KAEGI VS. DOWNTOWN LANDLORDS: ROUND 2

BY ALBY GALLUN

Fritz Kaegi, tormentor of downtown landlords, is back at it. After trying unsuccessfully to push through big commercial assessment hikes in Chicago last year, the Cook County assessor is trying again with more than 200 major downtown buildings, including the Aon Center, Prudential Plaza and the Old Post O ce. If Kaegi succeeds, many downtown o ce landlords could face steep property tax hikes at an especially bad time, as they grapple with the worst o ce market in decades.

It’s the next round in a ght Kaegi and commercial property owners have been waging since the former investment manager

See KAEGI on Page 18

THE ASSESSOR’S OFFICE MAY SEEM LIKE AN ARCANE BACKWATER OF COUNTY GOVERNMENT, BUT ITS DECISIONS HAVE MAJOR IMPLICATIONS FOR MILLIONS.

City Council is boxed out of budget making

Rushed votes, lack of independent analysis shield mayoral spending plans from aldermanic scrutiny

BY STEVE HENDERSHOT

As Chicago’s second Daley dynasty ended in May 2011, the departing regime left a gift for the new one: a pension-debt problem that had been quietly snowballing for a decade before exploding into view in the runup to the election.

With nearly a third of the City Council following departing Mayor Richard M. Daley out the door, a bewildered cohort of freshmen council members scrambled to understand the mess they had inherited.

At the turn of the 21st century, the city’s four pension funds all were stable and funded at or near the levels of peer cities. Chicago wasn’t ush, but it was solvent. But in the late 1990s, the state of Illinois sweetened the pension packages and the city didn’t raise its contribution levels. Chicago began falling behind — slowly at rst, during the market boom of the 2000s, and then sharply in

An ongoing collaboration between Crain’s Chicago Business and the University of Chicago’s Center for E ective Government. ChicagoBusiness.com/OneCity50Wards

INSIDE

Want better government? Strengthen the City Council. PAGE 12 Reform of Chicago’s City Council should come from within. PAGE 12

the wake of the nancial crisis of 2008. By the time Daley left ofce, the four pension funds were funded at only about half their levels in 2000.

One of the new council members, 43rd Ward Ald. Michele Smith, dug into the city’s budget to better understand the issues. She felt up to the task, armed with 15 years of experience as

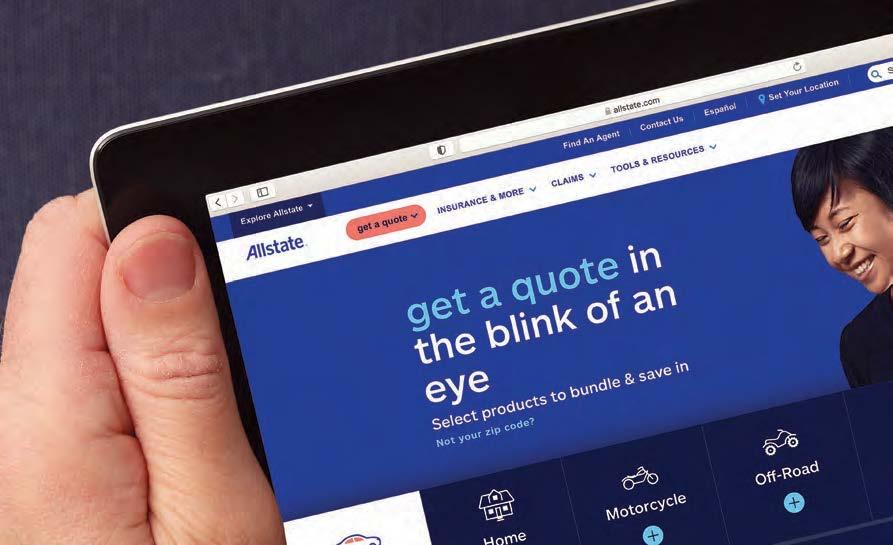

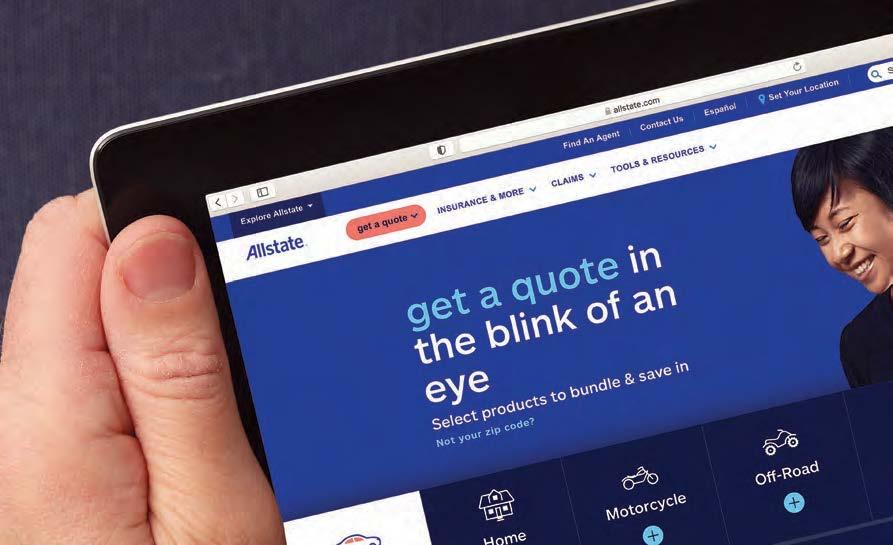

Red ink threatens Allstate’s stock-buyback machine

Hyperaggressive repurchases have shored up the giant insurer’s stock as losses rock its auto insurance business

BY STEVE DANIELS

A terrible 2022 knocked Allstate’s capital to historic lows that endanger the insurer’s aggressive stock buybacks.

Northbrook-based Allstate spent $2.5 billion on share repurchases last year despite posting a

$1.4 billion net loss. In response, Allstate has slowed buybacks slightly. A $5 billion repurchase program that was supposed to be completed by the end of March has been extended through September. ere was $802 million left on that authorization at yearend, and CEO Tom Wilson has

said that will be completed. What happens next? e answer matters because stock buybacks are a major source of Allstate’s investor appeal. e company doesn’t grow much, but its consistent practice of buying back much more stock than it issues each year boosts earnings

Rivian

per share, supporting Allstate’s share price even as its core auto insurance business spews red ink. Allstate’s auto insurance profit margins led the industry until about 18 months ago. Now it’s well into the red, which the

See ALLSTATE on Page 17

customers. PAGE 4

JOHN R. BOEHM CHICAGOBUSINESS.COM | MARCH 6, 2023 | $3.50 PERFORMING ARTS: Chicago’s cultural comeback is falling short. PAGE3 GREG HINZ: What our city needs from Vallas and Johnson . PAGE 2

rate shock coming this month for ComEd

UTILITIES Electricity

JOE CAHILL

may have to consider whether

makes sense to

NEWSPAPER l VOL. 46, NO. 10 l COPYRIGHT 2023 CRAIN COMMUNICATIONS INC. ALL RIGHTS RESERVED

it

go it alone. PAGE 3

This time, the assessor may have an edge in his campaign to boost property tax assessments on trophy towers like the Aon Center and Prudential Plaza I

Tom Wilson

BLOOMBERG See BUDGET on Page 20

What we need now from Johnson and Vallas

For those who like their elections to amount to good versus evil, who consider politics a blood sport entertainment cum cage match, Chicago’s upcoming mayoral runo election should be a thing of joy. By all indications, it’s going to be nasty on steroids, a stark clash of candidates who are as politically and ideologically opposed to one another as any mayoral nalists since World War II.

However, those of us who actually live and work here are hoping for something better. A city at an inflection point needs an honest debate on opposing visions, with a focus not on personalities but the issues at hand, yielding a synthesis of solutions that will engender widespread buy-in. It doesn’t need a racially tinged us-versus-them conflict in which the winner takes all.

How do we avoid the carnage?

Let’s start with the obvious.

The editorial cartoonists are making it out to be Paul Vallas,

champion of the Fraternal Order of Police versus Brandon Johnson, a loyalist to and employee of the Chicago Teachers Union. The resulting polarization writes itself. The reality is more complicated than that, I think — I hope. But it’s now up to each contender in the next six weeks to prove it.

For Vallas, the challenge is to lay out his vision for truly community-based policing and public schools that work for everyone without serving as the tool of either the FOP or big-buck charter school interests. That means detailing how he will fulfill terms of the federal consent decree, fund both a full roster of police and the anti-violence support programs that limit the need for police, and convince cops that respect is a two-way transaction. Core Chicago Police Department culture has to change. It also means selling Chicagoans on the need for things such as competition in the school system and the

closure of schools that are all but empty — selling Chicagoans, not telling them.

For Johnson, the challenge is to spell out how he will fund the programs everyone would like to see, from violence prevention to creating more a ordable housing, without stampeding business and its middle-class workers out of town. Does he still back “defunding” police, however he wants to call it? Does he really think imposing a head tax on any company that wants to create a job is good idea, or raising what already is the country’s highest hotel tax, or irting with a city income tax? All of those are right out of CTU’s playbook. Is Johnson willing to walk away from that playbook and be more than the darling of Milwaukee Avenue hipsters?

Those are sort of threshold tests, as far as I’m concerned. If the contenders pass them, then we can move on to other issues. There are lots of them.

GREG HINZ

ON POLITICS

Like who will fill the key jobs in their administration and kitchen cabinet — who they will listen to. The lack of a deep bench was a recurring problem in the Lori Lightfoot years. Another question: Will they be able to strike the right balance with their legislative branch, neither constantly feuding with aldermen as Lightfoot did nor rolling over them as Richard M. Daley did, but actually collaborate with them, something that Rahm Emanuel did better than any of Chicago’s recent chief executives. And, if they can handle the public safety situation, what is their solution to what is fast emerging as one of this city’s top woes: an unreliable

and uncomfortable public transit system.

It will help that both of the candidates seem focused on this, and only this, job. Though Lightfoot was dealt a bad hand and at times treated unfairly, I found it telling that, a few days ago, while fighting for her political life, she carved out an hour to talk to a New York Times columnist. Some priorities.

For what it’s worth, Chicago, we’re not in this alone. New York and Los Angeles both in the past year and a half or so have had similar left-versus-right elections. Those cities currently have problems at least as bad as ours. Hopefully, we’ll do better.

Final horn sounding on a treasured Hawks era

The Sacramento Kings were the fourth of Dick Motta’s six NBA coaching stops, and when he arrived, he immediately traded Danny Ainge, the team’s best player.

Fan reaction was predictable. “You’ve traded our best player!” they yelped.

Motta was unfazed. “Danny Ainge,” he countered, “is championship caliber. He doesn’t belong in a setting like this.”

at would be buried under a mountain of losses, miles removed from title contention.

e Ainge-Motta scenario comes to mind in response to Chicago Blackhawk franchise great Patrick Kane getting traded to the New York Rangers. Moreso than Ainge, Kane has easily been his team’s best player, but his artistry has often been lost on the pond-hockey kids and beer-leaguers with whom he has been skating, particularly since fellow stalwart Jonathan Toews acknowledged the debilitating e ects of long-haul COVID and stepped aside.

Icon status notwithstanding, Kane and Toews belong on a team with Stanley Cup aspirations . . . if Toews is ever t enough to play again.

Ainge was having a grand old time in Sacramento, given a reat-will green light after being the fth or sixth option on the championship Celtics teams of Larry Bird, Robert Parish and Kevin McHale.

“Even bad teams have a leading scorer,” longtime Kings xture Jerry Reynolds once said in dubious reference to Ainge’s shot selection.

Bad hockey teams have a leading scorer, too, but it’s more di cult — it’s not like one player can dominate the puck and take all the shots.

Kane has always excelled at setting up teammates, so given what he’s playing with, he had done well to collect 42 points (14 goals, 28 assists) in 53 games as of Feb. 22.

He was also on the minus side of the plus-minus stat for the third straight season, with a career-worst minus-25 gure that is jarring.

And he’d want to stay here why?

It’s painful and sad to say this, but watching Toews this season has been like watching Captain Serious at age 78. He nally came clean about long-haul COVID being the culprit that stole his energy; anybody familiar with the condition is astonished that Toews could push himself through 46 NHL games.

So what’s next for the Blackhawks? A dry spell of indeterminate duration.

e fallout from their abysmal handling of the Kyle Beach victimization cost them some of the goodwill Chairman Rocky Wirtz engendered by not being his tight- sted father, but a return to the bad old days of a half-full building, no home TV, and open contempt for a poor product and the aimless succession of people responsible for it seems unlikely. What’s currently happening on the ice isn’t much, but the accompanying show is pretty catchy.

Rocky Wirtz inheriting the team from his late father and hiring marketing magician John McDonough to run it is viewed as the catalyst for the franchise renaissance, but Dale Tallon’s work in the front o ce is really what started it; Kane, Toews, Duncan Keith, Brent Seabrook, Patrick Sharp and Corey Crawford arrived on his watch.

Alas, the NHL salary cap is a cruel and unyielding beast, one

Tallon never could tame. When the center of the 2009 squad that almost made it to the Stanley Cup Final couldn’t hold, it cost Tallon his job, mere weeks after coveted free agent Marian Hossa signed with the Hawks.

“Dale is a good general manager,” Rocky Wirtz told me once. “He just couldn’t count.”

Successor Stan Bowman did a nice job mixing and matching complementary parts to produce three Cups, but no dynasty can withstand age, injuries and that infernal cap.

And the abysmal handling of Kyle Beach.

Rocky Wirtz cleaned house in its

aftermath. His son Danny is the new McDonough, charged with keeping the building lled, which will be a lot easier if GM Kyle Davidson and Coach Luke Richardson can replicate the Tallon-Bowman-Joel Quenneville success formula.

But if there’s a Kane or a Toews or a Duncan Keith out there, he is yet to show himself.

It has been 17 years since Keith

arrived and began delighting United Center crowds with his talent and gumption; 16 years for Kane and Toews. From fresh-faced kids to grizzled vets. e good old days sure ew by quickly.

Crain’s contributor Dan McGrath is president of Leo High School in Chicago and a former Chicago Tribune sports editor.

2 MARCH 6, 2023 • CRAIN’S CHICAGO BUSINESS CORRECTION An article in the Feb. 27 Crain’s Forum, “Find the true value by identifying areas that matter the most,” misstated the year of a Boston Consulting Group study about the e ects of diversity on nancial performance. The study came out in 2018. Banking products pro vided by Wintrust Financial Corp. banks. GET ASSURANCE . LET US GET TO KNO W Y OUR BUSINESS . GET CO MMITMENT . GET AT TENTION. Be your banker’s top priority. WINTRUS T. CO M/PRIORITY DAN McGRATH ON THE BUSINESS OF SPORTS

JOE CAHILL ON BUSINESS

Rivian’s next di cult decision

It’s a time of hard choices for electric vehicle maker Rivian, and the hardest choice may be yet to come.

I think Rivian will have to consider whether it makes sense to go it alone in a fast-growing but increasingly competitive EV market. Here’s why:

Chicago’s cultural venues struggle to fill the seats

The Chicago Symphony Orchestra, Goodman Theatre and other performing arts citadels are facing a scal reckoning as COVID relief funds dry up and attendance lags pre-pandemic levels

I

BY BRANDON DUPRÉ

Chicago’s leading performing arts venues are back, but the crowds aren’t.

e Chicago Symphony Orchestra, Goodman eatre and Steppenwolf eatre say ticket sales rebounded last year from 2021, but not enough to restore their nancial health, as federal dollars that got them through the worst of the COVID-19 pandemic are drying up.

If attendance continues to lag pre-COVID levels, these and other local arts institutions face the possibility of persistent operating losses that could eventually erode their ability to deliver the world-class experiences audiences expect. Industry observers say the situation reveals the obsolescence of a longstanding nancial

See CULTURE on Page 22

“PEOPLE NEED TO BREAK UP WITH THEIR NETFLIX AND STREAMING DEVICES AND GET BACK OUT TO EXPERIENCE THE CITY’S CULTURE AGAIN.”

Erin Harkey, Chicago Department of Cultural A airs & Special Events commissioner

What will happen to Lightfoot’s economic development projects?

The fates of programs she has championed — such as Invest South/West and a LaSalle Street transformation — hang in the balance as she heads for the exit

BY DANNY ECKER

Mayor Lori Lightfoot’s impending exit from City Hall raises big questions about the future of economic development and real estate-focused initiatives she championed over the past four years.

Lightfoot’s wide-ranging Invest South/West program, her recent push to incentivize a LaSalle Street revival with a ordable housing, the planned Bally’s riverfront casino she has pushed forward and even future city sup-

port for an annual NASCAR race around Grant Park that Lightfoot has touted are among the high-pro le e orts that hang in the balance for the next mayor, with little clarity about what will continue, what won’t and who will be making those decisions.

Chicago mayors have historically wielded outsize in uence over economic development priorities for the city, and every mayor has had his or her pet projects. Mayors also play an essential role in marshaling the necessary political and private-sector

support for such initiatives.

Last week’s election results are eliciting a mix of enthusiasm and caution from real estate developers, depending on the types of projects they pursue. eir prospects will also be hard to determine until they know whether Paul Vallas or Brandon Johnson will be the next mayor.

For community developers that target the disinvested neighborhoods Lightfoot has prioritized, the unknown is cause

Illinois’ only current contender in EVs has lost any meaningful rst-mover advantage in electric pickup trucks, despite getting its trucks to market before others. Unlike electric car maker Tesla, Rivian didn’t have the market to itself long enough to establish dominance. It’s already up against deeper-pocketed rivals with stronger brand names and more manufacturing experience. Models from Ford and GMC have hit the market, and others are coming soon.

Rivian’s lost opportunity stems from an array of woes the company continues to battle. Production snafus and supply chain bottlenecks have throttled output at its sole plant in downstate Normal. Rivian failed to meet a sharply reduced production target of 25,000 vehicles last year. Late last month, executives announced a goal of 50,000 for 2023, less than Wall Street expected.

Rising costs for parts and materials plunged Rivian deeper into the red, with operating losses rising 62% to $6.9 billion last year. Cash reserves are shrinking fast as Rivian struggles to learn the complicated, capital-intensive business of auto manufacturing. e company had $12.1 billion in cash at the end of 2022, down 34% from $18.4 billion a year earlier.

In response, Rivian executives are cutting jobs and curtailing growth initiatives. Rivian cut its workforce by 6% twice since last summer, with the latest round announced in early February. It also dropped plans to make electric vans in Europe with Mercedes-Benz and delayed a production platform for lowerpriced vehicles. Management ratcheted back capital spending, which came in at $1.4 billion last year, well below the originally budgeted $2.6 billion.

PAINFUL MOVES

Painful but necessary, these moves are by no means sure to solve Rivian’s most pressing problems. Supply chain constraints persist, and Rivian will need to rev up capital spending again to reach production goals.

Cash consumption will continue for as long as it takes Rivian to master the essential skills of developing, marketing, producing and distributing cars for less money than they sell for.

at means Rivian may soon

face its most painful choice yet: whether it can survive over the long term as an independent company. Unless performance improves markedly, and soon, I think the company’s continuing need for capital, automotive expertise and other capabilities could force executives to seek a buyer.

Raising capital on its own will likely be a lot harder for Rivian now than it was in 2021, when investors poured $13.5 billion into the EV maker’s initial public o ering. Battered by Rivian’s serial setbacks, the stock has plunged nearly 90% from a post-IPO high of $146.07 per share. Another equity o ering would be a tough sell, and likely send the stock even lower.

at leaves debt nancing, an increasingly expensive and chancy option as interest rates rise and lenders grow more cautious.

BUYOUT OPTION

Against that backdrop, a buyout starts looking more attractive. Selling to an established automaker could help Rivian in several ways. Financially, Rivian would gain access to deeper pockets and greater capacity to absorb short-term losses until EV volumes pass breakeven. On the production side, an acquirer could provide a huge pool of auto manufacturing talent. Joining a bigger automaker also could provide leverage over suppliers, bringing down costs and easing supply chain constraints.

Of course, a buyout requires a buyer. And despite its challenges, Rivian does have something to o er an acquirer looking to break into EVs. Rivian could enable an automaker with no EV capabilities to quickly ramp up in the accelerating market.

No, Rivian doesn’t need a savior tomorrow. It has enough cash for the time being, especially if it focuses spending on core production activities. But the time to nd a buyer is before you need one so desperately that you’ve lost all bargaining power.

I also realize that selling Rivian at anything close to its current stock market value would mean a signi cant haircut for investors who bought shares during the heady days following the IPO. Rivian isn’t likely to fetch anything close to those prices in a sale anytime soon.

But Rivian is running out of time to turn itself into a manufacturer capable of competing on an equal basis with the best automakers in the world. At some point, a buyout may be the best investors can hope for, and Rivian’s best shot at long-term viability.

CRAIN’S CHICAGO BUSINESS • M ARCH 6, 2023 3

COURTESY OF GOODMAN THEATRE

Goodman Theatre’s production of “Ohio State Murders.”

See INITIATIVES on Page 7

Downtown condos are selling for long-ago prices

The market’s familiar pattern of poor performance as an investment persists, Crain’s research shows

BY DENNIS RODKIN

Many condominiums in downtown Chicago neighborhoods have performed poorly as investments, selling recently at prices well below what their sellers paid for them years ago.

A few among them are:

A condo on Monroe Street whose $1.51 million sale was 91% of what it sold for exactly a decade earlier.

A condo at Trump International Hotel & Tower whose Jan. 31 sale price of $1.325 million was 31% o of what it went for in 2009.

And one condo on Huron that went for $535,000 this year, down from $617,500 in 2012 and $720,000 in 2008, losing 27% of its value since December 2008.

“In all honesty, you have to give the same speech you’d give if you were a stockbroker,” Rick Druker, managing broker of Baird & Warner’s Gold Coast o ce said. “ ‘ is was not a great investment. It didn’t work out,’ and hope they have other investments that did better.”

e factors are familiar, as they’ve been hurting the downtown market for a few years: crime and the even worse perception of crime, the slower-than-expected recovery of urban downtown areas after COVID shutdowns, and high property taxes that sometimes ward o empty-nesters who would move in from lowertaxed Lake and DuPage county suburbs.

Also contributing is the boom in rental o erings, which allows people to make a less-invested commitment to living downtown.

A study the Chicago Loop Alliance

released last month showed that 78% of people who moved to the Loop in the past year were renters.

In the past two months, Crain’s has counted 21 condos that sold at a loss, most going for less than a decade ago. at’s out of 46 condos sold in that period in a roughly semi-circular area that starts at Division Street and the lakefront, bulges west to include River North and the Loop, and comes back to the lakefront at about Roosevelt Road.

at is, about 46% of the condos sold in that chunk of the city in the past two months went at a loss. But the gure might be higher. For 15 of the properties, Crain’s couldn’t nd a clear past sale price in Cook County property records.

at means of the 29 condos for which a comparison is possible, 21 sold at a loss. Eight sold for higher than their sellers paid for them.

Two more were new construction, with no past price for a comparison.

e missing 15 would help rene these gures a lot. But even if all of them sold for more than their past prices, the total would be 23, only slightly more than are conrmed to have sold at a loss.

“It’s always a disappointment to lose money,” said Keith Estrada, a Jameson Sotheby’s International Realty agent. On Feb. 22, his client sold a condo on Chicago Avenue for $825,000, which was not only less than what the sellers paid for it in 2014 ($1.05 million), but was also less than what the sellers before that paid in 2001 ($1.04 million).

When sellers look at the comparables and understand they’re likely to sell at a loss, Estrada said,

“It’s sometimes hard to swallow, but if they’ve been living here, they probably already knew.”

Cara Bu a, a Berkshire Hathaway HomeServices Chicago agent, agrees that the long-term pattern of losses in the condo market is known to most sellers. “People are pretty well informed by the time they get to me,” she said. “As brokers, we have no control over what the market is doing.”

Bu a represented clients who in mid-February sold a condo on Delaware Place for $1.4 million.

at was down about 8.5% from the $1.53 million the sellers paid in 2019, and down about 9.4% from the $1.55 million sale in 2010.

In the same period that condo dropped in value by 9.4%, the value of a dollar went up 37%.

Not all condo owners see their investments go sour.

A condo on McClurg Court in

Streeterville sold in early February for $552,500, reaping an increase of about 34% for the seller, who paid $413,000 for the two-bedroom unit in 2002. is calculation assumes the seller invested nothing in upgrades over the years. On Wells Street in Printers Row, a threebedroom condo went for $560,000 in late January. at’s about 25% more than the $447,500 the seller paid for it in 2016, and 58% more than the $355,000 the condo sold for in 2011.

Nevertheless, the money-losers are too numerous to ignore. Of the 21 condos Crain’s spotted selling at a loss, 16 sold for less than a price from a decade ago or longer.

e droop is largely con ned to the neighborhoods nearest downtown, except for the West Loop.

e median price of condos sold in the West Loop in January was up more than 28% from a year

ago, according to online real estate marketplace Red n. e Chicago-area condo market overall, while not soaring, has been outperforming the comparables in some other cities. According to data from Red n on six U.S. cities with large numbers of condos, Chicago’s price growth has been comparatively good.

Metrowide, Chicago condo prices rose by 130% between February 2013 and January 2023, according to Red n. e two other markets performing better during that time were Seattle, where prices grew by 185%, and Los Angeles (154%). Lagging Chicago were Boston (119%), Washington (40%) and Philadelphia (43%).

It’s primarily the Loop and its surroundings, long the hub of Chicago jobs and cultural o erings, where the losses are most persistent.

How Chicago won the new Chan Zuckerberg biotech lab

It only took $250 million to get the University of Chicago, Northwestern University and the University of Illinois Urbana-Champaign to learn the value of cooperation

BY JOHN PLETZ

Leave it to Mark Zuckerberg, who made a fortune by bringing 2 billion people together online, to bring together three Illinois universities that have more often competed than collaborated.

The Facebook founder and his wife, Dr. Priscilla Chan, did it by dangling a quarter-billion dollars for a biotech-research center with few strings attached — except that at least three universities participate in each bid.

Mayors and governors — and plenty of outsiders — have long wondered about the possibilities of harnessing three top-tier universities and the talent and capital available in the nation’s third-largest metro area. ey couldn’t help but notice the same ingredients that the Bay

Area or Boston have ridden to economic success.

“You just couldn’t bring them together,” says Paul O’Connor, former head of World Business Chicago under Mayor Richard M. Daley.

Thanks to a combination of pluck, luck and mutual self- int erest, it finally happened. The University of Chicago, Northwestern University and the University of Illinois Urbana- C hampaign partnered in a way they never have before to land the $250 million Chan Zuckerberg Biohub, which was announced March 2.

“ is is the Holy Grail,” O’Connor says. “It changes everything.”

For more than a year, two dozen scientists and the heads of research from the U of C,

U of I and Northwestern spent their Saturday mornings on Zoom working on the pitch to land the project.

e three universities already had a lot working in their favor. In many ways, the Chan Zuckerberg Initiative’s criteria for a follow-up to its successful San Francisco biohub seemed tailor-made for the Illinois schools.

TALENT

As part of its goal to “understand how cells and tissues function and increase our understanding of human health and disease,” CZI wanted the new research center to use embedded sensors and probes to collect biological signals from human tissues. It placed an emphasis on an interdisciplinary

approach, combining engineering and other sciences, such as biology and chemistry.

e U of C launched a molecular-engineering institute in 2011, attracting researchers such as Je rey Hubbell, who specializes in immunology and in ammation.

Northwestern has been building on its expertise in chemistry, materials science and nanotechnology and hired star researchers, such as John Rogers, an expert in micro uidics and implantable electronics, and Shana Kelley, whose research focused on biological sensing.

e University of Illinois launched the Institute for Genomic Biology in 2006, which includes a tissue-research program. e genomics institute and the engineering school already had partnered e orts to design engineered tissues to study and measure individual cells.

“ e whole idea of in amma-

tion and immunity — bringing in nanotech and sensors — intersects with the expertise of all three institutions,” says Rashid Bashir, a biomedical engineer who is dean of the U of I’s Grainger College of Engineering.

It didn’t hurt that the heads of research at the three schools are experts in elds related to what Chan Zuckerberg wanted to do with its next biohub.

Milan Mrksich, vice president of research at Northwestern, is a professor of biomedical engineering; Susan Martinis at the U of I is a professor of molecular and cellular biology. e U of C’s Juan de Pablo is a molecular engineering professor with research expertise in proteins and their relationship to diseases such as diabetes.

“Everyone knows each other pretty well,” de Pablo said. “Previous partnerships helped

4 MARCH 6, 2023 • CRAIN’S CHICAGO BUSINESS

JOHN R. BOEHM

See CHAN ZUCKERBERG on Page 17

Can a high school shed tears?

WE HAVE LOST A FRIEND who was the main reason we’re still here.

Andy McKenna was more than a well-known, widely admired business figure and civic leader here in Chicago. He was the recipient of the first Leo Lions Legacy Award for lifetime service to others.

His belief in us and our trust and gratitude toward him is why we’re still around for the 97th year of our Mission, a beacon of hope on 79th Street.

Andy inspired others to look at what we do for students who can’t a ord us. Scholarships that he helped finance now o er our young Leo Men opportunities they never dreamed of.

There may never be another Chicagoan as instrumental in lifting the vision of young, needy students toward a better tomorrow. Andy will be missed. But he would have wanted you to meet “our guys” and see the future of Chicago he saw in them, a future that Leo helped Andy see in himself when he was a student here back in the ’40s.

THANK YOU, ANDY. GOD BL ESS.

Dan McGrath ’68, President

Shaka Rawls ’93, Principal

In 2016, Leo held its first Scholarship Benefit. Mr. McKenna accepted the first Leo Lions Legacy Award, and the accompanying Leo school sweater, as recognition for his lifetime of service to others. The young men pictured are Damari Owens ’17 and Aamir Holmes ’17.

7901 S. Sangamon Chicago, Illinois 60620 773-224-9600

Leo Catholic High School Creating possibilities for life

STARTS

Georgian Style Home

Northern

Trust hired workers in ’22 at the fastest clip in a decade

Most of the net new jobs for Chicago’s largest locally headquartered bank were outside the U.S., though

BY STEVE DANIELS

Northern Trust added about 2,500 to the payroll last year, a 12% increase that was the company’s steepest one-year job boost in the past decade.

The global headcount of Chicago’s largest locally headquartered bank totaled 23,600 at the end of the year, according to a Feb. 28 Securities & Exchange Commission filing.

Much of that workforce growth took place outside the U.S. For the first time ever, Northern had the same percentage of employees — 42% — located in the Asia-Pacific region as in the U.S. The remaining 16% worked in Europe and the Middle East.

Over most the past decade, Northern’s annual workforce growth has been around 5%.

In recent years, Northern has hired those additional workers outside its Chicago base. In a strategy to reduce expenses, the company several years ago outlined a vision to bring in new employees in “lower-cost” regions; those didn’t include Chicago.

Northern employs 6,500 in Chicago now, spokesman Doug Holt says. That figure has bounced around over the past few years but is about the same as it was in 2019. Since then, the company has expanded its workforce by 19%, according to SEC filings.

GLOBAL HIRING

Last year marked another large bump in employment abroad for a company whose institutional clients span the globe while growth domestically has been more muted. Still, there clearly was meaningful hiring in the U.S. last year. e U.S. share of 23,600 comes to 9,912. In 2021, the do-

mestic percentage of Northern’s workforce was 43%, but with a smaller base of 21,100 employees, the total was around 9,073.

Northern has a major o ce in Tempe, Ariz., in addition to its headquarters on LaSalle Street and a substantial presence at 333 S. Wabash Ave.

Northern is under re from investors for expense growth last year that well exceeded revenue growth. It responded by saying it would lay o between 300 and 400 early this year.

But even after as many as 400 job cuts, Northern’s headcount is 10% higher than it was at the end of 2021.

RIVALS’ COSTS

By comparison, rival trust banks State Street and Bank of New York Mellon held the line more on costs. State Street’s workforce increased 8% while BNY Mellon’s was up 5% in 2022, according to filings. Northern, State Street and BNY Mellon compete globally in the business of safeguarding and processing transactions involving trillions of dollars for institutional investors, as well as managing money for wealthy families and individuals.

Says Holt in an email, “Northern Trust’s investment globally and in Chicago aligns with our commitment to strengthen our foundation through technology and resiliency, advance our digital modernization efforts and drive growth and client service excellence.”

Northern’s stock is down 6% since reporting disappointing earnings on Jan. 19 and 12.6% over the past year. In the last year, BNY Mellon’s stock has fallen 3.7%, while State Street’s has risen 5.8%.

6 MARCH 6, 2023 • CRAIN’S CHICAGO BUSINESS LUXURY HOME OF THE WEEK Advertising Section IZABELA DIAN OVS KY 847.409.5173 idianovsky@jamesonsir.com Hi

This iconic residence sits on two and a half acres of beautifully landscaped property and has undergone an extensive renovation in the past three years. The exquisite indoor and outdoor features, and unparalleled design, make this property a North Shore oasis! ©2023 Sotheby’s International Realty A liates LLC. All rights reserved. Sotheby’s International Realty® and the Sotheby’s International Realty Logo are service marks licensed to Sotheby’s International Realty A liates LLC and used with permission. Sotheby’s International Realty A liates LLC fully supports the principles of the Fair Housing Act and the Equal Opportunity Act. Each o ce is independently owned and operated PRIVACY

here Chicago Title Land Trust Company will help keep your personal real estate information private. www.ctlandtrust.com 888-878-7856 CONTACT US Chicago Title Land Trust Company

storic

Northern Trust’s global headcount totaled 23,600 at the end of the year.

BLOOMBERG

Lightfoot’s economic development, real estate programs in flux with next mayor

for hand-wringing that some of that momentum will be lost. Yet some also are re-energized by the change, hoping a new administration — perhaps with the highly progressive Johnson at the helm — could be more e ective and e cient in executing economic development projects.

Big developers and commercial property owners downtown, meanwhile, are counting on new leadership to improve public safety measures that might help bring more foot tra c downtown and get institutional investors and lenders to look at Chicago more positively. Vallas’ platform would appear to be more friendly to downtown real estate interests.

“It’s de nitely a point of in ection for the city,” said LG Development Chief Investment O cer Danny Haughney, whose rm is building apartments in the trendy Fulton Market District and also trying to complete a nancing puzzle for a $20 million Invest South/West residential project in Bronzeville. “So much needs to be gured out — there’s a lot for the new mayor to tackle.”

e fate of Invest South/West as a platform to channel more resources into disinvested neighborhoods is one of the biggest questions. Lightfoot billed the program early in her

term as a “Marshall Plan” for 10 investment-starved South and West Side communities, calling for $750 million in public money and resources to be directed into vacancyridden commercial corridors.

Neighborhood developers have widely praised that commitment as a vast improvement from previous administrations and say it is helping to bring new private investors to the table.

Prompted by city-solicited bids that served as the centerpiece of Invest South/West, housing and commercial projects totaling almost $500 million in costs — most of which is slated to come from public funding and incentives — continue to move through various city approvals, some in areas that have gone decades without meaningful investment.

Lightfoot has held a handful of ceremonial groundbreaking events for those Invest South/West projects in recent months, but only one of them — a pair of residential buildings in Auburn Gresham — is actually under construction today. Projects planned in Englewood and Austin have received some permits to begin work, according to the Department of Planning & Development, while others, including LG’s plan, still need approval from the City Council on zoning and public subsidies before they can move forward.

Critics of the Invest South/West program lament the red tape that has slowed those projects, most of which now hinge on the next administration shepherding them forward. But completing them and building on the foundation Lightfoot has laid will be crucial to maintaining the momentum of neighborhood investment, said veteran community developer Leon Walker of DL3 Realty.

“Future administrations will take some lessons learned from the execution (issues), but the underlying policy itself is durable and sorely needed,” said Walker, who recently won a city panel’s approval for more than $10 million in tax-incrementnancing money for an Invest South/ West residential project in South Shore.

HISTORY

Economic development programs and policies have a history of spanning multiple administrations in Chicago. Lightfoot herself leveraged former Mayor Rahm Emanuel’s Neighborhood Opportunity Bonus program — which redirects money from downtown developers into South and West Side neighborhoods — to supplement her Invest South/West strategy. As part of her Chicago Recovery Plan as the COVID-19 pandemic subsides, the city has used Neighborhood Opportunity Bonus and TIF funds to allo-

cate 75 grants totaling $55 million for small businesses in Invest South/ West corridors, according to the planning department.

Lightfoot’s nascent initiative for vacancy-plagued LaSalle Street is another key program the next mayor will either choose to adopt, modify or abandon, with the future of Chicago’s urban core at stake. e program dangles subsidies like TIF to developers that will revamp outmoded o ce properties on and near LaSalle with apartments, provided at least 30% of the new units created would be a ordable.

e planning department recently narrowed down a list of proposals for LaSalle Street to six nalists that were presented at a March 2 virtual community meeting. e city aims to announce three projects on which it would be moving ahead by the end of March. at plan envisions development work beginning in 2024.

Chicago developer Mike Reschke, who has proposed two of the six projects and is separately teaming with Google on a plan to redevelop the James R. ompson Center, said he’ll expect to take that LaSalle Street process “week by week” as the city prepares to transition to a new administration. But he’s hoping the change in leadership improves Chicago’s reputation among big nancial partners that may be avoiding the city because

of both real and perceived crime issues.

“I think everybody would have to say Chicago needs change. We’ve been maligned, I think mistakenly, by the national media, and that’s really hurt investor perceptions of Chicago. So change has to be positive,” Reschke said.

Another big unknown for the city’s real estate scene is the future of the planned Bally’s casino in River West, on the current site of the Chicago Tribune’s Freedom Center printing plant. Lightfoot, whose administration last year selected the Bally’s proposal from a handful of bidders, has been counting on the gambling complex to eventually deliver hundreds of millions of dollars in new annual tax revenue to help plug the city’s underfunded pension gap. e mayor’s o ce has been working to push that project forward, but Lightfoot is now due to leave at a tricky moment: Bally’s is still awaiting the Illinois Gaming Board’s signo for its license to run the casino, and another potential roadblock recently emerged as Chicago Tribune parent company Alden Global Capital is said to be driving a hard bargain for Bally’s to buy out its printing plant lease.

As those issues potentially drag on, it’s unclear whether a new administration will be as motivated as Lightfoot has been to help.

CRAIN’S CHICAGO BUSINESS • M ARCH 6, 2023 7 Download the can tv+ app on GET READY CHICAGO!

Zopp CHIC AG O Wednesdays at 7:30pm on CAN TV Watch it on CAN TV 19, streaming live on-demand on cantv.org and on the can tv+ app

with Andrea

INITIATIVES

from Page 3

Brace for electricity rate shock starting this month

BY STEVE DANIELS

BY STEVE DANIELS

e wholesale cost of energy is at its lowest levels in two years, and Commonwealth Edison customers will be paying the most they ever have for power over the next three months.

Yes, both of those things can be — and are — true.

e average household customer of ComEd will pay about $13 extra per month beginning in March and running through May, thanks to the highest power price ComEd customers will have ever paid and the fact that the cost no longer will be partially o set by payments from the owner of Illinois’ nuclear power plants, ComEd o cials con rm.

e explanation for this strange set of circumstances is a mix of energy politics, subsidies and wildly uctuating energy prices since Russia’s invasion of Ukraine a year ago.

First, the politics and subsidies. Illinois’ Climate & Equitable Jobs Act, or CEJA, enacted in 2021, subsidized three nukes then run by ComEd parent Exelon — now owned by Baltimore-based Constellation Energy Group. The subsidy set a price over five years that ComEd customers would pay for power from those plants.

If actual prices rose above that threshold, Constellation would pay the di erence back to ComEd customers. If they stayed below, customers would pay more to ensure the plants got what the law laid out.

Following the law’s passage, prices spiked and Constellation

was forced to pay beginning last summer. The anticipated credit from the power generator was so substantial that, last summer, it more than offset a remarkable increase in market prices — and kept electric bills manageable in northern Illinois. Gov. J.B. Pritzker and environmentalists who championed CEJA pointed to the result as a triumph for the law, which phases out coal and natural gas as power-production fuels in Illinois until 2045, when they’re banned.

But state regulators, who twice a year run a procurement process that establishes what utility customers pay for energy, opted to lock in for summer 2022, then again for the winter 2022 and spring 2023, at the ultra-high prices prevalent at the time. Since then, those prices have crashed, but customers remain on the hook for the high costs.

at is, until the end of May. At that point, the state will do something it’s never done since the Illinois Power Agency was established more than 15 years ago to run the power-procurement process that previously had been the responsibility of utilities like ComEd — nothing. Or next to nothing, anyway.

MARKET PRICES

Instead of conducting the normal spring procurement that would lock in the cost of most of what’s needed for the summer, the state will allow about half the summer demand to be met by ComEd market purchases on the day before the

power is needed. The Illinois Commerce Commission agreed to this change late last year. Ordinarily, that would leave customers exposed to unexpected price spikes. But Constellation’s subsidy, which CEJA calls a carbon mitigation credit, or CMC, effectively ensures the price can’t be above the threshold in the law, which, for the year beginning June 1, is $32.50 per megawatt-hour.

“To maximize the benefit that the CMC provides as a hedge, we need to be open” to the market rather than locked in, says Scott Vogt, ComEd vice president in charge of power procurement.

The energy cost over the summer — from June through September — is projected to be

about 8 cents per kilowatt-hour. That’s down from the nosebleed price of 9.65 cents for ComEd customers beginning March 1. But it’s nearly 50% above the 5.4 cents that ComEd customers paid last summer after the big Constellation credit was applied to their bills. That translates into about $18 a month more per month for an average household in a normal summer.

CLAWING BACK

Why are costs not coming down more beginning in June? ComEd rebated too much to customers based on what it thought it would get from Constellation per the CEJA credit. ComEd in June will charge close to a penny per kilowatt-hour each month just to begin to claw

back the rebates that turned out too generous.

Even though it’s lower than ComEd’s spring energy charges, that 8-cent charge otherwise is higher than any power price ComEd customers have paid in at least a decade.

CEJA now turns out to make electricity more expensive than it would have been otherwise — at least for the coming summer.

The higher energy costs may well put more pressure on the ICC to rein in ComEd’s proposal for a $1.5 billion delivery rate hike over four years beginning in 2024. Consumers’ electric bills are made up of energy charges, which ComEd passes along at no markup, and delivery charges are the source of ComEd’s profits.

O’Hare gets $50 million from FAA for Terminal 3 upgrades

BY JOHN PLETZ

e FAA is picking up a quarter of the $200 million tab for upgrades set to begin soon at O’Hare International Airport’s Terminal 3.

e $50 million comes from the 2021 infrastructure bill, which included $25 billion for airports. e new money will be used to recon gure the terminal’s security checkpoint, update its baggage handling system, add retail space, widen the corridor between concourses K and L and build restrooms that comply with the Americans With Disabilities Act. e rest of the tab — $150 million — is covered by previously allocated federal funds as well as landing fees and other charges paid by the airlines that serve O’Hare.

Additional Terminal 3 improvements also are planned.

“Americans deserve the best

airports in the world, and with demand for air travel surging back, this funding to improve the passenger experience couldn’t come at a more urgent time,” U.S. Transportation Secretary Pete Buttigieg said in a statement. “These grants will make it faster and easier to check your bags, get through security and find your gate, all while creating jobs and supporting local economies.”

‘ICONIC’

e face-lift is expected to start this summer and be completed in 2025. Terminal 3 is home to American Airlines, the airport’s second-largest carrier, behind United.

“Terminal 3 is an iconic piece of Chicago infrastructure that must remain a key part of the nation’s aviation system for decades to come,” Chicago Aviation Commissioner Jamie Rhee

said in a statement.

O’Hare is in the midst of a major terminal upgrade. Terminal 5, which primarily was used for international ights, has undergone a $1.3 billion expansion over the past four years.

But the big project is the $7.1 billion replacement of Terminal 2, which will create an entry point for inbound international travelers to connect more easily to the domestic terminals serving United, American and their partner airlines.

It also will include new satellite concourses that will boost overall gate space for aircraft by about 25%. Prep work on the new satellite concourses will begin this spring.

e Terminal 2 replacement might also qualify for funding from the infrastructure bill, which provides $1 billion in airport funding annually over ve years.

Rising material, labor and borrowing costs have driven up the price tag since the $8.5 billion program of new terminals and other projects that was announced ve years ago.

Combined with other related capital improvements and maintenance projects, O’Hare is undertaking what’s now projected to be $12.1 billion in assorted construction projects.

8 MARCH 6, 2023 • CRAIN’S CHICAGO BUSINESS

A mix of energy politics, subsidies and uctuating power prices will have ComEd charging far higher prices this spring. Summer doesn’t look great, either.

The average household customer of ComEd will pay about $13 extra per month beginning in March and running through May.

WIKIMEDIA COMMONS

GETTY IMAGES

The face-lift is expected to start this summer and be completed in 2025.

Target, Solo Cup warehouses coming to SW suburbs

Target’s plan to move into a 1.2 million-square-foot building in Joliet is the biggest industrial lease in the Chicago area in more than two years

BY ALBY GALLUN

Two well-known corporate names, Target and Solo Cup, are expanding their industrial footprints in the Chicago area, signing leases for huge warehouses in the southwest suburbs.

In the larger deal, Target conrmed it has leased a 1.2 millionsquare-foot industrial building under construction in the ird Coast Intermodal Hub, an industrial park under construction in Joliet. It’s the biggest industrial lease in the Chicago area in more than two years and part of a multiyear expansion of Target’s local distribution network.

Solo Cup, meanwhile, has leased a 1 million-square-foot warehouse in Country Club Hills built by Chicago developer CRG, according to people familiar with the transaction. e two new distribution centers combined could employ several hundred people, if not more.

e leases highlight the continued strength of the Chicago industrial real estate market, even as higher interest rates and economic uncertainty have caused many businesses to curb expansion plans and cut jobs. e industrial

vacancy rate fell to a record low of 4.5% at the end of 2022 amid a prolonged boom that has brought some glamour to a meat-andpotatoes real estate sector.

e leases also o er an encouraging sign to developers building monster warehouses on speculation, or spec — without signing up tenants before breaking ground.

Developers have been building on spec at a frenzied pace, breaking ground on 88 local spec industrial buildings totaling a record 31.8 million square feet in 2022, according to Colliers.

ough construction has slowed down amid higher interest rates and greater caution among lenders, strong demand for warehouse space will need to continue to soak up all that new supply.

“Both leases demonstrate that industrial demand hasn’t backed o much at all, especially for mega-sized spec warehouse projects,” Craig Hurvitz, vice president of research in Colliers Rosemont o ce, wrote in an email.

e Target spokesman conrmed the Minneapolis-based retailer has leased a 1.2 millionsquare-foot warehouse at 101 Compass Boulevard in Joliet for

a “supply chain facility.” It’s the rst building leased in a 530-acre industrial park approved by the Joliet City Council last May. A representative of the project’s developer, Kansas City, Mo.-based NorthPoint Development, did not respond to a request for comment.

EXPANSION

Target has been expanding its local distribution network in recent years, opening a 1 millionsquare-foot warehouse in Chicago’s Little Village neighborhood in 2021. It followed up last year with leases for two smaller warehouses in Elmhurst and on Chicago’s Southwest Side, near Midway Airport. e chain also operates a 1.4 million-square-foot distribution center in DeKalb and another 1.2 million-square-foot facility in Joliet that opened in 2019, according to real estate data provider CoStar Group.

Target also recently disclosed a $100 million plan to expand its next-day delivery capabilities by opening six new sorting centers around the country.

It’s unclear how many people will work at Target’s new Joliet warehouse. When it opened its Lit-

tle Village distribution center, the company set out to hire 2,000 employees to work there. e Target spokesman declined to elaborate on the retailer’s plans for the Joliet facility, writing that “we’ll have more details to share as we get closer to opening.”

Solo Cup is moving into the Cubes at Country Club Hills, a 1 million-square-foot building CRG developed near the intersection of interstates 57 and 80. Once a private company based in Lake Forest, the maker of the red plastic cups popular with partygoers was acquired in a $1 billion deal in 2012 by Mason, Mich.-based Dart Container.

A Dart spokeswoman declined to comment. CRG announced the lease but declined to name the

tenant, identifying it only as “a national manufacturer.”

e southwest suburbs are a popular spot with many companies seeking distribution space, because they’re close to important crossroads. With warehouses near the intersection of I-80 and I-57 or I-80 and I-55, they can ship goods by truck to a large section of the country in just one day.

“With proximity to a wide swath of the U.S. population, the Midwest ranks as a top industrial market, and modern super-bulk facilities like this one are in short supply,” Je Lanaghan, CRG senior vice president, said in a statement. Brokers at Cushman & Wakeeld represented CRG in the lease, while brokers at Newmark represented Solo Cup.

CRAIN’S CHICAGO BUSINESS • M ARCH 6, 2023 9 On being named President of Management Consulting Learn how Kate and Kaufman Hall’s team support healthcare and higher education clients. Congratulations, Kate Guelich KaufmanHall.com

Solo Cup is moving into this 1 million-square-foot warehouse, the Cubes at Country Club Hills. CRG

is issue must get its due in the mayor’s race

Now that we know who’s in the running to replace Mayor Lori Lightfoot — Brandon Johnson and Paul Vallas — it’s time to get serious about the least talked-about issue on the campaign trail so far: economic development.

ere’s no doubt the dominant themes that shaped the run-up to Election Day — education, housing, transportation and, of course, crime and policing — deserved to be hashed out vigorously as the mayor and her challengers jockeyed for position. All these issues matter deeply to voters, and public safety in particular — or the lack of it — proved to be the deepest thorn in the mayor’s side, the obstacle she could never quite seem to surmount, and the civic a iction that tarnished Chicago’s reputation on the world stage.

at said, Chicagoans can’t hope to solve the problems that ignited such sharp debate in the pre-runo period if the city doesn’t maintain and even shore up its economic base. So it’s been disappointing to see spending priorities and jobs take a back seat — only lightly touched on during debates, if at all — but now there’s an opportunity to put economic policy front and center in the runo .

As Crain’s Danny Ecker reported, Lightfoot’s wide-ranging Invest South/West program, her recent push to incentivize a LaSalle Street revival with a ordable housing, the planned Bally’s riverfront casino she has pushed forward and even future city support for an annual NASCAR race around Grant Park that Lightfoot has touted are just a handful of the high-prole e orts that hang in the balance for the next mayor, with little clarity about what will continue, what won’t and who will be making those decisions.

BOTH OF THE ELECTION DAY SURVIVORS HAVE SKETCHED OUT BROAD ECONOMIC PLANS THAT OFFER CONTRASTING IDEAS ABOUT HOW BEST TO FUND CITY GOVERNMENT, INVEST PUBLIC RESOURCES AND STIMULATE SMALL-BUSINESS GROWTH.

It so happens that both of the Election Day survivors have sketched out broad economic plans that offer contrasting ideas about how best to fund city government, invest public resources and stim -

ulate small-business growth. In a live forum sponsored by Crain’s, Johnson appeared to backpedal away from some of the worst proposals in his blueprint — especially a commuter tax on Metra

riders coming into the city. Vallas, meanwhile, also has laid out some plans — including a pitch to create an independent community development authority that “would operate free from City Hall politics” but be funded by City Hall money, while also envisioning the creation of a municipal bank — ideas that sound a lot like former Mayor Rahm Emanuel’s Infrastructure Trust, which never really produced much in the way of tangible results.

So the candidates have released their economic development manifestos, but each plan contains elements that deserve further scrutiny — certainly more than they have gotten so far. Now Chicagoans can and should start asking Vallas and Johnson to answer some key questions — and then they should focus closely on the answers. For instance:

What is your top spending priority — and how would you pay for it?

What city programs, if any, need to be cut, and by how much?

Is there a clash between creating more jobs downtown and in the neighborhoods? What would be your particular plan for each?

Do you support a city income tax? A head tax on city employers? Annual, in ation-adjusted property tax increases?

What changes, if any, would you make to the city’s tax-increment nancing program?

What further steps are necessary to improve the city’s bond rating?

e positions Vallas and Johnson stake out between now and April 4 will either give employers and investors reason to believe Chicago is open for business — or, on the ip side, further shake con dence in e City at Works.

Lowering energy costs starts with nuclear

As Illinois families and businesses continue to struggle with tightening budgets, lawmakers must prioritize reducing energy costs. There are many factors that play into price increases, including global markets, economic pressures and restrictions of production. However, there is something we can do right now to lower costs — eliminate the state’s arbitrary moratorium that has been restricting the construction of new nuclear power plants for over 35 years.

Illinois is one of just 12 states with such a restriction on the construction of new nuclear power facilities. This restriction has remained in place even though our

state has more nuclear power reactors than any other state, which have efficiently and safely produced carbon-free electricity for Illinois residents for roughly four decades. Additionally, states that have had these moratoriums in place have begun removing them, including West Virginia and Indiana. ese two states have traditionally produced the vast majority of their electricity through coal- red power plants and have recognized the potential nuclear energy can play in a ordably replacing their carbon-producing energy sources.

Thanks to our state’s nuclear energy history, we are poised to take immediate advantage once our own archaic mora -

torium ends. However, if we continue to sit back and allow the moratorium to continue, we risk losing our competitive edge in the nuclear energy industry, especially as newer and safer nuclear energy technology rapidly emerges.

This is why for the past two years I have filed legislation that would delete the language from our books that prohibits construction on any new nuclear power plants, and have advocated that our state take a long and serious look at emerging advanced small modular reactors or so-called “micro nukes.”

“Micro nukes” are small reactors that can be located in small factories, or even inside already existing legacy coal- red

power plants that are scheduled to be decommissioned under Illinois’ Climate & Equitable Jobs Act. An important factor is that these smaller nuclear reactors can be placed in pre-existing coal- red power

plants, which means we wouldn’t have to spend as much time and money building new infrastructure as we currently have to for new renewable projects.

Another added benefit to “micro nukes” is they offer large companies

10 MARCH 6, 2023 • CRAIN’S CHICAGO BUSINESS

EDITORIAL

Sound o : Send a column for the Opinion page to editor@ chicagobusiness.com. Please include a phone number for veri cation purposes, and limit submissions to 425 words or fewer. Write us: Crain’s welcomes responses from readers. Letters should be as brief as possible and may be edited.Send letters to Crain’s Chicago Business, 130 E. Randolph St., Suite 3200, Chicago, IL 60601, or email us at letters@chicagobusiness.com. Please include your full name, the city from which you’re writing and a phone number for fact-checking purposes.

AP IMAGES YOUR VIEW

State Sen. Sue Rezin, R-Morris, represents the 38th District.

“MICRO NUKES” ARE SMALL REACTORS THAT CAN BE LOCATED IN SMALL FACTORIES, OR EVEN INSIDE ALREADY EXISTING LEGACY COAL-FIRED POWER PLANTS.

seeking to reduce their carbon footprint the ability to replace their carbon-producing power plants with carbon-free, reliable and resilient power.

New nuclear power plants, whether they be traditional or “micro nukes,” would also greatly benefit the local economies of traditional coal communities in Illinois that are currently facing the potential loss of hundreds to thousands of permanent jobs once their coal plants’ fires are extinguished. Building 24-hour-producing nuclear power stations in traditional coal territory would infuse millions of dollars by providing good-paying jobs within communities that have become blighted over decades of job loss while dramatically increasing our state’s energy capacity.

As Illinois moves forward with its carbon-free energy goals, it is our duty to, at the very least, give our public utility and energy companies the option to choose whether they want to invest and build the most efficient and reliable means of producing carbon-free energy. It is time for us to end our nuclear energy moratorium by passing Senate Bill 76.

President/CEO KC Crain

Group publisher/executive editor Jim Kirk

Editor Ann Dwyer

Creative director Thomas J. Linden

Director of audience and engagement

Elizabeth Couch

Assistant managing editor/audience

engagement Aly Brumback

Assistant managing editor/columnist Joe Cahill

Assistant managing editor/digital

content creation Marcus Gilmer

Assistant managing editor/digital Ann R. Weiler

Assistant managing editor/news features

Cassandra West

Deputy digital editor Todd J. Behme

Deputy digital editor/audience

and social media Robert Garcia

Digital design editor Jason McGregor

Associate creative director Karen Freese Zane

Art director Joanna Metzger

Digital designer Christine Balch

Copy chief Scott Williams

Copy editor Tanya Meyer

Contributing editor Jan Parr

Political columnist Greg Hinz

Senior reporters

Steve Daniels, Alby Gallun, John Pletz

Reporters

Katherine Davis, Brandon Dupré, Danny Ecker, Jack Grieve, Corli Jay, Justin Laurence,

Ally Marotti, Dennis Rodkin, Steven R. Strahler

Contributing photographer John R. Boehm

Researcher Sophie H. Rodgers

Senior vice president of sales Susan Jacobs

Vice president, product Kevin Skaggs

Sales director Sarah Chow

Events manager/account executive Christine Rozmanich

Production manager David Adair

Events specialist Kaari Kafer

Custom content coordinators

Ashley Maahs, Allison Russotto

Account executives Linda Gamber, Claudia Hippel, Menia Pappas, Bridget Sevcik, Laura Warren

Sales administration manager Brittany Brown

People on the Move manager Debora Stein

Keith E. Crain Chairman

Mary Kay Crain Vice chairman

KC Crain President/CEO

Chris Crain Senior executive vice president

Robert Recchia Chief nancial o cer

Veebha Mehta Chief marketing o cer

G.D. Crain Jr. Founder (1885-1973)

Mrs. G.D. Crain Jr. Chairman (1911-1996)

For subscription information and delivery concerns please email customerservice@ chicagobusiness.com or call 877-812-1590 (in the U.S. and Canada) or 313-446-0450 (all other locations).

A recent Crain’s article (ChicagoBusiness.com/MJmansion) exploring some things Michael Jordan could try to get his Highland Park mansion sold after being on the market for 11 years prompted readers to weigh in on Facebook:

Open it as tourist attraction.

Should Airbnb or hotel.

— Richard Baccay

— Karen Choklad

Michael Jordan Camp for Young athletes . . . Training center plus is a write o . — Markus BlankeCorp

Make it a tourist attraction kinda like Elvis with Graceland. Charge tickets, etc.

— Angelo Gatsios

Level it and turn the entire area into a green space.

— Joseph Michael

But they sell his shoes for $100 million.

— William Creaney

Turn it into a school. It’s big enough. It has a gym, work out, pool.

— Scott Zenger

Bulldoze the freaky structure. Sell the dirt.

— Joseph Fosco

CRAIN’S CHICAGO BUSINESS • M ARCH 6, 2023 11 YOUR VIEW Continued READERS RESPOND

CRAIN’S CHICAGO BUSINESS ChicagoBusiness.com/CareerCente r Connecting Talent with Oppor tunity. Fr om to p ta lent toto p em pl oyer s, Crain’s Career Center is the next step in yo urhiring process or job se arch . G et started to da y

Want better government? Strengthen the City Council.

If there is one o ce I’ve never aspired to, it is that of a Chicago alderperson — not because it is unimportant but because it is. e quality of an alderperson makes not only a di erence, but the di erence, sometimes in the life of the city, certainly in the life of a community and the families and individuals who live there.

It is not the hours or the pay that have kept me from running, but the lack of anonymity. Unlike members of Congress, state legislators, Cook County board commissioners — whose names most people do not know — alderpersons are our neighbors. We see them on the street, at the grocery store or in the park. We can call or stop by their o ces. If we have an urgent issue to discuss, we are likely to be able to reach them on their personal cellphone.

Pundits and journalists point to Los Angeles, New York, Philadelphia, Houston and other cities and ask, Why can’t we be like them? Why can’t we adopt a formal city charter and streamline government, with fewer wards and fewer alderpersons who spend more time on policy and citywide issues?

I lived for 10 years in L.A., and from time to time have lived and worked in New York. I cannot begin to tell you the relief I felt every time I returned home to Chicago (well perhaps not so much in the last four years). Here

the streets are generally clean, building codes are followed, most neighborhoods are intact, and housing prices are relatively a ordable, especially compared to the wholesale destruction of neighborhoods in New York.

Of course, we worry about gentri cation in Chicago. It seems to me however that most longtime residents of underinvested neighborhoods welcome the density and income mix that attracts new stores, new jobs and other amenities. at’s unlike either L.A. or New York, where whole neighborhoods are razed despite the ardent, sometimes massive objections of the residents — if they know about the proposed changes at all.

Doubt me? Talk to the former residents of Fort Green, Dumbo and other historic neighborhoods where now sprawling complexes like Brooklyn Yards have taken the place of organic, human-scale development. Or go to L.A. where, while no one is watching, families are piled into illegally converted garages.

NO ONE TO CALL

In Brooklyn, when my daughter’s landlord took out the back wall of their apartment (while she was attending her fatherin-law’s funeral), there was no one to call; no one to answer the city hall phone; no one to advocate for her.

City Hall in Chicago is hard to reach, too. Try calling the housing, water or building departments, rat control or streets and sanitation. If you get a call back, lucky; if you get a human being, go play the lottery today. And if someone acts on your request, it’s a miracle.

e di erence in the lives of Chicagoans and our neighborhoods are local alderpersons, at least the good ones.

Consider that, when the manager of the Hispanic Housing Development Corp. imperiled senior citizens in their Rogers Park apartment building, it was the alderperson who raised the alarm.

Or take the Hilco issue, in which a botched smokestack demolition caused air-quality issues in Little Village. It was Ald. Mike Rodriguez who acted on behalf of the residents of the ward.

Or in the 10th Ward, it was City Hall that OK’d General Iron’s relocation to the 10th Ward, leaving Ald. Susan Sadlowski Garza to clean up the mess.

It was Ald. Tony Beale in the 9th Ward who, with his local police commander, protected the Walmart on which his constituents depend for food and medicine, when City Hall decided to not send police to the neighborhoods during the civil unrest of 2020. e 9th Ward Walmart was the only one on the South or West Side to avoid looting and vandalism.

Or we can go farther back and look at responsive, active alderpersons like Helen Shiller, Luis Gutierrez and Walter Burnett, who carefully calibrated essential new de-

velopment and investment with protections for residents, assuring that people of more modest means could continue to live in communities as new residents moved in and public and private investment brought jobs, stores and amenities.

Yes, alderpersons could do a better job at legislating, but the answer is not to reduce their numbers but support them with the tools they need to be more e ective in every aspect of their job.

SIMPLE MEASURES

We don’t need a complicated process or even a city charter to get this part right. As early as 2010, City Council members recommended simple strengthening measures including an independent budget analyst and parliamentarian and legal counsel of their own. Former Mayor Rahm Emanuel did not respond. Mayor Lori Lightfoot promised to adopt them but has not acted.

It’s not hard. Give alderpersons what they need to add e ective legislator to their essential role as advocate and agent for the quality of life, voice and well-being of the residents in their wards. Give them adequate sta , an independent budget o ce and access to their own legal expertise. Give them what they need to do every part of their job well, and then we can hold them accountable for a scally sound, compassionate, competitive, amenity- and opportunity-rich city as well as for the local services that contribute to an enviable quality of life for all of us.

Reform of Chicago’s City Council should come from within

The road to hell is paved with good intentions. E orts by reformers to radically ‘improve’ the City Council by cutting the number of aldermen is one such road, writes the former commissioner of Chicago’s Department of Planning & Development.

The road to hell is paved with good intentions. Efforts by reformers to radically “improve” Chicago’s City Council is just such a road.

Marilyn Katz’s recent piece in Crain’s (above) points to this conundrum. Katz is absolutely correct that the real challenge has nothing to do with the size of the council, as the reformers suggest, but rather with it claiming the powers and faculties it already possesses under Chicago’s strong-council/weak-mayor system of government.

Speci cally, Katz suggests that the council should implement several measures it has been considering, including the hiring of an independent budget analyst, as well as parliamentarian and legal counsels. ese are fundamental steps on the road to a more deliberate and e ective council, one that can deal e ectively with whomever the next mayor might be.

Yet there are a few radical reformers who insist that a dramatically smaller council should focus more on citywide public policy and legislative matters and less on what might be considered the mundane worries of neighborhood life, like zoning, land development and parking meters, that professional administrators (under mayoral control) should handle. is is where the road to hell begins.

As Katz points out, under the current system, an alderman’s greatest value is in the accessibility he or she now has with constituents — and with what they perceive (and their constituents believe to be) their duty to protect their constituents’ best interests. So they ght over such matters as construction projects, appropriate uses for vacant property, bar licenses and the like, all those things that dramatically affect a local community’s quality of life.

Now, for the sake of argument, let’s say that the number of wards is reduced from 50, to 10 “superdistricts.” Suddenly the ratio of aldermen to constituents goes from 1-to-55,000 (which already seems high) to 1-to-270,000. ere is simply no way that a superdistrict representative could have the same depth of interest in or knowledge of block-level issues, or the same accessibility that aldermen now have. So in e ect, these issues would indeed be ceded to the executive branch, making the superdistrict representatives even less e ective than today’s aldermen are perceived to be.

POWER BROKERS

On the other hand, legislatively, since there would be only 10 of them, each of the superdistrict representatives could become a formidable power broker in his/her own right (mini-mayors?) and quite possibly roadblocks to the city’s progress.

Another argument for the reduction of the council’s size is that it would save money and make city processes more ef-

ficient. It won’t. With district sizes that would roughly encompass five current wards, each of the districts would have to open fully staffed service offices throughout the district, as well as a central office (probably downtown). And there would likely be calls to create yet another government body, a “District Council,” to advise or even legislate on district concerns.

I worked with city councils and individual aldermen throughout my career, starting in 1979. A few were statesmen, a few were criminals; none were saints. But nearly all were sincerely dedicated to their communities and constituents. As Katz suggests, that radically important element of the close personal touch constitutes one of the most important duties of City Council members today — which would be lost in the midst of many of the pro ered reforms.

Katz is correct: Reform of the City Council should come from within and can be done now with little more than the determination of the council itself. at’s the road to reform that should be taken.

12 MARCH 6, 2023 • CRAIN’S CHICAGO BUSINESS

Yes, alderpersons could do a better job at legislating, but the answer is not to reduce their numbers but support them with the tools they need to be more e ective, writes a longtime media consultant to city government.

Marilyn Katz is president of MK Communications, a public policy strategy and communications rm. She has worked with city governments since 1983.

Andrew J. Mooney is a former executive director of the Chicago Housing Authority and most recently was commissioner of the city of Chicago’s Department of Planning & Development.

BANKING

Customers Bank, Chicago

Customers Bank hired industry veteran Frank Bukowski as Managing Director, Fund Finance to cover Financial Sponsors within its expanding Fund Finance Group. With 3 decades of experience banking alternative asset managers and hedge fund administrators, he will cover Private Equity, Venture Capital, Hedge Fund, and Private Debt Funds in the Midwest. Bukowski’s previous experience includes JPMorgan’s Funds Group where he served as executive director and covered similar clients within the region.

BANKING / FINANCE

Wintrust ESOP Finance, Chicago

Wintrust is proud to announce the promotion of Patrick Stoltz to President of the Wintrust ESOP Finance team. Pat has 31 years of commercial banking experience and a proven track record of developing and building relationships, nancial analysis, and risk management. Throughout his career, Pat has been responsible for leading a team of bankers tasked with generating middle-market opportunities in the Chicagoland area and new and mature ESOP opportunities across the country.

EDUCATION

McNair Scholars Program at DePaul University, Chicago