REAL ESTATE

The full impact and extent of the banking crisis is still being sussed out, but one thing that already seems clear is

Banking crisis could further damage the city’s real estate market The city and the state dish out a combined $10 billion in tax breaks and subsidies every year. The public payoff is murky at best PAGE 13 PLUS Aggressive lobbying keeps tax breaks in place for years PAGE 17

that it signals more bad news for a local real estate market still struggling to bounce back from the pandemic.

One of the biggest question marks came in the wake of the highly touted acquisition of Signature Bank by the New York Community

Bancorp division Flagstar. e transaction failed to include at least one giant piece of Signature’s portfolio: its nearly $50 billion in commercial real estate and multifamily loans.

NYCB CEO Tom Cangemi was asked about

this multiple times on a March 20 conference call discussing the deal. He essentially said the company passed on a chance to increase its real estate exposure at little to no cost

TAX INCENTIVES VISIT CrainsNewYork.com for more on the city’s zombies, including interactive graphics. See DAMAGE on page 22

THE LIST The largest health care nonpro ts PAGE 10 CHASING GIANTS STARTUP USES AI TO MAXIMIZE TAX REFUNDS PAGE 3 NEWSPAPER VOL. 39, NO. 12 © 2023 CRAIN COMMUNICATIONS INC. TECHNOLOGY Arti cial intelligence rms buck the venture capital downturn PAGE 2 CRAINSNEWYORK.COM | MARCH 27, 2023

BY AARON ELSTEIN, C. J. HUGHES AND EDDIE SMALL MIKE LAUGHEAD

ZOMBIE CITY INSIDE Pro les of zombie tax breaks that just won’t die PAGE 15

City’s artificial intelligence companies bucked the VC downturn, raised a whopping $483.6M in 2022

BY CARA EISENPRESS

The promise of generative artificial intelligence to drive business productivity and solve thorny problems has powered a speedy pickup of investment and deals in the space, according to data released by Pitchbook, and companies in the city are picking up a fair share.

Generative AI companies in New York raised $483.6 million last year over 28 funding rounds. That’s a seismic increase from the $41.1 million raised in 2018 across eight

San Francisco–based OpenAI brought the tech to wide attention when it released ChatGPT, a chatbot so accomplished that use cases began to proliferate. Programmers are using ChatGPT to research and write code, and students leverage the tech to do their homework. Publishers almost immediately replaced some writers. Recently OpenAI released an updated version: GPT-4. Engineers have been at work on the technology for 25 years, but few products have been released to the public, and none have had the popularity and promise of OpenAI’s chatbot.

VENTURE CAPITAL FIRMS PUT NEARLY $10 BILLION INTO THE INDUSTRY IN ThE PAST TWO YEARS

funding rounds, especially as large venture capital rounds continue to cool because of shaky market conditions.

Across the country, venture capital firms put nearly $10 billion into the industry in the past two years, Pitchbook found.

Generative AI is technology that can learn as it goes. But unlike tools that simply learn to respond to more and more complex prompts, generative AI tools actually create new, original work. Late last year

EVENTS CALLOUT MARCH 29

FORUM: LIFE SCIENCES

The city has invested deeply in life science infrastructure, such as laboratory space and incubator programs, to compete with heavyweights including Boston and San Francisco. The approximate $1 billion in investments have thus far paid dividends. But despite the windfall of investment, the industry still faces headwinds to attract the top talent, secure enough space and endure a volatile public. Crain’s panel will bring together stakeholders representing the public and private sectors to discuss how the industry can weather the storm, how academic institutions’ innovation labs and research spaces are fueling major discoveries in the sector, what real estate clients are looking for in lab space in New York City, how the life sciences present an opportunity for sustainable economic growth and workforce development, and which neighborhoods are showing promise as future life science hubs.

Time: 8 to 10 a.m.

Location: 180 Central Park S.

CrainsNewYork.com/marchforum

Though the space is undoubtedly trendy, it is finding a path to commercialization fast. Pitchbook estimates the market will be worth $42.6 billion by year’s end and will hit $98.1 billion by 2026.

Part of the success of the technology so far comes from partnerships between AI tools and large firms, such as Microsoft, which has committed $10 billion to OpenAI and incorporated ChatGPT to improve its Bing search engine. The Seattlebased software giant has taken an undisclosed financial stake in New York City–based Paige, which uses artificial intelligence to identify the pathology of cancer based on slides of patients’ tissues. Alphabet, Google’s parent company, put $400 mil-

lion into Anthropic, which has created what it says is a safer chatbot than OpenAI’s. (Sam BankmanFried also invested.) Last week Google debuted Bard, its generative chatbot, for testing by external users.

The speed of adoption has been unheard of, wrote Ali Javaheri and Brendan Burke, authors of the Pitchbook report. “ChatGPT reached 100 million monthly active users faster than any technology productivity app at two months,

surpassing TikTok’s nine months to achieve the same feat,” they wrote.

The top rounds

Financial District–based Asapp, a customer experience company that automates call centers, raised two of the top three local rounds in the past several years. In May 2020 the company closed a $185 million round. A year later it brought in $120 million. Paige is also at the top in terms of fundraising, bringing in $150 million in July 2020 and $125

million in March 2021. The most recent company to fundraise was Runway, a multimedia and design software automation company that can generate images and video content; it brought in $50 million in December.

Two Sigma is at the top of the heap among city firms funding the boom, followed by Remarkable Ventures, HBS Alumni Angels New York, the Partnership Fund for New York City, Coatue Management and Betaworks Ventures. ■

First Republic’s future could lie in serving low-income communities, analyst says

BY AARON ELSTEIN

First Republic’s future remains up in the air days after it was reported that Jamie Dimon was leading discussions among banks to help out the ailing lender a second time.

The San Francisco–based bank has hired Lazard to advise it on the wisest course of action, which could include raising capital, shedding assets or even an outright sale. Its stock trades for about $12 a share, down from $120 when the banking panic began a few weeks ago, and analysts believe First Republic depositors withdrew about half their money after the failures of Silicon Valley Bank and Signature Bank.

Like those two, First Republic held a lot of deposits that exceeded the Federal Deposit Insurance Corp.’s $250,000 insurance limit.

A $30 billion infusion from JPMorgan and other big banks didn’t end the crisis of confidence. While Wall Street awaits a solution,

some are speculating that First Republic will emerge as a very different bank. It may even convert from ser ving high-net-worth clients to focusing on the poor.

That idea was introduced in a recent report by analyst Timothy Coffey of Janney Montgomery Scott, a firm that specializes in following small and midsize banks.

He observed that the last time JPMorgan, Bank of America and others rescued an ailing bank was in 2021, and the lender was Broadway Financial, which serves low- to moderate-income communities in Los Angeles. In 2011 Goldman Sachs and other big New York banks teamed up to rescue a similar lender, Harlem-based Carver Federal Savings.

Coffey said one alternative is for the lender to become certified as a community-development financial institution. The mission of CDFIs is to provide access to financial services to low-income communities, a clientele completely different from First Republic’s ultra-high-

net-worth audience. But becoming a CDFI would make the bank eligible for capital investment from the U.S. Treasury’s Emergency Capital Investment Program, which is providing $9.5 billion in capital to CDFIs. Carver is a CDFI.

It would admittedly be a huge change. Essentially the old First Republic would be gutted. Its clients

would leave for JPMorgan and other big institutions, and its banking charter would be put to new use. First Republic doesn’t seem to have many good alternatives. Coffey warned in a report that by replacing outflows with borrowings and higher-cost deposits, the bank faces a drop in estimated earnings of up to 93%. ■

2 | CRAIN’S NEW YORK BUSINESS | MARCh 27, 2023 Vol. 39, No. 12, March 27, 2023—Crain’s New York Business (ISSN 8756-789X) is published weekly, except for no issue on 1/2/23, 7/3/23, 7/17/23, 7/31/23, 8/14/23, 8/28/23 and the last issue in December. Crain Communications Inc., 685 Third Ave., New York, NY 10017. Periodicals postage paid at New York, NY, and additional mailing offices. Postmaster: Send address changes to: Crain’s New York Business, Circulation Department, 1155 Gratiot Ave., Detroit, MI 48207. For subscriber service: call 877-824-9379; fax 313-446-6777. $140.00 per year. (GST No. 13676-0444-RT) ©Entire contents copyright 2023 by Crain Communications Inc. All rights reserved.

TECHNOLOGY

FINANCE

DETAILS

BLOOMBERG BLOOMBERG

This startup wants to use AI to maximize your tax refund

Muse Tax, based on the Upper West Side, leverages technology to plan personalized tax strategies

The upstart: Muse Tax

There are many digital services that can calculate how much you’ll owe the IRS on April 15. But what can you do to avoid paying so much next year? For that sort of guidance, taxpayers may pay an accountant $2,000 or more for a custom plan. But one city startup says it can dramatically lower the time and cost of tax planning by using arti cial intelligence.

Muse Tax, an Upper West Side out t founded a year ago by two certi ed public accountants, has developed AI-powered software that analyzes tax returns.

As do existing services on the market, it suggests deductions and exemptions to immediately lower your current bill. But Muse takes things one step further. It also suggests strategies you can take in the year ahead to lower your tax bill going forward. If a taxpayer owns a business and reports a lot of Schedule C income, for example, Muse might suggest forming an S corporation to shield some of that income from taxation. If the taxpayer has children, the rm might suggest starting a 529 plan so that money set aside for education can grow tax-free.

gate the complexities, such as legal and loan issues, associated with buying a home. Nestment co-founder and CEO Niles Lichtenstein says that integrating Muse’s tech will enable the platform to calculate the tax implications or savings for each individual in each co-buying group. “It forti es our mission around having the tools and resources available so people can make informed decisions,” he says.

Muse says it has also struck pilot test agreements with several banks and nancial advisory services.

Among the investors contributing to the startup’s $350,000 in preseed funding is Jordan Fliegel, managing director of accelerator Techstars NYC. “AI is a super hot space, and tax returns are a space where AI has a real role to play,” he says. “ ey’re in this at the right time.”

Fliegel sees a big market for the technology. Most people can’t a ord a CPA to do their tax planning, he notes. “And even if you can, why not get it double-checked?”

ANNE KADET

Muse takes 30 to 45 seconds to scan an uploaded return, crunch the numbers and produce a printable guide—complete with graphics—that provides step-by-step instructions for carrying out its suggested strategies, says co-founder Colin Horsford. It rates these strategies by complexity and ags them when a particular tactic may require the services of a tax professional rather than the do-it-yourself approach.

Rather than compete with existing tax service providers, Muse plans to partner with tax-prep companies, nancial advisers and other nancial service providers that want to integrate Muse’s AI technology into their own client o ering.

One such partner is Nestment, a San Francisco–based startup that helps family or friend groups that are pooling their money to buy a home. e platform helps groups navi-

The reigning Goliath: H&R Block H&R Block, founded in 1955 and based in Kansas City, Missouri, prepared 20.5 million U.S. tax returns last year. Its 2022 revenue topped $3.5 billion.

How to slay the giant Horsford met his co-founder, Busayo Ogunsanya, in 2008 while they were both working in the tax department of Ernst & Young. ey became fast friends. Both went on to launch their own boutique accounting rms, but they shared a fascination with tech and startups. ey came up with their idea while on a trip to Miami to visit a mutual friend.

Upon launching Muse in February 2022, they were quickly accepted into several mentorship programs and an accelerator. Realizing their idea had legs, they made the hard decision to shut down their rms and focus on the startup.

“It was bittersweet because you have clients relying on you,” Ogunsanya says. “But this was an opportunity to serve a much wider audience.”

ey built the rst version of the software themselves— Horsford had already taught himself to code, and Ogunsanya was the master tax strategist with a knack for instructional writing. eir initial plan was to o er the service directly to taxpayers. But potential investors worried that the approach couldn’t scale.

e co-founders soon realized they could reach far more taxpayers by partnering with the rms that they had initially seen as rivals. “We can try to reach 100 million people [ourselves] or go to four companies that have 100 million customers,” Horsford says.

e task of integrating their software with partners’, however, required hiring a small team of developers—which presented a big challenge, Horsford says. e developers they hoped to recruit were used to cushy work environments o ering free food, co ee and fat paychecks—perks that were out of Muse’s league.

e two say they’ve landed great talent by hiring developers who are working remotely—two in California and one in Washington, D.C. “But we really sold people on the potential of AI in the tax industry,” Horsford says. “ at’s been a real bene t for us in terms of recruiting the talent we need.”

The next challenge

e startup will need to raise a seed round and continue hiring to carry out the pilot partnerships they’ve launched, says Fliegel. ey’ll also have to decide on the optimal pricing strategy. “ ey will be delivering so much value for millions of clients,” he says, “and they deserve to extract a nice chunk of that value.” ■

MARCH 27, 2023 | CRAIN’S NEW YORK BUSINESS | 3

BUCK ENNIS

Anne Kadet is the creator of Café Anne, a weekly newsletter with a New York City focus.

CHASING GIANTS

MUSE TAX’S Ogunsanya and Horsford are planning to raise a seed round.

WHO OWNS THE BLOCK

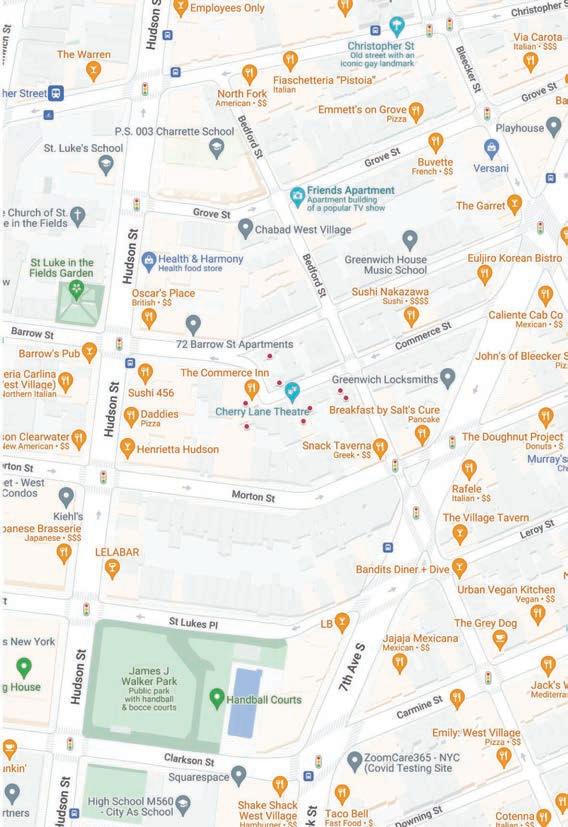

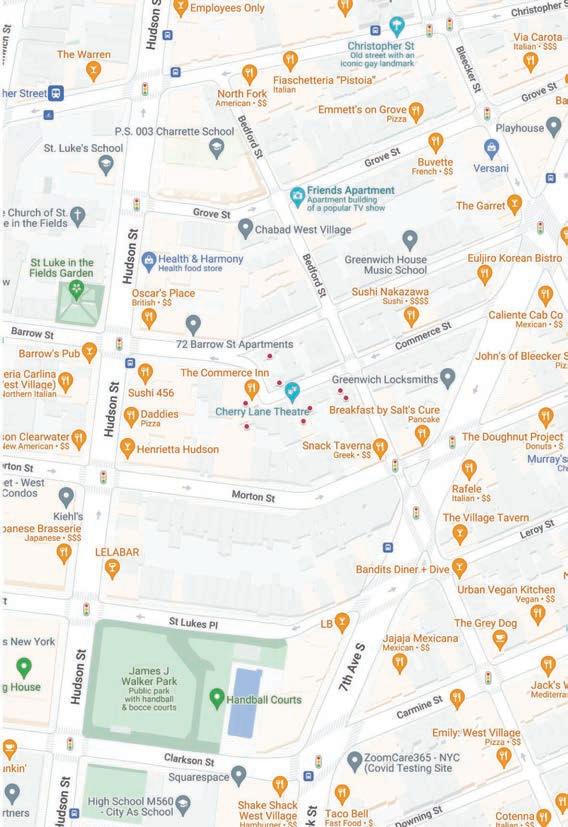

New owners for a Greenwich Village theater could shake up a change-resistant block

Movie studio A24 has partnered with financial firm Taurus Investment Holdings to buy the Cherry Lane Theater

BY C. J. HUGHES

Amajor winner at this month’s Oscars was the studio A24, which snagged nine awards, including six in the most talked-about categories: supporting actors, actors, director and film, for Everything Everywhere All at Once

A few days earlier A24 starred in a real estate transaction that attracted much less limelight. But the move, a $10 million deal to acquire the Cherry Lane Theater playhouse in Greenwich Village, for which A24 partnered with the global private-equity firm Taurus Investment Holdings, could have big implications in the neighborhood.

Indeed, on the theater’s block— Commerce Street between Bedford and Barrow streets—there are only about a dozen properties, and A24 and Taurus now own three of them. Two, at Nos. 38 and 42 Commerce, are interconnected and part of the 14,400-square-foot theater. The third, a single-family house at No. 36, was included in the transaction, according to public records, although the buyers did not announce that part of the deal.

Decades ago the Carroad family owned all three of the sites, as well as surrounding properties. In recent decades ownership of the block appears to have shifted to groups tied to Angelina Fiordellisi, Cherry Lane’s executive director, who was the face of the theater sale. Now, there’s a third landlord with a sizable footprint.

In some ways, that management wanted out isn’t surprising. Since buying the theater for $1.6 million in 1996 and spending $3 million to renovate it, Fiordellisi has said she often struggled to keep the nonprofit afloat, even as shows there won rosy reviews.

In 2010, stung by a recession, Fiordellisi revealed the theater was running a $167,000 deficit and would have to be sold, although that fate was reportedly averted after she took on new partners. Likewise, in 2021 the Lucille Lortel Theater Foundation was apparently in contract to buy Cherry Lane, which was still in the red, until the $11 million deal fell apart in a disagreement over its valuation. Fiordellisi again listed the theater, which includes eight upstairs apartments, for $13 million later that year, so this month’s purchase came at a considerable discount.

Fiordellisi did not return phone and email messages seeking comment by press time. A24, which is known for shunning publicity, had no comment; neither did Taurus, whose local developments include a rental building at 542 W. 153rd St. in Hamilton Heights but otherwise appear limited.

But in the press release accompanying the purchase, Taurus’s CEO Peter Merrigan suggested that alterations to the century-old theater, which is protected as a landmark, would be minimal. The deal “provides us with a highly unique investment opportunity due to [the theater’s] location, rich history and cultural significance,” Merrigan said. ■

39 AND 41 COMMERCE ST.

True to its name, Commerce once bustled with businesses, although they were of the 19th century variety. A milkman, Peter Huyler, developed twin Federal-style buildings at the corner of Barrow, at Nos. 39 and 41, historical records show; early residents of properties included bakers, librarians and artists. Both have curve-edged roofs called mansards, for French architect Francois Mansart, which were conceived as an artful way of tying in an added top floor. Parisians embraced mansards passionately in the late 1800s; the buildings added their versions around that time. Doris Keen, a specialist in Ottoman architecture who spent years living in Turkey, bought the twounit No. 39 in the mid-1970s for $32,000, records show, before selling it in 2021 for $5.3 million. The buyer was Isolde, a limited liability company.

The Commerce Inn, a Shaker-style restaurant that opened here in 2021, serves dishes such as pork chops and baked beans in a dining room of unadorned wood. The concept comes from Jody Williams and Rita Sodi, the team behind local hot spots like Buvette. The eatery’s building can be considered one of the block’s newcomers, in that St. John’s Realty Company developed the 6-story brick midrise in 1912. A Manhattan-based shell company called Pride Rock, which appears to be controlled by the Kingman family, bought No. 50 for $2.7 million in 1999. The site also contains 15 apartments, which have the address 75 Barrow St. because of their front door’s location. The apartments, wedge-shaped in some cases, don’t seem to become available often. Pride Rock hasn’t publicly marketed one since 2015.

In a neighborhood full of quirks, this 5-story, seven-unit rental building might be the most idiosyncratic. The 1844 structure, squeezed into a tight corner like an afterthought, was built for A.T. Stewart, an aspiring dry-goods merchant who within a few years had struck it big with a popular emporium at 280 Broadway, near City Hall, according to the city’s Landmarks Preservation Commission. Stewart would later relocate his department store to a two-building spread on Broadway and East Ninth Street; Vornado’s 770 Broadway office building occupies a vestige today. Norman Steele bought No. 48 for what appears to be $8,000 in 1974 and appears to have owned it since. The most recent apartment to rent there, in 2021, was a triplex two-bedroom for $9,500 a month.

38

COMMERCE ST.

This industrial site, built as a brewery in 1836 for Alexander McLachlan and later serving as a box factory, began staging plays in 1923; Bob Dylan performed there decades later. Angelina Fiordellisi, a former stage actress, purchased the site, made up of No. 38 and next-door No. 42, in 1996. The first off-Broadway play performed that year, a comedy about clowns called The New Bozena, was directed by Rainn Wilson, who would later play Dwight Schrute in the American version of The Office. The main theater, in No. 38, offers 179 seats, although Fiordellisi also created a smaller 42-seat venue in No. 42, which in the 1960s was reportedly a popular gay night club. The address’s current co-owner, A24, was founded in the city in 2012 and quickly achieved fame, winning the best-picture Oscar for Moonlight in 2017. The financial firm Guggenheim Partners has been an investor in A24, which was valued at $2.5 billion last year. Commerce Street was called Cherry Lane, for its trees, until the early 19th century.

77 BEDFORD ST.

The 1801 Isaac-Hendricks house, among the oldest structures in New York, takes part of its name from Harmon Hendricks, a copper magnate who prospered during the War of 1812 and died with millions of dollars, a vast fortune by 19th-century standards. Once covered with clapboards, No. 77 now just sports them on a side; the widening of Bedford Street lopped off a front porch in 1930, according to the history site A Daytonian in Manhattan. In 1938 the owner subdivided the interior into apartments. By the 1970s the house was in shambles. It stayed that way until Jacqueline Thion de la Chaume bought it in 1989 and began to restore the 25-foot-wide property. That restored the house to its single-family status. De la Chaume’s estate sold No. 77 for $7.4 million in 2013 to a limited liability company with a familiar face: Fiordellisi, of the Cherry Lane Theater, whose signature appears on the deed.

In a micro-neighborhood that can seem to have been controlled by just a handful of people in any era, this 3-story, 1,000-square-foot single-family house in the mid-1920s was briefly the home of poet Edna St. Vincent Millay, who was among the founders of the Cherry Lane Theater. Millay, the author of the oft-quoted line “my candle burns at both ends,” moved into the building when it was relatively new; the Dutch-style building, which was tucked into an alley, dates to 1873. Just 9 and a half feet wide (and that’s only on the outside), in a city where most townhouses are more than twice that, the fractional abode is believed to be New York’s narrowest residence. The locally notable Carroad family owned “Chez Millay” for years. George Gund bought it for $3.3 million in 2013.

36 COMMERCE ST.

A notable aspect of the Cherry Lane deal is that it included this 3-story 1841 building, a single-family residence nextdoor, according to a deed. A shell company paid $7.4 million for the Greek Revival-style edifice in 2017. That company presumably was controlled by the theater owners, Angelina Fiordellisi and her business partners, who then added No. 36 as part of the theater package. McLachlan, the 19th-century developer of the theater, took No. 36 as his own home. In 1900 Lottie De Ancy, a second-floor tenant, was alerted to a fire in Fannie Little’s third-floor unit by the meowing of Little’s cat. Although firefighters extinguished the blaze, it caused $1,500 worth of damage, The New York Times reported.

4 | CRAIN’S NEW YORK BUSINESS | MARCh 27, 2023

CHERRY LANE THEATER BUCK ENNIS, GOOGLE MAPS

48 COMMERCE ST.

75½ BEDFORD ST.

50 COMMERCE ST.

Nonprofit CEO Udai Tambar on the life-changing power of tennis

INTERVIEW BY RAINA LIPSITZ

INTERVIEW BY RAINA LIPSITZ

Udai Tambar sees his job leading New York Junior Tennis & Learning as the next logical step in a career that has been dedicated to serving low-income children. The nonprofit’s mission is to help young people build skills and character through tennis and education. During the pandemic, the organization became increasingly aware of young people’s growing need for mental health support. To help connect struggling students with essential mental health services, it partnered with the Silberman School of Social Work at Hunter College to pair graduate student interns with young people experiencing higher levels of anxiety, depression and stress.

Tambar spoke with Crain’s about how tennis lessons, coupled with a broader commitment to health and education, can help young people succeed throughout their lives.

Tell me how tennis lessons can enrich a young person’s life. We focus on creating success for young people through our host of tennis and education programs. Studies have shown that tennis players live almost 10 years longer than people who are sedentary, and that’s [a bigger benefit] than for people who play soccer or other sports. So it’s not just the physical enrichment; [playing tennis specifically] can actually help you live longer. For us, it’s both tennis and education. Tennis obviously fosters physical fitness, but it also teaches great perseverance, what we call stick-to-it-iveness. We combine this with academic support, leadership [and] development life skills training, and that helps young people succeed on and off the court. We believe that in New York City, talent is universal but opportunity is not. And what we try to do is create opportunities for young people in all communities to reach their full potential.

Takeaway for business professionals

New York Junior Tennis & Learning provides afterschool programming in approximately 30 schools and community tennis programming at roughly 40 sites throughout the city in the summer and at additional sites during the school year. The organization has provided 500,000 hours of free community tennis in every City Council district and reaches 85,000 children annually in all five boroughs; 500 staff members mentor more than 14,000 children each year.

POWER MARKS

EMPLOYEES 500 (Nine direct reports)

ON HIS RÉSUMÉ CEO and president of New York Junior Tennis & Learning; vice president of Community Health at Northwell Health; chief of staff and director of youth and children services for New York’s deputy mayor for health and human services; executive director of South Asian Youth Action

BORN Scotland

GREW UP India and Queens

RESIDES Forest Hills, Queens

EDUCATION Master of Public Administration degree from Princeton University’s School of Public and International Affairs and a Bachelor of Arts degree from Cornell University

BREAKING THE MOLD Tambar is the first person of South Asian descent to lead New York Junior Tennis & Learning.

communities in need, the voices of those communities in need. That’s the way I’ve thought of it throughout my career.

Did you play sports growing up? What did you learn from participating in athletics?

Yes. Throughout high school I played baseball and tennis. And to me, there’s obviously the importance of practice, the importance of bouncing back from setbacks. In any sport, a key part of it is, how do you deal with losing? And if you lose, how do you bounce back? You learn to say, “Hey, I’m going to work a little bit harder,” and that’s a great lesson in life. Often you might apply for a job, you might not get it, or you might want to do something, but you don’t get it on your first try. To me, hard work and discipline and camaraderie are [the biggest benefits of athletic participation]. People think of tennis as an individual sport, but you’re part of a community, and those are lessons I’ve taken with me in my personal and work life as well.

What are some things that the young people you work with need that are beyond the scope of your organization to provide?

That is a great question. As organizations we’re in communities, and the question often is, What’s your lane? What should you be doing and not [be] doing to meet the needs? And what we realized, especially coming out of the pandemic, was that a lot of [young people] were still

dealing with the pandemic, and mental health was a big issue. So to help address that, we partnered with the Hunter School of Social Work to bring mental health services into our schools. We work with them to place graduate social work students in the schools we serve. The demand for this has grown so much that we’ve actually hired a staff social worker for the first time to help us reach more schools. We started out teaching tennis on the tennis court. And over time you evolve and grow to meet the needs of the community more holistically, because that’s what you need to do to make sure that they actually show up to the tennis court and are able to succeed.

Your website praises NYJTL’s partner corporations for demonstrating corporate social responsibility.

What does CSR mean to you?

For us, it’s about really being partners.

Recently we had a partnership with Barclays Bank where senior executives from Barclays were interested in giving back to the community. And they spent a day at our Cary Leeds Center up in

the Bronx in Crotona Park. And we have a new program we launched this year, a scholar athlete program, which is very customized, high-level tennis instruction and academic support. Their volunteers came and worked one-on-one with our students on interviewing skills and career awareness. To me, corporate social responsibility is a way of using the skills or assets of a corporation to help the communities that they’re in. Obviously sometimes it’s funding and sometimes it’s the skills of the employees that can help fill a hole for organizations like ours.

What does power mean to you?

Here at NYJTL and throughout my 25-year career, it’s been public service, nonprofits and government. I think of power as amplification. It’s about being in a position of power or privilege, and how do you amplify the voice … the voice of those communities in need . . . and help bring them the resources [and] services [that they need] . . . to help them be successful. I think if you have the power, the privilege, with that privilege you try to amplify resources that are drawn to the

How can Americans without money or status gain more power in their daily lives?

To me it’s about being active. I think of the work that we do—it’s sort of like we’re building or trying to lead a movement for social change. And in a movement, there are different roles for different people. But the main thing is people need to raise their hands and say they want to get involved. Some people will write a check and some people will work with us; some will volunteer their time. [For] those that might not have the financial resources, it’s more just raising your hand or reaching out and saying, “Look, I want to get involved” and being active citizens, and that’s what creates real change.

How do tennis lessons relate to mental health?

We’ve been seeing a lot about mental health and tennis. One easy connection is just raising awareness. You have Naomi Osaka and Serena Williams speaking openly [about mental health]. You have a lot of professional tennis players who are talking about mental health. In the tennis space, there’s awareness about this and there’s a certain vocabulary developing, and that helps when you’re dealing with young people—being able to say, “Hey, this is tough, but you can talk about some of these issues.” Having said that, I think playing tennis does develop some toughness as well.■

March 27, 2023 | craIN’S NEW YOrK BUSINESS | 5

POWER CORNER

ASHLEY HOLT

Goldman Sachs’ median pay declines by 10%, a worrisome sign for New York tax collections

Pay is central to Wall Street work, but owing to last year’s bear market, there was less of it at Goldman Sachs, where wages fell by 10% in the first such decline since it has provided the data.

The median wage for all employees, from senior executives to executive assistants, clocked in at $150,000 last year, down from $166,000 in 2021, according to a regulatory filing from the bank.

Goldman, which declined to comment, wasn’t the only financial institution to pay its people less last year.

Median pay at private-equity giant KKR fell by 30% last year, to $225,000 from $320,000, according to the firm’s annual filing.

At American Express, median pay dropped by 27%, to $49,000, and at Bank of New York Mellon, by 7%, to $70,000.

American Express attributed the decline to hiring more people outside the United States, where wages are lower. The company pointed to language in a regulatory filing saying that for the third consecutive year the firm had no statistical dif-

ON POLITICS

ferences in pay for all genders globally and for all races and ethnicities in the U.S

Economic activity

The drops in pay to rank-and-file workers could be a troubling signal for the city and the state because they rely heavily on the financial sector for tax revenue. Wall Street is responsible for 16% of all economic activity in the city, according to data from the state comptroller’s office, but only about 5% of jobs

ELSTEIN

The comptroller is expected to soon release data showing a big drop in Wall Street bonuses for 2022. That’s because capital markets were dormant much of the year. Tough market conditions help explain the big drop in median pay at KKR, although at rival Blackstone, the figure rose by 3%, to $237,000.

KKR didn’t respond to a request for comment, and Blackstone declined to comment.

Public companies have been required to disclose the median wage for their workforce since 2017. The data is monitored, especially by labor groups, for evidence of how av-

erage workers are compensated relative to top management. Wages rose by 6.1% in the aggregate last year, according to the Federal Reserve Bank of Atlanta. But those gains were devoured by the 6.5% inflation rate.

Raises and cuts

Certain banks raised worker pay at rates significantly above inflation. These institutions tend to be larger and have more diverse revenue streams than those that cut pay last year. At Bank of America, the median pay rose by 15% in 2022, to $117,000, and the median wage at Citigroup rose by 13%, to $62,000.

BofA raised its minimum wage to $22 per hour last year and raised base salaries for most employees earning under $100,000 by up to 7%.

Citi and BNY Mellon did not have an immediate comment.

JPMorgan Chase and Morgan Stanley haven’t yet disclosed 2022

pay data.

Pay cuts were seen at firms whose fortunes aren’t so closely tethered to financial markets.

At IBM, the median wage fell by 10%, to $61,000. IBM declined to

comment.

At Pfizer, it fell by 18%, to $75,000. A spokeswoman said workers in 2021 “had other compensation that this year’s median-paid employee did not have.” ■

Madison Square Garden’s tax break is closer to the chopping block than it has been in a decade

Is James Dolan about to lose his most precious gift from the state of New York?

Madison Square Garden’s property tax break, worth more than $40 million a year, is closer to the chopping block than it’s been in at least a decade. State Senate Democrats included a repeal of the controversial tax abatement in their one-house budget, which sets their priorities ahead of negotiations with the Assembly and Gov. Kathy Hochul. Leading the push has been Brad HoylmanSigal, the Democrat who represents the Garden neighborhood in the Senate.

The reality is that Dolan—the Cablevision heir who also owns the New York Knicks, the New York Rangers, Radio City Music Hall and the Beacon Theatre—wouldn’t even have to fret about Albany Democrats threatening his tax break if he behaved like a conventional billionaire. All he would have to do is cut campaign checks to Hochul and the Democrat-run state Legislature while going about his business.

Instead, he has drawn the scrutiny of city and state lawmakers, members of Congress and the state attorney general’s office by wielding facial recognition technology to eject ticket holders from his properties. Of late, he has targeted attorneys who work for law firms engaged with litigation against his company. No other team owner or real estate mogul would behave so brazenly. The State Liquor Authority could revoke MSG’s liquor license, cutting into Dolan’s bottom line.

ROSS BARKAN

Democrats in the City Council are weighing whether to renew the Garden’s special permit for holding events; the expiration comes this year. Losing the tax break, which has existed for 40 years, would be another blow for Dolan.

Luckily for the billionaire, the Assembly didn’t include a repeal in their one-house budget. Carl Heastie, the Assembly speaker, appears to be less perturbed by Dolan’s recklessness—he recently came to a Rangers game to perform the ceremonial puck drop—and

Hochul has not denounced the abatement either.

“I know how important the Garden is to this city,” she said in an interview with Fox 5. “What’s been proposed by a senator is certainly something we look at. A lot of ideas are proposed, and so I just want to make sure we’re doing the right thing.”

Taxpayer giveaway

If MSG’s tax break survives another year, it will be further evidence that enough New York politicians are willing to tolerate a

taxpayer giveaway with no conceivable policy justification. In the early 1980s, when the fiscal crisis still shadowed the city, Mayor Ed Koch handed out the abatement to MSG to keep the Knicks from moving out of Manhattan. Koch believed the property tax break would be temporary. Instead, it persisted, even as the city recovered and the threat of any move out of Midtown Manhattan disappeared entirely.

There is no chance today that Dolan would abandon Manhattan, where tourists and commuters rou-

tinely help sell out Knicks games. Like any other lucrative venue, the Garden should be paying the property taxes it owes to the city. Hochul and Assembly Democrats have no reason to cater to Dolan any longer.

If anything, they’ll have to start putting pressure on him to move MSG to another Manhattan location if they ever hope to see a new Penn Station. Dolan is partially to blame for such a dismal commuter hub, since MSG sits atop the train tracks. He doesn’t deserve any corporate welfare.

Quick takes

● New York’s marijuana legalization rollout continues to be sluggish as illegal stores proliferate. Democrats in the Legislature plan to address this during budget season, but they have to act fast.

● Is this the year “good cause” eviction becomes law? Both houses of the Legislature included support of the idea in their one-house bills. The real estate industry will hope Hochul can roadblock the progressives in the chamber. ■

Ross Barkan is a journalist and author in New York City.

6 | CRAIN’S NEW YORK BUSINESS | MARCh 27, 2023

BLOOMBERG

IN

AARON

THE MARKETS

BLOOMBERG

DOLAN

OVER 6 IN 10 READERS BELIEVE CRAIN’S GIVES THEM A COMPETITIVE EDGE CRAIN’S PARTNER PROMOTE AND PUBLICIZE YOUR INDUSTRY EVENT NEWS INCREASE ATTENDANCE AT YOUR WORK EVENTS Networking & Educational Events / Seminars & Conferences Fundraisers & Galas / Events of Interest to the Business Community SUBMIT AN EVENT Debora Stein / dstein@crain.com

Tax breaks in perpetuity are like zombies: They devour state, city government coffers

Asound business wouldn’t lock itself into a multibilliondollar investment without rigorously studying potential returns or having a plan to exit the deal if it’s no longer fruitful. Neither should our government.

But that may be what is happening when it comes to subsidies across the city and the state, which fiscal watchdogs estimate dole out $10 billion worth of subsidies to businesses every year. The deals cause the city to forgo 8% of total tax collections and the state, 5%, senior reporter Aaron Elstein writes in this week’s cover story, “Zombie city.” Such deals are awarded to less than 1% of the city’s businesses.

The hope is that these investments pay long-term dividends in the form of job creation and economic activity that exceed their initial cost. That sounds good, but policy experts are in agreement that a proper analysis has never been done to examine whether businesses have held up their end of the bargain.

The minute number of businesses that are getting hefty incentives are certainly doing their homework when enlisting lobbyists.

OP-ED

Records show that in the past two years, Madison Square Garden paid lobbyists just $650,000 to combat legislation to repeal the Garden’s $87 million tax break over the same years, politics reporter Nick Garber found. Indeed, a 1,300% return on investment isn’t too shabby, especially for a break with no expiration date.

Although this year’s state Senate budget proposal included a provision to end MSG’s propertytax abatement, assessing subsidies via the budgeting process seems among the slowest paths to evaluate deals.

The third-party review of state subsidies expected in January 2024 is welcome. A rigorous city-level evaluation should be conducted in tandem.

Companies that enjoy these breaks argue that the city is an expensive place to do business, and top lobbyist Jeffrey Citron said they would “absolutely leave” without help. But the more than 99% of businesses that do not get breaks choose to stay, and more choose to set up shop in the five boroughs each day.

To be sure, there is a time and place for subsidies to businesses; our city’s economy has yet to reach prepandemic levels, and they can

be a strategic investment to jump-start promising new industries, such as the life sciences. But given the steep opportunity costs of subsidies for the city and state budgets, it’s worth a deep look into whether those subsidies are best spent at such places as MSG, Goldman Sachs and Hudson Yards. New York is the city where companies come to test the strength of their business and subject their ideas to the ultimate test. Our government’s picking of winners and losers through tax abatements runs the risk of

diluting the city’s spirit of grit and dampening entrepreneurialism from some of its largest entities.

Those who have managed to snag one of these sweetheart deals should be admired for their business acumen and political savvy. But such deals shouldn’t exist at the expense of taxpayers and other businesses that then foot more of the bill, and they certainly shouldn’t exist in perpetuity.

If those “zombies” are confident that their benefit to our economy outweighs the exorbitant costs of keeping them here, we hope to see the evidence soon. ■

Here’s how the mayor can help avert a food emergency for older adults

BY JEREMY KAPLAN

Every older adult should be well nourished and connected to the community, allowing them to age in place, with dignity, for as long as possible. Unfortunately, at many organizations, the ability to deliver on this mission is jeopardized by the cumulative effects of years of underinvestment in services for the aging.

Encore Community Services is a nonprofit that provides lifesaving nutritious meals to older adults on Manhattan’s West Side. We serve more than a half-million meals a year at our centers and through our home-delivered meals program. At the height of the pandemic, Encore stepped up and facilitated the recovery meals program across three boroughs, ensuring 9,000 vulnerable older adults received emergency meals until it was safe for them to venture outside.

Our meal recipients are older adults who can’t leave their homes. They are often immunocompro-

mised, live on a fixed income and are isolated. All of them deserve to have food.

It’s time to raise the alarm about the severe systemic risk to services for the aging. The sector’s nonprofits are approaching a crisis, and some may even struggle with solvency if there is not an immediate and long-term funding solution.

The population is aging rapidly, placing a strain on already limited resources. At the same time, functional budget cuts to the city’s services for the aging are taking a further toll on operations. We’ve seen the fastest and highest period of price increases in a generation and are being asked to do substantially more with considerably less.

Operational costs have skyrocketed, including up to 90% increases in the cost of providing home-delivered meals and up to 20% increases in the cost of providing meals at older adult centers. Yet the rate of reimbursement increases we’ve seen this year do not even meet the minimum we requested

nearly two years ago.

Encore has already maxed out its annual budget for meals. It has become imminently unsustainable to provide weekend meals, but we continue to do so because our clients often rely on us as their only source of nourishment. We urgently need Mayor Eric Adams to authorize an increase in reimbursement rates.

Champions such as Lorraine Cortes-Vazquez, commissioner of the city Department for the Aging, have worked miracles in years past to support the tapestry of nonprofits that serve older adults in our city. Without substantial new investment from the city now, the nonprofits that serve the most basic needs of older adults, including nutrition, may be forced to close their doors.

We urge the mayor to address the critical short-term funding gap for older adult meal providers in fiscal 2023, and to fully fund the city’s Aging Community Care Plan for 2024. The Department for the

president & ceo K.C. Crain

group publisher Jim Kirk

publisher/executive editor

Frederick P. Gabriel Jr.

EDITORIAL

editor-in-chief Cory Schouten, cory.schouten@crainsnewyork.com

managing editor Telisha Bryan

assistant managing editors Anne Michaud, Amanda Glodowski

director of audience and engagement

Elizabeth Couch

audience engagement editor Jennifer Samuels

digital editor Taylor Nakagawa

art director Carolyn McClain

photographer Buck Ennis

senior reporters Cara Eisenpress, Aaron Elstein, C.J. Hughes, Eddie Small reporters Amanda D’Ambrosio, Nick Garber, Jacqueline Neber, Caroline Spivack op-ed editor Jan Parr, opinion@crainsnewyork.com sales assistant Ryan Call to contact the newsroom: editors@crainsnewyork.com www.crainsnewyork.com/staff

685 Third Ave., New York, NY 10017-4024

ADVERTISING

www.crainsnewyork.com/advertise sales director Laura Lubrano laura.lubrano@crainsnewyork.com

senior vice president of sales Susan Jacobs account executives Paul Mauriello, Marc Rebucci, Philip Redgate people on the move manager Debora Stein, dstein@crain.com

CUSTOM CONTENT

associate director, custom content Sophia Juarez, sophia.juarez@crainsnewyork.com

custom content coordinator Ashley Maahs, ashley.maahs@crain.com

EVENTS

www.crainsnewyork.com/events

manager of conferences & events Ana Jimenez, ajimenez@crainsnewyork.com

senior manager of events Michelle Cast, michelle.cast@crainsnewyork.com

REPRINTS

director, reprints & licensing Lauren Melesio, 212.210.0707, lmelesio@crain.com

PRODUCTION

Aging is the lowest funded of all city agencies, with less than onehalf of 1% of the city budget despite older adults making up 20% of the overall population.

To improve the sustainability and broaden the reach of older-adult meal programs in fiscal 2024 and beyond, we are joining with leading aging advocates at LiveOn NY to call for an additional $64.6 million for the Department for the Aging to specifically address hunger among older New Yorkers. This includes $14 million for inflation costs for home-delivered meals (covering raw food, gas and other items), $46 million for inflation costs for congregate meals, $567,000 to address the department’s home-delivered meal wait list, and $4 million to support weekend and holiday home-delivered meals not provided through the department.

It’s time the city makes a longterm investment in older adults. ■

Jeremy Kaplan is executive director of Encore Community Services.

production and pre-press director Simone Pryce media services manager Nicole Spell

SUBSCRIPTION CUSTOMER SERVICE www.crainsnewyork.com/subscribe customerservice@crainsnewyork.com 877.824.9379 (in the U.S. and Canada). $140.00 one year, for print subscriptions with digital access.

Entire contents ©copyright 2023

Crain Communications Inc. All rights reser ved. ©CityBusiness is a registered trademark of MCP Inc., used under license agreement.

chairman Keith E. Crain

vice chairman Mary Kay Crain president & ceo K.C. Crain

senior executive vice president Chris Crain editor-in-chief emeritus Rance Crain chief financial officer Robert Recchia founder G.D. Crain Jr. [1885-1973] chairman Mrs. G.D. Crain Jr. [1911-1996]

8 | CRAIN’S NEW YORK BUSINESS | MARCh 27, 2023

EDITORIAL

ISTOCK

State must design a health care licensure and regulatory system that can grow and evolve

The pandemic taught us an important lesson: To keep up with the changing landscape of health care and medicine, we must be flexible and nimble.

We modified laws and regulations while we streamlined processes that had once created bureaucratic hurdles and slowed our ability to address health care needs.

Executive orders enabled much-needed flexibility in the past

allow our state to evolve as the health care delivery system and practice of medicine change—and to ensure we are providing the best possible care to New Yorkers.

Gov. Kathy Hochul’s executive budget provides for this evolution, including proposals to improve the licensing and oversight of the medical field. The first proposal, recognizing that assurance of a diverse and skilled workforce is a core public health function, would move the licensing of medical professions from the state Department of Education to the state Department of Health.

three years. They allowed pharmacists to administer an expanded roster of vaccines, enabled licensed nurses from other states to support our frontline efforts and empowered more medical professionals to operate at the top of their license.

But short-term executive orders are not the only solution to address staffing shortages across the state and keep up with the changing health care landscape. We also need permanent solutions to increase our workforce capacity and

OP-ED

It would allow our medical experts and health care regulators to lead the state’s approach to health care licensing and, ultimately, improve the delivery of care for New Yorkers.

Hochul is also proposing to expand what health care workers are permitted to perform under the scope of their license. Many of these changes would codify the flexibilities these workers were previously granted under the emergency orders, provide oversight of these changes and give our state better leverage with its existing workforce at a time when there is a pronounced

shortage of workers in many fields. For instance, these changes would permanently enable experienced physician assistants to practice without physician supervision. They would also expand community paramedicine by allowing emergency medical technicians to perform non-emergent care, including immunizations.

Expanding access

The governor also proposed legis-

lation allowing New York to join the Interstate Medical Licensure Compact for physicians and the Nurse Licensure Compact. These compacts make it simpler for physicians and nurses to practice across state lines, both physically and virtually. These multistate licensing agreements help to expand access to care for patients and increase the talent pool to providers struggling to address staff shortages.

In addition, these compacts help

to streamline the process for these professionals, allowing those licensed in one state to practice in others without the lengthy and arduous process of relicensing.

Thirty-seven states participate in the Interstate Medical Licensure Compact and Nurse Licensure Compact, in addition to the U.S. territory of Guam and the District of Columbia. More than 55,000 physician licenses have been issued by states participating in the Interstate Medical Licensure Compact. With other states embracing these compacts and bipartisan support for this effort in New York, the time has come for us to join.

New York must design a licensure and regulatory system that can grow and evolve with the practice of medicine. These proposed changes will accomplish this goal. They will bring our state in line with others and prepare us for the future. They will ensure New Yorkers receive the best health care possible. ■

Raising the minimum wage does not result in job losses

BY PAUL SONN

BY PAUL SONN

Every time we discuss raising the minimum wage, corporate business interests rush in to forecast catastrophic job losses if the wage goes up. This fear-mongering worked for a long time—until the facts started catching up with the debate.

Albany is debating raising the minimum wage again—and a broad coalition of lawmakers, unions and anti-poverty groups is pushing to raise New York’s minimum wage to $21.25 per hour by 2027. That’s the level that the minimum wage would be if $15 had been consistently updated each year to keep up with inflation and rising worker productivity.

Instead, the wage has been frozen in most of the state. That stalled minimum wage happened at the worst possible time—just as the highest inflation in 40 years has

caused prices to skyrocket.

Just as in the movie Groundhog Day, we’re seeing recycled predictions that $21.25 will hurt jobs or be too much for small businesses or for upstate to handle. The thing is, we’ve seen this movie before.

In 2016 New York approved the nation’s first $15 state minimum wage, which gradually raised pay from $9 to $15 per hour. That was a 67% increase—a good deal larger than the 42% increase to $21.25 proposed today. It raised pay by more than $4,000 a year for 1 in 3 New Yorkers, and it led to historic reductions in poverty and earnings inequality.

At the time we heard from the usual suspects that small businesses would suffer and so would workers, who would see their hours cut and jobs eliminated. Guess what? It didn’t happen.

Instead, five independent studies have confirmed that our $15 minimum wage helped millions of New Yorkers without hurting jobs. For example, the Federal Reserve Bank of New York examined job growth in upstate New York along the

Pennsylvania border at a time when New York’s wage was from $4 to $5 higher than the $7.25 Pennsylvania wage. The New York Fed found that pay increased significantly in New York while jobs grew at similar rates in the two states.

Effects analyzed

Just this year the Institute for Research on Labor and Employment at the University of California, Berkeley, analyzed the effects of New York’s $15 minimum wage for the fast-food industry, focusing on upstate counties and on Long Island. Fast food is one of the most

underpaid industries, where any job losses associated with a higher minimum wage would likely appear first. The Berkeley study found again that, across the state, fastfood jobs grew at least as fast or faster than in other states that didn’t raise the minimum wage.

This month more than 200 small businesses from across the state joined the push for the $21.25 minimum wage. Their message is that a $21 minimum wage, gradually phased in, is manageable and actually helps local businesses by putting more money in workers’ pockets, which they spend in their

neighborhoods.

The Raise the Wage Act would deliver urgently needed raises to 2.9 million workers, or 1 in 3 working New Yorkers, averaging $3,300 a year, or $63 a week—enough to actually help families cover sky-high grocery and gas bills.

By contrast, Gov. Kathy Hochul’s proposal ignores the tremendous erosion of the value of New York’s minimum wage since 2019 and proposes only modest adjustments for inflation. It would deliver only very small annual raises averaging $670, or just $13 a week—barely enough to buy a sandwich in New York. Even worse, her plan would cap increases at 3% annually, far less than what inflation has averaged in recent years.

New Yorkers are demanding that lawmakers respond to the cost-ofliving crisis with the urgency it needs—and without falling for recycled talking points. Lawmakers can lead at this moment with confidence that raising the minimum wage to $21.25 will restore broadly shared prosperity for both workers and businesses in our state. ■

Paul Sonn is the state policy program director at the city-based National Employment Law Project.

March 27, 2023 | craIN’S NEW YOrK BUSINESS | 9

Write us: Crain’s welcomes submissions to its opinion pages. Send letters to letters@CrainsNewYork.com. Send op-eds of 500 words or fewer to opinion@CrainsNewYork.com Please include the writer’s name, company, address and telephone number. Crain’s reserves the right to edit submissions for clarity.

THE raISE ThE WaGE acT WOULD DELIVER URGENTLY NEEDED RAISES TO WOrKErS

Dr. James McDonald is New York state’s acting health commissioner.

OP-ED

DR. JAMES MCDONALD

WE NEED PErMaNENT SOLUTIONS TO INCREASE OUR WOrKFOrcE caPacITY

GETTY IMAGES

BUCK ENNIS

A COVID TESTING SITE outside Grand Central Terminal

THE LIST

LARGEST HEALTH CARE NONPROFITS

New York–area organizations ranked by 2021 total operating expenses

10 | CRAIN’S NEW YORK BUSINESS | MARCh 27, 2023

RANK ORGANIZATION/ LOCAL ADDRESS PHONE/ WEBSITE TOP LOCAL EXECUTIVE TOTAL EXPENSES 2021/ 1-YEAR CHANGE % EXPENSES ALLOCATED TO PROGRAMMING 2021 % EXPENSES ALLOCATED TO FUNDRAISING 2021 TOTAL REVENUE 2021 % 2021 REVENUE FROM PRIVATE CONTRIBUTIONSORGANIZATION PURPOSE 1 Doctors Without Borders USAInc. 40 Rector St. New York,NY10006 212-679-6800 doctorswithoutborders.org AvrilBenoit Executive director $600M +20.1% 85%13%$649.4M96%Emergency medical aid to those affected by conflict, epidemics or disasters 2 New York Blood Center 310 E. 67th St. New York,NY10065 212-570-3100 nybloodcenter.org ChristopherHillyer President, chief executive $507M 1 +5.0% 91% 0%$554.7M 4%Community-based non-profit blood center 3 Leukemia & Lymphoma Society 3 International Drive Rye Brook,NY10573 914-949-5213 lls.org LouisDeGennaro President, chief executive $360M -8.7% 71%15%$477.7M92%Cure leukemia, lymphoma and myeloma, and improve the quality of life of patients 4 Project Orbis InternationalInc. 52 Vanderbilt Ave. New York,NY10017 646-674-5500 orbis.org DerekHodkey President, chief executive $359M +56.9% 95% 3%$362.9M13%Prevention and treatment of blindness 5 Catholic Medical Mission BoardInc. 100 Wall St. New York,NY10005 212-242-7757 cmmb.org MaryBethPowers President, chief executive $357M 2 -23.6% 97% 2%$416.4M10%Providing medical and developmental aid to remote, poverty-stricken communities 6 Planned Parenthood Federation of America 123 William St. New York,NY10038 212-541-7800 plannedparenthood.org AlexisMcGill Johnson President, chief executive $312M 1 -8.4% 70%17%$324.8M92%Reproductive and complementary health care services 7 The Michael J. Fox Foundation for Parkinson's Research P.O. Box 4777 New York,NY10163-4777 212-509-0995 michaeljfox.org DeborahBrooks Chief executive, co-founder $280M +62.5% 92% 5%$353.4M98%Accelerating a cure for Parkinson's disease and improved therapies through research 8 Services for the UnderServed 3 463 Seventh Ave. New York,NY10018 212-633-6900 sus.org JorgePetit, MD President, chief executive $248M -5.0% 83% 0%$256.4M 2%Services for people with disabilities, in poverty or facing homelessness 9 YAIInc. 220 E. 42nd St. New York,NY10017 212-273-6100 yai.org KevinCarey Interim chief executive $235M +15.7% 88% 0%$238.1M 1%Services for the intellectual and developmental disabilities community 10 Jewish Board of Family and Children's ServicesInc. 463 Seventh Ave. New York,NY10018 212-582-9100 jewishboard.org JeffreyBrenner Chief executive $235M -0.7% 87% 1% $233.6M 6%Mental health and social services 11 Public Health Solutions 40 Worth St. New York,NY10013 646-619-6400 healthsolutions.org LisaDavid President, chief executive $232M -6.5% 97% 0%$234.2M 4%Health services for the city's most vulnerable neighborhoods 12 ADAPT Community Network 80 Maiden Lane New York,NY10038 212-683-6700 adaptcommunitynetwork.org EdwardMatthews Chief executive $190M -11.6% 87% 0%$185.9M 3%Programs and services for people with intellectual and developmental disabilities 13 Children'sAid 117 W. 124th St. New York,NY10027 212-949-4800 childrensaidnyc.org PhoebeBoyer President, chief executive $141M -3.6% 81% 2%$150.4M14%Promoting lifelong success for children and youth from highpoverty NYC neighborhoods 14 National Multiple Sclerosis Society 733 Third Ave. New York,NY10017 212-463-7787 nationalmssociety.org CynthiaZagieboylo President, chief executive $138M 1 -12.7% 73%18%$146.4M95%Finding a cure for MS while empowering people affected by MS to live their best lives 15 WellLife Network 142-02 20th Ave. Queens,NY11351 718-559-0516 welllifenetwork.org SherryTucker Chief executive $119M +7.4% 91% 0%$133M 0%Empowering New Yorkers with diverse needs to achieve their full potential 16 Developmental Disabilities Institute 99 Hollywood Drive Smithtown,NY11787 631-366-2900 ddiny.org KimKubasek Chief executive $117M +3.9% 93% 0%$119M 1%Services and programs for people with autism and other developmental disabilities 17 JDRF International 200 Vesey St. New York,NY10281 212-689-2860 jdrf.org AaronKowalski Chief executive $115M -40.0% 64%20%$223M81%Type 1 diabetes research and advocacy 18 American Committee for the Weizmann Institute of ScienceInc. 633 Third Ave. New York,NY10017 212-895-7900 weizmann-usa.org DavidDoneson Chief executive $107M 4 +16.2% 82%13%$154.1M66%Orchestrating support for the Weizmann Institute of Science and the Feinberg Graduate School in Israel 19 Smile Train 633 Third Ave. New York,NY10017 212-689-9199 smiletrain.org SusannahSchaefer President, chief executive $95M 1 +15.9% 71%25%$113.1M81%Corrective surgery for children with cleft lips and palates 20 Ludwig Institute for Cancer Research 666 Third Ave. New York,NY10017 212-450-1500 ludwigcancerresearch.org EdwardMcDermottJr. President, chief executive $94M 5 +9.2% n/dn/dn/d n/dPrevention and control of cancer 21 Adults and Children with Learning and Developmental Disabilities 807 S. Oyster Bay Road Bethpage,NY11714 516-822-0028 acld.org RobertCiatto Executive director $87M 2 -0.7% 90% 1%$87.2M n/dProviding opportunities for people with autism and learning and developmental disabilities AMANDA.GLODOWSKI@CRAINSNEWYORK.COM

areaareaincludes NewYorkCity andNassau,SuffolkandWestchestercounties inNew York,andBergen,Essex,HudsonandUnioncounties inNew Jersey. To qualifyfor this

nonprofitsheadquartered in the NewYork area.Hospitals,healthsystems, home healthcare,rehabilitationcenters,medicalpractice groups, researchinstitutionsand universities

workin areasunrelatedtohealthcare.Information is fromthecompaniesunless otherwise noted. 1 Figures arefromForm 990. 2 Figures arefromauditedfinancialstatements.

are preliminary. 5 Represents operating expenses; figures are from audited financial statements.

March 27, 2023 | craIN’S NEW YOrK BUSINESS | 11 16 Developmental Disabilities Institute 99 Hollywood Drive Smithtown,NY11787 631-366-2900 ddiny.org KimKubasek Chief executive $117M +3.9% 93% 0%$119M 1%Services and programs for people with autism and other developmental disabilities 17 JDRF International 200 Vesey St. New York,NY10281 212-689-2860 jdrf.org AaronKowalski Chief executive $115M -40.0% 64%20%$223M81%Type 1 diabetes research and advocacy 18 American Committee for the Weizmann Institute of ScienceInc. 633 Third Ave. New York,NY10017 212-895-7900 weizmann-usa.org DavidDoneson Chief executive $107M 4 +16.2% 82%13%$154.1M66%Orchestrating support for the Weizmann Institute of Science and the Feinberg Graduate School in Israel 19 Smile Train 633 Third Ave. New York,NY10017 212-689-9199 smiletrain.org SusannahSchaefer President, chief executive $95M 1 +15.9% 71%25%$113.1M81%Corrective surgery for children with cleft lips and palates 20 Ludwig Institute for Cancer Research 666 Third Ave. New York,NY10017 212-450-1500 ludwigcancerresearch.org EdwardMcDermottJr. President, chief executive $94M 5 +9.2% n/dn/dn/d n/dPrevention and control of cancer 21 Adults and Children with Learning and Developmental Disabilities 807 S. Oyster Bay Road Bethpage,NY11714 516-822-0028 acld.org RobertCiatto Executive director $87M 2 -0.7% 90% 1%$87.2M n/dProviding opportunities for people with autism and learning and developmental disabilities 22 Jewish Child Care Association of New York 858 E. 29th St. Brooklyn,NY11210 917-808-4800 jccany.org RonaldRichter Chief executive $86M +1.0% 84% 1%$88.6M 5%Behavioral health, education and child welfare services for vulnerable children and families 23 Crohn's & Colitis Foundation 733 Third Ave. New York,NY10017 800-932-2423 crohnscolitisfoundation.org MichaelOsso President, chief executive $78M +4.6% 80% 7%$78M82%Finding cures for inflammatory bowel disease and improving quality of life for patients 24 Helen Keller Intl 1 Dag Hammarskjöld Plaza New York,NY10017 212-532-0544 helenkellerintl.org KathySpahn President, chief executive $78M +7.3% 84% 3%$89.2M52%Helping children and family members overcome barriers to health, nutrition and vision 25 Breast Cancer Research Foundation 28 W. 44th St. New York,NY10036 866-346-3228 bcrf.org MyraBiblowit President $61M +6.0% 85%10%$64.5M97%Advancement of research to prevent and cure breast cancer

tax-exempt 501(c)(3)

areexcluded.Datafromsomeorganizationsincludes

fortwoaffiliatedorganizations. 4 Figures

RANK ORGANIZATION/ LOCAL ADDRESS PHONE/ WEBSITE TOP LOCAL EXECUTIVE TOTAL EXPENSES 2021/ 1-YEAR CHANGE % EXPENSES ALLOCATED TO PROGRAMMING 2021 % EXPENSES ALLOCATED TO FUNDRAISING 2021 TOTAL REVENUE 2021 % 2021 REVENUE FROM PRIVATE CONTRIBUTIONSORGANIZATION PURPOSE 1 Doctors Without Borders USAInc. 40 Rector St. York,NY10006 doctorswithoutborders.org AvrilBenoit $600M +20.1% 85%13%$649.4M96%Emergency medical aid to those affected by conflict, epidemics or disasters 2 New York Blood Center 310 E. 67th St. New York,NY10065 212-570-3100 nybloodcenter.org ChristopherHillyer President, chief executive $507M 1 +5.0% 91% 0%$554.7M 4%Community-based non-profit blood center 3 Leukemia & Lymphoma Society 3 International Drive Rye Brook,NY10573 914-949-5213 lls.org LouisDeGennaro President, chief executive $360M -8.7% 71%15%$477.7M92%Cure leukemia, lymphoma and myeloma, and improve the quality of life of patients 4 Project Orbis InternationalInc. 52 Vanderbilt Ave. New York,NY10017 646-674-5500 orbis.org DerekHodkey President, chief executive $359M +56.9% 95% 3%$362.9M13%Prevention and treatment of blindness 5 Catholic Medical Mission BoardInc. 100 Wall St. New York,NY10005 212-242-7757 cmmb.org MaryBethPowers President, chief executive $357M 2 -23.6% 97% 2%$416.4M10%Providing medical and developmental aid to remote, poverty-stricken communities 6 Planned Parenthood Federation of America 123 William St. New York,NY10038 212-541-7800 plannedparenthood.org AlexisMcGill Johnson President, chief executive $312M 1 -8.4% 70%17%$324.8M92%Reproductive and complementary health care services 7 The Michael J. Fox Foundation for Parkinson's Research P.O. Box 4777 New York,NY10163-4777 212-509-0995 michaeljfox.org DeborahBrooks Chief executive, co-founder $280M +62.5% 92% 5%$353.4M98%Accelerating a cure for Parkinson's disease and improved therapies through research 8 Services for the UnderServed 3 463 Seventh Ave. New York,NY10018 212-633-6900 sus.org JorgePetit, MD President, chief executive $248M -5.0% 83% 0%$256.4M 2%Services for people with disabilities, in poverty or facing homelessness 9 YAIInc. 220 E. 42nd St. New York,NY10017 212-273-6100 yai.org KevinCarey Interim chief executive $235M +15.7% 88% 0%$238.1M 1%Services for the intellectual and developmental disabilities community 10 Jewish Board of Family and Children's ServicesInc. 463 Seventh Ave. New York,NY10018 212-582-9100 jewishboard.org JeffreyBrenner Chief executive $235M -0.7% 87% 1%$233.6M 6%Mental health and social services 11 Public Health Solutions 40 Worth St. New York,NY10013 646-619-6400 healthsolutions.org LisaDavid President, chief executive $232M -6.5% 97% 0% $234.2M 4%Health services for the city's most vulnerable neighborhoods 12 ADAPT Community Network 80 Maiden Lane New York,NY10038 212-683-6700 adaptcommunitynetwork.org EdwardMatthews Chief executive $190M -11.6% 87% 0%$185.9M 3%Programs and services for people with intellectual and developmental disabilities 13 Children'sAid 117 W. 124th St. New York,NY10027 212-949-4800 childrensaidnyc.org PhoebeBoyer President, chief executive $141M -3.6% 81% 2%$150.4M14%Promoting lifelong success for children and youth from highpoverty NYC neighborhoods 14 National Multiple Sclerosis Society 733 Third Ave. New York,NY10017 212-463-7787 nationalmssociety.org CynthiaZagieboylo President, chief executive $138M 1 -12.7% 73%18%$146.4M95%Finding a cure for MS while empowering people affected by MS to live their best lives 15 WellLife Network 142-02 20th Ave. Queens,NY11351 718-559-0516 welllifenetwork.org SherryTucker Chief executive $119M +7.4% 91% 0%$133M 0%Empowering New Yorkers with diverse needs to achieve their full potential 16 Developmental Disabilities Institute 99 Hollywood Drive Smithtown,NY11787 631-366-2900 ddiny.org KimKubasek Chief executive $117M +3.9% 93% 0%$119M 1%Services and programs for people with autism and other developmental disabilities 17 JDRF International 200 Vesey St. New York,NY10281 212-689-2860 jdrf.org AaronKowalski Chief executive $115M -40.0% 64%20%$223M81%Type 1 diabetes research and advocacy 18 American Committee for the Weizmann Institute of ScienceInc. 633 Third Ave. New York,NY10017 212-895-7900 weizmann-usa.org DavidDoneson Chief executive $107M 4 +16.2% 82%13%$154.1M66%Orchestrating support for the Weizmann Institute of Science and the Feinberg Graduate School in Israel 19 Smile Train 633 Third Ave. New York,NY10017 212-689-9199 smiletrain.org SusannahSchaefer President, chief executive $95M 1 +15.9% 71%25%$113.1M81%Corrective surgery for children with cleft lips and palates 20 Ludwig Institute for Cancer Research 666 Third Ave. New York,NY10017 212-450-1500 ludwigcancerresearch.org EdwardMcDermottJr. President, chief executive $94M 5 +9.2% n/dn/dn/d n/dPrevention and control of cancer 21 Adults and Children with Learning and Developmental Disabilities 807 S. Oyster Bay Road Bethpage,NY11714 516-822-0028 acld.org RobertCiatto Executive director $87M 2 -0.7% 90% 1%$87.2M n/dProviding opportunities for people with autism and learning and developmental disabilities WaNT MOrE OF CRAIN’S EXcLUSIVE DaTa? VISIT craINSNEWYOrK.cOM/LISTS.

NewNewYorkYork

list,organizationsmust be

healthcare

3 Includesdatafrom 990s

Zombie city

BY AARON ELSTEIN

BY AARON ELSTEIN

New York is swarming with zombies. No, not the brain-devouring ghouls in the movies. ese zombies are tax breaks and other incentives that elected o cials and their appointees have dished out over the years to a select number of New York companies and industries. Whether intended or not, they tend to last for eternity—or something close to it.

e Lord High Zombie is Madison Square Garden, which hasn’t paid a nickel in property taxes since the state granted it a blanket and perpetual exemption 41 years ago.

is has saved Chairman James Dolan’s company an in ation-adjusted $916 million in the past 40 years, including $42 million last year, according to gures from the city.

Zombies also can be found at Yankee Stadium and Citi Field. Not only are the Yankees and the Mets exempt from property taxes, but the payments they do make, which would ordinarily pay for city services, instead go to their stadiums’ bondholders until the 2040s, thanks to deals negotiated when the ballparks were built 15 years ago, the Independent Budget O ce said.

Hollywood has its own New York zombie in the form of $420 million in annual reimbursements to movie and TVshow producers who shoot in New York. Gov. Kathy Hochul and the state Legislature have agreed to expand the bene t to $700 million a year and extend this zombie, which made its debut in 2004, until 2034.

e entire insurance industry has been exempt from city income taxes since 1974, a bene t that cost $613 million in foregone revenue in 2022 alone. Cable television bills have been exempt from sales taxes since 1990, costing the state an estimated $461 million last year. Fuel for airlines has been tax-exempt since 1965, costing the state $122 million last year. Expenses for training and maintaining racehorses have been exempt since 1988, costing $6 million last year.

Zombies represent the leading edge of one of New York’s fastest-growing industries: the expansion of tax credits, property-tax discounts, sales-tax exemptions and other forms of nancial support granted to business in the name of economic development. Fiscal watchdogs estimate the city and the state dish out a combined $10 billion worth of subsidies every year. It means the city is foregoing 8% of total tax collections and the state, 5%, in the hopes that they will collect more in the long run.

So what is their return on this considerable public outlay? “ e truth is, we don’t know,” said Andrew Rein, president of the Citizens Budget Commission.

Marilyn Rubin, a distinguished research fellow at Rutgers University’s School of Public A airs and Administration, added: “ ere’s so little information about the level of bene ts produced by subsidies that it can be hard to know what people are arguing about. Fighting against them involves dealing in counterfactuals, and from that word alone, you can see it’s a harder argument than, ‘Let’s help the economy.’ ”

Level of bene ts

What is clear is the value of incentives has tripled since 1990, to $50 billion annually nationwide. But only a handful of states track what they’re getting in return, Pew Charitable Trusts nds, observing in a report last month that “policymakers often do not have the full picture of who

MARCH 27, 2023 | CRAIN’S NEW YORK BUSINESS | 13

JOHN KAEHNY AND ELIZABETH MARCELLO Democrats love giveaways PAGE 17

KEN GIRARDIN Call it a wrap on the wasteful lm credit PAGE 19 TAX INCENTIVES

MICHAEL KINK Tax breaks provoke income inequality PAGE 18

See ZOMBIES on page 14

The city and the state dish out a combined $10 billion in tax breaks and subsidies every year—to 1% of corporate taxpayers. The public payoff for those deals is murky at best

ILLUSTRATIONS BY MIKE LAUGHEAD

should show where incentives work best PAGE 18 INSIDE

ANA CHAMPENY Data

BUCK ENNIS

REIN of the Citizens Budget Commission questions the value of the lm tax credit.

ZOMBIES

these programs benefit.”

New York officials push back against any notion they’re flying blind. The state “routinely conducts analyses on key projects to ensure a positive return for the residents of the state in terms of economic and fiscal benefits,” said Empire State Development, New York’s economic development arm. “The incentive programs administered by Empire State Development are smart and strategic investments in New York’s economic potential, and the governor’s proposed expansions of these programs will lead to job growth, increased opportunity and a better quality of life for New Yorkers.”

Gifts that keep giving

BY THE NUMBERS

$916M

AMOUNT MADISON SQUARE GARDEN has saved on property taxes since the state granted it an exemption 41 years ago

$420M

AMOUNT OF ANNUAL reimbursements to movie and TV-show producers who shoot in New York

Economic development subsidies became widespread starting in the 1980s, when federal support for cities declined and flight to the suburbs caused urban tax bases to wither. In return for a promise to stay in Rockefeller Center, Mayor Ed Koch gave NBC a gift in 1988 that’s still giving: a property-tax discount that cut what would have been a $21 million bill last year in half, according to data from the New York City Industrial Development Agency. The discount expires next year.

Recipient businesses say life without subsidies is inconceivable, even if it would mean a fairer tax system for the estimated 99% of businesses that don’t get a deal, and more money for essential needs like transit.

“The city is expensive, and without help companies would absolutely leave,” warned Jeffrey Citron, managing partner at law and lobbying firm Davidoff Hutcher & Citron. “That’s not theoretical.”

The Hochul administration concurs. When long-term funding of the film credit program was uncertain, production fell off and relocated to other states, “many of which have more generous production incentives than New York,” Empire State Development said, noting that Steven Spielberg’s remake of West Side Story was filmed in New Jersey.

Still, decades of academic research show the benefits of economic development incentives are inconclusive. That’s in part because findings depend on the assumptions used, Rubin said.

“Without a doubt, there is a lot of art to this science,” she said.

“The one thing right-wing, left-wing and centrist economists agree on is subsidies don’t work,” said John Kaehny, executive director of budget watchdog Reinvent Albany.

Set them and forget them