Flatiron property sells for $161M at auction, ending a strange saga

BY C. J. HUGHES

For the second time in two months, the famous Flatiron Building has sold. But this time the winning bidders are familiar faces around the wedge-shaped landmark.

A group led by Je Gural’s GFP Real Estate, which already controls a majority of the downtown o ce

building, beat out four other rivals in a May 23 auction with a $161 million bid.

It’s the second auction since March for the Fifth Avenue property, which has been convulsed by in ghting among its owners and had to be sold on the orders of a judge. At the rst auction, a low-key investor from Virginia named Jacob Garlick, virtually unknown in New

York real estate circles, scored the win with a $190 million bid. But Garlick never paid his 10% deposit, or $19 million, killing the deal.

“I feel good, truthfully,” Gural said shortly after the gavel banged down on a podium outside a Lower Manhattan courthouse just before 3 p.m. “I really didn’t know how it

THE LIST New York’s Largest Publicly Held Companies PAGE 10

GIG Squire app helps hair salons and barbershops better manage admin work PAGE 39 VOL. 39, NO. 21 © 2023 CRAIN COMMUNICATIONS INC. CHASING GIANTS Startup wants to make electric vehicles more accessible to city dwellers PAGE 3 CRAINSNEWYORK.COM | MAY 29, 2023

GOTHAM

REAL ESTATE BUCK ENNIS BUCK ENNIS

GREENER

Owners and managers share strategies for slashing greenhouse gas emissions to comply with Local Law 97 PAGE 15 PLUS The most pressing questions about Local Law 97 PAGE 19 INSIDE Company’s ‘Cozy’ device covers radiators and can reduce a building’s heating cost by 45% PAGE 18

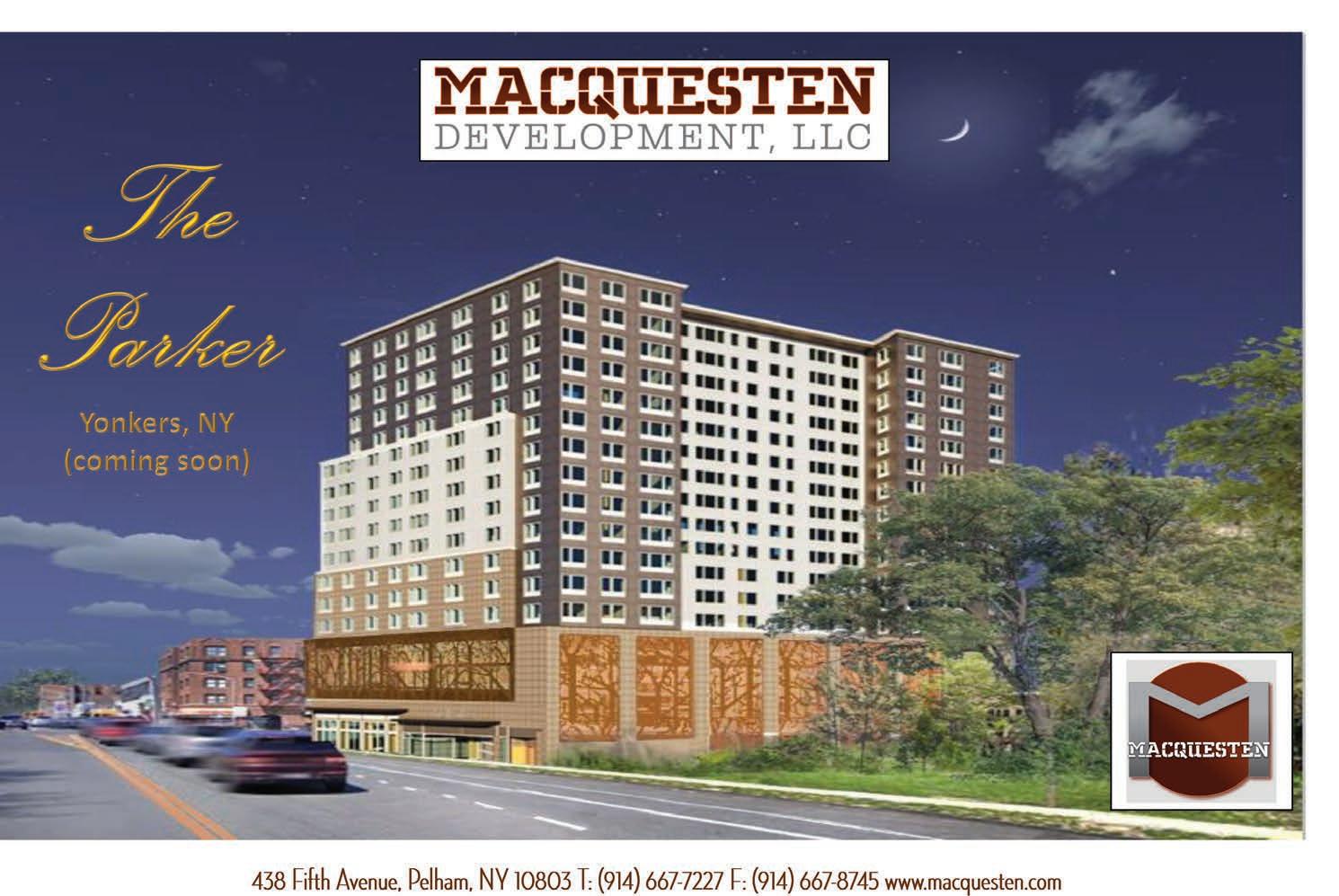

A GROUP LED BY Jeff Gural (holding No. 25) beat out four other rivals with its $161 million bid. See FLATIRON on page 37

BUILDINGS

GENESIS REALTY GROUP PRINCIPAL JAC ZADRIMA walks through solar panels on the roof of one of his Bronx apartment buildings.

City’s mental health response unit responded to only 16% of calls, new data shows

BY JACQUELINE NEBER

The city’s Behavioral Health Emergency Assistance Response Division continues to reach just a small portion of redirected 911 calls, 16%, according to data released by the city on May 24.

The goal of the program, known as B-Heard, is to deploy mental health professionals from the New York City Fire Department and mental health workers from New York City Health + Hospitals to scenes where an individual is experiencing a mental health crisis, instead of police.

Of the more than 13,000 mental health calls made to 911, just over 2,000 received a B-Heard response during July and December 2022.

people present imminent harm to themselves or others, or calls where EMS workers do not have enough information to assess harm risk. To that end, the teams reached 53% of eligible calls.

Both figures represent a downward trend from the last time the city shared data about the program’s reach. During the year prior, New Yorkers made 11,000 mental health 911 calls, 22% of which were routed to B-Heard. Teams from the pilot program, which launched in June 2021, were deployed to 73% of eligible calls for the period between July 1, 2021, and June 30, 2022.

However, not every mental health 911 call is eligible for a B-Heard response. According to the city, typically the program does not respond to calls that require immediate transport to a hospital, calls where

EVENTS CALLOUT

JUNE 13

DIVERSITY & INCLUSION BREAKFAST

Crain’s Third Annual Diversity and Inclusion Awards event will feature a live unveil of our 2023 D&I Awardwinning companies and individuals, as well as a keynote speech from Carla Harris, senior client adviser at Morgan Stanley and recipient of our Lifetime Achievement Award.

DETAILS

Time: 9:00 a.m. to 11:00 a.m.

Location: 180 Central Park S. CrainsNewYork.com/D&I2023

The most recent data, which speaks to the third and fourth quarters of 2022, shows that 39% and 42% of people per quarter, respectively, who were assisted by B-Heard teams were helped onsite with de-escalation, counseling services or a referral to community-based care. Meanwhile, 12% and then 7% of people were transported to a community-based health care or social service location, while 49% and 51% were taken to the hospital.

Fewer people were taken to the

hospital in these quarters than in the first year of operation, while a greater number of New Yorkers were assisted on-site.

Increased need

B-Heard launched in Harlem before expanding into parts of the Bronx, Brooklyn and Queens, and it is set to grow to cover the rest of the Bronx and other high-need neighborhoods. Since the program began, teams have consistently responded to an increasing number

of quarterly calls, with one exception in the first quarter of fiscal 2023, as the pilot expands to new neighborhoods.

In B-Heard’s first year of operation, the teams logged an average response time of 15 minutes and 30 seconds, almost two minutes slower than their average response time in the program’s first six months. The city has removed the response time metric from the data report.

In April Mayor Eric Adams announced the fiscal 2024 budget

would include $27 million in additional funding to expand the B-Heard program, but some representatives from the city agencies that coordinate the pilot were unclear in City Council hearings two weeks ago on how that money would be used to grow the pilot. The funding represents 68% of the city’s $40 million earmarked to address mental health in the city.

Joint effort

The program is a joint effort between the Mayor’s Office of Community Mental Health, New York City Health + Hospitals, the city Department of Health and Mental Hygiene, the New York City Police Department and the New York City Fire Department.

According to the Fire Department’s council committee hearing report, the fiscal 2024 funding for the program includes “an additional $26.9 million” and “a baseline addition of $24.5 million in the outyears to support increasing the program’s coverage to 25 precincts.” The funding will also add 64 positions to support the program’s expansion to south Brooklyn and western Queens, the report said. Crain’s has reached out to the mayor’s office of community mental health, H+H, FDNY, NYPD and the city Health Department. ■

For the first time, Manhattan edges out San Francisco in new early-stage startups

BY CARA EISENPRESS

Silicon Alley lives!

The borough of Manhattan has the largest number of earlystage startups in the U.S. for the first time, besting San Francisco, the longtime center of startup activity, over the 12 months ending March 31, according to data from Carta, a San Francisco-based equity management platform for startups.

There were 543 companies based in Manhattan that raised a seed or series A round between March of 2022 and March of 2023, according to Carta. During the same period, 486 San Francisco-based companies raised either of these earlystage rounds.

“Most of that is actually concentrated between Soho and Flatiron, a walkable stretch of 1.5 miles,” tweeted Shai Goldman, a New York employee for San Francisco-based financial management software firm Brex; Goldman helps build

founder communities in New York.

Goldman was nodding at one of the features that has set New York apart from its competition—being a dense, culture-rich city where tech workers want to live.

Carta’s figures are broken down by county, not region, and in total, the four Bay Area counties on its list still beat out the two included in New York, Kings and New York counties. Kings, or Brooklyn, had 101 companies that raised series A or seed rounds in the period.

New tech center?

Manhattan startups raised only $3.6 billion, Carta found.

$3.6B

Still, the data about early-stage companies rings true with the anecdotes of New York City’s enthusiastic tech leaders, who have noted that the city has felt like the center of the American tech universe for more than a year, especially as city life has come back from pandemic closures in the Big Apple. Even work-from-home trends seem to be working for New York, as tech employees elsewhere use their big salaries to make a move to Manhattan.

The name Silicon Alley was aspirational in the 1990s when early tech boosters coined the term. For decades following, the going wisdom for founders and engineers remained the same: go West for tech opportunity. Even after a slew of tech-enabled consumer-products companies found success in the 2010s, California remained the place to be for would-be software disrupters.

Overall funding in the San Francisco area is still more than twice the amount that is deployed in New York City, and both cities have seen extreme funding dips since 2021. The startups that raised seed or series A in San Francisco raised $4.3 billion in total in the year in question, while the 543

“There was a concern that location doesn’t matter anymore, and that wouldn’t be great for Manhattan,” said Alexander Rinke, co-CEO of Celonis, one of the largest private tech companies in New York. “I think that’s not the case,” he said, adding that team members spend a lot of time at Celonis’s 1 World Trade Center offices.

By 2016, when Rinke was scouting cities for the U.S. headquarters of Celonis, which he co-founded in Munich, Germany, he said that New York City didn’t seem like such an obvious place to build. He liked the diversity of the employers and noticed the momentum, especially among smaller startups scaling up.

“We haven’t regretted it,” he said of building the American business from the city. “It’s an amazing place to grow a company in the tech space.” ■

2 | CRAIN’S NEW YORK BUSINESS | MAY 29, 2023 Vol. 39, No. 21, May 29, 2023—Crain’s New York Business (ISSN 8756-789X) is published weekly, except for no issue on 1/2/23, 7/3/23, 7/17/23, 7/31/23, 8/14/23, 8/28/23 and the last issue in December. Crain Communications Inc., 685 Third Ave., New York, NY 10017. Periodicals postage paid at New York, NY, and additional mailing offices. Postmaster: Send address changes to: Crain’s New York Business, Circulation Department, 1155 Gratiot Ave., Detroit, MI 48207. For subscriber service: call 877-824-9379; fax 313-446-6777. $140.00 per year. (GST No. 13676-0444-RT) ©Entire contents copyright 2023 by Crain Communications Inc. All rights reserved.

HEALTH CARE

TECHNOLOGY

AMOUNT RAISED by 543 Manhattan startups

The B-Heard program is set to expand next year and receive $27 million in additional funding

OF THE MORE THAN 13,000 MENTAL HEALTH CALLS MADE TO 911, JUST OVER 2,000 RECEIVED A B-HEARD RESPONSE

BUCK ENNIS

A HIGHER PERCENTAGE of people were assisted by B-Heard teams on-site in the last six months of 2022 than in the pilot’s first year of operation.

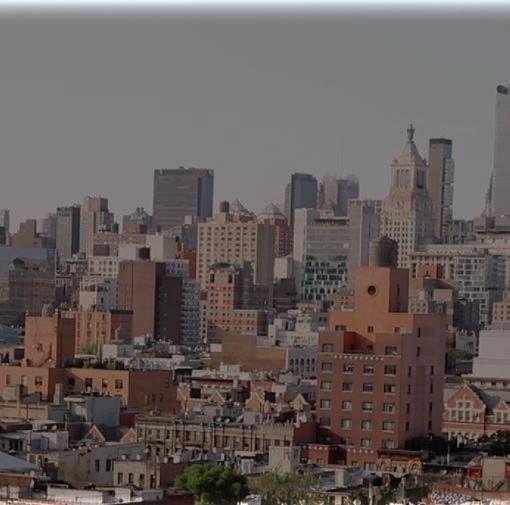

Itselectric wants to make EVs more accessible to city dwellers

The Brooklyn Navy Yard startup will share revenue with building owners

The upstart: Itselectric

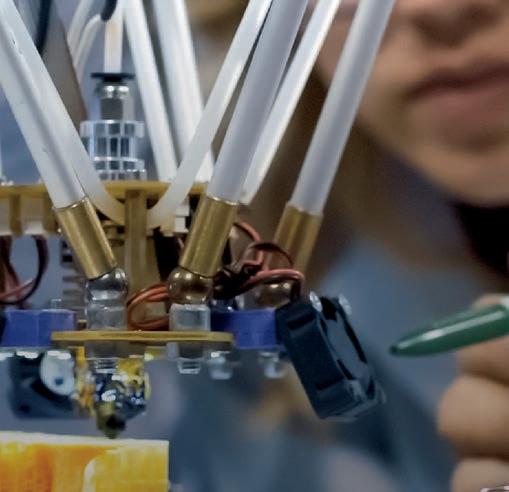

Like many New Yorkers, Nathan King and Tiya Gordon considered buying a car to provide safe transportation for their child during the pandemic. And to avoid polluting the city, they wanted to buy an electric vehicle. is, however, proved impossible. e couple lives on the bottom oor of Crown Heights brownstone where there is no place nearby to charge a car. eir quandary, however, inspired an idea—a new model for electric vehicle charging stations aimed at city neighborhoods where no one has a driveway or a garage to house a charger.

New York City aims to have 10,000 curbside electric vehicle chargers installed by 2030 to make the process convenient for the roughly one million residents who park their car on the street. It currently has roughly 100.

King and Gordon’s startup, Itselectric, aims to provide those chargers by employing a unique revenue share model that partners with property owners.

e company, based in the Brooklyn Navy Yard, says it can install one of its small chargers in front of pretty much any building in the city—residential or commercial. It runs a cable a few inches under the sidewalk and plugs into the property's existing electrical connection.

Itselectric pays for the equipment and installation. When vehicle owners pay for a charge, the startup shares the resulting revenue with the property owner.

Gordon, the company's chief operations o cer, estimates that given a 20% utilization rate, a single charger will generate about $1,000 a year in revenue for a property owner.

e company, which recently closed on a $2.2 million preseed round, hopes to have 100 chargers installed by the end of the year. It just installed the rst six, at the Brooklyn Army Terminal in Sunset Park and at Steiner Studios in the Brooklyn Navy Yard though a partnership with partnership with Hyundai Cradle and the city's Economic Development Corp. “Only 94 to go!” says King, the CEO.

The reigning Goliath: ChargePoint

Campbell, California-based ChargePoint, founded in 2007, provides electric vehicle charging to both businesses and homeowners. It maintains 225,000 active charging ports

across North America and Europe. Its annual revenue for the scal year ending January 2023 topped $468 million.

How to slay the giant King and Gordon met as students at Parsons School of Design in the late ’90s. By the time they got their startup idea, they had married, and King was an architect at a prestigious rm, specializing in large urban projects. Gordon was a design operations veteran. While neither knew anything about startups, King took a leap and quit his job. Gordon characterizes the move as “terrifying.” ey were risking their careers at the height of the pandemic.

“However, at the same time, right in front of us, there for the taking, was this idea,” she says. “And along with it, the chance to seize a once-in-alifetime opportunity to make a huge impact in the ght against the climate crisis. We had to go for it.”

Early indications provided some reassurance that they weren't crazy. eir rst step, in the fall of 2021, was to nd an industrial design rm willing to help them create an electric charger small enough for a city sidewalk.

“A lot of these companies won’t work with you unless you can give them a contract for hundreds, if not thousands, of units,” says Gordon. “We were like, ‘Well, we need one prototype, and we don't have a website.’ ”

But on the strength of their idea, they hooked up with a big design rm that has partnered with local governments, including New York City, to create urban street furniture.

e founders initially funded their business with small checks—typically $2,000 to $5,000—from professional contacts who liked their idea. In February 2022 they were accepted into a climate-focused startup accelerator program which provided another $100,000 in funding. ey sank nearly all their early funding—roughly $250,000—into the prototype. (It will cost about $2,800 to manufacture a market-ready charger).

Knowing they'd need to partner with cities to install curbside chargers, they cold-called potential advisers who could guide them. ey quickly teamed up with one of the original Citi Bike founders, along with Michael Replogle, a former NYC Department of Transportation deputy commissioner for policy.

It’s been relatively easy to nd property owners eager to have a charger installed in front of their home or business, the

founders say—their current wait list of several hundred potential partners was generated entirely by word of mouth.

La’Shawn Allen-Muhammad, executive director of the Central Brooklyn Economic Development Corporation, says she's excited about the possibility of having several Itselectric chargers installed at a large residential and commercial building, the BVille Hub in Brownsville, that is slated to be completed in 2025. If installed, they would be the rst electric chargers in the neighborhood.

“Typically, communities like Brownsville are 10 years behind when these shifts happen,” she says. “We wanted to be at the forefront.”

e biggest challenge, the founders say, has been fundraising. With no startup experience or business school pedigree, they didn't t the traditional pro le and have endured more than 300 rejections, according to Gordon.

Among their backers is e Helm, a venture capital rm which invests in early-stage, women-founded startups. Lindsey Wood Taylor, founder and general partner at e Helm, says she was attracted to the model's scalability and the startup’s willingness to share revenue with homeowners. “ ere’s a whole democratization piece not just around accessibility, but with sharing wealth and pro t,” she says.

The next challenge

Over the next ve years, Itselectric hopes to serve a large portion of the estimated 40 million U.S. drivers who park their car on the street. But to install their curbside chargers nationally, they’ll need to negotiate agreements with dozens of large municipalities.

Replogle, the former deputy commissioner, says the fact that they are Brooklyn-based and manufacturing their chargers right here in the U.S. will give them a leg up as municipalities look for partners that will help them comply with “Buy America” rules to quality for federal grants. “Some of the other companies are European and might have some challenges with the Buy America requirements,” he says.

ey’re also forging good relationships with key city agencies, he says, "and the pilot they launched at the Brooklyn Army Terminal and Steiner Studios bodes well." ■

Anne Kadet is the creator of Café Anne, a weekly newsletter with a New York City focus.

MAY 29, 2023 | CRAIN’S NEW YORK BUSINESS | 3

BUCK ENNIS

CHASING GIANTS

ANNE KADET

ITSELECTRIC co-founders

Tiya Gordon (left) and Nathan King

Price slashed by 23% at Billionaires Row condo

At $130 million, the unit at 432 Park Ave. is still the city’s third-priciest home

BY C. J. HUGHES

The top-floor unit at 432 Park Ave., one of the tallest apartment buildings in the world, may be starting to come down to earth on price, very relatively speaking.

The full-floor apartment in the skyscraping condo, which has seven bedrooms, nine baths and spans 8,255 square feet, reduced its price last week to $130 million, down from the $169 million it was asking in 2021 before being withdrawn from the market in 2022. The $39 million drop represents a 23% discount. The 96th-floor apartment also has a 93-foot-long great room, a library and a private elevator.

$130M

“The original listing was widely understood to be indefensible while our new price is in line with the market,” Alexander said. But Harry Levin, a New Jersey-based attorney who handled the paperwork for the initial transaction, did not return a call.

Even with the big chop, the Billionaires Row apartment is one of the city’s most expensive. Only two units at Central Park Tower, a new condo building at nearby 217 W. 57th St., are pricier, according to StreetEasy. The penthouse there is listed at $250 million, while a highfloor duplex, No. 107/108, is $175 million.

THE SELLER REPORTEDLY HAS NEVER SPENT ONE NIGHT IN THE APARTMENT

Its seller, Fawaz Alhokair, a Saudi Arabian billionaire whose development company owns nearly two-dozen malls, purchased the unit, No. 96, in 2016 for $88 million. He still stands to make a massive profit if the penthouse were to trade at its current price.

In the past seven years, Alhokair, who also reportedly controls Saudi Arabia’s Gap, Zara and Banana Republic franchises, has never spent one night in the apartment, according to comments that the unit’s listing agent, Tal Alexander, made to The Wall Street Journal last week.

POLITICS

In fourth place is another at 432 Park, No. 79, a five-bedroom apartment asking $92 million.

Elevated interest rates have dragged on the city’s sales market even in the luxury tier, whose affluent buyers may not seem like the types to rely on loans for home purchases. But the business world in general is feeling a sting from higher borrowing costs.

In April, condo and co-op sales in Manhattan plunged 42% year over year, according to research from the firm Douglas Elliman.

The third tallest residential building in the Western Hemisphere at 1,397 feet, 432 Park, which was developed by Harry Macklowe and

CIM Group, has also apparently been plagued by loud noises, broken elevators and flooding resulting from improper construction. In fall 2021, 432 Park’s condo board sued the de-

velopers over the alleged problems.

Twenty-two of the 125 apartments at 432 Park were for sale as of May 19, according to StreetEasy.

Living in Alhokair’s apartment

does not come cheap either. The unit’s monthly costs are $24,012 for common charges and $15,724 for taxes, a total of $39,736, or $476,832 a year. ■

Madison Square Garden can stay put if it makes room for a bigger Penn Station, Manhattan borough president says

BY NICK GARBER

Madison Square Garden should be granted its request for a new operating permit, the Manhattan Borough president said—but only if it shrinks its current footprint to make way for an expanded Penn Station.

Mark Levine’s recommendation, issued May 22, throws cold water on the idea that the Garden could move, which was a key demand by the local community board. Levine, echoing comments by MSG Entertainment executives, said in his recommendation that “no viable alternative site” had ever been found.

“There’s no site that has community buy-in, a willing current property owner, good mass transit, a way to finance it,” he said in an interview.

But Levine said he is “incredibly compelled” by a new plan, gaining momentum in recent weeks, in which MSG would sell its attached

theater and a service road to the Italian developer ASTM, which would in turn demolish them and build a new Eighth Avenue entrance to Penn Station as well as a glassy train hall surrounding the arena. Crain’s reported this month that the two parties were nearing a $1 billion deal.

“It would activate what’s currently a blank wall of a streetscape,” Levine said. “I think it’s an inspiring vision.”

Levine says the new permit should last five years—then be extended indefinitely, as MSG wants, if the Garden works with the city, state, Amtrak and NJ Transit to develop a plan for expanding Penn Station.

Levine’s stance, while only advisory, is a formal step in the city’s monthslong review process for MSG’s new permit request, and could influence the subsequent binding decisions by the City Planning Commission and City Council.

Community Board 5, which had the first say on MSG’s request, recom-

mended denying it a permit last month, unless it develops a plan to move within three years and make way for a fully expanded Penn Station.

‘Narrow opportunity’

The board’s hopes were bolstered by an MSG executive’s February suggestion that the Garden could move across Seventh Avenue to a site controlled by Vornado Realty Trust. But the company later clarified it had no intention to move, unless it were offered billions of dollars in public funding for a new arena.

Explaining why he came down differently than CB5, Levine said the city’s last attempt to tie MSG’s permit to its relocation, in 2013, failed to force the Garden to move. Plus, the city has a “narrow window of opportunity” to remake Penn Station, with relatively friendly faces in the White House, Congress and the U.S. Department of Transportation

who could pitch in funding.

“That might not be true in 18 months,” Levine said. “We’d be taking a big risk if we just sit back and wait. Last time we did that, we lost a decade.”

Layla Law-Gisiko, CB5’s land use chair, said she was not discouraged by Levine’s plan, since it would still task MSG with developing a plan for a better Penn within the decade.

“It’s a big victory against the status quo,” she said.

The new ASTM plan has a central role in Levine’s recommendation, which—while not naming a particular company—would instruct MSG to convert its theater into “a new train hall” along Eighth Avenue. Levine said he knew that the developer was in talks with MSG, and got the sense that MSG was open to the idea.

Skeptics, including Metropolitan Transportation Authority chief Janno Lieber, have called the ASTM idea wasteful, since 70% of Penn Station

riders pass through its east entrance on Seventh Avenue. But Levine points out that nearly 100,000 daily riders still use the Eighth Avenue side, which would make it one of the nation’s biggest rail hubs on its own.

MSG’s application will now head to the City Planning Commission, followed by a decisive City Council vote this summer. Elected officials appear to have learned lessons from 2013, when MSG’s initial 50year permit first came up for renewal. That year, then-Borough President Scott Stringer and the council both demanded that the Garden make a plan to move within 10 years—but it never did so.

Levine, who previously argued for moving the Garden, is not the only one to change his mind in recent months. The leader of the Municipal Art Society, a longtime proponent of relocating MSG, said in an op-ed last week that it should stay put and sign onto the ASTM plan. ■

4 | CRAIN’S NEW YORK BUSINESS | MAY 29, 2023

RESIDENTIAL SPOTLIGHT OFFICIAL

LISTING PRICE for No. 96 at 432 Park Ave.

432 PARK AVE. NO. 96 has seven bedrooms, nine bathrooms, a 93-foot-long great room, a library and a private elevator.

Super-big JPMorgan lays out plans to get even bigger

JPMorgan Chase executives laid out a case last week for the nation’s biggest bank, with nearly $4 trillion in assets, to grow bigger still by providing more services to a uent clients.

“We’re breaking records for the number of times we say ‘wealth management,’” Jennifer Piepszak, co-CEO for community and consumer banking, said at JPMorgan’s annual investor day.

and the bank is No. 1 in the New York, Los Angeles and Chicago markets. It is unlikely regulators would let the bank increase its total deposit share, although that was also the conventional wisdom before JPMorgan was essentially handed First Republic Bank.

Con dence

AARON ELSTEIN

e bank already does quite a bit in wealth management, managing $3 trillion in clients assets, but Piepszak said there are “real opportunities” to do even more by serving existing clients online and through a branch network that spans all states except Alaska and Hawaii. ose branches hold 11% of all bank deposits in the nation, up from 7% a decade ago,

ON POLITICS

Wall Street is con dent the bank can continue to grow, especially when smaller banks are hobbled by rising interest rates and lack the diversi cation of JPMorgan, which in addition to serving average depositors and small businesses is also a major corporate bank and lender to private equity rms. (Its market share has grown there, too.)

JPMorgan’s stock trades for 10 times next year’s expected earnings, a hefty 40% premium over regional banks. Its market value of

$400 billion is almost twice that of the second-biggest U.S. bank, Bank of America.

“ e point is simple: e company is resilient, and we believe we are well positioned for a broad range of environments,” Chief Financial O cer Jeremy Barnum said, noting the bank expects a “mild” recession this year.

JPMorgan is a “steady disciplined growth story that we’ve all gotten accustomed to,” Evercore ISI analyst Glenn Schorr said in a client note May 22. “ e fortress balance

Mayoral waves crash both ways. How now for Adams?

It’s been a momentous few years for mayoral races in major American cities.

Long the domain of parochial Democratic machines, mayoral elections have become nationalized, with progressive and moderate Democrats vying for in uence over cities like New York, Chicago, Boston, Philadelphia and Los Angeles. is month, progressives were hoping to continue their winning streak, aggressively backing a former city council member named Helen Gym in her quest to become the next mayor of Philadelphia.

Bernie Sanders and Alexandria Ocasio-Cortez arrived in the City of Brotherly Love for a raucous campaign rally. e Working Families

cialists didn’t formally endorse Gym—they focused on city council campaigns—but urged their membership to vote for her.

ere were reasons to believe this formula would be successful: e same politicians and groups had helped vault Brandon Johnson, a proud Black progressive, over Paul Vallas, a white former schools chief with a police union endorsement and close ties to Obama administration alums, in the Chicago mayoral runo . A city that had been governed for decades by the Daley machine and Rahm Emanuel, once Barack Obama’s combative and avowedly centrist chief of sta , has elected a staunch ally of the local teachers’ union in Johnson.

Last year, Los Angeles voters chose Karen Bass, a congresswoman who belonged to the Congressional Progressive Caucus, over Rick Caruso, a billionaire real estate developer and former Republican, to be their next mayor. In 2021, Boston voters overwhelmingly sent Michelle Wu, an Elizabeth Warren protégé, to City Hall. Johnson, Bass and Wu are not all alike, but they began to represent a progressive front in large cities where probusiness moderates had traditionally reigned.

Vulnerabilities

sheet…allows JPMorgan to weather storms and bene t from the occasional crisis casualty.”

e bene ts from the latest crisis casualty, First Republic Bank, became even more clear last week when JPMorgan said the acquisition would raise net interest income this year to $84 billion, $3 billion higher than the previous projection. At its investor meeting, JPMorgan served the freshly baked

cookies First Republic has been serving at its branches for years.

During a break in the management presentations, the bank played “Treat You Better” by Shawn Mendes, whose lyrics underscored JPMorgan’s marketing message: “Tell me, why are we wasting time/ On all your wasted crying/When you should be with me instead?/I know I can treat you better/Better than he can.” ■

Party, founded in New York but now a national player, invested signi cant resources in Gym, who campaigned on police reform and expanding Philadelphia’s social safety net. Local Democratic So-

Philadelphia, however, did not follow the same script as Chicago. For one, Philadelphia lacks a mayoral runo : e top nisher in the Democratic primary becomes the nominee automatically. Even with a runo , though, Gym would not have been elected. She nished a disappointing third behind Rebecca Rhynhart, a former city comptroller with more establishment ties, and Cherelle Parker, an ex-city council member. Parker won.

New York City, of course, had elected its own moderate Democrat in 2021, Eric Adams. Parker, who is set to become the new mayor of Philadelphia after a general election that is little more than a formality in the heavily Democratic city, is a politician in the mold of Adams. Both are Black and both are deeply concerned with the level of crime in their cities. Parker campaigned on restoring stop-and-frisk to curtail gun violence, which is a far bigger problem in Philadelphia than in New York. Despite being less than a fth of the size of New York, Philadelphia recorded more homicides in 2021 and 2022. Black voters represent the largest plurality in Philadelphia and they mostly backed Parker. In an echo of New York’s 2021 contest, upscale white voters and younger progressives were split, with the former

choosing Rhynhart and the latter rallying around Gym. Gym had hoped to make history as Philadelphia’s rst female and Asian American mayor. It was not to be.

For New Yorkers, the question might be what this means for 2025, when Adams is likely to seek re-election. Perhaps not much: Philadelphia is a very di erent city, with its own racial dynamics and struggles with crime. Still, Adams will be heartened that Parker can be his ally down I-95.

Incumbents usually win, and it’s easy to bet on Adams cruising to re-election, with his enormous war chest and support in New York’s Black working class neighborhoods. He does have vulnerabilities, however, particularly with the large number of voters who didn’t support him in 2021 and haven’t grown any

warmer to his style of politicking. Afuent and gentri ed neighborhoods won’t be friendly to Adams. He’ll have his work cut out in a rankedchoice voting election, particularly if a stronger contender emerges. ere’s still time for that to happen.

Quick takes

● As the legislative session in Albany winds down, it looks to be one of the more disappointing in recent memory. Major housing bills failed and the a ordability crisis will continue, unabated.

● Will the seasonal outdoor dining program work? Shed construction and storage is costly, and some restaurant owners may decide it’s not worth the hassle. ■

Ross Barkan is a journalist and author in New York City.

MAY 29, 2023 | CRAIN’S NEW YORK BUSINESS | 5

BLOOMBERG

IN THE MARKETS

ROSS BARKAN

JARED

“THE COMPANY IS RESILIENT, AND WE BELIEVE WE ARE WELL POSITIONED FOR A BROAD RANGE OF ENVIRONMENTS” JPMORGAN is the nation’s biggest bank.

PIPER/PHLCOUNCIL

CHERELLE PARKER, a former Philadelphia City Council member, is that city’s likely next mayor.

A LARGE NUMBER OF VOTERS DIDN’T SUPPORT HIM IN 2021 AND HAVEN’T GROWN ANY WARMER TO HIS STYLE OF POLITICKING

DR. LINDA FRIED Columbia’s Mailman public health system

INTERVIEW BY AMANDA D’AMBROSIO

INTERVIEW BY AMANDA D’AMBROSIO

Earlier this month, the federal government ended the Covid-19 public health emergency, transitioning the country from a period of historic investments in population health and preventive care. But as the country shifts from the emergency mindset, Dr. Linda Fried, who leads Columbia’s Mailman School of Public Health, is advocating for continued investments in public health from New York City of cials and business leaders. Fried, a geriatrician by training who has led the public health school for the last 15 years, said that as modern medicine lengthens our lives, leaders should invest in preventive health measures that improve the quality of our lives too.

Why should we invest in the public health system?

Over the last 100 years, we’ve added 30 years to human life expectancy, which is astounding. The challenge is how to stop this ridiculousness of thinking that longer lives are a disaster and recognize that there is a huge opportunity if we invest to create health across those longer lives for everybody. The history of medicine in the U.S. and the world has been the history of taking care of people when they’re ill. The history of public health is [about] how to keep them from getting ill in the rst place. You need both.

Do you think that interventions the city employed during the pandemic, such as the Test & Treat Corps, could be used for other public health crises?

I think the challenge is that those responsibilities were, to my mind, misallocated to the Health + Hospitals Corporation medical care system, and stripped away from the public health system. They should be reallocated

POLITICS

DOSSIER

WHO IS SHE Dean, Columbia Mailman School of Public Health; senior vice president of Columbia University Irving Medical Center; director of the Robert N. Butler Columbia Aging Center

GREW UP Stuyvesant Town

RESIDES Upper West Side

EDUCATION Bachelor of Arts, University of Wisconsin Madison; Doctor of Medicine, Rush Medical College; Master of Public Health, Johns Hopkins Bloomberg School of Public Health

MEDICAL BACKGROUND Before her training in public health, Fried became an internal medicine physician and geriatrician. She has become a nationally recognized expert in aging, and serves as the director of the Robert N. Butler Columbia Aging Center.

PROUD MOMENT As the Columbia Mailman School of Public Health recently commemorated its 100year anniversary, Fried said that she is proud of the scienti c knowledge her institution has produced to prepare the country for health emergencies. “We’re ready for the next 100 years,” she said.

back to the public health system—which has 100 years of knowledge about how to do this well— and then, built up. It makes no sense to keep allocating to medical care, things that are outside of medical care’s knowledge set.

Where would you like to see investments in New York City’s public health system? New York City’s public health system should be a source of pride because it’s among the top two in the country. It’s wonderful, but it’s highly underresourced. Like all public health systems in the US, it doesn’t have the workforce that it needs to deliver the programs on the ground that would protect health. We underpay people, we don’t hire

City sues architects who designed inaccessible Hunters Point Library

BY NICK GARBER

The city has led a lawsuit against the architects who designed the ashy-butinaccessible Hunters Point Library in Queens, saying the rm should be forced to cover the $10 million needed to make the building usable for people with disabilities.

e suit, led May 18 in Manhattan State Supreme Court, says Steven Holl Architects violated its contract with the city by designing an inaccessible building, since their 2010 deal stipulated that the library had to comply with the Americans With Disabilities Act.

Instead, when the $41 million building on the Long Island City waterfront opened in 2019 to rave reviews in some quarters, advocates quickly noted that its design, based around a central staircase, rendered it unnavigable for wheelchair users and others with limited mobility—not to mention risky for children clambering along the steep stairways.

Queens Public Library o cials quickly relocated some shelves of

books to areas near the building’s sole elevator, away from their initial location within “tiers” that were reachable only via the stairs. But within a month of the library’s opening, the Department of Justice opened an investigation into whether the building violated the ADA, later joined by a class-action lawsuit led by disability-rights advocates against the city and the library system.

Violations

Both of those cases remain pending, as well as a third probe by the city’s Human Rights Commission. And though the Queens Library system rst insisted that the building’s reworked shelves were technically ADA-compliant, the city admits in its suit that the “temporary” x—now nearly four years old—will not be enough to bring the building into line with ADA, as well as other federal, state and local laws.

Indeed, the suit contains a laundry list of inaccessible building features, including the staircase and “tiers” of shelves, a rooftop terrace, a second- oor children’s area with

multiple levels of steps, and cramped bathrooms that lack enough space for wheelchair users to maneuver.

“ e city will be required to make substantial changes to the Library in order to make it compliant,” the suit reads, putting the cost of those repairs at $10 million. e suit does not go into detail about what renovation work would need to be done.

In a statement, Steven Holl Architects said “there is no wrongdoing here.”

“ e community library is public architecture which we love and will continue to support in any way we can,” a spokeswoman from the rm said in a statement to Crain’s. “Since the City has made the unfortunate decision to commence a lawsuit, we will not be commenting further at this time and intend to vigorously defend against these claims.”

Besides breach of contract, the city also accuses the rm of negligence and malpractice for not catching the shortcomings sooner.

Chris McVoy, a senior partner at the rm who is named in the suit, told e New York Times in 2019

adequately quali ed people. Then it tends to get its money in very earmarked ways. This means that the public health system in New York—which does a great job of collecting data to understand what the problems are—can’t reallocate money to match the problems. Their hands are tied.

What’s the reason for the lack of investment?

The public health system, like our medical care system in a lot of ways, has not been modernized since 1960. There’s no governmental investment in the public health system. There’s a lot of health services research on medical care and a lot of funding for that research. This is the work that schools of public health should do, but there’s no money to do it. The second part is that there’s a lot of work that shows that human beings have trouble valuing prevention. We’re not so good at taking the long view of saving lives by preventing people from getting sick in the rst place, and making the prospect of proactive investments that the evidence shows are really effective.

How should leaders think about allocating resources to the public health system following the pandemic? Public health is one of the key bases of a successful society. New York City made this very important investment through the Economic Development Corporation Life Sciences Council in creating the Pandemic Response Institute which our school is leading. We need partnership from the business community and providing help with the operational funding that the city didn’t provide. The city provides capital funds. We need the business community, coming out of this pandemic, to remember that there’s going to be another one, and we could be ready. We could provide the world’s model on how a city pandemic-proofs itself. ■

THE CITY SAYS it will cost $10 million to bring the Hunters Point Library into compliance with the Americans With Disabilities Act and other laws.

that the inaccessibility was “a small wrinkle in an incredibly successful project,” conceding that architects had not considered the need to provide an “exactly equivalent browsing experience” for people with disabilities. (ADA requires that people with disabilities be given “the full and equal enjoyment” of public facilities.)

e rm’s other projects include a Columbia University athletics center, a building at Brooklyn’s Pratt Institute and expansions of

the Kennedy Center in Washington and the Museum of Fine Arts in Houston.

e federal suit over the library was brought by patron Tanya Jackson along with the Center for Independence of the Disabled New York. Filings from last month state that the city is in the midst of negotiations with the plainti s.

Plans for the Hunters Point Library were revealed in 2011, but years of delays pushed the start of construction until 2015. ■

6 | CRAIN’S NEW YORK BUSINESS | MAY 29, 2023

ASKED & ANSWERED

BUCK ENNIS

MICHAEL APPLETON/MAYORAL OFFICE

City moves to seize another property in Hudson Yards for a long-planned park

BY C. J. HUGHES

The city has moved to seize more property for a Hudson Yards park from the family that controls the ferry company NY Waterway.

Set down below the street and crossed by Amtrak tracks, the nearly two-thirds-of-an-acre parcel is between 10th and 11th Avenues and spans West 36th to West 37th Street. It sits in the path of the next phase of the Bella Abzug Park

of it, plans show. Indeed, the “city does not seek to acquire by condemnation in this proceeding any right, title or interest held by Amtrak,” according to a petition led with Manhattan’s Supreme Court on Tuesday that would initiate eminent domain proceedings.

e property appears to be owned by the Imperatore family of New Jersey, which made its fortunes in trucking in the mid20th century but may be best known for some shrewd bets in the 1980s to snap up defunct train tracks near the Hudson River in New Jersey to create the transit hub Port Imperial.

erty through an action known as an easement, documents show. Arthur Imperatore died in 2020.

e court ling does not spell out how much money the city would be willing to pay to seize the Imperatore property, which totals about 30,000 square feet. And a message left with Edward Imperatore, an attorney who handles real estate matters for the family, was not returned by press time.

Similar tactics

project, whose rst section opened in 2015 but which has been two decades in the making.

e city appears to be targeting not the land under the tracks but the air above them. A platform would be built at the sunken site to level it with the surrounding landscape and the park would go on top

e Imperatores have controlled the Hudson Yards site since at least the 1980s, according to court documents. In 1991, Amtrak began running trains through the property to Penn Station in a bid to lessen congestion at Grand Central Terminal, where Amtrak trains to Manhattan used to stop. Imperatore granted Amtrak permission to use the prop-

THOUGHT LEADER REPORT

MIDDLE MARKET

SPONSORED BY CITRIN COOPERMAN

But o cials often launch eminent domain proceedings if they can’t come to an agreement with landlords about appropriate values. Under eminent domain laws, the city has the right to seize property for a public purpose, such as a park or highway but is required to pay market value for the land, though that value is often disputed. e owners can also challenge whether their property is necessary for public use.

Michael Bauscher, an attorney with Carter Ledyard and Millburn, a rm that has handled many Hudson Yards cases on behalf of the city and is involved in the current case, did not return a call. And an email

MITIGATING RISKS FOR MIDDLE MARKET COMPANIES AMID CRISIS

issues continue to take root and demonstrate their staying power, how can middle market businesses mitigate risks during difficult times?

1. Build key relationships

3. Leverage technology

sent to the Hudson Yards Development Corp., the group that has orchestrated the development of the far West Side, was not returned by press time.

e move against the Imperatores comes a few months after the city began eminent domain proceedings against other landlords who own properties in the area in order to seize four sites. Among them is the Midtown Convention Center Hotel, a now-closed property at 522 W. 38th St.

And in June 2022 the city used similar tactics to take control of a title to 515 W. 36th St., a site with a 251-unit apartment building developed by Lalezarian Properties, though the goal appears to be to use a portion of the property for the new park.

When the master plan for Hudson Yards was unveiled in the mid-2000s, the city said 10 sites were needed to create the park. All told, the city rezoned the once-industrial neighborhood to allow 24 million square feet of o ce space, more than 13,000 housing units, 1 million square feet of retail space and 2 million square feet of hotels. But much of that vision has not yet been realized.

e Imperatore site, which sits in a shallow valley between two rough-faced rock walls, would gain a 150-foot-wide strip of parkland sandwiched between two skinny streets, Hudson Boulevard West and Hudson Boulevard East, according to a diagram led in conjunction with the case.

e con guration would be similar to what exists with the current Bella Abzug Park, which now spans West 34th to West 37th Streets. Ultimately, the park, named after a former Congresswoman, will be a total of four acres and reach all the way to West 39th Street.

In 1947, Arthur Imperatore founded APA Transport Corporation with several of his brothers. en in the early 1980s, he snapped up 2.5 miles of defunct rail lines in Weehawken, New Jersey from the bankrupt Penn Central company for about $8 million. Port Imperial, which is served by NY Waterway ferries, occupies the site today. ■

Three years have passed since the initial outbreak of Covid-19 and businesses have had to pivot and remain agile to respond to a volatile market and changing consumer demands. Ongoing disruptions in the supply chain, unstable capital markets, and a changing labor force are just a few challenges businesses continue to grapple with as a result of the pandemic.

Most recently, several U.S. banks have collapsed since March, causing turmoil for not only companies who banked with them, but others who worried about the stability of their own financial institutions. As these

Having trusted advisors that your business can rely on is paramount. In times of crisis, it is important to have an inner circle who can help the business navigate difficult situations. If your CPA was not one of the first phone calls you made for business advice during the pandemic or the banking crisis, then it might be time to find a new one. For middle market businesses, having an attorney and a banker you can trust is also critical.

2. Diversify

Most wealth advisors would recommend diversifying your portfolio, and the diversification should not stop there. Considering the recent banking crisis, businesses should consider keeping assets at several institutions and try to limit the exposure of cash exceeding FDIC limits. Businesses should also monitor customer and vendor concentrations which can expose companies to certain risks.

According to Citrin Cooperman’s Manufacturing and Distribution Practice’s forthcoming Spring 2023 Pulse Survey, only 37 percent of middle-market respondents have fully implemented data analytics tools and processes. Data analytics, process automation, and artificial intelligence can help businesses monitor important key performance indicators, improve efficiencies, and understand customer behavior. If your business is not using technology to improve processes and efficiencies, now is the time to make the investment.

Though the future of our economy, a recession, or a possible downturn remains unclear, history tells us that there will always be another issue on the horizon that is out of our control. In business, as in life, it is best to be prepared, proactive and anticipate disruption.

“Citrin Cooperman” is the brand under which Citrin Cooperman & Company, LLP, a licensed independent CPA firm, and Citrin Cooperman Advisors LLC serve clients’ business needs. The two firms operate as separate legal entities in an alternative practice structure. Citrin Cooperman is an independent member of Moore North America, which is itself a regional member of Moore Global Network Limited (MGNL).

MAY 29, 2023 | CRAIN’S NEW YORK BUSINESS | 7

CONTENT

Brian Sosa is a partner and NYC Manufacturing & Distribution Practice Leader for Citrin Cooperman with 15 years of experience in audit and business consulting.

SPONSORED

REAL ESTATE

NYC

PARKS

THE CURRENT Bella Abzug Park

THE CITY APPEARS TO BE TARGETING NOT THE LAND UNDER THE TRACKS BUT THE AIR ABOVE THEM

City must make sure Local Law 97 penalties are reinvested into climate goals

Local Law 97 shows the city is committed to shrinking its vastest source of greenhouse gases: emissions from buildings. Now the city must make sure the plan doesn’t punish building owners who are helping alleviate another of New York’s toughest challenges: a ordable housing.

As reporter Caroline Spivak writes in this week’s Crain’s Forum, upgrades in bringing buildings to compliance require hefty investments in replacing boilers, installing solar panels, modernizing HVAC systems, among many other upgrades. Many building owners have until 2024 to meet initial emissions targets.

something completely unrelated to strengthening the city’s resiliency. We are in favor of the city creating a dedicated fund, where that money can be used by owners of rent-regulated buildings to meet Local Law 97’s mandates in a timely fashion. ere are a multitude of pathways to compliance, and depending on the building, the changes can be complex and costly. But owners of buildings with rent-regulated units face a unique challenge: raising the rent to help cover the bill for upgrades is largely o the table due to state law.

COMPTROLLER BRAD LANDER attends a Local Law 97 rally.

Failure to comply will spell hefty nes, but as it stands, the penalties collected will go back into the city’s overall revenue. Not earmarking the funds for anything speci c runs the risk that it will be spent on

OP-ED

Mayor Adams’ administration has said they are exploring ways for the city to help with green nancing options, and this seems a relatively straightforward one. Comptroller Brad Lander has called on the city to create a Green A ordable Housing Fund to help a ordable housing developments comply with the law, and other large cities, like Boston, have similar funding mechanisms in place.

Additionally, it would set a bad precedent for the city to enact sweeping legislation requiring signi cant building upgrades for

buildings that have less exibility in increasing their bottom line to secure funds needed to be compliant. With the expiration of 421-a and no viable options to replace the plan, it would not be wise to pile on another disincentive to building more a ordable units in the city. To be fair, the city has granted buildings with a ordable units a decent amount of exibility. Under Article 321, owners can either demonstrate that the emissions are below the 2030 emission limits or show that they’ve implemented 13 changes on a list of energy conservation measures by the end of 2024. e

changes fall short of a full overhaul of a building’s systems and include tasks like repairing or replacing steam traps or upgrading common area lighting. e DOB has also hinted that it may reduce nes or lower emission targets for owners who can prove they’ve made a “good faith e ort.” ere is a deluge of big problems facing the city that require signicant time and money to solve. If the money from Local Law 97 doesn’t have a speci c destination, it could be allocated to initiatives that have nothing to do with climate change, watering down the impact of Local Law 97 and making the pathway to a greener city more strenuous. ■

New York isn’t dying; it just has to change

BY FORTH BAGLEY

Prognostications of the end of the city are everywhere. In a recent New York Times opinion piece, for example, omas Edsall argued that many of this country’s metropolises are being hollowed out as a uent whitecollar workers relocate to peripheral suburban centers and embrace work-from-home. e bigger the city, the more perilous its future. New York is in the cross hairs.

It’s true that remote work is putting tremendous strain on the city’s commercial o ce space. So, too, are high interest rates. Further, the adoption of AI will likely exacerbate dwindling o ce demand, doing to white-collar workers and their o ce space what robots did to their blue-collar counterparts and their workshops and factories.

But it would be a mistake to conate challenges to the traditional o ce building with those of the American city, especially New York. To write o our city because we identify it as purely a center of work is to underappreciate how

much it has been a magnet of innovation, activity and leisure, particularly over the past 20 years, as well as to lose the opportunity to project how the city will be occupied in the future. In fact, broader trends suggest that New York is still very much a place in which people want to live, visit and play, even if they aren’t working in traditional o ce buildings. While commuter ridership is down, for example, non-rush hour ridership is back to pre-COVID levels and rising.

Firstly, while hybrid work is putting pressure on the traditional ofce building, the sum total of the technological advances of the last two decades has fundamentally bene ted urban residents more than their suburban and rural counterparts, unlocking the commercial and social viability of neighborhood after neighborhood.

Secondly, just as the abandonment of industrial areas enabled the transformation of miles of urban waterfront across the U.S. into vibrant parks and residences, the shrinking o ce market will allow

us to remake many neighborhoods in the city into more exciting places to be. For decades, the basic building block of the city has been the o ce building. But as a single use it was limited in how it could activate street life. Cities with dense residential centers such as Vancouver and Miami are consistently rated higher as places people want to live than cities without downtown residential stock. Adding more and more residential and mixed-use buildings will make our city more dynamic and resilient.

Innovation

Lastly, not all o ce space is created equal. New York City’s neighborhoods breed more innovation, cultural capital and economic activity than surrounding non-urban areas. Neither remote work nor the adoption of AI will change the value proposition between centercity and non-urban o ce space. Our new o ce buildings will look radically di erent in ten years, re ecting how we work alongside AI, accommodate hy-

president & ceo K.C. Crain

group publisher Jim Kirk

publisher/executive editor

Frederick P. Gabriel Jr.

EDITORIAL

editor-in-chief Cory Schouten, cory.schouten@crainsnewyork.com

managing editor Telisha Bryan

assistant managing editors Anne Michaud, Amanda Glodowski

director of audience and engagement

Elizabeth Couch

audience engagement editor Jennifer Samuels

digital editor Taylor Nakagawa

art director Carolyn McClain

photographer Buck Ennis

senior reporters Cara Eisenpress, Aaron Elstein, C.J. Hughes, Eddie Small reporters Amanda D’Ambrosio, Nick Garber, Mario Marroquin, Jacqueline Neber, Caroline Spivack

op-ed editor Jan Parr, opinion@crainsnewyork.com sales assistant Ryan Call to contact the newsroom: editors@crainsnewyork.com

www.crainsnewyork.com/staff

685 Third Ave., New York, NY 10017-4024

ADVERTISING

www.crainsnewyork.com/advertise

sales director Laura Lubrano laura.lubrano@crainsnewyork.com

senior vice president of sales Susan Jacobs account executives Paul Mauriello, Philip Redgate people on the move manager Debora Stein, dstein@crain.com

CUSTOM CONTENT

associate director, custom content Sophia Juarez, sophia.juarez@crainsnewyork.com

custom content coordinator Ashley Maahs, ashley.maahs@crain.com

EVENTS

www.crainsnewyork.com/events

manager of conferences & events Ana Jimenez, ajimenez@crainsnewyork.com

senior manager of events Michelle Cast, michelle.cast@crainsnewyork.com

REPRINTS

director, reprints & licensing Lauren Melesio, 212.210.0707, lmelesio@crain.com

PRODUCTION

brid and reduced workforces, and focus on environmental, physical and mental health. ey will be more nancially successful because they will be that much more connected to the places where we want to congregate, learn, and advance our careers.

If New York City can quickly adapt zoning and building codes, invest in environmental resiliency, and upgrade transportation infrastructure, that will enable these transformed o ce buildings, as well as more residential and lifestyle program, to permeate and enliven our city. New York will then win the next three decades. Put simply, many of the critics are wrong. e story of the next half century won’t be the death of New York City. It will be a story of urban innovation as we transform our highest density commercial environments to accommodate the way we all want to live. ■

Forth Bagley is a managing principal at Kohn Pedersen Fox (KPF), a global architecture rm headquartered in New York.

production and pre-press director Simone Pryce media services manager Nicole Spell

SUBSCRIPTION CUSTOMER SERVICE www.crainsnewyork.com/subscribe customerservice@crainsnewyork.com

877.824.9379 (in the U.S. and Canada). $140.00 one year, for print subscriptions with digital access.

Entire contents ©copyright 2023 Crain Communications Inc. All rights reserved. ©CityBusiness is a registered trademark of MCP Inc., used under license agreement.

chairman Keith E. Crain

vice chairman Mary Kay Crain president & ceo K.C. Crain

senior executive vice president Chris Crain editor-in-chief emeritus Rance Crain chief nancial of cer Robert Recchia founder G.D. Crain Jr. [1885-1973] chairman Mrs. G.D. Crain Jr. [1911-1996]

8 | CRAIN’S NEW YORK BUSINESS | MAY 29, 2023

EDITORIAL

IT WOULD NOT BE WISE TO PILE ON ANOTHER DISINCENTIVE TO BUILDING MORE AFFORDABLE UNITS

OFFICE OF THE NEW YORK CITY COMPTROLLER/FLICKR

Adams must support all human services workers

BY MICHELLE JACKSON AND JENNIFER JONES AUSTIN

BY MICHELLE JACKSON AND JENNIFER JONES AUSTIN

New York City took an important step toward economic fairness and racial and gender justice recently. The Adams Administration and DC37, the city’s largest municipal labor union, agreed on a new contract that will raise wages for tens of thousands of city employees. The new contract demonstrated the mayor’s support for workers, many of them women of color, whose pay has been modest at best.

health clinics and immigration offices. They run domestic violence shelters, foster care agencies and after-school programs. They are 80,000 strong in this city; 75% of them are people of color, 70% of them are women, and 55% are women of color.

As head of an anti-poverty organization FPWA and executive director of the Human Services Council, both of which advocate for the sector, we know that New York City would be lost without these workers. Their pay doesn’t begin to equal their contributions, and that puts us all at risk.

MAYOR ADAMS MUST ALSO SUPPORT ESSENTIaL WORKERS IN THE HUMAN SERVICES SECTOR

But city workers aren’t the only ones who need fair, livable wages. Mayor Adams must also support essential workers in the human services sector. However, despite repeated calls for just pay, his budget proposal leaves them out.

Human service workers are the invisible engine that keeps this city moving. They work in childcare centers, food pantries, mental

Underfunded city contracts have led to insufficient, unjust pay that has not even remotely kept up with the cost of living in New York. Sixty percent of human service workers qualify for government assistance. Here’s what that means: Full-time case workers who connect New Yorkers to food and other public benefits by day often have to live on those very same benefits at night.

That’s why the Human Services Council started the JustPay campaign, which demands fair wages and a cost of living adjustment in this year’s city budget. Last year,

Without action in Albany, our housing crisis will worsen

BY CARLO A. SCISSURA

While Governor Kathy Hochul and Mayor Eric Adams have put forward long-overdue policy proposals to confront New York’s housing crisis head-on, the double-barrel bad news is that the governor’s proposals were not included in the final state budget — and the housing crisis is not slowing down.

The city needs 560,000 new homes by 2030 to keep pace with expected population and job growth. But without the policy tools in place to actually build this housing, the city won’t be able to meet this goal, and hardworking families will continue to suffer. Building multifamily projects in New York City is already increasingly difficult, if not nearly impossible, with rising construction costs, supply chain disruptions, high interest rates and the everexpensive cost of land.

The numbers are not encouraging: Only 22 filings for multifamily foundation applications were submitted to the NYC Department of

Buildings in February 2023 for 432 proposed units, according to recent data compiled by the Real Estate Board of New York.

The historically low number of filings follows a concerning trend we saw last year. There were 441 foundation filings in the first six months of 2022, followed by just 186 filings in the year’s second half. This steady decline began around the same time when the 421-a program expired on June 15 last year and never rebounded.

Necessary tools

We’ve been working closely with state leaders to ensure they understand that without procurement reform, robust capital spending and removing barriers to build more housing, New York will continue to fall behind other states in the region. Without the proper tools to spur the development of affordable rental housing, it simply won’t get built. And so it now rests on the legislature to pass, and the governor to sign into law, housing policies outside of the budget process by the end of session in June. If they don’t

hundreds of workers took the fight directly to City Hall. This year, you can expect to hear from us again. And that’s why FPWA has advocated since 2020 for a true cost of living measurement for New York City, to guide decision makers about what income is required to meet basic living expenses. Fortunately, 81% of voters in the 2022 citywide election supported that measure, and beginning in 2024 the

city will have to produce an annual estimate of what it costs to live and work here. But we can’t wait until then to pay human services workers fairly.

Stepping up

This sector’s work has become even more important this year, as New York has greeted a wave of asylum-seekers who need serious support — from immigration ser-

vices to housing to mental health counseling. The human services sector has provided all that and more. According to HSC’s winter survey, 96% of groups are providing these services out-of-pocket, without a formal contract in place. Stretched to their limits even before, this crisis has been nearly existential for some providers. But it hasn’t stopped this sector from stepping up for New York City in its time of need.

It’s time for New York City to step up for them. Giving these workers a raise will make our city fairer and more racially equitable. JustPay will help workers who provide lifesaving services reach self-sufficiency and true financial stability.

When Mayor Adams faced the need to pay city workers more fairly and combat governmentsponsored structural inequity, he responded. Now that the ink has dried on DC37’s new contract, the mayor needs to take the next step. He must ensure human service workers receive the fair wages they deserve. ■

Michelle Jackson is executive director of the Human Services Council. Jennifer Jones Austin is CEO and executive director of FPWA, an anti-poverty policy and advocacy organization.

act now, the housing crisis will only worsen and push middle-class families out of the city, further stalling our economic recovery.

An extension of the 421-a completion deadline by four years for projects that were approved before the program expired would cost the state nothing, and ensure that 33,000 new homes will be built, of which 8,200 are affordable. These units risk not meeting the current deadline due to financing and supply chain delays, putting their 421-a benefits at risk, jeopardizing the projects and further reducing our housing pipeline.

The governor’s executive budget also included a proposal calling for eliminating the outdated cap of 12

FAR that holds back our ability to meet the demand for housing. Removing the cap on density for residential development would encourage the construction of housing in high-opportunity areas that already have access to mass transit and job opportunities, as the Building Congress outlined in a recent report on Transit-Oriented Development. It would also trigger the city’s mandatory inclusionary housing requirements, paving the way to build housing that is truly affordable for New Yorkers.

Finally, judicious changes to state law would allow more largescale conversions of commercial buildings to residential use. Older office buildings in Manhattan are

struggling to compete with newer offices due to the impacts of the pandemic. Let’s reimagine them in a way that helps alleviate a different and far more pressing problem: lack of housing.

Some of our government leaders understand the urgency. The budget process showed that others are hesitating. But they have mere months left to take decisive action. Will New York continue its dangerous decline in housing production, or will we rewrite our future as a place that can be affordable, accessible and livable for all? ■

May 29, 2023 | CRaIN’S NEW yORK BUSINESS | 9

OP-ED

Carlo A. Scissura is president and CEO of the New York Building Congress.

OP-ED

Write us: Crain’s welcomes submissions to its opinion pages. Send letters to letters@CrainsNewYork.com. Send op-eds of 500 words or fewer to opinion@CrainsNewYork.com Please include the writer’s name, company, address and telephone number. Crain’s reserves the right to edit submissions for clarity.

FAIRSTEAD

AFFORDABLE HOUSING in the Bronx. The city needs 560,000 new homes by 2030 to keep pace with expected growth.

GETTY IMAGES

NEW YORK’S LARGEST PUBLICLY HELD COMPANIES

Ranked

10 | CRAIN’S NEW YORK BUSINESS | MAY 29, 2023

THE LIST

by 2022 revenue

RANK COMPANY (TICKER SYMBOL)/ ADDRESS PHONE/ WEBSITE 2022 REVENUE (IN MILLIONS) ONE-YEAR REVENUE PERCENTAGE CHANGEINDUSTRY 1 Verizon CommunicationsInc. (VZ) 1095 Sixth Ave.,New York,NY10036 212-395-1000 verizon.com $136,835.0 +2.41%Telecommunications 2 JPMorgan Chase &Co. (JPM) 383 Madison Ave.,New York,NY10179 212-270-6000 jpmorganchase.com $122,306.0 -6.56%Investment banking and financial services 3 PfizerInc. (PFE) 235 E. 42nd St.,New York,NY10001-2192 212-733-2323 pfizer.com $100,330.0 +23.43%Pharmaceuticals 4 PepsiCo (PEP) 700 Anderson Hill Road,Purchase,NY10577 914-253-2000 pepsico.com $86,392.0 +8.7%Food and beverage products 5 CitigroupInc. (C) 388 Greenwich St.,New York,NY10013 212-559-1000 citigroup.com $70,560.0 -5.91%Investment banking and financial services 6 MetLifeInc. (MET) 200 Park Ave.,New York,NY10166-0188 212-578-9500 metlife.com $69,898.0 -1.66%Insurance 7 International Business MachinesCorp. (IBM) One New Orchard Road,Armonk,NY10504 914-499-1900 ibm.com $60,530.0 +5.54%Technology 8 Merck &Co. (MRK) 2000 Galloping Hill Road,Rahway,NJ7065 908-740-4000 merck.com $59,283.0 +21.72%Pharmaceuticals 9 Prudential FinancialInc. (PRU) 751 Broad St.,Newark,NJ7102 973-802-6000 prudential.com $58,378.0 -17.63%Insurance 10 American International GroupInc. (AIG) 1271 Sixth Ave.,New York,NY10020 212-770-7000 aig.com $56,418.0 +8.39%Insurance 11 Morgan Stanley (MS) 1585 Broadway,New York,NY10036 212-761-4000 morganstanley.com $53,388.0 -10.65%Investment banking and financial services 12 American Express Company (AXP) 200 Vesey St.,New York,NY10285 212-640-2000 americanexpress.com $50,680.0 +15.71%Financial services 13 Bristol-Myers Squibb Company (BMY) 430 E. 29th St.,New York,NY10016 212-546-4000 bms.com $46,159.0 -0.49%Pharmaceuticals 14 The Goldman Sachs Group (GS) 200 West St.,New York,NY10282 212-902-1000 goldmansachs.com $44,650.0 -24.3%Investment banking and financial services 15 The Travelers CompaniesInc. (TRV) 485 Lexington Ave.,New York,NY10017 917-778-6000 travelers.com $36,884.0 +5.94%Insurance 16 Warner Bros. DiscoveryInc. (WBD) 230 Park Ave. South,New York,NY10003 212-548-5555 ir.wbd.com $33,817.0 +177.39%Media and entertainment 17 Paramount Global (PARA) 1515 Broadway,New York,NY10036 212-258-6000 paramount.com $30,154.0 +5.49%Media and entertainment 18 Macy's (M) 151 W. 34th St.,New York,NY10001 212-494-1621 macysinc.com $25,292.0 +39.76%Department stores 19 MastercardInc. (MA) 2000 Purchase St.,Purchase,NY10577 914-249-2000 mastercard.com $22,237.0 +17.76%Payment solutions 20 Marsh & McLennan CompaniesInc. (MMC) 1166 Sixth Ave.,New York,NY10036-2774 212-345-5000 mmc.com $20,720.0 +4.54%Professional services 21 Cognizant Technology SolutionsCorp. (CTSH) 300 Frank West Burr Blvd.,Teaneck,NJ7666 201-801-0233 cognizant.com $19,428.0 +4.98%Information technology 22 Colgate-Palmolive (CL) 300 Park Ave.,New York,NY10022-7499 212-310-2000 colgatepalmolive.com $17,967.0 +3.13%Health and beauty aids 23 BlackRockInc. (BLK) 55 E. 52nd St.,New York,NY10001 212-810-5300 blackrock.com $17,873.0 -7.75%Investment management 24 The Estée Lauder CompaniesInc. (EL) 767 Fifth Ave.,New York,NY10153 212-572-4200 elcompanies.com $17,737.0 +9.39%Health and beauty aids 25 Automatic Data ProcessingInc. (ADP) One ADP Blvd.,Roseland,NJ7068 973-974-5000 adp.com $16,498.3 +9.95%Human resources software 26 The Bank of New York MellonCorp. (BK) 240 Greenwich St.,New York,NY10286 212-495-1784 bnymellon.com $16,338.0 +1.09%Banking 27 Consolidated EdisonInc. (ED) 4 Irving Place,New York,NY10003 212-460-4600 conedison.com $15,670.0 +14.58%Electric and gas utility 28 Equitable HoldingsInc. (EQH) 212-554-1234 $14,509.0 +8.66%Retirement and insurance No. 1 Verizon Communications AMANDA.GLODOWSKI@CRAINSNEWYORK.COM $14B AVERAGE REVENUE for companies on the list. ON THE UPSWING These companies experienced the highest rate of growth in revenue over the past fiscal year. % change in revenue Warner Bros. Discovery Inc. 177% Global Business Travel Group Inc. 143% Sphere Entertainment Co. 112% Oscar Health Inc. 111% Apollo Global Management Inc. 87% SOURCE: S&P, Crain’s analysis SOURCE: S&P, Crain’s analysis

TURBULENCE Many financial firms suffered the biggest losses during a year marked by economic turmoil. % change in revenue KKR & Co. Inc. -78% Blackstone Inc. -64% Annaly Capital Management Inc. -31% Jefferies Financial Group Inc. -27% The Goldman Sachs Group -24%

BLOOMBERG

ENDURING

This year could very well be Bed Bath & Beyond’s swan song on the list of largest publicly held companies. Store closures first announced in mid-2022 turned into bankruptcy in a matter of months for Bed Bath & Beyond. After shuttering about 90 stores, and a few last-ditch efforts in the form of financial deals, the company filed for Chapter 11 in April of this year, putting the remaining 14,000 employees on the line. The initial steps in the court process are to liquidate the remaining 260 stores and search for a buyer for its assets.

The company estimated that the proceeds from all sales will be about $718 million, according to court documents, and the retailer has about $1.8 billion in total funded debt obligations. The company estimated it had assets of $4.4 billion and total debt of $5.2 billion as of late November, and the number of creditors is between 25,001 and 50,000, with BNY Mellon having the biggest unsecured claim of $1.18 billion.

— Amanda Glodowski