CITY’S USE OF OPIOID SETTLEMENT THREATENED BY LAX OVERSIGHT, LIMITED FUNDS

By Amanda D’Ambrosio

By Amanda D’Ambrosio

New York state in the next 18 years will distribute up to $2.6 billion in settlements from lawsuits against opioid manufacturers and distributors including Johnson & Johnson, CVS and Walgreens over their role in the opioid epidemic that has claimed the lives of at least 30,000 New Yorkers. Meantime, New York City will distribute its own, separate settlement of $286 million.

Despite the in ux of settlement money, the opioid epidemic has persisted in the city, with overdose deaths rising almost every year since 2010. While no one expected an overnight x, watchdog groups say e orts to reduce overdose deaths have been further threatened by a lack of transparency in the city’s spending of settlement funds and the reality that the money simply is not enough to make a dent in the nation’s most pressing public health crisis.

e city’s approach to managing its funds stands in contrast to the state’s, because it secured separate settlement agreements in the past few years that give the city more leeway. While the state has appointed an advisory board and reported on its spending, the city has kept conversations about how to spend the funds behind closed doors. Watchdogs say that’s a problem.

“ ere's a lot of wiggle room in there [on what] to spend the

A look at the rm behind the city’s migrant contracts

By Caroline Spivack

City o cials early this year hired DocGo, a Midtown-based health care company and regular city contractor, to shepherd migrants upstate. en reports surfaced in late July that migrants had been misled with promises about nding work and mistreated once they arrived at hotels near Albany and Bu alo.

Now, Attorney General Letitia James, among others, is investigating whether DocGo violated state or federal laws in its treatment of people in its care.

e city awarded the for-pro t rm a $432 million no-bid contract beginning in May, a procurement shortcut made possible

when Mayor Eric Adams declared a state of emergency in October over the ongoing migrant crisis.

e company previously contracted with the city to provide Covid-19 testing, vaccinations and homeless health services under the umbrella of Ambulnz, a DocGo subsidiary.

Despite a lack of a track record with immigration services, DocGo’s arrangement with the city requires the company to cover a variety of asylum seekers’ needs, including transportation, lodging, case management and medical care.

DocGo has provided shelter

and services to 4,000 people in 28 hotels, according to city o cials.

In addition to the no-bid contract awarded by the Department of Housing Preservation and Development, the city Health + Hospitals system this summer extended an existing migrant services contract with DocGo for $311 million.

If the company manages to reap the maximum value of the two contracts—more than $740 million—it would dramatically outpace the $440 million in

VOL. 39, NO. 30 l COPYRIGHT 2023 CRAIN COMMUNICATIONS INC. l ALL RIGHTS RESERVED CRAINSNEWYORK.COM I SEPTEMBER 4, 2023 PET-FRIENDLY Long Island City pet ownership surges, creating demand for services. PAGE 3 POWER CORNER A civil rights lawyer talks about working with a mayor who’s a friend. PAGE 13 GOTHAM GIGS An entrepreneur in the South Bronx is bringing capital to disadvantaged neighborhoods. PAGE 23

A no-bid $432 million agreement is only one component of DocGo’s dealings with New York City that are under re from elected of cials

Anthony

Despite a lack of a track record with immigration services, DocGo has contracted with the city to cover a variety of asylum seekers’ needs. | AMBULNZ, LINKEDIN, ALLIANCE FOR JUSTICE

Capone Lee Bienstock Norm Rosenberg

THE NUMBERS $889M The value of DocGo as of Aug. 17.

BY

See OPIOID on Page 18 See CONTRACT on Page 22 BY THE NUMBERS $286M IN FUNDS for the city 2,668 DRUG OVERDOSE deaths in 2021 in the city $20K TO TREAT an individual with an opioid use disorder ISTOCK/CRAIN’S COMPOSITE

MSG about to land 5-year permit as Penn Station rebuild looms

By Nick Garber

Madison Square Garden will get a new five-year permit allowing it to stay atop Penn Station, but the arena’s owners will be required to make improvements for pedestrians that could bring the aging facility more in line with a redesign of Penn Station, City Council members announced recently.

The council settled on a term shorter than the 10-year length recommended by the City Planning Commission—although it scraps some conditions that the commission sought to impose on the Garden—and is far more stringent than the permanent permit the Garden’s owners had sought. It is also shorter than the 10-year extension the council last granted in 2013, as urgency builds for reconstructing Penn Station in the near future.

The deal, unveiled after weeks of negotiations between the council, the Garden’s owners and the Metropolitan Transportation Authority, was quickly approved by two council committees Aug. 28. The arena’s owners immediately condemned the decision as “shortsighted” in a statement, but it is nonetheless expected to be approved by the full council in mid-September.

The Garden’s new permit answers a key question in the ongoing debate over how to rebuild Penn Station. It adds to the likelihood that any grand new train hall will need to be built below the hulking arena—a fact that city and state policymakers have come to accept, even as some transit and community advocates continue to argue that the Garden must relocate for Penn to reach its full potential.

Erik Bottcher, the Midtown council member who represents the Garden area and played a leading role in negotiations, said the recommendation is geared toward resolving the “use conflict” between pedestrian access to Penn Station and the Garden’s loading systems—an arcane, thorny issue that played a major role in convincing transit officials that the arena poses a serious threat to the safety and operations of the station below it. Within six months of council approval, the Garden will need to submit a plan that would clear its parked trucks from certain streets and limit delivery hours to help improve pedestrian access.

“Five years will go by very quick-

ly, I believe. But I actually don’t think that we’ll need the entire five years,” Bottcher said Aug. 28.

Although the council angered MSG by imposing a short permit, lawmakers made some changes that seem to benefit the arena. The council dispensed with City Planning’s requirement that the Garden plan to make itself “compatible” with a redesigned Penn Station in favor of narrower language about loading.

During negotiations, Bottcher had argued for the simple fiveyear permit while both the MTA and the council speaker’s office favored a two-year permit that could be renewed for another eight years if the Garden showed it was cooperating with the Penn Station redesign, or just three years if no such progress was made, according to a person with knowledge of the negotiations.

‘The simplest way’

Bottcher, speaking to reporters after the first committee vote, defended the basic five-year permit as “the simplest way, with the least risk of complications.”

Other changes to City Planning’s recommendation include removing a stipulation that the Garden pay for some largely cosmetic improvements to the area surrounding the arena, including seating, trees and glass canopies over its Eighth Avenue entrances.

Still, MSG Entertainment, the Dolan family-owned company that officially owns the Garden, said in a statement Aug. 28 that it was “disappointed” by the council’s decision.

“A short-term special permit is not in anyone’s best interest and undermines the ability to immediately revamp Penn Station and the surrounding area,” the company said. “The committees have done a grave disservice to New Yorkers today, in a shortsighted move that will further contribute to the erosion of the city—that’s true now and will be true five years from now.”

Layla Law-Gisiko, a local community board member who has long advocated for moving Madison Square Garden in order to remake Penn Station, praised the relatively short new permit as an “incredible” outcome.

“Five years will compel everyone to negotiate in good faith,” she said.

The city has been keen to use the permit process as leverage

EVENTS CALLOUT

POWER BREAKFAST

over the Garden, as local officials describe a narrow window of opportunity to redesign Penn Station in the next few years. Favorable factors include serious planning at the state level, temporarily low train volume at Penn thanks to the recent opening of Grand Central Madison, and the possibility of winning federal funding with President Joe Biden in office.

Lawmakers have approached this year’s permit process differently than they did a decade ago, when the Garden’s initial 50-year permit expired. In 2013, the council granted a 10-year extension on the condition that the Garden take that time to find a new location— but MSG’s owners disregarded that requirement, and lawmakers now acknowledge the arena seems likely to stay put.

The Garden, for its part, has touted the arena’s cultural and economic impact and argued that a permanent permit would help future efforts to rebuild Penn, by assuring rail agencies that their planning would not be disrupted by the arena’s sudden departure.

The council vote will mark the end of the Garden’s monthslong quest for a new permit. It got off to a rocky start in April, when a local community board, in a symbolic vote, said the Garden should be given only three years and forced to make a serious plan to move.

But the next two stakeholders to weigh in on MSG’s permit—Manhattan Borough President Mark Levine, followed by the City Planning Commission—both recommended that the Garden should stay in place and that its owners, the Dolan family, be forced to cooperate on a future Penn Station redesign.

Levine, in his report, threw his weight behind a rival Penn Station plan being pushed by Italian developer ASTM, which has complicated the state’s efforts to stick with its own plan. Both plans involve building expansive, new light-filled train halls below the Garden and in the mid-block area between Seventh and Eighth avenues that is now occupied by an unused driveway.

But ASTM’s plan, which seems to enjoy the support of the Garden’s owners, differs by also proposing a second new train hall on Eighth Avenue in place of the current Theater at Madison Square Garden, which ASTM would buy from MSG. The state-run MTA has been openly hostile to ASTM’s bid.

DETAILS

SEPT. 20

Council sides with 600,000 commuters

With mSG votes, the stars are finally aligning to build a dignified commuter hub at penn Station

For the first time, the interests of Penn Station’s 600,000 daily commuters took precedence over the wishes of Madison Square Garden and its owner, James Dolan.

Two City Council committees voted Aug. 28 to grant MSG an operating permit for five years, with the full council expected to approve it in mid-September. The Garden had asked for a permit in perpetuity, while the City Planning Commission and the Manhattan borough president thought 10 years was enough.

general’s office. Perhaps most importantly, since 2013 New Yorkers have learned they don’t have to settle for shabby public space.

LaGuardia Airport has been rebuilt and now is rated the best new airport in the world. The Moynihan Train Hall shows what a dignified rail hub can look like, and the grandly ambitious new Mario Cuomo Bridge came with pedestrian and bicycle lanes. The Second Avenue subway finally opened after decades of fits and starts.

Aaron Elstein

City Council member Erik Bottcher, who represents the Garden neighborhood, said granting the short-term permit was the best way to ensure the western hemisphere’s largest rail hub is rebuilt.

“All the stars are aligned to come up with something really great at Penn Station and we have a oncein-a-lifetime opportunity,” he said at a press briefing after the first committee vote. “New Yorkers have been waiting for six decades for relief from the cramped, drab, confusing Penn Station. We don’t want to wait. We want it now.”

Now, I understand there might be a little gremlin of doubt knocking on your door saying you’ve heard this all before.

It’s true that in 2013 Mayor Michael Bloomberg pressured Dolan to move the Garden so that a new Penn Station could emerge from the arena’s basement. The City Council voted to extend MSG’s permit for just 10 years so it could figure out a new location. The Garden, of course, was never evicted.

But over the past 10 years, some important facts on the ground have changed.

Yet the incredibly busy train station in Midtown remains a “hellhole,” as Gov. Kathy Hochul described it.

Dolan likes the Garden exactly where it is. But his own staff noted at a recent community board meeting that he has options to move the arena, starting with the site where the Hotel Pennsylvania stood across the street. There is also space in Hudson Yards.

Cost will surely be an issue, but then again, the Yankees and Mets managed to build new ballparks by negotiating property-tax exemptions that last until the 2040s. The Garden has an even better deal: It has enjoyed a blanket and perpetual property-tax exemption since 1982, an extraordinary benefit that has saved the owners more than $900 million over the years.

Assuming a new Garden generates more revenue than the existing one, its assessed value would rise and the tax benefit becomes even more valuable to Dolan.

Join us for a live interview with Andrew Kimball, President & CEO, NYC Economic Development Corp. He’ll share his priorities and outlook on the New York City economy, where the economy is heading, and how the EDC envisions the future for public-private partnerships.

Location:

Global warming makes investment in public transportation more urgent, especially while we have an Amtrak fan in the White House and a Congress that approved hundreds of billions for infrastructure. Dolan is an even more polarizing figure than before, and his practice of using facial-recognition technology to boot out unwanted ticket-holders drew the attention of the attorney

Dolan isn’t averse to spending on new arenas. He just spent $2.3 billion to build the MSG Sphere, a cutting-edge entertainment palace about to open in Las Vegas. He’s not eager to spend like that again, he said on a recent conference call, but he is interested in partners building Spheres in other cities.

“We’re looking at more of a franchise-type model, right, in terms of constructing the Spheres,” he said. “We’ve done a lot of innovation in the construction area...”

That sounds like an invitation to developers to design a new arena in Manhattan.

2 | CRAIN’S NEW YORK BUSINESS | SEptEmBER 4, 2023

Correction

City Council member Erik Bottcher said granting MSG a short-term operating permit was the best way to ensure Penn Station (above) is rebuilt. | BLOOmBERG

In

the Aug. 21 Notable Leaders in Accounting, Tax & Audit, the profile of FORVIS partner Rick Cole should have said he serves as the market leader for the nonprofit, education and public sector.

IN THE MARKETS

180 Central Park South, NYC CrainsNewYork.com/ pb_kimball

Pet parenthood surges in Long Island City, and Fido-friendly businesses are lapping it up

for residents’ four-legged friends

Long Island City has gone to the dogs. And cats. And possibly even hamsters.

e American Society for the Prevention of Cruelty to Animals reports that approximately 23 million Americans adopted a pet during the pandemic. And a boom in housing construction in the Queens neighborhood in the past ve years has included a large number of pet-friendly apartment buildings, according to research rm CoStar.

e Partnership for Long Island City, the local economic development agency, has found that the number of dog licenses granted in the neighborhood ballooned 184% between 2016 and 2022, reaching 2,786 in 2022. e number of dog licenses in western Queens overall shot up 171% during that time frame, the partnership found, hitting 7,782 in 2022.

Pet-service businesses such as veterinary o ces and grooming salons have taken notice and have been popping up in the area.

By some counts, as of August there are 30 pet-oriented businesses in a neighborhood of approximately 60,000 residents.

On 23rd Street, there is Dog Island City, which provides boarding services.

Over on Jackson Avenue is Pet Island, which sells pet supplies. City Vet has brought its services to Vernon Boulevard. And on 11th Street is Dogo Pet Fashions, which sells dog accessories and apparel.

Pet-friendly businesses

Laura Rothrock, president of the Partnership for Long Island City, said that in addition to the pet-centric companies around town, “a lot of businesses also became very pet-friendly, so they allow dogs or have special events or promotions for dogs.”

Another business taking part in the Long Island City pet bonanza is InstaVet Technologies, which provides emergency vet services. After starting out as a mobile vet scheduling app in 2014, the company pivoted to a service that worked with vets to do house calls. Its founder and CEO, Elijah Kliger, says Long Island City provided a small enough area in which to test the rm’s new direction.

In 2016 InstaVet partnered with real estate developer Rockrose, which owns several rental buildings in Long Island City, to o er house calls as an amenity at the landlord’s pet-friendly properties in the neighborhood, Kliger said.

e partnership gave Kliger’s company exposure to approximately 10,000 pet-friendly apartments in the neighbor-

hood, but the rm had to stop making house calls during the pandemic.

Veterinary care

e company pivoted again, opening a 4,500-square-foot veterinary emergency facility at 44-16 23rd St. Kliger employs 20 workers, and there are 10 veterinarians in InstaVet’s network. e company has now resumed house calls, but only for end-oflife care.

It wouldn’t be an understatement to say pet owners want what’s best for their fourlegged friends. And, Rothrock says, having so many businesses in the neighborhood that cater to Fido, Mittens and Spot o ers bene ts in the form of camaraderie and convenience.

“Pets are really important to people. ey are like a family member,” Rothrock said. “So it is important that when dogs go to a vet or a doggy day care, that it’s someone they can really trust. If it’s local, that is even better.”

SEPTEMBER 4, 2023 | CRAIN’S NEW YORK BUSINESS | 3

Puddle, a French bulldog, and Jolene, a goldendoodle, play at a dog park in Long Island City. | BUCK ENNIS

The Queens neighborhood has seen an uptick in demand for services

By Mario Marroquin

“Pets are really important to people. They are like a family member.”

Laura Rothrock, Partnership for Long Island City

Turtle Bay townhouse of late Broadway composer Stephen Sondheim finds a taker within weeks

the seven-bedroom property is in a neighborhood that was expected to have a big year in 2023

By C. J. Hughes

The year began with predictions that Turtle Bay would be hot in 2023. A recent deal suggests the prognosticators might have been onto something.

The estate of Stephen Sondheim sold the late composer’s townhouse in the Midtown-adjacent Manhattan neighborhood within just a few weeks of listing it.

$7M

The seven-bedroom, 5,700-square-foot property at 246 E. 49th St., which is between Second and Third avenues, went into contract the week of Aug. 14, according to

according to StreetEasy. The sale price won’t be clear until the home’s deed hits city records. But Compass does not appear to have reduced the price for the five-floor, prewar townhouse during the brief time it was on the market.

The property is in a one-block historic district called Turtle Bay Gardens that has 20 Civil War-era townhouses that share a common back yard.

the Olshan Luxury Market Report, which tracks high-end sales week to week. Brokerage Compass listed the property July 11 for $7 million,

Critically acclaimed and award-winning Sondheim, whose decades-long Broadway career spawned smashes including Sweeney Todd, Company and Into the Woods, as well as tunes such as “Send in the Clowns,” died in November 2021 at his country house in Connecticut at age 91. He bought the townhouse in 1960 for an unknown price with proceeds from his hit Gypsy, Olshan said. The home, which Sondheim shared with his husband, Jeffrey Romley, was the only Manhattan townhouse in the luxury bracket to trade the week of Aug. 14, Olshan added. Though several news reports identified the home as Sondheim’s, Michael Franco, the Compass agent with the listing, did not explicitly mention the Broadway connection in

the ad for the property, which has three and a half baths, a piano-adorned studio and solarium and numerous stained-glass windows. It sits inside a one-block historic district, Turtle Bay Gardens, whose 20 Civil War-era townhous-

es share a common back yard.

The district, created in 1966 and one of New York’s first, represents “a fine example of cooperation and understanding among neighbors,” according to the area’s official plaque. Franco did not respond to a request for comment.

At the end of 2022, with subway ridership still below prepandemic levels, StreetEasy predicted that New Yorkers would seek out homes with in walking distance of their offices, which was expected to benefit Turtle Bay. Search traffic seemed

to buttress the claim. The neighborhood, which sits east of Lexington Avenue and between East 42nd and East 53rd streets, saw the biggest increase in housing searches from 2021 to 2022, with a 47% leap, the company said at the time.

A middle-of-the-pack pricing strategy may have also helped sell 246 E. 49th St. According to brokerage Douglas Elliman, the median price in the second quarter in Manhattan for luxury properties, or those in the top 10% of all transactions, was $6.7 million.

Acclaimed club in West Village club resumes paying rent in a good sign for the city’s nightlife

By Aaron Elstein

West Village club Le Poisson Rouge has resumed paying rent, an encouraging sign for the city’s nightlife sector, which still hasn’t recovered its prepandemic mojo.

The acclaimed independent venue at 158 Bleecker St., which opened in 2008, went dark in March 2020. Even after reopening in August 2021, it didn’t pay rent for more than a year, according to Fitch Ratings.

But now the music club is not only paying rent, it is also in discussions to settle outstanding bal-

co, Radiohead drummer Philip Selway and a Taylor Swift dance party. It also regularly hosts art exhibitions, burlesque shows, movies and drag queen bingo nights.

It isn’t clear how much the club owes or exactly when rent payments resumed. Neither co-founder David Handler nor the club’s marketing department returned emails seeking comment.

Improving fortunes

Le Poisson Rouge’s financial revival is a sign of improving fortunes for the city’s arts and entertainment impresarios, even though business remains depressed by certain metrics.

The revival in concerts and shows appears to be spilling over to restaurants catering to tourists and the pre-theater crowd.

ances and extend its lease, Fitch said in a report last month.

The club has a capacity of about 700, with upcoming events including singer/songwriter Ani DiFran-

Employment in the arts and entertainment industry, at 88,200 in June, remained 10% below 2019 levels, according to the New York State Comptroller’s Office. Attendance at Broadway shows for the season that ended in May came in 17% below 2018-19 levels and gross revenue 14% lower. The Public Theater and Brooklyn Academy

of Music have let go staff, while the Metropolitan Opera will produce fewer shows in the upcoming season than before.

But in the past few weeks business appears to have improved.

Attendance at Broadway shows for the Fourth of July holiday week was 99.6% of 2019’s level, the comptroller’s office said.

Officials at Madison Square Garden said last month that they would produce 185 shows at this season’s Radio City’s Christmas spectacular, four more than last year, because ticket sales are running 40% higher than a year ago.

“Both demand and tourism are making a more complete return post-pandemic,” MSG Entertainment’s Chief Financial Officer, Da-

vid Byrnes, said on a conference call Aug. 18.

The revival in concerts and shows appears to be spilling over to restaurants catering to tourists and the pre-theater crowd. The owner of the Bryant Park Grill said revenue at New York locations rose by

4% last quarter, to $12 million, and was 2% higher than the equivalent period in 2019. This fiscal year, sales at Ark Restaurants’ local locations are running 17% higher over 2022.

“New York sales have been very good,” CEO Michael Weinstein said on a conference call last month.

4 | CRAIN’S NEW YORK BUSINESS | SEptEmBER 4, 2023

RESIDENTIAL SPOTLIGHT

List price for the townhouse of late composer Stephen Sondheim

Stephen Sondheim; 246 E. 49th St. | GEttY mAGES, COmpASS

Le Poisson Rouge, 158 Bleecker St. | WIKIpEDIA

MTA must not risk congestion pricing by ‘double-tolling’ drivers

How much should cars pay to enter Manhattan? is question, at the very heart of the congestion pricing plan set to be implemented next year, is proving to be one of the thornier political quandaries New York bureaucrats have had to grapple with in recent years. After the state Legislature passed legislation in 2019 to permit tolling south of 60th Street, the MTA spent several years securing federal approval and trying to beat back opposition from New Jersey politicians.

New Jersey Gov. Phil Murphy is still suing to scuttle congestion pricing altogether—the Democrat doesn’t want New Jersey commuters to pay extra to enter Manhattan—but his chances of success aren’t high. What he can do, however, is continue to foment backlash to congestion pricing, perhaps joining with Democrats in the outer boroughs and the surrounding suburbs to eventually undermine the pricing scheme.

As Charles Komano , the leading transportation analyst, recently

argued, congestion pricing must be implemented correctly to survive opposition from Murphy and his many allies.

While much of the opposition remains disingenuous, critics aren’t without merit. In a pre-Covid world, charging vehicles to enter Manhattan’s booming business corridors was a no-brainer. However, New York’s economic recovery from the pandemic has been gradual and uneven, with outer-borough businesses nding it much easier to return to full strength. e rise of remote work has emptied out Midtown and depressed various downtown enterprises. Commuting patterns have changed permanently.

Still, congestion remains a great concern on Manhattan streets; some New Yorkers got into the habit of buying cars to skip pandemic-era subway rides and now want to keep enjoying that comfort. Truck tra c, driven by the endless surge of online deliveries, clogs commercial corridors from sunrise to sundown.

New York desperately needs to

incentivize using public transportation. Congestion pricing can help and can o er critical funding for an MTA that can no longer rely on pre2020 ridership numbers.

Critics rightly point out that MTA o cials have a long history of wasting the revenue they hoover up— projects are routinely over budget, and New York construction costs, compared to what gets spent in London or Tokyo, are astronomical—and it will be up to state lawmakers to scrutinize where the tolling revenue actually ends up. But starving the MTA won’t produce better policy outcomes.

e MTA is considering imposing an extra toll on the tunnels that charge drivers to enter Manhattan. is would mean an automobile coming through the Hugh Carey Tunnel between Brooklyn and Manhattan or the Holland and Lincoln Tunnels from New Jersey would pay the current toll in addition to the new congestion charge.

Suddenly, a New Jersey motorist must reckon with the normal $14.75 peak hour toll and $15 congestion fee. e same would be true of a driver coming from Brook-

lyn who would pay the current $7 toll and the new congestion fee.

At least one member of the MTA’s congestion pricing team believes exempting these sorts of New Jersey and outer-borough drivers could require sticking other Manhattan-bound drivers with an additional $9 congestion tab. Komano and most transportation experts think the MTA’s math is wildly o , however. ey believe there’s no need to double-toll the tunnels and that a simple 15-9-3 pricing plan—capping the peak hour congestion toll at $15, reducing it to $9 on weekends and holidays, and $3 on various o -peak hours—would generate the $1 billion a year the MTA requires to hit its revenue targets.

e reality is that double-tolling the East River and Hudson River tunnels would incentivize the same sort of commuting patterns that plague outer-borough neighborhoods today. To avoid the Hugh Carey Tunnel, many drivers opt to stay on the Brooklyn-Queens Expressway and take the free crossings at the Brooklyn and Manhattan Bridges. In a scenario where motorists pay a $7 toll and a $15 conges-

WE'RE RAISING HEALTH FOR MORE PEOPLE IN NEW YORK THAN ANYONE

tion surcharge to drive through a tunnel into Manhattan, they’ll also decide to head to the cheaper option at the bridges. Toll-shopping would continue to blight the waterfront neighborhoods of the city. e greater question is why the MTA is insisting it must double-toll the tunnels. Going forward with such a plan would give credence to Murphy and other politicians who want to kill congestion pricing altogether. It amounts to sabotaging what is still a very good idea.

Quick takes

◗ Gov. Kathy Hochul is correct to call out the Biden administration for its slow response to the migrant crisis.

Temporary Protected Status authorization for immigrants from Venezuela would go a long way toward getting migrants out of shelters and into jobs to support their families.

◗ Hochul doesn’t want New York City’s right-to-shelter law to apply statewide, but it should—and it would take the burden o city shelters.

Ross Barkan is a journalist and author in New York City.

SEPTEMBER 4, 2023 | CRAIN’S NEW YORK BUSINESS | 5

With more experts across all specialties working together, we’re Raising Health for more people in New York than anybody.

MORE EXPERTS. DEEPER INSIGHTS. NEWER BREAKTHROUGHS.

ON

POLITICS

Ross Barkan

A plan the MTA is considering would force users of the Hugh Carey Tunnel to pay a regular toll and the new congestion charge. | BLOOMBERG

Developer thinks office-to-residential conversions, unique hotel perks have a big future in New York

Two ideas at the center of New York real estate these days are office-to-residential conversions and adding new types of entertainment options to the city’s hotels. Developer Bart Blatstein has plenty of experience with both. The Tower Investments CEO recently installed a massive water park at his Showboat Atlantic City hotel and has turned several office buildings into residences in his native Philadelphia. He believes there are several lessons from these projects for New York as the city struggles to figure out the future of its office and hotel properties in the wake of the pandemic. |

Interview by Eddie Small

CEO of tower Investments

68

Grew up: philadelphia

Why did you decide to add a water park to the Showboat?

This is a huge former casino, and it’s just filled with families. Everywhere you turn, there’s families. It became apparent that an indoor water park, which is year-round, would be a great fit. We built a huge arcade to start things off, and then we added a 40,000-square-foot indoor go-kart track in the lobby, and it was incredibly well received. And then a little over a month ago, we opened up the water park, and it’s been a kick. It’s a happy place.

Is there any concern that the casinos planned for downstate New York will hurt business in Atlantic City?

Everybody thought it was inevitable that New York would get more casinos, and the strong will survive. The problem with

Atlantic City casinos is there are some that are very, very old buildings, and in Las Vegas they would be demolished and rebuilt. It’s kind of like, innovate or die. If you don’t change things up, people will get bored going back, and opening up a new restaurant in a casino is not going to move the needle. It takes a lot more than that.

Will unique attractions like water parks and the thrill ride planned for one hotel in Times Square be an important way for hotels to attract business going forward?

Definitely. Everything is shifting to hospitality: taking properties and injecting heart and soul into them. You have to make sure that you give the customer a reason to come. It’d be very difficult in the city because of the cost of real estate, but there are all kinds

of other amenities that can go into these large hotels.

On the other side of real estate, what makes office properties challenging candidates for residential conversions?

The width of the buildings. It doesn’t matter how long the building is, but if it’s more than 70 feet wide, it’s a problem because the apartments become cavernous. The problem with a number of old office buildings is that they’re square as opposed to rectangular. That makes for difficult conversions unless you core out the center or come up with some other creative idea for using that space. You also have to take into account its location, and the replacement cost is outrageous. It’s helpful if you can buy the property very, very cheap.

Are office-to-resi dential conversions a good solution in general for the surplus of office space in the wake of the Covid?

One hundred percent. The conversion of office buildings into residential ones has been ongoing since the ’80s. It hasn’t happened as much in New York, but I’m sure it will. You’ve got a lot of very bright and capable leaders up there who are going to figure it out, and that will also help alleviate the demand for residential space. This is all about what’s missing.

Education: Bachelor’s in history, temple University

Poker face: Blatstein has been running a small, $100 poker game with friends for more than 40 years. they have played almost every version of the game in that timespan, but he says it is more about spending time together than winning money.

Waterworks: Blatstein’s Showboat hotel, which was built in 1987, has a water park that’s not just for fun. It also has two quiet areas where visitors can set up their laptops and get some work done, an acknowledgment from Blatstein that people really can work from anywhere these days.

Most rent-stabilized units don’t stay vacant long: report

By Eddie Small

A new report seeks to shed some much-needed clarity on a pair of hot-button issues: how many of the city’s rent-stabilized apartments are empty and how long they stay that way.

The report from the city’s nonpartisan Independent Budget Office found that fewer than 5% of rent-stabilized apartments are vacant on average, and most of them remain empty for less than a year. These have recently emerged as extremely contentious topics as the city deals with a severe affordable housing crisis and months of record-high rents.

The office estimated that in 2022

2022, while about 13,000 had been empty in 2022 and 2021, according to the report. The IBO could not determine how long the remaining roughly 4,000 apartments had been empty.

The number of empty rent-stabilized units hit its peak in 2021, when almost 60,000 were vacant, the report says. That was the only year since at least 2017 when the vacant number surpassed 5%, and nearly two-thirds of those units had been rented by 2022, according to the report.

The vacancy rate for rent-stabilized units in Manhattan and on Staten Island was 6% last year, while the rate in Brooklyn and Queens was 5% and the rate in Brooklyn was 4%, the report says. Manhattan had the highest number of empty units, at about 14,000, while Staten Island had the lowest, at 421.

estimate how many consecutive years city rent-stabilized units were staying vacant.

not cost-effective to renovate and upgrade apartments that they can’t charge more for in the end.

sands of apartments to stay empty.”

about 92.5% of rent-stabilized apartments, or 800,000, were rented, while 4.9%, or 42,000, were vacant. The remainder were temporarily exempt from rentstabilization rules, meaning they were likely occupied by an owner, employee or nonprofit.

Of the empty units, about 25,000 were newly vacant in

Queens had the highest median rent for vacant units, at $1,857, while the Bronx had the lowest, at $1,400, according to the report.

Landlords register an average of roughly 880,000 apartments per year with New York State Homes and Community Renewal, and IBO examined that data to

The number of empty rent-stabilized apartments in the city has been a source of heated debate, particularly given concerns that landlords are “warehousing” them, or keeping them off the market on purpose following the state’s strict 2019 rent law, which limits how and when they can remove units from rent stabilization, especially after renovations. Landlords have blamed the law for the empty units, saying it is

“The only rational conclusion you can draw from this data is that newer, high-rent apartments in 421-a buildings that were vacant during the pandemic are now being rented because there is high demand for housing,” said Community Housing Improvement Program Executive Director Jay Martin. “The number of overall vacancies should be dramatically lower, but the current laws are forcing thou -

Cea Weaver, campaign coordinator at Housing Justice for All, pushed back on that, arguing that the study showed the 2019 rent law is helping keep rents low and that the crisis of empty rent-stabilized units is overblown.

“These are normal vacancy rates. It’s just not a significant number,” she said, “and for those units that are vacant year over year, it’s simply not that many compared to the overall stock.”

6 | CRAIN’S NEW YORK BUSINESS | SEptEmBER 4, 2023

The city’s Independent Budget Office found that fewer than 5% of rent-stabilized apartments are vacant on average, and most remain empty less than a year.

ASKED & ANSWERED

BUCK ENNIS

Manhattan apartments. BUCK ENNIS

New York Power Authority bonds upgraded by Moody’s in part over strong fiscal year

By Caroline Spivack

Moody’s has revised the New York Power Authority’s bond outlook to positive from stable and upgraded the bond rating of its affiliate, SFP Transmission, to A1 from A2. The changes stand to impact $2.4 billion worth of debt se curities, according to Moody’s.

The ratings agency noted a strong past fiscal year for NYPA due to higher market energy pric es and positive momentum on two transmission line projects.

NYPA is in a critical moment of transition: In the state budget that passed in May, after four years of debate, lawmakers empowered the state-owned electric utility to play a greater role in New York’s shift to green energy. Additionally, NYPA has a new president and CEO, Jus tin Driscoll, who was able to drop “acting” from his title in July based on an obscure section of state law.

“NYPA serves as an instrumen tality of the state and plays a key part in its economic development goals,” Moody’s wrote in an Aug. 17 report. “[The upgrade] acknowl edges the successful execution of construction for SFP’s two inaugu

Moody’s analysts said the success of two transmission projects—so far both on time and within budget—bodes well for future power line projects.

ral projects and the increasing amount of revenue and cash flow visibility that will emerge and be sustained overtime as transmis sion assets are completed.”

SFP, which NYPA formed in 2021, was created to finance, oper ate and maintain transmission projects and collect revenue. SFP was purposely structured to have its bonds paid by revenue generat ed from the transmission projects.

One undertaking Moody’s cited in its report was SFP’s $484-mil lion Smart Path Reliability Trans mission project, which overhauled 78 miles of state transmission lines to help deliver more renewable energy downstate. Those upgrades went live in May.

Strong earnings

A second effort, known as the Central East Energy Connect Proj ect, is on schedule for completion by the end of this year. The project is set to expand electric capacity along 93 miles of transmission lines in the Mohawk Valley and Capital Region at a cost of $615 million.

Moody’s analysts said the suc cess of both transmission proj ects—so far both on time and with

in budget—bodes well for future power line projects.

Another key bright spot for NYPA was a strong year of earnings due to higher market energy prices and transmission revenues.

Operating revenues and operating income for NYPA in 2022 totaled

Moody’s upgrade. “The improved rating outlooks are critical for the Power Authority to ensure that we can continue leveraging the capital markets to provide affordable, reliable, and green electricity in support of the state’s transition into a clean energy economy,” he in an emailed state

As part of the Climate Leader ship and Community Protection Act passed in 2019, New York must

draw 70% of its electricity from renewable sources by 2030 and by 2040 have all of the state’s electricity be carbon-free.

Toward that end, the fiscal 2024 state

failed to keep pace with the state’s

PLEASE HELP MAUI

THE MAUI STRONG FUND USES 100% OF DONATIONS TO MEET COMMUNITY NEEDS

Please support our friends at Hawaii Business Magazine in collecting donations to help the victims of the one of the deadliest wildfires in U.S. history.

Maui Strong is a nonprofit fund that quickly deploys food, medicine, housing and other essentials to the survivors of the devastating wildfires on Maui and those le jobless.

To donate, use the QR code below or go to hawaiicommunityfoundation.org/maui-strong

Maui’s ‘ohana is grateful for your support!

September 4, 2023 | CrAIN’S NeW YOr

Power lines in New York. bLOOmberG

Prioritizing protection of bicyclists will help mayor rebuild residents’ trust

In 2014 the city launched Vision Zero, an initiative to reduce tra c deaths and injuries, including for the booming number of New Yorkers who get to school and work via bike. ough well-intentioned, the program has not curbed tra c collisions and fatalities for cyclists. Now the city is on pace to make 2023 the deadliest year for bike riders in 40 years, with 22 cyclists and e-bike riders dying as of mid-August.

While on the campaign trail, Eric Adams promised to champion street safety. is is important because making the city safe for people to get around is key to its attracting and retaining businesses. But as reporter Caroline Spivack reported recently, despite wins when it comes to keeping pedestrians safe, the mayor has been slow to follow through on his pledge to increase the number of protected bike lanes.

As a candidate, Adams said he would implement 300 miles of protected bike lanes in just four years—or an average of 75 miles per year. In his rst year in o ce, however, the Adams administration created just 26.3 miles of protected lanes. De-

partment of Transportation Commissioner Ydanis Rodriguez pointed to sta shortages as the reason for the city’s slow rollout of protected bike and bus lanes.

It’s disheartening that the mayor ipopped on installing a protected bike lane planned for the infamously dangerous McGuinness Boulevard in Brooklyn, home to restaurants and other businesses. Adams had approved the upgrades in March, but then his top aide raised concerns about the project after a push reportedly by the family behind the Broadway Stages lm production company, which is headquartered nearby. e Department of Transportation walked back its plans in July.

Essential to local quality of life

e Adams administration ultimately announced that it would proceed with scaled-down safety improvements on McGuinness Boulevard, including protected bike lanes. e new plan has received mixed reactions, and opponents of bike lanes have taken note that the mayor’s

purported focus on street safety is up for discussion, especially if his sta and top advisers get involved.

A mayor who aims to get stu done for the people of New York should stick to his plans, especially ones for which the community has weighed in and given its OK. Flip- opping on matters of public safety is not a good idea for Adams, who is ostensibly looking to rebound from a recent Siena poll that found 64% of the New Yorkers surveyed rate the job he’s doing as just fair or poor. In the same poll, only 32% of respondents said the city is on the right track. Showing that he is committed to putting New Yorkers’ needs and safety rst is a good way to rebuild trust.

As the city pushes to have fewer cars on the roads, that means more bikes will be hitting the streets. Making sure bicyclists are safe as they head to work or to run errands is essential to local quality of life as

well as to helping the city achieve its climate goals. is is not to mention that ensuring that the city is bicycle-friendly will help to attract European and Asian tourists used to zipping around on bikes and make life safer for the deliveristas who bring us our takeout and packages.

To make all this happen, the mayor must live up to his campaign promises. He should show New Yorkers that in getting stu done, he values sticking to his word.

We deserve a high-quality environment in Union Square

Union Square turned into a scene of unrest on Aug. 4 after social-media streamer Kai Cenat said he was holding a big giveaway. Such events underscore an important reality: Our parks and plazas are a vital thread in the fabric of our city. Union Square Park is the backdrop of so much life coursing through New York—the agship Greenmarket, the annual Earth Day Festival, subway commutes and meetings with coworkers and friends.

e melee also provides a clear case for the critical role that our business improvement districts play. In this case, Union Square Partnership team was among the rst to observe that a large queue was forming and the site would need to be secured to safely accommodate a growing crowd.

During and after the event, we worked alongside city and state agencies to monitor the situation, communicate with local stakeholders, clean and repair the park and reach out to local businesses to see if they sustained damage and make them aware of available support. We are proud of our team’s swift action and our partners’ dedication throughout that weekend to make sure the district was open for business the next morning.

is dynamic response and partner collaboration builds on the work that we do

every day stewarding the Union Square14th Street District—from our Clean + Safe program to our greening initiatives and a robust events calendar throughout the year—to ensure the best possible experience for tens of thousands of residents, workers and visitors every day. e work

projects including street murals, public art and holiday lights, Union Square Partnership is simultaneously advancing a bold new vision plan to transform Union Square’s public space—to make the rst major capital investment in the park in almost 15 years and the rst signi cant redesign of the entire square in almost four decades. Unveiled in 2021, the USQNextPlan pointed a way forward, centering on three key improvements: prioritizing accessibility, greening initiatives throughout the district and substantial increases in public open space.

health: It is a leading transit hub, a powerful jobs center, a robust residential community, a center for culture and recreation, a burgeoning tech campus and a shopping destination.

led by Union Square Partnership reaches these individuals daily—the families at Evelyn’s Playground, the o ce workers eating lunch at our bistro tables and the visitors watching a street performer or sampling the seasonal bounties of the Greenmarket.

USQNextPlan

In addition to keeping the park clean and undertaking a range of beauti cation

e vision plan is an opportunity to invest in the modernization of Union Square to ensure this important commercial center meets the needs of today’s New York—and those of generations to come. It is also a model of its kind, and it’s clear that New Yorkers and our civic leaders are ready to champion such ideas.

Just months ago, Gov. Kathy Hochul and Mayor Eric Adams introduced the “Making New York Work For Everyone” action plan by calling for the reimagination of our business districts into vibrant, 24/7 destinations for all through a suite of interventions including catalytic investments in beautiful, permanent public space. Union Square has many of the building blocks the action plan identi ed as key to business district recovery and sustained

at makes Union Square uniquely positioned for catalytic investment in its public realm, investment that would jumpstart not only a virtuous cycle of economic growth in the district itself, but also be a model live-work-play neighborhood that advances the city and state’s business district recovery goals for New York City as a whole.

After a banner year of new business openings throughout the district, now is the time to transform Union Square into the high-quality urban environment New Yorkers deserve—with contemporary, safe transit, improved accessibility, sustainable greenery and expanded open space— creating the dynamic mixed-use business district that New Yorkers need. ere has never been a better or more crucial time to invest in accessibility, safer public spaces and the modern evolution of the very heart of our city.

8 | CRAIN’S NEW YORK BUSINESS | SEPTEMBER 4, 2023

PERSONAL VIEW EDITORIAL Write us: Crain’s welcomes submissions to its opinion pages. Send letters and op-eds of 500 words or fewer to opinion@CrainsNewYork.com. Please include the writer’s name, company, title, address and telephone number. Crain’s reserves the right to edit submissions for clarity.

Julie Stein is executive director of the Union Square Partnership.

Lynne P. Brown is co-chair of the Union Square Partnership.

William Abramson is co-chair of the Union Square Partnership.

Union Square is uniquely positioned for catalytic investment in its public realm.

BUCK ENNIS

Time to tackle the insurance crisis in affordable housing

Recent news articles describing discrimination by insurance companies against buildings with affordable housing in New York City were met with shock and condemnation. But for organizations like ours, which partner with mission-driven organizations to bring affordable housing to communities in need, the findings were not surprising. Such discrimination is just one aspect of the broader problem of skyrocketing costs and diminishing availability of insurance for affordable housing in New York.

This problem has been much studied. In 2022, the New York State Department of Financial Services (DFS) released a report, mandated by New York state legislation, that analyzed the issue of high costs and the diminishing insurance marketplace. In its report, DFS describes its role under the NYS Financial Services Law as “the reduction and elimination of fraud, criminal abuse and unethical conduct by,” among other industries, over 1,700 insurance companies.

Meanwhile, the affordable housing world in New York has absorbed shocking insurance premium hikes over the past several years, with properties commonly seeing triple-digit percent increases at renewal, despite often solid claims history records. It has seen the number of companies willing to write policies for affordable

PERSONAL VIEW

housing dwindle down to a small handful.

And it has seen insurance companies persistently ask whether properties contain subsidized units, such as those with rental-assistance vouchers. This is despite a New York state law that our organization, Enterprise, led the effort to pass that prevents source-of-income discrimination by those very landlords.

As a low-income housing tax credit syndicator, asset manager and nonprofit lender, Enterprise has a window into these practices and has heard our partners, many of whom are nonprofit and minority and women business enterprise owners, speak with growing alarm about the pure unaffordability of insurance.

This is a serious concern. With these increases, the thin operating margins that affordable housing survives on gets thinner or worse, going from the black to the red. When this starts occurring across the state’s portfolio, it becomes a significant public policy concern.

Coupled with other expense challenges, such as increases in utility and labor costs and large rental arrears, the insurance crisis is creating a perfect storm. It threatens the very viability of projects, portfolios and the organizations that own them.

Why, then, hasn’t New York State taken a larger role in examining every option to reduce costs, enforce anti-discrimination

measures and reverse the trend of insurance companies simply walking away from affordable housing when the production and maintenance of that housing is one of the state’s most important priorities?

Not pure math at play

We understand the solutions are not simple. Insurance premium increases are not limited to New York or to the residential real estate market. The DFS report points to a number of factors influencing these rates, many of which are valid. However, when insurers treat rental assistance as a blanket risk, we know it is not pure market mathematics at play.

To that end, we are encouraged that a number of New York State legislators have pledged to tackle the issue of discrimina-

Enforcement alone will not solve New York’s gray market weed problem

Across New York state, raids of unlicensed cannabis retailers have become more ubiquitous than stores licensed to sell it.

These unlicensed retailers have put a gaping hole in the city’s balance sheet where elected officials thought tax revenue would be. Whether or not it is fair or moral to sic cops on cannabis business owners who operate in regulatory no-man’s land is a debate for another time. From a policymaking standpoint, the most important question is a narrow one: Will the enforcement actions work?

We can report that they will not. We know this because we invested the time and effort to poll New York residents who use cannabis, seeking to find out what’s keeping the gray market alive. Three hundred and fifty four people in New York state who use cannabis responded, and while the data is non-scientific and contains selection bias, it’s the first effort we’re aware of to investigate the situation by polling a critical mass of real people.

What we found was eye-opening. It’s not just that law enforcement can’t keep

up with the rate at which gray market locations open. It’s also that New Yorkers have a ton of misplaced trust in the unlicensed market for cannabis.

Consumer trust: that’s the real problem here.

Sixty-one percent of respondents who buy cannabis in unlicensed gray market locations said they trust that it has been tested for contaminants and 70% said they trust it is accurately labeled. But gray market purveyors do not have testing requirements. Much of their cannabis has been trafficked into New York state precisely because it failed testing requirements elsewhere. Counterfeiting and mislabeling are widespread, and many workers at gray market stores do not have the training sufficient to make informed recommendations to consumers. If left unchecked, this will cause greater problems.

The legal recreational market features useful regulations that govern cannabis production and cultivation. Licensed retailers provide pretty good advice to those who are new to the substance. But if the most common consumer entry point to

cannabis is via gray market retailers that sell tainted products and provide no guidance on use, then the customer experience will suffer.

Our data supports this view. Most respondents who buy cannabis in the gray market reported one or more negative experiences. About 30% said it made them higher than they expected, while 31% said the product looked, smelled or tasted odd and 65% said the product didn’t get them as high as they expected. Nearly 8% reported that it made them feel unwell.

A public health issue

So if not enforcement, what’s the solution? It’s a combination of more licensed recreational shops and more consumer education that highlights the differences between gray market weed and the good, legal stuff.

There’s been recent, if modest, progress to open more stores. As of mid-August, 12 recreational dispensaries had opened in the past four months, and the state has recently approved an additional 212 licenses. Operators will still have difficulties accessing capital and finding retail space that’s up to code, but the point is that it’s in motion from a regulatory standpoint.

tion. This is an important aspect of solving the broader problem. However, why is new legislation necessary when a source-of-income discrimination law is already on the books and when there is already a state agency—DFS—whose role includes overseeing the insurance industry and eliminating unlawful and unethical conduct?

High insurance costs are undermining both the state’s laudable goals with respect to increasing affordable housing production and the work done by the agencies responsible for meeting those goals.

The question we consistently hear from our partners is: “What is being done to fix this?” With some much-needed public attention on this longstanding problem, it is our hope that New York State leaders will soon have answers to that critical question.

More stores should address the budgetary shortfall that elected officials are encountering. But the problem is more than financial. It’s also a public health issue, and policymakers should treat it like one.

There has been no effort we’re aware of to educate the public about why legal cannabis is superior to gray market product. There needs to be. This, not enforcement, is where policymakers should focus.

September 4, 2023 | CrAIN’S NeW YOrK bUSINeSS | 9

N e WSCO m

Alex Milligan is co-founder and CMO of NuggMD, a cannabis telehealth company.

PERSONAL VIEW b LOO mber G

Baaba Halm is vice president and New York market leader of Enterprise Community Partners.

TOP-PAID CHIEF EXECUTIVES

10 | CRAIN’S NEW YORK BUSINESS | SEptEmBER 4, 2023 t HE LIS t

York-area CEOs ranked

total compensation (in millions) amanda.glodowski@crainsnewyork.com RANKCEO NAME COMPANY (TICKER) TOTAL COMPENSATION IN 2022 SALARY IN 2022 BONUS IN 2022 NONEQUITY INCENTIVE PLAN IN 2022 OPTION AWARDS IN 2022 STOCK AWARDS IN 2022 DEFERRED COMPENSATION IN 2022 OTHER COMPENSATION IN 2022 1 StephenSchwarzman BlackstoneInc.(BX) $253.1 $0.4$0.0$0.0$0.0$0.0$0.0$252.8 2 BarryMcCarthy PelotonInteractiveInc.(PTON) $168.1 $0.4$0.0$0.0$167.6$0.0$0.0$0.1 3 HenryKravis KKR&Co.Inc.(KKR) $108.3 $0.3$0.0$0.0$0.0$30.0$0.0$78.1 4 GeorgeRoberts KKR&Co.Inc.(KKR) $108.3 $0.3$0.0$0.0$0.0$30.0$0.0$78.0 5 JosephBae KKR&Co.Inc.(KKR) $80.0 $0.3$19.4$0.0$0.0$0.0$0.0$60.3 6 ScottNuttall KKR&Co.Inc.(KKR) $78.3 $0.3$19.4$0.0$0.0$0.0$0.0$58.6 7 PeterZaffino AmericanInternationalGroupInc.(AIG) $75.3 $1.6$0.0$7.8$3.2$62.4$0.0$0.3 8 PeterAnevski ProgynyInc.(PGNY) $68.6 $0.5$0.0$0.5$42.4$25.2$0.0$0.0 9 RichardHandler JefferiesFinancialGroupInc.(JEF) $56.9 $1.0$10.0$0.0$0.0$45.4$0.0$0.5 10 JamesLevin SculptorCapitalManagementInc.(SCU) $48.9 $1.0$4.0$0.0$0.0$39.4$0.0$5.5 11 StephenSqueri AmericanExpressCo.(AXP) $48.0 $1.5$10.3$0.0$18.8$16.8$0.0$0.6 12 PaulTaubman PJTPartnersInc.(PJT) $40.1 $1.0$0.0$0.0$0.0$39.1$0.0$0.0 13 JamesGorman MorganStanley(MS) $39.4 $1.5$7.5$0.0$0.0$30.4$0.0$0.0 14 DavidZaslav WarnerBros.DiscoveryInc.(WBD) $39.3 $3.1$0.0$21.8$1.4$12.0$0.0$0.9 15 JamesDimon JPMorganChase&Co.(JPM) $34.8 $1.5$5.0$0.0$0.0$28.0$0.0$0.3 16 AlbertBourla PfizerInc.(PFE) $33.0 $1.7$0.0$7.7$9.5$9.3$2.5$2.3 17 LaurenceFink BlackRockInc.(BLK) $32.7 $1.5$7.3$0.0$0.0$23.3$0.0$0.7 18 RobertBakish ParamountGlobal(PARA) $32.0 $3.1$0.0$12.9$0.0$16.0$0.0$0.1 19 DavidSolomon TheGoldmanSachsGroupInc.(GS) $31.6 $2.0$6.9$0.0$0.0$22.4$0.0$0.3 20 DanielGlaser Marsh&McLennanCos.Inc.(MMC) $30.9 $1.5$0.0$7.5$7.3$14.4$0.0$0.3 21 DouglasPeterson S&PGlobalInc.(SPGI) $28.6 $1.4$0.0$2.8$0.0$23.8$0.0$0.7 22 RamonLaguarta PepsiCoInc.(PEP) $28.4 $1.6$0.0$12.5$0.0$9.4$4.3$0.6 23 AdenaFriedman NasdaqInc.(NDAQ) $28.0 $1.3$0.0$4.4$10.0$12.4$0.0$0.0 24 FabrizioFreda TheEstéeLauderCos.Inc.(EL) $25.5 $2.1$0.0$7.0$4.9$9.9$1.0$0.6 25 RalphLauren RalphLaurenCorp.(RL) $24.9 $1.8$0.0$12.0$0.0$11.0$0.0$0.2 26 MorrisGoldfarb GIIIApparelGroupLtd.(GIII) $24.9 $1.0$0.0$7.5$0.0$16.2$0.0$0.3 27 DennisMathew AlticeUSAInc.(ATUS) $22.5 $0.2$1.3$0.0$10.0$10.6$0.0$0.3 28 JaneFraser CitigroupInc.(C) $22.1 $1.5$3.5$1.6$0.0$15.5$0.0$0.0 29 LachlanMurdoch FoxCorp.(FOXA) $21.7 $3.0$0.0$6.3$2.8$8.2$0.0$1.5 30 ChristinaSpade 1 AMCNetworksInc.(AMCX) $21.4 $1.2$0.0$2.1$0.0$7.4$0.0$10.5 31 AlanSchnitzer TheTravelersCos.Inc.(TRV) $21.1 $1.3$0.0$6.8$5.2$7.7$0.0$0.1 32 MichaelMiebach MastercardInc.(MA) $21.1 $1.1$0.0$5.0$3.0$11.7$0.0$0.2 33 PaulHennessy ShutterstockInc.(SSTK) $20.9 $0.3$0.0$0.6$0.0$19.9$0.0$0.1 34 CarlosRodriguez AutomaticDataProcessingInc.(ADP) $20.8 $1.2$0.0$3.6$5.8$9.8$0.0$0.4 35 DavidSteinberg ZetaGlobalHoldingsCorp.(ZETA) $20.7 $0.8$0.5$0.8$0.0$18.3$0.0$0.4 36 JohnWren OmnicomGroupInc.(OMC) $20.7 $1.0$0.0$12.0$0.0$7.5$0.0$0.2 37 CharlesLowrey PrudentialFinancialInc.(PRU) $20.1 $1.3$0.0$5.2$0.0$12.5$1.0$0.1 38 GiovanniCaforio BristolMyersSquibbCo.(BMY) $20.1 $1.7$0.0$3.5$0.0$14.3$0.0$0.6 39 HansVestberg VerizonCommunicationsInc.(VZ) $19.8 $1.5$0.0$3.3$0.0$14.5$0.0$0.6 40 RobertThomson NewsCorporation(NWSA) $19.7 $3.1$0.0$8.1$0.0$8.0$0.0$0.4 41 StephenCooper 1 WarnerMusicGroupCorp.(WMG) $19.4 $3.0$0.0$0.0$0.0$16.1$0.0$0.3 42 FranklinClyburn InternationalFlavors&FragrancesInc.(IFF) $19.3 $1.1$0.0$1.4$3.2$13.3$0.0$0.2 43 JamesDolan SphereEntertainmentCo.(SPHR) $19.2 $1.9$0.0$5.6$0.0$11.1$0.0$0.6 44 KennethMoelis Moelis&Co.(MC) $19.2 $0.4$0.0$0.0$0.0$18.8$0.0$0.0 45 RobertDavis Merck&Co.Inc.(MRK) $18.7 $1.5$0.0$4.1$3.5$8.9$0.2$0.4 46 PatriceJeanLouvet RalphLaurenCorp.(RL) $18.6 $1.3$0.0$7.9$0.0$9.2$0.0$0.1 47

New

by

JPMorganChase&Co.(JPM)

PfizerInc.(PFE)

DouglasPeterson S&PGlobalInc.(SPGI) RamonLaguarta PepsiCoInc.(PEP)

AdenaFriedman NasdaqInc.(NDAQ)

FabrizioFreda TheEstéeLauderCos.Inc.(EL)

RalphLauren RalphLaurenCorp.(RL)

GIIIApparelGroupLtd.(GIII)

AlanSchnitzer TheTravelersCos.Inc.(TRV)

MichaelMiebach MastercardInc.(MA)

PaulHennessy ShutterstockInc.(SSTK)

CarlosRodriguez AutomaticDataProcessingInc.(ADP)

DavidSteinberg ZetaGlobalHoldingsCorp.(ZETA)

JohnWren OmnicomGroupInc.(OMC)

BristolMyersSquibbCo.(BMY)

NewsCorporation(NWSA)

StephenCooper 1 WarnerMusicGroupCorp.(WMG)

FranklinClyburn InternationalFlavors&FragrancesInc.(IFF)

JamesDolan SphereEntertainmentCo.(SPHR)

KennethMoelis Moelis&Co.(MC)

September 4, 2023 | CrAIN’S NeW YOrK bUSINeSS | 11 35 DavidSteinberg ZetaGlobalHoldingsCorp.(ZETA) $20.7 $0.8$0.5$0.8$0.0$18.3$0.0$0.4 36 JohnWren OmnicomGroupInc.(OMC) $20.7 $1.0$0.0$12.0$0.0$7.5$0.0$0.2 37 CharlesLowrey PrudentialFinancialInc.(PRU) $20.1 $1.3$0.0$5.2$0.0$12.5$1.0$0.1 38 GiovanniCaforio BristolMyersSquibbCo.(BMY) $20.1 $1.7$0.0$3.5$0.0$14.3$0.0$0.6 39 HansVestberg VerizonCommunicationsInc.(VZ) $19.8 $1.5$0.0$3.3$0.0$14.5$0.0$0.6 40 RobertThomson NewsCorporation(NWSA) $19.7 $3.1$0.0$8.1$0.0$8.0$0.0$0.4 41 StephenCooper 1 WarnerMusicGroupCorp.(WMG) $19.4 $3.0$0.0$0.0$0.0$16.1$0.0$0.3 42 FranklinClyburn InternationalFlavors&FragrancesInc.(IFF) $19.3 $1.1$0.0$1.4$3.2$13.3$0.0$0.2 43 JamesDolan SphereEntertainmentCo.(SPHR) $19.2 $1.9$0.0$5.6$0.0$11.1$0.0$0.6 44 KennethMoelis Moelis&Co.(MC) $19.2 $0.4$0.0$0.0$0.0$18.8$0.0$0.0 45 RobertDavis Merck&Co.Inc.(MRK) $18.7 $1.5$0.0$4.1$3.5$8.9$0.2$0.4 46 PatriceJeanLouvet RalphLaurenCorp.(RL) $18.6 $1.3$0.0$7.9$0.0$9.2$0.0$0.1 47 MichelKhalaf MetLifeInc.(MET) $18.1 $1.4$0.0$5.0$1.3$10.1$0.0$0.3 48 BrianHumphries 1 CognizantTechnologySolutionsCorp.(CTSH) $17.9 $1.1$0.0$1.8$0.0$14.8$0.0$0.3 49 LeeOlesky 1 TradewebMarketsInc.(TW) $17.4 $0.8$0.0$6.0$0.0$10.5$0.0$0.0 50 DavidSchlanger ProgynyInc.(PGNY) $17.3 $0.3$0.0$0.3$8.4$8.4$0.0$0.0 51 MarcHolliday SLGreenRealtyCorp.(SLG) $16.7 $1.3$0.0$1.1$0.0$14.3$0.0$0.1 52 ArvindKrishna InternationalBusinessMachinesCorp.(IBM) $16.6 $1.5$0.0$3.5$2.0$8.9$0.0$0.6 53 JoshuaSilverman EtsyInc.(ETSY) $16.5 $0.6$0.0$0.4$0.0$15.4$0.0$0.0 54 JohnFoley 1 PelotonInteractiveInc.(PTON) $16.1 $1.0$0.0$0.0$15.1$0.0$0.0$0.0 55 DebraPerelman 1 RevlonInc. $15.9 $1.2$7.1$0.0$0.0$7.5$0.0$0.1 56 StephenRusckowski 1 QuestDiagnosticsIncorporated(DGX) $15.7 $1.3$0.0$2.9$2.9$8.4$0.0$0.3 57 MarkPearson EquitableHoldingsInc.(EQH) $15.3 $1.2$0.0$2.5$0.0$10.6$0.0$1.0 58 JohnWeinberg EvercoreInc.(EVR) $15.2 $0.5$3.3$6.0$0.0$5.4$0.0$0.0 59 JohnCaplan PayoneerGlobalInc.(PAYO) $15.1 $0.3$0.3$0.0$1.1$13.4$0.0$0.0 60 JoshuaSapan 1 AMCNetworksInc.(AMCX) $15.1 $2.0$0.0$13.0$0.0$0.0$0.0$0.1 61 KevinAli Organon&Co.(OGN) $14.9 $1.2$0.0$1.8$2.2$8.7$0.0$0.9 62 RodneyMartin VoyaFinancialInc.(VOYA) $14.7 $1.2$0.0$2.8$0.0$10.3$0.0$0.3 63 NoelWallace Colgate-PalmoliveCo.(CL) $14.5 $1.4$0.0$3.3$4.8$4.4$0.0$0.6 64 DavidFinkelstein AnnalyCapitalManagementInc.(NLY) $14.3 $1.0$6.0$0.0$0.0$7.3$0.0$0.0 65 RonaldKramer GriffonCorp.(GFF) $14.3 $1.2$0.0$9.1$0.0$3.6$0.0$0.4 66 ThomasGibbons 1 TheBankofNewYorkMellonCorp.(BK) $14.1 $1.1$0.0$2.4$0.0$10.3$0.2$0.1 67 JohnHess HessCorp.(HES) $14.0 $1.5$0.0$2.5$4.0$6.0$0.0$0.0 68 KristinPeck ZoetisInc.(ZTS) $14.0 $1.2$0.0$1.3$2.8$8.4$0.0$0.3 69 JoanneCrevoiserat TapestryInc.(TPR) $13.7 $1.3$0.0$4.3$3.2$4.8$0.0$0.1 70 PhilippeKrakowsky TheInterpublicGroupofCos.Inc.(IPG) $13.2 $1.5$0.0$5.8$0.0$5.7$0.0$0.2 71 ThomasNimbley PBFEnergyInc.(PBF) $13.1 $1.5$4.6$0.0$0.0$6.2$0.6$0.2 72 JosephFerraro AvisBudgetGroupInc.(CAR) $13.0 $1.2$0.0$3.3$0.0$8.2$0.0$0.3 73 RichardJohnson 1 FootLockerInc.(FL) $13.0 $1.2$0.0$2.9$1.6$6.4$0.8$0.1 74 HowardLutnick BGCGroupInc.(BGC) $13.0 $1.0$0.0$12.0$0.0$0.0$0.0$0.0 75 HenryFernandez MSCIInc.(MSCI) $13.0 $1.0$0.0$1.2$5.0$5.0$0.0$0.8 76 PaulAbbott GlobalBusinessTravelGroupInc.(GBTG) $13.0 $1.2$2.0$3.6$0.0$6.0$0.0$0.1 77 RalphIzzo 1 PublicServiceEnterpriseGroupInc.(PEG) $12.9 $1.5$0.0$2.3$0.0$9.1$0.0$0.1 78 StefanLarsson PVHCorp.(PVH) $12.1 $1.3$0.0$2.2$1.6$6.4$0.4$0.2 79 DouglasCifu VirtuFinancialInc.(VIRT) $12.1 $1.2$1.3$1.3$0.0$7.9$0.0$0.5 80 TheodoreHarris BalchemCorp.(BCPC) $11.9 $1.1$0.0$1.2$7.1$2.5$0.0$0.0 81 JamesDavis QuestDiagnostics(DGX) $11.9 $0.8$0.0$1.1$1.2$8.5$0.0$0.2 82 AndreasFibig 1 InternationalFlavors&FragrancesInc.(IFF) $11.8 $0.3$0.0$0.0$0.0$0.0$0.0$11.5 83 JamesDolan MadisonSquareGardenSportsCorp.(MSGS) $11.8 $1.4$0.0$3.8$0.0$6.0$0.0$0.5 84 ConorFlynn KimcoRealtyCorp.(KIM) $11.6 $1.0$0.0$3.5$0.0$7.1$0.0$0.0 85 RobertFauber Moody'sCorp.(MCO) $11.6 $1.0$0.0$1.6$1.8$7.2$0.0$0.0 86 JohnDoyle Marsh&McLennanCos.Inc.(MMC) $11.6 $1.2$0.0$5.3$2.0$3.0$0.0$0.1 87 ScottStephenson 1 VeriskAnalyticsInc.(VRSK) $11.5 $0.9$0.0$0.0$2.1$8.4$0.0$0.1 88 EdwardPitoniak VICIPropertiesInc.(VICI) $11.5 $1.0$0.0$4.0$0.0$6.5$0.0$0.0 89 SimaSistani WWInternationalInc.(WW) $11.4 $1.0$1.5$0.0$5.7$3.3$0.0$0.0 90 JoshuaPeirez SterlingCheckCorp.(STER) $11.3 $0.7$0.1$0.8$2.7$7.2$0.0$0.0 91 $11.3 $0.8$0.0$1.1$5.6$3.7$0.0$0.0 RANKCEO NAME COMPANY (TICKER) TOTAL COMPENSATION IN 2022 SALARY IN 2022 BONUS IN 2022 NONEQUITY INCENTIVE PLAN IN 2022 OPTION AWARDS IN 2022 STOCK AWARDS IN 2022 DEFERRED COMPENSATION IN 2022 OTHER COMPENSATION IN 2022 1 StephenSchwarzman BlackstoneInc.(BX) $253.1 $0.4$0.0$0.0$0.0$0.0$0.0$252.8 2 BarryMcCarthy PelotonInteractiveInc.(PTON) $168.1 3 HenryKravis KKR&Co.Inc.(KKR) $108.3 4 GeorgeRoberts KKR&Co.Inc.(KKR) $108.3 5 JosephBae KKR&Co.Inc.(KKR) 6 ScottNuttall KKR&Co.Inc.(KKR) 7 PeterZaffino AmericanInternationalGroupInc.(AIG) 8 PeterAnevski ProgynyInc.(PGNY) $68.6 $0.5$0.0$0.5$42.4$25.2$0.0$0.0 9 RichardHandler JefferiesFinancialGroupInc.(JEF) 10 JamesLevin SculptorCapitalManagementInc.(SCU) $48.9 $1.0$4.0$0.0$0.0$39.4$0.0$5.5 11 StephenSqueri AmericanExpressCo.(AXP) $48.0 PaulTaubman PJTPartnersInc.(PJT) JamesGorman MorganStanley(MS) DavidZaslav WarnerBros.DiscoveryInc.(WBD)

AlbertBourla

LaurenceFink

RobertBakish ParamountGlobal(PARA) $32.0 $3.1$0.0$12.9$0.0$16.0$0.0$0.1 DavidSolomon TheGoldmanSachsGroupInc.(GS) 20 DanielGlaser Marsh&McLennanCos.Inc.(MMC) $30.9 $1.5$0.0$7.5$7.3$14.4$0.0$0.3

23

JamesDimon

BlackRockInc.(BLK)

MorrisGoldfarb

DennisMathew AlticeUSAInc.(ATUS) $22.5 $0.2$1.3$0.0$10.0$10.6$0.0$0.3 JaneFraser CitigroupInc.(C) $22.1 $1.5$3.5$1.6$0.0$15.5$0.0$0.0 29 LachlanMurdoch FoxCorp.(FOXA) $3.0$0.0$6.3$2.8$8.2$0.0$1.5 ChristinaSpade 1 AMCNetworksInc.(AMCX) $21.4 $1.2$0.0$2.1$0.0$7.4$0.0$10.5

33

CharlesLowrey PrudentialFinancialInc.(PRU) $20.1 $1.3$0.0$5.2$0.0$12.5$1.0$0.1 GiovanniCaforio

39 HansVestberg VerizonCommunicationsInc.(VZ) $19.8 $1.5$0.0$3.3$0.0$14.5$0.0$0.6 RobertThomson

43

Merck&Co.Inc.(MRK) PatriceJeanLouvet RalphLaurenCorp.(RL) $18.6 $1.3$0.0$7.9$0.0$9.2$0.0$0.1

Source:Source: S&P Global Market Intelligence. Additional research by Amanda Glodowski. NewNew YorkYorkareaareaincludes New York City andNassau,SuffolkandWestchester countiesinNew Yorkand Bergen, Essex,HudsonandUnion countiesinNewJersey.This ranking is based on Crain's mostrecentlist of thelargest publiclyheld companies in the New Yorkarea. Executivesneeded to hold theCEOtitle in fiscal year2022 for theirrespective companies. Executives maysharetheCEOtitleand/orhave additionaltitles. Compensation dataare derived fromcompanyfilingsavailablefrom the Securities andExchangeCommission.BasesalariesaretakenasdisclosedfromtheSummary Compensation Tableandarenotannualizedfor executivesemployed forlessthan a fullfiscalyear. The mostrecentdataforcompanies with fiscal yearsending in March throughDecember areforthe year ended in2022, andthe mostrecentdataforcompanies with fiscalyearsending in JanuaryandFebruaryareforthe year ended in2023.Compensation andfinancial figures areexpressed in themillions.Rankingsare compiledwith unroundednumbers. Somefigures statedas zerohavea valueunder $50,000. TotalTotalcompensationcompensationrepresentsthesum of basesalary, bonus, nonequityincentiveplans,grantdatefairvalue ofoption and stockawards,deferredcompensationand other compensation.Salarymay bepaid for a full or partial yearif the executivebeganemployment duringtheyear. NonequityNonequity incentiveincentiveplanplanrepresentscashawardsearned in connection with short-and long-termincentiveplanawards. OptionOption awardsawardsrepresenttheaggregategrantdatefairvalue of serviceandperformance-based option awards.StockStockawardsawardsrepresenttheaggregategrantdatefairvalue of serviceandperformance-basedstock awards.Deferred compensation Deferred compensationrepresents the change in pension plan/nonqualified deferred compensation earnings.Other compensation Other represents the value of nonpension benefits and perquisites. 1 Prior.

12 | CRAIN’S NEW YORK BUSINESS | SEptEmBER 4, 2023 GAIN THE COMPETITIVE EDGE A Crain’s New York Business Corporate Subscription keeps you and your organization connected with what matters most. Purchase access for as few as five users, or your entire organization. Pricing is tailored by company size, and discounted rates are available for large groups. To learn more, email us at groupsubscriptions@crain.com. CORPORATE SUBSCRIPTION t HE LIS t TOP-PAID CHIEF EXECUTIVES 81 JamesDavis QuestDiagnostics(DGX) $11.9 $0.8$0.0$1.1$1.2$8.5$0.0$0.2 82 AndreasFibig 1 InternationalFlavors&FragrancesInc.(IFF) $11.8 $0.3$0.0$0.0$0.0$0.0$0.0$11.5 83 JamesDolan MadisonSquareGardenSportsCorp.(MSGS) $11.8 $1.4$0.0$3.8$0.0$6.0$0.0$0.5 84 ConorFlynn KimcoRealtyCorp.(KIM) $11.6 $1.0$0.0$3.5$0.0$7.1$0.0$0.0 85 RobertFauber Moody'sCorp.(MCO) $11.6 $1.0$0.0$1.6$1.8$7.2$0.0$0.0 86 JohnDoyle Marsh&McLennanCos.Inc.(MMC) $11.6 $1.2$0.0$5.3$2.0$3.0$0.0$0.1 87 ScottStephenson 1 VeriskAnalyticsInc.(VRSK) $11.5 $0.9$0.0$0.0$2.1$8.4$0.0$0.1 88 EdwardPitoniak VICIPropertiesInc.(VICI) $11.5 $1.0$0.0$4.0$0.0$6.5$0.0$0.0 89 SimaSistani WWInternationalInc.(WW) $11.4 $1.0$1.5$0.0$5.7$3.3$0.0$0.0 90 JoshuaPeirez SterlingCheckCorp.(STER) $11.3 $0.7$0.1$0.8$2.7$7.2$0.0$0.0 91 DevdattKurdikar EmbectaCorp.(EMBC) $11.3 $0.8$0.0$1.1$5.6$3.7$0.0$0.0 92 OlivierPomel DatadogInc.(DDOG) $11.2 $0.4$0.0$0.3$0.0$10.2$0.0$0.3 93 RobinVince TheBankofNewYorkMellonCorp.(BK) $11.2 $0.9$0.0$3.6$0.0$6.7$0.0$0.0 94 JeffreyGennette Macy'sInc.(M) $11.1 $1.3$0.0$1.3$0.0$8.3$0.0$0.1 95 RohitKapoor ExlServiceHoldingsInc.(EXLS) $11.0 $0.8$0.0$1.8$0.0$8.4$0.0$0.1 96 MarkTritton 1 BedBath&BeyondInc.(BBBY.Q) $10.9 $0.4$0.0$0.0$0.0$3.7$0.0$6.8 97 JasonGorevic TeladocHealthInc.(TDOC) $10.9 $0.7$0.0$0.2$0.0$10.0$0.0$0.0 98 DaleWhite MultiPlanCorp.(MPLN) $10.7 $0.7$3.0$0.0$0.2$6.8$0.0$0.0 99 IvanKaufman ArborRealtyTrustInc.(ABR) $10.6 $1.2$6.5$0.0$0.0$2.9$0.0$0.0 100 DevIttycheria MongoDBInc.(MDB) $10.6 $0.4$0.0$0.0$0.0$10.1$0.0$0.0

RANKCEO

TOTAL COMPENSATION IN 2022 SALARY IN 2022 BONUS IN 2022 NONEQUITY INCENTIVE PLAN IN 2022 OPTION AWARDS IN 2022 STOCK AWARDS IN 2022 DEFERRED COMPENSATION IN 2022 OTHER COMPENSATION IN 2022 1 StephenSchwarzman BlackstoneInc.(BX) $253.1 $0.4$0.0$0.0$0.0$0.0$0.0$252.8 2 BarryMcCarthy PelotonInteractiveInc.(PTON) $168.1 $0.4$0.0$0.0$167.6$0.0$0.0$0.1 3 HenryKravis KKR&Co.Inc.(KKR) $108.3 4 GeorgeRoberts KKR&Co.Inc.(KKR) $108.3 5 JosephBae KKR&Co.Inc.(KKR) 6 ScottNuttall KKR&Co.Inc.(KKR) 7 PeterZaffino AmericanInternationalGroupInc.(AIG) 8 PeterAnevski ProgynyInc.(PGNY) $68.6 9 RichardHandler JefferiesFinancialGroupInc.(JEF) $56.9 $1.0$10.0$0.0$0.0$45.4$0.0$0.5 10 JamesLevin SculptorCapitalManagementInc.(SCU) $48.9 $1.0$4.0$0.0$0.0$39.4$0.0$5.5 11 StephenSqueri AmericanExpressCo.(AXP) $48.0 $1.5$10.3$0.0$18.8$16.8$0.0$0.6 12 PaulTaubman PJTPartnersInc.(PJT) $40.1 $1.0$0.0$0.0$0.0$39.1$0.0$0.0 13 JamesGorman MorganStanley(MS) $39.4 $1.5$7.5$0.0$0.0$30.4$0.0$0.0 14 DavidZaslav WarnerBros.DiscoveryInc.(WBD) $39.3 $3.1$0.0$21.8$1.4$12.0$0.0$0.9 15 JamesDimon JPMorganChase&Co.(JPM) $34.8 $1.5$5.0$0.0$0.0$28.0$0.0$0.3 16 AlbertBourla PfizerInc.(PFE) $33.0 $1.7$0.0$7.7$9.5$9.3$2.5$2.3 17 LaurenceFink BlackRockInc.(BLK) $32.7 $1.5$7.3$0.0$0.0$23.3$0.0$0.7 18 RobertBakish ParamountGlobal(PARA) $32.0 $3.1$0.0$12.9$0.0$16.0$0.0$0.1 19 DavidSolomon TheGoldmanSachsGroupInc.(GS) $31.6 $2.0$6.9$0.0$0.0$22.4$0.0$0.3 20 DanielGlaser Marsh&McLennanCos.Inc.(MMC) $30.9 $1.5$0.0$7.5$7.3$14.4$0.0$0.3 21 DouglasPeterson S&PGlobalInc.(SPGI) $28.6 $1.4$0.0$2.8$0.0$23.8$0.0$0.7 22 RamonLaguarta PepsiCoInc.(PEP) $28.4 $1.6$0.0$12.5$0.0$9.4$4.3$0.6 23 AdenaFriedman NasdaqInc.(NDAQ) $28.0 $1.3$0.0$4.4$10.0$12.4$0.0$0.0 24 FabrizioFreda TheEstéeLauderCos.Inc.(EL) $25.5 $2.1$0.0$7.0$4.9$9.9$1.0$0.6 25 RalphLauren RalphLaurenCorp.(RL) $24.9 $1.8$0.0$12.0$0.0$11.0$0.0$0.2 26 MorrisGoldfarb GIIIApparelGroupLtd.(GIII) $24.9 $1.0$0.0$7.5$0.0$16.2$0.0$0.3 27 DennisMathew AlticeUSAInc.(ATUS) $22.5 $0.2$1.3$0.0$10.0$10.6$0.0$0.3 28 JaneFraser CitigroupInc.(C) $22.1 $1.5$3.5$1.6$0.0$15.5$0.0$0.0 29 LachlanMurdoch FoxCorp.(FOXA) $21.7 $3.0$0.0$6.3$2.8$8.2$0.0$1.5 30 ChristinaSpade 1 AMCNetworksInc.(AMCX) $21.4 $1.2$0.0$2.1$0.0$7.4$0.0$10.5 31 AlanSchnitzer TheTravelersCos.Inc.(TRV) $21.1 $1.3$0.0$6.8$5.2$7.7$0.0$0.1 32 MichaelMiebach MastercardInc.(MA) $21.1 $1.1$0.0$5.0$3.0$11.7$0.0$0.2 33 PaulHennessy ShutterstockInc.(SSTK) $20.9 $0.3$0.0$0.6$0.0$19.9$0.0$0.1 34 CarlosRodriguez AutomaticDataProcessingInc.(ADP) $20.8 $1.2$0.0$3.6$5.8$9.8$0.0$0.4 35 DavidSteinberg ZetaGlobalHoldingsCorp.(ZETA) $20.7 $0.8$0.5$0.8$0.0$18.3$0.0$0.4 36 JohnWren OmnicomGroupInc.(OMC) $20.7 $1.0$0.0$12.0$0.0$7.5$0.0$0.2 37 CharlesLowrey PrudentialFinancialInc.(PRU) $20.1 $1.3$0.0$5.2$0.0$12.5$1.0$0.1 38 GiovanniCaforio BristolMyersSquibbCo.(BMY) $20.1 $1.7$0.0$3.5$0.0$14.3$0.0$0.6 39 HansVestberg VerizonCommunicationsInc.(VZ) $19.8 $1.5$0.0$3.3$0.0$14.5$0.0$0.6 40 RobertThomson NewsCorporation(NWSA) $19.7 $3.1$0.0$8.1$0.0$8.0$0.0$0.4 41 StephenCooper 1 WarnerMusicGroupCorp.(WMG) $19.4 $3.0$0.0$0.0$0.0$16.1$0.0$0.3 42 FranklinClyburn InternationalFlavors&FragrancesInc.(IFF) $19.3 $1.1$0.0$1.4$3.2$13.3$0.0$0.2 43 JamesDolan SphereEntertainmentCo.(SPHR) $19.2 $1.9$0.0$5.6$0.0$11.1$0.0$0.6 44 KennethMoelis Moelis&Co.(MC) $19.2 $0.4$0.0$0.0$0.0$18.8$0.0$0.0 45 RobertDavis Merck&Co.Inc.(MRK) $18.7 $1.5$0.0$4.1$3.5$8.9$0.2$0.4 46 PatriceJeanLouvet RalphLaurenCorp.(RL) $18.6 $1.3$0.0$7.9$0.0$9.2$0.0$0.1 47 MichelKhalaf MetLifeInc.(MET) $18.1 $1.4$0.0$5.0$1.3$10.1$0.0$0.3 48 BrianHumphries 1 CognizantTechnologySolutionsCorp.(CTSH) $17.9 $1.1$0.0$1.8$0.0$14.8$0.0$0.3 49 1 $17.4 $0.8$0.0$6.0$0.0$10.5$0.0$0.0 WANT MORE OF CRAIN’S EXCLUSIVE DATA? VISIT CRAINSNEWYORK.COM/LISTS.

NAME COMPANY (TICKER)

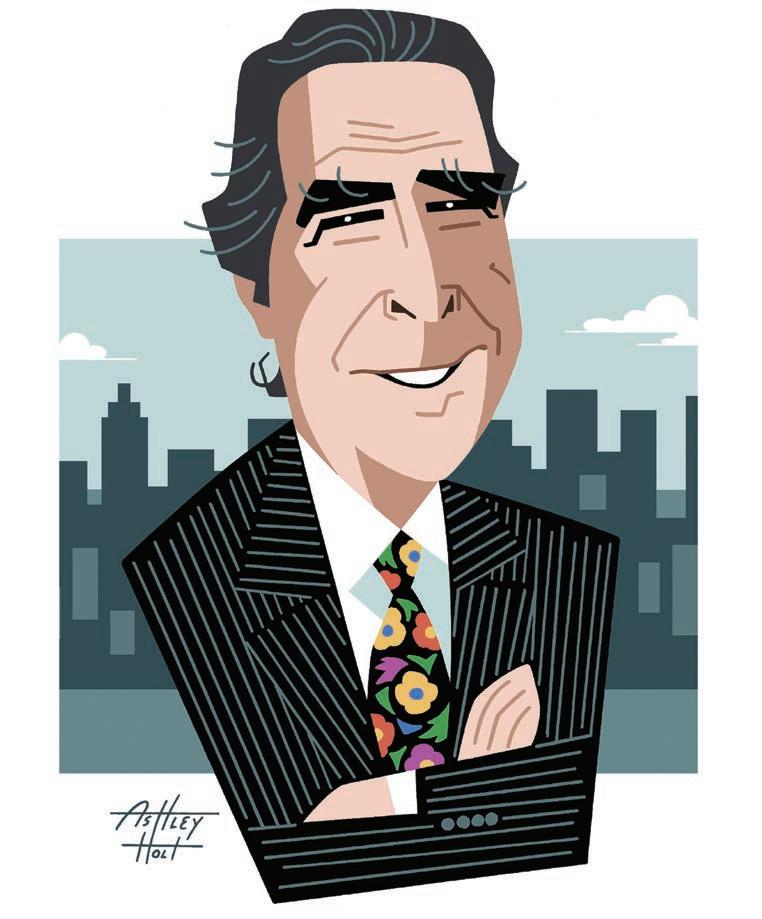

This civil rights lawyer sued the mayor’s office 34 times. Then the city elected his good friend.

Interview by Raina Lipsitz

Norman Siegel is so passionate about the Constitution that he goes to a New York City park with a group every Fourth of July to read and discuss it. In July 2022, the longtime civil rights and civil liberties lawyer appeared alongside Mayor Eric Adams and Community Healthcare Network President Robert Hayes to announce the launch of the Street Homeless Advocacy Project (SHAP), a volunteer-staffed initiative intended to support New Yorkers experiencing homelessness and, over time, to persuade them to accept shelter.

Having sued a number of city mayors in his former role as executive director of the New York Civil Liberties Union, Siegel has long been an antagonist of City Hall.

But at 79, he finally has a friend in Gracie Mansion; he and Adams go back decades.

Siegel spoke with Crain’s about addressing homelessness, safeguarding our rights and what it’s like to work with a mayor who’s also a friend.