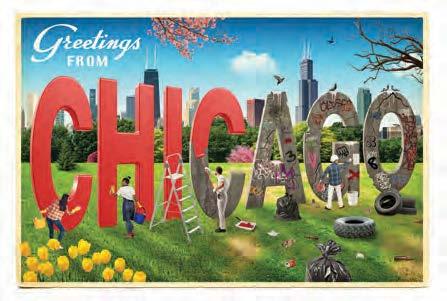

Architect’s visionary stadium aims to keep Bears in Chicago

Honoring the city’s ‘make no little plans’ tradition, Larry Booth has sketched out a big-picture vision for what a stadium could look like within city limits

|

By Dennis Rodkin

Like a lot of people, Larry Booth has been mi ed by all the talk of the Chicago Bears moving to Arlington Heights or Naperville or Waukegan or some other town.

Unlike most of them, Booth is an architect who’s worked out a concept for a stadium that he believes would not only keep the team in Chicago but showcase the city’s history as a hub of architectural innovation.

“Keep them in Chicago,” says Booth, the eminent architect who’s been practicing in the city since the 1960s, designing dozens of new buildings and renovations of old ones, as well as more in the suburbs and farther a eld.

As such, Booth is uniquely quali ed to spitball a blue-sky vision

Ringed in wood, the 80,000-seat stadium would greatly reduce the carbon footprint compared to concrete and steel construction.

Is the DNC a trial run for a Pritzker White House bid?

Biden aside, no one has more riding on a successful event than the governor does

When President Joe Biden walks onto the stage at the United Center this summer for the 2024 Democratic National Convention, it will mark the beginning of the last act for a veteran politician.

For Illinois Gov. J.B. Pritzker, the stage he helped set in Chicago could also serve as his own on-ramp to the White House.

“ is convention is a great platform for Gov. Pritzker,” said David Yepsen, former director of the Paul Simon Public Policy Institute at Southern Illinois University. “ is is a chance for the governor to look good, show his stu , to be a good host, do a lot of schmoozing, and not just with delegates who are clear party inuencers, but also big donors. So it's tailor-made for him to use it as a springboard.”

In 2022, Pritzker served as the keynote speaker at the New Hampshire Democratic Party’s state convention, provoking speculation that he was mulling a White House bid. at chatter tempered as Biden a rmed he would run. Talk of a Pritzker presidential campaign bubbled up again last fall with the announcement of his new organization, ink Big America, which will contribute to e orts to expand abortion access in states

across the country.

Still, Pritzker understands how to serve as the happy warrior for Biden even as theories about his political ambitions persist, according to U.S. Rep. Jan Schakowsky, D-Evanston.

“ at’s something that J.B. will manage well,” said Schakowsky, who once competed with Pritzker for her House seat. “He knows what it is to be a surrogate. He has no intention of trying to outstrip the president of the United States.”

A DNC spokesperson declined to comment for this story. e convention bodes well for Pritzker, who has already elevated his national pro le with his work as a Biden campaign

No place like here

BARNES & NOBLE

The bookstore giant is opening a new store in Wicker Park as well as three other surrounding locations. PAGE 3

CRAIN’S LIST

Check out our ranking of the Chicago area’s 25 largest employers.

PAGE 13

CHICAGOBUSINESS.COM I FEBRUARY 26, 2024 VOL. 47, NO. 8 l COPYRIGHT 2024 CRAIN COMMUNICATIONS INC. l ALL RIGHTS RESERVED

CRAIN’S An affordable big city with deep pools of talent, Chicago needs to regain its edge as a place to do business | PAGE 15

BOOTH HANSEN

Leigh Giangreco

No one worked harder than the governor to bring the Democratic National Convention to Chicago. | BLOOMBERG

See PRITZKER on Page 24

See STADIUM on Page 26

Northwestern Medicine plans $75 million expansion of Warrenville cancer center

Northwestern Medicine is planning to expand and modernize a cancer center in Warrenville, a project estimated to cost more than $75 million.

e plan is to construct a twostory addition and a three-story parking garage to the existing Warrenville cancer center at 4405 Weaver Parkway, according to an application led Feb. 15 with the Illinois Health Facilities & Services Review Board, which has to approve the project.

Northwestern spokesman Chris King said the expansion is needed to meet growing oncology and diagnostic imaging services demand in the area. From 2018 to 2023, annual infusion hours at the center grew 44% to more than 50,000 hours and MRI procedures jumped 34% to nearly 3,000 annual procedures, according to the application.

More space would allow the center to increase infusion stations from 26 to 38, add additional diagnostic imaging and expand laboratory testing, King added.

If the plan is approved, the expansion is expected to be completed by the end of 2027, according to the application.

e Warrenville cancer center, a liated with the Robert H. Lurie Comprehensive Cancer Center of Northwestern University, treats various types of cancers, o ering medical, surgical, radiation oncology and other supportive services.

Has focused on expansion

Like its nearby peers, Northwestern Medicine, the area’s second-largest hospital system by

HCSC bets on Medicare

Insurers are sounding alarms about the state of the market. But that isn’t discouraging Health Care Service Corp. from expanding.

Lauren Berryman, Modern Healthcare

Financial and regulatory challenges in Medicare Advantage aren't stopping Health Care Service Corp. from diving deeper into its suddenly murky waters.

Industry leaders UnitedHealth Group and Humana, along with other carriers such as Centene, Molina Healthcare and CVS Health subsidiary Aetna, recently disclosed that their Medicare Advantage operations are under nancial strain amid higher-than-expected medical expenses, federal policies to constrain spending and promote quality, and a looming payment cut.

Yet HCSC, a nonpro t Blue Cross & Blue Shield carrier, announced plans last month to pay $3.3 billion for Cigna's Medicare operations. e acquisition, slated to close in early 2025, would quadruple HCSC's Medicare Advantage membership to about 800,000.

“It’s rare to see an asset with this type of scale and magnitude of capability available, so when we did see it and we were able to align it with our strategic framework, it just made a lot of sense for us to go ahead and execute against it,” said Arun Prasad, senior vice president and chief strategy o cer at HCSC.

e Cigna deal emerged from HCSC's broader growth strategy that commenced after Maurice Smith became president and CEO in 2020, Prasad said.

Although HCSC is stronger in employer-sponsored health benets and other areas, it has sold Medicare Advantage plans since 2013. Moreover, the company expanded its geographic presence over the past few years, including entering 100 new counties for the 2024 plan year.

Acquiring Cigna's Medicare assets would give HCSC access to new markets. e company sells Blue Cross and Blue Shield plans in Illinois, Montana, New Mexico, Oklahoma and Texas, while Cigna

o ers Medicare Advantage plans in 29 states. HCSC must obtain licenses to sell insurance in new states.

“ is was de nitely a step into the Medicare Advantage business for HCSC where they didn't have a lot of enrollment,” said Brad Ellis, senior director at credit rating agency Fitch Ratings.

Moody’s Investors Service estimates HCSC would hold 2% of the Medicare Advantage market if the Cigna transaction is completed, which still makes the company a minor player compared with rivals such as UnitedHealth Group and Humana, which together cover almost half of the Medicare Advantage population.

“We’re not looking necessarily to be the largest. We’re looking to be the best,” Prasad said.

Counting on long-term gains

As other companies wait for the Medicare Advantage storm to pass, HCSC is counting on the long-term gains from the segment, which continues to grow in enrollment and has proven lucrative over the decades.

“ ere are tens of millions of people that will become seniors over the next several years. To us as a company, it was critically, critically important that we're aligning our capabilities appropriately to ensure that we can meet that need,” Prasad said.

HCSC looked past the current nancial struggles other insurers are experiencing because it could, Prasad said. “By virtue of not being publicly traded and having to worry about the quarterto-quarter ebbs and ows of investor sentiment, we are really about setting long-term objectives around our business,” he said.

And the recent outcry about costs and payments obscures the value Medicare Advantage has for insurers, despite recent di culties. “ ere are certainly challenges in the Medicare Advantage business right now. It's not a bad

revenue, has focused on expanding its physical footprint in the Chicago area. Aside from the Warrenville cancer center expansion, the health system is also developing a $100 million outpatient facility in Bronzeville and planning a nearly $389 million Lake Forest Hospital expansion.

e health system told Crain’s in December it is largely nancing much of this expansion with budget surpluses, which topped $1.1 billion in its most recent scal year ended Aug. 31, 2023, a boost from the prior year as the organization

recovered from COVID-19 headwinds.

A June 2023 credit rating by S&P Global Ratings gave Northwestern Medicine high marks and a stable outlook, saying it “has a prominent position in a competitive market, with a management team that is focused on strategic growth and pioneering e orts that include telehealth and arti cial intelligence.”

Altogether, Northwestern Medicine operates 11 hospitals and more than 200 ambulatory and diagnostic sites in the Chicago area.

business, but there are a number of areas that have caused some disruption,” Ellis said.

e insurer made the Cigna purchase at a good moment, said Gary Taylor, managing director and senior equity research analyst at TD Cowen. “ e time to buy a business is when the environment is bad, when it's at trough margin, when it’s under maximum regulatory pressure. at's when you’re going to get to pay the lowest multiple for it,” he said.

e HCSC-Cigna deal could inspire other smaller Medicare Advantage insurers to join with other companies and gain scale, said Michael Abrams, managing partner of the consulting company Numerof & Associates.

“We certainly could see some consolidation among the smaller ones, whether it's for market advantage or just for survival,” Abrams said. “As things get

tougher, you're likely to see more of that.”

Lauren Berryman writes for Crain's sister publication Modern Healthcare.

2 | CRAIN’S CHICAGO BUSINESS | FEBRUARY 26, 2024 1. Business Savings Advanced Account. Interest rate may change at any time. Fees may reduce earnings. 2. Business Savings Advanced Special. O er valid for accounts opened on or after 9/29/23, & subject to change at any time & without notice. Annual Percentage Yield ('APY') accurate as of 10/18/23, with qualifying activities. Minimum daily balance of $0.01 required to obtain APY. O er available to existing or closed savings account customers of Wintrust Financial Corporation ('WTFC') & its subsidiaries or employees. O er combinable with any WTFC checking o er, but not with a Business Savings deposit bonus o er. 3. Business Savings Advanced Special Qualifications. (i) Open new Business Savings Advanced account; (ii) mention o er during in-branch account opening; & (iii) deposit new money (money not currently held at any WTFC location) into the new Business Savings Advanced account at account opening. Business Savings Advanced1 Special .00% APY4 Open a new Business Savings Advanced account and get a 4.00% Annual Percentage Yield ('APY')2 with qualifying activities.3 Variable rate. No minimum required to open. Daily minimum balance of $1,000 required to avoid a $10 monthly maintenance fee. New money only. Learn more at wintrust.com/BizSavings

Advantage despite headwinds

Katherine Davis

COSTAR GROUP

Barnes & Noble store to open in historic Wicker Park building

The world’s largest retail bookstore chain is also opening three other locations around the metro area

|

By Rachel Herzog

Barnes & Noble will open four new Chicago-area locations this summer, including a store in a recognizable former bank building in Wicker Park.

e world’s largest retail bookstore chain plans to open a store in the former Walgreens agship building at 1601 N. Milwaukee Ave. early this summer, as well as locations at 651 W. Diversey Parkway in Lincoln Park and in suburban Northbrook and Oswego.

“We generally want a bookstore everywhere. Every community, we think, needs a bookstore,” Janine Flanigan, Barnes & Noble's senior director of store planning and design, told Crain's, adding that “we

See BOOKSTORE on Page 26

“We generally want a bookstore everywhere. Every community, we think, needs a bookstore.”

Janine Flanigan, B&N’s senior director of store planning and design

Waukegan hospital loses accreditations, staff and cash

Vista Medical Center East is battling a slew of challenges that reveal, in part,

why the troubled hospital is oundering

Katherine Davis

Vista Medical Center East, the Waukegan hospital that recently lost its Level II trauma center designation and is at risk of losing Medicare accreditation, is battling a slew of nancial and sta ng challenges that reveal, in part, why the troubled hospital is oundering.

e issues have led to sta resignations and a formal complaint led to the state against the medical center, which ultimately led to the stripping of the trauma designation last week, said Michael Sarian, CEO of American Healthcare Systems, a Glendale, Calif.-based hospital operator that purchased Vista Medical last year.

e hospital is losing about $1 million every month as it battles industrywide challenges, like rising expenses for labor and supplies, as well as low or inconsistent reimbursement rates from government and commercial insurance plans, Sarian said.

“Our costs are through the roof,” he said. “Reimbursement is not there.”

Vista Medical also faces worker shortages, particularly among nurses, though Sarian was unable to specify how many open jobs Vista Medical has. “We're doing our best trying to recruit and retain nurses,” Sarian said.

In the meantime, Vista Medical has leaned on travel nursing agencies, but the high costs associated with them are putting even more pressure on the hospital’s margins.

The hospital is losing about $1 million every month as it battles industrywide challenges, like rising expenses for labor and supplies.

Now with scrutiny coming from state and federal regulatory bodies, Vista Medical’s nancial and sta ng challenges are likely to intensify. Without the Level II trauma center designation, the hospital is unable to treat complex — and expensive — conditions. Additionally, if the hospital loses accreditation from the Centers for Medicare & Medicaid Services, or CMS, it will lose the ability to collect reimbursements from patients with Medicare plans. And all that will make it harder to recruit and retain nurses, physicians and other types of employees.

Even still, Sarian said

See HOSPITAL on Page 26

Upstart insurer Kin sees valuation climb over $1 billion

capital market crashed in 2021.

Kin Insurance keeps powering ahead.

e homeowners’ insurance startup raised $15 million in new funding led by San Franciscobased Activate Capital, but it’s the valuation that’s worth noting.

e company, whose valuation topped $1 billion last year, added another 10% in this round, says CEO Sean Harper.

at’s no small feat in what remains an ugly funding environment, especially for later-stage companies, many of which raised money when valuations were soaring before the venture-

Valuations for late-stage investments had dropped 40% by early last year, according to PitchBook. So-called unicorns, or venture-backed companies valued at more than $1 billion, face a culling of the herd. It helps that Kin got to break even last year, when the company added Texas to its list of markets that includes Louisiana, Florida, Arizona, Mississippi, Alabama, South Carolina and Virginia. e business grew about 50% last year, with premiums of about $345 million and Kin’s cut totaling roughly $105 million, Harper says. Kin now has more than 600 em-

ployees, up from 400 a year ago.

Kin launched in 2016, betting on the idea it could operate at a lower cost than traditional insurers by not selling policies through agents, developing its own back-

o ce technology and relying more heavily on technology, such as drones, to manage claims.

“We keep the money they spend on agents and tech,” says Harper, who adds that Kin settled

half the claims from a recent hurricane without visiting a customer's home.

Kin, which is just a fraction of the size of big boys Allstate and State Farm, also bene ted from geography last year. e company serves most coastal markets where hurricanes are a major threat. Last year wasn’t bad for hurricanes, but insurers such as State Farm and Allstate took a pounding because of heavy storm-related losses in the Midwest and parts of the South. State Farm, which also felt the repercussions of res on Maui, reported its worst level of losses on homeowner’s insurance in 15 years, according to S&P Global Intelligence.

FEBRUARY 26, 2024 | CRAIN’S CHICAGO BUSINESS | 3

it raises another $15 million, the Chicago-based home insurer says it’s breaking even

As

1601 N. Milwaukee Ave.

John Pletz

BLOOMBERG

One of the city’s largest hotels is changing hands in a $500 million deal

The owner of the Sheraton Grand Chicago exercised its option requiring Marriott International to buy the Streeterville hotel

Hotel giant Marriott International will purchase the Sheraton Grand Chicago in Streeterville for $300 million and plans to pay an additional $200 million for the land, in accordance with the terms of a settlement agreement with the property’s owner.

A venture controlled by New York-based Tishman Realty that owns the 1,218-room hotel at 301 E. North Water St. has exercised its option to require Marriott to purchase the hotel, which was granted to Tishman as part of a 2017 settlement.

e deal is expected to close in the fourth quarter of 2024, and Marriott has exercised its option to purchase the underlying land for an additional $200 million in cash at that time, Marriott disclosed in a Feb. 13 ling with the U.S. Securities & Exchange Commission. Marriott has factored in $500 million in outgoing cash into its net income for 2024, according to the corporation’s Feb. 13 earnings call.

e settlement stems from a lawsuit that a Tishman venture brought against Starwood Hotels in 2016 over Marriott’s merger with Starwood that year. e lawsuit alleged that 18 Marriott hotel

properties would breach a noncompete clause in Starwood’s management contract for the Streeterville hotel.

e settlement agreement gave Tishman the option to force Marriott to buy the hotel in 2022. In the third quarter of 2021, the agreement was amended to move the period in which Tishman could exercise that option to the rst half of 2024, according to Marriott’s SEC ling.

e amount Marriott is paying for the hotel is less than the property’s previous reported value. e hotel was appraised at $320 million in August 2017, according to Bloomberg data tied to the CMBS loan secured by the property. It was appraised at $380 million in 2013, Crain’s previously reported.

Meanwhile, the value of the land the hotel is on has skyrocketed since Tishman acquired it for about $52.5 million in 2009.

e 2.3-acre parcel was appraised at more than $100 million in 2011, according to loan documents.

It wasn’t immediately clear why Tishman chose to exercise the option to sell the hotel to Marriott, and the investor did not respond to requests for comment. Debt could be a factor: A

$115 million loan secured by the property that a Tishman venture obtained from Wells Fargo in 2017 came due in November, though the borrower had exercised an option to extend the due date, according to Bloomberg loan data. e loan was packaged with other loans and sold o to commercial mortgage-backed securities investors after it was issued.

Exercising the option to sell to Marriott likely provided Tishman with good value and a convenient infusion of cash at a time when re nancing the property would be di cult and expensive due to high interest rates, said Hans Detlefsen, president of Chicago-based consultancy Hotel Appraisers & Advisors.

‘Probably a good deal’

“It’s probably a good deal right now. It’s a way to recycle a lot of capital, and it’s a way to reduce your debt load by a lot and probably some of your more expensive debt if you’re re nancing it in today’s environment,” he said.

Hotel values have been volatile throughout the past decade, and downtown Chicago’s hospitality industry is still recovering from the pandemic. Revenue per available room — a key performance

metric that accounts for both room rates and occupancy — across hotels in the central business district averaged $147.87 during the 12-month period that ended in December, according to real estate information company

CoStar Group. at was up slightly from the average during the same period in 2019, before COVID-19 upended the market, but still below the pre-pandemic level when accounting for in ation.

Old Orchard mall owner taps local developer for 400-unit apartment and lifestyle project

The

24-hour destination, offering living, dining, entertainment and shopping options

e owner of the West eld Old Orchard shopping mall has tapped local developer Focus to build about 400 luxury apartments on the site of a vacant department store, a step forward in one of suburban Chicago’s biggest mall revitalization e orts. Paris-based Unibail-RodamcoWest eld’s endeavor to turn the Skokie retail center into an around-the-clock destination where people can live, dine, and seek out entertainment as well as shop is part of a broader trend among developers looking to reinvigorate suburban malls — and one that Focus has been a part of before. e Chicago developer recently started the second phase of a plan to build more than 600 apartments at Aurora’s Fox Valley Mall, and a 311-unit apartment complex that Focus built at Hawthorn Mall in Vernon Hills opened in June.

e rm’s experience with res-

idential development in suburban downtowns over three decades has given the developer an understanding of “the vision of these malls becoming mini city centers of suburbia,” Focus CEO Tim Anderson said.

Project to begin in 2025

Focus plans to break ground on the apartments at Old Orchard, which will involve demolishing a shuttered Bloomingdale’s store at the northwest corner of the property, in 2025 and open the apartments to residents in early 2027. e developer will go through the village’s planned development approval process this year, Anderson said.

Focus and URW are working on securing outside capital to help nance the project, Anderson said. He said the mall owner has been able to attract investment for its other North American mall redevelopment projects.

“I think the demand for multifamily is there, and the unique-

ness of this asset is so critical,” he said. Mall owners’ e orts to breathe new life into suburban shopping malls by adding housing stock coincides with strong demand for apartments in the Chicago area. Net monthly rent at apartment buildings in suburban Chicago was up 5.4% year over year in the fourth quarter of 2023, according to the Chicago o ce of appraisal and consulting rm Integra Realty Resources.

Geo Mason, executive vice president of U.S. development, design and operating management for URW, said that while some developers with underperforming malls are “densifying” with apartments to turn things around, at Old Orchard that strategy serves to enhance what’s already there. e mall has had more than a dozen tenants open locations or expand space in the last year, including home furnishings company Arhaus, fashion brand Zara and high-tech

“To be extremely successful,

you need to have the absolute best retail, dining and leisure options, and then it becomes a true enhancement to a larger mixeduse community,” Mason said.

4 | CRAIN’S CHICAGO BUSINESS | FEBRUARY 26, 2024

Grand Chicago COSTAR GROUP

Rachel

Herzog Sheraton

development aims to transform the shopping center into a

mini golf experience Puttshack, which are set to open locations in the mall’s former Lord & Taylor store in 2024.

Rachel Herzog

Rendering of Unibail-Rodamco-West eld and developer Focus’ planned apartment project at Old Orchard Mall in Skokie. UNIBAIL-RODAMCO-WESTFIELD

If your business accepted Visa and/or Mastercard between 2004 - 2019, you’re now eligible to claim your share of a $5.5 billion Settlement. Claim your share now.

Merchants (business owners) who accepted Visa and/or Mastercard at any time from January 1, 2004, to January 25, 2019, are eligible to claim their share of a $5.5 billion Settlement. Visa and Mastercard and their issuing banks (the “Defendants”) are alleged to have violated nothing wrong. They claim their business practices are legal.

www.PaymentCardSettlement.com to get more information about the Settlement. The May 31, 2024

STEP ONE:

Scan the QR code to go to www.PaymentCardSettlement.com

STEP TWO: information requested about your business.

STEP THREE:

Submit your claim! Your claim process is now complete.

www.PaymentCardSettlement.com.

you need additional help or information? Email: Visit

Call:

Do

Online:

PAID ADVERTISEMENT

McDonald’s founder Ray Kroc and wife live on in their old Lake Shore Drive co-op

The couple, both deceased, are depicted in a Renaissance-themed mural that wraps the stairs in the high-style residence they bought in 1969, which is now on the market for $1.6 million |

By Dennis Rodkin

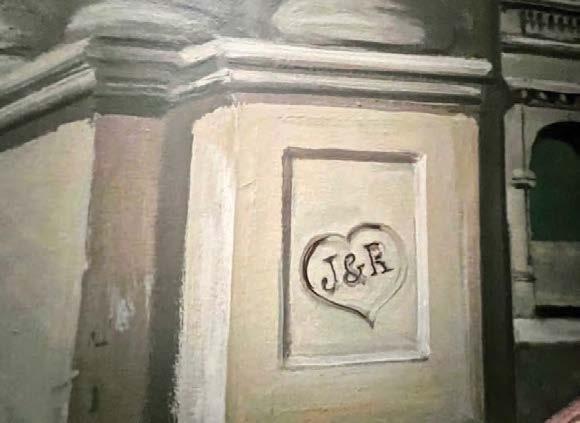

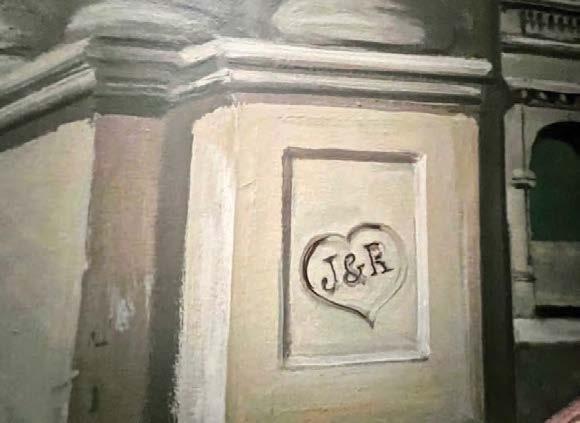

When Ray Kroc, who built the McDonald’s empire, and his wife, Joan, moved into a grand Lake Shore Drive co-op in 1969, they had a painter include them in a Renaissance-themed mural on the walls of the spiral staircase.

Half a century and two rounds of ownership later, the faces of Ray and Joan Kroc are still there.

On one wall is Ray Kroc, the Oak Park native who built one of the world’s largest restaurant chains, in the checkered costume of a harlequin. On another, Joan is depicted arriving by boat in a pink and white gown as an attendant shades her with a parasol. Nearby, a heart surrounds the initials J & R, painted to look like they’re carved in stone.

At the base of the stairs is a bar, with a glassware cabinet concealed behind some of the mural.

“It’s fascinating to see them in this operatic scene,” says Jim Kinney, Baird & Warner’s vice president of luxury home sales, who is representing the co-op unit for its sellers, the family of Michael Murphy, a former Sara Lee chief nancial o cer, who died in October.

e unit, on the 25th and part of the 26th oors of a 1920s coop building designed by Robert De Golyer, is for sale with an asking price of $1.6 million.

at’s less than Michael and Adele Murphy paid in 2003. Kinney says they paid more than $2 million, but he does not have a complete gure.

Because it’s a cooperatively owned building rather than a condominium, Cook County records do not say clearly what the Murphys paid.

e unit has formal living and dining rooms facing Lake Michigan, a kitchen on the building’s northeast corner with a view up the lakefront and several rooms with views west and south, into the city. On the 26th oor, most of what was originally a long west-facing terrace has been en-

closed for use as living space, but there’s still outdoor space on the southeast corner.

Reduced asking price

The reduced asking price is in large part because “the place needs redoing,” Kinney says. The work would include the kitchen and baths, redone two decades ago, and replacing antiquated windows, among other things.

Kinney is even sanguine about the possibility that a buyer might paint over the two-story mural that winds around the spiral stair-

case connecting the two levels.

“If a buyer would preserve it, that would be great,” Kinney says, but he and the sellers “know some people will think it’s kitsch.”

Signed only with the name Hoffman and the year 1969, the mural is likely part of a lavish decoration scheme done for the Krocs by the House of Raymond Jacques. A prominent Michigan Avenue design firm in the 1960s, the firm, according to archived Chicago Tribune articles, redecorated the Krocs’ Lake Shore Drive and Fort Lauderdale condos in the first few

years after they were married. The couple also had a ranch near San Diego.

e Krocs bought the Lake Shore Drive condo in 1969, historical articles say, but it’s not clear when they sold it. He died in 1984 and she in 2003. e owners who bought from the Krocs sold to the Murphys in 2003.

Kinney says the operatic theme of the murals resonates because it’s believed that the co-op’s original owner, in the 1920s, was Samuel Insull, the Chicago-based king of a vast American utilities empire and builder of the Civic

Opera House on Wacker Drive. Historical articles show Insull living at the building, 1242 N. Lake Shore Drive, but Crain’s could not con rm it was in this unit.

e Mitchells not only kept the Kroc mural intact but used it as inspiration for decoration in other rooms. On the 26th oor is a mural of a top-hatted man out of 19th-century artist Gustave Caillebotte’s paintings looking out over 20th-century Chicago buildings, and in the breakfast room are springtime murals on the wall and ceiling.

Portillo investment group markets a Florida penthouse at $32.5 million

If sold at the listing price, the 16,803-square-foot residence would be the highest-priced resale condominium unit ever in Naples

Corli Jay

Hot dog mogul Dick Portillo is one of a group of investors that have renovated a high-rise penthouse in Naples, Fla., and put it on the market for $32.5 million — an asking price that, if it holds up, would make it the highest-priced resale unit in Naples ever.

The 16,803-square-foot condo is being marketed by John R. Wood, the Southwest Florida affiliate of Christie's International Real Estate.

e property at 81 Seagate Drive in e Seasons at Naples Cay was restored by a development team that included Portillo, C&E Builders and an executive at Florida-based eory Designs.

No financial details were given on how much Portillo invested in the project.

The penthouse features floorto-ceiling glass windows and 360-degree views of the Gulf of Mexico and the city of Naples. Portillo, who owns a condo in Naples, has been investing in real estate for years, including properties in the Chicago area.

6 | CRAIN’S CHICAGO BUSINESS | FEBRUARY 26, 2024

PHOTOS BY DENNIS RODKIN

INTERNATIONAL REAL ESTATE

CHRISTIE’S

Rivian hires new marketing chief from Meta

Jennifer Prenner has more than 20 years of business experience

Laurence Iliff, Automotive News

Rivian Automotive has named Jennifer Prenner as chief marketing o cer as the EV maker prepares for a major expansion phase with newly hired executives from tech companies and the auto industry, including from Apple and Porsche.

Prenner comes from Facebook's parent company Meta, where she served as vice president of global marketing, with responsibility for its portfolio of virtual reality and augmented reality products, Rivian said.

Prior to her three-year stint at Meta, Prenner was Amazon's global head of marketing, growth and customer engagement for the company's Fire TV business, Rivian said in a post on LinkedIn.

“Rivian's mission is one that I'm proud to contribute to and I look forward to making the world more eco-friendly, and adventurous, one amazing vehicle at a time,” said Prenner, who also holds the title of vice president.

Prenner, with over 20 years of business experience, will lead Rivian's marketing worldwide, including customer loyalty and reaching new audiences, the company said Feb. 12.

Other high-level hires

e EV startup, based in Irvine, Calif., has announced other highlevel hires in recent months as it prepares its next phase of growth.

On March 7, Rivian plans to present its next-generation R2 platform that will underpin more affordable vehicles. e automaker is building a factory near Atlanta for the R2 models.

Rivian makes the R1T pickup and R1S crossover at its plant in downstate Normal, Ill., in addition to electric delivery vans for Amazon. e R1T starts at $71,700 with shipping and the R1S starts $5,000 higher. e R2 vehicles, expected in 2025, are expected to sell for under $50,000, Rivian CEO RJ Scaringe has said.

Rivian's recent hires include DJ Novotney, an Apple Inc. veteran who helped start e orts to develop an electric vehicle at the technology company, Bloomberg reported in late January.

Novotney's title at Rivian is senior vice president of vehicle programs, according to his LinkedIn pro le. His last title at Apple, where he worked for 25 years, was vice president of engineering. His list of accomplishments include working on Apple's rst-generation products, including the iPod, iPhone, iPad and Apple Watch.

In September of last year, Rivian hired Porsche's former North America CEO Kjell Gruner as chief commercial o cer, overseeing sales, marketing and service.

Gruner steered Porsche's U.S. business through the pandemic and put it on track to hit a threeyear sales high last year. During

Startup founded by former FTX exec closes second funding round

Architect Financial Technologies will use the $12 million raised to launch its derivatives brokerage, open a Chicago of ce and double headcount

Mark Weinraub

Architect Financial Technologies said it raised $12 million in capital, its second round of fundraising since its launch in January 2023.

e Chicago-based startup is led by Brett Harrison, who was previously president of FTX US before the crypto giant collapsed. Architect, which develops trading and portfolio management software for assets around the world, said it planned to use the money to support the launch of its U.S. derivatives brokerage for retail and institutional investors.

“It was an opportunistic time to raise funds for us,” Harrison told Crain’s. “It was a combination of our recent progress on the development and production of our trading platform as well as in response to what we see as changing market dynamics.”

Rising demand for retail and in-

his automotive career, Gruner also worked at Mercedes-Benz, according to his LinkedIn pro le.

“We will rely on Kjell's talent and experience as we position ourselves for growth domestically and internationally, the launch of a new platform in R2 at a new facility and the continued success of our commercial vehicle line,” Scaringe said at the time of Gruner's hiring last year.

Rivian also hired auto industry veteran Carlo Materazzo as vice president of logistics, the automaker said in November.

Before joining Rivian, Materazzo worked at Stellantis North America as vice president of manufacturing, Rivian said. He also worked at Stellantis predecessor Fiat Chrysler Automobiles and bring more than two decades of automotive experience.

“Carlo will play a crucial role in the continued improvements in our Illinois factory and as we set up our new facility in Georgia,” said Frank Klein, Rivian's chief operations ocer, in the November release.

Rivian said early this month that the R2 reveal will be March 7, but didn't provide details.

Public documents from the city of Laguna Beach, not far from Rivian's headquarters, said the auto-

maker plans to host a worldwide product reveal on that date at its brand-awareness center in the city and to display some vehicles on city property along the beach.

‘Need for alternatives’

“ ere's an extreme vacuum of choice we feel in the sort of $45,000 to $50,000 price range for midsize SUVs,” Scaringe said in November on Rivian's third-quarter earnings call. “We see very highly concentrated market share with Tesla, but we believe there's a need for alternatives.”

Because of delays in breaking ground on its factory in Georgia,

production of the R2 vehicles isn't scheduled until 2026, a year later than originally forecast by the automaker. Some forecasters say the start of production could slip further.

“With nearly three years to get the plant up and running, that timing is reasonable, but that timing is also likely to slip into 2027,” Sam Fiorani, vice president of global vehicle forecasting at AutoForecast Solutions, told Automotive News earlier this month. “Rivian is anticipating volumes as high as 200,000 per year.”

Laurence Ili writes for Crain's sister publication Automotive News.

stitutional derivatives trading as well as growth in the tokenized asset markets contributed to strong investor interest in Architect. e most recent fundraising round was co-led by BlockTower Capital and Tioga Capital. It brings the company’s total capital raised to $17 million following a $5 million raise in 2023.

Harrison said that although the company was in a “good place for capital,” there could be opportunistic reasons to raise more money, particularly since the most recent round was oversubscribed.

In addition to the launch of the U.S. derivatives platform, Architect will use the money to move its o ces from Evanston to the Lincoln Park neighborhood of Chicago, Harrison said. e company also expects to at least double its headcount in the next year from the current 15 and expand its offerings into the European and Asia-Paci c regions.

FEBRUARY 26, 2024 | CRAIN’S CHICAGO BUSINESS | 7

LUXURY HOME SPOTLIGHT Advertising Section MARY GRANT 312.339.2018 cell NE WLY RE BU ILT IN EA ST KE NI LWOR TH! 611 A BB OT SFOR D ROA D – Offered at $4,850,000 Complete restoration and new construction features of an iconic single-family East Kenilworth home. New floor plan with 7,500 square feet on a .56-acre double lot and new construction 4-car heated garage with coach house with a full kitchen and full bath.

Jennifer Prenner, Rivian’s new chief marketing of cer | RIVIAN

Ford CEO says automaker will rethink where it builds vehicles in the wake of UAW strike

Jim Farley also said the automaker is pivoting its EV strategy to focus on a cheaper platform that can make money sooner

Michael Martinez, Automotive News

Ford Motor Co. CEO Jim Farley on Feb. 15 suggested the automaker could move some production in the wake of an expensive UAW labor contract reached after a contentious strike last fall, though he reiterated that the Dearborn-based company can fully o set those increases through cost e ciencies.

Farley said Ford had been proud of its prior strong relationship with the UAW and was disappointed when the union shut down multiple plants, including its highly pro table Kentucky Truck operation.

“ at was a moment for us,” Farley said. “Clearly our relationship has changed. . . .Does it have a business impact? Yes.”

UAW President Shawn Fain has indicated that the union will take a more confrontational tone with the automakers in the future, saying “the days of the UAW and Ford being a team” to compete against nonunion rivals were over.

Farley said Ford understands that employing more UAW workers and building more vehicles in the U.S. than its competitors has a cost. e new contract could prompt some reevaluation as the business evolves, he said.

He added: “As we look at this EV transition and ICE lasting longer and our truck business being more pro table, we have to think carefully about our footprint.”

Ford previously pledged to invest more than $400 million in

its two Chicago-area factories as part of its new contract with the UAW.

Shift in EV strategy

Farley said the shifting market for electric vehicles has made it tougher to predict the pro tability of those models but that the automaker needs to develop smaller EVs that can make money quickly.

“I’ve been in the prediction business in the EV business; it

hasn’t been a great journey,” Farley said during the Wolfe Research Global Auto Conference in New York. “It feels great in the moment to say, ‘it’s 2027,’ or whenever it is, but it’s not reality anymore.”

Ford in recent months has delayed billions of dollars in investments, cut production, walked back margin targets and essentially recalibrated its EV strategy in the wake of slower-thanexpected growth in consumer

demand. Farley this month said the company is changing tack to develop a smaller, more a ordable EV platform that can be pro table soon after launch. “It’s nonnegotiable that we’re going to allocate capital to a new a ordable electric vehicle . . . and you have to make money in the rst 12 months,” he said Feb. 15, recounting the message he gave his team. “And I don’t want a bullshit road map. I want, like, a real plan. And if you can’t [exe-

cute] that plan, we ain’t launching the car.”

Farley said the company made that decision because the economics on smaller vehicles makes more sense for consumers.

“What the customer has now said to us is, if you have [an EV] larger than Escape, it better be really functional or a work vehicle,” Farley said. “But if you do the economics for a vehicle, let’s say the Escape or smaller, it’s totally different, it completely works. In fact, it’s dramatically better operating cost than a Corolla or Civic or even a Maverick.”

Farley promised that Ford eventually will turn around its money-losing EV business, likening it to overseas operations where the automaker used to lose billions of dollars per year but now turns a collective pro t. e company has said it expects to lose $5 billion to $5.5 billion this year on EVs.

Farley said smaller, cheaper EVs are needed to compete with Chinese automakers, which the head of Ford’s EV unit this month labeled a “colossal strategic threat.” ose companies sell large numbers of EVs in China and are expected to eventually enter the U.S. market.

“If you cannot compete fair and square with the Chinese around the world, then 20 to 30 percent of your revenue is at risk,” Farley said. “We have to x this problem. We have to address this.”

Michael Martinez writes for Crain’s sister site Automotive News.

Veteran Cushman & Wake eld broker sets out on his own

It’s a tough time for retail real estate. To Gregory Kirsch, that makes it a great time to start a new business

Veteran Chicago retail broker Gregory Kirsch is striking out on his own.

After a more than 25-year career at well-established real estate brokerages — most recently leading Cushman & Wakefield’s retail practice for the Midwest — Kirsch has started his own firm, Kirsch Agency, bringing his business partner, Corey Black, with him.

“I’ve been feeling like this is something I’ve been wanting to do for quite some time and finally had the nerve to act on it,” Kirsch said.

It’s a tough time for retail, with vacancy on the Magnificent Mile shopping corridor hovering around 30% since the COVID-19 pandemic decimated foot traffic on North Michigan Avenue. To Kirsch, that makes it a great time to start a

business.

“We’re sitting kind of at the foot of the mountain in terms of recovery,” he said. “It’s a great time to add value. It’s a great time to build.”

Kirsch joins a long line of brokers who have started their own companies after gaining experience at larger firms. While brokerages like Cushman come with resources and clients, boutique firms offer an opportunity to provide good service with low overhead costs — and pocket more commission dollars.

‘I’ll be that guy’

“The trend toward boutiques is really visible, it’s obvious to me,” Kirsch said. “Don’t get me wrong, I hate the idea of following a trend, but okay, yeah, I’ll be that guy.”

Kirsch has represented highprofile clients in the past, in -

cluding Starbucks and Under Armour, and some clients have expressed interest in retaining him and Black. But “Cushman clients are Cushman clients,” Kirsch said, and he wants to start his new firm from scratch.

“In this business, you can expand kind of quickly if you find people who are willing to en -

gage,” he said. Kirsch pivoted to real estate in the 1990s after a brief career in law, working at Baum Realty Group for 10 years, and then at Newmark’s Chicago office for nearly 11 years before taking the helm of Cushman & Wakefield’s Midwest retail business in 2019. Black has more than

10 years of retail real estate experience, including working for firms Sperry Van Ness and Newmark before joining Cushman in 2019. Both were named to the Crain’s 40 under 40 list: Kirsch in 2009 and Black in 2023.

Independent approach

Kirsch said the decision to start his own firm has more to do with his independent approach to solving problems for his clients than with Cushman. A representative for Cushman & Wakefield declined to comment on the departure.

“This is more like a, ‘It’s not you, it’s me,’ kind of thing,” Kirsch said. “I would rebuild my computer and rip it down and put it back together if I have a problem and want to create a solution. . . .I’m kind of an ‘I want to do it my own way’ type of person.”

8 | CRAIN’S CHICAGO BUSINESS | FEBRUARY 26, 2024

“Clearly our relationship (with the UAW) has changed. … Does it have a business impact? Yes,” Ford Motor CEO Jim Farley said of the aftermath of the weekslong union strike in the fall. | FORD MEDIA

Rachel Herzog

Gregory Kirsch

Corey Black

The new Northbrook center will provide a range of services aimed at urogynecology and gastrointestinal health

Katherine Davis

The University of Chicago Medicine opened a new office in Northbrook focused on providing a range of services aimed at urogynecology and gastrointestinal health.

The 15,000-square-foot office, located on the third floor of a building at 400 Skokie Blvd., opened Feb. 5 after moving from a temporary location in Glenview, according to a statement announcing the opening.

Patients can now book urogynecology and women’s health care appointments at the Northbrook location to address conditions like pelvic floor disorders, endometriosis and uterine fibroids.

Gastrointestinal services, like treatment for Crohn’s disease, ulcerative colitis and motility disorders, will be added this spring, UChicago Medicine said. To treat these conditions, the center will leverage a new intestinal ultrasound.

“We are excited to bring our innovative approach to complex care closer to where our patients live and to where many of our colleagues have asked us to

partner with them,” Dr. David T. Rubin, chief of the section of gastroenterology, hepatology and nutrition and director of the Inflammatory Bowel Disease Center at UChicago Medicine, said in a statement.

The opening of the center,

which holds about 25 employees, marks the latest addition to UChicago Medicine’s growing footprint in the Chicago area, which spans from the northern suburbs to northwest Indiana, where the health system is building a 130,000-square-foot multi -

specialty ambulatory center in Crown Point, Ind., slated to open in May.

Altogether, UChicago Medicine now operates 13 outpatient sites across the region, which complement its hospital and under-construction cancer center,

both of which are in Hyde Park.

Aside from its own medical centers, UChicago has a controlling interest in local AdventHealth facilities after the two organizations entered into a joint venture last year aimed at bringing academic medicine to more parts of the Chicago area. The deal gave UChicago Medicine a controlling interest in AdventHealth’s four Illinois hospitals in Bolingbrook, Glendale Heights, Hinsdale and La Grange, along with nearly 50 physician offices and outpatient locations.

UChicago Medicine is the fifth-largest health system in Chicago, according to Crain’s data. The nonprofit health system reported a nearly $50 million surplus on more than $3.7 billion in operating revenue in the fiscal year ended June 30, 2023, according to its most recent financial report.

UChicago Medicine, however, recently suggested it’s facing industrywide financial challenges when it laid off 180 workers, or more than 1%, of its workforce earlier this month.

“We continue to review further ways to operate more efficiently,” a spokesperson said at the time.

JOIN US

transit system adds over $17.2 billion every year to the region.

FEBRUARY 26, 2024 | CRAIN’S CHICAGO BUSINESS | 9

Chicagoland’s

But to continue driving

change how

TRANSIT IS THE ANSWER TO BETTER BUSINESS Learn more at TransitIsTheAnswer.org/Economy

our economy, we must

transit is funded.

UChicago Medicine expands on the North Shore

UChicago Medicine’s Northbrook medical of ce at 400 Skokie Blvd. UCHICAGO MEDICINE

For a rookie mayor in need of a win, here is a potential playbook

Let's face it: It's been a rough few weeks for Chicago's freshman mayor.

In relatively short order, Brandon Johnson torched his already singed relationship with Gov. J.B. Pritzker by doing an abrupt about-face on migrant funding, while also straining his long-standing bond with political mentor and Cook County President Toni Preckwinkle in the process. Meanwhile, he severed a contract with the maker of the controversial ShotSpotter gunshot detection system, but not before agreeing to extend the deal for an additional nine months — an extension that will cost the city more than it paid for the entire past year of service. And in the midst of all that, he attempted a hard reset of his fractious relationship with the media by agreeing to a sit-down with the Chicago Sun-Times editorial board, only to call the meeting o when he learned the conversation was to be on the record.

And that mess comes just a few weeks after what Crain's columnist Greg Hinz termed Johnson's "terrible, horrible, no good, very bad week" back in December, when a ap erupted over Johnson's plan to house migrants on top of a polluted Brighton Park site, the key leadership of World Business Chicago resigned pretty much in unison, Choose Chicago's chief headed for the exits, and erstwhile ally Ald. Jeanette Taylor openly declared progressives are "not ready" to govern Chicago.

So, to be clear, Johnson is a mayor in desperate need of a win. A big win.

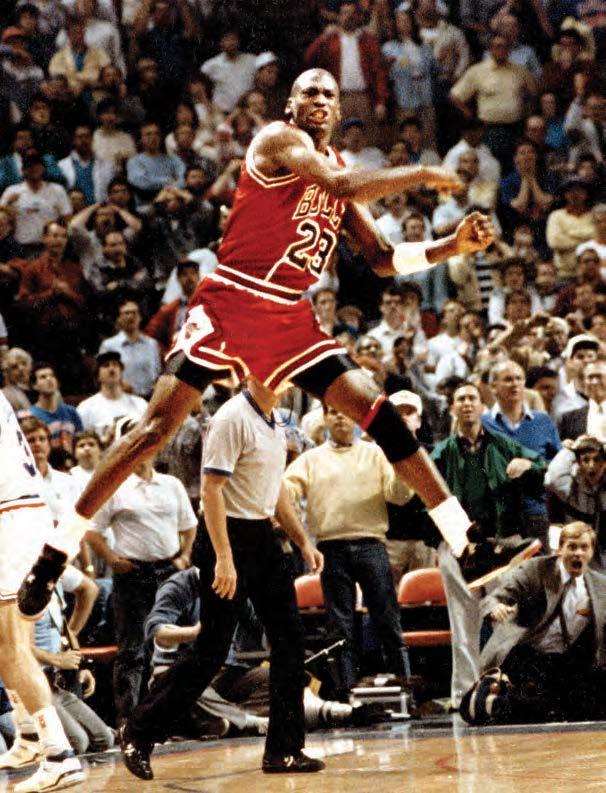

An opportunity for just such a win is emerging in the increasingly contentious debate around new stadiums for both the Chicago Bears and the Chicago White Sox.

As even non-sports fans know by now, the owners of both franchises are unhappy with their current digs and shopping around for better locations as well as 21st century amenities of the kind fans would experience at, say, SoFi Stadium in Inglewood, Calif., Allegiant Stadium in Las Vegas, or Globe Life Field in Arlington, Texas. ey're also shopping for public dollars.

PERSONAL VIEW

In a town populated by long-su ering fans of these two teams — not to mention people who still feel burned by having to help pay for the construction and renovation of the elds where their abysmal level of play has taken place — the idea of ponying up even more taxpayer dollars for new stadiums should be a political nonstarter.

Viewed another way, however, the Sox and Bears' appetite for new arenas could be an opportunity for Johnson — and, in turn, for the city at large.

at's because one of the biggest challenges Chicago faces — beyond hiring an all-pro quarterback or a better bullpen — is rethinking the very purpose of the city's downtown. Post-pandemic reality is setting in: e business district is unlikely to return to what it was in e Before Times. O ce vacancies are at record levels. e Loop is remarkably quiet on Mondays and Fridays, when

so many Chicago employers allow sta ers to work from home. Restaurants and retailers are reeling from the loss of foot tra c. And o ce building owners and the banks that lend them money are grappling with default, foreclosure and the so-far unanswered question of what happens next.

Against that backdrop comes Sox owner Jerry Reinsdorf, tin cup in hand, followed closely by Bears CEO Kevin Warren, who may not have as clearly de ned a plan just yet but is without a doubt equally as eager to tap into limited Illinois Sports Facilities Authority co ers to realize his apparent dream of building a new stadium in the city rather than Arlington Heights.

is is Johnson's opportunity to seize on their ambitions and press both teams to make a cogent and coordinated case for public nancing — a case predicated as much on the potential public bene t as it would be on the teams' own goals. Johnson could push the Bears and Sox organizations to work together on a combined proposal that would help answer the question of what the central business district could be going forward.

e teams wouldn't necessarily have to share a stadium under this scenario, but if they are going to ask for taxpayer nancing, they should be compelled to present an imaginative, ambitious and comprehensive plan that would not only enhance the value of their own franchises but generate the kind of investment, energy and round-the-clock activity that could jump-start a downtown in urgent need of a jolt.

Unhappy taxpayers and disgruntled sports fans — an overlapping Venn diagram if ever there was one — are unlikely to be thrilled by the prospect of devoting public dollars to this sort of enterprise. But with the right combination of big thinking and purposeful planning, a blueprint could be sketched out that would advance our shared civic interests and not just those of the Reinsdorfs and the McCaskeys. If Johnson uses the leverage that came with the job and makes something like this happen, it could go a long way toward erasing the memory of his until-now inauspicious tenure.

Chicago has a blueprint for xing college a ordability

There's a big debate and divide in Washington right now about student loan relief.

Ten years ago, Chicago cracked the code on college access. is year, 2024, marks the 10th anniversary of America's rst and longestrunning, city-administered free community college program: the Chicago Star Scholarship. It may shed light and provide inspiration on how to resolve a di cult and perplexing challenge: college a ordability.

e scholarship program struck a simple bargain between the city of Chicago and Chicago students. If you graduate from high school earning a B average, your education at City Colleges of Chicago is free. Tuition and textbooks won't cost you a dime.

City Colleges of Chicago classmates, Star Scholars' grade point averages are almost a quarter-point higher. eir retention rate is 27% better than the local average. e graduation rate of Star Scholars is seven points greater than the national average. In the last 10 years, the Chicago Star Scholarship has been copied by Los Angeles, Boston and many other cities; as they say, imitation is the sincerest form of attery.

to require students to develop a personalized postsecondary plan to receive their high school diploma. Upon graduation, you had to have an acceptance letter from a college, community college, vocational school, or armed services branch to receive your high school diploma. We dramatically expanded Dual Credit and Enrollment, Advance Placement, and International Baccalaureate o erings, all college-accredited programs.

e Chicago Star Scholarship premise drives responsibility: Its promise delivers opportunity. e statistics tell the story of this rst-of-its-kind initiative. In just one decade, nearly 18,000 students have earned Star Scholarships and enrolled at City Colleges. ree- fths of them — or almost 11,000 Star Scholars — are the rst in their family ever to attend college. Star Scholars outperform and outpace their peers in classrooms locally and nationally. Compared to fellow

Nearly two-thirds of Star Scholars who earned their associate degree free from City Colleges transferred to a four-year program upon graduation. As of this year, 26 colleges and universities have signed on as Star Scholar Plus partners, helping students complete their bachelor's degrees. e Star Plus program is based on the same bargain. If you maintain your B average during your community college years, you receive significant tuition reduction o your remaining college education from one of the partner universities. e Star program was built on the successful adaptation and reform of our high school education, from solely focused on graduation, to also encompass a collegecareer education model.

Chicago became the rst urban district in the country

By 2019, 50% of the city's students graduated with college credit in their back pocket. Our high school graduation rate jumped from 56% (2010) to 82.5% (2019). Finally, 64% of our high school students enrolled in a college program. is is more impressive and important when you remember that 84% of Chicago students come from households at or below the poverty line.

In this global race for talent, cities can't continue to wait to address college a ordability and accessibility for our nation's youth and their future. Today's students are tomorrow's workforce. Given that nearly 60% of all future jobs will require at least two years of higher education, a high school education alone won't cut it anymore. e Star program modernized our educational requirements and expectations to match the economic requirements

10 | CRAIN’S CHICAGO BUSINESS | FEBRUARY 26, 2024 EDITORIAL

Sound off: Send a column for the Opinion page to editor@chicagobusiness.com. Please include a phone number for veri cation purposes, and limit submissions to 425 words or fewer. Write us: Crain’s welcomes responses from readers. Letters should be as brief as possible and may be edited.Send lettersto Crain’s Chicago Business, 130 E. Randolph St., Suite 3200, Chicago, IL 60601, or email us at letters@chicagobusiness.com. Please include your full name, the city from which you’re writing and a phone number for fact-checking purposes.

ALAMY

Rahm Emanuel is U.S. ambassador to Japan, a former mayor of Chicago, a former White House chief of sta and a former member of Congress.

See AFFORDABILITY on Page 11

Brandon Johnson

A Sox move to e 78 could bene t the entire city

The White Sox's lease in Bridgeport is up in 2029, making this year pivotal, when the team's leadership must make decisions that will a ect the future of Chicago. ere's much debate over where the White Sox should land and over what's best for the team, the city and our neighborhoods.

Eleanor Gorski is president and CEO of the Chicago Architecture Center.

e Chicago Architecture Center, a champion of the built environment and a booster for Chicago, is watching this conversation closely. e proposed move of the White Sox from Bridgeport to e 78, a 62acre site along the river at Clark and Roosevelt, could jump-start development in two locations while creating new housing and amenities for Chicagoans.

As a former city of Chicago deputy commissioner of design and planning, I led the ve-year repositioning of Wrigley Field and have a unique perspective on large public/private urban projects and on how ballparks interact with, and in some cases create, their neighborhoods.

Stadiums are now the center of districts, rather than the standalone entities that proliferated across major U.S. cities in the 1970s and '80s. The White Sox's current home was one of the last stadiums completed under the old model, and its design and economics were almost obsolete upon delivery in 1991. A successful urban stadium now favors population density, transportation options and multiuses to generate income year-round. Some stadiums have stayed put while accommodating these needs (see Wrigley Field), and others have rebuilt entirely (such as PNC Park in Pittsburgh).

e 78 has bene ted from multiple planning e orts over the

AFFORDABILITY

From Page 10

and needs of the 21st century.

Every young person with drive and determination deserves a choice and a chance. Nearly 18,000 Star students earned it — nothing less. e Chicago Star program results o er Washington a road map to resolving the combined issues of college a ordability and income inequality. To open the doors of opportunity and transform college a ordability, Chicago developed a better idea and o ered our students a better bargain.

No student's educational outcome should be limited by their parent's income. No parent should have to take a second job or take out a second mortgage to give their child a chance at a better future. In Chicago, they no longer have to.

last eight years, including Amazon HQ2, Discovery Partners Institute and Bally's casino, with much community input resulting in an extensive planned-development framework that includes a new riverwalk and high design standards. With this lion's share of the pre-development work complete, it's possible to begin construction in this area quite soon. A new ballpark at e 78 would likely result in a mixed-use neighborhood and provide well-programmed open space for all to enjoy.

Moving the Sox to e 78 would

create opportunity to re-imagine the old Comiskey site, transforming the stadium and its surroundings into a well-planned area that blends into the Bridgeport neighborhood and creates housing and a tax base. As the site on 35th Street is owned by the Illinois Sports Facilities Authority with no prior planning or framework in place, the Chicago Architecture Center recommends a thorough community design process led by urban planning professionals who can balance local needs with best practices for a new neighborhood

that knits into the Bridgeport community. Whomever tackles these two projects must ensure that all of Chicago bene ts. e developer for e 78, Related Midwest, has a history in Chicago and a record of inclusion and diversity in its projects. It's a founding member of Hire360, whose mission is to strengthen the participation of underrepresented populations by prioritizing socially responsible hiring and vendor selection. Related's work at Roosevelt Square and e Row in Fulton Market proves

that large projects can help small businesses and provide on-thejob training for trade workers to launch their careers. (Full disclosure: Related Midwest Executive Vice President Ann ompson is a member of the Chicago Architecture Center board.)

e big picture: Redeveloping these large properties with sports stadiums provides an opportunity — and an obligation — to thoughtfully plan with community and professional input for the bene t of all Chicagoans and for our great baseball legacy.

FEBRUARY 26, 2024 | CRAIN’S CHICAGO BUSINESS | 11 PERSONAL VIEW

ARCHITECTURE / DESIGN

Gensler, Chicago

ARCHITECTURE / DESIGN

Gensler, Chicago

BUSINESS SERVICES

Circana, Chicago

FINANCE

J.P. Morgan Private Bank, Chicago

NON-PROFIT

CAN TV, Chicago

Rick Fawell, AIA, NCARB has been promoted to Principal at Gensler Chicago. With more than 40 years of experience designing, planning, and managing complex projects, Rick leverages his deep expertise and experience in his role as a trusted partner to leaders throughout the hospitality industry. He thoughtfully guides clients throughout the design process, from early-stage nancing to delivery phases. Rick’s design work has been recognized by numerous awards from organizations including AIA and ULI.

ARCHITECTURE / DESIGN

Gensler, Chicago

Randy Guillot, FAIA, LEED AP has been named Global Healthcare Leader at Gensler. With experience across the healthcare, sciences, education, and workplace sectors, Randy’s leadership in design leverages his belief in multidisciplinary partnerships and creating new models for healing, learning, and working. As a Fellow of the American Institute of Architects and a member of the ULI National Healthcare & Life Sciences Council, his projects have been recognized with more than 50 design awards globally.

ARCHITECTURE / DESIGN

Gensler, Chicago

Stephen Katz, AIA, LEED AP BD+C has been promoted to Principal at Gensler Chicago. As a recognized thought leader, he has authored features on façade design, intelligent building technology, and sustainability for numerous publications and journals. He recognizes an inclusive design process that prioritizes collaboration, listening, and the power of imagination. During his time at Gensler, he has been a Lieutenant in the US Naval Reserves serving as an of cer in the Civil Engineer Corps.

ARCHITECTURE / DESIGN

Gensler, Chicago

Lori Mukoyama, NCIDQ, IIDA, LEED GA has been named Global Hospitality Leader at Gensler. With 25 years in the industry, Lori’s dynamic approach to design champions the creation of brand-forward, experiencedriven environments. She frequently contributes inspiring thought leadership while building her awardwinning portfolio of impactful project work. Lori has a passion for mentoring the next generation of designers and is actively involved in industry organizations IIDA, DIFFA, and NOMA.

A. Sean O’Gorman Jr., LEED AP has been named Global Residential Practice Leader at Gensler. He also leads the residential practice area for the rm’s North Central region, guiding the design and delivery of large-scale multifamily, mixed-use, and adaptive reuse projects with a specialty in sustainability and energy performance. Sean is a licensed architect, LEED accredited professional, and a member of the Chicago Committee on High Rise Buildings.

ARCHITECTURE / DESIGN

Gensler, Chicago

Kristin Oleson, CPA, CGMA has been promoted to Principal at Gensler Chicago. As the Regional Operating Of cer of Gensler’s North Central Region and a licensed CPA, Kristin concentrates on nancial strategy and growth with a commitment to operational excellence. Her role utilizes her breadth of corporate nancial expertise, particularly with operational, nancial, and risk management. She is a member of the American Institute of Certi ed Public Accountants and the Illinois CPA Society.

ARCHITECTURE / DESIGN

Perkins&Will, Chicago

Global architecture and design rm

Eckmann

Fevurly

Perkins&Will announces the promotion of Aimee Eckmann, FAIA, ALEP, LEED AP to rmwide practice leader for K-12 Education and Yvette Fevurly, Managing Principal as the Branded Environments practice leader for the Chicago studio. Eckmann, who started her career at Perkins&Will in 1999, works closely with key school stakeholders –administrators, teachers, parents, students, and community members- bringing her expertise in educational planning and design. Fevurly’s 20+ years of experience in environmental graphics programs, signage, and way nding across the corporate, hospitality, healthcare, and legal sectors brings design direction and mentorship to the agship studio.

BANKING

First Bank Chicago, Northbrook

First Bank Chicago, one of the ve largest privately held banks in Chicago, proudly announces the promotion of Jacqueline Flick to SVP/Community Banking Operations Manager. Jackie is responsible for overseeing day-to-day operations to ensure each branch is operating ef ciently while adhering to bank policies and procedures. She is also responsible for developing procedures and conducting staff training on the implementation of new products and services. She joined our team in 2018.

Circana, a leading advisor on the complexity of consumer behavior, appoints Jeremy Allen as Chief Commercial Of cer. He previously served as President, Consumer Packaged Goods at Circana. In this newly created role, he’ll lead global commercial strategy, leveraging extensive client service experience to promote Circana’s technology, solutions, and insights to help clients worldwide nd new opportunities and spark growth.

BUSINESS SERVICES

Circana, Chicago

Circana, a leading advisor on the complexity of consumer behavior, appoints Wei Lin Wong as president, Consumer Packaged Goods. In this role, he’s responsible for leading CPG commercial teams across the globe, including client engagement, delivery of innovative solutions, and thought leadership. Prior to this role, he served as Circana’s President of Retail and Chief Strategy Of cer.

CONSTRUCTION

Krusinski Construction Company, Oak Brook

Jeffrey Jerry

Krusinski Construction Company, a leader in providing comprehensive construction services, is pleased to announce that Jeffrey Krusinski has been named CEO, in addition to his role as President, effective January 2024. The move follows the planned transition of former CEO Jerry Krusinski to Executive Chairman and the retirement of company founder Joe Krusinski, Sr., who continues to serve as Chairman Emeritus. Jeff and Jerry joined the company in 1994 and 1984, respectively, holding various roles throughout the organization. They focus on the rm’s strategic operations and provide executive oversight on client projects and relationships, leading the organization into its next chapter.

ENGINEERING / CONSTRUCTION

Ardmore Roderick, Chicago

Ardmore Roderick, a major infrastructure solutions rm, welcomes Larry LeMaster, CPA, as Chief Financial Of cer. Larry’s extensive leadership experience positions him as a key player in the company’s nationwide growth strategy. His deep nancial acumen will be crucial in driving Ardmore Roderick’s expansion initiatives.

Jonathan Schwartz has joined J.P. Morgan Private Bank in Chicago as an Executive Director and Banker. Jonathan works with a range of sophisticated clients, including highly successful entrepreneurs, multi-generational families, C-level executives, nancial and legal professionals, family of ces, endowments, and foundations. He delivers seasoned guidance backed by the fortress balance sheet and intellectual repower of a global leader. Jonathan joins the rm from Bluebird Pearson.

FINANCE

J.P. Morgan Private Bank, Chicago

Will Hancock has joined J.P. Morgan Private Bank in Chicago as a Vice President and Banker. Will partners closely with C-suite executives, successful business owners and stewards of family wealth who are looking for a holistic way to manage all aspects of their nancial pictures. He taps the rm’s specialists, thought leadership, and innovative opportunities that align with his client’s interests. Most recently, Will joins the rm from Charles Schwab.

FINANCIAL SERVICES

Buoyant Ventures, Chicago

Buoyant Ventures is proud to announce that Laura Dyer has been promoted to Principal Investor. Buoyant invests in early stage climatetech companies in North America, and is headquartered in Chicago. As Principal, Laura will lead the sourcing, diligence and management of investments, and will lead investment research. Laura has a CPA and previously worked at Ares Management and Deloitte as and an Auditor. She has dual masters in business and sustainability from the University of Michigan.

LEGAL

Adelman & Gettleman, Ltd., Chicago

Adelman & Gettleman, Ltd. is pleased to announce the elevation of Nicholas Dwayne to partner. He joined the rm as an associate in 2017 and his practice involves a full suite of transactional, litigation, and problem solving on behalf of clients facing insolvency issues. Mr. Dwayne is supported by a full team of experienced partners, associates, and staff. A&G is among the oldest boutique commercial insolvency rms in Chicago, handling all aspects of debtor-creditor relations for over 40 yrs.

CAN TV has appointed a new member, Daniel O. Ash, to its board of directors. Ash is the President of the Field Foundation of Illinois, which along with strategic funding partners distributes more than $6.5 million annually in grants to organizations working to address systemic issues in Chicago’s divested communities. Through his career, Ash has focused on developing and using marketing and communication tools to advance social causes.

NON-PROFIT

CAN TV, Chicago

CAN TV has appointed a new member, Nikki Lang, to its board of directors. Lang is the head of the Diversity, Equity and Belonging at Bimbo Bakeries USA, where she leads the company’s strategic goal to build an environment and workplace with BBU’s leaders and associates that advance programs, enact policies and promote mindsets and behaviors that appreciate and value diversity, equity and belonging.

NON-PROFIT

CAN TV, Chicago

CAN TV has appointed a new member, John Robak, to its board of directors. Robak is the former Chairman of the Board and Chief Executive Of cer of Greeley and Hansen, a leading international civil, environmental, and water infrastructure consulting engineering rm headquartered in Chicago. With over 30 years of professional business experience, Robak directs all business affairs of this 20-of ce global rm.

NON-PROFIT

The Morton Arboretum, Lisle

Karen Magid, Ph.D., joined The Morton Arboretum in the newly established position of Chief of Staff. She manages government relations, the institution’s civic presence and pro le, Board of Trustees engagement and institutional planning and project management. Magid holds a Doctorate in Materials Science from UC Berkeley and brings scienti c, sustainability and environmental justice experience to the role, providing key leadership capacity to advance the Arboretum’s new strategic plan.

PEOPLE ON THE MOVE Advertising Section To place your listing, visit www.chicagobusiness.com/peoplemoves or, for more information, contact Debora Stein at 917.226.5470 / dstein@crain.com

To order frames or plaques of profiles contact Lauren Melesio at lmelesio@crain.com

LARGEST EMPLOYERS CRAIN’S LIST

Ranked by full-time local employment as of 12/31/2023. e = Crain's estimate (in gray).

ResearchbySophieRodgers(sophie.rodgers@crain.com)|Localemployment guresincludefull-timeemployeesinCook,DuPage,Kane,Lake(Ill.),Lake(Ind.),McHenryandWillcountiesunlessotherwise noted.Crain’sestimatesareshowningray. e. Crain'sestimate. 1. U.S.government'sestimate. 2. FormerlyAdvocateAuroraHealth. 3. InDecember2022,AdvocateAuroraHealthmergedwithAtrium HealthtocreateAdvocateHealth. 4. Includesestimateddistributioncenteremployment guresfromMWPVLInternationalandWholeFoodsemployees. 5. Includespart-timeemployeesandWholeFoods employees. 6. IncludesemployeesofUniversityofChicagoMedicine,theuniversity'smedicalgroup. 7. FormerlyNorthShore–Edward-ElmhurstHealth. 8. Companyestimate. 9. CalculatedfromSEC lings. Re ects all Albertsons employees. 10. Robert Michael will succeed Richard Gonzalez as CEO on July 1. 11. Includes part-time employees. Get 70 employers and hundreds of executives in Excel format. Become a Data Member: ChicagoBusiness.com/data-lists