The high cost of dollar stores on low-income neighborhoods

Limited retail options on the South and West sides add to ongoing economic distress I PAGE 15

Limited retail options on the South and West sides add to ongoing economic distress I PAGE 15

Roz Brewer’s departure as CEO of Walgreens Boots Alliance comes in the midst of a multibillion-dollar e ort to stand up a new heath care business that has so far paid few dividends.

e Deer eld-based pharmacy giant announced Sept. 1 that Brewer stepped down from her role after less than three years — a period in which the company’s stock price lost more than half its value. In Brewer’s place, Walgreens lead independent board director Ginger Graham — an executive with the health care experience that Brewer, a veteran of Starbucks and Sam’s Club, lacked — will serve as interim CEO.

Brewer, 61, took over the company in 2021 as it embarked on an e ort to transition away from its core retail pharmacy business and leap head- rst into the complex and crowded health care

provider market. Like its peers and other retail companies — from CVS Health to Walmart and Amazon — Walgreens has attempted to make money in health care delivery as its traditional retail pharmacy business has come under pressure from e-commerce players and pharmacy industry entrants.

Walgreens has invested billions into acquiring health care assets, from primary care to specialty pharmacy services, many of which were executed under Brewer’s tenure. But the strategy has yet to excite investors as the segment is growing slower than anticipated. Industry analysts say it might still be too early to determine the strategy’s success or failure, but Brewer’s departure signals that Walgreens recognizes it’s time to kick-start the segment into growth and is hoping

A group of lawmakers, transit of cials and civic leaders has drafted a ‘bold’ outline of proposed changes for the region’s transportation system

By Greg HinzWith a looming nancial cli threatening to force cuts by as much as 40% in Chicago-area public transit service, voters are getting their rst look at a plan that’s spent months in development on how to remake the Chicago Transit Authority, Metra and Pace for the post-COVID era.

e plan is, to use its own word, “bold” — calling for new investments and fare cuts funded by expanding the state sales tax to cover more services and raising tolls on the Illinois Tollway, a shift of service away from its current downtown focus and the addition of more service, particularly on buses.

At the heart of the plan is what

amounts to a proposed massive regional deal in which City Hall would have to give up control of the Chicago Transit Authority, but in exchange get lots more money and relief from a current funding formula that the CTA argues has particularly worked against the interests of its riders.

Skeptics who said a retail veteran might not be the right kind of executive to lead a drive into the sector are vindicated as Brewer exitsGEOFFREY BLACK

For good or bad, the way of the world is that nothing lasts forever. Even political columnists, though we’re a long-lived breed. So below are some thoughts as, after an amazing half-century of watching Illinois politics and government, I dial way back on my tasks here at Crain’s.

Much as a few internet trolls would prefer, I won’t be disappearing. You can still call me a raging progressive, or a MAGA-loving Republican. I’ll still do a monthly column here, as well as an occasional special project. But this is a good time to take stock.

Let’s start with the pols — who, despite speculation to the contrary,

I really don’t hate. I nd politicians and government leaders in general to be no better or worse than the rest of humanity. eir egos may need regular stroking — an o ense that surely applies to journalists — but most are just people trying to do their job and look out for their future.

ere have been some real stars I’ve covered in government. e late U.S. Sen. Paul Simon and former President Barack Obama both went into this business for the right reasons, and both succeeded. Ditto for ex-Gov. Jim Edgar, a moderate conservative who knew and knows how to reach out. Close behind are ex-Mayors Richard M. Daley and Rahm Emanuel, who despite their mistakes had a vision for Chicago that made sense. And, reaching back a little further, former Mayor Harold Washington, whose death came when he was just nally

getting a chance to live up to his potential.

None of these folks were perfect. Edgar, for instance, bequeathed the state a backloaded pension system that decades later is still out of whack. Obama ignored the Democratic Party to focus on his own policy ideas, a mistake he paid dearly for during most of his tenure. Emanuel mishandled the Laquan McDonald tragedy. But all of them knew what they wanted to do and had a plan to do it, and — refreshing for Chicago politics — none were out to enrich themselves.

at said, local politicians still are too inclined to take care of their supporters — “the base,” in political parlance. at’s why Mayor Brandon Johnson’s treatment of the Chicago Teachers Union and its wish list will receive huge attention in coming months, because the mayor does not yet appear to realize

that what’s good for the CTU is not synonymous with what’s good for Chicago.

at split — taking care of the base — has worsened nationally. A visibly aged President Joe Biden has tried to hold together a center of sorts. But on issues such as abortion, gun control, LGBTQ rights, immigration and more, consensus seems increasingly out of reach. e cultural wars are back, with a vengeance. e mantra no longer is to come together and govern for everyone after the election. Instead, it’s take over and ram through what we want.

at is a recipe for civil war, not one nation.

A few thoughts for my media colleagues: Remember who your writing and reporting is really for: your readers and subscribers, people who count on you to inform them. Be passionate; if you check

out at 5 o’clock and don’t go the extra mile, your readers will be shortchanged. In other words, it’s personal. Treat public o cials and candidates with respect, but insist that you be treated with respect because you’re doing a job that, in a democracy, needs to be done.

More thoughts for the media: Keep it light and entertaining; your clients, your readers, don’t want to be lectured or ooded with minutia. Above all, tell the truth. at means reaching out to make sure your perspective is complete. In other words, progressives, try to understand why many millions of voters like Donald Trump. Truth-telling may mean burning a source or inviting retaliation. So be it. As a wise colleague once told me, if at any point in time at least a couple of pols don’t want to hang you by your toes, you’re not doing your job. See y’all a little later.

The walk from the Roosevelt Road el station to Soldier Field on game day o ers a lesson in numerical history, with Bears jerseys as the study guides.

Justin Fields (No. 1) is gaining on Walter Payton (No. 34) as the garment of choice. Sturdy linebacker mates Brian Urlacher (No. 54) and Lance Briggs (No. 55) still claim a following, as does Dick Butkus (No. 51) among us gnarly old-timers.

You half expect to see a Devin Hester acolyte (No. 23) darting in and out among fellow pedestrians, while Matt Forte (No. 22) is content to bob along behind his blockers and take what the tra c gives him.

It didn’t end well for Brandon Marshall here, but don’t remind the tall, trim target sporting the No. 15 Marshall jersey.

But No. 6, oddly, is nowhere to be found. Belonged to a fella named Cutler.

Butkus and Payton aside, each of the aforementioned luminaries has played for the Bears since I moved back to Chicago for the 1997 season. I’d spent 20 years in northern California, and I was spoiled. I had seen the 49ers revolutionize pro football under Bill Walsh. e Bears are still searching for their equivalent genius.

My rst year back was Dave Wannstedt’s next-to-last as coach.

en came Dick Jauron, Lovie Smith, Marc Trestman, John Fox

Correction

and Matt Nagy. Front o ce folks included Mark Hatley, Jerry Angelo, Phil Emery and Ryan Pace.

A lot of names, a fair amount of talent and not a lot of success. And now, Year Two of Matt Eber us and Ryan Poles.

A 100% improvement in the record gets them to six wins, which gets them nowhere. ey’ve brought in a big-play receiver.

ey’ve upgraded the roster. ey believe they’re building something on defense.

But it’s the NFL. It all comes down to Mr. Fields. If you haven’t got the quarterback right, you haven’t got anything.

e best thing the Bears might have going for them is that the division has come back to them.

Green Bay pretty much ruled it during the Favre/Rogers era, but the Packers are in for a serious retrenchment. If the carefully sheltered Jordan Love somehow maintains the standard to which the Packers are accustomed, he’ll be the NFL’s biggest stunner since Kurt Warner became a Super Bowl quarterback for the Rams.

Detroit is the avor of the month in the NFC North going in, but given their grim history — one playo victory since 1957 — the Lions will always be the Lions until they prove otherwise.

Meanwhile, some questionable salary cap decisions depleted the Vikings’ roster, and they’re still trying to win with a quarterback who hasn’t won anything of note.

So, coming o a dismal, the division is there for the Bears. Are they good enough to take it?

Not yet. e ask is too much.

Yet I remove my reporter’s

objectivity cap and hold out hope. My day job is at Leo High School, a small, all-boys, all-minority Catholic school on Chicago’s South Side. Eber us came for a visit last spring. During an assembly, he talked about resiliency, about setting goals and sticking to them, about getting up after you’re knocked down. He answered questions, posed for pictures . . . he could not have been more gracious.

Our guys come from some hardscrabble backgrounds. It meant something to have the head coach of the Chicago Bears share his time with them.

During training camp, several young Leo men attended “Scout School” at Halas Hall. ey watched practice with the scouts and listened in on their conversations. After lunch, representatives of various departments shared their stories of how they’d come to work in pro football, in keeping with Poles’ objective of showing the kids that a career in sports is possible without being an elite athlete. ey were . . . dazzled.

Some context: Wannstedt probably bought himself an extra year as Bears coach by being a good guy. But it’s a results-oriented game,

and if the results aren’t there for Poles and Eber us, character and kindness aren’t going to save them. Or maybe they’ll turn out to have a little Jimmy Johnson in them. Jimmy cut, among others, his wife after taking over the Dallas Cowboys. He proceeded to win two Super Bowls and a ton of games . . . without ever being accused of being a nice guy. Whatever works.

Crain’s contributing columnist Dan McGrath is president of Leo High School in Chicago and a former Chicago Tribune sports editor.

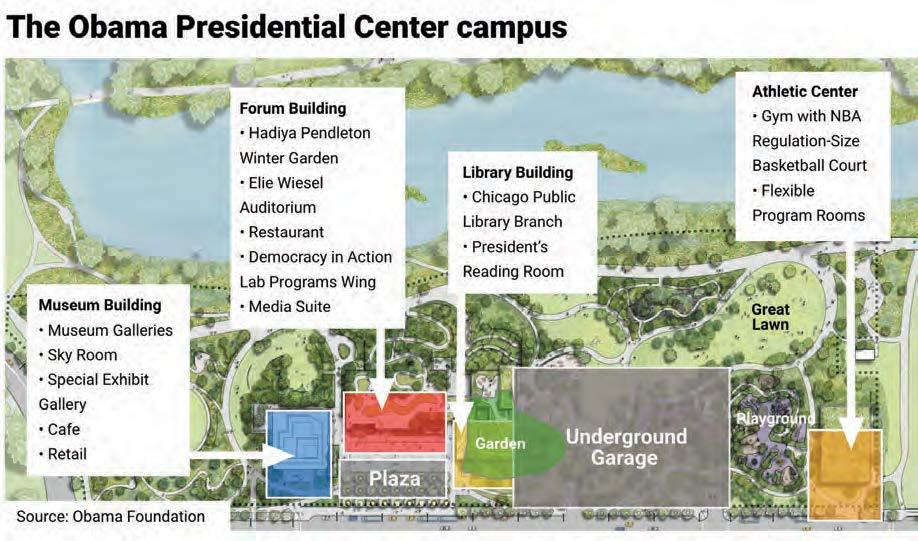

Construction of the $800 million museum campus is about halfway done and due to be completed by fall 2025

IIt’s still far too early to tell whether it indeed will be a transformative project, one that will raise Chicago’s pro le and change the direction of a big chunk of the South Side for better — or, according to a few critics, for worse.

But after years of planning and raising well over $1 billion, the Obama Presidential Center nally has emerged from the ground as a physical presence in Jackson Park, just across the street from Hyde Park Academy High School and a quick walk from the University of Chicago campus.

Cement trucks roar around the 19.3-acre site and workers — 53% of them minority, according to the center — scurry about.

The mayor has promised to not raise property taxes, a move that could box him in on making investments toward a more equitable Chicago

Mayor Brandon Johnson has about a month to decide whether to hold rm on a campaign pledge to not raise property taxes, a decision that will shape his rst budget and ability to make sweeping investments he says are needed to make Chicago more equitable.

Johnson is tentatively scheduled to release his rst budget proposal on Oct. 11 and has given no indication he’ll ip- op on raising property taxes. But absent other sources of revenue that are unlikely to materialize this year, his rst spending plan will be measured on the down payments it lays down, rather than “transformative investments,” according to his allies in the City Council.

But those allies say setting the foundation for how Johnson will govern through his rst budget is enough to keep their support and convince the broader movement that elected him that it was worth the e ort.

By Greg HinzThe center’s central tower, which will house a digital presidential library and museum, is now several stories in the air and set to be topped off by April.

Johnson has already scaled back his campaign rhetoric to match the governing reality on a number of important initiatives, including reopening the city’s shuttered mental health clinics over time, instead of during his rst year in o ce, and tweaking a real estate transfer tax to a tiered rate, rather than hitting all sales that eclipse $1 million.

A clearer picture of where the mayor’s budget is heading will emerge after the city releases its annual forecast later this month, which will provide more clarity

on whether 2023 revenues continue to outpace previous estimates and the anticipated budget de cit for 2024.

In April, just before handing o the reins to Johnson, former Mayor Lori Lightfoot released a released a midyear budget forecast that projected a 2024 budget shortfall of just $85 million, down from a previous estimate released last summer that set the gap at $473.8 million.

But the forecast relied on keeping in place a Lightfoot-era initiative to annually raise the city’s property taxes based on the yearly rise in the consumer price

The Chinese American Service League paid $8 million for a 5.2-acre property in Bridgeport, where it intends to build a mixed-use project

Danny EckerA long-vacant development site along the western edge of Bridgeport is poised to become a mixed-use campus serving the city’s growing Asian American population after it was sold to a locally based social service agency.

e Chinese American Service League paid $8 million late last month for the 5.2-acre property at 3000-3052 S. Pitney Court, according to a statement from ACO

Commercial, which marketed the property on behalf of the seller. e Chicago-based nonpro t plans to develop the site with a “comprehensive community care campus” that includes affordable senior housing, an adult day service center for seniors, an early child-care center and a commercial kitchen for senior meals and culinary training programs, the statement said.

e project, which would be built along the arm of the Chicago River’s south branch known

as Bubbly Creek, is slated to include a community center that o ers sports programs, meeting space and outdoor garden space along the water.

e plan would bring activity to a long-fallow property that was home to a Peoples Gas manufactured gas plant over a century ago and has undergone extensive environmental remediation over the past 15 years. It would also highlight the continued

A clearer picture of where the mayor’s budget is heading will emerge after the city releases its annual forecast later this month.FILEPHOTO The development site at 3000-3052 S. Pitney Court in Bridgeport. I ACO COMMERCIAL

An association representing more than 120 corporations, including high-pro le locally based heavyweights like drugmaker AbbVie and agribusiness giant Archer Daniels Midland, has asked state regulators to overturn a Commonwealth Edison surcharge that they say is collectively costing them more than $100 million.

e Aug. 31 ling by the Chemical Industry Council of Illinois, along with several other individual companies and other institutional power consumers, takes aim at ComEd’s monthly charge gradually clawing back credits the utility provided customers last year and early this year under the Climate & Equitable Jobs Act, or CEJA.

ose credits, which turned out to be wildly and overly generous, were tied to payments under the 2021 clean-energy law that nuclear power generator Constellation Energy Group made to ComEd under provisions to bail out three nukes in Illinois. e law set a power price those facilities were to get from ComEd customers over a ve-year period.

Under CEJA, if market prices turn out higher than the bailout price, Constellation is to refund the di erence, and ComEd customers get a credit on their bill. If

lower, ComEd pays Constellation the di erence and sends the bill to customers.

Customer arguments

ComEd ended up refunding $1.1 billion more than it should have in the year that began June 1, 2022. Beginning in June 2023, it now is recovering that amount and charging 5% interest to do so.

e industrial customers argue that the Illinois Commerce Commission didn’t follow CEJA in allowing ComEd to impose the surcharge without conducting a formal proceeding. e ICC voted instead in May to allow the surcharge to go forward without a review that would permit the involvement of outside parties.

ey also argue that ComEd’s alleged mismanagement of the program should bar the utility from collecting the surcharge.

ey’re urging the commission to halt it and order refunds of what ComEd has collected since June.

“ e Chemical Industry Council of Illinois is ling this complaint because our members are being whipsawed by the huge increase in ComEd Carbon Free Resource Adjustment charges, which began in June 2023,” council CEO Mark Biel said in a release.

“We are convinced that these charges are unjusti ed and should be disallowed by the Illinois Commerce Commission.”

A lawyer for the complainants cited ComEd’s admissions of bribery over nearly 10 years in calling on the utility to allow for a more open debate over how it’s managed the CEJA nuke bailout charges and credits.

“After its July 2020 Deferred Prosecution Agreement and ComEd’s alleged rededication to fully transparent and ethical management, it’s more than disappointing to see ComEd take back credits it had provided to customers without justifying its actions,” attorney Paul Neilan said in the release. In representing the plainti s, Neilan is joined by Patrick Giordano, a longtime attorney on utility issues who’s represented large users unhappy with ComEd’s actions in the past, such as the building formerly known as the Sears Tower.

In their complaint, the parties allege that the massive size of the clawback — $1.1 billion — was revealed in a Securities & Exchange Commission ling by ComEd parent Exelon only after the ICC moved to allow it without a formal proceeding.

“Since the commission did not suspend what appeared to be innocuous revisions to the Rider CFRA tari s, no hearings were held regarding the propriety of these tari revisions,” according to the complaint. “As a result of ComEd’s lack of disclosure of the

real nature of its lings of these tari revisions with the Commission, no party had an opportunity to object to the massive impacts of ComEd’s revisions to Rider CFRA before the revisions went into effect.”

Increase about 8%

ComEd currently is adding a charge equaling more than a penny per kilowatt-hour to customer bills to claw back the credits. at is about an 8% increase to electricity bills each month.

ComEd spokeswoman Shannon Breymaier said in an email that the utility was analyzing the complaint. But, she wrote, ComEd “expects to vigorously defend our actions in implementing CMCs.”

“We are appropriately charging and crediting customers and have been clear about the CMCs, and the charges and credits that implement them, with the commission and our customers,” she said.

e commission will have to respond to the complaint and is likely to get a motion to dismiss from ComEd. Commission Chairman Doug Scott joined the agency in June, about a month after its initial decision to allow the surcharges to go forward. He was a key architect of CEJA as an adviser to Gov. J.B. Pritzker in 2021, when the law was passed, and the way the nuclear bailout was structured was a point of pride for the Pritzker team.

It appeared to work better than anyone might have imagined when market power prices soared in 2022 after Russia’s invasion of Ukraine. But prices de ated within months while the ComEd credits to customers remained, causing the imbalance that led to the $1.1 billion recovery.

Whatever the commission does, the issue is likely headed to the Illinois Appellate Court, which hears appeals of ICC rulings.

being covered by insurers.

Facing multiple shareholder lawsuits tied to the ComEd bribery scandal, Exelon wants to use insurance proceeds for one settlement to defray insurance costs tied to another one.

Exelon has proposed to settle a series of shareholder suits brought against directors and ofcers on behalf of the company for $40 million. Plainti s’ attorneys would get $10 million of that under the proposal.

e remaining $30 million would go to fund part of a $173 million settlement that Exelon has entered into with shareholders who sued the company to compensate them for stock losses they said they su ered after Exelon-owned Commonwealth Edison admitted to a nearly decadelong scheme to bribe then-Illinois House Speaker Mi-

chael Madigan.

“As explained in court, the terms of the derivative settlement did not dictate how the settlement proceeds are to be used,” Exelon spokeswoman Rhea Marshall said in an email. “Exelon determined that it is in the company’s best interest to use the proceeds from the derivative settlement — net of attorneys’ fees — to fund a portion of the securities settlement.”

An outside attorney for Exelon disclosed the plans for the cash during a hearing Aug. 31 in federal court in Chicago. A group of plainti s seeking damages on behalf of the company have challenged Exelon’s proposed settlement, asking, among other things, if there’s more insurance coverage available to settle the litigation than what Exelon so far has disclosed.

Exelon thus far hasn’t been willing to say, plainti s’ attorneys

say. e company declined to disclose the gure to Crain’s.

e objecting plainti s want U.S. District Judge John Blakey, who’s overseeing the litigation, to force Exelon to disclose that gure. He has yet to rule on that and other objections.

Both settlements are pending court approval, but the $173 million one gures to go forward, since none of the parties is opposing it.

e $40 million settlement is a di erent story. at’s the culmination of a two-year process in which Exelon appointed a special committee made up of three outside lawyers to negotiate with the plainti s’ attorneys. e committee, and Exelon’s board itself, agreed to settle the suit in May, and the panel issued a 100-page report in June summarizing its work.

er to gather information from the special committee on how it reached its decision.

Attorneys representing the special committee argue that Pennsylvania state law, under which the case is being considered, provides such panels wide latitude on settlement terms if their members are independent and their probe adheres to reasonable standards.

When it rst disclosed the two settlements in May, Exelon looked to be committing to pay $213 million between the two. With $30 million from one going toward the other, the actual gure is $183 million. All of that is

Some plainti s have cried foul, saying a separate group of plainti s who signed onto the settlement came into the process just a few weeks before the deal was nalized.

ey’re challenging it in court and asking Blakey for more pow-

In court, a lawyer for the objecting plainti s also questioned why the only individual executive made to pay personally in the settlement is former Exelon CEO Chris Crane. Crane had performance shares he was set to collect reduced by $4.2 million earlier this year. He still saw his compensation for 2022 total more than $30 million, with $11 million of that made up of stock awards.

ComEd paid a $200 million ne in its 2020 deferred-prosecution agreement with the U.S. attorney’s o ce in Chicago. at was not covered by insurance.

Exelon has proposed to settle for $40 million a series of shareholder suits brought against directors and of cers on behalf of the company.

Fisher-Harrell, 53, a former dancer with Hubbard Street Dance Chicago, is the rst woman and rst person of color to be the company’s artistic director. Earlier this year, she signed internationally renowned Canadian-American choreographer Aszure Barton as a resident artist for three years at the contemporary dance company. She and her husband live in Uptown and have three children, ages 31, 29 and 15. I

Tell us about your early years. My childhood was unique because both of my parents were blind. My dad has no vision, and my mom has just a little, enough to cook and take care of us. We had a very middle-class lifestyle in Baltimore’s inner city.

How did that affect you?

I grew up fast. Helping my parents get around was just part of being. We always took the bus, and at 3 years old, I already knew enough letters to help my mom identify stops. By age 9, I was catching the bus by myself.

Why did you become a dancer?

I came to dance at an exciting time, in the ’80s. Michael Jackson was ghting to get on MTV. Movies like “Flashdance” and “Fame” were hot, and the TV series “Solid Gold” was super popular. I dreamed of being in an M.J. video.

How did you break into that world?

rough pure ignorance. At 14, with zero dance training, I auditioned for the Baltimore School of the Arts and was accepted.

What did they see in you?

I was exible, musical and I could move. I imagined them thinking, “She’s (dancing) all wrong, but she’s strong and wrong, and could be taught.”

A major hurdle?

Getting into dance so late. Unlike younger kids, I had to learn ballet, modern, jazz and West African technique all at the same time.

A pivotal moment?

At age 14, I went to a performance of the Alvin Ailey American Dance eater (a primarily African-American, New York-based modern dance company) and it kicked my training into high gear. I could identify with the people onstage. So long, Michael Jackson video. I had a new dream.

How did that turn out?

At 19, I joined Hubbard Street for three years, and then became a principal dancer at Alvin Ailey, which took me around the world.

Most memorable audience?

President George W. Bush and

By Laura Bianchithe rst lady, Colin Powell, Condoleezza Rice and Dick Cheney. It was mind-blowing! I was one of three Alvin Ailey dancers invited to perform at a White House state dinner.

What would surprise us about you?

Before I started dancing, I dreamed of being a Marine. Seriously.

Why?

e powerful precision of the Silent Drill platoons that I saw on TV, with Marines in dress uniform and white gloves with ri es or swords, was inspiring.

Why didn’t you enlist?

I realized that I was drawn to the choreographed movements, not the battle eld.

The legislative effort to gradually eliminate Chicago’s sub-minimum wage for tipped workers is back on track and teed up for approval as soon as early October after a key committee vote last week.

Introduced in July, the ordinance would phase out the city’s lower wage for tipped workers over a two-year period. The measure has the backing of Mayor Brandon Johnson and has been pushed by the national One Fair Wage campaign.

But at the July meeting, Ald. Anthony Beale, 9th, put up a temporary roadblock by sending the ordinance to the Rules Committee, a move that slowed down the process and gave the restaurant industry more time to galvanize opposition to the measure.

In a procedural voice vote Wednesday without significant opposition, the Rules Committee, which includes the entire City Council, voted to send the

measure back to the Workforce Development Committee. If the full City Council approves the same action at its meeting Sept. 13, a final vote on the ordinance would likely be set for the Oct. 4 City Council meeting.

Before a final council vote, the Workforce Development Committee would need to approve the proposal. Freshman Ald. Jessie Fuentes, 26th, who introduced the ordinance along with Johnson’s City Council floor leader, Ald. Carlos Ramirez-Rosa, 35th, said a vote by that committee would be scheduled for later this month.

The proposal would require the sub-minimum wage to be increased by about $3 by July 2024 and another $3 in July 2025 to match the city’s standard minimum wage, which is $15.80 for companies with at least 21 employees and $15 for smaller companies, with annual cost-of-living increases thereafter.

Currently, employers are on the hook to make up the difference when an employee’s hourly wage plus tips don’t add up to the city’s minimum wage. Even if the sub-minimum wage is approved, workers could still receive tips to boost their wages further.

The proposal is opposed by the Illinois Restaurant Association, which successfully fought a similar effort in 2019 by former Mayor Lori Lightfoot, who settled for a one-time bump in the sub-minimum wage without a path to eliminate it.

Sam Toia, president of the association, has argued that the two-year phaseout period is too short and will put a strain on restaurant owners who operate on thin margins.

Fuentes previously told reporters her coalition was open to a four-year phaseout, but the ordinance has not been amended.

“We have not been closed to negotiations or further conversations with folks like Sam Toia and the Illinois Restaurant As-

sociation,” Fuentes said after the meeting. “He knows how to get a hold of us and we will reach out.”

In previous negotiations, opponents of the measure, including large restaurant groups, have also offered a potential compromise where restaurants could opt to either agree to phase out the tipped wage or pay their workers a minimum

wage of at least $20, according to two sources familiar with the discussions, but that option has been shot down by the supporters of the ordinance.

“We shouldn’t have to invent systems to get people to a fair wage,” Fuentes said when asked about the floated compromise.

As they have during each step of the legislative process, supporters of the ordinance held a rally at City Hall after the Sept. 6 vote.

Atwo-level penthouse in the earliest downtown high-rise built expressly for condos is for sale by its owners of almost two decades.

Along with its spot in downtown real estate history, the condo has a feature that shows o its early-1960s pizzazz: a two-story wall of windows shaped like a barn because of the zigzag of the roo ine. It frames a nice view of surrounding buildings and Lake Michigan.

Priced at $588,000, the two-bedroom condo is one of four original penthouse units at 201 E. Chestnut St. Construction began on the 26-story Gold Coast tower in 1964, months after Illinois legislators passed a law in July 1963 making condominium-style ownership within multi-unit buildings possible.

By early 1965, the developer, Dunbar Homes, was touting the project with ads in the Chicago Tribune as “Chicago’s rst closein condominium,” which distinguished it from a contemporaneous building on Barry Avenue in Lakeview.

Dunbar, headed by Herb Rosenthal, had already completed the city’s rst new condos, as opposed to conversions of existing units, in a low-rise development at 6347 N. Ridge Ave. at the northwest corner of the Edgewater neighborhood.

At the Chestnut Street building, Dunbar’s ads promised “everything that spells urbane elegance, in the shadow of Chicago’s historic Water Tower, with the security of home ownership.”

e architect for the tower, Richard Barancik of Barancik & Conte, died earlier this summer, leaving behind a large portfolio of modern residential towers, bowling centers and other structures, including the zippy rolling roofs of two long-vacant bathhouses at Adeline Jay Geo-Karis Illinois Beach State Park.

Before his death, Barancik was the last surviving member of the Monuments Men, an international military group in World

War II that protected and recovered European artworks looted by Nazi soldiers.

On Chestnut Street, Barancik designed a 124-unit building with four duplex penthouses at the top, beneath a pyramidal cap that covered the “skyline lounge” common area and swimming pool. e roo ine over the penthouses bends up, over and back down several times to give each of the penthouses a 17-foot wall of windows in the gambrel shape, which resembles a barn.

e penthouse that’s on the market, represented by Compass agents Santiago Valdez and Elizabeth Pyle, has a river rock replace that the agents believe is original to the design, because another penthouse that sold several years ago has the same.

e condo, which has been on and o the market since June 2020, “needs some updating,” Pyle said. e kitchen and two baths are dated, but livable. It has one bedroom on the rst level with the living room, kitchen and balcony, and a second bedroom and open loft room on the upper level.

e sellers bought the condo in 2005 for $575,000, according to the Cook County Clerk’s O ce. At the present listing price, $588,000, they’re asking 2% more than they paid for it. ey originally listed it at $649,000 two years ago.

By Dennis RodkinMost insurers will cover only 30 one-hour therapy sessions — for an entire calendar year.

Dan and Jennifer Gilbert last week announced the Gilbert Family Foundation, Henry Ford Health and Shirley Ryan AbilityLab will bring a 72-bed state-ofthe-art physical medicine and rehabilitation facility and neurobromatosis research center to Detroit.

e rehab facility will become part of Henry Ford Health’s campus expansion and be managed by Shirley Ryan AbilityLab of Chicago.

e Nick Gilbert Neuro bromatosis Research Institute will be created in partnership with Henry Ford Health and Michigan State University Health Sciences.

e construction and operation of the initiatives will cost an estimated $439 million over 10 years, according to a news release. e Gilbert Family Foundation will contribute nearly $375 million in grant funding.

e neuro bromatosis institute is named after the Gilberts’ late son to house research advancing toward a cure for NF and increasing access to personalized

care. Nick Gilbert died in May after a lifelong battle with the genetic condition.

Dan Gilbert su ered a stroke in May 2019 and underwent treatment at the Shirley Ryan facility in Chicago.

“When I su ered my stroke back in 2019, I sought out the best care in the country and found it in Chicago with the Shirley Ryan AbilityLab,” Gilbert said Sept. 6. “I’m forever grateful to the doctors, nurses, therapists and sta who helped me improve every day. However, while there I met many other patients who could not get all the rehabilitative care they need because insurance limited the number of hours covered. is is too often the experience for Detroiters as well.”

$10 million fund

To that end, the Gilbert Family Foundation is establishing a $10 million fund speci cally for Detroit residents who make less than 400% of the federal poverty line to receive care at the new stroke center. It’s unclear how many patients will ultimately bene t from that fund, but Peggy

Kirk, president and CEO of AbilityLab, said she expects it to be “a lot of patients.”

e planned AbilityLab in Detroit — slated to open in 2029 — will occupy three oors of the planned Henry Ford Hospital tower and will total 125,000 square feet.

e Shirley Ryan AbilityLab has been ranked by U.S. News and World Report as the highest-ranking rehab hospital in the country.

“Our singular focus is helping patients regain ability through intensive rehabilitation that leverages the best tools and technology,” Kirk said. “ at really enhances their ability to function, to move, to communicate and participate in a meaningful life.”

A facility such as the planned AbilityLab has been discussed as needed in Detroit for some years, as Crain’s Detroit Business has previously reported.

“Normal insurance doesn’t pay for the rehabilitation” of a stroke at the level that Dan Gilbert was able to pay for, Phil Weaver, CEO of Hope Network in Grand Rapids, told Crain’s in early 2020.

“For a person with a serious stroke, or even a mild stroke, to be frank, it doesn’t move the needle far enough,” Weaver said at the time of the covered one-hour sessions.

While AbilityLab has its agship location in Chicago, the organization has partnerships around the world, Kirk said. However, the planned Detroit facility will make for a “new, smaller agship,” Kirk said.

Bob Riney, president and CEO of Henry Ford Health, said the inclusion of the Shirley Ryan AbilityLab, as well as the Nick Gilbert Neuro bromatosis Research Institute, t in perfectly with the planned $2.5 billion planned expansion.

“I think that what you’re going to see with this campus is what Detroit needs, which is a worldclass destination for care for both people that live in the immediate ZIP code and people that live beyond,” Riney said. “And with the Shirley Ryan AbilityLab — and some of the critical clinical services that we’ll be doing — this will not only take care of our im-

mediate neighbors, but people will be coming from all over to seek this care. And that’s another economic multiplier for the city.”

e Sept. 6 announcement makes for the “most signi cant and ambitious philanthropic project” on which the Gilberts have embarked since the couple’s initial launch of a $500 million initiative in March 2021.

at funding comes from the Gilbert Family Foundation and the Rocket Community Fund, with $350 million from the former and $150 million from the latter — expected over the next 10 years, or $50 million annually, to be given to a variety of initiatives in the city.

Other uses for that money have been numerous, and include $13 million to ght eviction, $10 million to help fuel startup growth and another $10 million to help contractors in the city of Detroit.

e Gilberts’ philanthropic funding comes, at least in part, from a March 2021 $500 million sale of stock in Rocket Companies, the parent company of Rocket Mortgage, of which Dan Gilbert is board chair and the largest shareholder.

Nick Manes writes for Crain’s sister publication Crain’s Detroit Business.

No matter where you stand on the contentious issue of school choice — shorthand for the debate over using state money to help families defray the cost of private schools — most fair-minded people can agree on this: Vociferous opponents of school choice should probably live by the rules they would enforce on others.

And yet, it’s come to light that one of the harshest critics of school choice in Chicago — who has gone so far as to characterize those on the opposite side of the debate as racists — is sending one of her children to a private school. Decrying the quality of the public schools available to her family on the South Side, she explained that this private school better matches her ambitious and talented child’s academic, social, emotional and extracurricular needs.

She is, surprisingly enough, Stacy Davis Gates, president of the Chicago Teachers Union, who, along with her rank-and-file membership of roughly 25,000 Chicago Public Schools employees, has successfully campaigned against measures that would divert public money to help families afford private school — families, we might say, just like hers.

In justifying her decision to send her son to a Catholic high school on the South Side, Davis Gates noted that “options for Black students, their families and entire Black communities on this city’s South and West sides are limited,” and cited disinvestment in

How will the CTU rank and le — not to mention the Chicago Board of Education — feel about Davis Gates’ critique of the quality of their work product in Chicago?

schools in those swaths of the city. And yet, in 2013, the school district’s total budget was $5.3 billion, or about $13,200 for each of its 403,000 students. The 2023 budget is $9.4 billion, or about $29,400 each for the current enrollment of roughly 322,000 stu -

dents.

Which isn’t to say school funding isn’t in crisis in Chicago. Far from it. About $4,000 of the CPS budget per student is used to pay for non-academic expenses such as pension payments and debt financing. And, as fed -

eral COVID money runs out, deficits loom. Meanwhile, personnel costs make up the lion’s share of CPS expenses at 65%, and its 43,000 employees get raises every year — thanks in part to a new contract signed after Davis Gates & Co. walked off the job for 14 days in October 2019, winning a 16% salary increase over the coming five years.

To be sure, Davis Gates isn’t getting state support to pay for her son’s private school education. Presumably, she and her family can afford to pay tuition in the range of $15,000 a year. But what about other parents on the South and West sides who might want to send their children to a private school for the same reasons Davis Gates did — but aren’t in the position to pay a tab of that size? Are they fascists and racists, as Davis Gates herself once characterized advocates of school choice?

As long as we’re asking questions, here are a few more: How will the CTU rank and le — not to mention the Chicago Board of Education — feel about Davis Gates’ critique of the quality of their work product in Chicago?

In a Sept. 7 letter to her membership sent in the wake of the news, she cast her team as the heroes who have “always fought and will continue fighting for the equitable resources that these school communities deserve.” As for the Board of Ed, the jury is still out: As of this writing, President Jianan Shi has not returned Crain’s calls seeking comment.

We are now a few weeks removed from the release of the Illinois Auditor General’s scathing performance audit of the Illinois Department of Employment Security Unemployment Insurance Program. is audit revealed that due to gross incompetence and mismanagement by IDES, the state of Illinois lost more than $5 billion in wrongful unemployment payouts, including massive fraud, between March 2020 and September 2021.

While IDES and its apologists will argue that every state dealt with fraudulent claims during the COVID-19 pandemic, they are ignoring the ndings of the audit,

which clearly show IDES made several poor key decisions that exacerbated the fraud problem. For example, IDES disabled routine identity cross-matches — speci cally designed to prevent fraud — in its undisciplined scramble to rush claims out the door.

is conscious decision to pay claims at a reckless speed helped lead to the eye-popping $5 billion in fraud, which included more than 10,000 payments to deceased people and more than 90,000 payments to incarcerated people.

Additionally, the report showed that IDES chose not to implement additional cross-matches that the

U.S. Department of Labor introduced in October 2021, and in fact still wasn’t utilizing this free resource as of February 2022.

If that wasn’t enough, the audit hammered IDES for being ill-prepared to handle an in ux of unemployment claims prior to the pandemic. One of the report’s key recommendations is for IDES to establish a “recession plan” for “future reference in times of rapidly increasing claim volumes.” I would argue that being prepared for a potential recession or any catastrophic event that leads to a high volume of claims is an essential responsibility of the agency that shouldn’t require recommendation from the state’s Auditor General. How is it possible they were so unprepared?

Overall, this lack of planning left qualied and deserving unemployment claim-

ants to face substantial delays in receiving their payments. I had constituents in my o ce in tears because their valid unemployment claims were not being paid, and IDES was unreachable and would not return their calls.

Democratic lawmakers chose to prioritize funding pet projects with federal pandemic relief funds instead of using this one-time federal windfall to pay o that debt in a timely manner like nearly every other state did. e federal government included a deadline of November 2022 for states to x their unemployment trust fund debts, or they would lose the Federal Unemployment Tax Act, or FUTA, credit in 2023.

When this deadline was missed, Demo-

11

Roughly two months after the unexpected death of Henry Crown & Co. CEO Jim Crown in June, the public safety task force he headed at the Civic Committee of the Commercial Club of Chicago has named two executives to lead the e ort to draft a set of business-backed crime- ghting recommendations.

Mark Hoplamazian, CEO of Hyatt Hotels, and Eric Smith, vice chairman of BMO Bank, are the new co-chairs of the task force, the Civic Committee announced on Sept. 8.

Hoplamazian, who co-chairs Hyatt’s

From Page 10

cratic lawmakers and the Pritzker administration nally decided to ll the unemployment insurance trust fund hole in late 2022, but it was too late to mitigate the impacts to businesses and their employees. Illinois employers have lost out in three signi cant ways: the FUTA credit is suspended for a year, a 2.5% increase in the taxable wage base has been implemented and employers are saddled with paying back a $450 million loan to the state.

Now that this audit makes it clear that the unemployment insurance trust fund de cit is almost entirely the fault of gross mismanagement of the state’s unemployment insurance program, the Pritzker administration needs to face the music. It must address the IDES negligence and make it right for our state’s employers.

Illinois businesses did not create the state lockdowns that put people out of work, nor are they at fault for the incompetence and fraud that led to overpayments. ey shouldn’t be expected to carry the burden of those mistakes, yet the Democrats and the Pritzker administration continue to place that heavy burden on job creators.

It is time for accountability for the devastation that was brought upon employers. While there is nothing the state can do now about the lost FUTA credit or the increased taxable wage base, it is still possible to forgive the $450 million that the state is requiring employers to pay back. is action should be taken immediately.

In July, the governor announced that the state has a “one-time” surplus of roughly $726 million. is announcement and this audit brought me back to the previous times I called for my fellow Illinois lawmakers to use unexpected revenue and federal relief funds to pay down the unemployment insurance trust fund debt, to no avail.

Just like those previous times, I once again call upon Gov. J.B. Pritzker and Illinois lawmakers to do what we know is right and stop making job creators pay for the state’s failures.

e state of Illinois owns this.

e state of Illinois should foot the bill.

Global Diversity, Equity and Inclusion Council, and Smith, who leads BMO’s Empower program designed to promote economic opportunity in underprivileged communities, take over leadership of the task force as it seeks to build community-level consensus and raise money for a plan rst unveiled in early June — just weeks before Crown, its main architect, died in a June 25 accident in Colorado.

Hoplamazian and Smith both served on the task force that developed the vepoint plan that includes a goal of cutting homicides by 75% over the next decade and slashing shootings by even more. To get there, the plan proposes a major ex-

pansion of violence intervention programs and investments in long-neglected neighborhoods.

“Our ve commitments re ect what business can bring to the table — a table that needs to be bolstered with leaders from across all sectors and work together and hold each other accountable,” Civic Committee President Derek Douglas said in an interview with Crain’s after the June 1 unveiling. He added, “We can and must support e ective, constitutional policing, while doing what we can to support those that put their lives on the line.”

In a joint statement, Hoplamazian and Smith said, “We are honored to build on

the legacy of Jim Crown, whose dedication to our City and the public safety task force was extraordinary. We reaffirm Jim’s vision that the business community has a significant role to play and are committed to building on his important work to help make Chicago the safest big city in America.”

Civic Committee Chair Jennifer Scanlon said in a written statement, “Mark and Eric have been key members of the Public Safety Task Force since its inception. ey are an ideal team to help ful ll the vision of a deeply engaged business community contributing to Chicago’s overall safety and well-being.”

I help you balance the two, with real-world, pragmatic, risk-aware guidance and advice.

I work with organizations and their in-house counsel, helping them stay current, compliant, and proactive through strong data governance strategies and programs.

Protecting their vital business data along with the customer and stakeholder data under their care. Creatively building and enhancing legal structures that support revenue-generating data use enabled by cutting-edge technologies.

Negotiating licensing, cloud, outsourcing, and IT agreements while preserving important relationships.

Spotting issues and developing creative solutions for managing the sheer volume of data, the rapidly evolving technology, The complex and varied global laws and regulations, and the increasingly sophisticated threats. The real world of data privacy and security can be gray and murky

I make it clearer. I also make it fun and rewarding.

I’m RYAN SULKIN

I’m on your team.

>

>

At the same time, data use and analytics present tremendous opportunity.

2022 RANKLAW FIRM LOCAL MANAGING PARTNER NO. OF LOCAL ATTORNEYS 6/30/ 2023; 1-YEAR CHANGE NO. OF U.S. ATTORNEYS 6/30/ 2023; WORLDWIDE LOCAL PARTNERS LOCAL ASSOCIATES LOCAL OF COUNSELS LOCAL PARALEGALS ANTITRUST BANKING BUSINESS REORG. & CREDIT CORPORATE & SECURITIES HEALTH CARE INSURANCE INTELLECTUAL PROPERTY LABOR LITIGATION ENVIRONMENTAL & LEGISLATIVE MUNICIPAL REAL ESTATE TAXATION 2022 FIRMWIDE REVENUE (MILLIONS); 1-YEAR CHANGE 20 19 NEAL GERBER & EISENBERGLLP 2 N. LaSalle St.,Suite 1700,Chicago 60602; 312-269-8000; NGE.com RobertG.Gerber Managing partner 131 -1.5% 21 21 REED SMITHLLP 10 S. Wacker Drive,40th Floor,Chicago 60606; 312-207-1000; ReedSmith.com JimHultquist Managing partner, Chicago o ce 128 -2.3% 1,109 1,828 5650191007172613181013315015$1,417.6 -1.3% 22 24 BARNES & THORNBURG 1 N. Wacker Drive,Suite 4400,Chicago 60606; 312-357-1313; BTLaw.com MichaelA.Carrillo Chicago o ce managing partner 126 3.3% 840 840 8231101853421893172210433 $608.8 1 5.8% 23 27 AMUNDSEN DAVISLLC 2 150 N. Michigan Ave.,Suite 3300, Chicago60601; 312-894-3200; AmundsenDavisLaw.com LarryA. Schechtman Managing partner 119 5.3% 240 240 6832990224109312612731— 23 24 PERKINS COIELLP 110 N. Wacker Drive,Floor 34,Chicago 60606; 312-324-8400; PerkinsCoie.com RichardL.Sevcik Chicago o ce managing partner 119 -2.5% 1,211 1,223 47432710—————————————$1,163.8 0.7% 23 17 POLSINELLIPC 150 N. Riverside Plaza,Suite 3000, Chicago60606; 312-819-1900; Polsinelli.com MaryClare Bonaccorsi O ce managing partner, Chicago 119 -17.4% 977 977 7742———————————————$796.4 14.2% CHICAGO PARTNERS' SPECIALTIES ResearchbySophieRodgers(sophie.rodgers@crain.com).

|Includesattorneysintheseven-countyChicagoarea:Cook,DuPage,Kane,Lake,McHenryandWillinIllinoisandLakeinIndiana.Allsta guresareasofJune30unlessotherwise noted. In the Chicago partners’ specialties section, partners in more than one specialty are counted in each area.NOTES: 1. From American Lawyer. 2. Formerly SmithAmundsen LLC. Want 58 law rms in Excel format? Become a Data Member: ChicagoBusiness.com/Data-Lists

The 2nd Annual Illinois Clean Energy Champion Aw ards

These awards recognize the creation and retention of good-paying jobs, with a special eye toward equitable jobs in historically left behind communities.

Thursday, October 19 12:00pm The Ivy Room 12 E Ohio Street Chicago, IL 60611

Ranked by local attorneys as of June 30. CHICAGO PARTNERS' SPECIALTIES NOTES: 1. From American Lawyer. 2. As of June 30, 2022.

Vrakas CPAs + Advisors, Chicago

Vrakas CPAs + Advisors is excited to welcome Michael Carney as Shareholder and CoManaging Director in Chicago! Michael brings over 20 years of professional services experience serving clients across various industries. Vrakas has been providing full-service accounting and business advisory services since 1971. Vrakas strives to take the nancial worry off business owners’ plates so they can concentrate on running their business. Experience the Vrakas Difference!

CrossCountry Consulting, Chicago

CrossCountry Consulting is pleased to announce that Mike Pugliese has been appointed Partner in the national Business Transformation practice and will lead the expansion of the rm’s Banking and Capital Markets solutions. With deep expertise in the areas of nancial and management reporting, planning and forecasting, risk-adjusted pro tability reporting, and regulatory compliance, his experience will be invaluable in supporting the growth of the national nancial services client base.

Rick Cosgrove has been named the CXO of EA Collective, a group of creative agencies, including Agency EA, Storyhorse and Studio Sage. Cosgrove will continue to also serve as President of Agency EA, Chicago’s top experiential marketing agency with a global reach. Rick will be dedicated to driving big ideas and concepts throughout projects across EA Collective’s agencies and identifying opportunities for strategic and organic growth.

DSP Insurance Services, Schaumburg

DSP Insurance, an independent insurance agency based in Schaumburg, is pleased to announce Taylor Virgil as its new President. Taylor, who joined the rm in 2017, will succeed Steve Webster, who held the role for 5 years and has 37 years with the rm. Taylor will be responsible for the overall strategy and execution of DSP’s longterm vision. Taylor graduated with high honors in 2009 from Georgia Institute of Technology with a degree in Industrial Engineering.

Shapiro+Raj, Chicago

Chelsey Merker has been promoted to the role of Senior Vice President, leading Shapiro+Raj’s Strategy and Research Excellence teams. Chelsey’s ability to unearth future-forward insights that drive impactful results has made her an invaluable leader at the rm. As Senior Vice President, Chelsey Merker will be at the forefront of shaping Shapiro+Raj’s strategic direction, contributing to the rm’s ongoing success and growth, and helping clients shape, not just respond to the future.

Global architecture and design rm Perkins&Will announces the hiring of Stephen Lenz, LEED AP, RA, Practice Lead, Planning and Strategies, and Kimberly Cook, NCIDQ, EDAC, Assoc.

Principal, Senior Interior Project Designer. Both are award-winning designers returning to the rm. Lenz brings extensive experience as a designer and business strategist for clients such as United Airlines, UL Solutions and Shure Corp. Cook brings prior expertise delivering experience-centered health interior design for clients such as Northwestern Medicine and Mount Sinai Medical Center. Both provide design solutions illustrating a deep understanding of the in uence of design on behavior, well-being, and business performance.

Slayton Search Partners is proud to announce the promotion of Allison McWeeney to Vice President and Principal. Allison joined the rm as a Research Associate in 2017 after graduating from University of Michigan with a bachelor’s degree in psychology, and she has since grown extensively in her skills and experience. She is focused on supporting Slayton partners with engagements in the consumer space, while also developing and expanding her own client relationships.

Neal & Leroy, LLC, Chicago

Neal & Leroy, LLC is pleased to announce that Bradley A. Smith has been elevated to serve as a Managing Member of the rm. Along with assisting the rm with strategic development and operations, Brad focuses his practice on real estate transactions and litigation, eminent domain, aviation law and related federal regulations, corporate law, and a broad range of insolvency-related matters.

BANKING

Artisan Advisors, LLC, Frankfort

Artisan Advisors, specializing in strategic consulting, risk assessment, organizational ef ciency and nancial technology services for nancial institutions, welcomes Stephen Heckard and Matt Bergman, as managing directors in the new Core Financial Technology Consulting practice. Stephen is a specialist in nancial technology with extensive experience in IT strategic planning, conversion planning and operational assessments. Matt is an expert technology solutions professional with decades of experience in core processing service programs for banks and credit unions. Their work will focus on generating more favorable contract outcomes for Artisan clients, resulting from a customized and highly competitive core vendor assessment process.

Slayton Search Partners, Chicago

Slayton Search Partners is thrilled to announce Bo Murray has been promoted to Vice President and Principal. After graduating from University of St. Thomas with a bachelor’s degree in business, Bo joined the Slayton team in 2016 as a Research Associate. Bo has progressed and continually contributed in valuable ways over the years. In this new role, he will be responsible for supporting Slayton partners with searches in the industrial sector, while building and nurturing client relationships.

Levenfeld Pearlstein, LLC, Chicago

Levenfeld Pearlstein welcomes Ryan Hardy as a partner in their Financial Services & Restructuring Group. Ryan directs clients through complex nancial disputes both in and out of bankruptcy courts. His bankruptcy representations have included debtors, secured lenders, trade creditors, landlords, of cial committees, and asset buyers. Ryan has rst chair arbitration experience and has argued appeals before the Seventh & Eighth Circuit Courts of Appeals and various state appellate courts.

CRG, Chicago

Susan Bergdoll joined CRG in August 2023 and serves as the Senior Vice President and partner for the rm’s Midwest Region. Susan brings an incredible 25+ year career in commercial real estate to CRG. In her role, she will be responsible for the development of CRG’s speculative and build-to-suit warehouses in the Midwest for e-commerce, Fortune 500 companies, and other clients. Before joining CRG, Susan oversaw Duke Realty’s $1.7 billion, nearly 40 million-square-foot Midwest industrial portfolio. Annually, she steered the development of a $150-$250 million speculative and build-to-suit pipeline, which included notable deals with major Fortune 100 and 500 brands.

LAW FIRM

LAW FIRM

In the 2.5 square miles that Chicago’s South Shore neighborhood occupies, you’ll nd at least eight fried chicken restaurants, six dollar stores, eight beauty supply shops and a slew of nail salons. At the intersection of Marquette Avenue and East 79th Street, a Dollar General and Family Dollar sit across from each other.

From an economic standpoint, South Shore is not oversaturated with these types of businesses. e stores would go under if it were, community development experts say. South Shore’s 54,000 residents spend their money there. But from a community health stand-

point, some say these businesses number far too many.

ey are also more likely to be owned by non-residents.

“( ose stores) take resources out of the community and don’t give us an opportunity to circulate the dollar within the community,” says Tonya Trice, executive director of the South Shore Chamber of Commerce. “ at money leaves our community as soon as it is spent.”

South Shore isn’t an exception. roughout Chicago’s South and West sides, retail corridors are heavily populated with stores that do

SPONSORS

not keep wealth in the community. So-called dollar stores are a prime example. ese variety stores sell food items in retail spaces that could be occupied by a full-service grocery store or health-conscious restaurant, say those who want to see economic improvements in disinvested areas. ese stores also leech o vulnerable, low-income customers by price gouging, activists and others say.

A lack of retail variety also forces neighborhood residents to spend their money elsewhere — a heightened concern for a commu-

See RETAIL on Page 16

All told, $200 million worth of retail spending leaves South Shore annually, according to a 2020 city study of the corridor.The South Shore neighborhood GEOFFREY BLACK

From Page 15

nity trying to reverse decades of economic disinvestment. All told, $200 million in retail spending leaves South Shore annually, according to a 2020 city study of the corridor

Two streets, 75th and 79th, that run through South Shore were once historically signi cant retail corridors. Today, where no dollar store or other small businesses exist along East 79th Street, entire blocks are lled with empty storefronts.

e composition of retailers in a community directly a ects the health of its economy and its residents. A grocery store might stay away from an area if several dollar stores create too much competition, meaning residents have access only to the processed food items sold there. Without a grocery store, other retailers might not see the area as worth investing in, which results in lower home values and a weakened tax base. Some types of retailers that proliferate in lower-income retail corridors are so small that they cannot a ord to hire employees, contributing to even lower unemployment rates.

e roots of these limited retail options are manifold. e majority of the residents in the a ected neighborhoods are Black and low-income. Decades of segregation, discriminatory practices and racist policies perpetuated by governments and the private sector have made it di cult for Black entrepreneurs to get loans and start businesses. Latino entrepreneurs face similar issues accessing capital.

In fact, just 9% of businesses with employees in Cook County are Black- or Latino-owned, though those groups comprise 57% of the population, according to a 2021 Chicago O ce of Equity & Racial Justice report. Community development experts say the lack of local business ownership in such communities invites more outside operators.

It’s a compounding issue. When hunting for a location, retailers often look for similar businesses to gauge whether they could be successful in a certain corridor, says Brad McConnell, CEO of nonpro t Allies for Community Business, a nonpro t that provides coaching, capital and connections for entrepreneurs who have been traditionally underserved. at’s why competing fried chicken joints sometimes set up across the street from each other, or two mobile phone stores open in the same strip mall. Landlords, for their part, are looking for the most stable potential tenants, prioritizing rent collection.

“ ere’s a lot of copycatism in the absence of true market analysis,” he says. “It’s just lazy market research.”

Dollar stores are an example of the types of businesses concentrated in Chicago’s South and West

side retail corridors. A study by the Brookings Institution released in April found that chain dollar stores have targeted majority-Black urban neighborhoods, “often saturating these communities with outlets and making it more dicult for local businesses and other grocery chains to become established.”

Income levels did not matter as much: e study found that in Chicago, majority-Black neighborhoods in the top income quartile were more likely to be near a dollar store than non-majority Black neighborhoods at any income level.

Take South Shore. Its population is almost 93% Black. e community’s per capita income is $27,734, according to the Chicago Metropolitan Agency for Planning’s July 2023 data snapshot.

Along the 79th Street corridor, two Family Dollar stores and one Dollar General are within about six blocks of each other. Two more Family Dollar stores are in the neighborhood, one on 71st Street and one on Stony Island Avenue. A Dollar Tree is at 72nd Street and Stony Island.

Dollar Tree, which owns Family Dollar, and Dollar General are both publicly traded companies that count private-equity rms among their largest shareholders. Private-equity rms are known for ruthlessly squeezing e ciencies out of companies they own. But they also have money to fuel expansion, an appealing attribute as interest rates remain high. As such, private equity-owned companies have the capacity to both exploit and bring bene ts to communities, particularly by hiring local employees.

“It’s a double-edged sword,” says Andee Harris, an adjunct lecturer

of entrepreneurship at Northwestern University’s Kellogg School of Management. “Job creation is a big piece of it. . . .We can’t ignore that.” Others argue that dollar stores do ll a void in communities with few other retail options.

Craig Chico, president and CEO of the Back of the Yards Neighborhood Council, says neighborhood residents do not hate the dollar stores and shop at them regularly. Walmart closed its Back of the Yards store in 2019, so the dollar stores ll a need, he says. One dollar store also took over a long-vacant building when it opened, which reduces blight. It’s a similar story with McDonald’s. e 40,000-person neighborhood has two, which some would argue presents too many unhealthy food options.

But the restaurants are always busy, Chico says. “You can’t complain about them if people are shopping” there, he says.

ough Dollar Tree and Dollar General missed Wall Street’s expectations in their most recent quarterly earnings, both national companies grew annual pro ts and sales last year, mostly through expansion. Dollar Tree’s net income was $1.6 billion last year, up 21.7% from 2021. Sales were $28.3 billion, up 7.6% from the previous year. Dollar General’s net income was $2.4 billion, up less than 1% year-over-year. Sales were $37.8 billion, up 10.6%.

South Side residents see that growth, and dollar store pit stops are ingrained in their routines.

“It’s de nitely one of the more prevalent kinds of stores around here,” says Amanda Eaves, while on duty at her job at the Chicago Public Library branch in West Pullman, across the street from a Family Dollar. e 45-year-old Calumet

Heights resident says she frequents dollar stores for housing supplies, buying toiletries or grabbing a drink. “You do have CVS and Walgreens and stu , but not nearly as much as the dollar stores.”

e harm dollar stores do to a community cuts beneath the surface, argues Mari Gallagher, principal of Chicago-based Mari Gallagher Research & Consulting Group. She refers to them as “fringe” stores.

“A fringe store mostly specializes in the so-called foods that are high in salt, fat, sugar and low nutritional value,” she says. “A fringe store is the kind of store that might provide some convenience, but if it’s your primary location for getting food, chances are over time your diet, your health will su er.”

Dollar General says in a statement to Crain’s that thousands of customers in Cook County and across the country rely on it for “convenient access to a ordable household essentials.” Such access to a ordable products is one of the economic bene ts each store provides to communities, the statement says.

“We believe our purpose-driven mission of serving others and our intense customer focus di erentiate Dollar General from other seemingly similar retailers,” the statement says. We invest “in communities where other retailers cannot or will not serve.”

Dollar Tree did not respond to requests for comment.

e Brookings study released in April also found that the presence of fast-food restaurants positively correlated with the percentage of Black residents in urban neighborhoods in the U.S. Too many fried food joints creates a situation similar to too many dollar stores: e competition they create can keep

away healthier food options, harming the health of residents over the long term.

Chicken and sh

e stretch of Madison Avenue that runs through the Austin neighborhood on Chicago’s West Side is less than two miles long, but it has more than half a dozen fried chicken or sh restaurants. Such restaurants’ business models are built around paying low rent and selling cheap, commodity items like chicken and sh, says Brandon Guthrie, general partner at Dubai-based Shatranj Capital Partners, a food- and beverage-focused private-equity rm. e one-o fried food restaurants on South and West Side street corners have low pro t margins. ey are typically run by the operator to keep labor costs down and rarely hire from the community. A locally owned mom-and-pop restaurant would not be able to compete.

“Mom-and-pop restaurants need higher margins,” Guthrie says. “If your whole living is based o this restaurant, you have to make some money.”

ese kinds of extractive business models aren’t limited to retail stores or restaurants. Churches can also take money out of a community, further hurting the economic health of a neighborhood.

How does that work? Churches are exempt from paying property taxes, says Samuel Brunson, associate dean for faculty research and development at Loyola University Chicago.

“It’s not unique to churches,” he says. “Anything that’s exempt from property tax takes money out of the city co ers, and it makes other people either have to pay more, or

allows the city to provide less.”

Property and sales taxes are the primary source of revenue for Chicago. e bulk of that revenue supports the budgets for the Chicago Public Schools, the Chicago Police Department, the Chicago Park District, the Chicago Public Library, and goes toward public employee pensions funds.

Churches are also not required to le 990s, a document that outlines nancial information about tax-exempt organizations. Without such a requirement, details about where the money goes are scarce and di cult to pin down unless the church’s leadership is willing to disclose it, Brunson says.

e bulk of church nances go toward building upkeep, paying rent or a mortgage and paying musicians, says Rev. Sidney Williams, CEO of New Jersey-based investment management company Crossing Capital Group.

Churches in certain neighborhoods are often found in clusters, like along 119th Street in West Pullman. ere are more than a dozen storefront churches along that corridor between Halsted and State streets.

“You shouldn’t have a block full of faith-based organizations,” says Abraham Lacy, president of the West Pullman-based nonpro t Far South Community Development

Corp. “ ey begin to cannibalize each other.”

Churches have proliferated on Chicago’s South and West sides because they act as refuges for Black people, a role born during the Civil Rights movement. Being so highly concentrated, though, means more empty storefronts if the churches start driving each other out of business.

To help alleviate the concentration of such non-pro t structures, Lacy suggests designating areas in commercial corridors where tax-exempt properties cannot locate. Such districts could instead focus on driving innovation, and recruiting retail the community wants or needs.

e city of Chicago said in a statement that it is making investments in South and West side neighborhoods that will strengthen retail corridors and “build household and community wealth.” Under the administration of former Mayor Lori Lightfoot, the Chicago Department of Business A airs & Consumer Protection provided funding to small business owners, artists and landlords to activate commercial corridors. Developers, nonpro ts and other groups are also working to take ownership of retail corridors.

e nonpro t Far South Community Development Corp. places

local entrepreneurs into brick-andmortar locations to ease nancial burdens. e program, called Far South CDC Marketplace, is part of a broader plan to repurpose 1 million square feet of blighted areas into “anchor” developments to build community wealth and increase the population.

Likewise, Chicago TREND, a commercial real estate developer, is deploying a strategy that allows

residents to invest in commercial retail properties. A social enterprise formed in 2016, it focuses on transforming retail economics in communities of color. It owns three neighborhood shopping centers in the city and one in south suburban Olympia Fields, with plans to buy two more Chicago properties in the next year.

Chicago TREND hired local property managers and local leas-

ing agents who put equity into the properties. It identi es, acquires and improves service-oriented community shopping centers in urban neighborhoods by partnering with entrepreneurs and residents. e enterprise has deployed this model at two properties in Baltimore.

“When was the last time local people had an opportunity to own the strip center at the corner, or mixed-use property that is the front door to the commercial corridor of the neighborhood?” says Chicago TREND CEO Lyneir Richardson. “ ose individuals will patronize and protect the commercial property in a di erent way.”

South Shore, too, with its oversaturation of fried food joints, beauty shops and dollar stores, is looking to take a similar approach.

e Chamber of Commerce is set to launch a model in late 2024 that would allow residents to invest in commercial properties. Trice, of the South Shore Chamber, says allowing residents to take ownership is one of the only ways to really control which businesses open in a community.

“When you don’t control the assets, you have very little say on what can go into those storefronts,” she says. “We need control of the assets in the community.”

40%

44% OF LATINX HOUSEHOLDS

69%

Ihope Chicago’s politicians move back to investing in Chicagoans.

I’ve lived here my entire life and feel like a survivor of the corporate apocalypse of my community and the city. It’s the people, not the conglomerates, who will reinvigorate this city.

With the abrupt departure of the most recent big-box operation, Black Chicago braced for the inevitable blame for its rapid exit. Never mind the fact that retail is su ering across the country. Brush past the mathematical reality. Online business is much more lucrative than retail. e “Black people are thieves” narrative will allow mainstream Chicagoans to be accepting of this insincere departure.

Greeted as liberators, big-boxes descended on our communities offering desperately low wages, forcing new generations of Black people to shift to government subsidies. When I was young, I didn’t know anyone on government aid. My community was lled with union labor, from teachers and nurses to

boilermakers and janitors. ose who didn’t have union jobs had small businesses. e mechanics, the hair salons, the pool halls, the community centers, the restaurants and the corner stores were everywhere. e money stayed in the community, if only for a while. People worked in the community. e bigbox stores coming into the inner city were the decimators of our small businesses.

When I was young, Chicago was full of cultural communities. We would go to the West Loop corridor and get real aming cheese in Greektown. We went to Chinatown and ate authentic Chinese food in such a densely, culturally rich community that we felt like we left the continent. We got authentic Italian pasta from Little Italy and real Ethiopian food from Wrigleyville.

When we were really fancy, we had ne dining downtown. I remember my grandmother letting me order “clams casino” from Arnie’s. While the South side ruled soul food, I

never felt unwelcome in Chicago. We were Chicagoans, period. Fast-forward to the new narrative, “segregation” is the problem. We had that mayor who decided that closing our schools and overpolicing our children was a start. He then had savior-missioned nonpro ts entice corporations to put warehouse facilities with grunge-labor, soul-crushing jobs in our once-beautiful neighborhoods. He would then gentrify the other Black communities. e city lost over 250,000 residents who didn’t want to live in pre-apocalypse Black Chicago.

Chicago used to be in the top ve places that a Black person should start a business. Now, it’s not in anyone’s Top 20 list. e designat-

ed “Black leaders” elevated only themselves. Most of them cannot identify three people who they’ve in uenced or even helped, let alone one community. To be independently upwardly mobile, you had to leave Chicago. e best you could aim for here was the “minority partner,” good for photographs, a few dollars and little else.

But those of us who stayed here decided the last mayoral race was our last chance. Some of us remember when Chicago was not about pitting this Chicagoan against that Chicagoan so that rich people could get richer. We got together and got back to basics. We elected an ordinary man to be mayor. I’m hoping he routes our tax dollars back into all of our commu-

Chicago’s neighborhoods are known worldwide for their grand architectural heritage — rows of stately twoats and greystones, broad, tree-lined parkways, courtyard apartments, craftsman bungalows and vibrant commercial corridors.

Amid this beauty is another familiar yet humbler sight: strip malls. While many provide essential community amenities, others are poorly maintained, partially vacant or home to businesses like liquor stores or predatory lenders that undermine neighborhood strength.

What if we were more intentional in harnessing the potential of these familiar sites to create community assets? What if this type of overlooked real estate could improve access to healthy food and needed retail? What if the properties themselves could be a vehicle to build wealth for nearby residents?