How New York’s most ambitious housing agenda in years fell apart

Essential proposals, ranging from growth mandates to “good cause” eviction, appear to be dead

For a while in late 2022 and early 2023, it seemed like the stars had aligned for a major new housing push in New York.

e City Council passed a series of high-pro le developments, followed shortly after by Mayor Eric Adams announcing his moonshot goal of building 500,000 more homes in the city over the next decade. en Gov. Kathy Hochul proposed building 800,000 new homes statewide in the next 10

years, unifying the political muscle of the mayor and the governor behind the same cause.

But the outlook seems much dimmer now as the state continues to slog through a budget process that has already been delayed several times. Key components of Hochul’s plan—namely 3% housing growth targets every three years in the suburbs and the state’s power to override local zoning laws—appear to be dead, as do the tenant protections and construction incentives that many assumed

CRYPTO CRACKDOWN

would make it into the budget in some form. News then broke on ursday that housing initiatives may be omitted entirely from the state budget, imperiling not only Hochul’s mandates but also tenant protections and a slew of other reforms. Although negotiations are ongoing and last-minute changes remain a possibility, it seems extremely unlikely that the bulk of the governor’s plan, dubbed the New York Housing Compact, will emerge

See HOUSING on page 19

WHO OWNS THE BLOCK

A Hudson Yards rooming house is set to turn into a dorm

ASKED & ANSWERED City councilman says agencies are “tired of ghting over crumbs”

City Council progressives call for big investment in affordable housing, schools and health care

BY NICK GARBERThe City Council’s Progressive Caucus unveiled its own budget agenda that would invest heavily in affordable housing, education and health care, venturing beyond the council’s already-hostile reaction to Mayor Eric Adams’ planned cuts.

e progressives’ plan calls for $4 billion in new spending to expand and preserve a ordable housing, $351 million to fund the city’s struggling Right to Counsel program and $20 million to expand supervised drug-injection sites to all ve boroughs.

e caucus also plans to try to reverse Adams’ latest 4% cut to agen-

an inaccurate assessment of what we need to ght for.”

Although smaller than it was months ago, the caucus still makes up nearly half of the 51-person council, so it likely will wield considerable in uence in the budget debate. But it might face an uphill battle in getting some of its priorities enacted, given City Hall’s insistence that the city needs to cut costs in the face of looming budget gaps.

e caucus’ $4 billion in housing spending surpasses the $3.3 billion o ered by council leadership, including Speaker Adrienne Adams, in its own response to the mayor’s budget proposal released earlier this month. e progressives’ plan would include $2 billion in capital funding for the New York City Housing Authority and another $2 billion for other city-owned buildings—broadly similar to the council’s overall plan.

MCCARTEN/NYC COUNCIL MEDIA UNITcy budgets—which council leaders have called unnecessary and damaging to city services.

“If we don’t make this investment, we are really going to su er in years to come,” said Shahana Hanif, a Brooklyn council member who co-chairs the 20-member caucus. “ e austerity budget that this mayor is doubling down on is really

EVENTS CALLOUT

APRIL 27

POWER BREAKFAST

Join Crain’s for a live interview with New York’s top federal prosecutor, Damian Williams, the U.S. attorney for the Southern District of New York. He’ll share his priorities, outlook and impressions since he took over the of ce in late 2021.

DETAILS

Time: 8:30 to 10 a.m.

Location: 180 Central Park S. CrainsNewYork.com/pb_williams

More money for Right to Counsel would meet a longstanding demand by tenant advocates to fully fund the groundbreaking program, which could help stave o evictions as displacements increase after the expiration of the coronavirus pandemic moratorium. An additional $60 million would allow the city to open 15,000 more units of supportive housing,

the caucus says. Funding for mental health care and substance-use support makes up another pillar of the progressives’ plan. Besides expanding overdose prevention centers beyond the two existing Upper Manhattan locations, the caucus wants to increase the number of respite centers for people in mental health crises up to 16, and increase funding for mobile treatment teams. Meanwhile, the caucus called for fully funding the city’s universal 3-K program, rejecting the mayor’s bid to halt its planned 6,000-seat expansion in the next scal year. Adams’ administration has said disappearing federal funding makes the expansion impossible, but council

COMMERCIAL REAL ESTATEleadership has said the city should focus on addressing other root causes that led to the program’s disappointing enrollment gures.

Next steps

e next step in the city’s budget process is scheduled for April 26, when the mayor is supposed to release his executive budget: an updated version of the $103 billion preliminary budget he unveiled in January, now taking into account feedback from the council and the public.

Another round of budget hearings is expected to ensue next month, followed by a budget deal by July 1—though that timeline has been thrown into question by the

delayed state budget.

e Progressive Caucus, formed in 2009, has released similar lists of budget priorities in past years. But the upcoming process might be unusually fraught, given the drastically di erent scal pictures painted by the mayor’s o ce and the council.

City Hall has called its belt-tightening budget a necessity, given the estimated $4.3 billion in costs imposed by the migrant situation, salary increases stemming from deals with municipal unions and new burdens that could be imposed by the state budget. e nonpro t Citizens Budget Commission has largely backed City Hall’s e orts, pointing to a $6.5 billion budget gap estimated to exist by scal 2027.

A counterproposal advanced by council leadership would invest $1.3 billion to o set cuts and make new investments next year, while stashing away $1.4 billion in reserves. e lawmakers have said their plan is backed up by their own nancial forecasts, which predict much higher tax revenues than the mayor’s o ce does.

Formerly numbering 35 people, the caucus lost 15 members this year after an internal dispute over a statement of principles that called for reducing the “size and scope” of the Police Department. ose who departed included ve members of the council’s leadership team. ■

MTA moves to seize nine sites in East Harlem for Second Avenue subway extension project

BY C. J. HUGHES AND CAROLINE SPIVACKSome East Harlem properties may soon meet a wrecking ball to make way for the next leg of the Second Avenue subway.

e Metropolitan Transportation Authority began eminent-domain proceedings against nine sites around Second Avenue and East 120th Street, two years after announcing plans to seize the properties.

e move comes as Washington, D.C., o cials last month signaled fresh support for the nearly $8 billion project, which would extend the Q line from East 96th to East 125th streets. e MTA is expecting the federal government to pick up the tab for nearly half the project, or $3.4 billion.

According to a petition led in Manhattan Supreme Court, the MTA has 30 days to alert the owners of the East Harlem sites about the plans. e landlords will then have

four months to respond to the court as to how much they think their condemned properties are worth, the ling says.

“ e lings follow the statutory process laid out in New York law to acquire these parcels, which will allow us to commence this important project for the community of East Harlem,” said MTA spokesman Michael Cortez in a statement.

Many sites empty, abandoned

Mostly lining the east side of Second Avenue between East 119th and East 120th streets, the sites are a mix of empty lots and low-slung mixeduse buildings and include some properties that look abandoned.

e Pecora family, a local developer and Upper East Side restaurateur, owns several of the properties.

Among them is a corner parcel made up of four tax lots that was once home to an apartment building but has been vacant since 2020.

at parcel has a market value of

$2.2 million, according to its most-recent appraisal by the city, which tends to undervalue properties. Still, that amount is less than half of what the site was worth just two years ago, tax records show.

Another address owned by the Pecoras is 246 E. 120th St., a 5-story building that had 20 apartments more than a decade ago but whose windows have sported plywood for years. e city values it at $790,000, records show. A phone message left at an o ce connected with the family’s business was not returned.

Also targeted for demolition is 2329 Second Ave., a 3-story prewar building that was once home to the Macedonian Pentecostal Church, and a separate parking lot behind the building. No one answered a phone at the church ursday, and no message could be left.

e other two sites are 2327 Second Ave., a 3-story structure that once had a dry cleaners but is now shuttered, and 2325 Second Ave., a

similar building with a laundry business.

Once the buildings are cleared, the MTA plans to use the site as a staging area for the huge machines needed to create tunnels for the subway, according to the ling. When they are done digging, the excavated spot will become an entrance for a new 116th Street station, the court papers say.

In March, in his new budget, President Joe Biden earmarked $497 million for the new subway project, which currently has a $7.7 billion price tag, a whopping $800 million increase from earlier estimates. During a recent brie ng with reporters, U.S. Secretary of Transportation Pete Buttigieg described the project as “game-changing.”

e balance of the $3.4 billion for the subway is expected to come from grants from the Federal Transit Authority, though the MTA still needs to sign a formal agreement with the agency. ■

“IF WE DON’T MAKE THIS INVESTMENT, WE ARE REALLY GOING TO SUFFER IN YEARS TO COME”

City casino opponents ex their muscles

BY NICK GARBERThe recent formation of a community coalition intent on defeating a proposed Times Square casino was bound to attract attention, given the high-pro le location and the presence of the Broadway League, an in uential theater owners’ group.

But the basic dynamic has much in common with the resistance that has greeted other casino proposals being oated around the city. Congestion, crime and other issues cited by the No Times Square Casino Community Coalition have been raised before in Coney Island, Flushing and elsewhere.

e opposition is more than symbolic. Under the state’s process for licensing a New York City casino, each application will come before a new, six-member community advisory committee, with members appointed by the mayor, the governor, the local state senator, the local Assembly member, the borough president and the local City Council member.

Bids will need to win support from twothirds of the committee before even being considered for a license—meaning neighborhood pushback could make a real di erence.

Even as high-level o cials including Mayor Eric Adams and Gov. Kathy Hochul support the new casinos, which they describe as potential economic boons, local reception has been less welcoming.

“No matter how much emphasis promoters try to place on glitz and glamour, a casino in Times Square has the potential to unravel

the fabric of the eater District and jeopardize the fate of its restaurants,” Sardi’s owner Max Klimavicius said in a statement released by the coalition. e bid they are opposing, by SL Green and Caesars, would include a resort and casino within the 54-story tower at 1515 Broadway. Backers estimate that the planned project could attract 7 million visitors per year.

In Manhattan, where ve casino bids have been publicly announced, the three community boards that cover each of the proposed sites have come out against the projects, as the Daily News reported.

Community Board 4 on the West Side of Manhattan said last month in a letter to elected o cials that the plan by e Related Cos. and Wynn Resorts to build a casino on the undeveloped western half of Hudson Yards would “further delay and complicate” the city’s long-promised plans to create housing and green space there.

A central Midtown community board that is home to proposed casinos in Times Square, the Penn Station area and atop Saks Fifth Avenue passed its own blanket resolution against any new casino in December. e board cited tra c and high rates of gambling addiction in low-income areas.

An East Side community board likewise

came out against a ashy proposal by the Soloviev Group and Mohegan to build a casino, hotel, museum and Ferris wheel on a long-empty lot along the East River near the United Nations.

Uncertainty about timing

Keith Powers, a City Council member whose district includes the Saks and Soloviev sites, said he has heard from plenty of constituents opposed to the proposals. Meanwhile, he said, uncertainty about the timing of the casino process—which still has no announced application deadline—has sti ed any major talks in city government about how to approach the issue.

“We’re still soliciting community feedback and awaiting clear information about what the process will be moving forward,” Powers said, “but we certainly want to make sure that the community around the casinos is well represented.”

Coney Island residents raised concerns about tra c and crime, and they dismissed a casino’s supposed economic bene ts when they held a protest last month against the proposal by or Equities.

Flushing residents rallied against Mets owner Steve Cohen’s concept of a casino on a parking lot next to Citi Field—even as state lawmakers have taken steps to boost Co-

hen’s bid.

Elected o cials including state Sens. Brad Hoylman-Sigal and Liz Krueger, Assembly member Tony Simone and City Council member Erik Bottcher have publicly expressed wariness about the prospect of adding a casino to their respective districts.

Getting past the community boards is hardly the only hurdle casino applicants face. Any selected bids likely will need to move through the city’s monthslong public-review process for zoning changes—which would give local o cials multiple chances to reject a project.

e City Council has considered making a citywide zoning change to ensure future casinos are up to code, but that e ort is still in its early stages.

Supporters of SL Green’s Times Square casino bid tout a coalition of their own. e group, which also includes Jay-Z’s Roc Nation Entertainment, has circulated a list of supporters including the restaurants Carmine’s and Nobu, Wyndham Resorts and trade unions such as the Actors’ Equity Association and the Mason Tenders’ District Council.

“We believe that a new gaming and entertainment destination will be a major bene t to Times Square and the Broadway community,” Tino Gagliardi of the American Federation of Musicians union said in a statement released by the casino bid group. “More topline entertainment options mean more tourism, bigger audiences and more jobs for New York’s theater industry.”■

GETTING PAST COMMUNITY BOARDS IS HARDLY THE ONLY HURDLE APPLICANTS FACE

WHO OWNS THE BLOCK

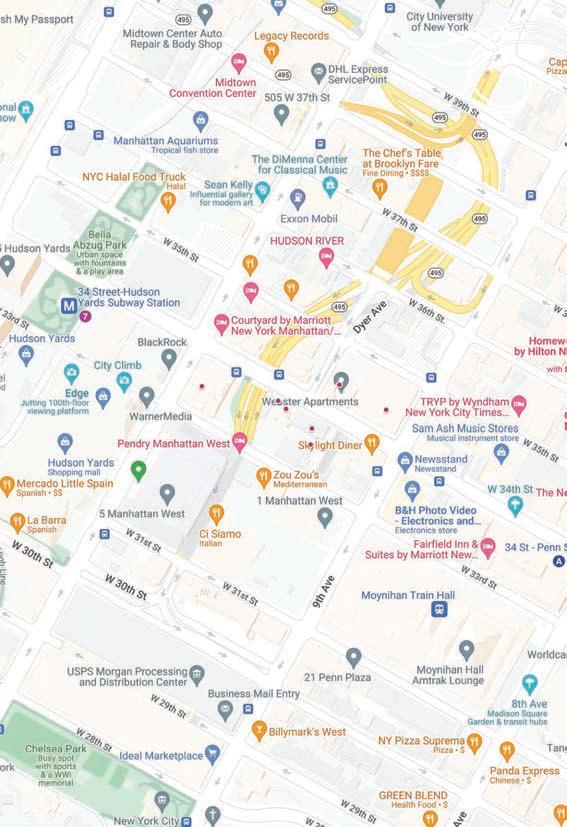

BY C.J. HUGHESWebster Apartments, a women-only rooming house in Hudson Yards that sold last month, will become a co-ed facility for college students, according to a source familiar with the plans.

The new owner, the nonprofit Educational Housing Services, plans to redevelop, though the extent is undetermined. In one option under consideration, Educational Housing, which paid $52.5 million for 419 W. 34th St., would construct a wing in an empty lot behind the building to allow 200 beds to be added to the 400 already there, said the source, who added that the cost of going that route would be $200 million.

But Educational Housing, a dorm developer, also might demolish Webster’s existing 13-story red-brick building and replace it with a tower containing 700 beds—a $300 million undertaking, the source said. Any new tower probably would depend on a commitment from a university in advance, according to the source, who asked not be identified because plans were still fluid.

Either way, the facility, which opened in 1923 with an endowment from heirs to the Macy’s fortune, would reopen for the 2024 school year.

Since the acquisition, Webster has joined forces with Found Study, another student-housing provider. Women who had been housed in the West 34th Street building now seem to be living at a former DoubleTree by Hilton hotel in Midtown, at 569 Lexington Ave., that’s operated by Found Study. Messages left for the company were not returned.

Educational Housing’s purchase of Webster, which closed on March 27, represents a shift in strategy for the company, which has mostly been a tenant that sublets rooms and not an owner of its properties. Its sites also include the former St. George’s Hotel in Brooklyn Heights, which has 1,300 beds, and the New Yorker Hotel at West 34th Street and Eighth Avenue, which can accommodate 600 people.

A bed in a room shared with another student, and with a private bath, costs about $1,850 per month for a school year, the company said. In contrast, in March, the median rent in Manhattan was $4,175 per month, according to Douglas Elliman.

Rooming houses for women are now almost all gone. The Markle Evangeline at 123 W. 13th St., which the Salvation Army has run since 1930, appears to have started welcoming men a few years ago. And the Parkside Evangeline on Gramercy Park became a 17unit luxur y condominium about 15 years ago. But the 8-story St. Agnes Residence at 237 W. 74th St. endures.

Jeffrey Lynford, chief executive of Educational Housing, declined to comment. And Roy Bernstein, Webster’s president, did not return a message seeking comment. ■

This sliver of a site has what could be one of the narrowest commercial buildings in New York. The 8,000-square-foot structure also has an odd orientation. Windows mostly face west, taking in Lincoln Tunnel traffic, and not south toward the sidewalk as is generally the case. In 2003 a religious group, the Church in New York City, purchased the 4-story Brutalist structure for $2.2 million, records show, before selling it in 2017 for $6.2 million to developer Greenpoint Consultants. Last year its principal, Mason Chen, converted the building into the Faith Condominium, a four-unit commercial development. The church then bought back two of the units for $5.1 million, records show, while the other two appear unsold.

Brothers Charles and Josiah Webster, who worked with R.H. Macy, founder of the department store to the east, bequeathed their fortune to developing a building for young professional women. The result, Webster Apartments, opened in 1923. It has operated on the site with the same mission and rules—no men above the first floor— ever since. In that first year, Webster’s occupants included about 40 Macy’s sales clerks; in 1935, there were 84 sales clerks from various stores, according to an official building history. No. 419 also was known for its library, roof deck, cafeteria, laundry and event space. Last year, residents paid rents of about $1,700 per month.

A concrete building constructed in 1927 for printing presses, this block-long structure in the 1980s and 1990s housed magazine publishers and postage-stamp companies. In 2019, as the Related Cos. portion of the Hudson Yards effort began to come online, developer SL Green bought a majority stake in No. 460 from the Kaufman Organization for $292 million. The renovation that followed sanded down some of the ornamentation on the facade for a sleeker look while adding a new hue popular in the area: black. In 2021 601W Cos. purchased the entire building, also known as 410 10th Ave., for $810 million, records show. The 630,000-square-foot site reportedly leases about two-thirds of its office space to Amazon. The building’s other major office tenant is First Republic Bank, which required a $30 billion rescue in March to avoid a collapse.

The shifting identities of this corner site might speak to broader neighborhood churn. When the block was still considered part of the Garment District, this 1962 building warehoused clothes. Developer Harry Macklowe later bought it through his Hamack Realty firm and reportedly invested $35 million to convert the structure into an 8-story, 320,000-squarefoot office building. In 1994 Group Health, an insurance company, picked it up from Macklowe for $31 million. Group Health then sold it in 2016 to a partnership of Cove and CommonWealth Partners for $330 million, paving the way for its biggest metamorphosis. Taking advantage of air rights, the developers constructed 17 additional floors. They also added multipane windows and gave it a new name: Hudson Commons. Peloton’s New York headquarters is there. Eight spaces on eight floors are currently available to lease.

This

one of several apartment buildings on the block, offers 134 units: studios to two-bedrooms.

It’s owned by Olshan Properties, whose chairman emeritus, Morton Olshan, an accountant turned developer, has owned a stake in the property since at least 1966, property records show. Today his privately held firm owns or manages 23 million square feet of real estate in 11 states, including offices, hotels and residential buildings. And it frequently invests with partners. Over the years, those partners have included Lloyd Goldman, the Feil Organization and Malkin Properties.

This Roman Catholic church, St. Michael’s, used to be located on West 32nd Street. But in the early 1900s, the construction of tracks and tunnels for the first Penn Station booted it from its home, roughly where the Manhattan West complex stands today. Still, St. Michael’s managed to salvage and reuse its organ, altar and windows, and even its rusticated limestone facade, according to an official account of the church from 1957. At that time, the neighborhood had only 1,750 Catholic residents, the account said, and the future of the parish seemed uncertain. Napoleon LeBrun & Sons, the architect of the 1907 church, was a designer of St. John the Baptist on West 30th Street, near the current Penn Station. Planners have targeted its site to be redeveloped with high-rise towers as part of a neighborhood renewal.

When this white-brick postwar apartment building opened in 1963, and continuing for many years after it went co-op in 1988, its location—an area thick with warehouses, parking lots and stables—probably felt remote. The building’s name—Convention Overlook, based on its proximity to the Javits Center—suggests an almost desperate bid for a hook. But since the Manhattan West and Hudson Yards projects started adding buildings to the area in the past decade, No. 430 might finally feel in with a trendy crowd. Four units were for sale on April 13, the priciest of which was a one-bedroom with parquet floors for $785,000. The co-op appears to have a liberal subletting policy, based on its number of available rentals on StreetEasy. A recent one-bedroom was going for $3,500 per month.

A Hudson Yards rooming house for professional women is set to transform into a co-ed dorm

Major renovations are planned for the Webster Apartments on West 34th Street in a part of Manhattan that is well-known for change

JUSTIN BRANNAN New York City Council

INTERVIEW BY NICK GARBERWhen Justin Brannan was first elected to the City Council in 2017, reporters gawked at the tattooed former punk-rock guitarist who’d won a seat. The novelty has since worn off, but Brannan’s power has only grown, after an unsuccessful bid for speaker thrust him into the council’s leadership team. As chair of the finance committee, Brannan will help lead the council’s upcoming budget negotiations, pushing back against Mayor Eric Adams’ austerity plan that Brannan derides as “doom and gloom.”

The plain-spoken Brannan sees a natural ally in Speaker Adrienne Adams, a fellow outer-borough lawmaker. But he’s had to get comfortable challenging the mayor, a longtime friend whom he now accuses of making needless cuts to city services.

Why should a typical New Yorker care about the city budget?

I like to see things through the lens of the average working New Yorker, the taxpayer who should measure the return on their investment through the efficient delivery of government services. New Yorkers pay their fair share of taxes, and they deserve to see some tangible returns on that investment. One thing that I like to demystify is this popular misconception that every year we start at zero, and we just spend money until we run out of ideas. But I think it’s important to remind folks that we’re not printing money. By law, we’re allocating the finite amount of revenue that the city takes in. So you can either spend it or you can save it. People don’t know that New York City is charter-mandated and required by law to balance the budget. And if you believe in New York City, and you believe in the durability of the city’s economy, you should want that budget to grow every year because that means that the economy is healthy and that we’re taking in revenue.

Reporters often refer to the council as one unified body, but it contains 51 people with wildly different opinions. How much work goes into crafting something like the budget response, where the council

DOSSIER

WHO HE IS: City Councilman representing southern Brooklyn; chair of the council’s finance committee

AGE: 44

RESIDES: Bay Ridge, Brooklyn

BETTER HALF: His wife, Leigh, runs a children’s arts school.

PUNK-ROCK VET: Brannan says his past life as a guitarist in prominent hardcore punk bands serves him well as a politician. “Touring the world and sleeping on concrete floors in over 50 countries prepares you for just about anything,” he said.

BEST FOOD IN BAY RIDGE: “Oh my God, this is an election year. I can’t answer that. It’s an embarrassment of riches. You throw a stone, you’re gonna find some amazing cuisine.”

SPARE TIME: Sampling Taiwanese whisky is a hobby of his. “They’re giving the Scots a run for their money.”

is supposed to speak with one voice?

It’s an insane amount of work. Often, up until an hour or two before the response is released, folks are working on it. It’s our way to refocus the mayor’s preliminary budget to what we want to see, with as much consolidation of priorities as possible—which is not always easy with 51 members. You take the proposals that have the most support, and those are the proposals that are going to get prioritized. Someone might have a great idea and no one else supports it.

The council has advanced a very different budget than the mayor has, with new investments instead of cuts. Is this

Extell plans 27-story project at shuttered Midtown hotel site

BY EDDIE SMALLDetails have emerged about Extell Development’s plans for the former Wellington Hotel site at 871 Seventh Ave. in Midtown.

The real estate giant, run by Gary

just because you’re working with a more optimistic financial forecast than City Hall is?

We believe in fiscal responsibility, but I think gutting agency budgets without regard for the impact that it’s going to have on everyday New Yorkers is not fiscal responsibility. We’ve identified a pretty substantial amount of additional tax revenues and resources that are available right now. This latest [4% budget cut] is puzzling to us because a lot of these agencies are already paper-thin. We all see the same tax receipts that come in. No one’s looking at any secret numbers. The speaker and myself, being both outer-borough folks who represent outer-borough districts, we’re tired of fighting over crumbs. We’re going in there looking for the full loaf. And, frankly, the mayor is also an outer-borough guy, so he understands that as well. So we head into budget negotiations looking for a partnership.

What’s your strategy going into the upcoming budget negotiations?

Executive budget hearings [in May] are where the rubber will really start to meet the road and where we’re going to lean into what we laid out in our preliminary budget response, to show that we can invest in these agencies and also put money away in general reserves to account for future risks. [We want] to show that our vision is a responsible one, that is going to make a real impact in the lives of the average New Yorker who doesn’t understand what their tax dollars go to. We want folks to believe and trust in their government. If we can’t get the garbage picked up on time, then how do we expect anyone to believe that the government can run a universal health care system?

You endorsed Eric Adams early in his mayoral campaign, and you’ve known him for a long time. Is it awkward now to be in a position where you need to be more antagonistic toward the administration?

No. I think they know that I’m just doing my job. It’s never personal; my job is not to attack. And I think it’s good to have someone who you’ve known a while be across the table when you’re negotiating. We’ve been in the foxhole together many times, and at the end of the day, folks know that I’m just trying to get a win for my constituents and for the council. ■

Barnett, has filed plans with the Department of Buildings for a new hotel at the site that will span about

336,000 square feet and contain 208 rooms. It will stand 27 stories and 403 feet tall and include 35 parking spots, along with retail space, office space, a lecture hall and a restaurant on the fourth floor, according to the filing. Beyer Blinder Belle is the architect of record.

Extell inked a deal with David Born’s BD Hotels for the site in October for about $94.5 million, property records show. The New York Post reported in December that Born would stay on as a partner in a new project, but he declined to comment on this when reached by phone. A rep-

resentative for Extell did not respond to a request for comment by press time.

The Wellington Hotel stands 26 stories tall and spans about 208,000 square feet. Demolition permits have not been filed for the site yet, according to city records.

The property is one of many hotels that shuttered during the pandemic. The most recent post on its Facebook page, from April 2021, says it had suffered from major flooding, requiring extensive renovations to the elevators, and had canceled all reservations through January 2022.

Other inns

Extell is also planning to build a 54-story hotel nearby, at 1710

THE PROPERTY IS ONE OF MANY HOTElS THAT SHUTTERED DURING THE PANDEMIC

Amended complaint filed in suit seeking to stop mayor’s mental health care plan

BY JACQUELINE NEBERAcoalition of public interest groups including New York Lawyers for the Public Interest, the National Alliance on Mental Illness of NYC, Community Access and people with disabilities filed an amended complaint for an emergency request tied to Mayor Eric Adams’ mental health plan.

The request, filed in December, seeks to halt the mayor’s controversial mental health agenda, which includes a directive for law enforcement, outreach workers and mental health professionals that emphasizes their authority to involuntarily transport to hospitals New Yorkers who seem unable to meet their own basic needs. The coalition called the plan unconstitutional and a violation of New Yorkers’ rights.

The amended complaint includes new plaintiffs, who allege they have been forcibly detained, involuntarily admitted to the hospital or both for mental health con-

cerns, despite that being unnecessary.

“At the time they were seized, the individual plaintiffs were unarmed. They were committing no crime. They presented no risk to themselves or anyone else,” the complaint reads. “Yet each plaintiff was subjected to an unconstitutional seizure and detention. Each was forcibly detained and injured physically and/or emotionally while being involuntarily transported to a hospital against their will.”

ADA violations

The plaintiffs want the court to declare that the city’s involuntary removal policy (which went into effect in December), the Police Department’s emotionally disturbed person policy and associated policies violate the Americans With Disabilities Act and the U.S. Constitution. The plaintiffs also seek that the city permanently halt Adams’ plan and submit a remedial plan, which would create a nonpolice mental health response program run by peers and health care providers.

Proposed bill would make fentanyl and xyalzine test kits more accessible

State Sen. Pete Harckham and Assemblyman John McDonald have introduced a bill that would allow licensed pharmacists to prescribe fentanyl and xylazine test kits to any New Yorker.

The bill aims to make the kits more accessible to people throughout the state. New York’s opioid-use crisis has continued to balloon, and fentanyl is playing an increasing role in overdoses.

Test kits currently are distributed mostly by treatment providers at locations that, according to Harckham and McDonald, are “few and often far between.”

ative known as “tranq,” is a dangerous additive that can depress the central nervous system.

“It has not responded to naloxone. So it’s critical that folks know what’s in their supply,” Harckham said. “It’s vital that we give drug users the tools to stay alive.”

He added that not every New Yorker wishes to go into treatment, driving his desire to create alternative policies that could increase safety and save lives.

Representatives from New York Lawyers for the Public Interest and the mayor’s office could not comment before publication.

The emergency request is part of federal litigation that challenges the city’s use of police officers as frontline responders dealing with people who have mental illnesses. ■

ONE TREE PLANTED FOR EVERY BABY BORN

BECAUSE WELL CAN’T WAIT

If the bill passes, health care professionals who are licensed, registered and authorized could dispense the kits to anyone. The kits could be stored at licensed pharmacies, hospitals, clinics and other facilities including retail stores that have pharmacies. Transactions would be limited to five kits at a time.

Harckham told Crain’s the bill is similar to one introduced last year. McDonald, who is a pharmacist, suggested adding the xylazine component. Xylazine, a non-opiate sed-

The bill is called Matthew’s Law in memory of Matthew Horan, a Westchester resident who died following a fentanyl overdose in 2021. Horan’s sister, Kailey, suggested Harckham introduce legislation to make test kits more accessible after her brother unknowingly ingested the additive, according to Harckham’s office.

The bill aims to use the existing Department of Health test kit retail structure to create many more distribution points within communities.

The measure is in committee. Harckham said legislators will shift their focus to stand-alone legislation after a final state budget is delivered. —J.N.

Find out more at RaiseHealth.com

When a newborn leaves a Northwell hospital, their journey to a healthy life is only just beginning. So we plant a tree to help clean the air that they, and all members of our community, need to breathe. It’s just one of many initiatives that our Office of Sustainability has launched to help create a more sustainable future for everyone.

The state’s crypto regulations can encourage, rather than sti e, innovation

New York has always been a place where individuals, companies and industries make new things. at’s why the city and state can and should continue to embrace cryptocurrency businesses while not shying away from thoughtful regulation e sector’s success must not come at the expense of investors.

If New York’s deliberate pace is a departure from the agility that has come to de ne the crypto industry, so be it. It’s better to move correctly than quickly, especially with so much on the line.

president & ceo K.C. Crain

group publisher Jim Kirk

publisher/executive editor

Frederick P. Gabriel Jr.

EDITORIAL

editor-in-chief Cory Schouten, cory.schouten@crainsnewyork.com

managing editor Telisha Bryan

assistant managing editors Anne Michaud, Amanda Glodowski

director of audience and engagement

Elizabeth Couch

audience engagement editor Jennifer Samuels

digital editor Taylor Nakagawa

art director Carolyn McClain

photographer Buck Ennis

senior reporters Cara Eisenpress, Aaron Elstein, C.J. Hughes, Eddie Small reporters Amanda D’Ambrosio, Nick Garber, Jacqueline Neber, Caroline Spivack op-ed editor Jan Parr, opinion@crainsnewyork.com

sales assistant Ryan Call to contact the newsroom: editors@crainsnewyork.com www.crainsnewyork.com/staff 685 Third Ave., New York, NY 10017-4024

ADVERTISING

PROPER CRYPTO REGULATION COULD BE A WIN-WIN-WIN SITUATION

Some in the crypto sector have complained that regulatory e orts can prohibit smaller players and sti e innovation. But others have welcomed the structure, and New York’s track record positions the state to be a model for others.

Crypto rms must show that they are capable of handling

OP-ED

consumers’ money responsibly. e state was on the right track with the introduction of the BitLicense, a mandatory credential for crypto rms that want to do business in New York. e program requires regular audited nancial statements and includes measures to prevent fraud. Some crypto companies found the BitLicense process too onerous and packed their bags. But on at least one important measure the scrutiny is working: Just one of the 33 licensed entities, Genesis, has led for bankruptcy. Regulation doesn’t have to throw cold water on innovation. In fact, the similarly disruptive technology sector is clamoring for more guidelines. Last month, more than 1,000 tech leaders, including Elon Musk, signed an open letter urging arti cial intelligence labs to pause development of advanced systems for six months to ensure proper planning and management. e letter also states that AI developers must work with policymakers to accelerate robust governance, including “new and capable regulatory authorities dedicated to AI.”

As reporter Ryan De enbaugh noted in this week’s Crain’s forum, last year’s so-called crypto winter wiped $2 trillion from digital currencies’ total market value, and 75% of Americans who know what crypto is aren’t con dent in its safety and reliability, according to a Pew Research Center survey. Despite such turmoil, the crypto industry isn’t going anywhere, with Bitcoin crawling back up in value and Nasdaq planning to launch a crypto custody service.

If crypto rms clearly spell out the risk of purchasing digital assets, that would go a long way

toward satisfying regulators. To be sure, disclosure and transparency won’t safeguard investors from bad actors, but consumers should know what they are getting into.

New York’s lawmakers have shown they’re capable of creating policies that work. Proper crypto regulation could be a win-winwin situation: Crypto rms could use compliance to salvage trust with consumers; potential and current investors would have a better sense of their rights; and the city and state could keep building an industry that is driving economic growth. ■

Through meaningful efforts, more women will view construction as a career path

BY LAURA BUSHThirty years ago, if someone were to sit me down and tell me that one day I would be leading the New York metro region for one of the construction industry’s leading rms and overseeing nearly $1 billion in major projects, I would not have believed them.

Girls from small towns in the U.K. like me did not grow up to manage construction portfolios like Consigli’s in one of the largest cities in the world. When I was growing up in England, the idea of working my way up through the ranks in a male-dominated eld in a place like New York City seemed foreign to me.

ere weren’t many female role models when I began exploring what it would mean to pursue a career in the construction industry. However, I did have an opportunity. rough an internship program when I was 16, I was able to

shadow a local construction company that was completing work on the new soccer stadium in my hometown: Ewood Park in Blackburn.

If it weren’t for that experience, I can’t say for certain that I would be where I am now, doing what I love. at internship gave me the con dence to pursue my ambitions, despite the underrepresentation of women in the eld.

Seats at the table

When young women consider their future, the idea of entering a workforce where there are 10 men for every woman can seem daunting. We have long been told that the trades and STEM pathways are not designed for girls. But that is not the case, and no woman should be deterred by the statistics from entering the workforce.

We know that, as women, our experiences often don’t mirror those of the men in our o ces or on our jobsites. Often we are the

only woman in the conference room or in the trailer. However, the construction industry is one that embraces diversity, equity and inclusion, and there are seats at the table ready and waiting for women eager to pull up a chair. We are members of an exciting and exclusive club, and our unique perspectives and shared experiences are critical to helping usher in the next generation of women in construction.

But in order to help welcome more women into our exciting club, we have to engage with girls so they can imagine themselves managing a major construction project in Manhattan. Opportunity and achievement gaps will not be closed for girls dreaming of a future in construction without intentional, meaningful e orts to help them.

Offering inspiration

When Consigli built the Manne Institute at the Bronx High School

of Science, we incorporated a program that I know works: We welcomed high school interns to the project and gave them a hands-on introduction to a career in construction management.

By o ering young people a chance to explore a jobsite, ask questions and see construction work in action, we equip more of them with the con dence and experience they need to pursue a future in the eld—just as I was inspired during my own internship 30 years ago.

Every young woman deserves an opportunity, and it is incumbent upon those of us who have already climbed the ladder to reach out and o er the resources and support necessary to introduce more young women to rewarding careers in construction. ■

Laura Bush is the New York metropolitan region director of operations for Consigli Construction.

www.crainsnewyork.com/advertise sales director Laura Lubrano laura.lubrano@crainsnewyork.com

senior vice president of sales Susan Jacobs account executives Paul Mauriello, Marc Rebucci, Philip Redgate people on the move manager Debora Stein, dstein@crain.com

CUSTOM CONTENT

associate director, custom content Sophia Juarez, sophia.juarez@crainsnewyork.com

custom content coordinator Ashley Maahs, ashley.maahs@crain.com

EVENTS

www.crainsnewyork.com/events

manager of conferences & events Ana Jimenez, ajimenez@crainsnewyork.com

senior manager of events Michelle Cast, michelle.cast@crainsnewyork.com

REPRINTS

director, reprints & licensing Lauren Melesio, 212.210.0707, lmelesio@crain.com

PRODUCTION

production and pre-press director Simone Pryce media services manager Nicole Spell

SUBSCRIPTION CUSTOMER SERVICE www.crainsnewyork.com/subscribe customerservice@crainsnewyork.com 877.824.9379 (in the U.S. and Canada). $140.00 one year, for print subscriptions with digital access.

Entire contents ©copyright 2023 Crain Communications Inc. All rights reserved. ©CityBusiness is a registered trademark of MCP Inc., used under license agreement.

chairman Keith E. Crain vice chairman Mary Kay Crain president & ceo K.C. Crain

senior executive vice president Chris Crain editor-in-chief emeritus Rance Crain chief nancial of cer Robert Recchia founder G.D. Crain Jr. [1885-1973] chairman Mrs. G.D. Crain Jr. [1911-1996]

Citywide festivals bene t neighborhoods. Let’s see more large events uniting businesses, the arts.

BY KAREN BROOKS HOPKINSCitywide festivals are a rarity and yet, especially here in New York where we have so many great venues, it is curious that more cultural institutions and local businesses don’t join forces regularly to collaborate in such an impactful and focused way.

Yes, we always have a multitude of arts programs going on seven nights a week in a vast number of places, but a truly connected festi-

will often travel to see programs in various venues located in neighborhoods they may never have visited before, and they will go not only for the shows, but for dinner, shopping and sometimes simply to enjoy checking out a new place.

One massive single event

val happening simultaneously in a variety of locations, that includes both for-pro t and not-for-pro t entities, lifts all boats.

First, a themed festival allows a great concept or idea to be explored in-depth by myriad di erent artists and thinkers.

Second, interested audiences

A uni ed festival also saves money because every participating organization promotes all of the events, not just their own, and one marketing budget and outreach campaign serves everyone. Best of all, working together turns a series of individual, smaller-scale programs into one massive, mighty single event. Big events, created by all di erent types of venues, add to the city’s luster and reputation as the world’s premier cultural destination.

Simply put, it’s not enough just to be near each other. We can accomplish so much more when we actually do something together that speaks in one voice. Let’s imagine, for example, this concept played

THOUGHT LEADER REPORT

out in the largest and most powerful way. It could start with organizations based in a cultural district collaborating on an annual program—then the idea could extend to a citywide undertaking and,nally, a group of like-minded partners could go even further by forming a regional network all engaged around a common artistic theme. is collaborative process has so many potentially positive outcomes for residents and visitors alike.

I have worked on at least four citywide festivals in my long career at the Brooklyn Academy of Music and beyond, including Muslim Voices: Arts & Ideas, Si Cuba, the Ingmar Bergman Festival and, most recently, as executive producer of Little Amal Walks NYC, where a magni cent 12-foot puppet visited 51 communities in every borough depicting the plight of displaced people.

Next up, from April 28 through May 6, the Onassis Cultural Center, based both here in New York and primarily in Athens, Greece, will

SPONSORED

DIVERSITY, EQUITY & INCLUSION

SPONSORED BY SHAWMUTMENTAL HEALTH AT WORK: A NEW ERA OF SUPPORT FOR EMPLOYEE AND BUSINESS WELL-BEING

We are in a new, muchneeded era for mental health at work.

launch a citywide multidisciplinary festival called Archive of Desire: A Festival Inspired by the Poet C.P. Cavafy in 10 locations including Columbia University, National Sawdust in Williamsburg, Rockefeller Center, seven McNally Jackson bookstores, the New Museum, and beyond. We learn so much about both the world and our own city through

these broad-based, concentrated events. And, as noted, each individual neighborhood bene ts from both the attention and the residual social and economic rewards. ■

Les Hiscoe is CEO of Shawmut Design and Construction, a $1.3 billion national construction management firm that’s built New York’s iconic spaces for 30 years.

Businesses only perform as well as their employees, and nearly one-fifth of U.S. workers rate their mental health as fair or poor. Construction specifically has the second highest suicide rate among major industries. Leaders need to be in lockstep with this paradigm shift to create an effective, supportive mental health program so everyone succeeds.

Establish the Business Imperative

Construction is complex, grueling work set in demanding environments. Years ago, I declared both safety and diversity, equity, and inclusion (DEI) business imperatives. We introduced Shawmut and our network to the concept of safety of the entire person—expanding

the notion of safety beyond physical to incorporate psychological and mental health. To create accountability and drive progress, our executive leadership team has safety and DEI efforts as goals and KPIs.

Lead by Example

New programs are only as strong and successful as the support behind them. Leaders need to address mental health stigmas head-on, lead by example, and model self-care and work-life balance. Being cognizant of energy drains and managing teams’ energy levels to help them thrive is a responsibility and goal for our leaders—they’ve undergone training focused on how to avoid or manage burnout.

Transparency is also key—as an employee-owned company, we share DEI and safety initiative progress, celebrating successes while highlighting areas of work. This creates a sense of ownership and shared responsibility, opening channels for grassroots initiatives.

Operationalize the Work Core to creating an inclusive workplace is providing an environment where

people feel safe opening up about their struggles—without blame, stigma, or judgment. It needs to be integrated into the fabric of a company. We now have mental health included in all meetings and during our new hire orientation; we launched an Inclusion Learning and Awareness Plan with trainings on how to understand and interrupt unconscious biases.

Provide Accessible Mental Health Benefits

At Shawmut, we have an intentional benefits strategy designed to support mental health and nurture wellness. This starts with our strong healthcare package, ample vacation and holidays, flexible work arrangements, and summer Fridays. Our mental health support includes well-being webinars, services for emotional and mental health support, and a confidential and free Employee Assistance Program available 24/7 that offers short-term counseling and referrals.

An effective approach to mental health is critical—it allows everyone to bring their best selves to work each and every day, which leads to a strong and successful business.

– Les Hiscoe CEO of Shawmut Design and Construction

“Employee health is business health. Engaged, supported, energized employees make world-class companies.”

BIG EVENTS ADD TO THE CITY’S REPUTATION AS THE WORLD’S PREMIER CULTURAL DESTINATIONLITTLE AMAL WALKS showcased a puppet of a young Syrian refugee representing human rights ALAMY

As attitudes toward new housing projects shift rapidly, Manhattan borough president crowdsources site ideas

BY NICK GARBERManhattan Borough President Mark Levine recalled that when he rolled out a list of 171 sites across the island where he thinks new housing should be built, he braced for “a NIMBY backlash.”

Instead, not only did his January plan get little pushback, but it was met with an enthusiastic response from his constituents, dozens of whom reached out proactively to

the initiative with a survey that asks residents to submit sites of their own. His sta ers will then review the suggestions, home in on promising locations and, ideally, start conversations with the landlords who own them—or the city agencies that control them, in the case of public land.

e project ips the script on typical land-use battles in which a developer proposes a project and is met with resistance from neighbors. Levine said he hoped to essentially put that process in reverse, putting residents in the driver’s seat.

gued.

“Community boards get a bad rap,” she said. “Asking the people who live and work here, and having bottom-up solutions, are the most successful solutions. You have automatic buy-in; you have automatic advocacy.”

Too much input?

suggest low-rise lots in their neighborhoods that could accommodate more apartments. To Levine, it was further evidence of the rapidly changing attitudes toward new development, as more New Yorkers become aware of the extent of the city’s housing shortage.

“It’s a marker of just how far the conversation has moved even in the last 12 months,” Levine said in an April 14 interview. “ ere’s just an acute, painful awareness of the a ordability crisis in Manhattan.”

Aiming to tap into that enthusiasm, Levine’s o ce is expanding

Tammy Meltzer, who chairs Lower Manhattan’s Community Board 1, is among those who contacted Levine’s o ce with ideas—such as the long-empty lot at Washington and Carlisle streets in the Financial District. at Meltzer came forward to demand more housing might seem like a reversal, given that her board has fought to block a long-stalled, partly a ordable apartment tower near South Street Seaport.

But Meltzer said there is no inconsistency, because Community Board 1’s opposition to that 250 Water St. project is based largely on its compliance with city landmark laws. Giving neighbors early input would avoid those pitfalls, she ar-

at formulation may not appeal to some development advocates, who argue that the cause of most cities’ housing shortages is too much public input, not a lack of it.

Promisingly, though, some of the Manhattanites who have already reached out to him, Levine said, are the same people who had come out against recent rezoning proposals.

Levine himself, who has opposed various developments, acknowledged that his own views on housing supply have changed in recent years.

He recently advocated reviving the failed One45 rezoning in Harlem, and he has pushed for lifting a state-imposed density cap, even as other Manhattan lawmakers want to keep it in place.

Other resident-submitted sites that Levine’s o ce is reviewing in-

clude the 3-story federal building next to the Staten Island Ferry Terminal and a city-owned parking lot within the New York City Housing Authority’s Lower East Side II complex, where tenants had already been calling for housing to be built.

e sites identi ed by Levine’s own sta span the borough, from

an unused auto shop in Inwood to a 2-story commercial building near Wall Street. Most of the 171 sites would require zoning changes for signi cant housing to be built there—although Levine’s o ce named whole neighborhoods, such as Morningside Heights and the Garment District, where major rezonings could result in thousands of apartments.

“We want to get beyond the way we’ve dealt with housing creation historically, which is waiting for someone to come forward with a proposal and then having a big ght about it,” Levine said. “We want to turn that on its head.” ■

Developer lands $150 million construction loan for massive project at 4650 Broadway in Inwood

BY EDDIE SMALLArden Group has landed $150 million in nancing for a major mixed-use project in Inwood.

e developer received the construction loan from Banco Inbursa for its 19-story project at 4650 Broadway. e development will include 222 residential units on the fourth through 19th oors, 30% of which will be a ordable housing,

and 20% for people earning 130% of the area median income, or about $173,000 for a family of four. e brand of charter school and grocery store haven’t been determined yet, and Arden said it is talking to medical o ce rms about taking space as well.

Méridien Central Park hotel at 120 W. 57th St. and has projects in several other states, including Pennsylvania, Texas, Florida and California.

Rezoning support

along with an 80,000-square-foot charter school, 111 parking spots and 38,000 square feet of retail, including about 15,000 square feet for a grocery store.

e a ordable units will be split between 10% for people earning 70% of the area median income, or about $93,000 for a family of four,

e building, located by Sherman Avenue near Fort Tryon Park, should be ready for residents to move in by the summer of 2024. Its total estimated cost is about $300 million, according to Arden Group. It is being built under the controversial and now-expired 421-a program, which gave developers a tax break in exchange for including a ordable housing in their projects.

Newmark’s Jordan Roeschlaub, Dustin Stolly and Chris Kramer represented Arden Group in the deal for the construction loan.

Arden Group bought 4650 Broadway in 2019 for $54 million, property records show. e Philadelphia-based rm also owns the Le

e city passed a rezoning of Inwood in 2018 under former Mayor Bill de Blasio, but a state Supreme Court judge annulled it the following year, arguing that the city did not examine its potential socioeconomic impact thoroughly enough. However, the ruling was reversed on appeal, and the rezoning was allowed to proceed after the state’s highest court declined to hear a case that could have overturned it.

Arden’s project is not happening directly because of the rezoning, but the rm is a strong supporter of it, according to Justin Gardinier, managing director of asset management for the company.

Other companies planning projects in the neighborhood include Joy Construction and Maddd Equities, which are working on a more than 600-unit development, and Taconic Partners, LMXD and MSquared, which are working on a more than 700-unit project. ■

“THERE’S JUST AN ACUTE, PAINFUL AWARENESS OF THE AFFORDABILITY CRISIS IN MANHATTAN”LEVINE (right) launched a survey asking his constituents to suggest sites where housing could be built. THE LOW-RISE FEDERAL BUILDING on South Street, near the Staten Island Ferry Terminal, is among the places that Manhattanites have said could accommodate more housing.

THE DEVELOPMENT IS BEING BUILT UNDER THE CONTROVERSIAL AND NOWEXPIRED 421-A PROGRAMWILLIAM ALATRISTE/NYC COUNCIL MEDIA UNIT

A New York tax subsidy for local news outlets to hire reporters would pay off for democracy

New York politicians have rarely met a tax subsidy they didn’t like.

Madison Square Garden, one of the most lucrative properties in the United States, hasn’t paid property taxes in 40 years. e cash- ush TV and lm industries are heavily subsidized to shoot in New York. Micron, the semiconductor chip manufacturer, is receiving a public subsidy far greater than what was promised to a potential Amazon headquarters in Queens.

Generally, tax breaks for wealthy corporate actors represent poor public policy. It’s rare that the business generates enough economic activity to make up for the fact that local and state governments can’t collect a standard tax. When states indulge in corporate welfare, such as Gov. Kathy Hochul’s taxpayer handout to the billionaire owners of the Bu alo Bills for a new stadium, the public loses.

and Hochul tussle over a new budget—now weeks late—it’s plausible the tax break for local media outlets could become law.

Should it? e answer at this point is yes. In an earlier age there were real concerns over whether public funds should be used to support the news media, given the watchdog role the press is supposed to play. If Albany is partially funding a newspaper that covers the Legislature, could it still do its job? Would coverage of the governor be compromised?

ROSS BARKANAll of these questions are fair, but they ignore a long tradition of public support for the news in the United States and beyond. Both NPR and PBS receive federal funding and neither functions as propa-

is a public good that needs public support.

Thriving misinformation

ere’s one taxpayer subsidy moving through Albany, though, that should be strongly considered. e proposal would provide a tax credit to subsidize media outlets hiring of reporters, up to $50,000 per person, and would have a veyear expiration. As state lawmakers

ganda organs for whichever president or Congress is in power.

National subsidies for the news industry are far greater in Europe.

e reasoning is simple: e news

e real crisis of democracy in the U.S. has little to do with gerrymandering or the return of Donald Trump. Rather, it’s the rapid erosion of reliable news sources. Until the 21st century, print advertising was a dependable business model that allowed for small towns, cities and counties to have their own media outlets that reported on local government and business. ese local newspapers were far from perfect—well-heeled advertisers could, at times, control coverage— but they o ered professional, regular accounts of what was happening in a given locality. at world, in the internet era, is fast disappearing. Misinformation thrives. e digital ad market, dominated by Facebook and Google, can never replace what was lost with print. Prestigious outlets or those with niche audiences can survive with paid subscribers and events, but local news can’t hope to hoover up enough paying readers to make their businesses fully sustainable. ey need taxpayer help. Otherwise, they will die.

at’s the ultimate di erence between a tax credit for news and one that supports the lm industry or a new Bills stadium. NFL owners and studio executives oversee thriving businesses that don’t need public bailouts. Local news is another matter. Democracy cannot in the long term function if there isn’t a healthy media to hold power to account.

Quick takes

● It’s been 100 years since New York broke ground on a subway tunnel that was supposed to connect the Brooklyn R train to Staten Island. e project, which wouldn’t

be especially costly, should be revived—a Staten Island subway would dramatically cut down on automobile congestion in and out of the borough.

● e governor successfully nominated Rowan D. Wilson, a well-regarded liberal who already sits on the Court of Appeals, to be the chief judge of the state’s highest court. is time Hochul listened to the state Senate, which easily approved Wilson last Tuesday, as opposed to her failed ght to make Hector LaSalle the chief judge. ■ Ross Barkan is a journalist and author in New York City.

“THE REAL CRISIS OF DEMOCRACY IS THE EROSION OF RELIABLE NEWS.”

REBRANDING CRYPTO

After hosting the crypto party, New York is in the middle of the cleanup

The state is a key battleground in the legal and regulatory showdowns to come after a tumultuous year for the industry INSIDE

BY RYAN DEFFENBAUGHThe wild crypto party was loudest in New York in November 2021.

A single Bitcoin, the world’s most popular cryptocurrency, cost a record $65,000. Thousands of people gathered around Times Square for NFT.NYC, an industry conference The New York Times called “crypto Coachella.” Local crypto-focused startups were on the way to raising $6.5 billion from investors that year—the most of any U.S. region. Incoming Mayor Eric Adams pledged to make the city a crypto capital.

Then came the crash.

The so-called crypto winter last year wiped $2 trillion from the total market value for cryptocurrencies and ended with the bankruptcy of FTX, a global exchange that investors had valued at $32 billion at the start of 2022. Investor dollars froze, and layoffs hit city-based startups that had risen to multibillion-dollar valuations just months earlier, such as crypto exchange Gemini and nonfungible-token marketplace OpenSea.

Before the crash, for five years crypto had been the fastest-growing subsector of local startup creation, according to the Center for an Urban Future think tank.

Now 2023 is shaping up to be the year of the crypto crackdown. Federal and state financial regulators have launched legal fights with the world’s largest crypto ex-

changes, and lawmakers in Congress and statehouses across the country have promised to act.

Crain’s spoke with lawmakers, regulators, business leaders, consumer advocates and lawyers to get a sense of what’s next for the industry, which once envisioned itself displacing traditional finance.

As the dust settles from the crypto crash, a debate has begun on how regulators can hold bad actors accountable and offer a path forward for the industry.

Top cr ypto companies are warning that an ongoing crackdown at the federal level could push the industry’s future overseas. New York—the first state to regulate the crypto industry—is a key battleground in the legal and regulatory showdowns to come. State Attorney General Letitia James has sued crypto companies she says are violating New York’s investor-protection laws. The Department of Financial Services, a powerful state banking regulator, has expanded its staff of industry inspectors and has new powers to bill companies for inspections.

The ‘OG regulator’

New York’s scrutiny of the crypto world started early. Bitcoin was just five years old in 2014, and one coin cost

See CRYPTO on page 14

CLYDE VANEL Crypto requires novel guardrails due to its unique challenges

Page 18

MARIA T. VULLO

States must protect their turf in policing crypto alongside the SEC Page 18

REBRANDING CRYPTO

CRYPTO

FROM PAGE 13

less than $1,000, when New York’s top banking regulator convened a set of hearings on how the state could address the new blockchain-based virtual currency.

Rules were needed to assure customers that money “they entrust to virtual currency companies won’t get caught in a virtual black hole,” Benjamin Lawsky, a former DFS superintendent, said at the hearing.

Out of that process came the BitLicense, a required credential for companies that want to facilitate crypto transactions in New York. Among its requirements are regularly audited nancial statements, capital reserves and systems to thwart money laundering.

A backlash ensued almost immediately. More than a dozen companies stopped operating in New York, calling the state review process and its requirements too slow and onerous for their new, fast-moving industry. But companies including Coinbase and the Winklevoss twins’ Gemini soon signed on. Coinbase is now the largest U.S.-based crypto exchange. e state Department of Financial Services has granted 33 separate BitLicenses or a charter to hold digital assets to operate virtual currency businesses.

“New York was out there when others were not doing anything to at least provide a regulatory framework to protect consumers of those businesses,” said Maria Vullo, who was DFS superintendent from 2016 to 2019. “Regulation can allow good businesses, who want to be regulated, to do better.”

As the federal government has struggled to clearly regulate the industry, New York’s role as the “OG crypto regulator” positions it to in uence the next generation of rules in the space, said Matt Homer, an early-stage tech investor and a former deputy superintendent at the DFS, where he focused on digital assets.

Homer said New York has a “strong blueprint” for how companies can o er stablecoins—a type of cryptocurrency typically pegged to traditional assets. e rst crypto-related bill that Congress is reviewing this year focuses

on stablecoins, and DFS Superintendent Adrienne Harris was billed as a top witness at an April 19 hearing.

Rebuilding trust

New York’s crypto rules have plenty of critics, who say the regulations disadvantage startups in favor of larger players that can a ord the compliance costs. Mayor Adams, who famously converted his rst paycheck into crypto, called for the state to do away with the BitLicense last year.

But the series of bankruptcies and investor losses—including FTX’s Chief Executive Sam Bankman-Fried, who is charged with a billion-dollar fraud—has changed the conversation. Although crypto in its early days was an industry with a libertarian outlook, most industry players today say there is need for regulation, with a wide range of opinions on what it should look like.

“You don’t have to know anything about how the blockchain works, but you read the headlines of what has happened with various companies in this space and it does not increase trust,” said Marc D’Annunzio, general counsel for Bakkt, a crypto rm spun out of the New York Stock Exchange’s parent company.

A Pew Research Center survey conducted in March found that 75% of Americans who have heard of crypto are not con dent about its safety and reliability.

Bakkt, which provides infrastructure for other companies to o er bitcoin trading, acquired a New York trust charter in 2019 and a BitLicense in 2021—important credentials in earning customer con dence, D’Annunzio said.

“Consumers and partners alike,” he said, “have gotten a lot savvier in this time and are asking, ‘Hey, you say you are doing this the right way. How can I know that?’”

New York model

e state rules have held up well under the stress of crypto winter, said Harris, who took over the role in September 2021.

“If you step back and say, ‘What does good regulation look like in a fast-moving innovative space that has a lot of risks?’ … You would come up with what we’ve put in place in New York,” Harris said at an April 11 event hosted by the Association for a Better New York. While New York–regulated rms have not been entirely spared from the FTX fallout, Harris has noted in several speeches that FTX’s American subsidiary was never approved to operate in the state. Other crypto rms that went bankrupt, including Celsius and Voyager, also were not licensed in New York.

ere is still the issue of the cost and time to get the license for companies that want to work with the state. Lowering the barrier to entry in the New York market could “allow good actors in the crypto and blockchain space to safely develop projects that provide meaningful bene ts to New Yorkers,” said John Olsen, New York state lead for the Blockchain Association, an industry lobbying group.

e state has attempted to improve the cryp-

to review process, in part by hiring more than 50 employees focused on digital assets, according to a number provided by a department spokesperson.

e state crypto rules also have allowed it to require changes at companies through enforcement. e department reached a $100 million settlement with Coinbase in January for, the DFS said, falling short of the state’s anti–money laundering requirements. Coinbase said in a blog post that the dustup showed how the industry can work with regulators.

e state regulator’s rst crypto enforcement came six months earlier through a $30 million ne against Robinhood’s virtual currency unit.

Outside of BitLicense rules, state lawmakers in the current session are considering bills that would add certain types of crypto scams to the penal code and require greater disclosures in the advertising of crypto products. Assemblyman Clyde Vanel, a Queens Democrat generally supportive of the industry, is sponsoring both proposals.

“It is important to have a steady hand,” Vanel said. “How do we make sure we have the proper guardrails to provide not just protection for consumers and investors but to provide the space for the industry to grow in New York?”

e state Senate banking committee is holding a hearing April 25 to discuss crypto and other types of ntech.

e Attorney General’s O ce, meanwhile, has sued crypto companies that James says are violating New York’s existing investor-protection laws. e most recent lawsuit was led in early March against KuCoin, the world’s fourth-largest crypto exchange. James also has warned

New Yorkers about the risks of investing in crypto. Under siege

As Harris has taken enforcement actions against crypto players, she has cast herself as supportive of the industry’s future in New York. She was not made available for an interview for this article, but a spokesperson said the superintendent’s “priority is to ensure that New York remains the global center for nancial services while providing a robust supervisory framework that encourages responsible innovation and protects consumers.”

In Harris’ testimony to Congress on April 19, she defended the state’s turf regulating the industry, saying federal legislation that preempts state rules would “hamper state regulators’ ability to respond nimbly to a changing nancial system.”

While acknowledging the “signi cant risks of virtual currency,” she said the industry “needs clarity on how to develop innovative products in a responsible and compliant manner.”

at’s likely a welcome sentiment for an industry that sees itself as under siege from the federal government. A March report from the U.S. Council of Economic Advisers called cryptocurrencies “largely speculative investment vehicles” that “are not an e ective alternative to at currency.” Federal regulators and crypto companies are battling over the industry’s future. Gary Gensler, who chairs the U.S. Securities and Exchange Commission, has said most cryptocurrencies outside of Bitcoin are securities that must play by the same rules as stocks and other invest-

REBRANDING CRYPTO

ments overseen by his agency. e SEC has launched a series of lawsuits against crypto companies it says are not complying with securities law. Crypto’s “noncompliance not only puts investors at risk but also puts at risk the public’s trust in our capital markets,” Gensler said during a House committee oversight hearing this month.

Industry leaders argue that instead of laying out a clear set of rules, the SEC is taking a punitive approach. Coinbase, after receiving a notice in March that the regulator is planning legal action, published a blog post titled, “We asked the SEC for reasonable crypto rules for Americans. We got legal threats instead.”

Last month’s government takeover of Midtown-based Signature Bank—led by the DFS—has fed into the view that the industry is being frozen out. Signature was one of the top banking partners for crypto companies. Barney Frank, a former congressman who served on Signature’s board, said the shutdown was designed to send other banks an “anti-crypto” message.

Harris was questioned about the shutdown during the House hearing on April 19, and said it was a “misnomer” that the shutdown was related to crypto, calling it instead a “new-fashioned bank run.” Congress could set guidelines for the industry, but previous attempts have stalled. Last year Sen. Kirsten Gillibrand, a Democrat from New York, co-sponsored the Responsible Financial Innovation Act, which is described as creating the federal government’s rst “complete regulatory framework for digital assets.” It was criticized as being too industry-friendly, though, particularly in giving more crypto oversight to the Commodity Futures Trading Commission over the SEC, which has greater resources and a stronger investor-protection mandate. Gillibrand told Crain’s in a statement that she and her co-sponsor, crypto-owning Republican Sen. Cynthia Lummis of Wyoming, are working on a new version of the bill. ey both still see an “urgent need” for regulation, Gillibrand said.

“Our updated bill will have even stronger consumer protections,” she said. “We are continuing to work with federal and state regulators, lawmakers, businesses and consumer advocates to ensure we release the strongest bill possible.”

Meeting muster

With a divided Congress, passing any new crypto laws could prove di cult. But Harris’s appearance on Capitol Hill is the latest sign of New York’s in uence on federal regulation.

“I think this year we will hopefully start to see a bit more clarity from the federal level to create that level playing eld,” said omas Hook, U.S. chief compliance o cer for BitStamp, a Europe-based exchange that was one of the rst to receive a BitLicense. “ e New York BitLicense and [the DFS] will continue to be a standard-bearer for state-level requirements and hopefully be a voice to in uence what comes at a federal level.”

Other states—including New Jersey and Illinois—are considering their own version of a crypto-speci c license this year. California lawmakers approved a similar law last

year, but Gov. Gavin Newsom vetoed it.

“An advantage of going to a state that has strong rules is the hope that, if you can meet the muster in that state, you’d also meet federal rules as well,” said Mark Bini, a former federal prosecutor and now a partner with law rm Reed Smith’s crypto and digital assets group. e major question about cryptocurrencies—what makes a token a security or commodity—will be left to federal regulators or lawmakers (or perhaps the courts) to decide. But the principles of the BitLicense—including its rules for holding assets, preventing money laundering and cybersecurity protections—“if applied at the federal level, those are a good start,” said Mark Hays, a senior ntech policy analyst at Americans for Financial Reform, a consumer group that has called for crypto companies to comply with existing investor-protection laws.

What’s next?

Despite the recent turmoil, crypto values are beginning to rise again. Bitcoin reached $30,000 on April 11, up 80% from the start of the year, although still cut in half from 2021’s high point.

Large nancial institutions continue to move in the space. Nasdaq plans to launch a crypto custody service, which would be regulated in New York. Fidelity Investments expanded crypto trading last month to all retail investors.

Max Galka, chief executive of Elementus, a blockchain data startup in the Flatiron District, said the past year has brought a necessary shakeout in the crypto world. Elementus’ software helps companies analyze blockchain transactions. Despite a frigid startup investment climate, it raised $10 million from venture investors in February.

Not everyone will be a “Bitcoin maximalist,” Galka said, and future adoption could be helped by large institutions that add blockchain technology. at could be good news for Adams’ bruised vision of New York as a crypto capital.

“As the space institutionalizes, New York is the center for the nancial sector,” Galka said. “So I think a lot of the next wave of adoption of crypto is going to be coming from New York.” ■

Nov. 11, 2022: FTX, once valued at $32 billion, les for bankruptcy protection.