Reinventing Walgreens

BY KATHERINE DAVIS

BY KATHERINE DAVIS

Walgreens Boots Alliance is betting its future on an unprecedented e ort to reinvent itself as a health care company, a venture of immense scale and complexity. ere’s no playbook for what the Deer eld-based company hopes to achieve. Never before has a retail pharmacy chain transformed into a full- edged provider of medical care. Walgreens’ ambitions threaten to disrupt long-standing U.S. health care delivery structures, a status quo guarded by powerful entrenched interests.

With a series of multibillion-

dollar investments and acquisitions, Walgreens is adding an array of services—including home health care and specialty pharmacy—to its existing drugstore network. But the strategy revolves around a bold and risky plan to attach doctor’s o ces to Walgreens stores across the country. Walgreens has opened more than 150 store clinics in partnership with primary care provider VillageMD, with plans to reach 1,000 stores by 2027.

“It is a giant, complicated undertaking,” says Erik Gordon, a professor at the University of

CAREER READINESS

JOHN R. BOEHM CHICAGOBUSINESS.COM | DECEMBER 19, 2022 | $3.50 NASCAR: Racing league is reaching for new fans with its Chicago race. PAGE3 Q&A: Cboe’s Tilly, CME’s Duffy differ sharply on cryptocurrency. PAGE 3

of 2022

the

of the home

PAGE 6

REAL ESTATE A recap

in

billionaire end

market.

The art and science (but mostly art) of cashing out. PAGE 9 NEWSPAPER l VOL. 45, NO. 50 l COPYRIGHT 2022 CRAIN COMMUNICATIONS INC. l ALL RIGHTS RESERVED FORUM AFFORDABLE HOUSING FIND THE COMPLETE SERIES ONLINE ChicagoBusiness.com/CrainsForum AT HOME ON LASALLE A proposed solution to Chicago’s affordable housing crisis is to bring economical units to the historic nancial hub. Is that idea a bridge too far? | PAGE 13 VALERIE CHIANG Readiness programs emerge to shepherd high school and college students into jobs that open a path to nancial stability and wealth-building I PAGE 23

BOOTH INSIGHTS

There’s no playbook for the drugstore chain’s metamorphosis into a health care provider. But there are plenty of challenges.

on Page 30

See WALGREENS

How Illinois Dems could still screw themselves

Two precepts lead Page 1 in my Book of How Politics

Really Works: 1) Never trust a politician, any politician, when they talk about their future electoral plans, because they all lie, and 2) Give any politician or group of politicians enough rope and, be they Democrat or Republican, liberal or conservative, they’ll eventually tie it around their neck and jump.

I kept the rst in mind in watching who led for mayor a few days ago. I’m glad I did, because more than one contender told me one thing and then ended up doing another. As for the validity of the second, look no further than the collapse of Donald Trump and the Republican Party that sold him its soul. After Georgia, unless there is a quick parting of the ways—a realization that, for instance, telling your base not to vote by mail is the message of a loser—the national GOP will join the Illinois GOP in superminority status.

at being said, Precept No. 2

still applies to Illinois Democrats who, thanks to changing demographics, GOP incompetence, J.B. Pritzker’s scal moves and the correct position on some key issues, own all the rope in Illinois politics, including supermajorities in both chambers of the Illinois Legislature.

So, how are they going to tie it and jump?

I suspect it’s the House that’s worth keeping an eye on, both because it’s larger than the Senate with more folks who can stir up mischief and because Speaker Emanuel “Chris” Welch leads the biggest Democratic House majority in state history, the kind of majority that the indicted but shrewd Mike Madigan never wanted because it made enforcing caucus discipline much harder.

Ergo, says one veteran Springeld Dem, keep an eye on pressure to bust the budget and spend money that a state that still has $140 billion in unfunded pension liability really doesn’t have. at pressure

will be even more intense now that House Majority Leader Greg Harris, who had a real talent for getting budgets through, is retiring.

e Democrats, of course, will have to deliver some things simply to satisfy their base. Abortion is the most obvious move, and the D’s will be perfectly within proper bounds if they, for instance, o er up a proposed amendment to include abortion rights in the Illinois Constitution.

Two other issues I’m watching are more problematic: A proposed ban on assault weapons and other steps to control gun use, and a menu of new taxes to help the Chicago Transit Authority, Metra and Pace adjust to the new, post-COVID normal.

On the rst, I and, according to a new poll, most Illinoisans agree that it’s damned foolish to let high school kids run around with military-style ri es that can pump out dozens of rounds every few seconds. Google “Highland

GREG HINZ

ON

POLITICS

Park shooting” if you have doubts. Republicans trying to get back in the game in Illinois politics would be well advised to try to nd a way to put some votes on Rep. Bob Morgan’s bill, if only to help their suburban candidates.

Democrats would be well advised to take their time on this and not appear to rush anything through, a perception that fueled much of the recent debate over the SAFE-T criminal-justice reform bill. And they ought to nd a tweak or a compromise or two to get some GOP votes, because few issues in American politics have the bite this one does.

I’m also sympathetic on CTA/ Metra, et al. But the fact is, the

world has changed and the big transit operators are going to have to change with it. eir business model—people commuting downtown ve days a week—may be irreparably broken, and pushing through a bill to just hike sales taxes or tolls risks irritating voters in what may be tough economic times.

It also would help if the Dems would seriously do something about pensions, and deliver some of that promised but mostly undelivered pledge to limit property tax hikes.

It’ll take a lot for the D’s to blow their majorities. But history says they eventually can, and will. Keep watching.

Why the worst predictions may not materialize

Despite a tumultuous year, the U.S. economy is slowing but isn’t down for the count. Rather, it is undergoing a necessary rebalancing, and an economic contraction would likely be mild. is is because consumers are still in better nancial shape than they were before the pandemic, and the Federal Reserve is waging an aggressive war against in ation to keep things that way.

While the latest wage growth numbers suggest bringing down in ation to the Fed’s target will require further belt-tightening, the strength of private-sector balance sheets indicates there’s light at the end of the tunnel. In ation remains public enemy No. 1, but the peak may already be behind us.

A few recent developments suggest that in ation may nally be on the way down.

A quick glance at the Zillow Home Value Index shows that home values have fallen from their peak this summer. Historically, a decrease in housing wealth has been linked to less consumer spending and less hiring. For that reason, the labor market is also expected to cool.

We are already seeing early signs of that cooldown. According to data from the Job Openings & Labor Turnover Survey, the number of job openings still exceeds the number of job seekers. However, the number of excess job openings has begun to decrease, and hiring has also fallen. According to LinkedIn’s workforce report, hiring is 20.5% lower compared to a year ago.

e Zillow Observed Rent Index, which leads the rent-speci c components of the consumer price

CORRECTION

index, is also falling. If this typical relationship holds, we should expect to see shelter in ation decline. In ation being too high is a threat to sustainable economic growth. It creates economic distortions that lower capital formation, erodes purchasing power and results in less savings and higher long-term interest rates. If high in ation continues to outpace incomes, there is a risk households could run out of savings and a deep contraction would follow. By eroding the value of savings and raising borrowing costs, high in ation hurts everyone, but it disproportionately squeezes lower-income individuals and seniors living on a xed income.

e Fed’s actions aim to realign demand with supply and reduce that risk. e combination of excess demand and inelastic supply suggests that a decline in demand would bring down prices more than economic output, which would be a positive outcome.

e current economic rebalancing began in the housing market, but this moderate price decline we have seen bears little resemblance to what triggered the global nancial crisis. Homeowners are not walking away from homes they can no longer a ord. is time around, most homeowners are in a strong nancial position with low xed mortgage payments and record home equity. Mortgage delinquency rates are at a record low. And while recent layo s at high-pro le rms have occupied headlines and hurt many families, private-sector layo s are still lower than in the 20 years preceding the pandemic.

Rather than a ood of for-sale

Corrected versions of the following profiles in Dec. 12’s Notable Gen X Leaders in Accounting, Consulting and Law can be viewed at ChicagoBusiness.com/notables:

homes from distressed sellers, this slowdown has so far primarily resulted from discouraged buyers taking a step back from the market.

More supply is coming—a recordhigh number of new units are under construction—but with a ordability 25% above historical norms on average, the expected downward price adjustments alone may not be enough to meaningfully improve housing a ordability.

Historically, business activities in the housing market have been a leading indicator of changes in economic growth. ere are major geopolitical and climate risks that

ORPHE DIVOUNGUY ON THE ECONOMY

threaten to disrupt a return to normal, and the decline in housing starts is a sign of trouble for the U.S. economy in 2023. However, if the Fed can e ectively reel in in ation, the economic slowdown could turn out to be a mild adjustment toward

a balanced, sustainable growth path.

2 DECEMBER 19, 2022 • CRAIN’S CHICAGO BUSINESS

Amanda Amert, Roderick Branch, Matthew Petersen, Terra Reynolds, Mitchell Roth and Jack Theis.

#1 IN CUS T OMER SATISF A CTION WITH RETAIL BANKING IN ILLINOIS & BY J.D. PO WER WINTRUS T. C OM/THANKYOU

Wintrust Community Banks received the highest score in Illinois in the J.D. Power 2022 U.S . Retail Banking Satisfaction Study of customers’ satisfaction with their primary bank. Visit jdpower.com/awards for more details. Banking products provided by Wintrust Financial Corp. banks.

Crain’s contributor Orphe Divounguy is a senior economist at ZillowGroup and former chief economist at the Illinois Policy Institute. His views may not re ect those of his employers.

JOHN R. BOEHM

NASCAR bets Chicago will fuel its turnaround

BY DANNY ECKER

After a decade of dwindling relevance, NASCAR is looking to Chicago for a jump-start.

e stock car racing circuit’s street race around Grant Park next July will be its boldest move yet in a broader effort to re-enter the mainstream sports conversation with a younger, more diverse crowd. Instead of staging the rst such event in its 75-year history in a NASCAR stronghold, the sport’s leaders are about to spend more than $50 million—among its largest outlays ever for an event—on a rst-of-its-kind track in the middle of an urban center where it has historically struggled to gain traction. See NASCAR on Page 22

BY STEVE DANIELS

e shocking demise last month of FTX, one of the largest cryptocurrency exchanges in the world, followed by the arrest of founder Sam Bankman-Fried on fraud charges, capped a terrible year for digital currencies and raised questions about their future in the broader nancial services arena.

If they have one, Chicago is home to two institutions— CME Group and Cboe Global Markets—with the expertise and

credibility to help pick up the pieces, along with a potentially lucrative opportunity.

e CEOs of the two exchanges have sharply di ering perspectives on the future of crypto. Correspondingly, they are positioning their companies far di erently in the wake of the FTX debacle.

CME in 2017 listed a bitcoin futures contract and followed later with an ether futures contract. But the exchange hasn’t expanded its o erings since then, and CEO Terry Du y maintains a wait-andsee posture on even the two exist-

ing products as 2023 approaches.

Cboe took a similar toe-in-thewater approach ve years ago but plunged into the industry late last year with a deal to acquire ErisX, an exchange for crypto coins and derivatives, after helping found the rm several years back. e buyout closed in May, just as crypto values were plummeting, which prompted Cboe to write down more than $450 million of the value of the platform. Cboe never disclosed what

JOE CAHILL ON BUSINESS

NAUGHTY

Abbott Laboratories. Abbott gets 2022’s biggest lump of coal, for a multipronged asco arising from safety lapses at its Sturgis, Mich., baby formula plant. Several infants fell ill and two died after consuming formula from the facility. No link to the formula has been shown, but after federal inspectors found bacteria in Sturgis, Abbott closed the plant and recalled formula produced there. e ensuing nationwide shortage caused widespread distress among American families. Abbott’s formula sales plunged, lawsuits rained down and federal o cials moved to boost competition in a market Abbott has dominated for decades.

Peoples Gas. e Chicago gas utility has turned its massive pipe replacement project into an ever-increasing annuity, funded by local customers. Originally projected to cost $2 billion and wrap up by 2030, the replacement of aging gas pipes in Chicago is now on track for an $11 billion price tag and a completion date closer to 2048. at means households already struggling to a ord high gas bills will continue paying extra for the project for decades to come. Mr. Potter would be proud.

The pols behind Illinois’ pot market. Illinois’ legal marijuana market is a case study in good intentions gone awry. Aiming to give communities hurt by the war on drugs a leg up, Spring eld Democrats crafted an elaborate application process and limited the number of pot-selling licenses available. e result has been lawsuits, scant minority participation, slow sales growth and high prices.

Baxter International. Baxter bungled its biggest acquisition ever, the $10.5 billion purchase of hospital bed maker Hillrom. In October, Baxter disclosed a $3.1 billion impairment charge related to the deal, indicating it overpaid by at least that much. e misstep hammered Baxter shares, sparked doubts about CEO Jose Almeida’s growth strategy and could even make Baxter a buyout target.

Illinois unions. Clout-heavy unions cemented Illinois’ reputation as an anti-business state by pushing through a constitutional amendment that hands organized labor even more power. e measure gave Illinois the country’s most pro-union state constitution, and gave businesses another reason to go elsewhere.

NICE

McDonald’s CEO Chris Kempczinski. e burger boss had the guts to speak frankly and publicly about the business impact of crime in Chicago. Speaking to the Economic Club of Chicago, Kempczinski warned of a “growing sense that our city is in crisis,” and said it’s getting harder to recruit executives from out of town to work at McDonald’s Chicago headquarters. But unlike a certain billionaire who left town after railing about crime, Kempczinski wants to solve the problem. He’s moving McDonald’s innovation center downtown from Romeoville, and urging city leaders and business to work together to reduce crime.

Kellogg. Packaged-foods giant Kellogg made a smart move, choosing Chicago as the headquarters for its snacks business as part of a breakup of the Battle Creek, Mich.based company. e biggest and fastest-growing part of Kellogg will t right in among the likes of Mondelez, Kraft Heinz and Conagra, which have made Chicago a hub of the packaged-foods industry. e move also gives Chicago a shot in the arm after high-pro le defections of Boeing, Caterpillar and that billionaire’s hedge fund.

Google. Chicago got another huge boost when Google agreed to buy the ompson Center in the Loop. e tech behemoth’s local workforce of nearly 2,000 is outgrowing its West Loop o ces, and the ompson Center can accommodate thousands more sta ers. e move con rms Chicago remains a growth center for Google, and will bring more people downtown at a time when remote work has depopulated many Loop o ce buildings.

Argonne and Fermi national laboratories. Our national labs continue to draw in federal dollars as they push the frontiers of innovation in key growth areas. anks to Argonne and Fermi, Chicago is on the leading edge of new technologies such as quantum computing and advanced energy storage, which promise to open the doors to new industries.

Companies that did right on Ukraine. e morally correct corporate response to Vladimir Putin’s unprovoked, murderous invasion of Ukraine was to stop doing business in Russia. Here’s to local companies that made the right choice, including McDonald’s, Illinois Tool Works, Motorola Solutions, Molson Coors and Heidrick & Struggles.

CRAIN’S CHICAGO BUSINESS • DECE M BER 19, 2022 3

It’s holiday time, when we decide who’s been naughty and who’s been nice in Chicago business this year.

Naughty or nice? Here’s the verdict on local business in 2022.

“THE CITY OF CHICAGO IS REALLY AN INCUBATOR OF SORTS TO LAUNCH WHAT THE NEXT VERSION OF THE SPORT MIGHT LOOK LIKE.”

Toure Claiborne, marketing executive

The downtown extravaganza planned for next summer is about more than stock car racing I

does the crypto collapse mean for Chicago’s exchanges? Cboe’s Tilly sees ‘opportunity to be the trusted market’ for digital currencies. CME’s Du y sees ‘no use case’ for them.

What

See CRYPTO on Page 22

Julie Giese is president of NASCAR’s Chicago Street Course.

Bears propose stadium-development subsidy plan

BY GREG HINZ

e Chicago Bears are oating in Spring eld the possibility of creating new form of tax subsidy for their pending redevelopment of Arlington Park, one which would give them nancial help but not penalize local school districts as harshly as a conventional tax-increment nancing district.

Under the plan, which has not yet been submitted in writing but has been raised with key legislative players, the Bears would be able to utilize something known as payment in lieu of taxes, or PILT.

PILT originally was developed by the federal government as a means to compensate local units of government for the loss of property taxes due to the existence of tax-exempt federally owned property within their borders. e concept since has spread to payments for state-owned property in some parts of the country and to some private developments, such as solar-energy generation, that are not feasible with normal property taxes.

e Bears’ pitch is in the preliminary stage and is receiving a mixed reception from Spring eld o cials. But because PILT payments can be negotiated rather than being set at a predetermined

rate, and because they can be shared with schools rather than stay with municipalities, they offer more exibility than a conventional TIF district.

NEGOTIABLE PAYMENTS

Under the proposed PILT plan, as explained, the Bears after acquiring the property would no longer pay regular property taxes, which would rise as the value of the property and improvements rose. Instead, they’d pay a negotiated annual amount that would be distributed as per the agreement among schools and other local taxing bodies. at amount presumably would be less than property taxes would, e ectively recompensing the team for some infrastructure and other development costs.

In a statement, the Bears conrm that they continue to explore options to fund the Arlington project.

“As we have mentioned publicly, in order for this project to move forward, we will need to have property tax certainty and infrastructure support,” Scott Hagel, vice president of marketing and communications for the Bears, said in an email. “We continue to do our due diligence on how that can be accomplished but have made no asks at this point.”

e team has said it would fund construction of a new stadium itself but needs help paying costs for a mixed-used development on the remainder of the property.

e Arlington Heights Village Board last month approved a pre-development agreement with the team that envisions the possibility of a TIF district or other public funding.

Asked Dec. 14 if PILT has been discussed, Village Economic Development Director Charles Perkins said he could not go beyond what was included in the pre-development agreement. e agreement commits Arlington Heights to “work in good faith with the Chicago Bears Football Club to explore options for such assistance from other governmental sources, in a manner that

provides net public bene ts for and best serves the interest of, the village and the surrounding community.”

However, sources in both the state Senate and House said the idea has been raised in recent meetings, though no nal wording has been submitted. Among key questions would be whether local o cials could block a proposed PILT, how much it would lower taxes below the level they otherwise would rise to after development, and how disputes among taxing bodies would be resolved.

BROADER SCOPE

Widening PILT to more than the Bears—for instance, adding in clean-energy projects—could boost its legislative appeal.

One area lawmaker,

Ann

Heights, who has been a critic of some TIF spending, said she’s “open to looking at” PILT. However, she added, “My bottom line is that if there is any public support, it’s got to be for di erent public purposes, such as a ordable housing.”

e Bears have projected that their entire proposed complex could generate $1.4 billion in economic impact, spinning o $16 million annually in local tax revenue as well as $60 million per year in tax revenue for Cook County and the state.

e Bears have not yet closed on the track property, but owner Churchill Downs has said it expects that to occur in the rst half of next year.

Horizon CEO set to reap windfall from Amgen buyout

But the future of the drugmaker’s Deer eld presence after the $27.8 billion deal closes is less certain

BY KATHERINE DAVIS

It’s not yet clear what the $27.8 billion sale of Horizon erapeutics to Amgen means for Horizon’s employees or the local biotech industry, but one thing is certain: Horizon CEO Tim Walbert will walk away with a nine- gure payday.

Walbert will collect more than $150 million in cash when his Horizon shares and stock options are converted at the $116.50-pershare buyout price. Horizon lings show that Walbert owns 693,907 Horizon shares, which would be worth $80.8 million in the deal. He also holds options to purchase 742,565 shares at a price of $22.14 each, according to his most recent ownership ling dated June 3 of this year. After deducting the strike price, those shares will convert into $70 million in cash in the buyout.

Walbert stands to get substantial additional sums from equity incentive awards that will also convert to cash at the deal price. e total value of those “performance share units” can’t be calculated because Horizon hasn’t disclosed how many Walbert

currently holds. ose details will likely be revealed in an SEC ling providing more information on the transaction, which is expected to close in the rst half of 2023.

“He’s been compensated very generously,” says Mark Reilly, managing director at Overture Alliance, an executive search and compensation consulting rm. “ ere was certainly an incentive for him to cash out.”

Horizon declined to comment on the gures.

In a statement, the company said Walbert plans to step down from his role after the deal closes, and Amgen CEO Robert Bradway will continue as the top executive of the combined company. According to Horizon’s most recent proxy ling, Walbert would be eligible for about $3.57 million in cash severance and about $4 million in bonuses if he leaves Horizon under certain conditions within 18 months of a sale of the company.

Walbert has led Horizon since 2008, overseeing a series of acquisitions and the development of treatments for rare conditions. Top sellers include a thyroid eye remedy called Tepezza and a gout drug called Krystexxa.

Horizon’s sales have grown to a projected $3.6 billion this year. With o cial headquarters in Dublin, the company employs 2,000 people globally, 700 of them at its operational base in Deer eld.

RESTRUCTURING

Initially approached by Sano , Horizon attracted interest from other large pharmaceutical players before accepting Amgen’s offer. e buyout price is 48% higher than Horizon’s stock market value before it revealed takeover talks, but still below its peak of $119.91 in October 2021. e proposed acquisition throws the future of Horizon’s workforce into doubt. Acquirers often cut jobs at acquired companies as they consolidate operations and reduce overhead.

“With regards to consolidation, I think that’s the promise of mergers, right?” said Dan Lyne, senior vice president in CBRE’s global life sciences practice.

Horizon hasn’t directly addressed the question of layo s in Deer eld or elsewhere. A “Frequently Asked Questions” document circulated to employees in-

cludes a query about the possibility of layo s, but says only that none are expected before the deal closes.

Amgen said it will consider consolidating some or all of Horizon’s o ces into Amgen’s global headquarters in ousand Oaks, Calif. Amgen also said there will be some operational and administrative restructuring of Horizon sta after the deal closes, but noted that it does not intend to make any “material change” to the sta and hasn’t yet made any decisions about the kinds of roles or locations that could be a ected if there are changes.

With control of Horizon moving to California, the Chicago region will have one less company in the life science sector e ectively headquartered here. Decisions a ecting the business will now be made by executives thousands of miles away. Even so, experts say the deal could be positive for the local biotech, pharma and biosciences industries.

“It’s completely a win for the community,” says John Conrad, CEO of the Illinois Biotechnology Innovation Organization. “ ey grew the company in Chicago. I think a lot of people probably

thought that they couldn’t do that, but they obviously built it into a multibillion-dollar company with research arms across the country and global sales.”

Conrad says the riches reaped by Walbert and his lieutenants could eventually seed new biotech startups in the area. He points out that Je Aronin launched Paragon Biosciences after selling Ovation to Lundbeck in 2009 for $900 million, and Sean Nolan started Jaguar Gene erapy after selling AveXis to Novartis for $8.7 billion in 2018, ventures largely made possible through fortunes amassed from the buyouts.

4 DECEMBER 19, 2022 • CRAIN’S CHICAGO BUSINESS

The organization is pitching o cials in Spring eld on nancing that would help them but not penalize local school districts as harshly as a conventional TIF

state Sen.

Gillespie, D-Arlington

Tim Walbert

A rendering of the proposed Arlington Heights complex.

BLOOMBERG

HART HOWERTON / CHICAGO BEARS

Happier holidays are within your grasp.

Spend and save smarter, all in one place. With impressive digital tools from Bank of America, you’ve got more power than you think.

Sometimes, the most wonderful time of the year can feel anything but wonderful. So if you need help with your business, financial future or just making paycheckto-paycheck go further — we’re here. With personalized products, simple solutions and experts in Chicago, you can keep life moving the way you need it to.

Go to bankofamerica.com/chicago to learn more

What would you like the power to do?®

Bank of America, N.A. Member FDIC. Equal Credit Opportunity Lender © 2022 Bank of America Corporation. All rights reserved.

Rita S ola Co ok

Presid en t, B an k of A merica C hica go

A year of billionaires’ real estate moves

Gri n,

I BY DENNIS RODKIN

The super-rich buy and sell homes like everyone else. Their deals just have more zeroes in them.

Here’s a look back at 2022’s noteworthy housing deals involving billionaires.

In January, two members of the Reyes family, the billionaire beverage clan whose $31.5 billion privately held company Reyes Holdings is based in Rosemont, bought the grand Lake Geneva estate left behind by the late nancier Richard Driehaus.

J. Christopher Reyes and Anne Reyes paid $36 million for the 40-acre estate, which includes a 13-bedroom Colonial mansion built in the early 1900s and over 620 feet of frontage on Geneva Lake. The couple, whose worth Forbes pegs at $7 billion, also have homes in Lake Forest and Jupiter Island, Fla.

When a condo at No. 9 Walton sold in April for $17.4 million, the buyers were not disclosed.

e Chicago Tribune later learned they were Steve and Nancy Crown. ey are members of the Crown dynasty, whose total wealth Forbes puts at $10.2 billion from their ownership stakes in General Dynamics, New York’s Rockefeller Center, the Chicago Bulls and the New York Yankees. e couple also own a Winnetka mansion that formerly belonged to Steve’s parents, Lester and Renee.

Jennifer Pritzker, a cousin of the governor and, like him, a member of the wealthy Pritzker dynasty, in April sold her fourth Evanston property. Estimated to be worth $1.9 billion, Pritzker, the world’s only known transgender billionaire, owned the four homes through her rm Tawani Enterprises. Two had operated as bedand-breakfasts, but Tawani did not disclose the uses of the other two.

David “Duke” Reyes is a younger brother of J. Christopher Reyes and Jude Reyes, who are co-chairmen of the family rm. Duke, who’s worth $1.2 billion, is CEO. It’s not clear whether Duke and Pamela Reyes maintain a Chicago-area residence. e last time their names appeared in public real estate records was 2013, when they sold an East Lake Shore Drive condominium.

In June, the founder of computer retailer CDW sold a lakefront mansion in Highland Park for $3.53 million. Michael Krasny, whose worth Forbes puts at $1.3 billion and who has a $4.5 million condo on Michigan Avenue, initially put the home on the market in September 2020 at almost $2 million more than it eventually sold for.

e 2.6-acre property has 400 feet of Lake Michigan shoreline, a swimming pool and a 13,000-square-foot house.

LAKEFRONT BATTLE

a fourth home, contiguous with two others they owned. Later, a pair of Winnetka residents pushed the town to use eminent domain to seize the Ishbias’ parcel that is between two parks.

The Winnetka Village Board, which is a separate governmental entity from the park district, this month approved the Ishbias’ application to combine three lots into one legal parcel.

More developments in this story should come in 2023, as the park district and the Ishbias haggle over the piece between two parks, and as plans for the Ishbias’ proposed house emerge.

Also in June, Citadel chief Ken Griffin announced he would move both his company and his family to Florida full time.

e next month, Gri n launched a sell-o of his portfolio of Gold Coast condos, putting four condominiums in three buildings up for sale. e sum of the asking prices is $54.5 million. at’s not all he may eventually o er; Gri n is known to own at least two more condos in Chicago.

IN COMING MONTHS, LOOK FOR TWO ADDITIONAL SALES AND POSSIBLY MORE OF GRIFFIN’S CHICAGO PROPERTIES HITTING THE MARKET. HE IS ALSO BUILDING THE FIRST MANSION, A HOUSE FOR HIS MOM, ON HIS 25 ACRES IN PALM BEACH.

In the sello , the four properties went for a combined $7.8 million. At least two were sold at a loss, but because property records aren’t clear on what Tawani paid for one of the four, it’s not possible to say whether the sello was pro table or not. Pritzker also owns a Winnetka mansion.

In May, two more members of the Reyes clan, Duke and Pamela, sold a Florida mansion for $21 million. at was 82% more than they paid for it four years earlier.

Justin and Kristen Ishbia, who had purchased three lakefront Winnetka properties for nearly $24 million in 2020 and 2021, ran into a roadblock in June. ey’d agreed on a land swap with the Winnetka Park District that would give one of the Ishbias’ parcels to the park district in exchange for a piece of park land that is next to their other two parcels. But that angered local residents, which led to the park district withdrawing from state and federal applications for beach improvements.

Justin Ishbia is the head of Shore Capital Partners, a private-equity rm, and a board member in a Michigan mortgage rm founded by his father and now run by his brother, Mat. Forbes says he’s worth $2.4 billion. e Ishbias also have a $12.6 million Lincoln Park mansion.

Over the next few months, the situation continued to unfold.

e Ishbias paid $16 million for

By December, the fourpart selloff was half-finished, with one unit sold at a loss of over $3 million and another under contract to a buyer.

In coming months, look for two additional sales and possibly more of Gri n’s Chicago properties hitting the market. Gri n has also begun building the rst mansion, a house for his mom, on his 25 acres in Palm Beach.

Forbes estimates Griffin is worth $31.7 billion.

In August, ex-spouses Bill Gates and Melinda French Gates put up for sale the Hyde Park house they had purchased for their son Rory to live in while he was enrolled at the University of Chicago. ey listed it at $1.55 million. Buyers put the house under contract nine days later, and the sale closed in mid-September at $1.5 million.

Bill Gates is reported to be worth more than $105 billion. Melinda French Gates’ wealth is estimated at $6.9 billion.

6 DECEMBER 19, 2022 • CRAIN’S CHICAGO BUSINESS

Ken

Bill Gates, Jennifer Pritzker and other super-rich homeowners made some splashy deals in Chicago and the suburbs in 2022. Here’s a look at the biggest.

Inside the Lake Geneva estate of late nancier Richard Driehaus.

No. 9 Walton

GENEVA LAKEFRONT REALTY ENGEL & VOELKERS CHICAGO NORTH

GENEVA LAKEFRONT REALTY

COMPASS

Billionaire Jennifer Pritzker sold this Evanston mansion in April.

SHORE

GOLD COAST REALTY CHICAGO

Duke and Pamela Reyes sold this Palm Beach, Fla., home in May for $21 million.

Late nancier Richard Driehaus’ Lake Geneva estate was bought by J. Christopher Reyes and Anne Reyes.

you to the

www.soill .org BIOSCIENCES INC.

Thank

2022 Special Olympics Illinois corporate partners, donors, volunteers, and coaches for providing opportunities for

2022 Statewide Sponsors

Lettuce reveals restaurants for St. Regis Chicago

The rst dining room is expected to open next spring in tandem with the high-end hotel

BY ALLY MAROTTI

Lettuce Entertain You announced the names of its two restaurants that will open next year in the St. Regis Chicago.

e rst restaurant, Miru, is expected to open next spring in tandem with the hotel, which has experienced delays. “Miru” is the Japanese verb for “view,” and it will have two terraces and an 11th- oor dining room that overlook the Chicago River and Navy Pier.

e Japanese restaurant from Chef Hisanobu Osaka will offer sushi, sashimi, hot pots and more. Osaka has worked at Michelin-starred Daniel in New York, served as private chef for a Japanese diplomat in New Orleans, and worked on menu development at other Lettuce restaurants including Wow Bao and Aba.

Overseeing both restaurants’ beverage programs will be Diane Corcoran, a Lettuce mixology alum. Additionally, Juan Gutierrez—previously of Four Seasons Chicago and a winner of Net ix’s “School of Chocolate”—will be the executive pastry chef.

Lettuce rst teased the restaurant concepts that would be going into the St. Regis this fall. Lettuce took over dining operations in the St. Regis earlier this year, after a previous deal between developer Magellan Development Group and Alinea Group fell through. at change contributed to a delay in the hotel’s debut.

e high-end hotel has been highly anticipated. It will occupy 11 lower oors of the Lake Shore East tower. At 101 stories, the Jeanne Gang-designed tower is the third-tallest building in the city. Residents started moving into the residential portion of the building in late 2020.

U of I plans weed research center at Discovery Partners Institute

DPI is teaming up with the city and state on marijuana research to capitalize on Chicago’s critical mass in the burgeoning cannabis industry

BY JOHN PLETZ

Discovery Partners Institute, the University of Illinois research center underway in the South Loop, has high hopes to launch a marijuana research facility.

DPI has begun a search for an executive director and researchers, and it has support from the city of Chicago and the state of Illinois. But it doesn’t yet have funding commitments from either one for a project that likely will need tens of millions to become a reality.

e cannabis research institute is the rst signi cant e ort by the city and state to build on Chicago’s critical mass in the marijuana industry. e city is home to several of the largest U.S. marijuana companies—including Cresco Labs, Green umb Industries, Verano and PharmaCann—which employ thousands of workers. Since legalizing recreational marijuana three years ago, sales have grown to about $1.5 billion.

e University of Illinois sees opportunities to draw on its strengths in agriculture, genomics and medicine to study topics ranging from marijuana production to the health impacts of cannabis.

“It’s a natural for us to be a gathering point,” says Bill Jackson, executive director of DPI. “It’s an industry that Illinois wants to win

in. It’s an industry that’s going to be sizable.”

Because cannabis is federally illegal, there hasn’t been as much research as in other elds. Universities are worried about putting their federal research grants for other projects at risk by working with cannabis. But recent federal legislation loosens some of the restrictions, making it easier for researchers to get approval to work with cannabis.

A handful of universities have marijuana research programs, including the University of Mississippi, UCLA and the University of California San Diego.

“Our intent is to be the best in that space,” Jackson says.

DPI is a research center for the

Saks discount chain to return to State Street

Saks O 5th is reopening a store that it closed in 2019, before the pandemic devastated retail in the Loop

BY ALBY GALLUN

e second restaurant, Tre Dita, is slated to open in the second half of 2023. “Tre Dita” is Italian for “three ngers,” and elicits the thickness of the Bistecca alla Fiorentina the restaurant is set to serve, according to a news release from Lettuce.

e restaurant group is working with award-winning Chef Evan Funke on the second- oor restaurant. e Los Angeles chef runs Roman-inspired

Beyond just the restaurant operator, the tower at 363 E. Wacker Drive has seen its share of changes since Magellan broke ground in 2016. e project was called Wanda Vista Tower then, but Chinese conglomerate Wanda Group bowed out and sold its 90% stake in the development to Magellan and partners Goldman Sachs and J.P. Morgan. e “Vista” name was later dropped.

e condo building was pitched as a place rich in amenities and services, and such changes matter to prospective buyers in the building. A twooor condo on the 71st and 72nd oors sold for $20.56 million earlier this year.

After a three-year hiatus, Saks O 5th is returning to State Street in the Loop, welcome news for a key Chicago retail strip awash in vacant space.

e discount women’s apparel retailer said it’s reopening a store at 6 S. State St. and another one in the NewCity shopping center on the Near North Side after closing them in 2019. e move will lower the retail vacancy rate on State Street, which has soared since the onset of the COVID-19 pandemic due to a wave of store closings.

Saks O 5th was among the bigger retail tenants on the Loop shopping strip, opening its 23,500-square-foot store there in 2016. ough the store has been closed since 2019, the chain, a unit of Toronto-based Hudson’s Bay, still controls the space through its original long-term lease with the owner of the prop-

erty, a joint venture between New York-based Madison Capital and Bethesda, Md.-based ASB Capital Management.

State Street needs many more retailers to recover from a pandemic that has been devastating to the Loop retail real estate market, and to State Street in particular. Chains including Urban Outtters, DSW and New York & Co. have closed stores there, and Old Navy decided not to renew a lease for its store at State and Randolph streets that expires at the end of the month.

ough a few retailers, including Five Below and shoe merchant JD Sports—Saks’ neighbor to the south—have opened stores on State Street, the Central Loop’s retail vacancy rate was 23.1% at the end of 2021, down from 26.1% in mid-2021 but still well above 14.7% in 2019, according to Chicago retail brokerage Stone Real Estate. But more retailers are seriously

U of I system that will be built in the South Loop, which still is in the formative stages. Construction on its facilities is scheduled to begin in 2024, but it has o ces downtown.

e idea of a housing cannabis research facility at DPI has been in discussion for about nine months, but funding is still up in the air.

“It’s not a wish and a prayer,” Jackson says. “It will happen. We’ve had long conversations with the city and the state.”

Jackson didn’t specify how much money will be required but says “$50 million wouldn’t be a bad target. Predominantly, funding will come from grants or independent groups.”

6 S. State St.

“It’s a sign that things are coming back,” he said.

Representatives of Madison Capital and ASB did not respond to requests for comment. e rms in 2014 paid $60 million for the storefront and two immediately to the south, one occupied by JD Sports and another, formerly occupied by Urban Out tters, that’s vacant.

Saks O 5th said it plans to reopen the State Street store and the one at NewCity, which totals 40,000 square feet, in the spring.

e chain already operates stores in Northbrook, Rosemont and Aurora.

8 DECEMBER 19, 2022 • CRAIN’S CHICAGO BUSINESS

Mother Wolf in California.

shopping for space on the street, said retail broker Luke Molloy, senior vice president in the Chicago o ce of CBRE. He’s encouraged by the return of Saks.

A rendering of Miru at the St. Regis Chicago.

GOOGLE

DISCOVERY PARTNERS INSTITUTE

ROCKWELL GROUP

An architect’s rendering of the headquarters building.

LETTUCE TOOK OVER DINING OPERATIONS IN THE ST. REGIS EARLIER THIS YEAR AFTER A PREVIOUS DEAL FELL THROUGH.

The art and science (but mostly art) of cashing out

One of the most di cult questions entrepreneurs face is how and when to sell a business. While many companies worry about selling too soon and realizing too little of the eventual enterprise value, few worry about selling too late and, in the worst case, missing the chance to sell altogether.

Every business is di erent, and some o ers of acquisition should be refused outright. But what considerations help most when valuing an early-stage business?

As the seller, the rst thing to consider is that your calculation of your business’s value may not be the same as the acquirer’s. Two common ways to value a business earlier on are discounted cash ow, or DCF, and multiples, in part because peer evaluation ( nding comparable rms) may prove dicult when the business is in a startup stage or hasn’t yet settled into an ecosystem of direct competitors.

However, these approaches don’t always work. Why?

DCF, an e ort to calculate the present value of future cash generated by a business, can be hard to use if a business is growing fast or in an industry experiencing uctuating margins. Modifying or “tuning” a DCF model often leads

to overcomplexity or a high number of assumptions—yet reducing the number of assumptions makes the model more dependent individually on each of a small number of assumptions, which is hardly a desirable simpli cation.

So is a multiple of current revenue the better approach to valuation? Perhaps.

But even mature companies in well-understood businesses may vary substantially in priceto-earnings ratio (or price-to-netrevenue, etc.). Take, for instance, Best Buy and Circuit City in 2004, when both were mature, nationwide, well-known retailers. Best Buy at $47 per share represented a 13 times earnings multiple, while Circuit City at about $13.50 per share represented a 22 times earnings multiple (the S&P 500’s average at the time was about 15.5 times earnings).

Looking more deeply, we see structural di erences, like Circuit City having a great deal of cash on hand. But entrepreneurs understandably worry their enterprises will be undervalued or valued on a whim rather than carefully appraised.

is uncertainty leads many to say: “I’ll wait until the business stabilizes and we have XX months

of proven revenues and can negotiate more robustly with counterparties.”

e problem is that turbulence never subsides, and greater certainty may actually reduce valuations by quelling otherwise-imagined upside. It's analogous to the old venture-capital saying that it’s easier to raise nancing for a com-

pany with $0 in revenue than one with $1 in revenue. What to do?

Don’t be afraid to negotiate using di erent metrics from the other side or using metrics peculiar to your industry. Educate the acquirer about how to value the enterprise.

Resist being seduced by the complexity and claimed precision of the acquirer’s valuation models. Be prepared to rebut their assumptions, especially around growth scale and rate.

Re ect on whether the business

is worth much less without you and what the acquirer might need to o er to retain you. ey very well may want you to stick around Be honest about the value of liquidity to you personally. If the business is a huge chunk of your personal wealth, you may reasonably want to take cash o the table. Selling a company slightly before it is “fully ripe” is a common fear, but bear in mind that all ripe fruit is soon spoiled. While there is no “right” time to do a deal, it is di cult to sell when people no longer want to buy.

CRAIN’S CHICAGO BUSINESS • DECE M BER 19, 2022 9 ChicagoBusiness.com/CareerCente r Connecting Talent with Opportunity. Fr om to p ta lent toto p em pl oyer s, Crain’s Career Center is the next step in yo urhiring process or job se arch . Get started to da y

Advice for small businesses and entrepreneurs in partnership with the University of Chicago Booth School of Business.

GETTY IMAGES

Karl T. Muth is a consultant who teaches new venture strategy at Chicago Booth and studies decision-making and negotiation.

The Bears’ subsidy play is a nonstarter

The Chicago Bears stuck a giant foam nger in the air this week in hopes of nding out how lawmakers and taxpayers would feel about contributing public money to their Arlington Heights stadium plans.

What they’re nding is that, even if it’s gussied up as a newfangled cousin of a conventional tax-increment nancing district, the idea is going over about as well as a botched Cody Parkey eld goal.

And that’s as it should be. What the McCaskey clan and the Bears organization are asking for in Spring eld is nothing short of a backdoor public subsidy of their stadium campus proposal. As Crain’s Greg Hinz was rst to report—so early to report, in fact, that some public o cials only learned of the idea when reached for comment—the Bears are shopping for a relatively obscure form of public support and are hoping some of the ne points will make the deal more palatable to taxing bodies like local schools, park districts and libraries.

Under the plan, the Bears would utilize something known as payment in lieu of taxes, or PILT.

PILTs are a tool originally created by the federal government to compensate local governments for the loss of property taxes because of tax-exempt federal property within their borders. e concept since has spread to payments for state-owned property in some parts of the country and to some private developments, such as solar-energy generation, that are not feasible to build with normal property taxes. But because PILT payments can be negotiated rather than being set at a predetermined rate—as TIF subsidies usually are—and because the revenue from these payments

can be shared with schools rather than stay with municipalities, they o er more exibility than a conventional TIF district. Here’s what the Bears want: After acquiring the Arlington property, the organization would no longer pay regular property taxes, which would rise as the value of the property and improvements rose. Instead, they’d pay a negotiated annual amount that would be distributed as per the agreement among schools and other local taxing bodies. at amount presumably would be less than property taxes would be, e ectively compensating the team for some infrastructure and other de-

velopment costs. But the payout to schools and other taxing bodies would, in theory, be more than they would get under a conventional TIF plan.

e village of Arlington Heights has agreed to consider helping to defray some infrastructure expenditures that arguably could bene t the entire community and not just the Bears. e PILT idea now circulating in the capital, however, is a signi cant step beyond that commitment. And it’s one that Arlington Heights and Spring eld lawmakers would be right to reject. e Bears ownership group has next to no leverage on this point. Leave Chicago? It’s hard to imag-

YOUR VIEW

ine the National Football League would abandon this market for long.

To use a PILT for building a stadium campus for a wealthy NFL franchise would be stretching the original purpose of this taxing tool past the breaking point—and would open the oodgates for other team owners looking for a similar handout.

Speaking of other team owners: e Ricketts family has nanced its Wrigley Field revamp without taxpayer help. Why can’t the McCaskeys do the same? e era of pro sports teams shaking down municipalities for public nancing is over—or, at the very least, it should be, and Arlington Heights should declare it thus. e village is a thriving, middle-class suburb with a lively downtown, two Metra lines, quick access to O’Hare, blue-ribbon schools, a park district that sports two golf courses as well as six swimming pool complexes and an indoor tennis center, one of the best libraries in the country and property values that are on the rise. In short, it’s not a community struggling to attract investment and development. ere is precious little reason this village should hand over a slice of its tax income to fund a stadium campus where fewer than 10 regularseason games will be played a year.

e Arlington International Racecourse property represents a unique opportunity to redevelop a relatively close-in parcel of suburban land that’s roughly the size of Chicago’s Loop—with or without a football stadium. If the Bears can’t gure out how to make the most of that opportunity on their own—or with the help of a deep-pocketed partner—then perhaps they should stand aside and allow someone else to draw up a game plan instead.

Let’s see a public safety New Year’s resolution

With the end of 2022 in sight, many Chicagoans’ thoughts naturally turn to their goals for the new year.

e Civic Federation suggests our local government leaders make some New Year’s resolutions of their own—starting with the city of Chicago and its plans for improving public safety.

As Chicago continues to emerge from the coronavirus pandemic and celebrates the holiday season with skating in Millennium Park and the CTA Holiday Train, the city’s improved nances are also worth celebrating. Less worth celebrating, however, is the city’s progress toward public safety and police reform.

e statistics remain deeply unsettling: Crime in Chicago is up 40% in 2022 over 2021 and 2020, per the Chicago Police Department’s data. While murders and shoot-

ings slightly decreased compared with 2019, violence levels in Chicago remain unacceptably high. We pay a tremendous price for this: the unnecessary loss of lives, a sense of reduced safety among residents and visitors, and the toll that heightened crime takes on the vitality of our city and businesses. is holiday season, public safety improvements are at the top of the business community’s wish list for the city’s future.

e Chicago Police Department has for four years been under a federal consent decree. is should be a strong road map to guide our city policing forward. However, progress toward implementing the policies and reforms spelled out in the consent decree—and importantly, communication of that progress to the public—has been insu cient. e department also continues to face criticism for being slow to imple-

ment constitutional policing practices, as expressed at a Nov. 29 public hearing on the consent decree.

In 2023 and beyond, we need to see and hear more about the city’s e orts and results.

As it stands, public statements from the police too often frame the department’s progress toward compliance with the consent decree in terms of percentages, which do not improve the public’s understanding of what the city is doing to achieve outcomes. We urge the city of Chicago to better communicate how consent decree requirements are informing its public safety strategy. City leaders need to demonstrate that the city is actively working to fundamentally reshape the way it approaches police services, with the dual goal of improving policing and reducing violence.

e Civic Federation joins calls for a cultural transformation of the Chicago Police Department into a modern, constitutional,

Write us: Crain’s welcomes responses from readers. Letters should be as brief as possible and may be edited.Send letters to Crain’s Chicago Business, 130 E. Randolph St., Suite 3200, Chicago, IL 60601, or email us at letters@chicagobusiness.com. Please include your full name, the city from which you’re writing and a phone number for fact-checking purposes.

data-driven department. is means: embracing the use of data in decision-making and ensuring that all city and county stakeholders are working from the same set of facts; welcoming evaluation from outside experts; fully embracing a community policing philosophy; and putting su cient resources, sta and processes in place to ensure successful implementation of the consent decree.

In line with a cultural transformation is an improvement in transparency and accountability. With one of the highest numbers of police per capita in the nation and a budget of nearly $2 billion, the Chicago Police Department must be more e ective and transparent. e Civic Federation urges the department to publish the basis on which o cer sta ng allocations are made and conduct a data-driven re-evaluation of its use of resources and sta .

Of additional concern to the Civic Federation is that we have little sense of how much

Sound o : Send a column for the Opinion page to editor@ chicagobusiness.com. Please include a phone number for veri cation purposes, and limit submissions to 425 words or fewer.

10 DECEMBER 19, 2022 • CRAIN’S CHICAGO BUSINESS

EDITORIAL

HART HOWERTON/CHICAGO BEARS

Laurence Msall is president of the Civic Federation.

A rendering of the propsed Bears stadium campus in Arlington Heights.

the full implementation of the consent decree will cost the city. What we do know is that the cost of not achieving transformation of the police department will be much higher—far exceeding the hundreds of millions of dollars that taxpayers have already paid in damages for unconstitutional policing and harm to Chicago citizens. We hope to see the department make public its progress toward consent decree requirements, including training, unity of command and e ective sta ng ratios. Similar sentiments have been raised by the new Community Commission for Public Safety & Accountability.

e public also needs to know how many police o cers and non-sworn personnel the department actually needs. We know it

CRAIN’S

President/CEO KC Crain

Group publisher/executive editor Jim Kirk

Editor Ann Dwyer

Creative

Director

Assistant managing editor/audience engagement Aly Brumback

Assistant managing editor/columnist Joe Cahill

Assistant

Assistant

Deputy

Account

Keith E. Crain Chairman

Mary Kay Crain Vice chairman

KC Crain President/CEO

Chris Crain Senior executive vice president Robert Recchia Chief nancial o cer

Veebha Mehta Chief marketing o cer

G.D. Crain Jr. Founder (1885-1973)

Mrs. G.D. Crain Jr. Chairman (1911-1996)

For subscription information and delivery concerns please email customerservice@ chicagobusiness.com or call 877-812-1590 (in the U.S. and Canada) or 313-446-0450 (all other locations).

is working to address recruitment, training and retention amid hiring challenges in the tight labor market, and we recognize that police hiring gures have improved since the height of the pandemic. However, we still don’t know where we need to be. e Civic Federation urges the city to communicate more e ectively what it is doing to secure quality sworn and civilian sta , and how those e orts are helping the department to reach sta ng goals.

e Civic Federation further recommends a much greater investment in safety on public transit. We remain concerned about safety, cleanliness and reliability on the Chicago Transit Authority. Ridership has not recovered to pre-pandemic levels, and the city

cannot a ord to continue to lose riders based on the perception that the CTA is unsafe. Chicago’s public transit system is critical to ensuring the city’s recovery post-pandemic and upholding its global reputation. We urge the city to work with the CTA on more e ective security measures and solutions to address the root causes of disruptive behavior.

Finally, the city should continue its longterm investments in the Invest South/West initiative and violence prevention programs, which show promise but require signi cant additional nancial resources to bring these e orts to scale and secure their continuation.

Lest someone mistake me for Ebenezer Scrooge, let me be clear that as the ball

drops on New Year’s Eve and Chicagoans make plans to start saving or exercising more in 2023, they still have good reason to feel hopeful about the future of our city. It is in better nancial shape, as recognized by bond rating agencies, and was able to include a sizable supplemental payment to its pension fund in its scal 2023 budget, thanks to better-than-expected revenue performance.

In order to stick to a resolution, most experts say it should be measurable and achievable. is, in essence, is what we are looking for from Chicago leaders in their plans for the consent decree and police modernization. Let’s hear, in detail, what those resolutions are.

CRAIN’S CHICAGO BUSINESS • DECE M BER 19, 2022 11

director Thomas J. Linden

of audience and engagement

Elizabeth Couch

managing editor/digital content creation Marcus Gilmer

managing editor/digital Ann R. Weiler Assistant managing editor/news features Cassandra West

digital editor Todd J. Behme

Deputy digital editor/audience and social media Robert Garcia

Digital design editor Jason McGregor Associate creative director Karen Freese Zane Art director Joanna Metzger Copy chief Scott Williams Copy editor Tanya Meyer Contributing editor Jan Parr Political columnist Greg Hinz Senior reporters Steve Daniels, Alby Gallun, John Pletz Reporters Katherine Davis, Brandon Dupré, Danny Ecker, Jack Grieve, Corli Jay, Justin Laurence, Ally Marotti, Dennis Rodkin, Steven R. Strahler

Contributing photographer John R. Boehm Researcher Sophie H. Rodgers

Senior vice president of sales Susan Jacobs Vice president, product Kevin Skaggs Sales director Sarah Chow

Events manager/account executive Christine Rozmanich Marketing manager Cody Smith Production manager David Adair Events specialist Kaari Kafer Custom content coordinators Ashley Maahs, Allison Russotto

executives Claudia Hippel, Bridget Sevcik, Laura Warren Sales administration manager Brittany Brown

People on the Move manager Debora Stein Digital designer Christine Balch

CHICAGO BUSINESS YOUR VIEW Continued

Access the ci ty’s leading business news in print, online or on any mobile device with our new app, now available for download for free with your subscription! Visit chicagobusiness.com today or find us in the app store GET MORE

PEOPLE ON THE MOVE

BANKING

First Bank Chicago, Northbrook

First Bank Chicago proudly announces the promotion of Marcela Melendez to Chief Lending Of cer, Lease Finance Group. In this executive role, she leads a diverse team of professionals that oversee the Lease Finance portfolio which includes business development, administration, credit, and documentation. With 30 years of banking and leasing expertise, Marcela is a seasoned banker who has contributed to various bank-wide initiatives and process improvements. She joined the First Bank team in 2019.

BANKING

First Bank Chicago, Northbrook

First Bank Chicago proudly announces the promotion of Ryan Liebgott to Vice President, Credit Manager for the Lease Finance Group. In this new role, Ryan will oversee and lead the credit team in the Lease Finance Group. Ryan and his team are responsible for underwriting and portfolio management for fortune 1000 customers within the Lease Finance Group. Ryan has over 15 years of underwriting experience in commercial and industrial leasing. He joined the First Bank Chicago team in 2019.

BANKING

First Bank Chicago, Northbrook

First Bank Chicago proudly announces the promotion of Patrick Niday to Vice President, Lease Finance Group. Patrick is responsible for supporting the Bank’s growth strategy by enhancing Lease Client relationships while also developing and building new customer contacts in the marketplace. He also oversees the Lease Finance Group’s business monthly and annual development reporting. Patrick has over 15 years banking and leasing expertise and joined the First Bank Chicago team in 2019.

BANKING

First Bank Chicago, Northbrook

First Bank Chicago proudly announces the promotion of Sam Jaramillo to Lease Documentation Of cer. He is responsible for managing the documentation of the leasing portfolio & funding of all lease transactions. This includes legal review of new lease originations and maintaining proper documentation for the lease portfolio including Latin American fundings. He works closely with our Lessor relationships and internally interacts with many areas of the Bank. Sam joined the First Bank team in 2019.

ACCOUNTING

ORBA, Chicago

ORBA, one of Chicago’s largest public accounting rms, welcomes Sandy Burhans as the rm’s Sports and Entertainment Group Leader. With more than 20 years of experience, Sandy is a trusted advisor who simpli es her clients’ tax preparation through the complicated “jock tax” spider web. Previously, she spent two decades with a top sports agency where she handled many client relationships spanning from the athletes’ rookie year to veteran status to retirement.

CONSTRUCTION

AECOM Hunt, Chicago

Jeremy Andersen has joined AECOM Hunt’s Chicago of ce as Project Executive. Spanning more than two decades, Jeremy’s work has included extensive projects throughout Chicago, largely focused in the aviation and high-rise, luxury, and mixed-use residential markets. Prior to AECOM Hunt, Jeremy served as Senior Superintendent at Leadlease. In his new role, he will provide eld and preconstruction expertise on major regional projects.

FINANCIAL SERVICES

Baird, Chicago

To place your listing, visit www.chicagobusiness.com/peoplemoves or, for more information, contact Debora Stein at 917.226.5470 / dstein@crain.com

INSURANCE

Newfront, Chicago

Chris Morse joins Baird as a Managing Director and Public Finance Banker. He brings over 29 years of experience in investment banking and corporate nance. In his new role, Morse will help develop nancing plans that use clients’ credit strengths to execute institutionally critical nancings. Morse received his Bachelor of Science from Louisiana Tech University and served in the United States Marine Corps.

FINANCIAL SERVICES

Baird, Chicago

Steve Simpson, CFA®, joins Baird as a Managing Director and Public Finance Associate Banker. He brings more than 30 years of experience to the business, having specialized in municipal nance, business development, managing complex transactions, investment banking, and capital services. In his new role, Simpson will help develop nancing plans that use clients’ credit strengths to execute institutionally critical nancings. Simpson holds a BA in Political Economy from Williams College.

FINANCIAL SERVICES

Baird, Chicago

CONSTRUCTION

Pepper Construction, Chicago

Pepper Construction has promoted Ashlie Stapleton to Director of Diversity, Equity and Inclusion. Ashlie has operational experience in construction project management, a strong understanding of Pepper’s culture, a passion for advancing the industry and a deep commitment to improve diversity, equity and inclusion in the community. Ashlie joined Pepper in 2018, holds a Bachelor of Civil Engineering from the University of Illinois and has been a key contributor to Pepper’s DE&I initiatives.

EDUCATION

People’s Music School, Chicago

Miriam Goldberg Owens has been appointed President & Chief Executive Of cer of The People’s Music School. Owens has served on the organization’s leadership team since August 2021, joining as Chief Operating Of cer. She became Chief of Development and Operations in April 2022, expanding the organization’s fundraising footprint while driving operational improvements. Owens enters the role with a wealth of senior leadership experience in the social and private sectors.

Carlo Fitti joins Baird as a Director and Public Finance Associate Banker. He brings more than 20 years of securities experience to the business. In his new role, Fitti will help develop nancing plans that use clients’ credit strengths to execute institutionally critical nancings. Fitti is a graduate of Swarthmore College, holding a BA in Economics.

HEALTH CARE

Compass Health Center and Compass Virtual, Chicago

Compass Health Center has named Justine Mitchell as its new Senior Vice President of Compass Virtual. Before becoming SVP of Compass Virtual, Mitchell served as one of the founding members of Illinois-based telepsychiatry provider Regroup. Under Mitchell’s leadership, Compass Virtual plans to expand virtual Partial Hospitalization (PHP) and Intensive Outpatient (IOP) programs to additional markets outside of Illinois.

WEALTH MANAGEMENT

BMO Wealth Management, Chicago

BMO Wealth Management welcomes Maureen Christie as Director, Private Wealth Advisor in Chicago. Maureen serves as a lead advisor and relationship manager to high-net-worth individuals, families and organizations, including closely held and familyowned businesses. Maureen joined the organization in 2022 and has over 20 years of experience in the nancial services industry.

John Newell was recently named Chief Commercial Of cer at Newfront. In this role, John leads the sales teams, with responsibility for the function’s strategies and plans. He oversees the property and casualty, employee bene ts, and 401(k) practices, as well as four growing regions, and the sales development and growth functions at the company. Prior to Newfront, John was a senior executive at Marsh, where he spent 20 years leading teams to historic growth and developing marketplace strategies.

INSURANCE / BROKERAGE

1706 Advisors, Chicago

Alana Kahan steps into the role of President at 1706 Advisors, a thirdgeneration business providing group bene t consulting, HR planning, and insurance protection strategies for businesses and individuals. Alana takes the helm as part of the rm’s expansion, including a rebrand from its former name Lang Financial. She ensures clients are productive and protected as their insurance and HR needs evolve. 1706 Advisors are trusted independent insurance consultants with a product-neutral approach.

Chuhak & Tecson, P.C., Chicago

Bryan Montana joins Chuhak & Tecson as a principal in the Estate Planning & Asset Protection group. He focuses on asset protection and tax minimization strategies, as well as wills, trusts, powers of attorney, trust administration, special needs planning and probate. Bryan has experience forming and structuring businesses, minimizing taxes and protecting assets from long-term care costs using complex Medicaid and Veterans Affairs planning strategies.

NON-PROFIT

By The Hand Club For Kids, Chicago

Rachel Gamarra joins By The Hand Club For Kids as Chief Development Of cer, bringing 10 years of education and faith-based fundraising experience to the nonpro t, which serves youth on Chicago’s South and West Sides. She will lead the Fund Development team, spearheading a fundraising strategy that spans donor engagement, grants, communication and events while deepening By The Hand’s relationships with individuals, families, churches and corporations that share its commitment to Chicago youth.

RESTAURANT

Corboy & Demetrio, Chicago

Corboy & Demetrio is pleased to announce the addition of two associate attorneys practicing in all areas of personal injury: Jamaal R. Buchanan joins the rm after working as a trial attorney at Mulherin Rehfeldt & Varchetto where he represented major insurance companies in personal injury and subrogation matters. He’s also a former Cook County Assistant State’s Attorney.

Jamaal is a graduate of Vermont Law School, Bradley University and St. Ignatius High School.

Mitchell W. Bild joins the rm after serving as a Judicial Law Clerk in the Cook County Circuit Court’s Law Division. Mitchell is also a former Corboy & Demetrio Law Clerk. He’s a graduate of Chicago-Kent College of Law and Michigan State University.

Cooper’s Hawk Winery & Restaurants, Downers Grove

Cooper’s Hawk Winery & Restaurants is pleased to announce the appointment of Martin Beally as Master Sommelier at Esquire by Cooper’s Hawk, a wine-centric concept located in Chicago’s Gold Coast. As one of 280 Master Sommeliers in the world, Martin brings next-level focus to the venue, which boasts over 1,600 label selections of vaunted and rare wines. Prior to joining Esquire, Martin served as Lead Sommelier at Canlis, a James Beard award winner for their Outstanding Wine Program.

Comcast, Chicago

Joe Browning has been named Vice President of Technical Operations for Comcast’s Greater Chicago Region, which includes Illinois, Northern Indiana and Southwest Michigan. Browning most recently served as the company’s Regional Vice President of Field Operations. In his new role, Browning will oversee the more than 1,500 technicians who install new service and repair work onsite at customers’ homes and businesses and manage the company’s 68,000 miles of network infrastructure spanning the region.

Advertising Section

12 DECEMBER 19, 2022 • CRAIN’S CHICAGO BUSINESS

To order frames or plaques of profiles contact Lauren Melesio at lmelesio@crain.com or 212-210-0707

LAW FIRM

TECH / TELECOM

LAW FIRM

Buchanan Bild

INHOSPITABLE HOUSING: Chicago’s high housing costs hit many residents hard. PAGE 14

ELITE STREET HURDLES: Six reasons LaSalle Street may pose challenges. PAGE 16

CITYWIDE CRISIS: Lack of affordable housing exists almost everywhere you look. PAGE 20

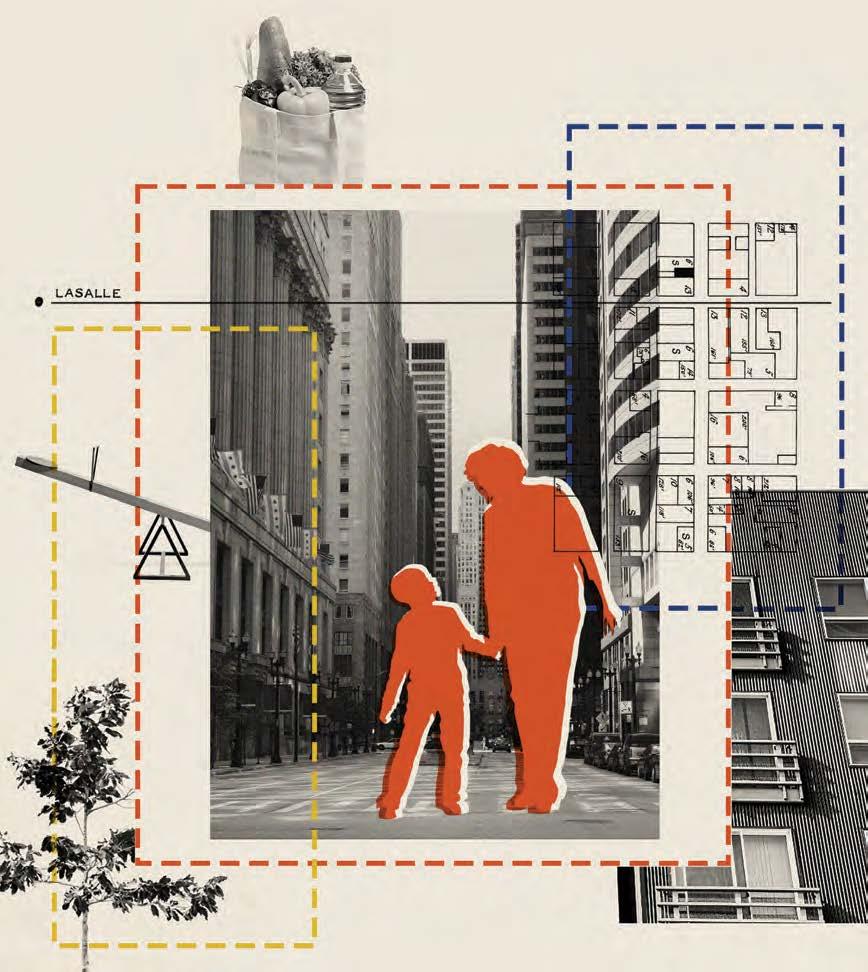

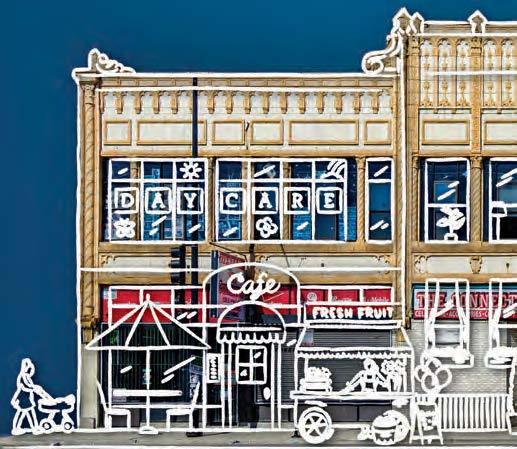

AT HOME ON LASALLE

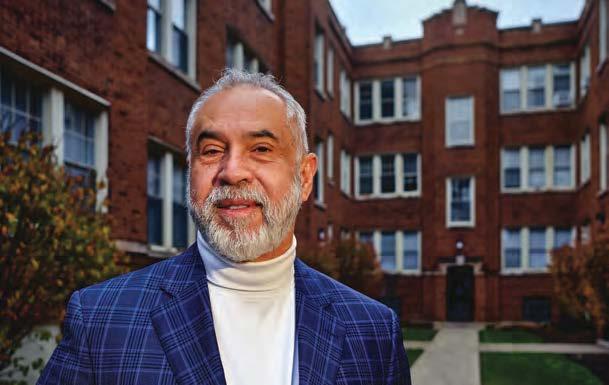

BY JUDITH CROWN

LaSalle Street traditionally has been the center of Chicago’s wealth—the historic home to major banks, financial firms and the Federal Reserve Bank of Chicago, many housed in architectural masterpieces such as The Rookery. If the street becomes a hub for affordable housing, with health care workers, hotel clerks and garage attendants joining the software engineers and financial analysts living downtown, it will be a 180-degree turn.

With iconic o ce buildings emptying out, Mayor Lori Lightfoot is o ering tax-incrementnancing funds and other incentives to convert unwanted o ce space to apartments, with 30% of the units to be designated a ordable. e city this fall issued an invitation for proposals to create 1,000 apartments with 300 a ordable units over the next ve years. Proposals are due Dec. 23.

While a ordable housing is much in need, bringing these units to the Loop will be a challenging exercise. Construction is more expensive downtown and especially in the historically signi cant buildings along LaSalle Street. e location away from the lakefront and a lack of amenities could constrain rents for market-rate units.

“ ere have been plenty of adaptive reuses of historic o ce buildings, but at the higher end without a ordable components, says architect Je Bone, a partner at Landon Bone Baker Architects, which specializes in a ordable housing.

To be sure, Bone and others welcome the possibility of democratizing the elite street. Most of the nearly 34,000 apartments in the Loop and West Loop are market rate. Currently, there are no a ordable apartments on LaSalle Street and only eight are completed or under construction in the Loop, according to the city’s proposal. O ce conversions o er the chance to bring more evening and weekend life to a district that’s largely quiet after 5 p.m.

Advocates for a ordable housing say the addition of a ordable units is always needed, but they question the wisdom of building downtown. Lacking schools and supermarkets, the Loop isn’t designed for families,

CRAIN’S CHICAGO BUSINESS • DECEMBER 19, 2022 13

AFFORDABLE HOUSING

SPONSORS

FIND THE COMPLETE SERIES ONLINE ChicagoBusiness.com/CrainsForum VALERIE CHIANG

A proposed solution to Chicago’s affordable housing crisis is to bring economical units to the historic nancial hub. Is that idea a bridge too far?

See LASALLE on Page 16

City’s spending plan for affordable homes shows little progress

BY CORLI JAY

A year ago, Mayor Lori Lightfoot’s administration announced $1 billion would go toward affordable housing, the largest investment ever in Chicago history.

e funds would help nance 24 Low-Income Housing Tax Credit developments and create or preserve 2,400 a ordable rental units across the city.

More than two-thirds of the developments would be concentrated on the West and South sides, the rest in less a ordable neighborhoods on the North Side.

“What the city’s doing through these investments is trying to create dedicated a ordable units through this subsidy program and through these strategic investments,” said Geo Smith, executive director and principal investigator of the Institute for Housing Studies at DePaul University.

e pandemic and in ation make the need for more a ordable housing units more critical, advocates say. Demand for a ordable housing exceeded supply in Chicago by 159,000 units even before the pandemic, according to the institute.

So far little progress has been made since Lightfoot’s announce-

ment, and a ordable housing proponents and activists question whether a real commitment exists. To date, zero dollars have been spent on developing mixeduse projects that include a ordable housing. None of the 24 Low-Income Housing Tax Credit developments has broken ground. Only $450,000 has gone to owneroccupied repair grants, according to the Chicago Recovery Plan update report.

Marisa Novara, commissioner of Chicago’s Department of Housing, says 17 of the 24 developments are scheduled to close on nancing by the end of 2023. In total, the department expects 31 a ordable housing projects to have closed on nancing by the end of next year. Some of the developments are from a previous funding round.

Two of the upcoming LowIncome Housing Tax Credit developments, the Laramie State Bank redevelopment in Austin and rive Englewood, are part of the Invest South/West initiative designed to revitalize disinvested communities. Austin is 58.7% renter-occupied with nearly 30% of the population living below the poverty level, compared with 18% for the entire city of Chicago.

Englewood is 23.8% renter-occupied, and 40.8% of the population lives below the poverty level.

Crain’s reported in September that after three years, no Invest South/West developments had begun construction.

e Austin project is scheduled to close on nancing this month and can potentially begin construction this year, Novara says.

e Laramie State Bank site was proposed as a $37.5 million development with 76 a ordable housing units. rive Englewood, estimated to cost $28.4 million, will include two phases with a total of 103 apartment units with 10 qualifying as a ordable. e rive plan was approved in the summer, but representatives of DL3 Realty, the developer, have not indicated when ground will be broken.

In ation has driven up the costs of materials, and that means project budgets will have to be rethought, Novara says.

Last spring, the Chicago City Council approved the acquisition of several lots at the intersection of Peoria and 18th streets in Pilsen for $12 million with the intent to create a ordable housing.