The sweet smell of innovation at Mars Wrigley’s candy lab

Take a look inside the research and development hub for the global candy company, which makes Snickers, Twix, M&M’s and Extra gum

By Ally Marotti

By Ally Marotti

Up in a lab in Mars Wrigley’s Goose Island innovation center, a machine mimics how people chew gum. Chewbacca, as it is a ectionately called, spurts green liquid into its chambers to imitate saliva, then chomps up and down, back and forth, squishing, squishing, squishing.

e test subject on a recent afternoon is Respawn Tropical Punch, a gum the candy company rolled out to try to capture the sizable gamer market. It’s infused with B vitamins and green tea extract to help with focus. Chewbacca is testing how those vitamins seep out as the gum is chewed.

See MARS on Page 16

Crucial O’Hare terminal revamp is years late

Johnson administration can nally get an ambitious effort to revamp the airport off the ground

The question now is whether the

With all his legendary gusto, then-Mayor Rahm Emanuel in February 2018 announced a massive project critical to Chicago’s economic engine: An $8.5 billion expansion and modernization of O’Hare International Airport’s outmoded terminals, a step he declared would put the city at the heart of international air travel growth and come online by 2026.

Five and a half years of COVID, raging in ation and City Hall turmoil later, it hasn’t exactly worked out that way.

e big airport job has virtually vanished from the news. O’Hare tra c has been relatively slow to recover from COVID.

ere’s been jostling between the city and its airline partners over spiraling costs, and construction on the rst of three promised new terminals is not even scheduled to begin until the last half of 2024.

e latest projected date for

completion on the project: 2032 — six years late.

e terminal revamp clearly has experienced a delayed, bumpy takeo . ough not unusual in ambitious aviation projects — O’Hare’s tranche of new runways was delivered several years late — the question now is whether the Johnson administration and particularly Aviation Commissioner Jamie Rhee nally can get the program o the ground, even as modernization e orts at competing airports in New York and Los Angeles pick up momentum.

e project is only a little more than 30% designed. Discussions with the airlines, who foot the bill through landing fees and rent, are intensifying. Airlines and the city need to come to agreement on exactly what will get built, at what cost and when.

In an interview and tour of the air eld, Rhee shrugs o

See O’HARE on Page 19

Teachers’ Pension Fund says no to Lincoln Yards

The fund said it will not pursue an opportunity to back Sterling Bay on the stalled megaproject

Danny Ecker

e Chicago Teachers’ Pension Fund has declined an overture from Sterling Bay to back the Lincoln Yards megaproject, sending the developer back on the hunt for a nancial partner to bail out the stalled $6 billion development.

e pension fund said in a statement Aug. 18 that it has “declined to take further action” on a proposition from Sterling Bay to become the primarynancial backer of the sprawling 53-acre project. Sterling Bay pitched the $12.1 billion fund’s

See PENSION FUND on Page 9

C HICAGOBUSINESS.COM I AUGUST 21, 2023 VOL. 46, NO. 33 l COPYRIGHT 2023 CRAIN COMMUNICATIONS INC. l ALL RIGHTS RESERVED CRAIN’S LIST See our updated directory of the area’s private-equity and venture-capital rms. PAGE 11 BOOTH INSIGHTS

to leverage uncertainty and downturns to create value in private rms. PAGE 7

How

I

New ideas often start in the marketing department, which tracks hot trends in candy markets.

Greg Hinz and John Pletz

Mayor Johnson needs more good hires

Even in the best of times, filling out a new mayor’s administration is tough.

Richard M. Daley could count on his family’s network and reputation to draw top talent, but the quality dropped off as Daley’s tenure wore on. Rahm Emanuel could tap pals from his service in Congress and the Obama White House but still lacked the talent to survive the Laquan McDonald scandal. Lori Lightfoot had some good people, but not nearly enough of them before she managed to drive a fair chunk of even those few out of City Hall.

So, what are we to say about the first few months of Brandon Johnson’s administration?

On top of the usual difficul -

ties — low pay compared to the private sector, long hours and inevitable criticism from political factions and media alike — Johnson had little preparation for his new job on the fifth floor of City Hall. He’d never managed anything bigger than his county commissioner’s office, and his rise in the mayoral sweepstakes came so late that he didn’t have time to do much serious planning.

All of that, combined with his propensity to keep taking victory laps — as I write this, Johnson is preparing to star at a Democratic Party meeting in Kansas City — have yielded a distinctly mixed record so far. There are some good hires. There’s also a huge mistake. And some head-scratching incompletes.

On the success side is the selection of Chicago Police Department veteran Larry Snelling as the city’s new top cop. I’ve yet to hear a bad word

about Snelling from aldermen or community groups. Even Paul Vallas, who lost to Johnson in the mayoral runoff election, says Snelling would have been his first choice. We won’t know for sure until Snelling actually gets into office. And there’s an argument that the panel that nominated Snelling for the job did the heavy lifting. My reply to that: Nope. Johnson made the pick. He gets the credit.

Johnson also gets the blame for the beyond amateurish firing of Dr. Allison Arwady as the city’s health commissioner. Now, the mayor has some governmental differences with Arwady and certainly is entitled to have a health commissioner who in his view fully buys into his policies. But Arwady overall led the city well during the COVID crisis and is respected by many Chicagoans, if not the Chicago Teachers Union, as a physician who puts science ahead of

politics. If she had to go, the way to deal with the matter was for the mayor to call her in, thank her for her service and explain that he just wants to go in a different direction. Arwady almost certainly would have resigned. But by dumping her on a Friday evening without allowing her to even say goodbye to her staff, Johnson sent the message that this is a place you don’t want to work because the CTU really runs it. Quoting Tupac Shakur does not change that reality.

With Arwady gone, Johnson now needs a health chief. He also has to find a successor for resigned Transportation Commissioner Gia Biagi and Planning Commissioner Maurice Cox. He’s yet to name a Department of Human Services chief or someone to run the Office of Intergovernmental Relations. Dorval Carter is expected to leave soon as head of the Chicago Transit Authority. And I hear

Johnson has had so much trouble finding an acceptable deputy mayor for corporate relations that the post may never be filled. The latter is particularly concerning. Any number of issues that affect the city’s economic health — Johnson’s ability to deliver prosperity to his political base — badly need attention. Like the slow-motion redevelopment of O’Hare International Airport’s passenger terminal, which my colleague John Pletz and I recently wrote about. Or the future of Ford’s huge Torrence Avenue assembly plant. Or the continuing post-COVID agony of the Loop and North Michigan Avenue, the cash cows that if sick won’t be able to help fund Johnson’s bold social-equity programs.

Finding good, talented people will only get harder with time, not easier. Johnson has some good aides around him. He needs more — and soon.

Rooting for pandemic-era mortgage rates? Don’t.

Affordability is the No. 1 challenge for first-time homebuyers today, a crisis compounded by high mortgage interest rates. The yield on 10-year U.S. Treasury securities hasn’t been this high since 2007 and mortgage rates are hovering around levels not seen in more than two decades.

Falling housing demand and supply would spell trouble for the housing sector and the U.S. economy.

Orphe Divounguy

Yet housing demand still exceeds supply. Family formation has outpaced homebuilding, contributing to the astronomical rise in home prices. While prices remain high, many first-time buyers might be rooting for mortgage rates to drop dramatically to their pandemic-era lows to make homes more affordable.

They should be careful what they wish for.

Hoping for mortgage rates to fall is like hoping our economy will enter another crisis. A sharp increase in unemployment and a sudden stop in homebuilding would likely precede any return to 4% or lower mortgage rates.

Corrections

The recent rise in Treasury yields and mortgage rates mostly reflects the underlying strength and resilience of the economy. In the past, it took large economic shocks like the bursting of the dot-com bubble, the Great Recession and a pandemic for mortgage rates to fall drastically. It would likely take another sharp increase in joblessness for Treasury yields and mortgage rates to ever return to the levels observed during the pandemic. That would spell bad news for housing because the unemployed aren’t able to qualify for a mortgage in the first place.

Since the Federal Reserve began its war on inflation, the yield curve has been inverted from the normal relationship, meaning the yield on longer-term bonds (usually riskier) has been lower than that of short-term bonds (usually less risky due to the shorter time commitment). Short-term yields rose above longer-term yields because of the Fed’s rate hikes. Unlike the yield on shorter-term bonds, which are very respon -

Greg Hinz’s Aug. 14 column, “ e state’s attorney race will boil down to Foxx’s legacy,” should have said the value of stolen goods for shoplifting to be considered a felony under Illinois law is more than $300.

An Aug. 14 story, “After a hiring binge, consulting rms are cutting back,” should have said ZS’ health care-related headcount grew 20% annually for ve years and is expected to grow 10% to 20% annually.

An Aug. 14 Equity story, “Englewood’s chilly reception puts Yellow Banana on notice,” should have said Yellow Banana has raised $26.5 million in funding to upgrade multiple stores.

sive to increases in the federal funds rate, longer-term yields, which mortgage rates tend to follow, crucially depend on future inflation and expected economic growth — which incorporate interest rate risk. If the economy were headed toward a deep recession, a likely Fed intervention would make bonds more attractive. Treasury yields and mortgage rates would fall.

That hypothetical, however, is unlikely. Recent data shows recession risk is receding and economic growth is accelerating. As a result, bond yields are going up, and mortgage rates moved higher along with them.

When inflation began running hot after pandemic-era economic support, the Fed reversed its course on monetary policy, no longer buying Treasuries and mortgage-backed securities,

letting maturing securities roll off its balance sheet. As of now, the Fed continues to shrink its balance sheet to cause additional monetary tightening and solidify inflation’s return to its 2% target.

The latest productivity estimates released by the Bureau of Labor Statistics are encouraging, since a large

2 | CRAIN’S CHICAGO BUSINESS | AUGUST 21, 2023

GREG HINZ ON POLITICS

ORPHE DIVOUNGUY ON THE ECONOMY

WINTRUS T. CO M/BANKER Banking products provided by Wintrust Financial Corp. banks. Accelerate your grow th with our expert banking solutions GR OW WITH C ONFIDENCE , BANK WITH US .

Greg Hinz

See DIVOUNGUY on Page 6

Will these ideas bring life back to State Street?

A city-commissioned Urban Land Institute panel suggests big changes to the vacancy-plagued shopping corridor I

By Danny Ecker

Stopping an exodus of retailers and revitalizing State Street requires periodically closing streets to vehicle tra c, recon guring streetscapes, adding new light and art displays, and staging programs tied to major city events, among other ideas in a new report from a city-commissioned panel.

In the latest of a series of recommendations from the Urban Land Institute to revive high-pro le parts of downtown in the wake of the COVID-19 pandemic, a group of real estate stakeholders and urban planners hosted a public forum last week sharing its vision for turning State Street into a “playful, engaging and welcoming space,” one less reliant on large brick-and-mortar retailers lling storefronts and

Illinois cannabis sales rose but taxes fell. How?

It’s an example of the growing pains of a young industry that’s being buffeted both by forces within the sector and broader economic headwinds

Illinois collected 3% less in marijuana taxes during the scal year ended June 30 than it did a year earlier, even though recreational cannabis sales grew 5% during that period.

Illinois collected $451.9 million in cannabis taxes in the most recent scal year, compared with $466.8 million the previous year. Recreational cannabis sales during that time rose to $1.59 billion from $1.50 billion.

It’s one more example of the growing pains of a young industry that’s being bu eted by both broader economic headwinds as well as the unique forces within the cannabis business — from national politics and local market dynamics.

e Illinois Department of Revenue didn’t have an explanation for the decline, but the state’s tax system is complicated when it comes to weed. e retail tax varies, depending on the amount of THC, from 10% to 25%. It also charges a 7% tax at the wholesale level.

Illinois has some of the highest taxes and highest prices for cannabis. e state ranked second last year in total taxes collected from weed.

But it hasn’t been immune from an industrywide decline in marijuana prices. Wholesale prices fell by one-third between July 2022 and June 2023, according to research rm Cannabis Benchmarks. Retail prices also have been under pressure, and some customers have traded down to lower-priced products.

“Revenues from cannabis taxes declined because of various factors, including the price pressure and reduced out-of-state purchases,” says Lucy Dadayan, a researcher at the Urban Institute. “Cannabis prices went down substantially, not just in Illinois, but in other states as well.”

No matter what the cause of the decline in tax collections, it means slightly less revenue — about $111 million each — went to the state’s general fund and community-reinvestment programs. A year earlier, each received $115 million, according to state data.

Cannabis sales are starting to pick up, however, as more newly licensed stores open their doors, which could boost tax revenue in the current scal year. irty-nine new stores have opened since the state issued 192 new licenses last year.

Maui wild res likely to cost State Farm hundreds of millions

In 2021 the insurer had 36% of the Hawaii homeowners market

By Steve Daniels

State Farm appears to face paying hundreds of millions to cover claims by property owners whose homes were destroyed or damaged in the deadly Maui wild res.

e Bloomington-based giant has far and away the largest market share in Hawaii for homeowners insurance. In 2021, the most recent data available, State Farm had 36% of residential property premiums in Hawaii, according to the National Association of Insurance Commissioners.

e distant-second largest in-

surer of homes in Hawaii was Tokio Marine Holdings, with a market share of just 13%. Northbrook-based Allstate, the second-largest homeowners’ insurer in the U.S. after State Farm, was fourth-largest in Hawaii, with a share of just 7%.

Moody’s Investors Service estimated Aug. 14 that the Maui wild res would cost insurers collectively at least $1 billion. State Farm doesn’t do much commercial property insurance in Hawaii, and that category makes up a portion of that total.

But most of the substantial

price tag is tied to the high average home value of $1.5 million in Lahaina, the Maui community most a ected by the res. e cost to cover policyholders could reach $300 million for State Farm based on its market share.

To put those gures in perspective, all insurers in Hawaii collected just $632 million in homeowners’ and commercial property premiums in 2021, according to the NAIC.

A State Farm spokeswoman had no comment on the

AUGUST 21, 2023 | CRAIN’S CHICAGO BUSINESS | 3

“The next version of State Street has to be very different from what it has been traditionally.”

Mark Kelly, who chaired the ULI panel

John Pletz

Illinois has some of the highest taxes and highest prices for cannabis.

BLOOMBERG

BLOOMBERG

See STATE STREET on Page 6 See STATE FARM on Page 18

Moody’s Investors Service estimated Aug. 14 that the Maui wild res would cost insurers collectively at least $1 billion. I GETTY

Discover’s CEO was pushed out by board

By Steve Daniels

e board of Discover Financial Services, not the company’s regulators, made the decision to remove Roger Hochschild as CEO.

In a “business update” conference call Aug. 17 with analysts hastily scheduled after the Riverwoods-based credit card company stunned investors earlier in the week with the news of Hochschild’s exit, interim CEO John Owen and Chief Financial O cer John Greene sought to reassure Wall Street that the company’s business is healthy.

e two tried to explain why the well-regarded Hochschild was removed, seemingly abruptly — a development that jolted investors and spurred a high-volume sell-o of Discover stock over two days. Investors were concerned that Discover’s issues with regulators might be more serious than the company communicated last month when it initially spoke about them.

Analysts asked repeatedly whether Hochschild’s departure was a result of regulators’ demands. Owen several times didn’t answer the question directly, but nally did toward the end of the roughly 30-minute question-and-answer session.

Owen, who joined the Discover board a little over a year ago after a decades-long career in consumer banking and information technology, said the CEO change “is really directed by the board, from the board, not from the regulators.”

Noting that Discover recently hired a new general counsel, chief information o cer and chief compliance o cer, he said, “If you look at our management

changes I’ve already mentioned, you’ll see we’ve replaced about half the senior team through either retirements or individuals being asked to leave roles. at’s something that I think will build a better organization going forward.”

at had a few analysts wondering aloud why the board didn’t keep Hochschild in the role while searching for a successor. Other banks in similar regulatory hot water have done that.

Owen responded that Discover wanted to look outside the company for a new CEO and wants the time to “get this right.” He said, though, that internal candidates would be considered as well.

Asked if anything on the regulatory front changed over the past month that led to Hochschild’s exit, Owen and Greene said no. But Owen hinted that the board’s discussion around Hochschild’s future hadn’t been drawn out.

“ e board’s been discussing this for several weeks as you might imagine,” he said.

He made clear Hochschild was leaving because of the troubles with compliance. “I think given the regulatory environment and the consent orders we’re facing, it’s time to make some changes in the management,” he said.

Owen said investors shouldn’t expect other senior-management departures.

Still, the regulatory cloud over Discover seems potentially darker than it appeared last month when Discover rst disclosed that the Federal Deposit Insurance Corp. was preparing a consent order in response to compliance shortcomings over several years.

But the order, which has yet to be made public, covers a period ending in 2021, Greene said.

“ at proposed consent order did not focus on ’22 and ’23,” he added. “So there could be other regulatory follow-ups on that from the FDIC or other agencies. . . .We’ll know those and make those public at an appropriate time in concurrence with the regulators’ direction.”

Underinvestment

In addition, Discover is operating under an existing order with the U.S. Consumer Financial Protection Bureau relating to its student lending practices.

Greene gave a sense of just how substantial Discover’s underinvestment in compliance had been over the years. From 2019 until 2023, the company has added more than $300 million to its annual compliance and risk management budget, he said, a gure he rst disclosed last month.

What he didn’t say then, but

did on Aug. 17, is that Discover’s total budget for compliance and risk management in 2023 is $460 million. at implies the company was spending only about $160 million before the ramp-up in investment — and increased compliance outlays 187% since then.

“ e company historically underinvested, and we’re paying the price right now,” Greene said.

Discover has hired about 200 compliance o cers just in the last several months, a spokesman con rmed.

Using bracing language, Greene told analysts Discover is in the process of “ensuring we don’t put pro ts before compliance excellence.” He hastened to add that wasn’t a deliberate choice of the company in the past. Unspoken but implied, though, was that that was the outcome.

Greene o ered a glimpse into how Discover got to this place in his response to an analyst’s question about whether the company was benchmarking its self-policing protocols with other big -

Chicago’s Invenergy completes largest-ever deal, buying huge wind, solar portfolio

By Steve Daniels

By Steve Daniels

Invenergy and two deep-pocketed investment partners have closed on a multistate acquisition of wind farms and solar energy projects with a collective capacity exceeding a typical nuclear power unit.

e purchase of the unregulated renewable power portfolio of Columbus, Ohio-based utility holding company American Electric Power, or AEP, is the largest ever for Chicago-based Invenergy, which is better known for developing and operating wind farms and other clean-energy projects rather than buying them. e deal has an enterprise value of $1.5 billion.

Behind the big deal is Invenergy’s investment alliance with New York-based private-equity giant Blackstone Group and Canadian pension fund CDPQ. e other major contributor is the landmark In ation Reduction Act, enacted just a year ago. e law, which funnels billions in federal dollars to the development of renewable energy projects, also for the rst time enables project owners to sell federal production and investment tax credits, along with the facilities, to third parties like banks. e easing of the tax-credit restrictions is aimed at attracting more outside investment in clean energy and freeing up cash for developers to build more.

To help nance the deal, the Invenergy-Blackstone-CDPQ partnership, dubbed IRG Acquisition Holdings, obtained a $580 million commitment from Bank of America Securities for what the partnership said was a rstof-its-kind tax-credit transfer. e AEP portfolio encompasses 14 wind projects in 11 states with the capacity to generate 1,200 megawatts. Also included are solar projects with 165 megawatts of capacity.

To put that in context, that’s nearly as much juice as Constellation Energy Group’s Quad Cities nuclear station produces to help keep the lights on in the Chicago area.

Invenergy already was operat-

ing some of the renewable facilities, which it developed on AEP’s behalf. Invenergy will take over operation of about half the projects now, while third-party operators will handle the rest on behalf of the Invenergy-Blackstone-CDPQ partnership.

“ is was really a unique opportunity,” says Meghan Schultz, executive vice president and chief nancial o cer for Invenergy.

Invenergy has acquired projects from others before, but typically when they’re in the development stage, not after they’re already operating.

e alliance with Blackstone and CDPQ means “we have the ability to do acquisitions like this

nancial services companies.

e short answer was, no. “Our business model is, frankly, simpler than many other institutions that have run into these sorts of issues,” he said.

In addition to one of the country’s largest credit-card businesses, Discover makes student loans and online installment loans to consumers. It runs an online bank that o ers checking and savings accounts as well.

After two days of heavy selling of Discover shares, investors took some comfort from the update, with the stock closing 2.4% higher on Aug. 17.

e stock price still is down 10% from before news of Hochschild’s removal and trading at levels last regularly reached in early 2021.

In the meantime, Discover has halted stock buybacks for the second time in less than 12 months over regulatory issues. Greene said he hoped to have an update for investors on resuming buybacks when Discover reports third-quarter earnings in October.

in the future,” she says.

Invenergy operates more than 21,000 megawatts of clean power and owns more than 13,000 megawatts, making it one of the largest independent renewable energy producers in the world.

4 | CRAIN’S CHICAGO BUSINESS | AUGUST 21, 2023

Roger Hochschild

The credit-card company held a hastily arranged call with analysts to discuss Roger Hochschild’s departure and its regulatory problems

BLOOMBERG

BLOOMBERG

Leadership In Uncertain Times Learn Strategies To Manage Today’s Workforce More information crainsacademy@crain.com | crainsacademy.com Designed and taught by renowned faculty from Chicago Booth School of Business. This executive education program is a 5-week series in leadership development. Crain’s Leadership Academy is custom-designed to hone the leadership skills of executives across the Chicagoland area. CRAIN’S LEADERSHIP ACADEMY APPLY NOW In Person | Fridays 9 AM–1:30 PM October 13–November 10

STATE STREET

more deeply rooted in the city’s cultural scene.

It’s one piece of what ULI sees as a road map for downtown to regain its vibrancy as e ects of the public health crisis wane. With remote work sapping the urban core of regular foot tra c, major retailers have closed up shop and dealt big blows to shopping-centric corridors. e departures of Old Navy, Urban Outtters, DSW and others during the pandemic pushed State Street’s storefront vacancy rate to almost 28% last year, towering over the 15.3% pre-pandemic rate, according to data from Stone Real Estate.

“I’ve heard State Street is dying many times (in the past), and it’s come back time and again,” said former Department of Cultural Affairs & Special Events Commissioner Mark Kelly, who chaired the ULI panel. “But the next version of State Street has to be very di erent from what it has been traditionally.”

e 12-member panel, commissioned by the city’s Department of Planning & Development and the Chicago Loop Alliance, gathered in June to share data and ideas about how to sketch out a new direction for State Street. e result: a plan that slices the nine-block stretch of the street from Wacker Drive to Ida B. Wells Drive into three districts, each designed to become places where pedestrians are compelled to gather. Crowds, in theory, would encourage retailers to stay on the street and address the perception that the area isn’t safe.

e northern third, north of Washington Street, would be rebranded with a new Chicago

Downtown Arts District brand and redesigned to house events, according to a draft of the public presentation reviewed by Crain’s. e panel suggests eliminating curbs along a portion of the street to make it easy to stage festivals, akin to New York City’s Herald Square.

e Chicago Loop Alliance’s “Sundays on State” events in recent summers, which have brought tens of thousands of attendees to the street for block parties, illustrate what could be a more frequent use.

e center third, running between Washington and Monroe streets, would be designated as a retail anchor. Planters along that stretch would be replaced with seating to encourage pedestrians to linger or dine as they shop. e city would work with property owners and brokers to try to coordinate themed retail areas, such as food and culinary or youth and fashion. “It can’t be letting market forces just play out” to ll retail space with any takers, Kelly said.

e panel didn’t have to look far for an example: e presentation points to the redevelopment of Fulton Street in the heart of the Fulton Market District, where extra sidewalk space is activated with retail and dining areas that discourage vehicle tra c and slow pedestrian ow. One possible change the panel suggests for State Street would be redesigning retail canopies and CTA stairwells to put more of a spotlight on storefronts and make access to underground train stations more inviting.

“Right now on State Street, you’re doing something transactional or (passing through) it. You’re going somewhere. But it’s not a place where you linger or where you want to linger,” Kelly said. “For all

the great architecture, the iconic Chicago eatre marquee and the Macy’s clock, it doesn’t feel inviting. It will have to be a destination going forward.”

Biggest challenge

Perhaps the biggest challenge for State Street is south of Monroe, where vacancy is rampant. e federal government has signaled its intention to demolish a pair of high-rises on the 200 south block of the street for safety reasons — something city o cials hope to stop by landmarking the buildings. Further south, a historic building stretching an entire city block at 401 S. State St. that previously housed Robert Morris University is in foreclosure and sitting empty.

e panel envisions the southern portion as a “civic and educational district,” with space inside the Harold Washington Library dedicated as a community center. To capitalize on the area’s population of students from DePaul University, Roosevelt University and other nearby institutions, the panel proposes additional funding and sta ng “to support collegiate life” there.

If the plans sound familiar, it’s because the city has tried something radical for State Street before. Backed by the creation of Chicago’s rst-ever Special Service Area in the late 1970s, the city developed the State Street Mall in 1979 with wide sidewalks and north-south vehicle tra c reserved only for buses and emergency vehicles. It was a bust, as eliminating cars kept people away from the street altogether.

“But that’s not what we’re suggesting. at was still designed to not favor pedestrians,” Kelly said.

“No one is suggesting that cars are banned from downtown, but right now, cars are favored in almost every street design decision,” he said. “I would argue (that) for these buildings to ll up again, there has to be energy on the street. Without energy, they will all be challenged.”

e big questions left unanswered by the ULI panel is how much any of the physical and programmatic changes would cost and who would shoulder that burden.

All 2 bedroom units with a substantial building remodel 5 years ago. Adjacent to Metra station, police and fire stations in between the Beverly and Morgan Park areas of Chicago. Off-street parking

— always rented, great net operating income

Suggested Opening Bid $935,000 On-site inspections 2-4pm on August 22 , September 7 and 13

Part of the nancial backing will require a public-private partnership. e city, for example, could o er retailers long-term use of newly created parts of the public way in exchange for their investment in outdoor retail space.

e panel advocates expanding

DIVOUNGUY

From Page 2

increase in labor productivity will help to restore the balance between supply and demand, lowering inflation risk. The Fed may even have to re-calibrate its policy stance in order to prevent credit conditions from tightening beyond what is needed to bring inflation back to target.

As productivity improves and inflation moderates, housing affordability will improve. In the meantime, we should focus on solutions that help more people find a home they can afford

“For

the LaSalle Central tax-increment nancing district to help generate funds, the same pot of money former Mayor Lori Lightfoot sought to tap to help subsidize residential conversions of vacant o ce properties along LaSalle Street.

Tax tool

Another tool the panel hopes to see used is a business improvement district, or BID. Such districts, which would require passage of a bill proposed in Spring eld, would levy special taxes on property owners to fund street improvements, programming or services such as security.

e concept is similar to the commonly used special service area taxing districts in the city, but with building owners having more say over how properties within the district are assessed for purposes of the special tax. Building owners also would initiate the creation of such districts, whereas proposed SSAs are blocked only when enough property owners oppose them. State Street improvements will “call for resources that, on the surface, are not clearly visible,” Kelly said, but they will be considered

instead of wishing for a drastic drop in interest rates. We can provide more direct support for first-time homebuyers, helping them access down payment assistance and promoting financial literacy around the home-buying process. Nearly 1 in 4 first-time homebuyers were not aware of how much they would need for a down payment, according to the National Survey of Mortgage Originations. Many first-time buyers likely don’t know about strategies like negotiating mortgage point buydowns as a seller concession or new mortgage products that enable down payment matching.

only “with a clear vision and a vision that excites people.”

A spokeswoman for Mayor Brandon Johnson didn’t immediately provide a comment on the ULI’s recommendation or how it prioritizes the revitalization of high-prole shopping corridors like State Street or the Magni cent Mile.

But key stakeholders on those streets hope the new administration starts to take more action to help, said Kimberly Bares, president and CEO of the Magni cent Mile Association, which promotes business on Michigan Avenue. Another ULI panel produced a similar recommendation last year to revitalize that street, and Bares said her group won support for some of the ideas from the city’s transportation and planning departments, but the leaders of those two arms of city government are now on their way out.

“Our districts are special and worth investing in because of what they produce for the entirety of Chicago,” Bares said, stressing the economic bene ts that come from having a strong downtown. “If we as a city value (investing in) our neighborhoods, we have to value downtown as at least a means to that end.”

On the supply side, we also need to support policies, such as zoning changes, that encourage more building.

Treasury yields and mortgage rates are likely to remain elevated so long as the U.S. economy remains on solid ground. Finding ways to support potential homebuyers while also cheering on builders is how housing sales recover in 2024. A deep economic downturn would have the opposite effect.

Orphe Divounguy, a senior economist at Zillow Group and executive adviser at Quantitative Research Group, writes a monthly column for Crain’s.

6 | CRAIN’S CHICAGO BUSINESS | AUGUST 21, 2023 Rick Levin & Associates, Inc. | since 1991 312.440. 2000 | www.ricklevin.com A LICENSED ILLINOIS REAL ESTATE BROKER HAS OWNERSHIP INTEREST IN THE PROPERTY. REAL ESTATE AUCTION SEPTEMBER 20, 2023 FOR INFORMATION CONTACT 10-UNIT APARTMENT BUILDING 11020 S. PROSPECT AVE., CHICAGO, ILLINOIS

From Page 3

EUGENE KRASNAOK/UNSPLASH

all the great architecture, the iconic Chicago Theatre marquee and the Macy’s clock, it doesn’t feel inviting. It will have to be a destination going forward,” Mark Kelly, former commissioner of the city’s Department of Cultural Affairs & Special Events, says of State Street.

Ways to create value in private rms during uncertainty

Just months ago, a recession seemed certain, a banking crisis was unfolding and the investing landscape was dour. In the struggle between exuberance and despair, however, tables turn quickly. Despite the market recovery, there are reasons for ongoing concern: a potential commercial real estate reckoning, the risk of more Fed action to combat in ation and a geopolitical landscape fraught with ash points. While no one knows what the future holds, there are ways to leverage uncertainty and downturns to create value in private companies — some unconventional. So what lessons can you take and apply to your business? Here are three:

1. Hire, don’t re. Put your employees rst, even ahead of customers, and use downturns to acquire talent as others reduce their workforces. Conventional wisdom suggests you should reduce sta in down cycles. While there may be trimming of underperformers, something you should do in any market, down markets are the time to focus on your people. Don’t destroy the business through overly aggressive cost cuts, which will hamstring your ability to capitalize on a recovery. Cost-cutting (in a vacuum) is not an operational best practice, and

only after your people know their jobs are secure will they focus on your customers.

In January, as big tech and nance rms slashed sta , Bloomberg went on a hiring spree — leveraging its advantage as a private company with a fortress balance sheet to make long-term investments in talent. It’s a familiar playbook Bloomberg has deployed before.

2. Catch a falling knife. Pursue opportunistic acquisitions of complementary companies while valuations are favorable. Conventional wisdom may lead you to suspend acquisitions during a crisis, either lacking capital or con dence. is is the wrong approach.

In 2019, we invested in a familyowned logistics company. In a cruel twist of fate, a few short months later, the pandemic froze the global supply chain. It would have been easy to be paralyzed by fear, but turmoil presented the opportunity to acquire a complementary business at a meaningful discount to our initial investment. When the economy roared back, the acquisition proved highly accretive far sooner than expected.

ere was calculated risk, but the upside potential outweighed the downside and, critically, our part-

ner company had the balance sheet capacity to move quickly.

3. Prune customers. Use downturns as opportunities to re unpro table customers, even if they are the largest. Conventional wisdom suggests that in a downturn you should focus on customer retention. Instead, refocus those resources — not the least of which is your time — on more pro table customers or investments that will help improve cash ow.

You can’t control when a pandemic will end or when the Fed will stop tightening, but you can control how you allocate the nite resources available to you (time, capacity, free cash ow). Whether you free up and redeploy productive resources to acquisitions, highergrowth product lines or even outside your business into other investments, identify and embrace the factors within your control to unlock your full potential.

So take care of your people and

invest during tough times, keep your balance sheet strong so you can seize opportunities and re folks who aren’t adding value (even if they happen to be your largest customer).

AUGUST 21, 2023 | CRAIN’S CHICAGO BUSINESS | 7

GETTY IMAGES

Advice for small businesses and entrepreneurs in partnership with the University of Chicago Booth School of Business.

Duane Jackson (left) is founder and managing partner at Author Capital Partners and an investor-in-residence at the Polsky Center for Entrepreneurship & Innovation at the University of Chicago Booth School of Business. Nick Brand is a partner at Author Capital Partners.

Is O’Hare on the new mayor’s radar?

O’Hare International Airport is thought of as the economic engine of the region for a reason.

By the Illinois Department of Transportation’s reckoning, the air eld throws o more than $37 billion in economic activity for the state each year, making it one of the most important generators of jobs and visitor spending for the city of Chicago.

As Rahm Emanuel used to put it back when he was mayor, every time he saw an airplane pass overhead, he heard the kaching of a cash register. at’s because when a plane lands at a Chicago airport, the city bene ts. Landing fees, terminal gate charges, rents, concessions and other airport revenues ensure O’Hare remains healthy, which keeps the city’s economy humming. A strong post-pandemic economy is something an ambitious mayor could use to make his progressive vision a reality, but it’s hardly guaranteed.

COVID-19 taught us that lesson in painful ways, not only during the worst of the travel downturn but even now, as business travel remains stubbornly resistant to the get-out-and-see-the-world impulses driving a remarkable rebound in post-pandemic leisure travel. Similarly, other U.S. airports in recent years have gained on and even lapped O’Hare by various metrics, which has denied Chicagoans their traditional “world’s busiest” bragging rights but, more signi cantly, also feeds into recent worries that the city is losing its mojo as a business center.

Meanwhile, as Crain’s Greg Hinz and John Pletz report this week, there’s another tension point on the O’Hare front: Other U.S. cities — most notably New York and Los Angeles — have been investing in modern terminal upgrades designed not only to wow visitors but to accommodate the next generation of planes that will form the backbone of many car-

PERSONAL VIEW

riers’ 21st-century eets.

It was concern about the advent of those larger jets — paired with a recognition that O’Hare is seriously starting to show its age, with even the Helmut Jahn-designed Terminal 1 springing leaks and looking grungy — that drove Emanuel in 2018 to unveil O’Hare 21, a $12.1 billion e ort to expand and modernize the air eld’s outmoded terminals, a step he declared would put the city at the heart of international air travel growth and come online by 2026.

But as Pletz and Hinz note, after COVID, a period of raging in ation and signi cant turnover at City Hall’s fth- oor mayoral suite, Emanuel’s vision isn’t exactly panning out as originally planned.

It got a splashy start, with so-called

starchitects from around the world competing for the prized commission. Chicago’s own Jeanne Gang and several collaborators eventually won the gig with a global terminal design that envisions a vaulted, wood-beamed ceiling suspended over a lush, garden-like interior. But after the initial ourish of excitement surrounding the competing designs — not to mention the exit of the project’s godfather, Emanuel — the O’Hare 21 project faded from the headlines.

Emanuel’s successor, Lori Lightfoot, had other priorities. And now, the latest projected date for completion of the project is 2032 — six years late.

Jamie Rhee, the o cial now serving her third mayor as the city’s aviation chief, insists to Crain’s that plenty of work has al-

ready taken place on the O’Hare 21 project, but it’s mostly involved e orts like installing two miles of pipe to drain away stormwater and digging underground roads to allow access to gates without passing in front of taxiing jets — which, to be fair, isn’t the sort of thing that draws the interest of Architectural Digest, as Gang’s initial designs once did. She also points to the recently opened 10-gate expansion of Terminal 5, the rst at O’Hare in 30 years, as evidence that her team is making progress toward the O’Hare 21 vision.

Even so, Crain’s reporting reveals that behind the scenes, cost pressures are building, raising questions about whether the Gang-designed global terminal that was to be the crown jewel of the air eld revamp can be delivered on budget or if the building will have to lose much of its luster. Discussion with the airlines, who will foot the bill through landing fees and rent, are intensifying. And it’s becoming increasingly clear that the carriers and City Hall under the leadership of new Mayor Brandon Johnson must come to an agreement on exactly what will get built, at what cost and when.

Modernizing O’Hare is more than a cosmetic enterprise, but that doesn’t mean optics aren’t important. An airport is often the rst and sometimes the only thing visitors see when they come to Chicago, and given the city’s recent image challenges, Johnson would be wise to put money and energy into spi ng up what is essentially Chicago’s front door to the world. Sadly, the massive O’Hare 21 project, one of the biggest civic construction jobs in the city’s history, rated all of two sentences in Johnson’s 223-page transition report. Chicagoans who care about the city’s future as an aviation hub have to hope Johnson will place more emphasis on the airport as mayor than he did as a candidate.

Yes, we can modernize Chicago’s recycling infrastructure

Chicago is known for innovation. It’s a place where trailblazers from all industries and walks of life make their mark. It is also the birthplace of modern architecture and a destination for travelers worldwide. Now comes a new, bold reimagining of the city’s recycling system that will make Chicago home to the latest in state-of-the-art recycling infrastructure.

According to the city’s data, only about 9% of Chicagoans’ waste is recycled. A $3 million investment from the beverage industry’s “Every Bottle Back” initiative aims to improve collection infrastructure for the city and those who call it home.

“Every Bottle Back” was launched by

American Beverage and America’s leading beverage companies — the Coca-Cola Co., Keurig Dr Pepper and PepsiCo — to reduce the industry’s use of new plastic by increasing the collection and remaking of our 100% recyclable bottles. “Every Bottle Back” is leveraging a $400 million investment to improve recycling infrastructure and education to help make recycling easier and more e cient. As a result of these actions, we hope to collect every single one of our bottles and cans so they can be remade not just once, but over and over again.

e Illinois Beverage Association and its beverage companies have joined with leading circular economy investment rm

Closed Loop Partners and Chicago’s Lakeshore Recycling Systems (LRS) to signicantly expand recycling infrastructure in our area and improve recycling rates along the way.

At full operational capacity, the new 10acre facility will house modern recycling technology that ensures recyclable materials are sorted and processed e ciently and e ectively. When fully operational, the new facility is expected to process around 280 million pounds of recyclable materials per year, including approximately 10 million pounds of PET plastic and 3 million pounds of aluminum.

Chicago is home to 2.7 million people and brings in millions of tourists each year. We are thrilled to see major changes to enable our city to better manage the inux of valuable recyclable materials so

they can be properly collected, sorted and recycled. Moreover, this impactful investment will help keep our parks and shorelines clean and beautiful.

At the Illinois Beverage Association, we work to make an impact in the communities we live in and serve. is includes larger communities like Chicago and smaller communities like LaSalle and Villa Park, which earlier this year received funding through the “Every Bottle Back” initiative to provide new recycling carts and improve recycling infrastructure.

We have seen an increase of hundreds of millions of pounds of raw materials recycled since the inception of “Every Bottle Back.” We hope the trend continues here in Illinois as we do our part to preserve its beauty and create a more circular economy for our bottles and cans.

8 | CRAIN’S CHICAGO BUSINESS | AUGUST 21, 2023 Sound off: Send a column for the Opinion page to editor@chicagobusiness.com. Please include a phone number for veri cation purposes, and limit submissions to 425 words or fewer. Write us: Crain’s welcomes responses from readers. Letters should be as brief as possible and may be edited. Send letters to Crain’s Chicago Business, 130 E. Randolph St., Suite 3200, Chicago, IL 60601, or email us at letters@chicagobusiness.com. Please include your full name, the city from which you’re writing and a phone number for fact-checking purposes. EDITORIAL

GETTY

Brad Harden is president of the Illinois Beverage Association.

PENSION FUND

From Page 1

investment committee in May on its vision for the development along the North Branch of the Chicago River between Lincoln Park and Bucktown, hoping to win what could be as much as a $300 million investment to jump-start it.

The CTPF board of trustees had considered hiring a consultant to “conduct additional due diligence into the opportunity” but declined to do so at a meeting Aug. 17, according to the statement.

“We are grateful for the chance to thoroughly evaluate this proposal,” CTPF board President Jeffery Blackwell said in the statement. “However, after careful deliberation, it became evident that the investment did not align seamlessly with the goals of our fund. This was a difficult decision for our trustees, as there were many positive aspects of the development, but ultimately it was not the right fit for CTPF. We will not be pursuing this investment.”

The CTPF board heard the proposal in June and tapped investment consultant Callan to look into it further, leading to a presentation of its findings at the Aug. 17 board meeting. “After thoroughly considering the research and engaging in extended debate, the board declined to take further action on the proposal,” the statement said.

Seeking capital

The denial comes as Sterling Bay tries to weather a financial storm at Lincoln Yards. The developer is vying for a new capital partner to finance the mixed-use campus as its two primary backers — New York-based JPMorgan Asset Management and Dallas-based Lone Star Funds — seek to sell their stakes in the project at substantial discounts, signals of their waning patience with the development’s path forward.

A Sterling Bay spokeswoman said in a statement that the developer “is engaged in ongoing conversations with several parties interested in investment, financing and leasing at Lincoln Yards and is committed to advancing the project and the many public benefits it will deliver to the city of Chicago.”

Sterling Bay disclosed to some of its investors in April that it is trying to consolidate ownership of the Lincoln Yards site to move forward with the 14.5 million-square-foot project, which would reshape a swath of the city’s North Side with high-rises and generate thousands of new jobs. In addition to hunting for a primary financial backer such as the CTPF, Sterling Bay recently solicited its existing investors for $25 million in new equity to help finance the development, according to slides from the presentation obtained by Crain’s.

The CTPF was an unlikely bedfellow for the Lincoln Yards fundraising effort. The pension fund invests on behalf of and is highly influenced by the Chicago Teachers Union, whose members have been among the most vocal opponents of Lincoln Yards and a $1.3 billion tax-increment financing district the city created to help reimburse the developer for certain pieces of new infra-

structure tied to the project.

Sterling Bay has publicly blamed former Mayor Lori Lightfoot’s administration for holding up financing that would have allowed the developer to begin infrastructure work on the site.

Sterling Bay executives pitched Lightfoot and senior advisers last summer on a bond deal that would have raised hundreds of millions of dollars through the Wisconsin-based Public Finance Authority to help finance things like new roads and bridges. The plan needed city approval because the transaction would involve the issuance of city notes backed by TIF proceeds and because the Public Finance Authority requires it.

Lightfoot eventually approved the deal, but only after rising inter-

est rates had soured the economics of the proposed financing, according to Sterling Bay. The developer ultimately did not pursue the PFA financing plan, and CEO Andy Gloor told Bloomberg earlier this year that Lightfoot “put a brake on our entire project.”

Lightfoot recently fired back in a statement to Crain’s, calling Gloor’s comments “unfortunate and demonstrably false.”

Former Lightfoot administration officials said Sterling Bay didn’t bring the city into the PFA deal until after it had been fully negotiated, forcing city officials to sift through hundreds of pages of documents to ensure Chicago taxpayers would not be put at additional risk and that the deal would not affect the city’s recent credit rating upgrades.

MY BENESCH

“Benesch is flexible, customer-facing, not afraid to jump on airplanes, transparent…it really has become a partnership that has far exceeded a traditional client-attorney relationship.”

MY TEAM

MICHAEL

SUSAN

JACOB MARSHALL

ANDREW MARATEA

JUSTIN DYKSTRA

STEVEN WALSH

ALEX AMEZCUA

BLERTA MILETI

LAURA HULT

JUAN MARTINEZ

ANDREW NICOLL

ERIN O’BRIEN

MICHAEL SWEARENGEN

JEFFREY WILD

*Paralegal

In the alternative investment world, deals are rarely cookie-cutter, and the road to success can take many different paths. Will and his team rely on Benesch to help avoid pitfalls while leveraging opportunities, always working to steer the ship in the right direction. Whether executing a real estate lending transaction, managing litigation, or overseeing a loan workout or bankruptcy, Benesch serves the team’s day-to-day legal needs while providing a deep bench of experienced, forward-thinking attorneys to keep them a step ahead.

How can we help your team stay ahead?

www.beneschlaw.com

August 21, 2023 | CRAIN’s CHICAgO BusINEss | 9

WILL NELSON

Director of Real Estate Lending Columbia Pacific Advisors, LLC

Featured team (left to right)

BARRIE

ETERNO*

© 2023 Benesch Friedlander Coplan & Aronoff LLP

A rendering of Lincoln Yards stERLINg BAY/gENsLER

PEOPLE ON THE MOVE

ARTS / ENTERTAINMENT

Driehaus Museum, Chicago

The Richard H. Driehaus Museum is pleased to announce that Lisa M. Key has been appointed Executive Director. Previously, Ms. Key served as Deputy Director at the Museum of Contemporary Art Chicago and was the Vice-President of Institutional Advancement at the Art Institute of Chicago. She is cochair of Board of Enrich Chicago. She holds an MA in Arts Administration from Indiana University and a BA in Art History and Communications from Valparaiso University.

CONSTRUCTION SERVICES

DSI - Development Solutions, Inc., Chicago

Denise Horsley joins Chicago-based general contractor DSI (Development Solutions, Inc.) as Project Executive. Boasting an impressive 34 years of industry experience in interior construction for corporate clients and landlords, Horsley will help lead the DSI project management team and oversee all project stages. Her exceptional leadership skills and industry expertise will ensure the highest quality delivery while fortifying DSl’s existing relationships and supporting new business growth.

FINANCIAL SERVICES

Wintrust Financial Corporation, Rosemont

Wintrust Financial Corp., a nancial services holding company based in Rosemont, Illinois, with 175 locations across Illinois, Indiana, and Wisconsin, is pleased to announce the promotion of Heather Japuntich. Heather will assume the SVP, Head of Retail position for Lake Forest Bank & Trust Company, N.A. Heather has spent her entire nancial career at Lake Forest Bank & Trust Company, N.A., joining nearly 23 years ago.

To place your listing, visit www.chicagobusiness.com/peoplemoves or, for more information, contact Debora Stein at 917.226.5470 / dstein@crain.com

Recognize them in Crain’s

FINANCIAL SERVICES

Wintrust Financial Corporation, Rosemont

Wintrust Financial Corp., a nancial services holding company based in Rosemont, Illinois, with 175 locations across Illinois, Indiana, and Wisconsin, is pleased to announce the promotion of Mike Moylan. Mike will assume the Retail Market Head position for Wintrust Financial and its North region. Mike has been with Wintrust for nine years.

HEALTH CARE

City of Hope, Chicago

Kevin King, M.D. joined City of Hope Chicago as a radiation oncologist at the Downtown Chicago Outpatient Care Center. He is particularly focused on breast, lung and prostate cancers, oligometastatic disease, and applying accelerated radiotherapy treatment. Recognized among Crain’s Healthcare Heroes, Dr. King earned his medical degree from Rush Medical College and completed a residency at Rush University Medical Center. For more, visit cancercenter.com.

NON-PROFIT

City Year Chicago, Chicago City Year Chicago is pleased to announce that Valencia Koker has been selected as the organization’s new Senior Vice President and Executive Director. Valencia has been a teacher, principal, a 2019-20 Chicago Principal Fellow and Charter School executive director; she is a United States Air Force Air National Guard veteran and recipient of the Air Force Achievement Medal. She is a 2023 Chicago Urban League IMPACT fellow and a member of the inaugural cohort of Change Collective’s national leadership network.

NON-PROFIT

Illinois Humanities, Chicago

NON-PROFIT

Ignite, Chicago

For listing opportunities, contact Debora Stein at dstein@crain.com or submit directly to CHICAGOBUSINESS.COM/PEOPLEMOVES

FINANCIAL SERVICES

Wintrust Financial Corporation, Rosemont

Wintrust Financial Corp., a nancial services holding company based in Rosemont, Illinois, with 175 locations across Illinois, Indiana, and Wisconsin, is pleased to announce the promotion of Jerry Nagaj. Jerry was promoted to SVP, Head of Retail for Northbrook Bank & Trust Company, N.A. Jerry joined Wintrust in January of 2017.

Ignite announced the appointment of R. Delacy Peters Jr., board member and Illinois Top 100 Attorney, to succeed as board chairperson in succession of Lindsey Mullen, Co-Founder/ Principal at Prosper Strategies effective July 1. As a creative and experienced member of Ignite’s Executive Board, Peters plans to use his vision and expertise to grow Ignite’s reach and impact throughout Chicago, working to end youth homelessness. Ignite stands with youth on their journey to a home and a future with promise. Read more at www.ignitepromise.org/ news-and-updates.

Illinois Humanities is pleased to announce two additions to its Board of Directors: Sylvia Ewing and Tawa Mitchell. Sylvia Ewing, is Principal Director, Strategic Partnerships and Communications, at Elevate, a nonpro t focused on equity through climate action. Ewing is also a member of the Forbes Communications Council, a poet, and a meditation teacher. Tawa Mitchell, Senior Program Of cer, Chicago Commitment, John D. and Catherine T. MacArthur Foundation, is a 2018 Leadership Greater Chicago Fellow and has a background as a leader and strategist for Chicago education.

TECH / TELECOM

Comcast, Chicago

FINANCIAL SERVICES

Wintrust Financial Corporation, Rosemont

Wintrust Financial Corp., a nancial services holding company based in Rosemont, Illinois, with 175 locations across Illinois, Indiana, and Wisconsin, is pleased to announce the promotion of Lynn Van Cleave. Lynn transitioned from Head of Retail for Lake Forest Bank & Trust Company, N.A. to Retail Customer Experience & Employee Engagement Leader across all banks. Lynn has been with Wintrust from the start. She joined the company 31 years ago.

NON-PROFIT

Ignite, Chicago

Ignite’s Board of Directors continues to grow its reach and ability to lead social change in Chicago in the area of youth homelessness. Ignite is pleased to welcome new members: Emily Drake, owner and CEO of The Collective Academy and James A. Byrd, Senior Managing Director, Senior Vice President of The Northern Trust Company. Ignite’s Board of Directors will expand its reach throughout Chicago, creating equitable pathways and solutions for youth facing homelessness and housing insecurity. Ignite envisions a world where all young people have the support they need to be de ned by their potential, not their circumstances. Read more at www.ignitepromise.org/missionvision-values.

Drake Byrd

Lisette Martinez has been named Vice President of Sales and Marketing for Comcast’s Greater Chicago Region, which includes Illinois, Northern Indiana and Southwest Michigan. In her new role, Martinez oversees the company’s regional direct and indirect, multifamily and retail sales channels, as well as its marketing strategy. Since joining Comcast in 2013, she has served in an array of progressive roles, the latest being Vice President of Retail Sales for the region.

To order frames or plaques of profiles contact Lauren Melesio at lmelesio@crain.com or 212-210-0707

1x7

INDUSTRY ACHIEVERS ADVANCING THEIR CAREERS

Advertising Section

Peters Mullen

Ewing Mitchell

AUGUST 21, 2023 | CRAIN’S CHICAGO BUSINESS | 11

12 | CRAIN’S CHICAGO BUSINESS | AUGUST 21, 2023

AUGUST 21, 2023 | CRAIN’S CHICAGO BUSINESS | 13 REGISTE R HER E ChicagoBusiness.com/SeptPB TUESDAY, SEPTEMBER 26 7:30–9:45 a.m. The Chicago Club Oscar Munoz FORMER CEO AND EXECUTIVE CHAIRMAN United Airlines PRESENTING SPONSOR

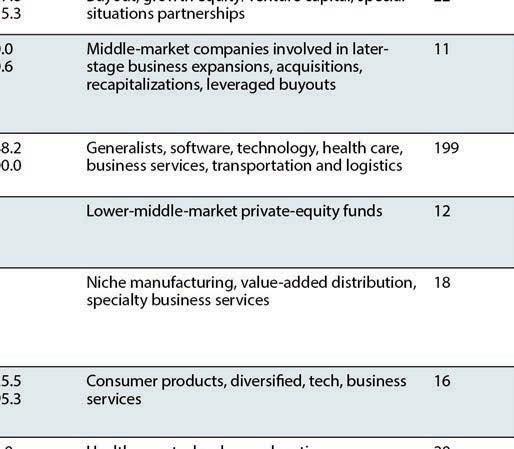

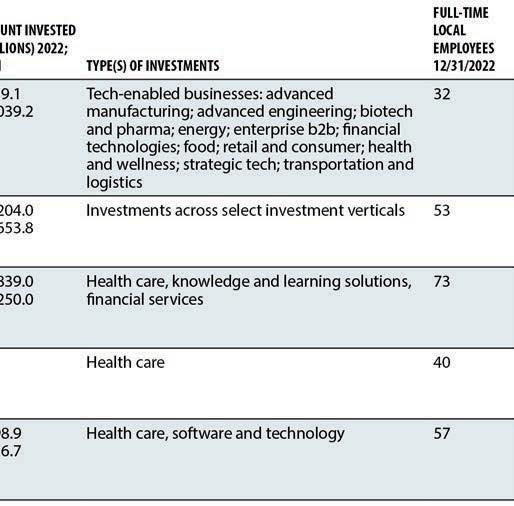

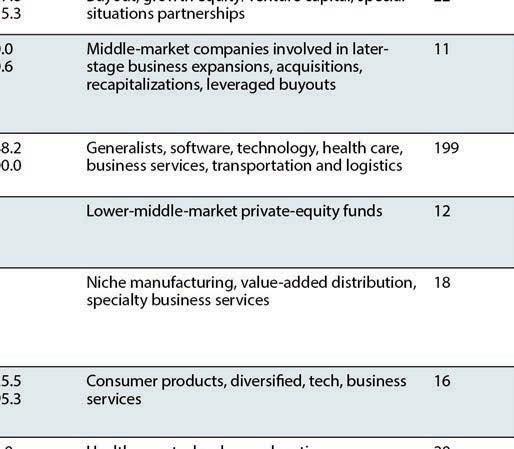

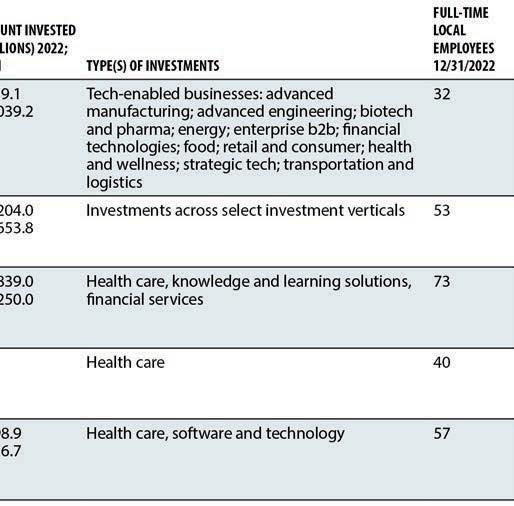

VENTURE-CAPITAL FIRMS CRAIN'S LIST

14 | CRAIN’S CHICAGO BUSINESS | AUGUST 21, 2023 COMPANY TOP EXECUTIVE(S) SIZE OF CURRENT FUND (MILLIONS) 2022; 2021SOURCES OF FUNDING NEW LOCAL INVESTMENTS 2022 NEW INVESTMENTS OUTSIDE CHICAGO 2022 AMOUNT INVESTED (MILLIONS) 2022; 2021 TARGETED INDUSTRIES FULL-TIME LOCAL EMPLOYEES 2022 7WIREVENTURES Chicago; 312-588-7060 LeeShapiro GlenE.Tullman Managing partners $200.0 $153.0 Strategic LPs, institutional investors, high-net-worth individuals, family o ces 24 Consumer-focused digital health solutions 10 ARCH VENTURE PARTNERS Chicago; 773-380-6600 KeithCrandell Managing director, co-founder $2,950.0 $2,950.0 Institutions, pension funds, university endowments, foundations 024$1,007.8 $850.5 Seed and early-stage information technology, life sciences, physical sciences 13 BAIRD CAPITAL Chicago; 312-609-4700 GordonG.Pan President $215.0 $215.0 Institutions, pension funds, high-networth individuals, employees 03 $54.4 $59.2 B2B technology and services 11 BRIDGE INVESTMENTS Chicago; 469-644-6209 ConnorRyan Vice president DanielGoldberg Principal JasonThomas Principal $20.0 $20.0 Private individuals, family o ces16 $2.1 $1.6 Tech-enabled services, consumer, ecommerce, media, digital marketing 3 CHAIFETZ GROUPLLC Chicago; 312-983-3600 RossChaifetz Principal RichardA.Chaifetz Chairman $500.0 $400.0 Richard A. Chaifetz, family o ce24 Enterprise tech, marketplaces, sports, SaaS, mobility, arti cial intelligence, ntech, HR tech, employee bene ts, health/wellness, consumer, media 5 CHICAGO VENTURES Chicago; 312-300-4650 KevinW.Willer StuartLarkins RobChesney General partners $67.0 $67.0 Instutional and private investors27 $10.5 $8.8 Consumer tech, ntech, transportation, logistics, health care IT 6 CHINGONA VENTURES Chicago SamaraHernandez Partner $6.0 Institutional LPs, pension funds, highnet-worth individuals $2.5 Fintech, future of learning, health and wellness, femtech ENERGIZE CAPITAL Chicago; 309-825-4018 KatieMcClain Partner, COO JohnTough Managing partner $800.0 $600.0 Corporate strategics, institutional investors, family o ces, impact investors 07 $260.0 $100.0 Renewable energy, electri cation and mobility, industrial operations, decarbonization 18 FIRST ANALYSIS Chicago; 312-258-1400 OliverNicklin Chairman $91.0 $91.0 Institutions, pension funds, family o ces, high-net-worth individuals 05 Technology, SaaS, health care 26 HPA Chicago; 703-909-7467 PeterWilkins Managing director $100.0 $100.0 Private investors 162 $17.0 $25.0 Digital transformation, AI, enabling technology, consumer products/services, emergent technologies 5 HYDE PARK VENTURE PARTNERS Chicago; 312-582-0436 GregBarnes AllisonLechnir IraS.Weiss GuyH.Turner Partners $100.0 $100.0 Institutional investors, family o ces31 Tech and early-stage tech-enabled businesses, consumer services companies 7 IMPACT ENGINE Chicago; 872-228-5197 JessicaDroste Yagan CEO $25.0 $15.2 High-net-worth individuals, foundations, family o ces 04 $5.1 Economic opportunity, environmental sustainability, health equity 9 IRISHANGELSINC. 1 Chicago; 574-323-8539 CarolineGash Managing director $57.8 $53.8 Individuals 17 $4.0 $11.7 B2B enterprise, B2B SaaS, consumer web/ mobile, consumer products 1 JUMP CAPITAL Chicago; 312-205-8900 MikeMcMahon SachChitnis Managing partners $350.0 $350.0 High-net-worth individuals 15 $50.0 $90.0 Fintech, B2B application SaaS, and IT/data infrastructure 13 KB PARTNERSLLC Highland Park; 847-681-1270 KeithBank CEO $196.0 $165.0 Family o ces, sports executives, professional athletes, high-net-worth individuals 28 $31.0 $24.0 Sports and technology intersection5 LIGHTBANK Chicago; 312-276-3204 MattSacks EricP.Lefkofsky Co-managing partners $207.0 $207.0 Institutional investors, high-net-worth individuals, family o ces 512$31.0 $30.0 Consumer, health care, enterprise, climate tech 5 LIONBIRD VENTURES Evanston; 847-721-2171 EdMichael Managing partner $60.0 $85.0 High-net-worth individuals, institutions 05 $14.0 $11.0 Digital health 2 LISTEN Chicago; 312-961-0153 Je Cantalupo Founder, managing partner RickDesai Managing partner, head of investments $62.0 $62.0 Family o ces, institutions, high-networth individuals 11 Consumer 6 M25 Chicago; 872-205-9775 VictorGutwein Managing partner MikeAsem Founding partner $31.8 $31.8 Endowments, fund of funds, family o ces, high-net-worth individuals 18 $7.5 $13.0 Enterprise software, nancial technologies, health care IT, transportation and logistics 6

Alphabetical directory. NOTES: 1. IrishAngels Angel Network and VitalizeVC share a common platform, Vitalize Venture Group, that encompasses the two entities.

VENTURE-CAPITAL FIRMS CRAIN'S LIST

Want 37 venture-capital rms in Excel format? Become a Data Member: ChicagoBusiness.com/Data-Lists

AUGUST 21, 2023 | CRAIN’S CHICAGO BUSINESS | 15 COMPANY TOP EXECUTIVE(S) SIZE OF CURRENT FUND (MILLIONS) 2022; 2021SOURCES OF FUNDING NEW LOCAL INVESTMENTS 2022 NEW INVESTMENTS OUTSIDE CHICAGO 2022 AMOUNT INVESTED (MILLIONS) 2022; 2021 TARGETED INDUSTRIES FULL-TIME LOCAL EMPLOYEES 2022 MATH VENTURE PARTNERS Chicago; 312-278-3460 MarkAchler DanaWright TroyHeniko Managing directors $46.0 $46.0 High-net-worth individuals, institutions 15 $6.9 $11.0 Digital technology 3 METHOD CAPITAL Chicago; 312-648-6800 BillWolf Managing partner JustinSmollar CFO $122.1 $122.1 High-net-worth individuals, family o ces, foundations, institutions 00 B2B software and tech-enabled service companies 6 MK CAPITAL North eld; 312-324-7700 MarkKoulogeorge BretMaxwell Managing general partners $120.0 $120.0 Institutions, family o ces, private investors, general partners 22 $18.0 $29.7 Software, cloud services 6 MODERNE VENTURES Chicago; 312-890-3453 ConstanceFreedman Managing partner $200.0 $200.0 Family o ces, high-net-worth individuals, institutions, strategic partners 113— Seed stage to Series B in real estate, nance, home services, insurance, hospitality, ESG-related technologies 7 OCA VENTURESLLC Chicago; 312-327-8400 JamesF.Dugan CEO, managing partner $300.0 Private investors, institutions, OCA general partners Technology, digital health, ntech, insurtech ORIGIN VENTURES Chicago; 312-644-6449 JasonHeltzer AlexMeyer Partners $130.0 $130.0 High-net-worth individuals, family o ces, institutions 28 $25.8 Software, marketplace, consumer3 THE PALO SANTO FUND Highland Park; 773-263-5751 DanielGoldberg Co-founder $50.0 High-net-worth individuals, family o ces, strategic biopharma Psychedelics, biotech, mental health, addiction treatment PRITZKER GROUP VENTURE CAPITAL Chicago; 312-447-6001 SoniaNagar Partner AdamKoopersmith Managing partner ChrisGirgenti Managing partner $250.0 $250.0 Tony Pritzker, J.B. Pritzker 05 $18.8 $10.4 Seed and Series A enterprise SaaS and B2B marketplace technology companies, B2C marketplaces and e-commerce 5 S2G VENTURES Chicago; 312-321-8000 SanjeevKrishnan Sr. managing director, chief investment o cer ChuckTempleton Sr. managing director AaronRudberg Sr. managing director $1,940.0 $1,640.0 Family o ce, high-net-worth individuals 134$409.0 $230.3 Early- and growth-stage investments in food, agriculture, oceans, clean energy 28 SANDBOX INDUSTRIES Chicago; 312-243-4100 MattDowns NickE.Rosa Managing partners $501.2 $497.6 Corporations, institutional investors, family o ces 16 $81.1 $158.9 Stage agnostic investments across health care, sustainable food and agriculture, insurtech 20 STARTING LINE Chicago; 312-488-9431 EzraGalston Partner $30.0 $30.0 Fund of funds, family o ces, CEOs, high-net-worth individuals 43 $7.5 $11.5 Technology 3 STERLING PARTNERS Chicago; 312-465-7000 StevenTaslitz Chairman AviEpstein Managing director, COO Pension funds, fund of funds, endowments, high-net-worth individuals 01 Small to mid-market growth equity and buyouts in education, health care services, business services and consumer sectors 36 SYNETRO GROUPLLC 1 Chicago; 312-372-0840 PantelisGeorgiadis CEO $195.0 $185.0 Private investors 29 $16.5 $35.5 Seed/early-stage internet, software and business services, seed-to-growth health tech, recapitalizations, buyouts of software, business services and niche branded manufacturing companies 1.5 TECHNEXUS VENTURE COLLABORATIVE Chicago; 312-435-1000 TerryHowerton CEO FredHoch General partner $17.8 $2.0 Corporations 118$12.6 $15.0 Seed and early-stage B2B tech companies across mobility, marine/outdoor recreation, manufacturing and audio 24 VCAPITAL MANAGEMENT Chicago; 312-690-4171 LeonardBatterson Chairman, CEO JamesVaughan Managing principal RyanKole Partner $53.6 $46.6 High-net-worth investors, wealth management advisers, registered investment advisers, family o ces 11 Digital sciences, life sciences, biotech, spacetech 6 VENTANA FINANCIAL ASSOCIATES Deer eld; 847-234-3434 AlbertJ.Montano Chairman $10.0 $1.0 Private investors, venture capitalists, high-net-worth individuals 32 $20.0 $1.5 Early-stage intellectual property1 VITALIZE VENTURE CAPITAL 2 Chicago; 608-852-4461 GaleWilkinson Managing director $21.9 $16.3 Individuals, corporations, family o ces 218— B2B SaaS, B2B enterprise 1 WINTRUST VENTURES Chicago; 312-291-2912 BaileyMoore Managing director $80.0 $50.0 Balance sheet 96 $16.3 $7.0 Enterprise software, marketplace, health care IT, omnichannel brand 4

Alphabetical directory. ResearchbySophieRodgers(sophie.rodgers@crain.com). |Thisdirectoryisnotcomprehensive.Includesprivate-equity rmswitho cesinCook,DuPage,Kane,Lake,McHenryandWillcountiesinIllinoisandLakeinIndiana.NOTES: 1. SynetroGroupisaprivateinvestment rmwithbothventure-capitalandprivate-equitybusinesses.Dataincludesallactivities. 2. IrishAngelsAngelNetworkandVitalizeVCshareacommonplatform,VitalizeVentureGroup,thatencompassesthetwo entities.

MARS

From Page 1

“We spend a lot of time guring out how people eat things,” says Chris Rowe, Mars Wrigley’s global vice president of research and development, as the machine chomps away in front of him. “ ere’s so much behind these simple products.”

In today’s packaged food industry, innovation is key to success. Exciting new products mean better shelf space at the grocery store, which equates to more sales, experts say. And with some customers switching to cheaper private-label products amid in ation, big brands need new o erings to defend their turf.

But innovation is hard, even for a giant like Mars Wrigley, with brands as well known as Snickers, Skittles, Twix and Extra Gum. Candy makers must get products to market quickly to keep pace with shifting consumer tastes. Often they’re competing with smaller, nimbler rivals that can roll out new treats faster. Failure can make it more di cult to raise prices high enough to shield pro t margins against rising costs of chocolate and other ingredients.

“Innovation is key to driving store tra c,” says Morningstar analyst Erin Lash. “It’s key to driving excitement around brands. Consumers are more amenable to paying a higher price when they see an added value.”

Innovation awards

Mars Wrigley’s innovation e ort is based at its Global Innovation Center on Chicago’s Goose Island. It employs about 600 people, half of whom are in research and development. At 1132 W. Blackhawk St., researchers ponder such questions as how long Americans chew gum (20 minutes) compared to Europeans (12 minutes). ey think about how to make M&M’s more snackable. Once they develop a product, then comes the hardest part: guring out how to scale it up while maintaining consistency.

“It’s not easy to come up with winning products,” Rowe said. “ e really hard part is to say, how do I make M&M’s — we make a billion a day — how do you make that consistently of great quality every single day, every single batch? at’s where a lot of the magic comes in.”

Leading the e ort is Rowe, who

started with Wrigley in 2003, half a decade before Mars announced it would purchase the gum company for $23 billion. Since then, he has worked in Germany, Russia and London.

His background is in packaging, a ripe area for consumer product innovations. When Mars Wrigley landed on Crain’s Most Innovative list in 2021, it had notched six patents the previous year, including sugar-free gum, envelope-style at packages and plastic ip-top containers for gum.

e company regularly wins innovation awards for its gum and candy creations, too. Mars Wrigley has won or been nominated for the National Confectioners Association’s annual Most Innovative New Product Awards every year since it rebranded to the combined Mars Wrigley Confectionery in 2017. at showing is on par with Reese’s maker Hershey and Nutella maker Ferrero.

On a recent tour of the facility, Rowe wouldn’t discuss speci c products under development. at’s con dential. But recent inventions from Goose Island include Skittles Gummies, with $72 million in annual sales; Snickers Protein Bars, which target the coveted “better-for-you” category; and Respawn, the rst gum made for gamers. Mars Wrigley declined to give sales gures, but said Respawn sales increased 400% this year over last year, when it launched.

New ideas often start in the marketing department, which tracks hot trends in candy markets. Retailers like Walmart might also ask Mars Wrigley to develop a product. Ideas for new candies can come from customers, too.

Respawn came from a consumer insight that there wasn’t a gum for gamers. Mars Wrigley’s R&D team worked with gamers to understand what they needed and would like. e idea then went to the test kitchen on Goose Island, where researchers worked on taste and infusion of active ingredients.

e winning idea was scaled up in the pilot factory there, then sent to a larger plant for high-volume production.

M&M Munchums, made with chickpea our, t into the “betterfor-you” category, a niche Mars Wrigley is targeting for growth. e innovation center came up with the idea of using chickpea our, which gives customers a lower-calorie, lighter option, while also tapping into the plant-based trend.

Additionally, Mars Wrigley can sell Munchums in the candy and cookie aisles, broadening the customer base.

Many new products are variations on existing o erings, or brand extensions. ey keep those products relevant, Rowe said. Skittles Giants, which are sold in the U.K., and Fudge Brownie M&M’s are examples.

Not every new product is a home run. Skittles Ginormous — an egg-sized Skittle with a blend of all ve original avors — fell at. A unique product, but too much of a mouthful, Rowe said.

Mars Wrigley, which has its global headquarters in Chicago, wants to double its business in the next seven years, Rowe said. McLean, Va.-based parent company Mars Inc.’s revenue was about $45 billion last year, but it does not disclose nancials for Mars Wrigley. Mars Inc. also does not disclose how much of its business Mars Wrigley accounts for, with its portfolio of candy bars, gum and other confections. A spokesman said it sinks “hundreds of millions of dollars” into innovation a year.

Gum test batches

e Goose Island hub is set to get a new $50 million building later this year. It will be focused on chocolate and add about 30 jobs. Such a focus on innovation is a trend at consumer goods companies, said Shivani Vora, who leads global consulting rm Accenture’s Innovation for North America.

“During the pandemic, we found companies reducing the investments in innovation,” she said.

“ ey’re starting to pick up again.”

In the existing Goose Island facility, test batches of gum are mixed up in the lab. e gum looks like dough for sugar cookies before it’s rolled and sliced into sticks. e sticks are aged in rooms that mimic store conditions, so researchers can learn about the shelf life.

Mars Wrigley’s gum and Skittles are made in large quantities at a factory in Yorkville, and its ice cream is made in Burr Ridge. e two sites employ about 650 people. e Goose Island facility has a pilot plant, and it smells fruity. Its goal is to test if the new candies can be made on a continuously running line and work out kinks for large-scale production.

“ at’s how you make and lose money,” Rowe said. “On the margins.”

16 | CRAIN’S CHICAGO BUSINESS | AUGUST 21, 2023 CLASSIFIEDS Advertising Section

your listing,

CAREER OPPORTUNITY CAREER OPPORTUNITY CAREER OPPORTUNITY CAREER OPPORTUNITY CAREER OPPORTUNITY ChicagoBusiness.com/CareerCente r Connecting Talent with Opportunity. From to p ta lent to to p em pl oyers, Crain’s Career Center is the next step in your hiring process or job search Get started to day CAREER OPPORTUNITY CAREER OPPORTUNITY CAREER OPPORTUNITY Crain’s Career Center jobs.chicagobusiness.com Contr oller sought for ServPro South Chicag o jobs.chicagobusiness.com

To place