New structures are popping up throughout the city to manage ooding and rising seas

City Council looks to relax ambitious goals of Local Law 97 PAGE 12

Commentary: How city, state should proceed on climate change PAGES 14-16

IN NEW YORK, real estate runs in the family. Huge swaths of the industry are under the control of a web of fathers and daughters, grandfathers and grandsons, second cousins and ex-wives. Read on to learn about four more names added to Crain’s list of the most noteworthy and powerful clans in the metro area. PAGES 18-19

ONLINE: See more pro les of the major names in New York’s real estate industry at CrainsNewYork.com/RealEstateFamilies

SEPT. 12

The industries that drive New York — and the city itself — are at a major crossroads. What kind of city do we want to be? How will business drive the future of housing, work, health care, climate change, technology, arts and transportation in the Big Apple? Crain’s New York Business and the Partnership for New York City will dive deep into the innovations, challenges and pivotal developments that will inspire the city’s reinvention over the next 50 years.

Location: New York City CrainsNewYork.com/NYCROSS

SEPT. 18

BEST PLACES TO WORK IN NYC

Annually, Crain’s New York Business ranks the Best Places to Work in New York City. These companies have gone the distance in creating an atmosphere of collegiality, collaboration and caring, whether assigning a mentor to ease each new hire’s transition into the fold, offering paid time off for volunteer work, empowering employees to turn their ideas into projects or hosting company getaways in scenic destinations.

DETAILS

Location: Marriott Marquis, 1535 Broadway, New York City CrainsNewYork.com/bestplaces2024

Correction

In 2024 Notable Real Estate Leaders, the pro les of the following were updated to correct their titles, names or roles: Nesa Amamoo, Mark D. Friedman, Tom McGee, Les Hiscoe, Laurinda Martins and Jessica Ross

Related Cos. is the developer of Hudson Yards, the complex of supertall of ce and residential towers that transformed Manhattan’s far west side. Now, chief executive Jeff Blau has unveiled plans to expand Hudson Yards westward, across Eleventh Avenue, with a casino at the heart of this $12 billion project. He spoke to Crain’s about his plan, how he’s dealing with high-pro le opposition and his plans for affordable housing. By

Let’s start by describing your casino proposal and what it would bring to the city.

We’ve partnered with Wynn Resorts to develop a world-class resort that would anchor the development of the western rail yards, including a 2 millionsquare-foot o ce building and another 1 million-square-foot residential building. It would include great community bene ts, including 324 a ordable housing units, a K-8 public school, and a large-scale public open space that would be bigger than Bryant Park. ere is no comparable economicdevelopment opportunity in the city, and there hasn’t been anything like this since probably the rst half of Hudson Yards or, going back in time, Rockefeller Center or the redevelopment of the World Trade Center. ere would be over 35,000 construction jobs and over 5,000 permanent jobs in the resort alone.

What do you think your odds are of winning the casino license given that elected of cials, including state Sen. Brad Hoylman-Sigal, City Council member Erik Bottcher and Assemblyman Tony Simone, have not been speaking very warmly about your bid?

We think we have lots of public support for this project for all the reasons that we’ve just described. And we will continue to talk to the elected o cials and the community groups as we go through this process, which will continue well into 2025.

Community Board 4 has criticized your plan because you’re proposing to build just 1,500 apartments in the western half of Hudson Yards, and under a 2009 zoning deal Related agreed to build 5,700. Why are you backing away when there’s a big housing shortage? So the zoning actually created the exibility to adjust for economic conditions. And what we have seen over time is increased demand for rst-class new o ce buildings and less demand for luxury condos, more demand for rental and a ordable housing. What’s being eliminated is a super-luxury condominium building in the middle of the park.

Manhattan’s of ce vacancy rate is about 20%. Does it give you pause to add 2 million

| Aaron Elstein

square feet of new of ce space in a market like this?

We have seen unprecedented demand here at Hudson Yards for these new modern o ce towers and are very con dent in our ability to lease this new building.

If you don’t win the casino license, would you still build a new of ce tower, housing and a school in Hudson Yards? It would not be on the same timeline at all because the infrastructure costs of building this platform have escalated so dramatically, and the resort is really the economic engine that’s paying for a big portion of this. I couldn't tell you when the western yards would get developed absent the resort, but it still would be.

The nonpro t Friends of the High Line also doesn’t like the idea of a Hudson Yards casino. Is there any room for compromise?

We’ve met with them over 10 times and have actually made signi cant modi cations to our plan based on all their physical suggestions on-site. We’re hopeful that we're able to continue the dialogue with them. But if their real desire is to have a kind of anti-development approach, then, you know, I’m not sure there’s going to be anything to work out here.

When Hudson Yards was rst developed, it was granted signi cant property tax

discounts, called PILOTs, which have about another 20 years to go. As part of the western expansion, would you seek a similar discount arrangement with the city? e answer is we’re not sure yet. We have not gotten to the tax component of this, so I don’t really have an answer for you.

You’ve said you envision a James Bond sort of casino, very high-end. Would there be a dress code?

Nobody wants to pick up Las Vegas and drop it into New York City because that’s not what Hudson Yards is about. is will be a resort that’s designed to be consistent with what we have here at Hudson Yards; we would design something that is re ective of New York and ts in New York. People will come from around the world to go to a Wynn Resort in New York City. You know, many casino resorts are very closed and insular where you go in and you never go out, but the whole idea here is to get people to New York and have them experience New York. We, in particular, decided not to build a theater at the resort, but instead would put in a concierge who would help guests get to Broadway shows or to the Shed.

What else is Related working on?

is year we’ll start construction on replacement buildings for 2,000 NYCHA apartments here in West Chelsea. We’re one of the largest private owners of

a ordable housing in the United States, so this commitment runs long and deep. We’re also developing at Willets Point a new MLS soccer stadium and 2,500 units of workforce housing.

Let’s talk about the opportunities you see in rent-regulated apartments. You bought a lot of mortgages for those after Signature Bank went bust, yet a lot of landlords are very discouraged by rentregulated housing these days because rents aren’t keeping up with rising costs. Do you have a different view?

No, the rent regulations passed in 2019 have caused signi cant strain on owners of those types of units. ere’s no way for an owner to invest in them and recoup costs, and we’re hopeful that will ultimately change. With Signature, we bought an interest in the FDIC ownership of a portfolio of loans that are primarily collateralized by those types of apartment buildings that you're talking about. But we did so at a basis that would allow us to invest in these units. I think part of the reason the FDIC selected us was our commitment to a ordable housing. We have never converted an a ordable unit to a market-rate unit as a business plan.

It sounds like rent-regulated housing isn’t something you're looking to get a lot more of. Is that fair to say? at’s fair to say.

Building and sustaining a healthy credit score is a tall task for many college students. Often short on cash and brand-new to the complex world of nance, the allure of a credit card is enticing for many young people — but a handful of missed payments can result in years of playing catch-up, paying o interest and rebuilding a score.

Enter Fizz, the debit card that acts like a credit card. CEO Carlo Kobe and COO Scott Smith dropped out of college to launch the company in 2021 to give students an alternative to the traditional system.

“College students are not afraid of credit as much as they are afraid of credit cards. So we were able to o er them an entry into credit building without all the scary stu .”

Users register via the Fizz app using their university email and graduating year and then link their checking account. Fizz works in the background to process transactions like a traditional credit card and underwrites a user’s daily variable credit limit of up to $1,000.

lion in transactions across Fizz cards this year. In June, the pair raised $14.4 million in their rst seed round.

Ilya Fushman, a partner at the venture capital rm Kleiner Perkins, which led Fizz’s seed round, recognized Kobe and Smith’s motivation to build a product for Gen Z.

“ e moment you go to college is the point where you start to become essentially an adult, from a nancial services perspective,” Fushman said. “And yet, nancial support is lacking in terms of products and education.”

Rather than giving borrowers sky-high credit limits that encourage people to spend money they don’t have, Fizz bakes in features that pay o the balance at the end of every day and it will automatically freeze the card if a user misses a daily payment. is helps college students slowly build a credit score, eliminates APR charges, and removes the stress of paying o a balance once a month.

Fizz reports users' daily payments to credit bureaus like TransUnion, Equifax and Experian. In addition to the debit card, Fizz o ers its users other subscription services, including smart spending recommendations, AI-backed proactive budgeting tools and nancial literacy courses.

e company launched the debit card in January 2023 at eight schools, including the University of Michigan, Harvard and USC. e company has expanded quickly and currently serves students in about 300 schools nationwide. Kobe and Smith said they will bring in over $3 million in annual recurring revenue by the end of 2024, which they attribute to subscriptions and interchange fees collected through Mastercard. ey expect to process over $250 mil-

e Discover it* Student Cash Back card is among the most popular student and starter credit cards. It’s aimed at college students, doesn’t have an annual fee and o ers several cashback rewards. e card o ers a 0% APR for the rst six months, then rises to an 18.24%-27.24% variable APR after the trial period.

One of the rst things Israel Lewis, 24, did upon moving to Philadelphia from Uganda in August 2023 to study at Drexel University was to try to sign up for a credit card. However, he was repeatedly rejected by banks that told him he needed a social security number to sign up.

He is already planning for his life after graduation: a job somewhere in New York or perhaps the Bay Area. “As someone who came here to this country as an immigrant to go to school, once you nish school, you want to settle down and start your life,” Lewis said. “You’ll need to get an apartment. You’ll probably need a car… So if you don't have a good credit history while in school, it kind of messes you up when you graduate.” In April, he came across Fizz on online forums and immediately signed up for the card using his taxpayer identi cation number. Lewis primarily uses the card for on-campus food, transportation, utility bills, and sometimes groceries and clothes. In June, he spent $396 on his Fizz card. According to Experian’s check on the Fizz app, his credit score increased by 73 points over three months. Lewis says he plans to keep using his card after he graduates in 2025. Before launching the company, Kobe and Smith spent

months interviewing peers about their concerns regarding credit cards.

“It was almost as if credit cards were the boogeyman when you mentioned them because people were aware of all these horror stories,” recounted Smith. Even Kobe, who had moved to the U.S. for college, couldn't get approved for a credit card. Finding a bank to back their company was also an uphill battle that took two years. e pair eventually partnered with Lead Bank, based in Kansas City, Missouri. e other obstacle was convincing students and young adults that they were their nancial allies. ey hired campus ambassadors, visited campuses around the country, and emphasized that they were students building a product for students. ey also built a collection of nancial literacy blog posts and sought to engage with college students on TikTok. ey made highly produced videos on TikTok starring their scary Cthulhu bear mascot, “Creg,” who guides students through the di erent ways to build credit.

“ e reason why the mascot was scary is because credit itself is scary. We just leaned into the scary and confusing and made a joke out of it,” Smith said.

Fizz aspires to become the go-to credit-building solution for college students. Smith said Fizz currently has more than 112,000 users, and more users signed up in Q1 of 2024 than in 2023. e company also has plans to launch a card catered to recent graduates to expand its pool of young customers. Fushman added that a person’s rst card is the one they keep for a long time — case in point, he still uses the one he signed up for as a college student.

As Fizz expands, it seeks to target freshmen, sophomores, and incoming freshmen. Older students and recent grads will still have access to the Fizz debit card. e company also wants to encourage Gen-Z to achieve better nancial independence. “ ere's this huge conversation nationally right now about student loans, and there are similar conversations about credit,” Smith said. “Students feel that they're facing an uphill battle in terms of adulting, speci cally nancial adulting.”

Olivia Bensimon is a freelance journalist in New York City who reports on human-centered stories.

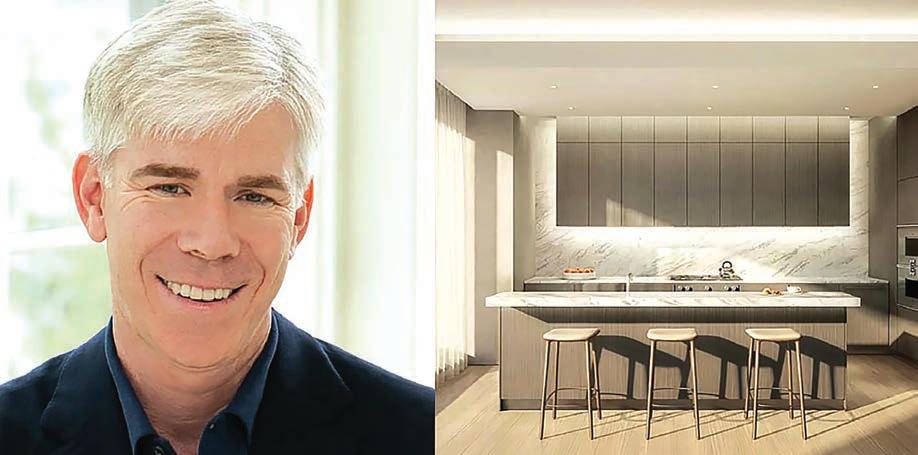

Jeffrey Levine and his wife, Randi Charno Levine, purchased the home for $12.7 million in 2010

One of the city's most proli c developers and his diplomat wife have sold their Greenwich Village home for $22 million, according to a deed that appeared in city records Wednesday.

$22M

Sale price for the three-story townhouse at 81 Barrow St.

Je rey Levine, founder and chairman of Manhattan-based Douglaston Development, which is credited with remaking Hudson Yards and the Williamsburg waterfront, and his wife, Randi Charno Levine, who is the current U.S. ambassa-

Levine is founder and chairman of Manhattan-based Douglaston Development. Charno Levine is the current U.S. ambassador to Portugal.

dor to Portugal, are moving out of their three-story townhouse at 81 Barrow St., records show.

Levine, who is known for developing the Edge, a luxury condo-

minium complex in Williamsburg, came under re in 2019 during former Mayor Bill de Blasio's administration when he was reportedly caught in the middle of a quid pro quo-type scandal. Douglaston Development was given more than $12 million in taxpayer funds and a plot of cityowned land in the Bronx to make way for a new affordable housing project around the same time the rm contributed $25,000 to de Blasio's now-defunct nonpro t the Campaign for One New York, which shut down amid investigations into wrongdoing. Levine had to cough up $10,000 in 2019 to settle state ethics charges, the New York Post reported at the time.

And de Blasio isn't the only politician to whom the Levines have donated. e U.S. ambassador to Portugal was tapped for the job by President Joe Biden in 2021 after helping to raise more than $100,000 for his 2020 campaign,

By C. J. Hughes

David Gregory, who grilled politicians as a host of NBC’s Meet the Press, has elected to buy a home near the High Line.

Gregory and his wife, Beth Wilkinson, a prominent trial lawyer, have purchased a threebedroom condo at 500 W. 18th St. for $6.6 million, according to a deed that appeared in the city register July 30.

square feet, is located in the westernmost tower in the two-building, angular 1 High Line complex, a mixed-use development formerly known as XI for its location at 11th Avenue that embattled developer HFZ Capital Group failed to complete after defaulting on a loan.

But in 2021 co-developers Witko and Access Industries acquired the debt on the property in a deal valued at $900 million and resumed construction at the 236unit project, which began closings in September, four years after its original expected completion date. It has enjoyed several big-ticket deals since bouncing back.

Gregory and his wife, Beth Wilkinson, a prominent trial lawyer, purchased a three-bedroom condo at 500 W. 18th St. for $6.6 million.

e apartment, which has two and a half baths, a combined living and dining room, and oorto-ceiling windows across 1,800

the tabloid also reported. e couple purchased the home for $12.7 million in 2010, records show, and it's unclear what the family's plans are come January — if they will continue to spend time in Europe on the Iberian peninsula, where Charno Levine is stationed for work for at least six more months, or move elsewhere in the city. Attempts to reach the

Levines, who signed the July 23 deed themselves, were unsuccessful, and their attorney in the sale, Lawrence Rader of his own Manhattan-based rm, declined to comment.

It's also unclear who bought the 5,500-square-foot property between Hudson and Bedford streets. e $21.5 million transaction was made under a limited

liability company named after the address. e mystery buyer's attorney, Barry Landsman of the Times Square-based rm Pryor Cashman, also declined to comment.

Meanwhile, Douglaston Development is still making big moves in the city. e rm recently led plans for a 39-story, 125-unit high-rise on the Upper East Side.

just slightly below the intended target, according to StreetEasy.

One High Line expects a sell-out of $1.9 billion, according to its most recent o ering plan.

Gregory and Wilkinson went into contract March 7 and closed July 10, according to the property’s transfer report. And there does not seem to have been much negotiation when it came to the price. Witko rst listed the unit in November for $6.8 million and so sold the apartment

A White House correspondent for NBC under President George W. Bush, Gregory went on to helm Meet the Press from 2008 to 2014, before Chuck Todd replaced him. Gregory currently works as a political analyst for CNN. Wilkinson, meanwhile, launched her career in the U.S. Department of Justice, where in the 1990s

she helped lead the prosecution of Oklahoma City bombers Timothy McVeigh and Terry Nichols. She currently helms Wilkinson Steklo , a rm she co-founded in 2016. Its clients have included the Washington Commanders football team, Philip Morris and Microsoft. In 2022 the Federal Trade Commission sued Microsoft over its planned $69 billion purchase of Call of Duty video-game maker Activision Blizzard, fearing the merger could have a monopolistic impact on consumer choice. But last month a California judge found in favor of Microsoft, for

which Wilkinson served as lead counsel, clearing a major hurdle in the deal’s path.

Residential sales have shu ed along in New York in the past few quarters, as high home loan costs have weighed down every sector, including new developments. But activity did pick up in the second quarter, suggesting that buyers have made peace with the fact that elevated interest rates aren’t going away anytime soon.

Gregory and Wilkinson could not immediately be reached for comment. And a phone message left with 1 High Line’s sales o ce was not returned by press time.

Your goals are important. With Erica® , you’ve got a virtual financial assistant to help you reach them. And our team of local advisors across New York City are here to help you along the way.

José Tavarez President, Bank of

New

City

The state is a true battleground again thanks to the vice president’s ascension to the top of the Democratic ticket

New York Democrats are thrilled that Kamala Harris will now top the presidential ticket.

Harris is still something of an underdog against Donald Trump in the fall, but she immediately seemed to ensure that an Electoral College landslide and down-ballot disaster aren’t in the cards for Democrats. Joe Biden was polling increasingly poorly against Trump, as concerns about his advanced age and ability to campaign mounted — his June debate performance was catastrophic — and Democrats in swing House seats wondered if they were all collectively doomed.

The vice president has her own flaws as a political candidate, and it remains to be seen what her coattails really look like. What she’ll be able to do is press the case against Trump, speak coherently and campaign extensively. Harris won’t shy from media appearances.

In New York, the Harris campaign’s goal will be, at the minimum, to match or come close to Biden’s 2020 performance. Biden won 61% to Trump’s 38% with minimal votes for third-party

candidates. The Greens lost their ballot status for 2024, but Robert F. Kennedy Jr., as an independent, will be on the ballot, and it’s plausible he will siphon votes from Harris as well as from Trump. Democrats are now excited for Harris, which should help her, and liberal revulsion for Trump should keep him under 40% — and nowhere close to the 47% Lee Zeldin won in the 2022 governor’s race against Kathy Hochul.

For Democrats to take control of the House and make Brooklyn's Hakeem Jeffries the speaker, there are at least three incumbent Republicans in New York they must defeat.

All are freshmen. They are Anthony D’Esposito on the South Shore of Long Island, Mike Lawler in Westchester and the Hudson Valley, and Brandon Williams in the Syracuse area. They also may need to knock off Marc Molinaro, a Hudson Valley moderate who is also in his first term.

Biden’s 2020 coattails helped hand victory to most of the Democrats who previously held versions of those House seats. D’Esposito and Williams were

probably hurt most by Biden’s 11th-hour decision to drop out of the presidential race, since they represent districts that are plainly Democrat-friendly. If Harris runs well enough, they might both be finished.

Lawler’s race against Mondaire Jones, who used to serve in Congress, is a genuine toss-up. Lawler has distinguished himself as a charismatic young conservative in the way Jones once did as a progressive in Washington. After a failed run for an open House seat in Brooklyn and Manhattan, Jones has now tacked to the center — he endorsed against Jamaal Bowman earlier this year — and is trying to win over swing voters skeptical of New York City liberals.

When Biden stepped aside and endorsed Harris, Lawler was one of the few Republicans to offer kind words for the president. He also attended the Republican National Convention and praised Trump without issuing a formal endorsement. It’s unclear if he’ll be able to keep walking this political tightrope — Jones has bashed him repeatedly for being a Trump Republican — but he will be a tough incumbent to

knock off. Molinaro, too, will be a reach for Democrats. His district has traded off between Democrats and Republicans; Hochul’s lieutenant governor, Antonio Delgado, used to represent a version of it in Congress. But Molinaro, a former Dutchess County executive, is the sort of Republican who has run well in the Hudson Valley in the past, distancing himself from the most conservative elements of his party. Democrat Josh Riley is taking another crack at him, and his goal will be to tie him as closely as possible

to the Trump-Vance ticket. Keep an eye, nally, on the East End of Long Island, where Zeldin used to be a congressman. e district has trended right for a decade, and Nick LaLota, another Republican freshman, won it easily in 2022. He should win again. But John Avlon, a former CNN host and Giuliani speechwriter, is making a bid as a centrist Democrat. He’s been a strong fundraiser, thus far, and he’s hoping to pull o the upset. It’s not an impossibility.

Ross Barkan is a journalist and author in New York City.

By Caroline Spivack

Migrant services contractor DocGo billed New York City some $11 million in costs that the Adams administration shouldn’t have paid and must recoup, according to a new audit by city Comptroller Brad Lander.

e audit found that the city’s Department of Housing Preservation and Development had “poor scal control” over a controversial $432 million no-bid contract the agency awarded DocGo in 2023. Lander's o ce reviewed paid invoices for May and June 2023 — the rst two months of the contract — and found that 80% of the $13.8 million paid to DocGo with-

cratic primary. e comptroller has questioned the mayor’s use of his emergency procurement powers to handle the surge of asylumseekers, and in September, the comptroller's o ce launched what Lander described as a “real-time audit” of DocGo’s contract to scrutinize oversight and invoices.

e 74-page report states that the audit found many issues with HPD’s monitoring of the rm. Namely, that HPD did not hold DocGo to its contract terms and didn’t require the company to document that its spending was reasonable.

City o cials did not immediately respond to questions about the audit’s ndings, including whether they will seek to recoup some costs from DocGo, which says it has served 32,000 asylum-seekers entering New York.

Lander’s of ce said that $9 million of the $13.8 million the city initially paid DocGo went to subcontractors that were not pre-vetted by the city.

in that time did not warrant payment, either because the amounts were not allowed under the contract or they weren’t adequately supported by documentation.

Lander is running against Mayor Eric Adams in next year's Demo-

In a written response to the audit, HPD Commissioner Adolfo Carrión Jr. said that in their oversight, housing o cials “exercised good judgment rather than insisting on bureaucratic steps” to expedite migrant services. Carrión said housing o cials often gave verbal permission to greenlight DocGo’s spending to move quick-

ly, providing food and housing for the daily in ux of migrants.

e response also said that HPD has xed or is in the process of resolving issues raised in the audit.

Unused hotel rooms

Auditors found that in the initial two months of the contract the city paid DocGo nearly $1.7 million for 9,874 unused hotel room nights in Manhattan, Brooklyn, Queens and towns north of the city; DocGo collected $408,680 in commissions from the sum. In one instance, the audit said, the city paid DocGo $78,540 for 462 vacant rooms at the Imperial Hotel in Brooklyn for nine nights. e amount charged by the hotel was $69,300, or $150 per night per room; DocGo collected a $9,240 commission.

Investigators similarly discovered that DocGo exceeded its contract terms in charging the city more than $2 million for security sta . e audit said the company billed the city for 40,219 hours, at an hourly rate of $50, for security above the contract’s limit. DocGo earned a $583,274 pro t from the transactions, according to the comptroller's o ce.

omas Meara, a DocGo spokesman, said the company paid the bulk of its invoices directly to its

subcontractors and hotel owners. HPD is required to preauthorize subcontractors used by DocGo to ensure they comply with the city’s standards, but the comptroller’s o ce said HPD provided no evidence that it conducted such reviews. Lander's o ce said this means that $9 million of the $13.8 million the city initially paid DocGo went to subcontractors that were not pre-vetted by the city. Since the contract’s initial twomonth period, the city has paid DocGo an additional $168.1 mil-

lion for contract-related expenses the company says it incurred through February 2024. Auditors warned that if the 80% error rate discovered in the rst two months of invoices is applied across that amount, the city could have overpaid DocGo some $134.5 million. DocGo could still claim an additional $250 million for the remainder of the contract for work through May 2024. Meara said that the company has received assurances from city o cials that it will continue to be paid.

TIRED OF YOUR BANK’S HOLD MUSIC?

With our single-point-of-contact banking experience, you’ll work directly with a Relationship Manager who gets to know you and your business and who stands ready to help you, every step of the way.

Switch to private business banking from Customers Bank today and experience the extraordinary service you deserve.

Let’s talk and see how we can take on tomorrow… together

After an incredibly storm-heavy week, which came after a string of 90-degree-plus days, it’s impossible not to focus on the changing climate.

Coastal storms remain a major cause for concern, but regular thunderstorms are also now wreaking havoc on the city, ooding streets and pushing our drainage systems to the limit.

e National Weather Service reported that on Tuesday, 5 inches of rain fell on parts of the Bronx in a one-hour span. e sewer system is equipped to manage 1.75 inches per hour.

As New York looks to guard itself against extreme weather swings, it is imperative that we procure city, state and federal funds to beef up our coastlines and upgrade our sewer systems as quickly as possible. e weather will not wait for us to deal with red tape.

Extreme wet weather has been taking its toll on the area for a number of years. In addition to the massive damage resulting from Superstorm Sandy, Tropical Storm Ophelia destroyed infrastructure at the Prospect Park Zoo last fall, shutting it

down for months. In July 2021 Tropical Storm Henri deluged a record 8 inches of rain on Central Park in 36 hours. Henri was followed by the remnants of Hurricane Ida, which killed 13 city residents, mostly in ooded basements. As reported

in this week’s Crossroads feature on ooding, in 2020 the National Climate Assessment o cially moved New York City from a continental temperate zone to a subtropical climate zone.

New York is slowly making progress on

the resiliency projects needed, but funding has been the major holdup. Rohit Aggarwala, commissioner of the city Department of Environmental Protection, told Crain’s it will take at least $33 billion to prepare our sewer systems and boost green infrastructure to handle stormwater — money that is not presently budgeted for. And nding the political will to spend billions to guard against bad weather on days when the sun is out has been a hurdle to achieving our climate goals.

But New York cannot wait for the next major storm to act. e ooded state of our streets during regular thunderstorms and often-discussed plans to make basement apartments safer must catalyze ocials to ensure the city and the state have the funding to handle what Mother Nature has in store. Otherwise more property will be damaged, and more lives may be lost. When it comes to New York’s extreme weather, we can’t let a lack of funds leave us treading water.

In recent weeks, Mayor Eric Adams’ administration has doubled down on the argument that New York City has one path forward to address a debilitating housing crisis. at path, adherents say, is to tweak zoning rules to make denser residential development an option in more of the city. Reports of rising rents in all ve boroughs have been accepted as de facto evidence of a very specific emergency — a three-alarm “lack of supply” re that only the cooling waters of “City of Yes for Housing Opportunity” plan can bring under control.

Opponents of the administration’s proposals object to their lack of a ordability standards and anti-displacement protections. ey are skeptical of the “enable private supply” theory of a ordability. But the most troubling thing about the City of Yes conversation is the implication that zoning liberalization gets the city where it needs to be on a ordable housing generation. Zoning monomania — tied to o cials’ determination to deliver market opportunities to developers and investors — is hijacking conversation about credible alternative responses. Two policies in particular would go further than upzoning in alleviating ordinary New Yorkers’ housing stress.

Sociologist Matthew Desmond ends his acclaimed book Evicted with a call to furnish all households unable to nd housing they can a ord with vouchers that subsidize them up to a “fair market rent.” Vouchers are a demand-side, not a supply-side policy. But vouchers would prevent evictions, slim down the wildly expensive (and miserable) temporary shelter system and deliver income to people who currently spend a mind-numbing proportion of their earnings simply to remain housed. A welladministered universal voucher program would create competition among providers, improve housing quality, and stabilize prices. It could even induce new moderately priced supply (as opposed to new market-rate supply with a few a ordable units tacked on).

e City Council has attempted to get more so-called CityFHEPS vouchers into circulation. But the mayor is resisting. Moreover, Adams has done nothing to advocate in Albany for state-level voucher legislation.

Social housing preservation

Preservation is another means to avert

the crisis. Homes operated by the New York City Housing Authority (NYCHA) are a critical social infrastructure. But cumulative, decades-long lack of attention to NYCHA capital needs is putting thousands of apartments at risk — and making current residents sick, whether from toxic mold or inadequate protection from extreme heat. Congresswoman Alexandria Ocasio-Cortez recently re-introduced legislation that would fund the upgrading and decarbonization of public housing around the country. With these resources, NYCHA and its peers in New York State could make thousands of units livable, reduce their carbon footprint and supply 15,000 new units — over 10% of the new stock projected from the City of Yes zoning amendments. Similarly, the city’s stock of rentregulated low- and moderate-cost private housing is decaying as many owners choose to take cash out of buildings rather than maintain them. e city’s Department of Housing Preservation and Development and a raft of nonpro t partners are working to acquire and renovate distressed buildings. But city capital allocations are deeply inadequate. Talk of how best to nance city-sponsored preservation (or state-sponsored preservation

and new construction through a proposed Social Housing Development Authority) is sidelined as City of Yes proposals consume political oxygen.

Vouchers and social housing would require scal re-prioritization: more upfront resources to government agencies and mission-driven organizations, less foregone tax revenue and possibly tax increases. But pursuing these policies would yield savings, too — for example, by reducing massive spending on emergency shelter. New Yorkers need the Adams administration to pull all possible levers (federal, state and municipal) in response to the housing crisis. Leaders should not allow zoning monomania to stand in for a comprehensive a ordable housing strategy.

VIEW

New York City, with its dazzling skyline and bustling streets, presents a facade of opportunities and dreams ful lled. Yet, beneath our skyline, in our subways, there is a daily reality far removed from such lofty aspirations.

A recent study conducted by the New York Immigration Coalition and Algún Día, a project I co-founded, reveals a troubling scenario for new immigrant families: a dire lack of child care availability. at’s what compels children and their parents to sell candy and fruits in subway stations and parks across all ve boroughs, a pursuit born out of necessity rather than choice.

Our volunteers, a compassionate network of social workers, traversed the intricate maze of our subway system and parks, reaching out to these families. e stories we collected are a testament to the resilience and determination of our immigrant communities, yet they also underscore the acute desperation and challenges they face.

Our investigation, involving heartfelt conversations with 75 families engaged in vending, uncovers a stark picture: Forty-two percent of these families cite child care as a signi cant hurdle. e cascading e ects of this challenge are profound, forcing parents to relinquish other employment opportunities and thrusting them into precarious situations devoid of stability and security. Eighty-eight percent of those surveyed turned to vending driven by a compelling need, while 83% harbor aspirations for alternate careers, aspirations stymied by the lack of child care support.

more inclusive and equitable world.

We do not have to wait for something bad to happen before taking action. e city has responded by bolstering Promise NYC, a program providing access to child care services for undocumented children and their families. is initiative is not merely a service; it represents a lifeline for families on the brink, enabling parents to pursue gainful employment while ensuring their children's safety and development in nurturing environments. As part of the city’s recent budget, a $25 million investment in Promise NYC will restore vital programs facilitating family communication and outreach.

After walking the subways and engaging with these families, I am more convinced than ever of the transformative potential of comprehensive child care support. ese families, brought here by aspirations for a brighter future, should not be relegated to the

shadows of our society. I came to the U.S. as a teenager to reunite with my undocumented parents, who had left me in Ecuador for ve years to fend for myself. ey made stark choices when they came to the U.S., ones that no family should have to endure. And I understand from experience that immigrants in the U.S. possess deep wells of strength.

While many young people may feel disillusioned by political engagement or even by issues such as immigration in the abstract, engaging with these families on a local level reminds me of the power we have when our political and social interests ignite action. In 2016, I was one of the

Gov. Hochul’s about-face on congestion pricing in June came as a shock to the millions of subway, bus, LIRR, and Metro-North riders who count on the system, as well as the broad community of contractors responsible for its improvement and expansion.

we address in our joint fact sheet shared with advocates, elected o cials, builders, and MTA riders.

rst graduates of the Dr. Anne Moses Ignite Fellowship, a program that empowers young women to engage politically and civically. What I learned then was that even if one doesn’t think of oneself as political, it’s about nding the local issues that motivate you to act. is is mine. By fully funding Promise NYC and expanding programs focused on helping families nd economic stability and opportunity, we will convert the fears and uncertainties of our immigrant neighbors into opportunities for growth and participation. I want us to ensure that New York City remains a beacon of hope and a place where dreams can be realized.

e consequences have become clear: 100,000 jobs at risk in every New York congressional district; $16.5 billion gutted from the MTA’s current capital program; long-promised expansions and improvements like the 2nd Avenue Subway, signal modernization on six lines, and ADA accessibility at 23 subway and at two LIRR stations put on ice. Vital state of good repair work is also being parsed and reprioritized. Hundred-yearold switches and substations can’t — and won’t — continue to work inde nitely.

Lisa Daglian is executive director of the Permanent Citizens Advisory Committee to

the MTA. Carlo Scissura is president and CEO of the New York Building Congress.

While Gov. Hochul has repeatedly claimed that all MTA projects will go forward as planned, the fact is that the pause of congestion pricing more than halves the $30 billion the Building Congress projected would be invested in the MTA system from 2023-2025. is misconception is one of many myths

Just last June, we were thrilled to stand with Gov. Hochul to celebrate the Federal Highway Administration’s approval to move forward — what we thought was the last signi cant hurdle to congestion pricing’s implementation, a feat decades in the making. e unprecedented investment in transit infrastructure that congestion pricing would have delivered for New York was poised to transform our state’s economy: each dollar spent on transportation infrastructure yields $4 in economic returns. It would bring critical help for the tra csnarled Central Business District, congestion that costs $20 billion a year, according to the Partnership for New York City, and improve our rapidly declining air quality.

A month after congestion pricing was supposed to start, we’re still in the dark as to how the governor plans to fund the MTA’s current capital plan, much less pay for the next one. e MTA has lost more than $82,000,000 in toll revenue and, as PCAC’s

analysis shows, none of the options pitched by various elected o cials thus far checks all the boxes and meets all of the goals that congestion pricing would achieve.

If the rationale behind this decision is truly an attempt to make New York more a ordable, we should focus on concrete actions rather than empty rhetoric, like creating jobs instead of putting them on hold.

We should nd ways to improve more equitable access to a ordable transit, including by expanding AM peak discounts on the LIRR and Metro-North to seniors and New Yorkers with disabilities, creating a weekly CityTicket with transfers to subways and buses, and expanding Fair Fares for lowincome New York City residents to the railroads within New York City.

A solid step in the right direction would be for the governor to commit to reinstating congestion pricing as soon as possible, but no later than Dec. 1. en enact a onemonth “free trial” period where people can see just how much it would cost them to drive into the CBD so they can make educated decisions about what’s best. We can’t wait until next year or the next state budget to address the region’s critical infrastructure needs and the high costs of failing to act. Canceling long-promised projects and killing jobs just as shovels were getting in the ground leaves billions of dollars of committed federal funding on the table

and at risk. It’s also potentially ruinous for the hundreds of thousands of construction workers who build the infrastructure that moves the region that moves the world.

Each project represents a beacon of economic opportunity, creating construction jobs, expanding socioeconomic mobility for those served by the transit, and enhancing the city’s and region’s appeal to businesses and residents. A forward-looking transit system is essential for a thriving, sustainable urban environment and its suburbs, and attracting talent and innovation to the city.

For New York City to compete in a postCOVID world, its transit system must evolve to meet changing and increasing demands, businesses must be able to count on support from government partners, particularly that they don’t arbitrarily out laws based on political headwinds, and New Yorkers must have faith that their elected leaders have our city’s long-term best interest at heart.

It’s time for Gov. Hochul to unpause the pause, follow the law, and get New York contractors and riders back on track.

Beth Moore has joined STO Building Group to help lead the rm’s Global Services group, which helps enterprise clients with their construction and facility delivery strategies. As SVP and Director of Global Services, Moore will co-lead the group with STOBG veteran Roger Saleeby. She joins STOBG from Raise Commercial Real Estate, where she served as Head of Strategic Growth, helping the company drive client-centric strategies.

Joining Moore is Oliver Petrovic, VP of Business Development. Petrovic’s most recent position was at Northwell Health, where he managed a 10-million-sf portfolio. He has also held executive roles at several leading brokerage rms, where he provided strategic advice on workplace management and project execution.

MetLife

Tamar Shapiro joins MetLife as Chief Data and Analytics Of cer. Shapiro was the Head of Analytics at Instagram and also worked for more than 10 years at American Express, leading analytics, reporting, experiments and customer insights. She comes to MetLife from TZP Group where she leveraged data and technology while applying Arti cial Intelligence and advanced analytics to drive engagement, sales and pro tability. Shapiro will be based at MetLife’s Global Headquarters in New York City.

Vinson & Elkins

Benjamin Heriaud has joined Vinson & Elkins as a New York-based partner in the Capital Markets and M&A Practice Group. He represents corporate, private equity sponsor and investment banking clients and specializes in capitalraising transactions, with a focus on initial public offerings, alternative, hybrid and private capital transactions, acquisition nancings and high-yield debt offerings. He works with companies in many industries, with a focus on technology and industrials.

Vibrant Emotional Health Vibrant Emotional Health (Vibrant), a premier national mental health organization and the administrator of the 988 Suicide & Crisis Lifeline, recently appointed Cara McNulty, DPA, as its new Chief Executive Of cer. As CEO, McNulty will lead Vibrant through its next growth phase. She will oversee all aspects of the organization, collaborating with a talented leadership team to develop, deliver, and scale innovative products and programs.

| By Valerie Block

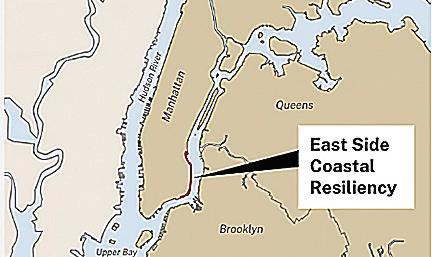

New Yorkers jogging along the East River bike path below 23rd Street are nding something new — a 10-foot concrete seawall. On the other side is Stuyvesant Cove Park, now elevated by 8 feet and featuring seating areas, plantings and views across the river.

In the event of a major storm, massive gates will close the gaps in the seawall to keep the storm surge at bay. Eventually, the entire East River Park will become a bulwark against storm surges.

e East Side Coastal Resiliency project is part of a larger e ort to keep the city safe from devastating storms, hatched after Hurricane Sandy crippled lower Manhattan. New York is building seawalls, boosting shorelines and recreating wetlands as it races to prepare for rising sea levels and more virulent storms — and in the process reshaping the city landscape from lower Manhattan to Far Rockaway.

ere is no time to waste. Already elevated compared with the past century, sea level is expected to rise by another 16 inches by 2050, leaving low-lying areas vulnerable to chronic ooding. Temperatures are

rising too. By 2050 New Yorkers will see 57 days of 90-plus-degree heat, compared to about 33 now.

“We have invested something on the order of $15 billion already. Much of it in federal money towards resilience to coastal storm surges like we had during Hurricane Sandy,” said Rohit Aggarwala, commissioner of the city’s Department of Environmental Protection.

Among the projects on the city’s agenda:

from increasingly devastating downpours.

A $2.3 billion seawall to run 5.3 miles from Fort Wadsworth to Oakwood Beach on Staten Island.

“The big questions are: Can we agree on what to build? Can we allocate the money and nd the funding? And can we deliver the projects?”

◗ An elaborate design to elevate the Financial District and South Street Seaport shoreline is expected to cost $7 billion.

Rohit Aggarwala, commissioner of the Department of Environmental Protection

◗ An Army Corps of Engineers plan to ring low-lying communities around New York Harbor with a series of seawalls and other protections could reach $52 billion or more.

◗ e city’s Cloudburst initiative to implement strategies to mitigate inland ooding

As the climate grows hotter, wetter and less predictable, resilience has become the mantra among New York City o cials and urban planners. anks to the lessons learned from Hurricane Sandy, projects already underway will bring revitalized parks and protections against storm surge to neigh borhoods around the boroughs with completion dates ranging from 2025 to 2050.

In addition, the city is building sunken parks that can retain ood water, “daylighting” streams that have been diverted underground and seeking to reengineer antiquated sewers to battle a newer problem: extreme rainfall. ese so-called

CROSSROADS UNDERWRITERS:

cloudburst events can rapidly deluge neighborhoods, impair infrastructure and turn deadly.

Of course, this is New York, and the road to resilience will be paved with budget shortfalls and delays.

“ e big questions are: Can we agree on what to build? Can we allocate the money and nd the funding? And can we deliver the projects? Right,” Aggarwala said. “And if we really focus on those three things and get it done, then yes, we can give the New Yorkers of 2050 a safe and secure setting. If we don’t do those things, then we can’t.”

“ e reality is major infrastructure projects like that take a long time,” he added. When it comes to coastal defense, New York is slowly making progress.

e East Side Coastal Resiliency Project, jointly funded by the city and federal government and stretching from East 25th Street to Montgomery Street, is one of the furthest along. It seeks to shield critical in-

frastructure like the Con Edison plant that was damaged during Sandy, blacking out half of Manhattan.

When the $1.45 billion project is completed by the fall of 2026, New Yorkers will nd an elevated and revitalized East River Park with massive seawalls tucked beneath the FDR Drive. Sliding and swinging gates will be closed during raging storms to protect neighborhoods from storm surge.

Informed by the Lower Manhattan Coastal Resiliency study, the city, state and federal government have committed $1.7 billion to create ood barriers and other strategies to protect the lower Manhattan coastline from Brooklyn Bridge to Battery Park City. Completion dates for the multipronged project range from 2024 to 2031.

A complex piece of the plan will raise and extend the shoreline of the Financial District and South Street Seaport, creating a multi-level waterfront with sweeping views of New York Harbor, more discreet seawalls and additional public space. is dreamscape will take 15 years to complete once approvals and funding are in place. City DEP expects to break ground by 2029.

In the Rockaways, the Army Corps of Engineers has built up the beach, added stone groins and restored dunes. Residents have spent years watching heavy equipment dig trenches and pile up forti cations. e $600 million project is expected to be completed in 2025.

e city will nally break ground this fall on a seawall on Staten Island, where 24 residents died during Sandy. e rst contract for $133 million is expected to continue for three years. Other parts of the project are still in the design phase.

Even with all these developments, there will be gaps in the city’s coastal defenses until the Army Corps of Engineers settles on a plan to ring New York Harbor with a series of sea walls and other protections for

low-lying communities from Red Hook to Harlem. e Harbor and Tributary Study, or HATS, is still years away from reality. Already the cost is estimated at $52 billion, and Aggarwala predicts that will double by the time it is nalized.

Some critics believe many of the Army Corps plans, complete with towering walls, will cut communities o from their beloved coastlines. “We need to build multipurpose infrastructure that enhances these communities for the next generation,” said Amy

Chester, managing director of Rebuild by Design, which designed the Lower Manhattan Coastal Resilience plan. eir plans incorporate added public space and amenities to enhance access to the shoreline, along with protections. “So we’re kind of at a crossroads of deciding whether we’re going to have communities that are enhanced by this or communities that are held back by this construction,” Chester said.

While the debate continues over coastal resilience, the city must focus on another vexing problem: stormwater. Freak storms are hitting the city with increasing frequency, causing inland ooding, damage to property and loss of life.

“Flooding is not just an issue coming from the edge over,” said Robert Freudenberg, vice president of energy and environment for the Regional Plan Association, referring to storm surge. “We have to really worry about ooding from the sky as well.”

Tropical Storm Ophelia deluged the Prospect Park Zoo last fall, destroying criti-

cal infrastructure and shutting it down for months. Tropical Storm Henri dumped a record 8 inches of rain on Central Park in just 36 hours in July of 2021. at storm was quickly followed by the remnants of Hurricane Ida that killed 13 city residents, mostly in ooded basements. In 2020 the National Climate Assessment o cially moved New York City from a continental temperate zone to a subtropical climate zone.

To reduce the threat, the DEP two years ago imposed a Uni ed Stormwater Rule that requires developers of large plots of land to contain stormwater on site, said Aggarwala, whether that’s through porous pavement, retention tanks or simply grassy areas with trees. “ e point is, you can’t just have it all be concrete and put all the water into the drain,” he said.

One of the city’s biggest problems is its antiquated sewer system built for “a di erent climate,” Aggarwala said. “So part of what we’ve got to do is, frankly, reengineer large parts of the city to handle much more intense rainfall.”

He said it will require a mix of underground gray (laying bigger pipes in sewers) and green infrastructure (planting more

By Valerie Block

Local Law 97 is an ambitious plan to reduce greenhouse gas emissions by 80% by 2050 from the heaviest emitters in the city: large buildings. However, the very body that passed the law in the rst place, City Council, is now considering legislation that would erode its potency.

In another potential setback for the law, a state court of appeals recently revived a lawsuit brought by building owners in Queens seeking to overturn it.

Local Law 97 would impose nes on building owners who fail to reduce emissions under a set of escalating caps. Com-

pliance could require expensive retro ts for aging buildings.

But now, a bill in City Council would slash nes for building owners who fail to meet the requirements. Queens Councilwoman Linda Lee is pushing legislation that would a ect 10% of the 50,000 buildings covered by the climate law, Lee recently told Crain’s. “I think, practically speaking, [the law] set a really high bar that really could impact people nancially in a negative way,” she said.

e law was passed in 2019 and gave building owners years to prepare, with compliance reports due by May 2025.

ose not in compliance could begin to

face hefty nes.

Rohit Aggarwala, commissioner of the city Department of Environmental Protection, called the City Council’s latest proposal, “absolutely wrong.”

“Buildings are the largest source of emissions in the city, and people who own real estate have got to recognize that part of their responsibility as owners is reducing the impact they have on the climate,” he said. “And, you know, frankly, I think it’s laziness to just say, oh, exempt us. We don’t want to be bothered, as opposed to actually solving this problem, because we have a way to do so.”

Observers note that buildings that can’t

a ord the costly upgrades will struggle to comply, or might even decide that paying the nes would be cheaper than compliance. “So those are real problems that need to be addressed,” said Eli Dvorkin, editorial and policy director at the Center for an Urban Future, an independent, nonpartisan policy organization.

Boosting compliance

But he added, “Addressing those problems by weakening penalties or enforcement isn’t the right solution. Instead, we need a much stronger focus on developing the capacity to provide a

trees). But that, too, is going to be a big investment. “Our best estimate is that it is at least $33 billion,” Aggarwala said, “and, you know, that is not in our current budget.”

One green infrastructure project moving forward is the daylighting of Tibbetts Brook in the Bronx. e city recently struck an $11 million deal with CSX Transportation to buy the land which will enable it to bring Tibbetts Brook back above ground and create a new rail-to-trail park on the banks. Removing the brook’s ow from the sewer system will help to reduce combined sewer over ows by 228 million gallons annually and help improve the health of the Harlem River.

As part of its Cloudburst initiative, the city is beginning construction on sunken basketball courts that double as stormwater containers at New York City Housing Authority properties, many of which were damaged by Sandy. “DEP is advancing these Cloudburst projects with NYCHA at the South Jamaica Houses, which will be the rst of its kind here in New York City,” said Maggie Hopkins, a vice president at engineering rm AKRF, which is engaged in multiple resilience projects around the city. AKRF is also evaluating the sunken park concept in Parkchester/Morris Park for other public properties including schools, playgrounds and more.

Still, nding the political will to spend billions on resilience when the sun is shining is one of the biggest hurdles to achieving these ambitious goals. “Flooding is only an issue when it happens, and it doesn’t happen every day,” said Freudenberg. “If it’s something that we think we don’t have to worry about you know, there’s less of a kind of collective movement to get everybody to say yes, this is worth paying a little more to protect, and that’s the challenge.”

Observers cheered the recently created Bureau of Coastal Resiliency which will put the myriad projects currently managed by various agencies under the DEP’s aegis. But full funding for the o ce has yet to be determined.

And while Aggarwala is laser-focused on resilience, he’s painfully aware of the challenges, a couple of which keep him awake at night.

“So it’s about money, and that certainly keeps me awake,” he said, “because I don’t know where all the money for stormwater is going to come from. I don’t know where the money for coastal resilience is going to come from yet. But the other one is the task of my agency and my colleagues and city government, which is to deliver these projects and make sure that we have the teams that are fully sta ed and empowered to do this work.”

ing and technical assistance needed to boost compliance.”

Aggarwala noted multiple city, state and federal programs that can help buildings comply with the law, o ering grants, lowcost nancing and technical assistance.

“We are working as hard as we can to ensure that there is funding and nancing available,” he said. He also called upon the City Council to enact the J-51 tax credit, which he said would provide many buildings with up to 80% of the costs associated with compliance.

“So rather than exempting them from an obligation, we have a clear path that’s been endorsed by the [Adams] administration that would help them pay for it, that would generate jobs,” Aggarwala said. “It would protect the environment. It would reduce local air pollution in those communities.”

THE PROBLEM When Hurricane Sandy hit New York, water came over the East River banks causing the explosion of a Con Edison plant transformer on the Lower East Side. The event knocked out power for half of Manhattan for nearly a week.

East

Protecting the neighborhood’s 110,000 residents and critical infrastructure from storm surges while elevating and rebuilding the East River Park for residents to enjoy year-round.

shut like a door.

From folding and swinging walls to rebuilt beaches to elevated promenades, these 11 projects incorporate a variety of approaches to help keep New York dry.

‘Daylighting’ Tibbetts Brook Reroutes Tibbetts Brook above ground from the sewer system below in an effort to reduce sewer over ow.

East Side Coastal Resiliency Reduces ooding by adding a series of walls and gates along the coastline.

Protecting the Financial District

A variety of shoreline improvements from The Battery to the Brooklyn Bridge that include raised shorelines, buried oodwalls and a more resilient stormwater infrastructure.

Staten Island Bluebelt

Preserves natural drainage corridors including streams, ponds and wetlands, and enhances them to manage runoff precipitation or stormwater.

Staten Island seawall

A 5.3 mile long seawall that reaches up to 20 feet high to protect the island from ooding.

Meanwhile, the revived lawsuit could spell more trouble. A panel of appellate judges from the New York State Supreme Court in May found one of the lawsuit’s four arguments compelling enough to let the case move forward, namely that the city “failed to show” that the state’s more comprehensive Climate Leadership and Community Protection Act does not preempt Local Law 97. e city has appealed the ruling, and state Attorney General Letitia James’ o ce led an amicus brief in support of the city’s case.

“ e Adams administration is fully committed to implementing Local Law 97,” Aggarwala reiterated. “ ere are no more important steps we can take to contribute to the global ght against climate change and to protect New Yorkers.”

Caroline Spivak contributed to this article.

145th Street promenade

An elevated promenade concept seeks to preserve a waterfront space while providing ood risk reduction. Project includes a 27.47-foot diameter steel at sheet cofferdam with sand back ll inside, and a reinforced concrete cap 18 inches thick.

106th Street promenade

An elevated promenade concept seeks to preserve a waterfront space while providing ood risk reduction.

Red Hook oodwall

Floodwall systems aim to provide ood risk reduction and typically include a reinforced concrete structure supported on steel H-piles.

Rockaway Beach Installs 19 new stone groin structures to stabilize and replenish the beach.

Manhattan Beach oodwall

Coney Island promenade

An elevated promenade concept seeks to preserve a waterfront space while providing ood risk reduction.

Floodwall systems aim to provide ood risk reduction and typically include a reinforced concrete structure supported on steel H-piles.

Scan the region’s skyline, and you’ll see skyscrapers, bridge towers and port cranes — a century’s worth of Port Authority infrastructure soaring into the clouds. But as we continue building at a breakneck pace, we’re starting a di erent conversation across the region. We’re now de ned not just by what we can put into the sky, but what we can keep out of it in the process.

e Port Authority has been collaborating with community and industry partners to put carbon reductions and environmental sustainability front and center in our infrastructure. is is true both in the operation of our facilities, garnering us a multitude of energy-e ciency accolades, and in how those facilities are built. It’s a crucial undertaking given the unprecedented amount of construction we’re doing. In addition to the current historic $19 billion transformation of John F. Kennedy International Airport, we have just completed the new LaGuardia Airport and the new Terminal A at Newark Liberty International Airport, and are embarking on building a modern 21st century bus terminal in midtown Manhattan to replace the existing outdated facility. Anyone who wants to build bigger and better with us should understand that sustain-

ability and the future of transportation are one and the same.

What does that mean? It means being imaginative and innovative. At JFK, it means using the airport’s water access to barge in sand, steel and other bulk building materials through Jamaica Bay for the construction of massive new airport terminals, while removing debris the same way. is idea, developed through robust community and industry input, replaces thousands of truck trips on streets near the airport. Each barge can carry the equivalent of 200 trucks’ worth of material. roughout the airport’s redevelopment, the barges will spare surrounding communities from the tra c and emissions associated with an estimated 1.5 million miles of truck travel — enough to circumnavigate the Earth 60 times. Following a precedent established during the reconstruction of LaGuardia Airport, we’re also recycling construction debris on-site, crushing concrete and repurposing it for new construction.

JFK’s crushing operation is a prime example of circularity, or the reuse of decommissioned materials in new projects. We’ve gotten creative in pushing the concept, launching SCRApp, the Sustainable Construction Reuse Application, for use within

our agency. is technology platform is similar to an online dating service, not for humans but for linking up extra or demolished bulk material such as crushed concrete from a demolished slab with another team in the agency looking for that material. Circularity substantially reduces land lling and the number of truck trips associated with it, and often has the added advantage of reducing the overall cost of a project. e more connections we can foster, the more bene ts we’ll see from circularity.

For Port Authority projects that need new concrete, contractors now must use newly established low-carbon standards as we focus on reducing concrete’s bakedin emissions known as embodied carbon. In 2023, the Port Authority set new limits on the amount of carbon allowed in concrete mixes for all future construction projects. e region’s contractors and suppliers gave input as we crafted new low-carbon concrete speci cations. And now requirements to use such mixes are part of every construction contract awarded by the Port Authority. In addition, years of Port Authority research with academic partners have led to new recipes for even lower-carbon concrete mixes that are being tested in the eld to ensure they meet the agency’s stringent safety and durability standards. For instance, one mix being tested at Newark Liberty International Airport may lower carbon intensity by as

much as 45% from the industry average. We’re setting a new precedent with our low-carbon concrete requirement, one we hope will contribute to an industrywide shift. With cement production estimated to account for 7% to 8% of global carbon emissions, that shift could make a huge di erence. And we’re not stopping at concrete mixes — we’re also working toward similar low-carbon standards and innovations for other building materials, including pre-cast concrete, asphalt and steel. Our goal is that this cutting-edge work on cleaner construction ripples beyond our region’s skyline to people and places across the world eager to take on climate change. It’s core to our roadmap to reaching net-zero emissions by 2050, which lays out what we as an agency must do to decarbonize our actions and how we must work with our operational and business partners across the region to do the same. We can help lead the way, but we cannot do this work alone. By pulling industry and community into the climate conversation, we see more cooperation, more creativity and more innovation as we build into the sky — and keep other things out of it.

New York City is at a crossroads; the decisions we make now will determine the city’s livability in a climate-changed world. e city faces growing climate threats that are exacerbating outdated infrastructure, and an a ordable housing crisis that already a ects about half of the city’s households.

In many cases, our homes and communities were built over wetlands and streams, stripping natural capacity to reduce oodwater in addition to putting homes and infrastructure directly in harm’s way. Our neighborhoods have also been subject to decades of redlining, racist land use and housing policies, and present-day NIMBYism when e orts are made to increase density. is has made certain communities — especially Black, Latino and low-income households — disproportionately at risk of climate threats like ooding and extreme heat, and less able to secure safer housing. Additionally, with sky-high housing prices and vacancies at an all-time low, moving out of vulnerable communities or homes can be out of reach for most New Yorkers.

York City passed a law requiring the development of a citywide adaptation plan. e rst iteration of this plan was issued last year and included bold commitments such as developing a forthcoming ood buyout program.

However, while the plan included many laudable components, it lacked a strategy for how to increase housing and ensure that we’re doing so in a way that doesn’t perpetuate or increase our risks of ooding and extreme heat. We need incentives and land-use planning that support private and public entities to not just build more housing more quickly (e.g., the City of Yes proposal), but also ensure that we’re leveraging that development and infrastructure to reduce climate risk and expand green infrastructure and a ordability.

long-term funding sources. In 2023, the city established its rst-ever Bureau of Coastal Resilience, a much-needed o ce to manage coastal ooding. e Department of Environmental Protection, where the bureau is housed, also has several projects and plans to manage increased rainfall.

However, both the bureau and the department are tremendously understa ed (along with many other agencies that have an important role to play in climate) — a challenge that not only necessitates budgetary action but other retention and hiring e orts that have been highlighted citywide.

It doesn’t have to be this way. New York City is making progress, but there are several ways the approach can be improved and expedited so communities can thrive despite climate threats.

First, we need a stronger strategy across all levels of government. In 2021, New

Compounding the local challenges, New York state lacks a plan at the state level — which would help establish stronger coordination and proactive strategies for risk reduction to complement the city’s e orts. Gov. Kathy Hochul committed to this in her state of the state address and, if passed, the Climate Resilient New York Act would compel agencies to work together toward shared goals for climate risk reduction.

Second, we need both new funding sources for climate resilience and to protect the ones we have. While there are several critical initiatives underway, there are few

And while the Metropolitan Transportation Authority recently came out with an impressive resilience plan, it is unlikely that the agency can fund signi cant improvements without implementing congestion pricing. Older and under-serviced infrastructure supporting New York’s subways, buses and other public transportation, paired with climate-driven ooding and extreme heat, continues to cause excessive delays, closures and other issues that a ect our daily lives. If we want a sustainable future for our city, establishing and protecting these longterm funding sources is critical.

Lastly and most importantly, we need to work together and include every New Yorker in the process. Determining block- and neighborhood-scale strategies to reduce ooding, keep down heat and accommodate more neighbors without displacement will require signi cant public engagement, user-oriented information and resources that foster an all-hands-on-deck approach.

e city has several existing initiatives that aim to do pieces of this, such as Ready NYC, a campaign to build awareness about extreme weather events. Another, Climate Strong Communities, aims to address climate risks in neighborhoods that have been left out of previous planning and infrastructure investments. ese are excellent programs but need to be better prioritized, integrated more frequently into planning and zoning discussions, and su ciently funded.

We don’t need to settle for today’s limitations, whether they be limited housing stock, outdated infrastructure or rising climate threats. We can do better and act today to determine the future we want for ourselves, our families and new generations. ese challenges are large, but the

are even

National Grid is at the heart of delivering a clean, fair, and affordable energy transition that further enhances the safety and reliability of our networks. That’s why we’re committed to working with our customers and communities to ensure the transition to more sustainable energy sources is as seamless as possible.

We’re building a smarter, stronger, and cleaner energy future that will benefit our customers for generations to come.

To learn more about our plans for a cleaner energy future, please visit ngrid.com.

It was not all that long ago that the merits of climate science were hotly debated at the highest levels of government. We discussed global warming’s impacts in terms of probability and best- and worstcase scenarios, with a sense that any effects were far o in the future.

In the time it took our lexicon to shift from “global warming” to “climate change” to the more denitive “climate crisis,” the impacts have arrived on our shores and in our streets. ese impacts manifest as rising sea levels, ash oods, and prolonged heat waves a ecting our most vulnerable populations.

e good news is that the debate is over, the science is accepted, and governments across the globe, including in New York City, are taking action.

heat, coastal ooding from storm surges, and ooding from cloudbursts — sudden, intense rainfalls that overwhelm our sewers.

New York City’s transformation will include both traditional gray infrastructure (pipes, dams and drains) and also ramping up our green and blue infrastructure — green spaces and waterways. Both man-made and natural defenses will be essential.

e National Oceanic and Atmospheric Administration has reclassi ed New York City as a “humid subtropical” climate. is change is not merely a matter of nomenclature; it signi es a shift that requires comprehensive adaptation strategies to handle a greater number of — and more extreme — ash oods.

of the future must include a comprehensive network of large, below-ground storage tanks to handle excessive rainfall and expanded bluebelt corridors — beyond their already successful use in Staten Island — to leverage natural defenses throughout the ve boroughs. We need porous pavement, rain gardens and other stormwater retention systems.

To avoid the most devastating consequences of climate change, we must drastically reduce our reliance on fossil fuels and transition to a clean energy economy. Simultaneously, we must prepare for the impacts we are already facing, which will only become more extreme in the coming decades.

What will a well-prepared New York City look like in 2030? In 2050?

Some changes will be visible, part of the landscape for all who visit, live and work in the city, while others will be buried under our streets. We need to shore up our resiliency on all fronts: to prepare for extreme

In recent years, New York has experienced increasingly severe weather events. In 2021, Tropical Storm Henri dropped 1.94 inches of rain in an hour, while Hurricane Ida unleashed 3.15 inches in an hour. On Sept. 29, 2023, the remnants of Tropical Storm Ophelia dumped 2.5 inches of rain on the city in an hour. Our current sewer network, designed to handle only 1.5 to 1.75 inches per hour, can’t cope.

e results are catastrophic for New Yorkers, a ecting subways, schools, homes and businesses, with substantial nancial costs for cleanup and recovery.

To combat this, the city must fully fund its cloudburst management program. e city

Boosting funding for parks is also crucial. is funding will allow for greater upkeep of existing properties and create more greenspaces throughout the city to help absorb stormwater before it reaches basement apartments and rst- oor classrooms; it will help our friends and loved ones nd a reprieve on a steamy summer day.

Looking ahead, we need much more tree cover, particularly in low-income communities and communities of color, which currently su er higher temperatures and too much heat-absorbing concrete compared to wealthier neighborhoods. Black New Yorkers account for 50% of heat-related deaths despite being only 25% of the population. Simply put, when a tree grows in Brooklyn, it can be lifesaving.

Major initiatives like the Battery Coastal Resilience project, which will rebuild and elevate the wharf promenade, and the

Before Hurricane Sandy, most in the New York metropolitan region thought of climate change as a distant possibility, unlikely to signi cantly a ect anyone but future generations. Today New York City’s heat waves, extreme rainfall, extreme ooding and milder winters are hard to miss.

According to the National Oceanic and Atmospheric Administration, as of July 9, 2024, 15 conrmed weather or climate disaster events have hit the United States, each bringing more than $1 billion in costs to local economies. Worse, the storms tragically claimed the lives of 106 people, not including deaths from extreme heat.

Smart legislation that would clarify legal ambiguity for the state’s local water and sewer authorities to manage stormwater — from Bu alo to New York City — made headway in the state Senate but failed to move in the Assembly. is is a blow to the city’s ability to pay for major improvements that would x climate change-fueled ooding in neighborhoods and would help save properties and livelihoods.