CO-OPS IN CRISIS

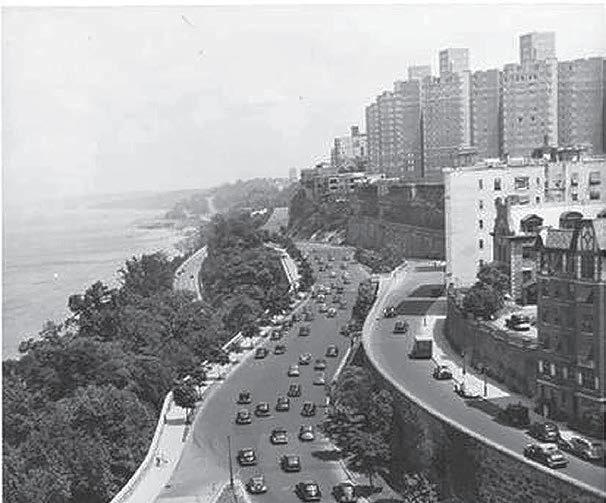

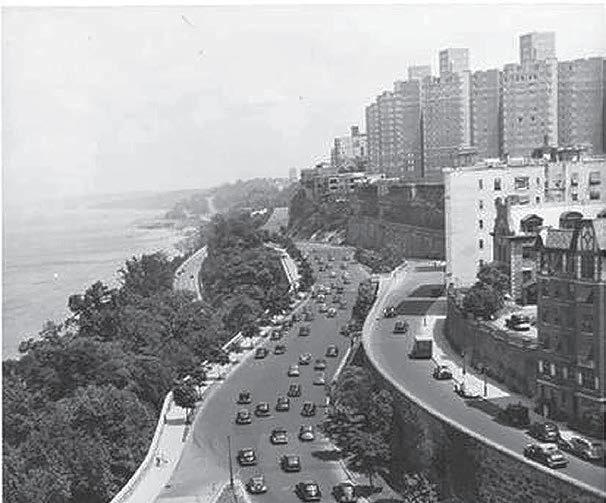

From her 12th oor living-room window high above the Hudson River in Washington Heights, Joanie Warner enjoys unobstructed views of the New Jersey Palisades and the George Washington Bridge.

“ e view is absolutely spectacular,” she said. “ e problems with my apartment are the things you don’t see.”

Problems start in Warner’s bathroom. Plaster has been peeling o

Returnto-of ce shows progress

Data from subway ridership and badge swipes show that in-person work activity is rebounding

By Caroline Spivack and Jack Grieve

By Caroline Spivack and Jack Grieve

Workdays in the city have picked up the pace in September, as both subway ridership and o ce occupancy numbers registered higher.

BY THE NUMBERS

53%

Rise in monthly co-op operating costs since the start of 2020

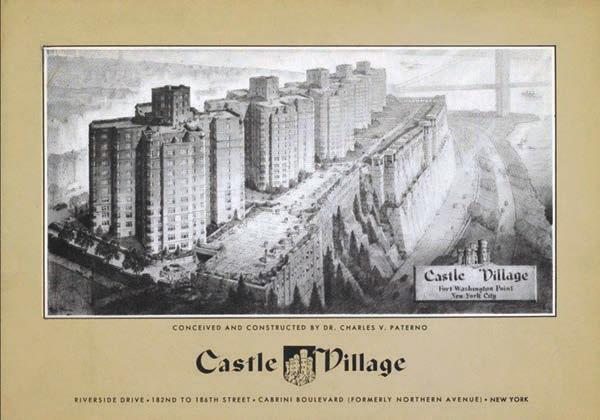

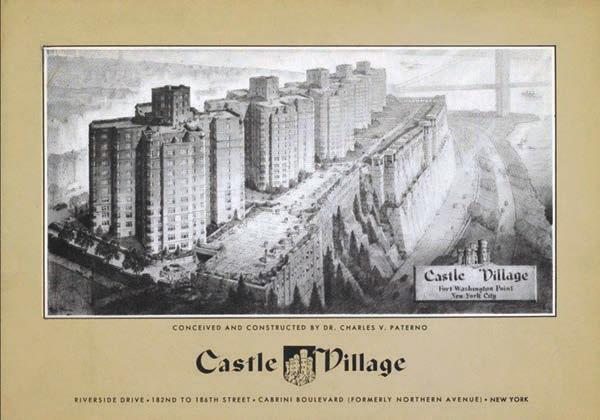

the walls for more than 10 years because rain seeps through the bricks outside. She’s had no gas in her kitchen since April 17 because the building’s pipes are being replaced. Adding injury to insult, early this year her co-op, called Castle Village, raised everyone’s monthly maintenance fee by a whopping 19%, according to documents seen by Crain’s.

at increase costs Warner $350 a

TECH SPOTLIGHT

A startup in the Garment District brings QVC-style shopping into the livestream age. PAGE 23

month. But it’s just the start. An ongoing assessment to rebuild the co-op’s reserve fund costs another $115 per month, and in January comes a “special assessment” that’s planned to last four years and that translates to about another $400 a month for Warner, a retired BusinessWeek editor who doesn’t have a mortgage on her apartment and lives on a xed income. When the special assessment kicks in, Warner’s cost to live in Castle Village will have risen nearly 50% in just a year, to about $2,700 a month.

“I moved here 14 years ago to spend the rest of my life,” she said. “Now, I don’t know if I can a ord to stay.”

e nancial stress a icting Warner isn’t

See CRISIS on Page 18

CHASING GIANTS

MilkMate wants to make return-to-of ce easier for new moms.

BY THE NUMBERS

4M Subway riders on Tuesday and Thursday after Sept. 11

Roughly 4 million straphangers rode the subway on both Tuesday and ursday during the rst full week after the Labor Day holiday, according to the Metropolitan Transportation Authority. at’s a gure the system has hit only seven other times since the onset of the Covid-19 pandemic.

In addition, New York’s in-ofce occupancy averaged 50.1% of prepandemic levels for the seven days ending Sept. 13, according to data from real estate technology rm Kastle Systems. e company tracks badge swipes at commercial

See RETURN on Page 22

ASKED & ANSWERED

How litigation can preserve health care access for vulnerable city groups. PAGE 10

VOL. 39, NO. 33 l COPYRIGHT 2023 CRAIN COMMUNICATIONS INC. l ALL RIGHTS RESERVED CRAINSNEWYORK.COM I SEPTEMBER 25, 2023

PAGE 4

Joanie Warner in her co-op at 140 Cabrini Blvd. in Castle Village with (from left) Jan Rehman, Hector Reyes and Gail Berson. The inset shows Castle Village. BUCK ENNIS

Subway crowd | BUCK ENNIS

The cost of living at a classic upper Manhattan co-op is soaring and longtime residents wonder if they can afford to stay in their homes. The problem is citywide. |

By Aaron Elstein

New York’s pandemic recovery strong, but ignoring housing, diversity could ‘screw it up,’ EDC chief says

By Nick Garber

New York City is recovering strongly from the pandemic, but could “screw it up” if it fails to build more housing and invest in a more racially equitable economy, the city’s top economic development official said last week.

The remarks by Andrew Kimball, president and CEO of the New York City Economic Development Corp., came during a Crain’s Power Breakfast at the New York Athletic Club. Kimball began on an optimistic note, saying the city has gained 255,000 jobs since Mayor Eric Adams released an initial recovery “blueprint” last spring.

“That really speaks to the spirit of entrepreneurship in the city,” he said.

But the remaining hurdles are obvious. Answering a question from Crain’s senior reporter Aaron Elstein, Kimball conceded that the five-day office workweek is likely gone for good, a prospect that alarms Manhattan landlords and could drive down the city’s property-tax receipts.

“Probably somewhere between three and four [days],” Kimball said of the city’s new typical schedule. “It’s hard to imagine a complete pivot back to five anytime soon.”

Kimball echoed his boss’s frustration at state lawmakers’ failure to pass any major housing reforms this year, such as a replacement for the 421-a tax break for affordable housing or a repeal of the de-

cades-old cap that limits residential density in the city.

“What worries me the most is, you look at New Yorkers with income levels of $50,000 to $100,000—that’s where we’re disproportionately losing New Yorkers,” Kimball said. “Why? Because we don’t have enough affordable housing.”

Defended tax breaks

During the event, Kimball offered a defense of the EDC’s routine offers of tax breaks in exchange for real estate development. Elstein quizzed him on a range of initiatives that some critics have called wasteful or ineffective, such as tax breaks aimed at increasing Manhattan office occupancy or a recently approved film studio deal with Vornado Realty Trust on a West Side pier—but Kimball said balancing costs and benefits is necessary when it comes to doing business in the city.

“When things are going really well, it’s logical that everybody asks, why do we need these incentives?” Kimball said. “But when things are going really badly, you’ve got to scramble to figure out where the incentives are to bring the economy back.”

Hundreds of New York City companies are able to make payments in lieu of taxes, Elstein pointed out, while major landowners like Columbia University and New York University manage

to pay no property taxes at all. What if they were asked to help cover city services? Kimball politely shot down the idea.

“These are not-for-profit organizations—we need to incentivize them to continue to invest,” he said, pointing to the State University of New York’s upcoming climate hub on Governors Island and Columbia’s transformation of West Harlem.

As for the EDC’s goal of creating a more equitable economy, Kimball announced during the event that the corporation is launching requests for proposals for two investment funds focused on supporting diverse entrepreneurs and making impact investments.

The first program, the Emerging Developer Loan Fund II, provides loans to real estate developers who have limited access to capital, and the EDC hopes to fund it with as much as $30 million. A second program, the NYC Catalyst Fund, will be capitalized with $40 million from the EDC in hopes of investing in around a dozen private credit and equity funds working in areas like community development, inclusive entrepreneurship, offshore wind, climate technology and life sciences.

Kimball took over the EDC early in Adams’ term. He formerly led the Brooklyn Navy Yard Development Corporation and held executive roles in the city’s 2012 Olympics bid and at the New York Public Library. Other highlights of his ap-

pearance on Sept. 20 included:

Kimball departed somewhat from the mayor’s near-apocalyptic rhetoric on the migrant crisis, arguing it has been managed well and that constant scrutiny of the crisis has distracted New Yorkers from “the amazing economic news and economic development projects that are happening here.”

Because the EDC is a not-forprofit that works on the city’s behalf, it would not be directly affected by the budget cuts of up to 15% that Adams has threatened in response to the crisis, but Kimball said their likely impact on city services will be “very challenging.”

Asked about the state’s Penn Station redevelopment plan, Kimball noted that the EDC has no formal role in the process—but he defended Vornado in the wake of the

developer’s apparent removal from the plan. Vornado, he said, is “a convenient punching bag for a lot of people”—but the company should be praised for its renovation of 2 Penn Plaza and the Seventh Avenue entrance to Madison Square Garden, he said.

One consequence of failing to make equitable investments, Kimball said, will be that New York will “continue to lose the Black middle class.” That, he said, would harm the city both morally and economically.

Kimball declined to take a position on where future casinos should open, or whether Madison Square Garden should move. But he offered one question for those who think the Garden should leave its position atop Penn Station: “Who’s going to pay for that?”

Affordable housing supply is ‘linchpin’ of New York’s rebound, Doctoroff says

By Caroline Spivack

EVENTS CALLOUT

OCT 11

TECH SUMMIT

Crain’s & Tech:NYC will bring together entrepreneurs, investors, policymakers, civic leaders, and technologists to explore the growth and investment of tech, while creating a new vision on how to keep tech the leading economic driver in New York City. This event programming will feature fireside chats, breakout rooms, demos, pitch workshops and sponsored panels.

DETAILS

Location: Accenture Innovation Hub, New York City CrainsNewYork.com/techsummit

New York’s rebound from Covid-19 depends in large part on growing the city’s supply of affordable housing, Dan Doctoroff told the City Planning Commission on Sept. 11.

Doctoroff, Mayor Michael Bloomberg’s deputy mayor of economic development and recovery and the current co-chair of the “New” New York panel assembled by Gov. Kathy Hochul and Mayor Eric Adams, described the buildout of low- and middle-income housing as the “linchpin” to a positive economic outlook for the city in an address to municipal planners.

“We have a dramatic imbalance between the supply of housing and the demand for it,” Doctoroff said. “We obviously need the state to help, but we need to be incredi-

Correction

In the Sept. 18 Notable Leaders in Real Estate feature, incorrect titles or scopes of responsibility were reported for Zachary Bernstein, Taryn Brandes, Les Hiscoe and Rod Kritsberg. See their corrected profiles at CrainsNewYork.com/notables.

bly aggressive and creative to build more housing, and that is, I think, the linchpin of our success as a city.”

The pandemic has fundamentally reshaped how people live and work, making it imperative that New York officials answer a fundamental question: In a world where people can increas-

ingly work from anywhere, why should they work in the five boroughs?

The answer, Doctoroff said, lies in reimagining the city’s business districts to be vibrant 24-7 destinations with residential and other uses; making it easier for New Yorkers to get to work; and establishing the city as a hub for future-focused industry, such as climate technology.

‘Instilling confidence’

The Adams administration has sought to do much of this through three citywide zoning text amendments as part of the mayor’s City of Yes vision geared at growing the economy, supporting sustainability and creating housing.

“The key thing at the end of the day, though, is instilling confidence that the city in the future is going to be greater than the city of today,” Doctoroff added, “because that’s what makes the private sector and other investors invest in the city, and we can’t do it without them.”

2 | CRAIN’S NEW YORK BUSINESS | SEptEmBER 25, 2023

Andrew Kimball, EDC president and CEO, at Crain’s Power Breakfast | BUCK ENNIS

Dan Doctoroff | BLOOmBERG

Meet the next generation of change-makers

For nearly two decades, our Student Leaders® program has helped prepare community-minded high school students to become successful in the workforce by connecting them to skills development, service and leadership training. Through paid internships with local nonprofits like DREAM and Vanderbilt YMCA , they gain practical work and life experiences. It’s just one more way we’re working together with our communities to build a better future for all.

José Tavarez President, Bank of America New York City

Learn more at bankofamerica.com/metroNYC What would you like the power to do?®

When you use the QRC feature certain information is collected from your mobile device for business purposes. Bank of America, N.A. Member FDIC. Equal Credit Opportunity Lender © 2023 Bank of America Corporation. All rights reserved. Scan for details

This startup wants to make return-to-office easier for new moms

midtown-based milkmate provides employers furniture and equipment to make pumping at work less onerous

The upstart: MilkMate

Over her 15-year career as a Manhattan commercial real estate broker, Patrice Meagher breastfed four children. And while her executive role with CBRE was a pleasure, she says, pumping milk at work was not.

Working mothers must pump at the office to keep their milk supply flowing, and Meagher had to lug a clunky kit to and from the office every day, spend her work hours assembling and cleaning the equipment and sometimes pump in a restroom stall. “I figured there’s got to be a better way to do this,” she says.

In March 2022, she launched MilkMate, a service providing breast-pumping equipment and furniture to employers.

The service starts with a consultation. MilkMate assesses the employer’s current room setup and recommends what furniture—such as a supportive chair with wipeable fabric or a storage cabinet with an optional mini-fridge—should be added for functionality and comfort. It provides one multi-user breast pump per room and an initial inventory of recyclable kits, which it restocks on an as-needed basis.

MilkMate says its offerings start at $6,500, which includes the furniture purchase, initial setup fee and ongoing service. The total cost varies based on the number of employees, workspace configuration and the equipment provided.

The five-person startup, based in Midtown East, closed a $5 million seed round in December 2022.

In April, the startup got FDA clearance to market its proprietary pumping equipment which allowed it to launch its first office installations. The timing couldn’t be better. That same month saw the initiation of the PUMP for Nursing Mothers Act, a federal law that guarantees nearly all workers nationwide the right to break time and a private space other than a bathroom to pump.

Among MilkMate’s early adopters is the Midtown office of Beacon Hill, a national staffing service. Senior Division Di-

rector Laura Colby, who heads the 100-person office— which is 75% female—says she pumped there for her own two kids. The old setup, which had moms toting their own pumps, leaving equipment in the office kitchen drying rack and storing milk in the communal fridge, wasn’t ideal.

In May, MilkMate installed a multi-user pump in Beacon Hill’s back conference room along with a storage cabinet, chair and mini fridge. The setup is being used by one breastfeeding mom.

The service was well received, says Colby. “It’s a retention tool. It’s a resource that shows your employees you are invested in their physical and mental health.”

The reigning Goliath: Medela

Based in Switzerland, family-owned and privately held Medela, with its 1,500 employees, provides breast pumping equipment, supplies and advice to more than 6 million homes and hospitals in 100 countries.

How to slay the giant

Meagher left her job to start MilkMate in 2020. “Taking the leap was the hardest part, because I love my job. But it seemed like the right time,” she says.

Given her background, which included advising real estate clients on wellness rooms, Meagher knew a lot about the office pumping problem from both the employer and employee perspective. But to come up with the best solution, there was a lot of research to do.

In addition to interviewing employers and HR professionals, she hired a research recruiting firm to gather breastfeeding moms to interview. While her initial goal was to simply provide employers with pumping equipment, both employers and parents said they’d prefer a full-service solution.

Initially relying on her savings, Meagher hired an engineering firm to design the pumping equipment and an FDA consultant to guide the approval process. Further down the

line, she paired with a medical device maker and furniture manufacturer.

It wasn’t easy landing these partners, given her startup status: “They needed some convincing,” she says. In the end, she fared best with experts who shared her passion for helping mothers return to the workplace.

By 2022, Meagher needed to raise outside funding. Knowing this would devour a lot of time, she hired her first employee to oversee production and client relations.

While she had a handful of meetings with venture capitalists, Meagher ultimately partnered with friends, family and angel investors for the company’s seed round. Folks in her existing network were better able to understand why her background made her the right person to solve the pumping problem, she says.

MilkMate has launched its service with several Manhattan employers since April and has been adjusting in response to customer feedback. One request: more hand-holding! Customers asked MilkMate to provide more education about how the service works and about pumping at work in general—in the form of both written materials and live presentations. “Which is awesome,” she says, “because it really means they care about their employees.”

The next challenge

Meagher first approached employers she knew from her broker days. Now her sales team is working to expand into industries eager for a full-service pump service—finance, real estate and retail. “A lot of those folks are back to work, full-time, in-person so there’s a lot of focus around recruitment, retention and wellness,” she says.

Some have offices in other cities, which Meagher expects will lead to MilkMate scaling beyond New York.

Over time, MilkMate could provide more supportive tools for working parents, she adds, but that’s down the road: “For now, pumping at work is our priority.”

4 | CRAIN’S NEW YORK BUSINESS | SEptEmBER 25, 2023

Anne Kadet is the creator of Café Anne, a weekly newsletter with a New York City focus.

CHASING GIANTS

Anne Kadet

MilkMate founder and CEO Patrice Meagher’s background in commercial real estate helped her source early adopters for the startup’s breast-pumping service. | BUCK ENNIS

Upper West Side behavioral health center seeks to sell its $14 million property, give the proceeds to Montefiore

By Amanda D’Ambrosio

An Upper West Side youth behavioral health center that was created to provide housing for “troubled youth” is seeking to sell its property and grant the proceeds to Montefiore Medical Center, legal documents show.

The August Aichhorn Center for Adolescent Residential Care proposed to grant the net proceeds from the sale of its $14 million property to Montefiore amid years of back-and-forth with state officials about the future of the facility. The center, at 23 W. 106th St., changed the conditions of the sale to award the proceeds to Montefiore after the attorney general rejected a previous plan last year.

In May 2022, the nonprofit tried to sell its property for $14 million to Liberty Acquisitions, a limited-liability company based in the Financial District. The Aichhorn Center proposed to use the proceeds to pay off its debts and cover other corporate costs, the petition said. But after the attorney general rejected that plan because of concerns about how the center would use the money, Aichhorn proposed to instead grant the funds left over after paying its debts to Montefiore.

State law prevents nonprofits from using assets outside of organizations’ “intended purpose”— which in this case was to provide youth mental health care. The Aichhorn Center’s decision to award the funds to Montefiore aligns with the organization’s original intent, it says, because the health system has agreed to use the money to build up youth mental health services.

‘Ideal time’

Peter Semczuk, senior vice president and executive director at Montefiore, said in a letter included in the legal filings that the call from the Aichhorn Center came at an “ideal time,” as Montefiore is finalizing its plan for a pediatric inpatient psychiatric unit known as the Montefiore Program.

“A grant of the [net proceeds] would significantly expedite Montefiore’s ability to implement the Montefiore Program going forward,” Semczuk said in the letter.

Joe Solmonese, senior vice president for government relations and strategic communications at Montefiore, said in a statement to Crain’s that “if Aichhorn’s petition is approved, Montefiore will use the funds from the transaction to support our planned additional pediatric and adolescent mental health services.”

Montefiore has received $8 million from New York state and $1 million from private funding sources to support the Montefiore Program, the petition says.

Richard Shore, an attorney representing the Aichhorn Center, said the nonprofit declines to comment while approval of the sale is pending before a court.

The Aichhorn Center was found-

ed as a nonprofit in 1977 with the goal of establishing a residential treatment center for children with severe behavioral and mental health conditions. The facility was opened to serve “troubled youth,” those described as “destitute, delinquent, abandoned, neglected or dependent children,” according to the petition.

It wasn’t until nearly 15 years after the Aichhorn Center was founded—and back-and-forth

with New York City and state agencies—that it became certified as a Medicaid-funded treatment facility. It opened 32 beds in 1991, mainly for criminal justice-involved kids and those within the foster system.

The center provided medical and psychiatric care and social services for nearly two decades, opening another facility at the New York State Children’s Hospital in Brooklyn because of high demand,

according to the petition.

But in 2018, funding cuts and leadership changes at state regulatory agencies led to a shift in how it provided care. Ultimately, the Aichhorn Center was asked by state regulators to convert its facility to outpatient-only—a request the center ultimately denied.

The state’s Office of Mental Health conducted investigations into the Aichhorn Center following questions about its operations and

ultimately ordered that the organization terminate its executive director, Dr. Michael Pawel. But because the agency did not find any wrongdoing by Pawel, the organization refused to fire him, the petition said. Instead, the center closed down in 2020.

The Aichhorn Center sale is awaiting approval from the attorney general, whose office is slated to appear in court on it at the end of November.

$0 deductible plan options?

$0 copays for 24/7 Virtual Visits?

You’ll get that. Plus, a $700 earning potential for achieving certain wellness goals.¹ These are just some of the ways an Oxford health plan may help your employees and your business’s bottom line get healthier.

1 Oxford fully insured subscribers can apply for reimbursement up to $200 when completing 50 workouts in a 6-month period (up to $400 per year). Workouts consist of fitness facility visits, physical fitness classes and fitness events. Subscribers may also earn up to $300 annually for completing certain one-time activities and reaching certain wellness goals.

Oxford insurance products are underwritten by Oxford Health Insurance, Inc.

This policy has exclusions, limitations and terms under which the policy may be continued in force or discontinued. For costs and complete details of the coverage, contact your broker or Oxford sales representative.

Oxford $0 deductible plans are available for New York-sitused employers and can be paired with either the Freedom, Liberty or Metro network. $0 24/7 Virtual Visit copays apply to all Oxford fully insured plans. Plans sold in New York use policy form numbers: OHINY_SG_GEA_2023 and POL20.OHI.2019.LG.NY.

24/7 Virtual Visits is a service available with a Designated Virtual Network Provider via video, or audio-only where permitted under state law. Unless otherwise required, benefits are available only when services are delivered through a Designated Virtual Network Provider. 24/7 Virtual Visits are not intended to address emergency or life-threatening medical conditions and should not be used in those circumstances. Services may not be available at all times, or in all locations, or for all members. Check your benefit plan to determine if these services are available.

September 25, 2023 | CrAIN’S NeW YOrK bUSINeSS | 5

Get started Contact your broker or visit uhc.com/oxfordnewyork B2B EI232427410.0-OXF 8/23 © 2023 Oxford Health Plans LLC All Rights Reserved. 23-2421699-G

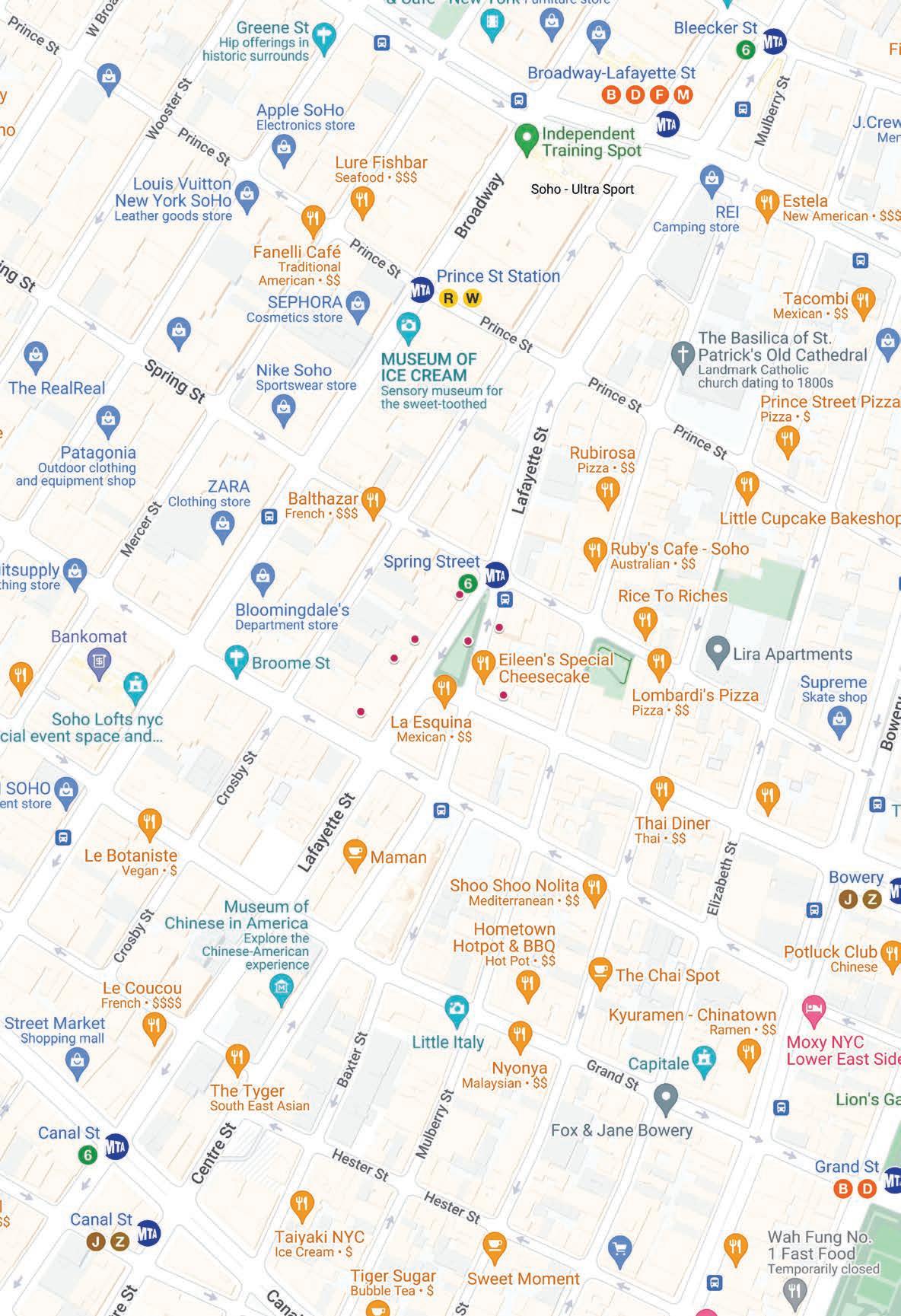

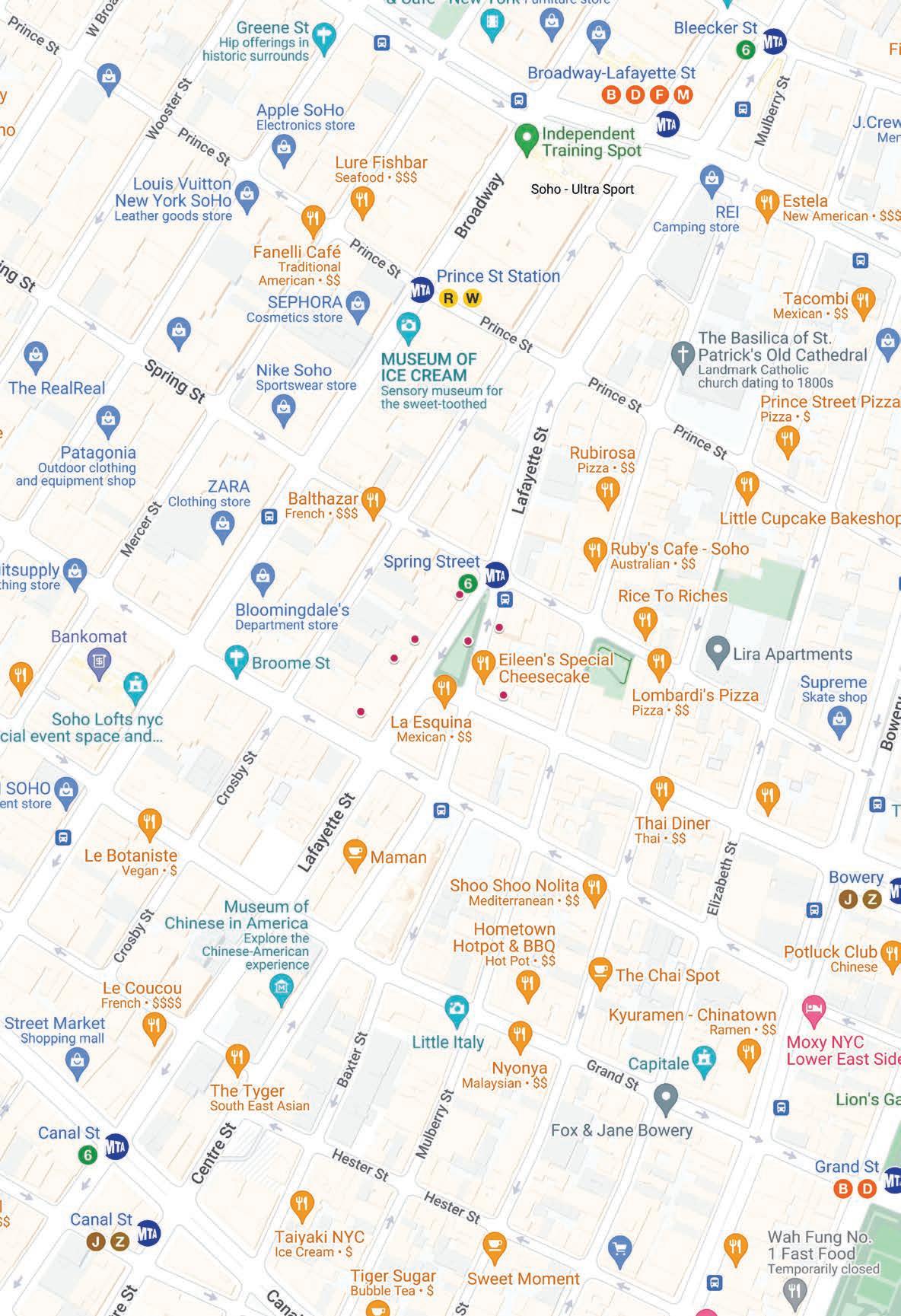

WHO OWNS THE BLOCK

A SoHo area’s retail status may offer a glimpse of what’s happening citywide

An Italian market opens as a sofa store shutters on petrosino Square

By C. J. Hughes

The spot on the edge of SoHo where Lafayette Street meets Spring Street could be considered a window into the hit-or-miss state of retail in post-pandemic Manhattan.

Pre-Covid, the area was hard to beat in terms of trendiness. Stylish home-furnishings shops, well-reviewed bistros and iconoclastic art galleries lined the blocks around Petrosino Square, a rare park in a densely settled neighborhood. And three-plus years after the pandemic slammed New York, much of that vitality has returned.

But dark storefronts still dot some areas, and some longtime shops have recently closed. It’s evidence that the retail recovery has been uneven and challenges assumptions that the city is completely back, brokers say.

“There were some exciting years that really drove rents up here,” said Michael Shkreli, an executive vice president with the brokerage Winick Realty Group who’s currently listing a vacant 2,000-square-foot retail space at 199 Lafayette St., where the owner’s loan is in receivership. “But since Covid, the market here has taken a little bit of a rest.”

In a glass-half-full scenario, the neighborhood will soon snap back to its former self with the imminent arrival of Eataly, the popular gourmet Italian food destination that will be opening its third location in Manhattan (its other branches are near Madison Square Park and the Financial District). Eataly will take an 18,000-square-foot space at 200 Lafayette that has sat empty for years.

But as the area progresses, there are backwards steps too. Last month, a mainstay of the area, a Mitchell Gold + Bob Williams furniture store, suddenly announced it would be closing its 11,000-square-foot outpost at the base of luxury condo 210 Lafayette after having been there since 2007.

Other blocks can have an inconsistent feel as well. Jack’s Wife Freda, a 12-year-old restaurant at 226 Lafayette, appears vibrant, with diners often packing it throughout the day. But at nearby 231 Lafayette, a retail berth by bustling Spring Street that sold cosmetics before Covid has been without a tenant for years.

Still, from a data perspective, there may be reasons to be hopeful, especially compared with recent months. Asking rents improved to $325 a square foot from $310 the previous year in SoHo during the second quarter, according to research from the brokerage Cushman & Wakefield. And over the same time period, the vacancy rate fell to 13% from 18%, the firm said. “It’s a neighborhood that has a lot of cachet,” Shkreli said. “And it will come all the way back.”

ST.

In the early days of mass-produced electricity, the city relied on structures called substations to help convey currents across neighborhoods. Designed to look like ordinary buildings in order to better blend in, most of these industrial relics are still almost invisible features of the streetscape. But peek behind the door with a mural of a blue Buddha at 214 Lafayette, a four-story, arch-windowed structure, and find a party venue whose beguiling features include exposed brick walls, barrel-vault ceilings and a petite 40-foot-by12-foot basement swimming pool. Marketed for “team building, product launches or birthday parties,” the 10,000-square-foot space can fit 200 people, its ad says. Marcus Nispel, who directed a version of “The Texas Chainsaw Massacre,” and Dyan Nispel, who wrote songs for Whitney Houston, appear to have owned the building since the mid-1990s, according to the city register.

In 2005, Andre Balazs and Cape Advisors co-developed the residential condo here, One Kenmare Square, a black-brick building with a sinuous facade that replaced a parking lot while adding a buzzy vibe. Two years after it opened, the building’s retail space, which extends all the way back to Crosby Street, began selling jewel-toned couches, courtesy of one of the first Mitchell Gold + Bob Williams furniture stores. But late last month, that era came to an end, as the 24-store chain said it was closing its SoHo branch, even though sofas still sat in the window weeks later. Developer Conjem Associates bought the commercial condo that contains the storefront in 2012 for $11.9 million, although news reports reveal that Cape Advisors had marketed it for as much as $17 million that same year. In 2017, Gold + Williams renewed its lease, suggesting it still owes a few years worth of payments, which might explain why Conjem does not seem to be rushing to market the property. A message left with the firm was not returned.

LAFAYETTE ST.

John Zaccaro, a major landlord in the neighborhood who was married to the late Geraldine Ferraro, the vice presidential candidate on the Democratic ticket in 1984, was an owner of this prewar corner building for decades. Operations were handled out of 218 Lafayette, where Osteria Morini serves up Italian dishes today. In the 1980s, when officials scrutinized Zaccaro’s finances for the 1984 campaign, they asked about a pornography company allegedly tied to the mafia’s leasing space at No. 200. Today, the building’s office tenants include a16z, the new moniker for the venture capital firm Andreessen Horowitz, which has controlled a 34,000-square-foot space across the third and fourth floors since 2021. In 2012, Zaccaro sold the seven-story, 82,000-square-foot building for $50 million to Kushner Cos., the family firm of Jared Kushner, who also had White House ties: He served as an adviser to former President Donald Trump from 2017 to 2021. The retail space, which has been empty since kitchen-product company Pirch left in 2017, is controlled by the landlord Brookfield, which at one point was reportedly asking close to $3 million in rent a year. The Italian market empire Eataly’s newest city offering will open there before the end of the year, a company spokeswoman said.

226 LAFAYETTE ST.

In the 1980s, Francis Greenburger, the founder of the development giant Time Equities, earned a reputation as the king of coops; his frequent conversions often included small downtown rental buildings, which can take years to turn over. Just last year, Greenburger bought unit No. 5 here for $5.3 million from a previous occupant’s estate, according to the city register. But the building appears to function mostly as a rental. In mid-September an open-floor-plan three-bedroom was asking $21,000 a month. For years, the vegetarian restaurant Spring Street Natural anchored the retail space at the base of the six-story prewar building. But since 2011, its tenant has been the bistro Jack’s Wife Freda, whose all-day service and street-facing outdoor rattan chairs imbue the corner with the vibe of a Parisian cafe. The city’s Italian consulate was on the site in the early 20th century, when the area was considered violent. News clips indicate that the consulate suffered three bombing attempts in 1915 alone.

225 LAFAYETTE ST.

Converted commercial buildings like No. 225, a former branch of the long-gone East River Savings Bank, predominate in this stretch of SoHo. Passersby can still glimpse the outlines of pried-off metal letters on a Lafayette-side wall. Designed by Cass Gilbert, the Woolworth Building architect, in 1927, the 15-story limestone tower offered small art studios and offices on its upper floors for years before a condo conversion in 2004 added 40 one- to three-bedroom apartments. Sales of the units resulted in a $70 million haul, according to the building’s offering plan. A two-bedroom apartment, No. 11D, which traded for $2.1 million in the first go-around, hit the market this month for $4.7 million. The tower’s ground floor space, where tenement-dwellers of a working-class area once likely cashed their paychecks, is occupied today by a Duane Reade pharmacy.

PETROSINO SQUARE

Wedged where Lafayette Street meets Centre Street (or technically Cleveland Place, the name of this particular segment of Centre), this tiny-but-teeming park is also a place where ethnic histories overlap. Once called Kenmare Square for a village in Ireland that was the birthplace of the mother of Tammany Hall bigwig Tim Sullivan, city officials later renamed the area for Giuseppe Petrosino, an Italian-speaking police lieutenant who waged a career battle against the Black Hand, a long-ago name for the mafia. Across his career, Petrosino allegedly arrested several thousand people in a bid for safer blocks in the neighborhood and in other cities, according to the Parks Department. But in 1909, while on a mission in Sicily, Petrosino was gunned down on the street, making him the only New York police officer to die in the line of duty outside the United States. About a decade ago, the park that bears his name was enlarged, including by adding a bowsprit of a point to its north, where rows of blue Citi Bikes cluster today.

With the opening of the Williamsburg Bridge in 1903, city planners sought a more direct and flowing route from it to the heart of Lower Manhattan and so created a new four-block extension of Delancey Street, which they dubbed Kenmare Street. But slicing it across the street grid resulted in unusual shapes, as with what happened on Broadway at the Flatiron Building. Trapezoidal No. 97, which measures 20 feet across one end but is just 3 feet wide at its tip, is a case in point. Since the early 1980s, the skinny structure’s ground floor has offered the Storefront for Art and Architecture, a not-for-profit gallery space. In 1993, architects Steven Holl and artist Vito Acconci added swinging panels to its facade to allow peek-a-boo glimpses of the pieces inside, weather permitting. Kiki Smith, Bjarke Ingels and Diller + Scofidio have all shown works there, and an exhibition from artist Francisca Benitez that explores the role of artists in protest movements wrapped up this month. Perhaps improbably, ultra-narrow No. 97 also has two apartments upstairs.

6 | CRAIN’S NEW YORK BUSINESS | SEptEmBER 25, 2023

210 LAFAYETTE

214 LAFAYETTE

200

210 LAFAYETTE ST.

97 KENMARE ST.

BUCK ENNIS, GOOGLE m A p S

Navigating the nancial impacts of commercial to residential property conversions

challenges, and (3) lack of nancial incentives.

ere is a need to modernize decades old regulations that greatly impede conversions. In particular, allowing for conversions in more o ce districts, broadening residential housing types quali ed for conversion, and increasing the cap on residential oor area eligible for conversion.

incentive for property owners to take on the nancial risk of residential conversion and help cities create more housing stock.

Tax Implications of Conversion

opportunities for taxpayers gauging whether to accelerate deductions.

If you have been keeping up to date with real estate trends, it is apparent that the COVID-19 pandemic has accelerated the shi towards remote and hybrid work models resulting in a surge in o ce vacancies. While the demand for o ce space has decreased, the demand for housing, especially a ordable housing, has continued to increase. is has presented

lawmakers and property owners with a rare common goal and unique opportunity to try and solve this issue through commercial to residential property conversions.

Obstacles

e main hurdles for commercial to residential property conversion are: (1) existing dwelling laws and zoning regulations, (2) architectural

Architecturally, buildings with deep oor plates are highly problematic to convert to residential dwellings due to the requirement for tenants to have ventilated windows, which is problematic for oors with deep windowless interiors and unventilated window facades. ere is also the issue of building around numerous elevator sha s and relocating and extending plumbing and gas systems for residential kitchens and bathrooms.

Without nancial incentives, property owners are le to shoulder the immense cost of conversion on their own. Governmental nancial assistance could create the necessary

Commercial to residential conversions carry several tax implications, such as the change to the depreciation of the converted property. Commercial property is generally depreciated over 39-40 years; however, residential property is depreciated over a shorter life, 27.5-30 years. For properties that are converted to mixed-use, any building that generates at least 80% of its gross rents from dwelling units is deemed to be residential rental property.

If nonresidential property is indeed converted to residential property, a “change in use” is deemed to have occurred. If a change in use results in a shorter recovery period, taxpayers can compute depreciation over the shorter recovery period or elect to continue computing depreciation as though a change in use did not occur. is exibility provides tax planning

Taxpayers should also be aware that they may be precluded from applying Sec. 168(k) bonus depreciation on quali ed improvement property and condo conversions may result in property owners attaining dealer status and the related ordinary income treatment on the sales of the condo units.

Conclusion

Conversions of real property are going to be complex challenges with signi cant nancial implications, including related tax matters. If you have an interest in converting your property to a residential dwelling, contact your Citrin Cooperman professional to further discuss navigating the murky waters of commercial to residential property conversion.

THOUGHT LEADER REPORT REAL ESTATE

SPONSORED CONTENT

Andy Dilone is a CPA with over 10 years of experience in taxation and business advisory. He services clients primarily in the real estate industry.

ANDY DILONE Director Citrin Cooperman

Jason Park is a CPA with over 10 years of experience in assurance and business consulting. He services clients primarily in the real estate industry.

JASON PARK Director Citrin Cooperman

The city must find a way to preserve one of the last viable paths to ownership

Aordable housing in the city has dominated public discourse and been billed as a top priority for residents, businesses and lawmakers alike. Despite the hubbub, there have been no solutions to show that will make a meaningful impact.

When the city talks about “a ordable housing,” it’s largely in reference to rental units, but co-ops, which represent 3.5 million units of housing across the ve boroughs, have been absent from the conversation, a missed opportunity to address the a ordability crisis.

For this week’s cover story, senior reporter Aaron Elstein learned that the price of living in a co-op has risen by more than 50% since 2020, due to the rising cost of insurance and repairs. e untenable increase doesn’t just threaten co-op residents, it illustrates that one of the last paths to ownership for the average New Yorker is in dire straits.

e city must gure out a way to preserve the viability of co-ops as a housing option for New Yorkers, and striking the right balance would be tricky. Such a

LETTER

TO THE EDITOR

move would be uncharted waters; coops have historically functioned as their own microcosms, and involvement from the government could be viewed as overstepping. Plus, co-op owners aren’t entitled to a bailout, and there are certainly very rich, well-funded co-ops in the city.

ere are several options for approaching the endeavor. First, guidelines can be imposed to make sure that buildings don’t defer repairs until it’s too late. In

Staten Island is prepared to back up secession talk

By Joe Borelli

By Joe Borelli

CRAIN’S READERS WERE recently treated to a bleak outlook on Staten Island’s secession prospects by columnist Ross Barkan [“On Politics: Let Staten Island pay the price for secession talk,” Sept. 11]. As it turns out, the picture presented is not accurate, nor are some of the facts used to paint it.

ough my goal is to provide a rationale for secession to non-Staten Islanders, the previous column’s insistence on its racist origins needs rebuttal.

e migrant crisis has certainly given Staten Islanders reason to be upset, alongside 82% of New Yorkers, according to a recent Siena poll. e borough has long had migrant shelters, which, as a result of their location and scope, have not caused as much public opposition as the two most recent additions. One was formerly a nursing home whose patients were shipped out to make room; the other was a site purchased by the city to be a school, which will now house 300 people on a sleepy suburban block.

Staten Islanders are angry, for sure. But for Barkan to attribute this to racism is o ensive to all Crain’s readers, most especially my neighbors. It also ignores

the same poll that clearly shows a broad geographic and ethnically diverse coalition that now believes the migrant train has gone o the tracks. Perhaps he was unaware of the toll it is taking on countless neighborhoods or the $12 billion hole it’s burning in the city’s budget.

Barkan attributes the 1993 referendum, when 66% of Islanders voted in favor of seceding, as “bound up in racism or xenophobia” as a result of David Dinkins’ re-election campaign. is is bizarre, given the actual timeline. Momentum built in the 1980’s during the Koch administration over one issue above all others: the Fresh Kills Land ll. e pressure nally got to Gov. Mario Cuomo, who in 1989 allowed a referendum on the next year’s ballot, over Koch’s protestations. In 1990, months before Dinkins took o ce, 82% of Staten Islanders voted to advance a secession plan.

Perhaps Islanders were not simply motivated by a hatred of Dinkins when, three years into his administration, 16% fewer voted to secede. Secession fever did not cool later that year because the city’s rst Black mayor lost, but rather that the winning candidate committed to closing our dump.

the case of Castle Village, a co-op in Washington Heights where most residents have a view of the Hudson River, the collapse of a wall in 2005 resulted in $27 million in repairs. e board didn’t increase maintenance enough at the time to re-pad reserves and now the complex carries $70 million in debt.

Board members live in a conundrum where they are in a decision-making position but are also elected by their neigh-

bors. Some pressure from the government could give them a welcome scapegoat when making tough choices that will be unpopular with their neighbors but wise in the long term. Such a dynamic is currently playing out on a smaller scale as Local Law 97 deadlines loom.

As other solutions emerge, a solid rst step is for Gov. Kathy Hochul to sign, by the end-of-the-year deadline, legislation that reinstates the J-51 tax credit, which o ers a 34-year-long property tax exemption for apartment buildings that have undergone signi cant renovations. No stone can go unturned in seeking a solution to the a ordable housing shortage. Furthermore, if businesses expect their employees to be back in the o ce, it would be in their best interest to ensure said employees can nd an apartment, and even perhaps own something one day. Without a larger governing body stepping in, the city, its businesses and its residents will be left with a bigger housing mess and fewer options to clean it up.

Barkan’s nancial arguments are driven less by historical inaccuracies than a lack of common sense. He writes, “Staten Island’s prized public schools . . . would lose all their city funding,” and the city government would no longer pay for our ferry or pave our roads. at is some piercing investigative work! It’s as though he’s broken some Maya code in revealing that New York City would no longer pay for services for cities that aren’t part of New York City. A nancial separation is literally the darned point of secession, after all.

e real question is whether Staten Island can a ord it, which we hope to de nitively answer in a study mimicking the one completed before the 1993 referendum.

But here is an interesting fact to weigh.

All municipalities base the bulk of

revenues on property taxes collected as a percentage of the total amount of taxable real estate. Most collect at an e ective rate somewhere between 1.5% and 2% of taxable value. Staten Island’s total taxable value was calculated as $90.1 billion in scal 2023. Atlanta and Miami, two similarly populated cities, were respectively valued at $44 billion in 2022 and $55.9 billion in 2023. I’ve been told that their roads still get paved and schools stay open, despite a lack of New York’s largesse.

e City of Staten Island could clearly generate the revenue it would need. Don’t bet against us.

Joe Borelli is the minority leader of the City Council, representing Staten Island’s south shore. He has authored two books on the borough’s history.

8 | CRAIN’S NEW YORK BUSINESS | SEPTEMBER 25, 2023

EDITORIAL GETTY IMAGES Write us: Crain’s welcomes submissions to its opinion pages. Send letters and op-eds of 500 words or fewer to opinion@CrainsNewYork.com. Please include the writer’s name, company, title, address and telephone number. Crain’s reserves the right to edit submissions for clarity.

GETTY

CASTLE VILLAGE CO-OP

IMAGES

Expedite process to put asylum seekers to work

The images of asylum seekers crowded around overwhelmed hotels and intake centers, waiting for available housing, is now an all-too-familiar sight for New Yorkers. In the past two years, we’ve seen a dramatic increase in immigration from states like Texas and Florida as they pass along those seeking refuge to our city. The clearest way to give these new New Yorkers a shot at the American Dream, and to ensure these newest New Yorkers are not simply a drain on government resources, is to allow them to work legally, because there are plenty of jobs available.

The New York Economic Development Corp. recently proclaimed that the labor force is just a few hundred jobs away from reaching pre-pandemic levels, but many small businesses in Brooklyn and across the city are searching for more employees. We cannot proclaim that New York has made a full recovery from the pandemic until these entrepreneurs can fill those key positions. The newest New Yorkers can help resolve this labor shortage.

Our city’s immeasurable growth over the past century has been catalyzed by waves

PERSONAL VIEW

of immigration, as newcomers found jobs, assimilated and became part of the city’s cultural and economic fabric. That’s why I was proud to stand with Mayor Eric Adams and other leaders in business and labor to call on Washington to expedite the process to help these asylum seekers obtain work permits.

The Brooklyn Chamber has been at the forefront of advocating for opportunities for underserved and marginalized communities to access labor markets and employment: advocating for the Clean Slate legislation that passed this year, fighting for greater investments in youth employment, such as Ladders for Leaders and the Summer Youth Employment Program. We also hold multiple community-based job fairs every year to connect local employers with local talent.

Some on the sidelines have labeled the migrant influx a problem, but we see it as a major opportunity to connect businesses looking to fill vacancies and a ready-andwilling untapped source of folks looking for steady jobs. Brooklyn employers need workers now, and the asylum seekers want to work.

Fast-tracking legal employment oppor-

tunities for the asylum seekers who are already here is the right thing to do, and it also makes sense for Brooklyn’s economy.

Brooklyn has always been a borough that has grown prosperous because we have welcomed immigrants with open arms. Brooklyn contributes more than a quarter of all jobs in the city, but that workforce is possible thanks only to immigration: Nearly 50% of households in New York speak a different language than English at home.

To continue our borough and our city’s economic future, the Biden administration and our leaders on Capitol Hill should work together to rapidly grant the current asylum seekers work authorization. The Biden administration’s decision to expedite the process for many of the Venezuelan asylum seekers is a good start, but

there are many more migrants who want and deserve to get employment authorizations.

The city and state should continue to look toward ways to expand our ability to pair businesses small and large looking for labor and with those who are hungry for an opportunity to legally work in our great city. For instance, while the city’s summer youth program SYEP cannot accept undocumented teens because of federal regulations, the City Council should look to create alternative programs to make sure those teens are able to gain skills and useful employment experience, putting them on a path toward success. Fast-tracking legal employment opportunities for the asylum seekers who are already here is the right thing to do for them, for Brooklyn and for our entire city’s economy.

Gov. Hochul should veto pro-lawsuit legislation again

New York is losing residents and it is losing businesses. But rather than focus on rebuilding the state’s economy, legislators in Albany are once again forcing a bill on Gov. Kathy Hochul that would codify New York’s reputation as the litigation capital of the world. Hochul vetoed identical legislation in 2021.

The proposal, sponsored by state Senate Deputy Majority Leader Michael Gianaris, would force all companies that are registered to do business in New York to be subject to the “general jurisdiction” of the state’s courts. This means lawsuits could be filed in New York by non-residents, even if the claim is unrelated to anything that happened within the state’s borders. That’s good for the

Unfortunately, lawyers who support the bill are spreading misinformation. George Carpinello, an attorney who cochairs the Office of Court Administration’s civil practice advisory committee, recently told Crain’s that an Empire State resident injured in a hotel in Florida could not now sue in New York courts even if the hotel chain had numerous locations here. That is untrue. In the Florida hypothetical described, New York’s existing long-arm statute, CPLR § 302(a)(3), would provide a basis for general jurisdiction. If a business regularly engages in business activity in New York, derives substantial revenue from services rendered in New York, or derives substantial revenue from interstate or international commerce, it can be sued here for alleged tortious injury to a state resident in another jurisdiction.

state’s politically powerful trial lawyers but bad for our court system’s crowded dockets and bad for attracting new businesses.

Further, there has been a mischaracterization of a recent U.S. Supreme Court decision in this area of law. In Mallory v. Norfolk Southern Railway Co., the U.S. Supreme Court declined to render Pennsylvania’s existing consent-to-jurisdiction law unconstitutional on due process grounds, concluding that the defendant was aware that doing business in the state subjected it to the statute.

But Pennsylvania’s law has been on the books for decades. In New York’s case, the state would be forcing companies to either comply with a brand new statute or give up their registration to do business here at all.

In deciding Mallory, not all the justices were convinced that Pennsylvania’s statute would survive a challenge under the Dormant Commerce Clause. If enacted, this new proposed law in New York is sure to be the subject of legal challenges. And at the end of the day, just because other

states have misguided laws does not mean New York should follow suit. A terrible law is a terrible law.

In our post-pandemic world, the Empire State must welcome investment opportunities and economic activity with open arms, not create an environment where the only sector left standing is the lawsuit industry. As the governor wrote when she rejected the bill in 2021, “fundamentally, enactment of this legislation is not in the public interest.” That remains true—and she should veto it, again.

September 25, 2023 | CrAIN’S NeW YOrK bUSINeSS | 9

G ett Y m AG e S

Tom Stebbins is executive director at the Lawsuit Reform Alliance of New York.

PERSONAL VIEW b UCK e NNIS

Randy Peers is the president and CEO of the Brooklyn Chamber of Commerce.

Just because other states have misguided laws does not mean New York should follow suit. A terrible law is a terrible law.

Attorney for retirees on how litigation can preserve health care access for vulnerable city groups

Jake Gardener began his career by taking a leave of absence from Yale Law School to be part of the Fire Department of the City of New York, and he credits his time as part of Ladder 43 in East Harlem with making him a better attorney. His unconventional experience and civil service work have spurred him to take complex cases where health care benefit access for vulnerable groups is under threat. He has notched recent wins for the city’s municipal retirees in a lawsuit against the city over its plan to push them from supplemental health insurance to Medicare Advantage. The NYC Organization of Public Service Retirees filed the suit in May and a judge blocked the switch in August though the city quickly filed a notice of appeal.

In light of the judge’s decision, Gardener spoke to Crain’s about how litigation can be a viable option for preserving health care access and whether he intends to take similar cases going forward. |

Walden Macht & Haran does criminal defense and commercial litigation. What made you want to take on these cases with the retirees?

I do mostly civil litigation.

What I like most is representing parties and cases that require complex legal analysis and creative legal strategies, and with the retirees, not only do you have very complex legal issues that require [creativity] . . . .The clients are important to me on a personal level because [there are] tens of thousands of retired firefighters, many of whom I know personally, and hundreds of thousands of other retired public servants. These cases are about their access to health care and benefits, and it should be an important issue to anyone. I’m gratified that they’ve entrusted me with the responsibility of defending [them].

How can litigation be effective in preserving care?

In New York City, litigation has

Dossier

Who he is: A partner at Financial

District-based Walden macht & Haran who represents municipal retirees in their medicare

Advantage lawsuit against the city

Grew up : Newton, m assachusetts

Resides: park Slope, Brooklyn

Education: Bachelor’s in political science, Stanford; Juris Doctor, Yale Law School

Mentor role: Gardener has been a “big brother” mentor to the same “little brother” in the Big Brothers Big Sisters of New York City program since 2012. t he organization pairs adults with children in all five boroughs looking for mentorship and guidance.

Proud moment: “ p rotecting the health care rights of elderly and disabled retired city workers” is a recent career moment he’s most proud of, Gardener said.

Interview by Jacqueline Neber

basically been the only hope of these elderly and disabled retirees. So far, they have not been saved by the city, they have not been saved by the state legislature, so we had to go to court and fight for our own rights. We have prevailed in our legal battles over the last two years—without a litigation strategy, I don’t know where we would be. But we are also hopeful the City Council will pass legislation that will essentially codify the health care benefits these retirees were entitled to.

What are other examples of your work in maintaining care access?

I’ve represented a large group of thousands of Delaware state retirees; we succeeded in challenging the state’s efforts to take away their health benefits. I’ve achieved, on behalf of similar groups of clients, whether they’re individuals or corporate entities, really

impactful victories through litigation that you can’t achieve easily through any other means. That’s one reason I became a lawyer— because you can make a huge impact in the lives of clients or the fate of a corporate client. It’s incredibly satisfying to have a concrete, valuable effect on your clients’ interests based on the work you do.

Do you intend to continue to take health care access cases going forward?

I would be happy to continue to represent the health care rights of vulnerable populations. It’s hardly the centerpiece of my practice, but because access, especially if it affects retired or active public servants, means a lot to me personally... If I can help people get the benefits they need, I would love to keep doing that.

Can you give an update on the NYC Organization of Public Service Retirees’ lawsuit that aims to stop the implementation of Medicare Advantage?

Nothing concrete has happened since [the city filed a notice of appeal]. But what is going to happen is, the city is going to perfect their appeal in the First Department appellate division in the coming weeks. We will have to respond to that. The city will also be perfecting its appeal in a separate case—so we will be litigating two, separate parallel retiree appeals in the next couple of

Boston Properties says office rents must double before new construction would make economic sense

The cost to build new office towers in New York City doesn’t make sense unless the space rents for more than $200 per square foot, a leading developer said this month.

That’s about double the typical rate for new Class A space—suggesting it may take a while for new office construction to make eco-

Rents for the most desirable Manhattan office spaces typically top out at around $100 per square foot, though a handful reach $140 or even more, Linde said. $200 is reserved for small spaces, such as restaurants on top floors. But that elevated rate is required for new building projects to “pencil,” thanks to fast-rising construction, materials and borrowing costs, Linde said.

the door for a new generation. But until that shakes out there is a significant mismatch between what developers say they need to charge in order to build new and what the market will bear.

“There’s a sort of really big bridge that we’re going to have to cross,” Linde said. “It may not allow for new construction in Manhattan for quite some time.”

build 10 new supertall towers around Penn Station. The Hochul administration had hoped to harvest tax proceeds from the buildings to help pay for rebuilding the dilapidated rail hub, but the project has been stalled since last year.

is pressuring the rents landlords can charge while costs for borrowing, labor, and construction materials all rise.

Rising costs

nomic sense in the city.

“We’re at a point now . . . that will require rents well in excess of $200 a square foot for anybody who wants to build anything,” Boston Properties President Douglas Linde said at an investor conference Sept. 11.

“We’re going to need rents at a significant premium to those you can currently find for space on Park Avenue, Lexington Avenue, or in the Plaza District,” Linde said. “It’s an interesting conundrum from my perspective for our industry and for the city.”

Over time, the lack of new supply should help existing buildings fill vacant space. During the difficult years of the early 1990s some prominent New York developers went bust or nearly so, opening

It’s not just a New York problem, Boston Properties officials added.

“In all of our markets, if you were to build something you would need rents that are way, way above our market rents in order to get a reasonable return,” Chief Financial Officer Michael LaBelle said at an investor conference sponsored by Barclays.

Project stalled

The new economics of development has repercussions not just for developers but also the state of New York, which partnered with Vornado Realty Trust to

Boston Properties probably won’t be developing properties in Midtown for a while, either, even though a few months ago the firm finalized a ground lease for a planned 982,000 square-foot office tower at 343 Madison Ave., next to Grand Central Terminal. The project doesn’t have a lead tenant and officials said they will wait a year or two before deciding how to proceed. If the tower doesn’t get built, the ground lease will be returned to the Metropolitan Transportation Authority and Boston Properties would get a refund, Linde said.

Boston Properties’ Midtown portfolio includes the General Motors Building.

Tepid demand for office space

The Federal Reserve has raised interest rates 11 times since in early 2022, going from nearly zero to around 5.5%, the highest in 22 years.

The prevailing wage for bricklayers working on public works projects in New York rose by 10% last year, to $64.23 an hour or about $135,000 a year, data from the City Comptroller’s office show. That’s almost twice the national rate for nominal wage growth, according to the Federal Reserve Bank of Atlanta.

Prices for steel rose by 22% between 2020 and 2022, according to consulting firm Gordian. Lumber rose by 16% and concrete by 15%.

“The cost of our product has gone up dramatically,” LaBelle said.

10 | CRAIN’S NEW YORK BUSINESS | SEptEmBER 25, 2023

ASKED & ANSWERED

BUCK ENNIS

By Aaron Elstein

“There’s a sort of really big bridge that we’re going to have to cross.”

Douglas Linde, president, Boston Properties

FAREED ZAKARIA

HOST OF CNN’S “FAREED ZAKARIA GPS”

LIFETIME ACHIEVEMENT

TOVAH FELDSHUH

SIX-TIME EMMY AND TONY NOMINEE

ARTS AND SCIENCES ICON OF THE YEAR

ALVIN AILEY AMERICAN DANCE THEATER CULTURAL ICON OF THE YEAR

EMPIRE STATE BUILDING LANDMARK ICON OF THE YEAR

ÉLAN FLOWERS

SMALL BUSINESS, LARGE IMPACT

OCTOBER 4, 2023 | 6 PM | GOTHAM HALL | WWW.BUSINESSAWARDS.NYC

Work could begin next month as first contracts approved for long-awaited Hudson River rail tunnel

By Caroline Spivack

After more than a decade of limbo, shovels could hit the ground as soon as next month on initial construction to build a new Hudson River rail tunnel linking New York and New Jersey.

The board of the Gateway Development Commission on Sept. 11 approved $47.3 million in contracts—the project’s first—to move utilities and reroute a road over the mouth of the new $16.1 billion, two-tract tunnel on the New Jersey side. The work will make way for hulking boring machines that will dig the long-anticipated tube.

“This is the start of the Hudson River tunnel project and we are not waiting for 2024, 2025 or 2026, as promised, we’re going to deliver it this calendar year,” said Kris

perstorm Sandy in 2012. The existing tunnel is a critical link in the northeast’s rail infrastructure. Even a temporary shutdown of the dilapidated tube could have profound consequences for the region’s commuter and economic activity; rush-hour commuting capacity would be slashed by a whopping 75%, according to Amtrak.

Splitting costs

Conti Civil was selected out of a dozen bids received for the initial infrastructure work, with a commitment to have 18% of the work go to women- and minority-owned businesses. Once completed, work to dig the actual tunnel is expected to begin in 2025. It won’t be operational for at least a decade.

Kolluri, chief executive of the commission, during the board’s monthly meeting.

The board approved a $28.6 million contract to Edison-based contractor Conti Civil for work that will raise a highway bridge on Tonnelle Avenue in North Bergen. The project will create a 19-foot clearance between the overpass and tracks leading to the tunnel, according to the commission.

A new tunnel is being built directly south of the current, 113-year-old tube that was badly damaged by saltwater during Su-

Work on the Tonnelle Avenue bridge got underway under New Jersey’s former Gov. Chris Christie, but was canceled in 2010 when he abruptly halted plans for a $8.7 billion tunnel project, which at the time was known as ARC or Access to the Region’s Core, due to cost overrun concerns.

Since then, the Hudson tunnel has seen a burst of interest from federal and state officials. In July the federal Department of Transportation said it would put $6.8 billion toward the work needed for the tunnel. The commission was also selected for a $292 million grant for work on the Manhattan side of the tunnel, along with $25 million in a RAISE Grant for the Tonnelle Avenue bridge and utility relocation work.

The funding amounts to the most federal grant dollars provided to a mass transit project in U.S. history, officials said. A signed federal funding agreement is not expected until sometime next year. In the meantime, New York and New Jersey have agreed to split the local share of the project’s costs.

Naik Consulting Group, a small business headquartered in Midtown, beat out 15 other proposals for a $5.5 million contract to manage construction on the tunnel project. The firm says it will ensure at least 27% of the firms it works with represent minority groups. Finally, build-out of a concrete

casing in Hudson Yards at the mouth of the tunnel on the Manhattan side—at a cost of $600 million—is also expected to begin in October.

Other projects

To govern the massive tunnel project, the commission has broken the effort down into nine packages, five of which are currently active, according to Anthony Gardner, the commission’s senior director of procurement.

Three other projects are expected to move into procurement this year: construction of a shaft through the Palisades in Hoboken,

on a portion of tunnel under Hudson River Park off Manhattan’s west side, and work to stabilize the Hudson’s riverbed.

“As you hear, there’s a lot of activity going on—a lot of concurrent permits,” said Gardner. “We’ve put a lot behind getting these out.”

In addition to the billions that the federal government has already allocated to the project, the commission has also requested a $3.8 billion grant to help New York and New Jersey pay for their portions of the project.

The commission expects a decision from federal transit officials by the end of the year.

Trading arm of crypto conglomerate cuts half of its staff

By C. J. Hughes

Digital Currency Group, a leading cryptocurrency company battered by the implosion of trading platform FTX and subsequent legal investigations, has suffered another blow.

One of its affiliates, Genesis Global Trading, a Flatiron District-based trading desk, has let go of 39 of its 89 employees, according to a notice that appeared this month in a state layoff database. The cuts were effective Sept. 1 and appear to be related to a decision to shut down the entire desk by Sept. 18. A message left for the company’s human resources department was not returned by press time.

The job losses, which come as corporate bosses are making yet another major push to get employees back into offices, occurred at 250 Park Ave. South, a prewar tower at East 20th Street owned by the Feil Organization.

In 2018 Digital Currency leased

the entire fifth floor of the 12-story building at a rent of around $70 per square foot annually, according to news reports. The company, founded by Barry Silbert in 2015, presumably has about five years left on its lease. The Feil Organization purchased the building from SL Green Realty Corp. in 1995 for around $13 million, public records show. The Feil Organization could not be reached by press time.

But other companies closely tied to Genesis Global Trading declared bankruptcy earlier this year and are now in the midst of the restructuring process in order to pay back creditors, a move that could complicate efforts by landlords to collect rents.

A year ago Digital Currency appeared to be riding high amid the Bitcoin boom. But in November allegations of fund mishandling prompted Sam Bankman-Fried’s

FTX to collapse, forcing FTX-dependent Genesis to freeze withdrawals over concerns that they would exceed the company’s liquidity levels.

By January, Digital Currency had filed for Chapter 11 bankruptcy protection for three affiliates:

Genesis Global Holdco, Genesis Global Capital and Genesis Asia Pacific. The same month the Securities and Exchange Commission charged Genesis Global with offering unregistered securities.

And last month New York Attorney General Letitia James piled on

by saying she is investigating hundreds in millions in loans that flowed between Genesis Global and Digital Currency. But to complicate matters, Genesis recently sued Digital Currency to recover those loans, some $620 million of them.

12 | CRAIN’S NEW YORK BUSINESS | SEptEmBER 25, 2023

“As you hear, there’s a lot of activity going on—a lot of concurrent permits.”

Anthony Gardner, Gateway Development Commission

A train emerges from the existing 113-year-old rail tunnel linking New York and New Jersey. | BLOOmBERG

250 Park Ave. South, Flatiron | GOOGLE StREEt VIEW mAGE

Barry Silbert BLOO m BERG

TOP FILM AND TV PRODUCTIONS

ranked by state tax credits earned in 2022

September 25, 2023 | CrAIN’S NeW YOrK bUSINeSS | 15 t H e LIS t

RANKPRODUCTION STUDIO/ PRODUCTION COMPANY SEASONS 2022 TOTAL TAX CREDIT (IN MILLIONS) 1 2022 QUALIFIED COSTS (IN MILLIONS) 2 2022 TOTAL STATE SPENDING (IN MILLIONS) 3 2022 TOTAL HIRES 1 City on a HillCity on Hill TV series Showtime Possible Productions S2 $26.1 $87.4 $105.73,296 2 HunterHunterss TV series Amazon Big Indie The Hunt $25.4 $85.0 $111.65,676 3 PPoowerwer TV series Starz Power Productions S6 $25.4 $84.7 $116.46,131 4 Ray DonovRay Donovanan TV series Showtime Possible Productions S7 $21.7 $72.4 $99.74,393 5 BullBull TV series CBS CBS Television Studios S4 $19.3 $64.5 $91.44,089 6 City on a HillCity on Hill TV series Showtime Possible Productions S1 $17.5 $58.4 $72.43,878 7 The Plot AgThe Against Americaainst America TV series HBO Random Productions $17.4 $57.6 $68.83,851 8 TTommyommy TV series CBS CBS Television Studios S1 $16.5 $55.3 $72.13,518 9 GothamGotham TV series WB Main Gate Productions S5 $16.5 $55.3 $65.43,147 10 ManifestManifest TV series WB Jay Squared Productions S1 $16.2 $54.1 $64.24,920 11 The UndoingThe Undoing TV series HBO Calling Grace Productions $16.2 $53.4 $78.93,857 12 JJohn Wick 3: P ohn Parabellumarabellum Film Lionsgate Journal Productions $15.7 $52.5 $79.83,761 13 PPoseose TV series FOX Pacific 2.1 Entertainment Group S2 $15.1 $50.4 $58.34,150 14 UnbrUnbreakable Kimmy Schmidt eakable TV series NBCU Universal Television S4 $14.1 $47.0 $66.13,844 15 The PThe Politicianolitician TV series FOX Pacific 2.1 Entertainment Group S2 $13.5 $45.0 $60.15,327 16 For LifeFor Life TV series SONY Topanga Productions S1 $12.9 $43.0 $61.84,373 17 Almost FAlmost Familyamily TV series NBCU Universal Television S1 $12.7 $42.4 $58.43,556 18 DickinsonDickinson TV series Apple Dickinson 1 S2 $12.5 $41.9 $53.51,832 19 WWoman in the Windo oman Windoww Film FOX 20th Century Studios $11.6 $38.7 $56.81,328 20 The SinnerThe Sinner TV series NBCU Universal Television S3 $11.3 $37.6 $48.12,556 amanda.glodowski@crainsnewyork.com

Source:Source: EmpireState Development Corp.,with additional research by Amanda Glodowski.Dollar figures reflecttaxcredits approved during the 2022 calendar year and arebased on spending receipts submittedto NewYork state.Full amounts areaddedacrossall television seasonscontained within thedata.Total hires include all hires for aproject, including actors. If two figuresappear tied, rank is based on ungrounded numbers. 1 Takenas a percentage of thequalifiedcosts. 2 Total expenses incurred that qualify for the state tax credit. Salaries of actors, writers and directors are not qualified. 3 Total spending by the production in New York state. This field includes the salaries of actors, writers and directors.

16 | CRAIN’S NEW YORK BUSINESS | SEptEmBER 25, 2023 SHOWCASE INDUSTRY LEADERS AND THEIR CAREERS RECOGNIZE TOP ACHIEVERS IN NEW YORK’S PREMIER PUBLICATION New Hires / Promotions / Board Appointments / Retirements / Special Acknowledgements MAKE AN ANNOUNCEMENT Debora Stein / dstein@crain.com CrainsNewYork.com/POTM t HE LIS t TOP FILM AND TV PRODUCTIONS RANKPRODUCTION STUDIO/ PRODUCTION COMPANY SEASONS 2022 TOTAL TAX CREDIT (IN MILLIONS) 1 2022 QUALIFIED COSTS (IN MILLIONS) 2 2022 TOTAL STATE SPENDING (IN MILLIONS) 3 2022 TOTAL HIRES 1 City on a HillCity on Hill TV series Showtime Possible Productions S2 $26.1 $87.4 $105.73,296 2 HunterHunterss TV series Amazon Big Indie The Hunt $25.4 $85.0 $111.65,676 3 PPoowerwer TV series Starz Power Productions S6 $25.4 $84.7 $116.46,131 4 Ray DonovRay Donovanan TV series Showtime Possible Productions S7 $21.7 $72.4 $99.74,393 5 BullBull TV series CBS CBS Television Studios S4 $19.3 $64.5 $91.44,089 6 City on a HillCity on Hill TV series Showtime Possible Productions S1 $17.5 $58.4 $72.43,878 7 The Plot AgThe Plot Against Americaainst America TV series HBO Random Productions $17.4 $57.6 $68.83,851 8 TTommyommy TV series CBS CBS Television Studios S1 $16.5 $55.3 $72.13,518 9 GothamGotham TV series WB Main Gate Productions S5 $16.5 $55.3 $65.43,147 10 ManifestManifest TV series WB Jay Squared Productions S1 $16.2 $54.1 $64.24,920 11 The UndoingThe Undoing TV series HBO Calling Grace Productions $16.2 $53.4 $78.93,857 12 JJohn Wick 3: P ohn Parabellumarabellum Film Lionsgate Journal Productions $15.7 $52.5 $79.83,761 13 PPoseose TV series FOX Pacific 2.1 Entertainment Group S2 $15.1 $50.4 $58.34,150 14 UnbrUnbreakable Kimmy Schmidt eakable Kimmy TV series NBCU Universal Television S4 $14.1 $47.0 $66.13,844 15 The PThe Politicianolitician TV series FOX Pacific 2.1 Entertainment Group S2 $13.5 $45.0 $60.15,327 16 For LifeFor Life TV series SONY Topanga Productions S1 $12.9 $43.0 $61.84,373 17 Almost FAlmost Familyamily TV series NBCU Universal Television S1 $12.7 $42.4 $58.43,556 18 DickinsonDickinson TV series Apple Dickinson 1 S2 $12.5 $41.9 $53.51,832 19 WWoman in the Windo oman Windoww Film FOX 20th Century Studios $11.6 $38.7 $56.81,328 20 The SinnerThe Sinner TV series NBCU Universal Television S3 $11.3 $37.6 $48.12,556 16 TV series Topanga Productions $12.9 $43.0 $61.84,373 17 Almost FAlmost Familyamily TV series NBCU Universal Television S1 $12.7 $42.4 $58.43,556 18 DickinsonDickinson TV series Apple Dickinson 1 S2 $12.5 $41.9 $53.51,832 19 WWoman in the Windo oman Windoww Film FOX 20th Century Studios $11.6 $38.7 $56.81,328 20 The SinnerThe Sinner NBCU Universal Television $48.12,556 21 The Good FThe Fightight CBS CBS Television Studios S4 $49.92,482 22 BlindspotBlindspot CBS CBS Television Studios $44.82,513 23 Love LifeLove Life TV series Lionsgate Love it NY Productions 24 HightoHightownwn Starz Starz $8.9 25 MrMrs. Fletchers. Fletcher HBO Cooler Waters Productions $7.0 $23.6 $30.72,427

State bill seeks to launch New York work permits for asylum seekers to overcome federal logjam

By Caroline Spivack

Fed up with the lengthy approval process for federal work permits, state lawmakers want New York to create its own, expedited system to issue work permits to asylum seekers.

A bill introduced by Queens Assemblywoman Catalina Cruz and Bronx state Sen. Luis Sepúlveda would task the New York Department of Labor with issuing work permits to asylum seekers within 45 days of receiving their applications, according to memos on the legislation reviewed by Crain’s.

Current federal law requires that after filing a court petition for asylum, a migrant must wait 150 days before they can apply for a work permit. A logjam of work permit applications means it can take federal officials anywhere from five to 14 months to process, leaving the asylum-seeker without a legal way to make money for upwards of a year.

“Everyone is pointing the finger at each other and almost abdicating their responsibilities,” Cruz, a former immigration attorney and Colombian immigrant, told Crain’s. “We said, let’s get creative, and we introduced this legislation in the hopes that this could become kind of a model for the country.”

Cruz said she’s received positive feedback on the bill from lawmakers in both the Assembly and Senate and is hopeful that if a special session is called, the bill would pass.

She fully anticipates, however, that the legislation would face legal challenges.

“Whether it’s the federal government itself or someone else who claims it’s unconstitutional, we fully expect to be sued,” Cruz said. “We took our time and deliberately wrote a piece of legislation that recognizes that this is an emergency, and we make it clear in the language that this is not a

permanent program.”

The bill, dubbed the New York Emergency Expedited Temporary Work Permit Act, would sunset after two years.

Would not charge fees

The work permit program created under the bill would not charge any fees and would enable asylum seekers to work for 18 months,

with the potential to renew, according to the memos.

“In view of the current federal inaction to expedite federal work permit applications for asylum seekers,” the legislative memos state, “it is incumbent on New York state to exercise its state’s constitutional duties and the powers reserved to states under the federal constitution and enact a worker permit program.”