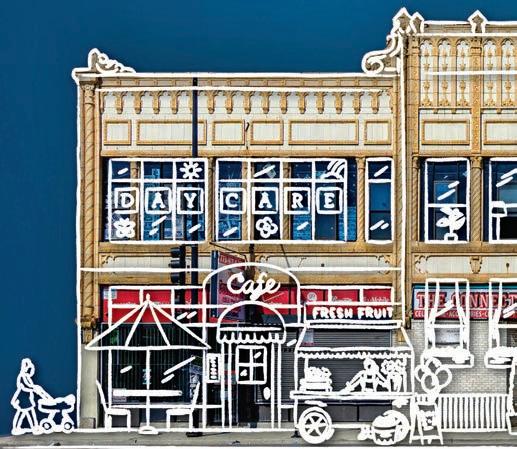

REDEFINING AFFORDABLE HOUSING

Chicago’s real estate community is trying several new approaches in the effort to make homeownership possible for working families | PAGE 11

Sellers struggling with downtown condo slump

Meanwhile, luxury-priced homes are in demand in other neighborhoods and in the suburbs

By Dennis Rodkine owners of a Pearson Street condo put it on the market in January with an irritating reality baked into the price: ey weren’t going to pro t on it.

e asking price they started with in January, $1.75 million, is the same number they paid ve years earlier for the threebedroom, 27th- oor condo a block from Lake Michigan. e unit sold May 9 for $1.55 million, a loss of a little more than 11%.

e Pearson Street sellers are among the latest of many who have “accepted the state of the market downtown,” said Brian Loomis, the Jameson Sotheby’s International Realty agent who represented the condo. “It’s a very frustrating market for sellers.”

It’s a long-running frustration at this point, four years into the reversal that COVID sparked and crime fueled, putting a deep chill into a sector that used to be one of the hottest parts of the

Chicago-area real estate market.

Perhaps most grating is the fact that “anywhere else you go, Wicker, West Town, the suburbs, the luxury market is back and it’s crazy,” said Matt Laricy, an

See CONDOS on Page 23

U of I tech founder came home from Silicon Valley to build a company in Fulton Market.

Sprout Social stock falls hard

The software company has stumbled in its move to chase bigger customers

By John PletzSoftware maker Sprout Social’s move upmarket to bigger customers is proving to be a much tougher climb than anticipated. Its stock price has fallen below $30 per share for the rst time since just after the company went public four years ago. Shares are trading around $28 apiece, down from $48.15 on May 2, before Sprout Social unexpectedly reduced its revenue growth forecast for the year to 22% from 28%.

“ is is about growth,” says Rob Oliver, an analyst at Robert

W. Baird, who downgraded the stock to neutral. “Small and midcap investors are growth investors. Growth expectations are considerably lower than they were before. When you gear your valuation toward growth and it changes, you see disproportionate changes in the stock.

“ ey’re pivoting to a company serving large companies, which isn’t easy,” he adds. “(Wall) Street had gotten comfortable with that and was taken by surprise things were not going as well as expected.”

See SPROUT on Page 23

Bears stadium proposal: Chicago won’t give up money it’s owed.

4

Littelfuse moving HQ to Rosemont office complex

An ongoing foreclosure lawsuit didn’t stop the company from inking a deal to relocate to the Riverway office property

By Danny EckerTen months after the owner of the Riverway office complex in Rosemont was hit with one of the largest foreclosure lawsuits ever for a suburban Chicago office property, the entity now controlling the buildings has landed the headquarters of a publicly traded company to its tenant roster.

Electronic component maker Littelfuse has signed a lease for 53,000 square feet at 6133 N. River Road in the Riverway complex near O’Hare International Airport, according to a statement from the company. Littelfuse will move its headquarters to the building at the end of this year from its current main office less than a mile east at 8755 W. Higgins Road, where its lease for 54,800 square feet expires around the same time.

It’s a rare example of a major company committing its headquarters to a distressed office property. Office tenants are typically wary of signing leases at buildings going through the foreclosure process, since lenders usually look to seize and sell off properties rather than pouring new money into renovations or leasing efforts. Signing a lease at a distressed property comes with the risk that the owner or lender won’t properly maintain the building or follow through with commitments like cash for office

As Littelfuse explored its options for a refreshed corporate headquarters near O’Hare, it got comfortable with Riverway as a viable option because Trigild and LNR are showing a long-term financial commitment to the property and its tenants, said Cresa Managing Principal Ed Lowenbaum, who negotiated the lease on behalf of Littelfuse.

The lease helps fill space vacated at Riverway by U.S. Foods, which consolidated its office at the complex in a 2019 deal.

buildouts, for example.

But with property values so decimated over the past couple of years by higher interest rates and remote work beating down demand, some lenders are choosing to play the long game on assets and competing for deals to try to recover some of the lost value.

That’s the case at Riverway, where a venture of Vancouver, British Columbia-based owner Adventus Realty Trust was hit with a $115 million foreclosure lawsuit last summer for allegedly failing to make a payment on the $128 million mortgage it borrowed against the building in 2016. Investment management company Wilmington Trust filed the complaint on behalf of bondholders in the loan, which was packaged with other loans and sold off to commercial mortgage-backed securities investors.

A Cook County judge in September appointed Dallas-based real estate firm Trigild as the property’s receiver, and Miami Beach, Fla.-based special servicer LNR Partners is overseeing the CMBS loan on behalf of bondholders.

The lender is continuing a multimillion-dollar capital improvement plan that Adventus had been working on prior to the foreclosure suit, with ongoing updates to the complex’s conferencing center and an auditorium and renovations to its outdoor space. Lowenbaum also verified other tenants that have signed recent new or renewed leases, such as benefits administrator Luminare Health and water systems treatment company Culligan, have received so-called tenant improvement allowances used for office buildouts.

“It’s definitely one of the best (office buildings) in Rosemont, with the hotels there and restaurants and amenities,” Lowenbaum said. The lender “has been putting money into this. Most (lenders) are just keeping the asset alive and the lights on, but (LNR) is doing active investment and they’ve shown a commitment.”

Lowenbaum declined to share terms of the lease, but called it a “strong agreement that protects Littelfuse backwards and forwards” regardless of what happens with the building’s ownership.

Spokesmen for LNR and Adventus did not respond to a request for comment. A Trigild spokesman declined to comment.

Littelfuse said in a statement

that the new Riverway office will be designed more efficiently than its current one, with space to help encourage employees to convene and collaborate.

“The move underscores our dedication to providing an exceptional work environment for our employees and fostering continued growth and success for our business,” Littelfuse CEO Dave Heinzmann said in the statement.

Founded in Chicago in 1927, Littelfuse designs, manufactures and sells a wide range of electronic components to major corporate

players in the electronics, automotive and industrial sectors. The company reported $2.4 billion in revenue in 2023, according to its most recent annual report.

The lease helps fill space vacated at Riverway by U.S. Foods, which consolidated its office at the complex in a 2019 deal, said Jones Lang LaSalle Executive Vice President Dan Svachula, who oversees leasing at the property.

Adventus’ portion of the Riverway complex includes three office buildings and a day care property just north of Interstate 90, and is

now about 72% leased, according to Svachula, up from roughly 61% early last fall. A Riverway building at 6111 N. River Road is owned separately and not involved in the foreclosure suit.

The Adventus property was just 58% in 2022, when it generated $4.9 million in net cash flow, according to Bloomberg loan data. That was just 60% of Adventus’ debt service for the year and less than half of the net cash flow the complex generated in 2016, when it was nearly full and Adventus bought it for $173 million.

Littelfuse’s impending departure from 8755 W. Higgins creates a new leasing challenge for Marvin Herb, the Barrington-based investor that has owned the 256,000square-foot building since 2006. Filling vacant office space has been especially difficult over the past few years, with changing work patterns recently driving the suburban office vacancy rate above 30% for the first time ever.

Littelfuse has signage atop the building, known as O’Hare Plaza II, where it has been located since 2009. The company is the largest tenant in the 11-story property, which is 90% leased, according to real estate information company CoStar Group.

A spokeswoman for the Herb venture declined to comment. Herb was the owner, chairman and CEO of Coca-Cola Bottling Company of Chicago, which he sold in 2001 to Coca-Cola Enterprises for $1.4 billion.

Lowenbaum and Cresa broker Liz Spence negotiated the lease on behalf of Littelfuse. Jones Lang LaSalle leasing agents Dan Svachula and Allyson Birchmeier represented building ownership.

Rick Bayless opening new spot in Skokie instead of downtown

The celebrity chef is opening a new Tortazo restaurant in Old Orchard mall, not in Chicago as he once had hoped |

By Jack GrieveCelebrity chef Rick Bayless is opening a second Chicago-area Tortazo restaurant, but instead of targeting a new downtown location, he’s taking the business to Skokie.

The fast-casual Mexican restaurant was set to open inside Macy’s at Old Orchard mall on May 25. “When the space became available, it was kind of a no-brainer for us,” Bayless said of the decision to target Old Orchard.

Bayless had hoped to open one or two new Tortazo restaurants in the Loop but opted for the suburban space instead as the downtown corridor continues to be plagued by its slow pandemic rebound.

“The Loop is not what it used to be pre-COVID, so we decided not to do that,” the Frontera Grill chef-partner said. “We’re waiting for the Loop to rebound before we put another place there.”

U of I tech founder chooses Chicago over Silicon Valley

The city is home, but it’s also an unconventional choice for Spencer Gore’s battery-tech maker, Bedrock Materials

By John PletzGrowing up in Naperville, Spencer Gore came to appreciate the scientists at Argonne National Laboratory during school field trips. After a decade in the Bay Area, he also came to appreciate how much more affordable his hometown was than his adopted home.

So when it came time for the University of Illinois graduate to build his second company, a battery-materials startup, he came back home.

Bedrock Materials set up shop in Fulton Market about a month ago. The startup will take its place alongside Nanograf, a Northwestern University battery spinout that’s making lithiumion cells on the Near West Side. They’re also part of a growing collection of companies related to electric vehicles, including automakers Rivian and Stellantis, bus manufacturer Lion Electric and battery producer Gotion.

Bedrock Materials has raised $9 million and has nine employees. The company plans to stand up an R&D and manufacturing facility of at least 15,000 square feet and create at least 25 jobs in exchange for tax credits under the state’s EV-incentive program that could be worth up to $2.8 million over 20 years.

Gore’s is exactly the kind of story that investors, business leaders, mayors and governors have been dreaming about for years: a homegrown tech entrepreneur who would choose to

build a cutting-edge company in Chicago to draw from its combination of talent, infrastructure and affordability. The surge in housing prices nationwide during the pandemic further heightened awareness of Chicago’s cost advantage.

Gore was at Stanford Universi-

The company plans to stand up an R&D and manufacturing facility of at least 15,000 square feet and create at least 25 jobs in exchange for tax credits.

ty, where he and his co-founder, Rafael Vila, were working on lithium-ion technology, which is used in EVs. But carmakers need to make EVs cheaper if they want to replace traditional vehicles. “We started asking ourselves, ‘Are we focusing on the wrong thing?’ ” he says. They settled on sodium as an alternative to lithium, an approach pioneered by Argonne. Their company is developing the powder used to coat cathodes inside batteries, which it plans to sell to battery makers. They produced their first prototype battery a year ago. Some Chinese

Lowering prices won’t fix McDonald’s marketing problem

The greater fast-food industry is grappling with an exodus of price-sensitive consumers. Here’s how they can be reeled back in.

By Erika Wheless, Ad AgeWhile stubborn food inflation has eaten into consumer purchasing power for years, reality has finally set in for fast food and restaurant chains—their value marketing is not working. This became clear in recent weeks as brands including Starbucks, McDonald’s, Pizza Hut and KFC reported disappointing quarterly earnings results with executives increasingly citing price-sensitive consumers as the culprit. While chains signaled more value marketing is coming—Mc-

Donald’s is reportedly working on a new $5 meal, for instance— just lowering prices won’t be enough, experts told Ad Age. Brands must streamline apps to more clearly communicate discounts and rewards, even putting themselves side by side with competitors to show who has the better deal. But in doing so, marketers must not stray too far from what their brand has always stood for. The challenge for some, including Starbucks, is that they have not made value a part of their core brand identity and risk sounding patronizing.

“There is a difference between

putting a deal out there and how it relates to the totality of the brand,” said Todd Sussman, chief strategy officer at FCB New York. “Creative done right can make value part of a brand’s story and not just a reaction to the economic times. You should be reacting, but in a way that does not discount the brand … You need to have a higher empathy for the moment and not just give a deal, but a value exchange. Consumers don’t want to feel like you’re giving them a handout.” Restaurant menu prices have

One silver lining under Bears stadium proposal: Chicago won’t give up nearly $50 million it’s owed

By Justin LaurenceA big selling point of the Chicago Bears’ proposal to tap into government bonds to help pay for a new lakefront stadium is it would save the city short-term pain tied to paying off the debt on Soldier Field. Left unaddressed was the fact the city would eventually get those payments, along with tens of millions in payments it’s already made, back.

As the Bears and Mayor Brandon Johnson have pushed for a deal to build a domed stadium with $900 million in public bonds while refinancing the existing debt on Soldier Field, an appealing aspect for city officials was the new repayment structure would smooth out looming annual balloon payments the city is illequipped to take on.

But an overlooked provision in the state legislation authorizing the 2% hotel tax that funds the Illinois Sports Facilities Authority ensures that, while those looming payments would mean short-term pain for the city’s annual budget, all of the money will eventually be repaid, beginning as early as 2033. If a deal for the Bears materializes in Springfield, the tax structure would remain in place, city officials confirmed to Crain’s. That would ensure the city receives what it’s owed, but could push out the repayment beyond 2033.

If no stadium deal for the Bears, Chicago White Sox or Chicago Red Stars were to materialize, the ISFA’s existing debt — largely tied to the 2003 renovations of Soldier Field — is set to be retired in 2032. But the structure of the debt, created by former Mayor Richard M. Daley, was backloaded, meaning the authority has primarily only paid annual interest payments while the principal was left untouched.

After all debt is retired, the 2% hotel tax would remain in place and the revenue would be used to

repay Chicago for the total amount the city spent making shortfall payments to the ISFA to cover the difference between its annual debt service and revenue from the hotel tax, as it has the past two years, with another $10 million projected in 2024.

After the city is paid back, the hotel tax would then be provided to the government entity that owns and operates McCormick Place and governs Navy Pier.

When asked if the city would seek to keep in place the repayment structure in any new deal with the Bears, city officials initially said the proposal was under review.

But May 15, the city’s chief financial officer, Jill Jaworski, said in a statement “the current proposal assumes the security and flow of funds for the ISFA bonds would not change.”

Under the proposal, the “city is not giving up the chance to be repaid,” she said.

“The current proposal projects that the hotel tax will provide rev-

enues in excess of 150% of debt service, which provides an opportunity for excess cashflow to be available to repay the city,” the statement said.

The Bears deal would refinance the ISFA’s current debt, create a $160 million liquidity reserve fund and issue up to $900 million in new bonds to pay for the new stadium, all to be repaid over 40 years at a total cost of $4.97 billion when interest is added.

The Bears declined to comment.

The ISFA’s annual debt service is projected to be $60 million in 2025, but ramps up to $79 million in 2030 and climbs to $90.5 million in its final year of 2032. With the pace of those annual payments rising faster than the annual projected growth of the 2% hotel tax, Chicagoans are on the hook for tens of millions in future costs.

Making up the difference

When hotel tax revenue, combined with $5 million annual sub-

sidies from the state and city, falls short, a portion of Chicago’s Local Government Redistribution Fund — tax revenue the state provides to local municipalities each year — is captured to make up the difference.

Currently, the total amount the city has lost to the ISFA payments is projected to be roughly $46 million by the end of the year, including $8.7 million in 2023, $27.3 million in 2022 and a projected deficiency amount of around $10 million in 2024, according to the ISFA’s 2023 audit and projections shared at its first quarterly meeting this year.

The Bears proposal would still require Chicago taxpayers to be the ultimate backstop to the ISFA’s debt service, but a new $160 million liquidity reserve fund would be created to serve as the first line of defense when the hotel tax revenue is insufficient to satisfy the agency’s annual debt payments.

While the city could benefit from restructuring the ISFA’s debt,

other aspects of the deal remain in the dark, including the parameters of a potential lease agreement between the Chicago Park District, which would own the new stadium, and the Bears.

The lease would set the team’s annual payment to utilize the stadium and lay out the revenue-sharing agreement between the district and the Bears, while spelling out who was on the hook for maintenance and operations costs.

Crain’s reported in April that the team, which would contribute $2.3 billion in private money to the stadium, is seeking the bulk of revenue from the new stadium, including from concerts and other sporting events. Mayor Brandon Johnson told Crain’s on May 11 that those details are left to be negotiated, despite his vocal support for the project.

The plan also calls for $1.5 billion in infrastructure improvements that are expected to be covered through state or federal grants.

Zara’s new Skokie store integrates in-store, online shopping

By Corli JayFashion retail company Zara opened a flagship store in Skokie on May 16. The new location is located in a 28,000-square-foot new development at Westfield Old Orchard mall, a 60% hike in space from its old spot at the same mall.

The company says the store creates an experience for shoppers that integrates both in-store and online shopping designed by Zara’s architecture team.

“Zara Skokie has advanced eco-efficiency systems that reduce environmental impact. These in-

clude efficient heating and cooling systems, energy-saving LED lighting and the use of more environmentally-friendly materials,” the company said in a press release. With the design, Zara says it is reaching its sustainability and efficiency goals by incorporating more natural light in the space and connecting the “Inergy” platform from its parent company, Inditex. The platform works by monitoring air conditioning and electricity consumption within the space and identifying opportunities for more “efficient systems, improving maintenance and

helping define strategies to reduce energy demand.”

The company has a goal to achieve climate neutrality by 2040.

In addition to Zara, global fash-

Weigel Broadcasting sticks to the plan, 60 years on

The Chicago-based broadcaster has been a pioneer in the live TV space with expansions and partnerships, while also filling a niche

By Corli JayWeigel Broadcasting has found success tapping into the power of free over-the-air television since 1964, and that same mission has been its saving grace in 2024.

The Chicago-based broadcaster has been a pioneer in the live TV space with expansions and partnerships, while filling a niche that persists even in an era when on-demand media is king.

Earlier this month, the company announced its own Channel 26 “The U” as an independent station after Nexstar revealed it would move CW programming to the networks it owns such as WGN-TV. Weigel will also expand its portfolio this summer with the launch of the national network MeTV Toons. The channel

population with live local news, significant franchises in many program genres and events,”

Neal Sabin, vice chairman of Weigel Broadcasting, said in a statement to Crain’s. “Broadcast television remains a critical reach medium for advertisers and viewers.”

Weigel prides itself on being “the leader in the multicast television network space.” With its emphasis on free broadcasts, the company is proving the impact of over-the-air television in a media landscape that has become focused on streaming and seen a migration of cord-cutters who choose platforms such as Hulu and Netflix instead of cable subscriptions.

A recent study by the Television Bureau of Advertising shows linear, or traditional broadcast,

With local programming such as the news magazine show “On The Block,” Weigel satisfies the need for audiences that turn to over-the-air broadcasts for hyperlocal news.

is a spinoff of its popular retro Memorable Entertainment TV (MeTV) network that will feature classic cartoons 24/7.

“The media world may be focused on streaming, but there is still significant viewing being done on traditional TV platforms. Many are free, don’t require usernames and passwords, and satisfy wide swaths of the

TV is more effective for advertisement than ad-supported streaming platforms. According to the study, which uses U.S. Census Bureau data, “optimal reach can’t be achieved without the inclusion of linear TV.”

Hadassa Gerber, executive vice president and chief research officer at the nonprofit trade association, said many viewers see lin -

ear TV as trustworthy, with local news broadcasting as a big reason why.

“There’s so many more options that are out there and that people have to choose . . . but the reach of linear television is still like 80% in one day,” said Gerber.

Antenna usage

These channels are often viewed with the use of an antenna. Anne Schelle, managing director of the business organization PearlTV, which works to innovate broadcast TV, said “self bundlers,” viewers who use an antenna while also paying for streaming platforms, are growing as broadcast companies expand their reach.

Schelle says audiences are increasingly learning there is quality TV available that they don’t have to pay for, using the popularity of the show “Yellowstone” starring Kevin Costner after it began airing on broadcast as an example.

“I think their total viewership for that was 2 to 3 million people (when) it was only available on their streaming platform. They decided to distribute it on their linear broadcast. Guess what happened? Viewership went sky high,” said Schelle. “That’s a different consumer. It’s not the same. The reach and frequency of broadcast is huge.”

According to another study by the Television Bureau of Advertising, the number of households that only rely on over-the-air

broadcasts has increased by 55% in the last 12 years.

Linear TV has also had continued success with sports viewership. One of the most extreme examples, the Super Bowl, continues to be the most-watched program in the nation; this year’s game set a record with a 7% increase in viewership at 123.4 million viewers, according to CBS Sports.

Weigel has carved its own niche by airing high school competitions. It’s also benefited from the WNBA’s burgeoning popularity by airing Chicago Sky games. In a multiyear deal with Cincinnati-based broadcaster E.W. Scripps, the WNBA increased its audience by 24% with its “WNBA Friday Night Spotlight” show on the TV broadcast channel ION.

Back in March, Weigel announced a simulcast with Marquee Sports Network of the spring training game between the Chicago Cubs and Milwaukee Brewers. Such partnerships with companies like Warner Bros., CBS and the Illinois High

School Association have elevated Weigel.

With local programming such as the news magazine show “On The Block,” Weigel satisfies the need for audiences that turn to over-the-air broadcasts for hyperlocal news.

Just as the required update from analog to digital helped provide more opportunities for over-the-air channels, Schelle of PearlTV said such advances will only lead to increased success for broadcast companies like Weigel.

Developments like NextGenTV, which was recently picked up by five Chicago stations, provide higher quality and an immersive experience for antenna TV, helping to create more of an interest in such programming and resulting in growth for the space.

“(People) realize it’s not that hard to take an antenna and connect it to your television and get a lot of free stuff,” said Schelle. “We’re giving (viewers) more. . . .They’re recognizing there’s huge value in that.”

World Business Chicago launches gender equity office

By Leigh GiangrecoWorld Business Chicago will launch a new gender equity office this summer, with the Chicago director of GET Cities at the helm.

Elle Ramel will transition from GET Cities to her new role as director of the office later this summer. Before joining GET Cities in 2020, Ramel directed redevelopment of the Michael Reese Hospital site for Farpoint Development and worked on economic development under Mayor Rahm Emanuel.

Gender Equality in Tech, or GET, Cities, a philanthropic initiative backed by Melinda French Gates and dedicated to increasing gender representation in the tech industry, announced it would shut down its chapters in Chicago and other cities this month, Miami Inno reported. Ramel maintains GET Cities

Chicago’s plan was always a fiveyear run, with the intention of subsuming itself into a local organization. In that sense, GET Cities isn’t closing so much as porting over its existing programs.

“World Business Chicago has been a partner since the very beginning,” Ramel said, adding the two organizations have already collaborated on entrepreneurship programs.

World Business Chicago has flown over 20 founders to conferences in cities like Miami and Toronto to help them fundraise capital, with plans to send more to New York later this year, she added.

“So when I was thinking about a place where we could think about growing inclusivity in the innovation economy, World Business Chicago has always been one of our starting partners and continual partners,” she said.

While Ramel will bring her

tech expertise to the table, the gender equity office will take a broader look at gender equity across other industries like finance, life sciences and quantum computing, she said. She plans to leverage her tech equity network of 15 organizations including Out in Tech, an LGBTQ

tech nonprofit, and Latinas in Tech.

“What I would love to support the most in this is retention of technical workforce or gender equitable workforce,” she said.

“How do they look for career opportunities, doing more mapping of how do they get to man -

agement, how do they lead?”

As Ramel transitions to World Business Chicago, she’ll bring over initiatives like the GETSeed Founder Cohort, which raises funds for startups spearheaded by women, trans and nonbinary founders.

GET Cities has partnered with Chicago:Blend, a nonprofit advancing diversity in the venturecapital and startup space, to help fund the mentorship program Chicago Venture Fellows. They also helped kick off funding for TechRise at P33, a tech development program fostering Chicago’s Black and Latino entrepreneurs.

“I've had founders that are driving from Indiana, not only women, but trans and nonbinary founders from the Midwest, saying, ‘This is a place where I can grow my business, there's programming that reflects me,’” Ramel said. “We're not just going to start these businesses, we're going to keep them growing.”

Johnson pitches Quebec leaders on Chicago’s ‘blue and green economy’

The mayor met in Montreal with companies focused on sustainability, water management

By Leigh GiangrecoIn a bid to position Chicago as the center of a burgeoning “blue and green economy,” Mayor Brandon Johnson met in Montreal with Quebec companies focused on sustainability and water management.

“Chicago’s proximity to one of the largest bodies of freshwater in the world is a competitive advantage that has been historically underutilized,” Johnson said in a statement to Crain’s. “We are working hard to identify and interact with economic sectors where we have an edge, so that we can attract sustainable businesses and good jobs to our city for long-term success.”

World Business Chicago's vice chair, Charles Smith, and Alaina Harkness, executive director of Current, joined Johnson in a roundtable hosted by financing corporation Investissement Québec, where the mayor hopes to attract and expand those companies’ footprints in Chicago while minimizing their carbon footprint. The roundtable highlighted the mayor’s trip to Montreal for the Great Lakes & St. Lawrence Cities Initiative annual meeting, where businesses and government leaders focus on using the region’s freshwater resources responsibly.

In an exclusive interview with Crain’s, Smith and Harkness touted Chicago’s strategic position on the Great Lakes and its access to clean water as a major draw for businesses.

“I do want to emphasize something, though, that there is a correlation between good policy and business growth in the green and blue economy,” Smith said. “Because what we want to do is encourage business growth and see businesses thrive without having to compromise the health and safety of the environment.”

Broader strategy

While Smith declined to elaborate on the specific companies at the closed-door meeting, he said the group would include “leading Québec companies” in the sustainable development, transportation, water management and green economy sectors that have either expressed an interest in investing in Chicago or have existing operations that they’d like to expand.

The meeting in Montreal reflects a broader strategy from World Business Chicago to spur investment in green businesses. In October, Johnson and Gov. J.B. Pritzker introduced the Chicagoland Climate Investment Alliance,

a new organization dedicated to pushing eco-friendly startups and climate investments in the Midwest. The group, with public and private partners like World Business Chicago and Invenergy, focuses on securing federal grants for climate-resilient technologies developed in the Midwest.

“What I do know is that for most small businesses and startup businesses in this space, government grants are their first sources of income and revenue and opportunity,” Smith said. “So that publicprivate partnership is really important.”

Economic silver lining

Harkness, who leads Chicagobased water innovation nonprofit Current, has warned of the existential threats to the global water supply, from contaminants to coastal flooding. But she sees an economic silver lining with the potential to develop technologies that could clean and manage water. In January, the National Science Foundation awarded a $160 million grant to Great Lakes ReNEW, a coalition of research partners led by Current from six Great Lakes states aiming to clean and extract valuable minerals from wastewater.

“Current’s role has been to bring the industry together with research and development leads, startup small businesses and community partners to build a vision for the blue part of this blue-green economy that we're talking about here in Montreal today,” Harkness told Crain’s. “That's all the businesses that are heavy water users, as well as the businesses that are creating solutions to water needs.”

As of last week, Exelon and Ingredion joined Current’s industry consortium, and more plan to join the ReNew initiative, she said. Though traditional industries like agriculture and manufacturing have used large amounts of water in their production, the tech sector can also strain water supplies. That doesn’t mean Chicago should shy away from those companies, according to Harkness.

“What we need to do is think ahead to use our water differently,” she said.

So far, Chicago’s abundant water resources have not forced it to deal with water reuse in the same way as Western cities, Harkness added.

“So we tend to not do that very well,” she said. “We have a real opportunity to start to think differently and to be able to recruit companies that are the future of the region.”

EDITORIAL

A golden age of female-led philanthropy

The news that Ashley Duchossois Joyce has been elevated to chairwoman of her family’s namesake investment firm, Duchossois Capital Management, is the latest confirmation of a trend that’s been evident for a few years now: Family firms are increasingly looking to daughters — not just sons — to lead key enterprises, and that leadership is also contributing to a golden age of female-led philanthropy.

Sure, there’s plenty to lament about the state of women’s progress in corporate C-suites: Only about 10% of CEO positions in the Fortune 500 are held by women. But in the realm of family offices, where generations of parents, siblings and cousins often participate in decision-making about a clan’s business endeavors as well as their giving, there’s evidence a positive shift is taking place.

In the case of Chicago’s Duchossois dynasty, Ashley Joyce, 48, is stepping up to the role held by her father, Craig, for years, representing the third generation to lead a sprawling family enterprise with roots in rail-car manufacturing but over time came to encompass consumer products, technology and service-sector holdings. In 2021, the Duchossois Group sold Chamberlain Group to Blackstone in a deal valued at $5 billion, wealth that’s helped fuel the Duchossois Family Foundation, of which Joyce has been chairwoman since 2022, and which has been a major contributor to the University of Chicago, the Field Museum and more.

PERSONAL

VIEW

It’s far too early to say whether Joyce’s elevation to the top role at her family’s business empire will result in any appreciable changes to the family foundation’s giving, but she joins the ranks of other significant decision-makers with enormous say in how their family funds will be deployed.

Locally, some of the most prominent female philanthropists in this realm include:

Environmentalist Wendy Abrams, a member of the Mills family of Medline fame, who has funded the Abrams Environmental Law Clinic at the University of Chicago as well as other climate-centric causes.

Penny Pritzker, the entrepreneur and civic leader who, along with husband Bryan Traubert, has led the Pritzker Traubert Foundation, a major investor in community economic development, workforce training and efforts to strengthen democracy.

Heather Steans, a former state senator who serves as chairwoman of the Steans Family Foundation, which was created by her father, Harrison, a banking executive, and which focuses on catalyzing economic opportunity in North Lawndale and North Chicago.

LGBTQ+ advocate Laura Ricketts, whose

philanthropic work has included helping to run her family’s Chicago Cubs Charities organization.

Liz Thompson, CEO of the Cleveland Avenue Foundation for Education, who along with husband Don, former CEO of McDonald’s, is focused on promoting educational opportunity and entrepreneurship in the Black community.

Helen Zell, who as executive director of the Zell Family Foundation, built with her late husband, Sam, has been a major supporter of the arts, including the Chicago Symphony Orchestra and the Museum of Contemporary Art.

These local efforts stand beside the global work of MacKenzie Scott and Melinda French Gates, who have without question become two of the most consequential philanthropists of our age, having leveraged the wealth they helped build while married to ex-husbands Jeff Bezos of Amazon and Microsoft’s Bill Gates, respectively, into large-scale giving aimed at medicine and housing, hunger and education, promoting women in technology and elected office, and beyond.

It wasn’t so long ago that a young woman in a family as influential as the Duchossois clan might have been passed over in favor of a male relative when the time came to hand down the torch of family leadership. So it’s inspiring to see Ashley Duchossois Joyce take the reins — and it’s also refreshing to note she’s in good company, particularly when it comes to philanthropic leadership.

Race is the Midwest’s economic Achilles’ heel

Well known to Midwest economic development officials and state and local leaders, in today’s knowledge-driven economy, communities wage what Midland, Mich., Mayor Maureen Donker described to me recently as a “war for talent.”

And for the many formerly manufacturing-dependent communities dotting the shores of the Great Lakes and sprinkled among the region’s fields and forests, the opportunity to both keep one’s homegrown talent and attract newcomers by offering a community that is less expensive, less congested and less hurried, with a rich quality of life, is a handhold toward new population and employment growth.

There is good evidence that quality of life and place — like good schools, transportation options and outdoor recreation opportunities — matters more today than traditional “business-friendly” measures like low taxes and lax regulation in keeping talent at home and attracting new

John Austin directs the Michigan Economic Center and is a nonresident senior fellow with the Brookings Institution.

Marwan Mikdadi of the University of Michigan contributed to this piece.

jobs and new people.

And there are growing signs of some movement of well-educated workers, including the important tech talent that is central to business growth in so many emerging sectors, now seeking alternatives to living in the coastal hothouses with their spiraling housing costs, gridlock, and dirty and degraded community fabric.

Many Midwest community leaders are looking to seize these opportunities to foster new growth. Particularly advantaged are those whose communities sport a great natural location, like along a Great Lake or riverfront, or are home to one of the many premier universities in the region that can serve as strong fulcrums for building an innovation-driven economy, as well as enrich the arts, cultural and entertainment environment.

This dynamic appears to be gaining steam as attractive outdoor and lifestyle communities in the West, New England and a tier of counties across the beautiful northern part of Great Lakes states have seen an influx of better-educated, high-income newcomers over recent years.

But for many Midwest metropolitan communities, the lingering legacy of racial segregation and divided communities may be off-putting to diversity-seeking talent who can now find the atmosphere of

inclusiveness and tolerance they value in some of the fast-growing cities of the South like Austin, Texas; Atlanta; Houston; and Nashville, Tenn.

As we’ve written before, the industrial cities of the North have long been hamstrung economically by the most intense racial divides in the country. These northern industrial communities were once a destination of hope and opportunity. The early 20th century saw the Great Migration of Black and white laborers from the South and Appalachia flocking to the Midwest’s mills, factories and machine shops and the decent jobs they provided. This migration threw races together in Northern cities. But rather than a happy melting pot, white Northern community leaders aggressively worked to keep the races apart. Those cities soon enabled and encouraged the flight of white residents (and their businesses, jobs and wealth) to the suburbs, while strict discriminatory housing and educational policies kept Black residents confined in increasingly segregated communities.

The result is, the region boasts the nation’s most racially and economically balkanized metropolitan communities. The industrial cities of the North and Midwest make up the lion’s share of the most segregated metropolitan regions in the country,

as measured by the dissimilarity index. Led by Milwaukee and Detroit, six of the nation’s 10 most segregated cities are in the industrial Midwest and Great Lakes region.

This separation has many damaging effects on Midwestern cities’ economic, political and social health, crippling decision-making and our ability to organize metropolitanwide solutions — for example, functional regional transportation systems that facilitate access to good jobs for all residents, which are still largely absent in communities like Milwaukee and Detroit. The redlining practices, school district line-drawing and deeded covenant practices in Northern cities have been gone for several years, but the resulting segregation is “baked in” today.

As Brookings Institution demographer William Frey told The Hill, with many Northern cities having lost or seeing stagnant populations since the 1960s, residents are older and communities are lacking in the “refreshment” of new, younger residents with different attitudes and expectations. Frey says: “In the Northern metros, those old neighborhood patterns are much more stuck in place. It has to do with where people grow up, it has to do with old patterns of discrimination.” He also notes that the cities attracting new residents in recent

years are adding people of all ethnic groups without the stigma of those past racist practices.

Now the Northern industrial states with their strictly segregated metropolitan communities are largely losing out on the movement of talented and often more well-off people to more diverse and richer-quality-of-life communities.

Looking at data on migration of high earners, none of the 12 Midwest industrial states rank above 24 in the nation for net migration of high earners. In fact, nine Midwest states are showing a net high-earner loss. This includes:

Illinois, with a net migration of -9,131

Iowa, -187 Michigan, -99

Minnesota, -1,453 Missouri, -38

New York, -19,795 Ohio, -1,258 Pennsylvania, -1,022 West Virginia, -82

While many of the highly segregated metros of the Midwestern and Northern industrial states are losing out, either experiencing population decline or slower population growth, most of the fastest-growing metros, including in terms of attracting the most new higher-income migrants, are also among the more diverse and least segregated. For example, the Black-white dissimilarity index for many metros in the South and West is around 60 or below; that compares with Northern metros in which Black populations are either slowing in growth or declining, such as Milwaukee, New York, Chicago, Cleveland, Detroit and St. Louis, where segregation levels are closer to the 70s.

Interestingly, some of the cities that gained the most in terms of youth population are concentrated heavily in the South, including Austin; Orlando, Fla.; Raleigh, N.C.; and Nashville. These communities have also experienced a significant influx of younger families as well as immigrants bringing their families, thus contributing to these areas’ younger populations, as immigrants and the children they have in the U.S. are younger compared to the rest of the nation. So, given the decline in the population of young white people since 2000 as more white Americans age out, areas with more diversity also happen to be the ones gaining the most in terms of population in a highly causal way due to immigration. These cities are also reflected in a Brookings Institution demographic analysis depicting the growth and decline of the population of people under 18 within U.S. metros. The places with growth rates of 5% or more include some earlier mentioned metros like Austin, Nashville, Orlando, Houston and Raleigh, while cities experiencing declines of 5% or more are scattered across the industrial Midwest, including Milwaukee, Detroit, Chicago and St. Louis, all cities that were listed as having some of the highest segregation indexes out of U.S. metros, per the 2020 census.

This is not a new trend. Going back to the period 2000-2010, the Population Reference Bureau in a 2011 release of census data observed, “U.S. cities with high levels of growth and new construction tend to be less segregated,” and — quoting Penn State University demographer John Iceland — “segregation persists in older cities in the Northeast and Midwest where a large share of the nation’s African American residents live, ‘buttressed by a history of poor race relations and continuing discrimination,’” while “metro areas in the South and West tend to have more mobile populations, fewer Blacks and sometimes no long-established Black

community. . . .The difference is ‘easy to see in a short drive through Milwaukee or Detroit, where there are starkly Black and starkly white neighborhoods that you don’t see to nearly the same extent driving in places like Tucson or Las Vegas.’”

An analysis from the Economic Innovation Group also shows the places experiencing the largest growth of higher-income earners tend to be centered throughout the Sun Belt. Meanwhile, apart from northern Great Lakes and New England lifestyle communities, the heartland regions of the North and Midwest continue to lose this demographic.

A painful irony for the Midwest,

and a worry for our country, is that just as the economic dynamics may favor new economic opportunity and a new economic storyline for many Midwest communities, based on unique assets like universities, an outdoor lifestyle or even smalltown charm and a simpler, saner quality of life, the lingering realities of segregation and discrimination may be off-putting to those who can help deliver on that opportunity.

And the longer some Midwest industrial communities continue in decline — losing residents, losing tax base to provide basic services, seeing diminishing job opportunities and degraded community physical conditions — the more angry

and resentful working-class white residents become. This in turn finds them increasingly intolerant and easily whipped to resentment of immigrants or people of color as somehow getting something like government benefits or job opportunities at their own expense. Residents of once-mighty but today in decline heartland communities remain responsive to the polarizing political movements that threaten our democracies from within.

Unless Midwestern communities can come together to acknowledge and treat our race-driven Achilles’ heel, our own economic future and the political future of our nation remain imperiled.

Recognize a Black leader making a difference in their industry and community.

PEOPLE ON THE MOVE

ACCOUNTING / CONSULTING

John Kasperek Co., Inc.

Calumet City / Mokena

Meagan Turner joined the John Kasperek Co., Inc. team in 2023 as an intern out of Governors State University (GSU). Through her internship, Turner gained experience in the firm’s consulting practice including processing payroll and monthly bank reconciliations. She recently earned her Bachelor of Science in Accounting from GSU and has accepted a full-time Associate role with the firm. Turner is also actively preparing for the Certified Public Accountant (CPA) licensure exam.

ARCHITECTURE / DESIGN

Lamar Johnson Collaborative Chicago

Lamar Johnson Collaborative (LJC) has promoted Joe Procunier

LEED to Associate Principal. His extensive expertise in advanced manufacturing, life science, higher education and more makes him a valuable resource to clients looking for architectural solutions to drive business forward. Joe holds a Master of Architecture and a Bachelor of Environmental Design, Architecture from Montana State Univ.-Bozeman.

LJC has promoted Mike Siciliano AIA to Associate Principal. His multifaceted experience in architectural design, construction knowledge, and collaborative rapport lead to innovative solutions customized to each project’s specific needs. Mike holds a Bachelor of Science in Architectural Studies from the Univ. of Wisconsin-Milwaukee.

ARCHITECTURE / DESIGN

Design Workshop, Chicago

Design Workshop, an international landscape architecture firm, has promoted Sara Egan to a principal. Egan is a registered landscape architect and a national certified planner. Her work in the Chicago region began by facilitating a vision to re-sculpt the heart of Wheaton’s public realm. Over the last decade, Egan and her team supported the City in the implementation of this vision creating streets and public spaces for gathering, commerce, and recreation.

LAW FIRM

Laner Muchin, Chicago

Laner Muchin is pleased to welcome Lauren Cook as an associate.

Lauren concentrates her practice in business immigration, representing employers of all sizes and industries who seek to sponsor foreign nationals and families under a broad range of immigrant and nonimmigrant visa categories. She has experience handling immigration matters before U.S. Citizenship & Immigration Services (USCIS), the U.S. Department of Labor and the U.S. Department of State.

LAW FIRM

Laner Muchin, Chicago

ENGINEERING / CONSTRUCTION

Ardmore Roderick, Chicago

Ardmore Roderick welcomes Emeka Okafor as Vice President of Energy and Utilities! With nearly two decades of experience in the energy and utility sector, Emeka has held key leadership roles in distribution engineering, operations, vegetation, and asset management. His dedication to fostering equitable opportunities aligns with our mission and will be vital in driving success for our clients and communities. Emeka will play a crucial role in our growth strategy in the Energy & Utilities markets.

Laner Muchin welcomes Eileen Lysaught as of counsel. With over 30 years of experience in business and corporate counseling, she assists clients with matters related to commercial agreements, corporate formation, general counsel services and business and employment law counseling. Her practice includes counseling clients on matters involving commercial concerns and compliance with federal, state and local laws regarding leaves of absence, accommodations, discrimination and harassment.

LAW FIRM

Laner Muchin, Chicago

Croke Fairchild Duarte & Beres LLC

Chicago

Croke Fairchild Duarte & Beres welcomes Penelope Campbell Ari Krigel as partners in the firm’s high-profile Real Estate practice group. Penelope brings significant experience across all aspects of commercial real estate and has played a pivotal role in transactions related to retail, shopping center, industrial, warehouse, office, hospitality, multifamily and manufactured housing matters. Ari represents clients in the commercial real estate space including large institutional investors, national and regional lenders, and mid-market real estate investment and development companies across a variety of matters and development projects.

Trident DMG, Chicago / DC

Krigel

Logan Booth joins Trident DMG, a Washington, D.C.based strategic and risk advisory firm, as SVP. With experience as an attorney and a McKinsey consultant, Logan is based in Chicago and will focus on strategic, litigation & investigations communications, stakeholder engagement, and crisis/risk advisory for critical issues at the intersection of media, reputation, policy, law, and business. With global experience, Trident is nationally recognized as a top advisory firm, including in Chambers.

MEDICAL

IV Solution & Ketamine Centers

Chicago

American Community Bank & Trust amcombank.com

Laner Muchin welcomes Andrew Slobodien as of counsel. Andrew concentrates his practice in labor and employment law, with a focus in employer-union relations. He possesses extensive experience handling all manner of labor relations and has regularly practiced in federal and state courts and before the NLRB, EEOC and similar state and local agencies.

Dr. Bal Nandra was recently awarded an Ellis Island Medal of Honor. One of our nation’s most prestigious awards, its recipients are read into the Congressional Record. A pioneer in the ketamine industry for mental health, Dr. Nandra leads the team at IV Solution & Ketamine Centers of Chicago. His clinic’s outcomes for depression, anxiety, PTSD, addiction and other mental illnesses are industry leading. He has made it his life’s work to make ketamine accessible to everyone who could benefit.

American Community Bank & Trust announces the opening of a new commercial banking office, located at 17W220 W. 22nd St., Oakbrook Terrace, under the leadership of Steve Davis, EVP. The office expansion supports a talented team of commercial bankers recently hired to build full-service commercial banking relationships with small to mid-size companies in the Chicago area. American Community Bank & Trust is a privately held commercial bank headquartered in Woodstock, IL with assets of $1 billion.

REDEFINING AFFORDABLE HOUSING

Chicago’s real estate community is trying several new approaches in the effort to make homeownership possible for working families | By Judith Crown

Carpenters at an assembly plant in North Lawndale are putting the finishing touches on Tyvekwrapped rooms of a modular home to be delivered to a customer in Homan Square. It’s designed to be “affordable,” but the homes built by Inherent L3C sell for $390,000. Not exactly a bargain price. True, there’s down payment assistance and other subsidies to help first-time buyers defray their costs. Inherent CEO Tim Swanson aims to get the price down by scaling up production and raising equity through tax credits.

Swanson is part of a real estate community trying to make homes more affordable for working families, a purchase that could help them build wealth to pass along to their children. Experts estimate that the city needs at least 120,000 affordable units and nearly 300,000 statewide. While affordable rentals are in high demand, new homes also could revitalize long-depressed neighborhoods and help attract supermarkets and other amenities.

Modular homes like Swanson’s help fill the gap because they can be constructed indoors all year and are

not subject to the weather. And developers on the South and West sides are trying to expand the supply by acquiring and building on the thousands of vacant lots owned by the city. But the slow pace of acquisition is a

SPONSORS

stumbling block, experts say.

The Cook County Board last month launched a pilot program to provide $3 million in down payment assistance to advance affordable homeownership. A second pilot, in partnership with the Cook County Land Bank Authority, is allocating $12 million for the construction of homes in Humboldt Park, Maywood and Chicago Heights. That includes working with Swanson’s Inherent Homes for modular units. The County Land Bank Authority and South Suburban Land Bank & Development Authority also offer abandoned homes at below-market prices to developers and buyers interested in rehabbing the properties or building on vacant lots.

Still, other homes in the city and suburbs are being sold through trusts — financial instruments that keep a lid on home prices.

Over the past two decades, the cost to build a modest three-bedroom house has nearly doubled to between

See HOUSING on Page 14

Renters seeking a mortgage must know the keys to homebuying

Rising rents and gentrification are prompting longtime renters to consider homeownership

Housing counselors at the Far South Community Development Corp., or Far South CDC, are advising an increasing number of renters interested in buying a home.

With higher property taxes and expenses, landlords are raising rents throughout the Chicago area. In gentrifying neighborhoods such as Pilsen, East Humboldt Park and Hermosa, renters are being displaced altogether. And that’s prompting longtime renters to consider a leap into homeownership.

Many Black renters are unfamiliar with the process of buying a home because their families weren’t homeowners, says Janece Simmons, vice president of community and housing services at Far South CDC. But often they get a nudge from a friend who’s bought a home and take a closer look. And there’s a wider recognition that homeownership helps build family wealth, she says.

In some ways, it’s a difficult time to buy. Mortgage rates are high and homeowners with low rates are sitting tight, which depresses the supply of available properties. But there’s a good supply of down payment assistance and help for closing costs available through government sources and lenders. “I tell clients, ‘You can layer it like a cake,’” says Pamela Stalling, vice president of the Housing and Fi-

nancial Empowerment Center at the Chicago Urban League. Longtime systemic barriers make it difficult for some Black and Latino buyers to cross the threshold. Lenders became more restrictive after the subprime mortgage crisis of 2007-2010 and look for higher credit scores, says Marisa Calderon, CEO of the nonprofit Prosperity Now. The minimum credit score for a Federal Housing Administration, or FHA, loan is 580, but lenders are requiring higher scores to ensure they can sell the loan, she says.

New construction appraisals

When developers build in a struggling neighborhood such as West Humboldt Park or Back of the Yards, appraisers may penalize the new construction by comparing to older homes in lesser condition. That could imperil a loan and require the buyer to make a larger down payment, or for the seller to either lower the price or find a grant to cover the gap. On the other hand, buyers of affordable homes in a gentrifying neighborhood can get beneficial loan terms with higher appraisals.

First-time homebuyers seeking down payment assistance are required to take a course through U.S. Department of Housing & Urban Development-approved local agencies that explain the basics of the mortgage process, insurance, inspection and appraisals. Still, a lot more tutoring and

hand-holding comes into play. While banks will approve loans based on a client's gross income, counselors like Stalling warn borrowers, “you don’t live off your gross.” She advises borrowers to budget conservatively based on their net income and consider all monthly expenses. You can be a well-educated professional and not understand how the system works, she says. “If there’s no financial literacy, you can lose everything.”

By Judith Crown Black homeownershipJohn Groene, neighborhood director at Neighborhood Housing Services of Chicago, tells clients to get pre-approved for a mortgage. He often gets calls from clients asking about grants but has to tell them it’s useless to talk about down payment assistance until they know what they can borrow.

“I had a client who had her eye on a house on Central Park Avenue. Did she get pre-approved? No,” Groene says. “She didn’t have enough for the down payment and she lost out on her dream house.”

At Far South CDC, counselors are seeing more prospective buyers older than 40, including seniors. One client in her 70s purchased a home for the first time under the Chicago Housing Authority's Choose to Own Homeownership Program, which covers a portion of the mortgage for voucher holders. “She has children and grandchildren and wants to leave them something,” Simmons says.

Chicagoans see this piece of the American Dream slipping away

We often think of the American Dream as having a spouse, two kids and a dog, and owning a home. Beyond its sentimental value, homeownership can be a wealth-creation catalyst. This path to financial security is increasingly out of reach for Chicago’s low- to middle-income families, however.

Half of city of Chicago residents (51%) are concerned about their local housing situation, according to a recent Harris Poll survey. To put this in perspective, Chicagoans’ worries about housing trump their concerns about the refugee and undocumented im-

William Johnson is CEO of The Harris Poll, a global public opinion polling, market research and strategy firm.

William Johnson is CEO of The Harris Poll, a global public opinion polling, market research and strategy firm.

Chicagoans believe that there is not enough reasonably affordable (43%) or low-income housing (29%) where they live.

migrant situation (46%), the local economy (33%), infrastructure (28%), social inequities (25%), health and community resources (25%) and the public education system (23%). The only issues about which city residents are more concerned are public safety

(64%) and taxes and fees (59%). Specifically, Chicagoans believe that there is not enough reasonably affordable (43%) or low-income housing (29%) where they live, and 2 in 5 say that the situation has worsened over the last year. Fifty percent fear that they will be priced out of their neighborhood within five years. And city residents are looking to local political leadership to help deal with this chronic problem: A plurality (47%) said that city government should be primarily responsible for managing the housing situation in the area where they live.

To his credit, Mayor Brandon Johnson has focused on addressing the problem — though with mixed results to date. In March, voters narrowly rejected his initial effort, dubbed "Bring Chicago

Home,” which would have raised the real estate transfer tax on million-dollar-plus real estate deals. Johnson has subsequently shifted his strategy away from using tax increases to deal with the problem. In early April, he announced plans to convert unused space in four financial district office buildings into apartments, with some portion being affordable housing. Two days later, he rolled out “Cut the Tape,” a large-scale initiative designed to streamline housing and commercial project development. The proposals aim to reduce unnecessary building requirements, cut extraneous reviews and alleviate administrative burdens. If successful, it could both increase the housing supply and improve affordability.

“This strategy will quickly increase residential and commercial projects, stimulating business sectors and addressing the urgent need for housing,” Johnson said. “Together, we're breaking down barriers to progress and building towards a more prosperous city for all.”

Taken together, these plans could be a step in the right direction for the city, and a majority of Chicago residents support the construction of reasonably affordable

housing (76%), additional housing (60%) and low-income housing (60%) where they live, according to our polling. That said, residents may believe it when they see it:

Nearly two-thirds of Chicago residents (62%) think it’s likely the city’s housing situation (e.g., availability, affordability) will actually decline over the next five years.

One key for Johnson will be engaging with other city leaders on this agenda. This would be smart politics in a couple of ways: Not only could it increase the chances of getting his agenda enacted, but even simply making the effort is likely to boost him in voters’ eyes.

Fully 9 in 10 city residents think it’s important for the mayor to work with others such as aldermen and union leaders on issues facing the city, with nearly two-thirds (63%) saying it’s very important. Chicagoans are pragmatic and understand that solving the city’s problems will require careful solutions and, most importantly, everyone pulling together. They want to see Johnson, other pols and key stakeholders such as business executives alike demonstrate that they get it as well.

That’s the challenge of leading a big city — and the opportunity, if

Who should handle housing?

In your opinion, which group should be primarily responsible for managing housing in the area where you live? Source: The Harris

$350,000 and $400,000. And that’s with eliminating the basement and garage. Meanwhile, price tags for homes in gentrifying Chicago neighborhoods such as Logan Square, Pilsen and Albany Park range from $500,000 to $1 million. With landlords raising rents due to higher property taxes, more tenants are looking to homeownership, housing counselors say. But stubbornly high interest rates coupled with elevated construction costs make the transition difficult. Moreover, many prospective Black and Hispanic buyers are skittish because they aren’t familiar with the homebuying process.

“It’s not part of their daily learning,” says Janece Simmons, vice president of community and housing services at the Far South Community Development Corp. “They see the $300,000 number and figure it’s unaffordable. But there are methods to purchasing that home.”

Homeownership by Black and Hispanic families grew in the years leading up to the 2008 subprime mortgage meltdown. But as much as two-thirds of household wealth among these groups was lost in the foreclosure crisis that followed, says Marisa Calderon, president and CEO of the nonprofit Prosperity Now.

Homeownership in Chicago and Cook County declined between 2010 and 2022, according to the Black Wealth Data Center and the American Community Survey. In Cook County, ownership among white families dropped by 3.7% to 66.1%, outpacing the drop in Black homeownership of 1.9% to 40.9%. Ownership among Hispanic families gained by 1.4% to 53.4%. The gap remains substantial: In Chicago, Black homeownership fell to 34.6% in 2022 compared to overall ownership of 45.6%.

Seeking economies of scale

Since launching Inherent L3C in 2020, “to enable and empower long-term affordable homeownership and generational wealth creation,” Swanson has delivered seven homes and was recently completing three more, selling to both developers and directly to consumers.

Trained as an architect, he’s worked at design firms Skender, CannonDesign and Skidmore Owings & Merrill.

Swanson expects to build 25 modular homes this year and double output to 50 as he moves into a larger production space and converts to an assembly line format. Under the current setup, workers construct one house at a time in three bays.

Still, Swanson says he’s breaking even on low volume and expects expansion will enable him to lower costs and gain supply chain efficiencies, much like the Walmart model.

His team members work with prospective buyers, helping them find down payment assistance and grants for closing costs — whether from the city or private

Homeownership rates (2010 vs. 2022)

Change in homeownership (2010 vs. 2022)

four earning about $90,000. The lack of private investment means dependence on government for subsidies and approvals, says Josh Braun, former CEO of Kinexx Modular Construction, a builder selling to affordable housing developers. And those wheels move slowly. Modular makes sense if production can be streamlined and scaled, Braun says. “You need orders of 100, 200, 300 and 1,000. That allows you to get economies of scale, like automakers who are building millions of cars,” he adds.

Last month, Braun sold his majority stake in the company he started in 2019 to a Kinexx investor, LaPhair Capital Partners, a New York minority-led, earlystage investment firm. LaPhair invested more than $2 million to acquire Braun’s ownership, pay down debt and shore up credit lines, says the new CEO, Scott Upshaw.

Under its new ownership, Kinexx aims to boost volume to operate more efficiently and seek new revenue streams. That includes tapping into new markets, possibly Detroit or Houston, according to Upshaw, a business development consultant and lecturer in management at Chicago State University.

Kinexx has delivered 69 homes, including 28 to developer Mike Drew of Structured Development for his Harrison Row Townhomes in East Garfield Park. Drew is selling them at an affordable $250,000, well below his per-home cost of $350,000. There was no financial backing from the city. Drew selfsubsidized the development by building 400 market-rate rentals in Lincoln Park. “It was a developer’s gamble that the value in Lincoln Park will more than offset the cost of building on the West Side,” he says.

Chicago’s Affordable Requirement Ordinance, or ARO, requires developers who seek a zoning change to make 20% of their units affordable. Drew fulfilled that requirement by building 34 affordable condos in Lincoln Park and 40 affordable townhomes offsite in East Garfield Park.

Median home value (2010 vs. 2022)

lenders. But it’s a burden on firsttime buyers to arrange their own “capital stack” of financing.

Swanson’s solution is the New Market Tax Credit Program — a tool traditionally used for com-

mercial development but has been used for workforce homes in 30 states, including Atlanta, Indianapolis, Houston, St. Louis and Austin, Texas.

With that equity, Swanson fig-

ures he can sell a house for $290,000 and hopes to offer a 3.5% mortgage. That would free prospective buyers from the burden of scrambling for subsidies. And it would be affordable to a family of

The majority of compliance with the city’s inclusionary housing policy is through affordable rents. Affordable homes built to fulfill ARO requirements are governed by the city’s Chicago Housing Trust, which sets income limits for buyers but requires that they qualify for a mortgage. It has more than 120 units in its portfolio. Residents agree that when they sell, it will be at a restricted price to keep the home affordable. “The priority is to provide stable housing for workforce families that enables them to avoid unscrupulous landlords,” Drew says.

One new resident at the Harrison Row Townhomes is Christian Boyer, director of development at the Chicago Loop Alliance. Boyer heard about the Housing Trust program through friends and says it took some time to understand the guidelines and then apply. He paid $249,000 for the home and landed $10,000 in down payment assistance from the Illinois Hous-

ing Development Authority. Because the home was appraised higher than his cost, he only had to put 3% down. He moved into the four-bedroom, two and a half bathroom home last summer.

“I never thought I would have enough money to own a home in Milwaukee (his hometown), let alone Chicago,” he says. The home is close to his job and is near the Green and Blue Chicago Transit Authority el lines, but he adds, “There’s still work to be done in the community.”

In North Lawndale, a tour of a new Kinexx modular home shows off a wrought iron fence, a kitchen with a large island, Samsung appliances and two baths. A concrete slab for parking can be used to build a garage later. The home doesn't have a basement. (Swanson of Inherent Homes says he is working on prototypes that would include basements — finished or unfinished).

The lack of a basement is a disadvantage because families need a place to stash their stuff, says John Groene, neighborhood director at the Neighborhood Housing Services of Chicago. He has a client paying $300 a month for a storage unit. “If you can afford to borrow $315,000, you probably will choose an older home with a basement,” he says. “You have a choice.”

Neighborhood Housing Services works with families to buy and renovate the homes. A typical deal might involve the purchase of a vacant home for $200,000 and a $150,000 rehab. In some tax-increment financing districts, where a portion of property taxes are dedicated for redevelopment and investment, a subsidy can cover 25% of the entire project.

This type of deal keeps the neighborhood affordable, Groene says. If a market-rate developer gets the same property first, he’ll add in a fancy kitchen and bath. “The developer will sell it for $400,000 and it's no longer affordable for many families,” he says.

Forgoing the profit

Like the Chicago Housing Trust, other land trusts run by nonprofits keep homes affordable by restricting resale prices. The buyer essentially owns the home, but the land remains in a trust with a renewable 99-year lease. The homeowner agrees to keep the home affordable and can’t sell at a big profit, even in a hot neighborhood like Logan Square.

The suburb of Highland Park established the first land trust in the state in 2002, when home prices were taking off and the community wanted elementary school teachers and paramedics to be able to live where they worked.

The Highland Park Community Land Trust expanded to nearby suburbs and merged with other affordable housing organizations to form the nonprofit Community Partners for Affordable Housing,

trifying neighborhoods where local organizations aim to keep a diverse population. It’s not a presence in striving neighborhoods, such as North Lawndale, where residents would welcome an appreciation in home values.

Vacant land waiting

What is top of mind for Richard Townsell, executive director of Lawndale Christian Development Corp., is acquiring a chunk of the estimated 10,000 city-owned vacant lots in Chicago. He and other leaders on the South and West sides have ambitious plans to build thousands of homes on vacant city land. But gaining approval is painfully slow, negotiating with six or seven different city departments for a standard 1,700square-foot home that is being replicated.

The city allocated 100 lots to Lawndale Christian Development, but the organization has received only 14, says Townsell, adding that he thinks the city is skeptical of his organization’s ability to deliver and is doling out the land.

The nonprofit is building on those lots as well as on privately owned land it’s acquired. But Townsell is worried about missing another construction season. “Builders will move on to other, more certain projects,” he says. “They’ve been waiting for us for a long time.”

Lawndale Christian Development is part of the coalition United Power for Action & Justice, which is building affordable homes in the Back of the Yards, Roseland and Chicago Lawn neighborhoods, as well as Lawndale. The consortium has sold 24 homes and has 70 under construction. (Townsell has purchased modular units from Kinexx but also uses on-site builders.)

At a minimum, the consortium is looking for the release of 500 lots during Mayor Brandon Johnson’s four-year term, translating to 150 a year for the four communities. “If we move fast, we should get more lots,” Townsell says. Releasing the lots will at least get the properties on the tax rolls. “If I build a house and don’t sell it, it’s on me to pay the taxes,” he says.

or CPAH, based in Libertyville. CPAH’s Community Land Trust program builds and rehabs homes for low- and moderate-income households. It has nearly 89 homes in its portfolio in Highland Park, Lake Forest, Evanston, Wil mette, Highwood, Mundelein and Lake Bluff, says Amy Kaufman, CPAH's vice president of community relations.

In Chicago, the nonprofit Chicago Community Loan Fund leads a governing federation, the Chicagoland Owners Land Trust. Last year, the fund extended a $1 million letter of credit to a recent

initiative, the Here to Stay Community Land Trust, which operates in Logan Square, Hermosa, Humboldt Park and Avondale, where gentrification is a concern. Here to Stay acquires and renovates the homes in its portfolio, says program director Kristin Horne. The trust has sold three homes ranging from $270,000 to $290,000 and uses a variety of funds to subsidize the transaction. It has two houses under contract and two more in renovation.

One of Here to Stay’s buyers is Ludivina Resendiz, who was set

to close on a four-bedroom, twobathroom home in Hermosa for $275,000. She and her family lost an earlier home in the foreclosure crisis and was recently renting in Logan Square.

“I’m grateful for the opportunity,” says Resendiz, a surgery scheduler at Rush University Medical Center. She says she accepts that she won’t have the opportunity of a financial windfall when it’s time to sell. “My intention is not to make money,” she says, “it’s about a home for my family and making memories.” Trusts are best suited for gen -

Townsell and other developers hope Johnson’s plan released in April to “Cut the Tape” and speed the approval process for real estate projects will change the paradigm. The mayor unveiled a report with more than 100 recommendations to speed up the approval process for new developments and help ease the shortage of affordable rentals and homes. However, much of the report is based on goals to be completed over months or years. A task force will be created to track progress. John Roberson, the city's chief operating officer and point person on the "Cut the Tape" initiative, did not respond to requests for comment on developers' needs for the vacant parcels.

“If we get the lots, we would build,” Townsell says. “All the city has to do is get out of the way.”

Closing critical housing gap demands state-level action