Medline’s new boss has new bosses

The rst CEO from outside the Mills family will answer to a board dominated by PE rms

By Katherine Davis

Newly appointed Medline Industries CEO Jim Boyle is tasked with leading the medical products manufacturer and distributor through its next phase of growth while also paying down a massive debt load left by a leveraged buyout two years ago. Boyle, who was named chief executive in late June after a 27year tenure at Medline, o cially

Renaissance of the Chicago steakhouse

begins his new gig Oct. 1. He is the privately held company’s rst leader not related to the founding Mills family, which launched North eld-based Medline in 1966.

“Five years ago, the Mills family was very intentional about establishing the succession process,” Boyle, 52, says during a recent interview at Medline’s headquarters. “We’ve been working on this for a while. is

Jim Boyle

is a legacy I plan to continue.”

But the Mills family no longer calls all the shots at Medline. Boyle reports to a board of directors dominated by private-equity rms that acquired control of

See MEDLINE on Page 22

By Ally Marotti

By Ally Marotti

Chicago’s steakhouse scene is entering a new era. roughout the city, at least half a dozen steakhouses have recently opened or soon will. ey are not your traditional Chicago-style steakhouse, with white tablecloths, big cuts of meat and buttery sides. ey are niche, modern and have crafted their menus not around exces-

sive beef consumption, but around moderation. e new school of thought: Instead of wowing the consumer with the size of the steak, impress them with the preparation.

ere is Smoque Steak, which smokes its steaks before cooking them sous vide and searing them to order. ere is Asador Bastian, a Basque steakhouse that works

See STEAKHOUSE on Page 23

DAN MCGRATH

Through triumph and setbacks, the smart and witty Rocky Wirtz did well by this town.

PAGE 2

REAL ESTATE

The Old Post Of ce’s owner looks to defy a brutal market with a new project. PAGE 3

C HICAGOBUSINESS.COM I JULY 31, 2023 VOL. 46, NO. 30 l COPYRIGHT 2023 CRAIN COMMUNICATIONS INC. l ALL RIGHTS RESERVED A REMOTE POSSIBILITY

a remote and hybrid workforce can and should change workplaces, neighborhoods and the city I PAGE 11

How

FORUM

JOHN R. BOEHM

New ones are popping up around the city, but they aren’t the traditional white-tablecloth spots

Good intentions aren’t enough to shape smart tax policy

The testimony was powerful enough to make the Grinch wince: A South Side man who spent seven years on the streets, his companions lice and bed bugs. A pediatrician who knows rsthand how homelessness particularly harms kids. A North Side woman who says she’s grown tired in 30 years of waiting for what is still a rich city to do something.

But there also was the business o cial who talked about the 22% vacancy rate in downtown o ce buildings, o ces that used to be lled with well-paid commuters but increasingly are running into insolvency. Or the woman from Rogers Park who urged the city to go slow, because she feared her rent was

going to rise and her relatives across town in Bronzeville could lose a big chunk of their hard-earned nest egg to the tax man.

So it went as a City Council committee held a subject-matter hearing on the proposed Bring Chicago Home ordinance, a well-intended proposal aimed at a real problem, but one that could spark its own unintended consequences unless o cials take care.

How this matter gets resolved is a real test of the governing chops of Mayor Brandon Johnson. He strongly backed the proposal during his campaign, asserting that raising taxes on some well-o people is the correct and progressive way to promote a ordable housing. But now that he is mayor, Johnson also is going to have to weigh the impact of potential overtaxation and cobble together a compromise that is both meaning-

ful and has the votes to pass.

A few facts: According to the city, on an average night, 4,139 Chicagoans are homeless — and that’s not counting refugees. Over the course of a year, 65,611 will spend at least one night on the street or sacked out on a welcoming friend’s couch, about 11,000 of them of school age. Ordinance advocates have seized on the larger number, arguing that it’s big enough that the homeless actually could constitute Chicago’s 51st Ward.

e proposed solution would more than triple the city’s realestate transfer tax on property sales of $1 million or more, moving it from the current 0.75% of the sales price to 2.65%. And despite its earlier billing as a “mansion tax,” the measure would apply not only to residences but any kind of property.

As my colleague Dennis Rodkin computed in a recent story, had the

tax been in e ect on the recent $415 million sale of a Wacker Drive o ce tower, the tax would have been $10.99 million instead of today’s $3.1 million. at’s real money. But then so is the estimated $163 million a year the tax would yield for a ordable housing and homelessness prevention.

ough business people like any other group exaggerate the downside of tax hikes, you don’t have to be a genius to conclude that jacking up taxes at a time when the Loop is reeling is counterproductive. I mean, Johnson is talking about spending tens of millions of dollars to convert old LaSalle Street o ce buildings to residential use. Raising the transfer tax so much at one time could undo the progress the city wants on LaSalle.

I’m more concerned, though, about little people. Much of the city’s a ordable housing stock is in

two-, three- and six- ats, many of them owned by aging people for whom those properties represent their retirement account. An increasing number of those buildings are worth $1 million or more. Taxing Uncle Joe 20 or 25 grand o the top is either going to reduce the nest egg or force up rents, the exact opposite of what advocates say they want.

Team Johnson has signaled it no longer will seek to enact its plan in Spring eld but instead pass it through the City Council and then a voter referendum. It’s also signaling it’s open to change. at’s good, because the $1 million level is too low (it’s $5 million in Los Angeles) and the rate is a lot higher than in competing suburbs where middle-class Chicagoans could move if need be, such as Evanston (0.5% to 0.9%) Oak Park (0.8%) and Skokie (0.3%). I look forward to seeing what the mayor comes up with.

Through triumph and setbacks, Rocky Wirtz did well by this town

Iwasn’t long into the job running sports at the Chicago Tribune when I took a call from William Wirtz’s assistant. Her boss, the autocratic baron of a liquor/ hockey/real estate empire, found it unfortunate that he hardly knew anyone in Chicago media circles these days, she told me.

In other words, a get-acquainted session might stanch the ow of bad publicity that had been washing over Wirtz’s futile Blackhawks operation for years. e call led to a lunch meeting at the United Center. I brought along the Trib’s editor, managing editor and some sports department colleagues.

Hawks VP Bob Pulford and Wirtz’s sons Peter and Rocky joined us in a well-appointed o ce/conference room about the size of a hockey rink. Before lunch Wirtz pulled open a canopy, revealing an astonishingly well-stocked bar, all top-shelf stu , and an obvious intention to start knocking ’em back and telling stories.

With my bosses ordering an iced tea and a Diet Coke, we wouldn’t be doing any meaningful knocking, which was just as well — I was due back at work, and I suspect Mr. Wirtz would have drunk me under the table if I’d tried keeping up with him.

But our abstinence didn’t deter him. e stories got better as the drinks owed, including one that had the Hawks agreeing to help out with a charity event, but only if tickets were priced at $50 rather than $25.

“I don’t do anything for 25

bucks,” Wirtz declared.

“And you wonder why they call you ‘Dollar Bill,’” his son Rocky Wirtz retorted.

at was pretty much the tone of an engaging afternoon, Rocky Wirtz bantering with his cantankerous father, clearly enjoying himself, the only one in the room not intimidated by the old man’s bluster.

is, I thought, is a pretty cool customer — smart, witty, sure of himself. But I didn’t foresee dealing with him much — Rocky busied himself with the liquor business, while Peter was the presumed heir apparent to the hockey team.

Fast forward to 2007, and didn’t the Wirtz family throw us all a curve when Dollar Bill died. Under terms of a little-known succession plan, Rocky got pretty much everything, including the Blackhawks, whom he set about transforming with a single-minded zeal he o set with natural a ability and an easy demeanor.

Pulford’s view of hockey was rooted in the Ice Age, but he retained the old man’s ear in each of his 18 incarnations with the Hawks. Rocky launched Pulford before Dollar Bill was in the ground.

Twice Rocky came to see us at the Trib, ostensibly seeking advice on how to improve the team’s dismal media relations. Rocky knew what he was doing and didn’t really need us, though I genuinely liked the guy and always enjoyed speaking with him.

He blew up a policy his father had long championed and put the Blackhawks on home TV, reconnecting with a fan base that had dwindled into irrelevance. He brought back franchise icons Bobby Hull, Stan Mikita and Tony Esposito as symbols of better times. He snatched John McDonough and Jay Blunk away from the Cubs, where they’d mastered the art of lling

seats with an often inferior product. But his Hawks weren’t inferior for long. e nucleus Dale Tallon assembled and Stan Bowman re ned produced three Stanley Cup championships in ve years, or as many titles as the city’s other pro teams have combined to win in this century. A 13-year string of sellouts at the United Center established Rocky as that rarest of Chicago sports commodities: a team owner who is admired and respected by the fans, if not beloved.

en Brad Aldrich’s depravity took a blowtorch to the entire

organization, setting it back years. Again Rocky did what he had to do and removed everyone who was complicit in the coverup, including some of his most trusted lieutenants. He was devastated . . . and uncharacteristically angry.

e opportunity to land Connor Bedard with the rst pick in this year’s draft had him game for another rebuild and smiling for the rst time in many months. But he won’t get to see it, and that’s just sad. Rocky Wirtz died on July 25, after a brief illness.

Remove hockey and the other business achievements from his

résumé and consider his other contributions: e commerce and jobs he brought to the forlorn neighborhood around the United Center. His commitment to causes promoting health, education and more stable families. His support for youth hockey.

A good man, gone too soon at age 70. Rocky Wirtz did well by his city. Even his old man would be proud.

Crain’s contributing columnist Dan McGrath is president of Leo High School in Chicago and a former Chicago Tribune sports editor.

WINTRUST COMMUNITY BANKS RANKED #1 IN CUSTOMER SATISFACTION FOR PERSONAL BANKING IN ILLINOIS 2 YEARS IN A ROW!

See why we’re also ranked #1 in Convenience, People, Value, and Trust by J.D. Power.

2 | CRAIN’S CHICAGO BUSINESS | JULY 31, 2023

For J.D. Power 2023 award information, visit jdpower.com/awards.

GREG HINZ ON

POLITICS

Greg Hinz

DAN MCGRATH ON THE BUSINESS OF SPORTS

Dan McGrath

Ken Grif n’s condo selloff in Chicago not going well

As the Citadel founder decamped for Miami, he put ve local condos of $10 million-plus up for sale. They haven’t moved as fast as some expected. I

By Dennis Rodkin

By Dennis Rodkin

Ayear ago last week, Ken Gri n put a portfolio of four upper-end Gold Coast condos on the market, each priced at more than $10 million, as he shifted his business and family from Chicago to Florida. Grifn later added a fth condo to the o erings.

It hasn’t gone well.

e asking prices for the ve condos, in three high-rises all within a few blocks of one another, add up to nearly $63.18 million. So far, Gri n, head of the Citadel nancial empire, has sold two, for a total of about $21.43 million.

ere’s still at least $42 million worth of Gri n’s condo inventory left to sell, and that’s only for the units he has put up for sale. Gri n has at least two

Old Post Of ce owner looks to defy market

601W makes a bold investment in a building yet to prove itself as an of ce destination

tively call for more than $300 million in taxpayer subsidies.

e city of Chicago may be trying to help developers get rid of downtown o ce space. But 601W is about to bring a lot more to the market.

e New York-based real estate developer is ramping up marketing for Canal Station, a refurbished o ce building at 801 S. Canal St. with 683,000 square feet of workspace that it aims to have mostly ready for tenants to move into by the end of the year.

e $265 million project is breathing new life into a six-story property stretching almost a full city block along Canal Street between Polk and Taylor streets; it was fully leased to Northern Trust from 1990 until the bank’s lease expired in late 2020.

It’s a bold investment by 601W that appears to y in the face of the prevailing o ce market trends. Downtown o ce vacancy has hit new record highs in nine of the past 11 quarters, driven by a barrage of companies scrapping big chunks of their workspace as they embrace the rise of remote work. at downsizing movement — combined with a big jump in interest rates over the past year — has devastated property values, creating a historic wave of distress that is nancially crushing landlords across the central business district.

Supply and demand are so out of balance that city planning ocials are working with developers on proposals to turn ve large ofce buildings on and near LaSalle Street into residential properties, projects that collec-

at’s the ugly backdrop for 601W and its local leasing partner, Telos Group, as they hunt for tenants to ll a building that has never proven itself as a destination for o ce users.

601W and Telos see a much rosier picture. Canal Station is poised to piggyback o the leasing success of the Old Post O ce, just one large block north and nearly full. e addition of nearby BMO Tower and its recent streak of tenant wins also has helped validate the corporate appeal of the southwest corner of the Loop, an area Telos now calls the “Post O ce District” to build cachet.

One centerpiece of Canal Station’s marketing: It’s meant to be a bargain. Telos projects annual rents in the building will be close to $45 per square foot, including taxes and operating expenses that tenants typically pay. at’s in line with what companies pay for competitive second-tier, or Class B, buildings downtown. Canal Station, meanwhile, will

See 601W on Page 23

Treatment Not Trauma advocates make case to council

The ordinance aims to expand mental health infrastructure by reopening clinics and implementing a non-police emergency response program

Chicago City Council members and public health o cials last week laid out components of a citywide mental health plan that Mayor Brandon Johnson campaigned on — but full details don’t yet exist on how much it would cost or how many workers it would require.

Johnson’s plan is based on the Treatment Not Trauma ordinance, which was originally proposed by Ald. Rossana Rodríguez-

Sánchez, 33rd, in 2020 and calls for reopening 14 mental health clinics and expanding the use of non-police emergency response to crisis events.

Johnson, who was not present at the July 24 hearing, promised voters he would implement Treatment Not Trauma as a way to overhaul and expand city-run mental health programs. Enthusiasm for the ordinance from organizers and residents followed police killings of people with mental illness and the COVID-19 pan-

demic, which exacerbated mental illness for many Americans.

“ e purpose of this hearing today was to open the space to talk about why Treatment Not Trauma is necessary,” said Rodríguez-Sánchez, a Johnson ally who now chairs the Committee on Health & Human Relations. “It was also a moment for people who have been working on this for over a decade to have an opportunity to share the knowledge

See HEALTH on Page 20

JULY 31, 2023 | CRAIN’S CHICAGO BUSINESS | 3

The condos Grif n has on the market or has recently sold are in (from left) No. 9 Walton, the Waldorf Astoria and the Park Tower.

GETTY IMAGES

Katherine Davis

Ken Grif n

See GRIFFIN on Page 22

BLOOMBERG

Danny Ecker

Canal Station is poised to piggyback off the leasing success of the Old Post Of ce, just one large block north and nearly full.

Fulton Market landlord sues developer

Danny Ecker

Danny Ecker

A property near the heart of the Fulton Market District is back on the market after an upstart developer’s plan to buy it and build a $170 million, 17-story o ce building on the site fell through, according to a recent lawsuit over the scuttled deal.

A venture that owns the property at 415-417 North Sangamon Street alleged in a lawsuit earlier this month that an entity led by Chicago commercial leasing broker Joy Jordan defaulted on a purchase agreement for the site by failing to complete the deal after multiple extensions of the closing date. Jordan, a former Telos Group and Sterling Bay leasing agent, launched her own development venture in 2021 and put the Sangamon building under contract last year, ultimately winning City Council approval in March for the 277,000-square-foot project.

e seller, an entity led by Chicago investor Grey Bemis-Kelley, said in the complaint that her venture agreed in March 2022 to sell her property to Jordan’s development rm, Fortem Voluntas, for $13 million. at deal was amended three

the purchase last month, according to the Cook County Circuit Court complaint, which seeks the release of $500,000 in earnest money, plus interest.

e dispute appears to kill a project that would have added another chunk of available o ce space to Fulton Market, the trendy former meatpacking corridor that has been a magnet for companies while many o ce buildings elsewhere in the city struggle with the rise of remote work.

from local high-net-worth real estate investors and aimed to develop the building on speculation, or without any tenants signed in advance.

But landing nancing for any major new commercial development over the past year has been di cult, let alone an o ce building at a time when many companies are cutting back on workspace. Higher interest rates have driven up borrowing costs and banks have tightened up lending amid economic uncertainty.

“Any time you start a company, especially in a heavily-male business, you have to have strong will behind it,” Jordan said in an April 2022 interview with Crain’s.

“A lot of women are just too scared and don’t feel like they have the support from capital (investors). It’s a very male, buddy-buddy business (where) the capital knows the capital and women are just not part of that community,” she said at the time.

and Kinzie streets and includes a 43,378-square-foot building with an adjacent vacant lot. e property was rezoned earlier this year with a DX-7 designation to allow the larger o ce development, though a new buyer would likely need to win City Council approval for a di erent planned development.

times to push back the closing date as Jordan sought City Council zoning approval for her project, ultimately delaying the date to June 14 and reducing the sale price to $12.2 million, the lawsuit said. Bemis-Kelley’s venture formally terminated the deal after Jordan failed to deposit the money to complete

Cushman & Wakeeld brokers Michael Marks and Evan Halkias are now marketing the Sangamon property for sale to other investors.

e lawsuit also casts a harsh spotlight on Jordan, who built her name as an o ce leasing broker before trying her hand at development with Fortem Voluntas. Jordan said last year she had raised some equity for the Sangamon project

It’s unclear whether those issues factored into the busted Sangamon property sale. Jordan did not respond to a request for comment, and Bemis-Kelley declined to comment.

Jordan told Crain’s last year that she named her development rm Fortem Voluntas — a Latin phrase meaning “strong will” — as a signal of her intention to stand out in a local development scene whose major players are mostly led by men.

Jordan had teamed with Chicago real estate veteran Howard Blair as a development consultant to oversee construction aspects of the Sangamon project. Blair, who has had a hand in construction of some of the most prominent new o ce buildings in the city over the past three decades, called Jordan a “real force” in an interview last spring about the Fulton Market project and was also an investor in the planned development.

Bemis-Kelley’s property sits at the northeast corner of Sangamon

e Real Deal Chicago rst reported news of the lawsuit against Jordan’s venture. Jordan spent more than seven years at Chicago-based leasing brokerage Telos, where she helped lure companies to Willis Tower as Blackstone Group began a massive renovation of the skyscraper. She joined Sterling Bay in 2019, where she helped lead leasing e orts at the Lincoln Yards megaproject along the North Branch of the Chicago River before parting ways with the developer in 2021.

Jordan was named to Crain’s 40 Under 40 list in 2019 and was previously named to Crain’s 20 in eir 20s list in 2015.

Northern Trust cutting 900 jobs to tame cost growth

ere have been no public pronouncements — no cost-cutting program nicknames like 2017’s “Value for Spend” — but Northern Trust so far this year is eliminating more jobs than it has in any single year in recent memory.

Chicago’s largest locally headquartered bank is in the middle of cutting 900 jobs, about 4% of its global workforce as of the end of 2022.

e cutbacks come as Northern CEO Michael O’Grady scrambles to show Wall Street the company is serious about bringing expense growth at least in line with revenue growth. Over the past 18 months, costs easily have outpaced revenue, in no small part due to substantially higher paydays for workers.

“Rationalizing our cost base remains a top priority, and the governance and control mechanisms we’re putting in place today should drive sustainable improvements for both the near term and for years to

come,” O’Grady told analysts July 19 on Northern’s second-quarter earnings call.

Northern laid o about 500 workers in 2021, its most recent signicant cost-cutting campaign. Last year, though, the bank hired aggressively, pushing its global headcount to 23,600 from 21,100 at the end of 2021, according to Securities & Exchange Commission lings.

e layo s this year “address roles in all areas of the company and all locations,” a Northern spokesman said in an email. He declined to reveal how many are occurring in Chicago but did say, “ e Chicago

employee base remains more than 6,500.”

“ at said,” he added, “we continue to selectively add sta . We’re prioritizing projects and bringing in resources where necessary to minimize risk and accelerate new business growth.”

Northern recorded severance costs of nearly $39 million in the second quarter. In the fourth quarter of 2022, the bank posted $32 million in severance expenses tied to 300 layo s announced in January. In the second quarter, Northern identi ed another 600 jobs to be cut, Chief Financial O cer Jason

Tyler told analysts on the call.

Between the two cutback waves, the bank expects to save $40 million to $56 million annually once they’re completed, according to information Tyler gave analysts.

Northern has navigated the volatile banking environment reasonably well this year. It’s remained liquid even as it’s seen its formerly low-cost deposits migrate to higher-paying certi cates of deposit and money-market accounts. e company also has repurchased nearly $200 million of its own shares in the rst half of the year, compared with just $35 million all of last year.

Even so, rst-half revenue grew just 1% over the same period last year, to $3.53 billion. During the same period, costs rose 8% to $2.62 billion. Excluding the severance charge and a $32 million charge related to the elimination of a product o ering, expenses increased 5% year over year. Investors took some comfort in the progress Northern made in the second quarter. e stock was up

11.7% as of July 28th’s close compared with July 18, just before earnings were released. But shares still are down 9.5% for the year.

By comparison to Northern’s arch-rivals, Boston-based State Street’s stock is down 8.3% for the year and New York-based Bank of New York Mellon’s is down 1.2%. ose two others in the past have been quicker and more aggressive in eliminating jobs when revenues are pressured.

In the rst half of this year, though, State Street and BNY Mellon’s sta -related costs are up 6% and 5.5%, respectively, over the same time frame last year, according to SEC lings. Northern’s are 4.5% higher after excluding the severance charge.

e question now is whether Northern employees not a ected by the layo s can breathe more easily for the remainder of the year. Northern’s spokesman didn’t respond to a question on whether these were likely to be the last signi cant layo s of the year.

4 | CRAIN’S CHICAGO BUSINESS | JULY 31, 2023

A rendering of the ground oor of Fortem Voluntas’ planned of ce building at 415 N. Sangamon St. | RENDERINGS BY ECKENHOFF SAUNDERS ARCHITECTS

A rendering of Fortem Voluntas’ planned of ce project.

The dispute appears to kill a project that would have added a chunk of available of ce space to the neighborhood.

Steve Daniels

JULIE KERTESZ/FLICKR

TUESDAY, SEPTEMBER 26 7:30–9:45 a.m.

Chicago Club REGISTER HERE Oscar Munoz FORMER CEO AND EXECUTIVE CHAIRMAN United Airlines ChicagoBusiness.com/SeptPB PRESENTING SPONSOR

The

DNC organizers sign labor peace deal

The agreement ensures that union workers will not strike during the convention at the United Center and McCormick Place

One year before the Democratic National Convention takes place in Chicago, organizers signed a labor peace deal with nearly a dozen city unions, a move they hope will signal friendly relations between the party and its working-class wing.

e labor peace agreement ensures that union workers will not strike during the DNC at the United Center and McCormick Place.

“It sets out the framework for dealing with working conditions and any disputes that we have,” said Chicago Federation of Labor President Bob Reiter, who noted that speci c working conditions under the agreement will need to be addressed later.

Led by Reiter, the DNC committee’s agreement includes the International Alliance of eatrical Stage Employees, International Brotherhood of Electrical Workers Local 134, International Union of Operating Engineers Local 399, Mid-America Carpenters Regional Council, Service Employees International Union Local 1, Teamsters Local 727, Unite-Here Local 1, Riggers Local Union 136 and United Steelworkers Local 17U Decorators Union.

“ is is historic,” Democratic National Committee Chair Jaime Harrison said during a press conference July 25 at McCormick Place. “(It’s) the fastest that we’ve ever done this type of

agreement with the DNC.”

Democrats and union representatives touted how early Chicago had inked the agreement, comparing their timeline with the 2016 convention in Philadelphia. Labor peace wasn’t inevitable in the union-friendly town in Pennsylvania; in 2014, a spat between the Pennsylvania Convention Center and the local carpenters union put Philadelphia’s front-runner status as host in doubt. Labor smoothed over those rifts in time for the

convention, and a little over a month before the event, the Democratic National Committee signed a project labor agreement with local unions. e agreement required that the committee use union labor and, in exchange, workers would promise not to strike. Even with that rocky start, the 2016 convention set a more optimistic tone with labor than the 2012 DNC in North Carolina, a rightto-work state.

By contrast, this year’s orga-

nizers want to show that all is at peace in Chicago. While union membership across the U.S. continues to decline — the percentage of workers who belong to a union fell from 10.3% in 2021 to 10.1% in 2022 — the labor movement has seen a resurgence in recent years. But that progressive push hasn’t always bene ted the White House’s relationship with unions. Last year’s rail strike threw cold water on President Joe Biden’s self-imposed moniker as “the

most pro-union president in history.” With the backdrop of two ongoing Hollywood strikes and a narrowly averted UPS work stoppage, the Democratic National Committee is trying to bring labor back into the fold.

Mayor Brandon Johnson, a former Chicago Teachers Union organizer, boosted those optics.

“My union card is still alive and well,” Johnson said at the July 25 press conference. e mayor added that the agreement would provide good jobs for communities across the city, making a point to single out communities like Gar eld Park and Humboldt Park. But when pressed on what language within the agreement would ensure that residents of Chicago’s South and West sides would get a slice of the convention, Johnson did not dive into details.

“As with any agreement, its effectiveness is based on its execution,” Johnson said. e labor peace agreement itself doesn’t control the makeup of the DNC workforce, according to Reiter.

“In terms of the economic development with the West and the South side(s) that ows out of that, that’s going to be more a function of the agreements that the DNC has in place with other vendors and how all that gets wrapped up into it,” Reiter said. “ is is an umbrella agreement that covers a lot of di erent unions who have their own processes.”

Zebra Technologies cutting jobs via layoffs, buyouts

Zebra Technologies is cutting 2% to 3% of its jobs through layo s and buyouts as it looks to trim costs in the face of post-pandemic headwinds in key markets such as e-commerce and logistics.

Keith Housum, an analyst at Northcoast Research in Cleveland, says in a research note that Zebra began trimming 200 to 300 jobs in the second quarter through layo s and buyout o ers to employees 55 and older at the maker of barcode readers and printers.

“Zebra has a track record of judiciously managing our operating expenses and investments with a long-term view,” the company said in a statement. “Our disciplined approach has enabled our long history of success, preparing us to succeed in challenging times.

“While we are facing a di cult and uncertain business environment, we believe these actions are needed to reprioritize and invest in parts of our business that will strengthen our business for the long run.”

e Lincolnshire-based company is among a growing list of Chicago-area businesses that have conducted layo s in response to post-pandemic slowdowns in some industries.

CDW, a provider of computer products and services that is also based in Lincolnshire, also saw layo s in the second quarter. e technology sector has been particularly hard hit, with a number of startups cutting back as funding and sales become harder to nd.

Revenue pressure

Zebra makes handheld computers, or devices with smartphone and barcode-reading capabilities, as well as printers, that retailers, trucking companies and warehouses use. Revenue fell 2% in the rst quarter from a year earlier and likely fell further in the second quarter, according to analysts’ forecasts.

e company reports secondquarter earnings Aug. 1. Zebra shares fell 6% from July 19 through July 27th’s close, while the S&P 500 fell 1% during the same period.

Zebra’s performance soared during the COVID-19 pandemic, which led to a surge in e-commerce sales and massive supply-chain disruptions that focused attention on its products, causing its stock to more than triple to nearly $600 per share in December 2021.

But demand is slowing, with Housum expecting a 5% decline in second-quarter revenue from handheld computers and barcode readers. He says Zebra has gained market share from competitors, such as Honeywell, but it

also has new competition from smartphone maker Samsung.

Technology push

Zebra also has made a push into so-called machine vision, or high-speed cameras and software that are deployed at manufacturing and distribution centers to spot defects and track products.

“Our analysis suggests that Zebra’s endeavors in the xed industrial scanning and robotics sectors have fallen short of management’s expectations in the

short-term,” Housum wrote in a note to clients. “. . . We expect management to double down and increase its investments in these products in response.”

Bill Burns helped build the industrial-scanning and robotics businesses through acquisitions before taking over as CEO of the company earlier this year.

Housum estimates Zebra’s second-quarter revenue will be down about 10%, with a full-year decline of nearly 5%. But he’s expecting a rebound next year, with 8% revenue growth.

6 | CRAIN’S CHICAGO BUSINESS | JULY 31, 2023

Leigh Giangreco

John Pletz

The Democratic National Convention is planned for August 2024 at the United Center (above) and McCormick Place.

ZEBRA

GETTY IMAGES

Zurich aims to unload almost half of its HQ

Danny Ecker

Zurich North America is trying to unload almost half its Schaumburg headquarters on the sublease market, a mammoth addition of available o ce space to a suburban landscape already awash in vacancy.

e insurance giant has hired Jones Lang LaSalle to nd new users for up to 362,974 square feet at 1299 Zurich Way in the northwest suburb, according to a yer. e o ering in the glassy, 11-story building along Interstate 90 represents roughly 46% of the building’s rentable o ce space. It is also the largest block of o ces formally being marketed for sublease in the Chicago suburbs, according to JLL data.

When Zurich moved across town into its new U.S. headquarters, then-Chicago Tribune architecture critic Blair Kamin wrote that the structure “makes you think that a giant child was playing a giant game of blocks and went o to grab a giant glass of milk while leaving the blocks slightly askew.” It quickly became one of the most eye-catching buildings along the I-90 corridor.

Zurich leases the entire building, which is around 783,000 square feet.

e listing now is one of the most dramatic cases yet in the Chicago area of remote work’s assault on o ce demand. Zurich joins a crowd of companies aiming to shed unwanted workspace; such moves have driven up o ce vacancy to an all-time high.

e company decided to sublease a big chunk of its headquarters “after a thorough real estate assessment that realized signicant, positive operational andnancial bene ts for our business, while also continuing to provide a working environment that accommodates di erent employee working styles, as well as encourages collaboration, e ciency and engagement,” a Zurich spokeswoman said in a statement to Crain’s.

Another blow

e sublease addition is another gut punch for suburban o ce landlords, many of whom are already being pushed to the nancial brink by the space-shedding trend. e vast gap between o ce supply and demand, combined with high interest rates, has devastated o ce property values and made it di cult for owners to pay o their mortgages when they mature. A growing number of landlords are facing foreclosure lawsuits or surrendering properties to their lenders to avoid a trip through the court system.

Zurich’s o ering pushes the amount of available suburban sublease space to about 3.3 million square feet, up from around 1.9 million square feet at the be-

ginning of the COVID-19 pandemic, according to JLL. e brokerage tracked that number as high as 4.3 million square feet during the public health crisis, though that gure included highly outdated space in buildings that were unlikely to compete for tenants and have been taken o the market.

Zurich’s space, meanwhile, is one of the most upscale o ces in the Chicago suburbs today. e company completed its new North American home o ce in 2016 — at the time the largest new single-tenant suburban Chicago ofce development in more than a decade — and out tted it with new amenities, including outdoor terraces, a conference center with a 300-seat theater, an on-site dry cleaner, two golf simulators, and a “wellness center” with locker rooms equipped with saunas and various table games, according to a JLL yer.

e building, designed by Goettsch Partners, sits on 39 acres and comes fully furnished with workspace in the sublease block, which could t 1,500 employees, the yer said. e property is owned by a venture of Atlanta-based real estate investor Stonemont Financial.

Zurich, which leases the building through mid-2042, is o ering a exible lease term length and can divide up the space it’s marketing for smaller users, according to JLL. e yer does not include an asking rental rate, but sources familiar with the o ering said the company is seeking rents in line with what other top-tier suburban ofce buildings command today.

Zurich’s use — or lack thereof — of its physical o ce space is at the center of a lawsuit that the company itself led early last year. Zurich alleges that the village of Schaumburg owes it millions of dollars in property tax reimbursements that the company was promised under its agreement to develop a new headquarters with at least 1,700 workers. e village struck that deal on the premise that those employees would be an economic

boon to the area, dining at lunch spots, lling up at local gas stations and shopping at nearby grocery stories, among other activities. en came the pandemic. ose employees were no longer around on a daily basis, and in 2020, Schaumburg proposed renegotiating the deal, according to the lawsuit. In 2021, the village refused to make any reimbursement payment to Zurich, the company alleges in the complaint, which is pending in Cook County Circuit Court.

Zurich argues that the tax incen-

tive agreement requires only that its employees be “assigned” to that o ce, whether or not they’re physically there every day. e company says in the complaint that about 2,100 employees were assigned to the building as of early 2021 and that missed reimbursements had cost Zurich $5.5 million at the time the lawsuit was led.

‘Longstanding commitment’

In the statement to Crain’s regarding the sublease o ering, the Zurich spokeswoman said the de-

cision to try to get rid of space “reinforces our longstanding commitment to Illinois because it’s expected the building’s transition to a multi-tenant facility will foster even greater economic impact to the region by drawing additional businesses and more jobs.”

Schaumburg Director of Economic Development Matt Frank declined to comment on the lawsuit but said the village is happy Zurich is hunting for users that could bring more employees there on a daily basis.

Zurich “trying to attract another company to occupy that space is a bene t and helps us with getting that additional daytime population to support (local) businesses,” Frank said. “We view that as a good thing that they’re being proactive to fully utilize the entire space.”

Zurich’s sublease listing is far larger than the next biggest block of suburban o ces available on the secondary market, according to JLL data. e second-largest is a roughly 150,000-square-foot o ering from educational products company Follett at 3 Westbrook Corporate Center in Westchester, followed by Caterpillar’s 116,000-square-foot sublease listing at the Corporate 500 o ce complex in Deer eld, JLL data show.

Zurich North America is the U.S. arm of Swiss insurance giant Zurich Insurance Group.

JLL’s Rick Benoy and Je rey Miller are marketing the Zurich space for sublease.

JULY 31, 2023 | CRAIN’S CHICAGO BUSINESS | 7 #5 Business Incentives Program in U.S. #7 Overall Cost of Doing Business 5% Corporate Tax Rate 20% Below National Average Cost of Living mississippi.org More leverage for your bottom line. GET MIGHTY.

GOETTSCH PARTNERS

The insurance giant has hired Jones Lang LaSalle to sublease up to 362,974 square feet at the glassy, Goettsch Partners-designed building in northwest suburban Schaumburg

Who will follow in these Chicago leaders’ footsteps?

Chicagoans will remember the summer of 2023 for reasons both good and bad: a rain-soaked NASCAR weekend, wild re smoke that sometimes nearly obliterated the skyline, and the triumphant visits of Taylor Swift and Beyonce come to mind just for starters. But for people in Chicago’s business and civic circles, this summer will also be noted for two shocking events that are likely to resonate long after the roar of the summer concert crowds become a distant memory.

at’s because the unexpected deaths of Jim Crown and, more recently, Rocky Wirtz rob the city of intelligent, caring and experienced leadership at a time when Chicago needs even more business-minded veterans to help a new mayoral administration nd its footing.

Crown died in a motorsports park accident on his 70th birthday, June 25, during a trip to Colorado, opening up questions about succession not only at his family’s Henry Crown & Co. investment empire but also on the public safety task force he helmed at the Civic Committee of the Commercial Club of Chicago, which has dedicated itself to helping Mayor Brandon Johnson map a plan to improve policing and reduce crime.

Exactly a month later, on July 25, Wirtz died at NorthShore Evanston Hospital after a brief but unexpected illness. He, like Crown, was just 70. And he, like Crown, leaves a void at the top of a multifaceted, family-run business as well as at some of the city’s most important civic organizations.

ose include the Field Museum, where

PERSONAL VIEW

Wirtz was board chair, and Northwestern University, where he was a trustee and would no doubt have hard-won perspective to o er now as the school struggles with an athletic hazing controversy sadly reminiscent of a scandal that tarnished the Chicago Blackhawks’ stunning revitalization under Wirtz’s stewardship.

It was heading the Blackhawks that put Wirtz in the public spotlight — certainly more so than Crown, who in recent years was only just beginning to step more fully into the civic-minded role his parents, Lester and Renee Crown, had carved out over

decades on causes ranging from modernizing O’Hare International Airport to protecting the Great Lakes. And indeed, the revivication of the Hawks after years of neglect and decline was a remarkable achievement under Wirtz’s time at the helm. e team’s extraordinary run of Stanley Cup wins brought hundreds of thousands of fans out of the woodwork and out onto the streets of Chicago for the kind of joyful celebrations that in recent decades have been seen only when the Chicago Cubs and White Sox won the World Series or a certain Chicagoan won the White House. And that gift of com-

munity and camaraderie is no small thing. As throngs of us celebrated, it was easy to forget, at least for a little while, how fragmented this city can be, how big our collective problems are.

If they were here now, one suspects both Crown and Wirtz would say the most important work they did happened away from the spotlight, however — in their behindthe-scenes roles as philanthropists, in uencers, advisers, employers and planners. ere was never any doubt that both men were proud of Chicago and cared deeply about its future. Both spoke of it time and again. ey also embodied a tradition that sets Chicago’s business community apart from other major metros: is city expects its business elite to play a role in its civic life, getting big projects like Millennium Park o the ground, contributing to the upkeep of beloved institutions such as the renovation of the Museum of Science & Industry, and helping elected o cials to take on giant, seemingly intractable challenges such as combating crime, improving education and creating economic opportunity in the neighborhoods as well as the Loop. Both Wirtz and Crown answered that call time and again. As a new mayor with arguably the most tenuous connection ever to the business community takes on his new role, who in the C-suites of Chicago will follow their example and extend a hand to Johnson? With so much on the line for a city still smarting from COVID, still grappling with a reputation for crime and still needing to get its scal house in order, someone must.

Something is rotten with the city’s pension funds

Chicago owes its current and future retirees more than $35 billion. However, its pension funds have only $9.2 billion in invested cash. In 2016, the “funded ratio” of the four direct pensions of the city of Chicago — re ghters, laborers, municipal employees and police o cers — was 30.8%. From 2016 to the end of 2022, the city increased its annual contribution to the pensions by hundreds of millions of dollars, and the stock market returned approximately a positive 12.8% per year. Yet the funded ratio of the four pension funds at the end of 2022 was 26.4%, a decrease of 4.4%.

e funded ratio is de ned as the percentage of assets on hand were a full payo made to annuitants and current employees. It is axiomatic that state and local pension funds should be funded to at least 90%. Private pension funds are required to be funded to 100%. at the funded ratio of Chicago’s pensions has gone down during a bull market and amid record contributions from the city means something is fundamentally

wrong with the construct of Chicago’s pension funds. e construct of a municipal pension fund is best compared to a three-legged stool. Employees and the employer make contributions; those contributions are invested and provide a return to the fund, and benets are paid by the fund to retirees — the annuitants.

Regarding contributions made by the city and its employees: For the past 75 years, until recently, they were based on the “multiplier” — e.g., for every $1 contributed by the employee, the city would contribute $2 to the pension fund. However, the multiplier had nothing to do with the Actuarially Required Contribution, or ARC, which is conventionally accepted as the metric for su cient contributions.

Recently — and due only to 2010 legislation calling for a massive increase in property taxes, which became e ective in 2016 — has the city’s contribution been made at the level of the ARC. Employees of the city still contribute the same 9% out of their paychecks as they have for the past 20-plus years. Kudos to the Lightfoot

administration for complying with the legislation by contributing that much more, but know that this has been possible based only on signi cant increases in Chicago’s property taxes and one-time federal COVID funds. It also may have been a classic case of throwing good money after bad.

Since 2016, the average annual investment return of the city’s pension funds has been approximately 7.2%. Compare that with the S&P 500’s return of 12.8% over the same period, and you can imagine the e ect that 5.6 percentage-point di erence would have had, each year for seven years, on $9.2 billion in assets. Had the pensions elected to invest in market index funds since 2016, by now the returns would’ve resulted in funding ratios at the 58% to 63% level — not quite the desired 90%, but closer and going in the right direction. Instead, the city’s pension funds elected to invest by swinging for the fences. And they have missed.

Now we come to the di cult part: pension bene ts paid to annuitants. Keep in mind that when originally designed, pensions were meant to kick in when an employee turned 65, with bene ts paid until

the employee died 10 to 15 years later. ere was no cost-of-living adjustment, or COLA, baked into the pension fund, and the contributions made by the employer and employees were invested primarily in bonds for their xed-income returns. Fast forward and we have had medical advances enabling retirees to live longer; retirement ages have been lowered; COLAs have been put into place, and stock market returns, while in general higher than bonds’, have been signi -

cantly more volatile. Yes, we’ve also had signi cant in ation, but only twice during the past 40 years.

Combine all that with an Illinois law that prohibits any diminution whatsoever of existing pension bene ts and, well, you’ve got a recipe for a soup that’s not so good.

Could the city’s pension funds survive being funded at 26% going forward? Maybe, but only barring any more bene t

8 | CRAIN’S CHICAGO BUSINESS | JULY 31, 2023 Sound off: Send a column for the Opinion page to editor@chicagobusiness.com. Please include a phone number for veri cation purposes, and limit submissions to 425 words or fewer. Write us: Crain’s welcomes responses from readers. Letters should be as brief as possible and may be edited.Send lettersto Crain’s Chicago Business, 130 E. Randolph St., Suite 3200, Chicago, IL 60601, or email us at letters@chicagobusiness.com. Please include your full name, the city from which you’re writing and a phone number for fact-checking purposes. EDITORIAL

A LY CE HENSON

BLOOMBERG

Dana Levenson was a banker for most of his career and was Chicago’s chief nancial o cer from 2004 to 2007.

The city’s pension funds elected to invest by swinging for the fences. And they have missed.

Jim Crown Rocky Wirtz

increases and/or market downturns, both of which have the e ect of driving down the funded ratio.

However, bene t increases such as COLAs are still being considered; a permanent, annual 3% COLA was granted to re ghter retirees in 2021 by Gov. J.B. Pritzker. And since 2000, the stock market has seen six down years, each of which averaged a 17.1% decline. A few more of those and the funded ratio drops further, clearly endangering the funds’ very viability. At least one of the city’s four pension funds has been selling assets to meet retiree bene t requirements. ere’s no better way to

miss out on higher returns when the market goes up than by not having assets on hand to invest.

If you’re looking for a magic bullet to cure the city’s pension fund debacle, you won’t nd one here. However, at a minimum, the pension funds need to achieve market returns, and bene ts, unfortunately, cannot increase.

If all sides could come to an agreement about what more must be done, perhaps there’s hope for the city of Chicago’s pensions. If not, get ready for the doomsday scenario: pension fund bankruptcies and huge property tax increases.

Crain’s adds reporter to government and politics beat

Leigh Giangreco, 32, has joined Crain’s Chicago Business as a reporter working alongside veteran columnist Greg Hinz and City Hall reporter Justin Laurence to cover government, politics, policy, civic life and the city’s power elite.

Before coming to Crain’s, Giangreco worked for several years as a freelance reporter whose work has appeared in

e Guardian, Politico Magazine, Bloomberg CityLab, e Washington Post and Pew’s Stateline. Before coming to Chicago, she covered the defense industry in Washington, D.C.

A graduate of American University, Giangreco wrote, produced and directed a play based on a story from the hit radio show “Snap Judgment” for D.C.’s Capital Fringe Festival in 2018.

JULY 31, 2023 | CRAIN’S CHICAGO BUSINESS | 9

PERSONAL VIEW Continued

Leigh Giangreco

PEOPLE ON THE MOVE

EDUCATION

Loyola University, Chicago

John G. Schreiber has been elected chair of the Board of Trustees. Schreiber is the president of Centaur Capital Partners, Inc. and retired as a partner and co-founder of Blackstone Real Estate Advisors (BREA) in 2015. John is an active civic leader and philanthropist, supporting Catholic education, social service, and healthcare institutions. He received his BBA from Loyola and his MBA from Harvard Business School. He has served on the Board of Trustees since 2014.

EDUCATION

Loyola University, Chicago

Timothy P. Kesicki, S.J. has been elected to another term as vice chair of the Board of Trustees.

Father Kesicki is the President of the Jesuit Conference of Canada and the United States, which oversees common goals and international projects for the Society of Jesus.

Father Kesicki earned a BA in political science from John Carroll University, an MA in philosophy from Loyola, and an MDiv from the Jesuit School of Theology at Santa Clara University.

To place your listing, visit www.chicagobusiness.com/peoplemoves or, for more information, contact Debora Stein at 917.226.5470 / dstein@crain.com

EDUCATION

Loyola University, Chicago

Omar Brown has been elected to the Board of Trustees. Brown is senior vice president, people and culture of cer for Big Ten Conference.

Previously, Brown was an organizational transformation leader in Deloitte’s Human Capital Consulting practice, and before that served on the leadership team at the Chicago Transit Authority. He holds a BA in political science from Northeastern Illinois, an MBA from Loyola, and an MA in public policy from Northwestern University

EDUCATION

Loyola University, Chicago

Jennifer Carolan has been elected to the Board of Trustees. Carolan is co-founder and general partner at Reach Capital, a venture capital fund founded in 2015 that supports entrepreneurs bringing leading-edge technology to education. She taught in Chicago district schools for 7 years before moving to Silicon Valley to attend Stanford University. There, she used her teaching experience to support edtech founders at the NewSchools Venture Fund. She earned a BA from Loyola and an MA from Stanford.

FINANCIAL SERVICES

Key Mortgage Services, Inc., Schaumburg

Jason Brown joins Key Mortgage Services, Inc. as Vice President, Area Sales Manager. Brown will lead one of Key Mortgage sales teams, focusing on long-term growth by supporting loan of cers to achieve their goals and strengthen relationships with their referral partners. Previously at Chase, Brown brings 23 years of lending experience to Key Mortgage, including being a part of the team that led the nation in servicing lowto moderate-income homebuyers.

FINANCIAL SERVICES

Wintrust Financial Corporation, Rosemont

First Insurance Funding, a subsidiary of Wintrust Financial Corp., a nancial services holding company based in Rosemont, Illinois, with 175 locations across Illinois, Indiana, and Wisconsin, is pleased to announce the promotion of Dominique Sawko. Dominique assumed the role of SVP, General Counsel at First Insurance Funding on July 1. She’s worked with Wintrust since February 2011.

INFORMATION / DATA TECH

SPINS LLC, Chicago

Amundsen Davis, LLC Chicago

Attorney Alice Lin joins Amundsen Davis as a partner in Chicago, Illinois. Alice’s practice focuses on a broad range of federal and international tax issues. She advises publicly traded and private companies on business formations, initial public offerings, mergers and acquisitions, joint ventures, loan agreements, and public and private debt/equity offerings.

MANUFACTURING

Hirose Electric Americas, Downers Grove

Hirose Electric Americas, a leading supplier of innovative interconnect solutions, has named Mark Kojak as President & COO. Mark most recently served Hirose Americas as Chief Marketing Of cer and Senior Vice President of Sales & Operations. Throughout his career, Mark has established an excellent track record, leading the organization to record breaking results in the Americas. Mark replaces Shinya (Sid) Tono, who is returning to Hirose Electric Co., Ltd. Japan to assume a new leadership role.

MARKETING

DDB, Chicago

Chuhak & Tecson, P.C., Chicago

Chuhak & Tecson, P.C. is proud to elevate Anne M. Wolniakowski to shareholder. Recently named co-practice group leader of the Corporate Transactions & Business Law group, Anne is a corporate attorney and focuses on mergers and acquisition and transactions involving closely held entities, including acquisitions and sales of businesses ranging in size and industry. She is involved in all aspects of business planning, business formation, ownership structure, succession planning and contracts.

Kiska Howell has been elevated to EVP Head of Business Leadership of DDB Chicago, reporting to the agency’s new CEO Emma Montgomery. Kiska brings with her a no-nonsense perspective as well as experience leading creative that drives business and creates culture for brands like Hershey, Southwest Airlines, and the Molson Coors family of brands.

NON-PROFIT

Let It Be Us, Chicago

EDUCATION

Loyola University, Chicago

Melody Spann Cooper has been elected to the Board of Trustees. She is the secondgeneration owner of Midway Broadcasting Corporation, an AfricanAmerican and female-owned media company. Midway broadcasting assets include WVON 1690AM, the oldest Black-oriented radio station in Chicago; WRLL 1450AM, Chicago’s Home for Hispanic Independent Broadcasters; and its digital streaming platform, VONtv. She earned a BS in criminal justice at Loyola.

EDUCATION

Loyola University, Chicago

Brian “Fitz” Fitzpatrick has been elected to the Board of Trustees. Fitzpatrick is founder and chief technology of cer of Tock, a next generation hospitality booking system. He started Google’s Chicago engineering of ce in 2005 where he founded and led several global engineering policy efforts. He has been an open source software contributor for 25+ years and was a lead engineer at Apple, Inc. as well as vice president of public relations of the Apache Software Foundation. He earned a BA from Loyola.

Jay Margolis has been named CEO of SPINS, a leading provider of wellness-focused data and analytics for the Consumer-Packaged Goods (CPG) industry. Under Jay’s leadership, SPINS will unlock new opportunities for consumers and businesses through innovation, growth, and advanced technologies. Jay brings more than 20 years of leadership experience in the healthcare industry, with a proven growth record spanning service, sales, marketing, product, delivery, portfolio strategy, and M&A.

INVESTMENT MANAGEMENT

Fiducient Advisors, Chicago

LAW

Meltzer, Purtill & Stelle LLC (MPS Law), Chicago / Schaumburg

EDUCATION

Loyola University, Chicago

Alicia Gonzalez has been elected to the Board of Trustees. Gonzalez is executive director of Cubs Charities, where she oversees investments that serve more than 19,000 children and youth across Chicago. She previously served as founding executive director of Chicago Run, which provides tness programs that serve 15,000 students in Chicago Public Schools, and as the head of Hispanic Business Development for First American Bank. Gonzalez graduated with honors from Brown University.

EDUCATION

Loyola University, Chicago

Antonio Ortiz has been elected to the Board of Trustees. Ortiz is the rst lay President of Cristo Rey Jesuit High School. He joined Cristo Rey in 2000 as the director of corporate and foundation relations and later as associate principal, before becoming president in June 2012. From 2010 to 2012, he worked as a director at the Big Shoulders Fund. Ortiz earned a BBA and an MEd from the University of Notre Dame through the Alliance for Catholic Education (ACE) program, and an MBA from Loyola.

Fiducient Advisors, an NFP company, introduced Sabrina Bailey as the rm’s next CEO. Bailey most recently served as London Stock Exchange Group plc’s (LSEG) global head of Investment and Wealth Solutions. She succeeds Bob DiMeo, who ascends to Chairman, the rm’s founder, and joins Fiducient Advisors on July 31. Headquartered in Chicago, with six additional locations and clients in 46 states, Fiducient Advisors is an investment consultant advising a diverse set of nancial clients.

As of July 1, 2023, the rm of Robinson Payne LLC will be joining Meltzer, Purtill & Stelle LLC (MPS Law). Both named partners, Russel G. Robinson and Richmond A. Payne, are making the move, bringing a wealth of experience and expertise in estate planning, corporate and business law, and banking and nance transactions to MPS.

Robinson’s law practice focuses primarily on estate planning, estate and trust administration and charitable distributions and counsel for highnet-worth individuals and families.

Payne concentrates his practice on business law, including family-held businesses, corporate, succession planning, mergers and acquisitions, commercial real estate, non-pro t organizations and banking and nance.

Let It Be Us, a licensed child welfare agency that is changing the landscape of foster care and adoption, has named Vince Foglia as the new board chair. He will help lead the nonpro t’s strategic priorities, including placement of children with special needs. Foglia supports many organizations, most focus on healthcare, youth, and community programs. Founder of Sage Products, Foglia is an innovator in the development, manufacturing, and marketing of prevention products for healthcare facilities.

REAL ESTATE

Evergreen Real Estate Group, Chicago

Jewell Walton has joined Evergreen Real Estate Group in the newly created role of vice president of public partnerships. Most recently, she was deputy chief of RAD programming for the Chicago Housing Authority. Walton brings 20 years of industry experience to Evergreen, a leader in affordable housing, where she will diversify the rm’s portfolio by working with public housing agencies to convert assistance for existing public housing communities to long-term, project-based Section 8 contracts.

LAW

FIRM

Robinson Payne

Advertising Section

LAW FIRM

A REMOTE

Debates around hybrid work push governments, landlords and companies to reconceive what makes a dynamic and desirable workplace

In 2019, says Mark Rickmeier, CEO of product innovation rm TXI, his company had “the best-smelling ofce in Chicago.”

Working together in their West Loop o ce was essential to the TXI culture. An on-site chef cooked daily for the then-40 employees. ere were “bacon days” and cooking classes. “It was a great reason to be in the o ce because you’re being so well taken care of and having that fun vibe in the space,” Rickmeier remembers.

When the coronavirus pandemic hit and

I

By Margaret Littman

By Margaret Littman

people had to work from home, the company chef started making food to deliver to everyone’s houses. Even then, Rickmeier thought it would be temporary: ere was no way TXI wouldn’t be back under one roof.

As the pandemic and the economy changed, so did things for TXI. e company, which now has about 75 employees, hired some sta who weren’t based in Chicago. en, after 18 years in the West Loop, Rickmeier didn’t renew the lease. See REMOTE on Page 12

JULY 31, 2023 | CRAIN’S CHICAGO BUSINESS | 11 CRAIN’S HYBRID AND REMOTE WORK SPONSORS

POSSIBILITY

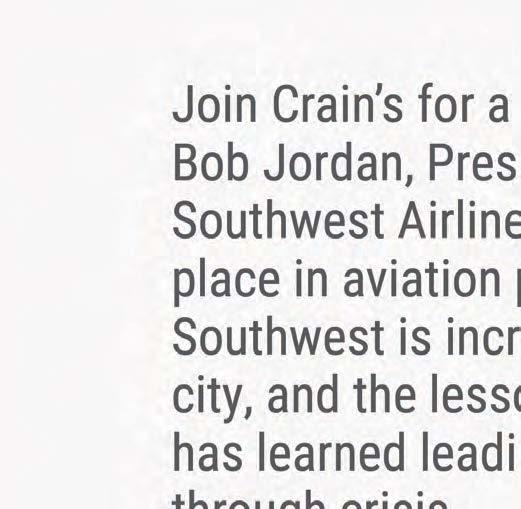

Source: McKinsey Global Institute analysis Work from home by employees’ income More than $150K $100K$150K $75K$100K $50K-75K Less than $50K Respondents who strongly prefer to work from home 0% 5% 10% 15% 20% 25% 30% People who prefer to work from home are typically in higher income brackets 33% 31% 16% 11%

9%

MICHAEL WARAKSA

From

“But I was still pretty convinced that people wanted to have a regular o ce space to go to,” he says. e cities in which TXI sta were located all had WeWork spaces, so Rickmeier bought WeWork memberships for everyone and signed up for a shiny glass WeWork o ce in Chicago.

“It rarely got used,” he says. Sta missed working together, but they didn’t want to have a long commute to go to a WeWork space to sit alone in a co-working phone booth for most of the day. “We did a yearlong experiment and ultimately decided to not continue it. What we’ve discovered is that humans, at least in our company, want to be together. But paying rent is a poor way of fostering connections. It’s kind of not a very e cient use of capital,” Rickmeier believes.

Now TXI employees are scattered in di erent cities, and the company invests in di erent initiatives to keep them engaged, connected and creative.

While some folks are still focused on the “will they or won’t they” question about whether employers will mandate that sta be back in a central o ce ve days a week, workplace experts, business owners, architects, designers, academics, employees and others say this is not the right question. e question is how stakeholders — city and suburban governments, landlords, employers and employees — can help build dynamic workplaces and neighborhoods. And that’s

Reasons for working in the of ce vs. at home

Employees with exible work arrangements were asked in a McKinsey survey to explain their top reasons for working in the of ce and at home.

the conversation that Rickmeier feels TXI is part of.

It’s absolutely no secret that Chicago and its suburbs have a lot of vacant commercial real estate, not just downtown but also in the neighborhoods. A recent report by the McKinsey Global Institute found that while o ce attendance in Chicago and other cities “appears to have stabilized, it remains below pre-pandemic levels.”

While Chicago is not as tech-centric as San Jose, Calif., it does have a larger percentage of jobs that can be done remotely than other cities, says Jonathan Dingle, associate professor of economics at the University of Chicago Booth School of Business. e national average of jobs that can be performed remotely is 32%, and Chicago’s gure is 40%.

Dingle notes it was 34 years ago

that management guru Peter Drucker said commuting to the o ce was “obsolete.” Obsolete may be extreme. If 40% of Chicago area-jobs can be performed remotely, then 60% cannot. But the way o ces and the neighborhoods around them look are changing and should continue to do so. (See Crain’s ongoing look at return-to-o ce numbers for weekly updates.)

Design for the culture

Kristin Cerutti, a Chicagobased regional design leader at design rm Nelson Worldwide, says a lot of clients are asking the same questions, but the answers are di erent for everyone.

“What I tell clients is the only thing your physical o ce o ers that no other space offers is your people. I can go work at Starbucks and get a lot of what you o er in the o ce. I can work from home. I can go work from someone else’s house or from the park. But the only thing that I truly get when I come to the o ce that I can’t nd anywhere else is the other people that work in my organization,” Cerutti says.

When helping clients gure out how to redesign o ce space or reduce the square footage of a lease, she says, “we have to nd what that thing is that’s unique to them that’s going to draw their people in.”

e majority of Nelson clients are signing on to an average of 40% less square footage than they would have if they were starting the same project two to three years earlier, she says. Even those who are keeping large footprints are thinking about those spaces di erently, such as not having a dedicated desk for everyone on payroll.

“We even have a law rm who

recently just moved in, and 75% of their seats are unassigned,” Cerutti says. “ at’s practically unheard of in a law rm scenario.”

Cerutti encourages clients to understand what employees are feeling when they are asked to make changes. Are they worried about cleanliness if they are sharing a desk? Not having somewhere to store their stu ? Commuting into an o ce only to spend the day on Slack?

Once you understand what your o ce culture needs, design the space accordingly. Simple xes include designating zones. Even if people don’t have assigned desks, the o ce can be arranged so that certain departments have speci c areas, but folks can grab any desk in that area. at allows people to work collaboratively with their team, but not have to have workstations sit unused. Cerutti says some clients are consolidating co ee and water stations so that people are forced to unintentionally bump into each other as they go to ll up.

“Your o ce needs to function more like an airport lounge or a hotel lobby than an o ce space,” she says. “ ose types of areas have proven that you can have thousands of people access them on a daily basis. And very rarely do you ever get a scenario where a bunch of people show up and don’t have a place to go. It’s just changing the mindset a little bit on space.”

It is not just the physical spaces that may change, but the furniture in them, too. As Crain’s reported, exhibitors at the annual NeoCon convention in Chicago showed adaptable desks designed for collaboration, acoustical pods for private phone calls and collapsible walls for changing workplace sizes.

Co-working spaces, too, are part of the overhaul. As TXI discovered, many employees don’t want to be siloed in o ces or working side by side (albeit quietly, with headphones) in an open

room where no one interacts.

At Itsy Bitsy Play & Cafe near Lincoln Square, parents can use co-working space while a “playmaker” takes care of kids at the on-site playground, an example of a space that o ers something not available at home.

Mike Healy, co-founder of Guild Row, an Avondale co-working space with a nonpro t, community-building focus, sees spaces such as his working more like a “student union” than the traditional rent-a-desk co-working space of a decade ago.

“We’ve become Gene & Georgetti 2.0,” he says. e ebb and ow of the 800 Guild Row members has changed since the space opened in 2020. Now, he says, it is more like a health club, where certain times of the day welcome the masses while other periods are less crowded, rather than people sitting in a chair from 9 to 5.

Healy is proud that connections at Guild Row have led members to get jobs, to join nonpro t boards and otherwise contribute to relationship-building and other factors in Chicago being a dynamic city. Guild Row members come from neighborhoods from Roscoe Village to Bronzeville, and he sees spaces like Guild Row contributing to “the city’s cultural

pipeline.” If fewer workers go downtown for the long term, he wonders whether spaces like Guild Row in neighborhoods will become like the Economic Club of Chicago and other institutions that were downtown for decades.

Change in patterns

When TXI jettisoned the WeWork expense, it started a number of other programs, including Work from H.O.M.E. at’s an acronym for “hang out, meet and experiment.” TXI employees occasionally work in each other’s neighborhoods. Employees take turns hosting, showing co-workers favorite co ee shops and the places they work and get inspiration. e program helps people feel connected not only to their co-workers but to their neighborhoods.

As fewer people head to a downtown o ce job ve days a week, the businesses that have supported those workplaces will have to adapt, too.

Sara Neuner, who works in communications at Northwestern University’s Feinberg School of Medicine in Streeterville, noticed her shopping and dining out patterns change. Neuner lives in Oak Park, and when she rst started

12 | CRAIN’S CHICAGO BUSINESS | JULY 31, 2023

CRAIN’S HYBRID AND REMOTE WORK

REMOTE

Page

11

TXI employees work together at the Bond Collective co-working space at the Civic Opera Building. | PHOTOS BY JOHN R. BOEHM

While Chicago is not as tech-centric as San Jose, Calif., it does have a larger percentage of jobs that can be done remotely than other cities.

Jonathan Dingle, associate professor of economics at the University of Chicago Booth School of Business

0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% Top reasons for working in the of ce

Source: McKinsey Global Institute analysis

20% 12% 11% 10% 9% To work with my team To comply with my employer’s policy To increase productivity To meet clients

better access tools, technologies

Note: Respondents were asked to name their top reason. Only the ve most popular responses are shown.

To

going back to the o ce on a hybrid schedule, she was driving, in part because the el trains did not have a reliable schedule. at drive meant less shopping downtown because she was missing the 30-minute window shopping

or errand opportunity between the o ce and the train.

Bevan Bloemendaal, chief brand and creative o cer at Nelson Worldwide, focuses on retail design and sees opportunities for “beautiful moments of collabora-

tion” in retail spaces. Just as o ces have to think about what they can o er employees that the home o ce cannot, retail spaces need to think about what they can o er customers so they feel like they are part of the commu-

nity and not just another online order.

Bloemendaal imagines an urban environment where groundoor commercial space can be used by pop-ups such as the immersive Van Gogh experience, Meow Wolf and other activities that will make people want to go to those areas. Retail spaces that function more as showrooms than warehouses can o er customization and entertainment options. ose elements may get people jazzed about interactions they can’t have online.

At TXI, part of the funds not being used for rent are spent on onboarding new employees in a way that helps them feel connected and learn the company culture (the former o ce chef now heads that e ort).

Farpoint Development coowner and Principal Regina Stilp agrees that this aspect is crucial to a healthy workplace. Leaders need to think about building spaces that foster mentorship as part of collaboration. Employees who went to college during the pandemic, for example, may have had limited experience with

in-person classes and in-person group projects. Asking them to onboard and develop skills remotely isn’t good in the long term — for them or their employers.

To make that happen, it is incumbent on C-suite executives to show up, Stilp says. “One of the greatest assets in an o ce is senior leadership. You can’t be in your house in Florida and expect everybody else to come into the o ce.”

Not everyone sees adapting to remote and hybrid schedules as the way of the future. Tom Gimbel, founder and CEO of LaSalle Network, a Chicago-based staing rm, predicts that by the fourth quarter of this year, fully remote work will be a memory and hybrid work will be more in o ce than not, perhaps with what used to be “casual Fridays” now “remote Fridays.”

“Remote work is terrible for the city. It is detrimental for the longterm development of the city,” Gimbel says, citing the decline in businesses like co ee shops and restaurants that relied on downtown workers. “ at is part of the fabric of the city.”

JULY 31, 2023 | CRAIN’S CHICAGO BUSINESS | 13

HYBRID AND REMOTE WORK CRAIN’S

From left: Mark Rickmeier, CEO, Cameron Silver, senior software engineer, and Jason Liao, software engineer, all of TXI, work together at the Bond Collective co-working space at the Civic Opera Building.

Kristin Cerutti is a Chicago-based regional design leader at design rm Nelson Worldwide.

Leaders must learn to manage from the middle

As the post-COVID workplace evolves, the pendulum is swinging between two extremes. On one side, many employers are requiring more in-person attendance with the belief that returning to the o ce improves productivity. On the other side, some companies allow permanent remote work as a way to attract talent.

Rather than dwelling in the extremes, the way to manage today can probably be found in the middle. With self-re ection, input from colleagues and a genuine desire to foster balance, managers can decide what makes the most sense for their teams — based on people’s roles, the team’s priorities and goals, and how work gets done at the company. Here are some issues to consider:

Square footage is not the measure. Many companies have opted for hybrid work, sometimes with a xed schedule. One CEO told me recently that part of the workforce at his company is in the o ce Tuesdays and ursdays and the rest on Mondays and Wednesdays. While that may enable a company to reduce its o ce space, this decision should not be based on square footage alone. Far more important is the

impact on how people collaborate and experience the culture. For example, are there times when the whole company should have the opportunity to be in the o ce together?

Unlocking the value of in-person work. A change in the labor market, especially layo s, has made it easier for some employers to require in-person work. For example, last year, Apple began mandating its employees work in the o ce at least three days a week to put greater emphasis on in-person collaboration. Google reportedly will take in-o ce attendance into account in employee performance reviews. A “gotcha” attitude, however, can make in-person work feel restrictive and even punitive. e real issue is what value is created by working together in the same location. Are the best ideas generated when people are physically present? How do team members feel about brainstorming in person versus online? Managers need to reach out to their teams to hear what people value about in-person work — and when it makes the most sense.

Seeking balance for everyone. During the pandemic, remote work and the ab-

sence of long commutes improved many people’s life balance. Now, post-pandemic, many employees still prioritize exibility in where and when they work. Perhaps they relocated during the pandemic, making in-person work nearly impossible. Unless managers understand their team members’ individual circumstances, it will be hard to strike a balance between what people want and what the company needs to optimize productivity.

Check-ins are more than just about work When I was a corporate leader, I made it a habit to go from cubicle to cubicle speaking brie y with people — not because of a business agenda, but simply to check in about their lives, what help or support they might need, and anything they wanted to discuss with me. Managers today need to replicate this practice. One