Melba’s Restaurant is one of over 440,000 small businesses we work with in New York City. With help from our Harlem Community Branch, Melba Wilson has expanded her business and helped revitalize the community that raised her.

Melba’s Restaurant is one of over 440,000 small businesses we work with in New York City. With help from our Harlem Community Branch, Melba Wilson has expanded her business and helped revitalize the community that raised her.

yB Nick Garber

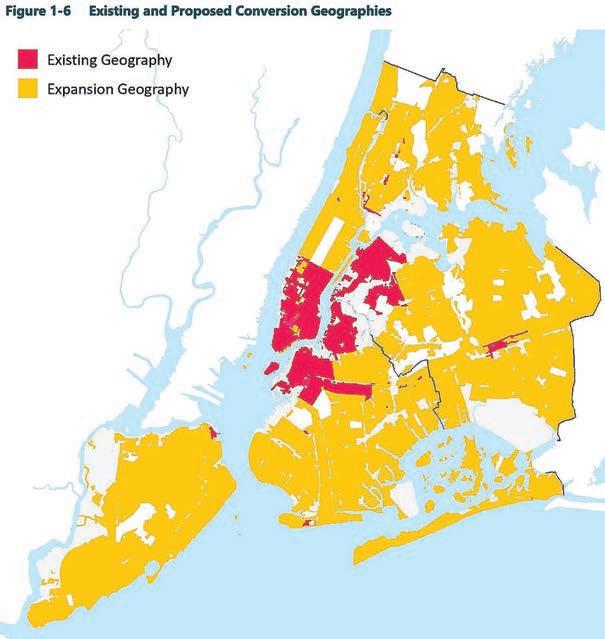

For Mayor Eric Adams, there’s no such thing as a good time to be indicted on corruption charges. But the scandal in City Hall comes at an especially inopportune moment as Adams prepares to pitch his ambitious housing plan to a skeptical City Council.

If the mayor manages to pass the plan despite his dramatically weakened standing, it would qualify as a potentially legacy-making accomplishment from his rst term.

e City of Yes for Housing Opportunity plan has been circulating among community boards throughout the summer and advanced on Sept. 25 with a 10-3 City Planning Commission vote that tees up a nal review by the City Council.

e mayor’s legal and political troubles, however, mean that the council will enjoy more leverage to extract concessions from City Hall, while Adams himself may play a less visible role in shepherding City of Yes toward the nish line.

BY THE NUMBERS 58K to 109K

NUMBER OF new homes City of Yes is expected to create over the next 15 years

36 OF THE city’s 59 community boards voted to symbolically oppose City of Yes, either in whole or in part.

“ ere were already issues with [the administration’s] ability to sell it. Now, the political capital is sort of depleted,” said one council source who requested anonymity to discuss the internal dynamics.

e housing plan would loosen zoning rules across the city to allow for an estimated 58,000 to 109,000 new homes over the next 15 years. e proposal, rst unveiled last year, includes allowing three- to ve-story apartment buildings near transit and above stores in the outer boroughs, permitting

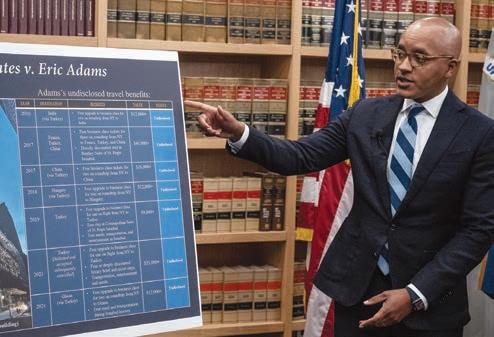

New York City Mayor Eric Adams is facing ve criminal charges in connection with what federal prosecutors call a yearslong corruption scheme in which he did favors for Turkish leaders in exchange for more than $100,000 in luxury travel and illegal political donations that helped him secure $10 million in public money for his campaign — all while covering up evidence of what he and his aides knew to be illegal behavior.

“This was a multi-year scheme to buy favor with a politician on the rise.”

U.S. Attorney Damian Williams

Adams, who swept into o ce in 2021 as a pro-police moderate with powerful ties to labor unions and the business community, now nds his mayoralty in peril amid growing calls to resign. e charges include bribery, wire fraud and soliciting contributions from foreign nationals. But the mayor has vowed to remain in o ce and defend himself against the charges, and suggested the indictment was payback from the federal government after his public disagreements with President Joe Biden’s administration.

e 57-page indictment states that Adams formed ties in Turkey starting in 2014, the year he became Brooklyn borough president. He properly disclosed an initial set of free airline tickets to Turkey that he received in 2015 but later omitted disclosures as he booked

See CHARGES on Page 19

Who’s calling on Eric Adams to resign? Read this story and all the latest developments at

Business leaders hunt for a new candidate to back after the mayor’s indictment. PAGE 17

The city’s industry went all in on Adams. What happens next will test that relationship. PAGE 17

Caroline Spivack

O cials at the Port Authority of New York and New Jersey are creating a blueprint for the development future of Newark Liberty International Airport through 2065, as part of the authority’s quest to revitalize the region’s once infamously dilapidated airports.

e next major step in the airport’s ongoing transformation is a $2 billion rebuild of the Newark AirTrain, which is currently a three-mile monorail that connects the airport’s terminals with its various parking facilities and mass transit. A new Newark AirTrain will essentially serve as the spine around which new airport terminals rise up, said Rick Cotton, the

awarded a nearly $1 billion contract to Austria-based Doppelmayr to design and construct a new AirTrain system, along with operation and maintenance for the infrastructure over 20 years. Later this year Cotton said the Port Authority intends to ink a contract to develop the AirTrain’s track and stations.

“A lot of those hard decisions and planning is right in front of us.”

e Port Authority’s transformation of Newark airport began to materialize in 2023 with the launch of the new $2.7 billion Terminal A. In its rst year of operation, the new terminal served 15 million passengers, which was 5 million more travelers handled during any year by the 50-year-old terminal it replaced. e Port Authority wants to replicate that success with additional structures at Newark Airport but hasn’t yet settled on the best way forward, said Cotton. He declined to share a potential project price tag.

plored implementing its own version of congestion pricing for its airports to help curb car tra c and promote the use of mass transit, but ultimately decided it wasn’t worth the investment and logistical hassle.

Port Authority’s executive director, at a Crain’s New York event on Sept. 24.

“We’re really trying to look at this question of where should the new terminals go,” said Cotton. “In terms of making the airport work as best as we can, our vision plan was trying to analyze the pros and cons of what is a new layout laid out around the guideway system for the AirTrain.”

Late last year the Port Authority

Join Crain’s New York Business and Tech: NYC for a day of conversations and inspiration about the future of the city’s tech ecosystem as a key economic driver. Connect with fellow entrepreneurs, investors, policymakers, civic leaders, and technologists for a lively day of programming, networking and deal making.

“ ere’s an active debate, when you look at Terminal A, obviously it needed to be replaced, but do you build a new Terminal D? Do you leave terminal C for a subsequent renovation?” said Cotton. “A lot of those hard decisions and planning is right in front of us.”

Regardless of the design, one destined result is decades of construction — some of which will require tearing up surrounding roads and is likely to cause tra c headaches for travelers. e Port Authority, Cotton said, has ex-

“It would require some signicant investment,” said Cotton. “So at least at this point, we’re not going down that path.”

Other noteworthy Port Authority developments Cotton discussed during his interview with Crain’s Editor-in-Chief Cory Schouten include:

e Authority is preparing to embark on what Cotton described as “10 years of hell” to orchestrate the $10 billion redevelopment of the Midtown Bus Terminal. Up to $2

billion of that price tag is expected to come in the form of property tax revenue from three commercial towers — two of which would rise over the new terminal. Cotton said he’s con dent the authority will be able to partner with developers interested in the project but that the agency is not waiting to lock in a developer to advance construction on the redevelopment. Apart from a gleaming new bus terminal, the structure will include street-facing retail, three acres of new green space and create an overpass structure along Dyer Avenue. Cotton says the new ramps, park space and bus storage facility could be complete by 2028, while the main terminal building is expected to be built by 2032.

e Port Authority has begun construction on a massive solar array of more than 13,000 solar

panels atop a JFK airport terminal that will cover an area the size of six and a half football elds. e Terminal One solar array will be the largest in New York City and the largest at any airport terminal in the country. Cotton has mulled the idea of reducing the fare for the JFK AirTrain throughout the airport’s years-long redevelopment to curb car tra c, but said travelers shouldn’t hold their breath for discounts. “We debated that at one point but we’re torn between the need for revenue to support these construction activities,” he said. Dock workers on the East and Gulf coasts are threatening to strike on Oct. 1 and the consequences of even a brief strike could be an economic blow to the region. “It is a major, major threat to our supply lines,” said Cotton.

Caroline Spivack

Dock workers on the East and Gulf coasts are threatening to strike on Oct. 1 and the consequences of even a brief strike would be nothing short of economically disastrous for the region, said Rick Cotton, the executive director of the Port Authority of New York and New Jersey at a Crain’s New York Business event Sept. 24.

“It is a major, major threat to our supply lines,” said Cotton. “We are the second busiest port in the country and to have it along with the Atlantic and Gulf of Mexico ports shutdown for any period of time is going to be a terrible economic blow.”

More than $2.4 billion worth of goods pass through New York and New Jersey’s ports each week, said Cotton. Disruptions would impact dozens of vessels that each week cruise into the region’s wa-

terways with tens of thousands of shipping containers, he added. Ships would either idle o the coast or divert to operational ports. ose challenges would quickly impact retailers and con-

sumers with shortages and higher prices.

e International Longshoremen’s Association says its 25,000 members will walk o the job this week if the union does not come to

a new agreement with the United States Maritime Alliance, which represents a coalition of cargo carriers and marine terminal operators. e existing six-year contract expires on Sept. 30.

e dockworkers’ union said it broke o contract talks with management in June over autonomous technology in port equipment at the Port of Mobile in Alabama. e union has ercely resisted automation because it can lead to the elimination of jobs.

“We urge both sides to nd a way to reach an agreement at the bargaining table,” said Cotton.

If there is a work stoppage Cotton added that the agency’s role — as the owner of the region’s ports — would be to assist with an orderly shutdown of operations and a smooth restart as soon as possible.

West Coast ice cream shop Salt & Straw dished out its rst scoops in the Northeast this month after opening its inaugural Manhattan location on Sept. 20.

Backed by proli c restaurateur Danny Meyer, founder and executive chairman of Union Square Hospitality Group and the man behind Shake Shack, the Portland, Oregon-founded ice cream company is making its Upper West Side debut at 360 Amsterdam Ave. Meyer serves as a partner and adviser to the brand.

Co-founders and cousins Kim and Tyler Malek started Salt & Straw by selling ice cream out of a single food cart in the Beaver State in 2011. ey have since expanded into Washington, California, Nevada, Florida and Arizona and ship their brand’s unique avors across the country.

New York avors

e roughly 1,200-square-foot storefront between West 77th and West 78th streets — the brand’s 42nd U.S. location — will pay homage to the Big Apple by serving ve avors exclusive to the ve boroughs, including Cinnamon Raisin Bagels & Schmear, Chocolate Babka with Hazelnut Fudge, Pastrami on Rye, Pistachio & Ricotta Cannoli, and Merlot-Aged Sour with Chocolate Figs. Eleven of Salt & Straw’s classic avors, such as Sea Salt with Caramel Ribbons, Honey Lavender, and Strawberry Honey Balsamic with Black Pepper, also will be available.

Kim Malek, who lives in Portland but visits the city regularly, told Crain’s Sept. 19 that the new shop has been a long time coming. She and Tyler Malek, an award-winning chef and the brains behind the avors, hosted a sold-out pop-up in Manhattan last summer and never heard the end of it.

“It’s the number one place we get requests to open,” Malek said. “I’ve been working on nding a location in New York for about seven years, and we’ve just been taking our time, making sure that we were ready for it and that we had the right location.”

Salt & Straw’s New York expansion isn’t stopping on the Upper West Side. e Maleks are opening up a second location, at 540 Hudson St. in the West Village, in the middle of next month, she said.

Malek declined to share how much Salt & Straw brings home in revenue — pints are sold for $12.95 — or how much it is paying in rent on Amsterdam, but retail availabilities nearby are listed on LoopNet for anywhere between about $60 and $100 per square foot. e landlord is Upper East Side-based real estate rm the Olnick Organization, which did not respond to a request for comment.

“I’ve been working on nding a location in New York for about seven years, and we’ve just been taking our time, making sure that we were ready for it and that we had the right location.”

Tyler Malek, co-founder of Salt & Straw

Other notable September and October openings:

Monkey Thief An Asian-inspired cocktail bar at 401 W. 47th St. in Hell’s Kitchen.

The Corner Store A classic American restaurant from the team behind Catch Hospitality Group at 475 West Broadway in SoHo. Carta Wine Bar A Mediterranean-inspired wine bar from a team of friends at 35 Bedford St. in the West Village.

Gus and Marty’s A Greek American restaurant from the founders of Eggshop, husband-and-wife team Sarah Schneider and Demetri Makoulis, at 232 N. 12th St. in Williamsburg.

Pasta Night A “ ne casual” pasta restaurant from James Beard award-nominated restaurateur, pastry chef and cookbook author Renato Polia to at 575 Vanderbilt Ave. in Prospect Heights.

Defense attorney Mark Heller, who retired in 2022, has put 59 E. 66th

yB C. J. Hughes

High-pro le defense attorney Mark Heller, whose occasionally controversial professional conduct recently forced his retirement, has put his Upper East Side townhouse on the market.

e landmarked prewar residence at 59 E. 66th St., which has six bedrooms, 11 replaces and an indoor swimming pool, is listed for $32 million, according to an ad that appeared Sept. 20.

Bouchout attributed it to “the historical aspect of the house, that every room is grand, that it’s very comfortable and very modernized. And it’s also next-door to where Andy Warhol lived.” e Pop artist resided in the townhouse at 57 E. 66th from 1974 until his death in 1987.

$32M

Sale price for No. 59 at 59 E. 66th St.

Heller, whose list of well-known clients has included actor Cuba Gooding Jr. in a rape case, actress Lindsay Lohan after an arrest for reckless driving and David Berkowitz, the “Son of Sam” serial killer of the 1970s, stepped down from his profession in 2022 after an investigation by a state panel over Heller’s alleged charging of excessive fees and other client issues.

Heller could not be reached for comment by press time.

Matthieu Bouchout, an agent with the year-old city o ce of the French brokerage Kretz Family Real Estate who is marketing No. 59 with his son, Adrian, said the Heller property’s relatively large price tag is justi ed.

Based on listings site StreetEasy, the Hellers’ townhouse is the 15th most expensive currently on the market in Manhattan; 10 of the properties, including No. 59, are found on the Upper East Side. Built in 1878 and remodeled in 1903, No. 59 was in the decades after World War II the home of the Polish Institute of Arts and Sciences. e Hellers bought the townhouse in 1986 for $2 million, according to the city register, or the equivalent of about $6 million today when factoring for in ation.

e 5-story, 7,000-squarefoot edi ce features a formal dining room on its parlor oor, a paneled library on its third oor and a solarium turned yoga room on the top level. e building, between Madison and Park avenues, also has an elevator.

Heller, who began practicing in 1969, joined the legal team representing Berkowitz in 1977 when Heller was 31, according to a 2010

pro le in e New York Times. Berkowitz later pleaded guilty to shootings that caused six deaths.

“A very easygoing guy,” said Berkowitz of his former counsel in an interview the Times conducted from Berkowitz’s upstate prison.

In 1994 Manhattan state Supreme Court ofcials suspended Heller for ve years for “a pattern of misconduct” with clients that included “dishonesty, neglect and failure to return unearned fees,” according to a court ling.

During his suspension, Heller, who was among the rst attorneys in New York to create ads in the Yellow Pages hawking legal services, reportedly had a business

that involved setting up 1-800 numbers on behalf of dentists and plumbers. He resumed practicing law in 1999.

In the 2022 decision that led to Heller’s stepping down, court ocials said he agreed to “not undertake to represent any new clients or accept any retainers for future legal services to be rendered,” according to the ling, nor undertake “transactional activity in any duciary account to which he has access other than for payment of funds.”

yB C. J. Hughes

Actor Norman Reedus, a pursuer of zombies on television, is hunting for somebody to buy his Chinatown apartment.

e longtime star of e Walking Dead apocalyptic horror series has put his duplex penthouse at 136 Baxter St. on the market for about $6 million, according to a listing that appeared Sept. 19.

e three-bedroom condo unit has about 2,600 interior square feet, three and a half baths, and a combined living and dining room with doors to a 480-square-foot terrace, at Hester Street. Taxes run $3,717 a month, while monthly common charges are $2,988. Reedus, who now plays the lead in e Walking Dead: Daryl Dixon, a year-old spin-o on the AMC network that shoots in Europe, does not appear to have been living in the apartment for a while, based on the empty rooms depicted in the listing’s photos.

Indeed, Reedus and actor Diane Kruger, who are now reportedly

engaged after having dated since 2016, seem to have shared a residence at 40 Leroy St., a stoop-fronted townhouse at Seventh Avenue South in Greenwich Village, until earlier this year.

e couple paid $11.8 million for the red-brick landmark in 2018 and sold it at a loss at $9.4 million in April after two years of marketing, which coincided with a period of sluggish sales blamed on high mortgage interest rates.

But the Federal Reserve’s rate cut of a half-percentage point on Sept. 18, the Fed’s rst since 2020 after it enacted a series of rate hikes over more than two years, is expected to provide a boost to the residential sales market.

For his home at 136 Baxter, No. PHA, Reedus paid $3.8 million in 2013, according to the city register. e unit, which features wood-beam-lined ceilings in some rooms, a likely vestige of the building’s previous use as a horse stable for the former police headquarters building at nearby 240 Centre St., is Reedus’ second

home at the site. A former model for the fashion house Prada, Reedus bought a unit on the second oor of 136 Baxter in 2009 for $1.8 million before unloading it four years later for $2 million, according to the register. His purchase of No. PHA followed.

Nick Gavin, the Compass agent marketing Reedus’ unit—and a neighbor of Reedus in the building until he sold his combined fourthoor four-bedroom unit in April for $4.8 million, the register shows—did not return an email

for comment.

In 2007 a team that included art gallery owner turned developer Max Protech converted the 6-story commercial building into a 14unit condo that generated $37 million in real estate sales, according to the condo’s o ering plan.

yB Aaron Elstein

A Plaza District landlord is close to losing one of his prize retail properties to foreclosure.

Robert Siegel, who has been investing in the neighborhood since 1980, last year defaulted on the $215 million mortgage for 681 Fifth Ave. and lenders have moved to seize the 80,000 square-foot building in the heart of one of the world’s prime shopping corridors.

e proceeding is playing out in a New York state court before Judge Jennifer Schecter.

Foreclosure, always a bitter pill, is especially so for Siegel given his long record of success and insis-

anchor tenant Tommy Hil ger moved out of the building between East 53rd and 54th streets.

e retailer continued paying rent, which accounted for 80% of the building’s income, until its lease expired in May 2023. But in the meantime Siegel was unable to secure a new tenant. He said in his a davit the market was “still suffering from the signi cant disruption due to the global pandemic.”

“ is is not a case where mismanagement or other actions or inactions of the borrower led to the lack of building revenue to pay the mortgage,” he said.

Robert Siegel of Metropole Realty Advisors has invested in the Plaza District since 1980 but could lose 681 Fifth Ave.

tence that 681 Fifth’s problems stem from the pandemic.

“ is is the one and only time in my forty-plus years in the industry any borrower entity of which I am or have been an active principal has ever defaulted on a mortgage,” he said in an a davit.

Hard times began in 2019 when

He had the former Hil ger space renovated, and last year hosted an event for the Real Estate Board of New York attended by 60 of Manhattan’s “most esteemed and recognized retail real estate brokers.” But no tenant would sign on the dotted line and, over Siegel’s objections, Judge Schecter earlier this year ruled Colliers would replace JLL as the building’s broker. Colliers declined to comment.

JLL Vice Chairman Richard Hodos said: “ is is a premier property situated among the very best retailers in the world. In fact, it is located on the ‘ fty yard line’ of the premier shopping street in the world.”

Siegel’s woes come at a time when some landlords along Fifth and Madison avenues have had to swallow dramatically lower rents to ll their storefronts. At the same time, retail giants such as Gucci and Prada have paid top dollar to acquire buildings on Fifth close to 57th Street.

Siegel, the CEO of Metropole Realty Advisors, understood the potential for 57th Street and the Plaza District a long time ago.

He acquired the retail building at 21 E. 57th St. in 1980, according to his a davit, and later acquired two adjoining buildings before developing the 100,000 square-foot LVMH Tower, which the France-based luxury giant plans to demolish and replace with a new agship store. Siegel also owns property in Waikiki and on Rodeo Drive in Beverly Hills. He has served as exclusive leasing agent for the Americana Manhasset, a high-end mall in Long Island, and a broker for fashion brands including Ferragamo and Burberry,

according to his court statement.

In 2005 he acquired 681 Fifth for $86 million and spent $27 million updating the building developed in 1980. He extracted $52 million in cash when he re nanced the mortgage in 2016 with a loan from UBS and Citigroup, according to bond-rating rm KBRA. Morningstar, another bond-rater, said Sept. 19 that the 17-story building was just appraised at $105 million, a

76% decline from its pre-pandemic value.

As to his arguments about how the pandemic damaged business, Siegel’s lenders aren’t the least bit sympathetic.

“None of [his] self-styled ‘a rmative defenses’ dispute the payment defaults or borrower’s resulting liability,” an attorney for the banks, Rishi Kapoor, said in a court ling last month.

An attorney for Siegel, Robert Wolf, didn’t immediately return a request for comment.

With the nation's highest cardiac success rates and most experienced team in the tri-state, there's nothing we can't handle.

It's why others trust us to help treat their patients with the most challenging conditions. And with 300+ cardiac specialists working together across Northwell, we're delivering deeper insights and bigger breakthroughs in cardiovascular care no matter where you live.

Northwell.edu/LimitlessHeart

Vacancy rates of 50% or more aren’t unusual in Class B or C buildings — resulting in a formula for defaults

The corks were literally popping at a major real estate brokerage rm after the Federal Reserve slashed interest rates by half a percentage point this month.

“We had Champagne,” said a senior executive who wished to remain anonymous. “Finally, nally rates are coming down. Business is going to get better.”

e stock market agrees: Shares in CBRE hit an all-time high last week, while SL Green and Vornado Realty Trust, New York’s two biggest commercial landlords, reached their highest levels in more than two years. Compass, a residential broker, trades for more than $6 a share, which doesn’t sound like much but that’s much higher than its low around $2 last year.

e race is now on to see if rates fall enough to rescue some of the city’s biggest property owners. But not even lower interest rates can probably save the landlords of many Class B and C buildings, many of which are 50% or more vacant.

Such is the case at 568 Broadway, a handsome 380,000 square-foot building in SoHo. Its $200 million mortgage has been extended twice already and needs to be renewed in early October, otherwise co-owners Eric Hadar and Stanley Cayre will be in default. Banks could refuse to kick the can any further because, according to Moody’s, 568 Broadway is half empty.

‘Plenty

manages 3 million square feet of mostly older o ce space, doesn’t blame WeWork for dooming his buildings so much as the persistent popularity of work from home.

Lower interest rates means lower borrowing costs and more breathing space for heavily leveraged landlords who need to renance their debts. Even better, the Fed indicated it will keep cutting rates. Huzzah!

It’s a similar story at 214-224 W. 29th St., a 200,000 square-foot property owned by Walter & Samuels. It’s been just 12% leased since WeWork moved out last year. e chairman of Walter & Samuels, David Berley, who owns or

“I have plenty of sick buildings that didn’t have WeWork,” Berley told my colleague C. J. Hughes.

Older towers like 568 Broadway or 214-224 W. 29th are considered Class B buildings, and there are a lot of them. ey account for almost 30% of Manhattan’s 600 mil-

lion square feet of o ce space, according to the New York City Comptroller’s O ce. Class C buildings, which are also older and usually located in the middle of blocks, account for 10% of Manhattan o ce space.

Not every Class B or C building is 90% vacant or even 50%, but many are. It’s hard to envision interest rates ever retreating to levels that could rescue their owners.

e cash ow produced by the buildings is simply too low.

“We had Champagne. Finally, nally rates are coming down. Business is going to get better.”

anonymous executive

at is a formula for defaults. e slow-moving wreck will take months or years to play out, but playing out it is. is year lenders led to foreclose on 681 Fifth Ave., a building in the heart of the ritzy Plaza District but one that lost 80% of its rental income after Tommy Hilger moved out. Landlord Robert Siegel said the pandemic was to blame, which is surely true. “ is is the one and only time in my forty-plus years in the industry any borrower entity of which I am or have been an active principal has ever defaulted on a mortgage,” Siegel said in an a davit. Sometimes, there’s a rst time for everything. Even with lower interest rates.

The Democratic presidential candidate should worry about her margin of victory in the state even if she carries it easily

Are the New York Democrats in trouble?

ere is no way to truly know, and certain indicators, at least, are decent for the Democratic candidates trying to ip crucial House seats in the suburbs. Fundraising has been strong, the contenders have been mostly scandal-free and investment has come from up top.

Gov. Kathy Hochul, despite her own political struggles, has dedicated large sums of cash to rebuilding a state Democratic Party that, before her tenure, could be said to have hardly existed at all. She has coordinated with Sen. Kirsten Gillibrand and Hakeem Je ries, the House Democratic leader, to boost down-ballot candidates.

All of that, though, may not be enough if Kamala Harris slips in New York. ere are encouraging signs for Democrats lately: In the latest Siena College poll, she led Trump 55%-42%, a lead virtually unchanged from August. If the race nishes this way, Harris will be in a much better position than

Hochul herself, who only carried the state by six points over Republican Lee Zeldin in 2022. is would mean, at the minimum, the 2024 election cycle would be much more favorable to Democrats than the midterm, when Republicans seized all four Long Island congressional seats and ran roughshod over Democrats in the Hudson Valley. Of the six seats Republicans won in 2022 — the four on Long Island and the two in Westchester and the Hudson Valley held by Mike Lawler and Marc Molinaro — at least a few should fall back under Democratic control.

Democrat Tom Suozzi has already recaptured the North Shore district won by the disgraced George Santos and looks like a lock to win re-election. On the South Shore, Democrat Laura Gillen should be favored over Anthony D’Esposito. Mondaire Jones is neck-and-neck with Republican Mike Lawler, if Lawler still probably has the edge, given Jones’ decision to decamp to Brooklyn to run in a di erent district two years

ago.

e but here is that Harris, at 55%, is roughly six points behind Biden’s 2020 performance in New York. Biden beat Trump with 61% of the vote. Clinton, in 2016, won 59%, and third-party voting was much higher then, which should have eroded her numbers.

Are they doomed?

e question for Democrats down the ballot is what they will do if Harris is running well behind Biden and Clinton. Are they doomed? Can they still ip enough seats to take back the House?

e election, nationally, is incredibly close, and the chances of Harris or Trump winning are both around 50%. Harris will probably win the popular vote but might not win by enough, like Clinton, to secure an Electoral College victory. Trump’s popular vote share could be similar to 2020 or even higher.

Democrats within New York are far less complacent than in past election cycles. ey are all aware of Trump’s strengths, and Hochul has helped open up many eld ofces for the down-ballot contenders. ey are doing, in theory, all they can. But if Harris doesn’t run well enough, their candidates could be overwhelmed by the Trump vote.

Harris herself doesn’t have to fret New York because the electoral votes are hers for the taking. But if she does care about having a Democratic-controlled House as president, she’ll have to start looking much harder at the Empire State and why she’s trailing 2020 Biden by so much.

Ross Barkan is a journalist and author in New York City.

Eddie Small

Catholic Charities of New York has given Lower Manhattan's struggling o ce market a rare bit of good news.

e nonpro t, which focuses on combating poverty, is leasing roughly 77,000 square feet of o ce space at 80 Maiden Lane, the building's landlord announced Sept. 23. Catholic Charities is expanding its existing footprint and moving administrators and other employees from Midtown to Maiden Lane, according to the organization and landlord. It will lease the 22nd, 23rd and 24th oors, along with part of the 14th oor, for 30 years. Catholic Charities currently leases about 27,000 square feet of space on the 13th and 14th oors.

The property at 80 Maiden Lane stands 25 stories tall and is 86.3% leased, with asking rents ranging from $40 to $49 per square foot.

e owner of 80 Maiden Lane appears to be a joint venture of the Chelsea-based real estate rms A.M. Properties and Cannon Hill Capital Partners along with Midtown-based Meadow Partners, according to a promotional website for the property. ey are converting the building into o ce condos for the Catholic Charities lease, which tends to be a popular option for nonpro ts. Leasehold condos allow the organizations to be seen as owning their o ce space, and because nonpro ts are exempt from real estate taxes, this can be a signi cant money-saving move for them.

e property at 80 Maiden Lane stands 25 stories tall and is 86.3% leased, with asking rents ranging from $40 to $49 per square foot, according to the commercial real estate database CoStar. e largest tenant is the city's Department of Investigation, which leases about 111,000 square feet on a deal that expires in July, CoStar says.

e downtown o ce market has consistently lagged behind Midtown and Midtown South in the wake of the pandemic, according to monthly market reports from Colliers. e Catholic Charities deal is the fth-largest o ce lease of the year for the area, according to Colliers data.

Problems in the neighborhood include its largely older o ce buildings and the opportunities for companies to get good deals in other parts of the city. Lower Manhattan previously saw a wave of

residential conversions in the 1990s and 2000s and is now a prime target for another wave post-pandemic.

Nonpro ts have been one of the bene ciaries of the city's weak ofce market, with lower rents and additional concessions from landlords allowing them to break into nicer o ce buildings that would

likely be out of their price range in a more competitive environment.

As a litigator, I’m ready to fight for your interests. But as a business advisor, I know that litigation isn’t always the best path to solve a problem or serve a business.

I take a 360° view.

Covering all the angles. Thinking ahead.

Balancing urgency and restraint; risks and rewards. All in the context of what’s right for your business. I work with companies in all industries, especially those that are highly technical and heavily regulated. Protecting intellectual property and trade secrets. Proactively anticipating and preventing issues. Meeting legal challenges with tailored strategies and clear objectives.

I used to be a professional musician.

Now my clients take center stage.

Relying on me to hear them, work alongside them, and deliver outcomes in tune with their needs.

I’m RENA ANDOH I’m on your team.

A JLL team including Matt Astrachan, Greg Wang, Kristen Morgan and Hannah Bernstein represented Catholic Charities in the deal. CBRE's Paul Amrich, Neil King, Jonathan Cope, Gerry Miovski and Masha Dudelzak represented the landlord. beneschlaw.com

> Partner, Litigation Practice Group > 646.777.0043 | randoh@beneschlaw.com

Mayor Eric Adams vows to remain in o ce despite the serious criminal charges brought against him on Sept. 25 by the U.S. attorney for the Southern District: bribery and circumventing federal laws meant to limit the in uence of foreign nationals on U.S. elections. is is a moment when the governance of New York City’s 8.3 million residents demands unwavering concentration. Yet the functions of city leadership are overshadowed by scandal and suspicion. e charges were just coming to light as this editorial went to press, with the mayor denying the accusations. It will be up to Adams to prove he can juggle the charges he’s facing and the exodus his administration is seeing with the big responsibilities of his job as mayor.

News of FBI raids and federal indictments marks a profound dysfunction in the city administration. is month alone, four top o cials have submitted their resignations: Schools Chancellor David Banks, Health Commissioner Dr. Ashwin Vasan, NYPD Commissioner Edward Caban and chief legal counsel Liza Zornberg.

PERSONAL VIEW

e Adams administration is on its third police commissioner in less than three years, a turnover rate not seen since the days of Mayor James J. Walker in the 1930s. Such instability inevitably trickles down, a ecting every facet of government and threatening critical initiatives like the mayor’s ambitious City of Yes housing project.

Nick Garber’s reporting on Page 1 for Crain’s highlights a grim picture: a cornerstone policy meant to address the city’s dire housing needs is now undermined by the administration’s near-complete loss of political capital.

e spectacle of successive police commissioners and other high-ranking ocials stepping down is not merely a bad look — it’s a blow to continuity. How can policies be carried out if the leaders are constantly in ux? e resignations and criminal charges directly impede the city’s progress.

If Adams is sincere in his pledge to carry on as mayor, he must do more than o er

platitudes like “Stay focused, no distractions and grind.” Leadership is measured by the ability to maintain the course despite adversity, to shepherd vital projects to completion, and, most importantly, to foster an environment of stability and trust both within the government and among the public.

As New Yorkers we must demand accountability. We need a mayor who cannot only envision bold solutions for issues like housing, the migrant crisis and post-pandemic real estate upheaval, but who can also navigate the complexities of governance without risking federal probes and losing key players.

In the face of ongoing investigations and the decline in administrative coherence, it’s the duty of everyone in city gov-

ernment to ensure that the city is not just functional but resilient amid these disruptions. is is not merely about one man’s political career; it’s about the well-being of millions who call this city home.

With global warming exceeding 1.5 degrees Celcius above pre-industrial levels, the climate ght touches every industry and facet of life. e transition towards net zero is the largest economic transition in history, with the International Energy Agency estimating it will cost $4 trillion a year over the next 30 years. ere is an enormous opportunity across the U.S. to lead the development of climate-oriented businesses, particularly in technology and innovations.

e state of New York has done this phenomenally well. In New York City alone, climate startups earned $664 million in venture or growth funding in 2023, creating more than 133,000 jobs. New York’s status as the nation’s burgeoning hub of climate tech is not taken for granted simply because it is the world’s largest nancial center — its leadership has taken conscientious, sustained e ort over the last decade.

ing their access to sun, wind, and land — opportunities for innovation with a global impact are abound.

Todd Khozein is the founder and

CEO

of SecondMuse, an impact and innovation company that works with communities to create

and well-being solutions.

Other cities and states can learn how New York has enacted policies to nurture a robust climate tech ecosystem. e future of climate tech will largely depend on how successfully we can replicate models like this across the US. Whether it’s coastal cities developing coastline resilience or the Southwestern region leverag-

Building a new market requires longterm continuity that cannot be in uenced by politics, short-term incentives, or shifting strategies. is is key to developing a collaborative innovation ecosystem, which include Futureworks by the New York City Economic Development Corporation has created networks that enable sharing and mentorship that could solve problems for entrepreneurs in their speci c contexts. Linking entrepreneurs of diverse perspectives and maturity can be more valuable than simply bringing in the CEO of a large company. is translates to a more rapid exchange of ideas, higher entrepreneurial success, and access to a more diverse range of entrepreneurs — a fundamental ingredient to a resilient, vibrant, and thriving economy.

Particularly for climate tech hardware companies, they have to navigate complex manufacturing processes, addressing questions of when to make, when to buy, and how to nd and collaborate with key suppliers. When startup Urban Energy was looking to scale its modular solar canopy solution, the joined Scale for ClimateTech, an innovation accelera-

tion program supported by the New York State Energy and Research Development Authority and administered by NextCorps and SecondMuse. By the program’s end, Urban Energy had received advice from technical experts and changed their product from steel to aluminum for lighter weight and easier installation.

e same consistency needs to exist for engaging investors. Over several years, Scale For ClimateTech has nurtured a group of 100 climate-curious investors, who were interested but not yet invested in climate solutions, to help them get familiarized, make connections, provide advice on due diligence, and introduce them to startups. is consistent groundwork was necessary to eventually lead to large, catalytic investments.

An ecosystem is made up of entrepreneurs, corporations, policymakers, capital providers, landowners, and developers — but they are also humans. Building relationships between people allows for frictionless transactions, which can only happen when they get together repeatedly.

Previously, one of the governmental policies o ered to startups were tax incentives. However, early-stage entrepreneurs often do not make a pro t, so tax incentives were not relevant to them. Later in 2016, the NYCEDC started to provide access to prototyping spaces, which was a more e ective incentive, as it enabled climate tech entrepreneurs to have physical places to acceler-

ate their innovations.

e EDC’s foresight extended to utilizing previously-stranded large industrial spaces, such as the Brooklyn Navy Yard and the Army Terminal — which have become some of the most accessible industrial spaces for innovators and manufacturers.

Policies need to be adaptive and responsive to the actual needs of entrepreneurs and help them meet their city’s unique opportunities and challenges. is can only happen by grounding policymaking in the innovation ecosystem, ensuring interface and interaction between policymakers and the entrepreneurial community.

Today there is a once-in-a-generation opportunity in climate funding. From the CHIPS Act and the Bipartisan Infrastructure Law, to the In ation Reduction Act, the federal government is making historic investments that are strengthening the capital infrastructure of climate tech.

Climate tech is a complex market where the need for coordination and engagement is particularly high, especially as we rely on new ideas to build a new economy. By bringing together leaders, institutions, investors, and governments to create an ecosystem of support that o ers entrepreneurs technical assistance, mentorship, and access to capital, we can create the environment necessary for entrepreneurs to grow their technology, create impact and become leaders in an unprecedented global economic transition already well underway.

According to the American Heart Association, more than 350,000 cardiac arrests occur outside of the hospital each year.

As with any medical episode, the road to rehabilitation and recovery can be arduous and time-consuming. However, failure to complete such a program often leads to complications delaying recovery, requiring further invasive measures, and diminishing the patient’s quality of life.

Cardiac rehabilitation is a Class 1 recommendation by the National Institutes of Health, meaning it is bene cial and effective in a patient’s recovery. A comprehensive cardiac rehab program includes home exercise training, nutritional counseling, stress and mental health counseling, smoking cessation coaching, and medication adherence.

Studies have shown that patients who complete a cardiac rehab program have decreased mortality rates, increased weight loss, reduced or stopped smoking, decreased their lipid burden, better-managed stress, and have lower rates of depression compared to patients who do not participate in or complete cardiac rehab.

Despite all these bene ts, only 15.4% of eligible New Yorkers complete a cardiac rehabilitation session after having a cardiac event. Cardiac events include Myocardial infarctions, stent placements, and other cardiac procedures.

With the CDC aiming for 70% participation in cardiac rehab, New York falls well below the national average. is stark reality underscores our urgent need to improve participation rates, remembering that people’s lives are at stake.

Several socioeconomic factors can contribute to low participation in cardiac rehab, such as patient expenses, di culty traveling to a physical facility, and time limitations. Due to these constraints, referrals to cardiac rehab are often scarce, and clinicians typically adjust their referral patterns based on patients they believe are in greatest need.

To address the factors limiting people from receiving the care they need, providers and health plans need to work together to

understand the needs of our communities and implement solutions that will result in increased cardiac rehab participation and completion. Hybrid models allowing treatment in-person as well as virtually, and remote cardiac rehab programs, are two proposed solutions that can provide

new avenues for patients to access rehab bene ts and o er promising steps towards increased completion rates in New York.

In response to this need, EmblemHealth launched a virtual cardiac rehab program to improve access, reduce patient costs and eliminate signi cant barriers to

care.

As we learned during the COVID-19 pandemic, remote options are not a one-size- ts-all solution to these barriers. However, the technologies available now allow us to address some of the obstacles to care by providing it in the comfort and spaces of one’s

home with limited hassle and interruptions. New York is a natural leader in many areas. Now is the time for stakeholders, including policymakers, to encourage and promote innovation to improve our communities’ heartbeat. Now is the time for the Empire State to lead cardiac rehab innovation.

copays for 24/7 Virtual

You’ll get that. Plus, a $700 earning potential for achieving certain wellness goals.¹ These are just some of the ways an Oxford health plan may help your employees and your business’s bottom line get healthier.

*The Designated Virtual Visit Provider’s

1 Oxford fully insured subscribers can apply for reimbursement up to $200 when

Oxford insurance products are underwritten by Oxford Health Insurance, Inc. This policy has exclusions, limitations and terms under which the policy may be continued in force or discontinued. For costs and complete details of the coverage, contact your broker or Oxford sales representative.

Oxford $0 deductible plans are available for New York-sitused employers. Plans sold in New York use policy form numbers: POL24.OHI.2019.SG.NY, POL24.OHI.2019. SG.HNY and POL24.OHI.2019.LG.NY.

24/7 Virtual Visits is a service available with a Designated Virtual Network Provider via video, or audio-only where permitted under state law. Unless otherwise required, benefits are available only when services are delivered through a Designated Virtual Network Provider. 24/7 Virtual Visits are not intended to address emergency or life-threatening medical conditions and should not be used in those circumstances. Services may not be available at all times, or in all locations, or for all members. Check your benefit plan to determine if these services are available.

y

B Nick Garber

e city canceled a planned vote on Extell Development’s proposal to open a large bank branch in an iconic Broadway building, following complaints from a veteran lawmaker who fears it would water down a rule intended to curb the spread of chain stores.

City Councilwoman Gale Brewer is asking the City Planning Commission to reject Extell’s request to lease the long-vacant 4,600-square-foot space on the ground oor of the Belnord Apartments to an unnamed bank. Because the storefront on the corner of West 86th Street has 46 feet of frontage along Broadway, Extell would need the city to grant an exemption from zoning regulations enacted in 2012 that limited banks to just 25 feet of ground- oor frontage on Broadway between 72nd and 110th Streets.

Brewer, who spearheaded that controversial policy during her rst stint in the council, wants City Planning to vote down Extell’s request. In a letter this month to the commission’s chair, Dan Garodnick, Brewer said granting the exemption would “set a precedent for other landlords to break the law.”

“Put in a CVS, put in a grocery store, put in a 99-cent store, whatever. Put in anything but a bank,” said Brewer, who views banks as uniquely uninviting, in an interview. “ e reason I don’t want a

proposal before making its decision,” commission spokesman Joe Marvilli said. ere is no deadline attached to the proposal, which can be granted or rejected by the 13-member commission.

Brewer was

“Put in a CVS, put in a grocery store, put in a 99-cent store, whatever. Put in anything but a bank.”

City Councilwoman Gale Brewer

bank is that it’s dead space.”

A City Planning spokesman told Crain’s on Sept. 19 that the commission would postpone a vote on the proposal that had been planned to consider Brewer’s request.

Brewer’s argument matches the rationale for the 2012 zoning changes on the Upper West Side, which the City Council passed to address complaints that large-format chains were gobbling up retail spaces once held by small businesses. But some small retailers opposed the new policy, fearing it would in ate property values and incentivize landlords to push them out, Crain’s reported at the time.

Brewer said Sept. 19 that Extell President Gary Barnett had asked her in a phone call to support his proposal, but she declined. An Extell spokeswoman did not immediately respond to a request for comment.

“ e City Planning Commission strongly takes into consideration all elected and public testimony related to a land use

Unusually, Brewer’s position puts her at odds with the local community board, not typically known for being warm to developers. Community Board 7 voted unanimously in June to support Extell’s proposal, citing a desire to ll the vacant space. Brewer said Sept. 19 that she was “shocked” by that vote, which she attributed to an in ux of new members on the board.

“ ey should know better,” she said.

Mayor Eric Adams’ administration may be put in an awkward spot with the request by Brewer, a former Manhattan borough president who is now part of City Coun-

cil’s leadership. e retail space in question has been empty since Banana Republic moved out in 2012, and the administration is fresh o the passage of a new set of zoning reforms, dubbed City of Yes for Economic Opportunity, designed in part to ll more vacant storefronts by easing regulations. Extell, in its application led in June, argued that permitting the big bank space would “help activate the Broadway streetscape and reinvigorate this portion of the [district] with needed commercial activity.”

e zoning changes enacted in 2012 under Mayor Michael Bloomberg limited all new ground- oor storefronts to 40 feet along Amsterdam and Columbus avenues between 72nd and 87th streets. On Broadway, it applied only to banks, which got a limit of 25 feet.

ey did allow for possible exceptions, if landlords could show that there is a high ground- oor vacancy rate “within a reasonable distance” of the retail space. Extell

makes that argument in its application, saying 26% of commercial spaces in the immediate area are vacant — above the 10% limit considered “healthy” by City Planning. e 12-story Belnord spans a full city block from 86th to 87th streets between Broadway and Amsterdam Avenue. Extell owned the whole landmarked building between 1994 and 2017, before selling o the residential portion in 2015 to HFZ Capital Group. Extell still controls the retail space, while Westbrook Partners took over the upstairs condominiums from HFZ.

Since Extell is only asking for an “authorization” instead of a full rezoning, Extell’s proposal can be decided by the City Planning Commission without any say by the City Council.

“I worked really, really hard on that for like ve years,” Brewer said of the 2012 rules. “ e idea of undoing that just for one guy is wrong.”

Julianne Cuba contributed reporting.

yB Eddie Small

A century-old Midtown o ce building owned by two prominent families in New York’s jewelry industry is headed toward demolition.

Adam Bassalali of Lali Jewels recently led plans with the Department of Buildings to tear down 15 W. 46th St. e 10-story, 115-foot tall Class C o ce tower, located between Fifth and Sixth avenues, was built in 1920 and spans about 26,000 square feet, according to city records and the commercial real estate database CoStar.

e building is owned by the Bassalali family and the Hematian family of Midtown-based E y Jewelry, according to property records. Representatives for the families did not respond to requests for comment by press time, and their plans for the building were unclear.

However, the property is the type of older o ce building that has been struggling greatly in the wake of the pandemic and that many developers are now targeting for residential conversions, indicating that a conversion may be the plan here as well.

e Hematian family previously purchased 590 Fifth Ave. from New York real estate giant SL Green in 2021 for $103 million and 145 W. 45th St. from Isaac Chetrit in 2019 for $92 million, both Midtown o ce buildings. Fatollah “E y” Hematian, who passed away last year, founded his namesake jewelry company in New York in 1979, according to his obituary in the trade publication National Jeweler. Lali Jewels dates back to the late-19th century and is currently run by brothers Adam and Arun Bassalali, according to the company’s website. e rm is based out of the International Gem Tower, an Extell Development property at 50 W. 47th St.

yB Nick Garber

e City Council is advancing a bill that would require the mayor to fund more a ordable homeownership projects rather than only rental apartments, re ecting an increasing priority among some city leaders.

Council Speaker Adrienne Adams’ bill, which faced a hearing this month, would require that homes available for purchase make up at least 6% of all the affordable units nanced each year by the city’s Housing Preservation and Development Department.

e speaker rst previewed the legislation in her State of the City speech in March, calling homeownership “a pathway of mobility for working-class families” that has become too scarce.

Many of the city’s most commonly used subsidy programs, like Mandatory Inclusionary Housing, focus on funding rental homes. But Speaker Adams and other lawmakers have lately called for devoting more attention to homeownership in hopes of addressing the stark di erences among demographic groups in the city: just 27% of Black households and 17% of Hispanic households own their homes, compared

numbers can be in ated in years when HPD nances repairs for large co-op complexes that contain many units, according to the agency.

“Affordable homeownership promotes economically healthy communities, the retention of working-class families in our city, and closing racial wealth gaps.”

City Council Speaker Adrienne Adams

to 42% of whites, according to a 2023 report by the Furman Center.

In a sign of that growing emphasis, Queens Councilwoman Selvena Brooks-Powers nearly tanked a proposed rental development in her Far Rockaway district last year before eventually approving the project after its developers agreed to a last-minute change — switching the project from 106 a ordable rental units to 89 homeownership apartments.

e proposed 6% minimum in the speaker’s bill would have made a di erence in some past years and had less of an impact in others. In the most recent scal year that ended in June, for example, HPD already exceeded that threshold by nancing 2,130 homeownership units such as condominiums and co-ops — 8.4% of its total, according to city data. But the prior year, HPDnanced only 926 homeownership units, or 4%. at percentage has been even higher in some years — like scal 2020, when homeownership units made up 54% of all homes nanced by the HPD. But those

e council’s bill addresses that issue by specifying that at least half of the homes that count toward the new 6% threshold must be newly constructed, as opposed to renovations. Altogether, the bill would approximately double the city’s production of new homeownership units, according to the speaker’s o ce, if data from the last 10 years is used

as a guide.

“A ordable homeownership promotes economically healthy communities, the retention of working-class families in our city, and closing racial wealth gaps,” Speaker Adams said in a statement shared with Crain’s. “It has become increasingly di cult for families to access homeownership opportunities, pushing more working- and middle-class families to leave the city they love.”

Lukewarm on the legislation

e bill appears likely to pass, since the speaker controls the council’s legislative process. But Mayor Eric Adams’ administration is lukewarm about the legis-

lation, according to testimony that HPD o cial Kim Darga made recently.

“Increasing our homeownership production requires us to make di cult tradeo s given the limited resources we have,” reads the testimony by Darga, the deputy commissioner for development.

Adolfo Carrión, the HPD commissioner, has previously defended the city’s focus on rental projects, explaining that homeownership programs like Open Door are far more costly to taxpayers.

“ e homeownership program is the most expensive program we run, the subsidy is unbelievable,” Carrión said at a March City

Council hearing. “For every one homeownership unit that we produce, we can produce two rental units for two families. e lion’s share of the need in our city is for renter households, workforce housing, housing for low-income families.”

Some a ordable housing experts and developers also di er slightly from the council’s emphasis on homeownership. ose advocates have argued that the city should focus on easing the backlog of hundreds of a ordable rental projects that are already in the pipeline, which have taken years to get started due to vacancies in HPD. ( e latest city budget directed $1.3 billion in new funding to HPD in hopes of tackling the backlog.)

Rachel Fee, executive director of the nonpro t policy group New York Housing Conference, said she applauds the council’s focus. Although it’s unclear how much impact the 6% minimum might have in future years, Fee said it would mark a meaningful shift if HPD focused more on condos and co-ops.

“We don’t have a real strategy” when it comes to homeownership, Fee said. Fee said the homeownership bill t with other housing policies advanced by Speaker Adams, such as the framework enacted last year intended to raise pressure on neighborhoods that have accommodated little development.

e new benchmarks set by the council would take e ect starting in the 2026 scal year. New homes created through the legislation would need to be marketed to households earning between 70% and 165% of the area median income, or between $97,860 and $230,670 for a three-person household.

Supporters of the bill include Habitat for Humanity, which has developed a ordable homeownership projects through the city’s existing funding programs and whose leaders believe the city could signi cantly step up its efforts. Matt Dunbar, the group’s chief strategy o cer and executive vice president, called the legislation a step toward “a more equitable housing policy.”

All eyes will be on the council in the coming weeks to see how lawmakers vote on Mayor Adams’ City of Yes housing plan, which would loosen zoning rules in hopes of building as many as 109,000 new homes over 15 years. Once it is referred to the council from the City Planning Commission, the council is expected to vote on City of Yes near the end of the year.

Darga, of HPD, testi ed this month that passing City of Yes will be one way for the council to ensure that more homeownership projects are built.

yB Jack Grieve

A fresh set of MBA rankings just came out naming a new best business school in New York City.

For the rst time in at least a decade, New York University’s Stern School of Business outranked Columbia Business School in Bloomberg Businessweek's Best Business School rankings.

Bloomberg surveys graduating students, recent alumni and companies that recruit MBAs to determine the rankings. Schools are evaluated in ve categories: compensation, learning, networking, entrepreneurship and diversity.

e accession was not so much Stern climbing the ranks but rather Columbia nosediving. In fact, NYU dropped year-over-year, going from No. 12 in 2023 to No. 15 in 2024. Columbia, however, fell much further, dropping from No. 5 last year to No. 17 this year. "(Columbia's) scores fell in all of our indexes, but especially in compensation, where the school reported lower starting salary gures for graduates and students and alumni reported lower satisfaction with their salaries," Bloomberg wrote.

As for the best business school statewide, clout-chasing MBAs will now have to leave the city for Ithaca. Cornell University’s Samuel Curtis Johnson Graduate School of Management rose two spots from last year and sits at No. 11 overall, above both NYU and Columbia.

Other New York schools dotted the list, which ranks 77 U.S. programs.

In the city, Baruch College’s Zicklin School of Business ranked No. 52, down four slots from last year. Fordham University’s Gabelli School of Business moved up one position to No. 54.

Elsewhere, Simon Business School at the University of Rochester fell from No. 25 to No. 28. Rutgers Business School in New Jersey dropped 15 spots to No. 59. e University at Bu alo School of

Management moved up seven spots to No. 62. Syracuse University Whitman School of Management dropped two spots to No. 63. And the Saunders College of Business at the Rochester Institute of Technology squeezed its way into the rankings at No. 73. Nationwide, Stanford University took the top spot for the fth year in a row. e University of Chicago Booth School of Business was next, followed by Northwestern University's Kellogg School of Management. Dartmouth College's Tuck School of Business and the University of Virginia Darden School of Business rounded o the top ve.

yB Eddie Small

e Gindis may not be developing a massive retail complex in Bay Ridge after all.

e real estate family has put their development site on 86th Street in the Brooklyn neighborhood up for sale, according to materials from the brokerage JLL, which is marketing the property.

e site spans about 64,500 square feet overall and can handle a project spanning nearly 200,000

span roughly 150,000 square feet. Potential tenants included grocery stores and tness centers.

The family had been planning a retail complex at the site, but JLL is now marketing it as a multifamily development opportunity.

square feet, according to JLL.

e site was formerly home to the Bay Ridge Century 21 store, and the Gindi family had been planning a new retail complex of their own at the site that would

However, JLL is now framing the site as a better t for a residential development. Marketing materials say it is “positioned to capitalize on the lack of Class-A multifamily inventory in the Bay Ridge submarket” with commercial space con ned to the ground oor, which remains a good t for a big-box retail tenant. It also says the site could bene t from 485-x, the state’s new a ordable housing tax abatement that replaced 421-a, and Mayor Eric Adams’ proposed City of Yes reforms, which are meant to boost housing production citywide. JLL’s marketing materials indicate the City of Yes changes could add more than 50,000 square feet to the project’s maximum size.

George Karnoupakis, head of

asset management at ASG Equities, the real estate investment arm of the family, said 485-x and City of Yes have led the Gindis to believe that a mixture of a ordable and market-rate apartments with street-level retail would now be the best use for the site.

“We are working with JLL to explore all of our options for moving forward with a redevelopment, which could involve new joint

venture partners or an outright sale to an experienced residential developer,” he said.

e Gindis, who just settled a bitter feud with developer Ben Ashkenazy, paid about $14.8 million for the site at 472 86th St. in April 2022 through ASG Equities. ey landed $20 million in nancing for the site from Peapack-Gladstone Bank in late 2023.

e Bay Ridge Century 21 closed

in December 2020, shortly after the company led for bankruptcy protection. e Gindis then bought the retailer’s intellectual property at an auction for $9 million and reopened the Lower Manhattan store at 22 Cortlandt St. in May 2023.

e JLL team marketing the Bay Ridge property includes Ethan Stanton, Je rey Julien, Michael Mazzara and Brendan Maddigan.

TUESDAY, NOVEMBER 12 8:30-10 a.m.

Kimball

yB Nick Garber

Gov. Kathy Hochul on Sept. 20 approved a four-year extension of a commercial tax break that costs New York City hundreds of millions of dollars each year despite questions about its e ectiveness that led watchdogs to urge her to reject it.

Lawmakers in June quietly passed a bill that extends the Industrial and Commercial Abatement Program until 2029, past it expected expiration in 2025. Hochul signed it without any public announcement, weeks after groups

to the abatement in the last scal year, according to the Department of Finance. ICAP’s biggest beneciaries included Tishman Speyer, whose tower at 28-10 Queens Plaza South got a $16.6 million exemption; and Citibank, which was forgiven $8.8 million on its Tribeca headquarters.

Despite that considerable expense, research has cast doubt on whether the tax break gives the city a return on its investment. A 2016 City Council study found that only 3.6% of ICAP recipients required the tax breaks for their projects to be nancially feasible.

“We need to ensure our economic incentives get the highest possible bang for the buck.”

Sean Campion, director of housing and economic development studies at the Citizens Budget Commission

like the Citizens Budget Commission and Reinvent Albany publicly urged her to either veto the extension or limit it to just one year to allow for a study of its e ectiveness.

e bene t, known as ICAP, reduces taxes for developers who build new commercial projects or renovate existing buildings in the city. e current version, established in 2008, fully exempts taxes for as long as 16 years for some projects, then phases out the abatement over another few years — with the exact bene t varying depending on the location and type of project.

New York City lost $506 million

And the city’s Independent Budget O ce plans to release its own analysis of ICAP later this year, which was supposed to help inform a debate over its possible renewal before the Legislature opted to extend it a year early. e total cost of the program has exploded over time, from just $14 million in scal year 2015 to last year’s total of $506 million.

Sean Campion, the director of housing and economic development studies at the hawkish Citizens Budget Commission, said Sept. 23 that “It would have been better to extend for a year and do the evaluation needed to better target the program.”

“We need to ensure our economic incentives get the highest possible bang for the buck,” Campion said in a text message. “Going forward, the state and the city should be tracking the data and evaluating this and other programs to identify what works best

and what is no longer needed.”

Tax abatements like ICAP are set at the state level, even as they take money out of the city’s coffers. Current City Council leaders have voiced support for reassessing some of the state’s multitude of abatements and incentives in hopes of saving money, but the highly entrenched system — supported by lobbying and justi ed by economic development claims — shows few signs of going away.

This particular tax break has some powerful supporters, including Mayor Eric Adams’ ad -

ministration and a cohort of real estate developers. The Adams administration had asked Albany to extend the program, arguing that letting ICAP expire could cause a sudden surge in electricity prices since regulators who set those prices consider the property tax rates paid by power plants, according to a memo from the bill’s sponsors. (No such power plants currently receive the break, noted the outlet New York Focus, which first reported on the controversy surrounding the bill.)

“Reforming ICAP continues to be a key focus for this administration, and we are committed to

working with our partners in the state to address equitable reform,” said Ryan Lavis, a spokesman for the city Department of Finance, in a statement last month.

Other ICAP bene ciaries in the last scal year, according to city records, included Brook eld Properties’ 450 West 33rd St. ($7.2 million in forgiven taxes), SL Green’s 1515 Broadway ($6.7 million) and the Irvine Cos.’ 200 Park Ave., better known as the MetLife Building ($6.1 million).

e Related Cos., Tishman Speyer and the Real Estate Board of New York all lobbied lawmakers on the extension this year, records show.

State agencies ‘just haven’t done their job’ on guiding New York toward climate targets, comptroller says

yB Caroline Spivack

New York is o course to achieving its ambitious renewable energy targets and the blame rests primarily on the agencies tasked with guiding the state toward achieving those goals, State Comptroller omas DiNapoli said Sept. 23 at a Citizens Budget Commission event.

“From my perspective, one of the challenges has been that the state agencies charged with giving us a roadmap just haven’t done their job,” said DiNapoli. He argued one such agency, the Public Service Commission within the Department of Public Service, hasn’t taken appropriate steps in assessing and planning around potential obstacles, like supply-chain challenges, when it comes to supporting new renewable energy projects.

Under the Climate Leadership and Community Protection Act, which was approved by the Legislature in 2019, the state is required

to phase out the use of planet-warming fossil fuels and generate 70% of its electricity from renewable energy by 2030. State o cials conceded in a July report that New York will likely fail to meet that major target by at least three years, if not more. Much of the blame falls on state o cials who have inadequately shepherded the state through the energy transition and the economic and logistical challenges to achieving it, said DiNapoli.

“Not only are we falling short on our rst round of [climate] goals, in fact the regulatory agency that’s supposed to take the lead on this really had been using outdated, inappropriate data, not doing their job to guide us to how we’re going to get there,” said DiNapoli.

e Department of Public Service has blamed delays to the state’s energy transition on factors outside of its control, such as economic conditions that led to the cancellation of high-pro le o -

shore wind projects policymakers were relying on to hit its renewable energy goal.

Other regulators, such as those at the O ce of Renewable Energy Siting, also share the fault, argues DiNapoli. An April audit from his o ce found that the O ce of Renewable Energy Siting, which was

created to speed up the approval of wind and solar projects, is moving slowly. Auditors found that the agency, which was created in 2020 to get projects online faster, took an average of three years to approve just 14 projects.

In response to the audit, ORES executive director Houtan Moave-

“Not only are we falling short on our rst round of [climate] goals, in fact the regulatory agency that’s supposed to take the lead on this really had been using outdated, inappropriate data.”

Thomas DiNapoli, state comptroller

ni said at the time that permit applications were often delayed due to missing information from applicants that required a lengthy back and forth.

e regulatory agencies DiNapoli mentioned as coming up short did not immediately respond to a request from Crain's to address his comments.

Associate, Real Estate (Apollo Management Holdings, L.P. – New York, NY); Mult. pos. avail. Assist the Real Estate Debt group in providing fixed and floating rate first mortgage and subordinate financing incl mezzanine and pref equity invstmts on behalf of mult invstmt vehicles incl a public mortgage REIT, ins companies and managed funds. Supp all aspects of the team’s invstmt activities, incl deal sourcing, evaluation, execution and asset mgmt and will provide analytical and project supp for the same. F/T. Pos based in New York, NY; telecomm perm up to once/wk. Domestic travel up to 15% of working time. Sal range $155,000 - $195,000/yr. Apply w/ resume to pkotakonda@apollo.com. Ref. Job ID: 7798645.

Software Engineer I (Citadel Enterprise Americas Services LLC – New York, NY); Mult. pos. avail. Job duties incl: Assist w/ designing, developing, testing, & deploying next gen software solutions for various business operations activities across the firm. Work closely w/ business & tech leaders to define priorities & deliver technical solutions. F/T. Salary range $150,000 – $225,000/yr. Apply w/ resume to citadelrecruitment@citadel.com. Reference Job ID: 7177268.

Workday Manager (Pacific Investment Management Company LLC (PIMCO) –New York, NY); Mult. Pos. Avail. Maintain PIMCO’s Workday sys by ensuring all configurations are integrated into the sys in alignment with the bus’ sign-off requirements. Assist testers in vetting updates and configuration chgs and act as a liaison w/ bus stakeholders on all sys-related issues. F/T. Sal range $150,000$190,000/yr. Resumes: trish.jusay@pimco.com. Ref: JobID: 7773999.

The New York Racing Association, Inc. (“NYRA”) is soliciting bids from qualified vendors to serve as a media agency for both general Marketing and NYRA Bets initiatives. Bidders are advised that the Authorized Contact Person for all matters concerning this RFP is Allan Howell EMail:ahowell@nyrainc.com

The bid document, including specifications and requirements, may be obtained via an email to procurement@nyrainc.com¬ or please register as a vendor on NYRA’s bidding portal at no cost. www.bidnetdirect.com/new-york/nyra.

Notice of Qualification of LEVEL STRUCTURED CAPITAL III, L.P. Appl. for Auth. filed with Secy. of State of NY (SSNY) on 09/05/24. Office location: NY County. LP formed in Delaware (DE) on 08/30/24. Princ. office of LP: 140 E. 45th St., NY, NY 10020. Duration of LP is Perpetual. SSNY designated as agent of LP upon whom process against it may be served. SSNY shall mail process to c/o Corporation Service Co. (CSC), 80 State St., Albany, NY 12207-2543. Name and addr. of each general partner are available from SSNY. DE addr. of LP: CSC, 251 Little Falls Dr., Wilmington, DE 19808. Cert. of LP filed with Secy. of State of the State of DE, Div. of Corps., John G. Townsend Bldg., 401 Federal St., Ste. 4, Dover, DE 19901. Purpose: Investments.

Notice of Qualification of INFORMA CONNECT USA LLC Appl. for Auth. filed with Secy. of State of NY (SSNY) on 08/05/24. Office location: NY County. LLC formed in Delaware (DE) on 04/30/24. SSNY designated as agent of LLC upon whom process against it may be served. SSNY shall mail process to Corporation Service Co. (CSC), 80 State St., Albany, NY 12207-2543. DE addr. of LLC: c/o CSC, 251 Little Falls Dr., Wilmington, DE 19808. Cert. of Form. filed with Jeffrey W. Bullock, Secy. of State, Div. of Corps., John G. Townsend Bldg., 401 Federal St., Ste. 4, Dover, DE 19901. Purpose: Any lawful activity.

DREAM VARIATION

ENTERTAINMENT LLC Arts. of Org. filed with Secy. of State of NY (SSNY) on 6/12/24. Office location: NY County. SSNY designated as agent of LLC upon whom process against it may be served. SSNY shall mail process to; 2248 Broadway, #1153, NY, NY 10024

Purpose: Any lawful activity

Notice of Formation of BUCK RIDGE PRINTING LLC

Arts of Org filed with Secy of State of NY (SSNY) on 6/5/24. Office

Location: NY County. SSNY designated as agent upon who process shall be served and shall mail copy of process against LLC, to 21 W 38TH ST, FL 10, New York, NY 10018. Purpose: any lawful act.

Notice of Formation of AURORA BLISS COMPANY, LLC

Arts of Org filed with Secy of State of NY (SSNY) on 7/24/24. Office Location: NY County. SSNY designated as agent upon who process shall be served and shall mail copy of process against LLC to 500 West 18th Street, Unit 20E, New York, ,NY 10011. Purpose: any lawful act.

Notice of Formation of 34 WEST 95TH STREET LLC

Arts. of Org. filed with Secy. of State of NY (SSNY) on 08/22/24. Office location: NY County. Princ. office of LLC: 34 W. 95th St., NY, NY 10025. SSNY designated as agent of LLC upon whom process against it may be served. SSNY shall mail process to the LLC at the addr. of its princ. office. Purpose: Any lawful activity.

Notice of Formation: Nagle Qiu & Shi LLC Art. Of Org. filed with Sec. of State of NY (SSNY) on 08/26/2024. Office Loc.: New York County. SSNY designated as agent of LLC upon whom process against it may be served. SSNY shall mail process to: 82 Nagle AVE, New York, NY 10040, USA Purpose: Any lawful activity.

CAMILLE GALLO, LLC Arts of Org filed with Secy of State of NY (SSNY) on 2/29/24. Office

Location: New York County. SSNY designated as agent upon whom process may be served against LLC to: Camille Gallo, 66 Madison Ave,Ste 8C, NY, NY, 10016, USA, CamilleGallo@Live.com

Purpose: any lawful act.