A new Crown steps into the civic spotlight

As head of a task force on Chicago crime, Jim Crown is taking on a challenge even more di cult than his father Lester’s causes I

BY STEVEN R. STRAHLER

BY STEVEN R. STRAHLER

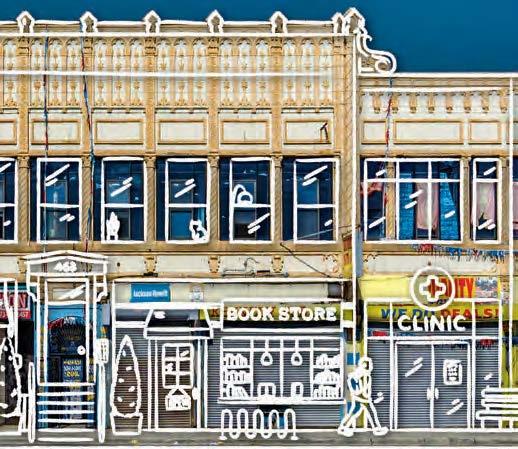

AT A RECEPTION LAST SUMMER at the Museum of Contemporary Art, an exhibition of works by Chicago artist Nick Cave wasn’t the only center of attention. Jim Crown, scion of one of Chicago’s richest families, was immobilized by a throng of well-wishers on the museum’s terrace. Crown, though, is on the move elsewhere. Since October, he’s been leading a public safety task force established by the Civic Committee of the Commercial Club of Chicago. At 69, he may be nally stepping into his father Lester’s civic leadership shoes to take on Chicago’s scourge of gun violence and the city’s regrettable global image as one big crime scene. e issue is more intractable and politically radioactive than even the knotty ones like O’Hare expansion and a new county hospital the elder Crown took on.

Olson, a Loyola University Chicago criminology professor

Get ready for income-based utility rates

BY STEVE DANIELS

BY STEVE DANIELS

For the rst time ever, Illinois utilities are proposing to charge lower-income customers lower rates than everyone else.

Both Nicor Gas, which serves most of suburban Chicago, and Peoples Gas, which serves Chicago, have proposed new discounts for tens of thousands of residential customers as part of their record-setting rate-hike requests led earlier this month. Chicago-based electric utility Commonwealth Edison says it will o er a “progressive” rate-set-

ting proposal by next year. But the discounts wouldn’t cost the utilities any money. eir other residential and business customers would pick up the tab for the subsidized customers.

e utilities are responding to a directive in December from the Illinois Commerce Commission, which was authorized in 2021 to reduce utility rates for lower-income households, funded by commensurately higher charges for those above the income threshold. e initiative

Tech ethos on trial in Outcome Health case

BY JOHN PLETZ

BY JOHN PLETZ

Not so long ago, Rishi Shah and Shradha Agarwal were the shining hope of Chicago’s startup scene. is week, the 37-year-old co-founders of Outcome Health will be tried in federal court on criminal fraud charges stemming from one of the most spectacular business ameouts in Chicago

history. ey pleaded not guilty, as did former Chief Operating O cer Brad Purdy, 33, who is also charged with fraud.

Shah, Agarwal and Purdy face up to 30 years in prison each if they’re convicted on charges of mail, wire and bank fraud in a scheme that prosecutors allege duped big drug companies and

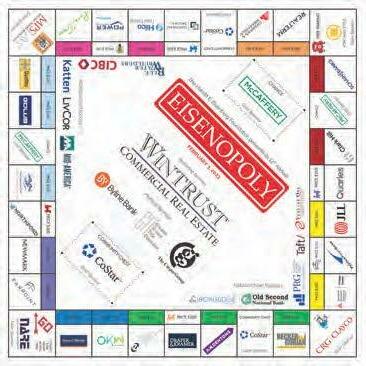

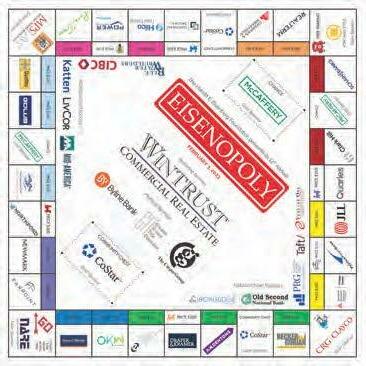

REAL ESTATE

GETTY IMAGES CHICAGOBUSINESS.COM | JANUARY 23, 2023 | $3.50 MADELEINE DOUBEK: One fix could solve many problems with city government. PAGE 2

A

their

in the sun . PAGE 3

JOE CAHILL:

irlines enjoy

moment

The

PAGE 23 YOUR VIEW Here’s how we

support women-owned businesses. PAGE 10 NEWSPAPER l VOL. 46, NO. 4 l COPYRIGHT 2023 CRAIN COMMUNICATIONS INC. l ALL RIGHTS RESERVED

rehabbers of this bungalow refused to pop the top.

can help

Huge rate hike proposals from Peoples Gas and Nicor include discounts for lower-income customers, funded by those who make more

Rishi Shah and Shradha Agarwal are the latest startup founders to face serious jail time if convicted of fraud

WANTS TO SEE POLICE VISIBLE IN FRONT OF ESTABLISHMENTS FOR THEIR OWN BENEFIT.”

“BUSINESS

See GAS on Page 22 See OUTCOME HEALTH on Page 20 See CROWN on Page 21

David

Jim Crown

In the nal weeks, it’s a wide-open mayoral race

With about ve weeks to go, the race for mayor of Chicago is absolutely wide open, up for at least ve of the nine contenders to capture—or fumble away.

Mayor Lori Lightfoot is in trouble, but don’t count out the wily and strong-willed incumbent. U.S. Rep. Jesus “Chuy” Garcia likely is the current leader, but he needs to quit acting like he’s got it won. Close on their heels are former Chicago Public Schools CEO Paul Vallas, Cook County Commissioner Brandon Johnson, businessman Willie Wilson and, perhaps, Ald. Sophia King, 4th.

In a nine-person eld—and after years of COVID, crime, economic decline and other woes—anyone who says they know how this will turn out is smoking bad weed. If average Chicagoans and big business donors wake up to that reality—so far, my impression is that voters are not really engaged and business remains uncertain—this election

will be one for the books.

Here’s what I see, and what to watch for:

Four years ago, if you’ll recall, a little-known lawyer named Lori Lightfoot caught a gust of public support when Ald. Ed Burke, 14th, was indicted on federal corruption charges and rumors exploded about the future of Illinois House Speaker Mike Madigan. Lightfoot’s vow to drain the swamp was exactly what voters wanted.

Instead, they got a mayor who has excelled in making enemies; someone who, whatever her legitimate claims to have moved Chicago in the direction of racial and economic equity, had to govern in the middle of a pandemic and a resulting crime wave her team has only begun to tame. at has put her solidly on the defense. And though she’s used her fundraising to burnish her reputation and go negative on Garcia, he still leads in most recent polls and much of her cash hoard is gone. At least as bad:

In lakefront wards like the 44th and 43rd that should be friendly territory, her support is so weak that her appointed 43rd Ward Ald. Timmy Knudsen wouldn’t even endorse her at a candidate forum last week. Will someone else join Lightfoot in trying to hobble Garcia? Will any Black candidates drop out? Will King, the only other woman on the ballot, come up short in raising the cash she needs to go on TV? Lightfoot could use some help on those. Garcia has big name recognition but has been running a fairly quiet, cautious campaign so far. at may not be enough. I’m told he’s reached out to prominent business gures, but none have gone public yet. And he still has yet to really explain why fallen crypto king Sam Bankman-Fried spent $200,000 on Garcia’s political behalf last year, or say whether his informal alliance with Madigan was real.

If I were Garcia, I’d be worried about who’s coming up on my left. at’s Johnson, who has quietly

GREG HINZ ON

POLITICS

assembled a seven- gure war chest; has substantial precinct help from the same progressive army that elected Delia Ramirez to Congress; and is trying to supplant Garcia as the voice of a new generation of activists who want to squeeze the well-o and privileged until the working class—and the Chicago Teachers Union—are content. en there’s Wilson, whose base is low-income Black voters, but whose politics borrow a few pages from the Book of Trump. And Vallas, who is trying to prove his talents as a former schools chief and his mainstream ideology in a left-leaning city are what Chicago wants.

Wilson has been trying to peel o some of Vallas’ base in what used to

be known as white ethnic wards on the Northwest and Southwest sides. Vallas needs to hold onto those while emphasizing his competence if he’s to pull votes elsewhere, especially on the North Side. His acceptance of an endorsement from the Fraternal Order of Police was a big gamble, but Vallas has been much more disciplined than usual this campaign.

Out of that morass, Chicago on Feb. 28 will chose two contenders to go to an April runo . Four years ago, in a larger eld, the top vote-getters nished the rst round with 17.54% (for Lightfoot) and 16.05% (for Cook County Board President Toni Preckwinkle) of the vote.

Like I said: wide open.

Solving this problem would resolve many others

Chicagoans, what worries you most?

Is it the escalating gun violence and crime? e rising cost of living and whether you can a ord to keep calling Chicago home? Maybe it’s the quality of the education your children are getting?

Whether it’s any or all of those things, or something di erent, the chances of those worries being addressed and dealt with head-on likely would increase exponentially if the city’s voters actually got to choose all of their elected o cials.

Sure, there’s an election for mayor and alderperson coming up Feb. 28, but a majority of the current incumbent council members chose who the voters would be for their wards or their successors’ wards when they cut a deal in a back room and then voted in public last May for a map that set new ward boundaries for the next decade.

ose boundaries, primarily, were drawn with regard to what made sense for the incumbents and their ability to keep their political power, not with any regard for what made sense for people in the neighborhoods and communities of Chicago. And, Chicago being Chicago, some of the boundaries were drawn in crazy-quilt fashion to punish those who wouldn’t go along to get along and who caused grief during the map process. Go ahead, Google a map of the 33rd Ward or the 15th Ward.

Chicago’s wards form the foundation of government, and, it stands to reason, elected o cials’ responsiveness to residents’ worries would increase if that foundation were set in a way that was fair and encouraged accountability from those members. In other words, if your council member is con dent she or he will win re-election, do they really need to pay more than lip service to you when you register a concern about that shooting in broad daylight the other day? Probably not.

at is why you need to care about the way wards are drawn. And that is precisely why more than a dozen community-based organizations from all over Chicago worked together to develop a survey to nd out where the mayoral and aldermanic candidates stand on how ward mapping and redistricting gets done.

Organizations as diverse as the Rainbow/Push Coalition, Muslim Civic Coalition, the Coalition for a Better Chinese American Community, the Resident Association of Greater Englewood and the Union League Club of Chicago, to name a few, believed it was important to get candidates on the record about ward mapping.

is rst-of-its-kind survey produced some promising results for those of us who believe ward redistricting should not be done by incumbents.

Most of the candidates for Chicago mayor and scores of the majority of aldermanic candidates who responded said they believe it’s time to change the behind-closed-doors, incumbent-controlled approach to ward remapping.

Mayor Lori Lightfoot rst campaigned on moving to independent ward mapping, but did not ful ll that pledge and encouraged a council compromise last year. Her campaign turned down the chance to answer the survey.

Five of the nine mayoral candidates did respond, and aldermanic candidates in 38 out of 50 wards also explained their views on shaping wards here.

Candidates have a lot of requests to answer surveys. It also can be telling when they choose not to participate. One resident commented on social media that she’d read the responses and added, “ ose who didn’t answer aren’t options for me.”

In 2021 and 2022, my nonpartisan nonpro t, Change Illinois, created a diverse resident redistricting

commission that took input from all over the city and drew its own map for Chicago, in public, to model and demonstrate a better way to map wards and communities. e residents who served on that commission centered their boundaries on what they thought worked for residents after they spent months listening to hundreds of residents who provided public input.

One of the council candidates now running followed that resident commission’s work and recently passed along her feedback: “ e education and the information provided by the Redistricting Commission was invaluable, and it surpassed

anything that regular citizens had been provided in the past. If all of our elected o cials could bring this type of transparency and professionalism to our communities, we could nally have a system by and for the people.”

Indeed.

Worried about gun violence? Rising in ation or taxes? Safe, quality

schools? Food deserts? en you also should care about how wards are drawn. Before you vote, learn about where the candidates stand on this core topic at ChangeIL.org.

Madeleine Doubek is executive director of Change Illinois, a nonpartisan nonpro t that advocates for ethical and e cient government.

2 JANUARY 23, 2023 • CRAIN’S CHICAGO BUSINESS Banking products pro vided by Wintrust Financial Corp. banks. GET ASSURANCE . LET US GET TO KNO W Y OUR BUSINESS . GET CO MMITMENT . GET AT TENTION. Be your banker’s top priority. WINTRUS T. CO M/PRIORITY MADELEINE DOUBEK ON GOVERNMENT

BLOOMBERG

Rebranding puts a spin on Ariel Investments’ philosophy

The Chicago asset manager’s 40th anniversary is marked with an enigmatic new tagline, ‘Active patience.’ But CEO John Rogers’ value-oriented investment approach isn’t changing. I

BY STEVE DANIELS

BY STEVE DANIELS

Ariel Investments is marking its 40th anniversary with a rebranding campaign that attempts to give the tortoise that for decades has been the asset management rm’s mascot a bit more pep in its step.

e Chicago-based rm—a pioneer as a Black-owned mutual fund house, founded by John Rogers Jr., who continues to manage money and serves as co-CEO along with longtime executive Mellody Hobson—is now using the tagline “Active patience.” It’s a tweak of its identity as a steady, value-oriented investment rm sifting for unjustly unloved stocks and then holding them until they are properly

See ARIEL on Page

18

BY STEVE DANIELS

Commonwealth Edison has led with state regulators to hike its delivery rates by $1.5 billion over four years, beginning in 2024.

e multiyear rate plan, authorized under the landmark Climate & Equitable Jobs Act, would boost ComEd’s distribution revenue by nearly 50% over that period if approved as submitted, according to a Securities

bills by 18% over four years

& Exchange Commission ling Jan. 17 by ComEd parent Exelon.

e numbers are well above the historically high rate hikes ComEd obtained under the 2011 formula-rate law, which permitted the utility to change its delivery rates annually under a formula that essentially removed the ordinary authority the Illinois Commerce Commission has to set utility rates.

In 2024 alone, ComEd seeks to hike its delivery rates by $894

million, by far the steepest oneyear rate increase ComEd ever has sought. After that, rates would increase by an average of $198 million annually through 2027.

Much of the eye-popping increase can be explained by a spike in the return on equity ComEd is requesting—essentially its pro t level. ComEd’s requested ROE for 2024 is 10.5%. Its

JOE CAHILL ON BUSINESS

Airlines enjoy their moment in the sun

Airlines are facing some of the toughest operating conditions they’ve ever experienced. And that’s been great for business at many carriers.

Along with the usual e ects of winter weather, supply chain constraints are holding airlines back as they emerge from the pandemic. ey’re short of pilots, planes and parts. And some are hamstrung by outdated technology, a shortcoming that became painfully apparent late last month when Southwest was forced to cancel thousands of ights as snowstorms swept the country. ese conditions hobble carriers as they try to absorb a surge of pent-up demand from travelers eager to hit the road after two years of COVID-19 restrictions. Total passenger volumes in the U.S. rose nearly 40% in the 12 months ended in October, according to the latest data available from the Bureau of Transportation Statistics.

Widespread cancellations during the summer and holiday travel seasons showed airlines couldn’t handle so much demand. Which isn’t to say it was bad for business.

In fact, airline economics have ipped from atrocious two years ago to nearly ideal today. Demand for airline seats exceeds the supply, giving carriers power to raise fares. So that’s what they’re doing, to the tune of a 22% rise in average airfares in October. Rising fares are driving revenues and pro ts past pre-COVID levels at major carriers like Delta, American and Chicago-based United.

IMBALANCE anks to the supply/demand imbalance, airlines are making more money carrying fewer passengers than they did before the pandemic. United, for example, posted fourth-quarter passenger revenue of $11.2 billion, up 13% from the fourth quarter of 2019. Pro tability soared, too, with pretax income up 34% and operating margin expanding to 11% from 8%.

Those gains came despite a 5% drop in passenger volumes and a 9.5% decline in available seating capacity. Delta reported similar trends, and American is expected to do the same when it discloses full fourth-quarter results on Jan. 26.

United CEO Scott Kirby was quick to credit his airline’s preparedness for post-COVID realities. In a triumphant fourth-quarter earnings call, he declared that “it’s a new world—you can’t run the airline like you did in 2019,” and bragged that “we saw that coming earlier than others and are better prepared to deal with it

than everyone else.”

ere’s no denying that United looked to the future as COVID ravaged air travel demand. While other carriers furloughed pilots, slashed eets and waited out the storm, United bet on a rebound in demand. Kirby kept pilots and planes at the ready, positioning the carrier to capitalize when customers came back. United also invested in technology and built slack into ight schedules, moves that keep the weather disruptions that routinely upend air travel from becoming full-scale meltdowns like the one Southwest experienced last month.

SEEKING AN EDGE

Kirby gures the investments will give United more than a short-term edge in the aftermath of COVID. He says the company also has what it takes to overcome “long-term structural issues” that will limit the industry’s growth for years to come: ere aren’t enough pilots, or planes, or spare parts; the air tra c control system can’t handle more ights.

“So to be clear, while I don’t think the industry can grow, I think—we think United can,” he said, in one of the boldest statements you’re likely to hear from a public company CEO on a quarterly earnings call.

How can United defy industrywide headwinds? Kirby says investments the carrier has made in areas such as pilot training, technology, operational resiliency and customer service will create advantages over rivals that he believes haven’t adjusted to fundamental industry changes.

Kirby is on solid ground when he argues that the industry’s current challenges will take a while to solve, and there’s no question that United’s operating performance has improved. But his nancial case gets a bit dicier over time. He’s essentially betting on a permanent supply/demand imbalance in air travel, which will give United the pricing power to expand pro t margins as labor costs and other expenses rise.

Yet economic history shows supply/demand imbalances don’t always last, particularly in the airline business. At some point, pilot shortages will ease and new aircraft will be delivered, creating new capacity to soak up excess demand. As supply and demand level o , airlines will likely nd it harder to push through fare hikes.

ey may even resort to the price competition that squeezed industry pro ts in the past.

at’s when we’ll nd out if Kirby has really future-proofed United Airlines. For now, United and other carriers can enjoy the ride.

CRAIN’S CHICAGO BUSINESS • J ANUAR Y 23, 2023 3

four-year rate hike totaling $1.5 billion The utility’s rate ling, authorized under Gov. J.B. Pritzker’s Climate & Equitable Jobs Act, would hike average household electric

ComEd seeks

John Rogers Jr., co-CEO of Ariel Investments

WITH $16.2 BILLION IN ASSETS UNDER MANAGEMENT AT YEAR-END, ARIEL HAS DONE A GOOD JOB CONVINCING INVESTORS TO SIT TIGHT.

See COMED on Page 21

Postgrads compete to be Wienermobile drivers

Kraft Heinz subsidiary Oscar Mayer is hiring college graduates to spread the good word about hot dogs

BY JACK GRIEVE

e Oscar Mayer Hotdogger position is the dream job you never knew you wanted.

is summer, 12 recent college graduates will travel the country in the meat packager’s six Wienermobile vehicles. Two Hotdoggers per Wienermobile, an average 20,000 miles each. And they’ll get paid to do it, bene ts and everything.

Being a Hotdogger is not for just anyone, though. More than 2,000 recent graduates apply to the program each year and only 12 make the cut. “It is statistically easier to get into an Ivy League university than to be granted acceptance into the Oscar Mayer brand’s class of Hotdoggers,” said Ed Roland, the company’s senior manager of brand communications.

But for those who do make it in, the job lives up to the hype.

“It was genuinely the coolest, most unique experience I could have had right out of college,” said Woodstock native Katie Ferguson, a former Hotdogger who drove the Wienermobile across the Midwest and Southern United States. She recalled taking trips to national parks and driving the 27-foot-long car around professional racetracks.

e Wienermobile dates back to 1936, when the brand tapped Chicago’s General Body Co. to

design the rst 13-foot hot dog vehicle. Oscar Mayer being a subsidiary of Chicago-based Kraft Heinz, the Wienermobiles have maintained a particularly strong presence in and around the city.

“We always used to joke that there’s always a Wienermobile in Chicago,” said Cameron Callanan, a member of the 32nd class of Hotdoggers. “ ey would rotate a team there all the time because there was so much need there between sales and corporate events.”

RECRUITMENT

Oscar Mayer frequents a slew of college campuses to recruit soon-to-be graduates for the program. at includes the University of Missouri, where Ferguson earned a degree in communications. “I knew it was a pretty prestigious position that people in my major often apply for,” she said. “So I thought I’d just give it a shot.”

is kind of work runs in the family for Ferguson. She says her grandmother held an almost identical job in the 1950s. “It wasn’t for Oscar Mayer, but she traveled the country spreading the good word about hot dogs.”

Hotdoggers take on two sixmonth stints traveling in pairs around di erent designated regions of the United States. Fer-

guson says every day is di erent, but a typical week entails driving to a new city on a Monday, getting two days o and then working six- to eight-hour days the rest of the week.

A big part of the job is hosting pop-up events at grocery stores where Hotdoggers show o the Wienermobile, hand out Oscar Mayer merchandise and give away in-store coupons. But depending on the day, Hotdoggers can nd themselves anywhere from corporate events to the Super Bowl.

Part of the appeal of the program is that Hotdoggers get to see the country in a way few oth-

ers can. “I had more small-world experiences than I’ve ever had in my life,” Ferguson said. at is true even on the days when the Hotdoggers are not working. “If you wanted to go grocery shopping or something, you were taking the Wienermobile,” explained Callanan. “I ended up in a Trader Joe’s parking lot for like 45 minutes once because I couldn’t get people to just get out of the Wienermobile.”

BRAND LOYALTY

e Hotdoggers’ love for the job lasts long after their time in the Wienermobile is over. Ferguson still speaks of the year on

the road with hotdog puns, insists that a Wieinermobile “meetand-greet” is spelled “M-E-A-T” and says the role of a Hotdogger is to “drive miles of smiles across America.”

“We are lifers,” Callanan said, adding that she even has a tattoo of the Wienermobile. is year’s Hotdogger applications are now open as the company continues to lean into levity and nostalgia for the brand. Kraft Heinz has a product lineup with the type of brand recognition other marketers envy, and it’s looking to revamp that status among its subsidiary companies like Oscar Mayer.

These are the best hospitals in Chicago, says a new list

BY KATHERINE DAVIS

Fourteen Illinois hospitals ranked among the country’s best facilities on a new list from Healthgrades, a Denver-based consumer marketplace for nding physicians and care.

e list, published Jan. 17, puts Ascension Alexian Brothers and Carle Foundation Hospital in Urbana among the nation’s top 1%, with Advocate Lutheran General Hospital in Park Ridge ranked among the top 2%.

e annual list groups hospitals into the top 50 (1%), 100 (2%) and 250 (5%) nationwide. e rankings are based on Healthgrades’ analysis of performance and outcome clinical data among nearly 4,500 U.S. hospitals across more than 31 of the most common procedures and conditions, like heart attack, stroke, hip replacements and pacemaker surgeries.

Both Ascension Alexian Brothers and Carle Foundation Hospital were ranked among the top 50 in the two previous years. Lutheran General Hospital was ranked among the top 100 hospitals in 2022 and 2021 as well.

Meanwhile, Chicago’s Northwestern Memorial Hospital and the University of Chicago Medical Center joined the list this year and were both ranked among the top 250 hospitals. ey were accompanied by Advocate Good Shepherd Hospital in Barrington, OSF Saint Joseph Medical Center in Bloomington, Evanston Hospital, Northwestern Medicine Lake Forest Hospital, Northwestern Medicine McHenry Hospital, Silver Cross Hospital in New Lenox, Advocate Christ Medical Center in Oak Lawn, and Javon Bea Hospital–Rockton in Rockford.

Rush University Medical Center is missing from this year’s ranking.

“Healthgrades ranks seven Rush University Medical Center specialties as among the best in Illinois so we were surprised to not be included in the national list,” the health system said in a statement. “While methodologies di er, that Rush University Medical Center is one of the few hospitals in the country to be ranked or rated very highly by U.S. News & World Report, Leapfrog, Vizient and the federal gov-

ernment’s hospital compare star system speaks to our continued commitment to provide the best care possible for our patients.”

CRITICISM

Other hospitals have also criticized and questioned the methodologies and criteria used by ratings organizations, including Healthgrades, U.S. News & World Report and Leapfrog, whose rankings sometimes con ict with one another.

“We appreciate the ongoing e orts made by Healthgrades to improve the usefulness and accessibility of information for consumers,” said Chris King, chief media relations executive at Northwestern Medicine, which owns Northwestern Memorial Hospital. “As an organization committed to providing high-quality, safe, patient-centered care, our physicians, nurses and sta are always focused on doing what is best for our patients.”

UChicago Medical Center didn’t immediately respond to a request for comment.

“ is is one of many hospital rating systems,” Amy Barry, the

University

vice president of corporate communications and marketing at the Illinois Health and Hospital Association, said in a statement to Crain’s. “Each system has a di erent criteria and methodology. Patients are encouraged to do their research when choosing a hospital for their healthcare needs and it is very important to get the full picture by accessing all the rating tools available.”

Healthgrades said it publishes the list to help consumers nd the best care in their area. e

organization says that if all hospitals performed similarly to the best 250 providers on its list, more than 160,000 lives could have been saved in 2019 and 2021.

“With these awards, we are helping consumers identify the highest quality care in their community by celebrating the hospitals that consistently deliver better-than-expected clinical outcomes,” Burt Kann, executive vice president and head of product at Healthgrades, said in a statement.

4 JANUARY 23, 2023 • CRAIN’S CHICAGO BUSINESS

The rst Wienermobile was designed in 1936 by Chicago’s General Body Co. The eet now includes six full-size Wienermobiles and an assortment of customized vehicles.

Northwestern Memorial Hospital and UChicago Medical Center join this year’s annual Healthgrades list. One prominent hospital was left o the ranking.

of Chicago Medical Center joined the list this year and was ranked among the top 250 hospitals.

UNIVERSITY OF CHICAGO MEDICINE

OSCAR MAYER

The diversity of the people and neighborhoods are the heartbeat of the Chicago region. United Way works to ensure every person has equitable access to opportunities and neighborhoods can thrive. With your support, we can invest in continue d progress and create a Chicago region where every child has better access to quality education, communities are safer, our neighbors are healthier, incomes increase, and our region prospers.

Now is the time to LIVE UNITED and build a stronger, more equitable Chicago region. Join us at LIVEUNITEDchicago.org

A ban on gas stoves? Chefs throw cold water on the idea.

While health worries fuel talk of regulating the appliances, restaurants have concerns and industry groups are ready for a ght: ‘Restaurateurs are up in arms’

BY H. LEE MURPHY

Recent research has shown gas-burning stoves emit a toxic stew of chemical compounds, leading to threats from regulators and legislators who want to ban gas ranges for residential use. Now restaurateurs, fearful they will soon get sucked into the debate, are speaking out.

“Gas being dangerous? If this were true, I’d be brain-dead by now,” says Ian Rusnak, chef and co-owner of the Chicago restaurant Elina’s, who has been cooking professionally on gas-powered stovetops since 2008. “There is a reason commercial chefs use gas ranges instead of electric—they are easier to work with and they cook more evenly and consistently. And they are more durable than the electric induction alternative.”

Local chefs estimate that somewhere around 90% of cooking in Chicago restaurants is done on gas-powered ranges; electric and wood-burning make up most of the rest.

Sarah Stegner, chef and co-owner of Prairie Grass Cafe in Northbrook, has been cooking with gas for 40 years. Powerful exhaust fans, plus an air filtration system, handle the smoke from her two massive six-burner ranges.

“I never feel bad or sick at the end of the day,” she says. “In fact, I feel good. I don’t think legislation banning gas is going to happen right away, but it could happen down the road. If somebody invents a solar oven for chefs like me eventually, I guess I could figure out how to cook with it. But some cooking techniques, like charring a sweet pepper, simply need an open flame. It’s hard to get around that.”

STUDIES

e prospect of regulatory action was sparked by recent comments from Richard Trumka Jr., a commissioner of the U.S. Consumer Product Safety Commission. He cited a study showing nearly 13% of childhood asthma is tied to gas-burning stoves. Other studies have shown the appliances can emit carbon monoxide and nitrogen dioxide at levels deemed dangerous by the Environmental Protection Agency and the World Health Organization. Trumka later told CNN, “We are not looking to go into anyone’s homes and take away items that are already there.”

What has restaurateurs particularly worried is lawmakers in some states who aren’t waiting for federal action. In 2020, Berkeley, Calif., was the rst city in the nation to ban gas hookups

on new buildings. Some 50 other cities around California have followed suit. New York Gov. Kathy Hochul this month backed a proposed ban on selling heating equipment powered by fossil fuels; the measure would not include gas stoves.

A conservative backlash has erupted as Republicans, in particular, have complained about legislative overreach.

And an industry group is ready to fight. Lauren Tuckey, a Chicago lawyer who sits on the advisory council of the Illinois Restaurant Association, says she is prepared to sue to stop any commercial gas appliance bans that might be passed in the state. She and others are skeptical of proposed legislation that would make an exception for commercial dining establishments. If gas hookups to buildings are forbidden in the future, the assumption is chefs eventually won’t have a choice.

“We need to see real data on this before prohibitions are enacted,” Tuckey says. “Is there any evidence that kitchen sta is dying of cancer at a higher rate than the rest of the population? We need to see a cost-bene t analysis. And we need to see evidence that if all cooking reverts to electric, can the current electric grid even handle this?”

Isidore “Izzy” Kharasch, a

restaurant consultant based in Deer eld and a former chef, predicts “the debate about gas ranges could become a big war.”

He notes that Republican legislatures in Texas and some other Southern states have already acted to forbid towns within their states from enacting gas bans.

ARGUMENTS

“State restaurant associations will be taking strong stands against a gas range ban,” he says. “Restaurateurs are up in arms. ey argue that electric ranges don’t have the power or the adjustability of natural gas.

Gas burners give you a superior amount of control over your cooking, and therefore a better

nished product.”

Some chefs, with $200,000 tied up in gas ranges in a typical restaurant, wonder how they could a ord to switch to electric even if they had to.

“I’m all for trying to make the environment safer, but who will pay for this?” asks Paul Virant, the owner of Vie in Western Springs and two other restaurants. “A switch to electric sounds great until you consider that much of the electricity in this state is still derived from power plants using fossil fuels. As for cooking dangers, it’s been known for years that the process of smoking and grilling foods results in carcinogens. is whole issue is very complicated.”

Groupon says it got stiffed by Uptake in sublease deal

BY JOHN PLETZ

Two of Chicago’s best-known tech siblings are in court fighting over unpaid rent.

Groupon is suing Uptake Technologies over $1.5 million in unpaid rent under a sublease agreement at 600 W. Chicago Ave.

Groupon was co-founded by Eric Lefkofsky and longtime business partner Brad Keywell. Lefkofsky is a board member of Groupon and one of its largest shareholders. Keywell is chairman and founder of Uptake, a data-science startup that achieved unicorn status—when that still meant something— with a $2.3 billion valuation five years ago.

Both companies have lost some of their luster over time, having gone through pivots and layoffs. Groupon, an online-deal provider, was just about to pull off Chicago’s biggest tech IPO when it leased more than 300,000 square feet at 600 W. Chicago Ave.

As the longtime home base for Lefkofsky and Keywell, two of Chicago’s most prolific tech founders, the former Montgomery Ward catalog house at 600 W. Chicago was Chicago’s best-known tech address before Fulton Market exploded.

GROWTH

Lefkofsky’s precision-medicine company, Tempus, which has nearly 1,000 Chicago employees and is valued at $8.1 billion, has grown to about 163,000 square feet. Echo Global Logistics, an online freight brokerage founded by Lefkofsky and Keywell, is the second-largest tenant with 183,076 square feet, according to CoStar Group.

Uptake subleased 57,572 square feet on two floors from Groupon in 2016 in a deal worth $18.2 million over 10 years. In its lawsuit, Groupon says Uptake hasn’t paid rent since July.

Groupon and Uptake declined to comment on the litigation.

A year ago, Groupon put all of

its space on the market for sublease amid rising office vacancies just after it laid off nearly 20% of its staff. Another round of cutbacks whittled its local headcount down to about 800 employees, or about one-third of its peak in 2012.

The company hired a new CEO in December 2021, but since then its stock is down by more than half. Groupon's business of retail deals was cashflow positive until the pandemic. The company had negative free cash flow of $182 million through the first nine months of last year.

SHRINKAGE

Headcount at Uptake—which focuses on providing data-analytics software and services to industrial, transportation and government entities—topped 800 ve years ago but eventually dropped by more than half. e company had hoped to ride the twin waves of Big Data and the internet of things to become a serious enterprise software player.

Not paying the rent could be a red flag for Uptake—which raised $117 million more than five years ago—in an environment where tech startups are cutting back wherever possible to conserve cash, especially if they raised money at high valuations.

Or it could be another sign of the lack of leverage landlords

have in a dismal office market with record vacancies that’s flooded with sublease space in a post-pandemic world of remote work.

Tech companies were among the most aggressive in adopting work-from-home policies during the pandemic, although some are bringing employees back to the office.

6 JANUARY 23, 2023 • CRAIN’S CHICAGO BUSINESS

Some chefs, with $200,000 tied up in gas ranges in a typical restaurant, wonder how they could a ord to switch to electric even if they had to.

The Chicago tech siblings are in court ghting over $1.5 million in unpaid rent

GROUP BLOOMBERG

600 W. Chicago Ave COSTAR

BY BRANDON DUPRÉ

Since 2020, billionaire philanthropist MacKenzie Scott has donated around $273.7 million to 30 Chicago nonpro ts, schools and other organizations, revealing for the rst time the extent of her giving spree here.

With a new website called Yield Giving, Scott’s foundation has released the records of her threeyear run that has bene ted more than 1,600 nonpro ts nationwide with north of $14 billion in unrestricted donations. e website gives some clarity into Scott’s often cryptic philanthropic endeavors: e donations, which are frequently the largest ever given to recipient organizations, are made without a formal proposal or application process.

“Information from other people—other givers, my team, the nonpro t teams I’ve been giving to—has been enormously helpful to me,” Scott wrote in an essay featured on the Yield Giving website.

“If more information about these gifts can be helpful to anyone, I want to share it.” She also discusses the process on the site.

In a 2022 study from the Cambridge, Mass.-based Center for E ective Philanthropy that looked at Scott’s public donations, the report found that while her approach to unrestricted grants isn’t new, the sheer volume and scope of her giving is unprecedented, as nonpro ts around the country have received massive lump sums. While some critics have said the amounts could overwhelm smaller nonpro ts, the study found the donations “allowed organizations to ful ll basic, unmet needs—from expanding programs to strengthening nancial sustainability to improving operations.”

CONTEXT

For some context, the Bill & Melinda Gates Foundation, one of the country’s most active and highest-pro le philanthropic organizations, gave a total of $12.5 billion from 2020 through 2021. Figures for 2022 are not yet available.

Scott’s largest donations in the Chicago area were $40 million to the University of Illinois Chicago; $25 million to United Way of

Chicago; $25 million to Chicago Public Schools; and $20 million to Easterseals, which serves the Chicago and Rockford areas. Some of Scott’s donations share grants with organizations outside of Chicago.

Scott has also given to One Million Degrees, the OneGoat Foundation and Habitat for Humanity Chicago South Suburbs, but Yield Giving is not saying how much they’re getting. On the website, a note for some recipients reads, “Disclosure delayed for bene t of recipient.”

ere’s also a question of why Chicago has been the focus of so much of Scott’s giving. Only one area in the U.S. seems to have received more of her money: Los Angeles County, with a total of $298.7 million. Other areas that have drawn large donations include Houston, with $179.2 million; and New York City, with $173.9 million.

Unlike other big philanthropists, Scott does not seem to have a spokesperson to answer that question, and contact information is missing from the Yield Giving website. Click on a

button labeled “Inquires,” and the site redirects to a page that reads, in part: “In order to cede focus to the organizations we’re supporting, we choose not to participate in events or media stories.” Scott has not given any interviews about her donations, instead discussing her gifts in blog posts.

ENTHUSIASM

Meanwhile, her gifts have been greeted with great enthusiasm. Karen Freeman-Wilson, president and CEO of the Chicago Urban League, which re -

ceived $6.6 million from Scott, said “we are ecstatic and humbled by the donation” and “we know that we have a responsibility to be great stewards of these resources and are grateful for this opportunity.”

Access Living President and CEO Karen Tamley last November called the group’s $8 million donation—the single-largest contribution in the organization’s 42-year history—”a truly life-changing investment for our community and will make an enormous impact in supporting the goals we’ve set for the future.” e disability service and advocacy nonpro t said the donation would go toward supporting “economic opportunity, racial and health equity, greater community-based support and digital inclusion.”

On her website, Scott also announced plans to introduce an “open-call process” that allows nonpro ts seeking donations from her to send information for consideration.

Scott has signed e Giving Pledge, promising to give away more than half of her wealth, most of which comes from her divorce from Amazon founder Je Bezos. Forbes puts her current net worth at $27.9 billion.

CRAIN’S CHICAGO BUSINESS • J ANUAR Y 23, 2023 7 Ten-X is a licensed Real Estate Broker | compan oad, With $30

Ten-X

SELLERS

transactions

See all current licensing at: https://www.ten-xx.ccom /compan p y/lega eg g l/liceensi n ng / Ten n n-X, X LLC 17600 Laguna Canyon Road, Ir vine, CA 92618 (888) 952-6393 © 2023

Billion sold and nearly 10,000 transactions closed,

is the digital transaction marketplace where

and BUYERS

twice as with twice the certain

2022 S ALE S VO LUME $613M $517M $166M $447M $58M $144M $639M

d and nearly ons transaction e BROKER S, R S can close as fast and cer taint y.

MacKenzie Scott reveals her Chicago donation spree

ALAMY

MacKenzie Scott

The billionaire philanthropist’s foundation released records showing who’s bene ted from the more than $273 million she’s given here

What two housing economists expect for the Chicago market

The worst is likely behind us, the economists told city and suburban agents recently, but the market will remain in the doldrums for most of the year

BY DENNIS RODKIN

e worst is likely behind us, housing economists told real estate agents gathered at two annual meetings recently, one for city and one for suburban agents.

e worst of the interest rate shocks, which knocked the wind out of a booming and sometimes frothy real estate market in the second half of 2022, may be over, though the housing market will remain in doldrums for much of the coming year.

at’s the essence of comments made by Dr. Lawrence Yun, chief economist for the National Association of Realtors, at a Chicago Association of Realtors market outlook event Jan. 11, and Anthony Chan of Chan Economics and former chief economist for JPMorgan Chase Bank at a similar event Jan. 13 for the suburban Main-

surging in ation using its primary weapon: interest rates.

“Rising mortgage rates suddenly upended all the aspirations” buyers, sellers and their agents had for the coming year, Yun said. As the year progressed and rates kept rising, “that led to hammering away at the market” for homes, he said.

HURTING AFFORDABILITY

By early November, the xed rate on a 30-year mortgage hit 6.95%, the highest in 20 years.

e impact on the housing market was clear: Sales dropped by more than 30% both nationally and in the Chicago area.

Yun expects year-end data, which would re ect both the still-booming early part of the year and the latter months’ drops, to show sales down about 16% from 2021 nationwide.

Interest rates have subsided in the past two months—down to 6.33% as of Jan. 12—but are still hurting a ordability for buyers.

more than 4.4%” by the end of 2023, nancial markets believe.

e Fed, he suggested, talks up higher rates because “they are trying to slow in ation. If they say they aren’t going to (raise rates), consumer con dence goes up, we continue spending and then in ation doesn’t slow.”

Quoting a Chinese idiom his father used to use, Chan said, “Sometimes you have to kill the chicken to scare the monkey.” at is, by appearing to be more pessimistic than they might actually be, Fed o cials can deter consumers from feeling the zzy optimism that drove spending during the recent boom years.

“ e reality is, (the Fed) may not do that much, and that’s going to be very bene cial,” Chan said.

Yun noted that the spread between the 10-year Treasury rate and 30-year mortgage rate, typically less than 2.5 percentage points and often below 2, grew sharply to more than 3 percentage points during the mortgage rate surge. Something of an overreaction “that will correct,” Yun said, as mortgage shocks subside.

has been relatively at, each week landing within about 1.5% higher or lower than the corresponding week in 2021.

at includes weeks from late November to early January, when many deals made on the steep up-slope of interest rates would have closed.

Prices, Yun said, “are still holding on.” at’s in large part because the inventory of homes for sale is super tight everywhere.

LOCAL JOB GROWTH

street Organization of Realtors.

A year ago, interest rates were in the 3% range, where they’d been for most of the past two years, fueling an unprecedented housing boom. en the Federal Reserve launched its attack on

Chan said he believes further Fed increases will be smaller than the Fed forecast in late December. e central bank’s forecast is that its e ective rate, which is typically a point or more below mortgage interest rates, will get to 5.1%. but Chan said “it’s probably going to be no

“We will not see higher rates again,” Yun predicted. “ is year, I think there will be a steady decline in rates.”

While interest rates shot up and sales sank in the second half of the year, the third leg of the stool—prices—were resilient. Weekly reports from Midwest Real Estate Data show that the median price of homes sold in the Chicago metropolitan area

Two reasons inventory is tight: Nearly everyone who was likely to sell sometime soon jumped into the market during the boom, ready or not, and homeowners “are very happy with their 3% mortgages,” Yun said, and disinclined to trade them for 6% or even 5% mortgages.

If interest rate and price conditions improve, Yun said, the Chicago area is positioned to see the housing market become vi-

brant again. e key reason is job growth.

Illinois has about 0.4% more payroll jobs now than immediately before COVID, according to an analysis of Bureau of Labor Statistics data by Yun’s research team. at’s well below places like Idaho, Utah, Texas and Florida, which are more than 6% ahead of their preCOVID jobs totals, he said, “but at least it’s in positive territory.”

Several Midwestern states, including Wisconsin, Michigan and Minnesota, are still behind their pre-COVID numbers. Indiana is the Midwest’s standout, with jobs up 2.2% from pre-COVID gures.

Illinois job growth, Yun said, “is not Spring eld and Peoria, it’s all Chicagoland where those jobs are created.”

Positive job growth is a good sign for the housing market in the coming year, Yun said. “It means more people are working in the state, which means more buyers as soon as rates come down.”

Ken Griffin sells Park Tower condo for $11.2 million

BY DENNIS RODKIN

Florida man Ken Gri n sold another of his former Chicago homes, this one for $11.2 million.

e 66th- oor condo at the Park Tower on Michigan Avenue sold Jan. 13. It’s the second completed deal in the sell-o of his downtown Chicago portfolio, which began in July when he put four units on the market with a combined asking price of $54.5 million.

e listings hit the market a few weeks after Gri n announced he would move his Chicago-based nancial empire and his family to Florida full time.

At the time of the announcement, Citadel spokesman Zia Ahmed told e New York Times that rms in Chicago “are having di culty recruiting top talent

from across the world to Chicago given the rising and senseless violence in the city. Talent wants to live in cities where they feel safe.”

It’s not only Gri n moving to Florida. News reports have said about 300 Citadel employees will also make the move within the rst year. To date, Crain’s has con rmed only one sale by a Citadel sta er who relocated to Florida. On Jan. 6, Rob Satzger, vice president of institutional sales at Citadel Securities, sold a house on Locust Road in Winnetka for a little over $1.82 million.

Gri n’s latest Chicago sale is a ve-bedroom, 8,000-square-foot unit he bought in 2012 for $15 million. At $11.2 million, Friday’s sale represents a 25% loss for the seller.

He also took a loss in the rst of his recent Chicago sales. at

was a full oor at the WaldorfAstoria tower on Walton Street, sold in October for $10.225 million, more than $3 million o what he paid for it in 2014.

REMAINING INVENTORY

Gri n still has two condos on the market. One, priced at $15.75 million, is one ight up from the one he sold on Jan. 13, on the 67th oor of the Park Tower, where he’s asking $15.75 million.

e other is one of his four oors at the top of No. 9 Walton. e unit, about 7,100 square feet on the 35th oor, has an asking price of $14 million.

e sale is by far the highest price recorded in the new year, although it’s been a hot few weeks at the upper end of the market, with four homes already sold at $5 million or more in 2023.

In

8 JANUARY 23, 2023 • CRAIN’S CHICAGO BUSINESS

“Rising mortgage rates suddenly upended all the aspirations” buyers, sellers and their agents had for the coming year, Dr. Lawrence Yun said at a Chicago Association of Realtors event Jan. 11.

2022, nine homes sold for $10 million or more in Chicago and the suburbs.

Susan Miner of Premier Relocation represented the Park Tower unit that Gri n sold Jan. 13, while Katherine Malkin of

Compass represented the buyers, who are not yet identi ed in public records. Listed for sale July 26, it went under contract to the buyers Nov. 22. No photos of the condo’s interior were included in the listing.

It’s the second of four upper-end Chicago condos the Citadel nancial chief has sold after putting them on the market shortly after announcing his move to Florida

The Park Tower on Michigan Avenue.

GOOGLE MAPS

VHT STUDIOS

BY APPEARING TO BE MORE PESSIMISTIC THAN THEY MIGHT ACTUALLY BE, FED OFFICIALS CAN DETER CONSUMERS FROM FEELING THE FIZZY OPTIMISM THAT DROVE SPENDING DURING THE RECENT BOOM YEARS.

Discover jolts investors with a bleak forecast

hasn’t seen since 2011

Discover Financial Services jolted investors on Jan. 19 with a projection that defaults on its consumer loans will roughly double in 2023.

Credit card companies like Riverwoods-based Discover experienced extraordinary growth in loan balances from their card customers last year. In Discover’s case, growth topped 20%, and card loans now exceed $90 billion. Investors are jittery about whether consumers are taking on too much debt in the face of inationary pressures and with the potential for more job losses as the economy slows this year.

Discover is projecting that net charge-o s on all its consumer loans, the bulk of which are credit cards, will range between 3.5% and 3.9% in 2023. In 2022, that gure was 1.82%, about equal to 1.84% in 2021.

e projection caught analysts by surprise. ey were projecting a gure between 2% and 3%. Discover’s stock price dropped more than 7% at the open of trading on Jan. 19 but clawed back much of that loss and closed down 0.4%.

e last time net charge-o s at Discover were that high was in 2011, when the company posted a 3.97% rate. at was as Discover and other card issuers were recovering from the ravages of the Great Recession. Discover’s loan losses peaked at 7.57% in 2010.

e economy today is not nearly as bad as then, so analysts peppered Discover executives with questions on its surprisingly dim outlook on a conference call this morning.

PUSHBACK

BY STEVE DANIELS BLOOMBERG

Discover Chief Financial Ocer John Greene pushed back on the notion that anything unexpected is happening. With lots of new cardholders and borrowers, losses from people Discover isn’t familiar with yet tend to be higher in the rst year or two than from longtime customers, he said.

“No surprises in the portfolio performance whatsoever,” he said.

“Overall, what we’re seeing here is a very strong portfolio and very signi cant vintages that came through in ‘21 and ‘22 and that are seasoning at levels that are completely within our expectations of total return thresholds,” he added.

In what bodes ill for consumer lenders who focus on borrowers with below-prime credit scores, Greene did say that the relatively small slice of Discover Card borrowers who fall into that category “are certainly feeling the impacts from in ation.” But the company so far has correctly predicted how those customers would perform, he said.

He expects loan losses to peak

in 2024 and then fall again after that. Discover is projecting that unemployment will rise 1 percentage point this year. It’s currently at 3.5%, according to the Bureau of Labor Statistics.

Asked whether loan losses would exceed 4% in 2024, Greene wouldn’t o er a projection.

How rival card companies forecast 2023 is key to Discover’s stock performance going

forward. If peers like Capital One, which lends to a riskier set of borrowers than Discover, predict significantly rising loan losses, that will ease investor concern about Discover in particular.

But it may raise worries about the resilience of the American consumer in the face of continued in ation, rising interest rates and increased unemployment.

CRAIN’S CHICAGO BUSINESS • J ANUAR Y 23, 2023 9 Women Who Make a Difference Signature Event International Women’s Day March 8, 2023 5:30-8:30 PM | Four Seasons Chicago keynote Chanel DaSilva Co-Founder and Artistic Director, MOVE|NYC| Choreographer, The Joffrey Ballet MEDIA SPONSOR GLOBAL CITIZEN

Schwartz and Julia Stasch Purchase your tickets today! info@iwfchicago.org | 815-806-4908 IWFChicago.org Advancing women’s leadership and championing equality worldwide.

Debra

VISIONARY LEADERS

In

a worrying sign, the credit card company is projecting loan loss levels it

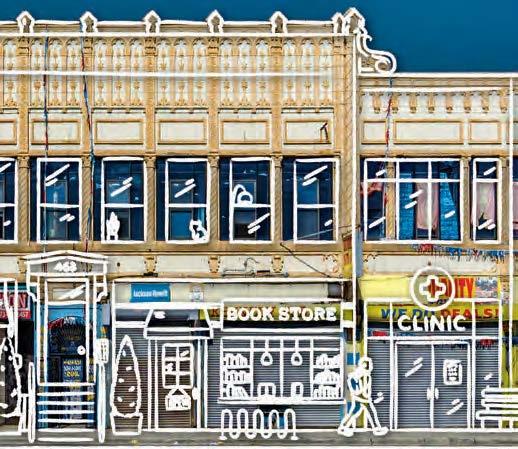

e Loop crisis must be a priority

As has been chronicled comprehensively in the pages of Crain’s, landlords in downtown Chicago are facing enormous challenges—awash in unused o ce and retail space, bu eted by rising property taxes, and staring down mortgages coming due in an economy teetering on the brink of recession.

Normally misery loves company but, in this case, knowing that their peers in other markets around the world are in a similar squeeze has got to be cold comfort to owners of Chicago commercial real estate.

Indeed, as Crain’s and Bloomberg News report, almost $175 billion of real estate credit around the world is distressed—about four times more than the next biggest industry. As the toll from higher interest rates and the end of easy money mounts, many global real estate markets are almost frozen. Weak demand and a surge of sublease o erings from companies trying to shed unneeded workspace are forcing landlords to shell out huge amounts of cash and other perks to get deals done, while pushing some to surrender their properties to their lenders rather than face foreclosure battles.

Distress levels in European real estate, for instance, are at the highest in a decade. It’s a similar story in Asia as well as in other American metros beyond Chicago. As Bloomberg reports, several U.S. banks predict credit losses will grow this year. Bank of America, for instance, agged an additional $1 billion of o ce property loans with an elevated risk of default or missed payments, while Wells Fargo expects more stress to emerge in the U.S. market as demand for commercial space weakens.

e slump has been especially visible in

downtown Chicago since the outset of the pandemic. Soaring construction costs, rising property taxes and interest rate hikes have all had a huge impact. So, too, has a record amount of available o ce space. Retail landlords, meanwhile, are just as anxious to see more o ce workers coming downtown regularly again. Loop storefront vacancies stood at a 20-year high during much of 2022, as the absence of daily foot tra c compounded the e ects of online shopping on brick-andmortar retailing.

While a small parade of downtown o ce tower owners have turned over their buildings to lenders in recent months rather than engage in a foreclosure battle, the most bracing example of the trend came Jan. 11, when

Crain’s Danny Ecker reported that New York investment giant Apollo Global Management has taken control of the Chicago Board of Trade Building in the Loop and hired a developer to try to inject new life into the distressed landmark tower. A joint venture of Chicago-based Glenstar and Oaktree Capital Management of Los Angeles in December transferred the building to an Apollo-led venture rather than default on a $256 million mortgage—a maneuver that, much like the Board of Trade Building itself, now casts a shadow over the entire LaSalle Street canyon. e climb out of this hole will be particularly steep for buildings of the Board of Trade’s vintage, especially as gleaming new glass and steel towers continue to sprout

YOUR VIEW

west and north of the river and attract tenants who want sleeker, more exible space even if their workers only occupy it for a few days a week.

e Lightfoot administration has rightly recognized the trouble unfolding on City Hall’s very doorstep, pushing e orts to spark a major rethink of the LaSalle Street corridor and its future. As Crain’s reports, some of Chicago’s best-known developers are collectively pitching more than $1.2 billion in projects to turn outdated o ce buildings in this strip into places to live in response to a Lightfoot administration call for such proposals. But, as Crain’s has further explained, turning old o ce space into residential use will be a heavy lift, particularly if Lightfoot is to ful ll her goal of making a large swath of that new residential space a ordable. Construction is more expensive downtown and especially in the historically signi cant buildings along LaSalle Street. e location away from the lakefront and a lack of nearby amenities—including schools—could constrain rents for market-rate units.

Even so, it’s a crucial experiment worth taking on. As much as Lightfoot and many of the challengers hoping to unseat her are correct to call for renewed investment in troubled neighborhoods far from the Loop, the city can ill a ord to allow its central core to hollow out. e crisis unfolding in the Loop—and make no mistake, it is a crisis— deserves to be a much more front-and-center issue in the current mayoral campaign. Every candidate for the Fifth Floor o ce overlooking LaSalle Street must be pressed to articulate a vision for reviving the Loop. Even people who live far from the nancial district have a stake in that vision.

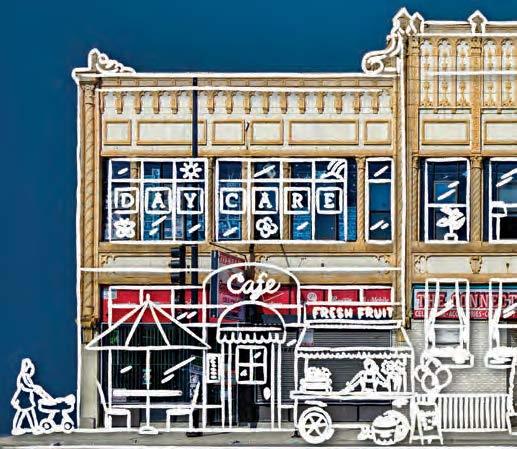

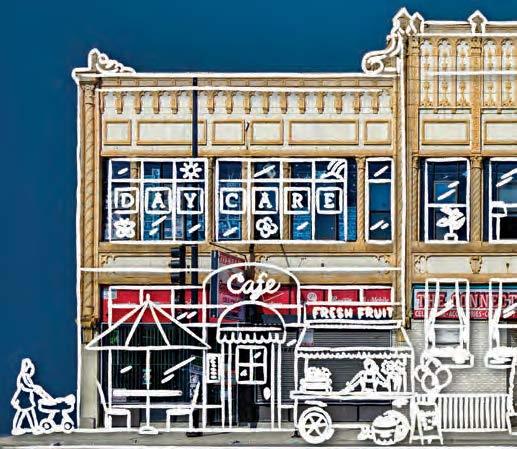

Here’s how to support women entrepreneurs

Women-owned businesses are on the rise, and much of America’s current startup boom is due to women starting businesses. Black women especially are entering entrepreneurship at rates that have not been seen before. Corporate America as well as government and philanthropic entities have taken note of this trend, and there is more support available for women founders than before.

Examples from Chicago include Gender Equality in Tech (GET) Cities supporting technology development of women-owned businesses on the philanthropic front, Cook County’s Source Grow grants for historically excluded businesses— including those owned by women and entrepreneurs of color—and corporations such as BMO Financial Group

supporting women entrepreneurs in finance through the WMNfintech initiative.

Amid such initiatives, it is easy to lose sight of the fact that we still need profound, systemic changes in order for women entrepreneurs to truly succeed. Despite all of the strides made over the past years, women are still underrepresented as entrepreneurs: The latest Global Entrepreneurship Monitor data show that for every 100 men engaged in entrepreneurship in the United States, there are 85 women.

As an entrepreneurship educator, researcher and supporter, I see a need for two systemic changes that can further elevate the status and success of women entrepreneurs. First, the narrative around capital raise as a metric of startup success needs to change. Sec-

ond, we are in desperate need of child care and elderly care options that are flexible, affordable and sustainable.

BIASED INDICATOR

The success metric that receives disproportionate attention in the startup world is capital raise. It is a biased indicator of success in that only certain industries and geographic areas have access to venture capital. It also creates unhelpful expectations for aspiring entrepreneurs who are led to believe that being able to attract capital from investors makes them successful—or, in reverse, that growth that is financed by revenues from the business itself is somehow less valuable than growth enabled by outside capital.

This means that much of the conversation on how to support women entrepreneurs focuses on capital access: Venture investment to all-female-founded companies persists at only 2.3% of the investments in all-male-founded companies, so women need help.

Write us: Crain’s welcomes responses from readers. Letters should be as brief as possible and may be edited.Send letters to Crain’s Chicago Business, 130 E. Randolph St., Suite 3200, Chicago, IL 60601, or email us at letters@chicagobusiness.com. Please include your full name, the city from which you’re writing and a phone number for fact-checking purposes.

Risk capital is necessary for some technology-based startups to scale, and it may serve an individual female founder well to learn to navigate fundraising strategies in the male-dominated VC world. But rather than training women how to behave like men for the sake of fundraising, we need to alter the system of startup capital access to be more varied and inclusive.

To get there, we can start by changing our collective narrative around equity funding in entrepreneurship. Today, capital raise remains the unquestioned metric for startup success and it directly factors into rankings as varied as best college programs in entrepreneurship and most friendly states for female founders.

But when only a small percentage of venture capital flows to female-founded companies, and simultaneously only 0.3% of owners of U.S.-based businesses ever receive venture capital, we should be questioning the relevance of the metric. Let’s start measuring and talking

Sound o : Send a column for the Opinion page to editor@ chicagobusiness.com. Please include a phone number for veri cation purposes, and limit submissions to 425 words or fewer.

10 JANUARY 23, 2023 • CRAIN’S CHICAGO BUSINESS

EDITORIAL

Maija Renko is a professor and Coleman Chair of Entrepreneurship in the Department of Management and Entrepreneurship at DePaul University’s Richard H. Driehaus College of Business.

JOHN R. BOEHM

about metrics that are relevant for the 99.7% of American business owners, including women: profitability, meaningful employment, community impact, family wealth, upward mobility, survival in tough times, serving customers with dignity, saving money for the future and paying back loans. Women entrepreneurs have a lot to say on these topics, and once the conversation on entrepreneurial success reflects these realities, even new funding options may follow.

FAMILY CARE

In addition to changing the narrative around success in entrepreneurship, women founders would also greatly ben -

CRAIN’S

Group publisher/executive editor Jim Kirk

Editor Ann Dwyer

Creative director Thomas J. Linden

Director of audience and engagement

Elizabeth Couch

Assistant managing editor/audience engagement Aly Brumback

Assistant managing editor/columnist Joe Cahill

Assistant managing editor/digital content creation Marcus Gilmer

Assistant managing editor/digital Ann R. Weiler

Assistant managing editor/news features Cassandra West

Deputy digital editor Todd J. Behme

Deputy digital editor/audience and social media Robert Garcia

Digital design editor Jason McGregor

Associate creative director Karen Freese Zane

Art director Joanna Metzger

Copy chief Scott Williams

Copy editor Tanya Meyer

Contributing editor Jan Parr

Political columnist Greg Hinz

Senior reporters

Steve Daniels, Alby Gallun, John Pletz

Reporters

Katherine Davis, Brandon Dupré, Danny Ecker, Jack Grieve, Corli Jay, Justin Laurence, Ally Marotti, Dennis Rodkin, Steven R. Strahler

Contributing photographer John R. Boehm

Researcher Sophie H. Rodgers

Senior vice president of sales Susan Jacobs

Vice president, product Kevin Skaggs

Sales director Sarah Chow

Events manager/account executive Christine Rozmanich

Production manager David Adair Events specialist Kaari Kafer

Custom content coordinators

Ashley Maahs, Allison Russotto

Account executives

Claudia Hippel, Bridget Sevcik, Laura Warren

Sales administration manager Brittany Brown

People on the Move manager Debora Stein

Digital designer Christine Balch

Keith E. Crain Chairman

Mary Kay Crain

KC Crain President/CEO

Chris

Robert Recchia Chief nancial o cer

Veebha Mehta Chief marketing o cer

G.D. Crain Jr. Founder (1885-1973)

Mrs. G.D. Crain Jr. Chairman (1911-1996)

For subscription information and delivery concerns please email customerservice@ chicagobusiness.com or call 877-812-1590 (in the U.S. and Canada) or 313-446-0450 (all other locations).

efit from affordable access to reliable care for family members.

Without such access, we are not making progress. Staying at home to run a business while caring for family will hold women entrepreneurs back as unstructured contacts with co-workers, customers and colleagues in the eld are crucial for ideation, execution and scaling in the most unexpected ways.

Appreciation for women entrepreneurs starts by talking about the very things their businesses provide—not focusing on old systems and structures that exclude them. Chicago can be the city that leads this conversation and innovates solutions that make success possible for even more women entrepreneurs.

CRAIN’S CHICAGO BUSINESS • J ANUAR Y 23, 2023 11

President/CEO KC Crain

Vice chairman

Crain Senior executive vice president

CHICAGO BUSINESS YOUR VIEW Continued

GETTY

IMAGES

Amazon delays West Side warehouse opening

Expected to employ 500 people, the warehouse is sitting idle amid a broader retrenchment by the area’s largest private employer

BY ALBY GALLUN

e building is nished, the trees are planted and the parking lot is striped. But you won’t see any people or trucks at the new Amazon warehouse in Chicago’s West Humboldt Park neighborhood.

Amazon had planned to hire as many as 500 people at the 140,000-square-foot distribution center, which was expected to open at the end of 2022. But the e-commerce giant has put that plan on hold. Now, it says the facility won’t open until late this year.

e decision represents another step back for Amazon, which went on a real estate and hiring binge here and across the country in 2020 and 2021. More recently, the Seattle-based company has been closing distribution centers or postponing plans to open them, an acknowledgement that it overexpanded during the pandemic. Earlier this month, Amazon said it would cut 18,000 jobs, about 1% of its workforce, mostly white-collar employees.

e move also represents a setback for Chicago’s West Side, where residents were counting on an economic boost as Amazon ramped up hiring at the warehouse. Some local activists argue that Amazon hasn’t been fair or transparent about its hiring plans, and they question the company’s commitment to hire locally.

“People in our community are looking for jobs, and Amazon keeps stringing us along,” said Edie Jacobs, director of Get to Work, a jobs placement program in Chica-

go’s Austin neighborhood.

Amazon lifted the hopes of many in the area when it bought the property at West Division and North Kostner streets in June 2021, in the midst of the company’s rapid growth spurt.

“In addition to bringing much-needed jobs and opportunity for under- and unemployed local residents, it will also inspire renewed hope to already disadvantaged neighborhoods further recently ravaged by the economic shutdowns caused by the COVID-19 pandemic,” Ald. Emma Mitts, 37th, who represents the neighborhood, said at the time.

PULLING BACK

Amazon, which paid nearly $38 million for the property, spent many millions more—a company spokeswoman declines to say how much—building the warehouse. But the building is eerily quiet today, with temporary fencing blocking entrances to the property. e company hasn’t installed its logo on the building, but the structure is distinguishable by a pale blue band along its roo ine, an element found at other Amazon properties.

e building is a delivery station, where semi-trucks drop o packages to be processed and loaded onto vans headed for customer’s homes.

“ e facility is slated to open late this year,” the Amazon spokeswoman wrote in an email. “ e hiring process will not begin until closer to the building launch. Any hiring events for this site will be hosted in the Hum-

boldt Park neighborhood.”

Amazon has grown so quickly over the past few years that it passed Advocate Aurora Health (now Advocate Health Care) as the Chicago-area’s largest privatesector employer, with 27,000 employees at the end of 2021, up from 16,620 a year earlier, according to Crain’s research. Last October, it disclosed plans to hire 3,500 more people in Illinois. Amazon has opened new distribution centers throughout Chicago and its suburbs to build out the company’s delivery network and speed up delivery times.

But it has taken steps to pull back, too. Last year, Amazon closed small warehouses in Mundelein and Elgin and dropped plans for new ones in Crystal Lake and Homan Estates. e Amazon spokeswoman described the change of plans for the West Humboldt Park location as nothing unusual.

“It’s common for us to adjust launch timetables based on capacity needs across the network,” she wrote. “I will provide an update on our speci c launch timing at a later date.”

e company has not postponed the opening of any other distribution centers in the Chicago area, according to the spokeswoman. In addition to the West Side facility, Amazon plans to open one other property in Illinois this year, a delivery station in North Pekin, she wrote.

Amazon’s plans in West Humboldt Park attracted the attention of community activists, who pressed the company to hire lo-

cally at high wages and sign a socalled community bene ts agreement. One group demanded that Amazon pay new workers $28.60 per hour—about $10 more than its starting wage—pick up a share of property taxes from homeowners nearby, and build a community training and recreation center in the neighborhood. But Amazon never signed an agreement.

LACK OF TRANSPARENCY

Amazon built the warehouse in a federal opportunity zone, an area that entitles investors to tax breaks, but the company received no subsidies from the city for the project.

Now, Get to Work and another group, Black Workers Matter, are criticizing Amazon for not following through on its plans in West Humboldt Park and for keeping them in the dark. ey say the company has encouraged residents in the neighborhood to

apply for jobs at other local Amazon facilities for the time being, but is making it hard for them. It has directed them, for instance, to a hiring event at a Skokie hotel, a di cult place to get to for many residents.

e two groups are holding a news conference at the warehouse tomorrow to call out Amazon.

“ ey’re not being straight with their story,” said Dan Giloth of Black Workers Matter. “ ey’re not transparent.”

Ald. Mitts, meanwhile, is preaching patience. In a statement, her o ce said she “continues to be staunchly supportive of the forthcoming Amazon facility, and notably is in collaborative communication with (Amazon’s) regional policy and development teams regarding the process moving forward. Rest assured that this Amazon distribution center is scheduled to open during 2023.”

Logistics firm inks deal at former Gallagher HQ

BY DANNY ECKER

One of the Chicago area’s fastest-growing companies is planting its ag in the former Arthur J. Gallagher headquarters in Itasca, notching a key victory for the New York real estate investor that bought the highly vacant property last year.

AIT Worldwide Logistics has leased nearly 57,000 square feet at 2 Pierce Place in the northwest suburb, where it will relocate its headquarters later this year from a nearby industrial building at 701 N. Rohlwing Road it has called home since 1997, the company con rmed. e new deal includes AIT signage on the 27-story building’s exterior and will nearly double the roughly 30,000 square feet of corporate o ce space it occupies today.

e move makes AIT stand out from the crowd as a company expanding its o ce footprint, growth that belies the broader trend of o ce users shedding unwanted

space amid the pandemic-induced rise of remote work. O ce downsizing has pummeled landlords, who will collectively celebrate AIT’s deal while they struggle with record-high vacancy. It’s especially good news for the venture of New York-based Sovereign Partners that bought Two Pierce Place a year ago at a steep discount with a plan to re ll it with tenants.

“After more than four decades in business, and immense growth to more than 100 locations around the world, we’re looking forward to expanding our roots in the Chicago area,” AIT Executive Chairman and CEO Vaughn Moore said in a statement. “ is strategic relocation will provide our teams with the collaborative space and resources they need to best support our global customers.”

RESTRUCTURING

AIT did not disclose terms of the new lease, but Moore’s statement said he expects the building to serve as the company’s global

headquarters “for the next one to two decades.”

AIT, which provides services that help companies around the world with their supply chain transportation needs, will move to the new o ce as part of larger restructuring of its local real estate. e company is also building a new warehouse property in Palatine, where it will move its operations team from the Rohlwing building and a facility it occupies in nearby Wood Dale.

Moore said in the statement that AIT chose Two Pierce Place for its updated tenant amenities and the high visibility its signage will get overlooking the intersection of Interstate 290 and the Elgin-O’Hare Tollway. e company also wanted to recommit to Itasca and “avoid uprooting commutes and other aspects of dayto-day living for our teammates,” Moore said in the statement.

AIT’s growing headcount prompted the need for more ofce space, even though some of

its 437 full-time Chicago-area employees work remotely some or all of the time. e company grew its revenue by 400% over a ve-year period to $2.1 billion in 2021 through a combination of acquisitions and organic growth. at rise landed the company at No. 33 on Crain’s most recent list of the Chicago area’s 50 fastest-growing companies. Six other logistics-related rms made that list, as companies grappling with supply chain issues since the start of the COVID-19 pandemic have turned to rms like AIT to help.

BETTING BIG

AIT becomes the rst prominent new tenant to sign on at Two Pierce Place since Sovereign bought the building for $24 million in January 2022. Sovereign’s purchase price was a fraction of the roughly $84 million that Johns Creek, Ga.-based Piedmont Ofce Realty Trust, then-known as Wells REIT, paid for the property in a 2006 sale-leaseback deal with insurance broker Gallagher, which leased more than 60% of the building through a 2018 expiration date.

After Gallagher moved out,

Piedmont spent an estimated $5 million to $10 million renovating and updating the building—which was purpose-built for Gallagher in 1991 and is part of the 300-acre Hamilton Lakes Business Park— hoping to lure new users. But the pandemic thwarted that e ort, and Piedmont sold the property to Sovereign when it was just 40% leased, according to real estate information company CoStar Group.

Buying a building with around 300,000 square feet of available ofce space coming o of a two-year stretch in which companies collectively vacated a staggering 2.8 million square feet of o ces across the suburbs is a gutsy bet on the market’s post-COVID revival. But Sovereign is betting it can win over new tenants like AIT as companies ock to buildings with the most updated amenities to help compel employees to show up rather than work from home.

A Sovereign spokesman did not respond to a request for comment.