INSIDE:

Q&A

SL Green CEO

Marc Holliday on why his Times Square casino bid will win in the end.

PAGE 31

Q&A

SL Green CEO

Marc Holliday on why his Times Square casino bid will win in the end.

PAGE 31

By Aaron Elstein

You can see Manhattan from bottom to top from the observation deck of SL Green Realty’s 73-story 1 Vanderbilt Ave. at East 42nd Street, but the latest target for leaders of the real estate investment trust is just 10 blocks north. ere lies the Seagram Building on Park Avenue, the rst skyscraper built with oor-to-ceiling windows, a handsome, 30-story, 1958 building with some bigname tenants but roughly $1 billion in debt that owner RFR Realty may have trouble re nancing when the loan comes due next May.

SL Green hears the sound of opportunity knocking. It has become Manhattan’s largest o ce landlord in part by snagging top-shelf properties from tapped-out own-

The number of buildings SL Green has assembled in its portfolio after 44 years of near-constant buying and selling of buildings

ers, most recently when it seized control of 245 Park Ave. in bankruptcy court two years ago. At a dinner last month at e Summit, the restaurant and observatory at the pinnacle of 1 Vanderbilt, SL Green o cials told institutional investors they’re now eyeing the Seagram.

“ ey just used it as an example of a building with looming loan maturities that they’d target,” said Alexander Goldfarb, a real estate industry analyst at Piper Sandler who hosted the dinner. “ e point is, here is the type of building they’re thinking about.”

SL Green’s chief executive, Marc Holliday, in an interview said : “We’re always interested in investing in those

See SL GREEN on Page 30

By Amanda D’Ambrosio and Amanda Glodowski

This startup is on a mission to automate the detection of deepfakes.

PAGE 3

e state Health Department has approved Beth Israel’s closure plan with some conditions. e state says Mount Sinai must operate a new urgent care center near the site of the Lower East Side hospital for at least three months and develop an agreement with NYC Health + Hospitals to invest in an expansion of Bellevue Hospital’s emergency room and psychiatric emergency department, according to Erin Clary, a spokeswoman for the Health Department. e health system had pushed to close Beth Israel for the last 10 months because of nancial challenges it said were too vast to overcome. e hospital reportedly had faced cash ow de cits that left it with just $29 million in cash reserves by the end of 2023. e hospital has been losing $18 million per month, according to the submitted closure plan. e state approval comes shortly after Mount Sinai was forced to keep Beth Israel open past its July 12 deadline, awaiting the green light. e hospital still faces an ongoing lawsuit from community members blocking the closure that must play out in court.

Mount Sinai has now asked the state court for an expedited review of that suit so it can o cially close Beth Israel, said Loren Riegelhaupt, an outside communications specialist who represents the health system. A new closure date has not been set.

2024

Crain’s spotlights 79 trailblazers. PAGE 11

By Nick Garber

Mayor Eric Adams and Council Speaker Adrienne Adams have maintained a publicly cordial relationship even as they battled over budget cuts and butted heads on legislation. But that decorum could dissolve in the coming months, as lawmakers prepare to campaign against a set of questions the mayor is putting before voters in November that could rewrite the city’s governing document to curb the City Council’s power.

“It is a dangerous attempt to shift power away from the people represented by the City Council to one single individual,” Speaker Adams said during a rally on July 25, outside the Brooklyn Public Library’s central branch. “Do you want a king?”

a ect public safety, and tightening rules about how the council studies the scal impact of new laws.

Speaker Adams described the charter commission’s ballot measures as an “attack on democracy,” a claim that was echoed by the other politicians and progressive groups that spoke out against the charter rewrite. e allusion to former President Donald Trump was intentional.

A City Council sta er who spoke on the condition of anonymity argued that the mayor had “laid the groundwork for people to compare him to Trump.” (City Hall declined to comment on the provocative comparisons, and skeptics will note that none of the proposed revisions would radically change how the council does its work.)

“It is a dangerous attempt to shift power away from the people represented by the City Council to one single individual.”

She made the remarks minutes before the mayor’s handpicked 13-member Charter Revision Commission met inside to approve the proposed changes, which mirror Mayor Adams’ own grievances against the City Council by slowing the legislative process when it considers bills that

The industries that drive New York — and the city itself — are at a major crossroads. What kind of city do we want to be? How will business drive the future of housing, work, health care, climate change, technology, arts and transportation in the Big Apple? Crain’s New York Business and the Partnership for New York City will dive deep into the innovations, challenges and pivotal developments that will inspire the city’s reinvention over the next 50 years.

Council members were clearly conscious of the charter revisions’ unusual placement on a presidential election-year ballot — a change from the most recent City Charter changes in 2019, which took place during a lower-turnout, oddnumbered election years and passed easily. ose 2019 amendments all passed with about threequarters of the vote, including a measure that instituted ranked-choice voting. is year, the presidential turnout will alter the landscape.

Adams kickstarted this year’s fast-moving e ort just two months ago, in what lawmakers saw as a clear maneuver to block the City Council from adding its own No-

vember ballot measure, which would increase its oversight of mayoral appointments.

To persuade New Yorkers to reject the proposals, however, council leaders and their allies may need to mount a paid campaign.

Details of the potential opposition campaign remained unclear on July 25. But Gale Brewer, a veteran Manhattan City Councilwoman, predicted that “the money will come.”

“And I think we can do it in a very short time period,” Brewer added. (Any campaign could not be paid for by the City Council itself, since it would amount to illegal electioneering; instead, it would need to be funded by outside groups or through elected of-

cials’ campaign accounts.)

In a last-minute twist on July 25, the Charter Revision Commission revealed right before its meeting that it had removed a few of the more controversial measures announced earlier in the week. A proposal forcing the council to wait about three months before voting on bills that a ect the NYPD, Fire Department or Corrections Department has been shortened to require just a 30-day window. It no longer tasks those departments with ling their own “public safety impact statements” on proposed laws.

Carlo Scissura, the commission’s chair and head of the New York Building Congress, said July 25 that the changes came in re-

sponse to feedback from the public “and others” in the short time since the proposals were released on July 23.

But the City Council showed no immediate signs of being mollied by the changes. Mayor Adams, who has consistently defended the charter rewrite as a sincere e ort at improving government responsiveness, praised the nal ballot measures as “thoughtful.”

Besides the contested items that a ect the City Council, the commission also approved a few less controversial questions that would clarify the Sanitation Department’s street-cleaning authority, enshrine a new City Hall position focused on boosting minorityand women-owned businesses, ease permitting for lm shoots and tweak how the city plans for costly capital projects.

Dominated by friends and allies of the mayor, the Charter Revision Commission held a dozen public hearings — many of which were sparsely attended. Although the mayor has come under re from legislators, he got nothing but praise on July 25 from members of the commission he convened.

“I want to take the time and thank a man that really cares about the city, our very own Mayor Eric Adams,” commissioner Jackie Rowe-Adams, an anti-gun violence advocate, said at the start of the meeting. “He heard the voice of the people.”

By Eddie Small

A Manhattan-based developer appears to have new plans in mind for the site of a nearly 100-year-old rent-regulated building on the Upper West Side.

ABS Partners Real Estate recently led plans with the Department of Buildings to demolish 2560 Broadway, a multifamily property located by the West 96th Street subway stop for the 1, 2 and 3 lines. e building spans about 53,000 square feet and stands 7 stories and 74 feet tall with 27 residential units, two of which are still occupied, according to the ling. It was not immediately clear as of press time what will become of the parcel once the building is torn down.

The Ancott

Known as e Ancott, the property was built in 1925, according to commercial real estate database CoStar. It includes about 7,500 square feet of retail space in addition to the residential units, CoStar says.

e building includes rentregulated apartments, according to the demolition ling, but many

seem to have gone for market-rate prices in recent years, according to StreetEasy. A three-bedroom unit went for about $6,000 per month in October 2020, for instance, while a two-bedroom unit was $4,000 in May 2021, the site says.

e building is part of developer

ABS Partners’ expansive portfolio, which includes 102 properties across 11 states spanning more than 14 million square feet overall, according to its website. Its other Manhattan buildings include 200 Park Ave. South at Union Square, where the rm itself is headquar-

tered; 270 Madison Ave. in Midtown, where it recently inked a deal to lease space to the New York Public Library; and the boutique o ce building at 145 E. 57th St.

A representative for ABS declined to comment on the company’s plans for 2560 Broadway.

Four years ago, Ben Colman, Ali Shahriyari, and Gaurav Bharaj received research grants to investigate how deepfakes and generative arti cial intelligence could a ect the presidential election.

“We were certainly correct about the problem. We were incorrect in the timing,” said Colman. “While the technology existed, the methods to use the technology did not yet exist at a level that was easy enough and cheap enough. at’s changed over the last 24 months in a dramatic way.”

ere are now thousands of apps and websites that allow people without any technical skills to create “synthetic content” and broadcast it to the world for little to no money. Colman, Shahriyari, and Bharaj founded Reality Defender in 2021 to combat the prevalence of deepfakes by creating a platform to verify content created by generative AI.

Weinberg, founder of ex/ante, an early-stage venture fund that backed Reality Defender in 2021.

The reigning Goliath: Meta

Reality Defender’s software can detect a variety of deepfakes across audio, video, image, and text les. Clients use Reality Defender’s web application to drag and drop les and pay to verify individual les, or they can pay for the API and pre-purchase a certain number of scans. e API is priced between $100,000 and $1 million a year. Businesses in particular are at risk of being defrauded by bad actors using AI for voice-cloning or identity theft, for example.

e company has raised just over $22 million over three funding rounds and has over $1 million in annual revenue. Clients have included Comcast and Microsoft, and its technology has been used in broadcast newsrooms, bank call centers, humanitarian organizations and governments around the world.

“ ey were very early at recognizing that this would be a meaningful threat both to democracy and society writ large as well as a key challenge for enterprises as we enter an age in which generative AI is increasingly globalized,” said Zoe

is spring, Meta announced it would begin labeling content made or altered with AI. e decision follows Meta’s Oversight Board’s recommendations to update its review policy as AI-generated content sweeps the internet.

Meta will not automatically detect the software and instead give users the choice to label their content as “Made with AI” themselves. However, the announcement noted that moderators will add the label if they detect the use of AI.

Colman, Shahriyari, and Bharaj were so early to the world of deepfakes and generative AI that it made fundraising an uphill battle when they started to pitch venture capital rms in late 2020. Colman described being repeatedly told that deepfakes would not be a problem.

“It wasn’t di cult. It was impossible. It was like we were trying to sell, I don’t know, we’re going to go mine gold on Mars,” he recounted. But Colman and his team insisted that this would be an issue that companies and governments needed to get ahead of. “We were really, really con dent that if bad actors can do something with new technology, they will.” ey eventually found support from a couple of investors, participated in incubators like Y Combinator and the FinTech Innovation Lab, and were selected to attend events and conferences like TechCrunch Disrupt and the RSA Conference (“Like the Oscars” for the cybersecurity world, according to Colman.) At the same time, Reality Defender carried out paid and unpaid pilots with companies, government and humanitarian organizations, and journalists.

“In the early days, there was just not a sophisticated un-

derstanding of how this could be a market,” said Weinberg. “What Ben has done a really good job of, over the years, is helping people to see that this is a cybersecurity problem and can be a fraud issue.”

Eventually, as platforms like OpenAI and ChatGPT became ubiquitous, Reality Defender’s technology found a market.

“Fast forward to today. We’re no longer begging and pleading to attend conferences. We’re now being invited to speak at them,” Colman said.

In April 2024, Colman testi ed in front of the Senate Judiciary Committee in support of more robust regulation and legislation to curb the threat of generative AI. “Within cybersecurity, AI is changing everything,” he said. “Both from the traditional cybersecurity tools and services, but also creating a whole new vector for risk.”

Colman now nds himself spending a lot of time in Washington, D.C., advocating for policies that would indicate that something is AI-generated or manipulated, all while acknowledging that the most comprehensive solution would necessitate checking in real-time—comparing Reality Defender’s tools to a metal detector.

In Colman’s view, the current push for more content moderators that can watermark or add notes to indicate media is AI-generated is short-sighted and could end up deceiving more people versus helping the general public.

“My father will forward me something that is, in his view, obviously real because it’s been community-noted,” he explains.

“Even the things that look real can be fake. Because while our team of 40 is two-thirds Ph.D. researchers and engineers, in the last six months, to their trained eye, they cannot know the di erence,” he added. “Which means that my father just doesn’t stand a chance.”

Olivia Bensimon is a freelance journalist in New York City who reports on human-centered stories.

University Place is becoming like the Meatpacking District as historic businesses fade away

Alongtime hub for Regency armchairs, Chippendale chests and Louis XV-style tables may be on its last legs.

Earlier this month a developer acquired the Greenwich Village building that for nearly a century housed Charles Cheri Galleries with plans to convert the 7-story site into housing. e move has in turn helped shrink the antiques district around University Place, which teemed with about two dozen shops in the 1970s but is down to just a handful today.

“It’s sad, because it’s the place where our family has been since the 1930s,” Alan Wachman said of his four-generation family business. “ is was home.”

Wachman likely exited with his head held high. His prewar building, located at 84 University Place near East 11th Street, sold for $11.3 million, a solid haul when considering his family paid around $500,000 for the 14,900-square-foot commercial structure in 1981, or the equivalent of $1.8 million today when adjusting for in ation. And Charles Cheri , which specializes in French furniture that glimmers with gold-leaf detailing, did not call it quits but rather moved to Long Island City.

Renting 19th-century chairs to period dramas like HBO’s “ e Gilded Age” has been a bright spot for the company. But “people’s tastes have changed,” said Wachman, who works with his brother Stephen and son Jonathan. “ ey’re not entertaining at home and not willing to buy special pieces.”

In a sense, Charles Cheri may have overstayed its welcome in the district, which once stretched from about East 10th to East 13th streets and University Place to Fourth Avenue. Indeed, for years now expensive condos, trendy chain restaurants and upscale boutiques have been creeping into the neighborhood, much of which is not considered an historic district, which might have checked development.

And it perhaps should not come as a surprise. Several other neighborhoods once associated with a single industry—Chelsea’s ower district, the Garment District and especially the Meatpacking District—have few traces left of their historic selves.

Some antiques shops do hang on by University. Survivors include Seidenberg Antiques at 36 E. 12th St. and Hyde Park Antiques at 836 Broadway, though the latter isn’t long for that location. e Karr family, which has owned the store’s 6-story building since the 1980s, unloaded it in 2021 to developer ZG Capital for $39.3 million, according to the city register, and ever since has leased its space there as a tenant.

And ZG, which is renovating the landmark o ce building, has not extended the store’s lease past next year.

One of the most beloved (and only) bowling alleys in Manhattan for years, Bowlmor Lanes rumbled at this site from 1938 to 2014. Then-Vice President Richard Nixon hurled balls there in 1958. After it shuttered, owner William Macklowe Co., headed by longtime developer William Macklowe’s son Billy Macklowe, demolished the site and its sidewalk stores to put up a 22-story, block-long condo and retail complex. Billy Macklowe, who partnered with Goldman Sachs on the project, earned $304 million from sales of the building’s 52 homes, which are mostly 1- to 4-bedroom units, according to the condo’s offering plan. Closings began in 2019, though the retail spaces, which line a wide podium under the tower that uses the address 110 University Place, took longer to ll. Tenants in them today include a wine bar from the Sera na restaurant group that opened in the fall. Tom Shannon, who bought Bowlmor in 1997 but had to exit when the site sold, has since become a bowling mogul, buying other alleys like the Lucky Strike line in 2023. His Bowlero Corp. today owns 12,000 lanes across the country.

Although this 3-story plain-fronted building may look unassuming, it played a starring role in the area’s bohemian history. It contained the studio of photographer Arthur Swoger, known for his portraits of the poets and abstract expressionist painters who imbibed at Cedar Tavern, a nexus of the downtown art world when it was at University and East Ninth Street, according to historical accounts. (The bar’s building later came down to make way for the massive Brevoort East apartment complex.) Swoger’s subjects included painters Willem de Kooning and Joan Mitchell and poet Frank O’Hara, sometimes drinking, sometimes in their studios. No. 90 has had the same owners for decades, records indicate, and they seem to include members of the Erlitz family. But the building’s retail spaces turned over frequently and have included a housewares store, jazz bar and noodle shop through the years. In 1978 one of the city’s rst sushi joints, Japonica, moved in before decamping in 1991 to a larger berth at 100 University Place. But when a wrecking ball claimed No. 100 a decade ago, Japonica returned to its No. 90 berth, according to the restaurant news site Eater. An outpost of the café chain The Grey Dog occupies the other narrow storefront.

The Textile Workers Union of America owned and operated this ornate 10-story Beaux Arts building in the mid-20th century, around when the area near Union Square was a base for labor organizations. The word “Union” in the park’s name, however, refers to its location at the merger of several roads. In 1991 local landlord Bijan Nassi purchased No. 99 from TWUA for $2.4 million, according to the city register, and the 41,500-square-foot site has mostly served as a Class C of ce building for small companies since then. But Nassi did not pry off the facade’s metal “TWUA Building” letters until around 2017, according to photos from Google Maps. Fashion giant Ralph Lauren operated stores in the retail space in recent years, including for its Rugby brand and Denim & Supply offshoots. Cncpts, a store dedicated to skate-wear fashion that sells sneakers and caps, occupies the 2,500-square-foot berth today. Nassi, who has appeared on the public advocate’s worst landlords list, faced foreclosure on the site in 2022 after defaulting on a $10.5 million mortgage note but squared away his debts the following year, according to court records.

The history of this site is as colorful as the strings of lights that twinkle in its downstairs Mexican restaurant. Once the home of Benjamin Field, a prominent hospital philanthropist, the building later housed the human hair wig business of German immigrant Bernhard Mittelstaedt, according to Village Preservation, an in uential nonpro t advocacy group. His name remains carved on the cornice. During Prohibition No. 86 housed a speakeasy, and in the 1940s it was home to a lesbian bar called the Bagatelle, accounts show. The current eatery, whose name El Cantinero means “the bartender” in Spanish, opened in the early 1990s. Its 3,500-square-foot two-level berth pours margaritas seven days a week. The 5-story property, which also features four apartments, has changed hands several times in recent decades. In the most recent transaction from 2015, New Jersey investor Lewis Lustbader sold No. 86 to Mark Lundy of Long Island rm Gould Investors for $13.7 million. Lundy borrowed $6.8 million for the transaction from Florida-based BankUnited, the city register shows.

This 7-story Italianate building, whose facade is somewhat shrouded with dark-toned re escapes, was home to Charles Cheriff Galleries from the 1930s until this year. The antiques store specializes in French furniture made in the late 19th century to resemble classics from the 18th-century era of Kings Louis XV and Louis XVI. Earlier this year brothers Stephen and Alan Wachman sold the site for $11.3 million to developer Mark Guindi, the CEO of GD Capital Group, who plans on turning the building into a six-unit rental that has retail space on the ground oor. Guindi did not return a call for comment. The Wachmans, whose grandfather Charles founded the business in 1924 after emigrating from Russia, have relocated their 3,000-piece collection to 22-19 41st Ave. in Long Island City near the Ed Koch-Queensboro Bridge. With Charles Cheriff’s departure from University Place, a longtime antiques district in the neighborhood has almost disappeared.

Cedar Tavern, whose crowd in the abstract expressionist heyday of the 1950s might have had the highest number of artists in the city’s history, was based rst at 24 University Place. It was dislodged by development in the 1960s and wound up at this address soon afterwards. Bob Dylan was among the new site’s early habitués. Amid the frenzy of the mid-2000s condo boom, tavern owner Michael Diliberto took a turn as a developer and added seven oors atop the existing structure to create a seven-unit condo, sales of which nabbed him $16.4 million, according to its offering plan. A stipulation of that plan was to not allow bars again, and the downstairs retail space offers bikini waxes today. The 3-bedroom duplex penthouse, which has a terrace, traded for about $4 million in 2023. It sits “just steps away from Whole Foods,” its ad said, “making it the perfect location.”

83 UNIVERSITY PLACE

This 11-story, 191,000-square-foot building from 1890 seems to have once been a manufacturing building. Textile and garment companies were early tenants, according to news clips. But in recent decades, No. 83 has served as an of ce building catering to PR rms, doctors, insurance companies, ntech startups and co-working providers. Its most visible contribution, though, might be the numerous fast-casual style restaurants that ring the building’s ground oor. A two-year-old location of the popular and quickly-growing Naya chain, which serves falafel and hummus dishes at 11 locations in Manhattan, is here. The building’s ownership hasn’t changed since at least the 1960s, according to property records. It seems to involve members of the Manley family, though a trust has controlled No. 83, which also uses the addresses 95 University Place and 41 E. 11th St., since 2005. The rm that runs the building day to day is the Thomas F. Campenni Company. It is currently listing a 20,000-square-foot berth on the fth oor for a rent of $40 per square foot annually.

C. J. Hughes

A couple with ties to the cryptocurrency world has picked up a penthouse on the Lower East Side in the largest deal in the neighborhood in years.

Chris Paik, a venture capitalist who has invested in crypto platforms, and his wife, Keely Paik, who works for an online art gallery requiring payments in blockchain, bought a six-bedroom triplex with a private roof deck atop 199 Chrystie St.

e price, paid not in crypto but in conventional dollars, was $9 million, which included a deeded parking space and a storage unit, according to the city register.

It appears to be the largest sale involving a co-op or a condo in the neighborhood in three years, according to listings service StreetEasy, which takes a broad view of the area and lumps it in with the Seaport district. By its data, the last comparable sale was in 2021, when a condo unit at Seaport development 252 South St. traded for $9.1 million.

But in terms of the immediate area, no home has sold for more than $7 million going back to 2019, according to a Crain’s analysis.

Despite the steep price, the Paiks, who went into contract June 4 and closed July 10, according to the deed, can claim to have scored a deep bargain.

According to the 2019 offering plan for 199 Chrystie, a 14-unit condo near Stanton Street, developer KD Sagamore Capital assumed someone would pay a hefty $20.5 million for the unit, whose 4,700 square feet includes six baths, a living room with a replace and 18-foot ceilings, and a kitchen that opens to a balcony.

But by the time the penthouse arrived on the market in 2023, its price had been trimmed to $19.5 million, and further reductions followed until it nally sold for $9 million, meaning the developer miscalculated by more than 50%.

e Paiks, who borrowed $6.8 million from JPMorgan Chase for their purchase, are not the only buyers at 199 Chrystie to wind up with an apartment that traded far below what developers initially hoped.

No. 9S, a three-bedroom, for instance, was supposed to command $6.5 million, according to the plan, but was unveiled at $5.6 million in September before itnally changed hands for $4.4 million last month.

Adjustments to prices in o ering plans are typical, especially when markets uctuate as a project drags along. But 199 Chrystie’s developer, who expected a total sellout of $102 million, will likely fall far short of that amount. Two units remain unsold at the building, including the other penthouse, which once sought $18

million and is now asking about $9 million. KD Sagamore could not be reached for comment.

“ ere’s just not that deep of a pool for this kind of product walking around on the Lower East Side,” said Glenn Davis, the Douglas Elliman agent handling sales at the condo, which previously had two other sales teams. “We had to be opportunistic with the market.” (But a previous o er in bitcoin from a di erent buyer was declined, he said.)

Davis added that although home sales activity did indeed show surprising strength in the

second quarter, those deals often came about because sellers were nally willing to slash prices.

For her part, Keely Paik, who works for TRLab, a startup that sells nonfungible tokens, or NFTs, including works by gunpowder-focused Chinese artist Cai GuoQiang, could not be reached by press time.

And Chris Paik, a co-founder of the early-stage VC rm Pace Capital, whose $400 million under management has been deployed in part toward companies that have created crypto platforms, did not return an email seeking comment.

We take excellence seriously. And with 7 hospitals recognized as best in the nation across 30 specialties, including NY's #1 hospital, North Shore University Hospital, we deliver that excellence throughout the state. With more experts, deeper insights, and newer breakthroughs, we'll never stop investing in our care, in our community — in you.

Northwell.edu/ LeadTheWay

Democrats should regret not having an open primary, but Kamala Harris is an upgrade to take on Donald Trump in November

It all happened faster than I ever could have imagined: Kamala Harris is on track to be the Democratic nominee for president. e endorsements are rolling in.

Joe Biden desperately didn’t want to exit the race, but the pressure from elite Democratic politicians and donors was, in the end, too much. ey were abandoning him in droves, both privately and publicly. e reality is that the June 27 televised debate was too devastating and revealed what should have been known all along: At 81, Biden simply wasn’t up to the task of waging another national campaign.

after one term with many legislative successes, he wasn’t running again. en Democrats could have found their battle-tested nominee to take on Donald Trump. at might have been Harris anyway. But her political weaknesses are obvious. She ran a disastrous 2020 campaign for president and would have faded into obscurity if Biden hadn’t plucked her for his ticket. Before then, she had won a noncompetitive Senate primary and struggled in the general election during her rst race for attorney general.

At 81, Biden simply wasn’t up to the task of waging another national campaign.

Democrats paid the price for not having an open primary. Biden and his team did a great deal of damage by insisting, until now, that he could run again. A year or two ago, Biden could have declared victory and announced,

In the White House, she never had a large pro le under Biden, and when she was handed signicant if unenviable tasks like managing the politics of immigration, she didn’t exactly succeed. Harris critics will have much to pick over these next few months.

Democrats, however, were right to dump Biden. Harris may not be the strongest Democrat to replace him — there are senators and governors who have won very competitive elections in swing states — but she is an upgrade. She can campaign forceful-

ly and press the case against Trump on abortion rights. If Trump agrees to a televised debate with her, she will perform far better than Biden because she can talk coherently and nish sentences.

Harris has energy and charisma. She also has a chance to choose a running mate who genuinely bolsters the ticket and gives Democrats a real shot to win as many swing states as possible. Michigan Gov. Gretchen Whitmer, Pennsylvania Gov. Josh Shapiro, North Carolina Gov. Roy Cooper, Kentucky Gov. Andy Beshear, and Arizona Sen. Mark Kelly all t the bill. It’s a shame they couldn’t have all competed against each other in a primary with the voters deciding who was best. Instead, Harris and her team will pick someone, and her team will de nitely have the Electoral College in mind.

Is Trump still the favorite to win this fall? Yes. In ation continues to rise, and many voters blame the Biden administration. Trump has hammered Biden for the in ux of immigrants across the southern border. All year, Democrats have been on the defensive, and Trump will relish lashing Harris in all the

By Caroline Spivack

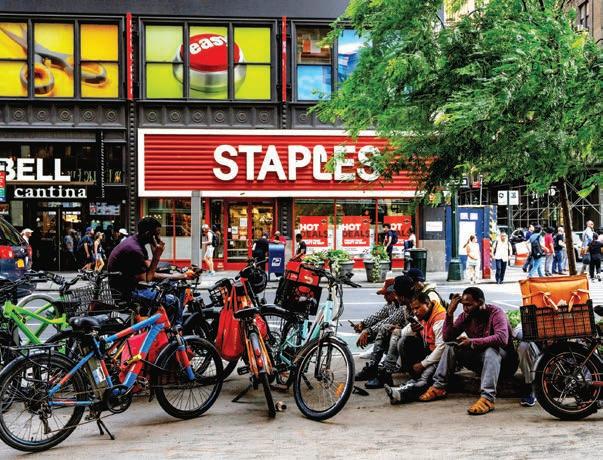

Property owners looking for a safer way for their tenants to charge e-bikes will soon have the option to install city-approved charging sites on sidewalks outside of their buildings.

e Department of Transportation is proposing an expedited city process for building owners to in-

“The idea is to be able to come together with the private sector, where they can charge a small fee in a safe way, so that we’re not looking at businesses that are effectively death threats.”

Laura Kavanagh FDNY commissioner

stall e-bike battery swapping and charging cabinets on the public sidewalks outside of their properties, which current city rules do not allow.

Such a process would enable landlords, or commercial tenants with the owner’s consent, to apply for a city permit to set up sidewalk

e-bike charging stations outside of buildings or storefronts. e Adams administration says the e ort seeks to make safe charging infrastructure more accessible to curb re safety concerns, while giving private property owners the perk of monetizing public space and the ability to better serve their commercial tenants, said Meera Joshi, the city’s deputy mayor for operations, at a July 22 news conference on e-bike safety.

“Often there’s a small fee that goes along with using these [charging sites] and so there is that aspect of it,” said Joshi. “But also many of these are the same businesses that are working regularly with deliveristas, and so it really helps to create that organic environment to support the workers that they’re using day in and day out.”

Proposed charging locations would have to comply with specific safety and dimension requirements — like sensors to monitor the batteries and automatic shut-

ways he lashed Biden. e new ticket, though, should rejuvenate Democrats. Harris can expect a modest boost in the polls. Biden was not capable of launching sustained, aggressive attacks on Trump. is won’t be a problem for Harris and her running mate. ey’ll be on the campaign trail enthusiastically, and they won’t hide from the media like Biden did.

e Democratic pressure campaign against Biden was evidence that they wouldn’t fall prey to the

sunk cost fallacy. Just because they had come this far with Biden didn’t mean they had to continue, especially with the formal nomination slated for August. Now, Biden’s delegates will choose Harris.

If far from ideal, it is a more seamless process than anyone might have imagined. As time passes, it will seem all the stranger that Biden ever decided to run at all.

Ross Barkan is a journalist and author in New York City.

o s if a battery is overheating — and would undergo reviews and approvals by Fire Department and the Department of Buildings inspectors.

DOT o cials haven’t crafted the speci c rules yet and will hold a virtual hearing on Aug. 21 at 10 a.m. to incorporate the public’s feedback in its rule making process. e Adams administration says it aims to begin accepting applications for the program before the end of the year, and to have the application and installation process take roughly six weeks.

e in uential Real Estate Board of New York, along with some landlords, have told the city they’re potentially open to the model, said FDNY Commissioner Laura Kavanagh, who intends to resign from her post but has said she will stay on until a successor is named. REBNY, at FDNY’s request, said it hosted a recent meeting with its members on battery safety. “We plan to review these proposed rules more closely and provide feedback to the Department of Transportation,” said Zachary Steinberg, REBNY’s se-

nior vice president of policy.

“ e idea is to be able to come together with the private sector, where they can charge a small fee in a safe way, so that we’re not looking at businesses that are effectively death threats,” said Kavanagh, referring to illegal, potentially re-starting sites where e-bike users pay to have their bikes juiced up or improvise their own setups. Due to a lack of public charging infrastructure, it’s common to see extension cords snaking out of apartment windows hooked up to e-bikes.

Unregulated batteries and plugins can have deadly consequences. Since 2019, lithium-ion

batteries have started 733 res, killing 29 New Yorkers and injuring 442 more, according to city data.

e Adams administration also intends to share updated info on its website to make it easier for companies that sell lithium-ion battery storage and swapping cabinets to receive FDNY approval. To inform that guidance the city will convene a working group made up of representatives from tech companies, the real estate industry and transit and re safety experts. “ ese e-mobility vehicles and bikes, they’re not the enemy,” said Mayor Eric Adams. “Proper use is what we must do.”

NewYorkCIO has announced the nalists for its 2024 New York ORBIE Awards. The New York ORBIE Awards honors chief information of cers and chief information security of cers who have demonstrated excellence in technology leadership. With support from Crain’s New York Business, NewYorkCIO will honor CIOs and CISOs who are driving innovation and transforming Greater New York’s leading organizations. The 2024 New York ORBIE Awards event is scheduled for November 14 at Ziegfeld Ballroom. www.orbie.org/newyork/2024.

Ascorching heat wave has plagued the city this summer, with real-feel temperatures routinely reaching triple digits. Local o cials must acknowledge that many residents are at risk from the heat and ensure they have the resources they need to survive the sti ing weather.

One solution is continuing to push for more money from the federally funded Low-Income Home Energy Assistance Program, which foots the bill for residents to buy and install cooling units. en, ocials must ensure that the funds — which are distributed by Congress and allocated by the Department of Health and Human Services — are being stretched as far as possible. e program spent its full $22 million budget on 27,000 households, or about $815 per AC unit.

ere’s an outsize demand for the program with about 2 million New Yorkers living below the poverty line. ough the city received $5 million more than last year, it ran out of funds on July 19, just 29 days into summer, Crain’s health care reporter Ethan Geringer-Sameth found. Last

year, the program ran out of money even quicker: in just three weeks. City and state o cials must negotiate fair prices with vendors to ensure the funding is reaching more households. If

the funding is still not enough to meet New Yorkers’ needs, the city and state should tap local funding to supplement the program. e city also must continue to push for su cient cooling systems in new buildings, as outlined in Mayor Eric Adams’ strategic plan for climate resilience. e business community needs livable housing stock for its employees as temperatures rise. New York City is a “heat island” — densely populated with skyscrapers, cars and buses with minimal tree cover. at leads to an average temperature that is 9.7 degrees hotter than it would be otherwise, which is the highest per-capita bump of 65 cities nationwide, according to a new report from the

Raymond Kessler, once known as “ e Haiti Kid,” remembers the cheers as he wrestled professionally against opponents like Hulk Hogan. Today, at 76, the roaring crowd is replaced with his neighbors at e Woodstock Hotel. Kessler is one of 290 tenants in the permanent housing facility owned by Project FIND, which has been improving seniors’ lives for over 50 years.

His arc underscores a profound truth: Anyone, regardless of past success, can nd themselves in need of a ordable housing. And as housing becomes increasingly scarce, we applaud e orts to bolster housing security via e City of Yes for Housing Opportunity plan.

City of Yes is a planning framework to boost housing production in the city. We commend Mayor Adams’ bold vision, inspiring hope for a more accessible future for all. However, no legislation is perfect to start. Currently, certain provisions may have unintended consequences, especially the Universal A ordability Preference (UAP), which replaces the Voluntary Inclusion-

ary Housing (VIH) program.

VIH preserves a ordable housing stock and provides capital to maintain quality living environments. e plan’s 10-year phase-out of density bonuses and other changes, though well-meaning, may harm organizations like ours, which depend on these incentives to build and operate housing for middle- and lowincome communities.

is

director of Project FIND, a nonpro t that operates four supportive housing residences, and is an adjunct professor at NYU’s Silver School of Social Work.

Importantly, the plan lowers the bonus ratio in R10 districts.

e city currently permits developers to build beyond the maximum ratio of building-size-tofootprint for providing certain public bene ts, like a ordable housing units. City of Yes lowers this ratio, increasing construction costs without o setting them — disincentivizing developers from building additional a ordable housing units. Removing certi cates, a funding source for nonpro t developers, exacerbates this.

e City of Yes’ impacts are not theoretical, they have real-life consequences. With VIH funding, we are installing needed upgrades at our Upper West Side

Hamilton House location, like a new boiler, updated electrical, and free Wi-Fi. ese improvements enhance tenants’ quality of life, particularly for seniors with mobility challenges or who remain unconnected to modern technology. Removing that critical funding source would jeopardize our ability to complete those upgrades. Similarly, the Woodstock Hotel, where Kessler lives, direly needs modernization that would be threatened by proposed changes in the City of Yes. Improvements like new elevators and ADAcompliant bathrooms may not happen, as they depend on the sale of air rights under the current VIH program. However, the City of Yes risks drying up the market for this valuable asset. Further, the potential lost value of unsold air rights would negatively impact our balance sheets and negate our ability to nance future a ordable housing development deals.

Given these concerns, the City Planning Commission and City Council must carefully amend City of Yes policies. While its goals are commendable, certain policies must be tweaked to ensure they don’t accidentally decelerate a ordable housing production.

nonpro t Climate Central. e city heat has sent at least 285 people to the emergency room so far this summer, a 74% increase over last year. e majority of heat-related deaths occur in homes without air conditioning. is disproportionately describes Black New Yorkers who are twice as likely to die from heat-exacerbated conditions.

Older New Yorkers with preexisting conditions — obesity, heart and respiratory illnesses — are also at higher risk for heat-related injury and death, a key consideration as the city strives to increase residents’ life expectancy.

Elected o cials appreciate the risks and have issued warnings: “Stay indoors. Stay with your air conditioning,” Gov. Kathy Hochul said at the start of summer. Added Adams: “It is crucial that you plan ahead and make sure everyone is safe including your pets.” ey should add to their message a push to fund more ACs.

Raymond Kessler’s story reminds us that real people are impacted by these policies — and that preserving incentives helps sustain a ordable housing access for those like him. Industry experts and experienced developers must be heard to avoid unintended negative consequences that prevent New Yorkers from accessing the housing they need and deserve.

As Mayor Adams addresses housing scarcity, developments like Project FIND’s must be protected. Keeping provisions like density bonuses in R10 districts and maintaining existing certi cates’ value will enable the City of Yes to produce more a ordable housing. is proposal can be a force for good. But without addressing these concerns, it risks doing more harm than good. Let us take time to get this right so the City of Yes lives up to its name.

In February, New York Gov. Kathy Hochul proposed sweeping artificial intelligence regulatory measures intended to protect against untrustworthy and fraudulent uses of AI. Then in May, the state of New York committed $275 million to launch a state-of-the-art AI computing center at the University at Buffalo. This center aims to promote responsible research and development, create jobs, and advance AI for the public good.

While these statewide initiatives are commendable, there is still widespread confusion around proper implementation of AI in business in New York. For instance, according to BDO’s CFO Outlook Survey, across all New York CFOs surveyed, 1 in 3 have not yet formalized a policy for generative AI usage. Looking specifically at New York technology CFOs, a smaller subset of the data collected, 62% say their employees do not have a clear understanding of policies and processes related to data collection and processing.

ness operations, those who take a proactive and thoughtful approach to generative AI can gain market share now and reap success in the future.

Russell Diller is an assurance principal with BDO, an international network of public accountants and tax advisers.

That’s because embracing AI in business is more than just new tools or grappling with evolving legislation. It’s a mindset shift. And in an era where AI is rapidly becoming integral to busi -

AI is an invaluable tool for decision-making, brainstorming, automating processes and improving accuracy. However, it also presents significant challenges. Bad actors can exploit AI to fabricate identities and documents with unprecedented credibility and realism. To mitigate AI risks, companies must proactively establish robust technical and physical safeguards to protect personal information, prevent data leaks, and ensure unauthorized access is averted. And while New York technology CFOs are ahead of most other technology CFOs across the country with privacy protection (85% of New York’s technology CFOs plan to deploy privacy technologies to combat future breaches vs. 42% of technology CFOs nationally), there is a rising threat of data breaches as reliance on AI to organize personal information increases. It is key for fraud prevention

and risk management departments to work closely with data protection professionals as it can reduce the potential for privacy breaches and identity theft. It is also important for businesses to do more than improve their company’s data privacy positioning; they must also find ways to communicate their policies to customers. Transparent data privacy policies and the documentation to back them up can help companies build trust in a world where it’s quickly disappearing.

Data is the building block of AI systems. Managing that data with tactics, such as data mapping and inventory management, is essential to building resilience against AI's risks. BDO’s survey shows that only 23% of the smaller sampling of New York technology companies surveyed have already begun deploying these tactics, compared to 51% of technology CFOs across the country. Building resilience against AI risks requires an effective data governance strategy that prioritizes data management, quality control and collaboration across business functions. By digitizing as much data as possible and applying an agreed-upon methodology, organizations can reduce disrup -

Airport service workers demand more workplace support. It’s time we listen.

Service workers at John F. Kennedy, LaGuardia, and Newark Liberty International airports gathered this month to protest stagnating wages and inadequate bene ts, pushing the Port Authority of New York and New Jersey to update its existing workplace standards rules so that all airport service workers’ compensation keeps up with rising costs. ese workers — including cleaners, wheelchair agents, baggage handlers, caterers, concessions and cargo workers — report struggling to stretch their wages enough to cover basic living necessities, like rent, utilities and car payments, while also fearing the loss of health care coverage.

Karla Walter is a senior fellow for inclusive economic policy at the Center for American Progress.

Research shows that when airport service workers are poorly compensated, the public also pays the price as airports struggle to retain quali ed workers. By raising its minimum standards now, the Port Authority could support safer, more e cient air travel for countless Americans every day.

Yet, current airport workplace standards in New York and New Jersey are stagnating as the cost of living climbs, jeopardizing the region’s ability to attract and retain a well-quali ed workforce. Without Port Authority action, the $19-per-hour mini-

mum wage for all regional airport workers will stay at, as will the health care bene t contributions for workers at JFK and LGA. is may mean thousands of low-wage workers losing their current healthcare plans, a devastating blow to New York working families that could also result in higher reliance on public assistance. Even now, many service workers in concessions, retail, cargo handling and other services as well as all part-time workers in New York are excluded from existing bene ts. e reality is many of these standards fall short of other national leaders. For example, jurisdictions governing the Los Angeles, Seattle and Chicago airports have all adopted pay standards that rise automatically with increasing costs. San Francisco requires employers at its airport to provide health care coverage for service workers and their families at no cost. And Philadelphia’s airport standard covers concessions workers and includes a bene ts supplement that increases periodically.

Inadequate worker compensation doesn’t just harm airport workers; the public bears hidden costs by providing services to supplement airport employers’

poverty wages — like housing, nutrition assistance and Medicaid. If New York’s standard is not updated to re ect the cost of health insurance, costs to public programs could also rise, as workers previously covered by employer health insurance plans could be forced onto the Medicaid rolls.

Coupled with a tight labor market and high turnover, airline and airport employers will fail to maintain a well-quali ed workforce, reducing airport e ciency and security. What’s more, we rely on airport and airline service workers to help respond to emergencies like extreme weather events, active shooter situations and terrorist attacks.

Research shows strong airport standards produce good outcomes for the public. A study of San Francisco Airport showed that among security screeners, turnover fell from nearly 95% to just 19% after a wage standard was adopted, saving employers thousands of dollars per employee in re-sta ng costs. Similarly, the Port of Seattle found low wages, poor bene ts and other job quality factors drove high turnover rates before it adopted its own workplace standard.

ere’s a long-established link between airport workplace standards and positive outcomes for the public. A federal study conducted in 2000 found that low wages led to high turnover among security screen-

tions caused by new or dissonant data, be it from a business acquisition or an enterprise resource planning (ERP) system implementation. Establishing master data management provides uniform processes for effective data analysis, reduces manual reconciliations, and enables data to be used for multiple purposes, accelerating business growth.

As AI technology continues to evolve, so will the regulatory landscape. New York’s proactive measures in regulating AI and investing in AI infrastructure demonstrate a commitment to fostering a secure and innovative technology environment. However, businesses cannot afford to wait for statewide policies to catch up with the rapid pace of AI advancements.

To remain competitive and innovative, New York businesses must proactively address AI risks and establish clear guidelines for AI use. Those that embrace a data-driven approach to AI risk management and develop robust AI policies will reduce vulnerabilities and position themselves as pioneers in the AI landscape. By taking these steps, companies can ensure they are not only compliant with future regulations, but also leaders in ethical AI use.

ers and, consequently, poor performance in detecting dangers. Similarly, a 2007 government report found that low wages and high turnover among ramp and fuel workers contributed to ramp accidents and aircraft entering runways without permission. Finally, implementing wage standards helps level the playing eld for airport employers who respect their employees. Without strong standards, companies that pay good wages and provide decent bene ts can be forced to compete against low-road contractors that undercut the market. By adopting best practices that uphold parity across all airports, the Port Authority could catch up with other national airport leaders. Ensuring wages and bene ts increase with rising costs, supporting universal access to paid leave, and broadening coverage to include more service workers would not only improve the lives of airport service workers across the region, but it would also increase aviation workforce stability in New York and New Jersey, making air travel safer and more e cient for the public.

To place your listing, visit www.crainsnewyork.com/people-on-the-move or, for more information, contact Debora Stein at 917.226.5470 / dstein@crain.com

Prager Metis

Prager Metis, a leading global accounting and advisory rm, is pleased to announce the appointment of Jared Mahar as a new Partner in its Tax Department. With nearly two decades of service in the eld of taxation, Jared brings a wealth of expertise in investment partnership taxation and a proven track record of delivering exceptional client service to the rm. His specialized focus includes, emerging managers, registered investment advisers, and family of ce fund structures.

Weber Shandwick

Weber Shandwick has announced the appointment of Ben Branham as Head of New York Corporate & Public Affairs. In his new role, Branham will oversee 70+ employees on an integrated team that re ects the agency’s recent expansion in corporate and public affairs. Branham served as the CCO for The Port Authority of New York & New Jersey from 2018 to 2022, where he led comms on key projects including the total overhaul of LaGuardia Airport and the 20th anniversary of 9/11.

Gabriella Rowe has been named Chief Executive Of cer at Green Ivy International Schools and its parent company, KSS Immersion Schools, a top-tier language immersion school and multilingual programs. With over 15 years of transformative leadership experience as Head of School at The Mandell School in NYC and the Village School in Houston, she plans to spearhead the East Coast expansion of the Green Ivy brands, including Battery Park Montessori and Pine Street School, both located in NYC.

Nadav H. Schwartz joins IDB Lido Wealth with over 17 years of experience in Private Wealth Management. He provides customized investment strategies, sophisticated planning, and family-of ce solutions for entrepreneurs, executives, and multigenerational families. Nadav holds the NASAA Series 65 & 63 licenses and has robust experience in building investment portfolios with notable nancial institutions. He works extensively with clients to enhance their nancial decisionmaking.

Benesch

Ana Bou-Goldsmith has joined IDB Lido Wealth, a Registered Investment Adviser and joint venture between IDB Bank and Lido Advisors, LLC, as Senior Vice President & Senior Wealth Manager. Leveraging more than 15 years of industry experience, she helps to drive portfolio growth, as well as investment strategy and planning across the rm’s highnet-worth clientele. A seasoned wealth manager, Ana holds a NASAA Series 65 license.

Tannenbaum Helpern Syracuse & Hirschtritt LLP

Eric Schlabs focuses his practice on litigation. He has extensive experience handling bet-thecompany disputes, including trade secret, trademark, patent, antitrust, breach of contract, class action, corporate governance, nancial fraud, unfair competition, digital assets, securities, and founders’ disputes. Eric’s career has encompassed all phases of litigation, from pre-suit investigation to trial, and spanned federal and state courts, arbitration, and administrative agency proceedings.

Tannenbaum Helpern proudly announces the arrival of partner Howard W. Kingsley to the Firm’s Litigation and Dispute Resolution practice. Howard is known for his strategic approach to cases and a tenacious litigation style, as well as his successful history of litigating important cases in New York state and federal courts. Howard’s extensive expertise in real estate, commercial and construction litigation makes him a soughtafter asset in complex, highstakes litigation.

It’s no exaggeration to say that real estate has been a driving force behind New York City’s economic vitality over the centuries. A recent Columbia Business School article cautions, however, that “the rise of remote work, declining commercial property values, and the resulting decreased tax revenue demand bold solutions.”

Fortunately, this dynamic sector consistently attracts some of the boldest thinkers in business, as evidenced by the 79 real estate professionals we spotlight in this issue. Whatever their role, each of these leaders is pushing the boundaries of development, design, construction, leasing and sales to keep New York City a vibrant heart of real estate innovation and economic growth. Read on to celebrate these trailblazers and their contributions to the essential fabric of the city.

Methodology: Featured honorees were nominated by peers, companies and acquaintances. Crain’s New York Business editors selected nominated honorees based on their accomplishments and success and contributions to their industry and community, as outlined in the eligibility section of the nomination form.

Nessa Amamoo

Partner, Skadden, Arps, Slate, Meagher & Flom

Scope of work: Nessa Amamoo is a partner at the law rm Skadden, Arps, Slate, Meagher & Flom. She holds experience with large-scale construction and development projects, casino and gaming transactions, U.S. and offshore private placements, real estate investment trusts, leasing and real estate-related capital markets and syndicated loan transactions.

Biggest career win: Amamoo helped represent the gaming company Las Vegas Sands in connection with its pursuit of a downstate New York gaming license and the Port Authority of New York and New Jersey with the redevelopment plan for John F. Kennedy International Airport.

Other contributions: Amamoo is a trustee of the New York Academy of Medicine and represents The Eye-Care Foundation pro bono.

Partner and co-chair of construction and design practice, Tannenbaum Helpern Syracuse and Hirschtritt

Scope of work: Melissa Billig is partner and co-chair of legal services company Tannenbaum Halpern Syracuse and Hirschtritt’s construction and design practice group. She oversees multimilliondollar development projects for commercial, residential, religious and educational buildings.

Biggest career win: Billig expanded the construction and design capabilities of the company to construction, design and real estate projects incorporating her diverse client base of architects, designers and engineers in the New York area.

Other contributions: Billig co-chairs her rm’s diversity, equity and inclusion committee as well as the sustainability committee of the Women Builders Council. She previously served on the board of The Center of Architecture for more than 10 years.

Shlomi Avdoo

Principal and founder, Avdoo and Partners

Scope of work: Shlomi Avdoo, principal and founder of 10-yearold real estate company Avdoo and Partners, directs acquisitions, strategic development, nancing, construction and marketing.

Biggest career win: Avdoo united development and construction, facilitating his team’s ability to ensure value engineering, product quality and achievable construction timelines, all while fostering a people- rst culture that is re ected in community partnerships and amenities. Other contributions: Avdoo has volunteered for more than six years with Project Sunshine, a nonpro t that sends volunteers to hospitals to provide companionship to pediatric patients and their families. He also actively integrates local artists and businesses into company development projects.

Founder and chief executive of cer, Tredway

Scope of work: As founder and chief executive of cer of real estate developer Tredway, Will Blodgett leads all strategic decision-making, including sourcing investment transactions and investment decisions.

Biggest career win: Blodgett expanded Tredway’s footprint across the country with 3,500 units owned in nine states and 1,500 units in development in New York City. The rm recently acquired Sea Park Apartments in Brooklyn, Midtown Towers in Pittsburgh and 14 properties in North Carolina.

Other contributions: Blodgett sits on the board of the Affordable Housing Tax Credit Coalition and is a trustee of the Citizens Budget Commission. He also serves on the board of the Children’s Museum of Manhattan and the American Institute for Stuttering.

Benjamin Bass

Executive managing director, JLL

Scope of work: Benjamin Bass, executive managing director at real estate company JLL, specializes in representing landlords and tenants in the high-end sector of ce market. He has helped clients through underwriting and acquisition executions, new construction and developments and complicated lease renewals.

Biggest career win: Bass helped rearrange more than 800,000 square feet of leases at SL Green’s One Madison Avenue, helping to reinvigorate the Midtown South market and attract companies such as IBM, Coinbase and FanDuel to the neighborhood.

Other contributions: Bass is chair of the Next Generation board at the U.S. Holocaust Memorial Museum and works on national JLL initiatives, including the rm’s leadership counsel advisory board.

Managing director and co-founder, BIG Equity Investors

Scope of work: At real estate platform BIG Equity Investors, managing director and cofounder Dale Burnett spearheads investment strategy, sourcing and acquisitions of real estate assets. He boasts more than two decades of experience and this past year executed $800 million of transactions alongside minority investors.

Biggest career win: Along with Basis Investment Group, Burnett founded BIG Equity Investors, forming partnerships with rms and innovating investment structures that empower retail investors of color.

Other contributions: Burnett serves as chairman of the board of Praxis Housing Initiatives and board director of the New York State Real Estate Board and the Congressional Black Caucus Foundation.

Jonathan Bennett

President, AmTrust Realty

Scope of work: Jonathan Bennett manages property management company AmTrust Realty’s more than 10 million-square-foot portfolio of commercial and multifamily properties, guiding the rm’s strategic approach and overseeing investment activity, capital improvements and leasing initiatives. He manages a team of more than 100 employees and 14 properties.

Biggest career win: In 2023, Bennett spearheaded physical upgrades to many of AmTrust RE’s properties. Among other notable projects, he was involved in the 36,500-square-foot retail lease with Fitness International at 59 Maiden Lane, one of New York City’s largest retail leases of the year. Other contributions: Bennett, who volunteers at a local nonpro t focused on delivering food to those in need, also serves on Yeshiva University’s real estate committee.

Partner and head of New York real estate group, Skadden, Arps, Slate, Meagher & Flom

Scope of work: Marco Caffuzzi is partner and head of the New York real estate group at law rm Skadden, Arps, Slate, Meagher & Flom. He advises clients including Brook eld Properties and JPMorgan Chase on transactions and was involved in restructurings for the American Dream Mall in New Jersey as well as 9 DeKalb in Downtown Brooklyn. Biggest career win: Caffuzzi is currently representing real estate development company Silverstein Properties in connection with the development of 2 World Trade Center.

Other contributions: Caffuzzi has represented the New York Theater Workshop pro bono in connection with its expansion into a custom theater and production facility.

David Carlos

Head of nonpro t, education and government practice of New York, JLL

Scope of work: David Carlos is head of real estate company

JLL’s nonpro t, education and government practice in New York. He focuses on strategic planning, portfolio analysis, acquisitions, dispositions and ground-up development for clients including the City University of New York, New York Presbyterian Hospital and the New York Public Library.

Biggest career win: Carlos recently secured a contract with Weill Cornell Medicine to evaluate their 3.4 millionsquare-foot portfolio.

Other contributions: Carlos, who is a three-time recipient of the Most Ingenious Deal of the Year Award from the Real Estate Board of New York, also serves on the building committee at Larchmont Temple in Westchester.

Peter Chavkin

Managing member, Biddle Real Estate Ventures

Scope of work: Peter Chavkin, managing member of Biddle Real Estate Ventures, oversees the development of the $1 billion mixed-use, transit-oriented Edge-on-Hudson community in Westchester County. He also oversees the team focusing on East Coast projects with a budget exceeding $1.2 billion.

Biggest career win: Chavkin is set to develop housing, a boutique hotel, retail space and of ce space in the Edge-on-Hudson community, with all completed units and rental units sold out and leased, respectively. The project won the National Association of Home Builders Silver Award for Multifamily Community of the Year in 2020.

Other contributions: Chavkin has supported the educational nonpro t Historic Hudson Valley as well as the Hudson Valley Make-a-Wish Foundation.

Melissa Cohn

Regional vice president, William Raveis Mortgage

Scope of work: Melissa Cohn is regional vice president for mortgage lender William Raveis Mortgage, managing mortgage operations in Florida and leading a private practice in New York.

Biggest career win: Cohn has been consistently ranked as a top originator nationwide in recent years by the nancial institution Scotsman Guide and Mortgage Women Magazine. She is frequently quoted by news outlets including CNBC, Business Insider, CNN and The Wall Street Journal.

Other contributions: Cohn sits on the board of the Damon Runyon Cancer Research Foundation and is treasurer of the board of the Ellen Hermanson Foundation, which works to help breast cancer patients. She is also a former governor of the Real Estate Board of New York.

$4.9B

Greg Corbin

President, Northgate Real Estate Group

Scope of work: As president of Northgate Real Estate Group, Greg Corbin oversees the operations of the company and works as lead broker on deals. He focuses on originating new business and negotiating transactions, and also works on business development and brand building.

Biggest career win: Corbin founded Northgate Real Estate Group in 2023 to focus on bankruptcy, foreclosure and restructuring arenas. He and his team have arranged for the sale, workout or recapitalization of 49 buildings, development sites, membership interests or loans.

Other contributions: Corbin co-founded Give2Give Foundation in 2015, an organization supporting people facing mental, physical or nancial burdens to their health and well-being.

Craig Deitelzweig

President and chief executive of cer, Marx Realty

Scope of work: As president and CEO of real estate company Marx Realty, Craig Deitelzweig oversees development, construction, leasing and property management. He also manages 5 million square feet of commercial of ce, retail and residential space.

Biggest career win: Deitelzweig recently oversaw the construction of 10 Grand Central, Marx Realty’s foray into hotel-style of ce buildings. He has also worked on the 1.4 millionsquare-foot Cross County Center in Yonkers, an open-air shopping center.

Other contributions: Deitelzweig is an Urban Land Institute mentor and sits on the nonpro t’s ULI New York committee. He also serves on advisory boards at Tulane University, Shadow Ventures and Merchants National Properties.

Buckingham Palace is the most expensive residence on Earth, valued at

$4.9 billion.

Founder and chief executive of cer, Ecotone

Scope of work: Craig Desmond works as founder and CEO of Ecotone, a company using woodworking to enhance community wellness. Desmond and his team design high-end spas, gardens and retreats for top developers and high-net-worth individuals. Biggest career win: Desmond helped Ecotone secure a contract with the New York City Department of Parks & Recreation to install 15 community garden structures, in line with the company’s vision for urban wellness. Other contributions: Desmond has built public parks and gardens to foster community wellness and has worked to educate youth through woodworking apprenticeships, reaching more than 100 children. Ecotone has received support from The Doe Fund, Green City Force and Apex Trade School.

President and chief executive of cer, Douglas Elliman

Scope of work: Scott Durkin is president and CEO of real estate company Douglas Elliman. With three decades of experience, he directs the brokerage’s operations, technology initiatives and strategic growth efforts.

Biggest career win: Under Durkin’s leadership, Douglas Elliman expanded its national footprint to include Texas; Nevada; Mid-Valley in Basalt, Colorado; Washington, D.C.; Virginia; Maryland, Naples, Vero Beach, Weston, Sarasota and Santa Rosa Beach in Florida; Wellesley and Nantucket in Massachusetts; Fair Haven in New Jersey and a joint alliance with Knight Frank in the Bahamas.

Other contributions: Durkin sits on the boards of nonpro ts God’s Love We Deliver and Have a Heart Animal Welfare Fund.

(Forbes)

Founder and chief executive of cer, The Designers Group

Scope of work: Blima Ehrentreu is founder and CEO of The Designers Group, an interior design rm specializing in residential and commercial interiors. She focuses on streamlining operations, delegating responsibilities and promoting the rm to potential clients and partners.

Biggest career win: Ehrentreu expanded the rm into New York and Miami, and has developed initiatives including TDG Tech Hub and TDG Virtual Team with the goal of enhancing ef ciency and client engagement.

Other contributions: Ehrentreu founded TDG Gives Back, a program that supports local community initiatives and serves residents in senior living communities that the rm designs. She also established TDG Furniture Exchange, connecting people in need with donated furniture.

President of retail leasing, Meridian Capital Group

Scope of work: At commercial real estate brokerage Meridian Capital Group, James Famularo is president of retail leasing. He started the division in 2018 and has expanded the team to include more than 60 brokers since.

Biggest career win: Famularo was able to close 200 deals in 2020 despite the Covid-19 pandemic, with noteworthy leases including Brooklyn Chop House and a 20,000-square-foot restaurant near Times Square.

Other contributions: Famularo sits on the Real Estate Board of New York’s retail committee and is a member of the International Council of Shopping Centers. He also writes a column in The New York Real Estate Journal, discussing market trends on a quarterly basis.

Bess Freedman

Chief executive of cer, Brown Harris Stevens

Scope of work: Bess Freedman, CEO of luxury brokerage rm Brown Harris Stevens, oversees more than 2,200 agents and 44 of ces. She has built a team of tech, marketing and managerial experts and is responsible for instituting new policies to maintain industry standards.

Biggest career win: Freedman was involved in the successful merger of Brown Harris Stevens and Halstead in 2020, and has since helped the company boost its agent ranks and launch new brand campaigns.

Other contributions: Freedman is a member of the Real Estate Board of New York’s board of governors, the Fordham Real Estate Institute’s executive advisory council and the board of The Bridge, a male-centric sober luxury living home.

Mark D. Friedman

Licensed real estate salesperson, Brown Harris Stevens

Scope of work: Mark D. Friedman is a licensed real estate salesperson at luxury brokerage rm Brown Harris Stevens, where he leads the Friedman Rosenthal team. He specializes in Manhattan neighborhoods, including Soho, Tribeca, and the Upper West and Upper East sides, and has been successfully marketing properties in video format.

Biggest career win: Friedman was chosen from thousands of brokers to sell musician Sting’s apartment, responsible for dealing with sensitive issues and respecting the privacy of selling a celebrity property.

Other contributions: Friedman has raised funds for cancer charities including the American Cancer Society. He is a member of the Real Estate Board of New York and The Screen Actors Guild-American Federation of Television and Radio Artists.

Raja Ghawi

Partner, Era Ventures

Scope of work: Raja Ghawi is partner at venture capital rm Era Ventures, which invests in projects or ideas that use technology and innovation to reimagine the built environment. In that role, he supports the company’s founders and plays a key role in various fundraising and operational activities.

Biggest career win: Ghawi has been instrumental in Era Ventures’ growth since the rm’s inception, most notably his involvement in all eight of the investments made by the company to date.

Other contributions: Ghawi recently became involved in Cycle for the Cause, a three-day, 275-mile bike ride from Boston to New York that aims to raise money and awareness in the ght against HIV/AIDS.

$1.4B Investors today can buy properties in the virtual world on the Metaverse platform, a $1.4 billion market that’s expected to grow dramatically over the next few years.

(The New York Times)

Keyvan Ghaytanchi

Chief investment of cer, BEB Capital

Scope of work: Keyvan Ghaytanchi has been CIO of real estate investment rm BEB Capital since 2022, working to develop industrial, of ce and multifamily assets throughout the East Coast. He manages the rm’s day-to-day business activities, overseeing transactions and operations including asset management, developments, legal affairs and leasing.

Biggest career win: He spearheaded BEB Lending in March 2020 to provide private and creative nancing solutions for commercial real estate assets in primary and secondary markets across the U.S., with loan sizes ranging from $5 million-$50 million.

Other contributions: He is a board member of Mobile Health, which provides pre-employment health screening services; and Care Connect, which provides technology to home health care agencies.

John Gluszak

Head of real estate, Of ce of the New York City Comptroller

Scope of work: As head of real estate at the Of ce of the New York City Comptroller, John Gluszak oversees the management and growth of the real estate portfolio for all ve New York City retirement systems. He is tasked with strategically investing an additional $2 billion per year.

Biggest career win: Gluszak negotiated a $250 million separate account in 2021 with the Hudson Companies to build quality “green” properties in New York City. This portfolio has created hundreds of workforce housing units, 125 of which are affordable.

Other contributions: Gluszak serves on the board of the Pension Real Estate Association, a nonpro t for the global institutional real estate investment industry.

Jeffrey Goldberg

Chief executive of cer, Fairstead

Scope of work: As real estate developer Fairstead’s CEO, Jeffrey Goldberg leads all operational and investment decision-making. The rm owns more than 170 communities, which in total contain more than 25,000 units, across the country.

Biggest career win: Under Goldberg, Fairstead has closed on more than 10,000 units since 2020. Notably, the Fairstead team recently closed on a preservation project in Brooklyn involving more than 1,600 homes in a New York City Housing Authority PACT deal. In addition, Affordable Housing Finance recently named Fairstead a top company in completing acquisitions and substantial rehabilitations.

Other contributions: Goldberg supports and serves on the Child Psychiatry advisory board of Mount Sinai Hospital.

Adam Gordon

Managing partner, Wild ower Limited

Scope of work: Adam Gordon, founder and managing partner of Wild ower Limited, creates and evolves the real estate developer’s strategy, oversees design and acquisitions and focuses on creating real estate infrastructure for New York City.

Biggest career win: Wild ower is opening a new lm studio in NYC that will aim to provide more than 1,000 union jobs for local lm creatives. The company is also creating a new public electric-vehicle supercharger station at John F. Kennedy International Airport as part of its mission to advance the clean energy transition.

Other contributions: Gordon was previously a director’s cabinet member at the Scripps Institution of Oceanography at the University of California, San Diego.

Eric Gotsch

New York market manager, Wells Fargo Home Lending