BUSINESS OF ART

market share of

auctions

Art is universal, but the art market is centered in New York, where nearly half of all auctions are held and world-renowned museums hold court. Collectors and investors spent $65 billion last year buying artwork, often with only a handshake to seal the deal, and millions more on collectibles from dresses to baseball cards to diamonds. is month Crain’s takes a deep dive into the unregulated world of art and “alternative asset” collectibles from multiple angles.

Biden administration has kicked off a sweeping rule change that could affect 900,000 gig workers in the state

BY CARA EISENPRESS

BY CARA EISENPRESS

City gig workers and the technology companies they contract with are facing a shakeup, as the federal government seeks to revise a rule that determines

whether workers toil for themselves or for the companies paying them.

Gig workers, or independent contractors, generally do not have all the same bene ts, protections or pay as employees engaging in similar work.

e o cial change, promised early in the Biden administration, would likely go into effect next year, following a 45-day comment period that began late last week. It creates a more robust checklist for determining whether someone is on contract.

e proposed checklist now includes six factors, considered equally: how managerial skill plays into the ability to succeed in the position; the type of investment made by the

Crain’s Hall of Fame honorees have had a distinguished career and taken part in exceptional civic and philanthropic activities that have transformed the city’s economy. Crain’s will recognize them at a celebratory luncheon open to the public. By attending, you will be able to experience high-level networking with the exceptional executives who make up the classes of 2021 and 2022, along with keynote speeches and an awards ceremony highlighting their esteemed work.

Time: Noon to 2:00 p.m.

Location: Manhattan Manor CrainsNewYork.com/HallofFame2022

STATS AND THEAs venture capital investments and deal counts dip in the city, early-stage startups may prove to be a bright spot in the tech sector’s tumult.

In all, just $5.6 billion was invested in the city’s startups, down nearly 50% from last quarter and 60% from the same period in 2021, according to PitchBook’s latest report monitoring venture activity.

There were 424 deals made in the city in the third quarter of this year, a 25% decrease from the second quarter and a 31% decrease from the same period last year, when deal-making activity was nearing its peak.

Although the steep drops appear to cement a trend of investor hesitancy amid a volatile public market, parsing the city’s late- and early-stage companies paints two different stories.

startups in

MEDIAN SIZE of deals for seedstage deals, a new high

Late-stage venture capital deals have dropped dramatically from 2021’s record highs, with the median deal so far this year coming in at $13.25 million compared with last year’s $20 million. Venture capital exit activity has tanked compared to recent quarters, with just $125 million in deals in the third quarter, compared with $13.9 billion in the third quarter of 2021 and nearly $3 billion in the third quarter of 2020. There were just eight initial public offerings in New York, New Jersey and Connecticut, down from 30 in the same period last year, EY found.

“The pressure that’s building at the late stage is definitely causing worries for investors and companies, and paints a shadow over the potential of these companies for the next few years,” said Kyle Stanford, a senior venture capital analyst at PitchBook.

On the other hand, a glimmer of hope could be found in early-stage companies, where the median deal amount is on the rise, contrary to their more mature counterparts, which are spiraling downward. In the New York metropolitan area, the median value of a seed-stage company is $3.58 million, a 31% increase from last year. However, late-stage companies’ median deal size has shrunk by 34% since 2021.

Stanford said the divergence likely stems from the fact that seed companies, which are likely at least five years away from considering an exit strategy, are insulated from the immediate volatility of the public market. New York is well suited to weather the storm, he said, because talent and companies are still attracted to the “vibrant” area. But the city’s sector can’t rely entirely on its newest companies.

“New York is in a really strong position,” said Stanford. “But from the broader perspective, everyone is looking at IPOs. It will be a worry until IPOs come back.”

Veterans have always put others first. Now it’s their turn. So we created the Department of Military Liaison Services to meet the unique needs of vets and their families.

at

WELL CAN’T WAIT

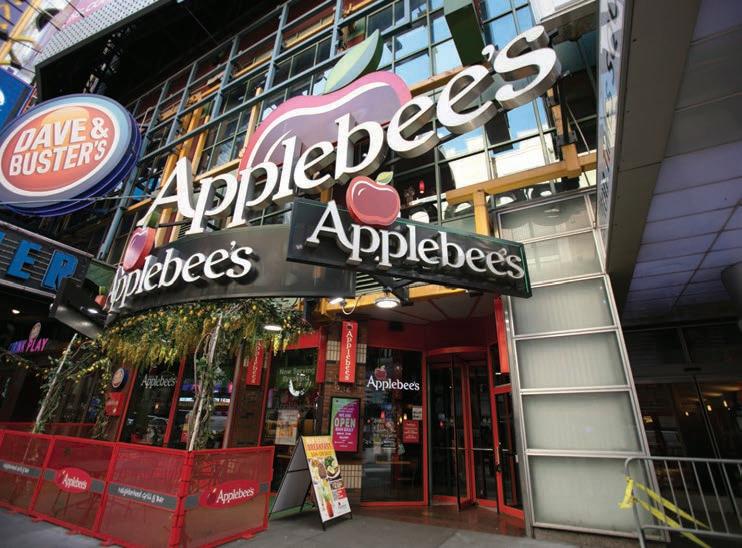

Applebee’s Times Square location was recently hit with a nearly $7 million judgment and an ejec tion notice by a state Supreme Court judge in Manhattan over unpaid rent and expenses dating back to June 2019, according to court records.

The company blamed cash flow issues for its prepandemic arrears, its attorney Peter Sartorius said during court proceedings. The pandemic exacerbated the problem and made it impossible to conduct proper busi ness at the restaurant, located at 234 W. 42nd St., he said. The restaurant reopened its doors in June 2021.

In October 2021 the landlord of the proper ty, Madison International Realty, served the tenant with a notice of default for the overdue amounts and a month later terminated the lease agreement, which was set to expire in 2025.

The location is owned and operated by a franchisee, Apple-Metro.

The parties tried to negotiate a settlement to have Applebee’s stay in the 11,000-squarefoot space, but none was reached, an attor ney for the landlord, Deborah Riegel of Rosenberg & Estis, said during court pro ceedings. The landlord wouldn’t accept any thing less than the full amount due, which the tenant said it would not pay.

The restaurant was allegedly rak ing in more than $700,000 per month, Riegel claimed in court, but none of that money has been paid back to the land lord. She also suggested that if Applebee’s was ejected from the space, ownership could fill it with another tenant that is prepared to pay the asking rent.

The eatery, however, employs 80 people at the location and doesn’t want to leave, Sarto rius said.

Earlier in the pandemic, the restaurant’s owner submitted a hardship declaration claiming it was struggling financially be cause of govern ment-mandated closures and re strictions on restaurant capac ity.

To make things worse, the at tached Hilton Times Square hotel, which was a major source of customers for the restaurant, per manently shut down in September 2020, said Roy Raeburn, the co-founder of Apple-Met ro, in an April affidavit.

Since the pandemic began, the location's

sales are down 75% compared to the same two-year period prior to the pandemic, Rae burn said. Ever since the restaurant re opened in June 2021, sales have been 23% lower compared to the same 10-month peri od prior to the pandemic, he added.

In April 2020 the company received nearly $3 million in Paycheck Protection Program loans that were forgiven, according to Pro Publica, though all that money went to pay roll expenses rather than rent.

The building has struggled with tenant re tention during the pandemic. By March 2021 three spaces occupied by major tenants in cluding Modell’s, Ripley’s Believe It Or Not and the Liberty Theater were being marketed for lease.

In July it was announced that candy retailer It’Sugar had signed a lease to take over the 20,450-square-foot outpost formerly occu pied by Modell’s.

Sartorius did not respond to a request for comment.

and is served an eviction

AN ATTACHED HOteL WAS A bIG SOUrce OF CUSTOMERS, BUT IT cLOSeD DOWN

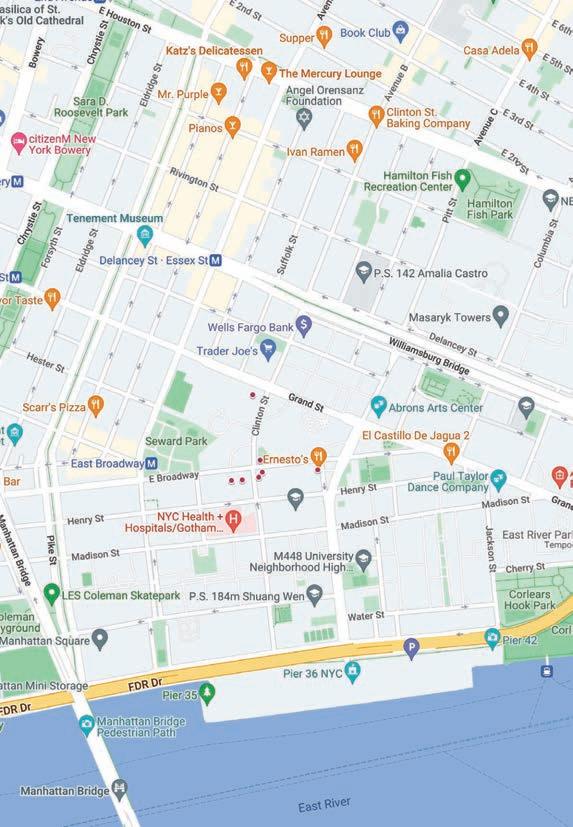

A 70-unit, two-tower condo project at 222 East Broadway is hitting the market following issues with a neighbor and years of delays

BY C. J. HUGHESALower East Side condo proj ect is hitting the market, after experiencing enough twists to resemble a map of its neighborhood.

Developer Optimum Asset Manage ment has been planning its project at 222 East Broadway since 2016. It ini tially sought to build a larger develop ment than what it is today: 70 condos across two touching towers. But Opti mum ran into some problems with a neighbor, forcing it to scale back and causing years of delays.

New condos are still rare in No. 222’s part of the Lower East Side, a bulge into the East River below Delancey Street with postwar megaprojects and modest rentals. The area has rapidly gentrified, making the development team hope the wait was worth it.

“The shabby-chic quality of the neighborhood is changing, and I guess we’re sort of part of that,” said Richard Cantor, a veteran real estate broker and a co-founder of Cantor Pecorella, which handles sales. “But we like to think of this building as where the past meets the future of New York.”

That dual nature is apparent with the design of the project. One of the towers, gray-toned, 28-stories tall and with 52 units, is new construction. The other, the 11-story former Bialystoker Center and Home for the Aged, which has 18 apartments, is an art deco land mark built in 1931. The units through out range from studios to four bed rooms and have herringbone floors and marble counters.

Prices average $2,100 per square foot and start around $975,000 for some studios. Optimum expects a $157 million haul, according to the of fering plan. Move-ins should begin next year.

The average price per square foot in Manhattan during the summer for new condos was $2,600, according to data from Miller Samuel.

The developer purchased the three tax lots that make up the development site for $47.5 million in 2016, records show. The developer then approached Seward Park Cooperative, a large apartment complex next door that’s lined with open spaces, about pur chasing its air rights, which usually transfer between adjacent buildings.

But reportedly because of concerns about overdevelopment and height, the co-op rejected the developer’s $54 million offer.

Had Optimum managed to secure that extra volume, it would have con structed a third 33-story tower on the property. The site where it was meant to go, a parcel at the corner of Clinton Street, will instead turn into a 6,700-square-foot green space.

Cantor, who used to shop for clothes on the Lower East Side as a child, hopes it doesn’t change too much.

“It’s always been an incredibly di verse place, with young and old, and all kinds of races and religions,” he said. “It’s wonderful.”

East Broadway can seem to be a hinge between two eras. To the west is the 20th century, courtesy of vast redevelopment efforts, while the east belongs to the 19th century, embodied by rows of short and skinny brick apartments. Fairly typical is this ad dress, a 5-story, 8,500-square-foot prewar walk-up with retail at its base, occupied by May Kaidee, a vegan restaurant. The building last sold for $7 mil lion in 2018. Its buyer, a limited liability company, appears to be controlled by a Huizhen Wang, based on a deed. According to the city, No. 215 has a mar ket value of $1.4 million, higher than its Covid-af fected 2021 estimate of $1.2 million but still not as strong as its 2020 valuation of $1.7 million.

This site contains two of the four multitowered 20-story complexes that make up the Seward Park Cooperative, a sprawling 1960 development financed by labor unions. Cherry trees dot spacious lawns at the site, which uses multiple addresses. Seward Park, a fully market-rate com plex since the 1990s, had a studio for sale for $489,000 this month. In the mid-20th century, this part of the Lower East Side was consid ered by many to be a slum. Officials condemned blocks and blocks of buildings before razing them, which displaced thousands of people, including many Puerto Ricans. Despite promises to rebuild, some of the razed sites sat dormant for decades. The nearby Essex Crossing megadevelopment, which broke ground in 2015, rose from land that was cleared in 1967 and subsequently served as parking lots.

This midblock site is home to the Primitive Christian Church, a denomination founded in the neighborhood in 1953 and based at this site from about that time. In 1973 the church was renovating two adjacent ten ements that it owned as part of an effort to accommodate its growing membership. But the $97,000 project reportedly went awry, and the buildings collapsed, injur ing 10 people, some of whom had to be pulled out from under piles of bricks. A new building went up in its place soon af ter and remains to this day. In a place that can feel as diverse as it did when it was an immigrant haven, the church offers several Masses in Spanish or English.

For years this 6-story, 26-unit prewar walk-up building, which is called the Mayflower based on a sign on its por tico, had a large deli on its ground floor. But things be gan to change when the owner of the 21,300-square-foot building, a limited liability company, sold it to a similar shell company for $11.3 million in 2013, records show.

The buyer appears to have ties to Michael Young Realty of Englewood, New Jersey. The new owner sliced up the deli space into a half-dozen retail berths, which had rents of around $100 per square foot annually—pricey for the area. But trendy businesses still arrived, including Eastwood, a bar with Scotch eggs on its menu. The pandemic seems to have put some tenants permanently out of business, although 7 Elephants, a Thai restaurant, remains open.

The most recent apartment to rent there, meanwhile, was a two-bedroom in April, last listed at $3,100 a month.

The condo from Optimum Asset Management that’s near ing completion on this site includes an art deco building that was once the Bialystoker nursing home, which closed in 2011 because of financial struggles after 80 years of operation. The city made it a protected landmark in 2013. Bialystok, a province in Poland, sent many migrants to the neighborhood; the fieldstone-fronted Bialystoker Syna gogue, a former Methodist church on nearby Willett Street, is another vestige. At 222 East Broadway, a green-paneled 1950s office building to the north of the nursing home was razed. The third lot, to the south, once contained the Dora Cohen Memorial Park. Residents will be able to relax there once a planned green space is finished.

This 6-story beaux-arts building appears to be owned by the Malkin family, which controls the Em pire State Building. A shell company with the same Midtown address as Malkin Properties purchased the 12,000-square-foot walk-up for $3.5 million from Shih Equities in 2013, records show. At the time its retail spaces contained takeout joints and DVD stores. Now, after a major renovation, a single tenant occupies the ground floor. Ernesto’s (as in Hemingway) is a Spanish restaurant serving tapasstyle dishes that opened just before the pandemic to strong reviews. Its walls, like some of the 15 upstairs apartments, are lined with exposed brick.

Around the turn of the last century, Jewish immigrants from Eastern Europe came to the Lower East Side in droves and built or converted many structures into synagogues, not all of which survived. Young Israel, an Orthodox congregation, was founded in 1912 at 205 East Broadway, a brownstone building that’s still there, before moving in 1929 to the larger No. 229, according to its official history. A relocation next door to No. 225 happened in the 1950s. But in later years the congregation appears to have had money problems, and the city foreclosed on Nos. 225 and 229 in 1985, records show. The side-by-side buildings were demolished a decade ago, and no new building permits are on file. Young Israel, which now has synagogues across the country, continues to meet at various sites in its original neighborhood.

Technology designed for use in the real estate industry—known as prop-tech—is catching on, particularly in global real estate capitals such as New York City. e global prop-tech market is expected to grow from $18.2 billion this year to $86.5 billion in 2032, according to the market research rm FMI. In hot demand are technologies designed to create a better experience for tenants or to help landlords with investments or property management.

“Over time, prop-tech has become a global phenomenon comprising a broad array of technologies that drive innovation in the real estate market,” says Morris F. DeFeo, Jr., a partner and chair of the corporate department in the law rm Herrick.

Prop-tech technologies are improving operational e ciencies and data analytics, reducing expenses and enhancing the leasing and ownership experience for customers, DeFeo says, as well as facilitating the sale, leasing and nancing of real estate. ey also are improving the ability of owners, operators and nancing sources to extract and optimize value from real estate, he says.

DeFeo recently shared his insights with Crain’s Content Studio on how the prop-tech boom is a ecting the New York City real estate market.

DEFEO: Despite its apparent conventionality, the real estate market has evolved signi cantly and at an increasingly rapid pace. The industry has become more institutionalized, with enormous in ows of capital, resulting in a closer convergence of the industry and capital markets, particularly private equity. Covid, in ationary pressures and rapid technological changes have been additional catalysts for consolidation and differentiation in the industry and, consequently, a vastly more competitive real estate market.

expense side of the ledger. This includes solutions that are designed to identify and eliminate or streamline the numerous inef ciencies found in real estate, such as processes in project management, development, construction, maintenance and tenant services.

and governance technology companies that focus on real estate. Investors are anticipating that owners of real estate will need to make signi cant capital expenditures to reduce their carbon footprint and reduce energy costs.

the full range of prop-tech solutions available and under development as part of their strategy to strengthen their competitive position. No two REITs are the same, so the challenges they face and the opportunities presented will call for different solutions.

CRAIN’S: When did prop-tech take hold in New York City?

MORRIS DEFEO: The real estate industry is not the rst sector one thinks of when envisioning cutting-edge technology and innovation. In the past 20-plus years, however, participants in the New York real estate market have embraced various technology solutions that are designed to improve their overall value proposition and thereby create competitive advantages. New York is the world’s preeminent real estate market in virtually every segment of the industry. It is also the most competitive.

The dramatic increase in investment capital directed at the industry has accelerated these trends, as investors seek out real estate market participants that stand out from the crowd. Numerous prop-tech companies are active in the New York real estate market, such as Common Living, NeueHouse, EasyKnock, Latch and Realm.

CRAIN’S: How are technology solutions coming into play as a competitive factor?

In response, real estate owners, developers, operators, nancing sources and other industry participants are looking to technology as a means to reduce costs, improve operating

There is also an intense focus, however, on technologies that are designed to target opportunities to grow revenue and market share. These include, for example, solutions that help market participants gather and analyze data to identify market trends, enhance the experience of tenants and other users of real estate, and target potential marketing opportunities and acquisition candidates.

Investors are anticipating that owners of real estate will need to make signi cant capital expenditures to reduce their carbon footprint and reduce energy costs.

ef ciencies and pro tability, improve visibility into the needs and preferences of owners and tenants and identify potential growth opportunities, including potential acquisition targets. In addition, landlords and developers can use the proptech tools available to them to create more desirable spaces and creative environments with the balance in hybrid work environments that we have seen after Covid. Prop-tech can now be seen more fairly as a competitive necessity and not a luxury.

CRAIN’S: What new tech developments are most signi cant for this sector?

DEFEO: Unsurprisingly, much of the focus has been on technology targeting the

Trends that we see emerging include closer collaboration and integration between real estate businesses and tech companies in the form of joint ventures, consortia and other similar relationships, as well as a potential increase in business combinations between prop-tech entities and businesses focused on real estate ownership, construction, management and development.

In addition, as has been widely reported, nearly 40% of the world’s carbon dioxide omissions come from real estate both as a result of building operations and construction. Private equity, venture capital and other major sources of funding continue to raise and invest an enormous amount of capital targeting relating to environmental, social

CRAIN’S: How can real estate investment trusts position themselves for success in this environment?

DEFEO: Like all real estate market participants, REITs should seek out and assess

An increasingly dynamic and differentiated market calls for a more innovative and proactive approach to improving pro tability and seeking out opportunities for growth. Proptech solutions can and should be one weapon in that arsenal.

Herrick lawyers bring a number of benefits to the deal table, including sophisticated legal advice, exceptional partner involvement and a relentless focus on efficiency.Attorney

The migrant crisis in the city would have been a strain on any mayor, no matter how competent or well run the administration may have been. More than 18,600 asylum seekers have arrived since the spring, and at least 14,777 are in city shelters. ese numbers, quite simply, are unprecedented and are pushing the shelter system to its limits.

But the response from Mayor Eric Adams has been middling at best, disastrous at worst. He has complained about the Republican governors sending migrants here and has begun erecting an enormous tent complex on isolated Randall’s Island to house them. e tents are the second attempt Adams has made at temporary shelter—a plan for a tent city in the Orchard Beach parking lot was abandoned after he belatedly listened to critics who pointed out the location was a ood risk.

Randall’s Island isn’t much better. Activists aren’t always right, but again they are pressing Adams to do more and again they have a point.

New York has the existing hotel space to at least take some of the strain o the shelter system and avoid the need for dangerous, substandard tents on an island that exists for recreation, not habitation.

Adams should get aggressive about processing the migrants quickly and nding them rooms in as many vacant hotels as possible, especially those that have been shuttered already. To an extent, Adams has begun to listen; 200 families will be temporarily housed in a Midtown hotel. But this move came only after the outcry against the tents.

ere are other steps Adams should take: e city can immediately get rid of a waiting period that forces homeless people to live in shelters for 90 days before they can apply for city-funded housing assistance.

ing, with President Joe Biden introducing stricter eligibility requirements for Venezuelan asylum seekers. Rather than toughen the border further, the Biden administration should seek a national strategy for immigration so more cities can handle the new in ux, especially those that have struggled with population loss. If New York is bursting at the seams, Cleveland, Detroit and St. Louis are not, and Biden could coordinate with mayors there to take migrants that could, in the long run, help rejuvenate dying neighborhoods in those cities.

ough the in ux is ultimately a federal issue, the Adams administration can be blamed for some of the chaos because it lacks sta and vision. Adams keeps a tight inner

e Adams administration can hire more workers to help expedite the application process.

In the meantime there should be some short-term federal help com-

circle of political allies, not policy experts, and he is slow to delegate responsibility. Talented sta have departed the city in droves. It is not clear that Adams or his team is ca-

Signature Bank’s stock price dropped by half this year amid concerns over its exposure to the wild world of bitcoin, but Chief Executive Joseph DePaolo insisted last Tuesday that his ship is steady.

Even though crypto customers yanked out $3 billion in deposits, total out ows were only $1.3 billion, thanks to other customers adding to their balances. e bank’s New York–heavy business loan portfolio showed few signs of stress even as interest rates have soared. Signature reported record quarterly earnings, and loan growth continued.

“Now that’s a good quarter,” DePaolo said, a phrase he used four times describing results in a conference call with analysts.

Investors took the cue, and Signature’s stock, the best performer in banking for many years until crypto winter set in, perked up 3% in midday trading to $153 a share.

Analysts noted some concerning trends on the margins. Even with record quarterly earnings of $358 million, total capital declined because of a $2 billion write-down in Signature’s investment portfolio, a consequence of rising bond yields.

e reduction would be reversed if bond yields fell.

Signature traded for as high as $365 a share in January because its

blockchain-based payments platform made it a favorite of the crypto crowd. e bank has 1,439 digital clients, and crypto exchanges have become its biggest depositors, management said, with $12.3 billion in deposits. Two weeks ago Signature unveiled a partnership with Coinbase.

At the same time, the bank is trying to calm excitement around its crypto activities without alienating customers. It attributed strong third-quarter results to “an emphasis on safe, less risky assets.”

Investors have also been concerned about Signature’s New York real estate exposure, but borrowers have shown little stress so far. While the bank boosted provisions for loan losses to $29 million from just $4 million a year, reserves as a percentage of loans were almost at at 0.63%. e bank has $115 billion in total assets.

“We’re just not worried about our commercial real estate portfolio,” Chief Operating O cer Eric Howell said, adding that not a single o ce loan is delinquent. “We’re doing business with the right people.”

■

pable of e ectively governing the city in the long term. His rst year in o ce, at least, has done nothing to assuage critics.

At some point this crisis will pass. But the pace of housing construction in the city has slowed, and Adams has mostly abandoned creative solutions to housing shortages, such as converting old hotels into apartments for the working class and poor. ere is no plan to build on city-owned land or to revive single-room-occupancy units, which could take homeless people o the streets. ere is no plan, tragically, for much of anything.

● Can Lee Zeldin get within 10 points of Gov. Kathy Hochul? If he does, it will have been the closest gubernatorial election in 25 years or since Republican George Pataki unseated Mario Cuomo, the threeterm incumbent.

● Speaking of Cuomos, the disgraced Andrew has talked about starting a political action committee and launching a podcast. He should walk away from public life. He’s done enough damage. ■

Ross Barkan is an author and journalist in New York City.

EVEN THOUGH THEY’RE worlds apart, Goldman Sachs’ consumer lending division now shares something in common with Pluto: Both have been demoted.

In its third-quarter earnings report last Tuesday, Goldman Sachs announced a major restructuring that will all but make Marcus, its consumer division, disappear. e rm will wrap Marcus into a new division called Platform Solutions.

e new sector will comprise transaction banking in one leg and consumer partnerships, such as a card deal with Apple, in another.

CEO David Solomon acknowledged that the restructuring of its consumer banking business represents a toning down of the lofty aspirations the bank touted for the division when it launched in 2016. He said the focus would be on maximizing pretax pro tability.

To do that, Goldman will move away from seeking to acquire consumers on a mass scale and instead focus on existing deposit customers and consumers who work at companies with which Goldman already has a relationship.

Solomon said the consumer division doesn’t make money, making

further investment a luxury Goldman’s shareholders have little patience for when the stock market is having a down year.

“Deposits are hugely valuable,” he said, so even though the rm is pulling back on how it gathers them, Goldman still believes “what we’re doing will deliver accretive returns for the rm.”

“We’re better to play to our strengths,” he acknowledged.

Evercore ISI analyst Glenn Schorr said Goldman was making the right move.

stakeholders said they were bracing for higher costs.

The collision of inflation and increasing health care uti lization will drive health-benefit costs up roughly 10% next year for employ ers and insurers globally and up 6.5% across North America, accord ing to a new survey conducted by Willis Towers Watson.

The global increase outpaces both this year’s 8.8% cost growth rate and last year’s 8.2% increase, WTW found.

The human resources and actu arial consulting giant’s projection of a 6.5% increase for North Ameri ca would actually mark a slower rate of growth than that of the past two years. Across the continent, the cost of health care benefits rose 9.4% this year and 9.1% last year.

WTW’s findings suggest even steeper cost increases than the 5.6% growth that Mercer, another consulting firm, projected in Au gust. Mercer’s projection is based on a sur vey of nearly 900 employers across the United States, while WTW reached its figure by survey ing health insurers.

No matter the exact growth rate,

Leslie Moran, senior vice presi dent of the New York Health Plan Association, said high hospital and prescription drug prices remain the key cost drivers for insurance carri ers across the state, while health care utilization is expected to con tinue rebounding for non-Covid ser vices.

“Those show no signs of moder ating,” she said.

BY MAYA KAUFMAN ISTOCK

BY MAYA KAUFMAN ISTOCK

That means self-insured employ ers, which use their own funds to pay claims on behalf of their em ployees instead of purchasing a group health plan for them, will also feel the squeeze.

“We’re expecting pretty tough in creases,” said James Gelfand, presi dent of the ERISA Industry Com mittee, a national trade group representing self-insured employ ers.

According to the WTW survey, 74% of insurers worldwide said the leading driver of medical costs was overuse of care, due to health care professionals recommending too many services or overprescribing

medications. Half of insurers iden tified underuse of preventive care as a significant cost driver.

Eric McMurray, global head of health and benefits for WTW, said next year’s steep cost growth would force employers and insurers to think differently about health bene fits.

“Old solutions will not work,” McMurray said in a statement. “Cost shifting is not an option. There’s a critical need for innova

tion, strategy and new solutions to have any substantive impact. Those that don’t lead will fall behind in their ability to manage cost and re tain key talent.”

To soften the blow, Gelfand said, self-insured employers are turning to add-on benefits that require an upfront investment but may mod erate costs over the year—histori cally a hard sell for human resourc es departments to make to the C suite. That might be a care-man

agement solution that can keep employees out of the hospital by making sure they are taking their medications or, if they have diabe tes, for example, that they are checking their insulin.

Employers may also resort to ex cluding certain high-priced hospi tals and health systems from cover age, taking advantage of data that is newly public under a federal price-transparency law. That was what the 32BJ Health Fund, the in surance plan of Local 32BJ of the Ser vice Employees International Union, did last year with New York-Presbyterian.

“You will see networks tightening in terms of inclusion of those outli er hospitals that are charging too much and, to a lesser degree, other sites of care,” Gelfand said, adding that drug formularies may also be come more restrictive to temper the cost growth.

WTW was formed in 2016 by the merger of Willis Group and Towers Watson. The company is head quartered in London, and its U.S. division is based in Arlington, Vir ginia. ■

You’ll get that. Plus, enhanced 1-to-1 support for your employees — thanks to our health advocates. These are just some of the ways an Oxford health plan may help your employees and your business’s bottom line get healthier.

Contact your broker or visit uhc.com/oxfordnow

Oxford insurance products are underwritten by Oxford Health Insurance, Inc. Oxford $0 deductible plans are available for New York-sitused employers and can be paired with either the Freedom, Liberty or Metro network. $0 virtual care copays apply to all Oxford fully-insured non-HSA plans except for Healthy NY. Plans sold in New York use policy form numbers: OHINY_SG_GEA_2023 and POL20.OHI.2019.LG.NY.

24/7 Virtual Visits is a service available with a provider via video, or audio-only where permitted under state law. It is not an insurance product or a health plan. Unless otherwise required, benefits are available only when services are delivered through a Designated Virtual Network Provider. 24/7 Virtual Visits are not intended to address emergency or life-threatening medical conditions and should not be used in those circumstances. Services may not be available at all times, or in all locations, or for all members. Check your benefit plan to determine if these services are available.

Advocate4Me® services should not be used for emergency or urgent care needs. In an emergency, call 911 or go to the nearest emergency room. The information provided through Advocate services is for informational purposes only and provided as part of your health plan. Wellness nurses, coaches and other representatives cannot diagnose problems or recommend treatment and are not a substitute for your doctor’s care. Your health information is kept confidential in accordance with the law. Advocate services are not an insurance program and may be discontinued at any time.

It’s unusual and refreshing to witness a governor’s race in New York where either candidate has a chance of winning. Recent polls show Rep. Lee Zeldin, a Republican, with a margin as small as four points behind the incumbent, Gov. Kathy Hochul, a Democrat.

e decline of the Republican Party as a contestant in statewide races has disenfranchised many voters and has allowed some runaway Democratic nominees to avoid tough questions.

e unfortunate aspect of the Hochul-Zeldin contest, however, is that Zeldin is so closely aligned with former President Donald J. Trump. In Congress, Zeldin voted to decertify the 2020 election. e Long Island Republican also supported the Supreme Court’s decision to overturn Roe v. Wade, putting him out of step with most New Yorkers and a wide majority of Americans.

Republican candidates to approach the governor’s mansion in recent memory.

For the most part, Hochul has responsibly led New York since she took over from former Gov. Andrew M. Cuomo in August 2021, with a few exceptions. She cynically inserted a last-minute, $1.4 billion deal for a new stadium for her hometown Bu alo Bills during state budget negotiations. And she has had to defend a decision to award a $637 million Covid test kit contract to a major campaign contributor.

ose actions raise valid concerns. Also concerning is the governor’s failure to spell out a vision for what she wants to bring to a rst full term.

Nothing is impossible in today’s polarized political climate, but Zeldin is one of the more extreme

Here is our list of must-do items, no matter who wins on Nov. 8.

● Put forward a plan to spur

needed new housing in the suburbs and the city, one that improves on the now-expired 421-a.

● Find a way to help tenants who are facing crushing city rents.

● Fix the funding of the Metropolitan Transportation Authority, which faces enormous budget gaps as federal aid dries

up and ridership remains soft.

● Continue to amend the bail reforms of 2019, so that they protect public safety but don’t penalize people simply for being poor.

And a note to our readers: Early voting begins Oct. 29, and in person voting will take place Nov. 8. Don’t forget to take part. ■

More than 82,000 tech roles were available in the New York metropolitan area during the rst quarter of this year. With nearly half of these job postings not specifying a minimum level of education and 45% not requiring prior tech experience, high-quality tech careers might be one of the most promising economic mobility strategies for many New Yorkers. Yet we’re leaving talent and opportunity on the table.

Extensive technology education can be hard to get outside of costly higher education and formal technical study programs. Who gets that training is another issue. Research shows that inclusive teams make better decisions up to 87% of the time, and diverse teams produce a minimum of 19% more revenue. Yet a recent analysis of the city’s tech sector shows underrepresentation of Hispanic and Black populations and women.

While we can blame Covid-19, which continues to exacerbate unemployment—especially among working-age Blacks—and low wages for the problem in the city, the continued burden of student debt, tired curriculums and lack of access to quality tech training all play a role. So where can we step in and channel this untapped passion, talent and curiosity into transformative careers—while building a more diverse workforce and stimulating the U.S. economy?

Let’s use satellite learning and job-training programs that help communities access tuition-free tech education from a locally accessible community center. It’s a proposal I’ve begun implementing to serve all ve boroughs from our two Per Scholas campuses, in the Bronx and Brooklyn. e results are encouraging and can serve as a blueprint to expand nationally.

rough a satellite model, students can overcome socioeconomic limitations and commuting chal-

lenges. e opening of a satellite on Staten Island this year eliminated a two-hour commute to one of the organization’s main campuses in the Bronx while it also ful lled the needs of local organizations and businesses seeking diverse and well-trained tech talent.

e new model, which launched in earnest in mid-2021 with four satellite facilities, can serve as an important tool for policymakers, funders, workforce program leaders and others nationally to leverage one another’s skills across tech sectors and increase their impact and growth.

e case to focus those e orts on tech training is strong: e industry has been one of the bright spots in workforce development, given the relative accessibility to thriving wage jobs and career pathways for individuals who do not possess a college degree. Skills training, however, is absolutely necessary.

Tuition-free training that equips prospects with in-demand technical and professional skills, such as information technology support programs, software engineering, cybersecurity and Amazon Web Services courses, can move the dial. ese skills will provide individuals with long-term careers.

Looking beyond the “usual suspects” of major colleges and institutions for diverse tech employees is a rising trend. Companies need to rethink where they are looking for diverse talent and expand their searches to nontraditional learning and training environments. Diverse teams create more diverse products, leading to a stronger return on investment.

It’s the right thing to do for the welfare of our communities, our companies and our country. ■

Plinio Ayala is CEO of Per Scholas, a nonpro t that provides tuitionfree professional and technology training.

president & ceo K.C. Crain group publisher Jim Kirk publisher/executive editor Frederick P. Gabriel Jr.

EDITORIAL editor-in-chief Cory Schouten, cory.schouten@crainsnewyork.com managing editor Telisha Bryan assistant managing editors Anne Michaud, Amanda Glodowski director of audience and engagement Elizabeth Couch audience engagement editor Jennifer Samuels digital editor Taylor Nakagawa art director Carolyn McClain photographer Buck Ennis senior reporters Cara Eisenpress, Aaron Elstein, Eddie Small reporters Maya Kaufman, Jacqueline Neber, Natalie Sachmechi, Caroline Spivack op-ed editor Jan Parr, opinion@crainsnewyork.com sales assistant Ryan Call to contact the newsroom: editors@crainsnewyork.com www.crainsnewyork.com/staff 685 Third Ave., New York, NY 10017-4024

ADVERTISING www.crainsnewyork.com/advertise sales director Laura Lubrano laura.lubrano@crainsnewyork.com senior vice president of sales Susan Jacobs account executives Kelly Maier, Marc Rebucci, Philip Redgate, Laura Warren people on the move manager Debora Stein, dstein@crain.com

CUSTOM CONTENT associate director, custom content Sophia Juarez, sophia.juarez@crainsnewyork.com custom content coordinator Ashley Maahs, ashley.maahs@crain.com

EVENTS www.crainsnewyork.com/events manager of conferences & events Ana Jimenez, ajimenez@crainsnewyork.com senior manager of events Michelle Cast, michelle.cast@crainsnewyork.com

REPRINTS director, reprints & licensing Lauren Melesio, 212.210.0707, lmelesio@crain.com

PRODUCTION production and pre-press director Simone Pryce media services manager Nicole Spell

SUBSCRIPTION CUSTOMER SERVICE www.crainsnewyork.com/subscribe customerservice@crainsnewyork.com 877.824.9379 (in the U.S. and Canada). $140.00 one year, for print subscriptions with digital access.

Entire contents ©copyright 2022 Crain Communications Inc. All rights reserved. ©CityBusiness is a registered trademark of MCP Inc., used under license agreement.

chairman Keith E. Crain vice chairman Mary Kay Crain president & ceo K.C. Crain senior executive vice president Chris Crain editor-in-chief emeritus Rance Crain chief nancial of cer Robert Recchia founder G.D. Crain Jr. [1885-1973] chairman Mrs. G.D. Crain Jr. [1911-1996]

As the city continues to flail under the crushing weight of its housing and homeless ness crisis, the recently re leased mayor’s management re port tells us two important things about Mayor Eric Adams.

The first is a good thing: He has taken some positive steps toward providing more meaningful hous ing metrics in the report—in con trast to the previous mayor’s frus trating reliance on obfuscation and spin. But what these metrics show brings us to the second point: Adams seems to have no in tention of actually addressing mass homelessness.

permanent housing and increase the housing capital budget to $4 bil lion per year.

But since being elected, Adams has paid only lip service to the city’s immediate and desperate need for vastly more affordable housing, dedicating far less funding for housing than promised.

According to the report, the city financed only 16,042 affordable housing units in fiscal 2022, down 45% from 29,408 the year prior. Only 9,625 of these housing units were new construction, with the rest being preservation of existing housing.

units. To put these numbers in perspective, the same re port notes that 45,563 people in 26,463 households slept in Department of Homeless Services shelters on an aver age night last year. All of this has been exacerbated in re cent months by the large number of asylum seekers coming to the city.

The city’s homelessness crisis is at its core a housing crisis—a no tion embraced by Adams himself during his mayoral campaign last year, during which he promised to move homeless New Yorkers into

OP-ED

OP-ED

Rather than acknowledging that this level of produc tion fails to move us toward the goal of reducing homeless ness, the mayor moved the goal posts: The annual target for housing production was lowered from 25,000 to 18,000 units.

Just as troubling, the subset of housing started specifically for homeless households dropped by 24% last fiscal year, to only 2,170

While the mayor touted an increase in the number of homeless households that moved into affordable hous ing financed by the city, that figure was a mere 2,203 households for the entire year. The number of unique individuals in the DHS shel ter system at some point over the course of a year consis tently exceeds 100,000.

The impact of the mayor’s failure to create housing options for home less New Yorkers is further evi denced by another troubling metric in the report: The average length of stay in DHS shelters has risen to alltime highs, with single adults spending an average of 509 days in shelters, families with children spending 534 days, and adult fami lies spending a staggering 855 days.

This comes at a massive human and financial cost; DHS spends an aver age of $186 per family each day they sleep in a shelter.

Adams has a unique opportunity to dramatically improve the city for all who live, work and travel here.

He must commit to producing at least 6,000 apartments per year for homeless households and 6,000

apartments per year for households with extremely low incomes.

Doing so would cement his lega cy as the mayor who finally turned around the city’s homelessness cri sis, if he would just heed his own numbers and do what he promised to do: embrace housing as the an swer.

■

Jacquelyn Simone is policy director at the Coalition for the Homeless.

As two leaders of former May or Bill de Blasio’s Pre-K for All program, we applaud Gov. Kathy Hochul’s and Mayor Eric Adams’ commitments to early care and education.

But by linking these investments to an old approach of “targeting” them to only those judged to need them the most, their implementa tion will get bogged down in costly red tape, and we will undercut im portant progress that we made on early care and education by build ing one high-quality system for all New Yorkers.

system sorts families into the de serving and the undeserving through onerous, intrusive and stigmatizing rules—signaling to many voters that this program is meant for “others.”

Families must meet punishingly specific rules: They must be low-in come, but if they make too little, they don’t qualify; they must pro vide multiple pay stubs, but if too much time lapses, they must start the collection process over.

Most contradictory of all: They must have a job to qualify but have to wait up to 30 days to receive care—putting the very job they have at risk. The re sult is that families don’t get what they need and services go unused, despite the large number of families that should qualify.

were serving close to 70,000 4-year-olds, and we were fill ing seats for 3-year-olds as fast as we could create them.

What’s more, our leaders should not follow the old ar gument that a system that ser ves everyone cannot be of high quality. This represents a false choice: Universal pro grams give decision-makers and voters the confidence to invest in the systems and re sources that build quality.

In the city, thanks to the ef forts of the hundreds of ex pert early childhood educa tors and social workers that visited thousands of class rooms several times each year, we saw pre-K program quality on national measures improve even as we expanded.

Targeted approaches to social programs are based on old, bad politics. Our federal system of child care is an example: Because it was a product of the backward race and gender politics of welfare reform in the 1980s and ’90s, the

Pre-K for All represented a step forward from this failed mod el. Families chose their program with an easy application, registered and showed up; all they needed was proof that they lived in the five boroughs. Before the pandemic we

Finally, our economic recovery depends upon a robust child care system for families across the in come spectrum. During the pan demic many women with children left the workforce for lack of child care, erasing decades of progress.

Universal care can help bring them back; Washington, D.C.’s universal pre-K program drove a 10% increase in maternal work

force participation.

Our city must not return to a failed approach that separates children into different classrooms based on their families’ circum stances and makes this one of our children’s first, formative experi ences.

The best way to foster a sense of common purpose, understanding

and hope in our children is to build one free, excellent system of early care and education for all. ■

Josh Wallack and Emmy Liss partner with local and state governments to create universal pre-K programs. They were deputy chancellor and chief operating officer, respectively, for the Division of Early Education at the city Department of Education.

ADAMS HAS PAID ONLY LIP SerVIce TO THE NeeD FOR VASTLY MOre HOUSING

As president and CEO of the Brooklyn Community Foundation, Jocelynne Rainey leads an organization that is the first public foundation dedicated to supporting Brooklyn’s charitable community. Since its start in 2009, the foundation has provided $75 million in grants to nonprofits throughout the borough.

Rainey has deep ties to Brooklyn. She lives in Bedford-Stuyvesant and worked for eight years at the Brooklyn Navy Yard Development Corp., where she attained the role of chief administrative officer and executive vice president. Rainey was instrumental in turning the derelict Navy Yard into a neighborhood jobs hub.

The former human resources executive sat down with Crain’s to talk about her career and what she’s learned about people, communities and mission-driven work.

How did you come to your position as CEO of the Brooklyn Com munity Foundation?

I started my career in nonprofits, and I’ve been working in the nonprofit industry for most of my career, with an eight-year stint in the for-profit world. At some point I realized I missed doing nonprofit or mission-driven work, and I found that my personal and professional passions had to match. The work I was doing in the for-profit sector was, how do I use my human resources expertise to level the playing field for people who look like me? I wanted to do it in a more meaningful way.

The Brooklyn Community Foundation supports local nonprofits, an essential part of the city’s economy. City nonprofits generated nearly $78 billion in economic activity last year and employ almost 20% of the workforce across the five boroughs.

I was at the Brooklyn Navy Yard for eight years, and Getting Out and Staying Out for two years, when this job at the Brooklyn Community Foundation became available. It was the intersection of all the things I care about most— mainly philanthropy, which I believe can be done regardless of your social or economic place in this world.

Could you tell us about the importance of the Brooklyn Community Foundation? We have gone to a completely participatory grant-making model. It’s one of the things I’m hugely proud of. During Covid and the Black Lives Matter movement, the foundation was able to galvanize donors to give $6 million, which we immediately gave to our nonprofits. That was huge. There weren’t a lot of obstacles or questions on an application, and we were able to get that money in and get the money out. It helped nonprofits keep their doors open.

The other thing we’re doing is a listening tour across all of Brooklyn and really trying to understand what is going on with communities—what do communities need, what is happening in the communities, and who is doing the work?—so we can be sure we’re supporting the right nonprofits.

What’s the biggest misconception New Yorkers have about the nonprofit sector?

I think that nonprofits need a lot more support than New Yorkers understand. Even if nonprofits are funded by the city and other foundations, there’s so much red tape and difficulty in getting to that funding. [There is a lack of] understanding that nonprofits need support to do the work they do, because the work they do is really the heart of New York City.

and that goes across all nonprofits, whether cultural institutions, advocacy organizations or those that give direct services. They’re the ones allowing mothers to work because they have evening babysitting or allowing people to [stay] in place because of housing insecurity or feeding young people due to food insecurity. They’re helping everyday New Yorkers thrive.

How did the Brooklyn Navy Yard become what it is? What was the secret to that project’s revival?

I think the biggest secret is we didn’t just talk the talk; we walked the walk. I worked under the leadership of Andrew Kimball and David Ehrenberg, and I think they were both visionary leaders.

When I got to the Navy Yard [in 2014], there were 3,000 people coming to work every day; when I left [in 2020], there were 10,000 people coming to work every day. That had to do with two

businesses that represented Brooklyn, that represented the community, and businesses that had the ability to hire people from the community.

What’s the key to being a successful chief executive?

I think the key is courage—the courage to be able to hold people accountable but also hold yourself accountable. The courage to know what you don’t know and the courage to bring your full self to your role every day. And the courage to surround yourself with people who are experts or smarter than you or will help you realize your vision.

Power to me is about creating equity for all. The most powerful people know how to share power and lift up everyone else. The more powerful people are, the more powerfully they can contribute to communities. It’s true that the

NUMBER OF EMPLOYEES 19. “A small team doing a lot of work,” Rainey said.

ON HER RÉSUMÉ Director of human resources, Independent Living Associ ation (1991–2004); regional human resources manager, Boar’s Head Provi sions (2004–2007); director of human resources, J.A.V. Food Corp. (2007–2011); senior vice president, chief ad ministrative officer and executive vice president, Brooklyn Navy Yard (2011–2020); chief executive officer, Getting Out and Staying Out (2020–2021); president and CEO, Brooklyn Communi ty Foundation (2021–present)

BORN Richmond, Virginia

RESIDES Bedford-Stuyvesant, Brooklyn

EDUCATION Bachelor’s in sociology, Southern Connecticut State University; master’s in administration, Metropoli tan College of New York; certification in nonprofit executive leadership, Columbia Business School; doctor of education in executive leadership, St. John Fisher University,

BREAKING THE MOLD Rainey helped start the Brooklyn Navy Yard Employment Center, which implemented a new workforce development model. The center moved away from a social ser vices philosophy to allow people to try jobs with some of the more than 500 businesses in the Navy Yard.

organizations that are most successful allow a diversity of thought, and that results in the best outcomes. There’s power in sharing power.

Where is your favorite place to connect with people?

Great question. I will say my favorite place is going for walks. I love Brooklyn. I love to be outdoors. There’s something about not having a ceiling or a wall that allows people to really connect.

I’m an empty nester. My children are done. They were my whole life outside of my work for a long time, so now what I’d like to do for fun is I like to spend time with my husband and friends, and I love to cook. When I’m cooking for someone, it’s how I show love. I like to have people enjoying my food while we’re enjoying good wine. I feel like I’m giving while I’m getting. ■

Crain’s is bringing together leaders in transportation to go inside what’s next for getting around in NYC. In this conversation we’ll talk to policymakers and transportation experts about the future of planes, trains, automobiles, as well as innovation in public transportation.

CrainsNewYork.com/OctoberForum

As the city grapples with a housing crisis, the future of affordability has come into question. Although some developers have taken a step back from build ing ground-up rental projects, others like Rick Gropper, principal of Camber Property Group, are continuing to invest in public housing and affordable developments. Since it was founded in 2016, Camber has built, bought and preserved about 7,000 units of mostly affordable hous ing primarily in New York City, and has several ground-up projects in the pipeline. But Affordable New York, a popular tax-abatement program known as 421-a that incentivized developers to build affordable housing, expired in June. Without it, Gropper says, the economics make it tough to keep building rental units in the city.

Why is your firm still committed to affordable housing? From a financial perspective, we have investors who are mission-oriented and are interested in providing a social good, providing housing that wouldn’t otherwise be available to people on the market because the rents are discounted or it’s Section 8.

What programs are you using, now that 421-a is gone, to continue creating and preserving affordable housing units?

For now we’re using tax abatements like Article 11 and 420-C as well as city subsidies and tax-exempt bonds. We also buy and preserve affordable housing under Section 8. We’ve bought market-rate properties and converted them to affordable housing using a tax abatement. Without 421-a, it’s very difficult to make the economics work for constructing new market-rate housing without a tax-abatement. The city’s tax system makes it really difficult, and you can end up paying 30% of your gross income to real estate taxes. The rents might be high, but they’re not high enough to justify the fact that you’re taking 30% off the top to pay your real estate taxes. It’s not worth it for the investment you have to put into a brand new building. Without 421-a, the new construction rental market has really slowed down to nothing.

WHO HE IS Principal, Camber Property Group AGE 40

GREW UP Ridgewood, New Jersey

RESIDES Murray Hill

EDUCATION Bachelor’s in sociology, Connecticut College; master’s in real estate development, Columbia University

ATHLETIC NATURE “I’ve done the NYC Marathon three times in a wheelchair,” he said. “But I used to be a semi-professional ski racer.”

TV STAR Gropper appeared on MTV’s in a Wheelchair

CRAIN’S MVP He was a 40 Under 40 honoree in 2021.

Why are landlords hesitant to offer Section 8 housing?

There are certain connotations about that type of housing. But I think it’s changed in the last 10 years— investors now realize the value of it.

During the pandemic, many tenants were able to pay rent because the U.S. Department of Housing and Urban Development will cover it if a tenant loses his or her job. Investors saw the value in that security.

But not everyone is accustomed to doing Section 8; it has a lot of regulations.

Do you anticipate the state replacing 421-a with another program, or do you think it’s gone for good?

Something has to be done in order to continue building rental housing in New York City. It’s really important to build all types of housing, and I don’t

think housing leads to gentrification. I think there’s an opportunity to create a new program that provides an additional level of affordable housing that also works for developers. If that means requiring 30% of units at 80% of the area median income and making that work, I think there’s a conversation that can be had to revive the program.

What have you been working on recently?

The project we closed on most recently is with the Bowery Residents’ Commission, one of the best operators of homeless shelters in the city. We’re building a 150,000-square-foot building that has two components: one is transitional housing with 100 beds, and the other is a 147-unit permanent affordable housing component through city subsidies. It’s not Section 8, but there’s an operating subsidy from the city for the people who will be living in the building.

Your company recently made headlines when a building it owns in the Bronx caught fire, killing 17 people. What is Camber doing to make sure you’re keeping tenants in your properties

The fire was beyond tragic, and I think one thing that we did was jump in and do everything we could to respond to our residents. We have spent more than $2 million on hotel rooms, rent waivers, arrears forgiveness and worked with our partners in the city and state to help anyone move into other buildings that we or other affordable housing developers own.

As a result of this fire, we have been working on a program for our portfolio that really focuses on education and training on fire safety systems for our property managers, for our team and for our residents. Everyone learned from this horrific event. I think the biggest takeaway is something that we started the company with, which is that the people who live in our buildings are paramount, and we do everything we can to assure their safety and security. ■

Anew homeless shelter is be ing planned in the South Bronx as the surge of asylum seekers arriving in the city puts ex treme pressure on the shelter sys tem.

The project from developer Da vid Sjauw will span about 166,000

and 162 feet tall with 195 residential units. Curtis + Ginsberg is the archi tect of record.

The site is currently home to a 2-story parking facility, city records show.

The new facility will serve as a re placement for an older site current ly serving families with children experiencing homelessness, said Neha Sharma, a spokeswoman for the city’s Depart ment of Social Ser vices.

Sjauw did not re spond to a request for comment by press time.

care, according to DSS.

New York’s shelter system has come under extreme pressure with waves of migrants coming to the city. Mayor Eric Adams recently de clared the situation to be a state of emergency. The shelter system is at capacity, with 61,000 people, and the city will likely spend $1 billion to deal with the crisis in the current fiscal year, he said.

square feet at 1298 Inwood Ave. in the borough’s Mount Eden neigh borhood, according to plans re cently filed with the Department of Buildings. It will stand 15 stories

The nonprofit Department of So cial Services partner HELP will pro vide multiple services at the shelter, including counseling, housing placement assistance and child

His administration has asked af fordable housing developers to help by taking their units out of the city's housing lottery and using them for the homeless instead. The City Council is also trying to change New York’s homeless policy to make more room in shelters for asylum seekers, including ending a rule that requires people to be in shelters for 90 days before becom

ing eligible for the city’s rental voucher program, known as City FHEPS

The 1298 Inwood Ave. shelter is unlikely to provide any immediate

relief for the crisis. Demolition per mits have not been filed for the ad dress yet, and its anticipated open ing date is mid-2025, according to DSS ■

BUCK ENNISTHE CItY WILL LIKELY SPEND $1 BILLION TO DEAL WITH THE ISSUE THIS FISCAL YEAR

NEW YORK has been the nation’s art capital since John Singer Sargent immortalized the great and the good of the Gilded Age. A century later, in the 1980s, the art world transformed into the art market as collectors began reaping enormous sums from selling works by the hottest artists. Art remains one of the leastregulated markets around, and this month’s Forum explores how an ambitious young dealer took advantage of its blind spots to create a massive Ponzi scheme.

It’s not just art that’s hot. Collectibles of all kinds are fetching record sums, and so we also meet a diamond dealer who is ready to give the people what they want after they’ve perhaps grown tired of speculating on crypto and NFTs.

Meanwhile, reporter Caroline Spivack takes a look at one of the art world’s third rails: how New York museums

displaying art that has passed through Nazi hands must now acknowledge that history in their galleries.

—Aaron Elstein, senior reporterA West Village-raised

paints a cautionary tale about

for

assets like ne art

BY AARON ELSTEINSome boys grow up wanting to be baseball players or re ghters. Inigo Philbrick wanted to be a world-famous art dealer. Specically, his mother recalled, he aspired to be the next Julien Levy, who introduced New Yorkers to Salvador Dali and Frida Kahlo. Or maybe Pierre Matisse, son of impressionist Henri Matisse.

“Inigo is authentically art world born and bred,” recounted Jane Philbrick, a former lecturer at Parsons School of Design whose husband, Harry, was director of the Aldrich Contemporary Art Museum in Connecticut. eir West Village-raised son was a constant studio companion, attending every exhibition and opening “from literally one week old,” Jane remembered.

At 27 Philbick opened a gallery bearing his name in London’s posh Mayfair district. He dealt in Jean-Michel Basquiat and other hot artists whose works sold for $5 million or more at Christie’s in Midtown and other leading auction houses. He ew in a private jet, wore a $50,000 watch and got engaged to a British reality TV star after breaking up with his Argentinian girlfriend who runs a perfume

studio.

By 2016 the gallery Inigo Philbrick Ltd. was generating $65 million in sales, according to a ling with British regulators, and nearly double that the following year. In 2018 he opened a branch in Miami as clients swooned over the young charmer.

“He is extremely well educated and mannered.” recalled Ferdinand Gros, a Paris gallery owner. “I never felt like he was interested in me for my family or business opportunities.”

Yet Philbrick’s success was a forgery. In July he entered a federal prison in Allenwood, Pennsylvania, after pleading guilty to running an art world Ponzi scheme in which he defrauded customers and lenders out of $86 million. He sold the same painting to multiple buyers without their knowledge, forged sale documents and photoshopped paintings to make it look as if he possessed them. U.S. Attorney Damian Williams called him a “serial swindler” who committed “extensive fraud.”

When it all came crashing down Philbrick, who is

As the FBI steps up its quest to nab art criminals, age-tested advice holds true: Buyer beware

CATHERINE K.B. LUCAS

CATHERINE K.B. LUCAS

An art market that’s “intertwined with the deeply personal” demands a sensitive approach to government regulation

35, tried eeing to Vanuatu, an island nation near Australia.

“It seems very clear that he was a keen and talented young man with big dreams,” recalled a sympathetic neighbor, Karen Adams, a 49-year-old retired General Electric oil and gas executive. But Philbrick, she understood, was “manipulated by unscrupulous people in the already corrupt world of art dealing.”

Corruption was endemic in art dealing long before Humphrey Bogart hunted down a fake Maltese falcon. Art is the largest unregulated market in the world after bitcoin, and last year $65 billion worth changed hands. Deals are still based on handshakes and faith that a dealer won’t eece you. After the U.S. Senate published a report showing Russian oligarchs used art to dodge sanctions, the Biden administration is writing regulations to make the market less accommodating for bad actors.

“It’s a market where if you look right, talk right and dress right, you can fool some people a lot of the time,” said Judd Grossman, a Manhattan attorney who rep-

1987, at Sotheby’s on the Upper East Side, when the son of former New York Mets owner Joan Payson auctioned o Irises by Vincent van Gogh. e painting sold for $54 million, even though the stock market had sunk by 22% in a single day a month earlier. It was the third van Gogh to sell for more than $20 million in 1987 alone. e rst sale was nearly twice the previous auction record of $11.9 million, set in 1983 by a medieval manuscript.

e van Gogh transaction a rmed that art was the hottest investment opportunity in town.

“I hope it–everything in the art market–will continue, as the mother of Napoleon used to say, ‘as long as it can last,’” New York dealer David Wildenstein said after the van Gogh sale.

Along the way art became, in the jargon of nancial marketing, an “alternative asset class” that appealed to collectors and investors alike. In 2017 Leonardo da Vinci’s Salvator Mundi sold for $450 million, still the highest sum ever for artwork. In the spring of this year an Andy Warhol silkscreen of Marilyn Monroe sold for $195 million at Christie’s in Midtown, a record for American and 20th-century art.

resents some of Philbrick’s victims.

iago Piwowarczyk, CEO of New York Art Forensics, whose clients include the United Nations and the State Department, said art is unique for the way it makes starry-eyed dreamers out of wealthy buyers who usually are astute bargainers.

“Art is the only place where the more unbelievable the story is,” he said, “the more people believe it.”

Blessed thou art Philbrick’s birth in 1987 coincided with the art world turning into the art market. e transformation occurred on Nov. 12,

An index for top 100 artists compiled by the marketplace Artnet calculated an 8% compound annual growth rate between 2000 and 2018, compared with 3% for the S&P 500. A price database maintained by Artnet grew from 8,300 artists at 18 auction houses in 1988 to 90,000 artists and 632 auction houses in 2012. rough it all New York remained the dominant destination for art sales, with a 45% market share, Deloitte found.

e art world-born-and-bred Philbrick got his start as a docent and gallery attendant at his father’s museum. In 2010 he landed an internship at White Cube, a contemporary art gallery in London run by Jay Jopling, whose clients include Julie Mehretu and Damian Hurst. After a year at White Cube, Philbrick was promoted to director of secondary sales. His ancee’s sister deemed working conditions “in nearly all respects, immoral [and] inappropriate.”

“ e pressure to hit sales targets and slaving absurd o ce hours was comparable to those kept by Wall Street bankers,” she said.

For an ambitious young salesman, contemporary art o ered opportunities. With old masters and impressionists priced out of reach, contemporary art grew from 1% of sales in 1988 to 14% in 2018, according to Artnet’s gures.

Yet as the young Philbrick made his way into this fast-moving market, his personal life was in turmoil. In 2006 his parents divorced after his father had an a air with a secretary and left the younger Philbrick responsible for supporting his family, according to court documents.

“My mother very clearly told 19-year-old Inigo that he was nancially responsible for both her and me,” his sister, Clara, said in a federal sentencing

memorandum that contained statements from family members and friends.

Harry Philbrick denied cutting o his family, though agreed Inigo was given “completely inappropriate emotional and nancial responsibilities.” is, he opined in a court document, rendered his son “unable to discern that he was on an inappropriate path.”

Philbrick’s London gallery opened in 2014, when global art sales reached $68 billion, a record that hasn’t been broken, according to a report from Art Basel and UBS. He sold fractional stakes in artworks to customers who hoped to resell them at a pro t, the way someone would ip a stock or a house. “ is wasn’t a group of collectors that cared about art,” Philbrick’s lawyer, Je rey Lichtman, said in an interview.

A handwritten note by Philbrick’s assistant in Miami discussing a repeat customer asked “How to f— them?” Philbrick did that mostly by selling more than 100% shares in paintings to multiple buyers without telling clients.

His crime spree involved 29 artworks over three years. To help pay for it, Philbrick turned to Athena Art Finance. Park Avenue-based Athena was founded in 2015 by Olivier Sarkozy, half-brother of the former president of France, and backed by private-equity giant Carlyle Group.

Art- nance houses such as Athena grew fast in the past decade, partly because they don’t have to verify customer net worth or sources of funds like banks, which are subject to rigorous “know your customer” laws adopted after 9/11. One dealer told U.S. Senate investigators that she “relies on her gut” when picking and choosing customers.

e nancial system’s blind spot suited Philbrick just ne. “You will die” when you see Athena’s bare-bones nancial-disclosure requests, he said, according to a victim’s lawsuit.

Athena gave Philbrick a $10 million revolving loan in early 2016. Funding secured, Philbrick began living his dream as the next Julien Levy or Pierre Matisse.

He approached London collector Sasha Pesko about teaming up to acquire Basquiat’s Humidity for $18.4 million directly from its owner. Pesko sent $12.2 million for a 66% share, but Philbrick used the money to buy the painting from the auction house Phillips for $12.5 million. He didn’t tell Pesko, nor did he tell him when he sold a 12.5% stake in the painting to a third investor for $2.75 million. Athena raised Philbrick’s credit line by $3.25 million.

He also targeted White Cube Gallery owner Jay Jopling, described by prosecutors as his mentor. e two bought an untitled Christopher Wool painting for $3.5 million, which Philbrick quickly sold.

When Jopling asked for his cut, Philbrick said there were legal hangups and blamed Martin Herrero, an Argentinian nancier related to his girlfriend at the time. For a year Jopling got emails from Herrero explaining why the money hadn’t come.

But Herrero didn’t exist. Philbrick and an assistant had sent the emails.

Philbrick’s Ponzi scheme unraveled when he misjudged the market for a portrait of Pablo Picasso by Rudolf Stingel.

Philbrick sold more than 100% of the work to three parties for more than $15 million in cash and commitments. Unfortunately, the picture sold for only $5.5 million at a May 2019 auction at Christie’s.

Unable to pay his partners, Philbrick defaulted on his Athena loan in October 2019

“THE MORE UNBELIEVABLE A STORY IS, THE MORE PEOPLE BELIEVE IT”BUCK ENNIS BASQUIAT’S “Humidity” remains in a Queens warehouse for now. PHILLIPS

and a week later ed to Vanuatu, where he lived in a boat house with ancee Victoria Baker-Harber, a cast member on the show Made in Chelsea

“He nds joy in the simplest of things,” neighbor Adams said in a letter to the court. “A beautiful tree, a kaleidoscopic sunset, a cheap but exquisite bottle of Sancerre.”

e fugitive’s idyll ended in June 2020, when FBI agents swooped in and arrested Philbrick, leaving behind a ve months pregnant Baker-Harber. An indictment was unsealed a month later, and he spent the next two years at the Metropolitan Detention Center in Brooklyn so he couldn’t ee again. His cellmate, who pleaded guilty to trolling dating websites, said Philbrick kept mostly to himself and avoided con ict, “which can be almost impossible at MDC.” He helped inmates write legal letters and read a biography of Catherine the Great.

“I beg you take courage,” the Russian empress said, according to a letter from Philbrick’s mother to court. “ e brave soul can mend even disaster.”

Two weeks after Philbrick was indicted, the Senate permanent subcommittee on investigations released a 150-page report calling to reform the art market. “Given the intrinsic secrecy of the art industry, it is clear that change is needed,” the report concluded. In response, Congress passed the Anti-Money Laundering Act of 2020. e Treasury Department is drafting regulations that are expected to require auction houses and art- nance rms to know their customers better.

“As we tackle systemic challenges like corporate transparency and other loop-

holes that allow criminals to abuse the U.S. nancial system, we will look at what else might be needed to address money-laundering risks speci c to other industries, including the art industry,” said Scott Rembrandt, deputy assistant Treasury secretary for strategic policy in the O ce of Terrorist Financing and Financial Crimes, in a statement earlier this year.

e Basquiat that Philbrick secretly bought with his partner’s money and then sneakily sold a part of is in a Queens warehouse, according to court papers. Athena was acquired by Yieldstreet, a Midtown rm that works in private-market investments and wouldn’t comment for this article. In November 2021 Philbrick pleaded guilty to one count of wire fraud and was ordered to pay $83 million in restitution. On Sept. 23 business partner Robert Newland pleaded guilty to one count of conspiracy.

At the hearing in which Philbrick entered his guilty plea, U.S. District Judge Sidney Stein asked why he did it.

“For money, your honor,” he replied.

“ at simple?” the judge said.

“ at simple.”

Daniel Tümpel, a client in Germany, lost $22 million and told the judge that Philbrick “knew how enormous the nancial damage would be for us—and yet he did not care.”

It will take years in court to sort out the rightful owners of the paintings Philbrick sold. Grossman, the attorney representing some of the victims, said collectors wishing to demonstrate ownership of art not in their possession can use a UCC-1 form, available on the New York Department of State’s website for a nominal fee.