issued.

What to know about New York’s of ce-to-residential conversion tax incentive in this year’s state budget

Eddie SmallO ce-to-residential conversions have been a popular idea for how to simultaneously deal with the city’s housing shortage and its o ce surplus since the pandemic hit, and a tax incentive included in this year’s state budget aims to turn them into a reality.

e Adams administration ocially kicked o its implementation of the program June 7, launching a portal on the Department of Housing Preservation and Development’s website with detailed information about how the incentive will work. e agency expects to start accepting applications for it later this year.

Here are the key things to know about the incentive.

Timeline

Work on all eligible conversions must have started no earlier than 2023 and no later than July 2031. e projects must be nished by Dec. 31, 2039. e tax bene t will last 35 years for projects where work starts before July 2026, 30 years for projects where work starts before July 2028 and 25 years for projects where work starts before July 2031.

Affordability

Eligible projects must make 25% of their residential units permanently a ordable to households earning no more than 100% of the area median income, or about $140,000 for a family of three. At least 5% of the a

must include a minimum of six residential units to be eligible for the program. At least half of the a ordable apartments must be two-bedroom units or larger, and no more than 25% of

Of ce-to-residential conversions have been a popular idea for how to simultaneously deal with the city’s housing shortage and its of ce surplus.

them can be studios. Alternately, the sizes of the a ordable units must be proportional to the sizes of the market-rate units.

Geography

Conversions can happen anywhere in the city, although the tax bene ts will be greater for those in the Manhattan prime development area, which is any tax lot in the borough below 96th Street. Projects within that area will receive a 90% tax exemption for the rst 20 to 30 years of the program, depending on when the project starts. is will decline by 10% per year for the nal ve years, ending at a 40% exemption. At projects outside of the Manhattan prime development area, the tax break will start at 65% and then go down to 10% by the nal year.

Popular East Village dive bar to reopen under new ownership

Julianne CubaA hospitality group based in Little Italy that’s known for a handful of nightlife hotspots around the city is taking over a now-shuttered East Village watering hole with plans to reopen the space and bring it back to its original character.

Golden Age Hospitality, founded by Jon Neidich in 2012, has signed a lease at 135 Ave. A, formerly home of the popular dive

The bar likely still will be called Lucy’s and is expected to reopen in the fall.

bar Lucy’s, with Gowanus-based property investment rm Ryco Capital, which purchased the property for $19.1 million late last year.

e acquisition vexed some locals and longtime Lucy’s stalwarts

when news spread that Ryco was planning to evict the bar, which originally opened under the name Blanche’s Tavern in the 1980s. It soon after became known as Lucy’s for Ludwika “Lucy” Mickevicius, its beloved bartender.

Keeping the spirit

Operations at the Avenue A staple may be getting a shakeup, but Lucy herself is staying put, said Ed Robertson, director of asset management at Ryco. He praised Golden Age Hospitality’s record of success operating bars in Manhattan and said the company is “really pleased we found a long term way to keep the spirit of Lucy’s bar alive.”

The bar likely still will be called Lucy’s and is expected to reopen in the fall, said Robertson. He declined to say for how long the firm’s lease is with Golden Age or for how much per square foot.

Golden Age, which is known for trendy spots such as Le Dive on the Lower East Side, and Acme

and e Nines in NoHo, declined to provide more details about its plans for the space, but a liquor license application the hospitality group led with the state in April, which was rst reported by Eater, indicates the well-known name is staying the same.

Ryco bought the 5-story, mixeduse building, with the roughly 1,200-square-foot bar on the ground oor and apartments

above it, under the limited liability company West Lake 135-139 Ave.

A, according to Robertson and the deed. Robertson declined to say what else Ryco has in store for the building, between St. Marks Place and East Ninth Street, but permits led with the Department of Buildings last month so far only show renovation work slated for the residential units.

Ryco, which according to its

website manages $310 million in assets and operates 30 properties, including 270 residential units, 28 retail units and 800,000 square feet of o ce space across New York, recently scooped up a mixed-use parcel in Williamsburg — a 3-story building at 168 Wythe Ave. — for $10.2 million from Chicago-based private equity rm L3 Capital, Crain’s reported this month.

Co-living provider Outpost takes over several Common Living sites

C. J. HughesNew Jersey-based co-living rm Outpost Club has snapped up a chunk of properties from failed rival Common Living, the latest example of consolidation in the once-crowded co-living industry.

After negotiations with the landlords that played out over the past few months, Outpost is in control of seven sites across New York that used to belong to Midtown-based Common, once the country’s largest provider but one whose debts became unsustainable and that is now seeking to sell o its assets after ling for chapter 7 bankruptcy protection.

And the eight-year-old Outpost is jockeying to grab an additional 10 Common sites by way of the liquidation process, which is now working its way through a federal Delaware bankruptcy court, an Outpost spokesman said.

Ultimately, Outpost looks to take over more than 60% of Common’s city portfolio, “dorms for adults” rental properties where unrelated tenants lease individual bedrooms and share an apartment’s common areas while re-

ceiving housekeeping and other services for below-market rents.

It’s not the rst time that Outpost, whose CEO, Sergii Starostin, emigrated from Ukraine and lived with random roommates in his rst New York homes, has grown through mergers. In 2019 Outpost picked up apartment buildings once controlled by failed provider Bedly, for instance.

Manages buildings

Like Common, Outpost is not a property owner but manages buildings on behalf of landlords while providing furniture, housekeeping and security as well as utilities such as Wi-Fi for additional fees.

But Common got into trouble by outsourcing too many of those functions under a “growth at all costs” business model fueled by more than $100 million in venture capital funding, according to a statement from Outpost.

Common, which could not be reached for comment, has up to $10 million in assets but as much as $50 million in liabilities, according to a court ling. Critics also hammered the company in

Hochul names interim leaders for cannabis regulatory agency

By John Schroyer, Green Market ReportNew York Gov. Kathy Hochul on Monday announced a trio of new appointments to lead the state Ofce of Cannabis Management following the resignation of former Executive Director Chris Alexander, whose last day on the job was June 7.

Taking over for Alexander will be Felicia Reid, whom Hochul named as executive deputy director and acting executive director for the OCM. Reid will oversee the primary functions of the o ce, including business licensing, regulatory compliance, and enforcement, according to a press release from Hochul’s o ce.

communications director Jessica Woolford to the post of director of external a airs to “ensure that communication and community engagement are prioritized.”

recent years with complaints about a lack of cleanliness at some properties and insu cient security.

Outpost, in contrast, “maintains in-house control over these critical areas, enabling them to manage expenses e ectively,” the company’s statement said.

e seven properties once controlled by Common but whose owners now have contracts with Outpost are located in Manhattan, Queens and Brooklyn and contain about 350 units total.

Included on the list are a handful of sites in the BedfordStuyvesant neighborhood, such as 355 Tompkins Ave., a 4-story offering that’s owned by Edmund Soleymani, who purchased the prewar site in 2019 for $2.6 million, according to the city register. Rooms there rent for $1,500 a month and up, according to Outpost’s site.

Nearby is 151 Tompkins Ave., a similar-size property owned by Alberto Benamu, who acquired it in 2016 for $2.5 million. Benamu also owns the Common-turnedOutpost apartment building at 1287 Madison St. in Bushwick, which he bought for $2.02 million in 2016, records show.

e Manhattan o ering in the group is ve-story Harlem property 125 W. 138th St., which Albert Dweck purchased in 2020 for $6.3 million, according to the register.

As for the other 10 Common sites that Outpost seeks to put under its wing, the company said it could not comment on speci c addresses while the receivership process plays out.

Landlords who switch to a co-living model can reap returns that are up to 30% higher than with typical apartment buildings, which often have a one-familyper-unit arrangement, according to Outpost, which reports $25 million in annual revenue.

But the sector, bu eted by the pandemic and sti competition, has been beset by closures in recent years, including that of StarCity, Quarters and the Collective.

Reid is a career bureaucrat who has worked in New York state government for more than a decade. She comes to the OCM from the state O ce of Children and Family Services, where she worked for six years, including the last three as deputy commissioner.

Reid’s appointment is only temporary, however, as Hochul’s Appointments O ce is also launch-

“I’m committed to ensuring New York’s nation-leading cannabis market continues to thrive,” Hochul said. “With these new appointees, the O ce of Cannabis Management will continue to focus on expanding the most equitable adult-use market in the nation while cracking down on illicit storefronts.”

“I’m committed to ensuring New York’s nation-leading cannabis market continues to thrive.”

Gov Kathy Hochul

ing a nationwide search for a permanent replacement for Alexander. e full-time replacement will have to be con rmed by the state Senate.

“Cannabis is an enormous opportunity for our state, and OCM is obligated to ensure that its work makes those opportunities accessible, transparent, and responsive to the industry’s movement and trends,” Reid said in the announcement.

Hochul also appointed Susan Filburn to act as chief administrative o cer at OCM, with the job of “stabilizing and formalizing administrative functions of the agency,” and promoted former

e appointments come one day before the next Cannabis Control Board meeting and exactly a month after Hochul released a scathing state audit regarding New York’s recreational marijuana market rollout, during a press conference at which she also announced Alexander would not be reappointed to lead the OCM. Alexander then resigned a few weeks later. Damien Cornwell, the president of the Cannabis Association of New York, hailed the move by Hochul for “moving quickly” but pointedly noted the agency’s lack of a plan of action for enacting reforms suggested in an audit last month by the O ce of General Services.

“ e OCM has been under investigation since March at the Governor’s request, we are now one month removed from the ndings of the OGS report, and we’re still without a plan developed with stakeholder input, making us worry that appointing new leadership could simply result in shu ing chairs on the Titanic without preventing it from sinking,” Cornwell said in an emailed statement.

city. ose names are expected to be made public this fall.

Separately, Steve Cohen is part of a group of investors that recently agreed to inject $3 billion in an entity controlled by the PGA Tour that will give some players an equity stake.

It remains unclear, however, just how popular the league will be. e Woods and McIlroy buy-in certainly helps, as does having a primetime window on a major sports network. But golf’s TV ratings are generally on the decline, and although many Americans picked up playing the sport in the years since the pandemic began, fandom at the professional level has yet to follow.

Even public simulator golf facilities paint a blurry picture of what’s to come. Some companies have signaled that interest in the pandemic-fueled trend is cooling. Topgolf Callaway Brands, for example, reported mixed results for the rst quarter of 2024 after cutting its pro t forecast late last year. Other simulator brands continue to expand. at includes Five Iron Golf, which received a $20 million investment in March from restaurateur Danny Meyer.

Despite the untested water, Cohen Private Ventures and TGL are projecting con dence ahead of the January launch.

“ ere are some thousands and

thousands of avid golfers in New York,” Andrew Cohen said, “and I think it’s exciting to have a team to root for and have some brand identity with a golf club.”

Star power

Each TGL team is made up of four PGA Tour golfers. New York’s inaugural club consists of profes-

sional players Rickie Fowler, Xander Schau ele, Matt Fitzpatrick and Cameron Young, a Westchester native.

e New York team will tee o against squads representing Atlanta, Boston, Los Angeles, the Bay Area and Jupiter, Florida. e league’s star players include Justin omas, Collin Morikawa, Justin Rose and Max Homa.

“New York is the media capital of the world and a global sports hub,” McCarley said in a statement to Crain’s. “Having a TGL team in New York was always a priority and goal for the rst year of TGL. Steve Cohen and Cohen Private Ventures’ ability and willingness to operate, promote and market this team to New York fans is signi cant as we build toward our

News | Analysis | Events

launch in January.”

Maybe the notoriously sport-fanatic masses of New York will buy into the New York Golf Club. Or perhaps TGL matches on ESPN will become akin to the low-rated late-night poker games keeping TV screens at city bars busy when there’s no bigger game on. But come January, the local club will have at least one native pulling for the team: Young, the sole New Yorker on the squad.

“Growing up in New York, I have always been a big fan of New York sports teams,” he said in a statement. “Given that golf has traditionally been an individual sport, I never anticipated the opportunity to represent my home state in a team setting.”

He is bullish on the potential for buy-in too. “I’ve experienced the technology,” Young said, “and fans are going to be blown away by this new form of golf.”

Kimball, CEO of the New York City Economic Development Corp., said in a statement.

As a result, the wealth of studio space, in addition to the city’s iconic skyline and the state’s generous lm tax credit, is turning the Big Apple into Hollywood East, even as the industry may face headwinds from the lingering impact of the recent writers and actors strikes and a potential decline in content demand from the major streaming platforms.

Flipping the script

Formerly relegated to relative backwaters like Long Island City back when it was still industrial, the newer studio wave has few geographic boundaries.

Sunset Pier 94, for instance, a public-private partnership involving Vornado Realty Trust, Blackstone and Hudson Paci c Properties, is set to open next year along the Hudson River waterfront near West 54th Street.