A SoHo startup looks to help music venues

REAL ESTATE

BY EDDIE SMALL

REAL ESTATE

BY EDDIE SMALL

As New York lays the groundwork for a major housing push in the years ahead, two neighborhoods that are already seeing huge in uxes of residential projects, along with all of the optimism and concern that come with them, are Mott Haven and Gowanus.

e neighborhoods—separated by a borough and more than an hour apart on the subway—took very di erent paths to arrive at this point. e main factor in Gowanus, Brooklyn, was a long-gestating rezoning, nally passed at the end of 2021, that could bring about 8,000 new housing units to the neighborhood. In Mott Haven in the Bronx, developers have spent years predicting a residential boom, but the neighborhood only recently has seen the development of glossy high-rises like the ones that sprung up in other parts of the city throughout the 2010s.

“It’s certainly feeling like ‘if you build it, they will come’ in Mott Haven, whereas it seems like such a no-brainer for Gowanus,” said Colin Rankowitz, a partner at Tavros Capital, which is developing multiple projects in the Brooklyn neighborhood.

As with any areas that have seen a recent uptick in

COMMERCIAL REAL ESTATE

Here’s how of ce-to-residential conversions can actually work

BY NATALIE SACHMECHI

More than 1,000 days have passed since the pandemic pushed the city into remote-work mode, and o ce occupancy rates remain below 50%, data from the city comptroller’s o ce shows.

“ e hybrid work model has persisted far

longer than I expected it to,” SL Green Chief Executive Marc Holliday acknowledged in an investor presentation late last year.

But an o ce landlord’s vacant building could be a residential real estate developer’s dream come true. After months of hoping for a more robust o ce recovery, developers have begun giving serious consideration to

o ce-to-apartment conversions. City leaders are cheering on the change of heart as a way to relieve a deepening housing crisis and revive moribund o ce districts, including Midtown.

e consensus is that older, prewar buildings that have smaller oor plates are ideal for these types of conversions because they

can comply with the city’s light and air requirements for apartments. A study by the Real Estate Board of New York found that some 20 million square feet of o ce space below 60th Street is ripe for conversion.

Experts say such moves will require

CHASING GIANTS

book shows PAGE 3 THE LIST

PAGE 10 CRAINSNEWYORK.COM | JANUARY 23, 2023 NEWSPAPER VOL.

© 2023 CRAIN COMMUNICATIONS INC.

The largest mergers and acquisitions

39, NO. 3

THE NEW Mott Haven waterfront development Bankside

BUCK ENNIS

Some are calling Mott Haven and Gowanus the next Williamsburg, which is either an aspiration or a warning

RESIDENTIAL

THE CITY’S NEW ‘IT’ DISTRICTS

DISTRICTS

See CONVERT on page 19 GOTHAM GIG ECO-FRIENDLY CONTRACTOR STREAMLINES RENOVATIONS PAGE 23 ASKED & ANSWERED Gensler chair on why neighborhoods need more than one use PAGE 6

See

on page 14

Schumer calls on Hochul to compromise with Midtown neighbors over Penn Station overhaul

BY AARON ELSTEIN

Sen. Charles Schumer is calling on Gov. Kathy Hochul to compromise with Midtown residents over her plan to pay for a new Penn Station by developing o ce towers.

“I’m hopeful that the governor can come up with a compromise with the people in the surrounding community,” the Senate majority leader said at a Crain’s breakfast forum Tuesday. “I know she’s working to try to get that done.”

He didn’t elaborate what a compromise might look like and wasn’t

square feet of o ce and residential space in the neighborhood around Penn Station, in the hopes that the tax revenue would help pay for a new rail hub. But Vornado said in November that it wouldn’t be building soon, and state Sen. Leroy Comrie, who sits on a powerful oversight panel called the Public Authorities Control Board, said last month that Hochul must produce a new plan for rebuilding Penn Station.

Four community groups have sued to halt the development plan, arguing it’s unlikely to generate sufcient tax revenue because the market for o ce space is weak. One of the groups, ReinkNYC, said Hochul hasn’t moved toward a compromise, but it hopes she will.

FOUR COMMUNITY GROUPS HAVE SUED TO HALT THE DEVELOPMENT PLAN

available for questions afterward.

Schumer wouldn’t comment when asked if Madison Square Garden should move so the train station is no longer in its basement.

“I’ll have to get back to you on that,” he said, after a pause, and called Madison Square Garden “an institution.”

During the summer the Hochul administration approved a plan for Vornado Realty Trust and other developers to construct 18 million

“I think she realizes this project has real problems and she hasn’t found the secret sauce for support,” Re inkNYC Chairman Sam Turvey said. “It’s one of the largest public works projects in the country, and the governor just gave her second State of the State speech where she didn’t tout the plan at all.”

In a statement, Empire State Development said the governor “will continue to work with all stakeholders, including local, state and federal partners, to realize her vision for

REAL ESTATE

more a ordable housing, new park space, improved transit access and a station worthy of New York.”

Other notable topics

● Schumer implored leaders in the New York nancial community to use all their in uence with Congress to lobby against the government defaulting on its obligations.

A debt-ceiling default, Schumer warned, would cause interest rates to shoot higher and forever damage the government’s credibility with

the markets.

● He had some advice for House Speaker Kevin McCarthy: Listen to every member of your caucus, no matter how di cult that may be. All Democratic senators have the number of Schumer’s old-school ip phone so they can call directly.

● One of his top priorities this year, Schumer said, is enacting a law that enables banks to provide loans and other services to cannabis wholesalers and retailers.

● He remains a fan of working in

person and thinks most people will eventually return to o ces.

● He hinted that more federal aid will be available for the Metropolitan Transportation Authority, once its $15 billion pandemic lifeline runs dry, although he provided no details.

● He said he would oppose efforts to extend the $10,000 cap on state and local tax deductions that’s set to expire in 2025. e deduction is popular with wealthier residents of New York and New Jersey. ■

Vornado cuts its dividend by almost 30% and gets demoted from the S&P 500

BY AARON ELSTEIN

balance of power in a sale negotiation is with buyers.

MAY 17

POWER BREAKFAST

Mark your calendar to hear Janno Lieber, chair and CEO of the MTA, interviewed live on stage by Crain’s New York Business Editor-in-Chief Cory Schouten.

DETAILS

Time: 8:30 to 10 a.m.

Location: 180 Central Park S.

CrainsNewYork.com/ pb_lieber

Vornado Realty Trust cut its dividend by nearly 30%, a surprisingly steep drop that highlights the pressure facing the city’s second-largest commercial landlord as rental income erodes and borrowing costs rise. Separately, its stock was removed from the S&P 500 earlier this month.

Vornado said the dividend cut reects its estimate for how far taxable income will fall this year. It cited “the current state of the economy” and rising interest rates as culprits in a statement after markets closed last Wednesday.

Manhattan o ce landlords are starting to run short of runway, with o ce vacancy rates hovering around 15%.

Last year landlords restructured debts and sold properties where they could. But debt restructuring makes less sense when interest rates are higher. With fewer than half of workers back in o ces, the

“I don’t know if you’ll see o ce landlords le for bankruptcy this year, but individual buildings denitely could,” a leading restructuring adviser said.

As an example, the adviser cited 245 Park Ave., which went into Chapter 11 bankruptcy protection in 2021. SL Green Realty, New York’s largest commercial landlord, took ownership from Chinese conglomerate HNA and is trying to sell the 1.8 million-square-foot tower.

Ripple effects

SL Green shares are close to their 2020 low. Vornado’s stock trades below that depressed level and lost two-thirds of its prepandemic value. Its stock was removed from the S&P 500 e ective Jan. 4 because, S&P said, the shares have become “more representative of the midcap market space.”

e demotion means the stock no longer must be held by index

funds tracking the S&P 500.

Vornado owns 20 million square feet of o ce and residential space around the city, including 1290 Sixth Ave., Penn Plaza and the Farley O ce Building. CEO Steven Roth hopes to redevelop the area around Penn Station by building 18 million square feet of space a few blocks east of Hudson Yards, developed by Stephen Ross of e Related Cos. But in November Roth said

the Penn project would be delayed because of the uncertain market.

Vornado’s dividend cut will save the rm $30 million in the rst quarter. Analyst Steve Sakwa of Evercore ISI had forecast a roughly 10% reduction and said the higher-than-expected gure suggests more di cult times ahead.

“ e dividend cut has us second-guessing growth this year,” he wrote in a client report. ■

Vol. 39, No. 3, January 23, 2023—Crain’s New York Business (ISSN 8756-789X) is published weekly, except for no issue on 1/2/23, 7/3/23, 7/17/23, 7/31/23, 8/14/23, 8/28/23 and the last issue in December. Crain Communications Inc., 685 Third Ave., New York, NY 10017. Periodicals postage paid at New York, NY, and additional mailing of ces. Postmaster: Send address changes to: Crain’s New York Business, Circulation Department, 1155 Gratiot Ave., Detroit, MI 48207. For subscriber service: call 877-824-9379; fax 313-446-6777. $140.00 per year. (GST No. 13676-0444-RT) ©Entire contents copyright 2023 by Crain Communications Inc. All rights reserved.

BUCK ENNIS

2 | CRAIN’S NEW YORK BUSINESS | JANUARY 23, 2023

EVENT CALLOUT

CRAIN’S POWER BREAKFAST

BUCK ENNIS

CRAIN’S Editor-in-Chief Cory Schouten, left, with Schumer

GIGFINESSE co-founder Mir Hwang

Music venues rely on outdated booking systems; this SoHo startup has a solution

GigFinesse combines AI and local tastemakers to modernize the business of live music

The upstart: GigFinesse

The nation’s independent clubs set the trends when it comes to live music. But the way these venues do business is typically outdated. Many still tally ticket sales by hand, use paper calendars for scheduling shows, and rely on a network of small-time middlemen to work with artists and book shows.

Mir Hwang, 26, got a rsthand view of the frustrating system when he toured as a session drummer.

“ e live music business is becoming more and more important for musicians to make a living, but it was stuck in the dark ages,” he says.

After graduating from New York University in 2019, Hwang launched a booking platform with his cousin Ryan Kim, a software engineer at Google.

GigFinesse, his 30-person startup based in SoHo, takes care of scheduling, sets ticket prices and pays performers directly—an act might pocket 100% of the revenue, for example, after hitting a certain sales minimum, such as 30 tickets. is frees its 100 partner clubs—ranging from underground spots in the city to rural Texas barbecue joints—to focus on patron hospitality.

employs the human touch—seasoned “tastemakers” who are familiar with the local music scene and rely on their own knowledge and experience to re ne and expand on the digital recommendations.

Jackson Lardner, lead singer for city-based group Stolen Gin, says his dance-pop-jam band joined the platform just as the pandemic was waning, and it played its rst GigFinesse show in July 2021.

“We were amazed at the ticket deal. We got paid really well compared to other gigs we had done, ” he says.

With the increased exposure, the band graduated from playing for an audience of dozens to hundreds of fans.

The reigning Goliath: Live Nation

“ ey’re the kings and queens of their own empire that they’ve built,” Hwang says.

Hwang made connections the old-fashioned way, visiting clubs again and again until the owner agreed to see him. In meetings he emphasized his music background over his proposed technology x.

GigFinesse hit a big speed bump early on when the pandemic shuttered every venue in the city for more than a year. Hwang packed his bags and moved to Austin, Texas, where the clubs stayed open.

“ ey found out where the lemons were and they went and made some real tasty lemonade,” says Frank Rimalovski, managing director of the NYU Innovation Venture Fund, which invested in both the startup’s pre-seed and seed rounds. “ ey came back from Texas in a position of strength, with a better product and more customer experience.”

ANNE KADET

Los Angeles-based Live Nation Entertainment, with its 44,000 employees, produces thousands of concerts and festivals around the globe and negotiates sponsorship deals with more than 1,000 brand partners. It sells a half-billion tickets annually under its Ticketmaster brand. Its 2021 sales topped $6.2 billion.

at strong customer traction persuaded other VC rms to invest in the company, even though it relies heavily on human relationships that are di cult to scale.

The next challenge

But here’s where the service gets interesting: GigFinesse also uses arti cial intelligence to help program shows. Drawing from the screened pool of 5,000 acts that have so far joined the platform, the startup’s recommendation engine considers each performer’s music along with metrics such as its average draw and how much the performer’s fans typically spend at the bar— statistics that GigFinesse tracks for every performance.

“ e data makes the entire booking process a lot more ecient. It’s no longer a guessing game,” Hwang says.

But the startup, which recently raised $3.6 million in seed funding and booked more than 3,500 shows last year, also

How to slay the giant

Luring performers to the platform was the easy part. GigFinesse is free for musicians, and there’s no risk in signing up to receive potential opportunities.

e clubs were another story. Venues pay a subscription fee for the service—typically starting at $1,000 to $1,500 a month. e partnership required them to trust an unknown startup with the most crucial aspect of their business—the entertainment.

en there’s the fact that the industry rests mainly on oldschool relationships.

GigFinesse is using its latest funding round to grow in additional cities with a strong music scene, including Nashville and Los Angeles. As it scales up, it will have to balance tech-enabled e ciency with the need to maintain strong relationships with clubs and artists.

“I don’t think anybody really likes a monopoly or anything that gets too big,” says Lardner, the singer. “If GigFinesse were in every city, with tons of di erent independent clubs, they’d have to work extremely hard to keep it a human experience like the one our band had.” ■

JANUARY 23, 2023 | CRAIN’S NEW YORK BUSINESS | 3

Anne Kadet is the creator of Café Anne, a weekly newsletter with a New York City focus.

COURTESY OF GIGFINESSE”

CHASING GIANTS

BY C. J. HUGHES

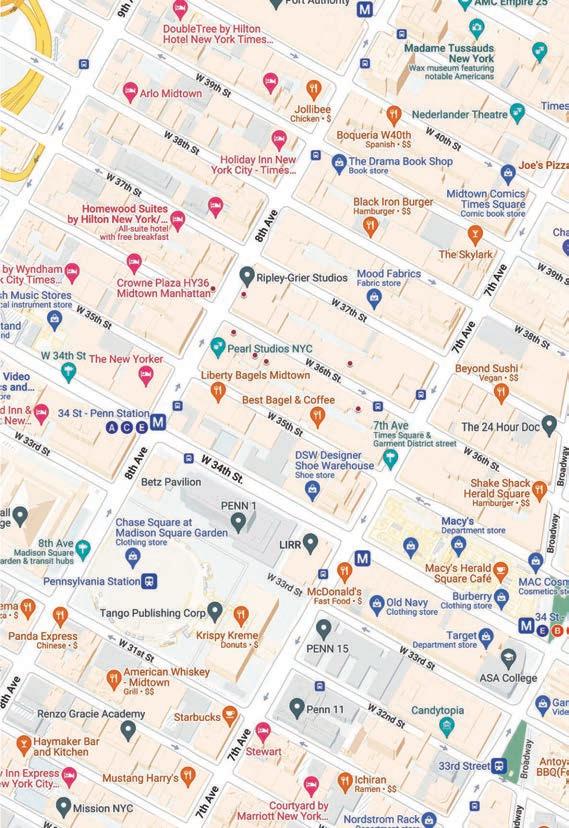

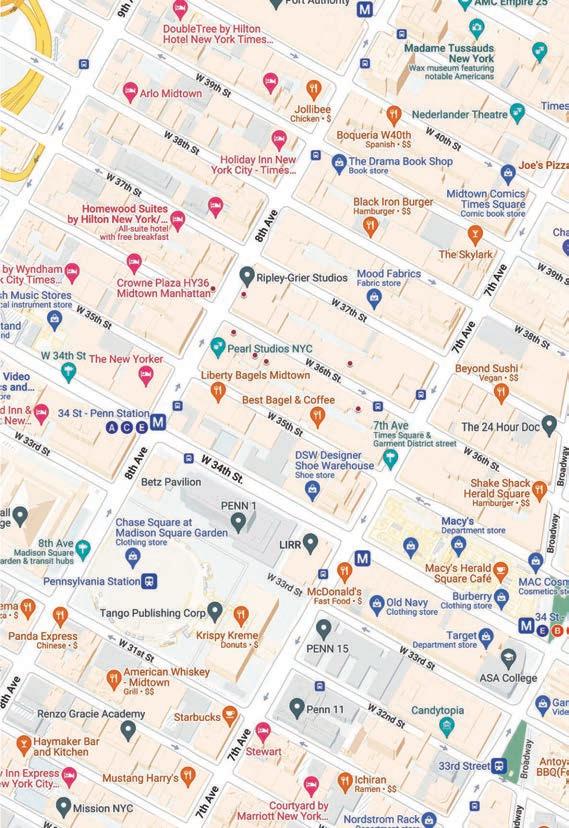

uch of the 120 million square feet of commercial space in the city that’s ripe for residential conversions, which Gov. Kathy Hochul highlighted this month in her State of the State address, might sit in Manhattan’s Garment District.

The neighborhood spans between West 34th and 42nd streets and Fifth and Ninth avenues, and offices make up 26 million square feet of it, according to a fall report from the Garment District Alliance, a landlord-supported nonprofit. (Garment factories, a shell of their former selves, have 713,000 square feet in the manufacturing-zoned area, it says.)

About 18% of that office space is vacant, a number expected to climb because office tenants are generally abandoning 1920s and 1930s structures, such as the kind found there, for much newer products.

But as suggested by the recent deal for 260 W. 36th St., a somewhat empty prewar building near Eighth Avenue that traded for $33 million on Dec. 19, it may not be so easy to just swoop in and declare something an apartment. Like many sites in the neighborhood, No. 260 abuts the building behind it, meaning a developer would likely have to shave off 30 feet of the entire building to satisfy light and air zoning requirements.

“People approached us left and right about converting this building,” said Chris Varjan, senior managing director with the brokerage Lee and Associates, which represented the seller in the transaction. “But the development costs would be high, and this is not a luxury neighborhood, so it will be hard to charge enough for the apartments to cover those costs.”

Indeed, No. 260, which Albert Monasebian’s Quartz Realty sold to apparel executive Ouni Mamrout and partner Meyer Equities for $400 per square foot, was probably too pricey for such a conversion to be feasible, Varjan added. He did explain, though, that some older garment-type families that bought their properties in the area long ago and have little debt on them could afford to sell for less, making for a sweeter proposition.

The buyers were not immediately available for comment. But it’s assumed that a renovation will occur at the 10-story prewar property, which features rusticated stone sections and bay windows. No. 260 was about 33% vacant during marketing, and another third could be empty as soon as leases expire, according to marketing materials.

But even if the building stays commercial, its fortunes might improve if its neighborhood were to embrace more housing, which makes up just 6% of the pie, according to the Alliance’s report from October. “Residential is almost guaranteed to be successful,” it says, and more housing “would improve the perceptions of the neighborhood and ultimately increase office demand.”

Sam Chang, sold his leasehold to NY 8th Ave Investor, a limited liability company, for $47.4 million in 2021, after the hotel was up and running, records show. The cheapest rate at the hotel for a weekend night in January was $166.

270 W. 36TH ST.

This retail building is checkered with vacancies, although it does have a store that sells bags as well as a third-floor tattoo parlor, Inkology Art Gallery. Jergil Manufacturing Corp. sold the 12,500-square-foot site, also known as 516 Eighth Ave., to a shell company for $25 million in 2016, which presumably took into account the unused air rights above the 3-story structure. Recent ads for empty retail berths at the address suggest a new glass-walled building is planned, although no new building permits are on file. Attempts to install a rooftop sign in 2016 led to a stop-work order, records show. The building’s market value as determined by the city, which tends to undervalue properties, is $3.4 million, down from $3.5 million in 2022 and $3.8 million in 2021, according to tax records.

520

EIGHTH AVE.

This stretch of Eighth Avenue has always been a little rough-and-tumble–perhaps more so since the pandemic. But this building, which is lined with about a half-dozen steady retailers, is a property that has proved the strip can support a strong mix of stores. Tenants include Houndstooth Pub, a 6,800-square-foot watering hole; a branch of Gregory’s Coffee; and Chef Yu, a two-level spicy Chinese food joint. The owner of the 27-story, 860,000-square-foot office building is GFP Real Estate, a major landlord whose chairman is Jeffrey Gural. The designer of the 1926 building was the architecture firm Schwartz and Gross, which was known for elegant uptown co-ops, such as the two-towered 55 Central Park West and 215 W. 75th St., also known as the Majestic.

225 W. 36TH

ST.

SLH Group purchased this narrow 37-footwide building with 7 stories for $2.9 million in 1998, according to a deed. A garment store selling accessories, DL NY, is in the sole retail space. Upstairs tenants include New York Combat Sambo, a 20-year-old school dedicated to a martial art invented by the Soviet army for better hand-to-hand combat. The school is also connected to Breakfall Studios, which teaches actors how to do stunts. The business’s owner, Stephen Koepfer, was an adviser on Keanu Reeves’ John Wick movies and on James Spader’s TV show The Blacklist, his website says.

230 W. 36TH ST.

260 W. 36TH ST.

This 10-story, 81,400-square-foot prewar building, which sold for $33 million in December 2022, has had a mixture of non-garment tenants in recent years, including a theater, photo studio and architectural model practice. The seller, Quartz Realty, appears to have owned the building for decades. It was built in 1907, according to city records, which was nine years before New York created its first zoning codes. They mandated that buildings must taper as they rise, like wedding cakes, so as to not overshadow streets. Indeed, the facade of No. 260 shoots straight up without setbacks. Many of the first buildings developed under the new code were in the Garment District, at a time when the city was encouraging clothing businesses to relocate there from Fifth Avenue.

56

About a decade ago Verizon considered plans to convert this hulking brick fortress of a building, which takes up nearly a half-block. In fact, in 2014 the telecom company put out a request for proposals to developers interested in creating a hotel across the top two floors of the 9-story, 23,300-square-foot building while Verizon would hang on to the rest. After all, Verizon, originally called the New York Telephone Company, had been on a tear at the time to divest itself of structures filled with obsolete equipment. An example was 212 W. 18th St. in Chelsea, which developers later remade as a luxury condo, Walker Tower. But the 36th Street hotel plans never came to fruition. Hotels are generally allowed in manufacturing zones. But in a bid to protect hotel union workers, the de Blasio administration in 2018 changed the rules for the lodging-dotted Garment District to force developers to seek a special permit first.

W. 36TH ST.

This lantern-adorned structure, a 12-story, 35,000-square-foot office building with tall arched windows from 1917, is today home to iLoft, a coworking space, although several floors appear to be for lease. An entity tied to Windsor Management, owned by the Kiamie family, purchased the building from a shell company for $17.8 million in 2012, records show. Unusually, it has no retail space at its base. Manhattan-based Windsor also owns nearby office buildings at 16 W. 36th St. and 37 W. 26th St. The Kiamies founded Windsor in 1944.

4 | CRAIN’S NEW YORK BUSINESS | JANUARY 23, 2023

Garment District could be prime target for highly touted office-to-residential conversions

Conversions have become a popular idea for dealing with the city’s excess amount of office space in the wake of the pandemic

W. 36TH ST.

WHO OWNS THE BLOCK

M■ 260

BUCK ENNIS, GOOGLE MAPS

523 EIGHTH AVE.

For years a single-story cluster of storefronts with chain restaurants such as Subway stood on this site. But in 2017 a developer took advantage of the thousands of square feet of unused air rights to build a 28-story, 320-room hotel. Today it operates as a DoubleTree by Hilton, while the site of a longtime Dunkin’ is now a plaza welcoming tourists. The hotel’s developer was McSam Hotel Group, which paid $27 million for a ground lease in 2016. McSam, whose principal is

THANK

ALVAREZ & MARSAL PROPERTY SOLUTIONS

Daniel Bodner

CBRE

Brendan Cavender

Lou Christopher

Joe Cybulski

Jamie Dennison

Ben Friedland

Hannah Gerard

Jason Gorman

Dana Henry

Robert Hill Sinclair Li

Anthony Manginelli

Greg Maurer-Hollaender Lewis Miller

Patrick Moroney Paul Myers

Joshua Pernice Silvio Petriello Jason Pollen

Zachary Price Clyde Reetz Arkady Smolyansky Zachary Weil Daniel Wilpon

COGENT REALTY ADVISORS

Mitchell Waldman

COLLIERS INTERNATIONAL

Daniel E. Arends John Brasier

Michael Cohen Clint Dewey Eric Ferriello Sheena Gohil Howard Kaplowitz Jack Senske

CRESA Gregg Cohen

CUSHMAN & WAKEFIELD

Evan Algier Jonathan Fein Paul Ferraro Dan Johnson Matthew Livingston Michael Mathias Brendan O’Leary

FIRST NEW YORK REALTY Eric Kahn

GEORGIA MALONE & CO

Georgia Malone

JLL

Charles T. Gerace II

Justin Haber

TJ Hochanadel

William Korchak

Donald M. Preate

David Pudlosky Henry Warner

LEE & ASSOCIATES

Richard Kave

Seth Rosen

Kenneth Salzman Brad Schwarz JP Sutro

NEWMARK

Corey Borg

Thomas Burrus

Eric Cagner

John Cilmi

Andrew Du y

David Falk

Timothy Gibson

Brian Goldman

Jason Greenstein

Paul Ippolito

Brian D. Lee

Matthew T. Leon

Andrew Margolin

Brad Needleman

Leo Paytas

Peter Shimkin

Fred Smith

Hal Stein Kyle Wainwright Cooper Weisman

SAVILLS

Kirill Azovtsev

Brandon Cooperstock Zev Holzman Gary Stein

WINICK

Steven Baker

Louis Eisinger Maxwell Greengrass Yoel Gorjian Ken Hochhauser

Douglas Durst

Jonathan Durst

are

the

for your

YOU We

grateful to

New York brokerage community

support in helping us lease over 759,000 SF in 2022.

JOSEPH BRANCATO Gensler

INTERVIEW BY C. J. HUGHES

Earlier in the pandemic, when Gensler Chairman Joseph Brancato went to work at his of ce in Midtown, he was disappointed to nd that many of the local takeout joints were closed. Grabbing lunch meant instead walking a few blocks west into a residential area, a stroll that inspired some thoughts on zoning. If neighborhoods are too dependent on one use, he thought, as is often the case in business districts, they may be vulnerable when something deals a blow to that purpose, such as a workplace-shutting crisis like Covid. Blocks with a mix of commerce and housing might be more resilient. In his work at Gensler, a giant architecture rm, that lesson informs Brancato’s conversations with landlords considering converting obsolete of ces into apartments.

Are of ce owners starting to embrace conversions? There are about 20 buildings in New York that we have studied or that we are now converting on behalf of developers and funds. There aren’t as many projects as in some other places, but I think New York landlords are waiting to see what happens when leases roll over before they make any decisions. Maybe then they would sell in order to cut their losses. But we are working on the conversion of 160 Water St. in the Financial District, an of ce building from 1970. It’s adding 586 apartments.

DOSSIER

WHO HE IS Chairman, Northeast and Latin America, Gensler

AGE 64

GREW UP Fair Lawn, New Jersey RESIDES Cortlandt Manor, Westchester County EDUCATION Bachelor’s in architecture and urban studies, University of Maryland CHILDREN Brancato and his wife, Carla, have ve children ranging in age from 24 to 41.

WORK LIFE Brancato joined Gensler in 1985 as a project architect.

GLOBAL EATS His favorite foods from work trips abroad include the ceviche in Peru and the asado with rice and beans in Argentina.

CHILDHOOD INSPIRATION “When I was 4, I went to this construction site near my house with my mother to see the bulldozers, and the workers lled up my wagon with dirt, which I carried all the way home,” he recalled. “I was just so excited.”

We’re working on another downtown project as well.

What is the city doing to encourage conversions? What can be done?

This whole thing about residential conversions is much bigger than just converting one building. It’s about creating an entire vibrant community. Government needs

to add special infrastructure, like parks and plazas. Tax breaks can also help to reduce the risk, to allow developers to move forward, though I do think we need to be very careful about whatever incentive we come up with. But the application process for breaks needs to be simple.

Which kind of New York of ce towers are best suited to conversions?

There needs to be about 30 or 40 feet between the elevator shafts and the windows to lay out apartments properly. Any more than that makes it dif cult. In New York, apartment buildings must have windows that open, but a lot of of ce buildings were constructed with sealed windows to be more energy-ef cient. That’s why a lot of the buildings from the 1920 and 1930s were so ideal, because their windows opened. Even if buildings have some warts, we can make them work. Sometimes all their bathrooms are in the central core, by the elevators, which we don’t need in conversions. But we can turn those spaces into libraries for working from home or laundry rooms. Some 1960s and 1970s buildings may be inef cient because of their cores, but we can give them great amenity spaces.

Is there too much of a focus on converting? Will people just return to of ces at some point soon? Not like before. A hybrid model of work is here to stay. It might mean you work from the of ce twice a week. And we’re seeing people in the of ce more than before, three to four days a week now versus one to two days a year ago. Some companies are saying, “Hey, we haven’t innovated in a while, and maybe that’s because we haven’t been together?” But I don’t think we will ever all be in the of ce ve days a week again. ■

6 | CRAIN’S NEW YORK BUSINESS | JANUARY 23, 2023

Lauren

at

or

for a unique opportunity to co-brand your company with a reputable news source. SHARE YOUR SUCCESS with custom reprints, logo licenses, awards and more. HIGHLIGHT YOUR COMPANY’S RANKING!

Contact

Melesio

lmelesio@crain.com

212-210-0707

ASKED & ANSWERED

BUCK ENNIS

MSG struggles to hang on to investors while giving customers the boot

Madison Square Garden can’t seem to persuade investors to stick around even as it goes to disturbing lengths to keep unwanted fans out. The share price of corporate parent MSG Entertainment has lost more than half its value in the past two years, more than triple that of Nasdaq.

But so far, as the market sees it, the problem isn’t the world’s most famous arena using creepy facial recognition technology to identify and kick out ticket holders deemed hostile by management. Rather, it’s that more fans are refusing to tune in to Knicks or Rangers games on MSG’s cable network while costs for MSG Sphere, a state-of-the-art arena under construction in Las Vegas, have gone stratospheric.

ticket resellers who have sued the arena. In a separate incident over Thanksgiving, a lawyer chaperoning her daughter’s Girl Scout troop was thrown out of MSG-owned Radio City Music Hall because she was identified as working for a firm suing one of the company’s restaurants. Rep. Jerry Nadler and seven other state and city lawmakers demanded in a letter last week that MSG stop using tactics that recall Orwell.

“It is absolutely time for the city and the state to reconsider any and all permits, licenses and benefits provided to MSG in the face of their continued malfeasance,” state Sen. Liz Krueger said in a statement.

The city has leverage over the Garden, should it choose to use it. In June an operating permit granted to the Garden by the City Council 10 years ago will expire. If the permit isn’t renewed, the city theoretically could bar MSG from holding events before big crowds. Council member Erik Bottcher, whose district includes Madison Square Garden, was one of the lawmakers who criticized MSG, which has avoided $875 million in property taxes over the past 40 years, thanks to an exemption granted by the state, according to the Independent Budget Office.

Shrinking audience

live entertainment. That was a smart strategy until the pandemic forced the Garden to go dark for a year.

When the arena came back to life in the spring of 2021, Dolan bought full control of MSG Networks for $900 million. It looks like he paid for a melting ice cube. Operating income at the cable network fell by half for the year ending June 30, 2022, to $130 million, as subscribers fell by 7%. In the quarter ending Sept. 30, subscribers fell by an additional 9%.

wide, and it will feature a 160,000-square-foot LED screen plus 17,500 seats. Estimated construction costs have doubled, to nearly $2.2 billion, due to the continuing impact of inflation, global supply-chain pressures and the project’s complexity, Garden officials say. To raise cash for this venture, the New York Post reported, MSG is looking to sell its Tao restaurant chain.

AARON ELSTEIN

“Those are two things weighing on the stock,” said one financial analyst. “Please don’t use my name. I’d like to keep my Knicks tickets.”

His concern is understandable.

The New York Times reported that a lawyer was denied entry to the Garden because his firm represents

MSG provided a statement on Krueger’s remarks to Crain’s that read: “We are disappointed that, with all the challenges that the residents of this city and state face today, these elected officials have chosen to focus on taking up the cause of a small group of attorneys, who are defending ticket scalpers and other money grabbers, so they can attend sporting events and concerts.”

Public relations fiascoes aren’t new to the Garden. In 2007 the company paid $11.5 million to settle a sexual harassment case brought by a senior marketing executive. And Chairman James Dolan’s business decisions over the years have sometimes been baffling, such as when in 2008 he bet big on the free-falling newspaper business by paying $650 million for Newsday. To his credit, in 2015 Dolan sold the family business, Cablevision, at a top-of-the-market $17.7 billion and doubled down on

The shrinking audience isn’t unusual because sports fans everywhere are streaming games instead of ponying up for cable subscriptions. Diamond Sports Group, a regional sports network that carries games for dozens of pro sports teams, is at risk of filing for bankruptcy protection. Analyst Brandon Ross of LightShed Partners said cord-cutting “is badly hurting every network.”

The Garden also has troubles of its own making. They start with MSG Sphere, which is expected to open this year next to the Venetian Resort. It is billed as the largest spherical structure in the world, measuring 366 feet high by 516 feet

Meanwhile, Dolan is looking to rearrange the deck chairs. His company recently proposed to spin off Sphere, Tao and MSG Networks into a separate company while housing the Garden, Radio City and other entertainment assets in another. In a statement last Wednesday, an MSG Entertainment representative said: “We are confident that MSG Sphere and the potential spin-off of our live entertainment business places us firmly on the path to creating long-term value for shareholders.”

However the spin-off shakes out, Dolan will retain control, thanks to his super-voting stock. Scandals come and go, but at the Garden, the song remains the same. ■

Light rail idea would transform Brooklyn and Queens ON POLITICS

Lost in the thicket of Gov. Kathy Hochul’s State of the State address was a proposal that could be both genuinely transformative and politically straightforward. Unlike her disgraced predecessor, Andrew Cuomo, Hochul is attempting to bolster public transportation in the city. It’s plausible, sometime in the next decade, that Brooklyn and Queens could have an entirely new rail system.

This is under the aegis of the Metropolitan Transportation Authority, so there will be caveats. The Interborough Express builds off a decades-old blueprint from the Regional Plan Association to build a subway network atop a freight rail line that runs through Brooklyn, Queens and the Bronx. It would not be fully integrated with the existing subway system. Rather, the MTA would pursue a light rail project that would span from the Brooklyn Army Terminal in Bay Ridge to Roosevelt Avenue in Jackson Heights.

would be able to travel between Bay Ridge and Jackson Heights in 39 minutes, cutting through neighborhoods such as Midwood, East New York, Ridgewood and Maspeth.

Significant addition

commutes. Slow-going local buses or automobiles wouldn’t be the only way to travel east-west. If Hochul can make the IBX real, she will have done more than most governors in modern times.

ROSS BARKAN

If the IBX is completed and functional, it will be the first significant addition to the city’s transportation network in a century. The Second Avenue Subway, which took many decades and encountered numerous cost overruns, amounted to a minor extension of the Q train to the Upper East Side of Manhattan that may, at some point, reach East Harlem. The Hudson Yards extension is one additional stop on the 7 line. These projects, heralded at the time, have only made a marginal difference to the commutes of most New Yorkers.

According to the MTA, the IBX, as it’s known, would have transfer points to 17 existing subway lines, the Long Island Rail Road and major bus corridors. Commuters

The designers of the original subway system did not imagine that one day the outer boroughs would be more populous than Manhattan, with their own richness and density. Traveling into and out of the city is relatively easy; going from Brooklyn to Queens is another matter, and the IBX would revolutionize

That’s the catch, of course: The MTA remains bloated and inefficient, running up enormous construction costs. In major global cities such as London and Seoul, entire new underground lines are built with ease. The IBX is projected to cost $5.5 billion, low by MTA standards but elevated compared to the rest of the world. Had New York been an equal to other leading international cities, the IBX would likely be heavy rail, seamlessly integrated into the subway network. The MTA chose light rail because it’s cheaper to build—although expensive to maintain over time. Had the transportation authority chosen to mirror international standards, such as overhauling outdated work rules and allowing for more competitive bidding among contractors, heavy rail might have been a possibility.

Another disappointment is that the IBX would not go to the Bronx, as the Regional Plan Association originally proposed. The MTA said it was not feasible because the rail line would interfere with the Penn Station Access Plan, which will add

Metro-North commuter rail stations in the Bronx.

For now, there’s no hard timeline on the IBX. The MTA chairman, Janno Lieber, previously suggested the light rail line would take between three and five years. Given the MTA’s history, seeing a fullfledged light rail line before the end of this decade would be a welcome miracle. Right now Hochul is focused on having the MTA finish its environmental review in time to include the IBX in the MTA’s upcoming 2025-29 capital plan.

New Yorkers have a right to be cynical—the Second Avenue Subway was a punchline for more than a half-century—but the MTA has a chance in the next few years to show government still works. What

a revelation it would be if it could prove the doubters wrong.

Quick takes

● Hochul’s pick for chief judge of the Court of Appeals, Hector LaSalle, was struck down by her own party last week. She has signaled that suing to initiate another vote is not off the table, but that gambit seems like a long shot at best.

● Queens Democrats seem to want a casino much more than Manhattan Democrats. Either way, the economic impact will inevitably be more marginal than anticipated, as nearby casinos continue to cannibalize each other’s business. ■

January 23, 2023 | CraIn’S nEW yOrK BuSInESS | 7

BLOOMBERG

IN THE MARKETS

Ross Barkan is an author and journalist in New York City.

OFFICEOFGOVERNORKATHYHOCHUL/FLICKR

HOCHUL

It’s time for the state to crack down on unlicensed marijuana retailers

New Yorkers who aren’t closely following the chronically delayed rollout of the retail program for adult-use marijuana might be surprised to learn there’s still just one legal dispensary up and running in the city.

at’s because smoke shops, weed vans and street vendors selling unlicensed cannabis products, untaxed cigarettes and avored vapes have been sprouting up all over the ve boroughs. ey’re as common these days as bodegas.

You might charitably call it an expression of the city’s entrepreneurial and opportunistic spirit that so many shops jumped out

than 1,200 unlicensed smoke shops are operating citywide. It’s time to nip the problem in the bud, and recent months have proved that enforcement must go beyond con scation to include legal jeopardy for the sellers.

Mayor Eric Adams announced in December the launch of a joint task force involving the city’s sheri ’s o ce, the Police Department and the Department of Consumer and Worker Protection, as reporter Olivia Bensimon noted on CrainsNewYork.com last week. In a two-week span the task force inspected 53 storefronts and seized more than 100,000 illegal products worth an estimated $4 million. Investigators found the smoke shops reopened within a few days, however, fully restocked.

THE INFLUX OF ILLEGAL STORES COULD DAMAGE THE REGULATED INDUSTRY

ahead of state regulators who have moved quite slowly on permitting legal shops. But the in ux could do serious damage to the nascent regulated industry by ooding the market with cheaper, untaxed and potentially harmful marijuana products.

e city estimates that more

OP-ED

“ ese illegal stores, to me, seem to suck up revenue that should be going to licensed dispensaries that still cannot open due to state delays,” said City Councilwoman Gale Brewer, chair of the Committee on Oversight and Investigations, during a recent hearing at which some council members called for the arrest of illegal sellers.

e state opened its rst legal

dispensary on Dec. 29, almost two years after the state Legislature passed and then-Gov. Andrew Cuomo signed into law the Marijuana Regulation and Taxation Act, which legalized recreational cannabis use for adults, created a framework to produce and sell cannabis and expunged marijuana-related criminal records. A second shop is scheduled to open this week.

e state has also placed an emphasis on social and economic equity by prioritizing the issuing

of licenses to people who have previously been convicted of marijuana-related crimes.

e state projects that taxed marijuana sales will generate $56 million in revenue in scal 2023, growing progressively to $363 million in scal 2028.

But for that to happen, the state’s O ce of Cannabis Management, which has approved just 36 licenses so far, will have to pick up the pace, and authorities will have to show there are actual consequences for unlicensed vendors. ■

Let’s not repeat past mistakes with the Cross Bronx Expressway

BY GUIDO HARTRAY AND ANNYA RAMIREZ

New Yorkers have a once-ina-lifetime opportunity to a ect how Bronx neighborhoods connect to one another and the rest of the city.

As Caroline Spivack described in “City launches two-year study to reimagine the Cross Bronx Expressway,” we need to insist on creating an urban infrastructure that builds, not divides, communities. In the service of interstate cars and trucks, the Cross Bronx Expressway has undermined the quality of life and economic potential of local neighborhoods as places to live and call home.

ough city and regional agencies have made notable individual investments in the Bronx, we urge planners, city o cials and developers to implement a neighborhood infrastructure where residents can work, shop, study and access health care within a

15-minute walk from their homes.

Despite the burden of infrastructure they bear, many Bronx neighborhoods are isolated, making simple activities and day-today living more challenging than they should be.

In part, this stems from the borough’s underlying topography of signi cant north-south crests.

ese natural divisions are heightened by rail and highway infrastructure that privileges connections to Manhattan rather than facilitates interborough connections within the Bronx.

rough our design work with cultural institutions, public spaces and a ordable housing in the Bronx, we have tried to repair these disconnects. Transforming the CBE o ers a chance for improvement that can scale the entire borough.

e CBE cuts across the grain of the Bronx, slicing through neighborhoods and dividing city blocks in half. Yet it does not create e ec-

tive east-west connections along its length. Traversing a 2-and-ahalf-mile stretch of the CBE from Morris Heights to West Farms can take more than 45 minutes by public transit, ve minutes less than it would take to walk.

Large-scale solutions

Even if capped, the CBE will impose a burden on tra c along its length. Shouldn’t it at least serve commuters’ and residents’ transit needs without forcing them into cars or tra c jams?

e city—indeed, the metropolitan region that uses the CBE— owes the residents of vital Bronx neighborhoods the infrastructure that serves their needs as well as the region’s. Capping the CBE would bring essential bene ts, such as improved public health and the restoration of residents’ right to breathe fresh air.

We need a large-scale framework to nd large-scale solutions. We also need opportunities to

make smaller, incremental moves that spur connectivity between neighborhoods and build social resilience. From our experience in working in the Bronx, we recognize the urgent need for more affordable housing, better educational resources and quality recreation spaces.

Solutions need to be developed and directed to the individuals who live, work and play in the Bronx. ey should not spur gentri cation and push out residents as a condition for investment.

If we use the land above the CBE in bold ways, we can empower Bronx residents with the quality of life that they—and we—deserve. We are eager to see what’s to come. Let’s start now. ■

Guido Hartray is a founding partner of Marvel, a New York–based urban planning, architecture and landscape architecture rm. Annya Ramirez is its director.

ISTOCK

president & ceo K.C. Crain group publisher Jim Kirk publisher/executive editor Frederick P. Gabriel Jr.

EDITORIAL

editor-in-chief Cory Schouten, cory.schouten@crainsnewyork.com managing editor Telisha Bryan assistant managing editors Anne Michaud, Amanda Glodowski director of audience and engagement Elizabeth Couch audience engagement editor Jennifer Samuels digital editor Taylor Nakagawa art director Carolyn McClain photographer Buck Ennis senior reporters Cara Eisenpress, Aaron Elstein, C.J. Hughes, Eddie Small reporters Jacqueline Neber, Natalie Sachmechi, Caroline Spivack op-ed editor Jan Parr, opinion@crainsnewyork.com sales assistant Ryan Call to contact the newsroom: editors@crainsnewyork.com www.crainsnewyork.com/staff 685 Third Ave., New York, NY 10017-4024

ADVERTISING

www.crainsnewyork.com/advertise sales director Laura Lubrano laura.lubrano@crainsnewyork.com senior vice president of sales Susan Jacobs account executives Paul Mauriello, Marc Rebucci, Philip Redgate people on the move manager Debora Stein, dstein@crain.com

CUSTOM CONTENT associate director, custom content Sophia Juarez, sophia.juarez@crainsnewyork.com custom content coordinator Ashley Maahs, ashley.maahs@crain.com

EVENTS

www.crainsnewyork.com/events manager of conferences & events Ana Jimenez, ajimenez@crainsnewyork.com senior manager of events Michelle Cast, michelle.cast@crainsnewyork.com

REPRINTS

director, reprints & licensing Lauren Melesio, 212.210.0707, lmelesio@crain.com

PRODUCTION

production and pre-press director Simone Pryce media services manager Nicole Spell

SUBSCRIPTION CUSTOMER SERVICE www.crainsnewyork.com/subscribe customerservice@crainsnewyork.com 877.824.9379 (in the U.S. and Canada). $140.00 one year, for print subscriptions with digital access.

Entire contents ©copyright 2023 Crain Communications Inc. All rights reserved. ©CityBusiness is a registered trademark of MCP Inc., used under license agreement.

chairman Keith E. Crain vice chairman Mary Kay Crain president & ceo K.C. Crain senior executive vice president Chris Crain editor-in-chief emeritus Rance Crain chief nancial of cer Robert Recchia founder G.D. Crain Jr. [1885-1973] chairman Mrs. G.D. Crain Jr. [1911-1996]

8 | CRAIN’S NEW YORK BUSINESS | JANUARY 23, 2023

EDITORIAL

Economic good trumps location in rating casino bids

BY EDWARD GIBBS

Nearly as soon as the state Legislature approved the potential creation of three downstate casinos in New York, immediate opposition by a few loud voices chimed in on where not to build them: Manhattan.

Folks seem OK with a casino in lower-income communities, such as the Corona and Flushing areas of Queens, but not so much in the much wealthier areas of Manhattan. It’s a safe bet these things are related.

As a member of the Assembly representing Manhattan, I am not weighing in on where new casinos

standards, and not just which communities host the new developments?

Decade after decade in New York, wealthier communities say no to controversial projects— whether they are low-income housing, high-density real estate projects or new commercial centers—and they are often successful. This not-in-my-backyard approach has essentially frozen many privileged communities in time, freezing out the vast majority of New Yorkers who cannot afford to live there or have businesses there.

sent, Harlem, is underserved by infrastructure and struggling to deal with gentrification brought on by development—some good, some bad. Though the average household income has increased in the past 20 years, many families struggle to make ends meet as rents and basic expenses increase.

Viability, not popularity

should go in the city. Although I do see tremendous potential for new jobs and tax revenue from these projects, I want to make sure we get the details right, including guaranteed work for lower-income New Yorkers and economic benefits that support working people. But shouldn’t we be judging these casino proposals based mostly on those

Manhattan in particular has more of these neighborhoods than any other borough. Almost every ZIP code below 96th Street has a significantly higher average income than the city average, and a much larger share of the population is white. At the same time, that area also has the best infrastructure, including unmatched transportation options and modernized sewer and power. Yet many residential areas have ferociously blocked upzonings, and many industrial and commercial areas remain underdeveloped.

Meanwhile, the district I repre-

Compare this, for instance, to the Upper West Side and Chelsea areas of Manhattan, near where a casino has been proposed over the rail yards. The average household earns three times as much in those neighborhoods as it does in Harlem. The average income in Flushing and Corona, Queens, where another casino is being proposed near Citi Field, is even less.

In other words, those who are in blanket opposition to a casino in Manhattan—but, notably, not flatly against a casino overall—are not just saying “not in my backyard” in their wealthy communities. They’re also saying “yes, in your backyard” to lower-income communities.

That is not right. The decision-makers choosing which casino proposals can go forward should rate projects based on how much of a positive impact they will have on the city overall—especially for working-class people. The quality

of the jobs created—and who gets them—and how much tax revenue each proposal yields should be major considerations. In addition, any casino that comes with guaranteed affordable housing would be a big bonus.

Finally, we should ask who the customers of these casinos would be. Will these projects attract visitors to add to our tax base, or will they just cannibalize preexisting local business or divert the dollars of city residents?

Although public officials should, of course, also take into consideration if a location for a casino proposal makes sense, their evaluation must be based on viability, not popularity.

Because if we do add a casino or two to the city, the siting process should be a fair game. For an equitable outcome, social justice has to be in the cards. ■

OP-ED BY AMY DORIN

The mayor’s solution to homelessness won’t work

not do the things we’ve tried repeatedly without success.

The Coalition for Behavioral Health, New York’s largest advocacy organization for community behavioral health providers, agrees with Mayor Eric Adams that people with mental illness who are homeless deserve better than living untreated and unsheltered lives on the streets and subways, but we strongly object to his proposed solution.

Unhoused people with mental illness are a result of inadequate housing and mental health care, not a gray area in the interpretation of mental hygiene law. After decades of failing to address their needs, it’s time we rethink our approach and

Having police involuntarily remove to a hospital homeless people they suspect of having a mental illness, who are not at imminent risk of harming themselves or others, will unnecessarily traumatize them. Even if the Police Department, the Fire Department, the Fire Department’s emergency medical technicians and the Metropolitan Transportation Authority Police Department apply the policy change with nuance and refinement and they remove only small numbers of such people, they will have traumatized them without having significantly improved their condition.

Even if hospital care is appropriate, our constrained inpatient psychiatric capacity and inadequate continuum of services mean that they are off the streets for only a few hours, days or weeks.

When they leave the hospital, most will end up on the street or in shelters without continuing care to maintain any progress made during hospitalization. They will be wary and will hide from outreach teams and law enforcement to avoid forced hospitalization again.

An approach that builds trust

We urge the mayor and Gov. Kathy Hochul to immediately implement a more effective approach that builds trust with vulnerable New Yorkers and facilitates access to essential services. The governor’s State of the State address included some proposals our coalition’s members have long supported:

• Expand the supply of supportive housing that combines homes with behavioral health care.

• Develop more intensive, community-based treatment, such as assertive community treatment and intensive mobile treatment.

Other proposals not in the State of the State address that the city and state should act on immediately

• Streamline city processes that keep people from accessing help.

• Use available enhanced federal funding to expand mobile crisis capacity.

• Increase both outpatient and inpatient treatment capacity.

• Create additional psychosocial rehabilitation services to help people with serious mental illnesses build lives of productivity and dignity.

• Add more on-site mental health care to homeless shelters. (Only 71 of 554 city homeless shelters have on-site mental health services.)

cy medical and hospital services, civil rights lawsuits and incarceration, which will inevitably result from police interactions. These dollars would be better spent on comprehensive solutions that work to transform the behavioral health and homeless services system to posi-

THIS CrISIS IS A RESULT OF DECaDES OF FAILURE BY SUCCESSIVE ADMINISTRATIONS

• Address the workforce crisis that is preventing behavioral health providers from expanding.

This crisis is a result of decades of failure by successive administrations to develop and implement a plan to scale up the services that we know work to end homelessness, engage people with severe mental illness in treatment, and address the economic and health care access disparities faced by Black and Latino New Yorkers, who are disproportionately represented in the city’s homeless population.

The mayor’s proposal will cost the city heavily. In addition to the training and other law enforcement costs, there will be significant costs associated with increased emergen-

tively change the lives of people who are homeless and have a serious mental illness.

The mayor has a historic opportunity to forge a more thoughtful and sustainable approach than past mayors, who failed to address the problem at its roots.

We urge him to collaborate with the city’s community mental health agencies to develop a comprehensive plan to transform lives while he reduces the number of people forced to live in public spaces because they lack a better option. ■

Amy Dorin is president and CEO of the Coalition for Behavioral Health.

January 23, 2023 | CraIn’S nEW yOrK BuSInESS | 9

Write us: Crain’s welcomes submissions to its opinion pages. Send letters to letters@CrainsNewYork.com

Send

fewer to

Please include the writer’s name, company, address and telephone number. Crain’s reserves

.

op-eds of 500 words or

opinion@CrainsNewYork.com

the right to edit submissions for clarity.

Assemblyman Edward Gibbs represents New York’s 68th District.

OP-ED

CrEaTED SHOULD BE

COnSIDEraTIOnS ISTOCK ISTOCK

THE QuaLITy OF THE JOBS

MAJOR

LARGEST MERGERS AND ACQUISITIONS

Francisco Take-Two Interactive Software Manhattan $13,867 Interactive home entertainment 1/105/23

American Campus Communities Austin, Texas

Biohaven Pharmaceutical Holding Company New Haven 7

8

9

10

$13,434 Residential REITs 4/198/9

Alleghany Corporation Manhattan Berkshire Hathaway Omaha $11,410 Reinsurance 3/2110/19

VANTAGE TOWERS AG #1

DRYING FUNDS

After an exuberant 2021, the total value of all mergers-and-acquisitions in the New York area fell by more than half in 2022.

Total value (in billions)

Tenneco Lake Forest Apollo Global Management Manhattan $7,567 Auto parts and equipment 2/2311/17 $1,200 2022 2017

Tegna Tysons, Va. Standard General Manhattan $8,563 Broadcasting 2/22$600

South Jersey Industries Folsom J.P. Morgan Asset Management Manhattan $7,875 Gas utilities 2/24$800

PS Business Parks Manhattan Blackstone Real Estate Advisors Manhattan $7,642 Diversified REITs 4/257/20 $1,000

Spirit Airlines Miramar JetBlue Airways Corporation Long Island City $8,755 Airlines 5/16$400

A FLEETING HIGH

Global Blood Therapeutics South San Francisco Pfizer Manhattan $5,882 Biotechnology 8/810/5 7,000

The number of transactions in the New York area plummeted by 61% in 2022 after 2021’s record high. Number of

Renewables Americas Austin, Texas $6,800 Renewable electricity 10/14,000

Hitachi Transport System Japan KKR & Co. Manhattan $6,745 Air freight and logistics 4/2811/29 5,000

ContourGlobal London KKR & Co. Manhattan $6,274 Independent power producers and energy traders 5/1712/20 6,000

Con Edison Clean Energy Businesses Valhalla $398 3,000

Preferred Apartment Communities Atlanta Blackstone Real Estate Income Trust Manhattan $5,387 Residential REITS 2/166/23 8,000 2022 2017

Atlas Air Worldwide Holdings Purchase Apollo Global Management, J.F. Lehman and Company, Hill City Capital Manhattan, Boston $5,118 Air freight and logistics 8/43,095

Cornerstone Building Brands Cary, N.C. Clayton, Dubilier & Rice, CD&R Investment Associates X CD&R Investment Associates X, Clayton, Dubilier & Rice Manhattan $5,027

10 | CRAIN’S NEW YORK BUSINESS | JANUARY 23, 2023 THE LIST

Deals in the New York area announced last year, ranked by deal value

71

TRENDS

DEALS with a value of more than $1 billion

BLOOMBERG

AMANDA.GLODOWSKI@CRAINSNEWYORK.COM RANK TARGET LOCATION BUYERS/INVESTORS LOCATION DEAL VALUE, IN MILLIONS PRIMARY INDUSTRY OF TARGET BUSINESS DATE

DATE

1 Vantage Towers

2 Nielsen

3

4 Zynga

5

deals

ANNOUNCED

CLOSED

Germany KKR & Co., Global Infrastructure Management Manhattan $17,541 Integrated telecommunication services 11/9 -

Holdings Manhattan Brookfield Business Partners, Evergreen Coast Capital Corp. Manhattan, Menlo Park $16,143 Research and consulting services 3/2910/11

Climate Technologies Business of Emerson Blackstone, GIC Private Limited, Abu Dhabi Investment Authority Abu Dhabi, Manhattan, Singapore $14,000 Industrial machinery 10/31 -

San

Blackstone Real Estate Advisors, Blackstone Real Estate Income Trust Manhattan 6

Pfizer Manhattan $12,184 Biotechnology 5/1010/3

Zendesk San Francisco

11

12

13

14

15

RWE

16

17

18

19

20

21

Hellman & Friedman, GIC Private Limited, Abu Dhabi Investment Authority, Permira Advisers Abu Dhabi, Singapore, San Francisco, Manhattan Building products 2/147/25 22 MGM Grand Las Vegas/Mandalay Bay Resort -

$10,990 Application software 6/2411/22 VICI Properties Manhattan $4,270 Real estate operating companies 12/11/9/2023 23 Ryder System Miami HG Vora Capital Management Manhattan $4,084 Trucking 5/1324 Turning Point Therapeutics San Diego Bristol-Myers Squibb Company Manhattan $3,976 Biotechnology 6/38/15 25 Resource REIT Philadelphia Blackstone Real Estate Income Trust Manhattan $3,843 Residential REITs 1/245/19 26 Oldcastle BuildingEnvelope Dallas KPS Capital Partners Manhattan $3,800 Building products 2/284/29 27 Covetrus Portland, Maine Clayton, Dubilier & Rice, TPG Capital, TPG Global Manhattan, Forth Worth $3,558 Health care distributors 5/2010/13 28 Wood Mackenzie Limited Scotland Veritas Capital Fund Management Manhattan $3,300 Research and consulting services 10/3129 iStar Manhattan Safehold Manhattan $3,176 Diversified REITs 8/1130 Houghton Mifflin Harcourt Company Boston Veritas Capital Fund Management Manhattan $3,134 Education services 2/224/6 $577MAVERAGE deal size in 2022 in the New York area

City Practice Group of New York Manhattan Village Practice Management Company Chicago $8,900 Health care facilities 11/71/3/2023 $200

2/23/22

CON EDISON CLEAN ENERGY BUSINESSES INC. #15

January 23, 2023 | CraIn’S nEW yOrK BuSInESS | 11

BUCK ENNIS 41DEALS

List

Dates

RANK TARGET LOCATION BUYERS/INVESTORS LOCATION DEAL VALUE, IN MILLIONS PRIMARY INDUSTRY OF TARGET BUSINESS DATE ANNOUNCED DATE CLOSED

COLUMBIA CARE INC. #47 31 Net Lease Asset Portfolio of iStarCarlyle Net Lease Income Manhattan $3,072 Real estate operating companies

32 Albioma Paris KKR & Co.

$3,030 Renewable electricity

33 Vantage Towers Germany KKR & Co., Global Infrastructure Management

$2,972

34 Corporate Property Associates 18-Global Manhattan

35 Ripic Holdings Clayton,

& Rice

$2,892

36 Hospice and Personal Care Divisions of Kindred at Home Clayton, Dubilier & Rice

37 Terminals, Solutions & Services business of Worldline

38 Tom Ford

39 U.S. data center business of

Tower

40 Applied, Food and Enterprise Services Businesses of PerkinElmer

41

42 Pharma

43

44 Biffa

45 Apria

TRENDS Source: S&P Global Market Intelligence care services 1/103/29 46 Accell Group The Netherlands KKR & Co., Teslin Capital Management, Teslin Participaties Coöperatief Manhattan, the Netherlands $1,872 Leisure products 1/246/23 47 Columbia Care Manhattan Cresco Labs Chicago $1,774 Pharmaceuticals 3/2348 St. Lachlan Hotel & Suites Sri Lanka Blackstone Manhattan $1,705 Hotels, resorts and cruise lines 3/1012/31/2021 49 BTRS Holdings Lawrenceville EQT Partners Manhattan $1,690 Application software 9/2812/16 50 Theravance Respiratory Company Wilmington, Del. Royalty Pharma Manhattan $1,610 - 7/137/20 51 AmeriVet Partners Management San Antonio AEA Investors, Abu Dhabi Investment Authority Abu Dhabi, Manhattan $1,600 Health care facilities 2/252/25 52 Computer Services Paducah, Ky. Centerbridge Partners, Bridgeport Partners Manhattan $1,599 Data processing and outsourced services 8/2011/16 53 Parata Systems Durham Becton, Dickinson and Company Franklin Lakes $1,548 Life sciences tools and services 6/67/15 54 111 WoodSpring Suites-Branded Hotels Blackstone, Starwood Capital Operations Manhattan, Miami $1,500 Real estate operating companies 1/243/31 55 Falck Renewables Milan J.P. Morgan Investment Management Manhattan $1,478 Renewable electricity 2/245/16 56 PANTHERx Rare Pittsburgh Nautic Partners, General Atlantic Service Company, Vistria Group Manhattan, Providence, Chicago $1,373 Pharmaceuticals 5/57/14 57 Imago BioSciences South San Francisco Merck Sharp & Dohme Corp. Kenilworth $1,348 Biotechnology 11/211/11/2023 58 Cowen Manhattan TD Securities Toronto $1,330 Investment banking and brokerage 8/259 A.C. Milan Milan RedBird Capital Partners Manhattan $1,278 Movies and entertainment 6/18/31 60 Lakeland Bancorp Oak Ridge Provident Financial Services Jersey City $1,249 Regional banks 9/27Number of transactions by sector Industrials 566 Information technology 475 Real estate 411 Financials 324 Consumer discretionary 307 Communication services 302 Health care 274 Consumer staples 92 Materials 71 Utilities 46 Energy 18 WanT MOrE OF CRAIN’S EXCLuSIVE DaTa? VISIT CraInSnEWyOrK.COM/LISTS. BLOOMBERG

made by KKR & Co., making the firm the most active buyer in the New York area last year SOURCE: S&P Global Market Intelligence, with additional research by Amanda Glodowski. New York area includes New York City and Nassau, Suffolk and Westchester counties in New York, as well as Bergen, Essex, Hudson and Union counties in New Jersey.

includes announced transactions for which terms were disclosed and that were not canceled and in which a buyer or target was based in the New York area. In some cases only partial interest in the target was acquired.

are 2022, unless otherwise noted.

INDUSTRIALS MAINTAIN APPEAL 20% of mergers-and-acquisitions in the New York area happened within the industrial sector in 2022.

Manhattan

4/289/9

Manhattan

Integrated telecommunication services 11/9 -

W.P. Carey Manhattan $2,894 Diversified REITs 2/288/1

Dubilier

Manhattan

- 6/111/22

Manhattan $2,800 Health care services 4/218/11

Apollo Global Management Manhattan $2,776 Data processing and outsourced services 5/25 -

International Manhattan Estée Lauder Companies Manhattan $2,600 Apparel, accessories and luxury goods 11/15 -

American

Corporation Stonepeak Partners Manhattan $2,500 Real estate operating companies 7/118/31

New Mountain Capital Manhattan $2,450 Life sciences tools and services 8/1 -

Safety Business of Intrado Corporation Stonepeak Partners Manhattan $2,400 Internet services and infrastructure 9/16 -

Intelligence U.K. Limited London Warburg Pincus, Mubadala Investment Company Abu Dhabi, Manhattan $2,318 Life sciences tools and services 2/106/1

Aareal Bank Germany Advent International Corporation, Centerbridge Partners, Cpp Investment Board Europe Boston, Manhattan, Luxembourg City $2,119 Thrifts and mortgage finance4/6 -

High Wycombe, U.K. Energy Capital Partners Summit $2,020 Environmental and facilities services 6/7 -

Indianapolis Byram Healthcare Centers White Plains $1,940 Health

New

SPONSORED PANEL Gain valuable insight on New York State’s Climate Leadership and Community Protection Act and how it leads the nation in setting ambitious climate goals and advancing the clean energy economy. REGISTER AT: CRAINSNEWYORK.COM/CLEANENERGY Thursday, February 9 • 9-11 AM 180 Central Park S.

FEATURED SPEAKER: DOREEN M. HARRIS President and CEO New York State Energy Research and Development Authority (NYSERDA)

York’s

Climate Goals SPONSORED BY

Position on Setting Ambitious

Executive Vice President Public A airs Invenergy

KELLY

SPEAKES-BACKMAN

PERKINS President and Project Director Community O shore Wind

DOUG

WILSON Chief Strategy and External A airs O cer National Grid

BEN

What to expect from the Interborough Express

BY CAROLINE SPIVACK

BY CAROLINE SPIVACK

THE ISSUE

1The 14-mile Interborough Express line between Brooklyn and Queens will move forward as a light rail project, Gov. Kathy Hochul unveiled in her State of the State policy book. Light rail, unlike the subway, can operate on both dedicated tracks and on city streets with tramlike passenger cars smaller than the average subway car. A link between Brooklyn and Queens has long been a fantasy of urban planners to cut travel times significantly for riders and to bolster economic activity in underserved neighborhoods between Bay Ridge and Jackson Heights. Hochul endorsed the idea in her 2022 State of the State address and now, after a year of study by the Metropolitan Transportation Authority, is advancing the project in what would become the city’s first true light rail line.

THE PLAYERS

2The MTA would be on the hook to build and operate the potential light rail line, and it would have the most power to shape its course. Transit officials have not completed a full environmental review of the undertaking, but in a “planning and environmental linkages study” released this month, the agency recommends light rail over conventional rail, such as the subway and bus rapid transit.

In the MTA’s study, transit planners found light rail attractive on multiple fronts. Quick acceleration and short dwell times make it the fastest of the three options. It can run on the street, avoiding construction of a costly and complex tunnel at a key pinch point. Plus, the light rail vehicles can be procured “off the shelf” without modification from a pool of suppliers. Limited suppliers for new subway cars, conversely, have contributed to major delays.

High ridership estimates (115,000 projected weekday riders by 2045) and “a relatively low construction cost” of $5.5 billion in 2027 dollars make light rail the best value, according to the MTA’s study. A timeline for the project has yet to be detailed, although MTA Chairman and CEO Janno Lieber has said completion will likely take from three to five years.

“The bottom line is it was judged to be superior in terms of capacity, speed and engineering viability,” Lieber said at a recent news conference.

WHAT’S NEXT

5Hochul has pledged to support the MTA as it works to complete an environmental review in time for the Interborough Express to be pushed into the MTA’s next capital plan, which is to earmark funds for major infrastructure investments from 2025 to 2029. A full environmental review is expected in the coming months.

YEAH, BUT …

3Light rail is not without its challenges. Namely, it would require the MTA to operate a new class of vehicles that would need specialized maintenance and storage facilities to operate and maintain the system. Annually, such work could cost $83.2 million in 2027 dollars, with the Brooklyn Army Terminal a possible location for light rail facilities, according to the MTA’s study.

Some transit advocates balk at the light rail option because it wouldn’t be able to seamlessly link with the subway and commuter rail lines. Renae Reynolds , executive director of the Tri-State Transportation Campaign, said a conventional subway line could better serve the region because it would require fewer transfers and limit rider friction to access major employment centers, airports and housing.

“It’s time to break free from the fragmented, patchwork transit system that leaves too many people stranded and disconnected,” Reynolds said. “The governor and MTA must prioritize the needs of all riders and the whole region, and invest in a system that will bring us into the 21st century.”

Looming over all of this, of course, are the MTA’s financial problems. The agency needs $600 million this year alone to avoid drastic service cuts and, if transit officials are not able to tap into new revenue streams, might have to dip into capital dollars for infrastructure projects, such as the Interborough Express, in a last-ditch effort to keep the system operational. Even in the best of times, the MTA’s projects have a reputation for bloated costs and lengthy timelines, so New Yorkers can be forgiven for being cynical about the Interborough Express becoming a reality within the next decade.

SOME BACKGROUND

4Hochul’s Interborough Express partially reimagines a proposal the Regional Plan Association has championed since 1996. Each vision relies on underused freight rail and existing infrastructure to create the new link, but with a key difference being that the association’s proposal—the Triboro RX—calls for the rail line to extend beyond Queens and culminate in the Bronx’s Co-op City. Hochul ultimately cut the rail line short because of engineering concerns that Hell Gate Bridge, which spans between Queens and Randall’s Island, could not handle more trains; it already carries Amtrak cars and will soon link the Metro-North with Penn Station.

As proposed, the Interborough Express corridor is home to 900,000 people and 260,000 jobs, according to MTA estimates. The project’s footprint is made up of existing infrastructure from the Long Island Rail Road’s Bay Ridge Branch and the Fremont Secondary line owned by CSX, a major freight railroad company that operates in the eastern U.S.

January 23, 2023 | CraIn’S nEW yOrK BuSInESS | 13

INSTANT EXPERT

“IT’S TIME TO BrE aK FrEE FROM THE PaTCHWOrK TRANSIT SYSTEM THAT LEAVES TOO MANY PEOPLE STranDED”

MTA

NEWSCOM

NEWSCOM

MTA

LIEBER

HOCHUL

development, the comparisons with Williamsburg inevitably arise. Dubbing a changing neighborhood “the next Williamsburg” has proven irresistible for developers and community activists alike, with the former generally viewing it as aspirational and the latter viewing it as a warning, especially when it comes to high rents.

Although some of the new developments on their way to Mott Haven and Gowanus would not look out of place in Williamsburg, neither neighborhood is following the same development path. Here is a closer look at what is going on in both places.

Mott Haven

After more than a decade of predictions that Mott Haven’s relative a ordability and close proximity to Manhattan were poised to turn the South Bronx from a notorious symbol of urban decay into the next trendy area, the neighborhood really is now home to a cluster of glistening high-rises on the waterfront by the ird Avenue Bridge.

ese new apartment buildings, many still under construction, are from some of the most established developers in the city, namely RXR and Brook eld. e boldface names indicate that betting on Mott Haven’s real estate market is not just for small investors and land-

lords anymore. Institutional capital has arrived and brought much larger projects with it.

e towers from both developers dwarf prior projects that were thought to signal an impending real estate boom. e Clock Tower, for instance, a converted residential building that opened back in 2002, stands only 5 stories tall with 75 units, according to StreetEasy.

RXR’s project at 2413 ird Ave., meanwhile, stands 27 stories tall with 200 units, and Brook eld’s

project will include about 1,400 apartments across seven buildings standing as high as 25 stories tall.

e Brook eld project in particular has long been viewed as a makeor-break moment in determining whether Mott Haven is ready to handle large market-rate developments, and the site’s history encapsulates many of the gentri cation fears of longtime residents.

Developers Somerset Partners and the Chetrit Group purchased the sites in 2014 and 2015, and

eld then purchased the sites from them for $165 million in 2018.

Rubenstein still has an interest in several Mott Haven businesses and said the neighborhood is essentially developing as he hoped it would.

e resistance to new projects has also lessened since his infamous billboard, he said.

“I’m sure not everybody is happy, but from my perspective, it seems like people are calm and accepting,” he said. “ ere’s a big housing crisis, whether it’s market-rate or a ordable, so in order to resolve that crisis, there needs to be development.”

e completed portion of Brookeld’s project, called ird at Bankside, was about 68% leased up as of mid-January, and rents for available units range from $2,950 for a studio to $4,605 for a two-bedroom, according to the rm. It also

14 | CRAIN’S NEW YORK BUSINESS | JANUARY 23, 2023

Somerset Principal Keith Rubenstein sparked controversy in 2015 after putting up a billboard rebranding the neighborhood as the Piano District. Brook

DISTRICTS FROM PAGE 1 Your Story, Your Way Crain’s Content Studio offers special advertising opportunities and programs to expand your brand’s reach and connect you to your target audience. SPONSORED CONTENT Position your team members as thought leaders. CUSTOM RESEARCH Leverage the Crain’s audience for key insights in your market. TURNKEY EVENTS Make connections and generate leads. For more information, contact

at

Sophia Juarez

sophia.juarez@crainsnewyork.com.

1 2

THE TRENDY SOUTH BRONX: Development rm Brook eld’s Bankside project in Mott Haven will include about 1,400 apartments across seven buildings standing as high as 25 stories

includes 138 a ordable units interspersed throughout, and the rm received more than 16,000 applications for those, according to Brookeld Vice President Charles Howe. Work on Bankside is slated to be completed by the end of the year.

He viewed comparisons to Williamsburg as o -base, arguing that projects in the two neighborhoods don’t have much in common apart from the general idea of waterfront development and (hopefully) their popularity.